Global Fund Positioning Analysis, August 2022

-

Steve Holden

-

August 16, 2022

-

Global

-

0 Comments

362 Active Global Funds, AUM $960bn Investor Positioning Insights Communication Services: Lowest Exposure on Record Taiwan Technology: Pause and Reverse Australia: Sleeping Giant Awakes UK Consumer Discrexodos Momentum in the Trucking Industry South Korean Autos. All Over? Communication Services: Lowest Exposure on Record Charts clockwise from top to bottom Communication Services allocations among active Global managers are at their …

Continue Reading

Asia Ex-Japan Fund Positioning Analysis, August 2022

-

Steve Holden

-

August 16, 2022

-

Asia

-

0 Comments

93 Active Asia Ex-Japan Funds, AUM $63bn Investor Positioning Insights Singapore Financials: Surging Higher China Technology: Stalling Sentiment Asian Restaurant Boom Singapore Financials: Surging Higher Allocations in Singapore Financials continue their cyclical turnaround. From a low of 0.67% in early 2021, average holding weights have soared to 1.81%, closing in on the highs of 2%+ through 2018 with managers …

Continue Reading

The ASEAN Rotation

-

Steve Holden

-

August 14, 2022

-

Emerging Markets

-

0 Comments

275 Active GEM Funds, AUM $370bn. The ASEAN Rotation In this piece we provide a comprehensive analysis of active EM fund positioning in the ASEAN region. We find that ASEAN has been a key beneficiary from a drop in EM Europe allocations following the Russian exodus, in addition to a stall in the major EM Asia nations. Indonesia and Thailand …

Continue Reading

Asia Ex-Japan Funds: Stock Sentiment Analysis

-

Steve Holden

-

August 13, 2022

-

Asia

-

0 Comments

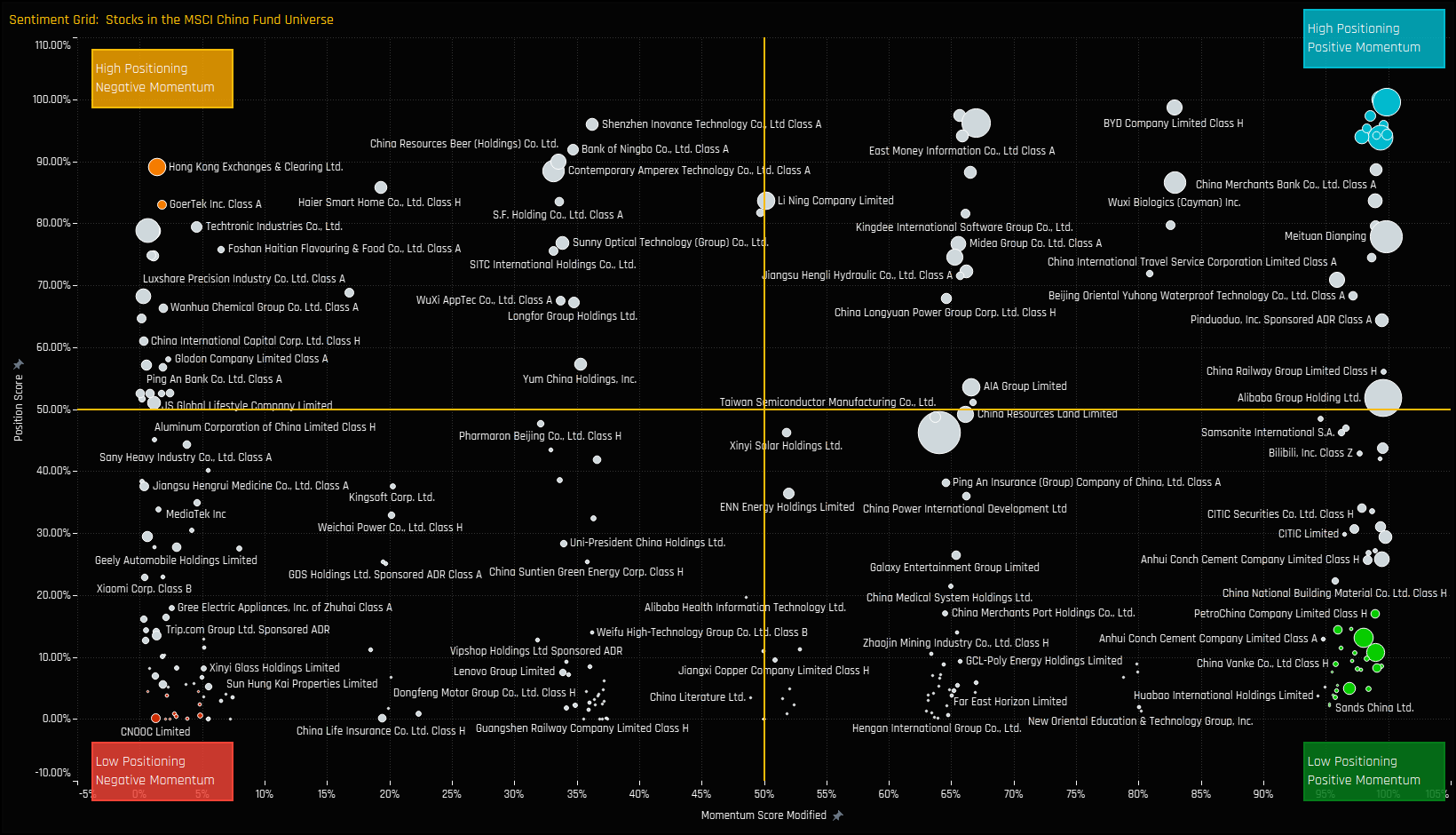

93 Active Asia Ex-Japan Funds, AUM $63bn. Asia Ex-Japan Stock Sentiment Investment levels among the thousands of stocks in the investible Asia universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock …

Continue Reading

Greater China: Materials Rotation

-

Steve Holden

-

August 12, 2022

-

China

-

0 Comments

45 Active Greater China Funds, AUM $17bn. Greater China Materials Greater China managers are increasing allocations to the Materials sector. Part of a general rotation out of the Information Technology sector, active managers are buying in to selected names, led by IMEIK Technology Development Co, ENN Ecological Holdings and Baoshan Iron & Steel. Versus the benchmark, Greater China managers are …

Continue Reading

China A-Shares: Health Care Fall

-

Steve Holden

-

August 10, 2022

-

China

-

0 Comments

115 Active China A-Share Funds, AUM $63bn. China Health Care Health Care weights among China A-Share managers have fallen to some of the lowest levels on record, with managers moving from overweight to underweight over the last 12-months. The recent moves have been caused by a number of domestic A-Share funds closing out, or significantly cutting exposure to key stocks …

Continue Reading

China Communication Services: Lowest Exposure on Record

-

Steve Holden

-

August 10, 2022

-

China

-

0 Comments

119 Active MSCI China Funds, AUM $60bn. China Communication Services Portfolio weights in the Communication Services sector have hit their lowest levels on record, declining from a high of over 18% in mid-2015 to just 9.90% today. In this analysis. we look at positioning in the communication services sector in detail, highlighting the funds and stocks that make up exposure …

Continue Reading

France: Europe’s High Conviction Holding

-

Steve Holden

-

July 13, 2022

-

Global

-

0 Comments

365 Active Global Funds, AUM $906bn France Global equity managers are positioned at their highest ever overweight in French equities. France is the 4th largest country allocation globally and the largest in the European Union. Versus the benchmark, only the Netherlands has more funds positioned overweight. Sanofi and Cap Gemini SA have benefited from fund rotation this year, with the …

Continue Reading

Microsoft Corp: The Growth / Value Split

-

Steve Holden

-

July 13, 2022

-

Global

-

0 Comments

365 Active Global Funds, AUM $906bn Microsoft Corp (MSFT) Microsoft Corporation is the most widely held stock among active US equity investors. Of the 365 active strategies in our analysis, 75% own Microsoft at an average weight of 3.02%. There is a growing dispersion between Value and Growth managers in MSFT. Growth managers are at record levels of ownership, whereas …

Continue Reading

Recent Comments