Magnificent 7 Deep Dive

-

Steve Holden

-

December 21, 2023

-

Global

-

0 Comments

342 Global Equity Funds, AUM $990bn Riding High: The Magnificent 7 Surge in Global Equity Funds • The Magnificent 7, comprising Microsoft, Apple, Alphabet, Amazon, Meta, NVIDIA and Tesla have hit record high allocations among active Global equity funds this year. • Thought of as a standalone allocation, they represent the 2nd largest country weight, but also stand as a …

Continue Reading

Global Fund Positioning Analysis, November 2023

-

Steve Holden

-

November 20, 2023

-

Global

-

0 Comments

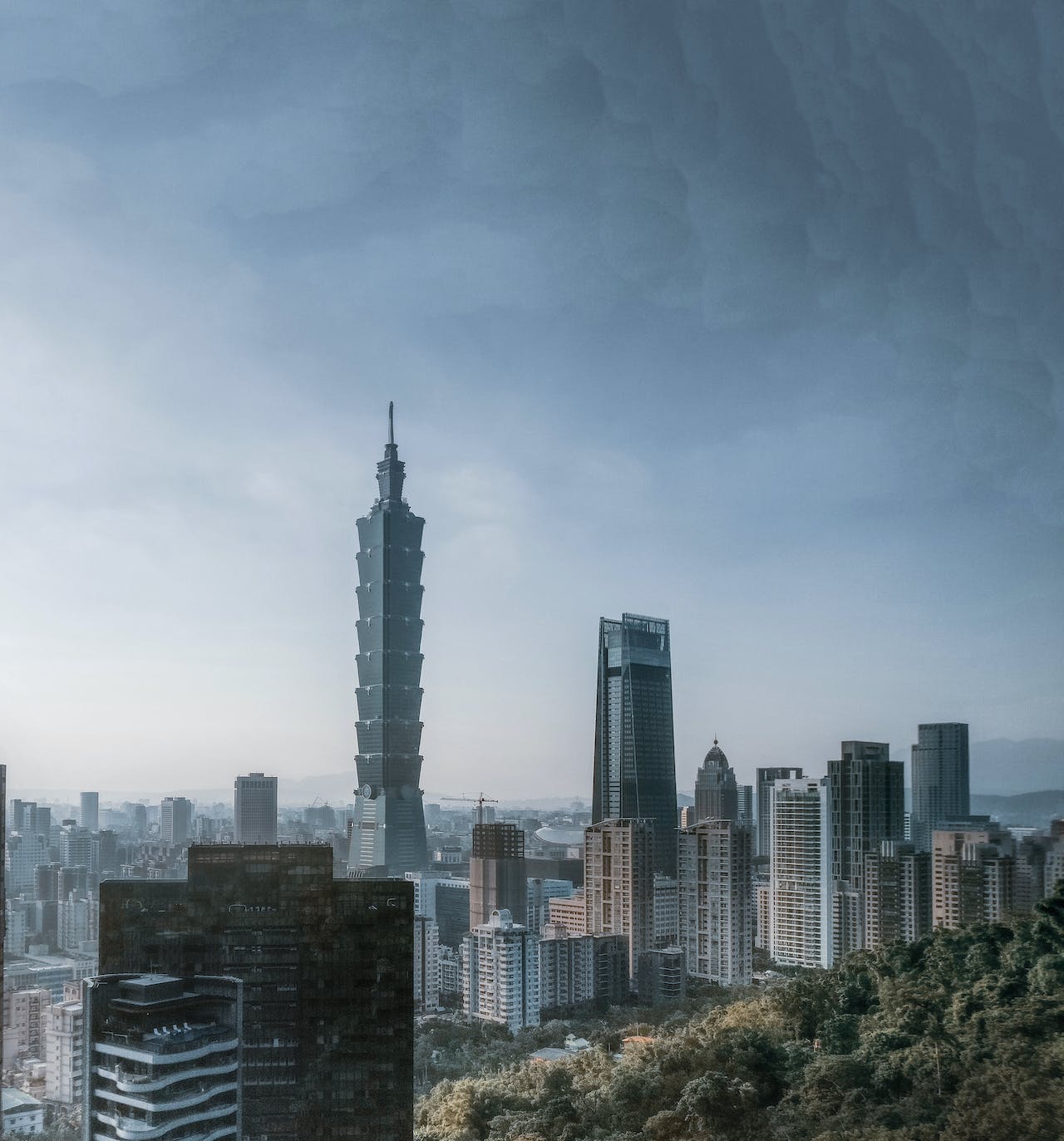

344 Global Equity Funds, AUM $905bn Global Fund Positioning Analysis, November 2023 Taiwan: Underowned Yet Gaining on Peers ServiceNow.Inc: Global Funds Ramp Up Exposure Global Funds Stock Radar 344 Global Equity Funds, AUM $905bn Taiwan: Underowned Yet Gaining on Peers • The percentage of Global funds invested in Taiwan hits an all-time high of 57.8%. • Taiwan has been …

Continue Reading

Global Fund Positioning Analysis, September 2023

-

Steve Holden

-

September 12, 2023

-

Global

-

0 Comments

349 Global Equity Funds, AUM $999bn Global Fund Positioning Analysis, September 2023 In this issue: Global Equity Managers Trim EM Underweight, but Remain Bearish Global Funds Country/Sector Radar Global Managers Lead a Bullish Charge on Linde plc 349 Global Equity Funds, AUM $999bn Global Equity Managers Trim EM Underweight, but Remain Bearish • The heavy decline in EM allocations …

Continue Reading

Global Fund Positioning Analysis, July 2023

-

Steve Holden

-

July 26, 2023

-

Global

-

0 Comments

349 Global Equity Funds, AUM $988bn Global Fund Positioning Analysis, July 2023 In this issue: H1 Performance & Attribution H1 Top Down Positioning Update NVIDIA: New Highs 349 Global Equity Funds, AUM $988bn H1 Performance & Attribution The latest stats on performance and the drivers of performance for H1 2023. H1 Performance Summary Active Global funds returned a healthy 12.13% …

Continue Reading

Global Fund Positioning Analysis, June 2023

-

Steve Holden

-

June 30, 2023

-

Global

-

0 Comments

350 Global Equity Funds, AUM $940bn Global Fund Positioning Analysis, June 2023 Japan: Early Signs of Potential Re-Weight US Technology: Max Weight, Max Underweight Global Funds Stock Radar 350 Global Equity Funds, AUM $940bn Japan: Early Signs of a Potential Re-Weight Global active funds make tentative moves back in to Japanese equities after a 5-year decline. Time-Series and …

Continue Reading

Global Fund Positioning Analysis, May 2023

-

Steve Holden

-

May 14, 2023

-

Global

-

0 Comments

352 Global Equity Funds, AUM $962bn Global Fund Positioning Analysis, May 2023 Global Banks Deep Dive Netherlands Positioning: Extending Gains Stock Positioning Update 352 Global Equity Funds, AUM $962bn Global Banks Deep Dive Positioning in the Banking industry group stalls after US Banking failures, but non-US sentiment is improving. Time-Series & Industry Positioning Among active Global equity funds, …

Continue Reading

Recent Comments