China Fund Positioning Analysis, December 2022

-

Steve Holden

-

December 14, 2022

-

China

-

0 Comments

277 Active China Funds, AUM $102bn China Fund Positioning Analysis, December 2022 In this issue: MSCI China Consumer Discretionary: Reducing the Underweight China A-Share Sector Review: Industrials Gain as Financials Languish Greater China: Stock Radar 119 Active MSCI China Funds, AUM $46.2bn Consumer Discretionary: Reducing The Underweight Active MSCI China funds are rotating back in to the Consumer …

Continue Reading

China Fund Positioning Analysis, November 2022

-

Steve Holden

-

November 22, 2022

-

China

-

0 Comments

277 Active China Funds, AUM $102bn China Fund Positioning Analysis, November 2022 In this issue: MSCI China. Casinos/Gaming: Early Stage Recovery China A-Shares. Telecommunications Equipment Decline Greater China. Alibaba: Fighting Back 118 Active MSCI China Funds, AUM $37.5bn Casinos/Gaming: Early Stage Recovery Ownership levels in China Casino & Gaming stocks are creeping off their all-time lows. In the …

Continue Reading

China & HK Semiconductors: Fund Positioning Analysis

-

Steve Holden

-

October 17, 2022

-

Asia, China

-

0 Comments

92 Asia Ex-Japan Funds, AUM $52bn, 115 China A-Share Funds, AUM $57bn, 117 MSCI China Funds, AUM $44bn, 45 Greater China Funds, AUM $15bn China Semiconductors With US sanctions hitting Chinese domestic Semiconductor stocks this week, we analyse allocations in the China & HK Semiconductor Industry group among Asia Ex-Japan, MSCI China, China A-Share and Greater China actively managed equity …

Continue Reading

China Funds: Q3 Performance & Attribution

-

Steve Holden

-

October 11, 2022

-

China

-

0 Comments

118 Active MSCI China funds, AUM $50bn Q3 Performance & Attribution In this piece, we provide an overview of Q3 performance among the active MSCI China funds in our analysis. We look at quarterly performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then breakdown this quarter’s performance based on the …

Continue Reading

MSCI China Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 19, 2022

-

China

-

0 Comments

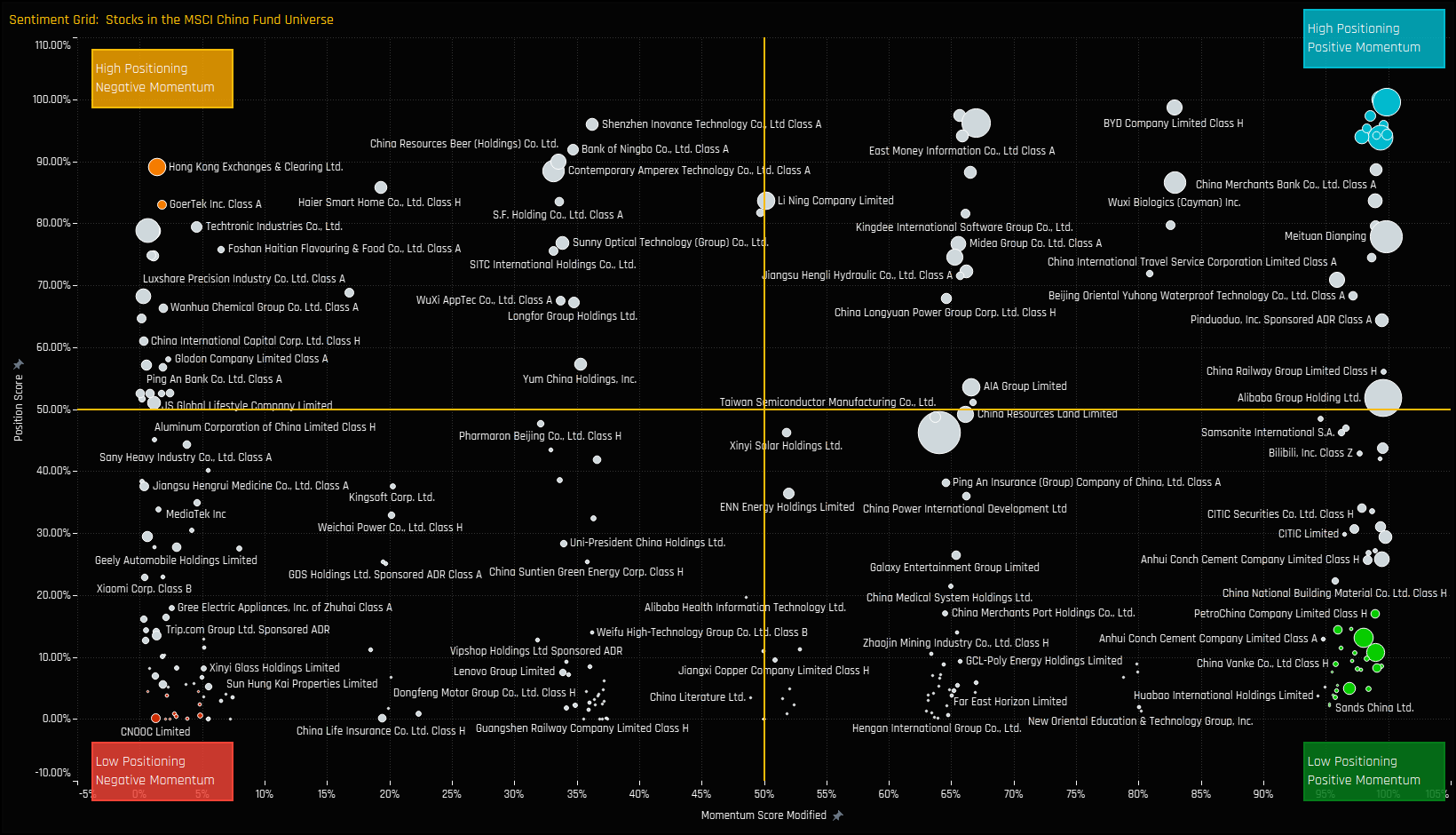

119 Active China Funds, AUM $52bn. MSCI China Stock Sentiment Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in …

Continue Reading

China A-Share Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 18, 2022

-

China

-

0 Comments

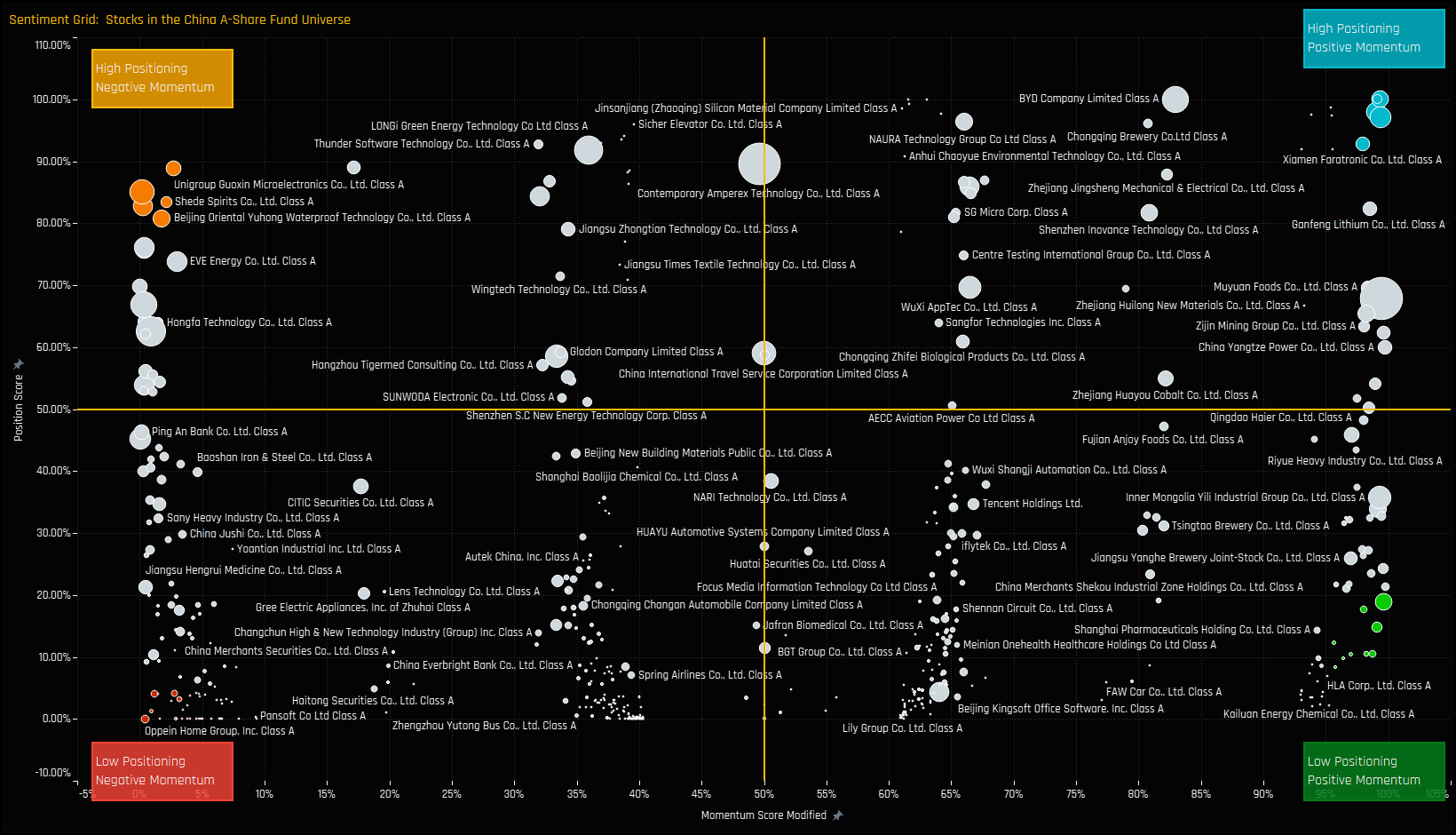

115 Active China A-Share Funds, AUM $63bn. China A-Share Stock Sentiment Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock …

Continue Reading

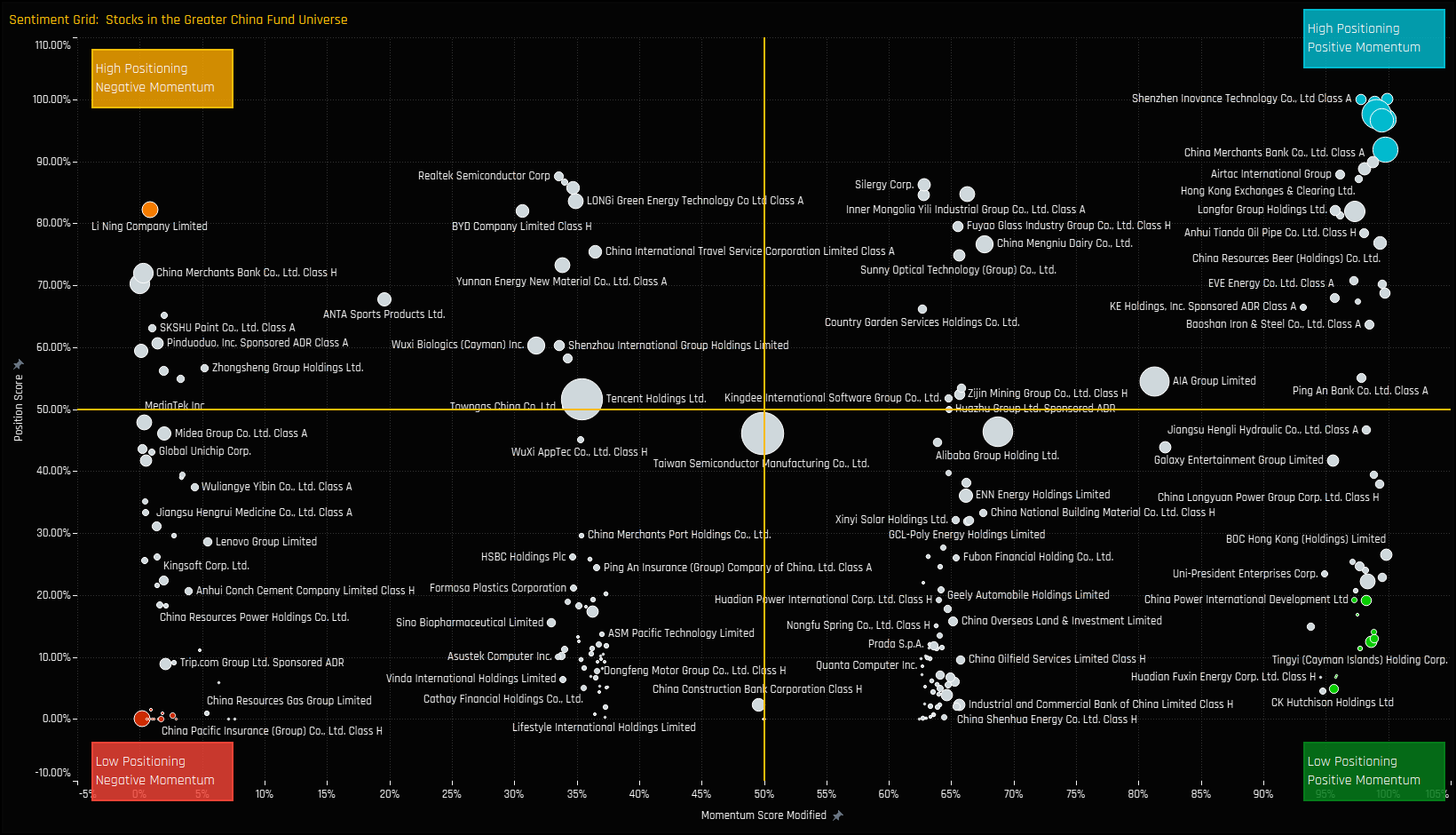

Greater China Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 18, 2022

-

China

-

0 Comments

45 Active Greater China Funds, AUM $20bn. Greater China Stock Sentiment Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock …

Continue Reading

Greater China: Materials Rotation

-

Steve Holden

-

August 12, 2022

-

China

-

0 Comments

45 Active Greater China Funds, AUM $17bn. Greater China Materials Greater China managers are increasing allocations to the Materials sector. Part of a general rotation out of the Information Technology sector, active managers are buying in to selected names, led by IMEIK Technology Development Co, ENN Ecological Holdings and Baoshan Iron & Steel. Versus the benchmark, Greater China managers are …

Continue Reading

China A-Shares: Health Care Fall

-

Steve Holden

-

August 10, 2022

-

China

-

0 Comments

115 Active China A-Share Funds, AUM $63bn. China Health Care Health Care weights among China A-Share managers have fallen to some of the lowest levels on record, with managers moving from overweight to underweight over the last 12-months. The recent moves have been caused by a number of domestic A-Share funds closing out, or significantly cutting exposure to key stocks …

Continue Reading

China Communication Services: Lowest Exposure on Record

-

Steve Holden

-

August 10, 2022

-

China

-

0 Comments

119 Active MSCI China Funds, AUM $60bn. China Communication Services Portfolio weights in the Communication Services sector have hit their lowest levels on record, declining from a high of over 18% in mid-2015 to just 9.90% today. In this analysis. we look at positioning in the communication services sector in detail, highlighting the funds and stocks that make up exposure …

Continue Reading

Recent Comments