Asia Ex-Japan: Top-Down Positioning 2023

-

Steve Holden

-

January 22, 2023

-

Asia Insights

-

0 Comments

91 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, January 2023 91 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan: Top-Down Positioning 2023 We start with the major regional splits. EM Asia Major, which includes the top 4 country weights of China & HK, India, South Korea and Taiwan, accounts for 80.1% of the average active Asia …

Continue Reading

Emerging Market Funds: Performance & Attribution in 2022

-

Steve Holden

-

January 15, 2023

-

GEM Insights

-

0 Comments

276 Active GEM Funds, AUM $343bn. 2022 Performance & Attribution Report In this report, we provide an overview of 2022 performance among the GEM active funds in our analysis. We look at annual performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then identify the drivers behind 2022 performance based on …

Continue Reading

Oil Refining All-Time Highs

-

Steve Holden

-

November 28, 2022

-

Asia Insights

-

0 Comments

92 ACTIVE ASIA EX-JAPAN FUNDS, AUM $49BN Oil Refining All-Time Highs 4 charts from our recent analysis on Oil Refining/Marketing positioning among active Asia Ex-Japan Equity Funds. Fund allocations in the Oil Refining/Marketing industry group have soared to new all-time highs this month. Average fund weights hit a new peak of 1.53%, the percentage of funds overweight increased to a …

Continue Reading

Alibaba: Fighting Back

-

Steve Holden

-

November 28, 2022

-

China Insights

-

0 Comments

45 ACTIVE GREATER CHINA FUNDS, AUM $13BN Alibaba: Fighting Back 2 charts from our recent analysis on Alibaba positioning among active Greater China Equity Funds. Ownership in Alibaba Group Holdings is on the rise among active Greater China managers. Peaking in October 2020 at 88.6% of funds invested, the subsequent Tech crackdown saw investors cut exposure, bottoming out at just …

Continue Reading

The Largest Underweights in EM

-

Steve Holden

-

November 21, 2022

-

GEM Insights

-

0 Comments

278 ACTIVE GEM FUNDS, AUM $312BN Underweight Stock Risks in EM Active Emerging Market investors face a myriad of risks when constructing and running a portfolio. One of those is benchmark risk, with even the most active of managers required to state relative performance versus their benchmark. In this summary piece, we identify the largest aggregate underweight stock positions among …

Continue Reading

The Vodafone Exodus

-

Steve Holden

-

November 17, 2022

-

UK Insights

-

0 Comments

276 ACTIVE UK FUNDS, AUM $161BN The Vodafone Exodus In over a decades worth of holdings data for UK active funds, ownership in Vodafone has never looked so bad. Sentiment is at rock bottom, with the number of funds holding a position at all-time lows and an increasing number of funds deciding to throw in the towel. Time Series Analysis …

Continue Reading

Saudi Arabia Financials: New Highs

-

Steve Holden

-

November 17, 2022

-

GEM Insights

-

0 Comments

278 ACTIVE GEM FUNDS, AUM $312BN Saudi Arabia Financials: New Highs The ownership picture for Saudi Arabian Financial stocks is changing. The addition of Saudi Arabia to the MSCI Emerging Markets index, high oil prices, China concerns and a pullback in Tech have all worked in Saudi’s favour over the last couple of years. Time Series Analysis & Stock Holdings …

Continue Reading

Record Exposure as North American Rotation Continues

-

Steve Holden

-

October 18, 2022

-

Global Insights

-

0 Comments

358 ACTIVE GLOBAL FUNDS, AUM $930BN North American Rotation Active Global investors are at record allocations in North American stocks. Driven higher by rising Health Care, Industrials and Energy exposure, North America continues to take market share from the key regions in Europe and Asia. Yet with Global investors still underweight North America, does this rotation have further to run? …

Continue Reading

UK Equity Funds: Stock Sentiment Analysis

-

Steve Holden

-

October 18, 2022

-

UK Insights

-

0 Comments

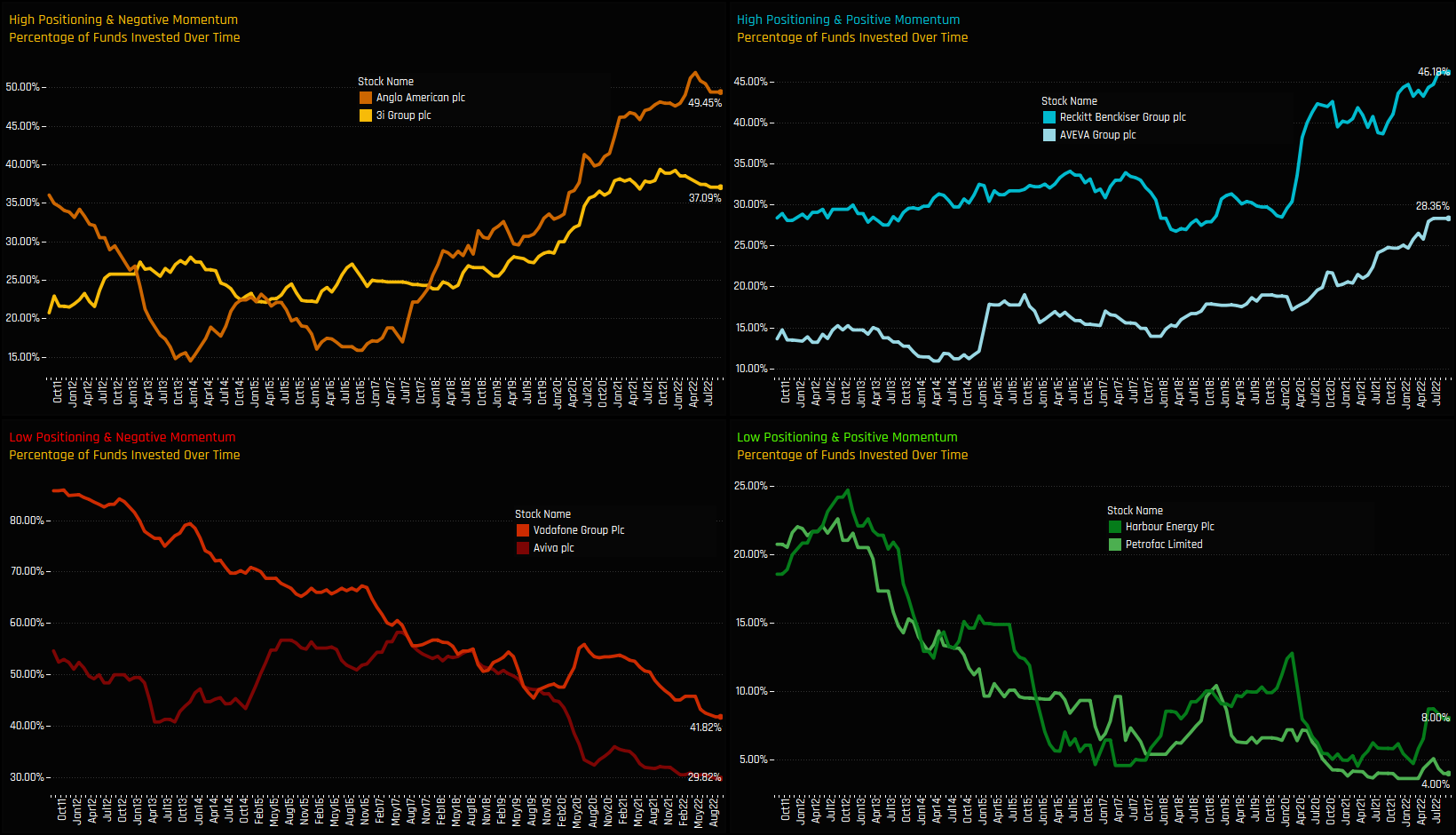

275 Active UK Funds, AUM $141bn. UK Stock Sentiment Investment levels among the hundreds of stocks in the investible UK universe differ greatly. Some stocks are widely owned, others largely avoided by UK active managers, with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for …

Continue Reading

China & HK Semiconductors: Fund Positioning Analysis

Asia Ex-Japan China A-Share MSCI China Greater China China Semiconductors With US sanctions hitting Chinese domestic Semiconductor stocks this week, we analyse allocations in the China & HK Semiconductor Industry group among Asia Ex-Japan, MSCI China, China A-Share and Greater China actively managed equity funds. Without the distraction of Taiwan technology or HK listed internet stocks, China A-Share funds are …

Continue Reading

Recent Comments