278 ACTIVE GEM FUNDS, AUM $312BN

Underweight Stock Risks in EM

Active Emerging Market investors face a myriad of risks when constructing and running a portfolio. One of those is benchmark risk, with even the most active of managers required to state relative performance versus their benchmark. In this summary piece, we identify the largest aggregate underweight stock positions among active EM funds, together with stocks that are simply avoided and unloved.

Underweight and Unloved

The chart below shows the largest 30 stock underweights among the 278 active EM funds in our analysis. We take the average weight for each stock across all funds (including zeros) and subtract from the weight in the iShares MSCI Emerging Markets ETF (cash removed and weights adjusted). The list is headed by Tencent Holdings, a stock held at an average weight of 2.02%, a deficit of -0.99% compared to the benchmark weight. And though 74.5% of EM funds hold Tencent, only 31.3% are overweight. If any of the stocks on this list outperform the broader market, relative performance of the active EM peer group will suffer.

Just because a stock is held underweight doesn’t mean it is not well regarded. After all, stocks such as TSMC, Tencent and Samsung Electronics are held by over 70% of active EM investors, hardly a damming indictment of the investment case. To find stocks that EM investors really don’t like, we add another layer to our screen. As well as being held underweight, the stocks in the list below are also held by less than 5% of the EM funds in our analysis. The overwhelming majority of managers are happy to run the benchmark risk on these stocks – they truly are the untouchables of the EM investible universe.

Tencent Holdings Stock Profile

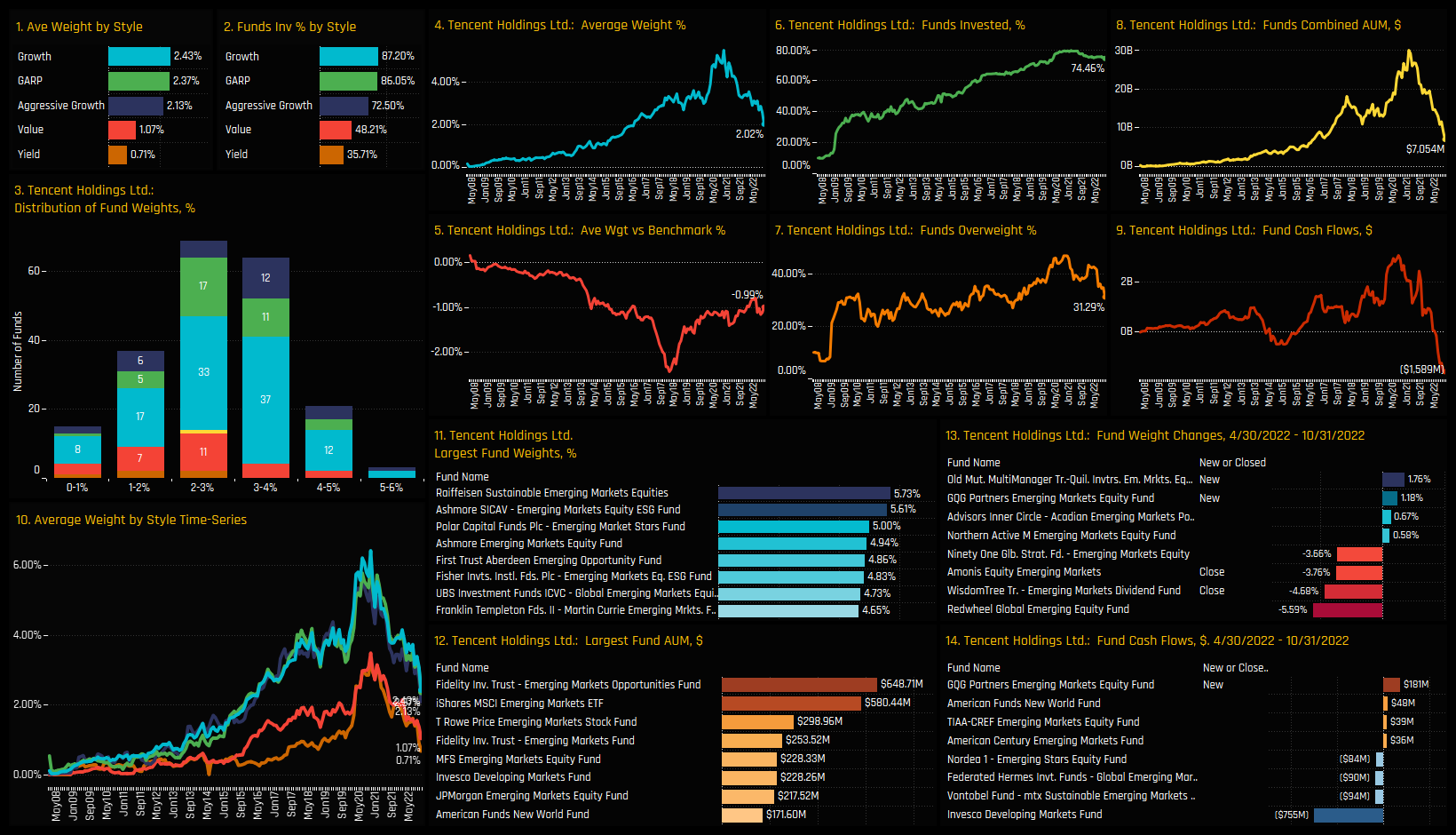

Copley hold detailed ownership profiles for all stocks in the EM investible universe. They highlight the current ownership picture, the long-term time series of investment and more recent activity among the funds in our analysis. Tencent Holdings is favoured by funds at the Growth end of the spectrum, with average weights among Growth funds of 2.43% versus just 1.07% among EM Value managers (ch1). The holdings distribution is centered between 2%-4% (ch3), with a tail to the upside headed by Raiffeisen Sustainable Emerging Equity (5.73%) and Ashmore EM Equity ESG (5.61%) (ch11).

The longer term trends show a dramatic collapse in average holding weight for Tencent, falling from a high of over 5% back in October 2020 to 2.02% today (ch4), with fund flows (ch9) and the percentage of funds overweight (ch7) falling in unison. Despite this, the majority of EM funds still hold Tencent (ch6), with a combined $7bn in holdings across our $312bn fund universe. Activity over the last 6-months has been mixed, with GQG Partner’s +1.18% opening position more than offset by $755m of selling from the Invesco Developing Markets fund.

If you are a Fund Manager or finance professional and would like to know more about our positioning research, please fill in the form opposite. or contact us.

Related Posts

- Steve Holden

- February 28, 2023

Greece: Confidence Returns Among EM Investors

270 emerging market Funds, AUM $360bn Greece: Confidence Returns Among EM Investors Active EM i ..

- Steve Holden

- February 28, 2024

Global EM Funds: Country Positioning Update

361 emerging market Funds, AUM $400bn Country Positioning Update • China weights fall to lowe ..