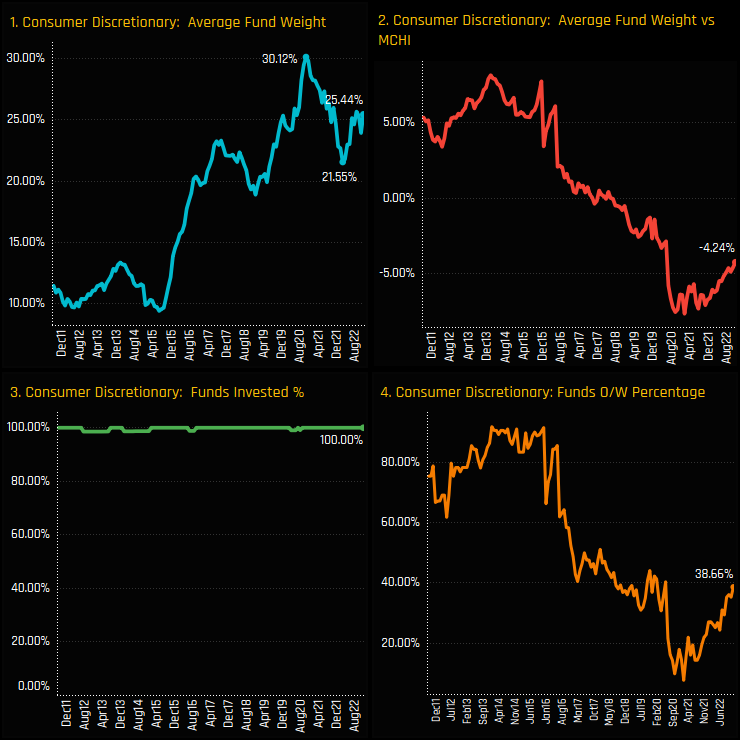

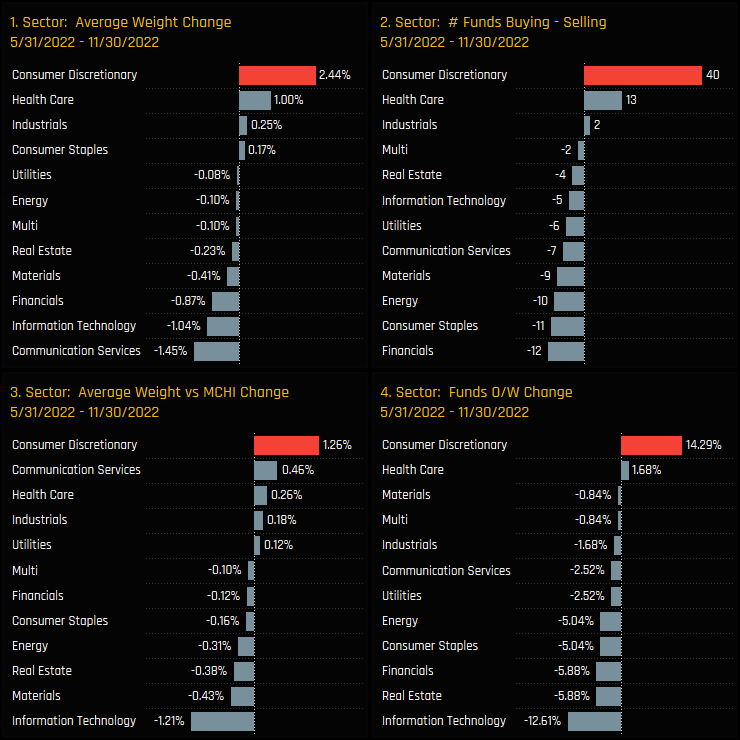

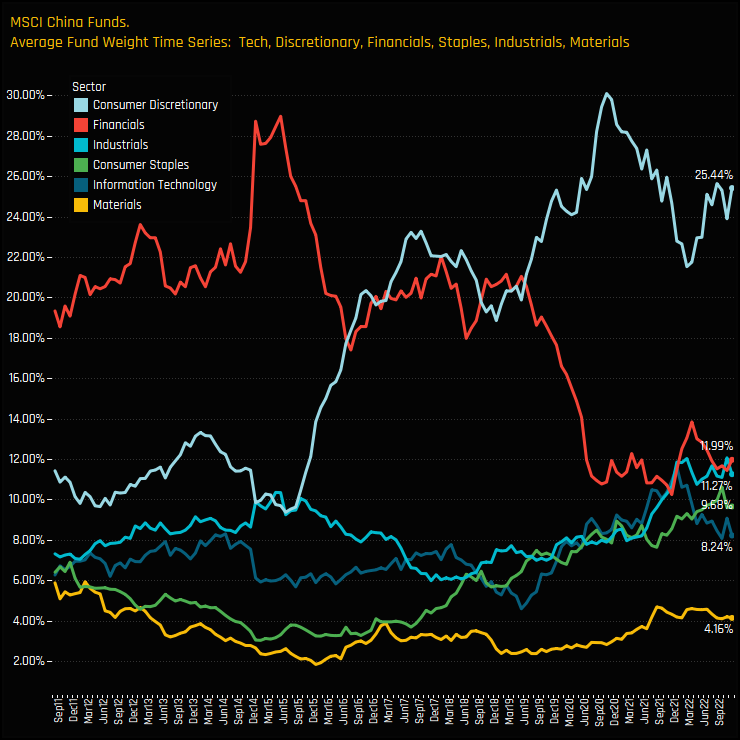

Active MSCI China funds are rotating back in to the Consumer Discretionary sector. The decline from the highs of 30.1% in late 2020 bottomed out earlier this year at 21.55% and has since climbed to 25.4% (ch1). Versus the benchmark, an increasing number of managers are re-positioning themselves as overweight (ch4), though on average managers remain underweight the MSCI China index by -4.24%.

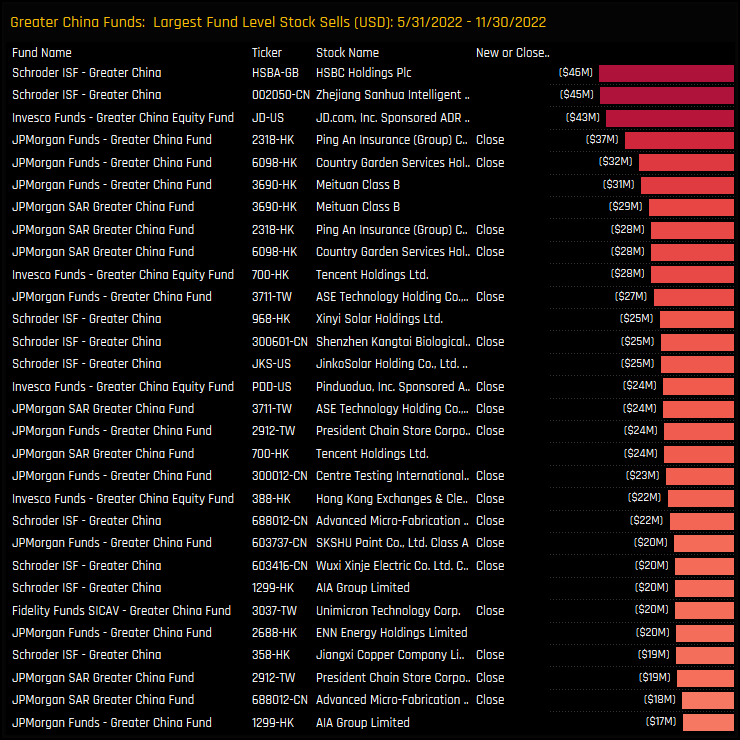

Over the last 6-months, the rotation in to the Consumer Discretionary has been the strongest versus sector peers, with managers instead scaling back exposure to Communication Services, Tech and Financials. Chart 2 highlights the excess of buyers over sellers for each sector between 05/31/2022 and 11/30/2022, with Consumer Discretionary capturing a strong excess on the buy-side.

Fund Holdings & Activity

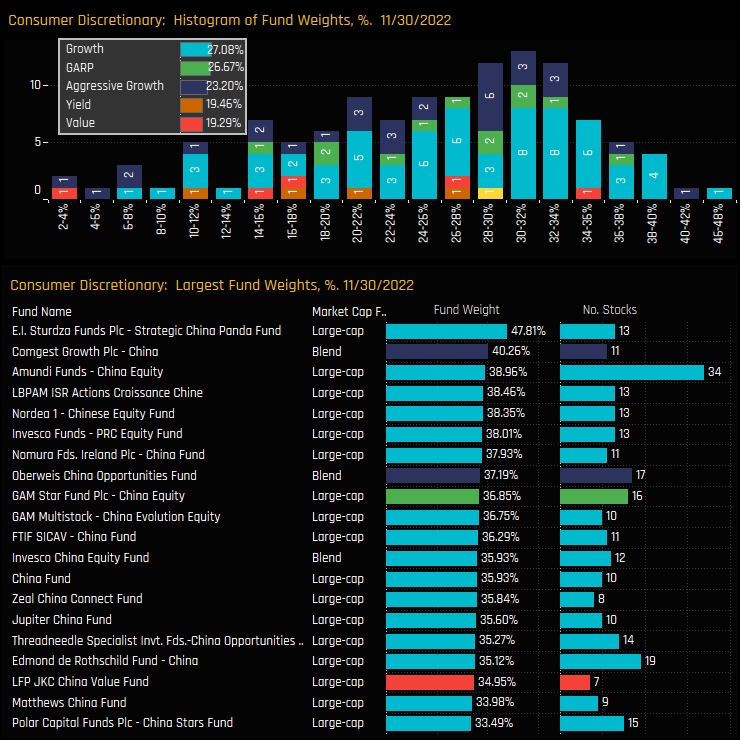

The distribution of fund weights in the Consumer Discretionary sector is centered around the 24% to 34% level, with a longer tail to the left-hand side. On a Style basis, Growth investors are significantly better allocated than their Value peers, led by E.I Sturdza Strategic China Panda Fund (47.8%) and Comgest Growth China (40.2%).

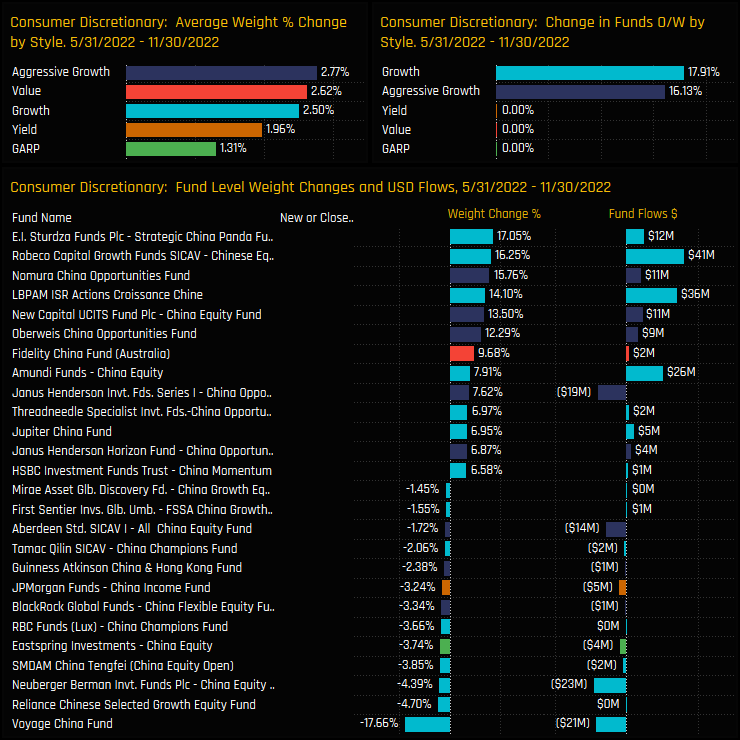

The fund activity driving allocations higher is shown in the charts below. Between 05/31/2022 and 11/30/2022, Aggressive Growth and Growth funds were the key drivers, raising weights by +2.77% and +2.5% as +16.1% and 17.9% of funds moved to overweight. respectively. Big weight increases were led by E.I Sturdza Strategic China Panda (+17%) and Robeco Chinese Equities (+16.25%).

Stock Holdings & Activity

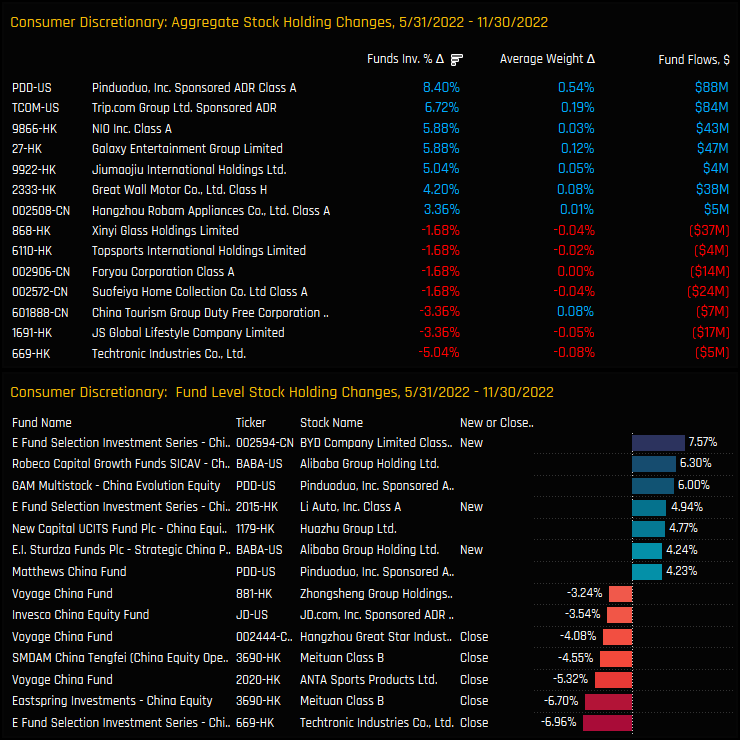

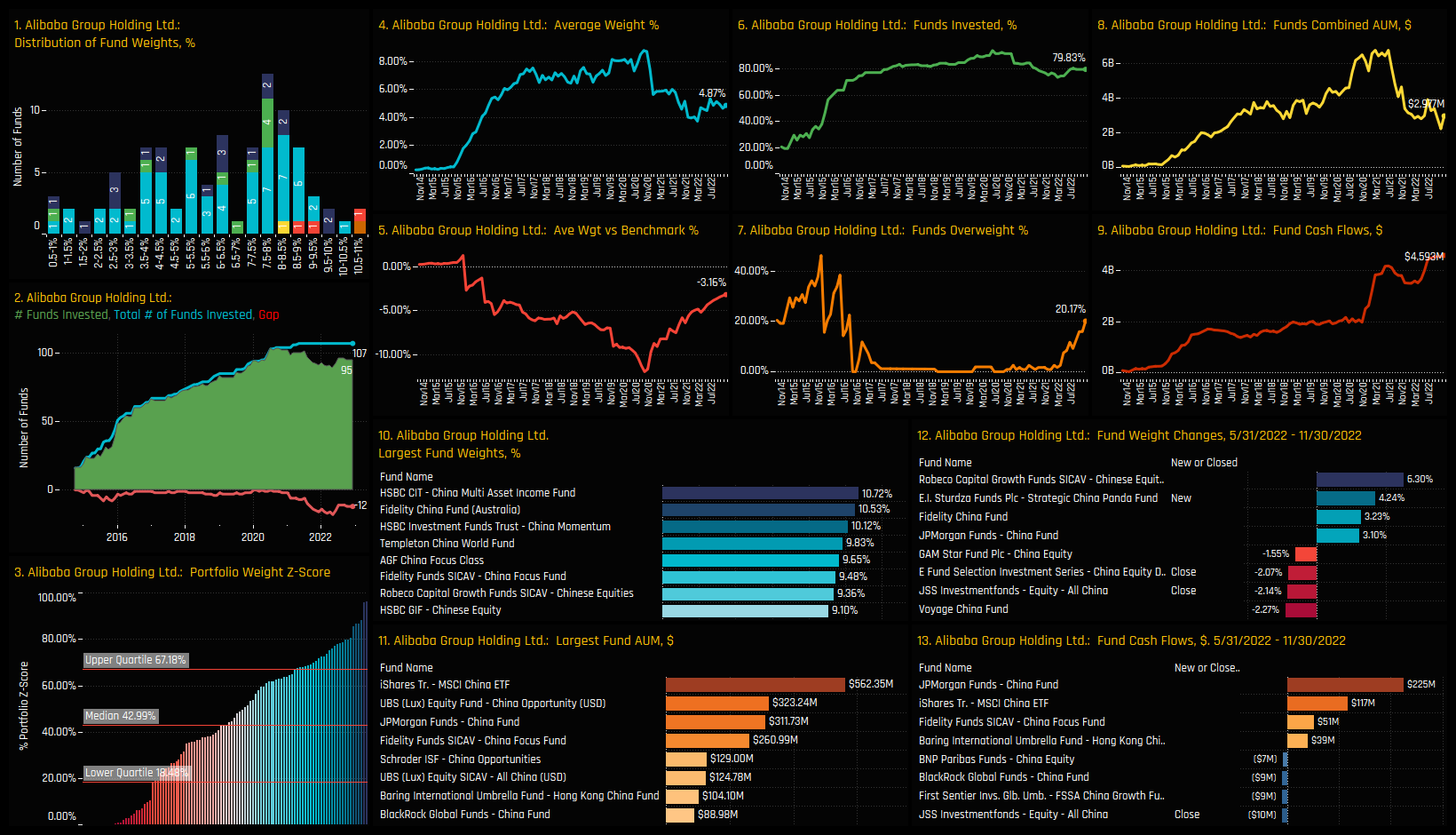

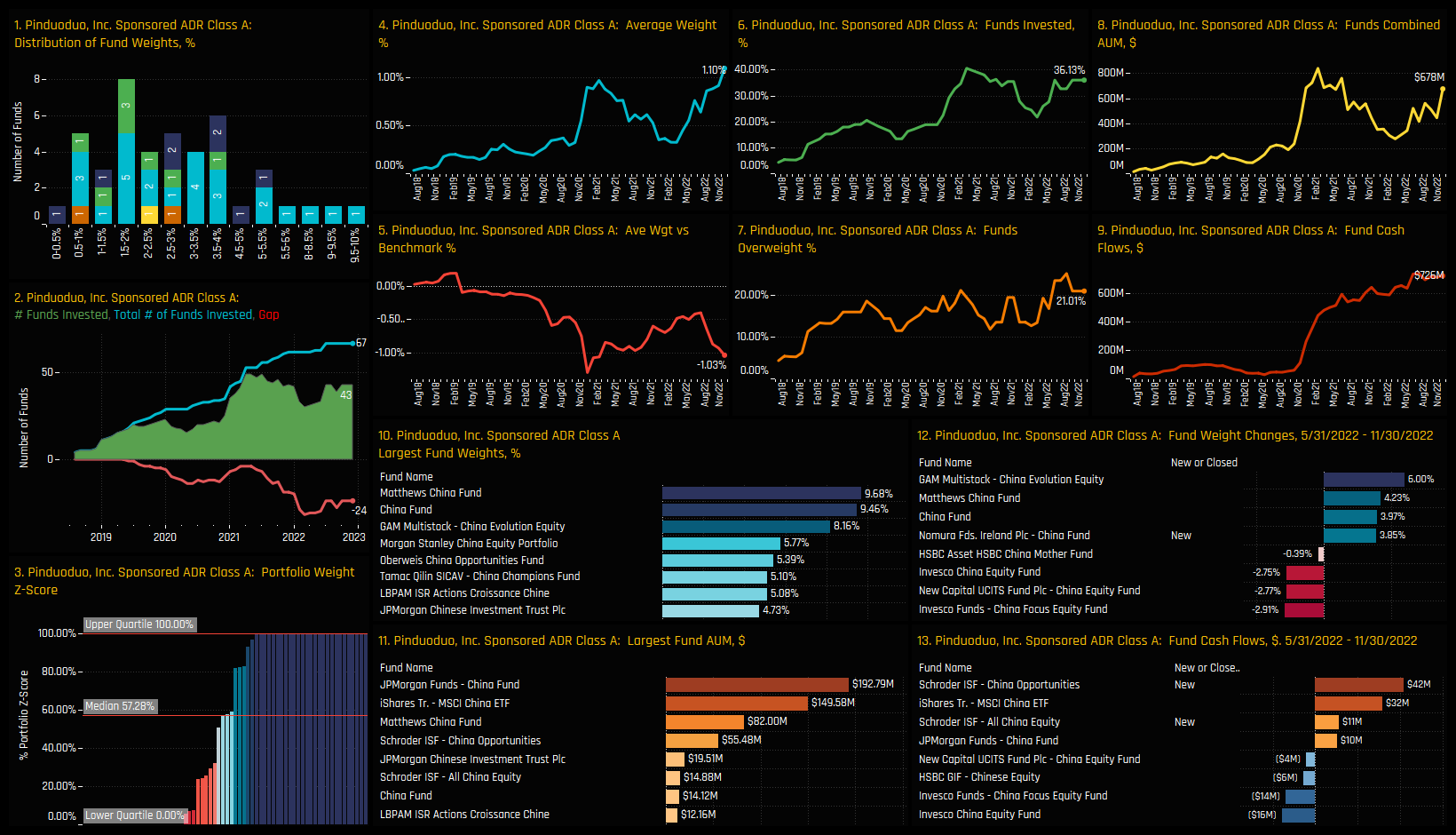

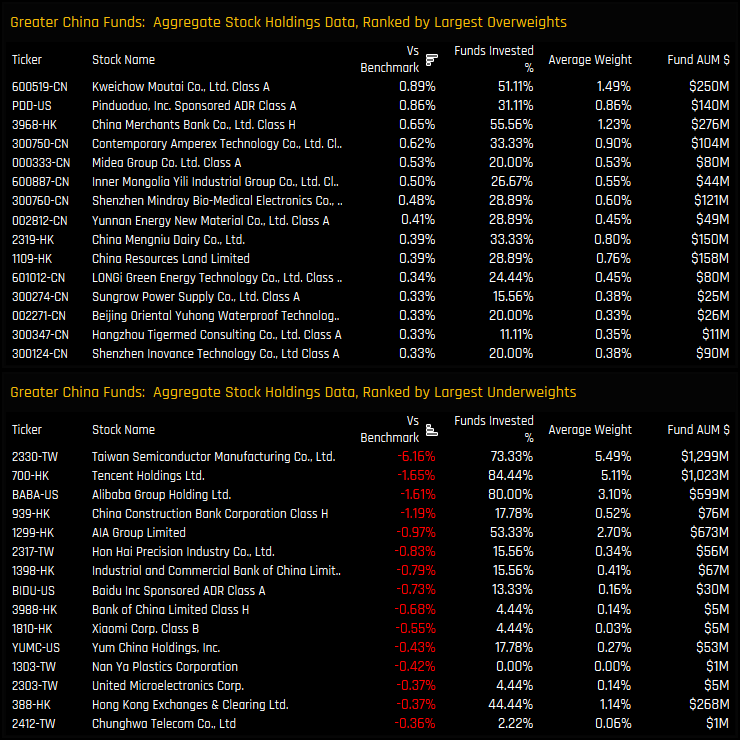

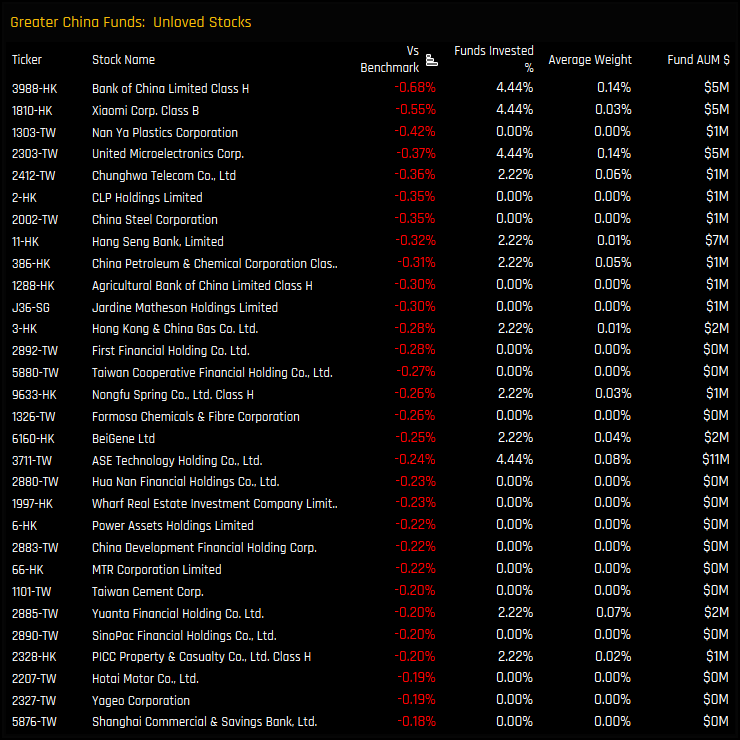

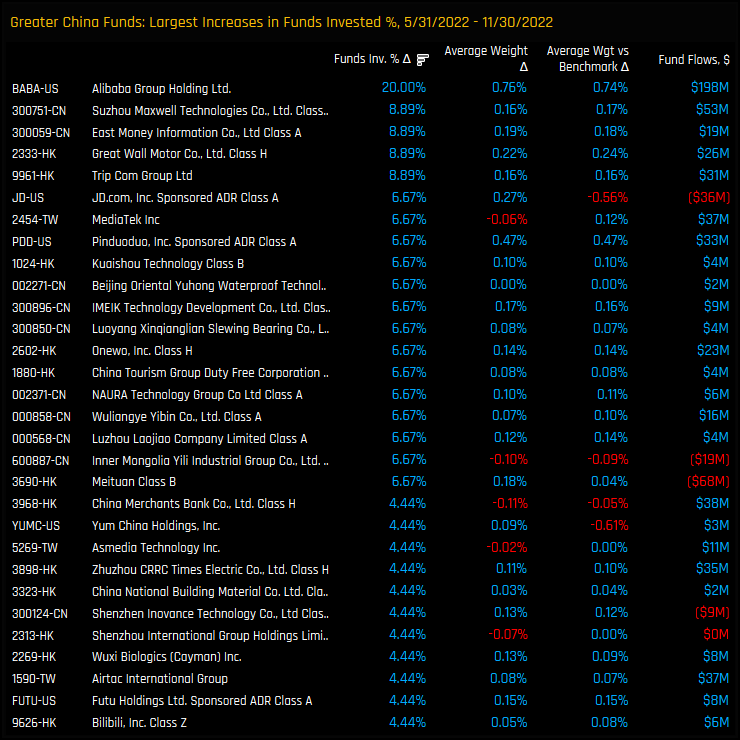

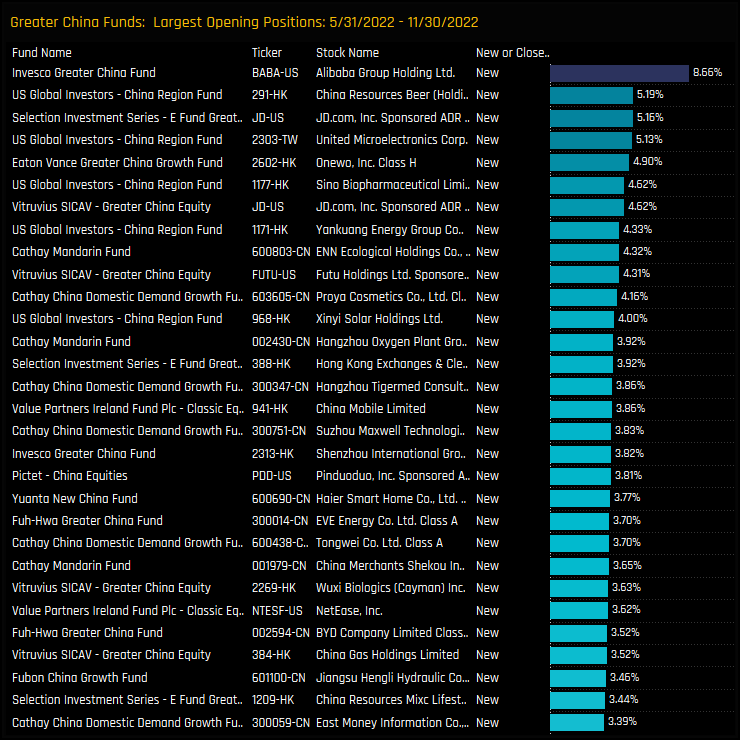

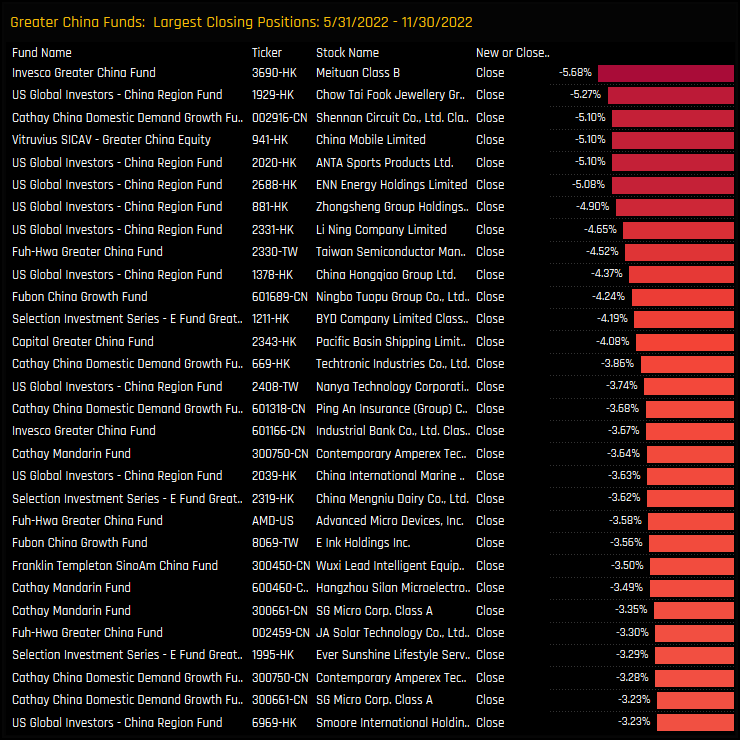

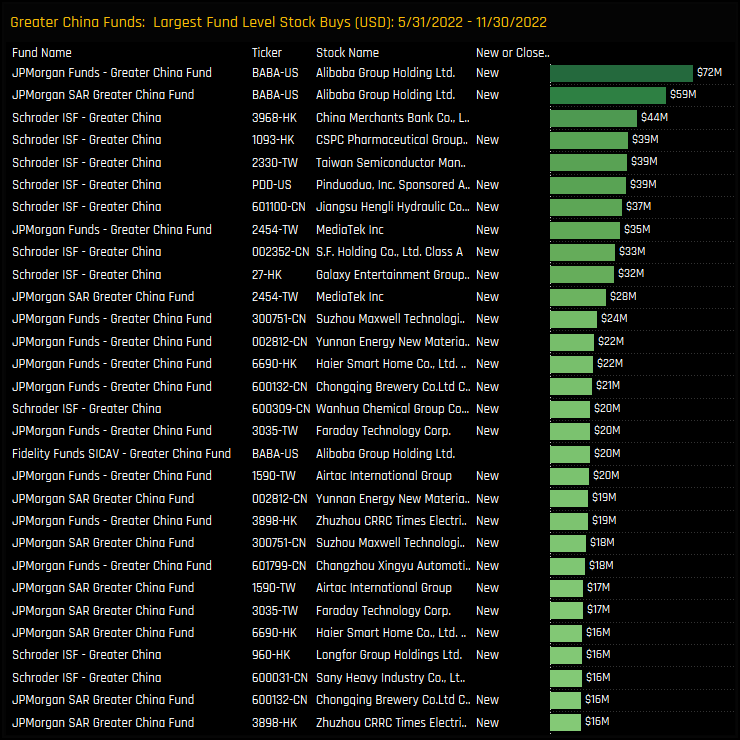

On a stock level, large increases in ownership across a number of names underpin the sector rotation. Pinduoduo Inc saw an +8.4% increase in the percentage of funds invested, Trip.com Group +6.7% and NIO Inc +5.88%. Of the larger fund level increases, Alibaba Group Holdings and Pinduoduo Inc stand out, with Techtronic Industries one of a few stocks seeing a reduction in exposure.

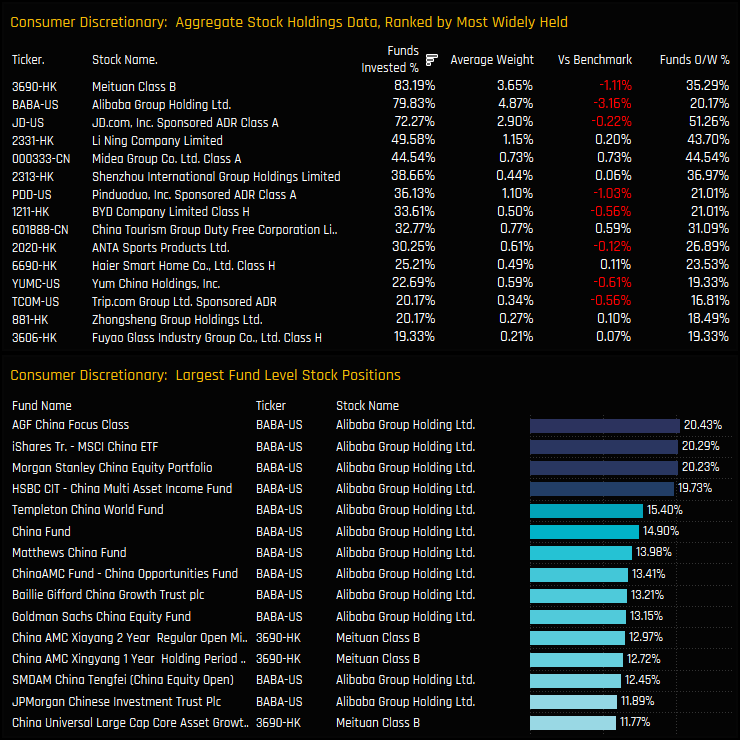

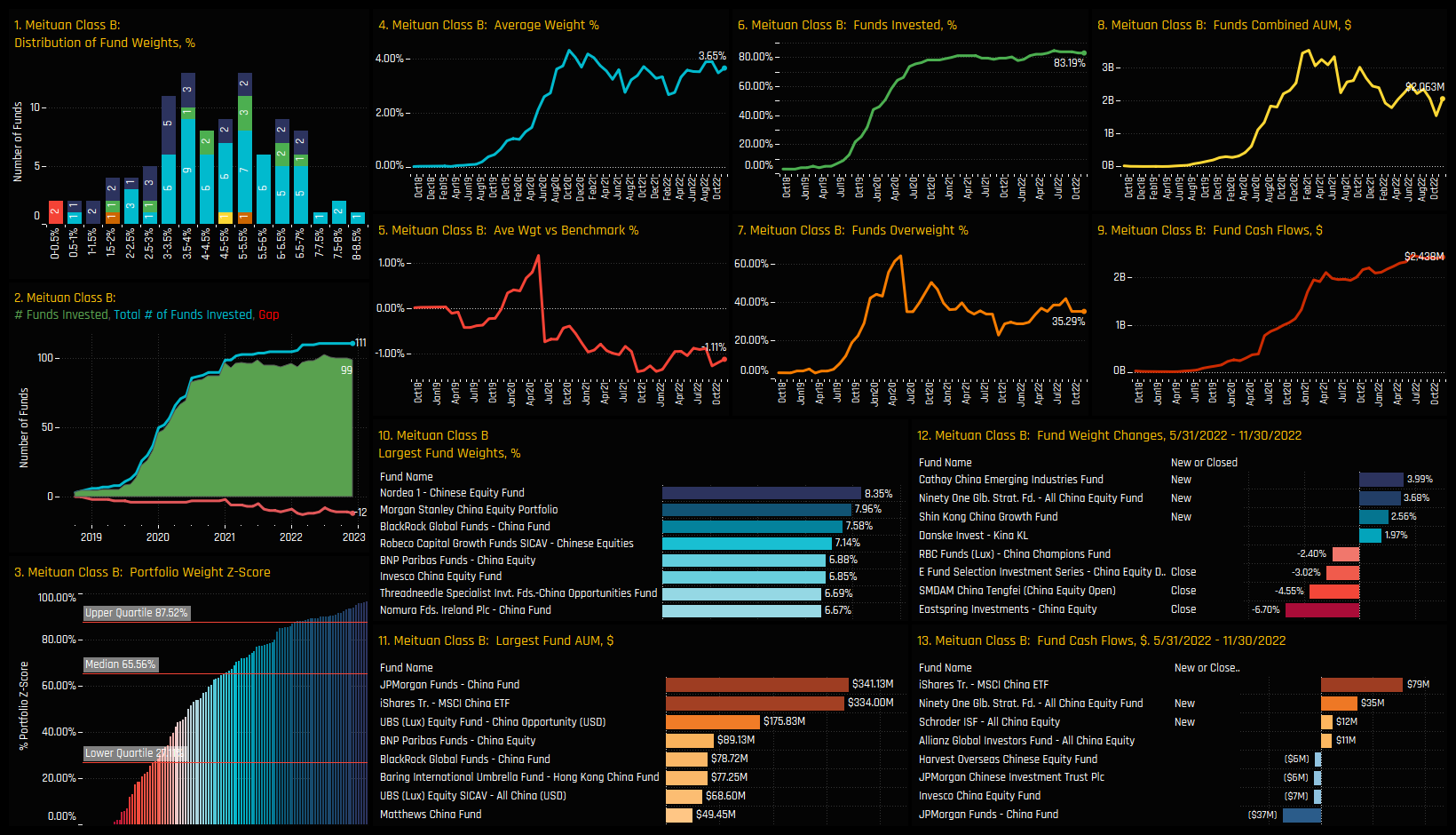

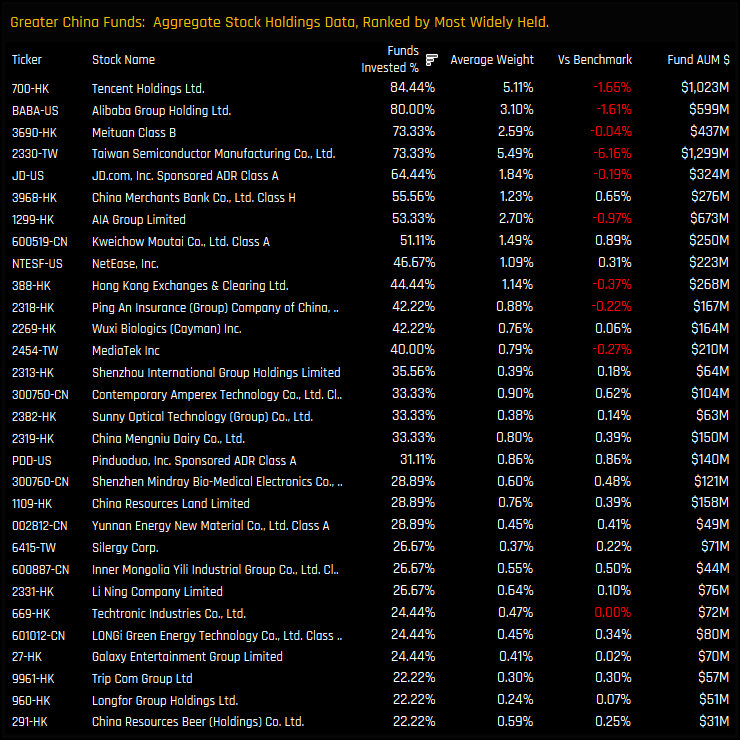

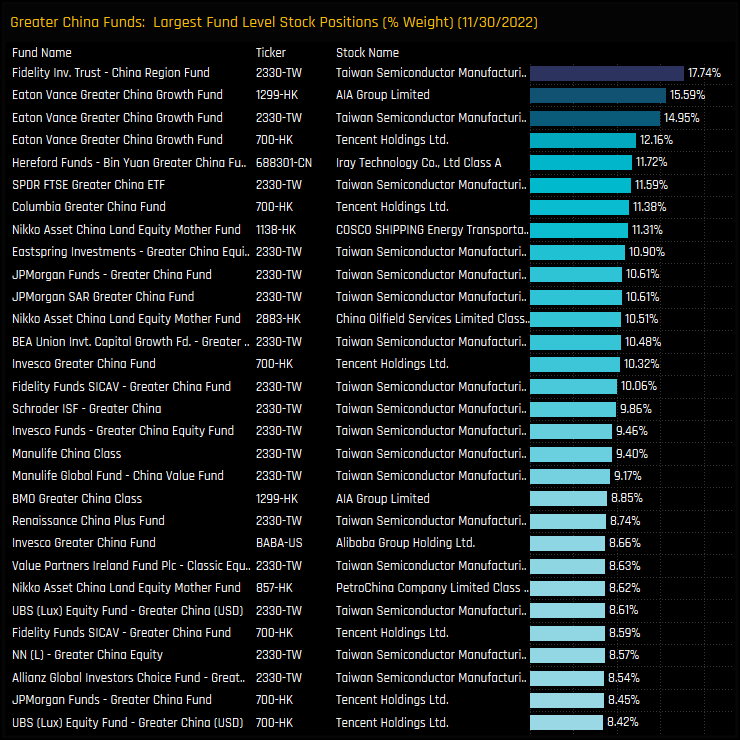

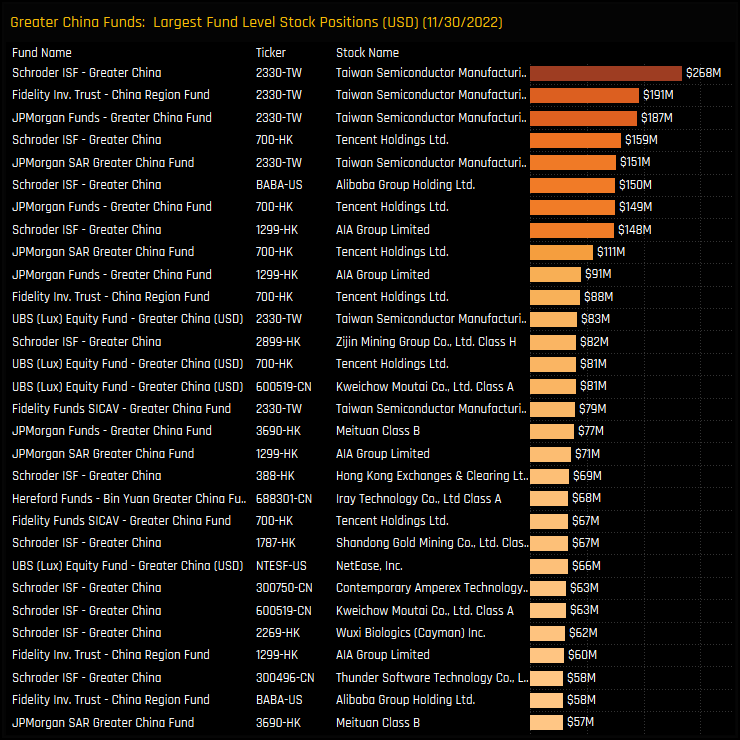

This leaves a deep level of fund ownership among stocks in the Consumer Discretionary sector. Meituan Dianping is the most widely held stock with 83.2% of funds invested, though Alibaba Group Holdings is held as a larger weight, on average. A total of 10 stocks are held by more than 30% of MSCI China active funds. Alibaba Group Holdings dominates the larger fund level positions, but is still held underweight by 80% of managers at a net -3.16% below benchmark.

Conclusions & Data Report

Sentiment towards China’s Consumer Discretionary sector is clearly shifting. After a knock in confidence following the Tech Crackdown of late 2020, prolonged COVID lockdowns and concerns over political leadership, active China investors are making a concerted effort to increase exposure.

In truth, sentiment is improving from a position of strength, with Consumer Discretionary overtaking Financials as the largest sector holding in 2019 and occupying over a fifth of total allocations ever since (see chart opposite). Indeed, the depth of stock ownership highlights the preference that active investors have over other stocks in competing sectors.

Relative to benchmark, China investors switched from overweight to underweight from 2018 onwards, refusing to chase index weights higher in names such as Alibaba, Pinduoduo and Nio Inc. With a sell-off in these names, active investors are more comfortable increasing exposure and reducing underweights in the process.

If the rhetoric is that China is oversold here, then Consumer Discretionary stocks appears well placed to benefit from further inflows.

Please click on the link below for an extended data report on the Consumer Discretionary sector among China active equity funds. Scroll down for ownership profiles on Meituan, Alibaba and Pinduoduo and for more analysis on China fund positioning.

Stock Profile: Meituan

Stock Profile: Alibaba Group Holdings

Stock Profile: Pinduoduo Inc.

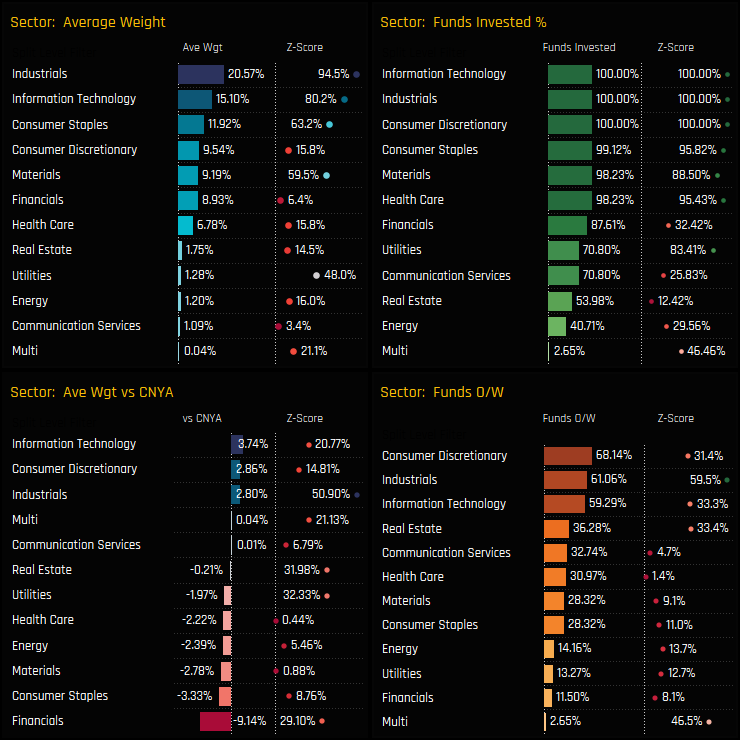

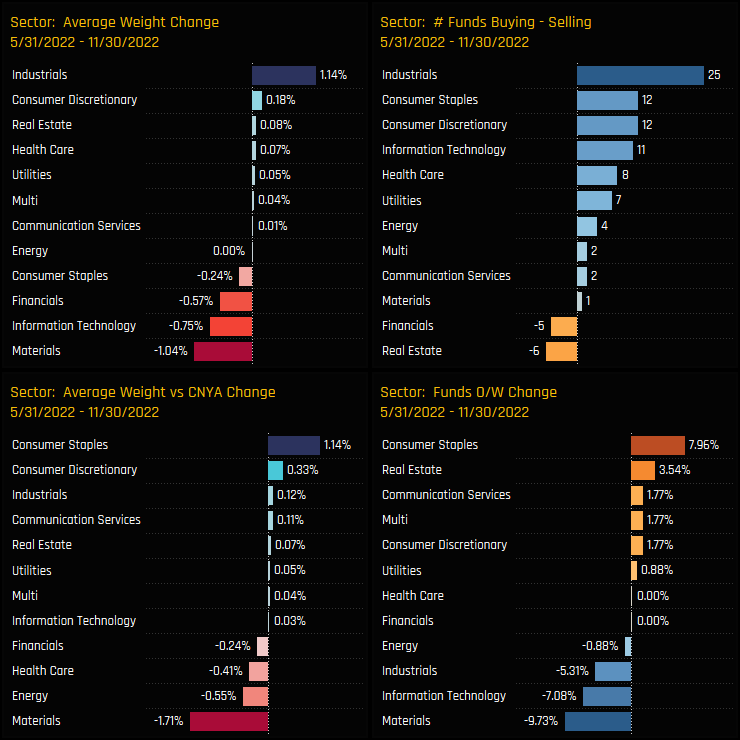

The latest sector ownership stats are shown in the charts below. Industrials are the highest sector weight on average, accounting for 20.6% of total allocations, held overweight by 61% of funds at an average overweight of +2.80%. The major underweight is in Financials, with average weights -9.14% below the iShares CNYA ETF and 89% of managers positioned underweight. 7 sectors dominate the holdings picture, with Communication Services, Energy, Utilities and Real Estate failing to capture widespread ownership among A-Share funds.

Over the last 6-months, conviction in the Industrials sector has only strengthened. Average fund weights increased by +1.14%, overweights by +0.12% with a clear excess of buyers over sellers. On balance, both of the Consumer Sectors benefited from rotation over the period, whilst Materials, Technology and Financials saw average weights fall.

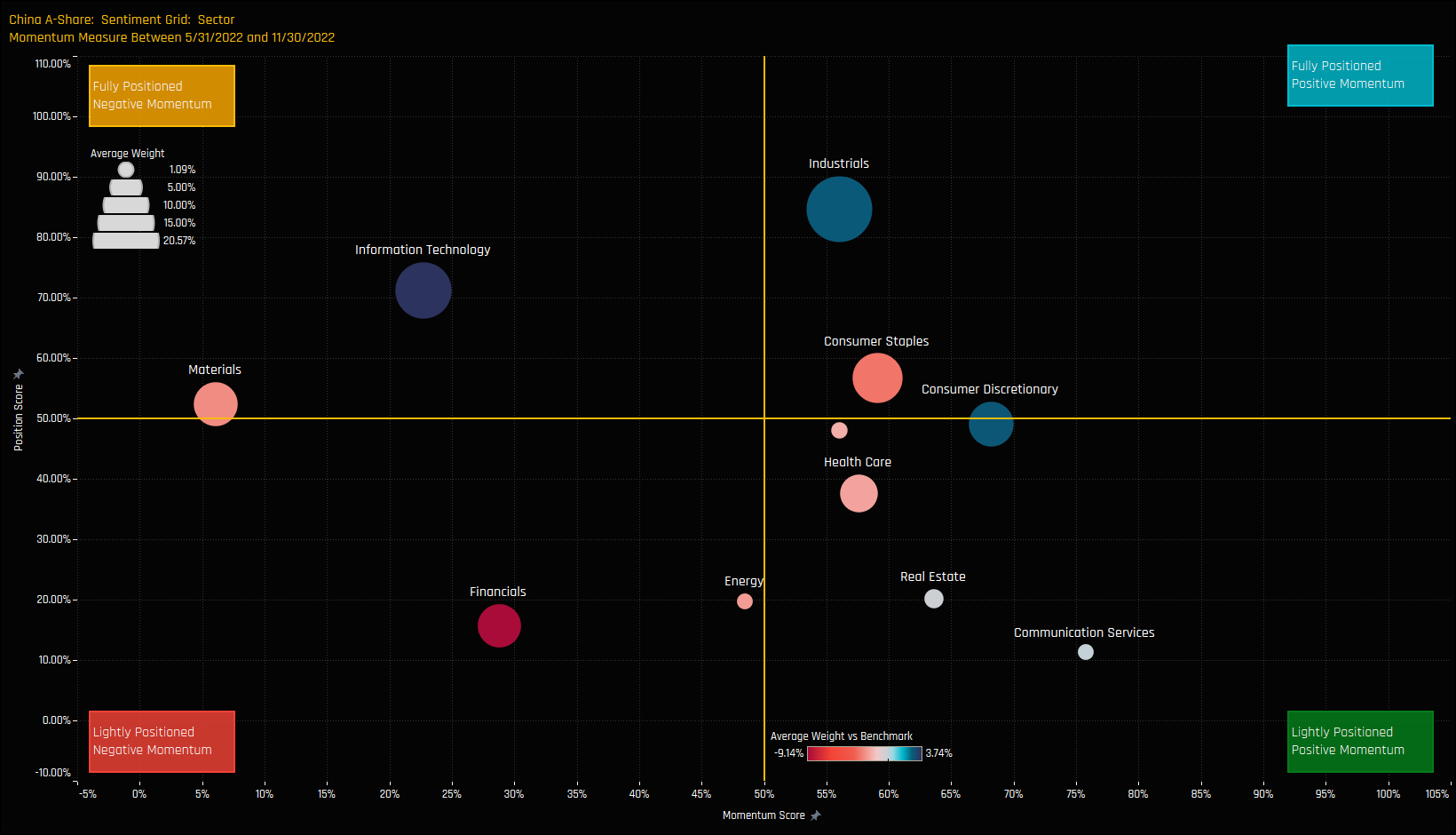

Sector Sentiment

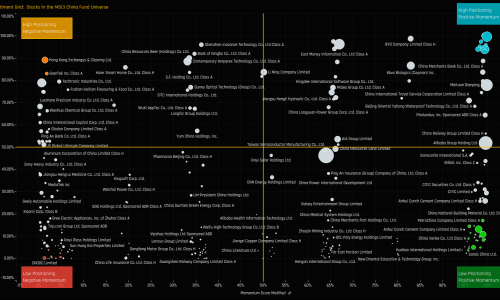

The sentiment grid below shows where current positioning in each sector sits versus its own history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each sector between 05/31/2022 and 11/30/2022 (x-axis). It pulls together long-term positioning, current positioning and short term changes in allocations. A-Share sectors are well dispersed across the Grid, highlighting clear variances in both positioning and fund momentum.

Perhaps the key difference is between Industrials and Financials, with the former well positioned with positive momentum and the latter exactly the opposite. Staples, Discretionary, Tech and Materials are at less extremes in terms of positioning, but occupy different ends of momentum scale. To understand the drivers behind this set up, we provide a more detailed analysis on each of these 6 sectors below.

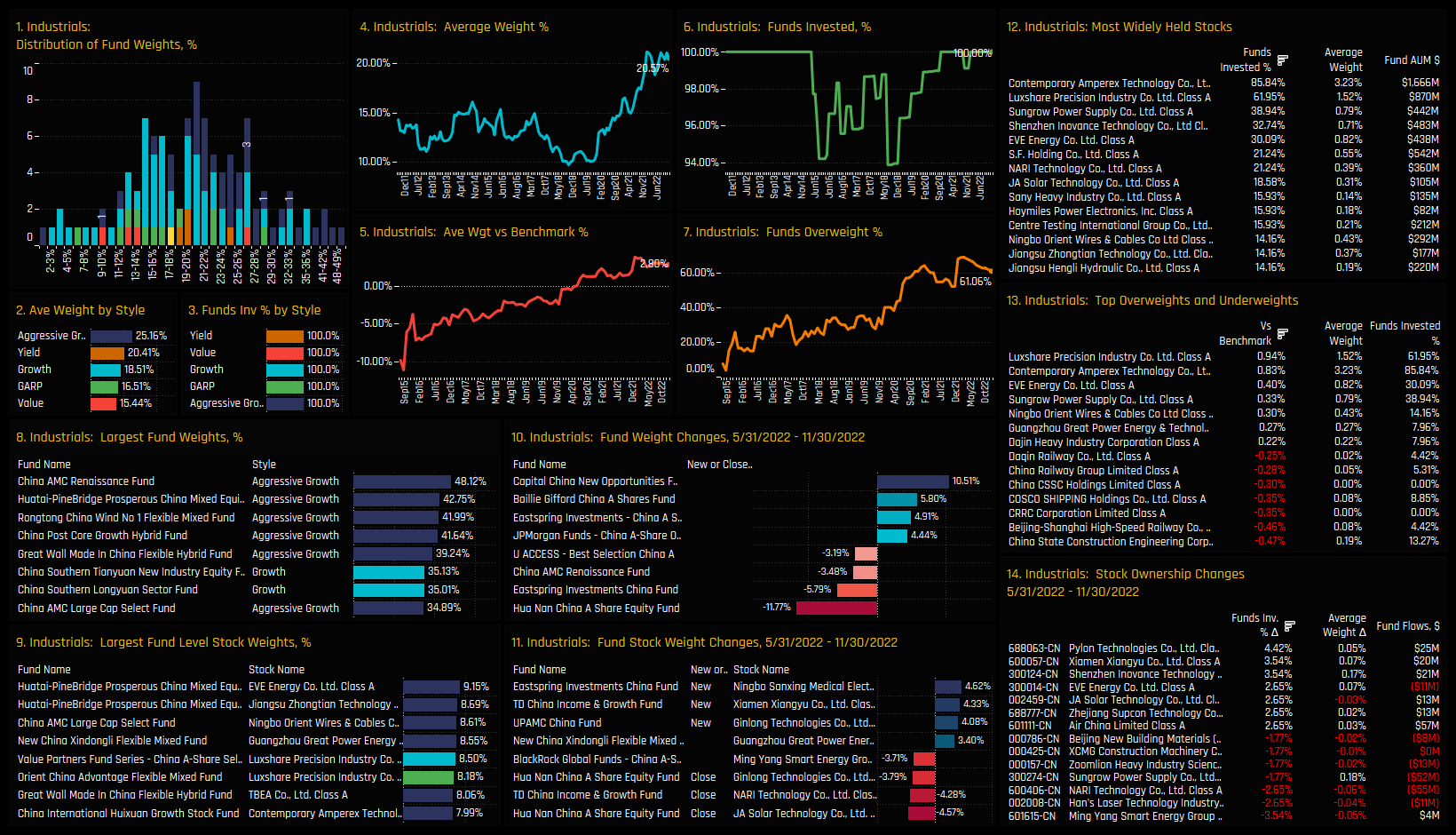

Industrials Focus

The darling of the A-Share fund manager, the Industrials sector has seen a huge surge in investment among active funds over the last 3-years. Average weights have doubled from 10% back in mid-2019 to over 20% today (ch4), moving active A-Share funds from a net underweight to a net overweight in the process (ch5). Fund allocations are clustered between 15% and 26% with a decent tail in either direction (ch1). Aggressive Growth investors are the most bullishly positioned with a 25.16% average weight (ch2), led by China AMC Renaissance (48.1%), Huatai-PineBridge China Mixed Equity (42.8%) and Rongtong China Wind (42.0%).

On a stock level, Contemporary Amperex Technology (CATL) is the most widely held stock by some margin, held by a record 85.8% of managers at an average weight of 3.23% (ch12). Luxshare Precision Industry is also a key holding and the top overweight position alongside CATL, EVE Energy Co and Sungrow Power Supply (ch13). Stock activity over the last 6-months has seen A-Share funds increase exposure to Pylon Technologies and Xiamen Xiangyu Co, whilst the major decreases were in Ming Tang Smart Energy and Han’s Laser Technology (ch14)

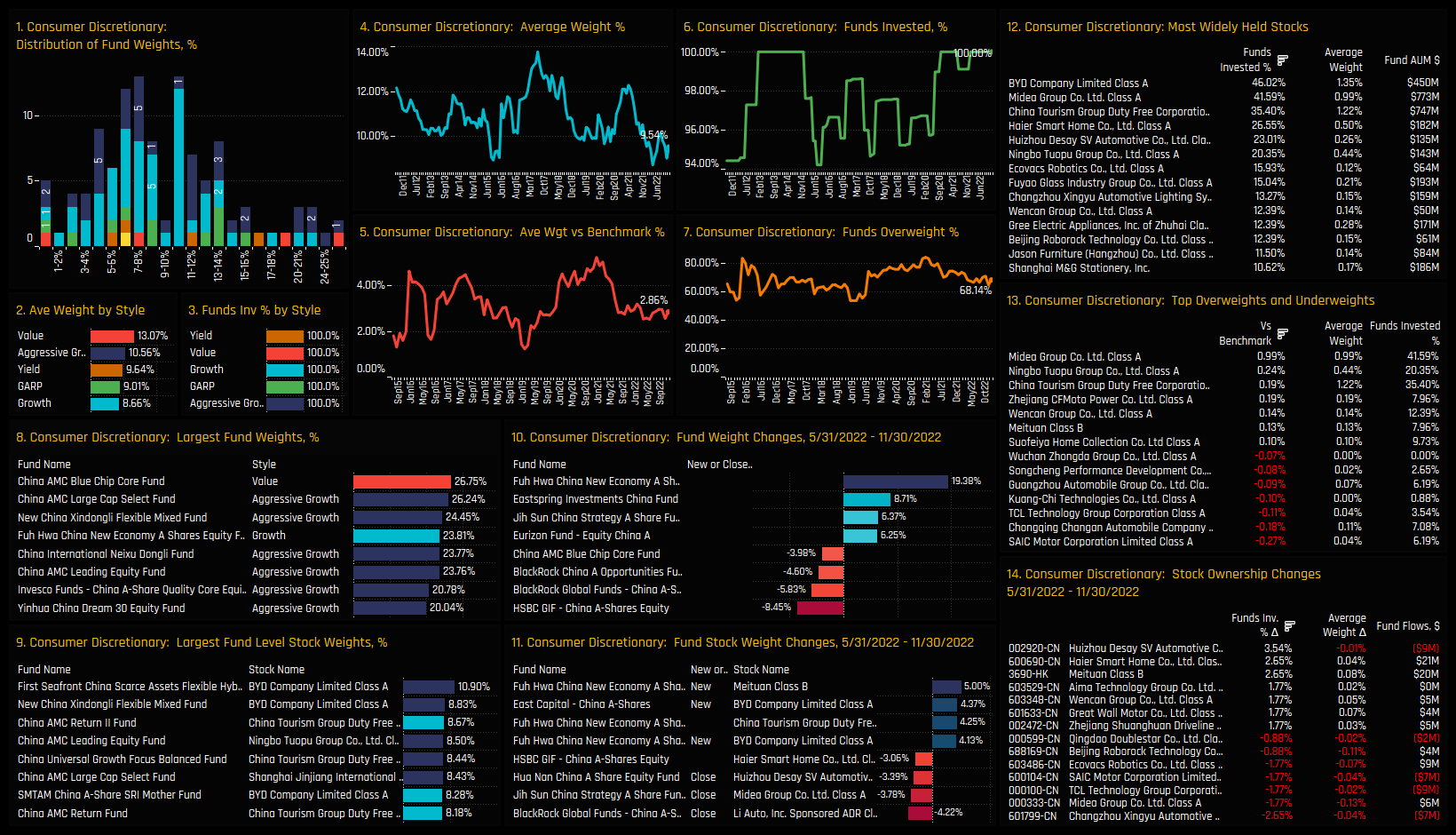

Consumer Discretionary Focus

Consumer Discretionary allocations sit towards the bottom end of their decade-long range at 9.54%, though sentiment is slowly turning more positive. As well as an uptick in weights from the lows of March this year, outright fund ownership in the sector has hit the maximum 100% (ch6). In addition, over 2/3rds of the managers in our analysis remain overweight the sector (ch7) at an average +2.86% above the CNYA benchmark (ch5). The distribution of fund allocations peaks at between 6% and 10%, with a long right-sided tail led by China AMC Blue Chip Core (26.75%) and China AMC Large Cap Select (26.24%).

From a stock perspective, BYD Company, Midea Group and China Tourism Group are the high conviction holdings in the sector, with investors largely avoiding the top 5 benchmark sector holdings of SAIC Motor Corp and Chongqing Changan Auto. Over the last 6-months, opening positions in BYD Company by East Capital (+4.37%) and Fuh Hwa China New Economy (+4.13%) stand out, alongside increased positioning in Huizhou Desay SV and Haier Smart Home Co.

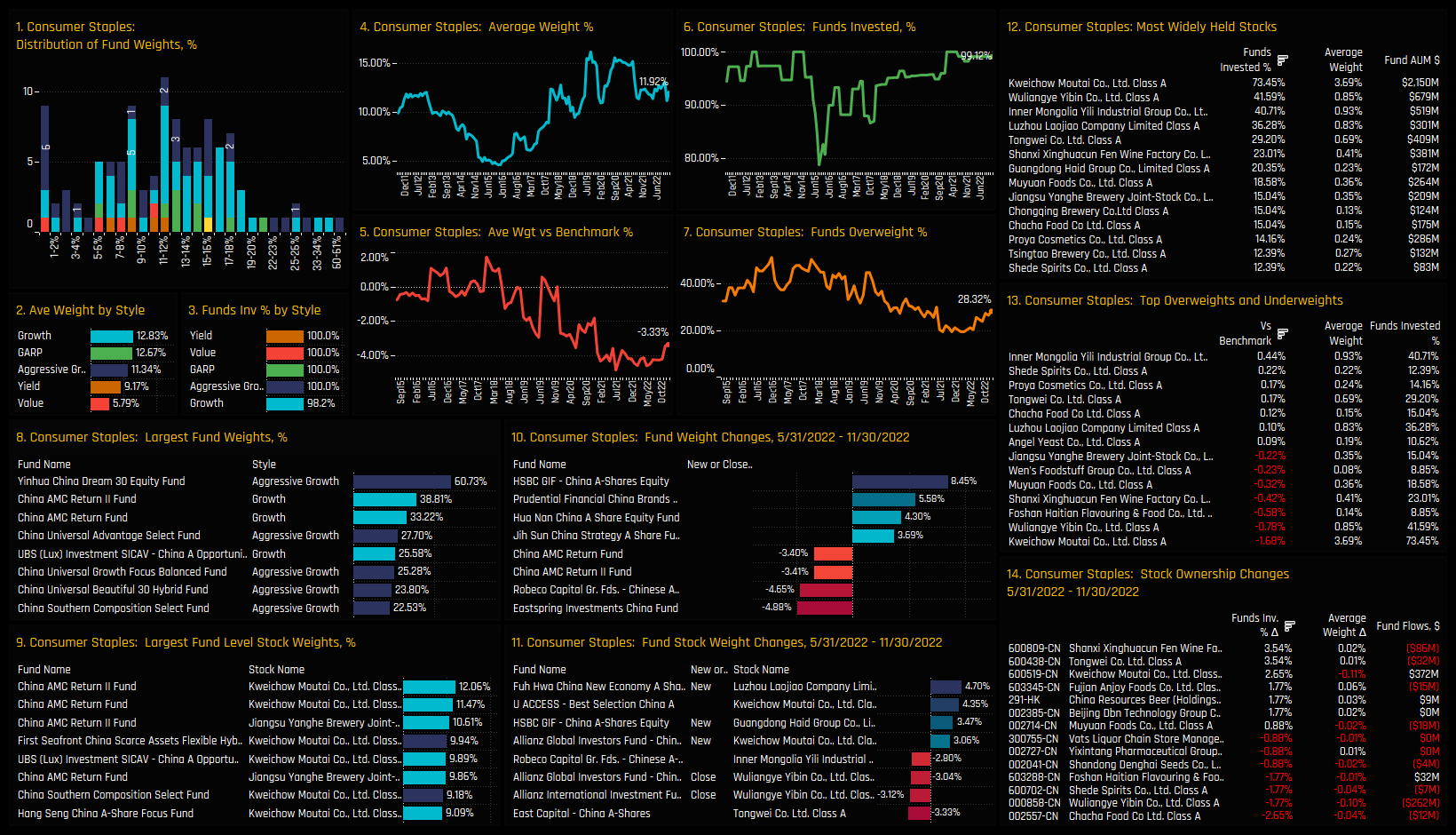

Consumer Staples Focus

Consumer Staples allocations have increased markedly since the lows of <5% in late 2015, but have struggled to maintain the highs of >15% last seen in 2020. Today’s allocations sit somewhere just above mid-range, but an effort by managers to decrease underweights in recent months points at a strengthening of sentiment. The sector is favoured by Growth investors, with Value and Yield some way behind. Fund allocations are centered around the 8% to 18% level, though there are number of funds allocating more than 20% to the Staples sector. Recent increases in allocations by HSBC China A-Share (+8.45%) and Prudential China Brands (+5.58%) are the standouts.

The most widely held stock by a margin is Kweichow Moutai, owned by 73.5% of funds at an average weight of 3.69%, though even at these levels it remains the largest underweight in the A-Share universe. The 2nd tier contains Wuliangye Yibin, Inner Mongolia Yili and Luzhou Laojiao Company, all sharing similar ownership profiles among A-Share investors. Over the last 6-months, ownership levels in Shanxi Xinghuacun Fen Wine and Tanwei Co increased, whilst decreases in Wuliangye Yibin were notable and led by the Allianz China A-Share Funds.

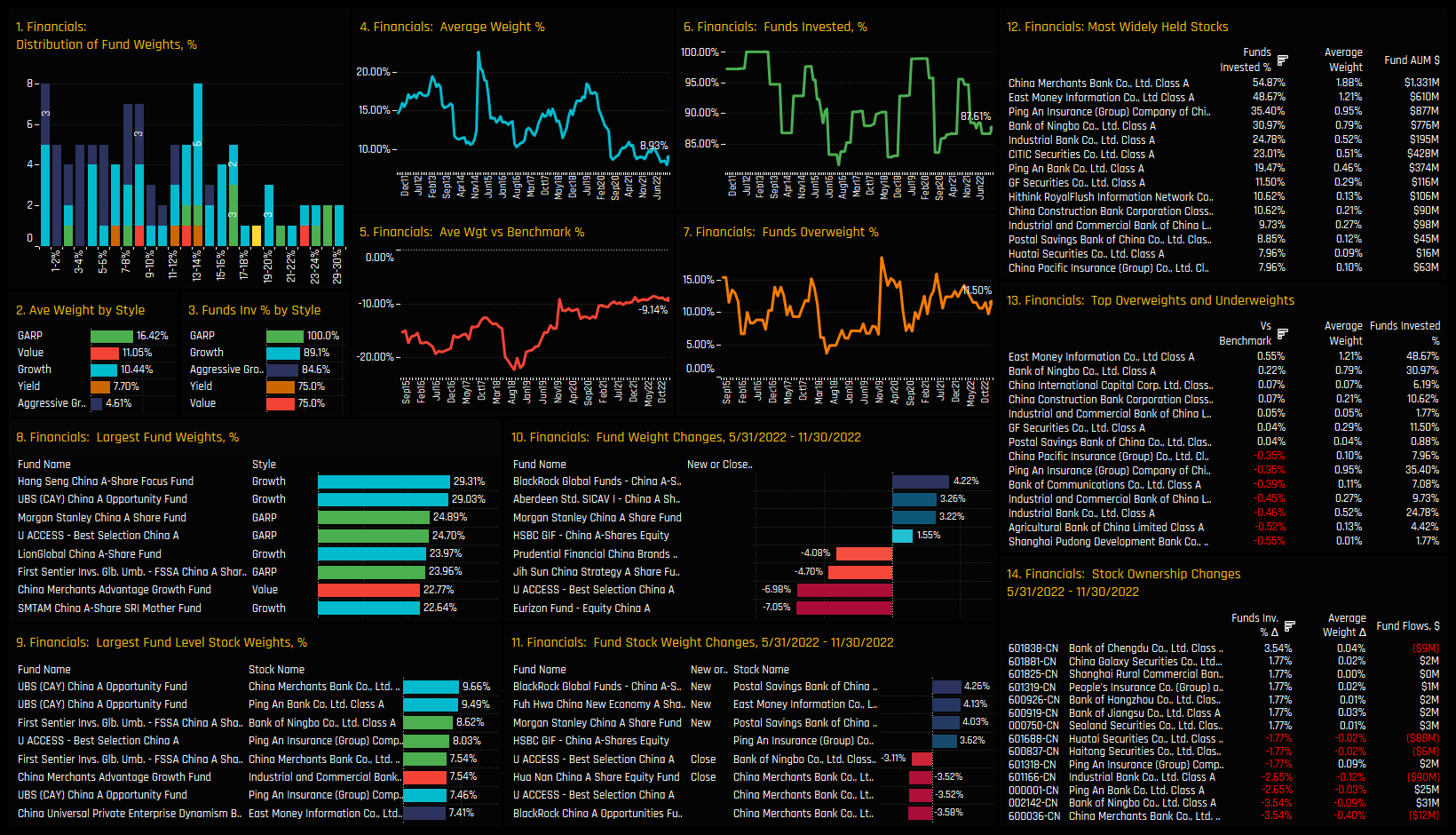

Financials Focus

Financials allocations are close to their lowest levels on record. Apathy in the sector is evident in all of our metrics, with 12.4% of A-Share investors avoiding exposure entirely (ch6), 88.5% underweight (ch7) and outright allocations drifting ever lower (ch4). The fact that A-Share active managers are comfortable running a -9.14% underweight on average speaks volumes (ch5). Fund allocations are well dispersed, though a lack of opportunities for Aggressive Growth funds is evident in their smaller than average net holdings (ch2&3).

On a stock level, China Merchants Bank and East Money Information Co are the standout holdings and account for just over a third of total allocations in the sector (ch12). Underweights are dispersed across a wide number of stocks and led by the mostly avoided Shanghai Pudong Development Bank and Agricultural Bank of China. 6-Month activity is skewed to the sell-side, led by falling investment in China Merchants Bank and Bank of Ningbo as both stocks saw the percentage of funds invested fall by -3.54%.

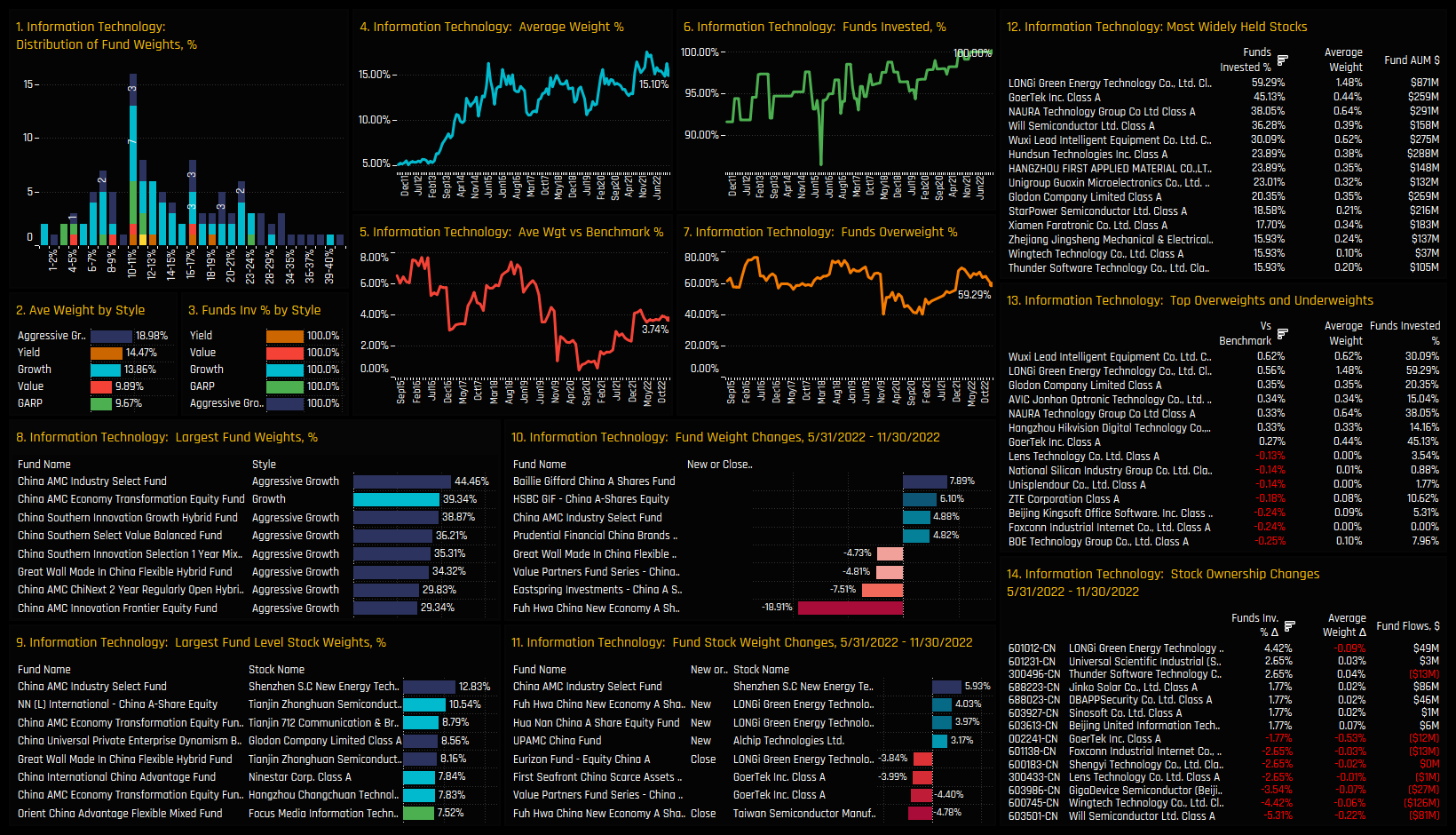

Information Technology Focus

Average weights in the Technology sector have fallen from the highs of 17.5% late last year, though remain at the higher end of the 8-year range of between 10%-18%. Commensurate with this drift lower is a fall the in percentage of funds overweight the Tech sector, though A-Share investors are still majority overweight and by an average +3.74% above the CNYA index. Perhaps this is best thought of as a consolidation rather than a full blown reversal of sentiment. Aggressive Growth investors are still committed, with average weights of 18.98% buoyed by outsized positions from China AMC Industry Select (44.5%) and China Southern Innovation Growth (38.9%).

LONGI Green Energy Technology is the poster child for the A-Share Tech Sector, held by 59.3% of funds at an average weight of 1.48%, far above the 2nd tier of GoerTek Inc, NAURA Technology Group Co and Will Semiconductors. New positions in LONGI Green Energy Technology from Fuh Wha China New Economy (+4.03%) and Hua Nan China A Share Equity (+3.97%) helped push net ownership higher by +4.4% over the last 6-months. Stock activity was negative on balance though, with A-Share funds scaling back holdings in Will Semiconductor, Wingtech Technology and GigaDevice Semiconductor over the same period.

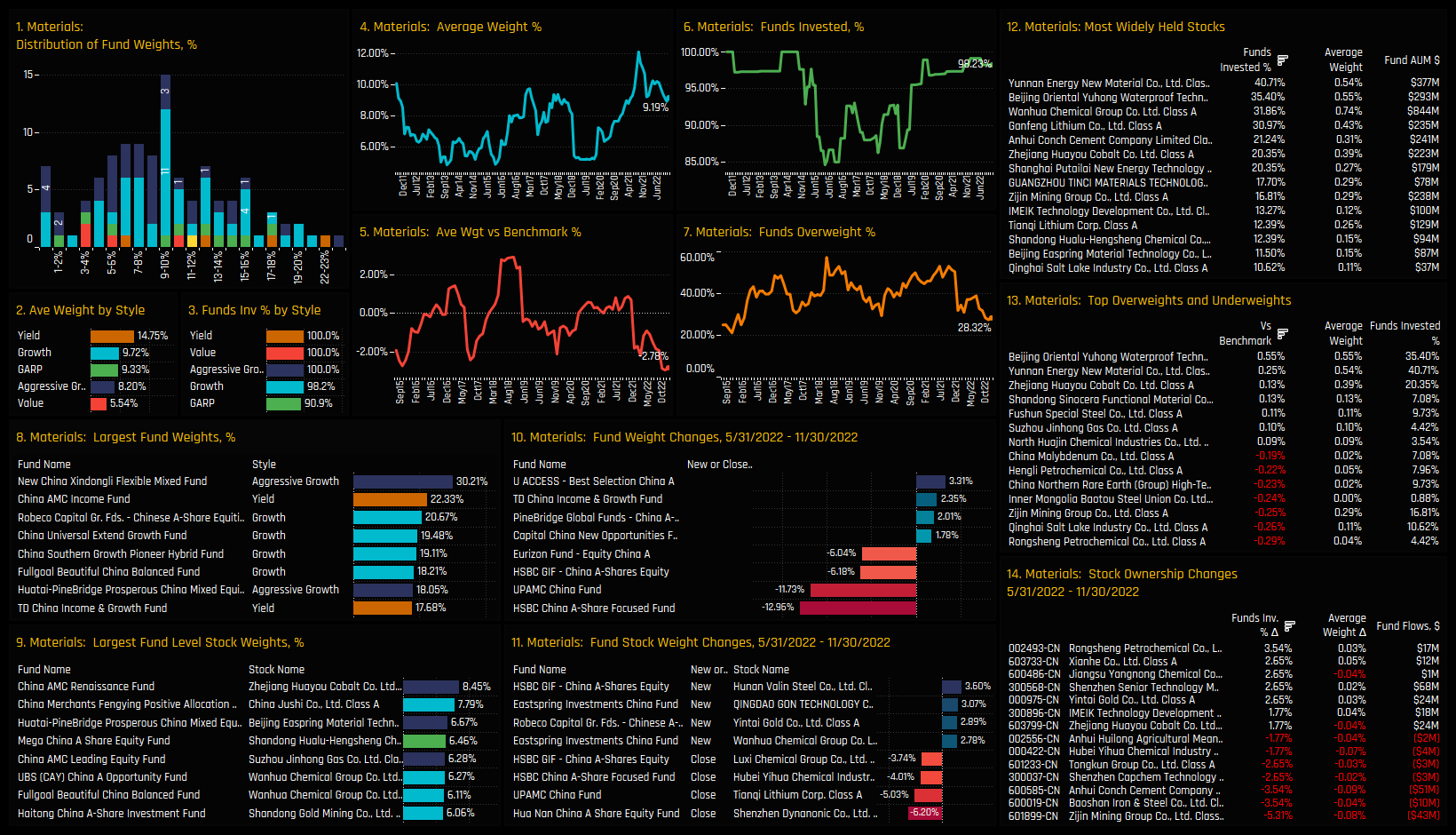

Materials Focus

The reversal in the Materials sector has been more severe. From a peak of 12.1% at the tail end of the last year, average allocations have fallen to 9.19% (ch4). This was an active rotation, with domestic funds scaling back allocations in the 1st wave between August/December 2021 and then international funds over the last 6-months, led by HSBC China A-Share Focus (-12.96%) and UPAMC China (-11.73%). The effect has moved Materials from a net overweight in 2021 to record underweights of -2.78% today.

Yunnan Energy New Material and Beijing Oriental Yuhong Waterproof Technology are the high conviction holdings, owned by the most funds and the key overweights in the sector. There are a number of benchmark stocks that are largely avoided by active A-Share investors, such as Rongsheng Petrochemical (owned by 4.4% of funds) and Inner Mongolia Baotou (owned by 0.9%). Stock activity over the last 6-months has been 2-way, but skewed to the sell-side. Rising ownership in Rongsheng Petrochemical and Xianhe Co was offset by falling ownership in Zijin Mining Group, Baoshan Iron & Steel and Anhui Conch Cement Co.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 19, 2022

MSCI China Funds: Stock Sentiment Analysis

119 Active China Funds, AUM $52bn. MSCI China Stock Sentiment Investment levels among the thous ..

- Steve Holden

- April 18, 2024

China Funds: Performance & Attribution Review, Q1 2024

143 MSCI China Equity funds, AUM $39bn MSCI China Funds: Performance & Attribution Review, ..

- Steve Holden

- April 27, 2023

China Fund Positioning Analysis, April 2023

257 China Equity Funds, AUM $108bn China Fund Positioning Analysis, April 2023 In this issue: Q ..