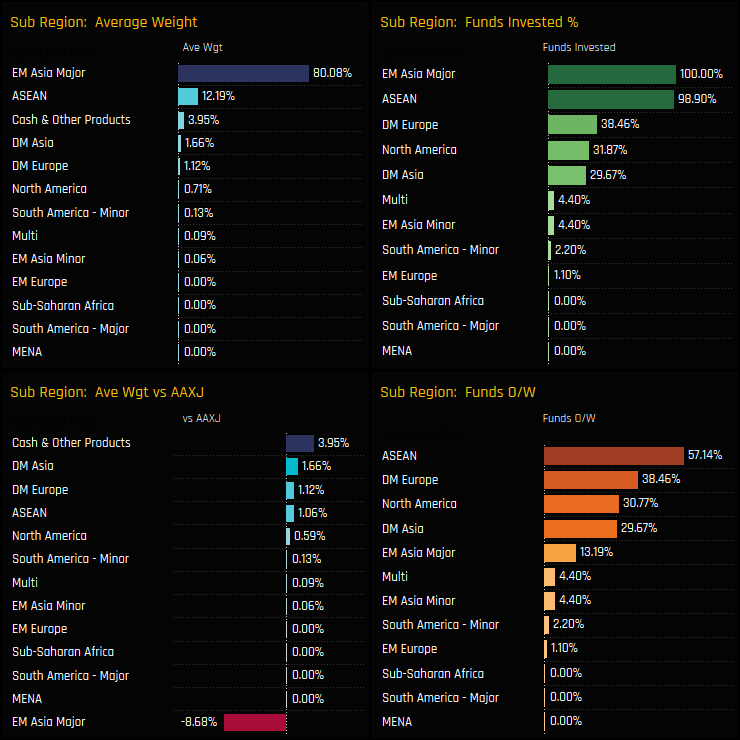

We start with the major regional splits. EM Asia Major, which includes the top 4 country weights of China & HK, India, South Korea and Taiwan, accounts for 80.1% of the average active Asia Ex-Japan fund. Versus the iShares AAXJ ETF benchmark, this represents an underweight of -8.68% on average, with just 13.2% of managers positioned above in the benchmark. Overweights are led by Cash holdings, developed Asia and European holdings and ASEAN exposure.

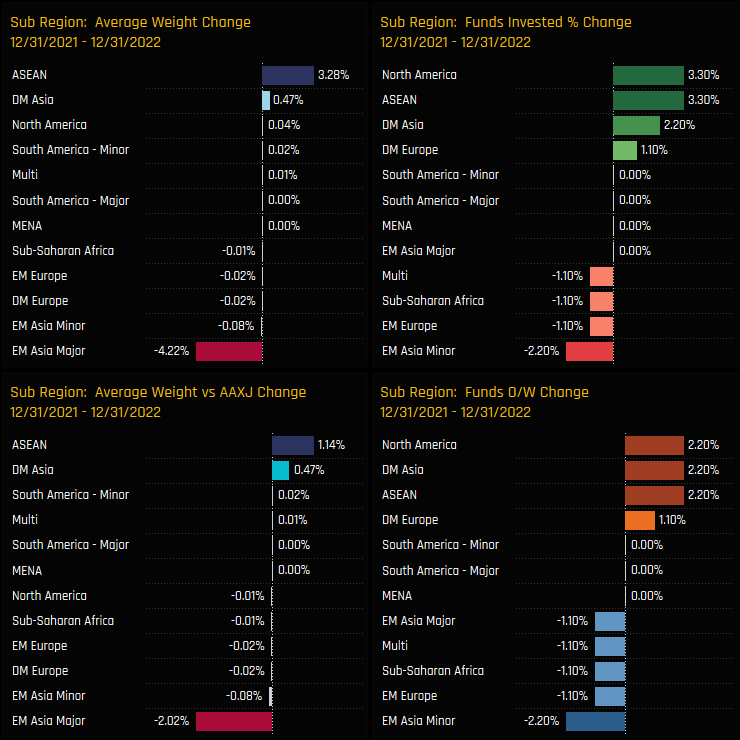

Over the course of 2022, there was a clear rotation in to the ASEAN region and out of the Major EM Asia countries. Average holdings weights in ASEAN increased by +3.28%, with +3.3% of funds opening exposure and weights relative to benchmark increasing by +1.14%. EM Asia Major saw weights drop by -4.22% and underweights increase by -2.02%.

Country Positioning

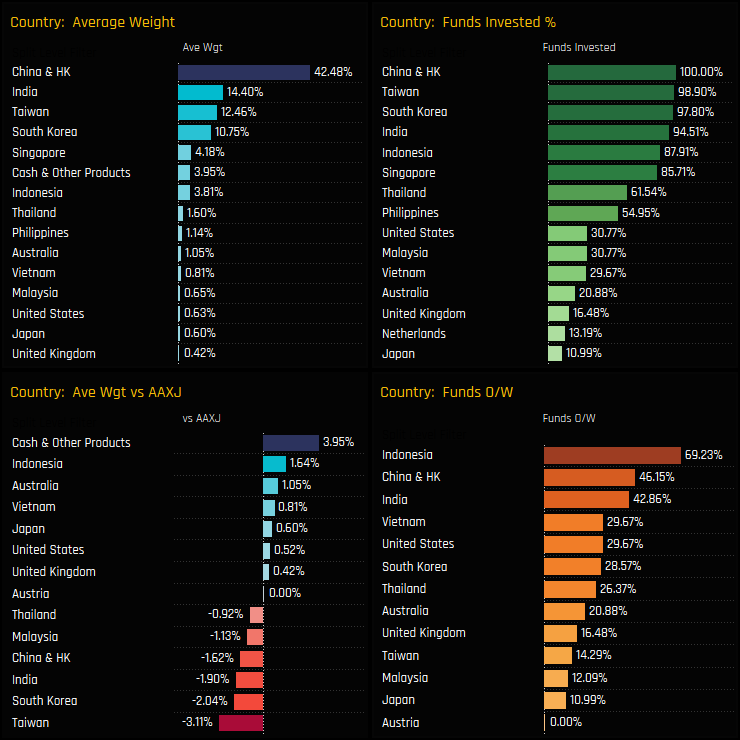

On a country level, China & HK remains the dominant exposure by a margin, held at almost 3x the weight of India. Versus the benchmark, Asia Ex-Japan investors are running big underweights in the major EM countries, led by South Korea (-3.1%) and Taiwan (-2.04%), whilst overweights consist mainly of Cash (+3.95%), Indonesia (+1.64%) and out-of-benchmark exposure in Australia (+1.05%), Vietnam (+0.81%) and Japan (+0.60%). Indonesia is the consensus overweight here, held above benchmark by 69.2% of funds.

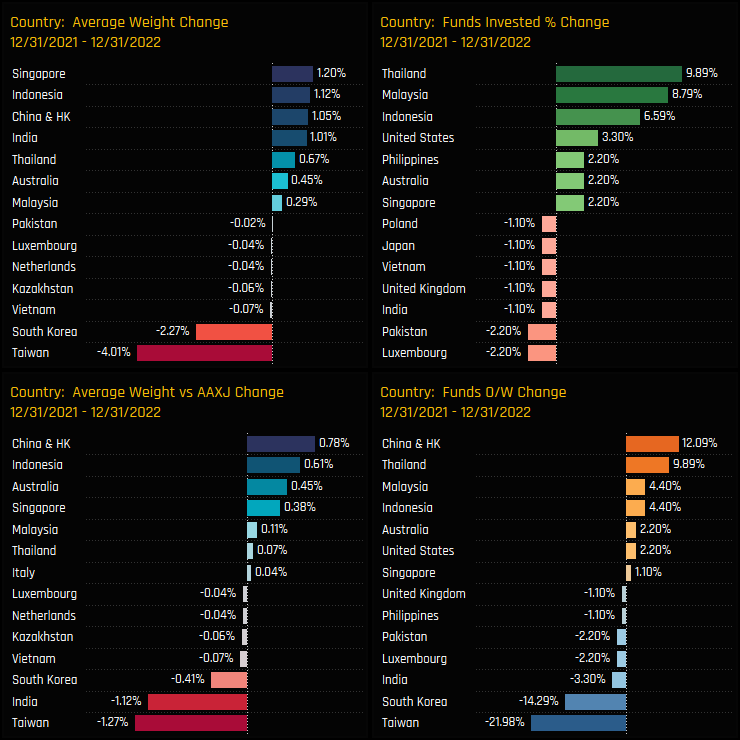

Country activity over the course of 2022 broadly reflects to EM Asia Major to ASEAN rotation, though with some nuances. China & HK saw an ownership recovery, with average weights increasing by +1.05% and 12% of managers switching to overweight. India weights moved higher on the year though managers sold in to strength, increasing underweights by -1.12%. All of the major ASEAN countries with the exception of Vietnam saw ownership levels recover over the year.

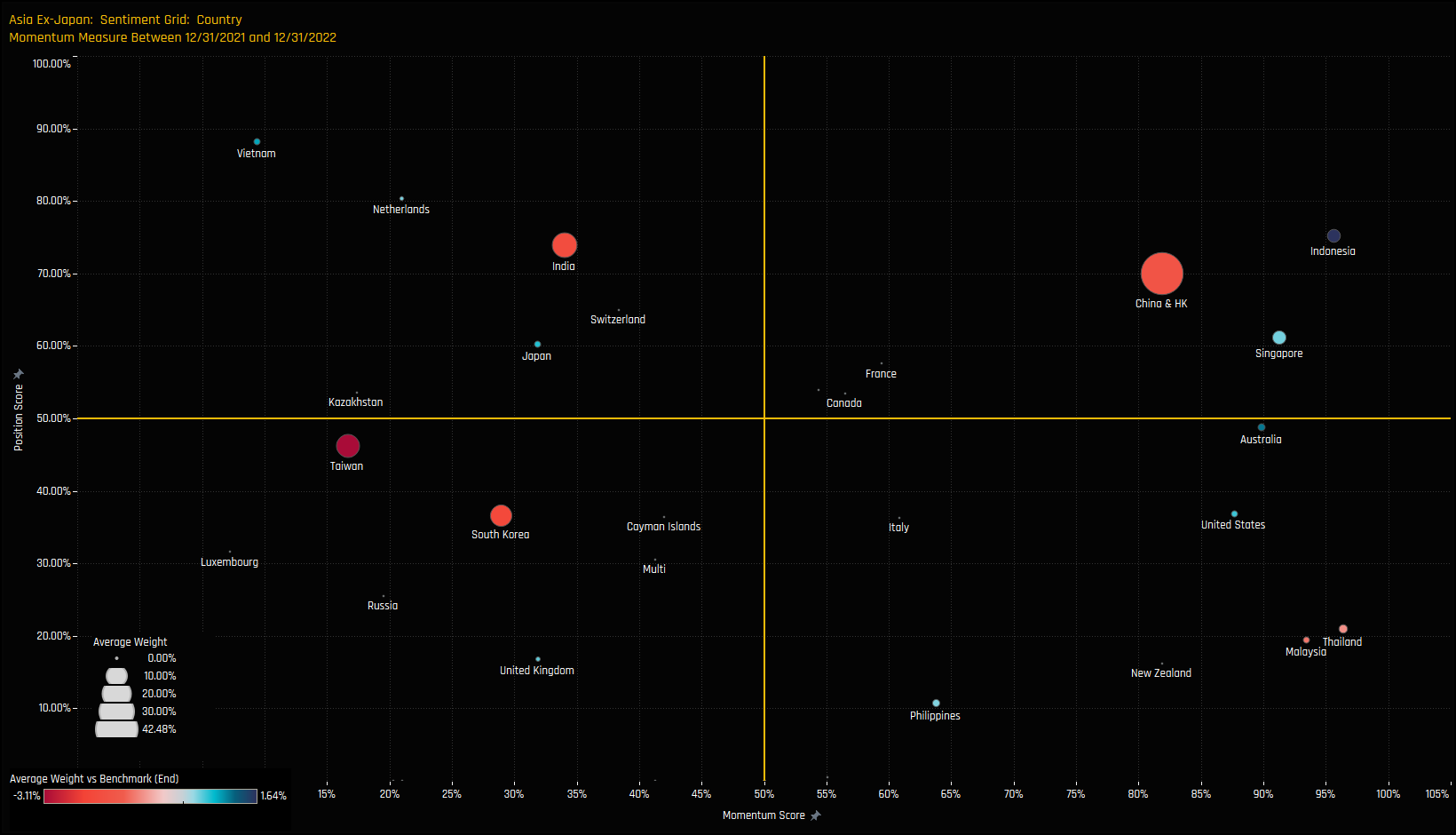

Country Sentiment

The sentiment grid below shows where current positioning in each country sits versus its own history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each country between 12/31/2021 and 12/31/2022 (x-axis).

It shows Indonesia, Singapore and China & HK as key beneficiaries of the rotation last year, pushing ownership towards the higher end of their respective ranges. Taiwan and South Korean allocations continue to fall with exposure below 50% of historical levels, whilst the smaller ASEAN nations benefited from inflows yet allocations sit near their lowest levels on record.

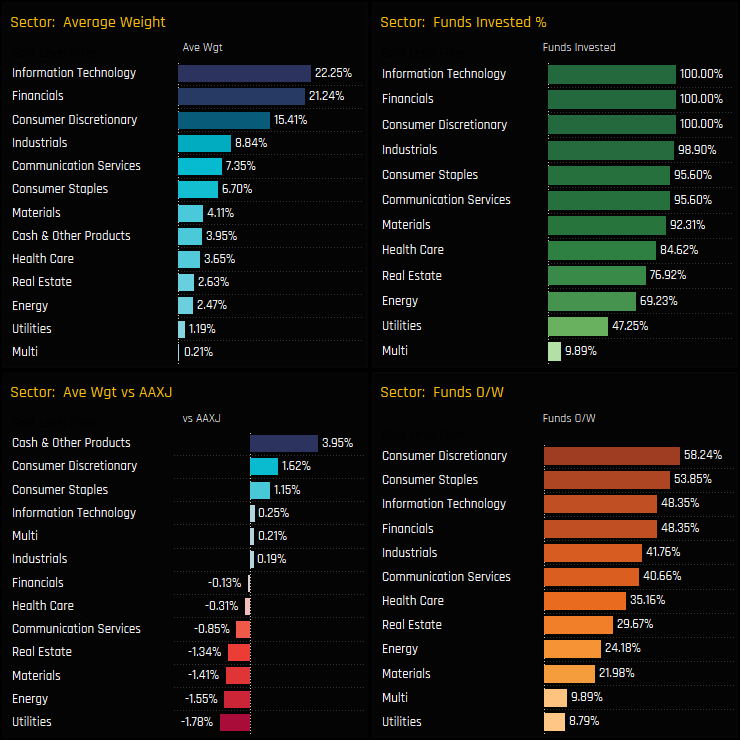

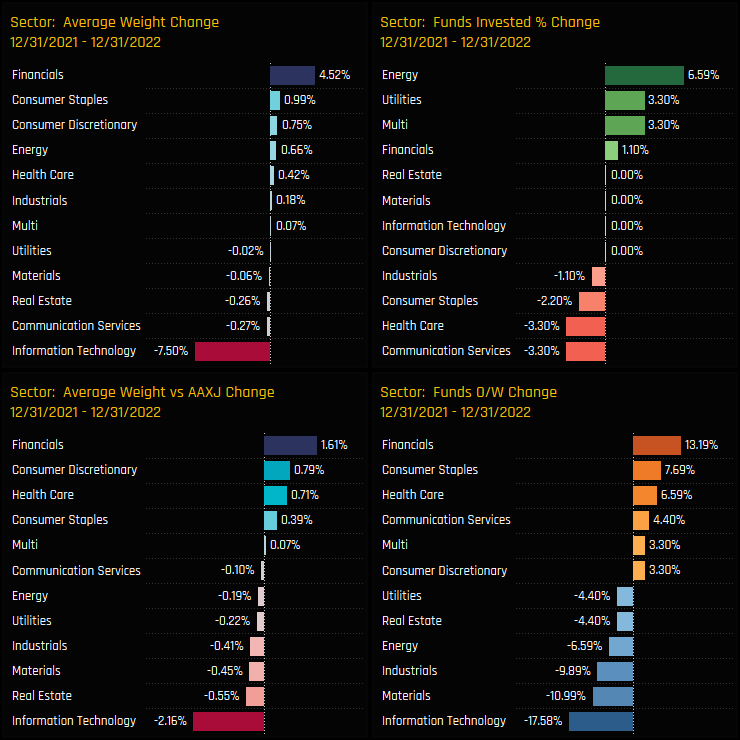

Sector Positioning

Information Technology is still the largest allocation among Asia Ex-Japan investors, but Financials have caught up over the last year. Both of the Consumer sectors represent the key overweight exposures, with over half the managers in our analysis positioned ahead of the benchmark in each. Underweights are led by the Utilities and Energy sectors on account of their low absolute ownership, with 47.2% and 69.2% of funds exposed respectively.

Activity over the last 12-months highlights the strong rotation out of Tech and in to Financials, with the Consumer sectors benefitting to a smaller degree. This has been an active rotation, with 13.2% of managers switching to overweight in Financials and 17.6% to underweight in Tech. The result has been a narrowing of both absolute and relative positioning between the 2 sectors.

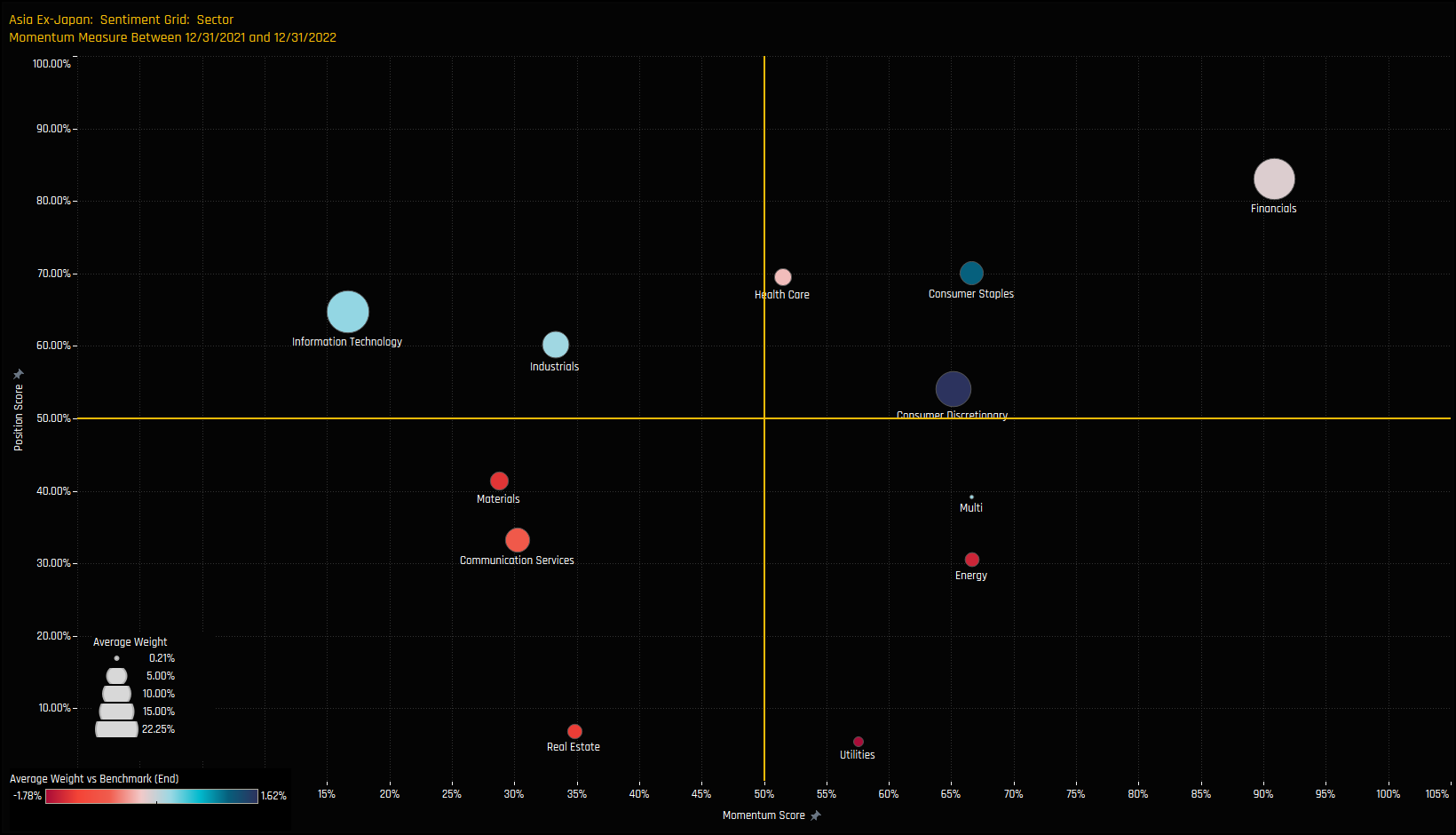

Sector Sentiment

Despite the recent reversal, Technology allocations are still towards the higher end of their 10-year range, whilst the rotation into Financials moves positioning closer to record levels. Consumer Staples and Discretionary appear in favour with managers, whilst Materials and Communication Services are still in a consolidation phase.

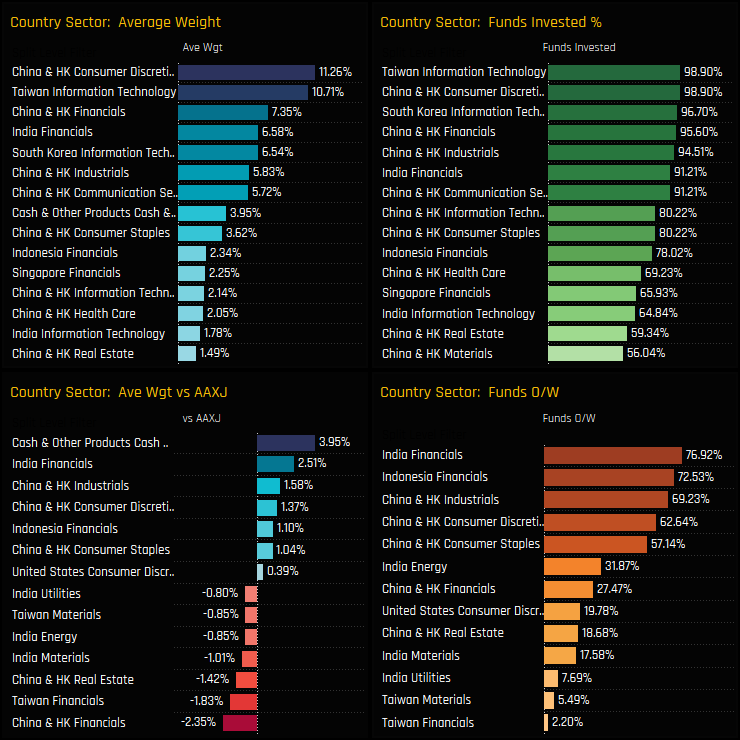

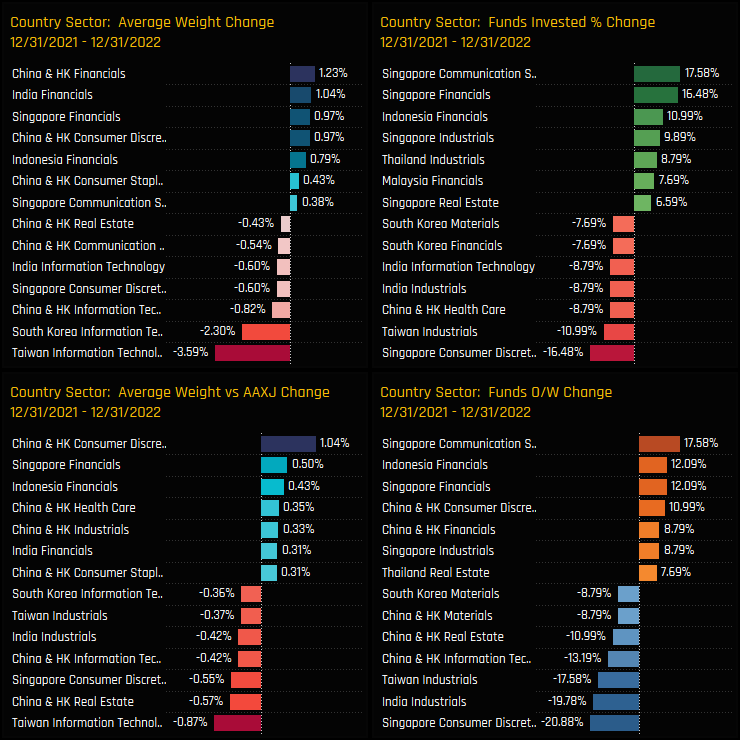

Country Sector Positioning

On a country/sector level, China & HK Consumer Discretionary and Taiwan Tech are the most widely held and largest allocations, accounting for more than a fifth of total Asia Ex-Japan portfolio weights, on average. Relative to benchmark, active managers prefer to run overweights in India and Indonesia Financials against underweights in China & HK and Taiwan Financials. Indeed, outside of Tech, Taiwanese sectors find little love among the funds in our analysis, with just 2.2% of funds overweight Taiwan Financials and 5.5% Taiwan Materials.

Activity over the last 12-months shows active managers rebalancing between key Singapore sectors, with Asia Ex-Japan funds adding to exposure in Singapore Communication Services and Financials whilst scaling back in Consumer Discretionary. Elsewhere there is clear evidence of rotation out of the key Technology markets, with Taiwan, China & HK, India and South Korea all suffering a degree of investor flight. On the positive side, ASEAN Financials benefited from inflows, whilst China & HK Financials appear well supported.

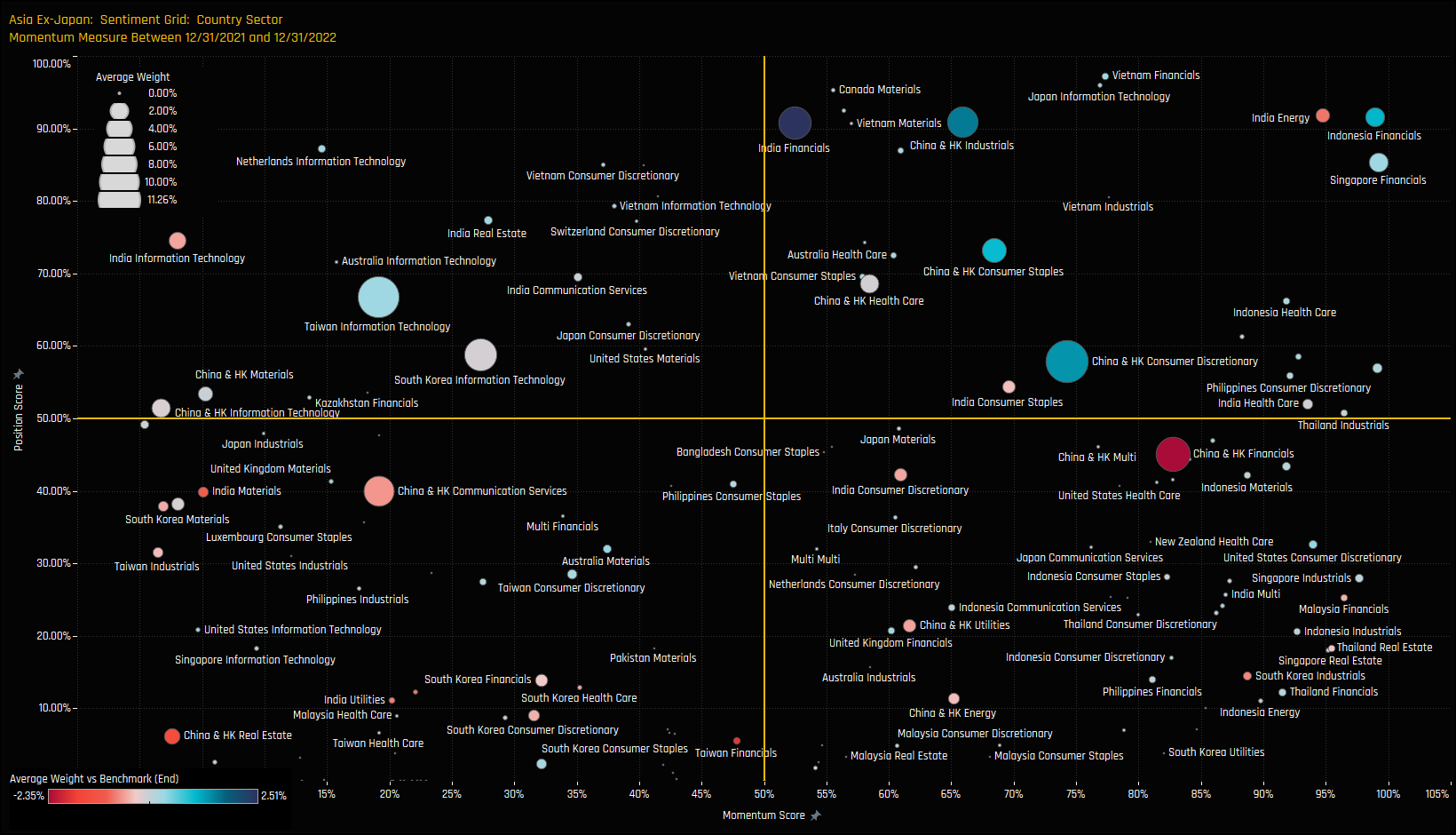

Country Sector Sentiment

The sentiment grid below shows where current positioning in each country/sector sits versus its own history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each country/sector between 12/31/2021 and 12/31/2022 (x-axis).

Both India Energy, Indonesia Financials and Singapore Financials appear at the top-right of the grid, having captured strong inflows last year that has taken positioning towards all-time highs. Momentum in the key Technology exposures is soft though positioning is still above mid-range. China & HK Real Estate is as bad as it gets, whilst greenshoots are emerging for key exposures across the ASEAN region.

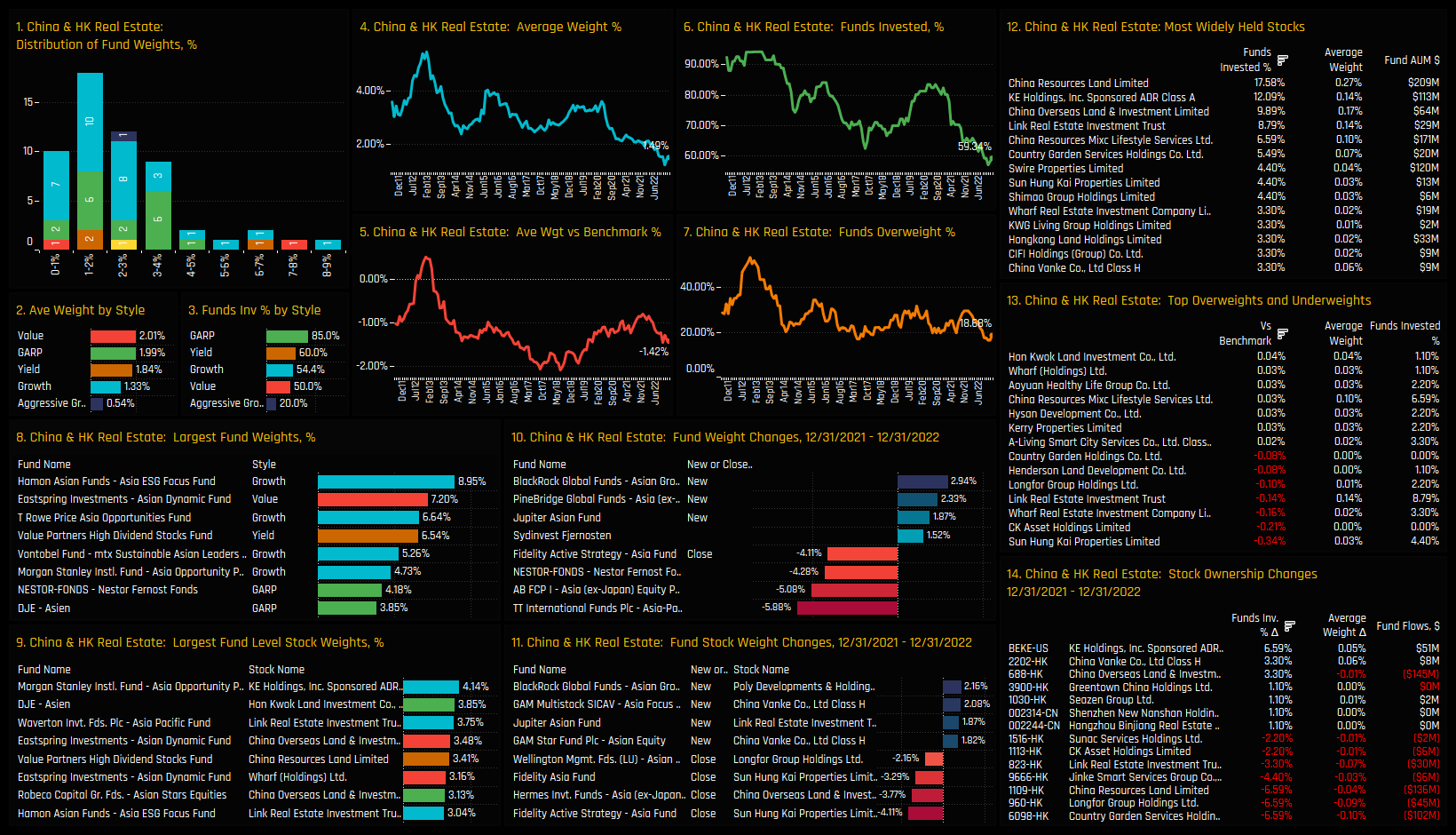

China Real Estate Focus

If you’re looking for a non-consensus position for 2023, then look no further than China & HK Real Estate. Positioning has been on a largely downward trend since 2011, with the recent down move since 2020 the most aggressive on record. Positioning is at all-time lows, with average weights of 1.49% and just 59.3% of funds invested, contributing to a net underweight of -1.42%, on average. Asia Ex-Japan investors are mostly anticipating underperformance in the year ahead.

Stock holdings within the sector are extremely light. The most widely held name is China Resources Land Limited, owned by 17.6% of managers at an average weight of 0.27%. Underweights are driven by a number of stocks that appear almost totally uninvestible to active managers, led by Sun Hung Kai Properties and CK Asset Holdings Limited. Stock activity through 2022 was skewed to the sell-side, with heavy closures seen in Country Garden Services and Longfor Group Holdings, among others.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- February 13, 2023

Vietnam: Time to Invest?

89 Active Asia Ex-Japan Funds, AUM $55bn Vietnam. Time to Invest? Vietnam is attracting growing ..

- Steve Holden

- November 28, 2022

Oil Refining All-Time Highs

92 ACTIVE ASIA EX-JAPAN FUNDS, AUM $49BN Oil Refining All-Time Highs 4 charts from our recent a ..

- Steve Holden

- October 17, 2022

China & HK Semiconductors: Fund Positioning Analysis

Asia Ex-Japan China A-Share MSCI China Greater China China Semiconductors With US sanctions hit ..