Time-Series & Country Activity

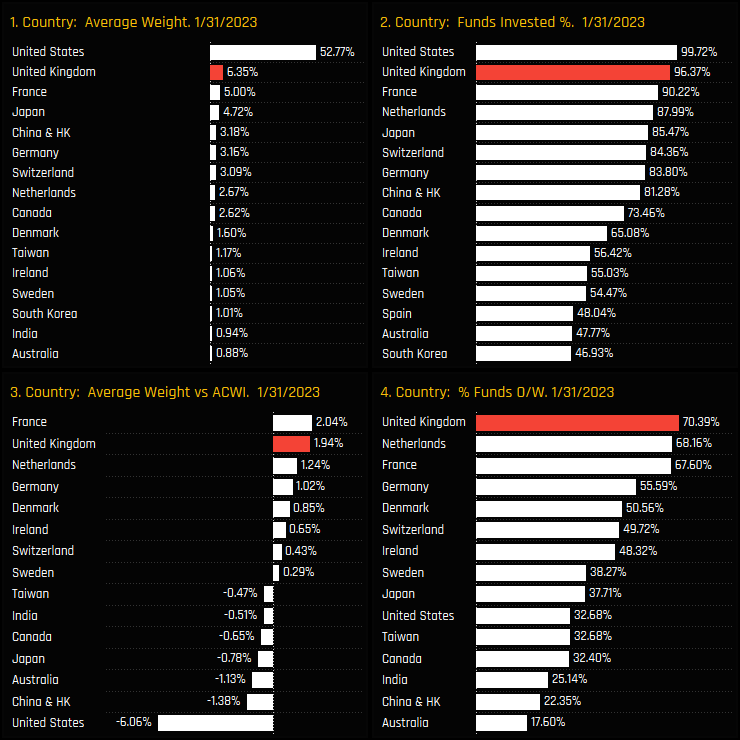

The majority of active Global Funds are expecting UK equities to outperform. Relative to the SPDRs ACWI ETF, a record 70.4% of funds are positioned overweight (ch4), with average fund weights +1.94% above the benchmark level (ch2). On absolute terms, fund weights in the UK are low compared to history at 6.35%, though there are signs that the decline from 2012 onwards is starting to reverse (ch1), with both average weights and the percentage of funds invested moving off the recent lows (ch3).

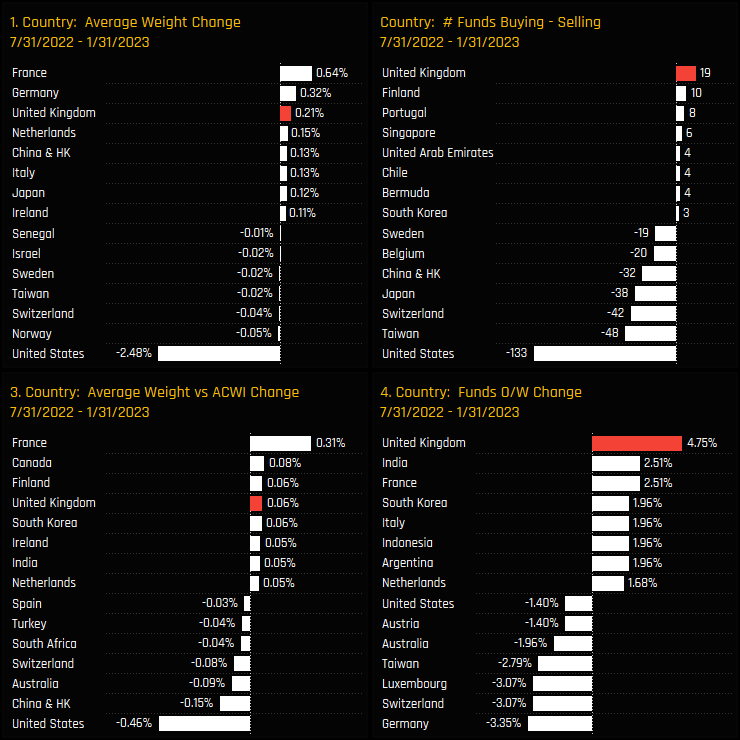

Over the past 6-months, the evidence for a positive re-positioning of UK stocks is clear, with average weights increasing by +0.21% (ch1), overweights increasing by 0.06% (ch3) and a further 4.75% of funds switching to overweight (ch4). In a period where the number of funds seeing outflows outnumbered those seeing inflows by a factor of 2, an excess of 19 funds bought in to the UK, the most of any country and in contrast to a net 133 funds selling down USA positions.

Peer Group Positioning & Sentiment

Outside of the USA, the United Kingdom is top of the 2nd tier, ahead of France, Japan and China & HK on both an average weight and funds invested basis. Relative to benchmark, no country is held overweight by more funds, with the net overweight only bettered by France. Global Funds are running a significant underweight in US equities.

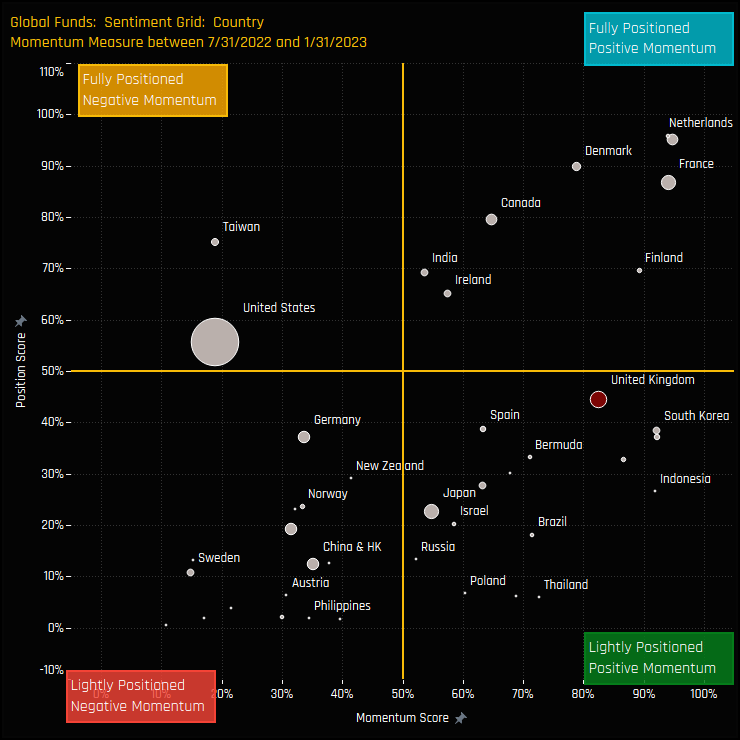

The sentiment grid below shows where current positioning in each Country sits versus its own history going back to 2012 on a scale of 0-100% (y-axis), against a measure of fund activity for each Country between 07/31/2022 and 01/31/2023 (x-axis). The UK’s position in the bottom right of the grid reflects its positive momentum but low absolute weight compared to history.

UK Sector Positioning

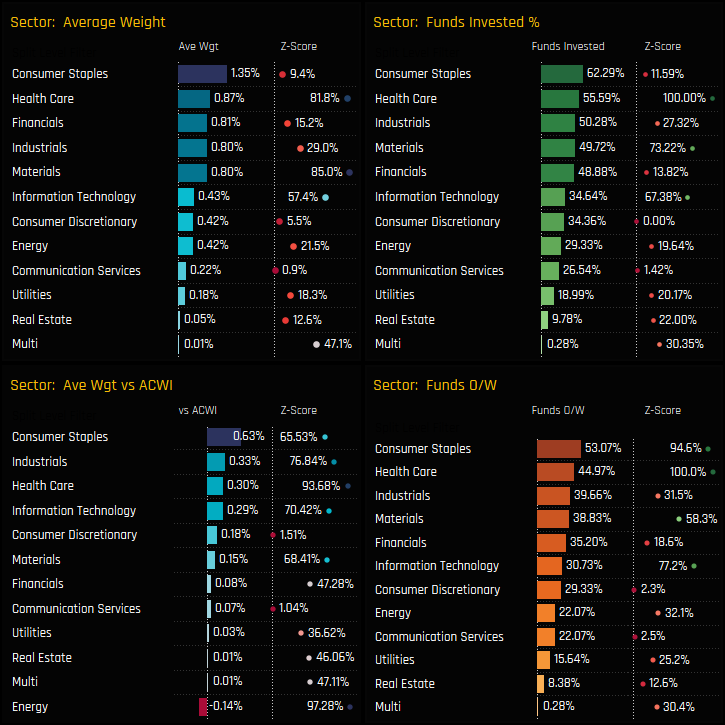

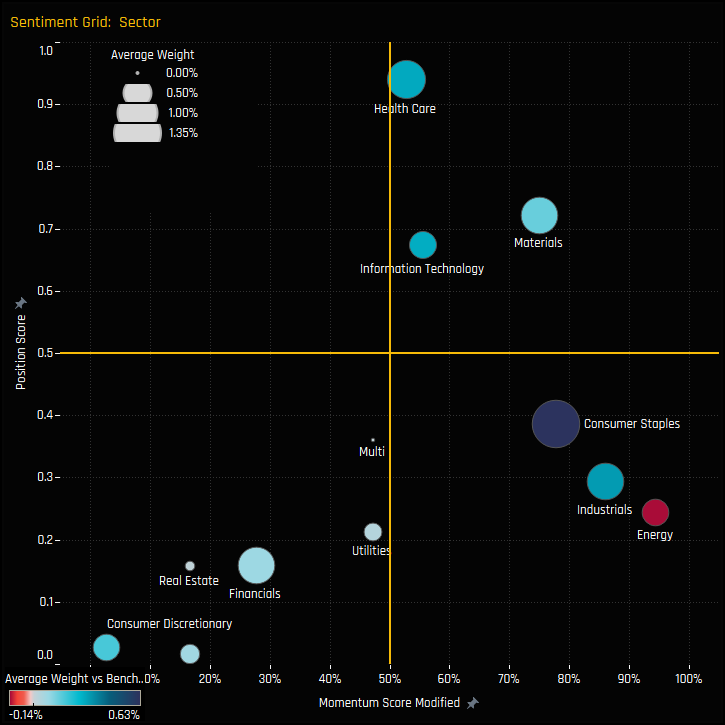

Of the 6.35% allocation in UK equities, nearly three quarters is taken up by the top 5 sectors of Consumer Staples, Health Care, Financials, Industrials and Materials. The overweight is driven by UK Consumer Staples, with 53% of funds overweight at a net +0.63% above benchmark. Only the Energy sector is held as a net underweight and could be described as ‘underowned’, with just 29.3% of funds exposed.

The Sentiment Grid for UK sectors highlights positive momentum among Consumer Staples, Industrials, Energy and Materials, with all but Materials positioned at the lower end of their historical ranges. UK Financials, Consumer Discretionary and Communication Services are out of favour, with depressed positioning and outward rotation over the last 6-months.

Fund Holdings & Activity

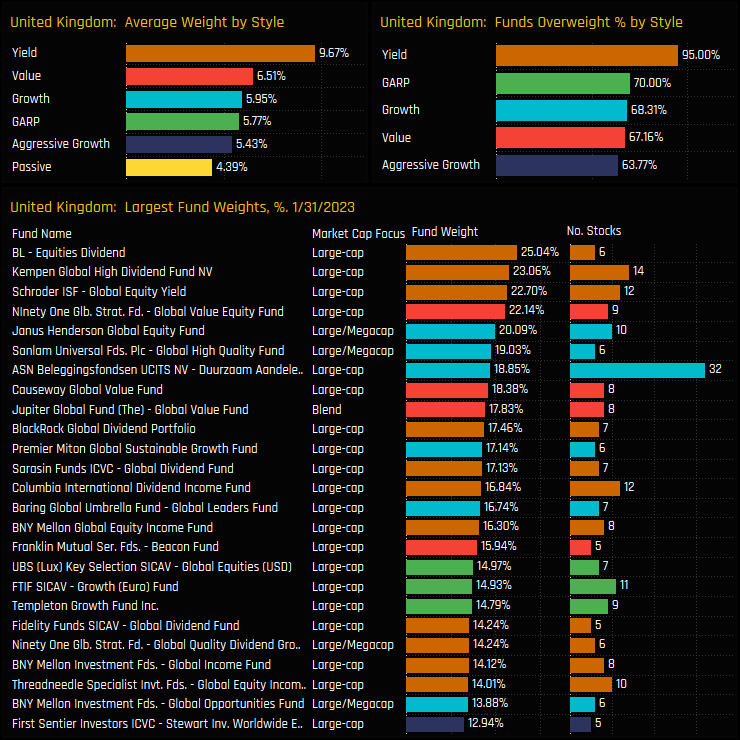

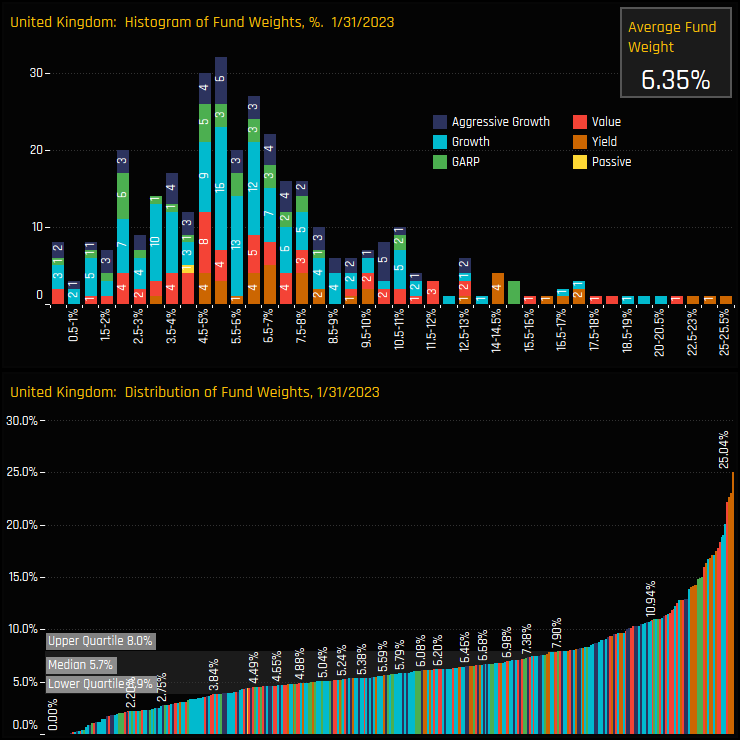

The consensus overweight stance is common across the Style groups, with 95% of Yield managers overweight the UK and 64% of Aggressive Growth managers. All are positioned net overweight the SPDRs ACWI ETF, on average. Yield managers are the most heavily allocated by a distance, with average weights of 9.67% and a dominance among the top 20 largest fund weights.

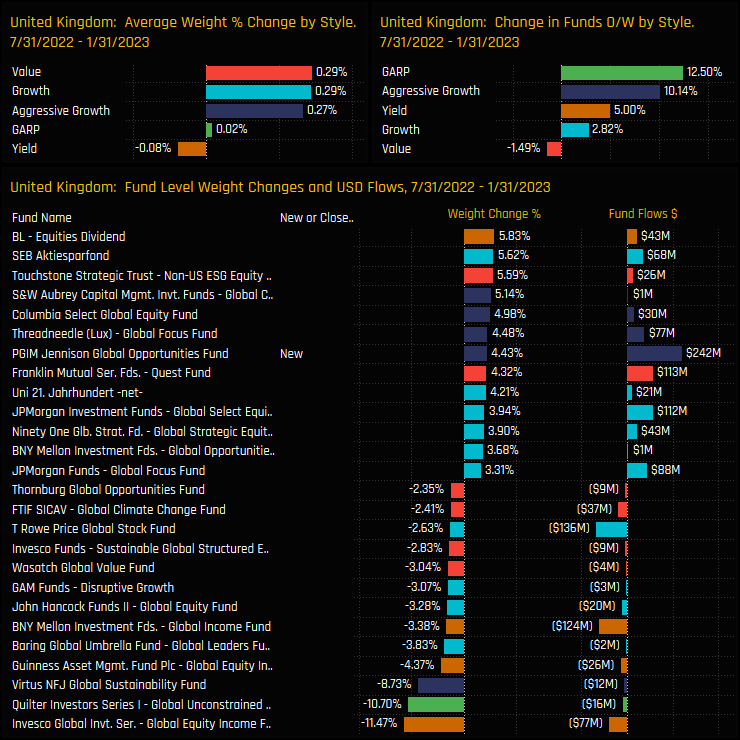

Fund level activity over the last 6-months reflects the growing overweight stance towards the UK, with 12.5% of GARP funds and 10.14% of Aggressive Growth managers switching to overweight. Fund inflows were more common than outflows, though activity wasn’t entirely one-directional, as Invesco Global Income and Quilter Global Unconstrained both cut positions by more than 10%.

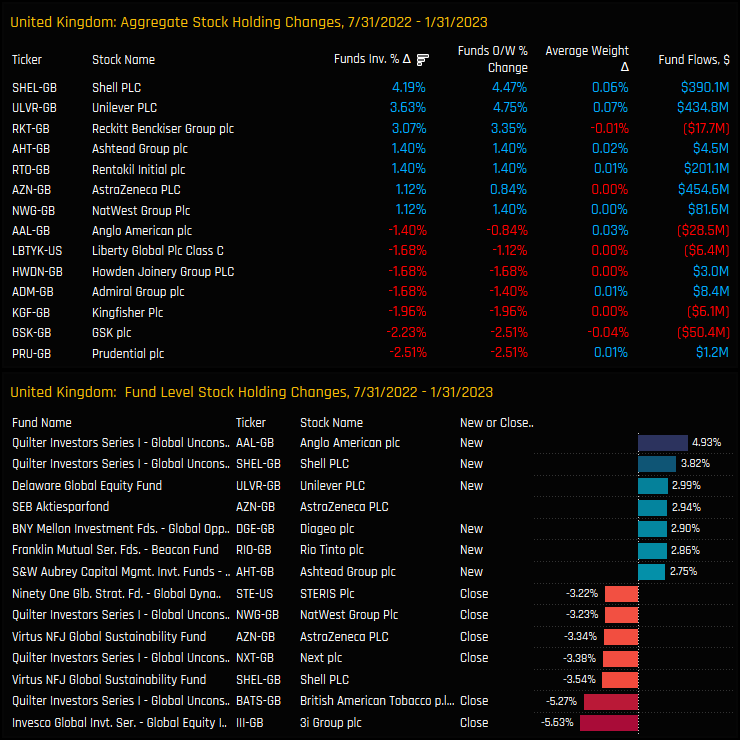

Stock Positioning & Activity

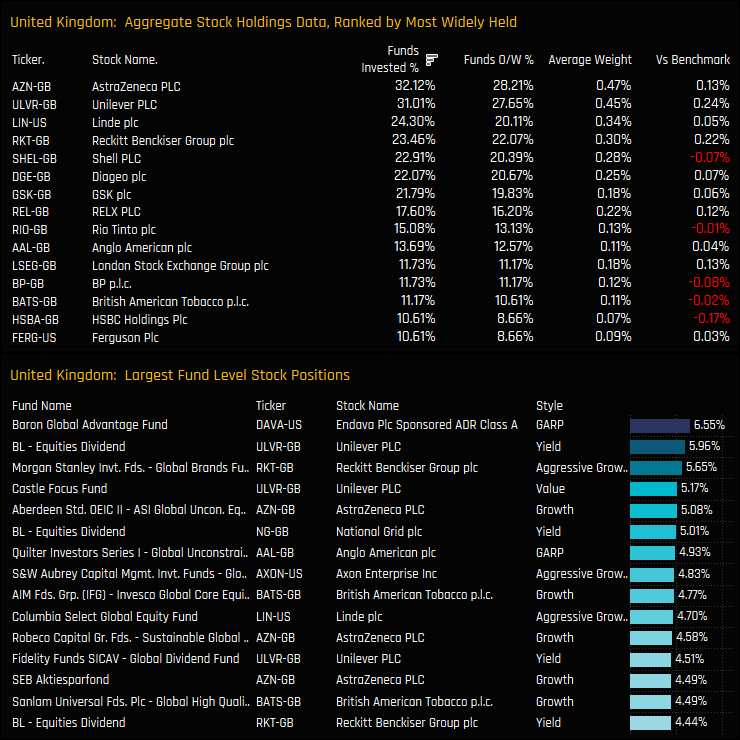

The latest snap of positioning shows AstraZeneca and Unilever as the most widely held stocks in the UK, owned by 32.1% and 31% of funds respectively. Most of the major stocks in the UK are held overweight the benchmark on average, save for BP, Shell and the perennially underowned HSBC Group. Among a sea of high conviction positions in Unilever, AstraZeneca and Reckitt Benckiser Group, Baron Global Advantage’s 6.55% holding in Endava is the standout.

Positive sentiment was reflected in increased positioning in Shell PLC, Unilever PLC and Reckitt Benckiser over the last 6-months, with the percentage of funds invested increasing by 4.2%, 3.6% and 3.1% respectively. These increases outweighed decreases in positioning among Prudential, GSK and Kingfisher.

Conclusions & Data Report

Global managers appear optimistic towards the UK. A record number of managers are positioned overweight, marking a reversal in the trend of decreasing allocations seen over the last decade. With the USA so dominant in Global strategies, the United Kingdom is carving a niche for itself as ‘The best of the rest’.

In a market as broad and as diverse as the UK, this increase in sentiment hasn’t been spread evenly across all sectors, with a clear rotation in to Industrials, ‘Staples, Energy and Materials partially offset by decreases in Financials and Consumer Discretionary. However, as it stands, active Global managers remain overweight every sector bar Energy, and every Style group from Value to Growth is positioned overweight the SPDRs MSCI All Country World ETF.

The charts to the right show the histogram and distribution of UK fund weights among the 358 funds in our analysis. The bulk of the distribution sits above the benchmark weight of 4.39%, with 50% of managers above 5.7% and 25% above 8%. To be a Global fund underweight the UK today puts you in the clear minority.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- June 2, 2023

Copley Fund Research Fund Positioning Chart Pack II

1600 Active Equity Funds, AUM $4.7tr Fund Positioning Chart Pack BYD Co Ltd Becomes Most Popula ..

- Steve Holden

- November 21, 2022

The Largest Underweights in EM

278 ACTIVE GEM FUNDS, AUM $312BN Underweight Stock Risks in EM Active Emerging Market investors ..

- Steve Holden

- March 14, 2023

SVB Financial Corp: US Fund Closures Hinted at Trouble Ahead

295 US Equity Funds, AUM $3tr SVB Financial Corp: US Fund Closures Hinted at Trouble Ahead Owne ..