UK Funds: Q3 Performance & Attribution

-

Steve Holden

-

October 20, 2022

-

UK

-

0 Comments

275 Active UK Equity funds, AUM $141bn Q3 Performance & Attribution UK Funds suffered another negative quarter, both in absolute terms and relative to the benchmark FTSE All Share benchmark. Only 25% of the funds in our analysis managed to beat the index, lead by poor performance from the Value and Small/Midcap end of the spectrum. Underperformance was driven by …

Continue Reading

Mexico Hits Record Overweight

-

Steve Holden

-

October 19, 2022

-

Emerging Markets

-

0 Comments

280 Active GEM Funds, AUM $325bn Mexico Mexican exposure among active EM investors continues to grind higher. Rotation among managers this year has moved Mexico to the largest country overweight in EM, with current levels of +1.22% above benchmark the highest on record. In this analysis, we look at the underlying fund holdings that make up this picture, and highlight …

Continue Reading

Record Exposure as North American Rotation Continues

-

Steve Holden

-

October 18, 2022

-

Global Insights

-

0 Comments

358 ACTIVE GLOBAL FUNDS, AUM $930BN North American Rotation Active Global investors are at record allocations in North American stocks. Driven higher by rising Health Care, Industrials and Energy exposure, North America continues to take market share from the key regions in Europe and Asia. Yet with Global investors still underweight North America, does this rotation have further to run? …

Continue Reading

UK Equity Funds: Stock Sentiment Analysis

-

Steve Holden

-

October 18, 2022

-

UK Insights

-

0 Comments

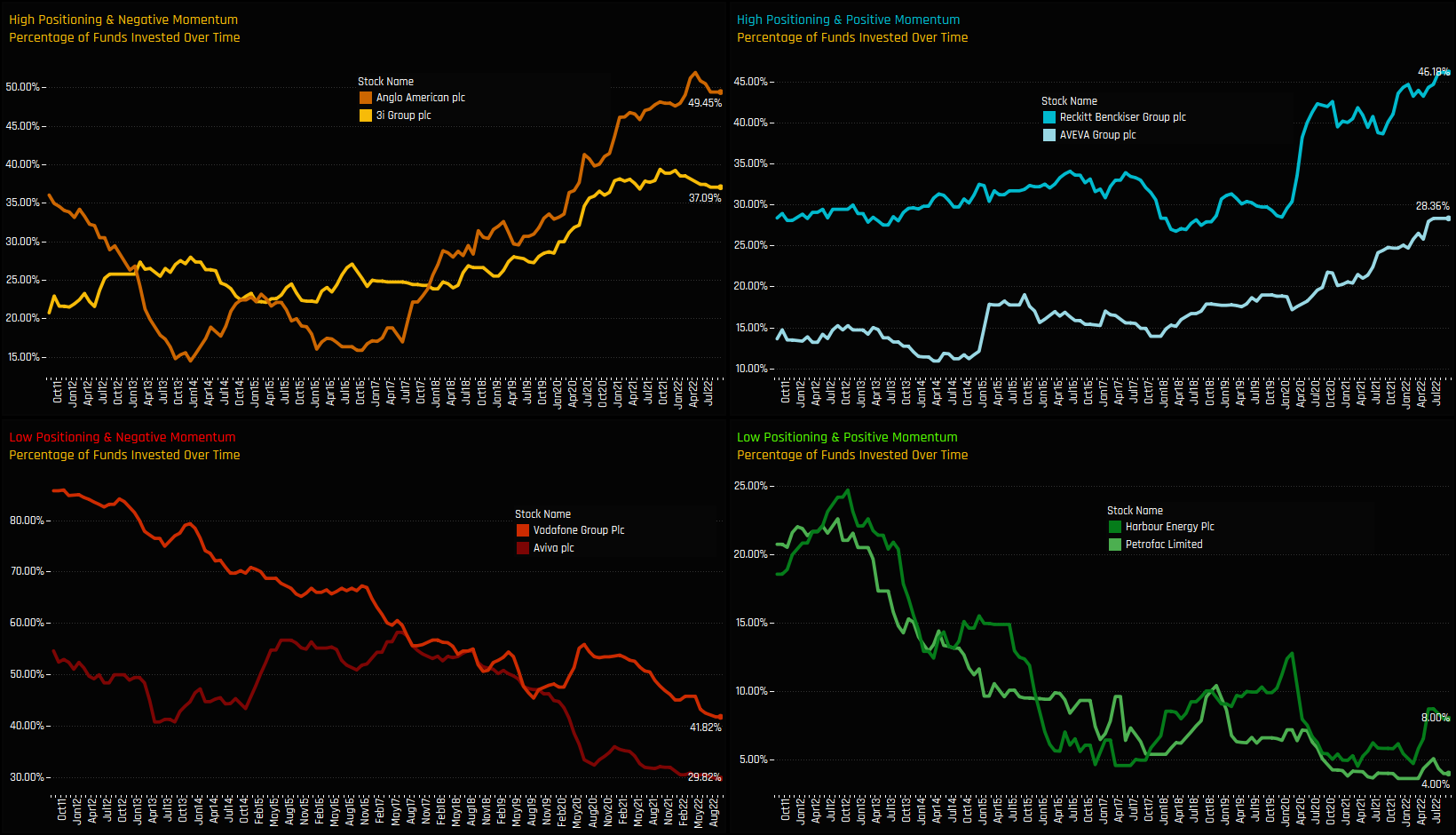

275 Active UK Funds, AUM $141bn. UK Stock Sentiment Investment levels among the hundreds of stocks in the investible UK universe differ greatly. Some stocks are widely owned, others largely avoided by UK active managers, with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for …

Continue Reading

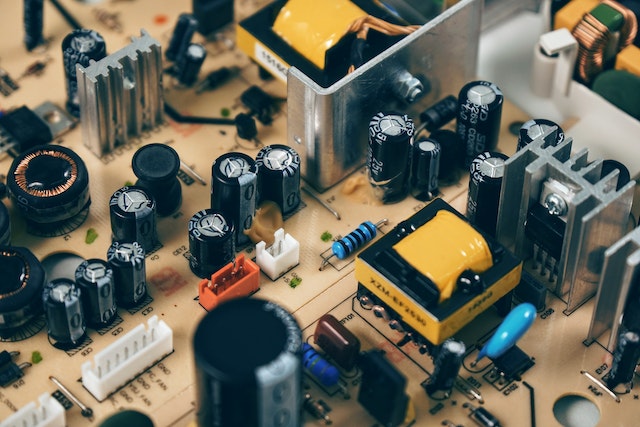

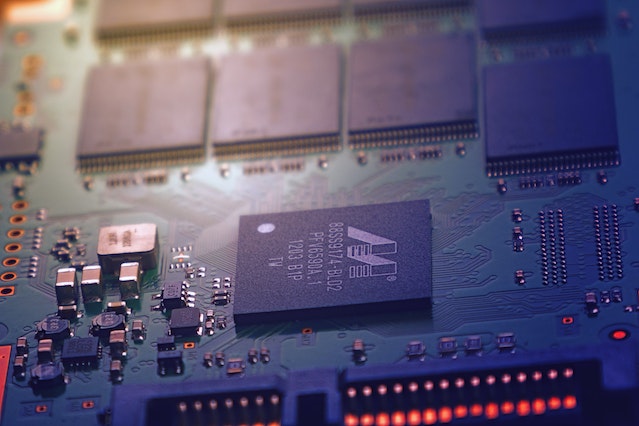

China & HK Semiconductors: Fund Positioning Analysis

Asia Ex-Japan China A-Share MSCI China Greater China China Semiconductors With US sanctions hitting Chinese domestic Semiconductor stocks this week, we analyse allocations in the China & HK Semiconductor Industry group among Asia Ex-Japan, MSCI China, China A-Share and Greater China actively managed equity funds. Without the distraction of Taiwan technology or HK listed internet stocks, China A-Share funds are …

Continue Reading

China & HK Semiconductors: Fund Positioning Analysis

-

Steve Holden

-

October 17, 2022

-

Asia, China

-

0 Comments

92 Asia Ex-Japan Funds, AUM $52bn, 115 China A-Share Funds, AUM $57bn, 117 MSCI China Funds, AUM $44bn, 45 Greater China Funds, AUM $15bn China Semiconductors With US sanctions hitting Chinese domestic Semiconductor stocks this week, we analyse allocations in the China & HK Semiconductor Industry group among Asia Ex-Japan, MSCI China, China A-Share and Greater China actively managed equity …

Continue Reading

UK Equity Funds: Stock Sentiment Analysis

-

Steve Holden

-

October 13, 2022

-

UK

-

0 Comments

275 Active UK Funds, AUM $141bn. UK Stock Sentiment Investment levels among the hundreds of stocks in the investible UK universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in the …

Continue Reading

UK Utilities Rotation

-

Steve Holden

-

October 13, 2022

-

UK

-

0 Comments

275 Active UK Equity funds, AUM $145bn UK Utilities In this piece we provide a comprehensive analysis of Utilities sector positioning among active UK Equity funds. We find that Utilities exposure among active UK equity funds has been on an upward trend since bottoming out in 2019. Underweights have been closed as managers increase exposure to key stocks in the …

Continue Reading

China Funds: Q3 Performance & Attribution

-

Steve Holden

-

October 11, 2022

-

China

-

0 Comments

118 Active MSCI China funds, AUM $50bn Q3 Performance & Attribution In this piece, we provide an overview of Q3 performance among the active MSCI China funds in our analysis. We look at quarterly performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then breakdown this quarter’s performance based on the …

Continue Reading

Global Funds: Q3 Performance & Attribution

-

Steve Holden

-

October 11, 2022

-

Global

-

0 Comments

359 Active Global Funds, AUM $950bn. Q3 Performance & Attribution In this piece, we provide an overview of Q3 performance among the Global active funds in our analysis. We look at quarterly performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then breakdown this quarter’s performance based on the average active …

Continue Reading

Recent Comments