340 Global Equity Funds, AUM $1tr

China: Darkest before the Dawn?

Date: February 14th, 2024

Fund Universe: Global Equity

China's Decent

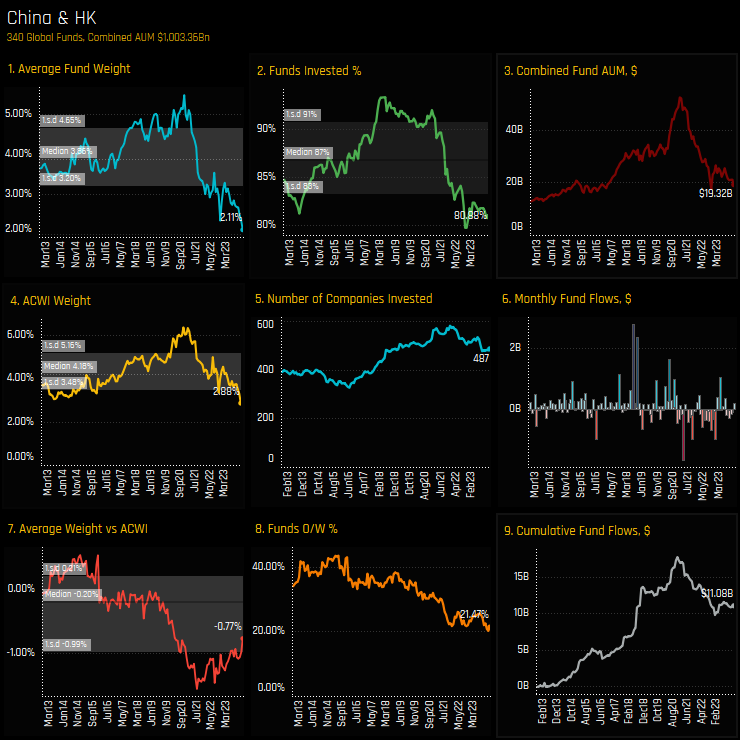

Chinese equity ownership among Global equity funds has reached an all-time low. The chart set opposite documents the time series of fund exposure and ownership among global funds in Chinese equities between 2012 and 2024.

Chart 1 shows average exposure to China & HK stocks falling to an all-time low of just 2.11%, with only 21.5% of funds positioned ahead of the SPDRs MSCI ACWI ETF (ch8). Among the 340 Global funds in our analysis, the percentage that hold exposure to China & HK has fallen from over 90% to just 81% today (ch2), and the number of invested companies has decreased from 600 to 487 (ch5).

Combined fund AUM in China & HK stocks (from the $1tr of fund assets in our analysis) stands at $19.3bn, down from over $50bn during its peak in 2020. In short, positioning is as depressed as it’s ever been.

Fund Level Activity

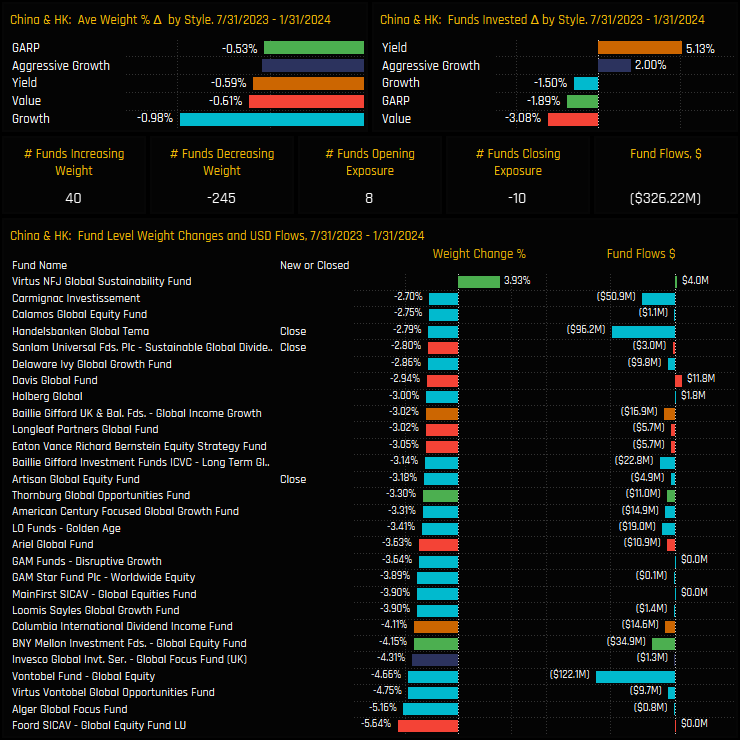

The chart set opposite details the fund activity driving this trend. Between the filing dates of 07/31/2023 and 01/31/2024, 245 funds have seen their China & HK weights decline, with just 40 increasing weights. Closures were led by Artisan Global Equity (-3.18%) and Sanlam Sustainable Global Dividend (-2.9%).

Within these figures there are some small positive signals. Though 10 funds closed exposure over the period, 8 opened new exposure. On a Style basis, the percentage of funds invested in China & HK fell for Value, GARP and Growth funds, but increased for Aggressive Growth and Yield managers. It’s not enough to change the balance of the investment picture, but it does show an appetite from some managers to engage with China at this juncture.

Stock Holdings

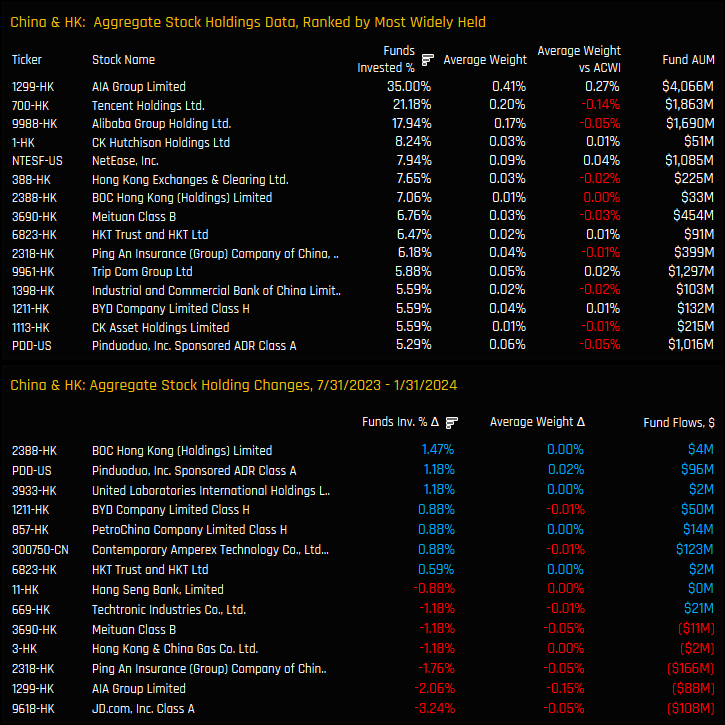

This chart set documents the stock holdings picture for China & HK equities among active Global funds. Investment concentration in China & HK companies, notably in Tencent, AIA Group, and Alibaba Group, highlights a significant reliance on a few key stocks. Combined they account for 37% of the total China & HK allocation, with no other stock owned by more than 9% of funds. When we consider that 76% of Global funds own Microsoft at an average weight of 3.6%, it puts in to context how seriously Global managers view China & HK at this point in time.

Activity between the filing dates of 07/31/2023 and 01/31/2024 has leaned towards the sell-side, particularly in JD.Com, AIA Group, and Ping An Insurance, but selected funds have upped their stakes in BOC Hong Kong and Pinduoduo Inc. As with fund level activity, there are small positives to take from the data.

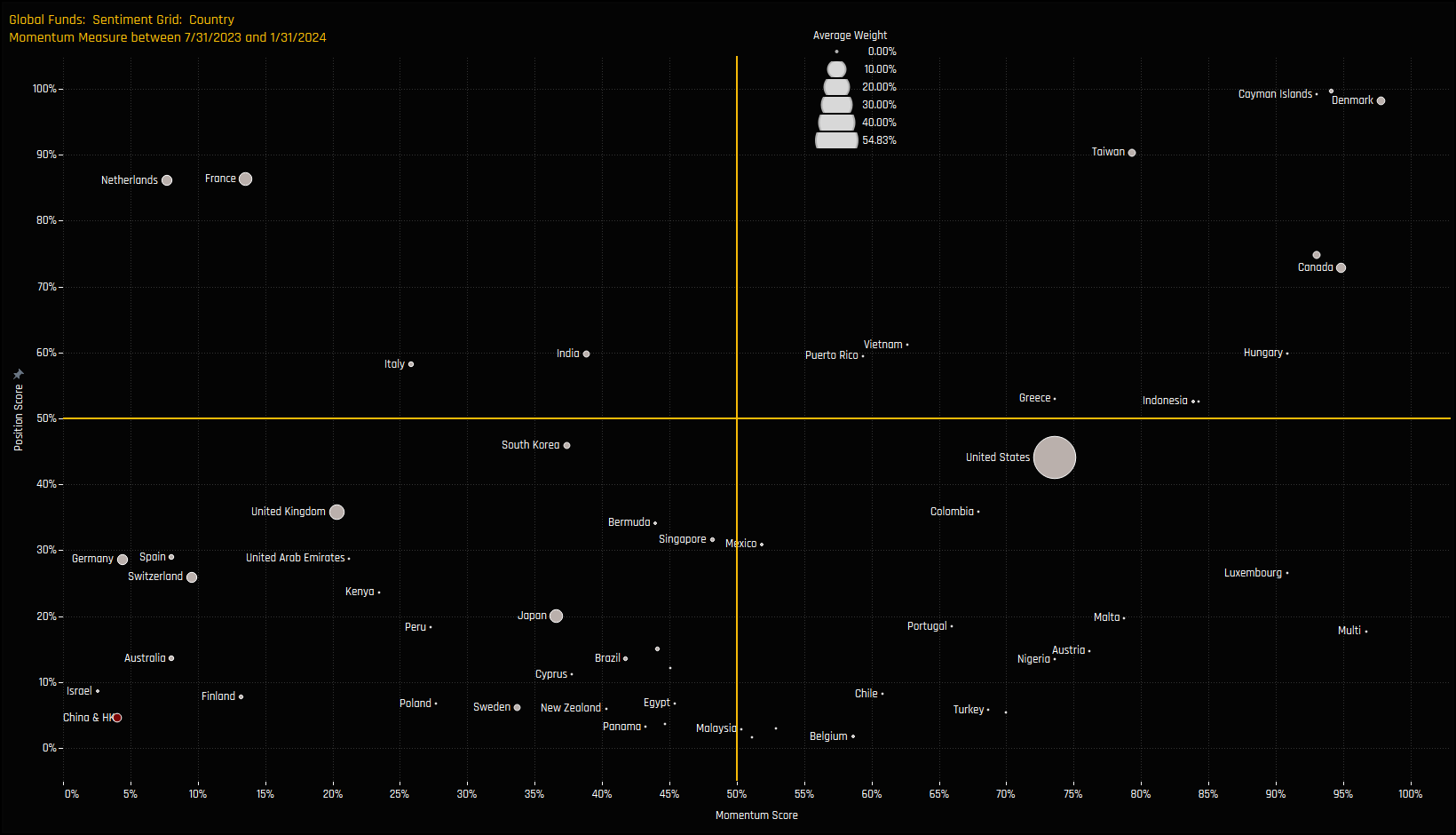

To round things off, the chart below shows the Sentiment Grid for all countries in the Global investible universe. China’s position in the far bottom left corner is indicative of where sentiment is for China right now. Record low positioning, continued underperformance and net selling among managers has pushed China to new grounds. Considering the adage ‘it’s always darkest before the dawn,’ the current positioning set up in China & HK could hardly be darker, signaling a potential pivotal moment for investors.

Country Sentiment

Analysis taken from our Global Equity positioning research, covering 340 active strategies with a combined AUM of $1tr. For more information on our research, contact me directly on the email below.

Related Posts

- Steve Holden

- February 20, 2023

Consensus Overweight in UK Stocks

358 Global Equity Funds, AUM $914bn Overweight Consensus in UK Stocks A record 70.4% of Global ..

- Steve Holden

- January 10, 2024

Riding High: The Magnificent 7 Surge in Global Equity Funds

The Magnificent 7, comprising Microsoft, Apple, Alphabet, Amazon, Meta, NVIDIA and T ..

- Steve Holden

- March 22, 2023

Global Stock Radar

356 Global Equity Funds, AUM $938bn Global Funds: Stock Radar Investment levels among the thous ..