1600+ Active Equity Funds, AUM $4.7tr

Fund Positioning Chart Pack IV

US Funds: Is Ford Motor Company Uninvestible?

Global Funds. H1 Performance & Attribution

Asia Ex-Japan Funds: India: Outperformance Potential in Doubt

UK Funds: Softcat PLC: Record Overweight as UK Managers Buy In

Emerging Market Funds: Americas: Consensus Overweight

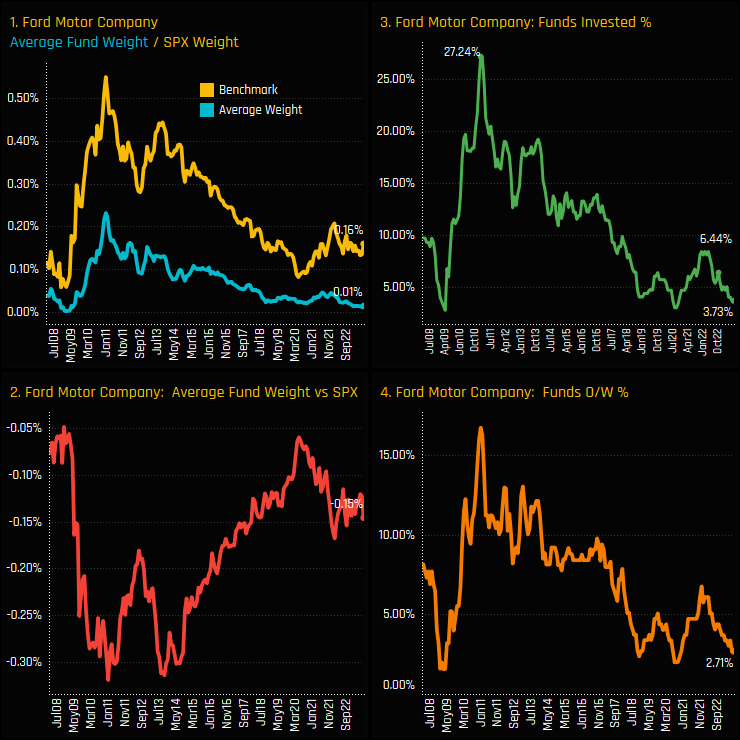

Time-Series and US Autos Positioning

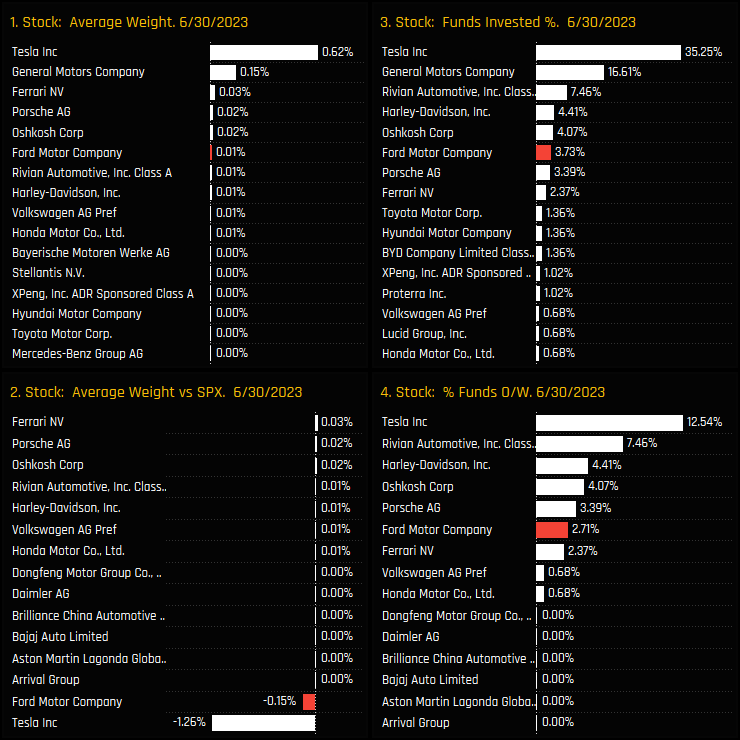

Ford Motor Company is owned by just 11, or 3.7% of the 295 US active funds in our analysis. Chart 3 below shows the decline in the percentage of funds invested in Ford, with peak ownership of 27.24% occurring in late 2010 and today’s level close to the lowest on record. Average fund weights have fallen to just 0.01%, or underweight the S&P 500 weight by -0.15%.

Versus Auto peers, Ford Motor Company is now the 6th most widely held Auto stock among US active investors. The most widely held is Telsa Inc, owned by 35.25% of funds at an average weight of 0.62%. Both GM, Rivian Automotive, Harley Davidson and Oshkosh Corp are all owned by more funds. Versus the benchmark, Ford is the 2nd largest Auto underweight after Telsa Inc.

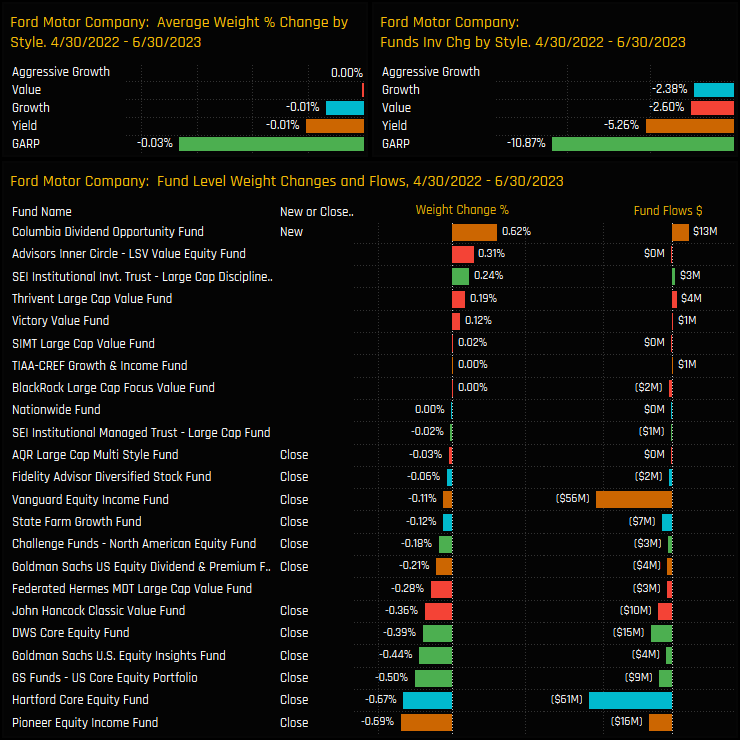

Fund Activity & Latest Holdings

Since the most recent highs of April last year, fund activity has been overwhelmingly skewed to the sell-side. Closures were led by Pioneer Equity Income (-0.69%) and Hartford Core Equity (-0.67%), heading a total of 12 funds who removed Ford Motors from portfolios over the period.

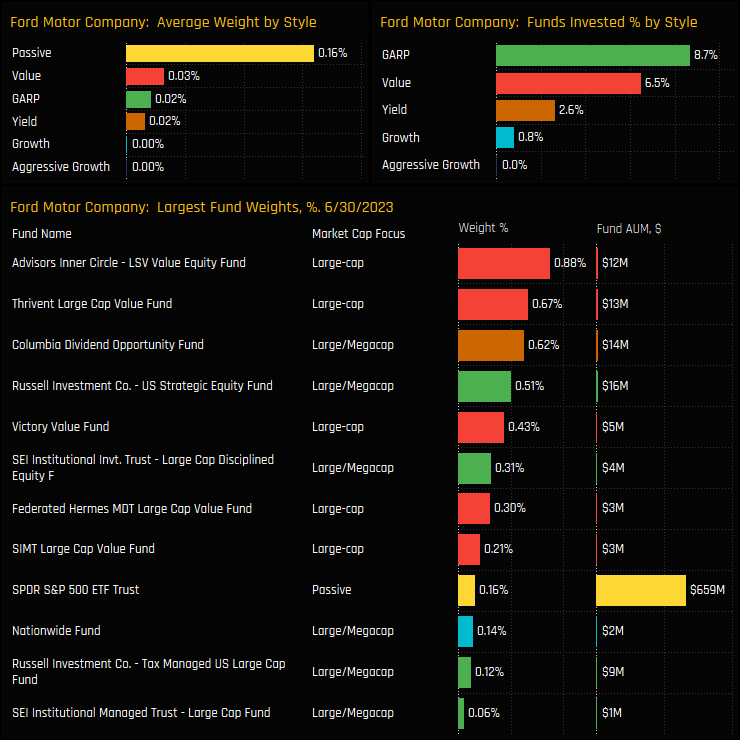

This leaves a small investor base for Ford among active US equity funds. Top holders are at the Value end of the spectrum and led by LSV Value (0.88%) and Thrivent Large Cap Value (0.67%), but the truth is, Ford is a fringe portfolio holding for even the most bullish of US investors.

Underowned & Unloved

- Average holding weight among active US funds < S&P500 Weight

- Held by less than 5% of the 295 active US funds in our analysis

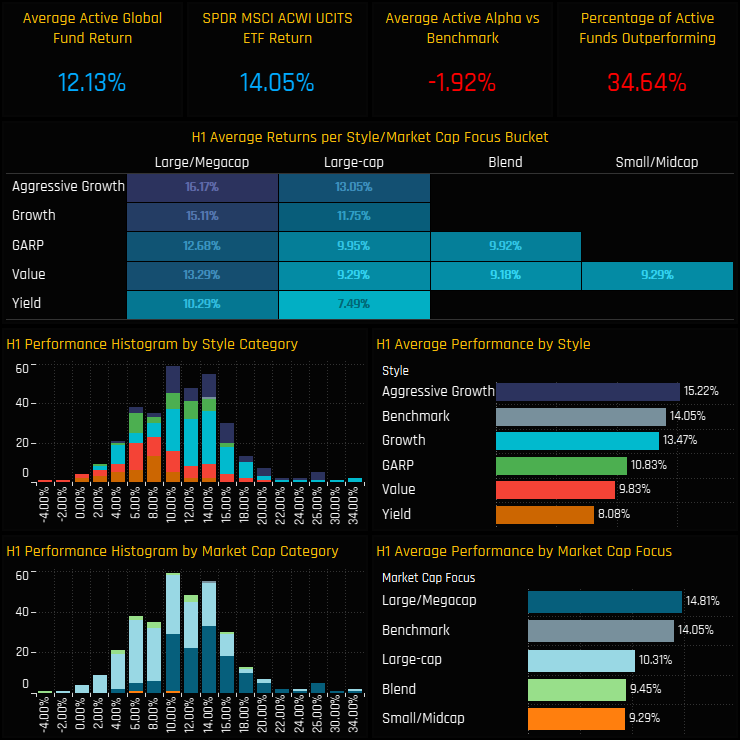

Active Global funds returned a healthy 12.13% on average during the first half of 2023, but an unhealthy underperformance of -1.92% compared to the SPDRs MSCI ACWI ETF. Style really mattered, as did Market Cap, with Aggressive Growth (+15.2%) and Large/Megacap (14.8%) funds the only groups to outperform the benchmark (14.05%) over the period. Value (9.8%), Yield (8.1%) and Small/Midcap (9.3%) funds dragged down the averages over the period.

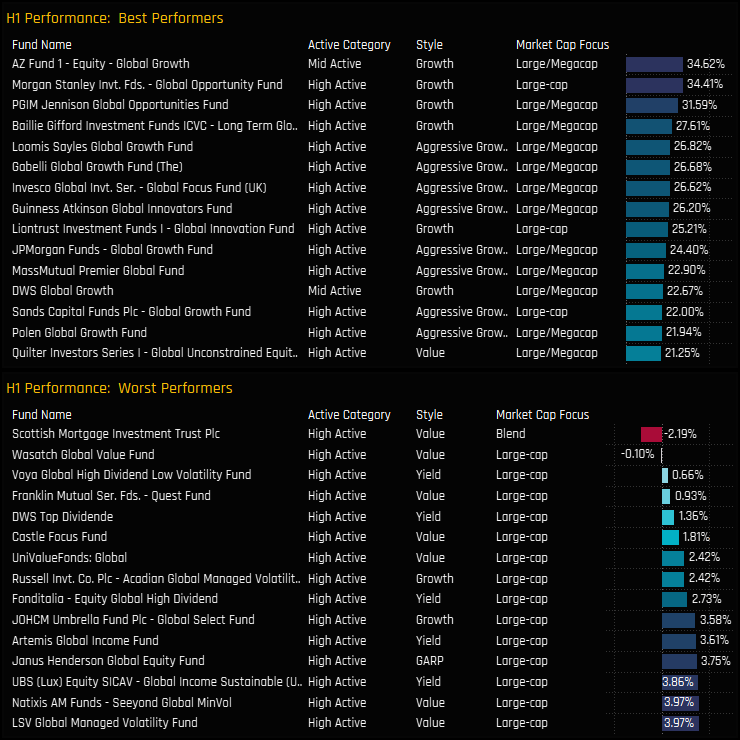

On a single fund level the dispersion in returns was even more pronounced, with the top performers of AZ Fund Global Growth, Morgan Stanley Global Opportunity and PGIM Global Opportunities returning >30%, against Scottish Mortgage and Wasatch Global Value who failed to break even. Large/Megacap funds took 12 of the top 15 spots, whilst Value/Yield took 12 of the bottom 15.

Portfolio Attribution

We perform attribution analysis on a portfolio based on the average holdings of the 349 active Global funds in our analysis versus a representation of the benchmark based on the SPDRs MSCI ACWI ETF. This helps us better understand the drivers behind this year’s underperformance so far. The portfolio underperformed by -0.86% over the period, with one of the major pain trades being the underweight in Apple Inc that Global funds continue to run. A summary of the key drivers are documented below.

What worked:

- Underweights in China & HK, India Energy, USA Utilities.

- Overweights in France, Netherlands, Germany

- Stock selection in Canada, Industrials, Health Care

- Underweights in Chevron, Exxon Mobil, Pfizer Inc.

- Overweights in ASML Holding, Adobe Incorporated, Schneider Electric

What didn’t:

- Underweights in USA Technology, US Consumer Discretionary

- Overweights in Cash, the UK, Health Care, Consumer Staples

- Stock Selection in the USA, Information Technology, Consumer Discretionary

- Overweights in AIA Group, Charles Schwabb

- Underweights Apple. NVIDIA, Telsa Inc.

Long-Term Trends & Country Activity

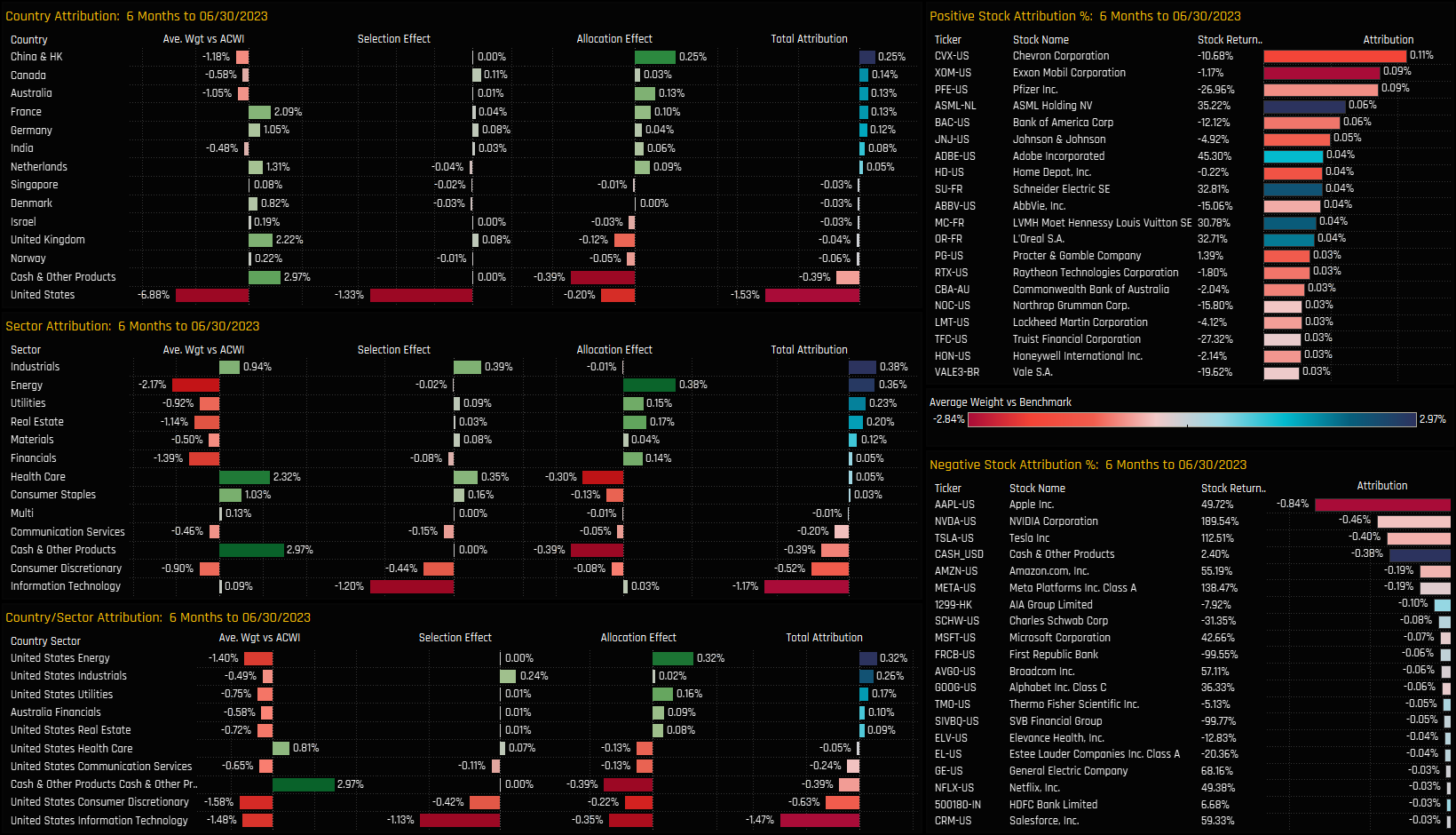

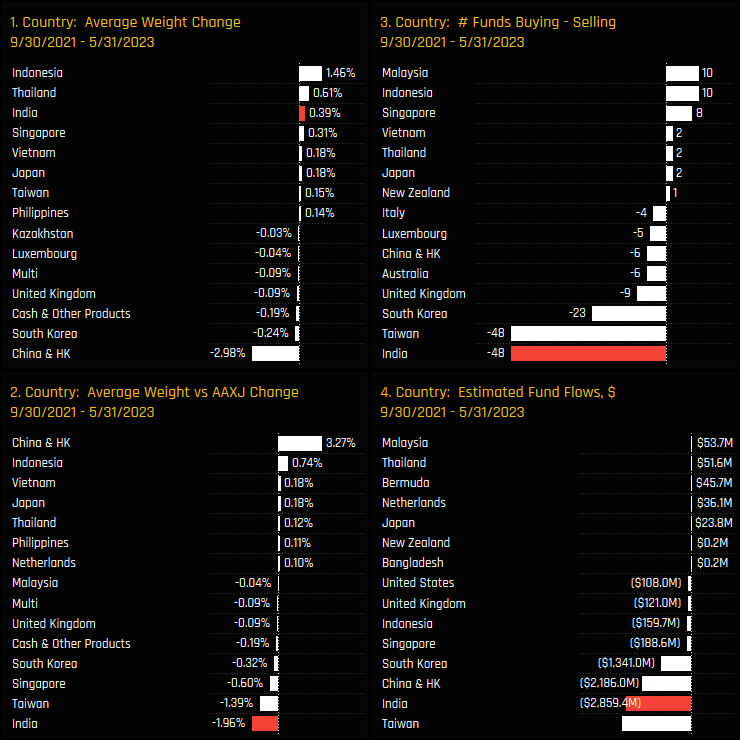

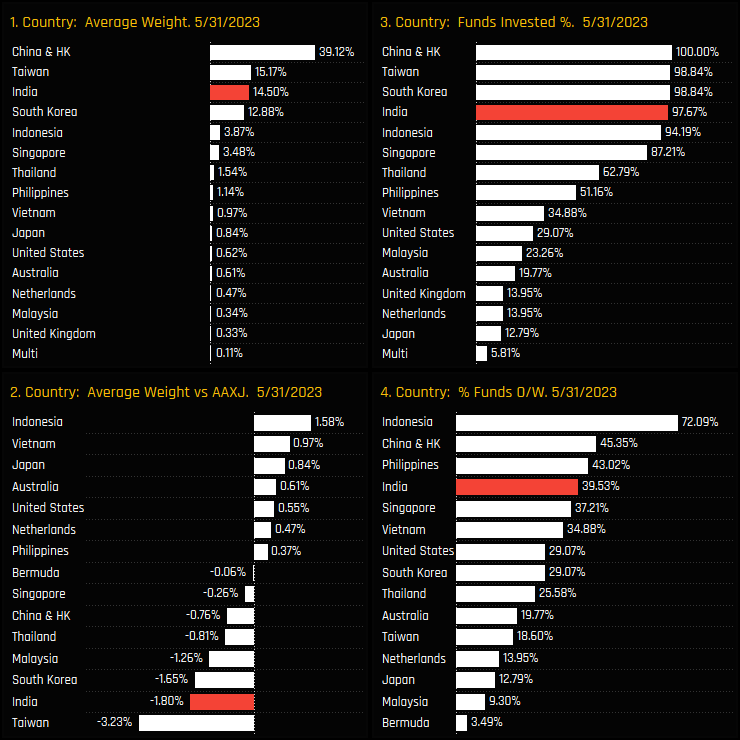

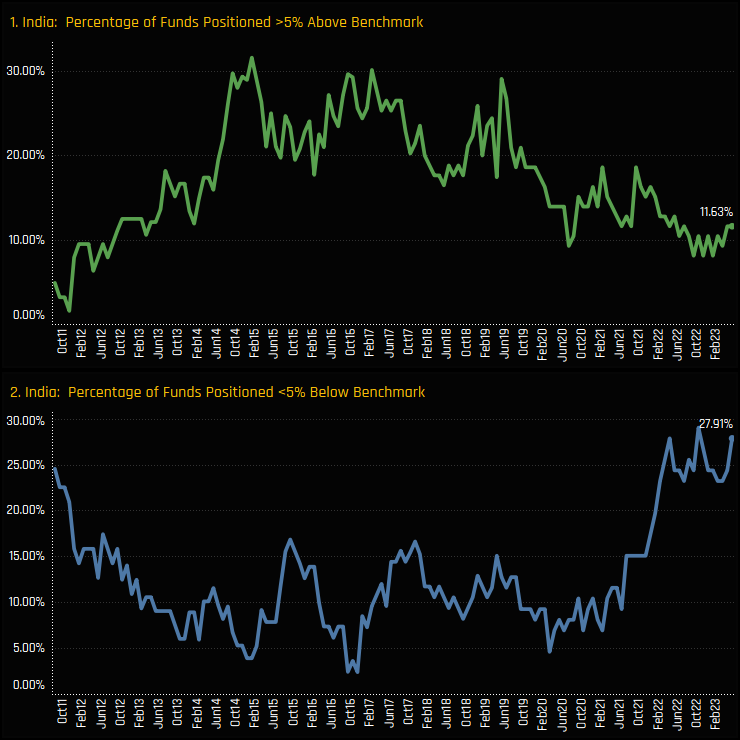

Since the last time Asia Ex-Japan managers were positioned overweight in September 2021, India has been the victim of some fairly aggressive manager rotation. The charts below document the changes in our ownership metrics between 09/30/2021 and 05/31/2023. As India’s outperformance pushed average weights higher by 0.31% (ch1), active managers sold in to this strength. A net 48 managers sold down Indian positions over the period (ch 3) with an total -$2.85bn of fund outflows. This pushed positioning relative to the iShares MSCI Asia Ex-Japan ETF lower by -1.96%, the largest decrease of any country over the period, with managers reducing underweights in China & HK in the process.

Country Positioning

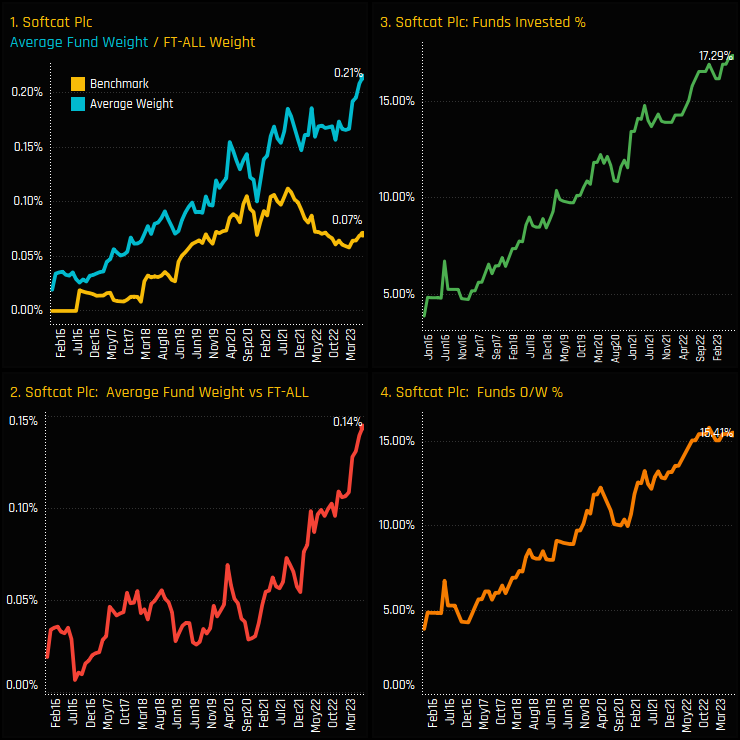

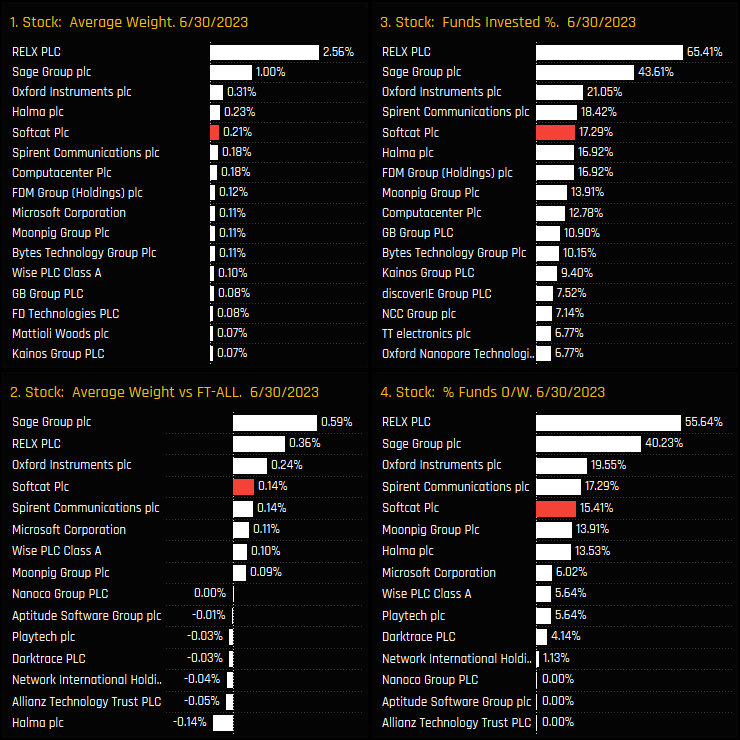

Long-Term Trends & UK Tech Positioning

The below charts show our ownership statistics for stocks in the UK Information Technology sector. The recent ownership surge has moved Softcat PLC to the 5th most widely held Technology stock in the UK, sharing similar ownership characteristics to Spirent Communications, Halma PLC and Oxford Instruments. The sector leaders by some distance are RELX PLC and Sage Group PLC.

Room for Further Growth?

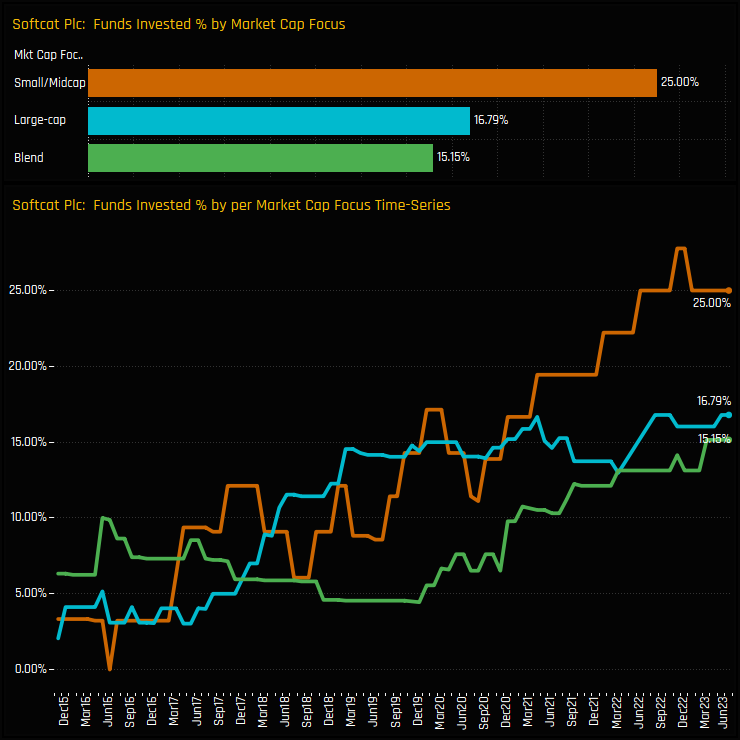

The chart to the right shows the percentage of funds invested in Softcat over time for each of our Market Cap Focus categories. Given Softcat’s market capitalization of <£3bn, the growth in exposure among Small/Midcap strategies is understandable. The fact that exposure is also at record highs among Largecap funds highlights Softcat’s appeal as a genuine alternative to the more established large-cap companies in the UK market.

But whilst investment growth in Softcat has been impressive, there is clearly room for ownership to move higher from here. Remember, over 80% of the 266 UK Equity funds in our analysis still do not hold a position. With Softcat approaching the boundaries of FTSE 100 inclusion, it’s not hard to envisage investment levels moving higher from here.

For more information on our UK fund positioning analysis, from market insights like these to peer group analysis on individual funds, contact us.

Time-Series and Fund Level Positioning

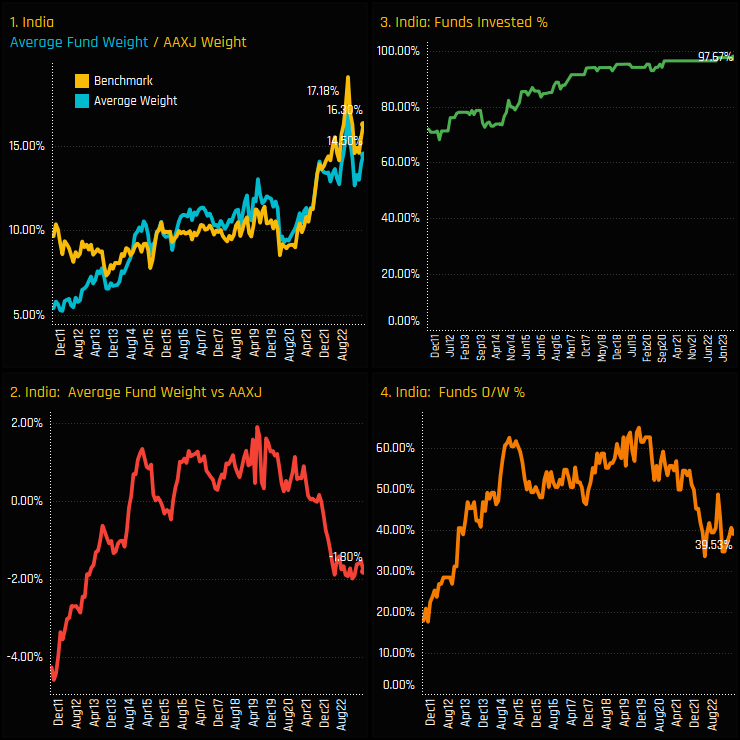

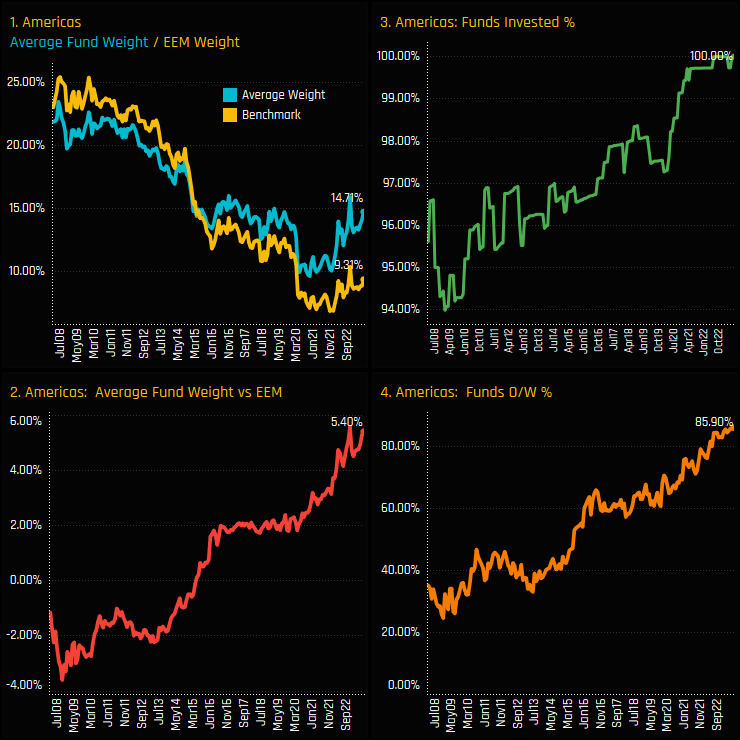

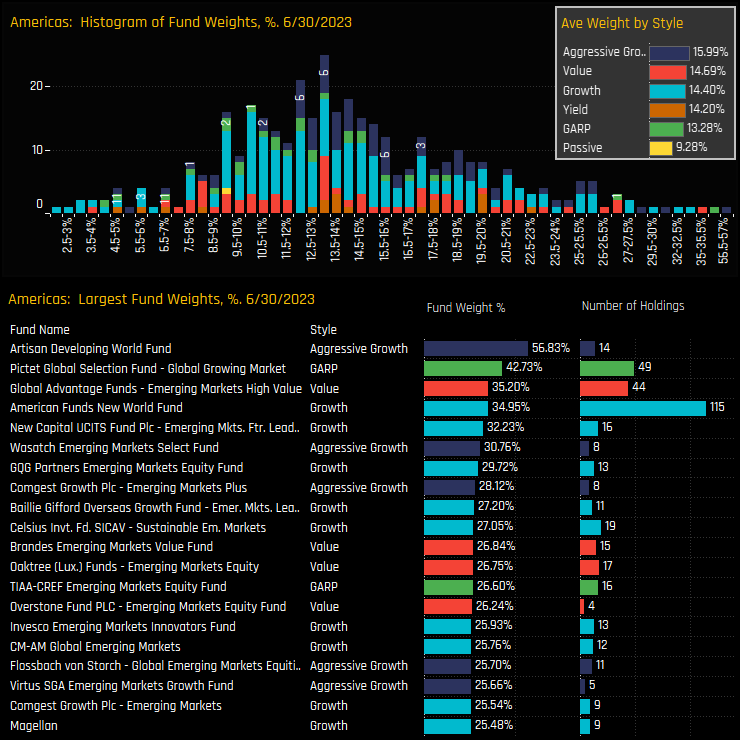

Active Emerging Market funds are going all in on the Americas. The percentage of funds overweight the region hit an all-time high this month of 85.9% (ch4), with an average overweight of +5.4% (ch2). Allocations snapped a decade long decline in late 2021 with holding weights below 10%, but have since rallied from the lows to hit 14.7% today, and breaking away from the iShares MSCI EM ETF Benchmark in the process. In no uncertain terms, EM funds are banking on outperformance.

Conclusions

Active EM managers have never been so bullishly positioned in the Americas region relative to benchmark as they are today. To say this is a consensus position is an understatement, with just 14.1% of managers positioned lighter than the benchmark index.

On an absolute basis the picture is less one-sided. Pre 2015, active EM managers were more accustomed to holding >15% in the region on average, so there is a historical precedent for the Americas to command a higher regional allocation.

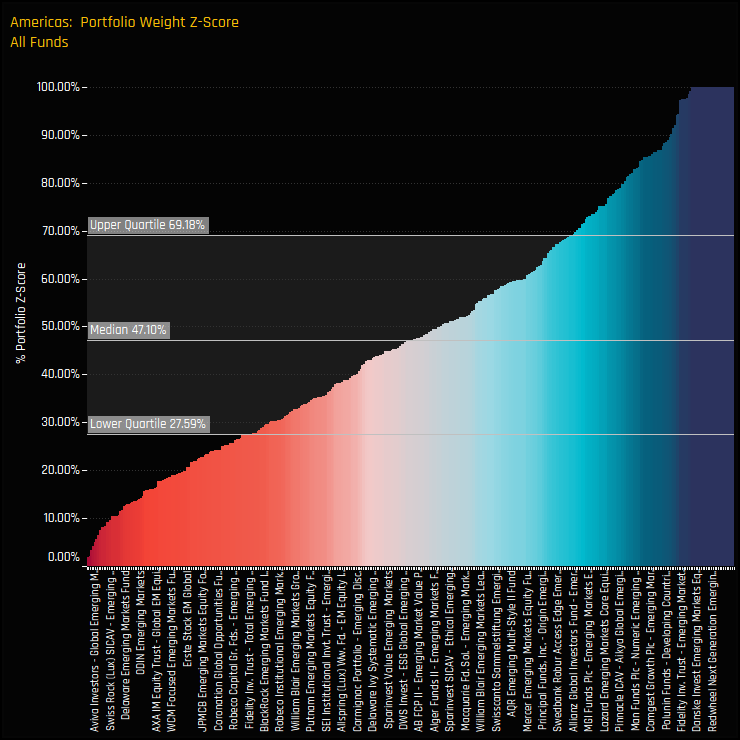

The chart opposite shows the Z-Score of current weights versus history in the Americas for all funds in our analysis. A value of 100% means today’s weight is the highest on record for that fund, 0% the lowest. The picture is evenly split, with 50% of funds showing a Z-score of less than 47%. Only 24 funds are at their maximum ever exposure in the region out of the 376 funds in our analysis. There is clearly room for allocations to move higher from here.

In the full analysis we breakdown exposure in the Americas region by country, sector and stock, and highlight the funds that are driving this allocation shift. To enquire about our Emerging Markets Research, contact us.

To request access to the full reports mentioned above or inquire about a subscription to our research, please e-mail me directly on the below:

Related Posts

- Steve Holden

- April 18, 2023

TSMC: Crowded Trade?

384 emerging market Funds, AUM $400bn TSMC: Crowded Trade? Active EM managers are heavily posit ..

- Steve Holden

- November 17, 2022

Saudi Arabia Financials: New Highs

278 ACTIVE GEM FUNDS, AUM $312BN Saudi Arabia Financials: New Highs The ownership picture for S ..

- Steve Holden

- November 21, 2022

The Largest Underweights in EM

278 ACTIVE GEM FUNDS, AUM $312BN Underweight Stock Risks in EM Active Emerging Market investors ..