Positioning Insights, September 2024

-

Steve Holden

-

September 29, 2024

-

UK

-

0 Comments

253 Active UK funds, AUM $183bn Active UK Funds: Positioning Insights, September 2024 Summary Consumer Discretionary: UK Funds Move to Record Overweights Multi-Line Insurance: Falling Investment Pushes Sector towards Record Lows Anglo American: Surpasses Rio Tinto as Ownership Hits New Highs Chart Pack Health Care Chart Pack Banks For more analysis, data or information on active investor positioning in your …

Continue Reading

Positioning Insights, August 2024

-

Steve Holden

-

August 27, 2024

-

UK

-

0 Comments

255 Active UK funds, AUM $189bn Active UK Funds: Positioning Insights, August 2024 Summary Health Care: Underweight Hits Record Highs UK fund managers are positioned at record underweights in the Health Care sector, as a growing number of funds move away from an overweight stance. AstraZeneca is the core driver of the sector-level underweight as ownership growth stalls, whilst GSK …

Continue Reading

UK Funds: Extreme Stocks, July 2024

-

Steve Holden

-

July 29, 2024

-

UK

-

0 Comments

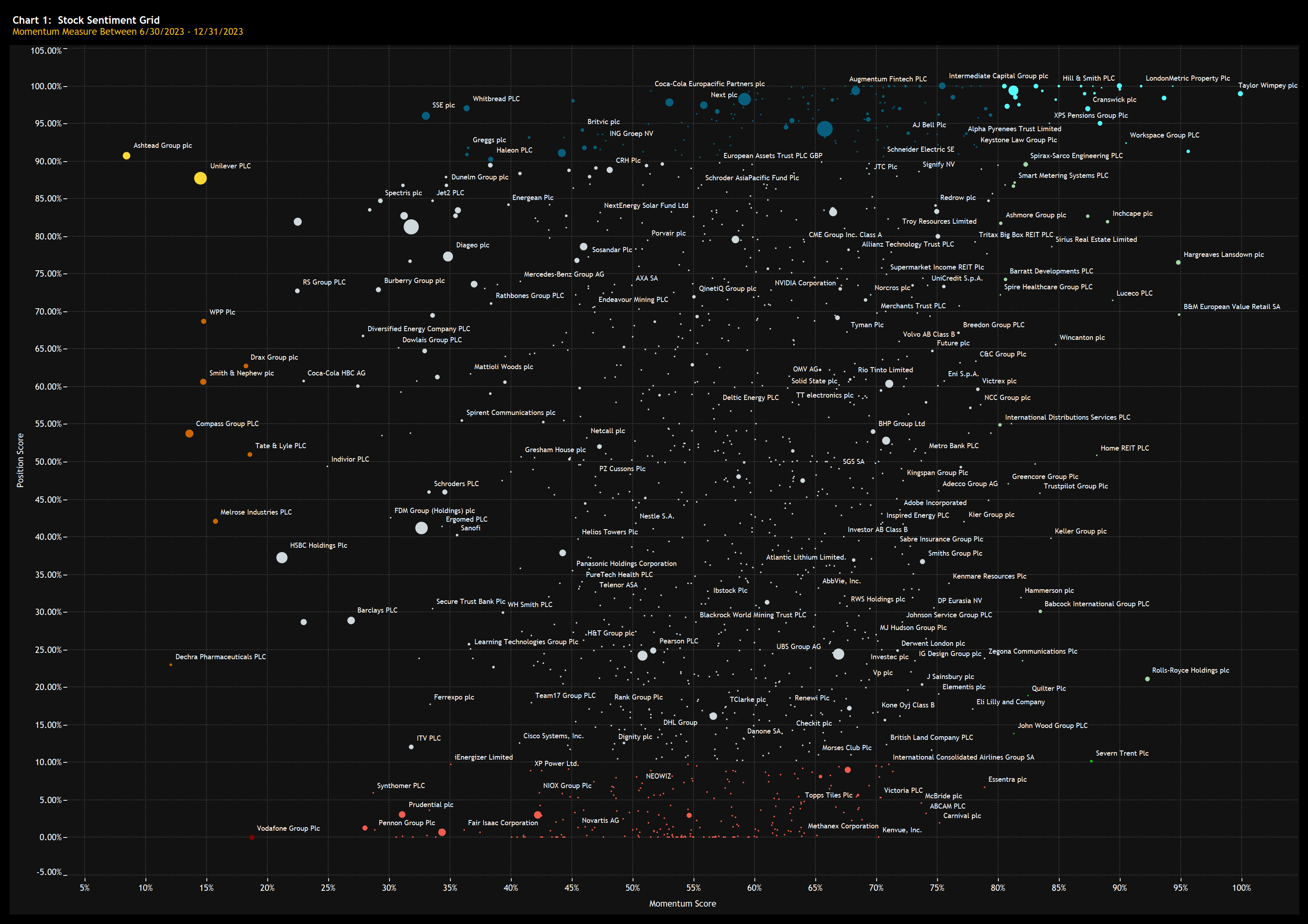

260 UK active equity funds, AUM $185bn UK Funds: Extreme Stocks Summary In this report, we screen for stocks at the extreme ends of their positioning or momentum ranges. We synthesize current and historical data on fund positioning with recent manager activity to assess sentiment for each stock in our coverage. In focus this month: High Positioning, Positive Momentum: Dunelm Group …

Continue Reading

UK Funds: Performance & Attribution Review, Q2 2024

-

Steve Holden

-

July 19, 2024

-

UK

-

0 Comments

260 UK Equity funds, AUM $185bn UK Funds: Performance & Attribution Review, Q2 2024 Summary UK Funds Match Benchmark in Q2: Active UK funds achieved an average Q2 return of +3.62%, in line with the benchmark and with just over half of funds outperforming the index. Performance Correlated to Style: Performance was strongly influenced by style, with Value funds leading …

Continue Reading

UK Communication Services: Old Guard Fuels Sector Downturn

-

Steve Holden

-

May 29, 2024

-

UK

-

0 Comments

264 active UK equity funds, AUM $190bn UK Communication Services: Old Guard Fuels Sector Downturn Summary • Significant Decline in Sector Allocation: Exposure to the Communication Services sector among active UK investors has dropped from over 10% in 2012 to a new low of 4.14%, with a record 12% of funds completely avoiding the sector. • Widespread Reduction in Ownership: …

Continue Reading

Active UK Small/Midcap Funds: Extreme Stocks

-

Steve Holden

-

April 28, 2024

-

UK

-

0 Comments

104 active UK Small/Midcap equity funds, AUM $37bn Active UK Small/Midcap Funds: Extreme Stocks Summary In this report, we identify seven stocks that are currently positioned at the extreme ends of their historical position ranges, or have experienced significant shifts in fund ownership in recent months. Extreme Stocks in Focus: -Diversified Energy Company PLC-Team17 Group PLC-Rentokil Initial plc-St.James’s Place Plc-NCC …

Continue Reading

UK Funds: Performance & Attribution Review, Q1 2024

-

Steve Holden

-

April 18, 2024

-

UK

-

0 Comments

268 UK Equity funds, AUM $192bn UK Funds: Performance & Attribution Review, Q1 2024 Summary • UK Funds Stick to Benchmark in Q1: Average UK fund returns of 2.74% sit marginally behind SPDRs MSCI ACWI ETF by -0.33%, with 47.6% of funds outperforming. • Value Trumps Growth: Value and GARP funds beat their Growth peers, with 20% separating the …

Continue Reading

UK Fund Positioning Insights, February 2024

-

Steve Holden

-

February 25, 2024

-

UK

-

0 Comments

270 UK Equity Funds, AUM $190bn UK Fund Positioning Insights, February 2024 • UK Real Estate Hots Up: Record number of UK funds now exposed to Real Estate sector. • UK Stock Radar: Natwest and Serco among 10 stocks at the extreme ends of their positioning and momentum ranges • Stock Activity Data. They key moves in stock positioning over …

Continue Reading

UK Fund Positioning Dashboards Overview

-

Steve Holden

-

January 29, 2024

-

UK

-

0 Comments

267 UK Funds, AUM $185bn UK Fund Positioning Dashboard Overview In this week’s analysis, we present a “teach-in” of our newly released suite of positioning dashboards, illustrated through three instructional videos. These videos guide you through the latest functionality and also offer some valuable insights on the latest positioning among active UK funds. • Macro & Sector Dashboards: The latest …

Continue Reading

UK Small/Midcap Fund Positioning Update

-

Steve Holden

-

October 18, 2023

-

UK

-

0 Comments

106 UK Small/Midcap Equity Funds, AUM $37bn UK Small/Midcap Fund Positioning Update, October 2023 In Brief: • Industrials maintain top Sector weight. Real Estate and Consumer Discretionary underweights fund Technology overweight. • Investment Managers Industry group hits record exposure. REITs largely unloved by UK Small/Midcap funds. • Future plc remains the most widely held company. XPS Pensions and Foresight Group …

Continue Reading

Recent Comments