98 Asia Ex-Japan Funds, AUM $50bn

Asia Ex-Japan Positioning Insights, February 2024

• The China/India Divide: Spread between 2 nations hits tightest levels on record.

• Tech Allocations Close in on the Highs: Allocations approach the 2021 highs as Tech takes portfolio share from Industrials and Consumer Discretionary.

• Pinduoduo Rotation Continues: Ownership levels hit record highs as funds continue to add exposure.

• Stock Activity Data: The latest stock activity data for Asia Ex-Japan equity funds over the last 6-months.

98 Asia Ex-Japan Funds, AUM $50bn

The China / India Divide

Spread between India and China weights in active Asia Ex-Japan funds narrows to lowest levels on record.

Time-Series Analysis

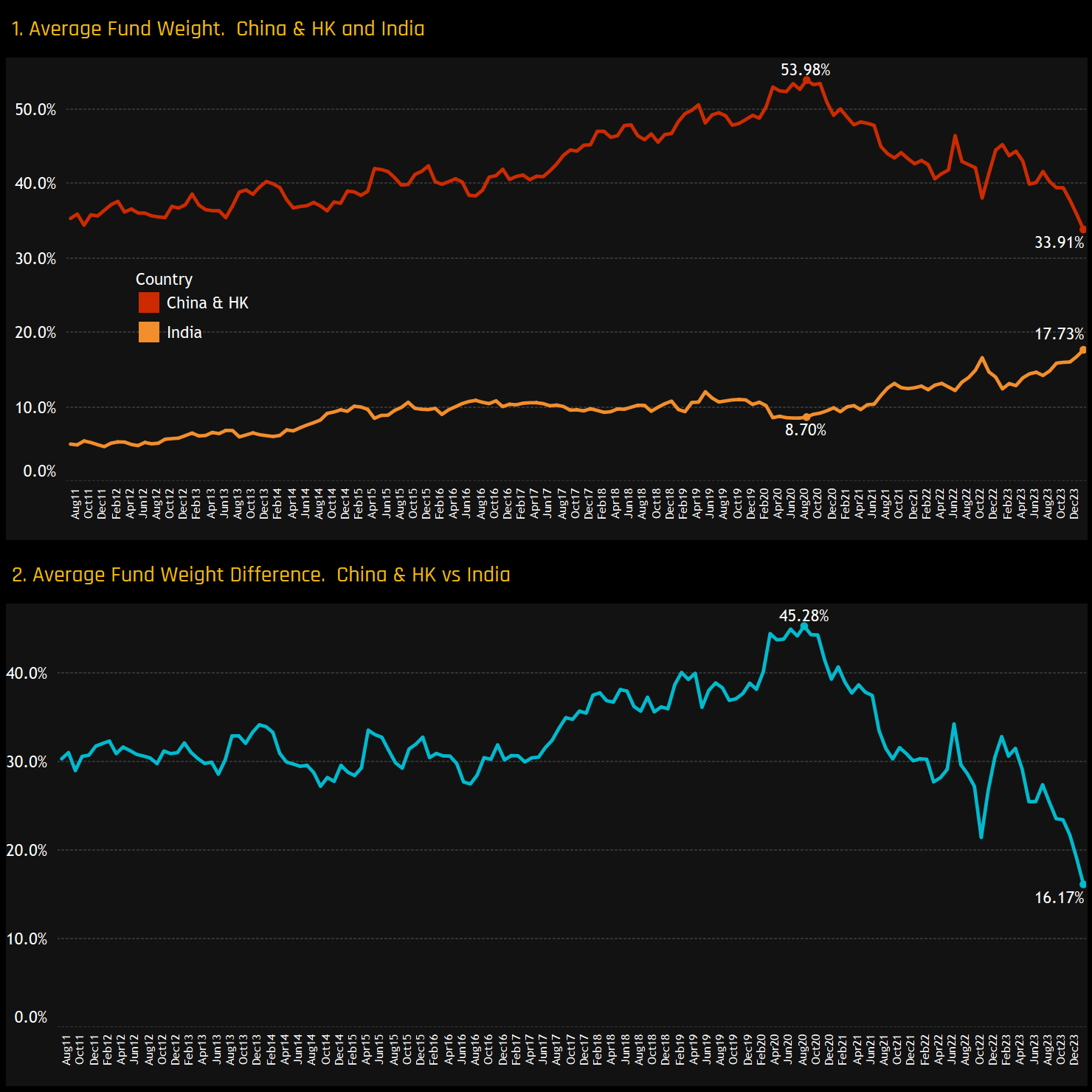

Quite a few commentators have highlighted the narrowing divide between China and India’s weight in the MSCI Indices this month. So we thought it was worth some analysis on the active side. The charts below highlight the average China & HK weight and the average India weight among active Asia Ex-Japan funds. Since the peak spread of 45.3% back in August 2020, there has been a gradual decline on China’s dominance. The current spread of 16.17% is the tightest in our 13-year history.

Sector Drivers

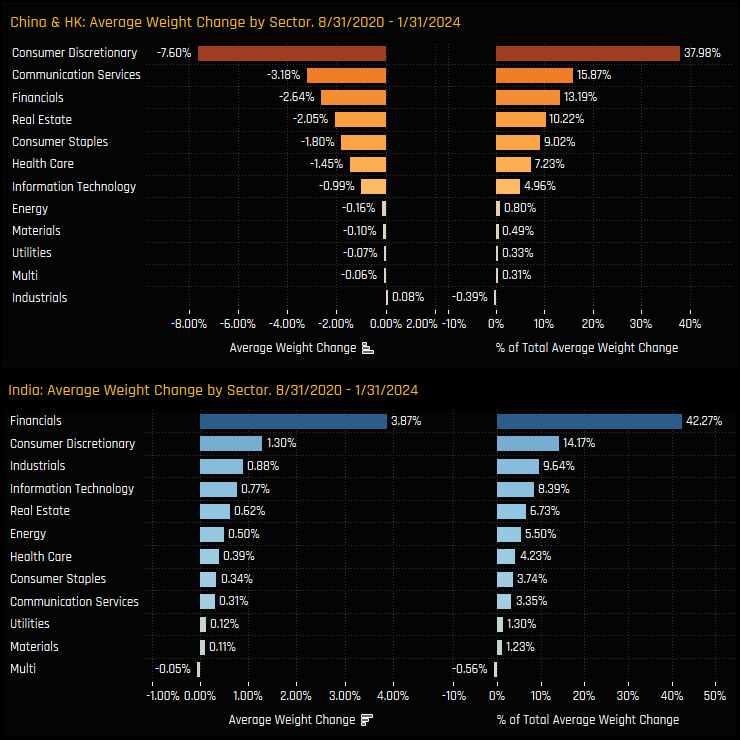

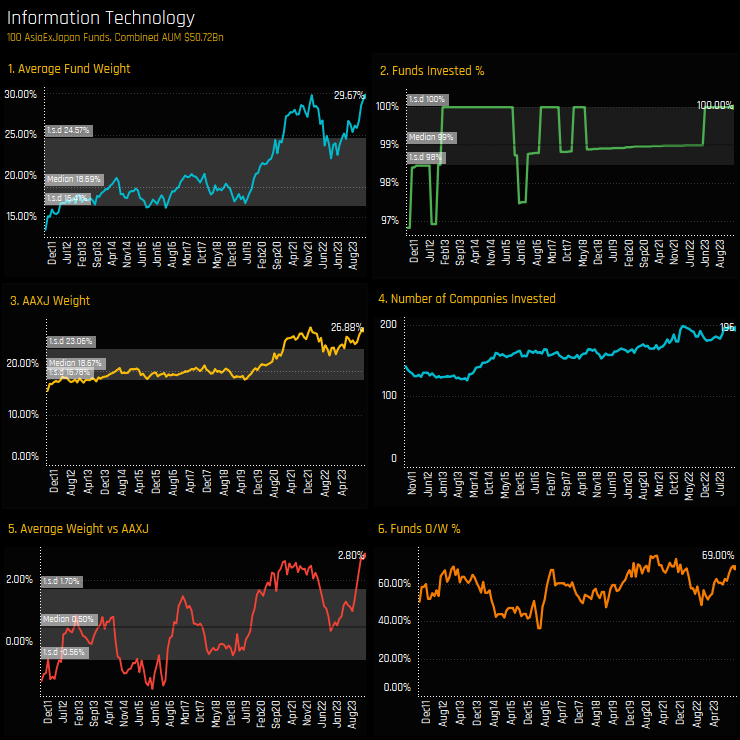

But what is driving this trend? The charts below show the breakdown of the weight changes for China & HK (top) and India (bottom), by sector between 08/31/2020 and 01/31/2024. It also shows the percentage of the total that each sector accounts for in the move. China’s decline is dominated by Consumer Discretionary, Communication Services and Financials, which together account for 67% of the total decline. India’s rise was mainly driven by the Financials sector, with the 3.87% rise in weights over the period accounting for 42.3% of the total move.

Stock Drivers

Drilling down to a stock level, 3 companies in China & HK standout as key drivers of the move lower. Of China & HK’s -20% decline in average fund weight over the same period, 5.1% was driven by Alibaba Group Holdings, -3.05% by Tencent Holdings and 1.17% by Ping An Insurance. Increases in fund weight were minimal, with Pinduoduo Inc, BYD Company and Trip.com seeing moderate upticks.

India’s rise was driven by the 3 banks of ICICI Bank, HDFC Bank and Axis Bank, with all 3 accounting for 37% of India’s 9% rise over the period.

It’s a timely reminder that country allocations are driven by underlying companies, and that sentiment and positioning among a few select names can heavily influence the top-down picture.

Please click on the links below for a comprehensive data pack on both India and China positioning among Asia Ex-Japan funds.

98 Asia Ex-Japan Funds, AUM $50bn

Tech Allocations Close in on the Highs

Allocations approach the 2021 highs as Tech takes portfolio share from Industrials and Materials.

Rising Allocations

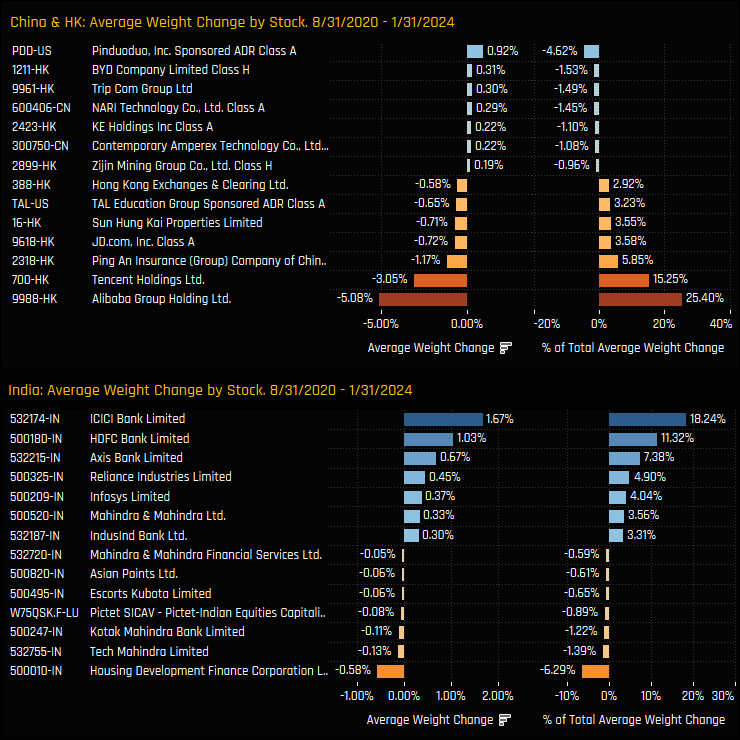

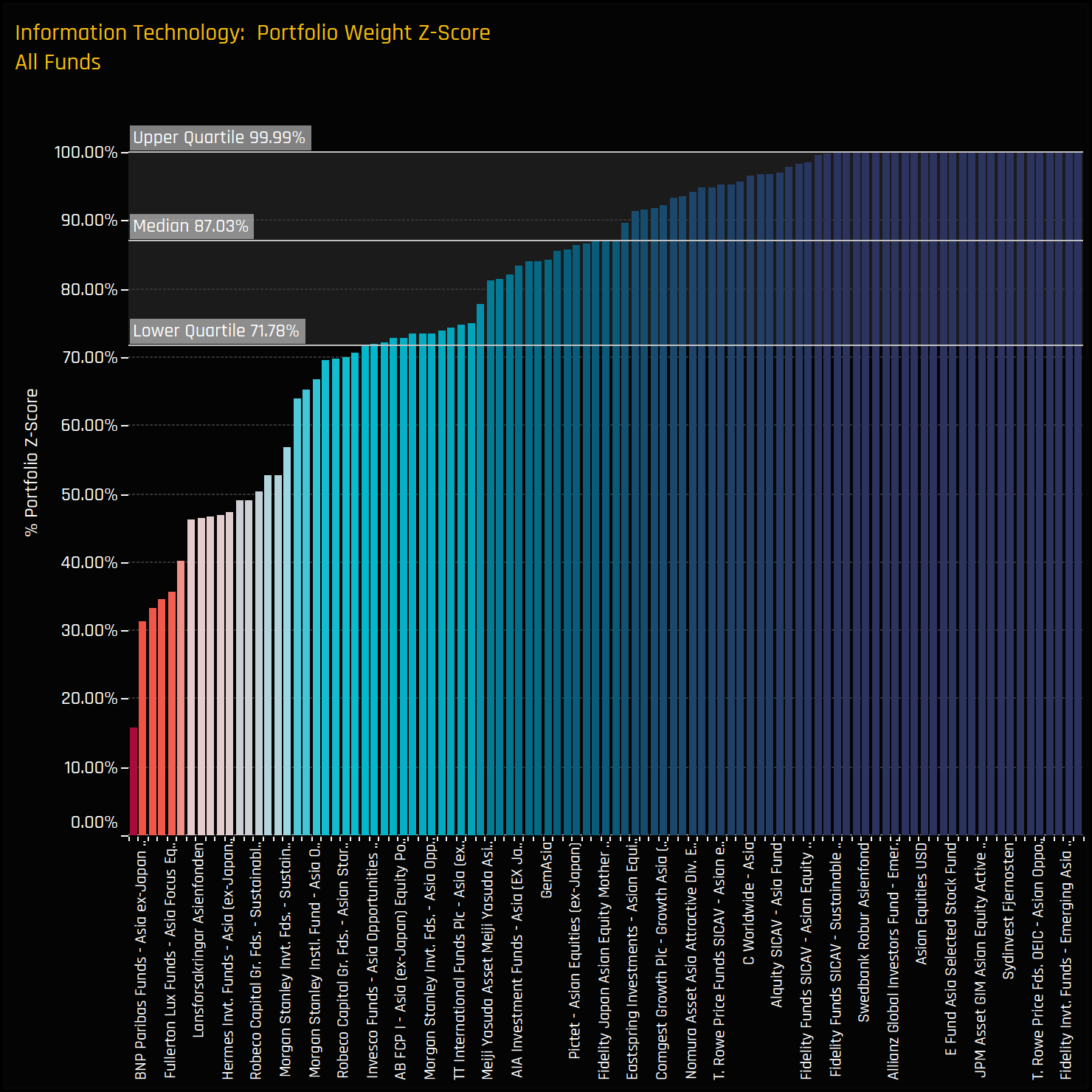

Technology allocations among Asia Ex-Japan funds are closing in the highs of late 2021. Allocations had drifter lower through 2022 but turned north again through last year, with today’s average weight of 29.67% just shy of the record 29.86% back in December 2021. This move coincides with a record overweight of +2.8% versus the iShares AAXJ ETF, with 69% of funds positioned ahead of the index.

Sector Rotation

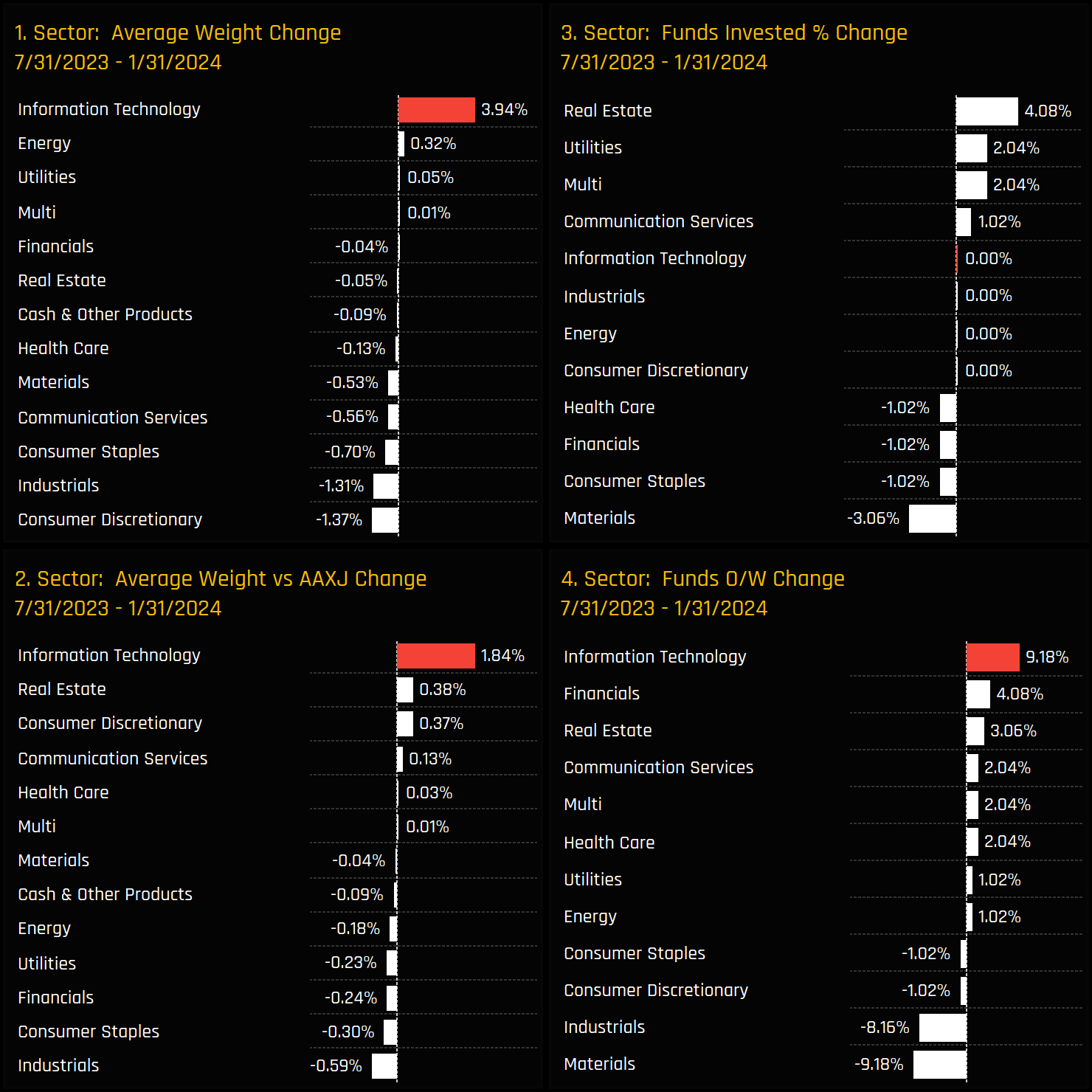

Chart set 5 below shows the changes in sector exposure and ownership between 07/31/2023 and 01/31/2024. The rise in Information Technology weights of +3.94% was the highest among sector peers, taking portfolio share from the Consumer Discretionary, Industrials and Consumer Staples sectors. Ownership measures relative to benchmark also jumped higher, with 9.2% of funds switching to overweight over the period, with a similar number of funds switching to underweight the Industrials and Materials sectors.

Fund Positioning vs History

Stock Positioning

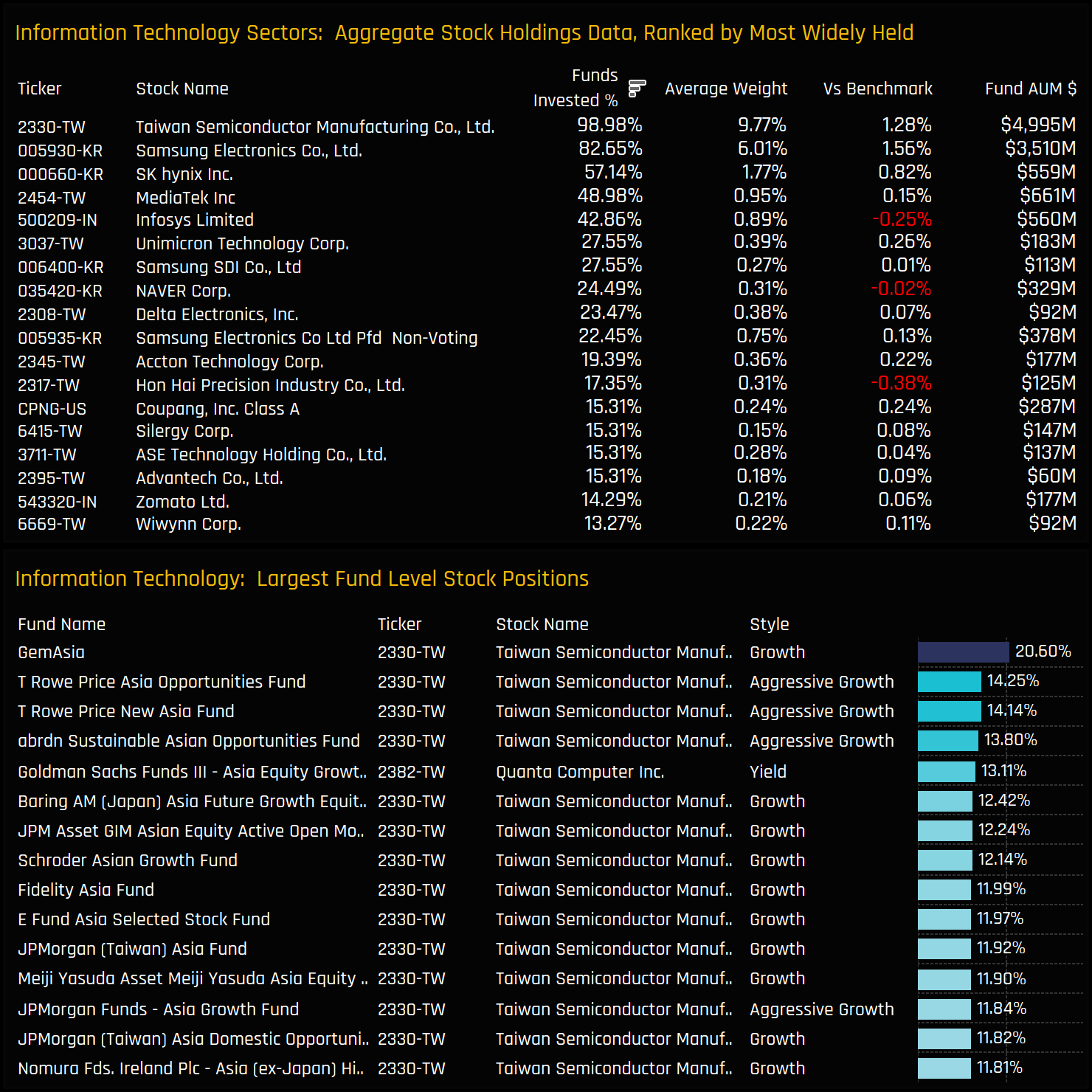

The stock holdings picture in the Tech sector is dominated by TSMC and Samsung Electronics. Each is held by 99% and 82.7% of funds respectively and at weights that dwarf the 2nd tier of SK Hynix and MediaTek Inc. Most of the key holdings are net overweights for active Asia Ex-Japan managers, with the exception of Infosys, Hon Hai Precision and Naver Corp.

Stock Sentiment

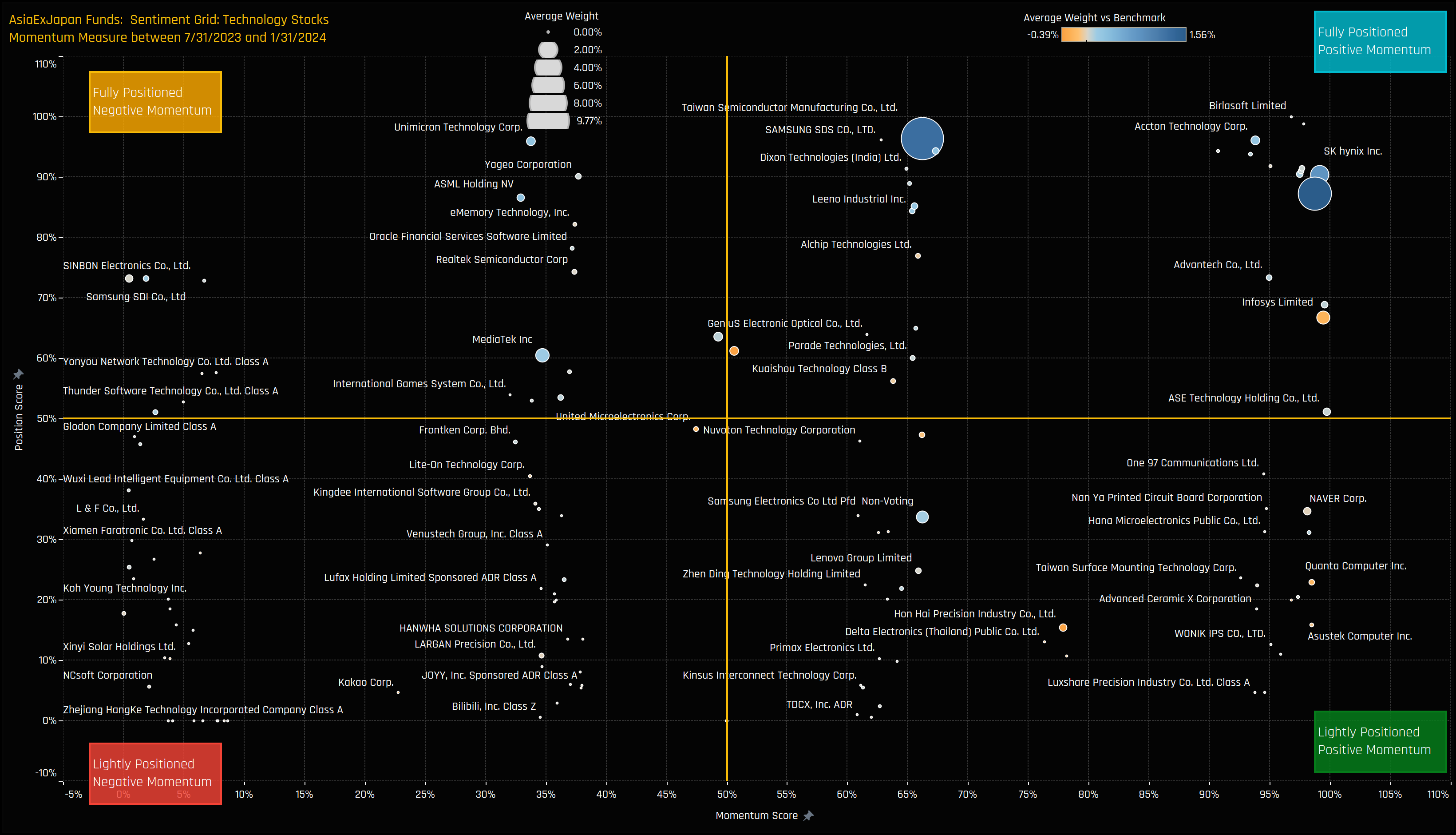

The Sentiment Grid below shows where positioning and momentum stand for all stocks in the Technology sector. The Y-axis shows the ‘Position Score’, a measure of current positioning in each stock compared to its own history going back to 2012 on a scale of 0-100%. It takes in to account the percentage of funds invested in each stock and the average fund weight versus history. The higher the number, the more heavily a company is owned by active Asia Ex-Japan managers compared to its own history. The X-Axis displays the ‘Momentum Score,’ which measures fund manager activity for each stock from July 31, 2023, to January 31, 2024, on a scale from 0% (maximum negative activity) to 100% (maximum positive activity). This score reflects changes in the percentage of funds invested and shifts in average weight.

The chart serves to highlight the different levels of ownership and momentum among companies. Stocks such as Accton Technology Corp and SK Hynix are near maximum levels of exposure whilst still experiencing net increases in ownership, hence their position in the top-right hand quadrant. Samsung SDI and SINBON Electronics are in the top-left quadrant, indicative of strong positioning yet selling from the managers in our analysis. Stocks seeing buying from a low base include Quanta Computer, Naver Corp and AsusTek Computer. Please click on the link below for an extended data report on Technology positioning among active Asia Ex-Japan funds.

98 Asia Ex-Japan Funds, AUM $50bn

Pinduoduo Rotation Continues

Ownership levels hit record highs as funds continue to add exposure.

Time Series Analysis

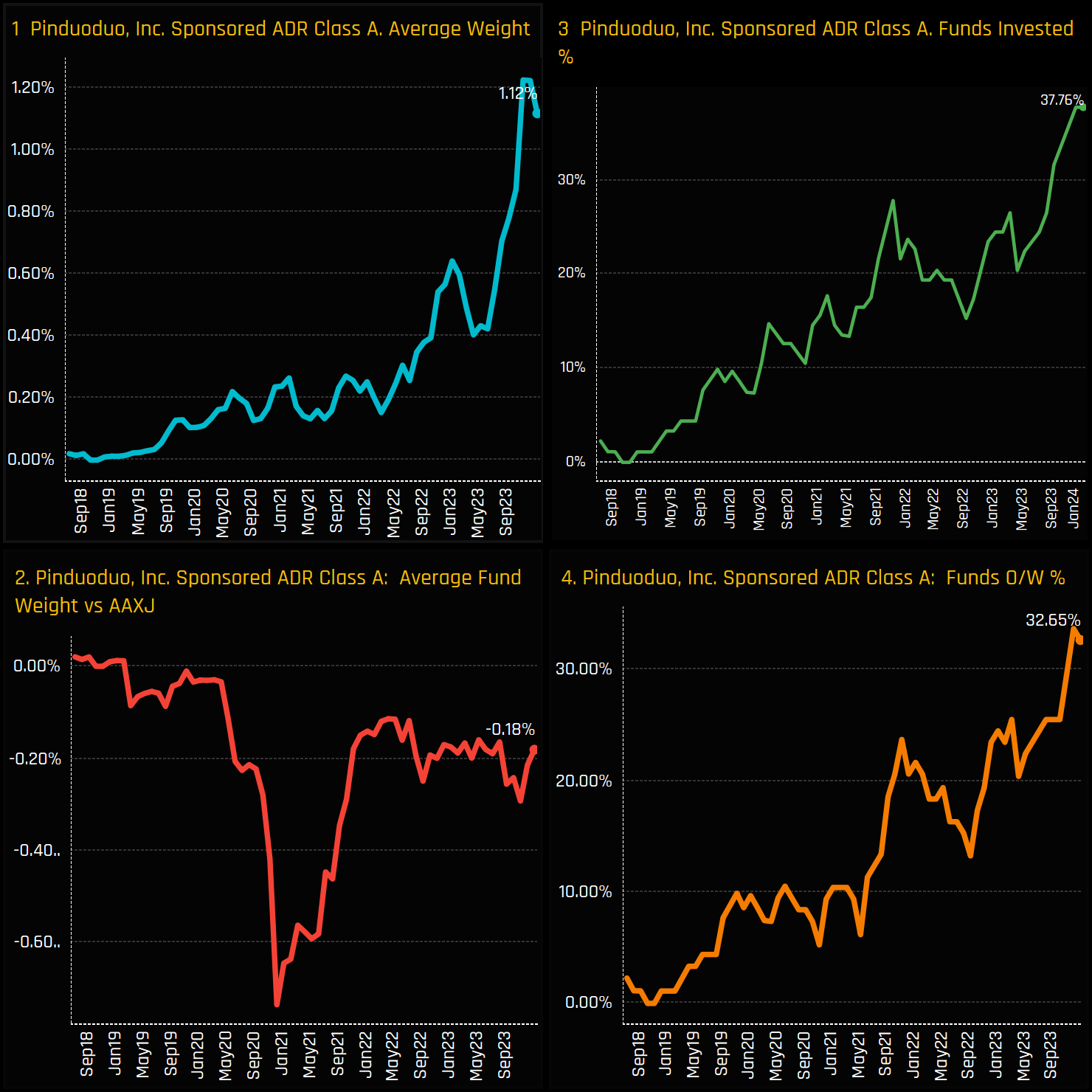

Asia Ex-Japan fund ownership in Pinduoduo Inc has soared to new highs. Average fund weights have been driven higher by an increasing number of funds buying in to the stock. A record 37.8% of the funds in our analysis now own Pinduoduo, Inc. at an average weight of 1.12%. The majority of owners hold Pinduoduo at weights above the benchmark, yet over the full sample Asia Ex-Japan managers remain underweight by -0.18%.

Stock Rotation

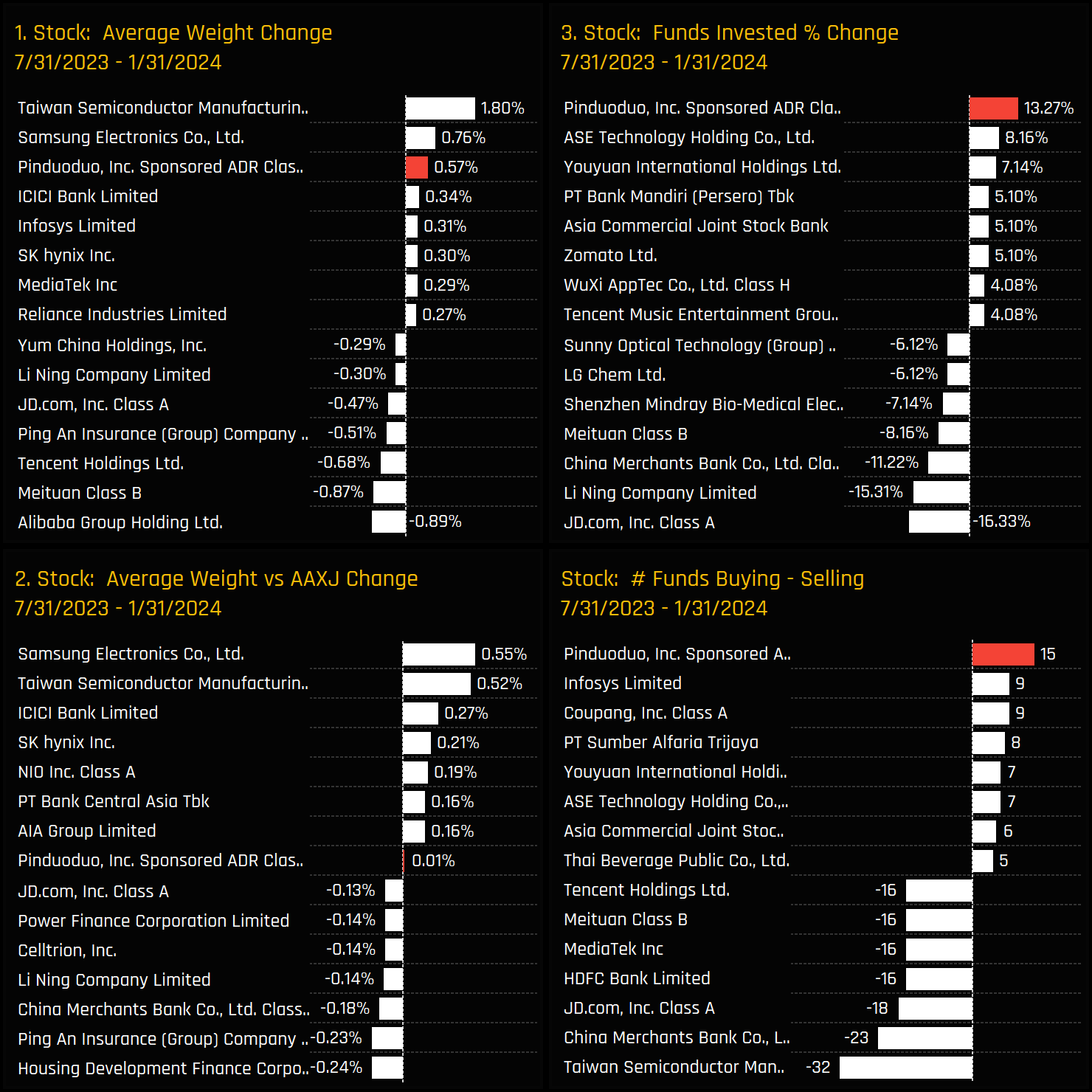

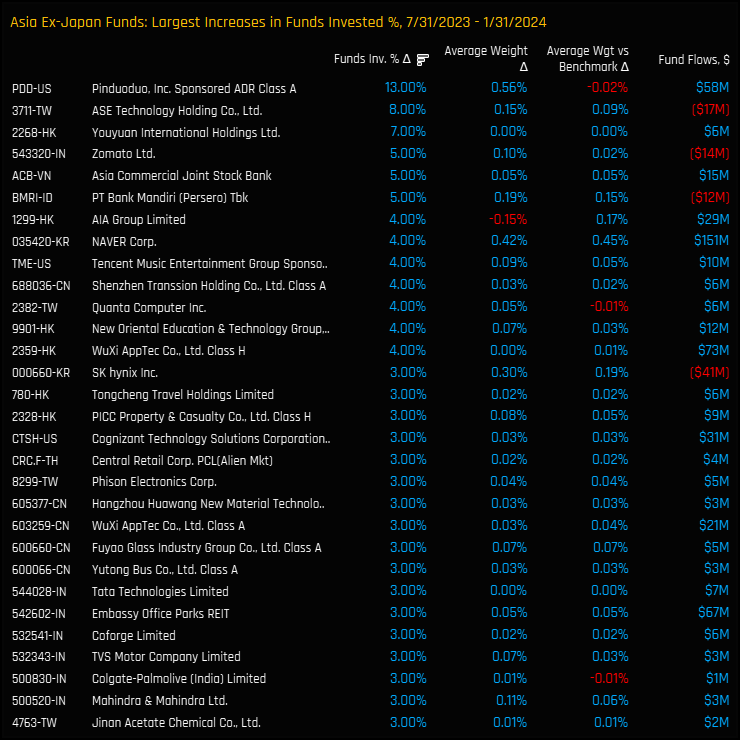

The charts below summarize stock exposure and ownership shifts for companies in the Asia Ex-Japan universe from 07/31/2023 to 01/31/2024. Pinduoduo Inc leads in the increase of funds invested as shown in chart 3, with a notable average weight increase of 0.57%, the third highest, and the highest buyer-to-seller ratio.

Fund Activity

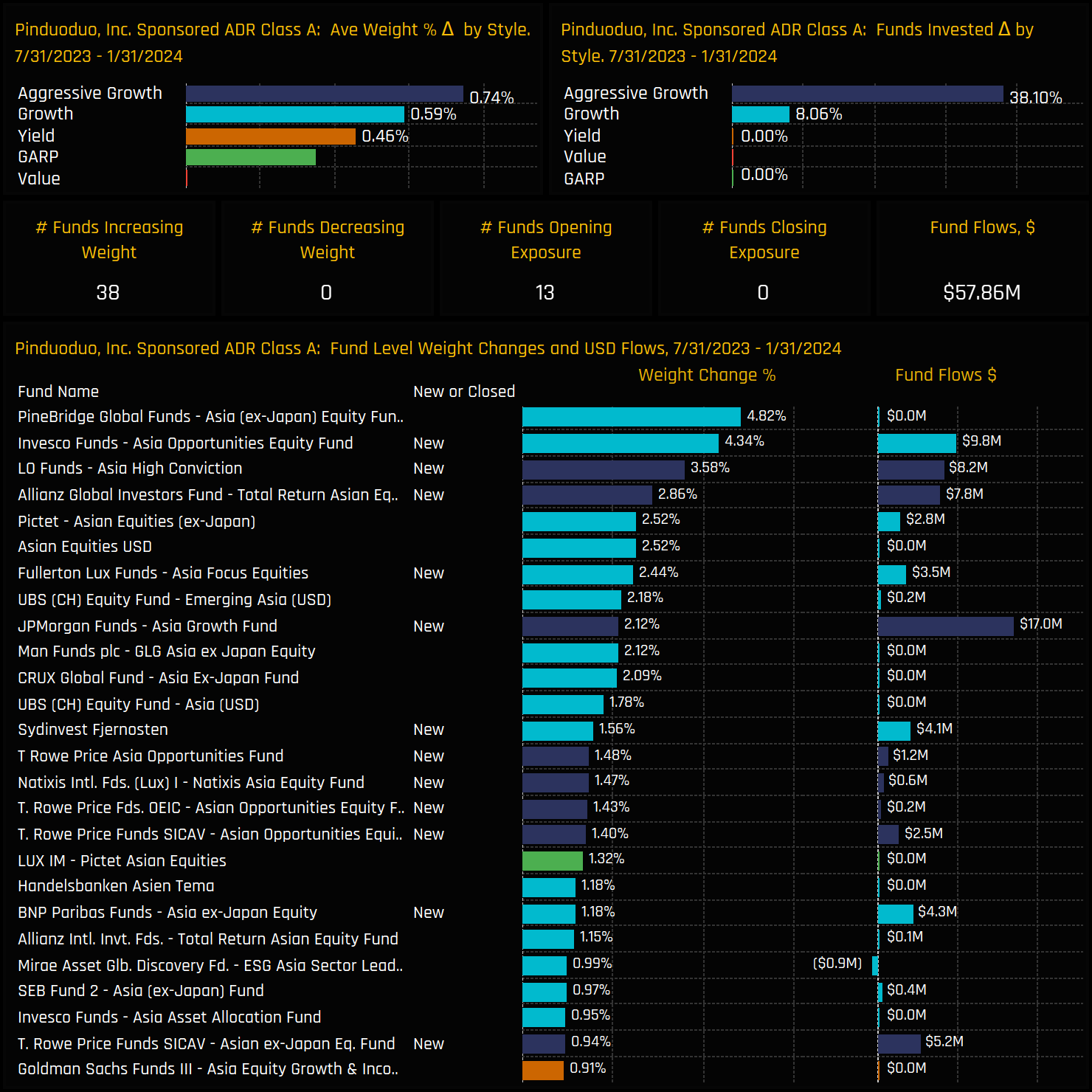

Driving this rotation were funds at the growth end of the spectrum. New positions were added by Invesco Asia Opportunities (4.3%), LO Funds High Conviction (3.6%) and Allianz Asian Equity (2.9%), with 38% of the Aggressive Growth funds in our analysis adding exposure over the period.

In the face of a broader downturn in the China market, Pinduoduo”s investment growth is all the more impressive. It stands as one of the highest conviction names in China right now.

Please click on the link below for a comprehensive data pack on Pinduoduo, Inc positioning among Asia Ex-Japan funds.

98 Asia Ex-Japan Funds, AUM $50bn

Stock Activity Data

The latest stock activity data for Asia Ex-Japan equity funds over the last 6-months.

Largest Aggregate Increases in Ownership

Largest Aggregate Decreases in Ownership

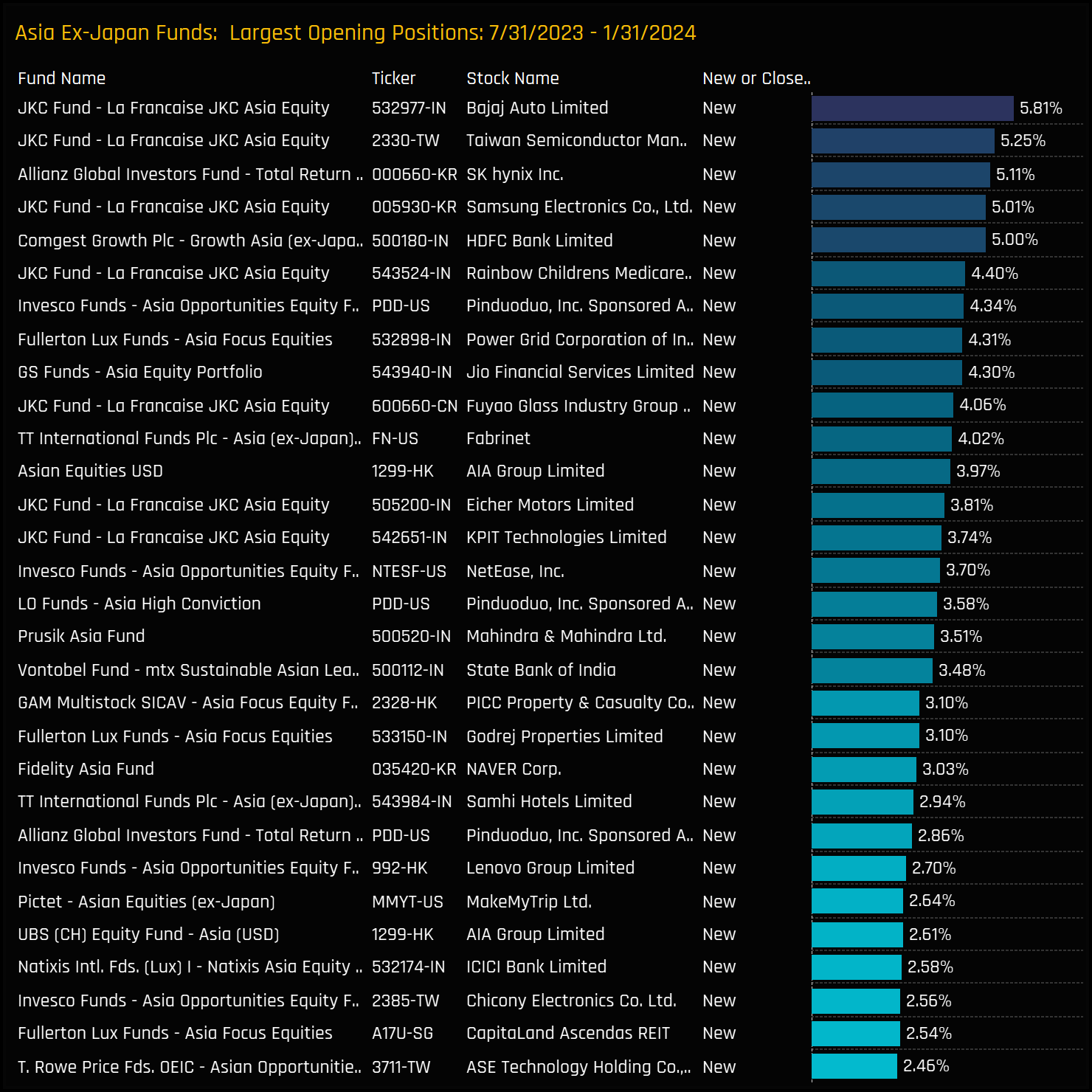

Largest Fund Level New Positions

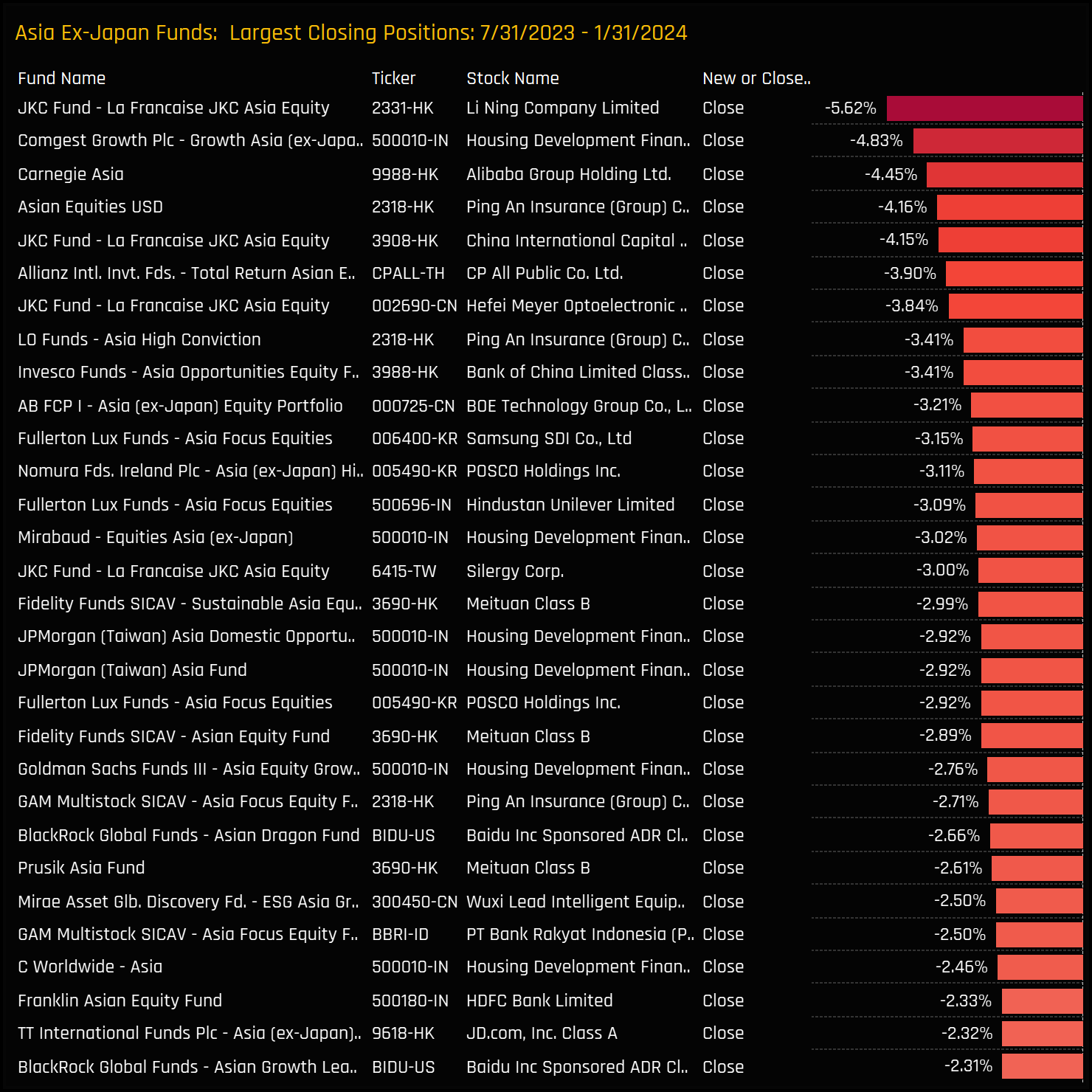

Largest Fund Level Closed Positions

98 Asia Ex-Japan Funds, AUM $50bn

Asia Ex-Japan Equity Fund Positioning Report

Click on the link below for the full data report on fund positioning among the 98 Asia Ex-Japan funds in our analysis.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- January 17, 2023

Asia Ex-Japan Fund Positioning Analysis, January 2023

91 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, January 2023 ..

- Steve Holden

- March 17, 2023

Asia Ex-Japan Fund Positioning Analysis, March 2023

89 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, March 2023 In ..

- Steve Holden

- September 15, 2022

Asia Ex-Japan: Country Positioning Update

92 Active Asia Ex-Japan Funds, AUM $62bn Country Positioning Update In this piece we provide a ..