Asian Autos: Increasing Exposure Reflects Rising Market Confidence

- Steve Holden

- 0 Comments

100 Active Asia Ex-Japan Funds, AUM $54bn

Asian Autos: Increasing Exposure Reflects Rising Market Confidence

• Improved sentiment in Asia Ex-Japan Autos sector as sustained increases in positioning continue through 2023.

• BYD Company most widely held but stabilizing; Li Auto sees increased buying. Sector 7th most owned, underweight by -0.85%.

• Rising allocations, low historical positioning and net underweight suggest potential continued demand for Auto stocks

Time Series & Industry Activity

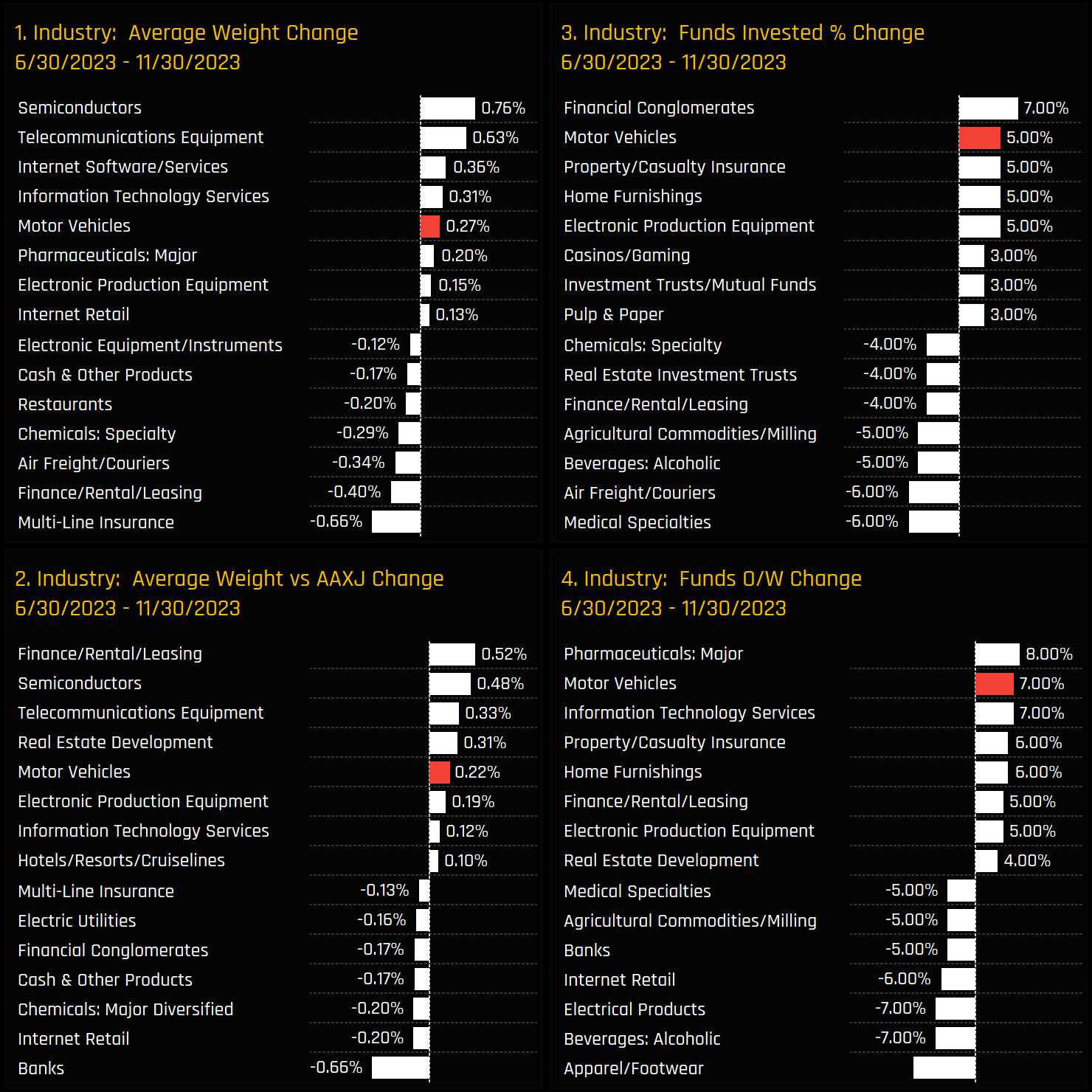

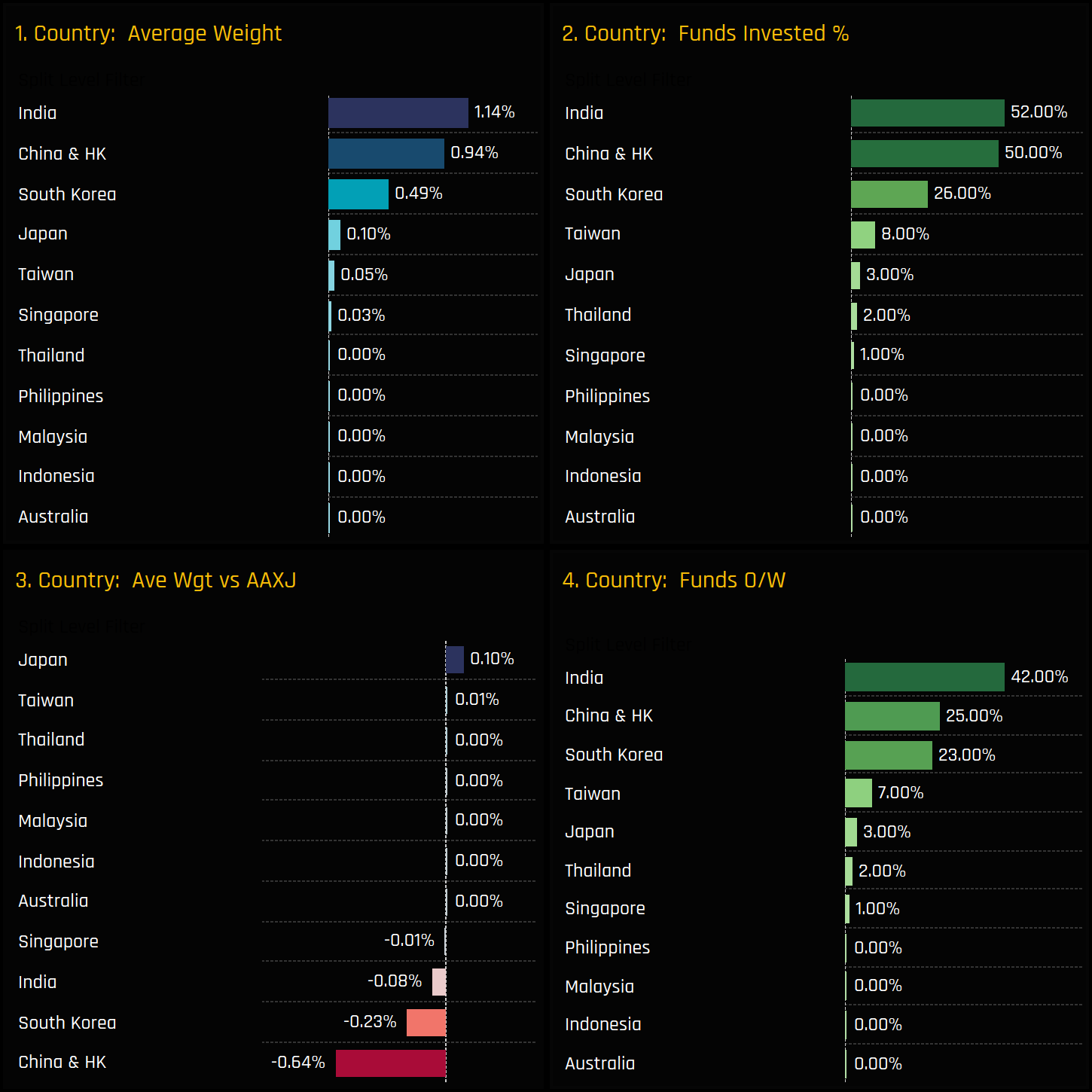

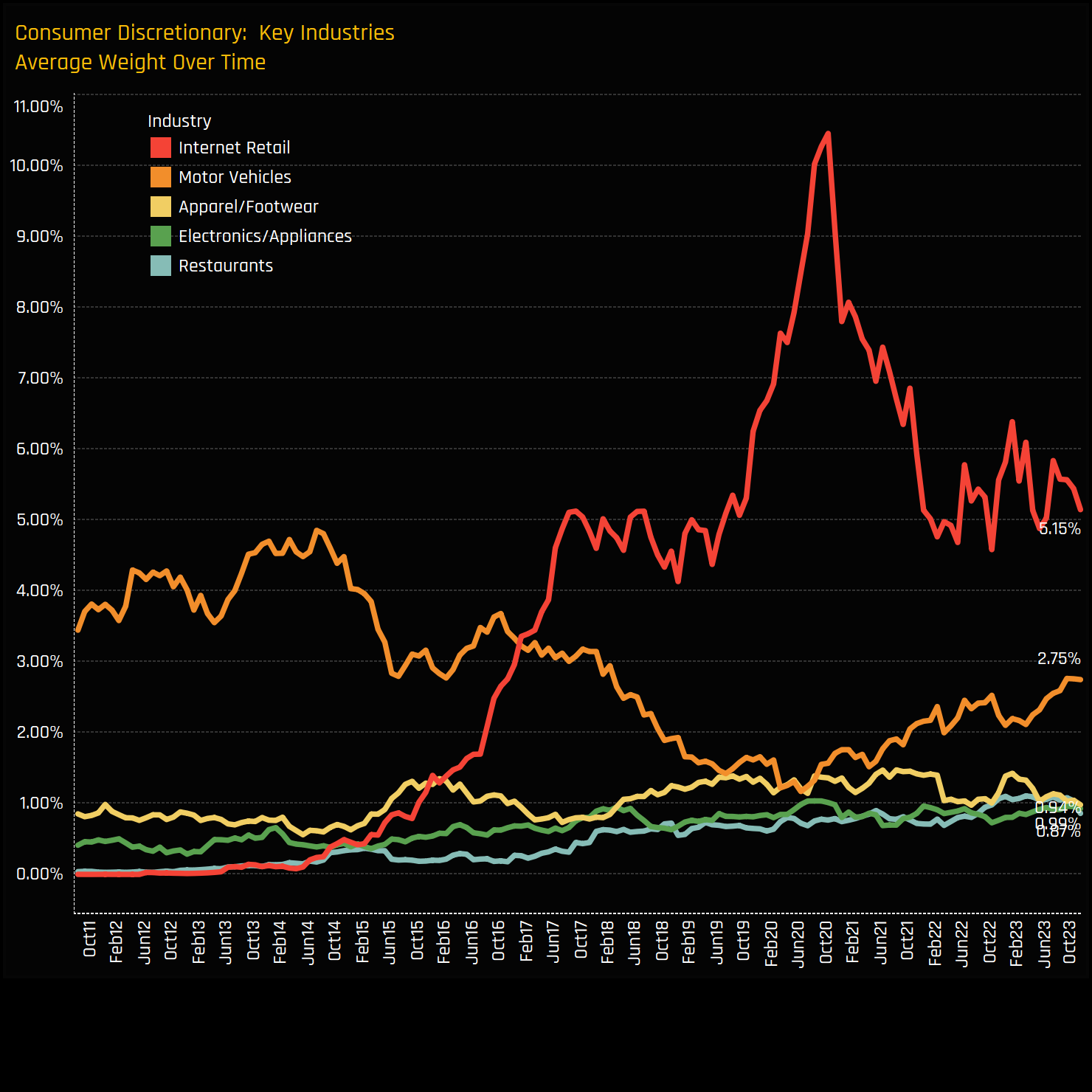

Active Asia Ex-Japan funds continue to increase their positions in the Motor Vehicles sector. From a high of 4.86% in 2014, average weights fell to a low of 1.18% in mid-2020, but have since shown a consistent recovery to 2.75% today, as detailed in Chart 1. Previously a holding in nearly all of the funds in our analysis back in 2014, Motor Vehicles are now an exposure for 75% of the funds in our analysis, up from a low of 66% in 2020, though suffering a dip in-between (chart3). Compared to the benchmark, Asia Ex-Japan funds are underweight by -0.85%, with 34% holding an overweight position. Again, these figures have improved from their lows but remain below previous peak levels (ch 2&4).

Since June of this year, Motor Vehicles exposure has experienced one of the most pronounced rotations among industry groups in the region. The sector’s 5% increase in fund investment was surpassed only by Financial Conglomerates, and the shift to an overweight position by 7% of funds was exceeded only by Major Pharmaceuticals. The average weight gain of +0.27% in Motor Vehicles ranks among the highest in the region, contributing to a reduction in the net underweight of +0.22%.

Industry Positioning & Sentiment

Motor Vehicles now occupy a unique position as the 7th most widely owned industry group in terms of both ownership and average holding weight. They stand distinct from the top six groups, which are held by over 89% of managers and carry average weights of at least 4% – and higher still in sectors like Semiconductors and Banks. Compared to the benchmark, the Motor Vehicles underweight of -0.85% ranks as the third largest deficit across all industry groups, trailing only Information Technology Services at -0.88% and Electric Utilities at -1.34%.

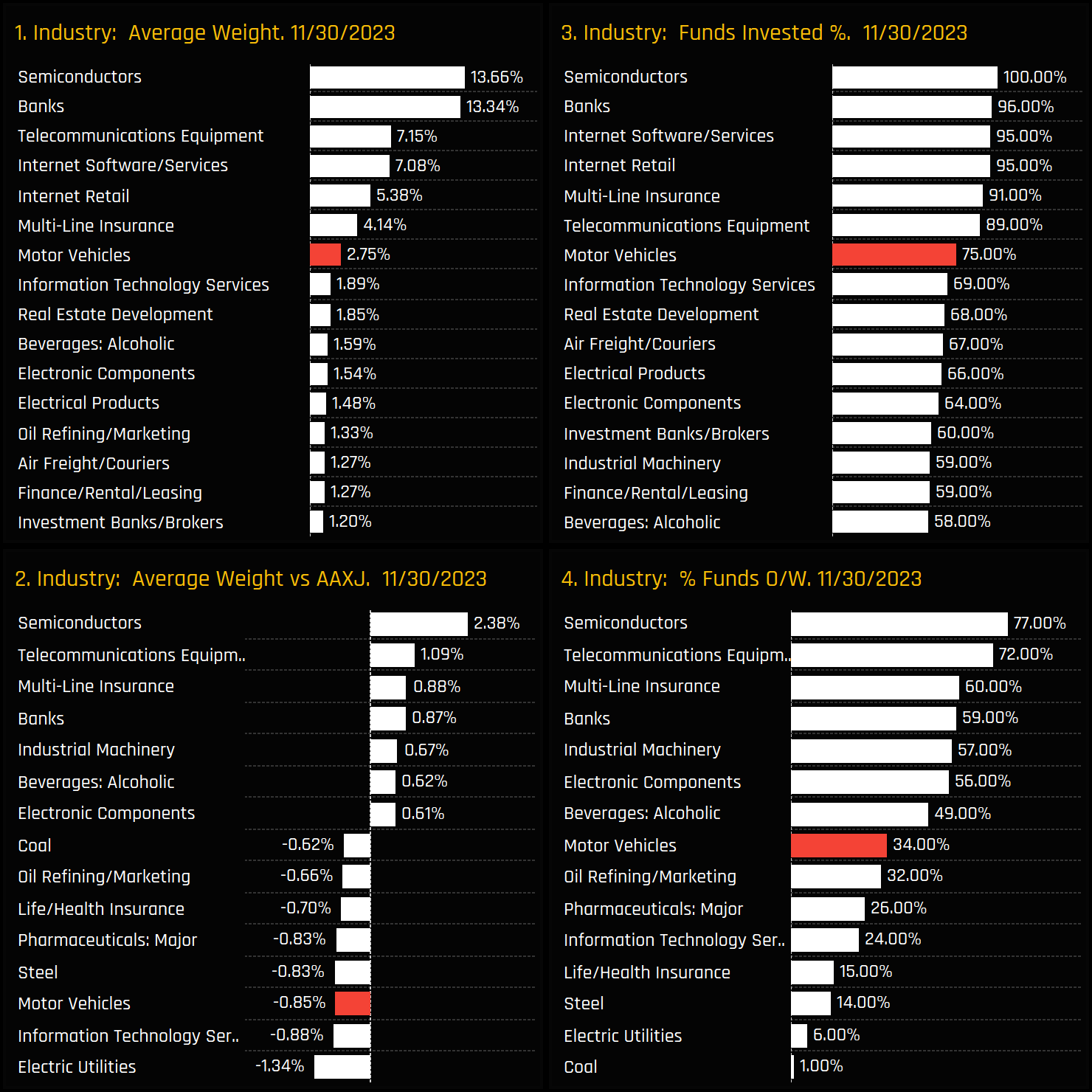

The Sentiment Grid below combines long-term positioning with recent manager activity into one chart. The Y-axis shows the ‘Position Score’, a measure of current positioning in each Industry compared to its own history going back to 2011 on a scale of 0-100%. The X-Axis shows the ‘Momentum Score’, a measure of fund manager activity for each Industry between 06/30/2022 and 11/30/2023 on a scale of 0% (maximum negative activity) to 100% (maximum positive activity). The recovery in the Motor Vehicles sector is clearly depicted in the bottom right quadrant, signifying a sector that is attracting inflows while remaining underowned compared to its historical average.

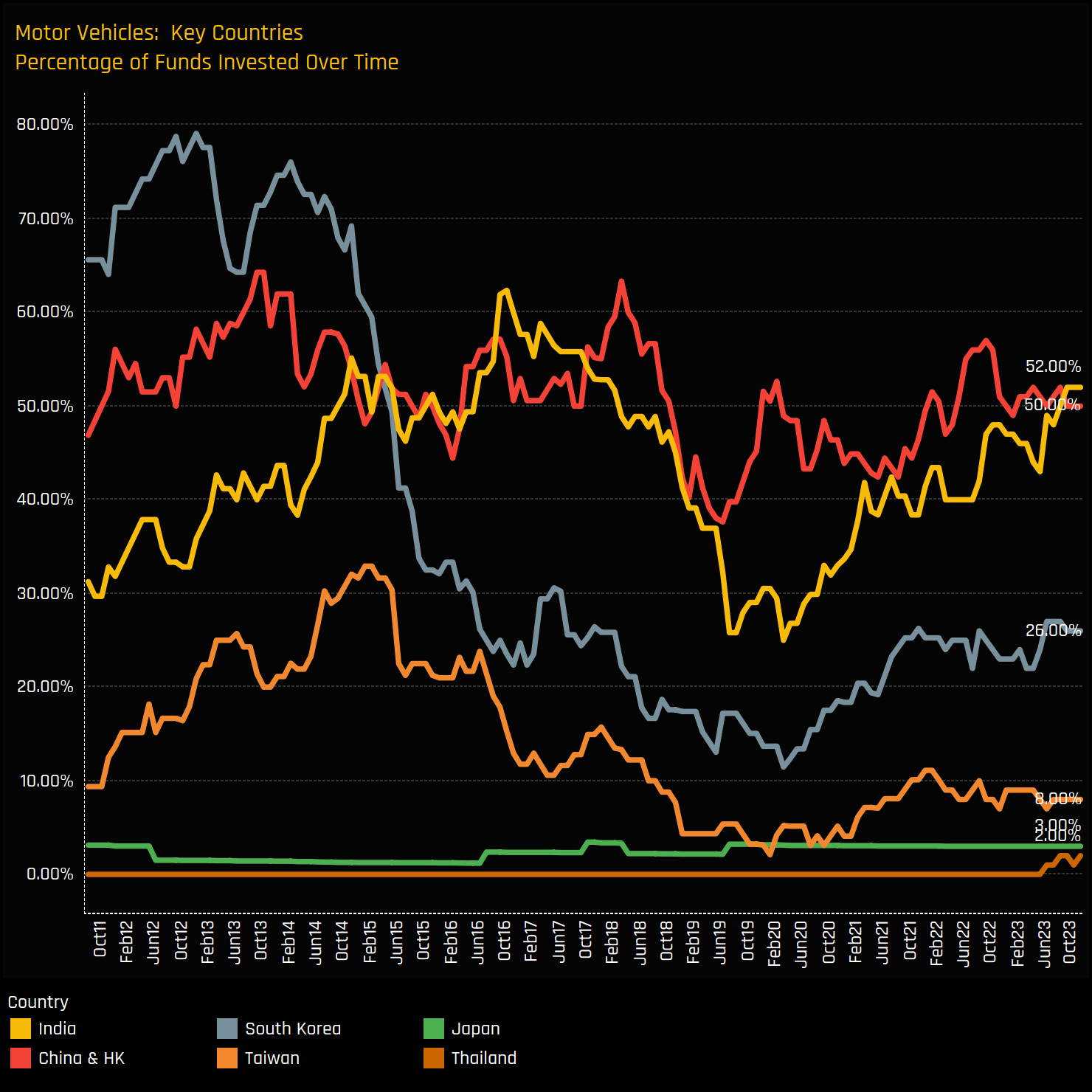

Country Breakdown

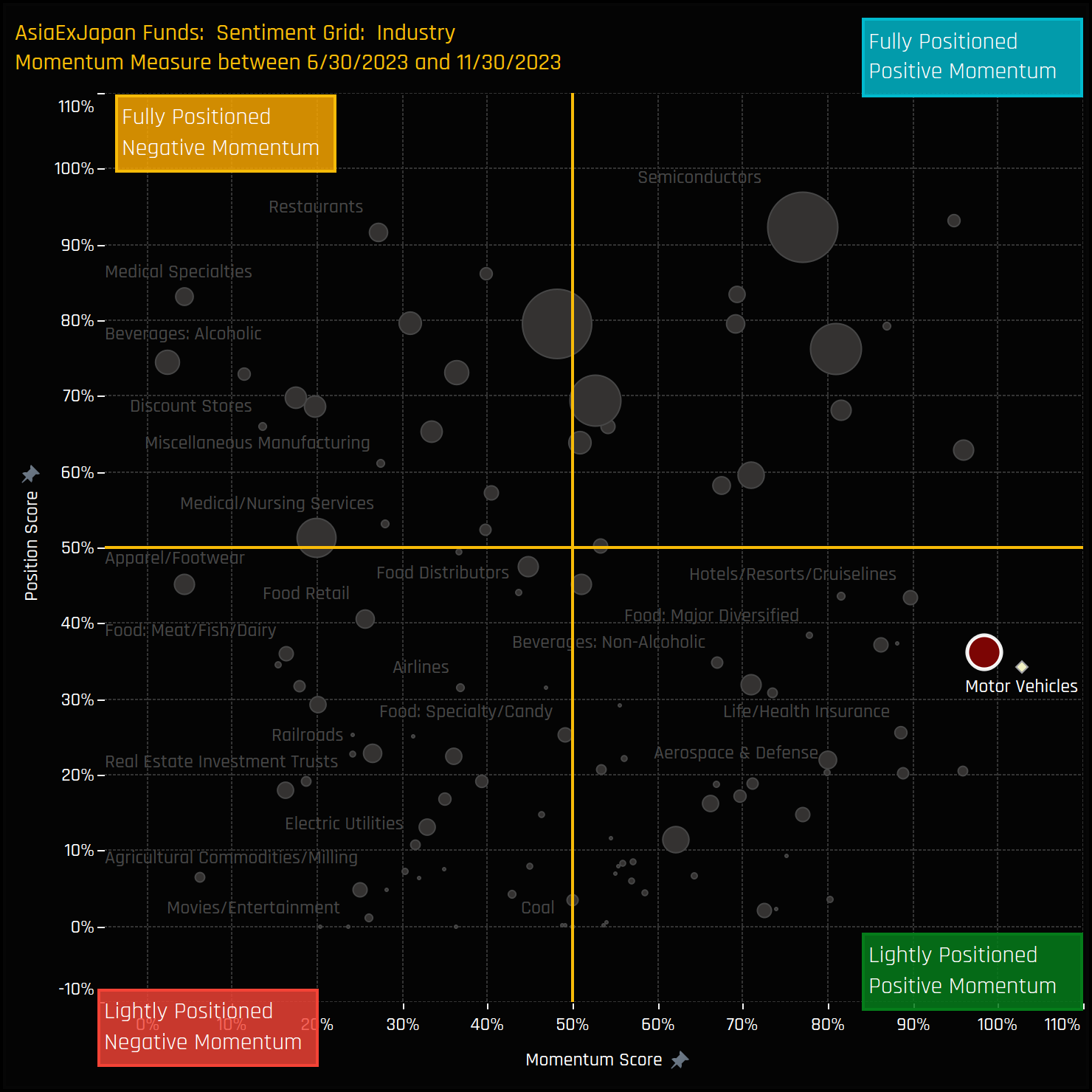

Analyzing Motor Vehicles exposure by country, the majority of holdings are in India, China & HK, and South Korea, which together make up 94% of the total industry allocation (Chart 1). India and China & HK lead with 52% and 50% of funds invested respectively, while South Korean autos are held by just 26% of funds (Chart 2). All three countries are net underweights relative to the benchmark, though China & HK stands out. It is an underweight for 75% of funds at an average of -0.65% below the iShares All Country Asia Ex-Japan ETF (Chart 3).

India Motor Vehicles Focus

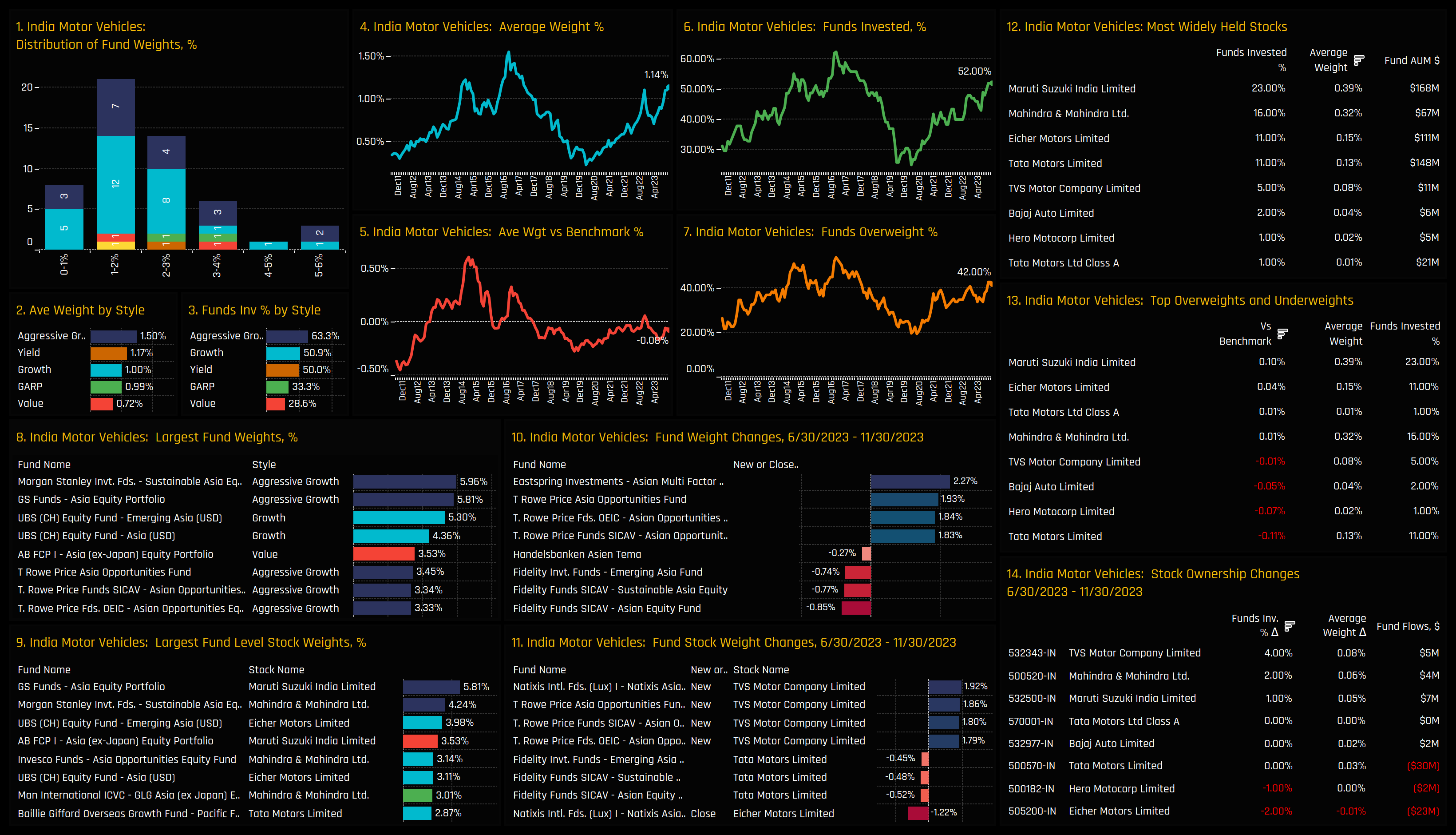

The chart dashboard below shows the latest holding metrics for the Indian Motor Vehicles sector. Chart 1 shows the distribution of fund weights, with most of the current holders maintaining between a 1%-4% allocation. Charts 2 and 3 show the holdings split by Style, with Aggressive Growth funds the most bullishly positioned and Value lagging some way behind. The larger allocators sit above 5% and are led by Morgan Stanley Sustainable Asia Equity (5.96%) and GS Asian Equity (5.81%), both helping to drive allocations back towards the highs of 2016, as shown in charts 4 and 6. At the stock level, Maruti Suzuki stands out as the most widely held, owned by 23% of funds with an average weight of 0.39%, closely followed by Mahindra & Mahindra. Notably, recent fund activity has shown a preference for TVS Motor Company, with four funds initiating exposure since June. The PDF attachment at the end of the report contains profiles for all major countries in the Motor Vehicles industry group.

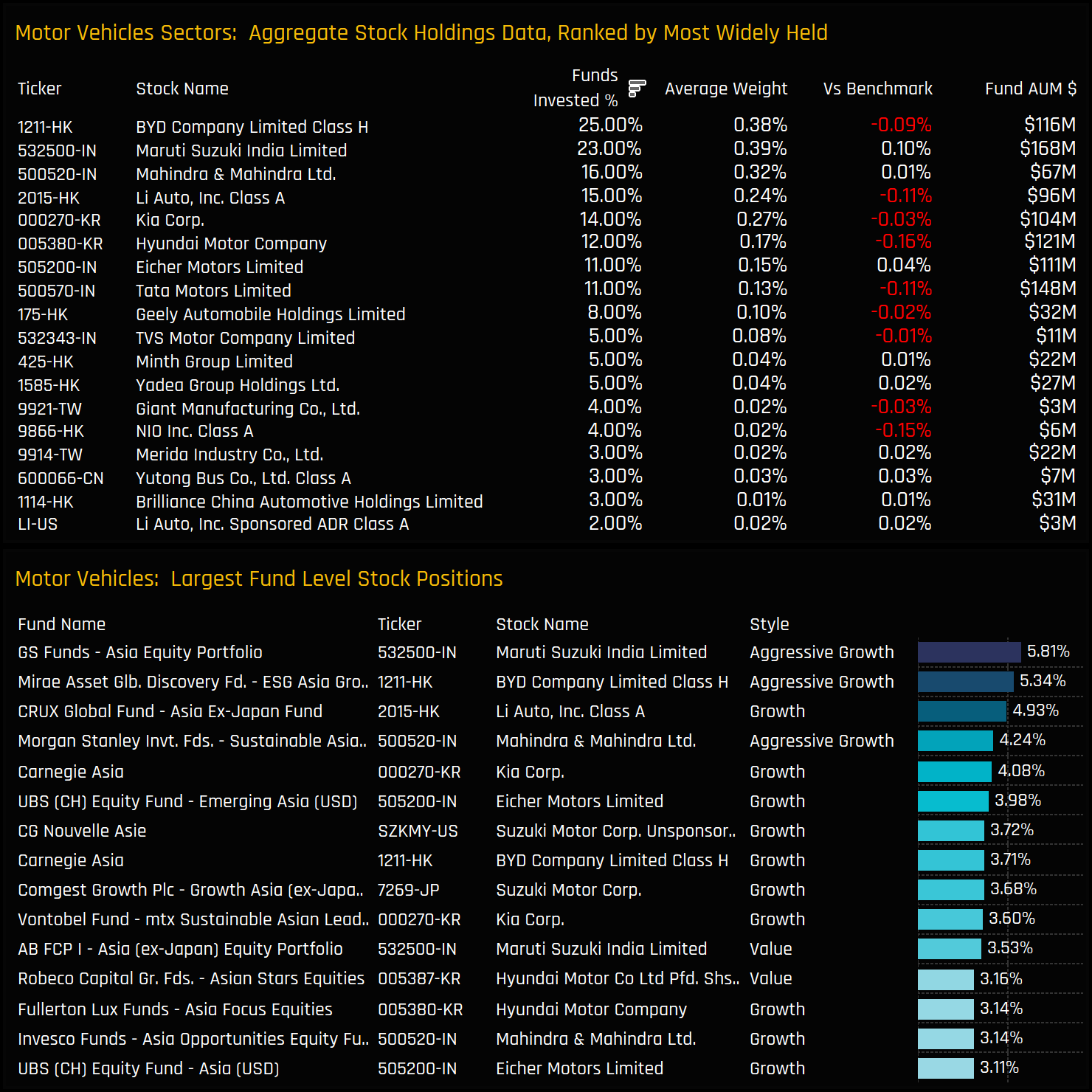

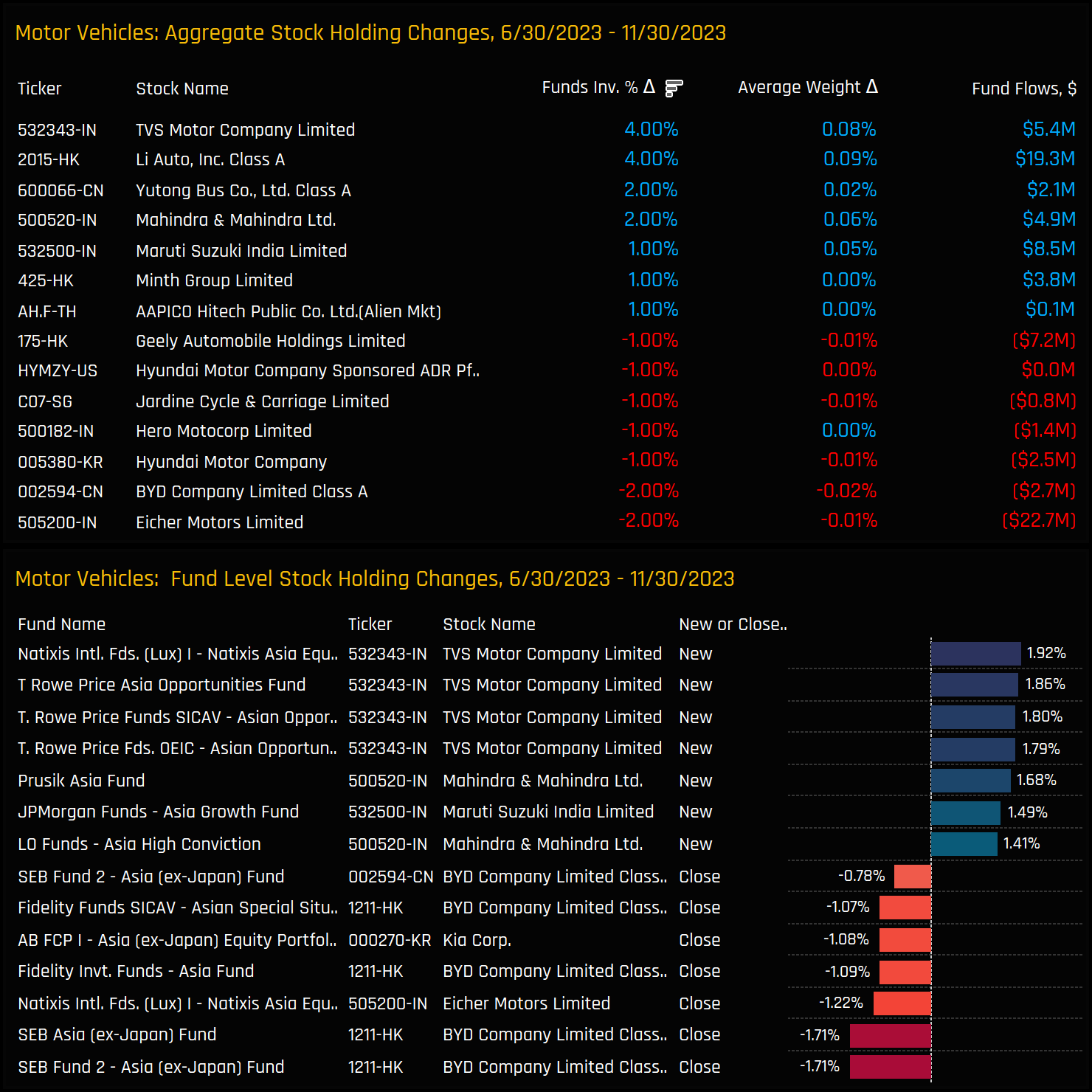

Stock Holdings & Activity

Incorporating stocks from across the region, BYD Company emerges as the most popular name in the Autos sector, held by a quarter of managers with an average weight of 0.38%. Li Auto ranks just after the two leading Indian companies, followed by the notable South Korean autos, Kia Corp and Hyundai Motors. In general though, ownership levels are very low for most of the Auto stocks in the region. Noteworthy individual stakes in specific companies include GS Funds’ 5.8% position in Maruti Suzuki and Mirae ESG Asia’s 5.3% stake in BYD Company.

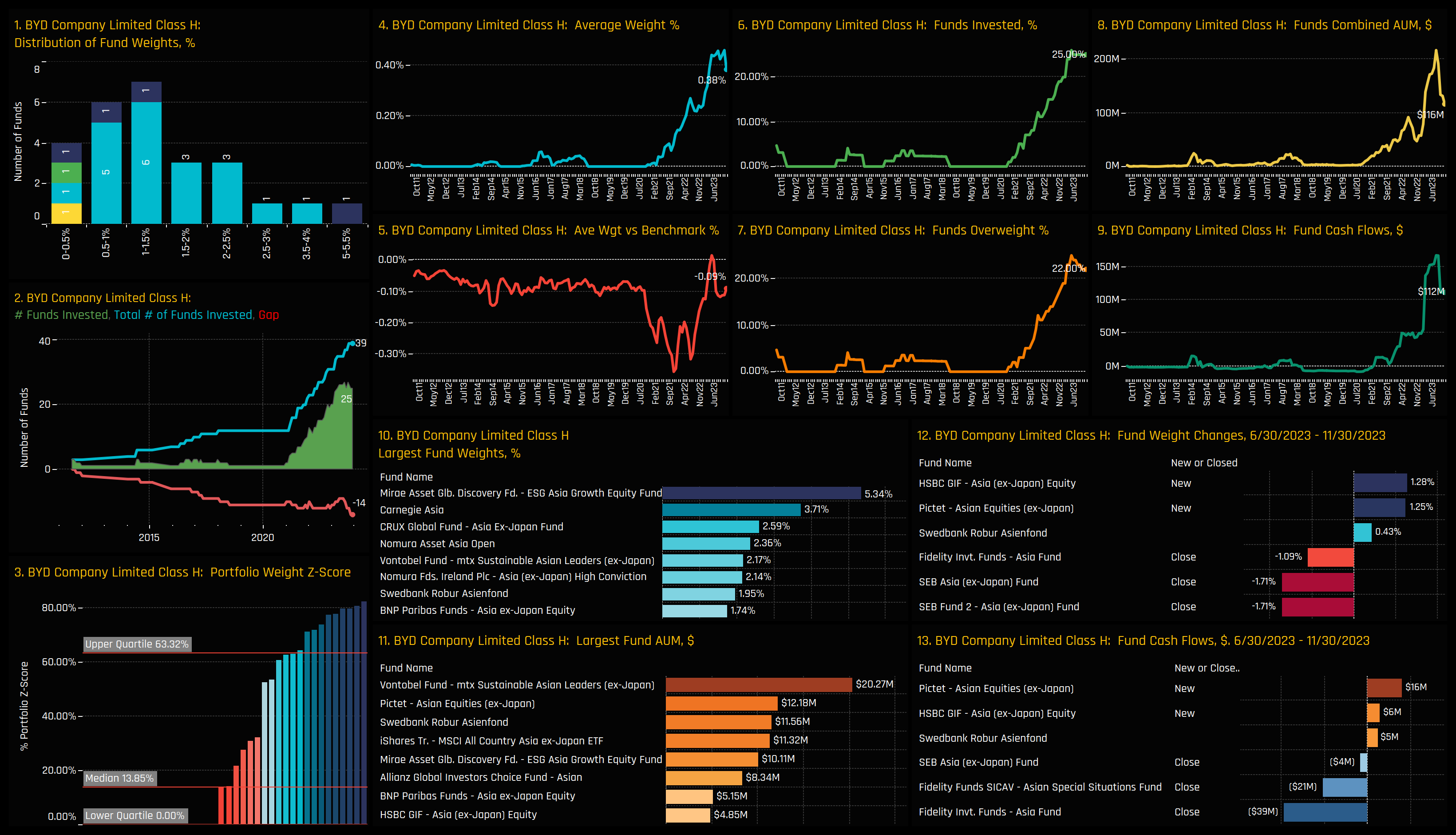

BYD Company Focus

BYD Company, after experiencing significant ownership growth from 2020 to 2023, now stands as the most widely held stock in the industry group. Recently, however, ownership levels have begun to stabilize, with select funds from Fidelity to SEB reducing or closing their positions. While the majority of the current investor base hold position sizes in BYD Company below 2.5%, there are exceptions, led by Mirae ESG Asia (5.3%), Carnegie Asia (3.7%) and CRUX Asia Ex-Japan (2.6%). The PDF attachment at the end of the report contains profiles for all major Motor Vehicle stocks.

Fund Holdings & Activity

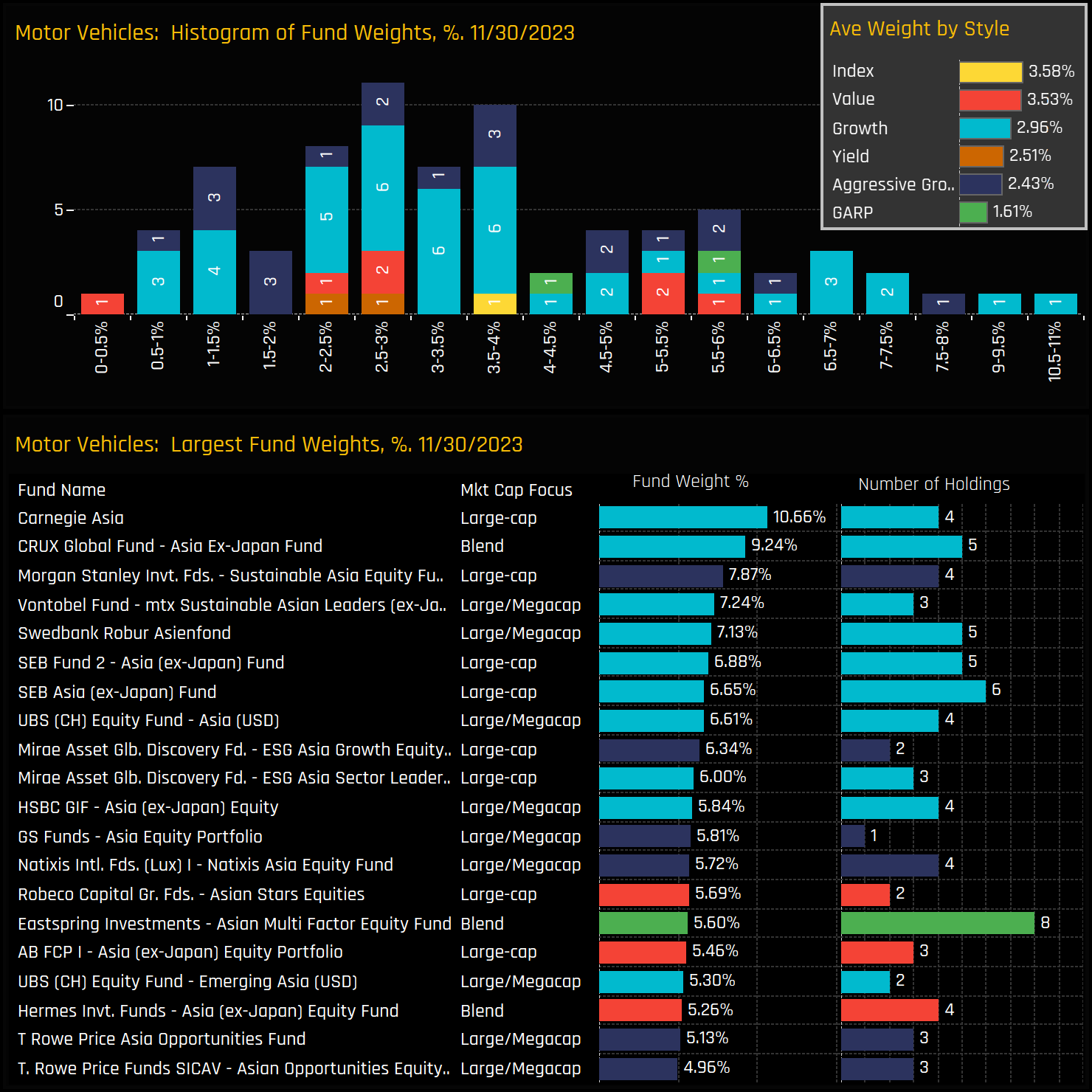

The top chart below illustrates the range of fund weights in the Motor Vehicles sector as of the end of November, revealing a core grouping of funds with allocations in the 2-4% range and a smaller group extending beyond 6%. Despite Growth and Aggressive Growth investors dominating 16 of the top 20 allocations, the limited number of Value investors in our analysis hold a comparatively higher average weight.

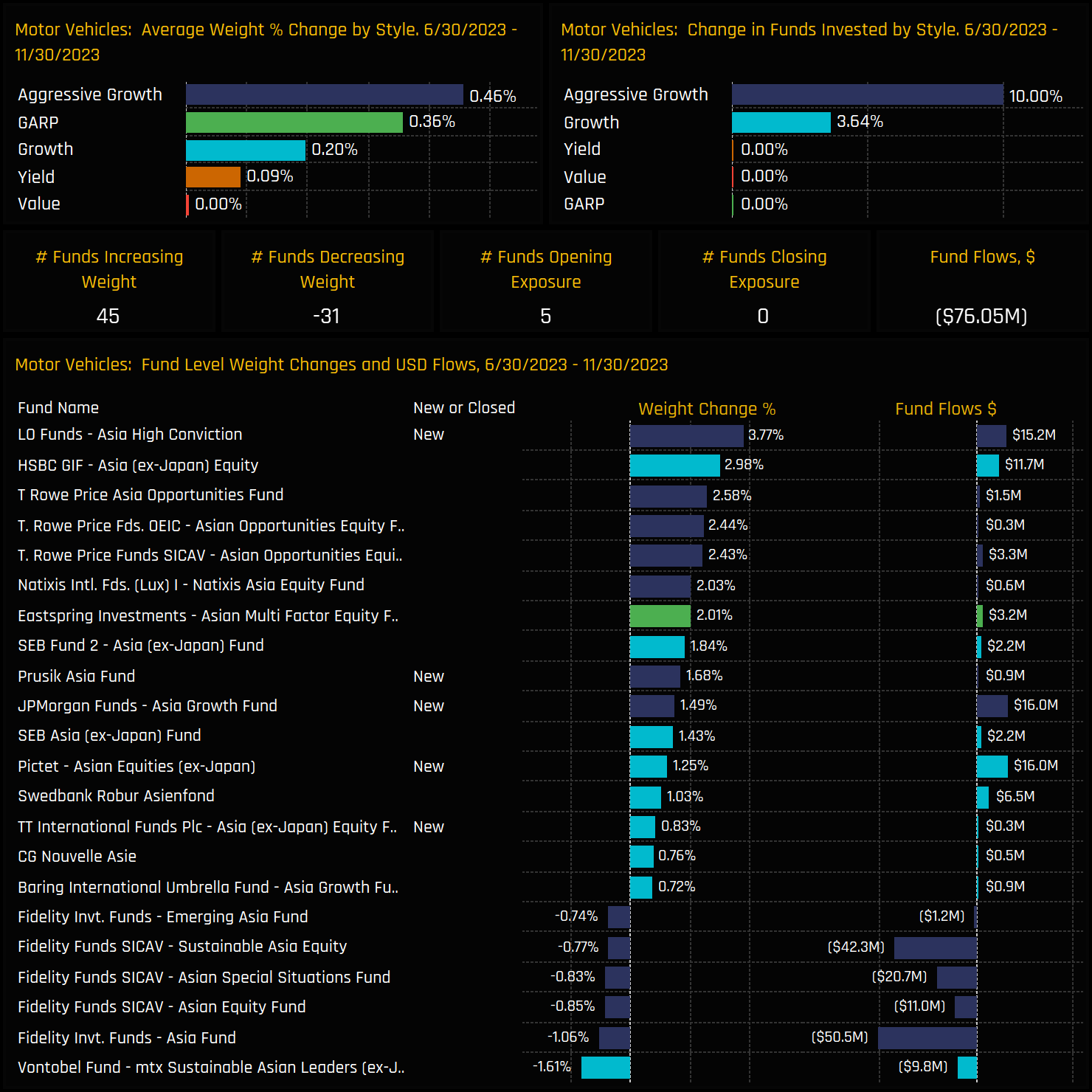

Fund activity in the Motor Vehicles sector between 06/30/2023 and 11/30/2023 reflects the net positive trend, with five new positions opened and none closed. Gains outnumbered reductions, with 45 funds increasing and 31 decreasing their weights. Increases were led by LO Funds Asia High Conviction and HSBC Asia Ex-Japan. It wasn’t entirely positive, with outflows from Fidelity and Vontobel contributing to a total net outflow of $76m during the period, highlighting some cautiousness in the sector.

Conclusions & Links

The adjacent chart illustrates the average fund weights across the six major industry groups within the Consumer Discretionary sector. A key shift occurred in 2016 when Internet Retail surpassed Motor Vehicles in average fund weight, with the spread peaking at over 8% in late 2020. The subsequent decline in Internet Retail stocks corresponded with a rebound in Motor Vehicle stock allocations. Over the past three years, the gap between these two industries has steadily narrowed, reaching its smallest differential since 2018 of ~2.4%.

On our metrics then, we appear to be witnessing a tangible improvement in sentiment towards the Asia Ex-Japan Motor Vehicles sector, evidenced by rising allocations and an increasing number of funds reinstating their exposure. Given the sector’s current low positioning relative to historical levels and its net underweight status against benchmarks, these factors could well underpin robust demand for Motor Vehicle stocks in the months ahead.

Click below for an extended data report on Motor Vehicles positioning among Asia Ex-Japan funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- June 28, 2023

Asia Ex-Japan Fund Positioning Analysis, June 2023

86 Asia Ex-Japan Equity Funds, AUM $54.5bn Asia Ex-Japan Fund Positioning Analysis, June 2023 I ..

- Steve Holden

- September 28, 2023

Asia Ex-Japan Fund Positioning Analysis, September 2023

103 Asia Ex-Japan Funds, AUM $61.4bn Asia Ex-Japan Fund Positioning Analysis, September 2023 In ..

- Steve Holden

- October 30, 2023

Asia Ex-Japan Fund Positioning Analysis, October 2023

100 Active Asia Ex-Japan Funds, AUM $54bn Asia Ex-Japan Fund Positioning Analysis, October 2023 ..