92 Active Asia Ex-Japan Funds, AUM $62bn

Country Positioning Update

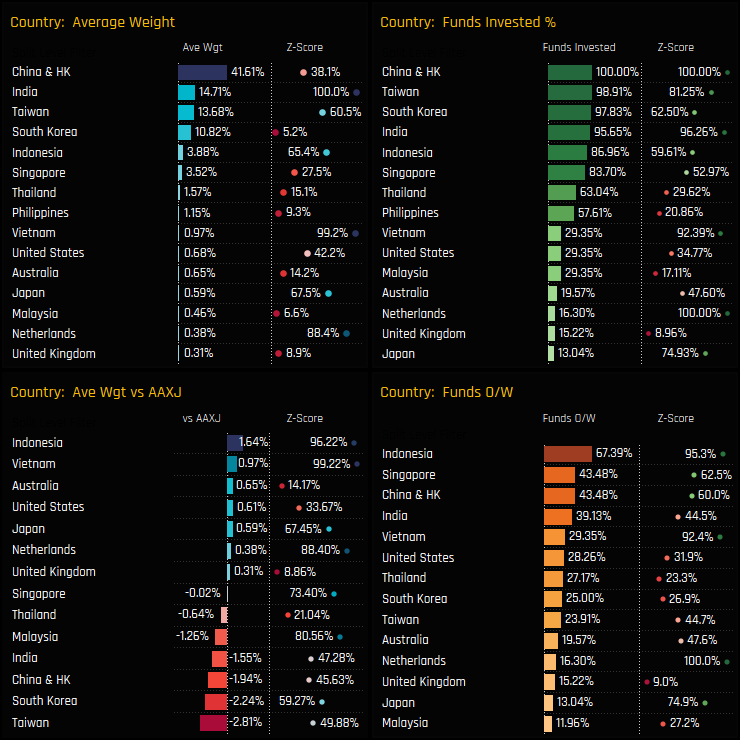

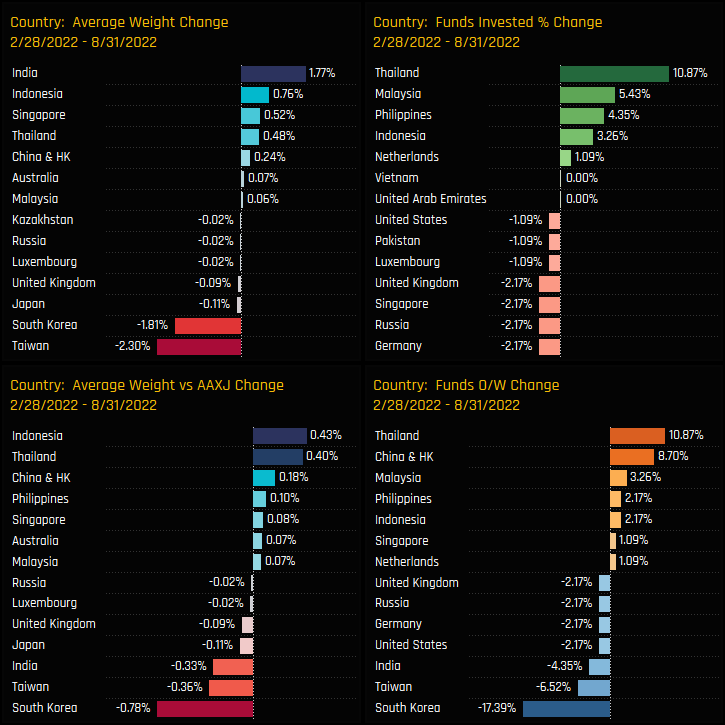

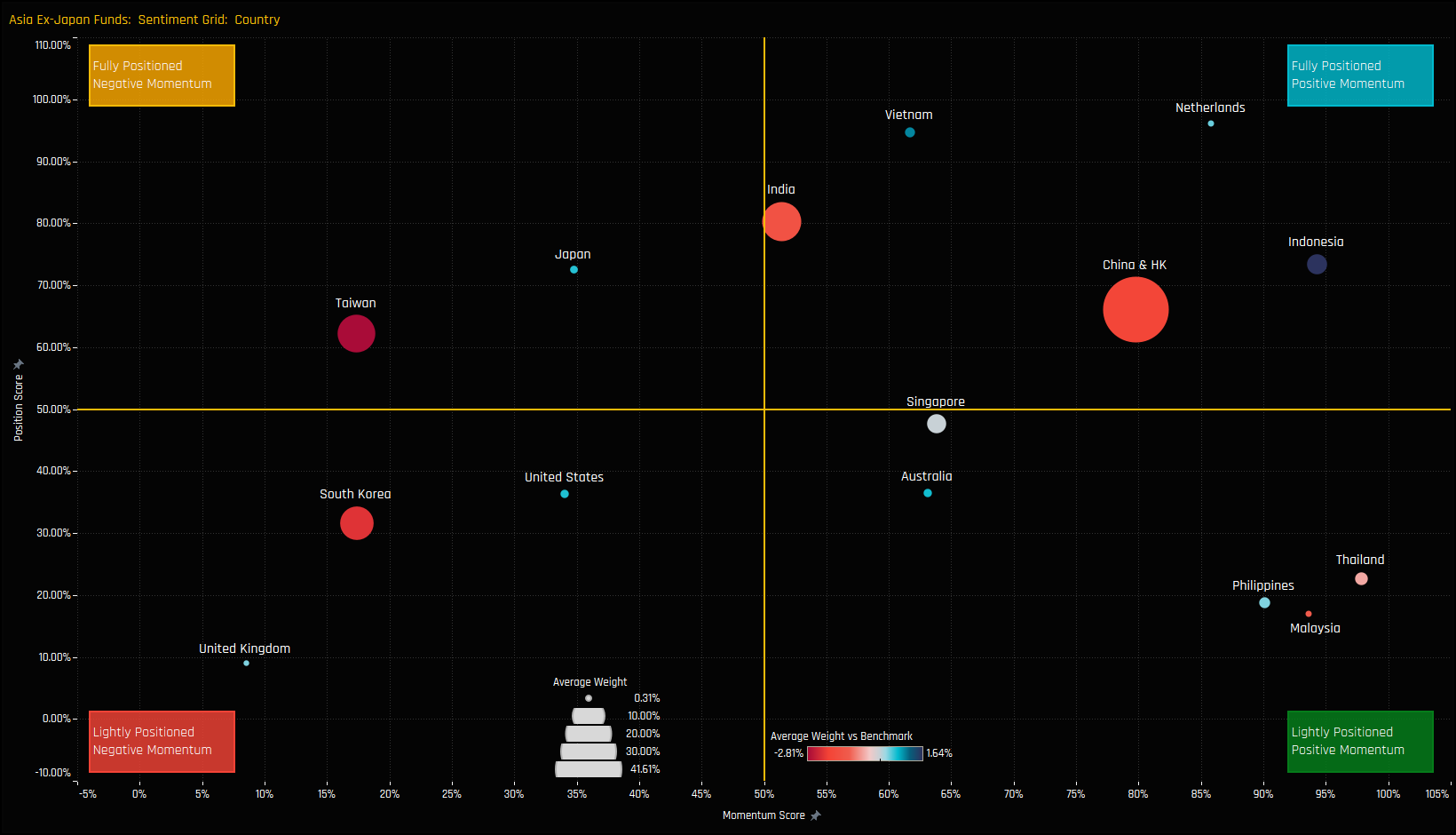

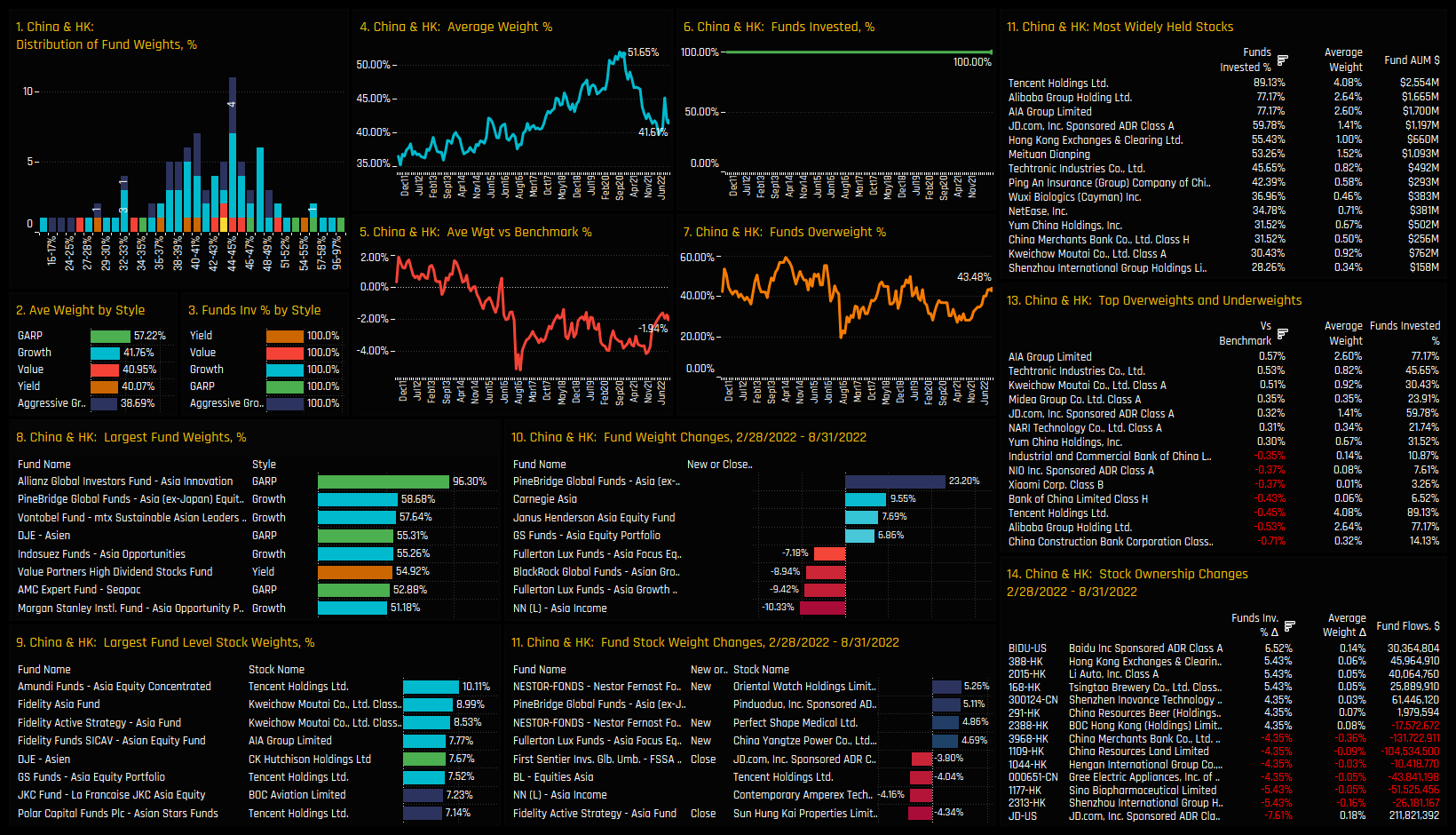

In this piece we provide a comprehensive analysis of country positioning among Asia Ex-Japan equity funds. We look at the current ownership dynamics and tie that in to the long-term trends in country positioning and more recent manager activity. We find that Taiwan and South Korea have born the brunt of recent investor rotation, with Asia Ex-Japan investors moving towards the relatively underowned Malaysia, Thailand and The Philippines. Indonesia is the current darling of the region, with investors also re-engaging with China & HK after a period of consolidation.

Country Ownership Picture

Country Sentiment

China & HK

Click on the link below for the latest data report on China & HK positioning among active Asia Ex-Japan funds.

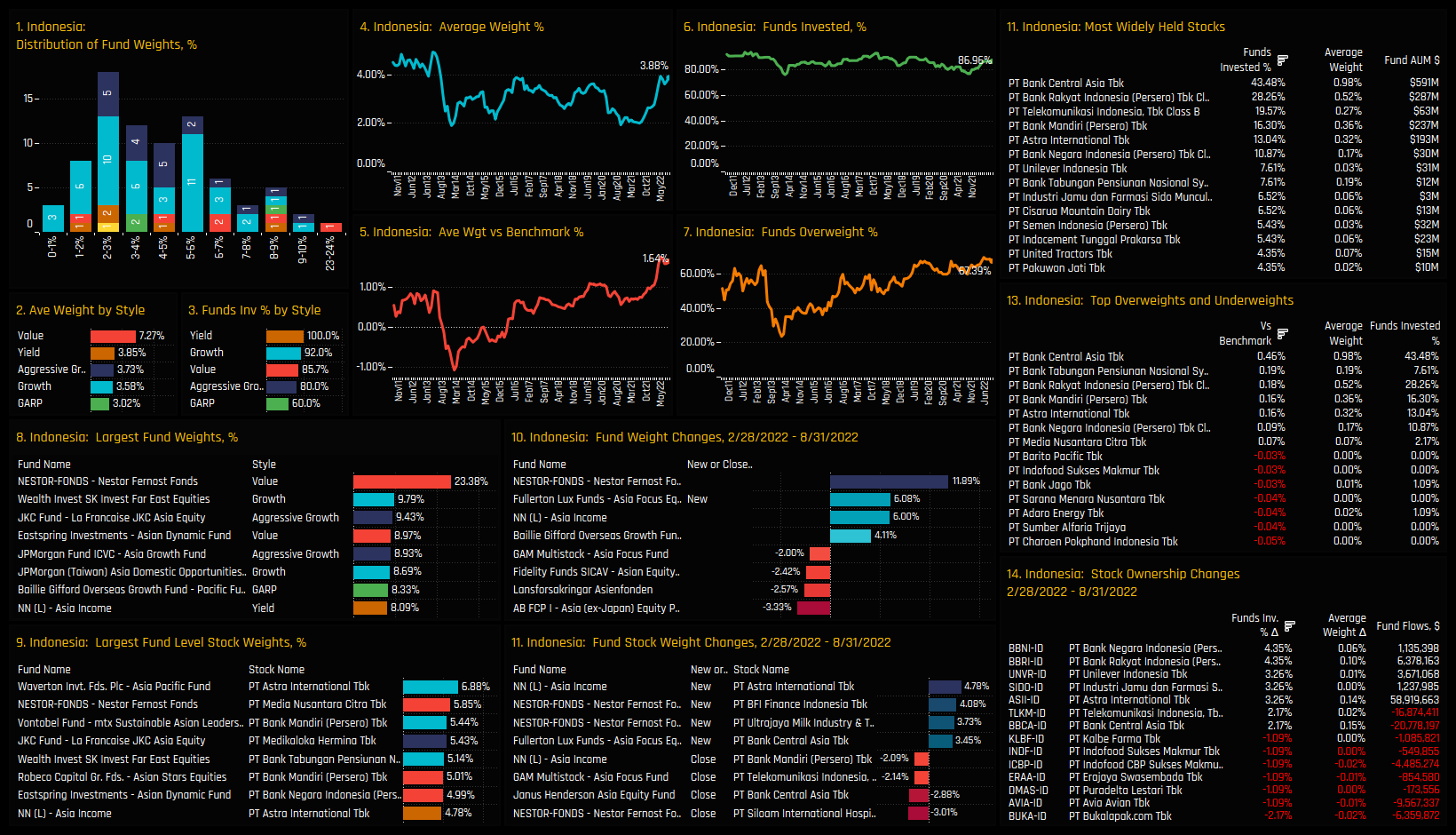

Indonesia

Click on the link below for the latest data report on Indonesia positioning among active Asia Ex-Japan funds.

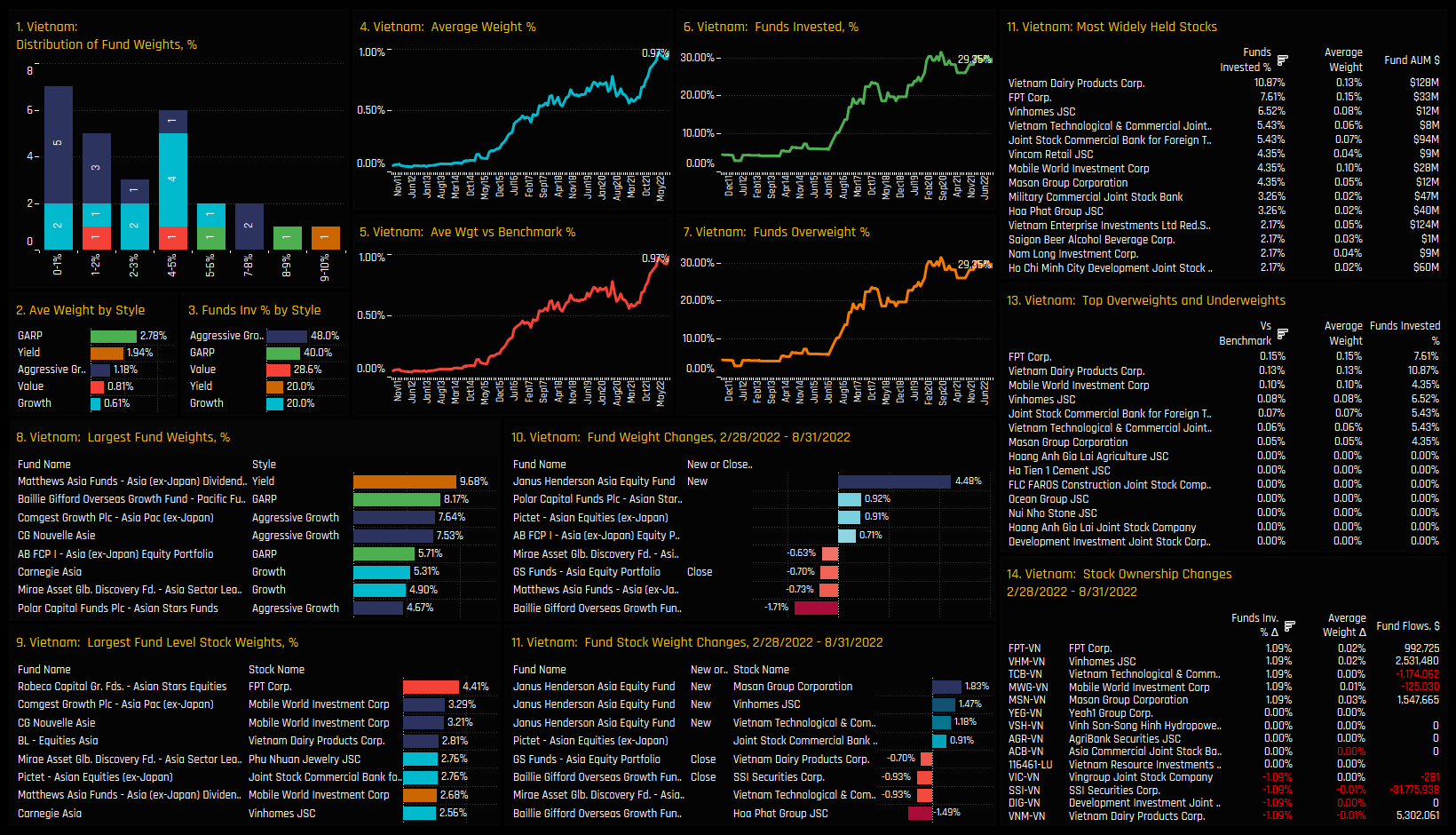

Vietnam

Click on the link below for the latest data report on Vietnam positioning among active Asia Ex-Japan funds.

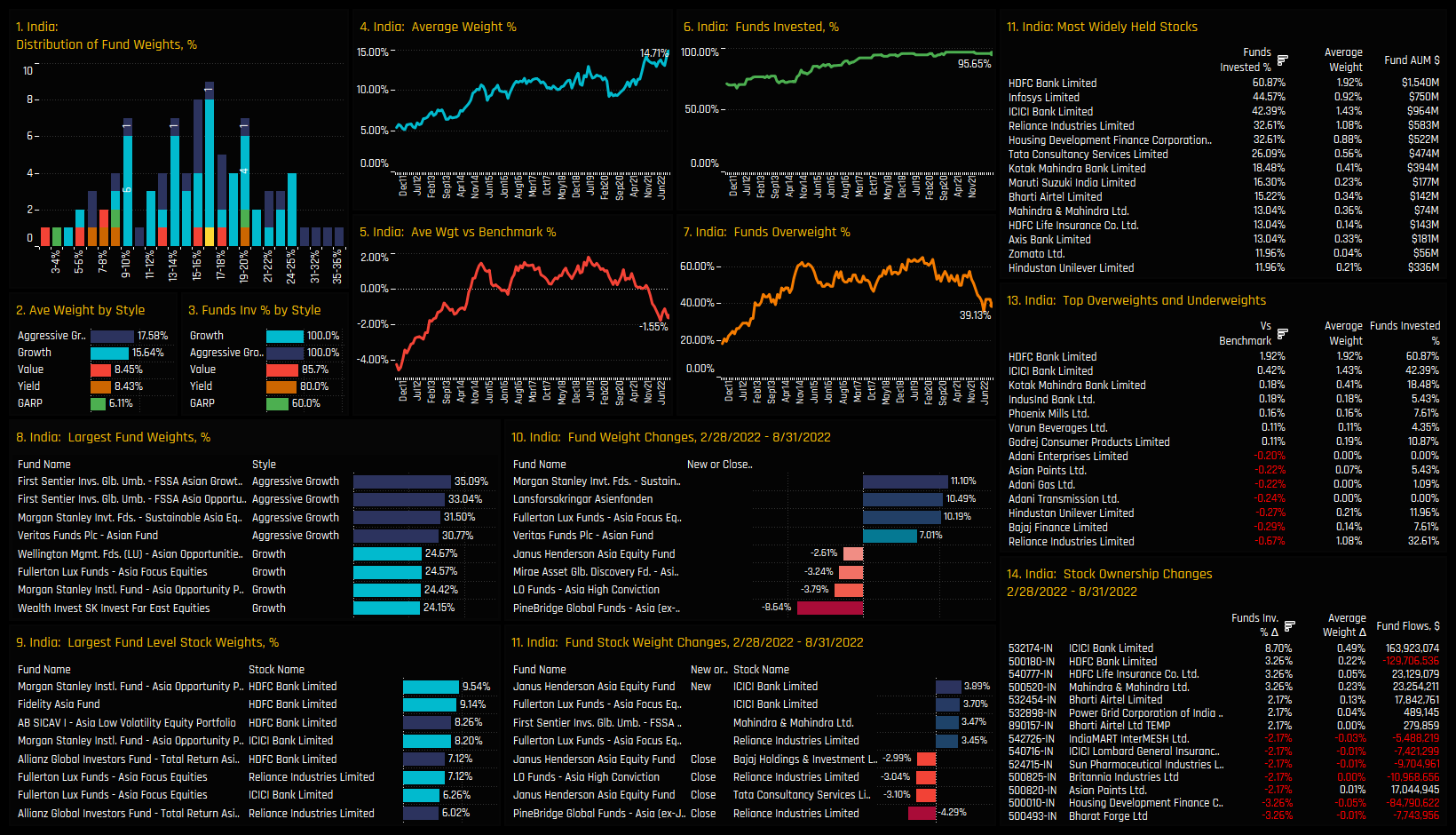

India

Click on the link below for the latest data report on Indian positioning among active Asia Ex-Japan funds.

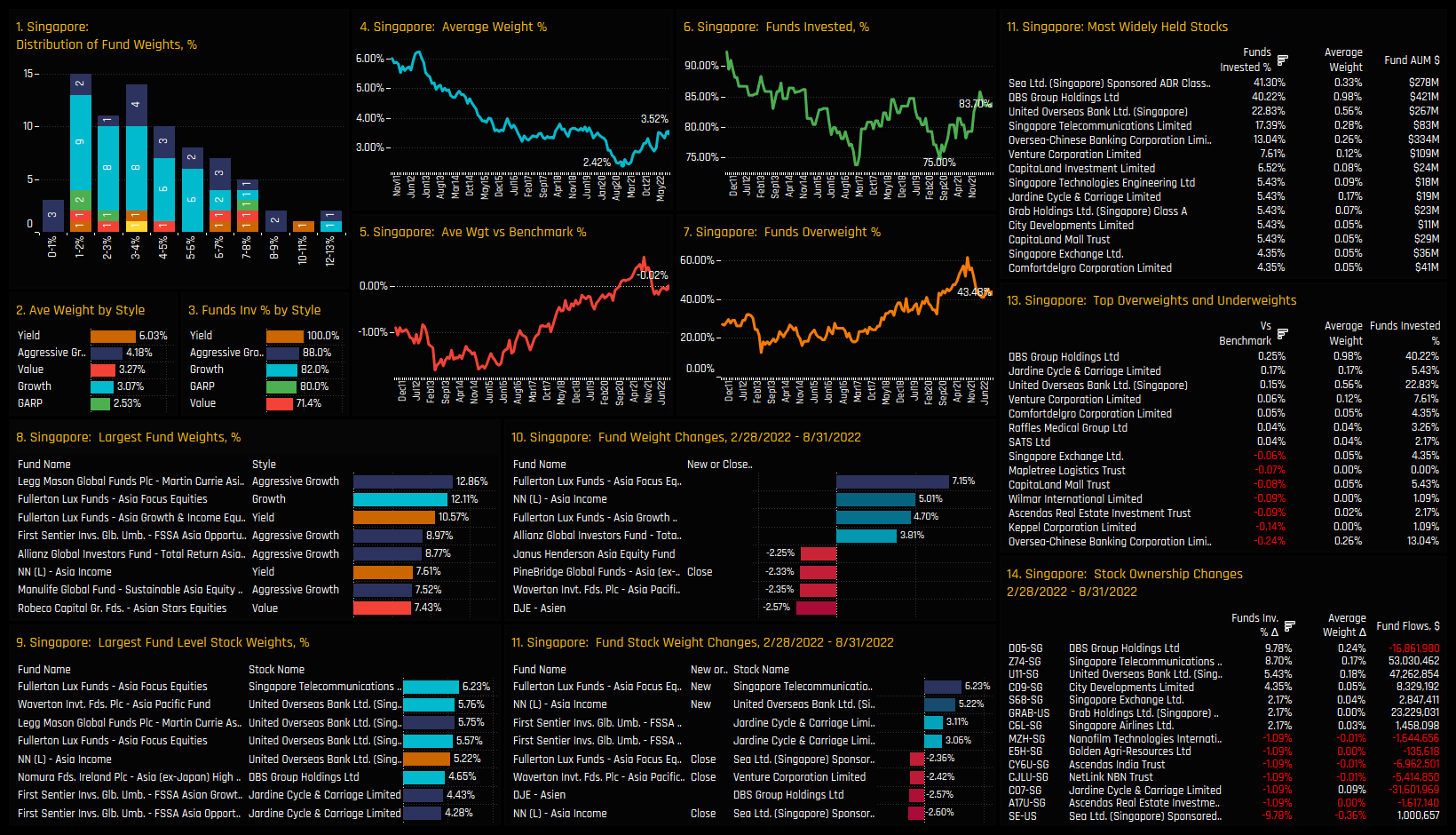

Singapore

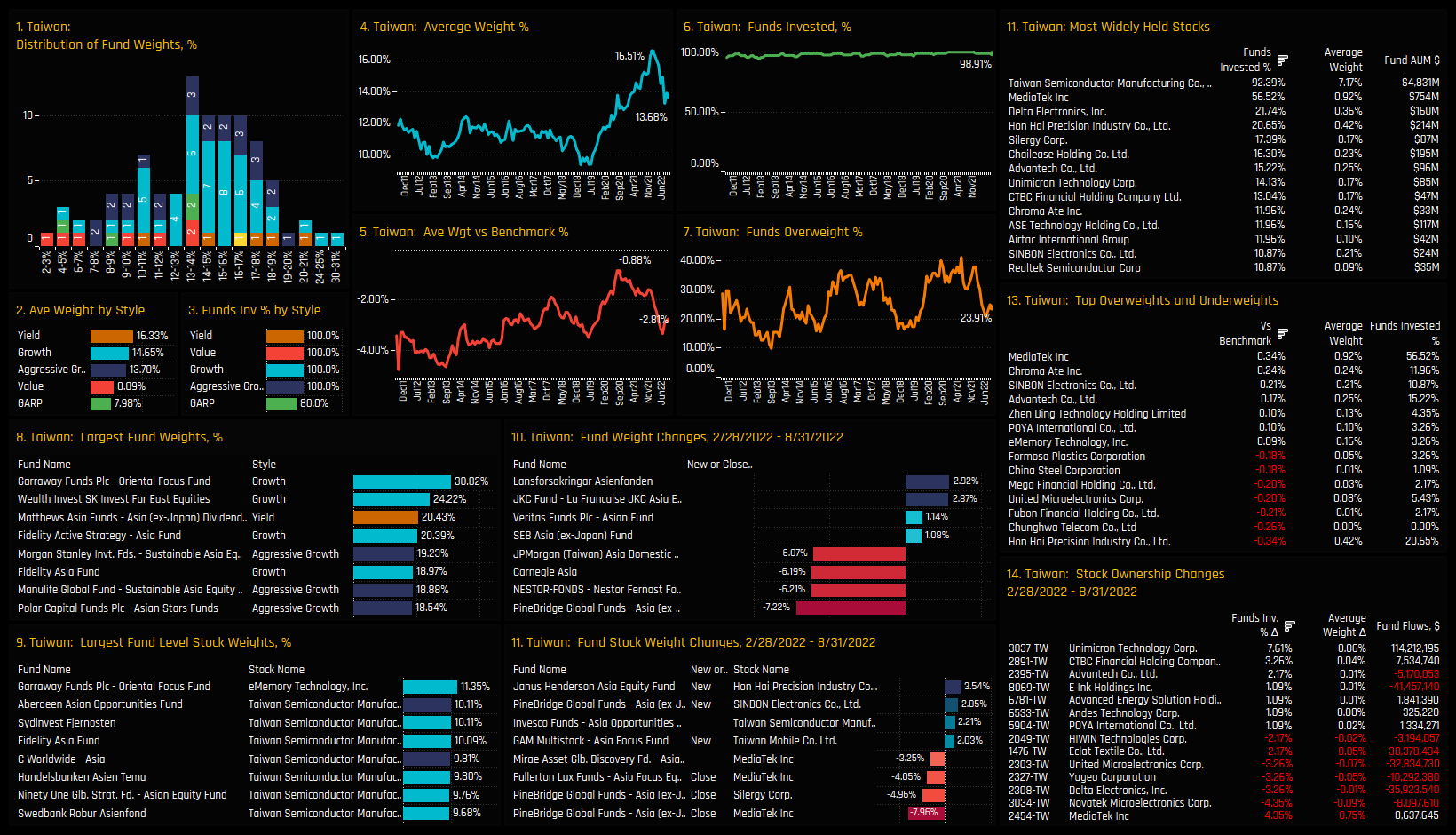

Taiwan

Click on the link below for the latest data report on Taiwan positioning among active Asia Ex-Japan funds.

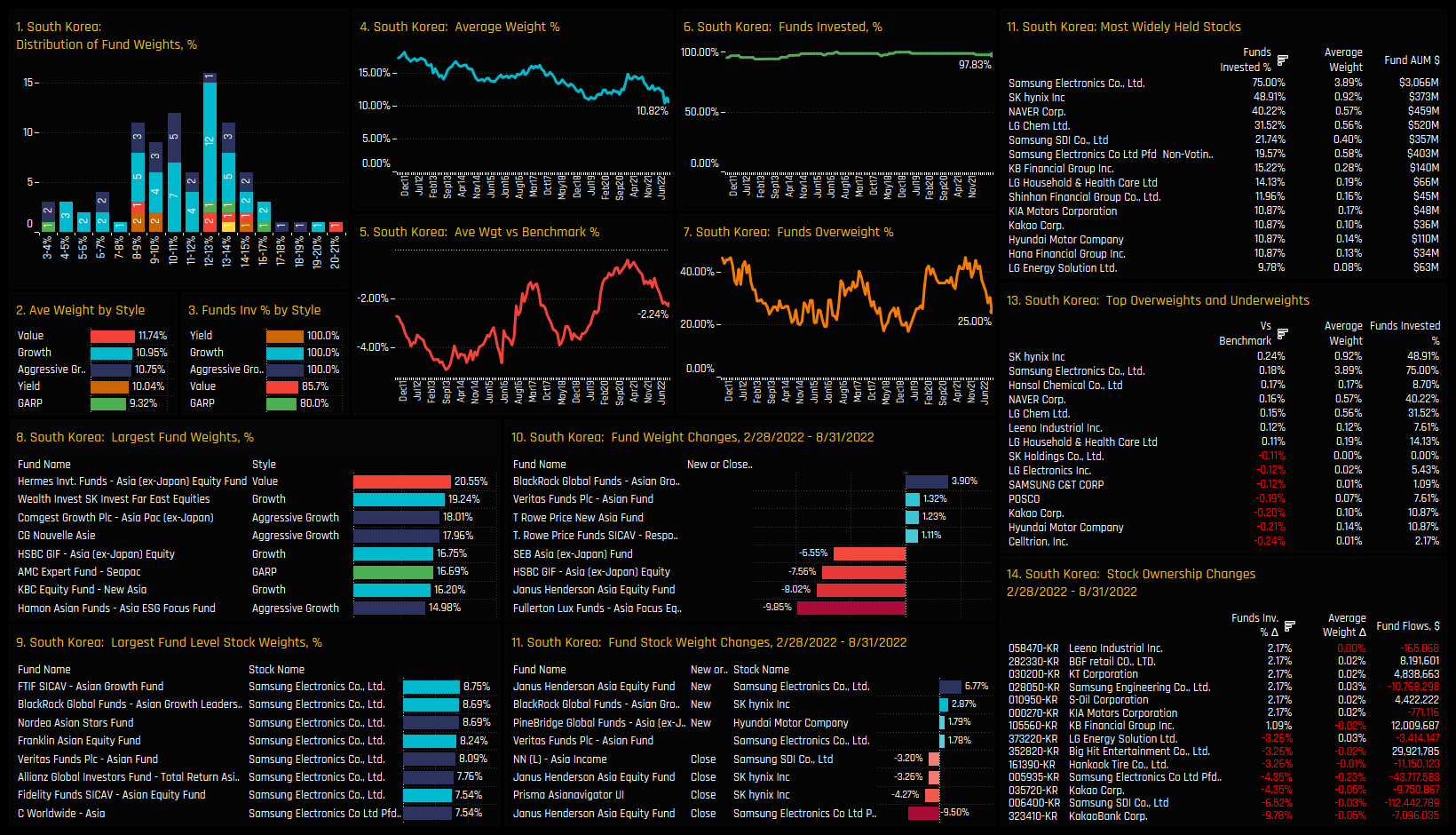

South Korea

Click on the link below for the latest data report on South Korean positioning among active Asia Ex-Japan funds.

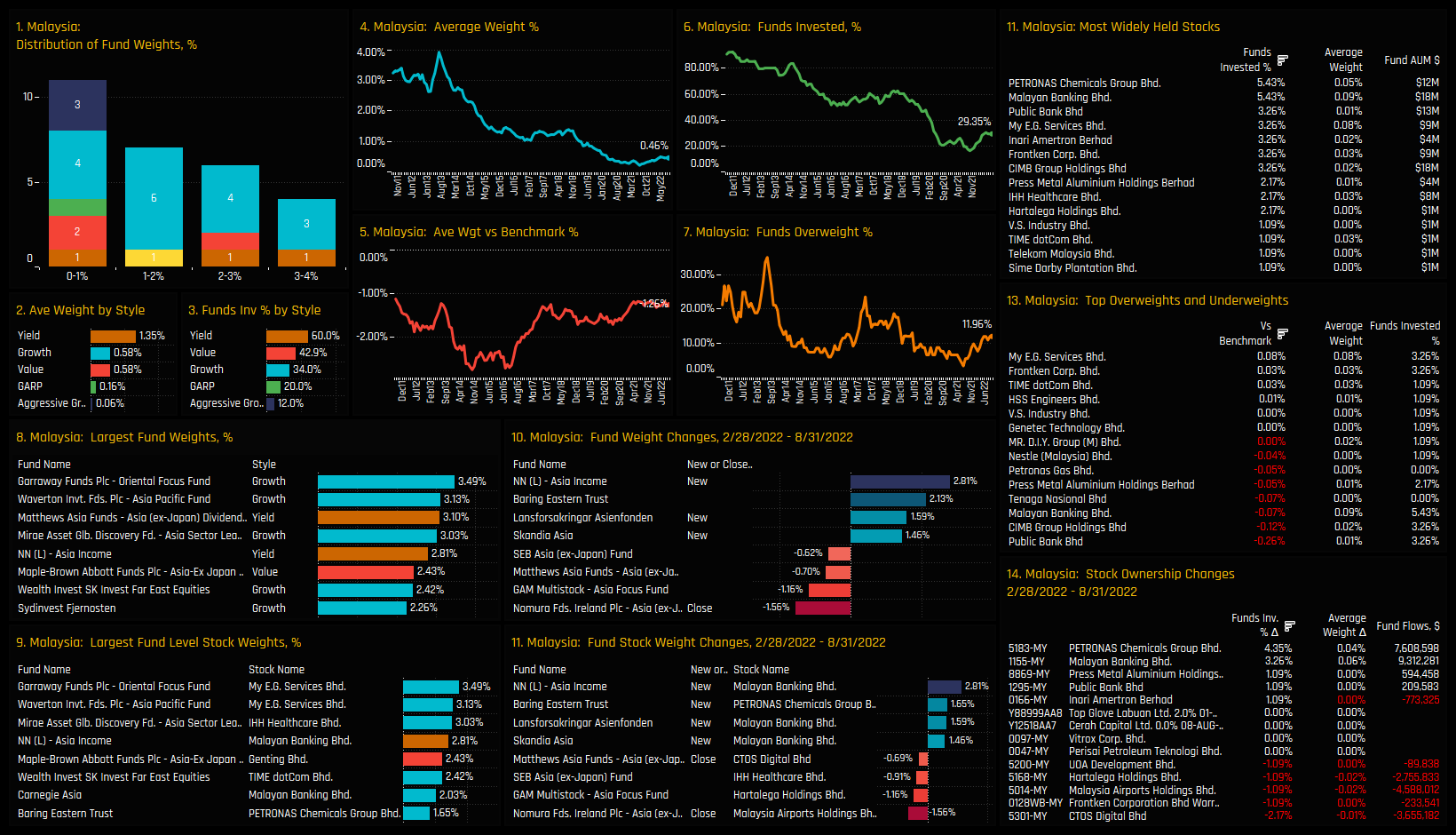

Malaysia

Click on the link below for the latest data report on Malaysia positioning among active Asia Ex-Japan funds.

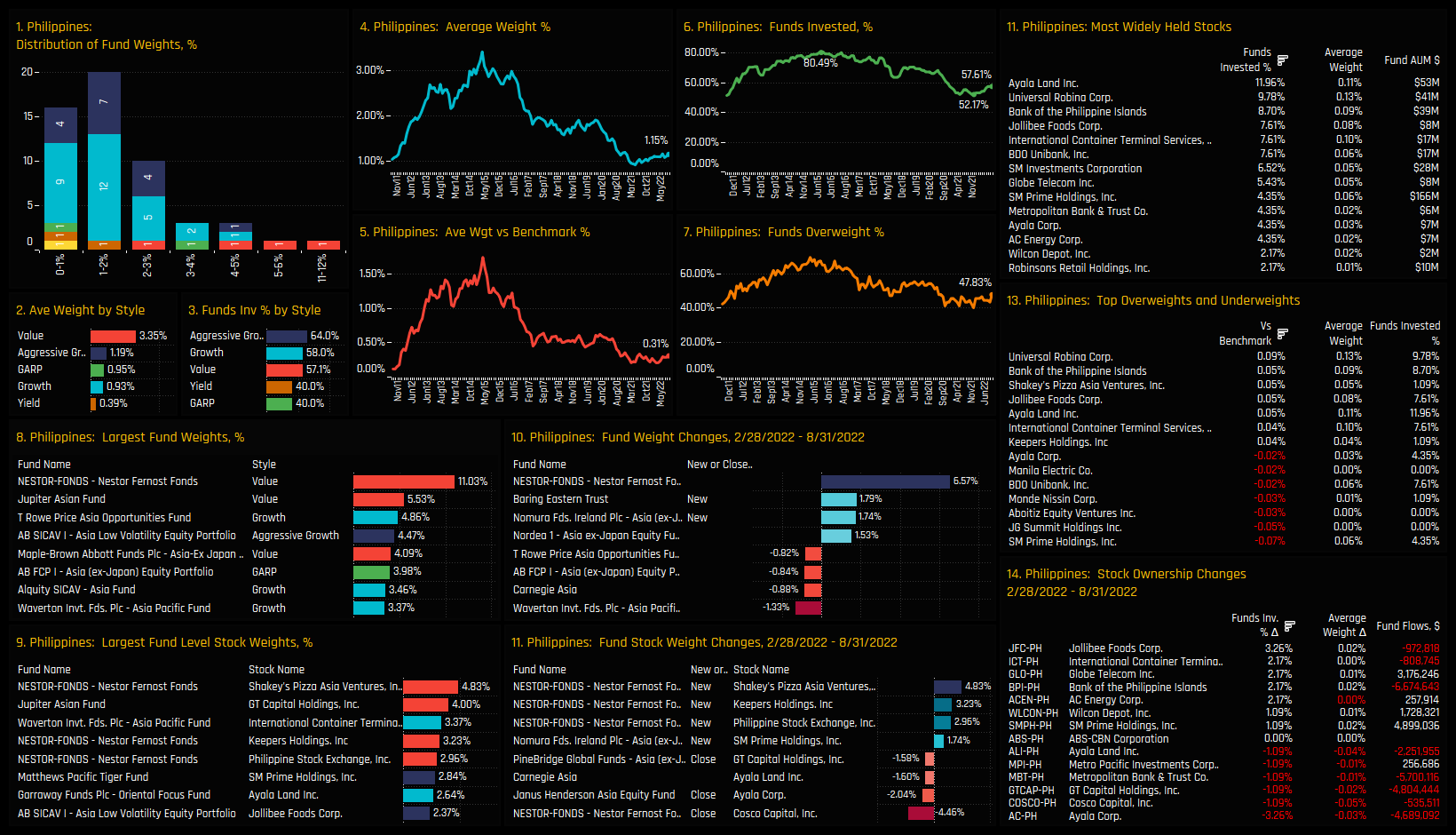

The Philippines

Click on the link below for the latest data report on Philippines positioning among active Asia Ex-Japan funds.

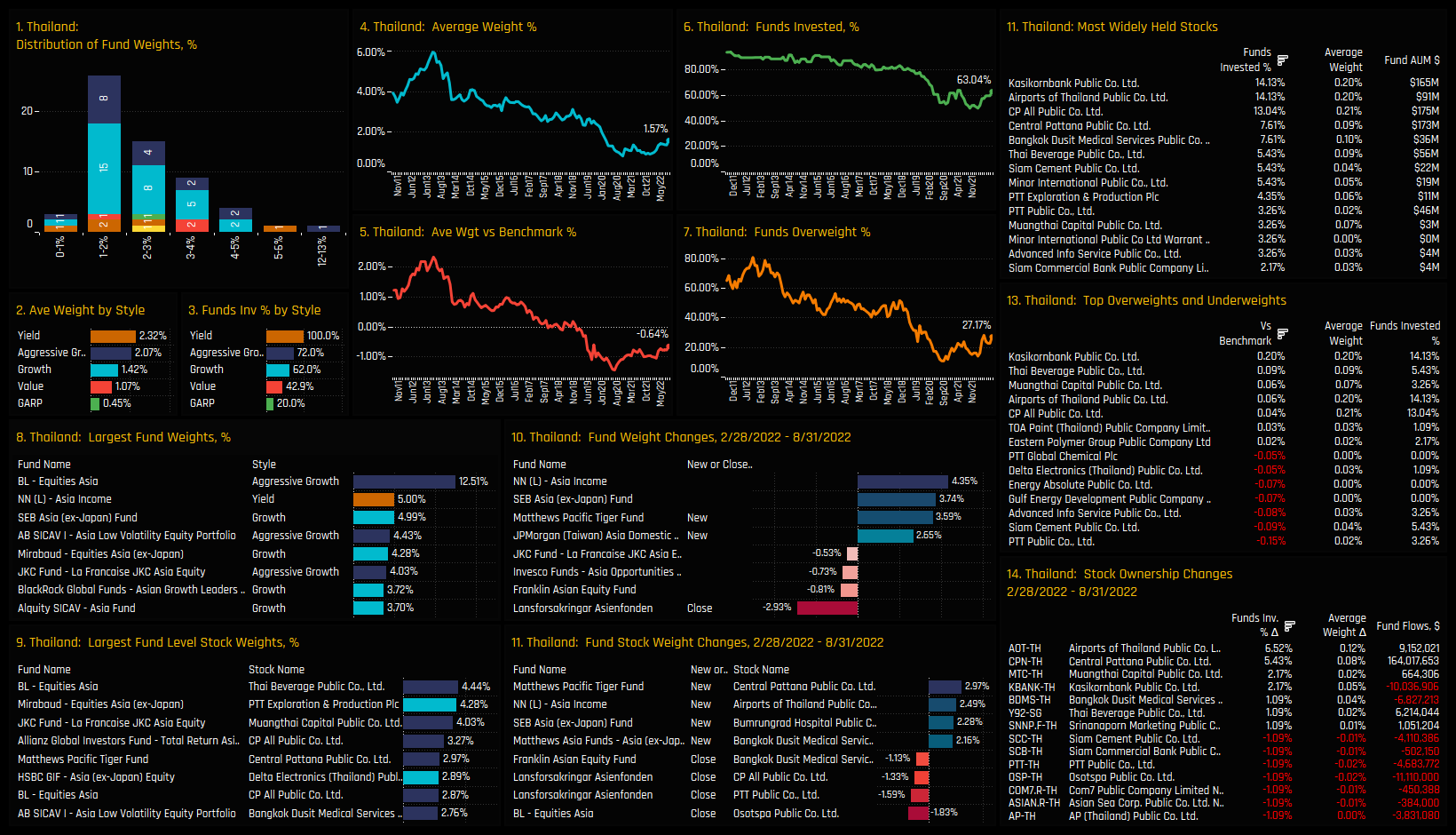

Thailand

Click on the link below for the latest data report on Thailand positioning among active Asia Ex-Japan funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- February 12, 2023

Asia Ex-Japan Fund Positioning Analysis, February 2023

91 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, February 2023 ..

- Steve Holden

- January 11, 2023

Asia Ex-Japan Funds: 2022 Performance & Attribution Report

91 Active Asia Ex-Japan Funds, AUM $70bn. 2022 Performance & Attribution Report In this rep ..

- Steve Holden

- June 28, 2023

Asia Ex-Japan Fund Positioning Analysis, June 2023

86 Asia Ex-Japan Equity Funds, AUM $54.5bn Asia Ex-Japan Fund Positioning Analysis, June 2023 I ..