Active GEM Funds: Extreme Stocks

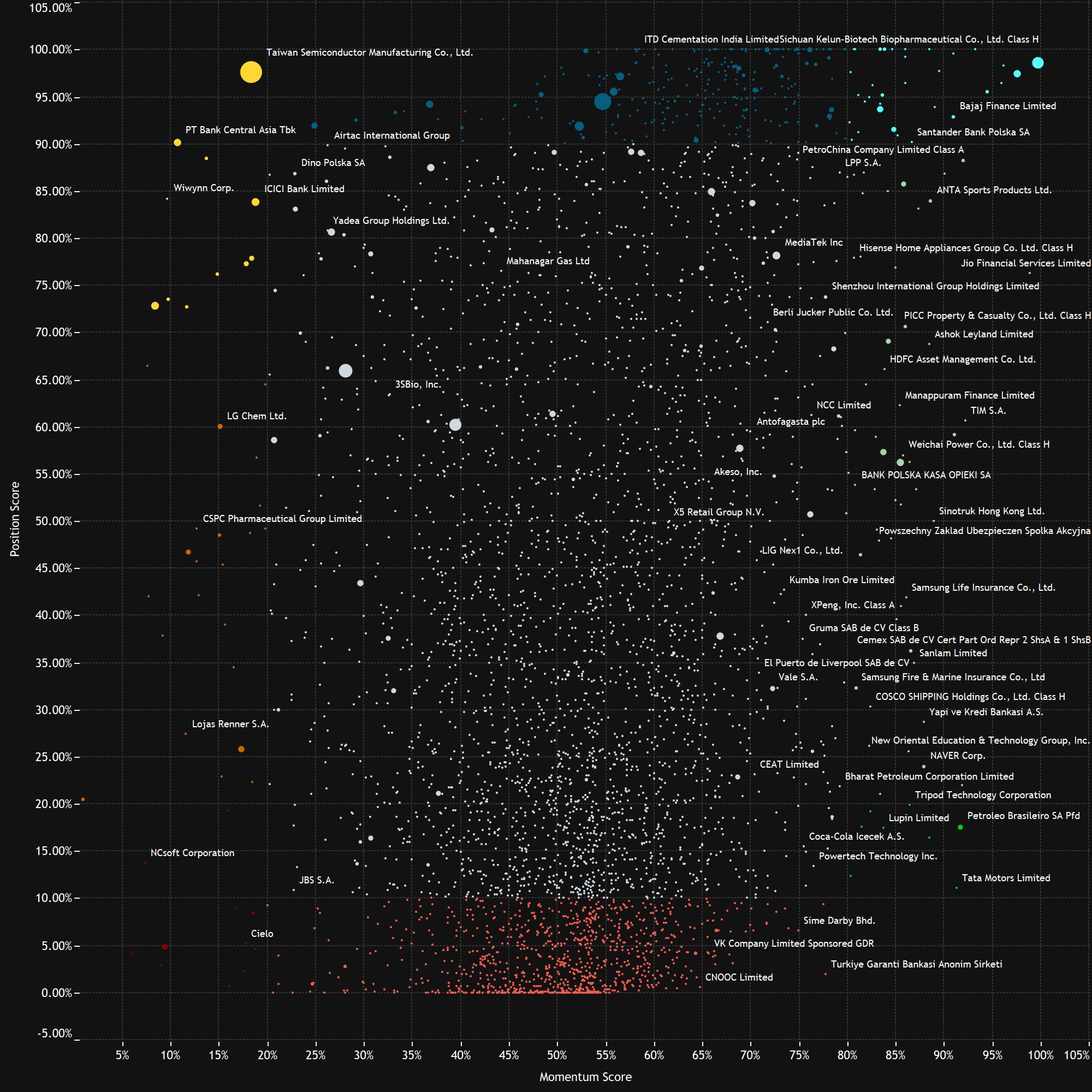

351 Global EM active equity funds, AUM $420bn Active GEM Funds: Extreme Stocks Summary In this report, we identify eight stocks that are currently positioned at the extreme ends of their historical position ranges, or have experienced significant shifts in fund ownership in recent months. Extreme Stocks in Focus: – HDFC Bank Limited – Delta Electronics, Inc. – POSCO Holdings …

Continue Reading

GEM Funds: Performance & Attribution Review, Q1 2024

352 Global Emerging markets active equity funds, AUM $423bn GEM Funds: Performance & Attribution Review, Q1 2024 Summary • Strong start to 2024 as majority outperform: Average returns of 2.8% beat the iShares MSCI EM ETF by 0.66%, with 63% of funds outperforming. • Value/Yield beats Growth: Yield funds the star performers with 4.5% returns on average. Aggressive Growth the …

Continue Reading

India Deep Dive: Record Allocations Mask Growing Underweight

360 emerging market Funds, AUM $400bn India Deep Dive: Record Allocations Mask Growing Underweight Summary Record Allocations Mask Caution: Record investments in India contrast with a rising underweight, as selected managers pare back exposure. Valuations Prompt Strategic Pause: Record underweights among Value funds reflect valuation concerns, with growth funds also seeing overweights decline. Selective Sector Optimism: Fresh interest in Utilities, …

Continue Reading

Alibaba Group Holdings: Positioning Update

-

Steve Holden

-

February 27, 2024

-

Emerging Markets

-

0 Comments

361 emerging market Funds, AUM $400bn Alibaba Positioning Overview • Despite average weights falling from over 6% in 2020 to under 2% today, 73% of EM funds remain invested in Alibaba. • The make up of the investor base has changed, with a rotation between high growth investors (out) and Value investors (in). • Of the 73% of current holders, …

Continue Reading

Reassessing Turkey: EM Fund Managers Show Signs of Sentiment Shift

-

Steve Holden

-

February 12, 2024

-

Emerging Markets

-

0 Comments

361 emerging market Funds, AUM $400bn Reassessing Turkey: EM Fund Managers Show Signs of Sentiment Shift • After a decade-long bear market in investor positioning, GEM managers are beginning to show tentative signs of a sentiment shift towards Turkey. • Positive fund flows and numerous new positions over the past six months highlight Turkey as a primary beneficiary of recent …

Continue Reading

Fund Positioning Dashboards Overview

-

Steve Holden

-

January 24, 2024

-

Emerging Markets

-

0 Comments

365 emerging market Funds, AUM $412bn Emerging Markets Fund Positioning Dashboard Overview In this week’s analysis, we present a comprehensive “teach-in” of our newly released suite of positioning dashboards, illustrated through three instructional videos. These videos guide you through the latest functionality and also offer some valuable insights on the latest positioning among active EM funds. • Macro/Regional Dashboards: The …

Continue Reading

Emerging Market Active Fund Performance & Attribution Review, 2023

-

Steve Holden

-

January 14, 2024

-

Emerging Markets

-

0 Comments

365 emerging market Funds, AUM $412bn Emerging Market Active Fund Performance & Attribution Review, 2023 2023 was a good year for active EM managers as 60% outperformed, generating +1.6% of alpha versus the tradable benchmark. Returns driven higher by strong performance from Value and Small/Midcap managers, whilst high Growth struggled. China & HK positions were costly, whilst LATAM and Technology …

Continue Reading

Saudi Arabia Special Report: A Tipping Point in EM Equity Allocations

-

Steve Holden

-

December 13, 2023

-

Emerging Markets

-

0 Comments

367 emerging market Funds, AUM $396bn Saudi Arabia Special Report – A Tipping Point in EM Equity Allocations 2023 marks a pivotal year with EM investors significantly increasing holdings in the Saudi market. Major EM investors from GQG Partners to Capital Funds record notable fund inflows into Saudi for the first time. Despite growing interest, the Saudi market still presents …

Continue Reading

GEM Fund Positioning Analysis, November 2023

-

Steve Holden

-

November 22, 2023

-

Emerging Markets

-

0 Comments

370 emerging market Funds, AUM $368bn GEM Fund Positioning Analysis, November 2023 In this issue: EMEA Financials: Uneven Recovery JD.com: Test of Investor Resolve as Selling Continues GEM Funds Stock Radar 370 emerging market Funds, AUM $368bn EMEA Financials: Uneven Recovery • EM Funds are at historically low levels of exposure to the EMEA Financials sector. • EMEA Financials are …

Continue Reading

GEM Fund Positioning Analysis, October 2023

-

Steve Holden

-

October 23, 2023

-

Emerging Markets

-

0 Comments

371 emerging market Funds, AUM $385bn GEM Fund Positioning Analysis, October 2023 In this issue: EM Semiconductors Deep Dive Saudi Aramco: Record Holdings Emerging Markets Stock Positioning Update 371 emerging market Funds, AUM $385bn EM Semiconductors Deep Dive • Semiconductors are the 2nd largest industry allocation and the 6th largest overweight among EM active managers. However, the momentum witnessed between …

Continue Reading

Recent Comments