China & HK Semiconductors: Fund Positioning Analysis

- Steve Holden

- 0 Comments

Asia Ex-Japan China A-Share MSCI China Greater China

China Semiconductors

With US sanctions hitting Chinese domestic Semiconductor stocks this week, we analyse allocations in the China & HK Semiconductor Industry group among Asia Ex-Japan, MSCI China, China A-Share and Greater China actively managed equity funds. Without the distraction of Taiwan technology or HK listed internet stocks, China A-Share funds are the most heavily exposed, whilst Asia Ex-Japan and Greater China funds have curtailed investment in recent months. On a stock level, LONGi Green Energy Technology is the high conviction holding by quite a margin, whilst Will Semiconductors has started to see closures from a number of managers. On the whole though, China & HK Semiconductor stocks do not represent a significant risk for the majority of managers in our analysis.

Rising Ownership

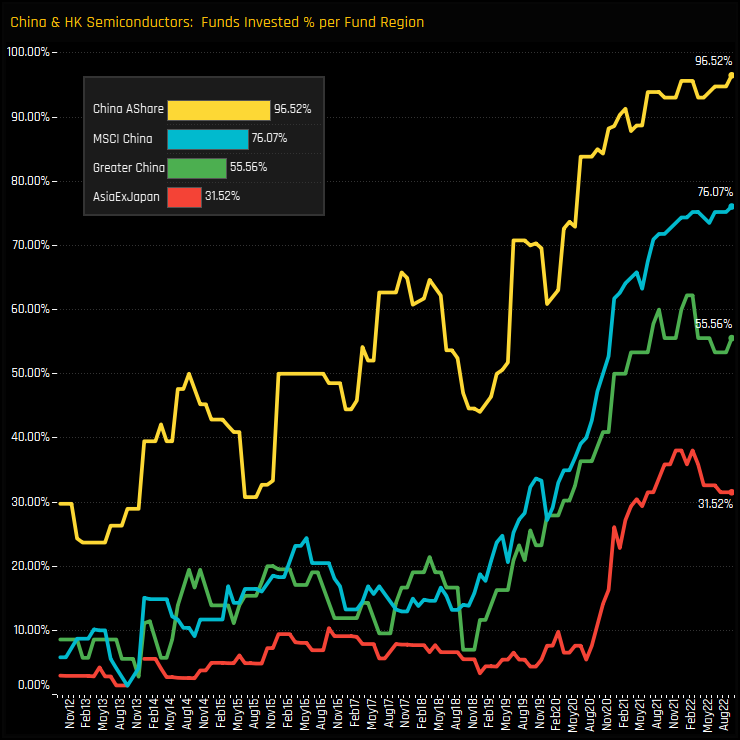

“Investment in the China & HK Semiconductor sector has seen strong growth over the past 10-years. The chart to the right shows the percentage of each fund group with exposure to China & HK Semiconductor stocks over time. China & HK Semiconductors are owned by 96.5% of China A-Share funds but just 31.5% of Asia Ex-Japan funds. There has been a divergence in recent months too, with both MSCI China and China A-Share funds at maximum ownership, whilst the percentage of Greater China and Asia Ex-Japan funds invested has reversed from the highs.”

In the full analysis, we look at the distribution of fund weights across each of the 4 fund groups, identifying top holders and the key changes in weight over the last 6-months. We also look at aggregate and fund level stock holdings, highlighting the most widely held stocks and those who have seen large changes in ownership over the period.

If you are a fund manager or a finance professional and would like to read the full report, please fill in the form below.

Related Posts

- Steve Holden

- January 22, 2023

Asia Ex-Japan: Top-Down Positioning 2023

91 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, January 2023 ..

- Steve Holden

- November 28, 2022

Oil Refining All-Time Highs

92 ACTIVE ASIA EX-JAPAN FUNDS, AUM $49BN Oil Refining All-Time Highs 4 charts from our recent a ..

- Steve Holden

- November 28, 2022

Alibaba: Fighting Back

45 ACTIVE GREATER CHINA FUNDS, AUM $13BN Alibaba: Fighting Back 2 charts from our recent analys ..