Asian Autos: Increasing Exposure Reflects Rising Market Confidence

-

Steve Holden

-

December 18, 2023

-

Asia

-

0 Comments

100 Active Asia Ex-Japan Funds, AUM $54bn Asian Autos: Increasing Exposure Reflects Rising Market Confidence • Improved sentiment in Asia Ex-Japan Autos sector as sustained increases in positioning continue through 2023. • BYD Company most widely held but stabilizing; Li Auto sees increased buying. Sector 7th most owned, underweight by -0.85%. • Rising allocations, low historical positioning and net underweight …

Continue Reading

Saudi Arabia Special Report: A Tipping Point in EM Equity Allocations

-

Steve Holden

-

December 13, 2023

-

Emerging Markets

-

0 Comments

367 emerging market Funds, AUM $396bn Saudi Arabia Special Report – A Tipping Point in EM Equity Allocations 2023 marks a pivotal year with EM investors significantly increasing holdings in the Saudi market. Major EM investors from GQG Partners to Capital Funds record notable fund inflows into Saudi for the first time. Despite growing interest, the Saudi market still presents …

Continue Reading

GEM Fund Positioning Analysis, November 2023

-

Steve Holden

-

November 22, 2023

-

Emerging Markets

-

0 Comments

370 emerging market Funds, AUM $368bn GEM Fund Positioning Analysis, November 2023 In this issue: EMEA Financials: Uneven Recovery JD.com: Test of Investor Resolve as Selling Continues GEM Funds Stock Radar 370 emerging market Funds, AUM $368bn EMEA Financials: Uneven Recovery • EM Funds are at historically low levels of exposure to the EMEA Financials sector. • EMEA Financials are …

Continue Reading

Global Fund Positioning Analysis, November 2023

-

Steve Holden

-

November 20, 2023

-

Global

-

0 Comments

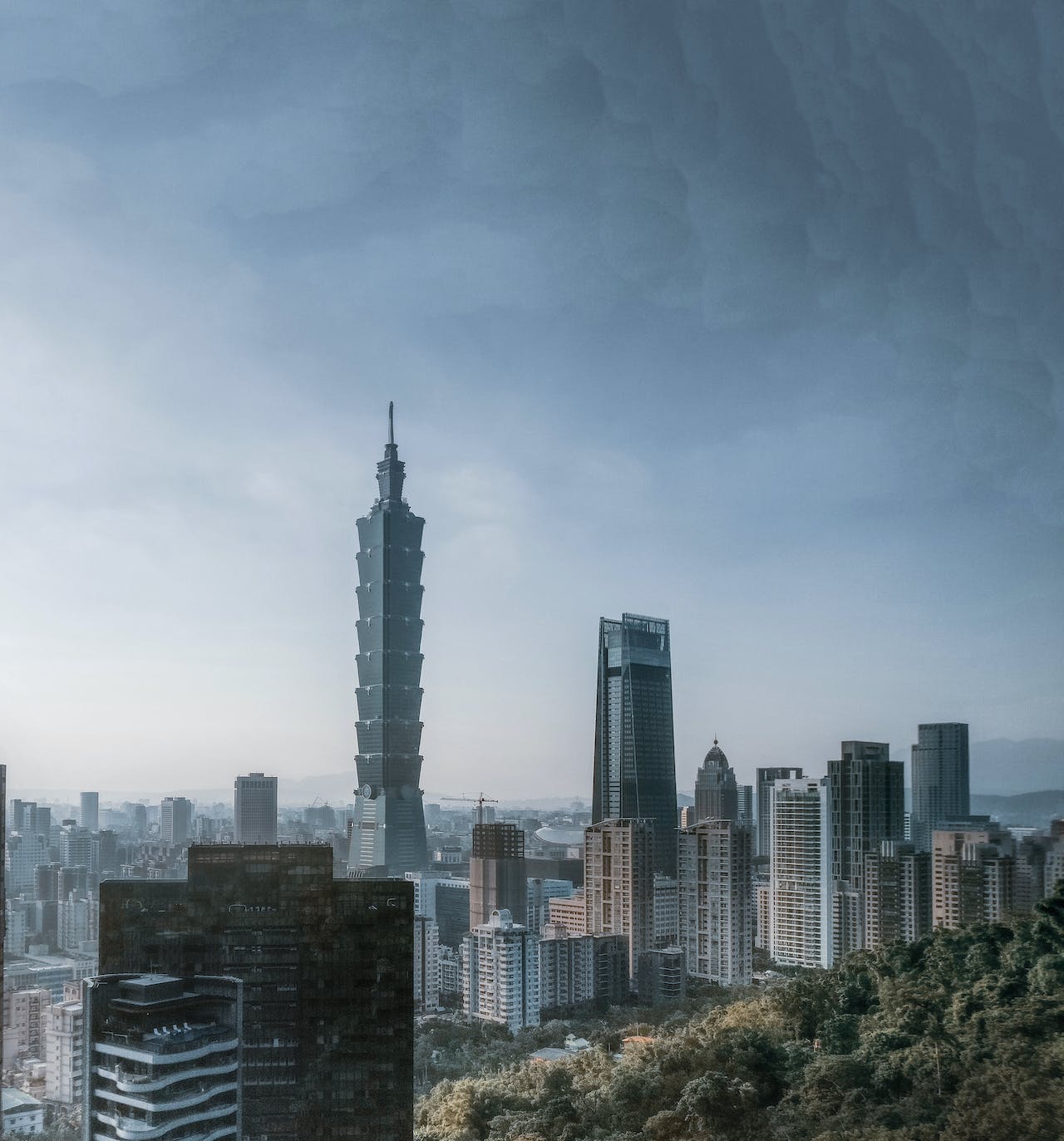

344 Global Equity Funds, AUM $905bn Global Fund Positioning Analysis, November 2023 Taiwan: Underowned Yet Gaining on Peers ServiceNow.Inc: Global Funds Ramp Up Exposure Global Funds Stock Radar 344 Global Equity Funds, AUM $905bn Taiwan: Underowned Yet Gaining on Peers • The percentage of Global funds invested in Taiwan hits an all-time high of 57.8%. • Taiwan has been …

Continue Reading

Asia Ex-Japan Fund Positioning Analysis, October 2023

-

Steve Holden

-

October 30, 2023

-

Asia

-

0 Comments

100 Active Asia Ex-Japan Funds, AUM $54bn Asia Ex-Japan Fund Positioning Analysis, October 2023 In this issue: Betting on Recovery: Asia Ex-Japan Funds Return to Casino Stocks JD.Com. Losing its Appeal? Asia Ex-Japan Stock Positioning & Activity Update 100 Active Asia Ex-Japan Funds, AUM $54bn Betting on Recovery: Asia Ex-Japan Funds Return to Casino Stocks • Ownership levels in …

Continue Reading

China Fund Positioning Analysis, October 2023

-

Steve Holden

-

October 25, 2023

-

China

-

0 Comments

150 Active MSCI China Funds, AUM $47bn China Fund Positioning Analysis, October 2023 In this issue: China Banks: Consolidating The Lows as Old Guard Makes a Come Back New Oriental Education & Technology: Back From the Dead MSCI China Stock Positioning & Activity Update 150 Active MSCI China Funds, AUM $47bn China Banks: Consolidating the Lows as Old Guard Makes …

Continue Reading

GEM Fund Positioning Analysis, October 2023

-

Steve Holden

-

October 23, 2023

-

Emerging Markets

-

0 Comments

371 emerging market Funds, AUM $385bn GEM Fund Positioning Analysis, October 2023 In this issue: EM Semiconductors Deep Dive Saudi Aramco: Record Holdings Emerging Markets Stock Positioning Update 371 emerging market Funds, AUM $385bn EM Semiconductors Deep Dive • Semiconductors are the 2nd largest industry allocation and the 6th largest overweight among EM active managers. However, the momentum witnessed between …

Continue Reading

UK Small/Midcap Fund Positioning Update

-

Steve Holden

-

October 18, 2023

-

UK

-

0 Comments

106 UK Small/Midcap Equity Funds, AUM $37bn UK Small/Midcap Fund Positioning Update, October 2023 In Brief: • Industrials maintain top Sector weight. Real Estate and Consumer Discretionary underweights fund Technology overweight. • Investment Managers Industry group hits record exposure. REITs largely unloved by UK Small/Midcap funds. • Future plc remains the most widely held company. XPS Pensions and Foresight Group …

Continue Reading

Copley Fund Research Fund Positioning Chart Pack. October 2023

-

Steve Holden

-

October 3, 2023

-

Insights

-

0 Comments

1600+ Active Equity Funds, AUM $4.7tr Fund Positioning Chart Pack: October 2023 This week, selected charts and commentary from our Global, EM and Asia Ex-Japan research. • Global Equity Managers Trim EM Underweight, but Remain Bearish • EM Industrials Deep Dive • Baidu: Back in the Mix 349 GLOBAL EQUITY FUNDS, AUM $999BN Global Equity Managers Trim EM Underweight, …

Continue Reading

Asia Ex-Japan Fund Positioning Analysis, September 2023

-

Steve Holden

-

September 28, 2023

-

Asia

-

0 Comments

103 Asia Ex-Japan Funds, AUM $61.4bn Asia Ex-Japan Fund Positioning Analysis, September 2023 In this issue: Information Technology: Back to Top Overweight After Upward Trend Resumes China & HK Banks: Depressed Positioning Baidu: Back in the Mix 103 Asia Ex-Japan Funds, AUM $61.4bn Information Technology: Back to Top Overweight After Upward Trend Resumes • Technology allocations resume their upward trends …

Continue Reading

Recent Comments