Emerging Market Funds: Q3 Performance & Attribution

-

Steve Holden

-

October 11, 2022

-

Emerging Markets

-

0 Comments

279 Active GEM Funds, AUM $354bn. Q3 Performance & Attribution In this piece, we provide an overview of Q3 performance among the GEM active funds in our analysis. We look at quarterly performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then breakdown this quarter’s performance based on the average active …

Continue Reading

Asia Ex-Japan Funds: Q3 Performance & Attribution

-

Steve Holden

-

October 11, 2022

-

Asia

-

0 Comments

92 Asia Ex-Japan funds, AUM $60bn. Q3 Performance & Attribution In this piece, we provide an overview of Q3 performance among the Asia Ex-Japan active funds in our analysis. We look at quarterly performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then breakdown this quarter’s performance based on the average …

Continue Reading

EMEA Focus: Allocations Hit All-Time Lows

-

Steve Holden

-

September 28, 2022

-

Emerging Markets

-

0 Comments

275 Active GEM Funds, AUM $370bn EMEA Focus: Allocations Hit All-Time Lows In this piece, we provide a comprehensive analysis of EMEA country positioning among active GEM equity funds. After the demise of Russia, active EM managers are positioned at their lowest ever levels in the EMEA region, moving from a multi-year overweight to a key underweight in little over …

Continue Reading

EMEA Focus: Allocations Hit All-Time Lows

-

Steve Holden

-

September 21, 2022

-

GEM Insights

-

0 Comments

275 ACTIVE GEM FUNDS, AUM $370BN EMEA Focus: Allocations Hit All-Time Lows In this piece, we provide a comprehensive analysis of EMEA country positioning among active GEM equity funds. After the demise of Russia, active EM managers are positioned at their lowest ever levels in the EMEA region, moving from a multi-year overweight to a key underweight in little over …

Continue Reading

Asia Ex-Japan: Country Positioning Update

-

Steve Holden

-

September 15, 2022

-

Asia

-

0 Comments

92 Active Asia Ex-Japan Funds, AUM $62bn Country Positioning Update In this piece we provide a comprehensive analysis of country positioning among Asia Ex-Japan equity funds. We look at the current ownership dynamics and tie that in to the long-term trends in country positioning and more recent manager activity. We find that Taiwan and South Korea have born the brunt …

Continue Reading

Record Exposure as North American Rotation Continues

-

Steve Holden

-

September 13, 2022

-

Global

-

0 Comments

358 Active Global Funds, AUM $930bn North American Rotation Active Global investors are at record allocations in North American stocks. Driven higher by rising Health Care, Industrials and Energy exposure, North America continues to take market share from the key regions in Europe and Asia. Yet with Global investors still underweight North America, does this rotation have further to run? …

Continue Reading

China A-Share Deep Dive

-

Steve Holden

-

September 13, 2022

-

Emerging Markets

-

0 Comments

279 Active GEM Funds, AUM $370bn. China A-Share Deep Dive In this piece we provide a comprehensive analysis of China A-Share positioning among active EM funds. We find that the growth in China A-Share exposure has slowed as we approach full ownership across the active funds in our analysis. China A-Share allocations have remained solid throughout this year’s volatility and …

Continue Reading

MSCI China Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 19, 2022

-

China

-

0 Comments

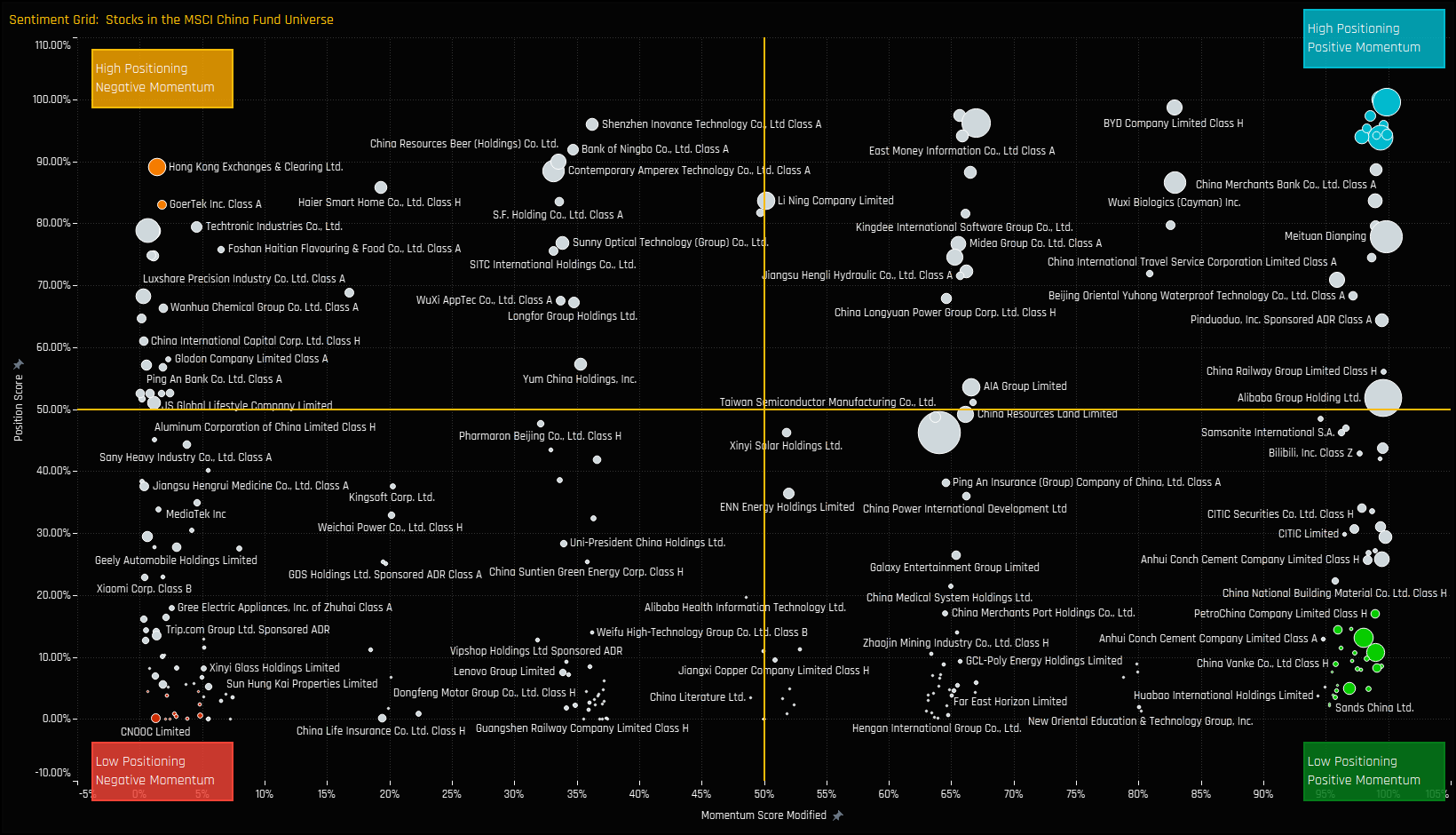

119 Active China Funds, AUM $52bn. MSCI China Stock Sentiment Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in …

Continue Reading

China A-Share Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 18, 2022

-

China

-

0 Comments

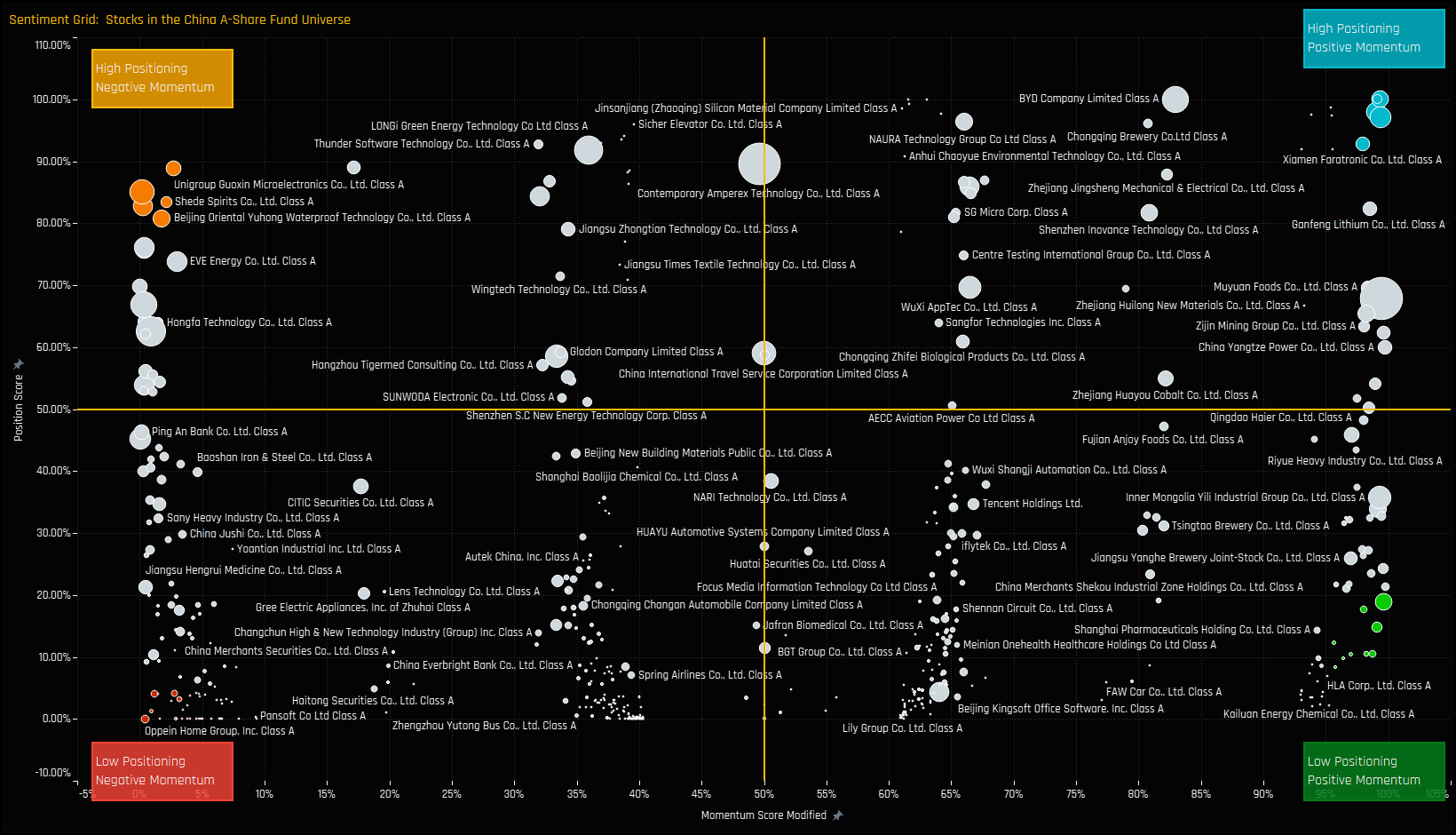

115 Active China A-Share Funds, AUM $63bn. China A-Share Stock Sentiment Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock …

Continue Reading

Greater China Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 18, 2022

-

China

-

0 Comments

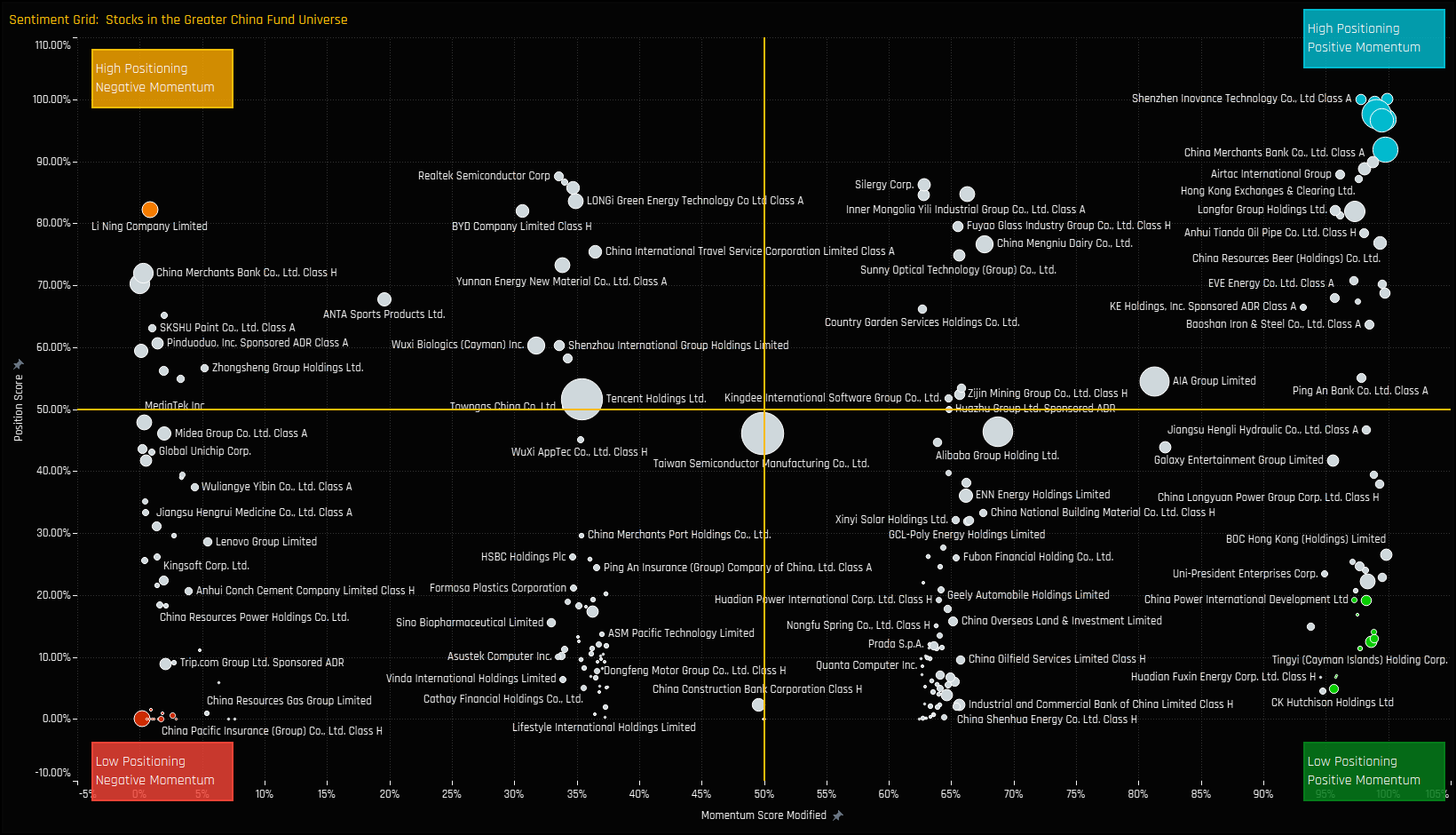

45 Active Greater China Funds, AUM $20bn. Greater China Stock Sentiment Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock …

Continue Reading

Recent Comments