Reassessing Turkey: EM Fund Managers Show Signs of Sentiment Shift

- Steve Holden

- 0 Comments

361 Global EM Equity Funds, AUM $400bn

Reassessing Turkey

• After a decade-long bear market in investor positioning, GEM managers are beginning to show tentative signs of a sentiment shift towards Turkey.

Author: Steven Holden

Date: February 20th, 2024

Fund Universe: Global Emerging Markets Equity

Turkey Positioning Overview

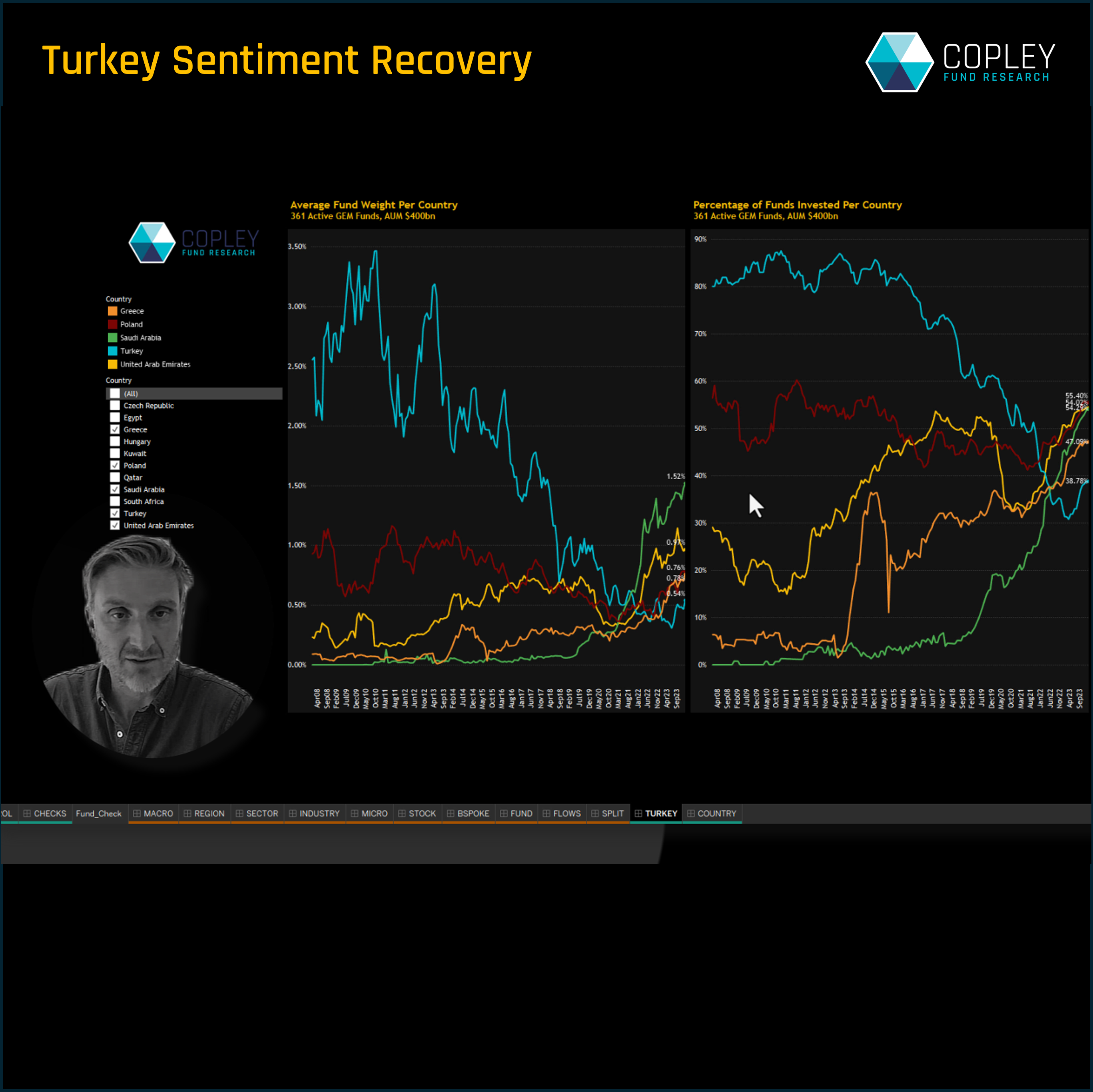

In this video, we look into the fundamentals of Turkish market positioning among active emerging market funds. We show how the decline in Turkey bottomed out in 2023 and has joined Saudi Arabia, Greece, Poland, and the UAE in capturing inflows from the $400bn in combined EM assets in our analysis.

Following this, we spotlight the funds most bullishly positioned in Turkey, including those that have established new stakes since the early 2023 reversal. To conclude, we focus on the equity landscape, highlighting two stocks that have attracted inflows and have become the favoured investments among EM fund managers. We also include below some of the key charts from our full analysis on Turkey positioning this month.

Turkey's Recovery

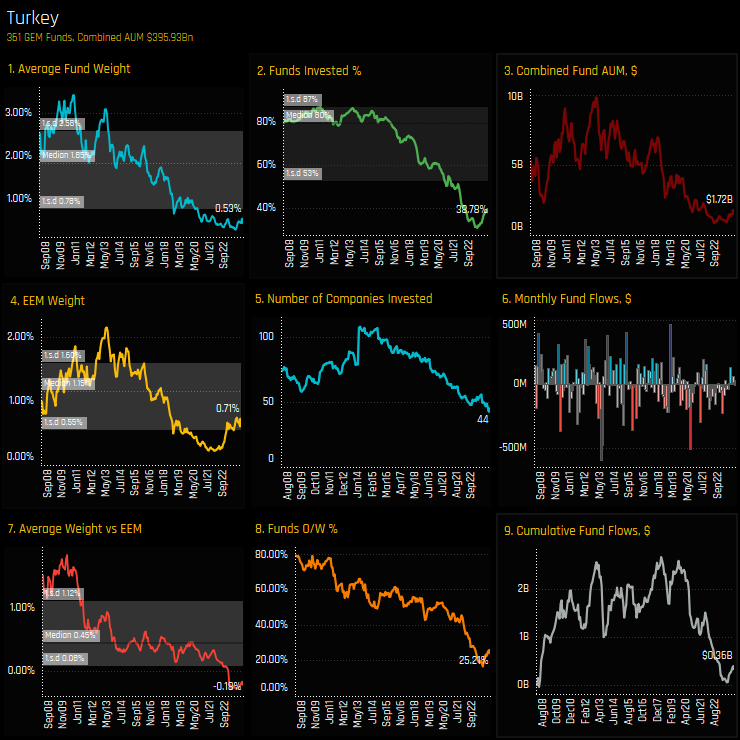

Active Emerging Market funds are showing renewed interest in the Turkey investment case. This follows on from a decade long decline in investor positioning, as evidenced by declining in average fund weights (ch1), the percentage of funds invested (ch2), the number of funds overweight (ch8), and combined fund AUM (ch3) over the past decade.

However, current data indicates a notable shift, marking the first instance of a reversal in this long-standing trend. Since late 2023, most ownership metrics have experienced an upward movement from their previous lows.

Country Level Activity

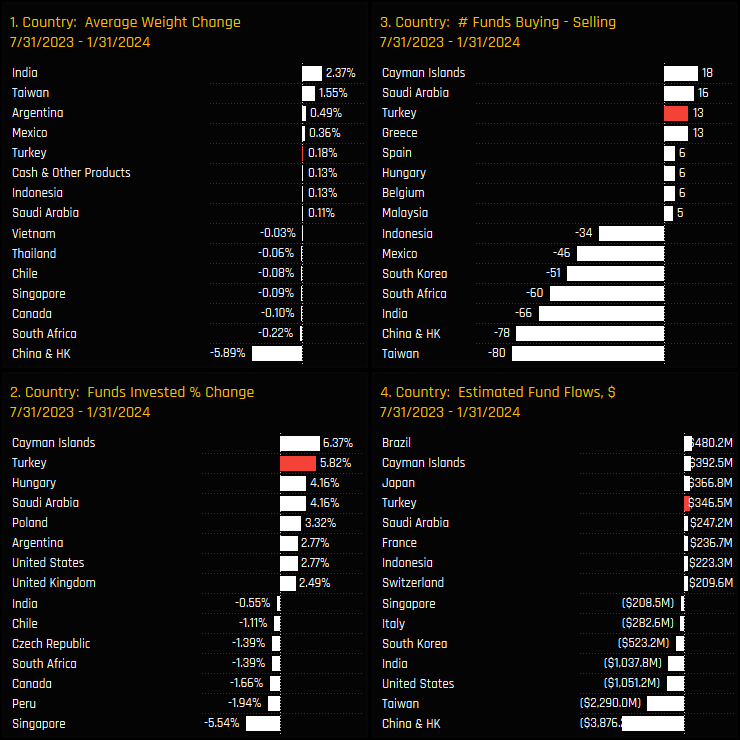

Between July 31, 2023, and January 31, 2024, our analysis reveals a reasonable shift in fund positioning across countries, with a marked active rotation towards Turkey. This adjustment is reflected through an increase in average weight of +0.18%, a rise in the percentage of funds invested by +5.8%, positive fund flows of $347 million, and a greater number of buyers than sellers.

These indicators, some of the most pronounced among global Emerging Market peers, highlight the proactive nature of the rebalance. This active shift towards Turkey stands in contrast to the clear outward rotation observed in several of the larger Asian nations.

Low Positioning

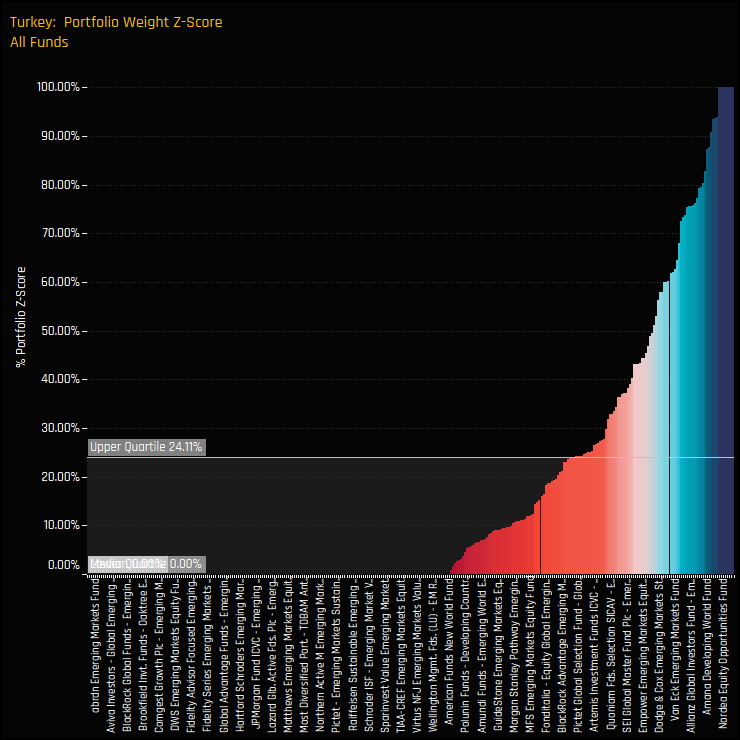

The Turkish investment narrative highlights two main points: firstly, a shift towards positive investor activity, and secondly, that current investment levels remain near historic lows.

The chart opposite calculates the Z-Score for current fund weights in Turkey against all historical monthly observations since 2008, or since the fund’s inception. A Z-Score of 100% indicates the highest recorded weight, while a score of 0% marks the lowest. The chart reveals that 75% of funds have a Z-Score below 24.1%. Most funds are either not invested in Turkey or maintain minimal exposure relative to their historical positions.

The combination of cautious optimism, low current allocations, and a significant track record of investment by emerging market managers suggests potential for further growth in Turkey. With increased scrutiny on some of the larger EM country allocations, notably China, Turkey is once again gaining attention as a compelling alternative within the Global EM landscape.

Analysis taken from our Global Emerging Markets Equity positioning research, covering 361 active strategies with a combined AUM of $400bn. For more information on our research, contact me directly on the email below.

Related Posts

- Steve Holden

- September 21, 2022

EMEA Focus: Allocations Hit All-Time Lows

275 ACTIVE GEM FUNDS, AUM $370BN EMEA Focus: Allocations Hit All-Time Lows In this piece, we pr ..

- Steve Holden

- April 18, 2023

TSMC: Crowded Trade?

384 emerging market Funds, AUM $400bn TSMC: Crowded Trade? Active EM managers are heavily posit ..