H1 Performance Summary

H1 Performance Summary

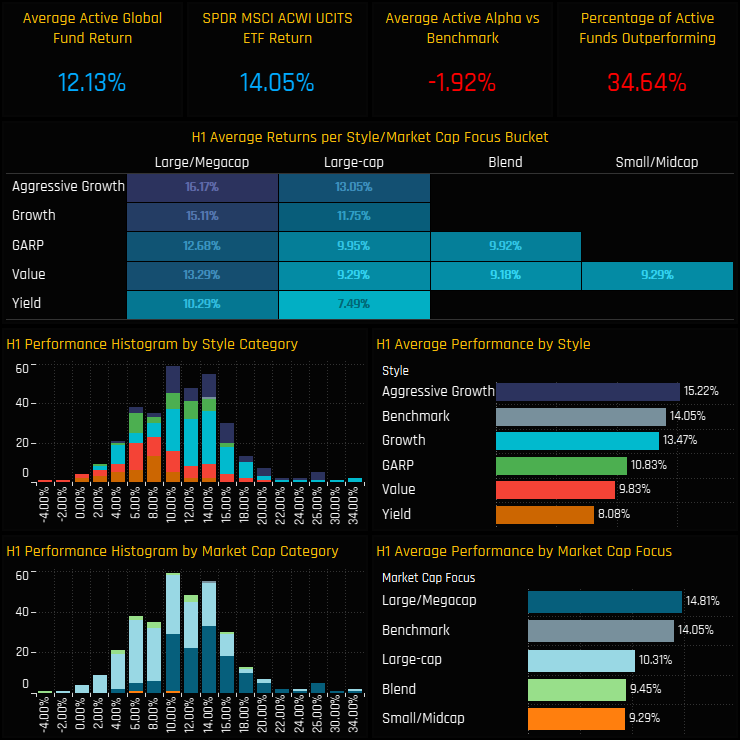

Active Global funds returned a healthy 12.13% on average during the first half of 2023, but an unhealthy underperformance of -1.92% compared to the SPDRs MSCI ACWI ETF. Style really mattered, as did Market Cap, with Aggressive Growth funds (+15.2%) and Large/Megacap (14.8%) the only groups to outperform the benchmark (14.05%) over the period. Value (9.8%), Yield (8.1%) and Small/Midcap (9.3%) funds dragged down the averages.

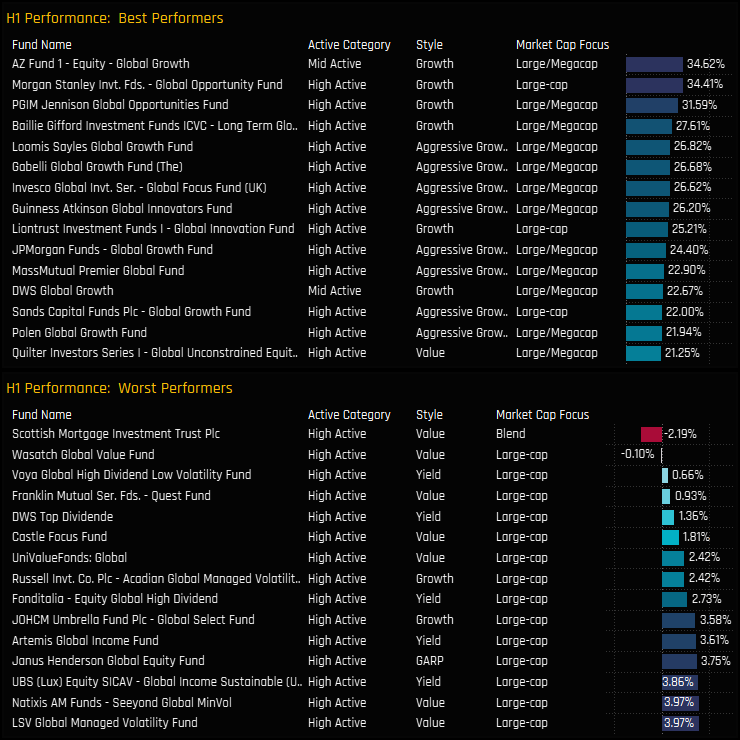

On a single fund level the dispersion in returns was even more pronounced, with the top performers of AZ Fund Global Growth, Morgan Stanley Global Opportunity and PGIM Global Opportunities returning >30%, against Scottish Mortgage and Wasatch Global Value who failed to break even. Large/Megacap funds took 12 of the top 15 spots, whilst Value/Yield took 12 of the bottom 15.

Portfolio Contribution

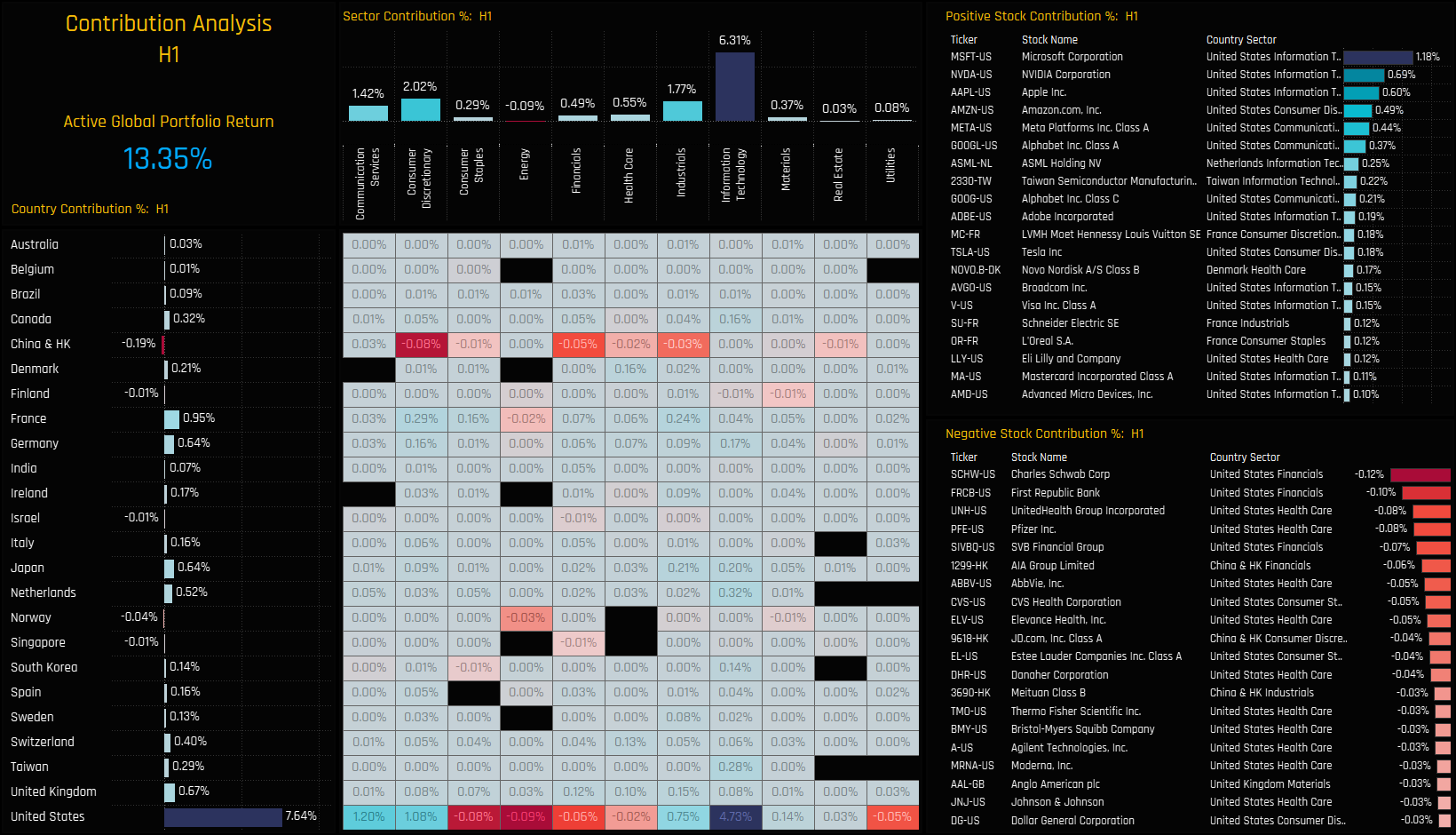

What were the drivers of these returns over the year across countries, sectors and stocks? The chart set below breaks down the performance of a portfolio based on the average holdings of the 349 active Global funds in our analysis. This theoretical portfolio returned 13.35% in H1 2023, with Technology (+6.3%) and Consumer Discretionary (+2.02%) the key drivers and Energy (-0.06%) the only sector to contribute negatively on the year. On a Country level, the USA was main driver of returns (+7.64%) with healthy contributions across the major European countries and Japan, whilst China & HK positions cost managers -0.19% on the year so far.

Drilling down a level further, costly country/sectors were China & HK Consumer Discretionary (-0.08%), US Energy (-0.09%) and US Consumer Staples (-0.08%). The major drivers of positive returns were US Technology (+4.73%), US Communication Services (+1.2%) and US Consumer Discretionary (+1.08%). The key stocks driving performance can be seen in the right hand charts below, with positive contributions led by Microsoft Corp (+1.18%), NVIDIA Corp (+0.69%) and Apple Inc (0.6%). On the negative side, Charles Schwab (-0.12%), First Republic Bank (-0.1%) and UnitedHealth Group Corp (-0.08%) dragged on returns in the first half of the year.

Portfolio Attribution

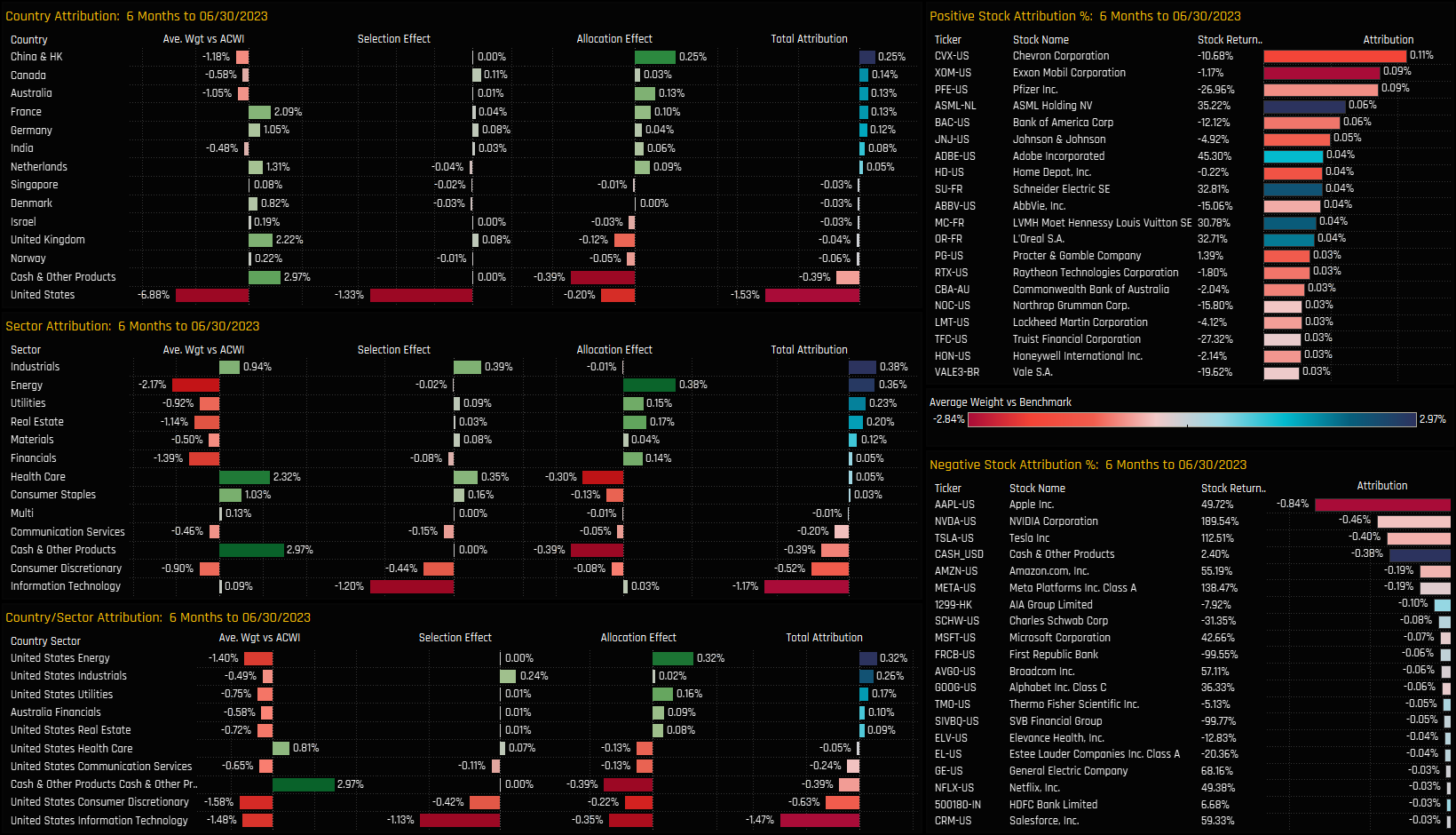

We perform attribution analysis on this portfolio versus a representation of the benchmark based on the SPDRs MSCI ACWI ETF, to help us better understand where this year’s underperformance came from. The portfolio underperformed by -0.86% over the period, with one of the major pain trades being the underweight in Apple Inc that Global funds continue to run. A summary of the key drivers are documented below.

What worked:

- Underweights in China & HK, India Energy, USA Utilities.

- Overweights in France, Netherlands, Germany

- Stock selection in Canada, Industrials, Health Care

- Underweights in Chevron, Exxon Mobil, Pfizer Inc.

- Overweights in ASML Holding, Adobe Incorporated, Schneider Electric

What didn’t:

- Underweights in USA Technology, US Consumer Discretionary

- Overweights in Cash, the UK, Health Care, Consumer Staples

- Stock Selection in the USA, Information Technology, Consumer Discretionary

- Overweights in AIA Group, Charles Schwabb

- Underweights Apple. NVIDIA, Telsa Inc.

Regions

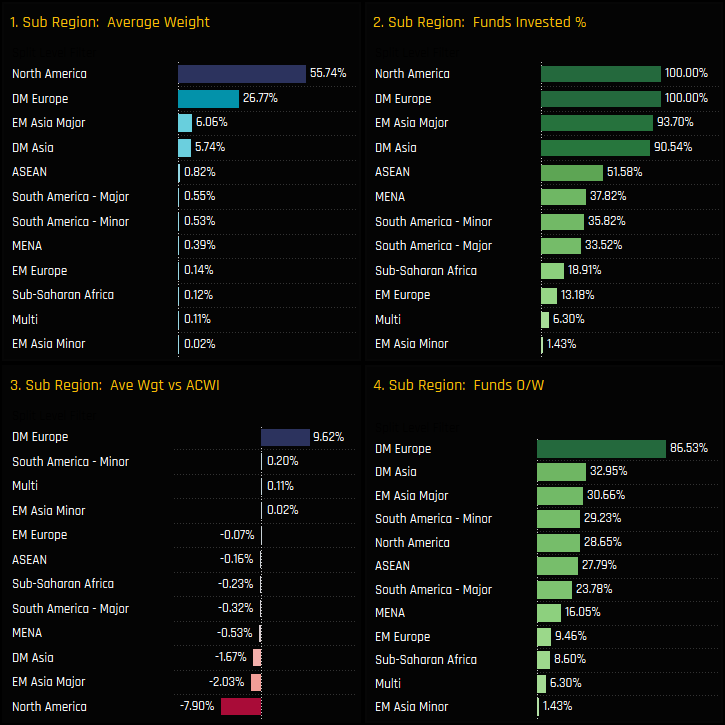

Active Global Funds start the 2nd half of 2023 with 82.5% of all allocations invested in North America (55.74%) and Developed Europe (26.77%). The remainder is mostly split between EM Asia Major (China & HK, India, S.Korea, Taiwan) and Developed Markets in Asia (Singapore, Japan, Australia). Versus the SPDRs MSCI ACWI ETF benchmark, active Global managers are running a sizeable overweight in DM Europe (+9.62%), with 86.5% of the 349 funds in our analysis positioned as overweight. Against this, record underweights in North America (-7.9%) are complemented by smaller underweights in the Asia and MENA regions.

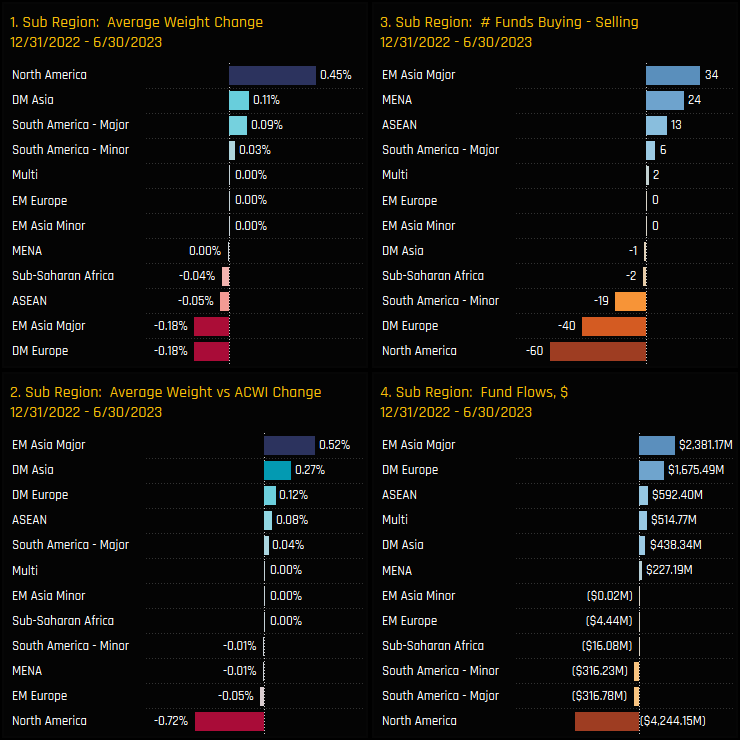

Between the filing dates of 12/31/2022 and 06/30/2023, active Global funds saw average weights increase in North America by +0.45%, exacerbating the existing underweight by -0.72%. Active managers sold in to this strength, with a net $4.24bn in outflows and an excess of 60 sellers over buyers during the period. Elsewhere, evidence that Global funds are warming to the major EM Asia nations came in the form of net fund inflows of $2.3bn, underweights dropping by 0.52% and an excess of buyers over sellers.

Countries

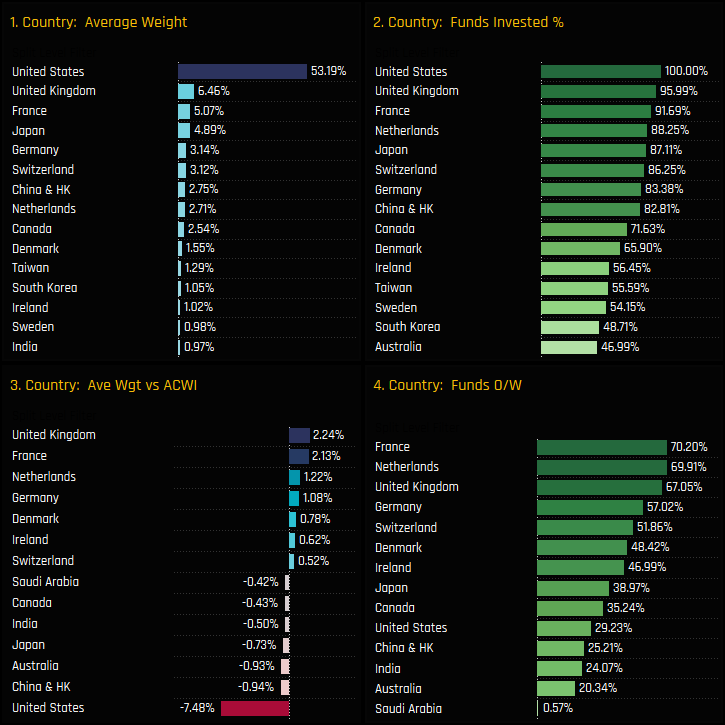

Country positioning is dominated by the USA, which accounts for 53.2% of the average active Global Fund. Relative to the SPDRs ACWI ETF benchmark this represents an underweight of -7.48%, with managers overweight Developed Europe via the major countries, led by the UK (+2.24%), France (+2.13%), the Netherlands (1.22%) and Germany (+1.08%). In fact, 70.2% of funds are now overweight France and 69.9% overweight the Netherlands. China & HK, Australia, Japan and India are all key underweights alongside Saudi Arabia, which is held underweight by 99.4% of the funds in our analysis.

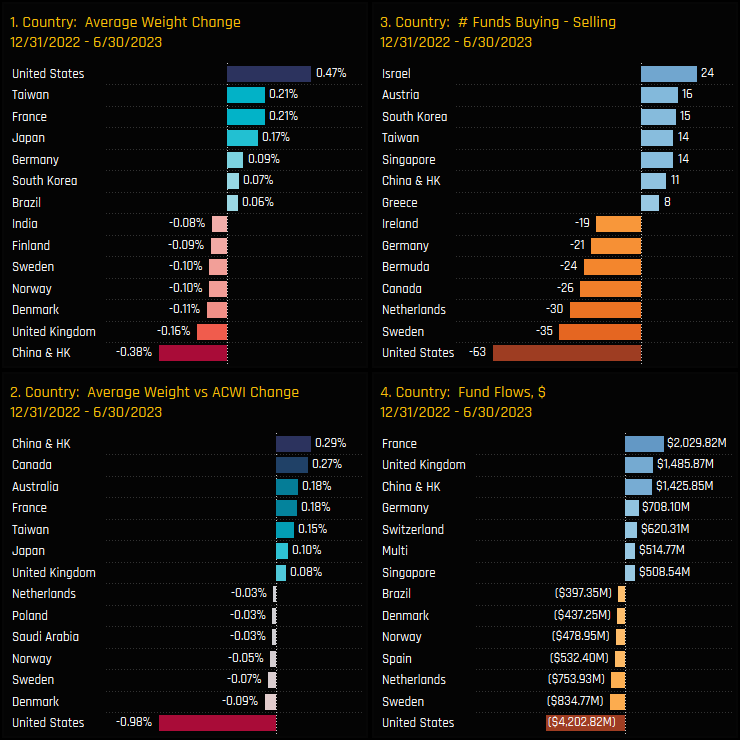

Country level ownership changes over the course of the year highlight a drop in China & HK weights (-0.38%) against an increase in the United States (+0.47%). These moves were driven by price, with ‘active’ rotation going the other way. China & HK saw net fund flows of +$1.43bn against the USA -$4.2bn, and an excess of buyers vs sellers of +11 versus the USA’s excess of 63 sellers. Elsewhere, Israel captured some positive rotation alongside Taiwan and South Korea, whilst Sweden and the Netherlands lost out.

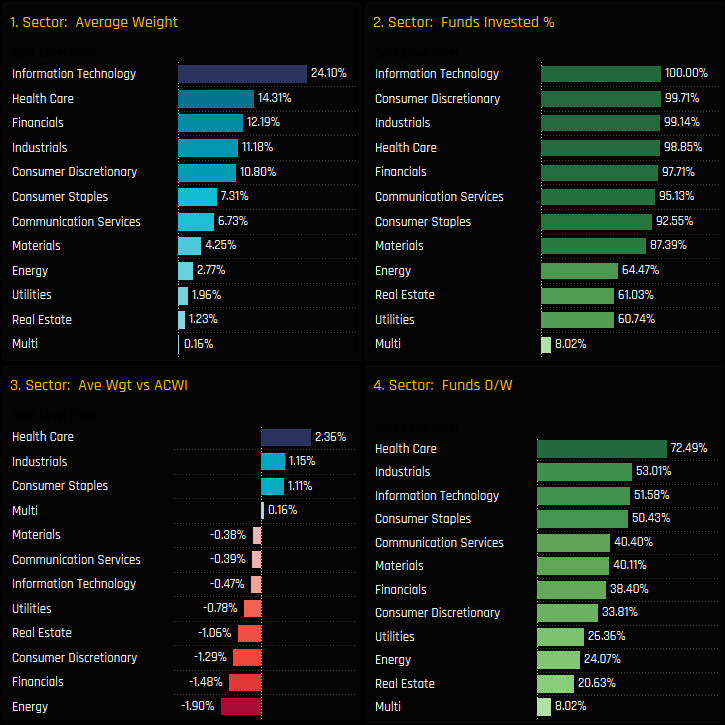

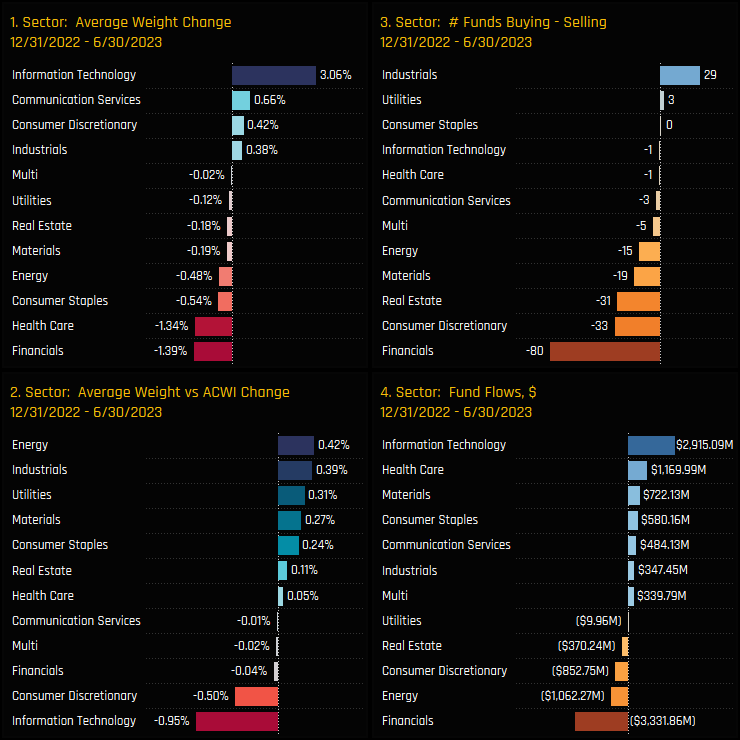

Sectors

On a sector level, Information Technology remains the dominant position by a margin, accounting for 24.1% of the average Global fund. The trio of Health Care, Industrials and Consumer Staples form the overweight sector holdings, offset by underweights in all other sectors and led by Energy, Financials and Consumer Discretionary. Energy, Real Estate and Utilities are not universally held among active Global managers, with over 35% of funds avoiding exposure to each.

Sector ownership changes between 12/31/2022 and 06/30/2023 favoured the Tech sector, with average weights increasing by +3.06% on the back of positive inflows totaling +$2.9bn. This rotation was not enough to keep pace with the benchmark though, with active funds moving from overweight +0.48% to underweight -0.47% over the period. Financials really bore the brunt of the outward rotation, with a net 80 funds selling out of the sector, average weights decreasing by -1.39% and fund outflows of -$3.3bn.

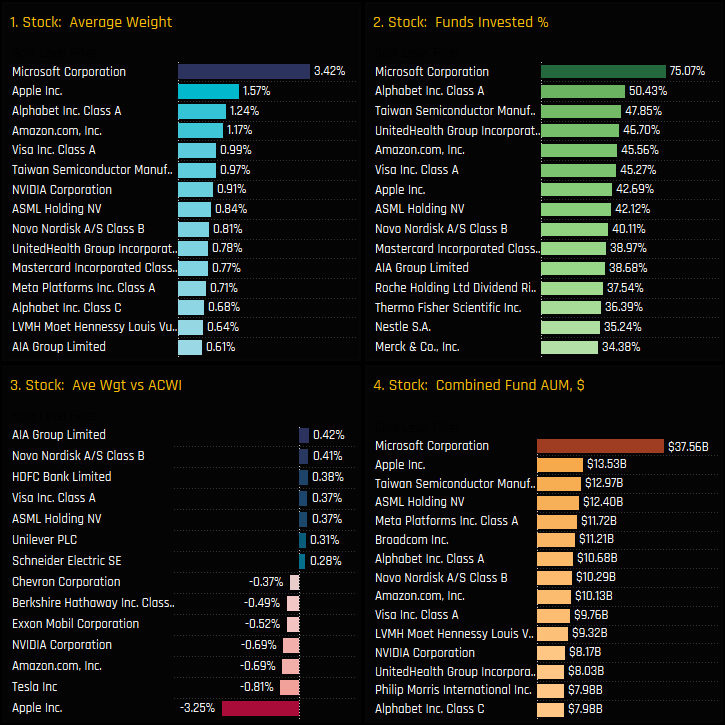

Stocks

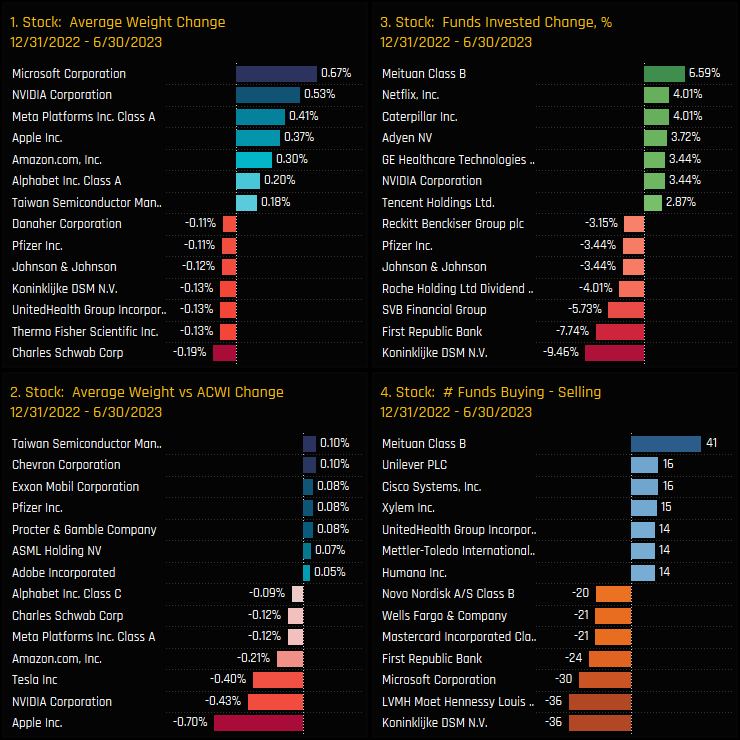

Microsoft remains the dominant stock holding, owned by 75.1% of funds at an average weight of 3.42%. Apple Inc is the next largest average weight on 1.57%, though more funds hold exposure to Alphabet Class A, TSMC and UnitedHealth, as shown in Chart 2. Global active funds are running big underweights in Apple Inc, with average exposure way below the ACWI weight of 4.82%. In fact, the -3.25% Apple underweight is the highest on record for Global active funds. Other decent sized underweights are in Telsa, NVIDIA and Amazon.com, with overweights spread across a large universe of stocks led by AIA Group, Novo Nordisk, HDFC Bank and Visa Inc.

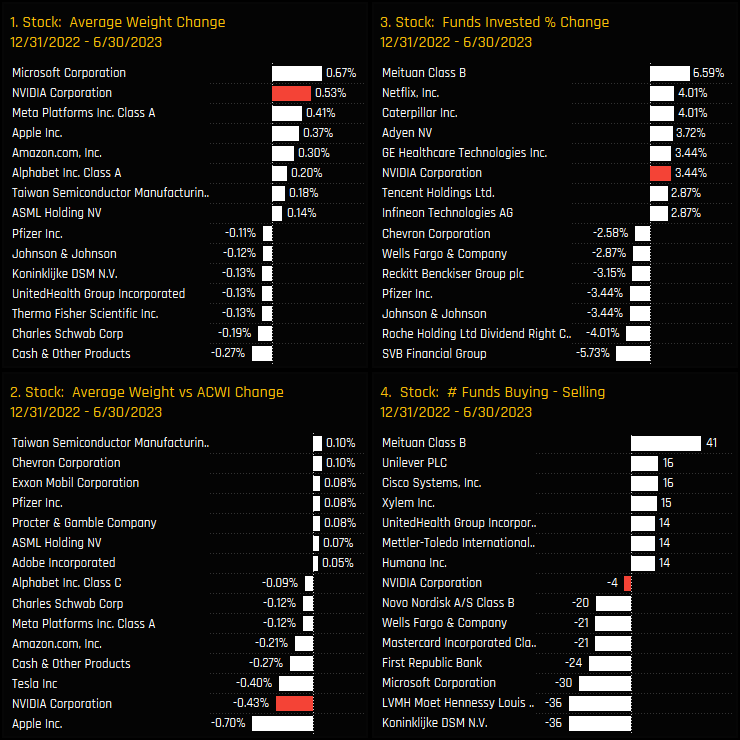

Microsoft’s strong performance helped push average holding weights higher by 0.67% this year, whist a doubling of NVIDIA’s share price helped push weights higher by +0.53% and underweights higher by -0.69%. On a funds invested basis, Meituan, Netflix and Caterpillar saw some of the largest increases, whilst Koninklijke (merger), First Republic Bank and SVB Financial saw ownership levels drop over the period.

Global Active Funds Ownership Report

Time Series & Stock Activity

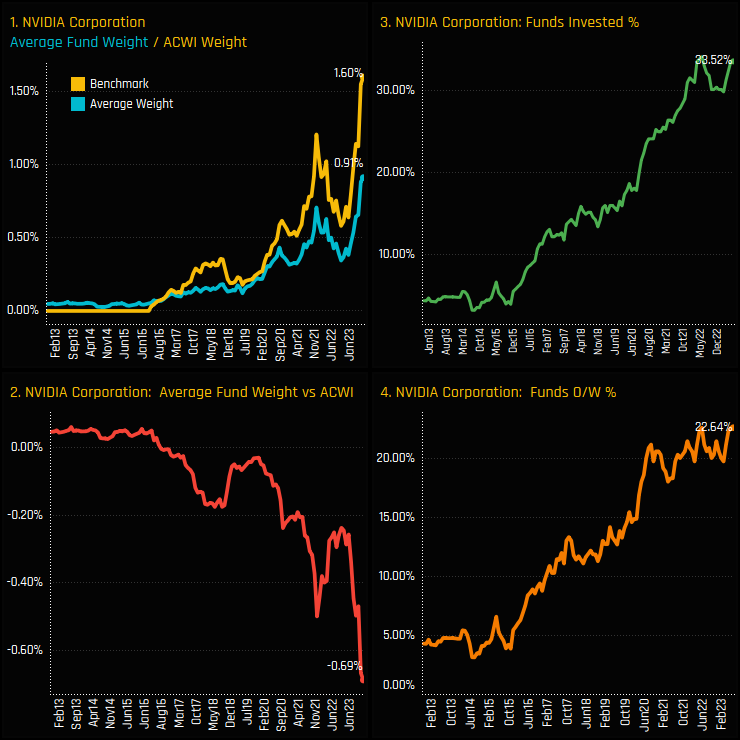

Global Fund exposure in NVIDIA Corp has moved to record levels after a doubling of the share price this year. Average weights among the 349 funds in our analysis stand at a record 0.91%, mainly driven by price but with the percentage of funds invested also moving back to the all-time highs of 33.5%. Given the pre-existing underweight in NVIDIA, these price increases have driven benchmark weights higher still, with the average active fund underweight plunging to a record low of -0.69%.

In the context of the broader stock universe, these moves are among the largest over the last 6-months, with only Microsoft seeing a larger increase in average weight. NVIDIA Corp captured the 5th largest increase in the percentage of funds invested, but the small excess of sellers over buyers does suggest there has been a degree of selling in to the recent strength.

Fund Activity & Latest Holdings

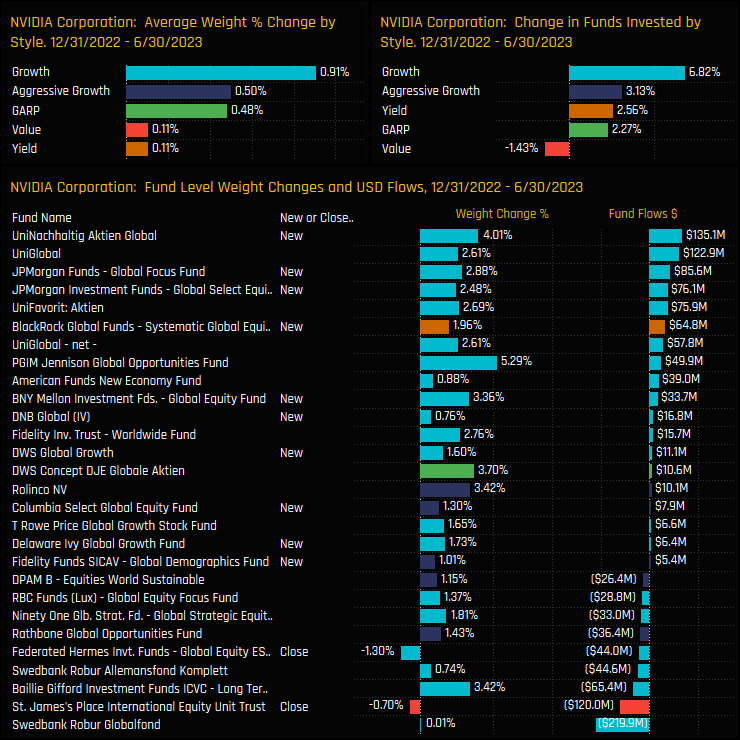

Between 12/31/2022 and 06/30/2023, new positions from UniNachhaltig Global (+4.0%), JP Morgan Global Focus (+2.88%) and BNY Mellon Global Equity (3.36%) were among a total of 14 funds who opened exposure to NVIDIA Corp. Growth managers were prevalent among the larger buyers, with 6.8% of the Growth funds in our analysis opening new positions, and all but Value funds seeing ownership levels rise. Closures were by St James Place International Equity Trust (-0.7%) and Hermes Global ESG (-1.3%).

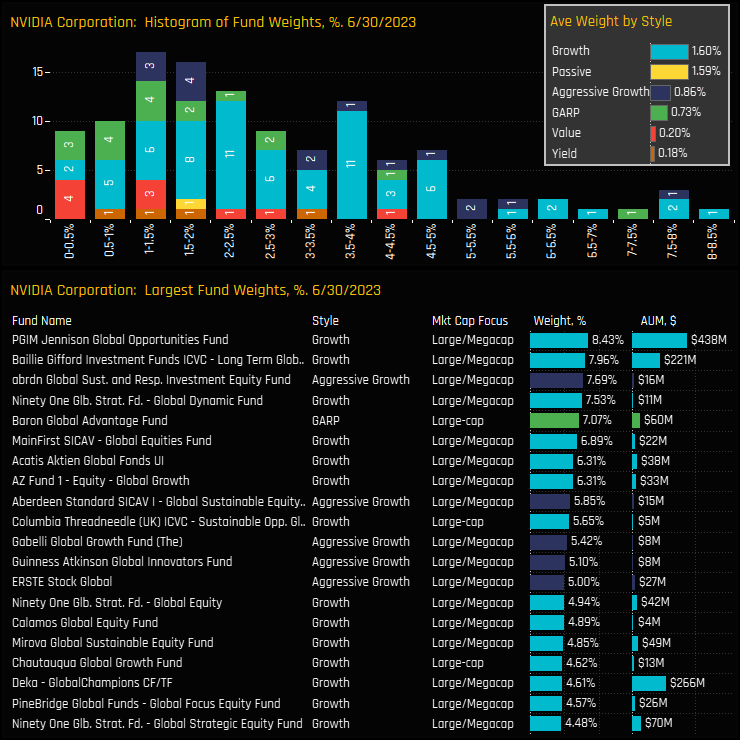

This leaves the latest distribution of fund weights in NVIDIA Corp clustered at between 1% and 5%, though it is a larger portfolio position for a number of managers. PGIM Jennison Global Opportunities (8.4%) and Baillie Gifford Long Term Global Growth (7.96%) lead a group of managers who are comfortable with a +7% position. NVIDIA is becoming a top portfolio holding for a growing number of funds.

Conclusions & Data Report

Can NVIDIA sustain these record levels of investment after seeing such an abrupt doubling of it’s market cap this year?

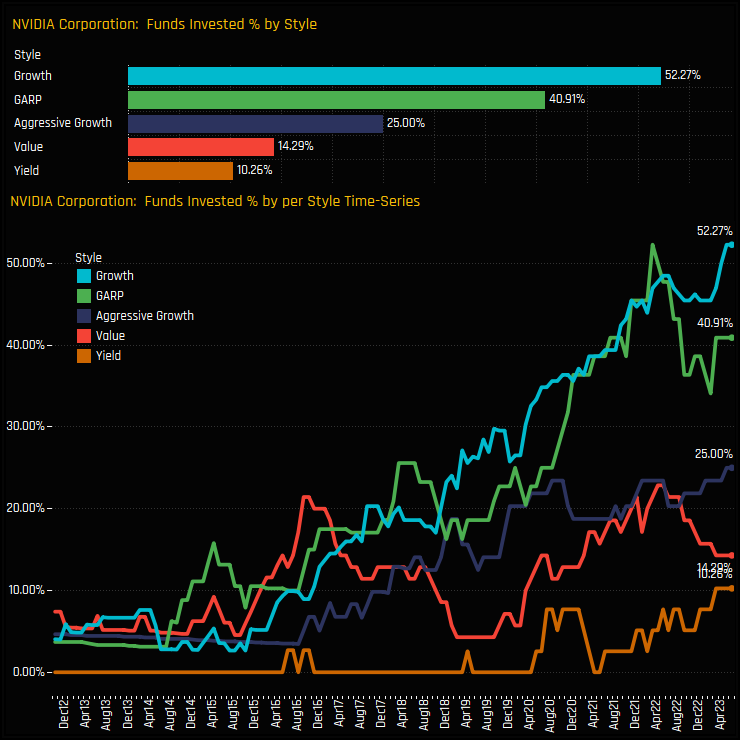

As is often the case among high growth companies, the picture is split. The chart opposite shows the percentage of funds invested in NVIDIA Corp over time, split by the Style of the fund. Growth funds have seen sustained increases in ownership over the last decade, with current levels the highest on record. They remain the most widely held Style group with 52.3% of funds invested. Aggressive Growth funds are some way behind but also stand at peak levels of ownership.

The fact that both GARP and Value fund ownership has fallen from the highs suggests there is some hesitation among those with a more traditional valuation led approach. However, given that 41% of GARP funds are still exposed shows that NVIDIA’s growth potential has some solid foundations.

Click below for an extended data report on Global fund ownership in NVIDIA Corp.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- December 12, 2022

Global Fund Positioning Analysis, December 2022

359 Active Global Funds, AUM $947bn Global Fund Positioning Analysis, December2022 In this issu ..

- Steve Holden

- September 12, 2023

Global Fund Positioning Analysis, September 2023

349 Global Equity Funds, AUM $999bn Global Fund Positioning Analysis, September 2023 In this is ..

- Steve Holden

- January 17, 2024

Global Active Fund Performance & Attribution Review, 2023

342 Global Equity Funds, AUM $1.1bn Global Active Fund Performance & Attribution Review, 20 ..