275 Active UK Funds, AUM $141bn.

UK Stock Sentiment

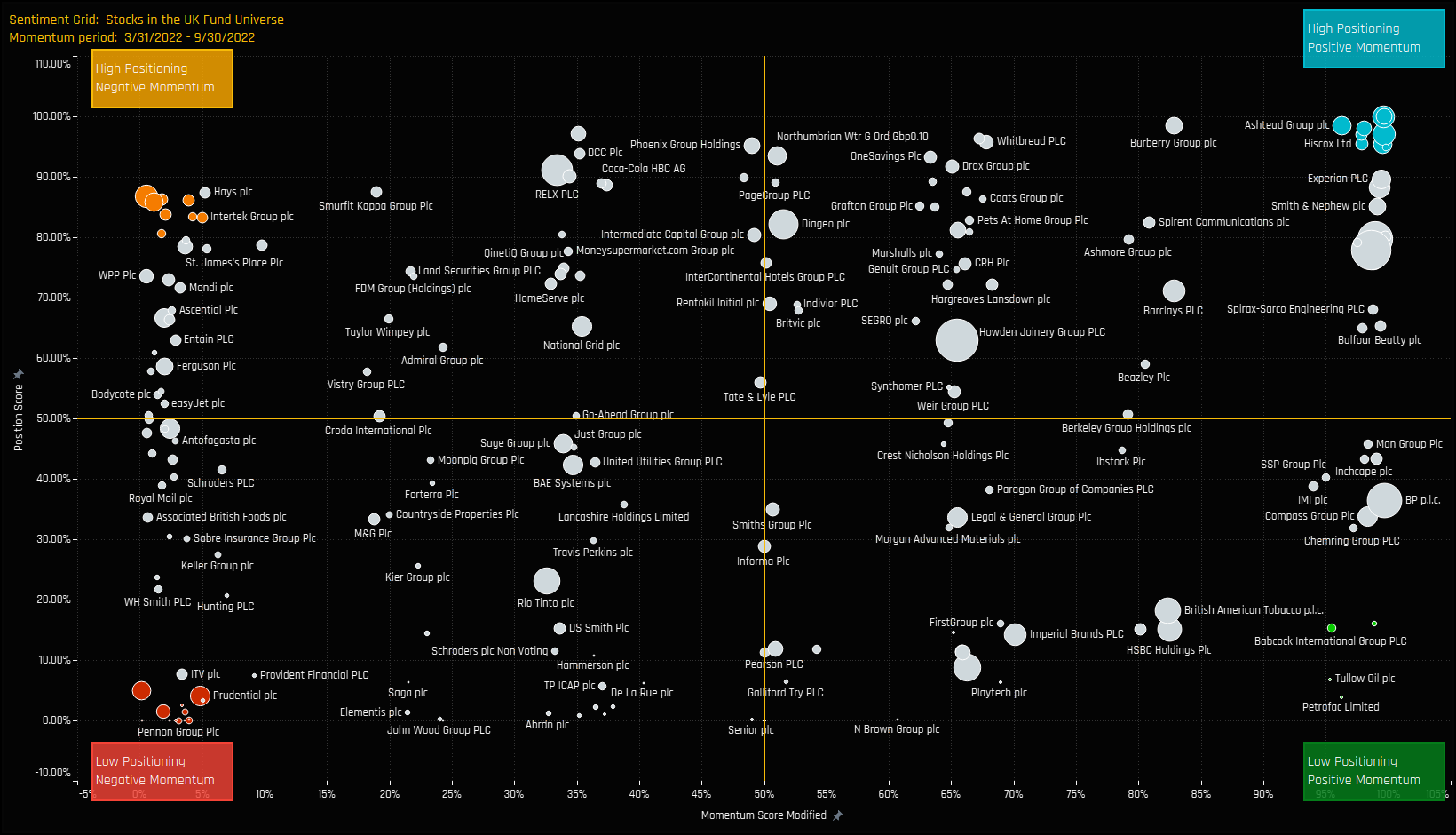

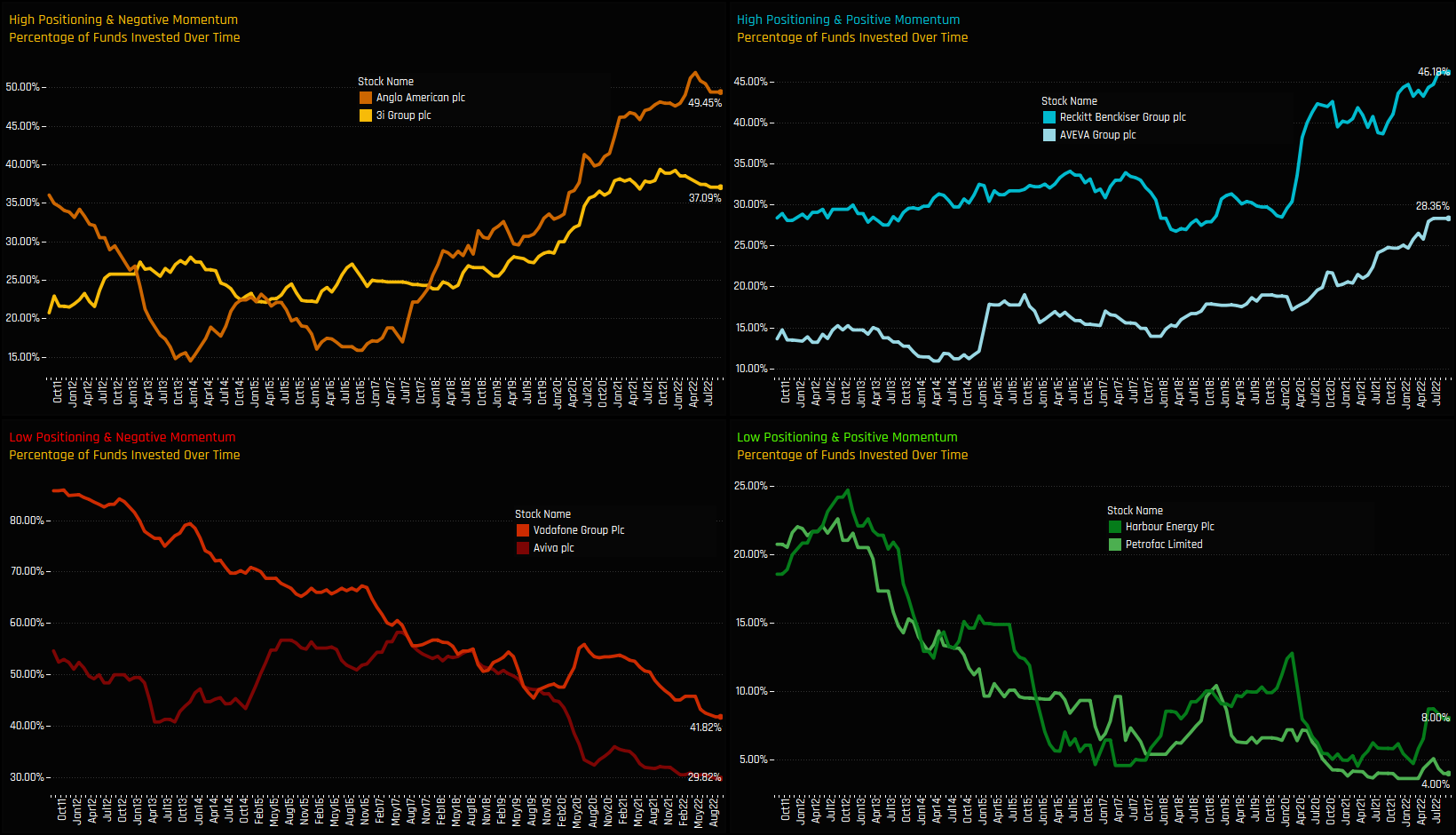

Investment levels among the hundreds of stocks in the investible UK universe differ greatly. Some stocks are widely owned, others largely avoided by UK active managers, with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in the UK market. We highlight 8 stocks at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

The Sentiment Grid

Extreme Stocks

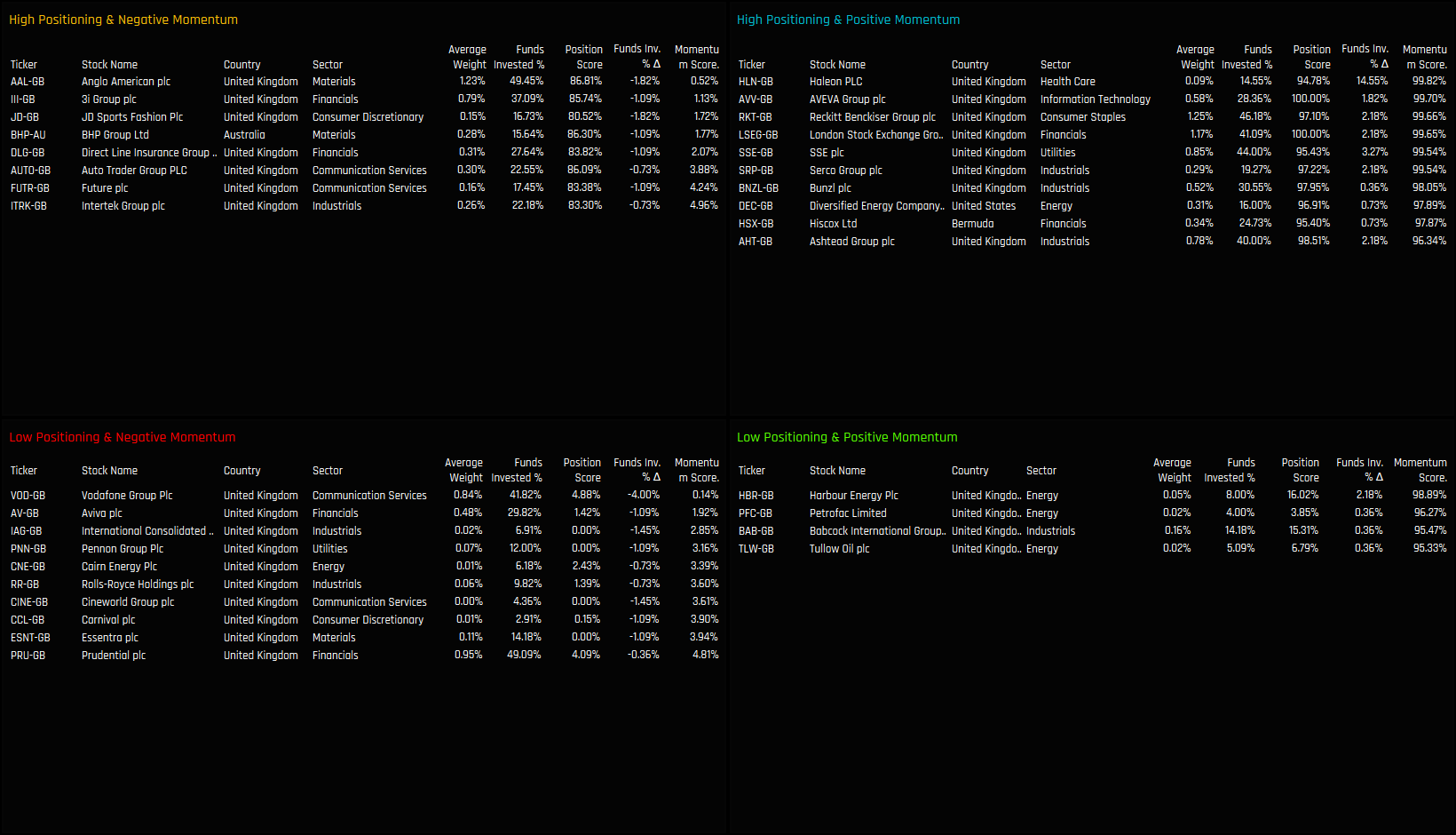

The tables below list the stocks in the extreme corners of each quadrant. The screening methodology is as follows:

- High Positioning & Negative Momentum: Position Score > 80%. Momentum Score < 5%

- Low Positioning & Negative Momentum: Position Score < 5%. Momentum Score < 5%

- Low Positioning & Positive Momentum: Position Score < 20%. Momentum Score > 95%

- High Positioning & Positive Momentum: Position Score > 90%. Momentum Score > 95%

Extreme Stocks

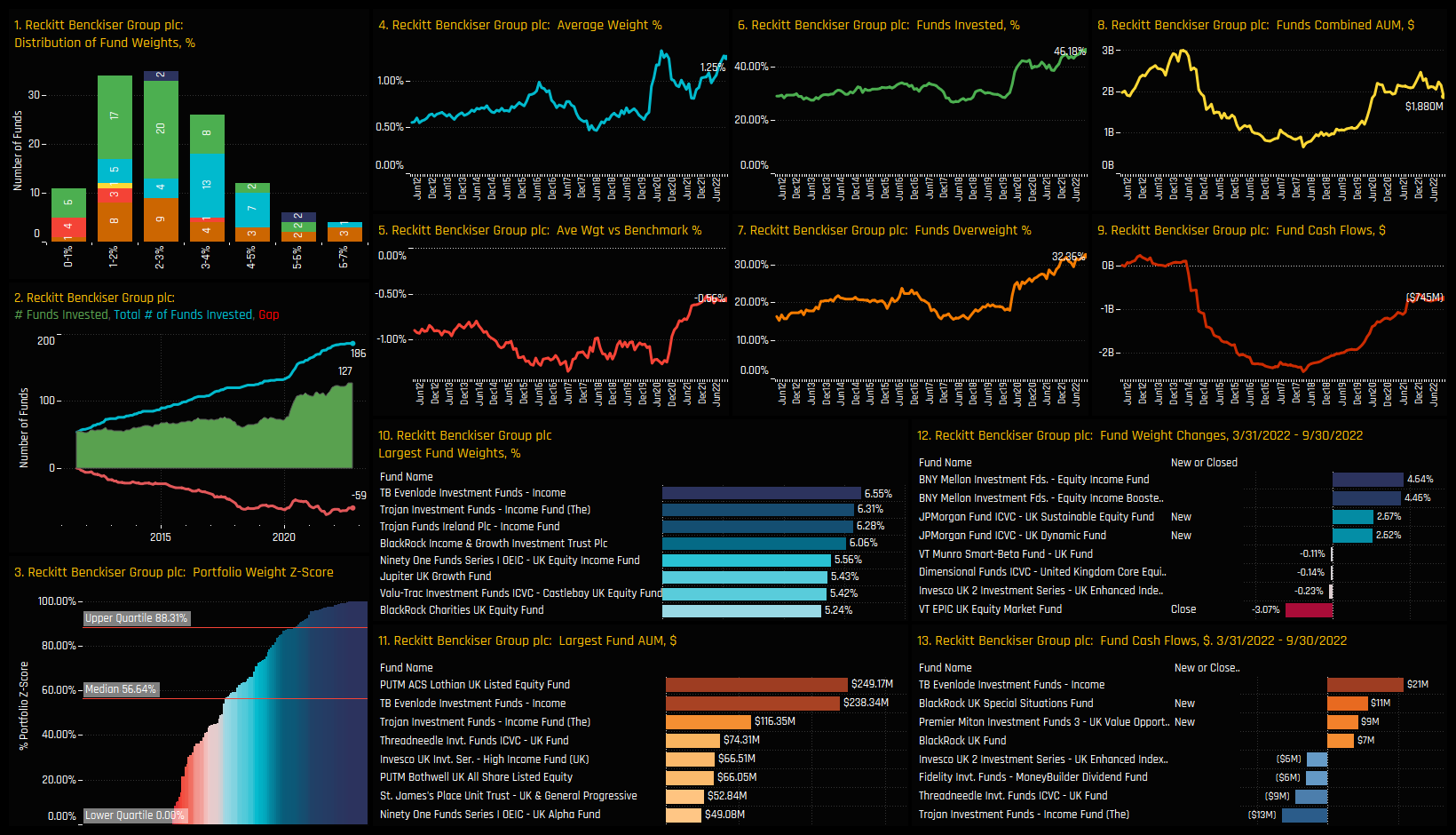

High Positioning, Positive Momentum: Reckitt Benckiser Group

In the full analysis, we provide profiles for the remaining 7 stocks highlighted above, together with a 47 page report on sector and stock positioning among active UK managers.

If you are a fund manager or a finance professional and would like to read the full report, please fill in the form opposite.

Related Posts

- Steve Holden

- March 6, 2024

UK Real Estate Hots Up

270 UK Equity Funds, AUM $190bn UK Real Estate Hots Up • Record number of UK funds now expose ..

- Steve Holden

- November 17, 2022

The Vodafone Exodus

276 ACTIVE UK FUNDS, AUM $161BN The Vodafone Exodus In over a decades worth of holdings data fo ..

- Steve Holden

- March 5, 2023

UK Homebuilders: Momentum Reversal Among UK Equity Managers

272 UK Equity Funds, AUM $185bn Homebuilders: Negative Momentum Sentiment reversal in UK Homebu ..