149 Active MSCI China Funds, AUM $45bn

Precious Metals Buck Weakening Materials Trend

• Rotation in to China Precious Metals stocks pushes ownership to record levels, bucking the trend of overall Materials sector decline.

• Precious Metals overtake Industrials Specialties as the largest industry holding in the Materials sector.

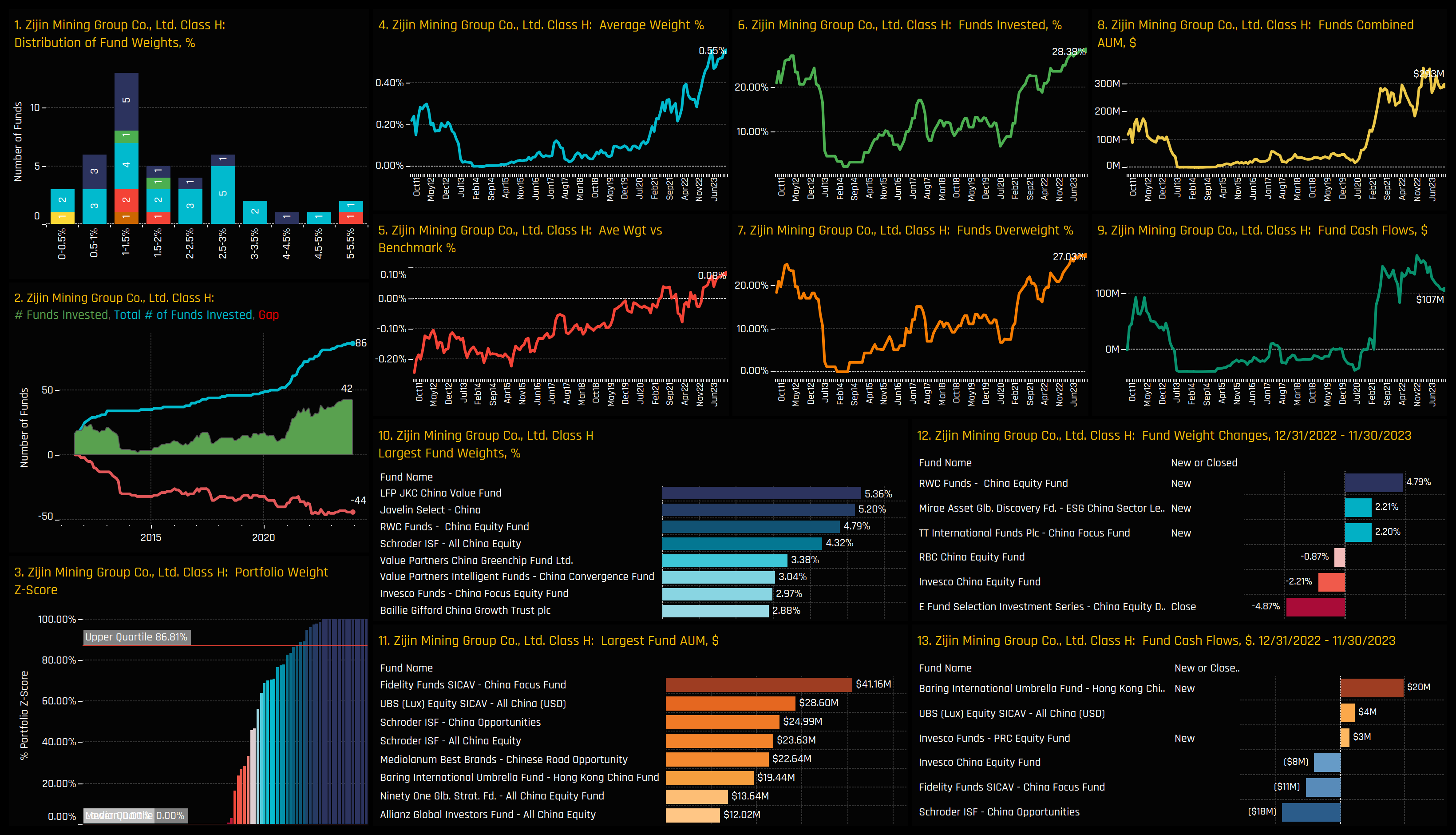

• Zijin Mining Group soars to new ownership highs, attracting funds such as RWC, Mirae and TT International over the course of 2023.

• Second tier stocks showing signs of life, though remain lightly held among investors.

Precious Metals vs China Materials

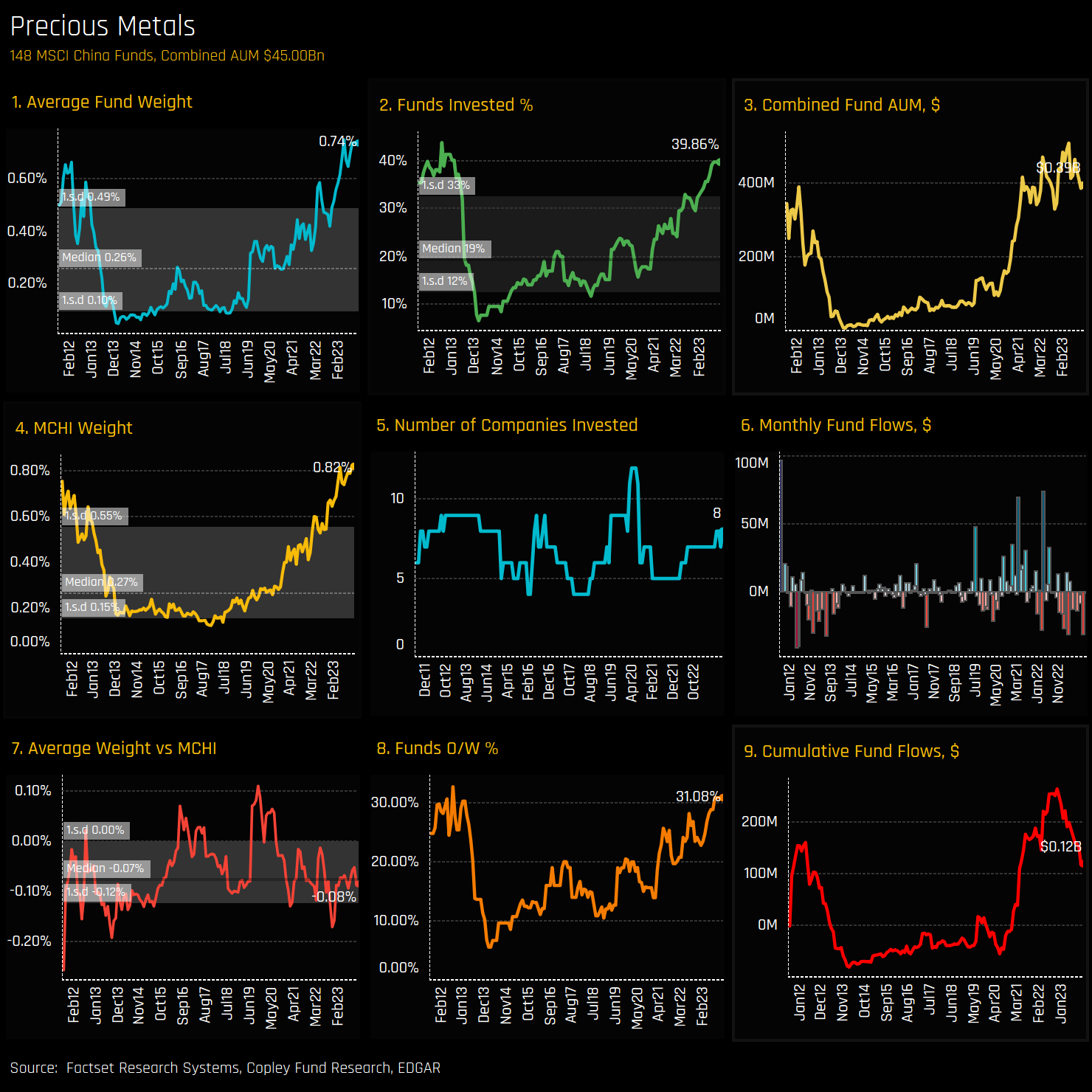

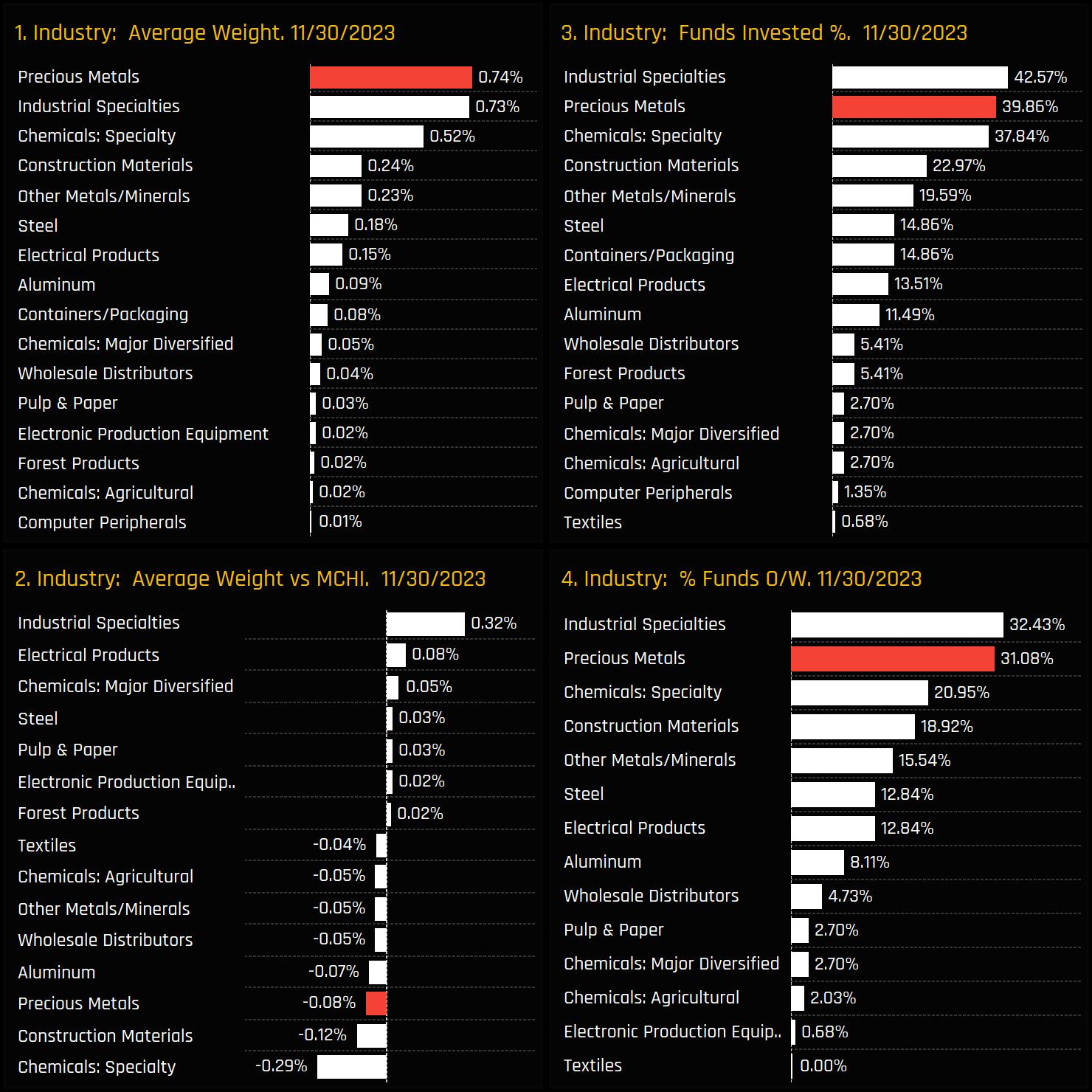

Active China funds continue to raise allocations to the Precious Metals sector. The 9-chart dashboard below documents this rise, with most measures of fund ownership in a multi-year bull trend. Average fund weights of 0.74% are near all-time highs (ch1), so too the percentage of funds with exposure at 39.9% (ch2). Commensurate with these increases, the iShares MCHI ETF is also at peak weights, so active China funds are merely keeping in line with the benchmark, as chart 7 depicts.

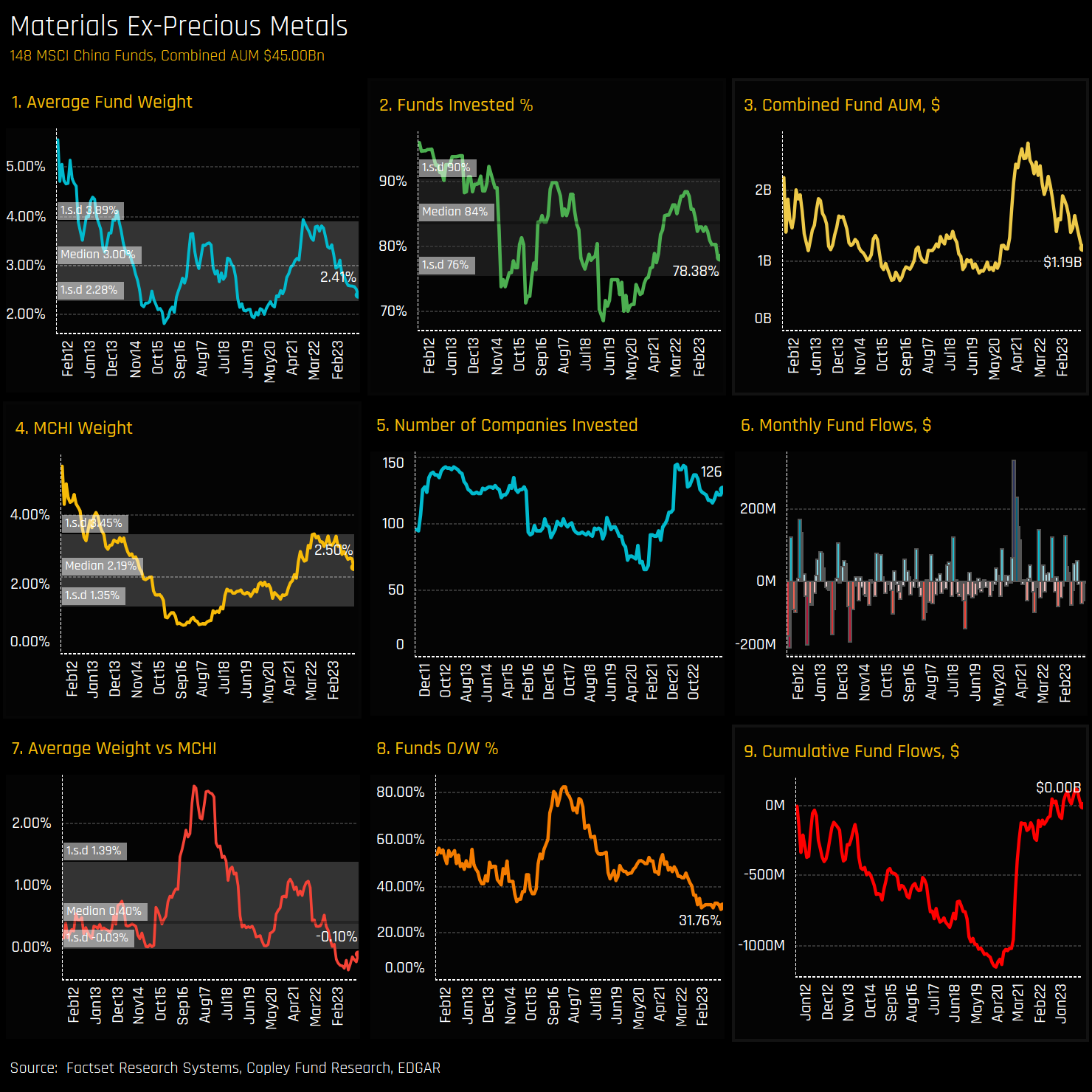

The increased focus on the Precious Metals sector is in contrast to the broader trends observed in the Materials sector. The charts below show the same ownership statistics for the Materials sector, excluding the Precious Metals industry group. Although allocations in the Materials sector (ex-Precious Metals) increased from 2020 to 2021, a downward trend began around mid-2022. Since then, there has been a noticeable decline in both fund weights and overall ownership, with exposure levels close to the lower end of the 10-year range.

Industry Sentiment & Long-Term Trends

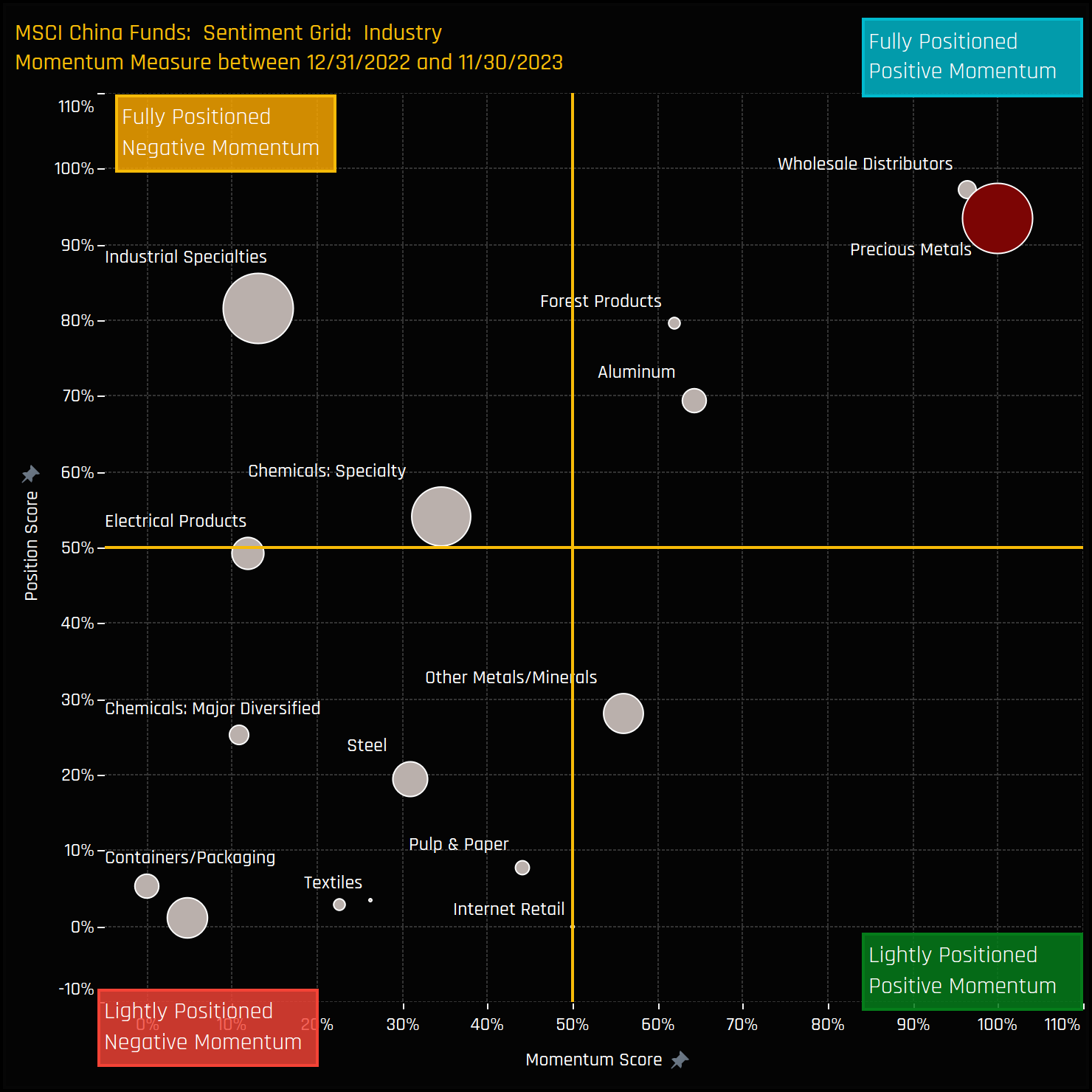

This disparity becomes more apparent when we analyze the positioning and momentum of each industry group within the Materials sector. The Grid’s Y-axis below represents the ‘Position Score,’ which quantifies the current positioning of each industry relative to its own history since 2011, scaled from 0 to 100%. The X-axis displays the ‘Momentum Score’, reflecting the activity of fund managers in each industry from 12/31/2022 to 11/30/2023, ranging from 0% (maximum negative activity) to 100% (maximum positive activity). In this context, Precious Metals, positioned in the top-right quadrant, markedly differs from other major industry groups, which are either experiencing negative momentum or lower levels of positioning compared to their historical averages.

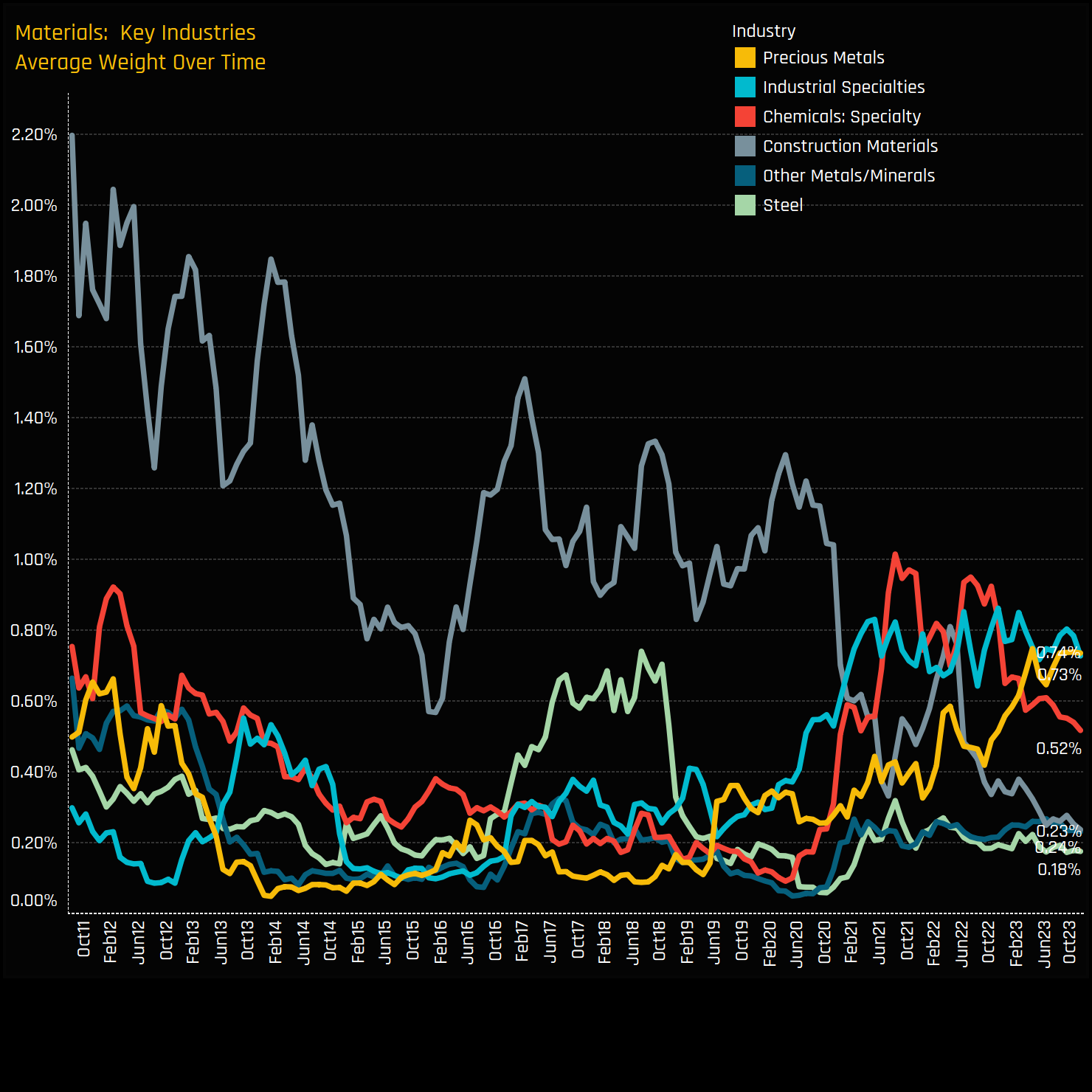

The time series chart below tracks the average weights of the six largest industry groups in the Materials sector, providing insights into the sector’s composition changes over time. A key observation is the significant decline in the Construction Materials industry group, where weights have fallen from over 2% in 2011 to just 0.24% today. More recently, weights in the Specialty Chemicals group have decreased from their highs, while those in Industrial Specialties have remained stagnant. This is against a backdrop of steadily increasing weights in the Precious Metals industry group.

Fund Holdings & Activity

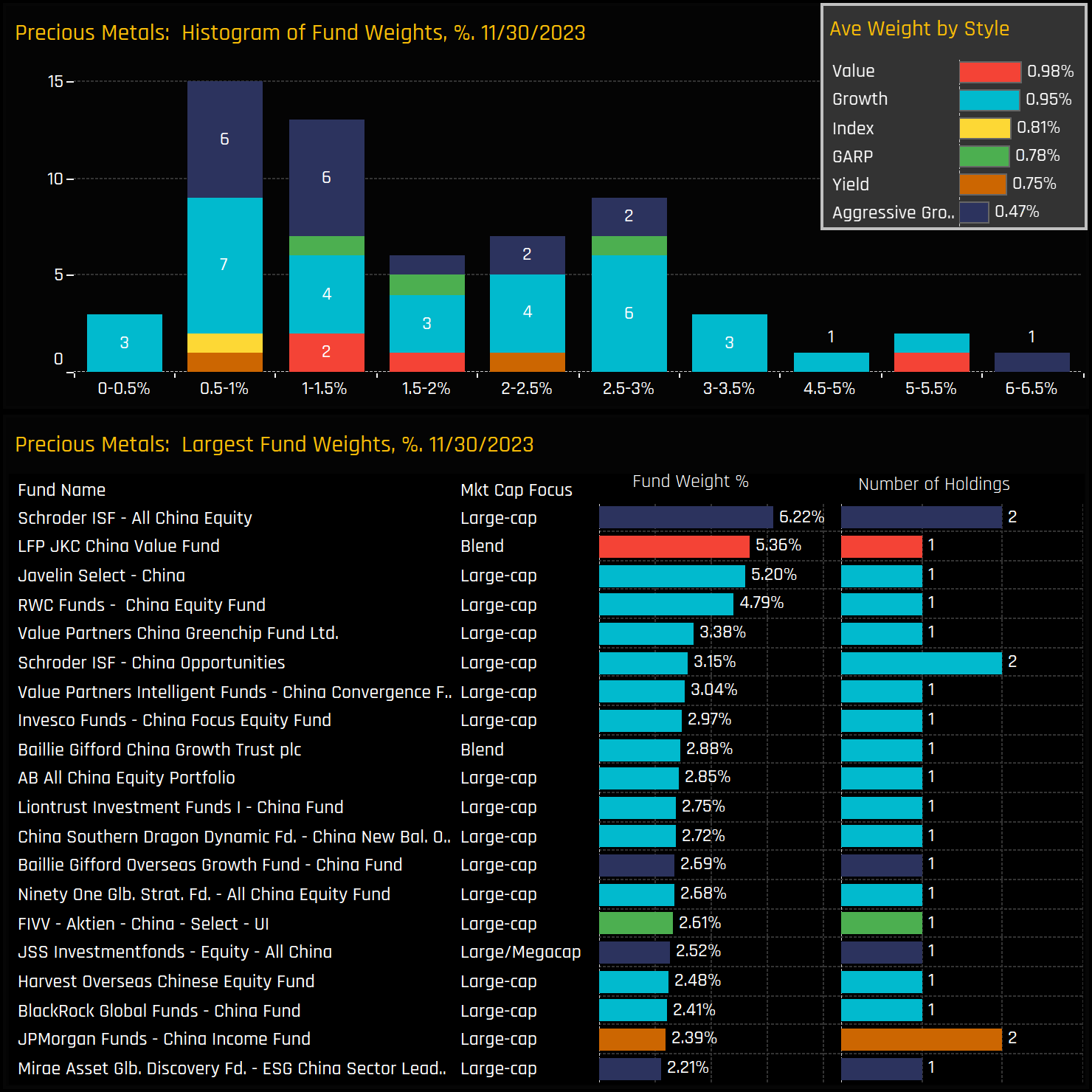

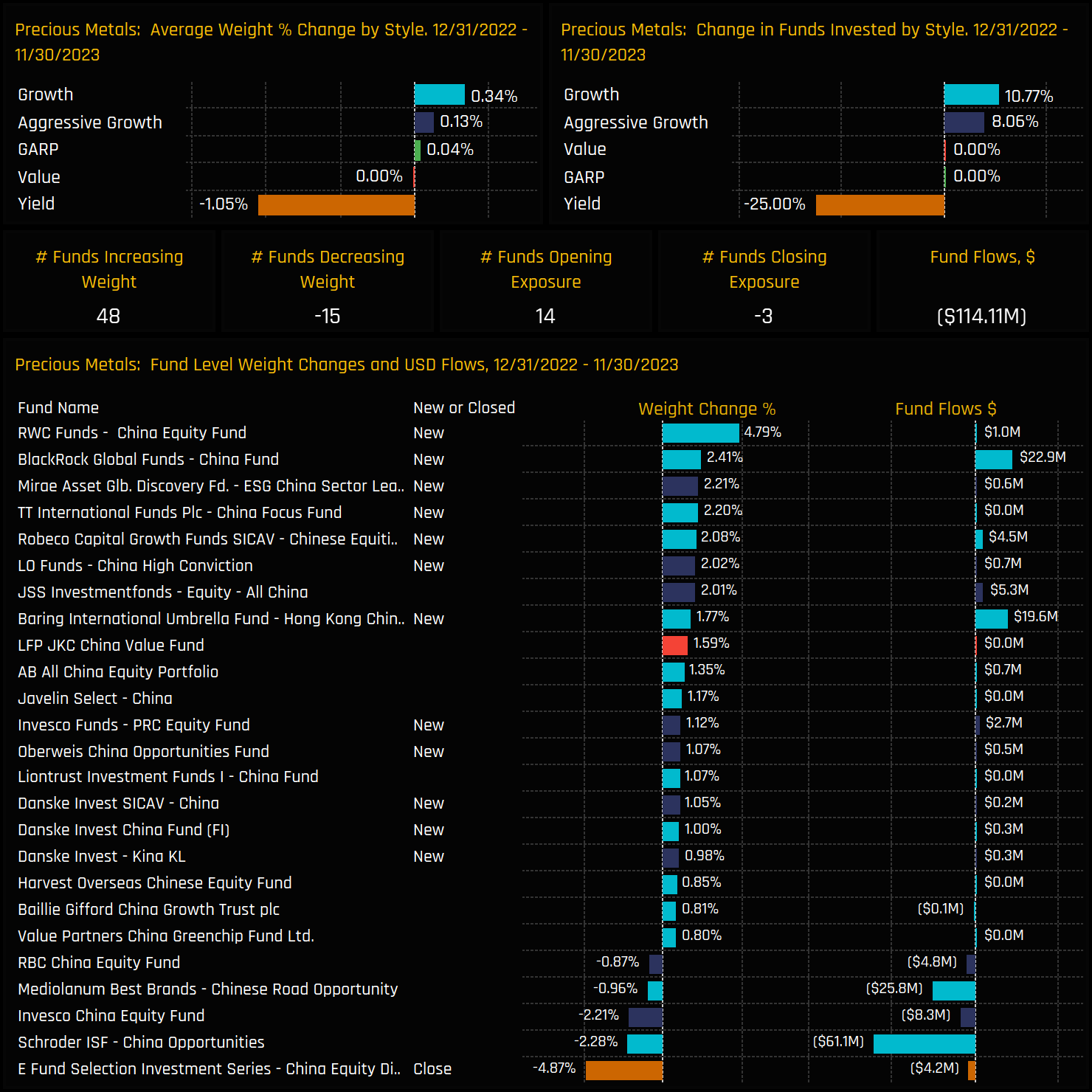

Analyzing fund allocations within the Precious Metals industry group, the top chart below presents a histogram of fund weights. Most funds are concentrated in the range of 0.5% to 3%, with a few outliers at the top end, notably Schroders All China Equity at 6.22% and LFP JKC China Value at 5.36%. All style groups appear well represented, with the small number of Value funds in our analysis sharing similar allocations to the many Growth and Aggressive Growth strategies.

Fund activity through the course of the year shows a definite positive skew, backing up what we see at the aggregate level. Over the period, 48 funds saw weights increase compared to 15 decreasing, with 14 funds opening new exposure compared to 3 closing. The momentum was largely driven by international players, with RWC China Equity opening a significant 4.79% position. BlackRock China and Mirae ESG China followed suit with 2.41% and 2.21% positions respectively. Despite these positive movements, the sector experienced net outflows of $114 million, primarily due to position reductions by Schroders and Mediolanum.

Stock Holdings & Activity

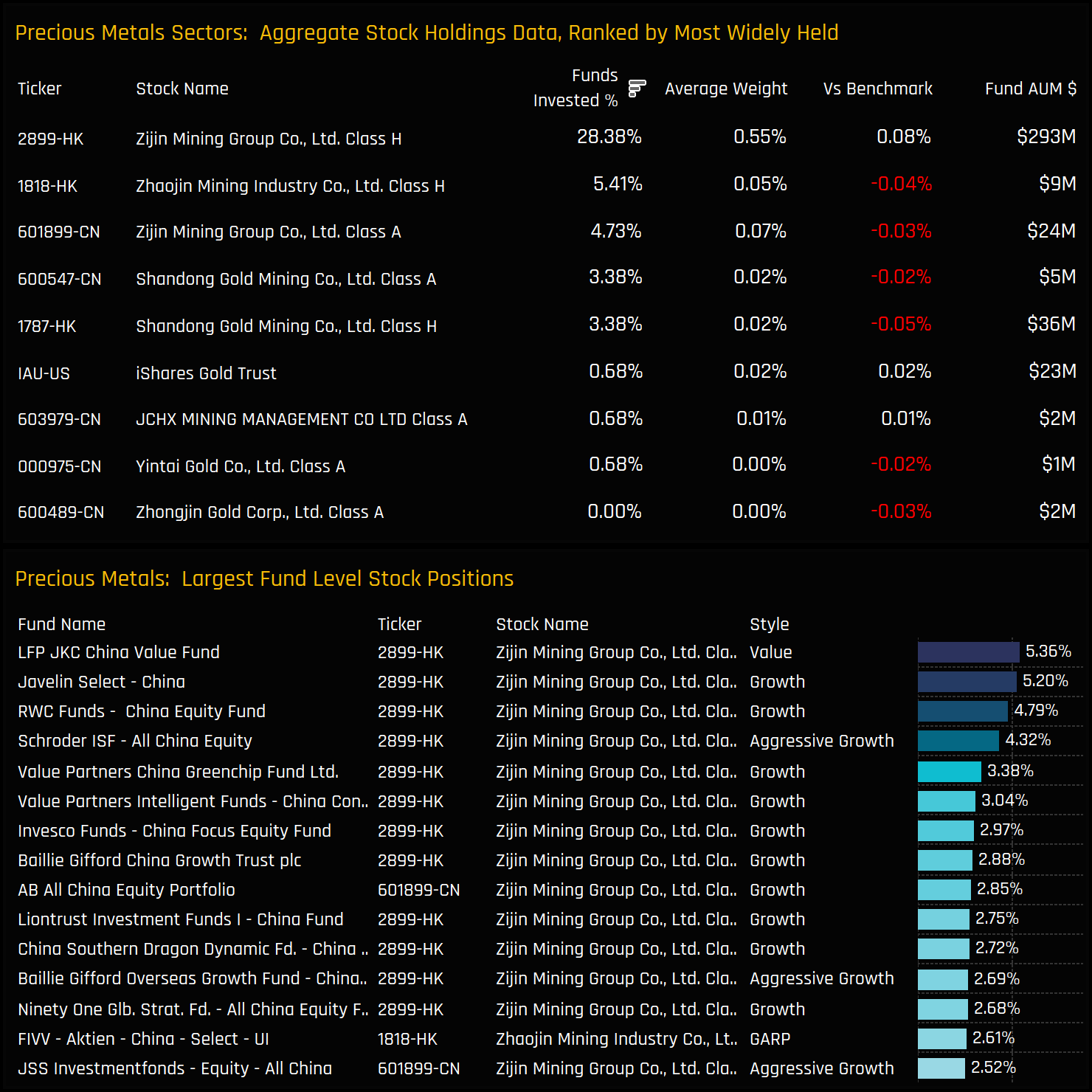

The Precious Metals Industry group is comprised of holdings in just 8 companies, but heavily skewed towards 1. Zijin Mining Group is owned by 28.4% of funds and accounts for 74% of the total Precious Metals allocation. It also accounts for 14 of the largest 15 individual fund positions, as shown in the bottom chart. There are other players in the picture though, with small but not insignificant holdings in Zhaojin Mining Industry and Shandong Gold Mining.

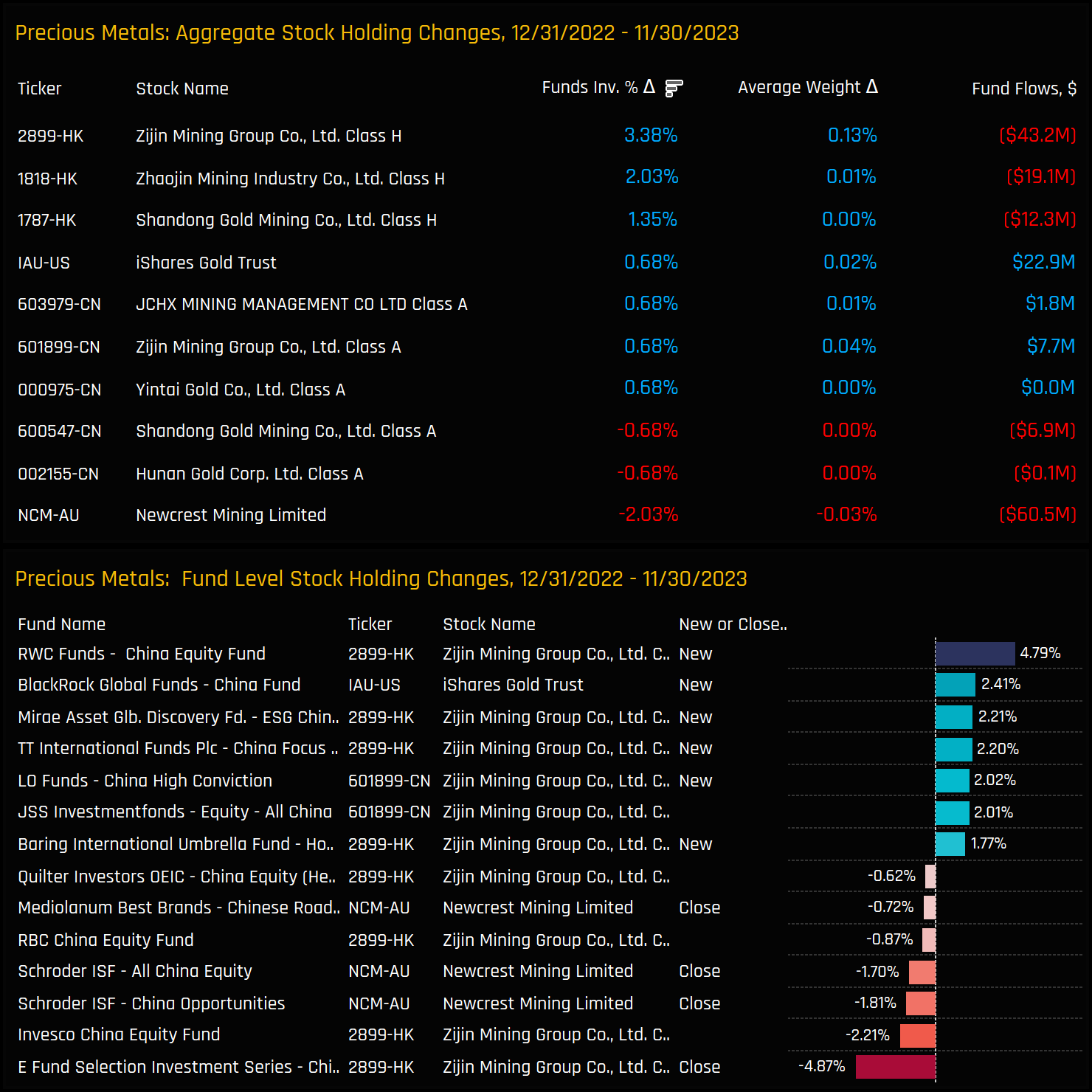

Throughout 2023, stock activity reflected the overall positive trend, although it wasn’t entirely one-directional. Zijin Mining Group experienced a notable uptick in interest, with a net +3.4% of the 149 funds in our analysis initiating positions. Zhaojin Mining Industry and Shandong Gold Mining also saw smaller yet significant increases in ownership. On the other hand, two Schroders China strategies exited their positions in out-of-benchmark Newcrest Mining. The majority of the fund-level activity, however, was concentrated around Zijin Mining Group.

Stock Profile: Zijin Mining Group

The recent shift towards Zijin Mining Group has pushed ownership to unprecedented levels. This is evident across various measures: average fund weights (ch4), relative to benchmark weights (chart 5), the proportion of funds invested (chart 6), and the percentage of funds positioned overweight (chart 7) have all reached record highs. While most managers maintain portfolio allocations below 3% (chart 1), LFP JKC China Value and Javelin Select China stand out with 5%+ fund weights (chart 10). New investments by RWC China Equity, Mirae ESG China, and TT International China Focus contributed to this trend, with E Fund China Dividend being the only significant exit. Chart 2 displays the total ever (blue line) versus current (green line) number of funds invested in Zijin, suggesting that 44 funds have past experience with Zijin but are not currently invested.

Conclusions & Links

The charts on the right provide the most recent ownership data for each industry group within the China Materials sector. In this context, Precious Metals emerge as the industry with the largest average weight (ch1), whilst ranking second in both funds invested (ch3) and funds positioned overweight (ch4).

Compared to the benchmark, industry-level positioning generally aligns closely with the iShares MSCI China ETF, with overweights in Industrial Specialties offset by underweights in Specialty Chemicals (ch2). Precious Metals positioning is largely in line with the benchmark on an average weight basis, but as chart 4 indicates, the majority (69%) of funds are still positioned underweight.

On a stock level, Zijin Mining Group stands out as the preferred choice. However, as this stock becomes more crowded, the potential value in second-tier stocks like Zhaojin Mining Industry and Shandong Gold Mining should also be a consideration.

Click below for the extended data report on China’s Precious Metals Industry Group.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 10, 2022

China A-Shares: Health Care Fall

115 Active China A-Share Funds, AUM $63bn. China Health Care Health Care weights among China A- ..

- Steve Holden

- January 12, 2023

Greater China Funds: 2022 Performance & Attribution Report

45 Active Greater China Funds, AUM $17bn. 2022 Performance & Attribution Report In this rep ..

- Steve Holden

- March 28, 2024

MSCI China Funds: Stock Radar

125 MSCI China active equity funds, AUM $38bn MSCI China Funds: Stock Radar Summary In this rep ..