UK Real Estate Hots Up

-

Steve Holden

-

March 6, 2024

-

UK Insights

-

0 Comments

270 UK Equity Funds, AUM $190bn UK Real Estate Hots Up • Record number of UK funds now exposed to Real Estate sector. • CT, BlackRock and Quilter among funds adding to exposure since mid 2023. • SEGRO and Land Securities the key holdings and the drivers behind the recent rotation Author: Steven HoldenDate: February 14th, 2024Fund Universe: UK Equity …

Continue Reading

UK Homebuilders: Momentum Reversal Among UK Equity Managers

-

Steve Holden

-

March 5, 2023

-

UK Insights

-

0 Comments

272 UK Equity Funds, AUM $185bn Homebuilders: Negative Momentum Sentiment reversal in UK Homebuilding sector drives fund weights to 6-year lows. Long-Term Trends & Short-Term Fund Activity UK active funds continue to scale back exposure to the Homebuilding sector. The bullish ownership trend that stretched the best part of the last decade has peaked, reversed, and continues to track …

Continue Reading

The Vodafone Exodus

-

Steve Holden

-

November 17, 2022

-

UK Insights

-

0 Comments

276 ACTIVE UK FUNDS, AUM $161BN The Vodafone Exodus In over a decades worth of holdings data for UK active funds, ownership in Vodafone has never looked so bad. Sentiment is at rock bottom, with the number of funds holding a position at all-time lows and an increasing number of funds deciding to throw in the towel. Time Series Analysis …

Continue Reading

UK Equity Funds: Stock Sentiment Analysis

-

Steve Holden

-

October 18, 2022

-

UK Insights

-

0 Comments

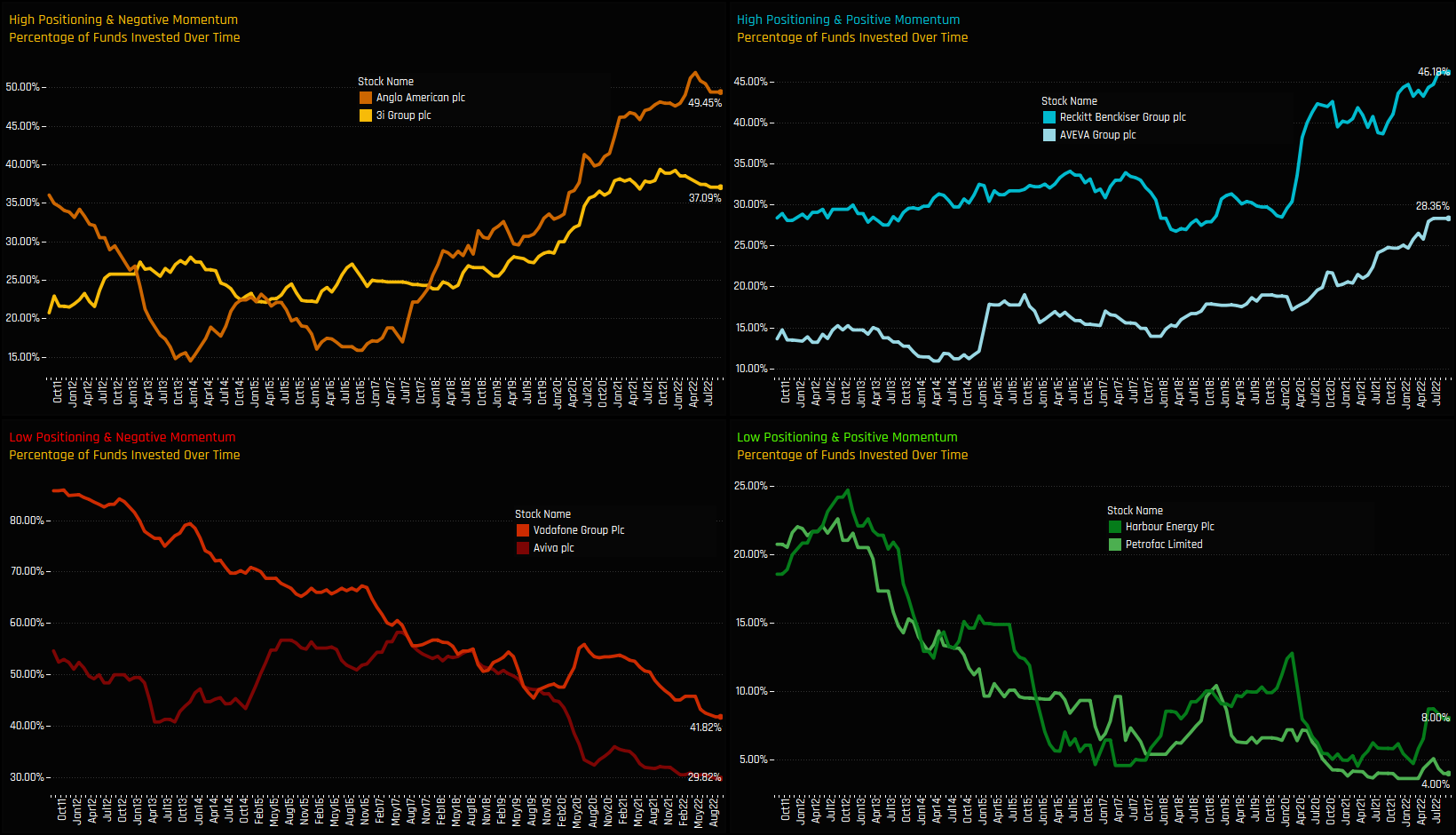

275 Active UK Funds, AUM $141bn. UK Stock Sentiment Investment levels among the hundreds of stocks in the investible UK universe differ greatly. Some stocks are widely owned, others largely avoided by UK active managers, with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for …

Continue Reading

Recent Comments