119 Active MSCI China Funds, AUM $60bn.

China Communication Services

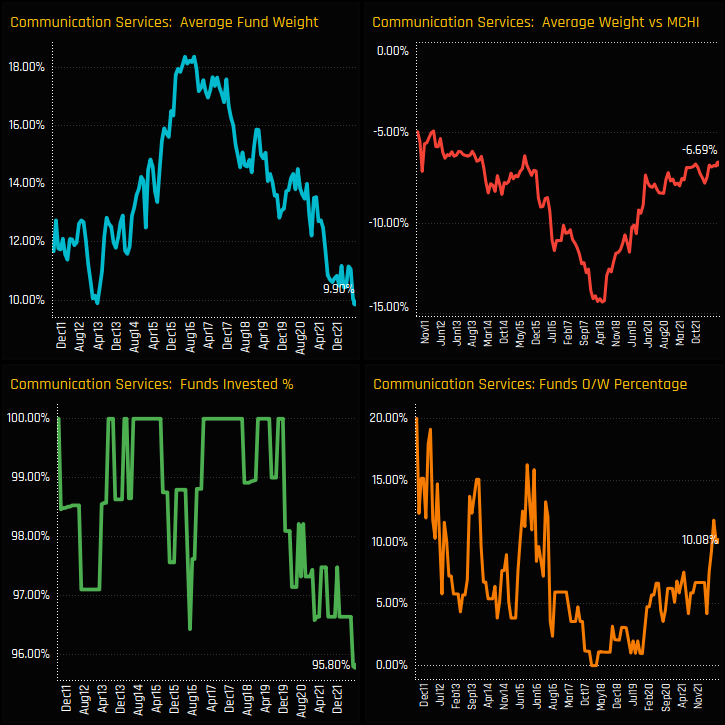

Portfolio weights in the Communication Services sector have hit their lowest levels on record, declining from a high of over 18% in mid-2015 to just 9.90% today. In this analysis. we look at positioning in the communication services sector in detail, highlighting the funds and stocks that make up exposure in the sector.

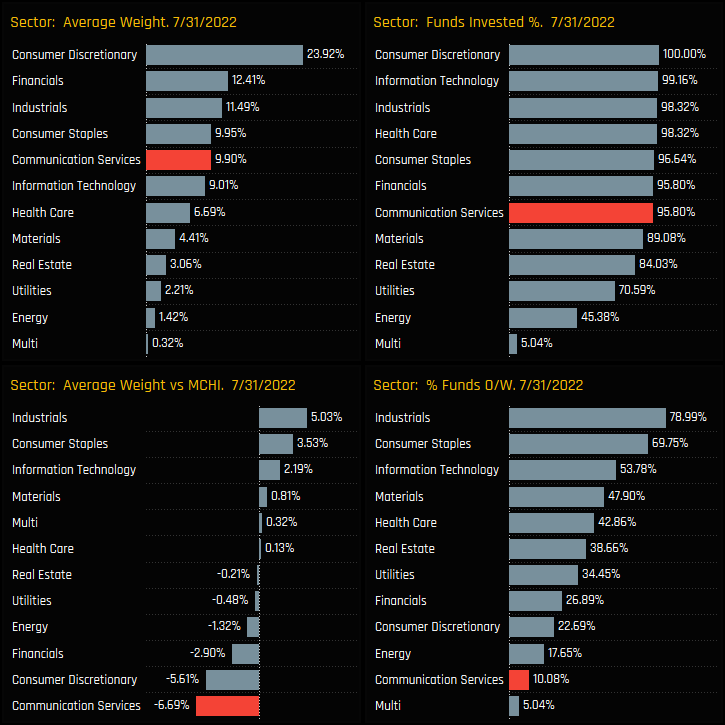

Time-Series & Sector Positioning

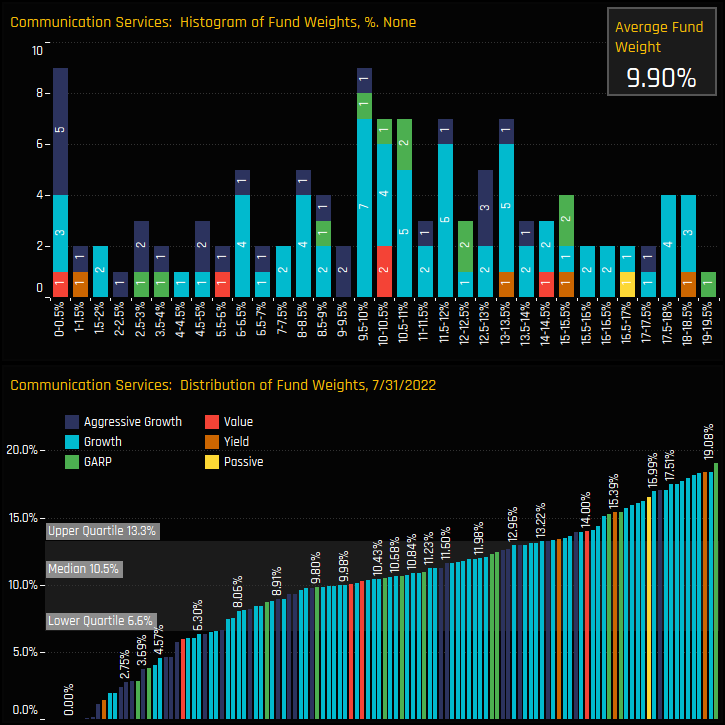

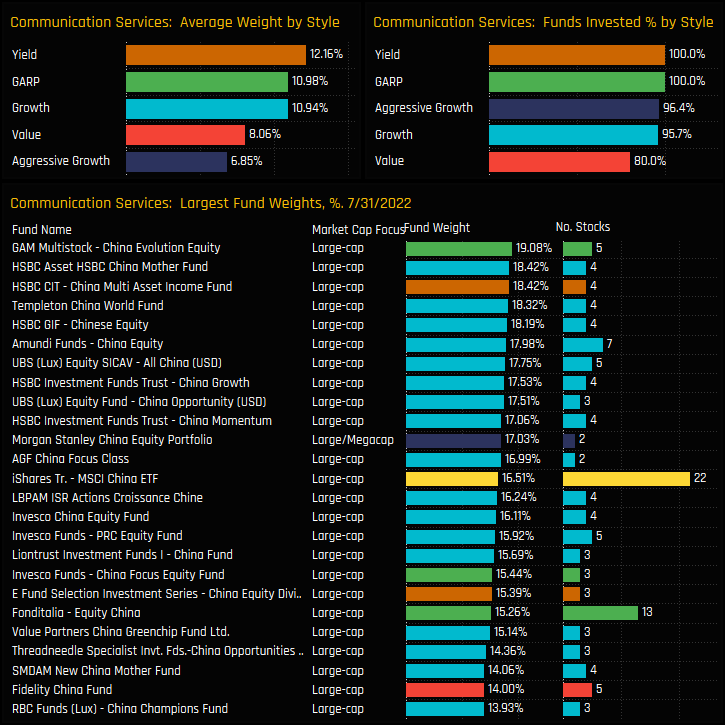

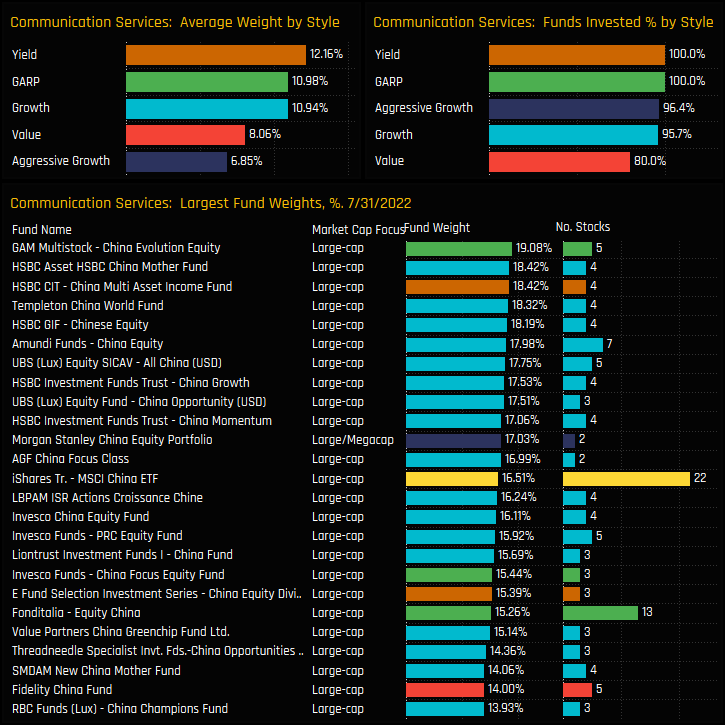

Fund Holdings & Style

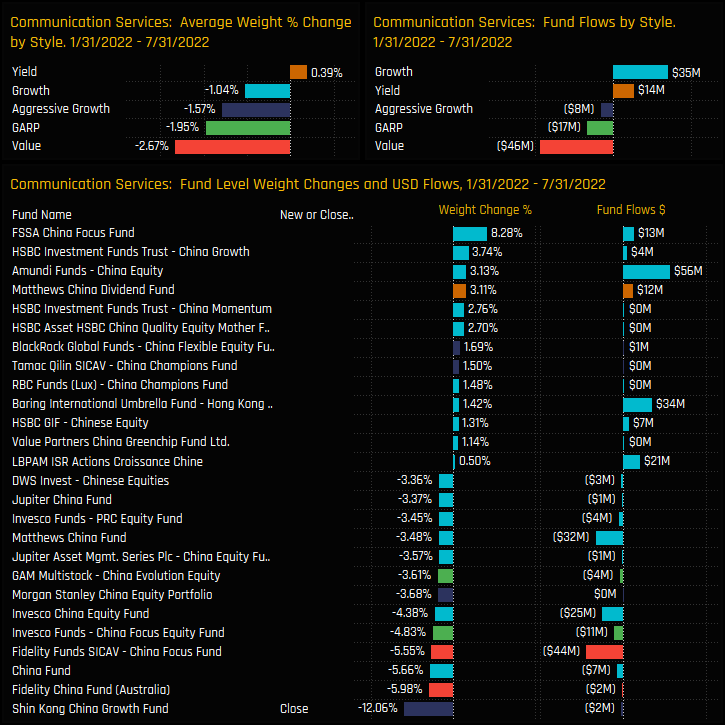

Fund Activity & Style Trends

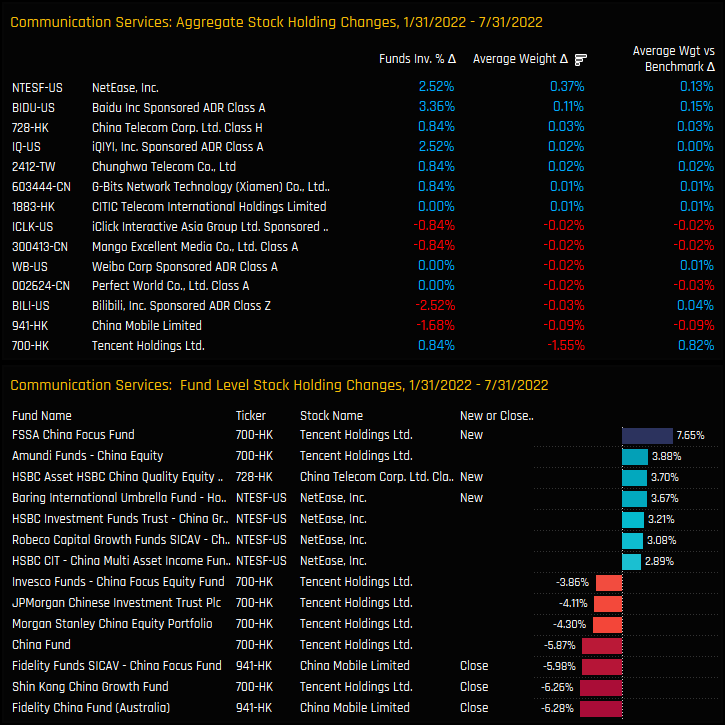

Stock Holdings & Activity

Conclusions

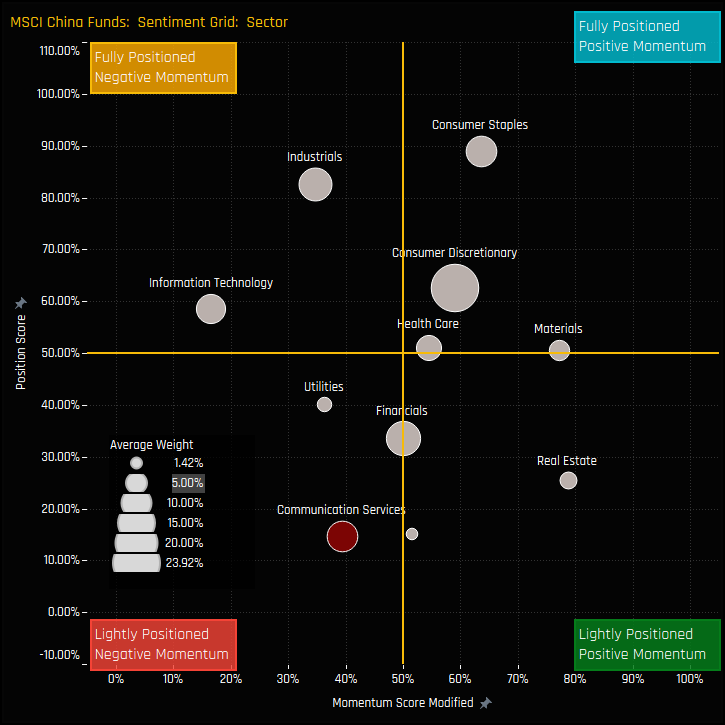

Sentiment in the Communication Services sector is close to an all-time low. The chart to the right shows where current positioning in each China sector sits versus history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each sector between 01/31/2022 and 07/31/2022 (x-axis). Positioning is the lowest of all sectors and momentum is what we might call apathetic.

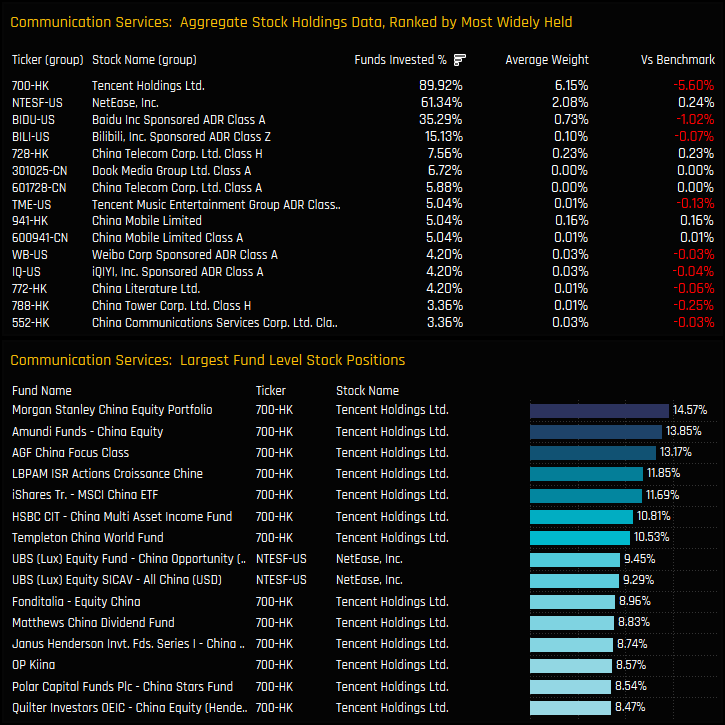

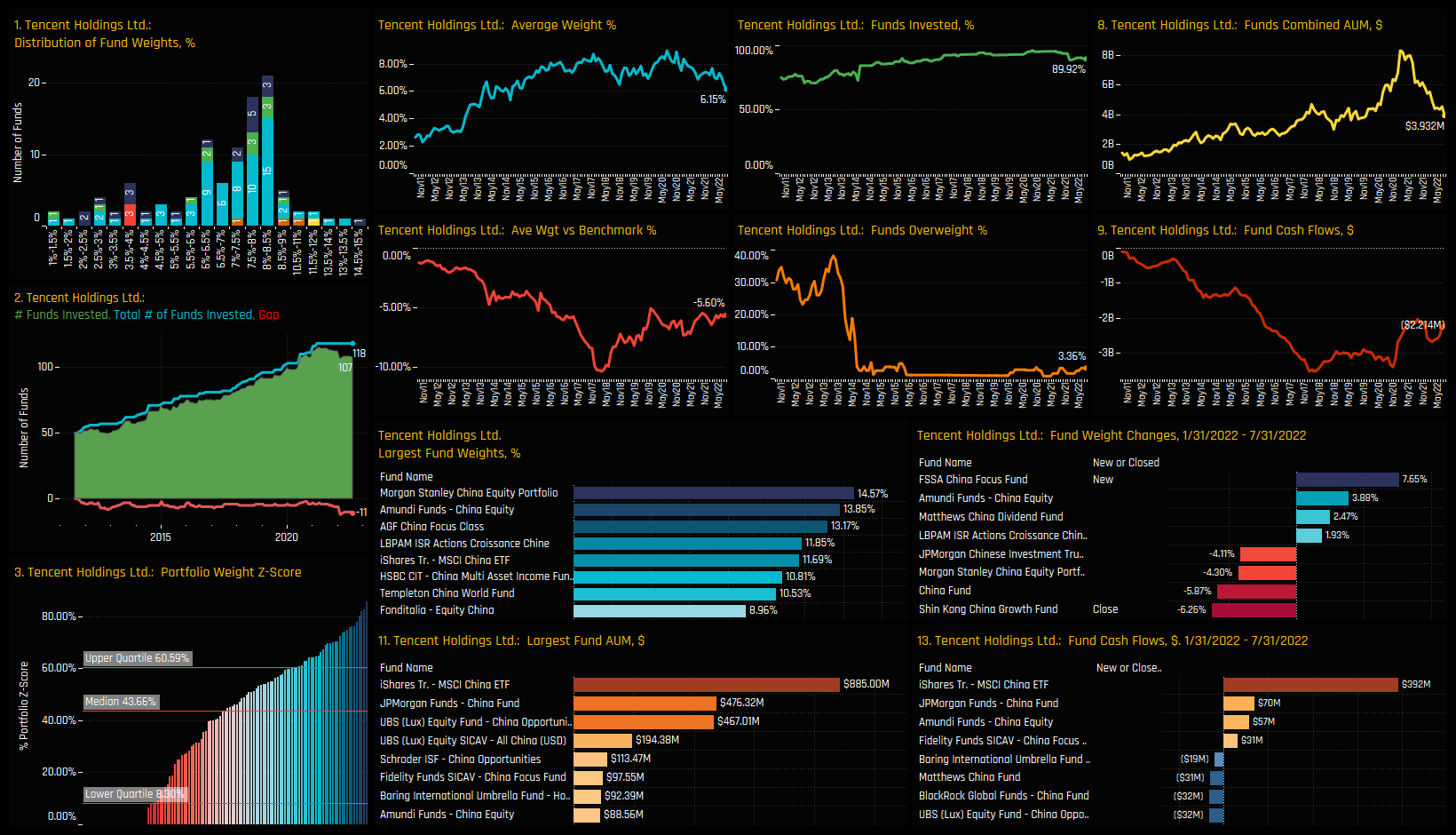

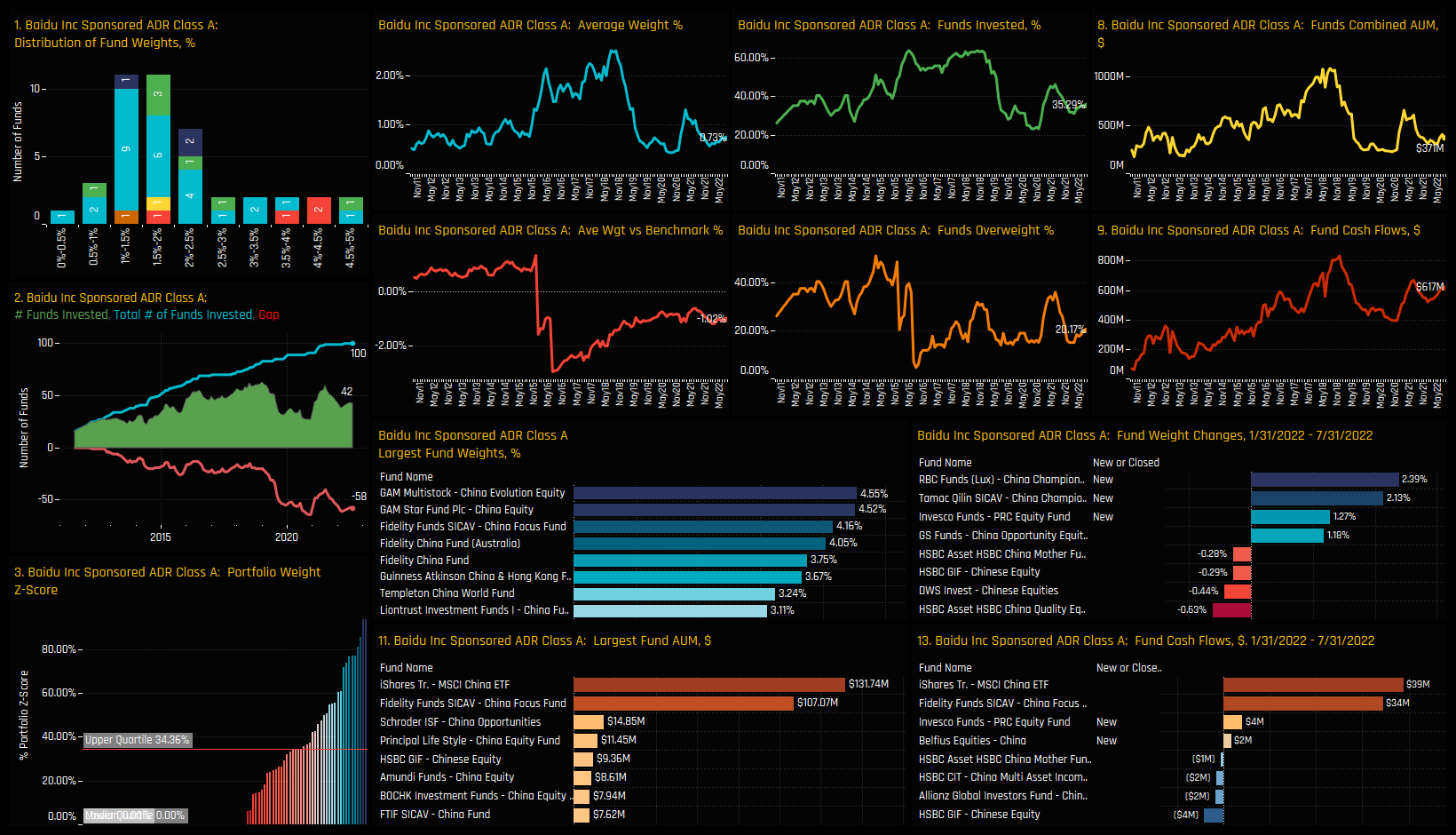

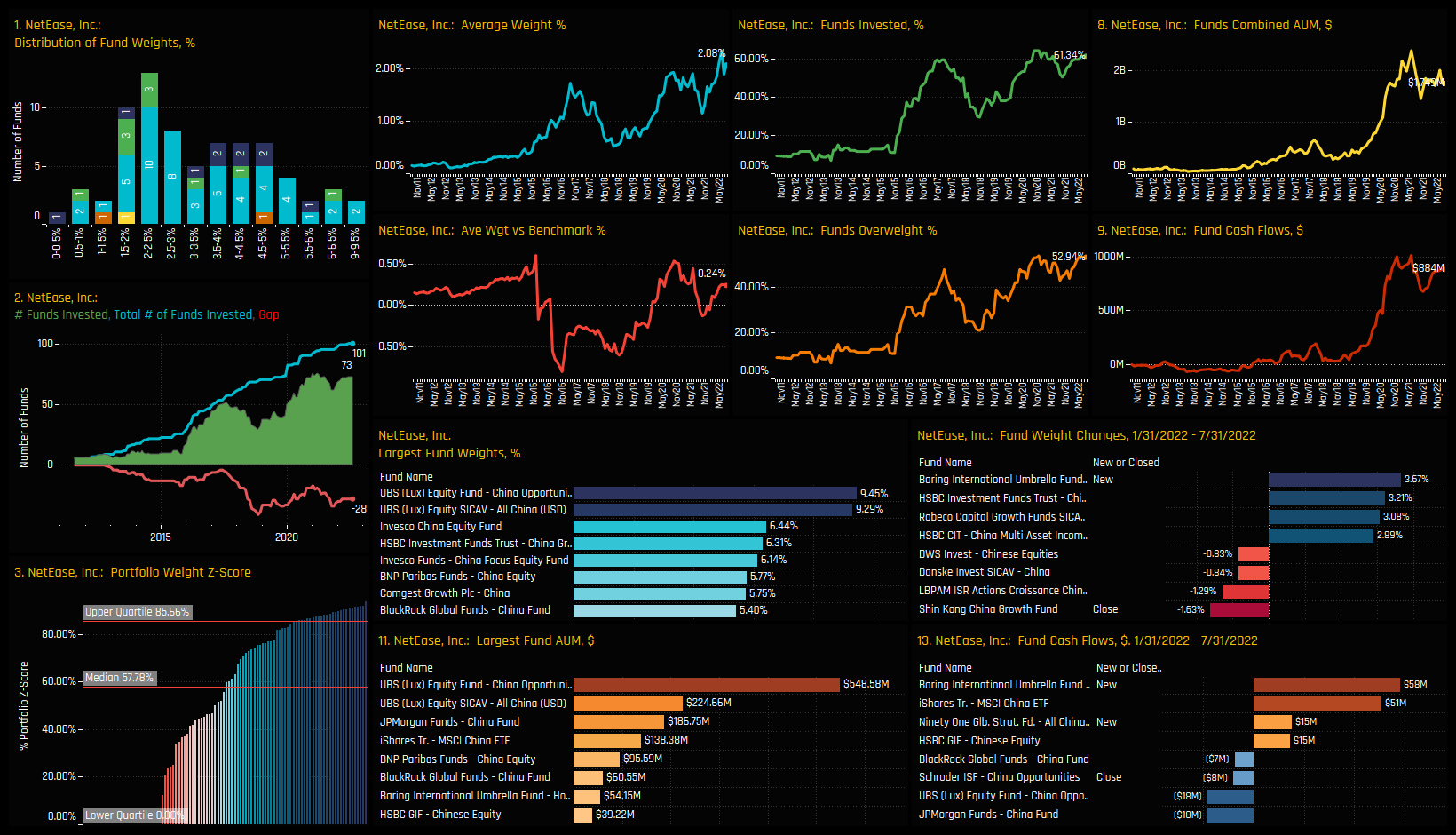

The fact that active China funds are sticking with Tencent through this period of underperformance is encouraging, in addition to the increased ownership levels in key holdings Netease Inc and Baidu Inc. Rather than an outright exodus, it feels like active China managers are riding out the storm.

See below for more ownership information on Tencent, Baidu and NetEase. Please click on the link below for the extended report on Communication Services exposure among active MSCI China funds.

Click on the link below for the latest data report on Communication Services positioning among active China funds.

Stock Profile: Tencent Holdings Ltd

Stock Profile: Baidu Inc

Stock Profile: Netease Inc

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- October 17, 2022

China & HK Semiconductors: Fund Positioning Analysis

92 Asia Ex-Japan Funds, AUM $52bn, 115 China A-Share Funds, AUM $57bn, 117 MSCI China Funds, AU ..

- Steve Holden

- December 14, 2022

China Fund Positioning Analysis, December 2022

277 Active China Funds, AUM $102bn China Fund Positioning Analysis, December 2022 In this issue ..

- Steve Holden

- January 29, 2023

China Fund Positioning Analysis, January 2023

264 China Equity Funds, AUM $114bn China Fund Positioning Analysis, January 2023 In this issue: ..