Saudi Arabia Special Report: A Tipping Point in EM Equity Allocations

- Steve Holden

- 0 Comments

- 2023 marks a pivotal year with EM investors significantly increasing holdings in the Saudi market.

- Major EM investors from GQG Partners to Capital Funds record notable fund inflows into Saudi for the first time.

- Despite growing interest, the Saudi market still presents ample room for broader investor engagement.

- Saudi Arabia remains comparatively ‘under-owned’ in relation to its Asian and LATAM peers.

Saudi Fund Ownership Trends

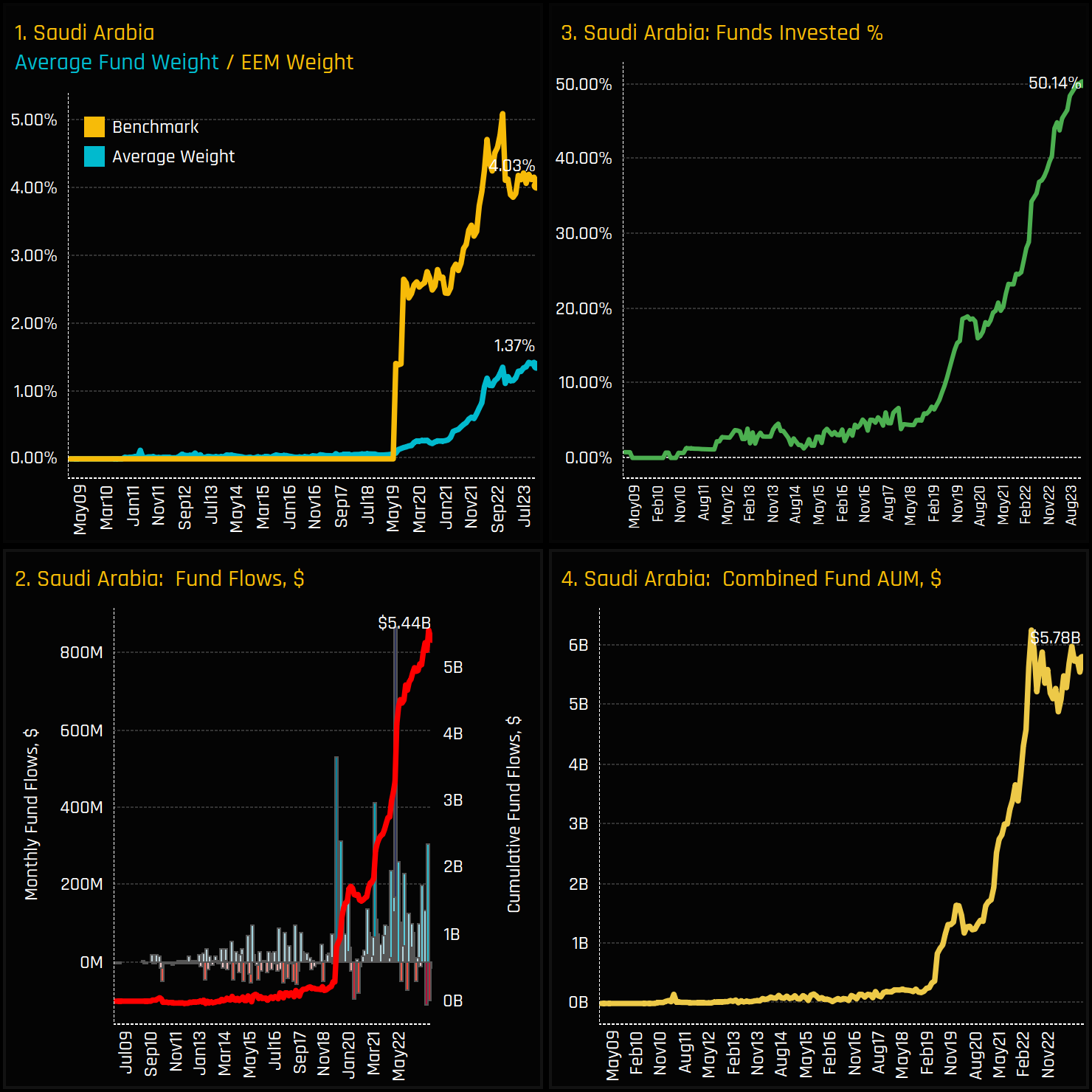

The percentage of active EM funds investing in Saudi stocks has surpassed 50% for the first time in our fund holdings history. Chart 3 opposite shows this remarkable rise in ownership, with the percentage of funds invested in Saudi Arabia doubling over the past 2-years, supported by consistent fund inflows as shown in chart 2. In the 55 months post-MSCI EM entry, 43 months have seen net inflows, totaling $5.15 billion. Average fund weights of 1.37% are close to their highest on record, with total Saudi assets of $5.8bn at the top of the decade-long range.

2023 Fund Activity

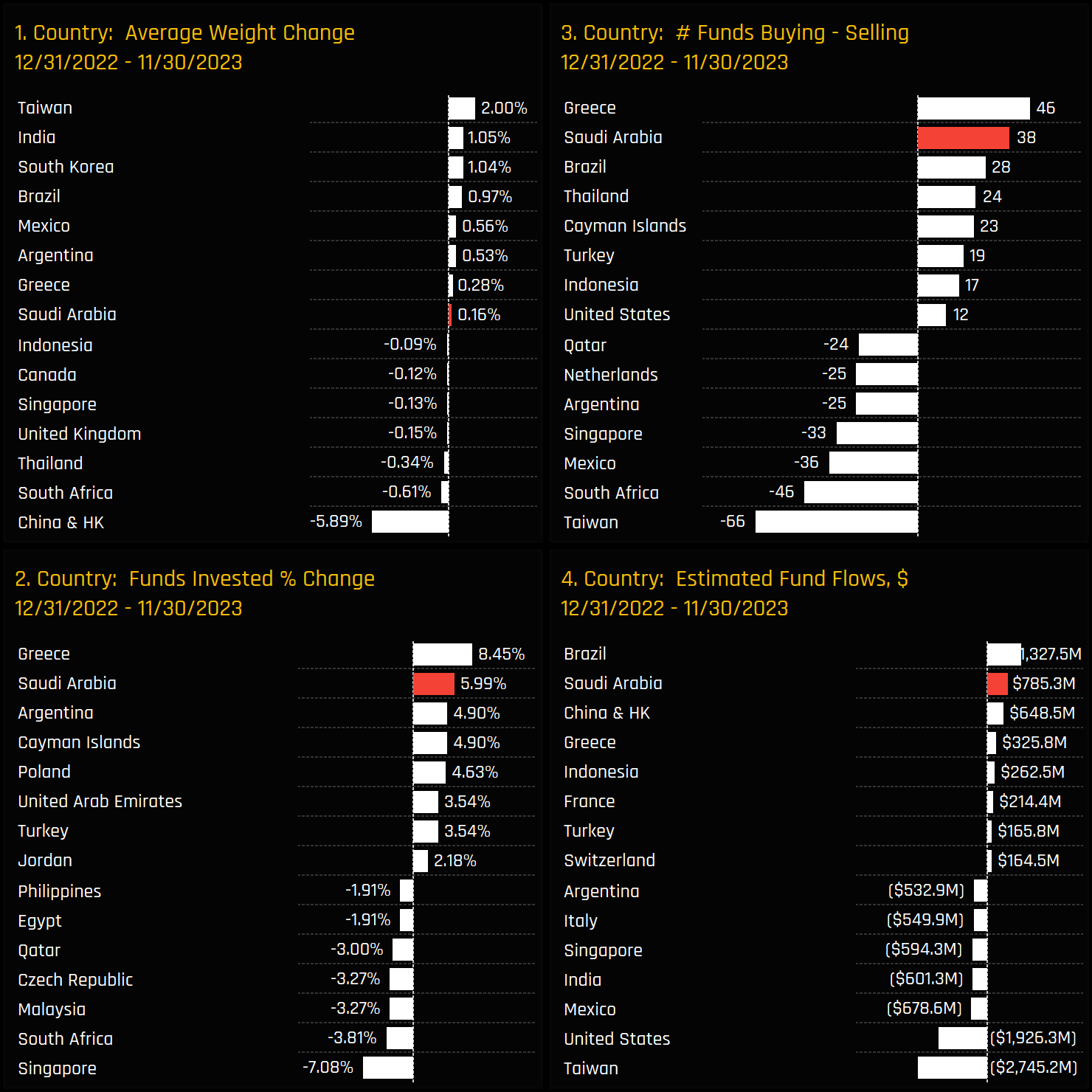

In 2023, Saudi Arabia really gained traction among EM active investors, as seen in the chart collection opposite. It achieved the second-highest fund inflows of $785m after Brazil (ch4), and a significant increase in the percentage of funds invested of +5.9%, just behind Greece (ch2). These metrics reflect a targeted and active reallocation towards Saudi assets over the year

Stock Ownership

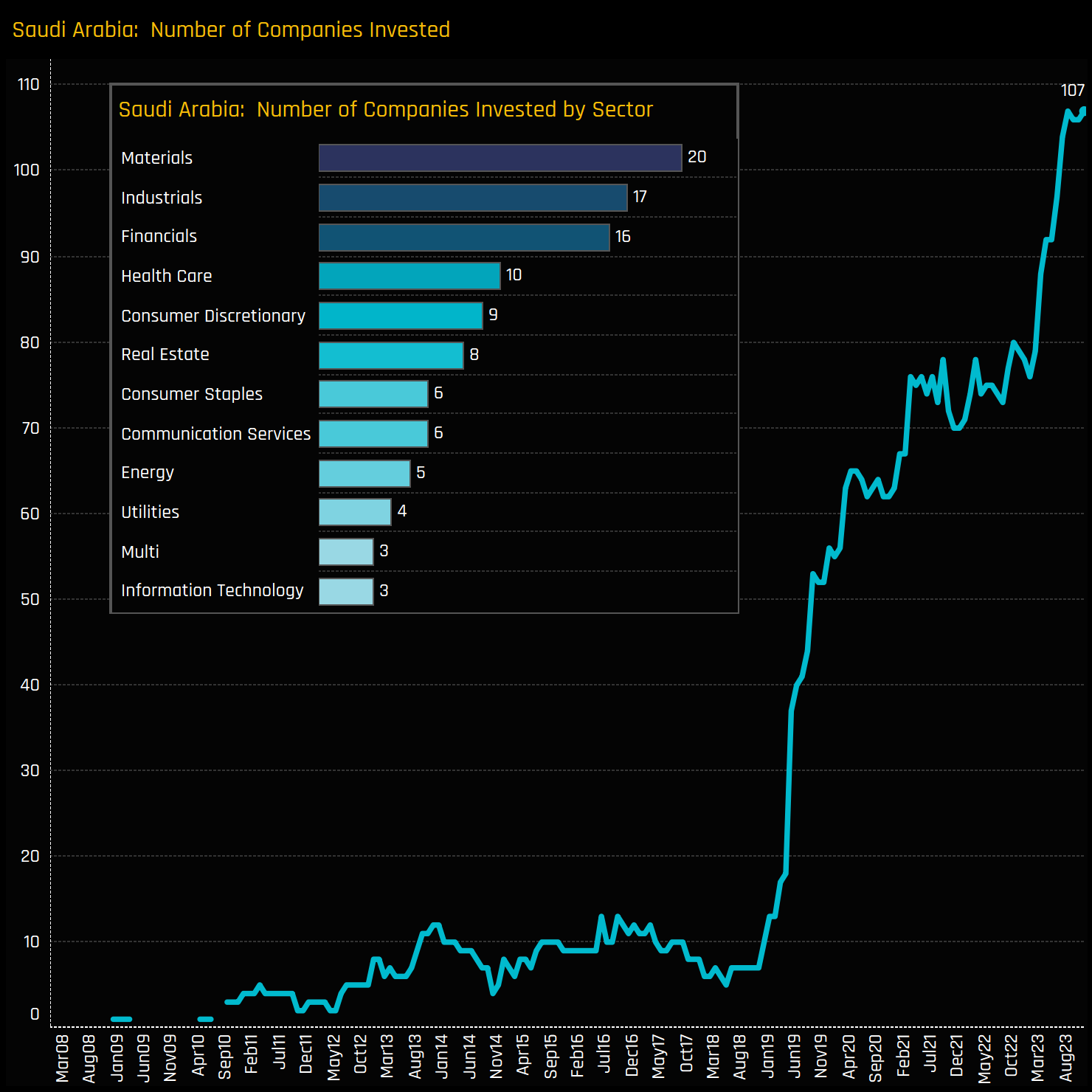

Alongside the rise in overall Saudi investment, there has been an expansion in the breadth of stock holdings. A record 107 companies have now found investment from the 367 EM funds in our analysis, indicating a willingness by investors to explore beyond the major index constituents. By comparison, the iShares MSCI Emerging Market ETF includes only 42 companies.

Under-Owned?

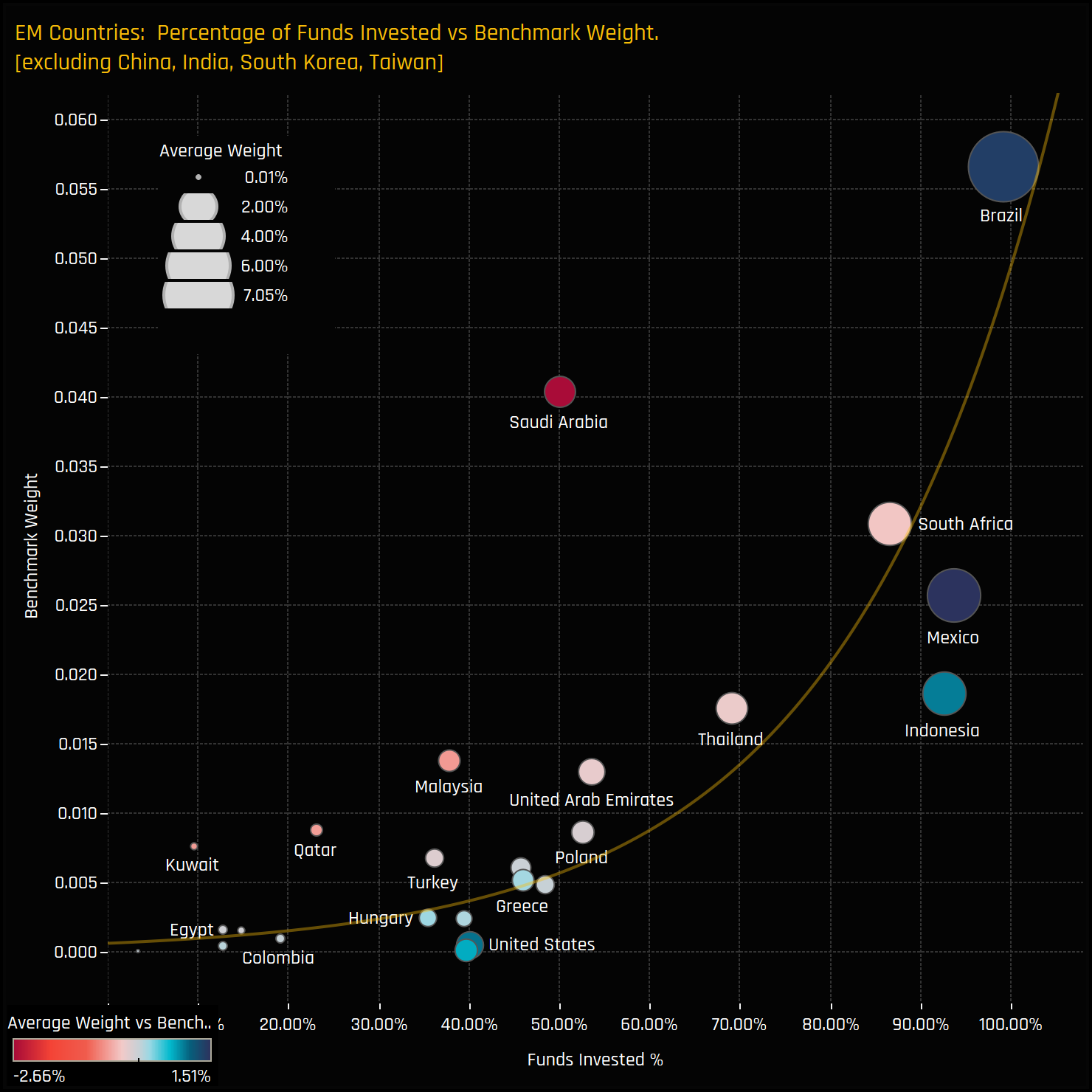

Yet despite this meteoric rise in investment, we would still go as far as saying Saudi Arabia is ‘under-owned’ here. The adjacent chart illustrates the correlation between the percentage of funds invested in each country and their respective benchmark weights. This relationship is positively skewed and grows exponentially towards 100% ownership (which is why we have excluded the universally held China, India, Taiwan, and South Korea from the chart). Saudi Arabia stands as a significant outlier from the trend line. To align with markets such as Brazil, South Africa, and Mexico, around 90% of funds should have exposure to Saudi Arabia. While nothing is certain, the 40% of funds that have yet to invest in Saudi Arabia account for $127 billion in total fund AUM, so the flow potential is real.

Conclusions

Historically, managers have been content with maintaining a benchmark underweight in Saudi, but as an increasing number of active investors increase their exposure, this stance has evolved into a peer group underweight. Consequently, the relative risks associated with non-investment in Saudi are escalating with each passing month.

In the full report, we deep dive in to the most popular stock holdings, the key ownership moves across sectors and stocks and the funds driving this allocation shift. If you are a financial professional and would like to see the full report as part of a trial, please get in touch directly on the email below.

Taken from our Emerging Markets positioning analysis, covering 367 active strategies with a combined AUM of $400bn.

Related Posts

- Steve Holden

- January 15, 2023

Emerging Market Funds: Performance & Attribution in 2022

276 Active GEM Funds, AUM $343bn. 2022 Performance & Attribution Report In this report, we ..

- Steve Holden

- February 20, 2024

Reassessing Turkey: EM Fund Managers Show Signs of Sentiment Shift

361 Global EM Equity Funds, AUM $400bn Reassessing Turkey • After a decade-long bear market i ..