Singapore Financials: Surging Higher

Fund Holdings, Style & Activity

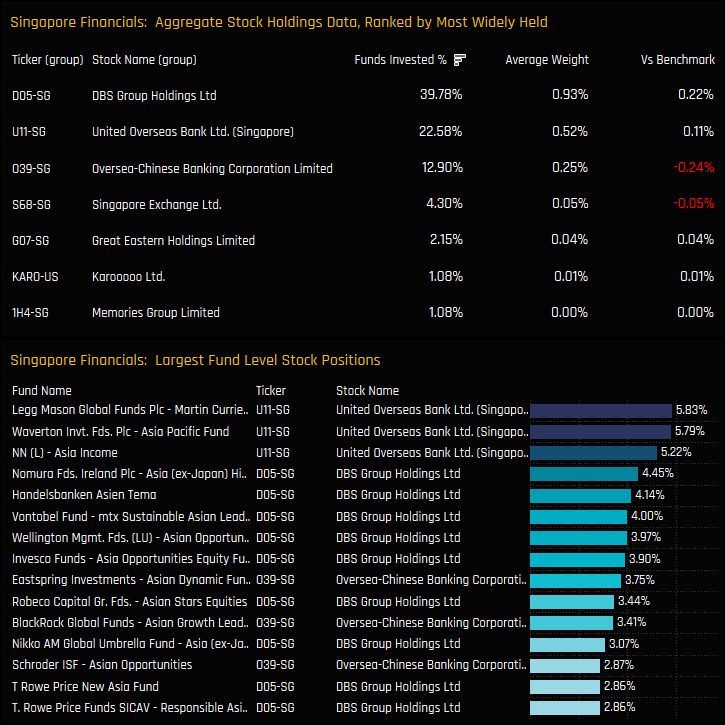

Stock Holdings & Activity

Conclusions

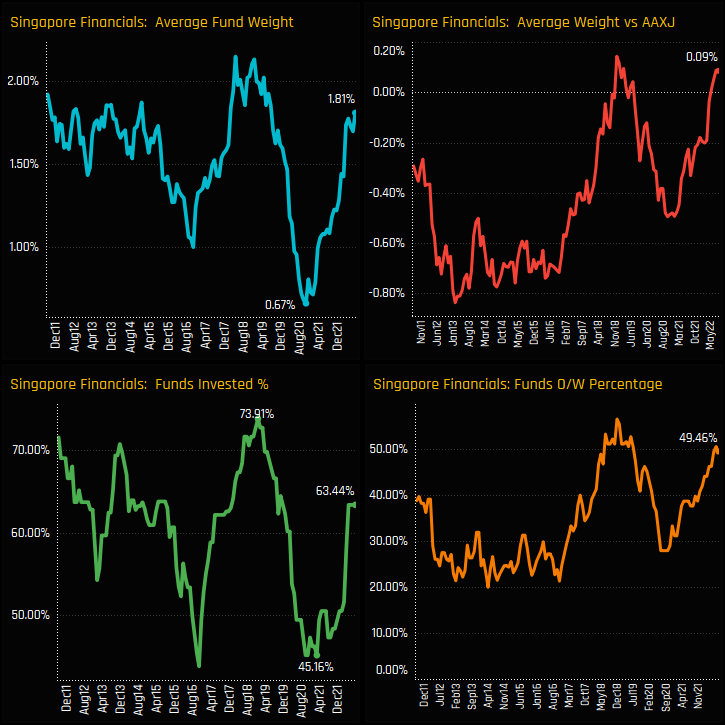

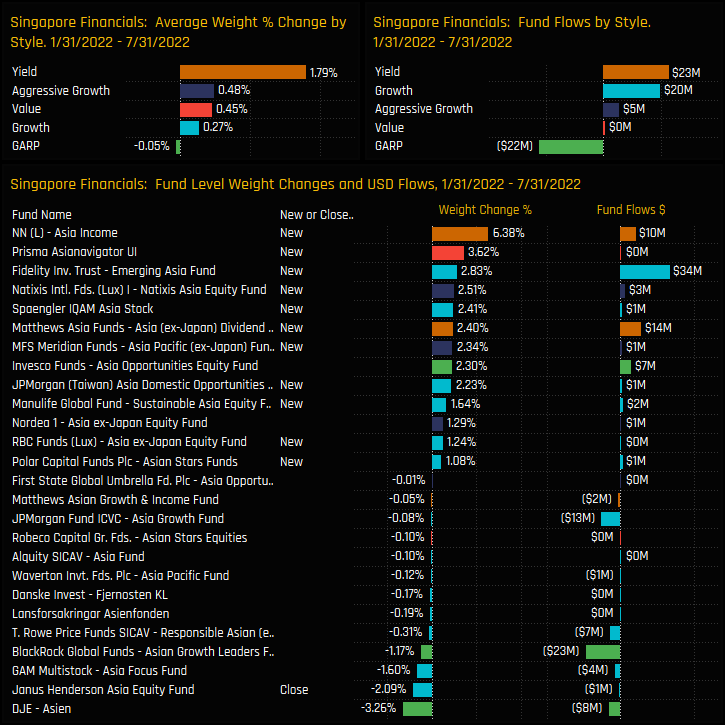

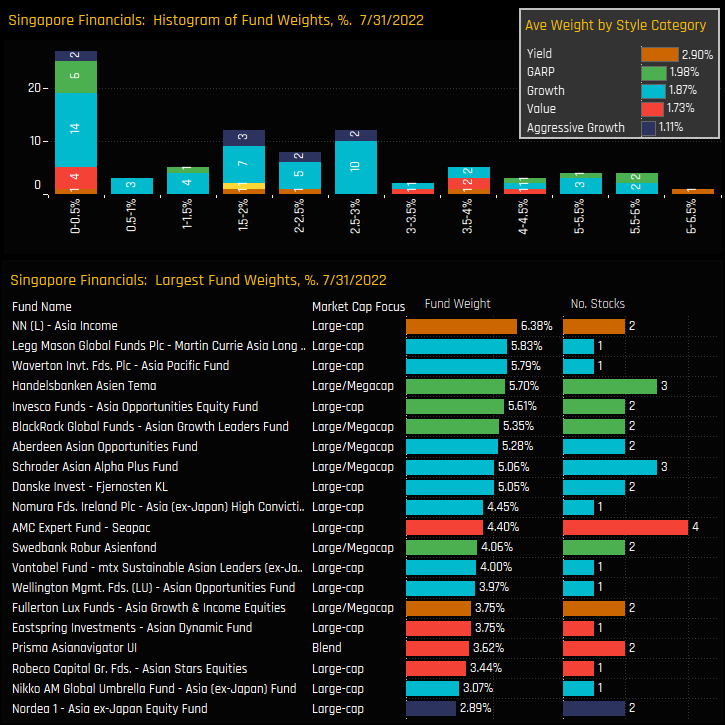

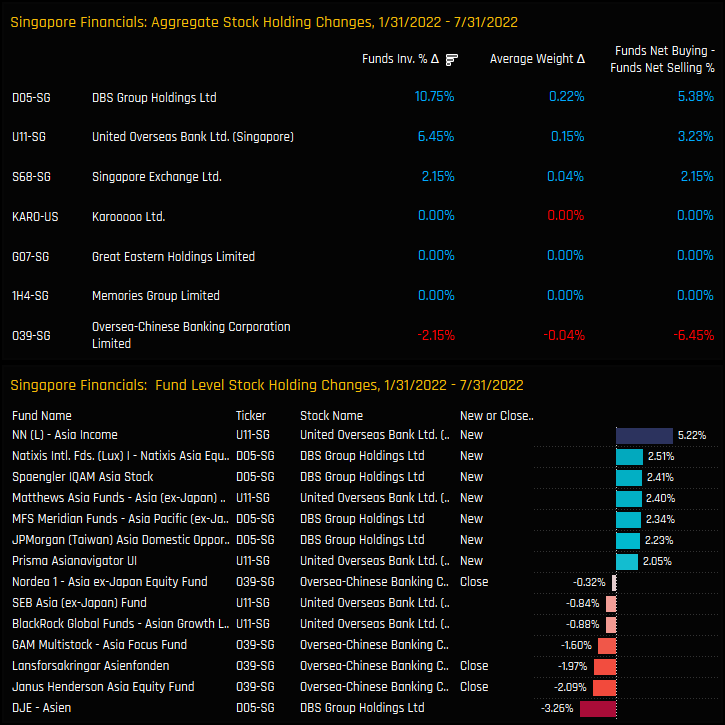

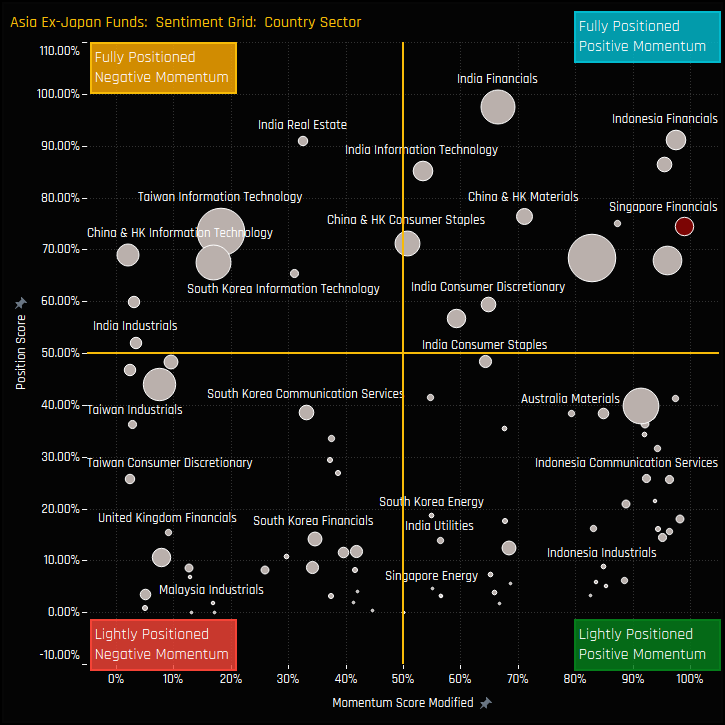

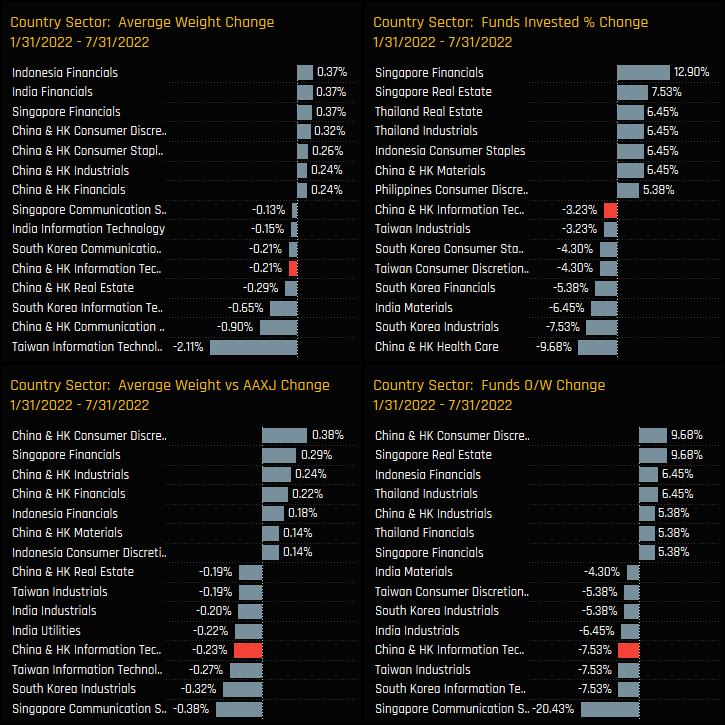

Sentiment in the Singapore Financials sector has seen a huge reversal. Allocations have recovered at an incredible rate after a decline between 2019 and 2021 that left allocations at record lows.

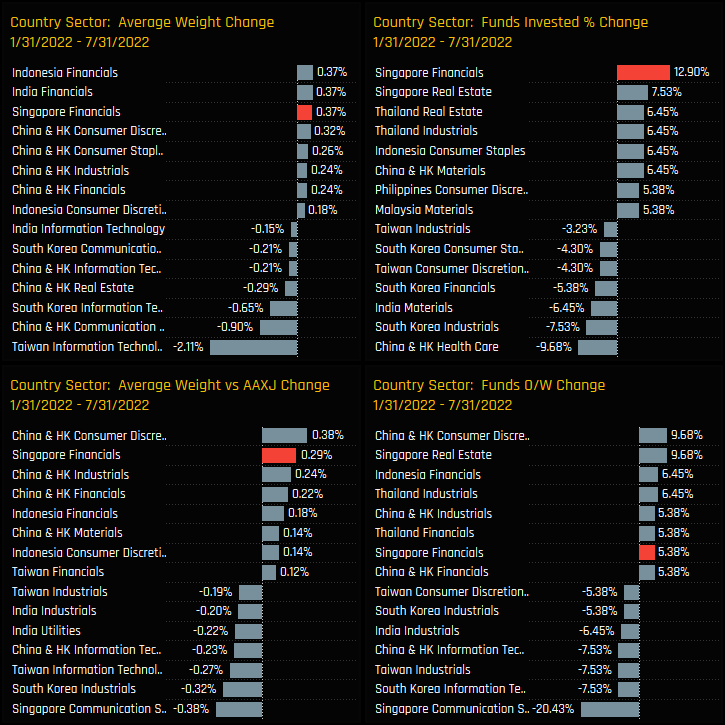

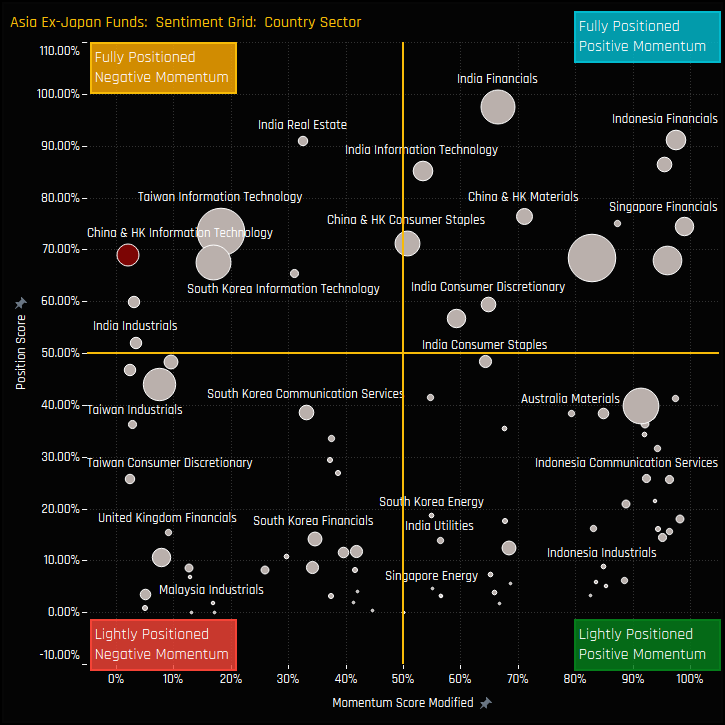

The chart to the right shows where current positioning in each country/sector sits versus history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each sector between 01/31/2022 and 07/31/2022 (x-axis). The momentum measure is the most bullish across all country/sectors, yet positioning is some way from the all-time highs.

Versus sector peers, Singapore Financials are way down the pecking order. They are the 14th largest country/sector allocation and the 4th largest country level Financials exposure, behind China & HK, India and Indonesia (see PDF, page 3). Undoubtedly, there is plenty of room for Singapore Financials to play a greater role in Asia Ex-Japan active portfolios.

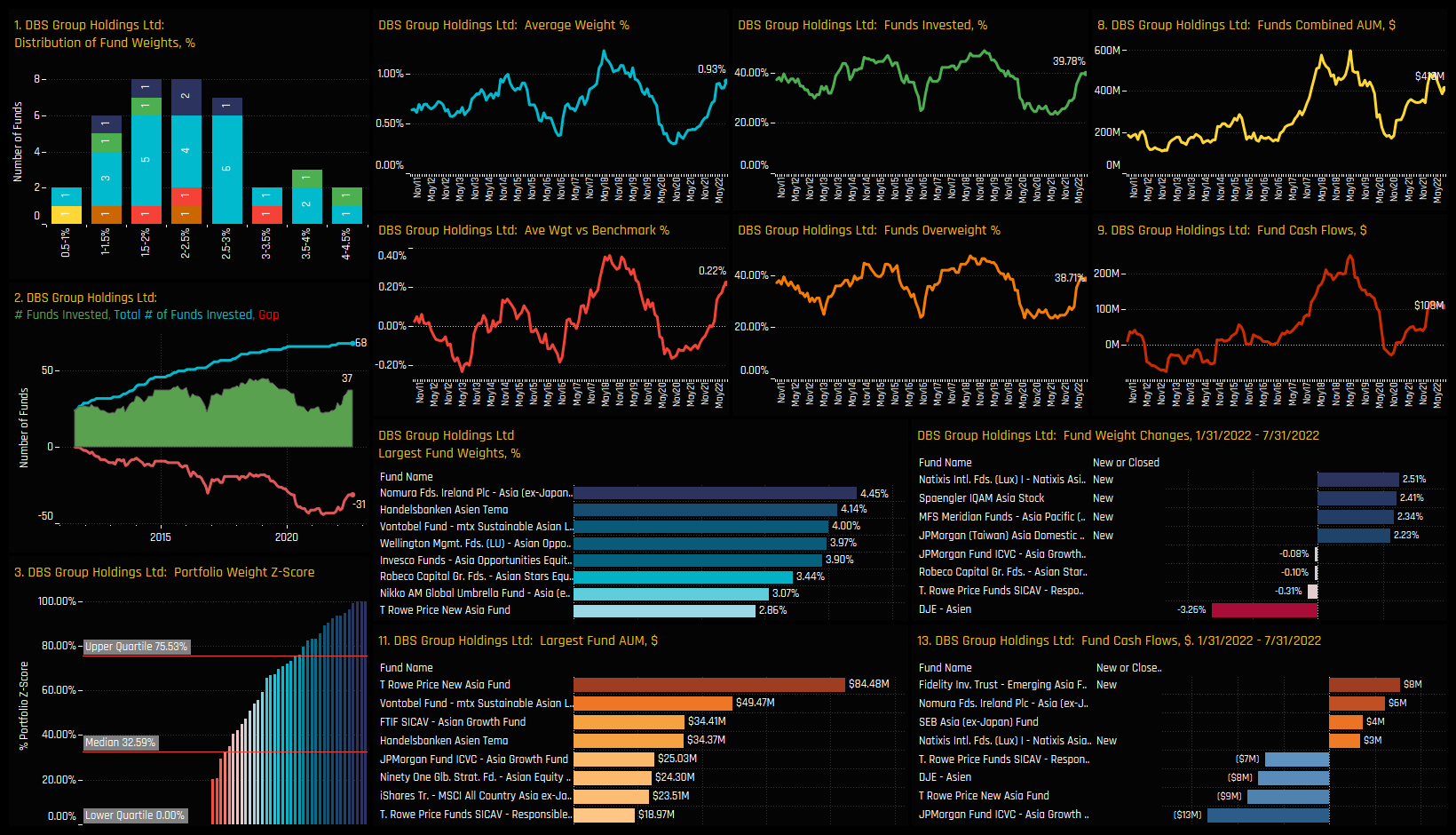

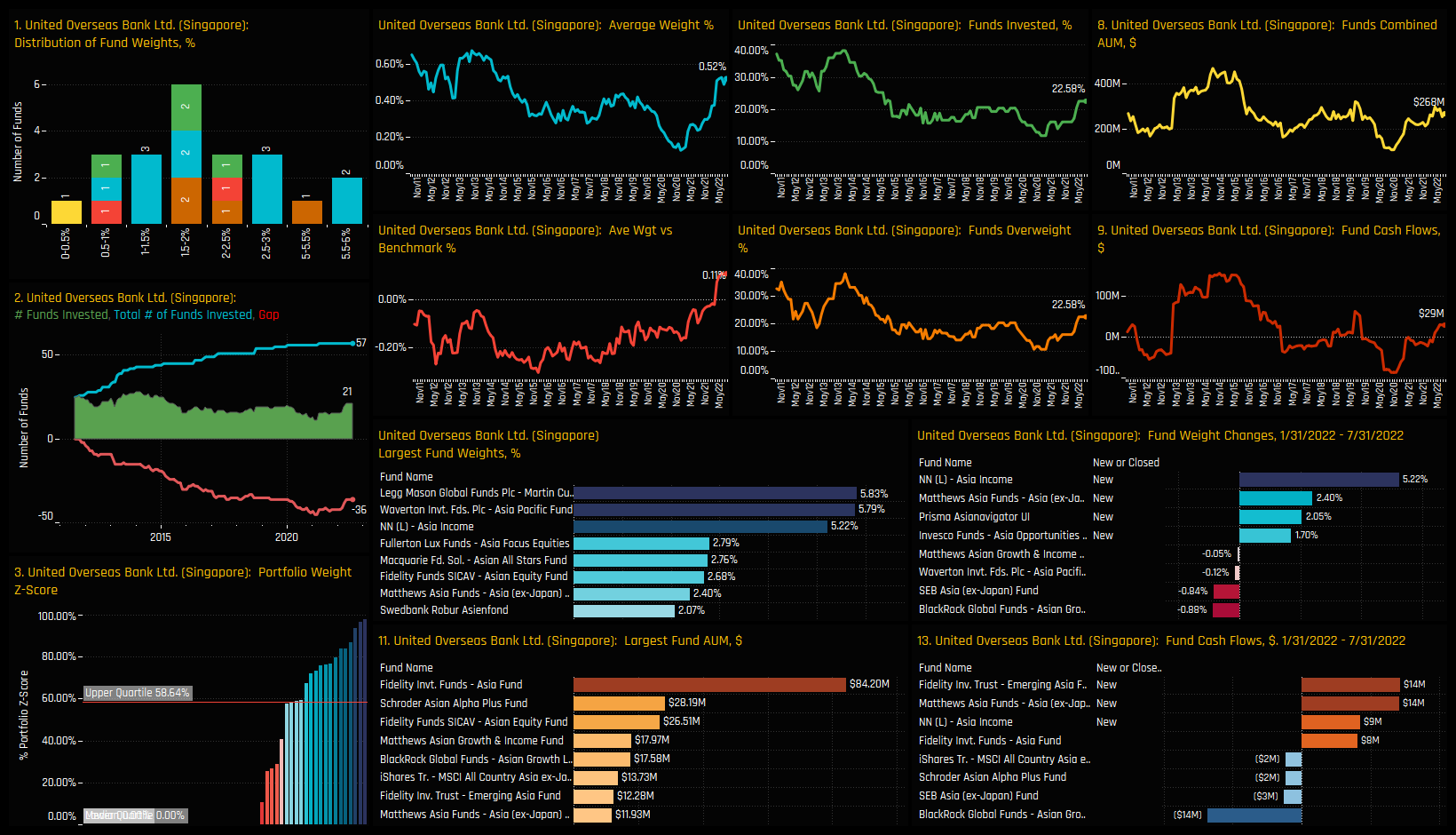

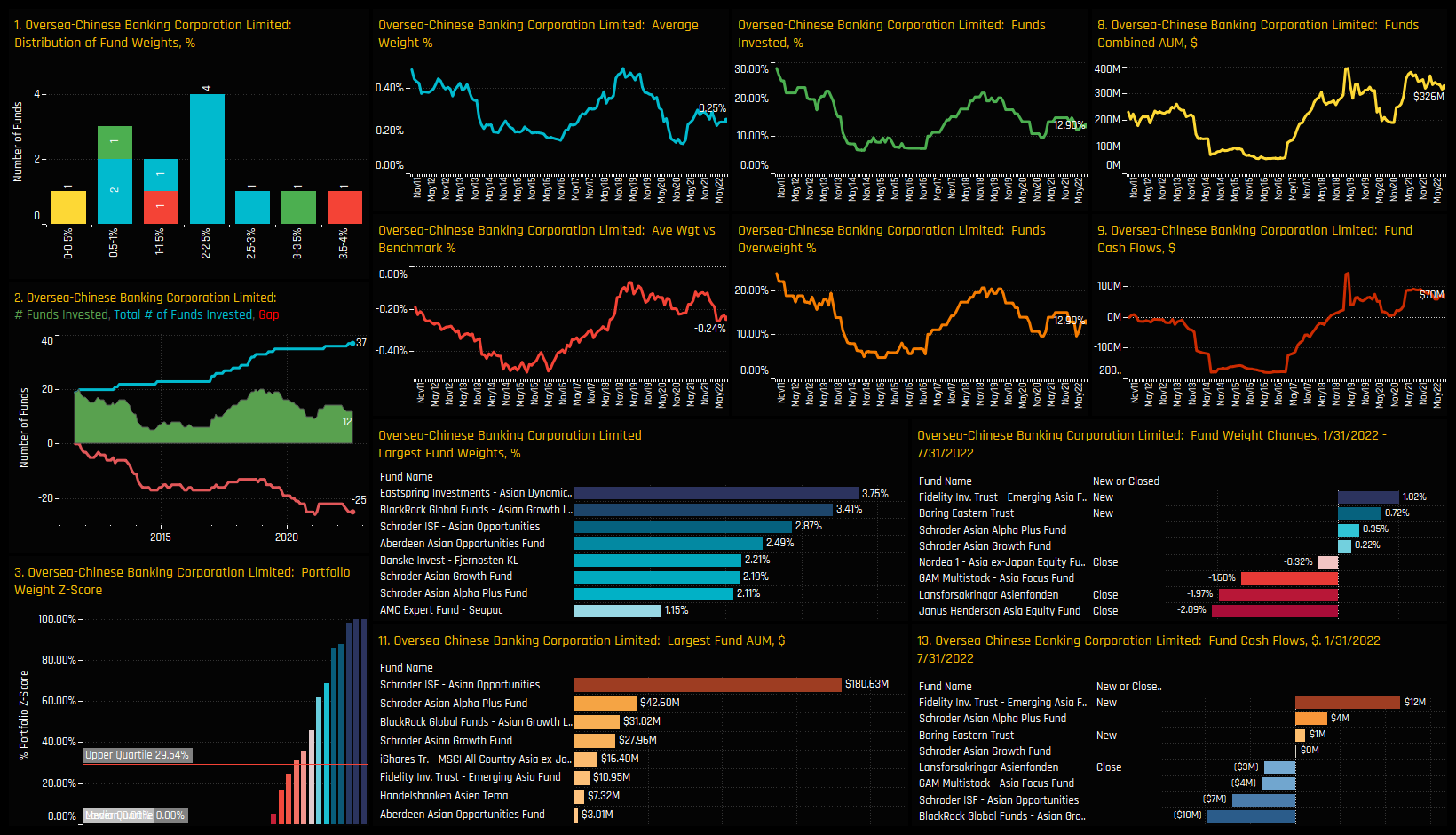

See below for more ownership information on DBS Group Holdings, United Overseas Bank Ltd and Oversea-Chinese Banking Corp. Please click on the link below for the extended report on Singapore Financials exposure among active Asia Ex-Japan funds.

Stock Profile: DBS Group Holdings Ltd

Stock Profile: United Overseas Bank Ltd

Stock Profile: Oversea-Chinese Banking Corporation Limited

Click on the link below for the latest data report on Singapore Financials positioning among active Asia Ex-Japan funds.

China Technology: Stalling Sentiment

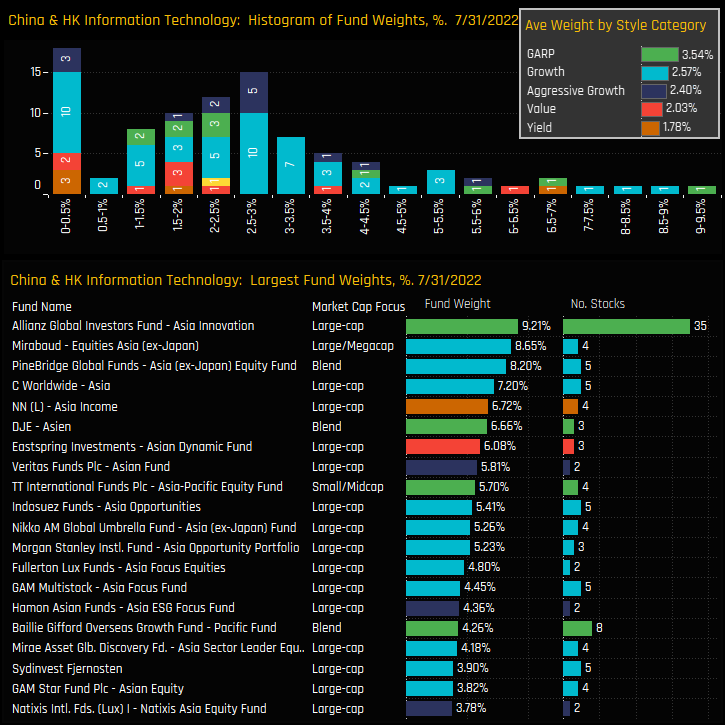

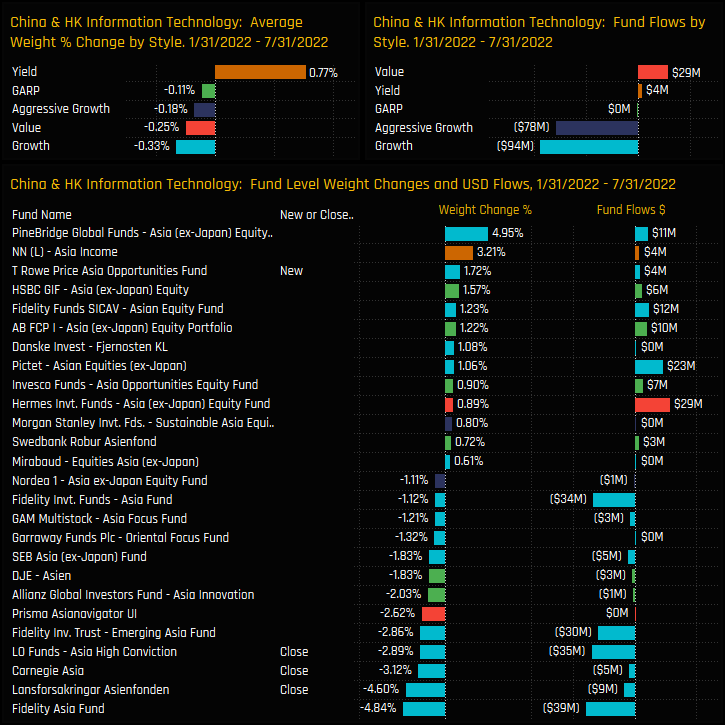

Fund Holdings & Style

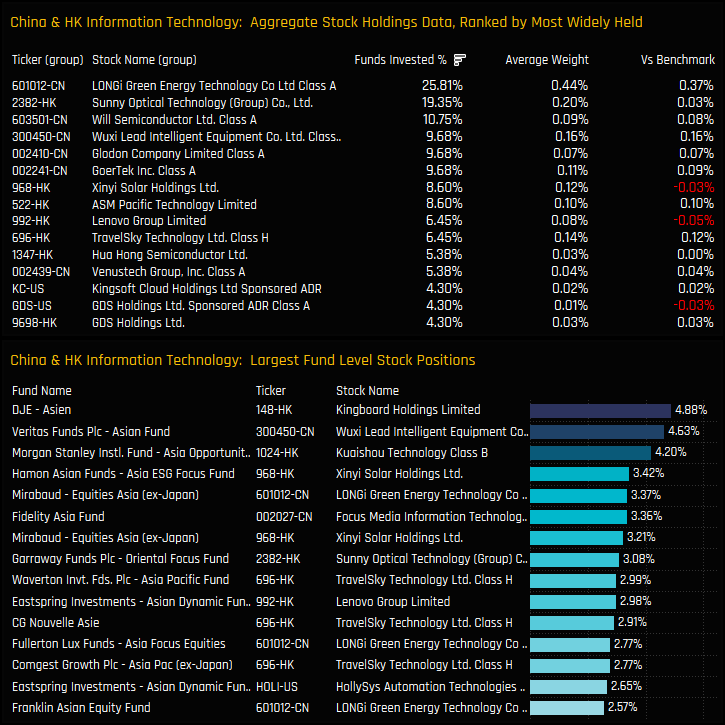

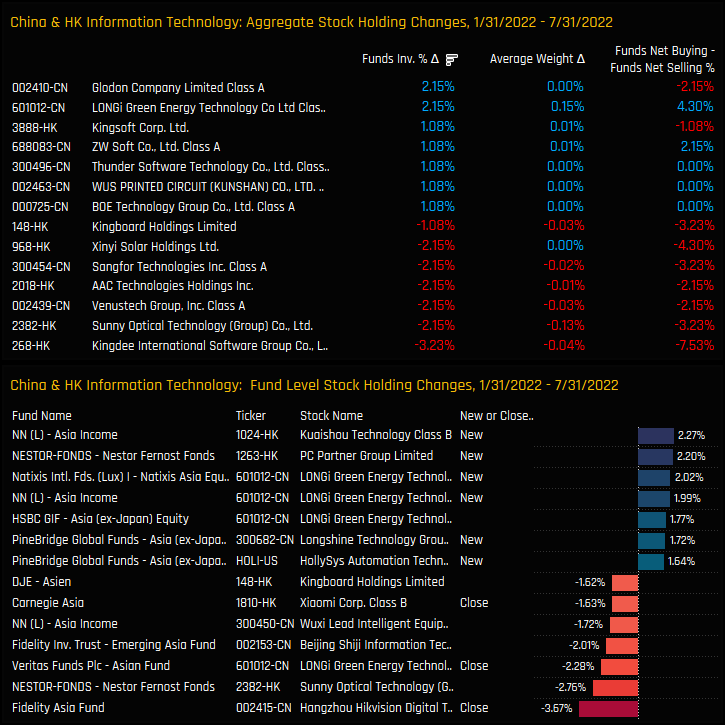

Stock Holdings & Activity

Conclusions

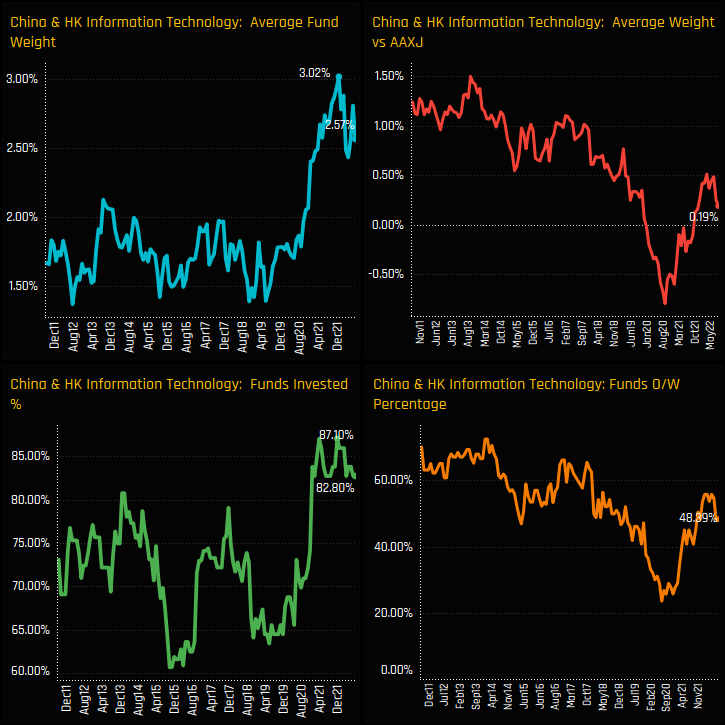

China & HK Technology allocations are in a state of consolidation. Whilst not a total reversal or exodus, we can say with certainty that the bull run between 2019 and 2021 has taken a breather, and ownership levels are stalling for many names in the sector.

The same Sentiment Grid as in the previous insight highlights the differing fortunes of the China & HK Technology sector versus Singapore Financials. Both are at similar levels on the positioning scale (higher end of the range/off the highs), but China Technology is on the far left, indicative of managers scaling back exposure versus other sectors in the Asian universe.

The fact that Taiwan Technology and South Korea Technology are at similar placements on the Grid suggests that this is part of a broader sector move, yet China & HK Technology appears to be bearing the brunt.

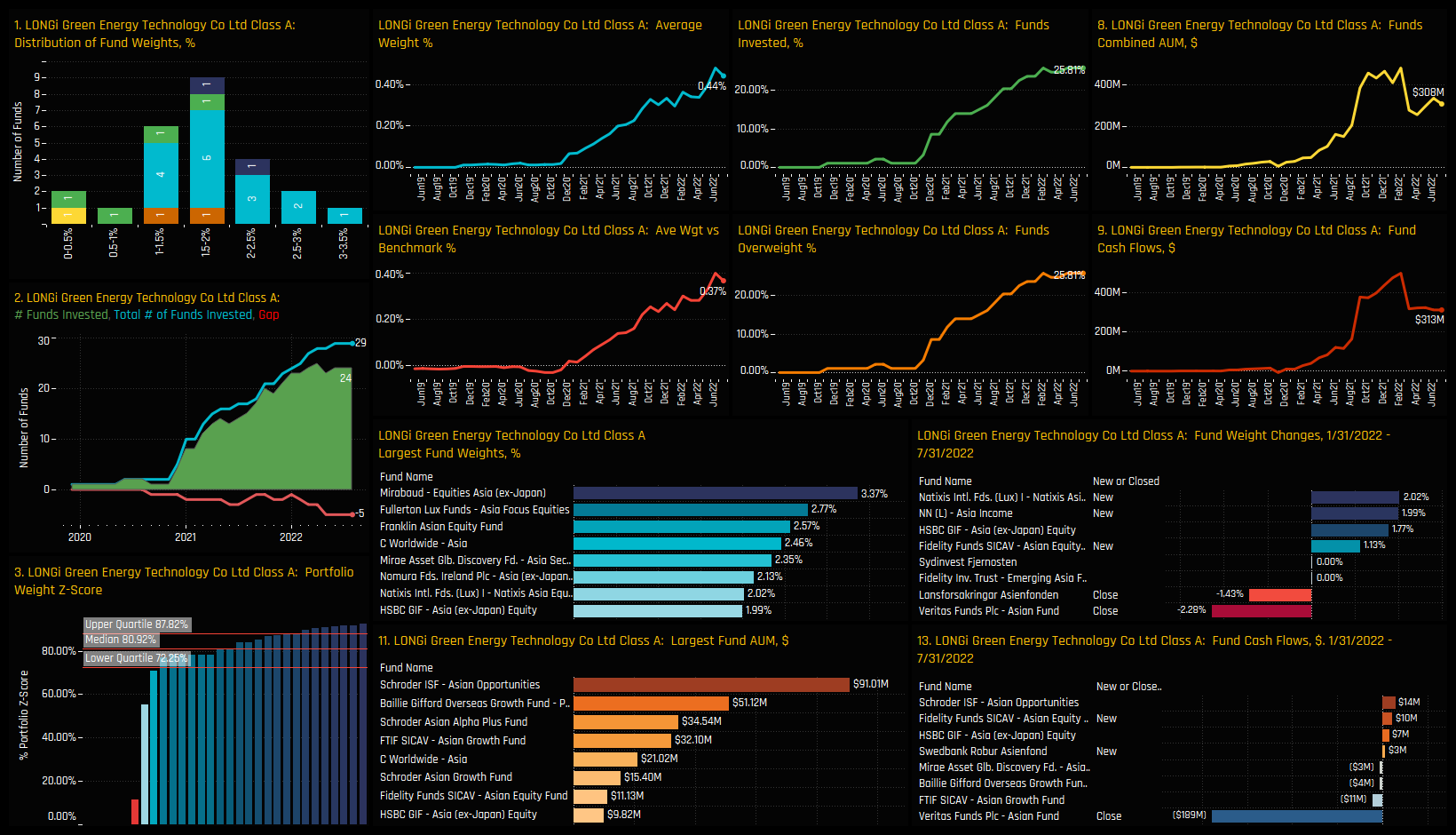

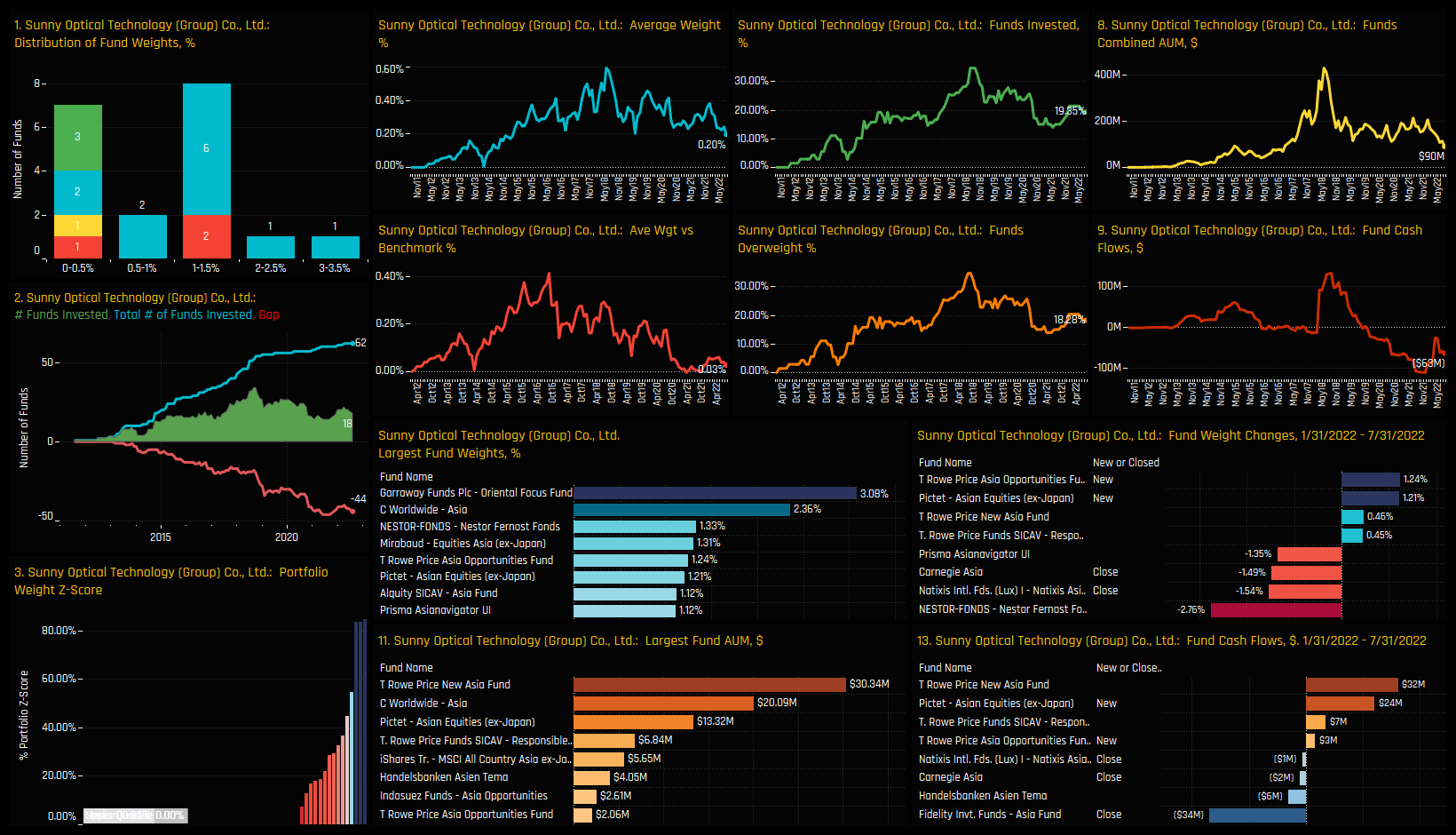

See below for more ownership information on LONGi Green Energy Technology and Sunny Optical Technology. Please click on the link below for the extended report on China Technology exposure among active Asia Ex-Japan funds.

Stock Profile: LONGi Green Energy Technology

Stock Profile: Sunny Optical Technology Co

Click on the link below for the latest data report on China Technology positioning among active Global funds.

Asian Restaurant Boom

Fund Holdings and Activity

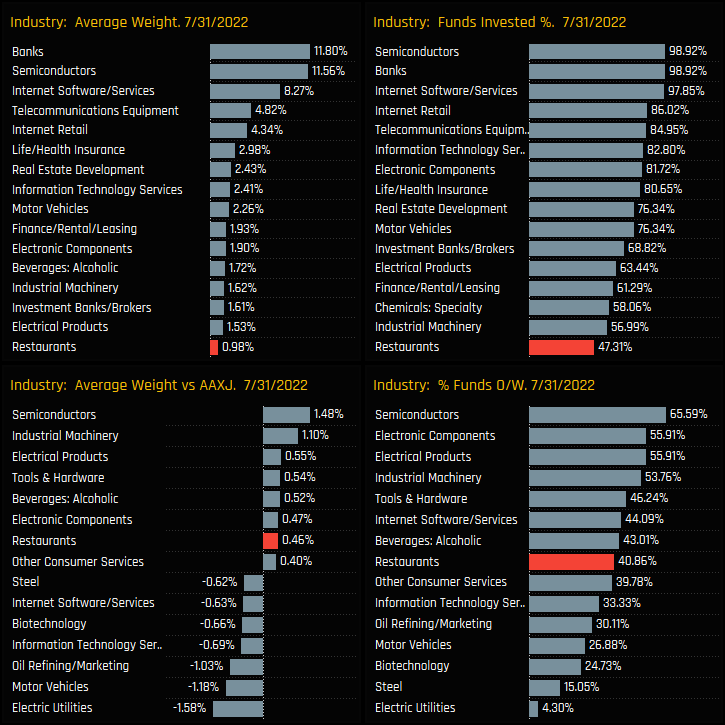

Stock Holdings and Activity

Conclusions

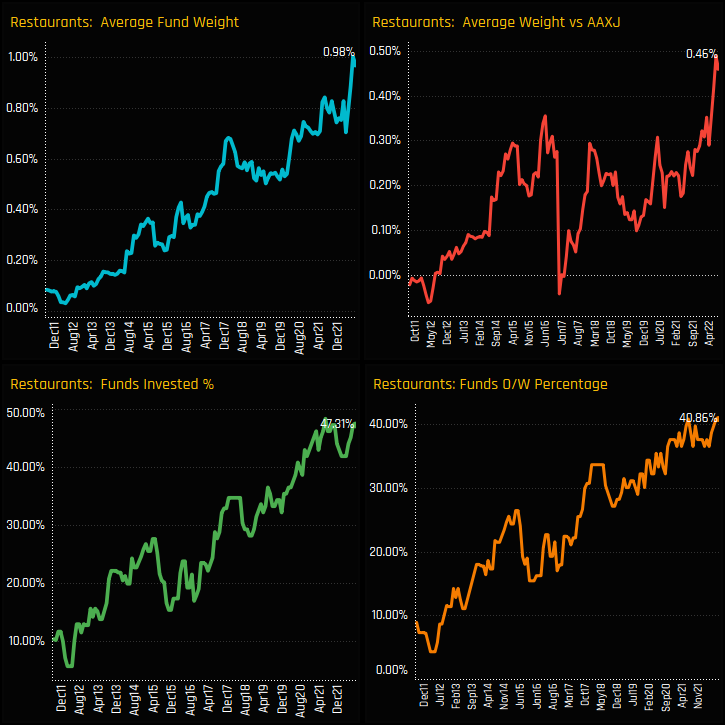

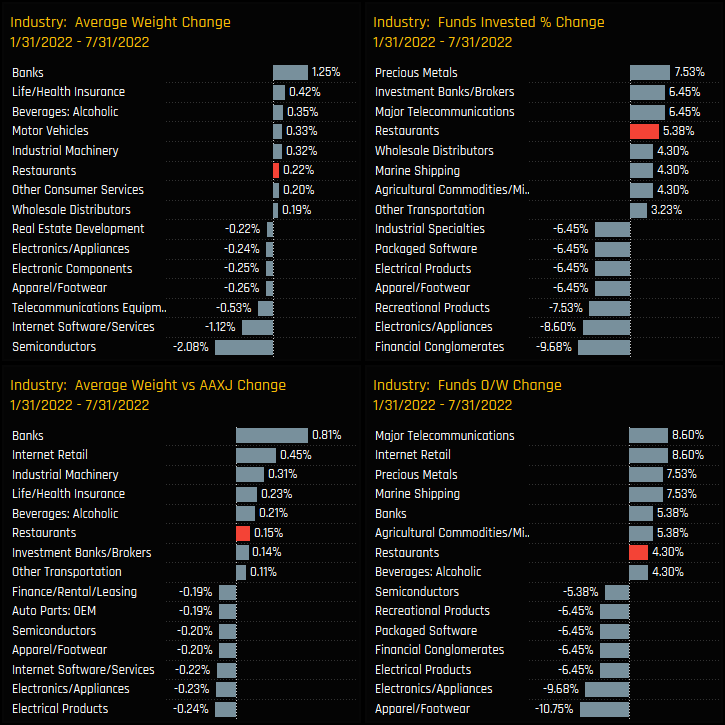

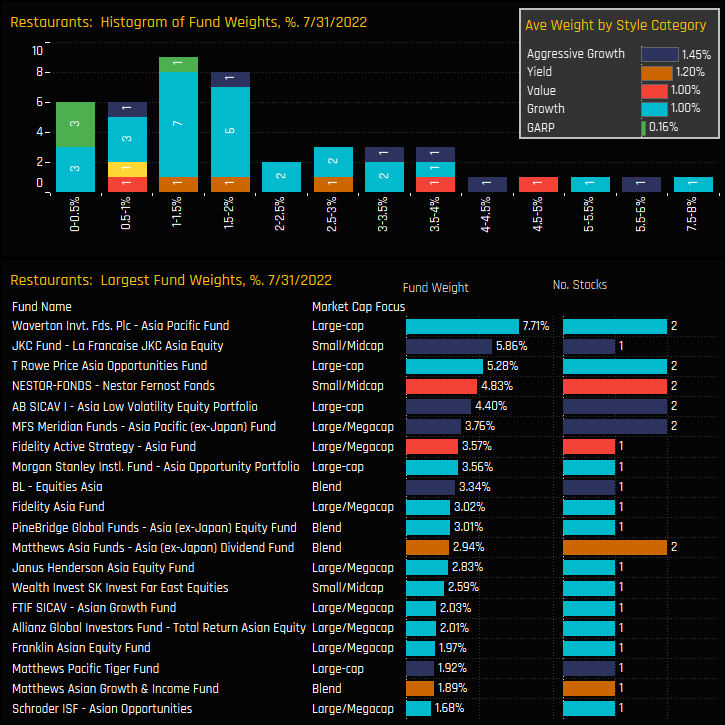

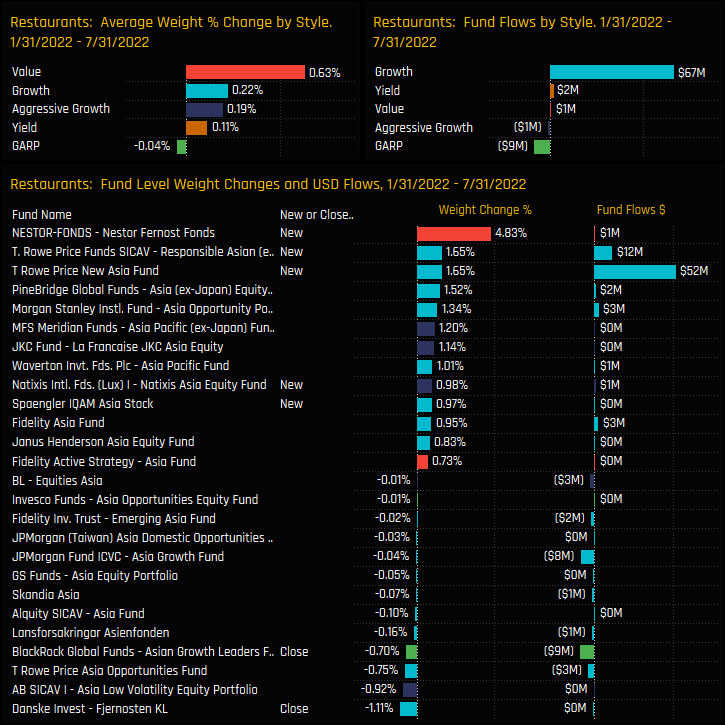

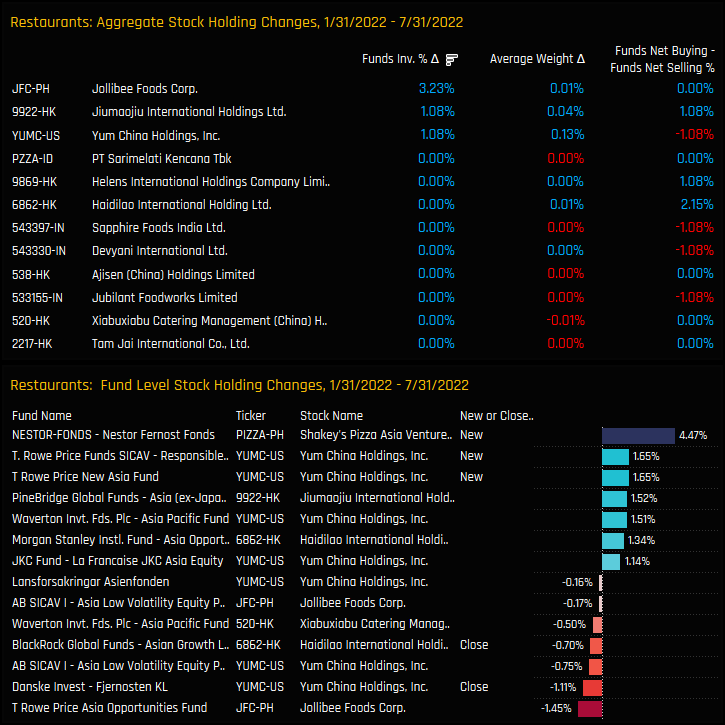

The top 2 charts to the right show Restaurant stocks a long way down the pecking order of industry allocations on an absolute basis, with Financials, Tech and selected Consumer related industries dominating the picture. On a relative basis however, the bottom charts show Restaurants as the 7th largest Industry overweight, a mark of the growing confidence that active investors have placed in the sector.

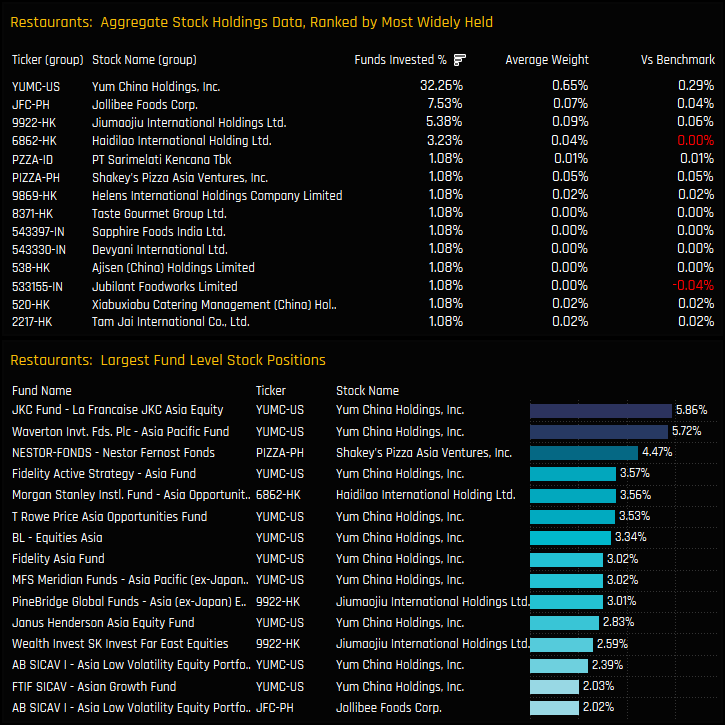

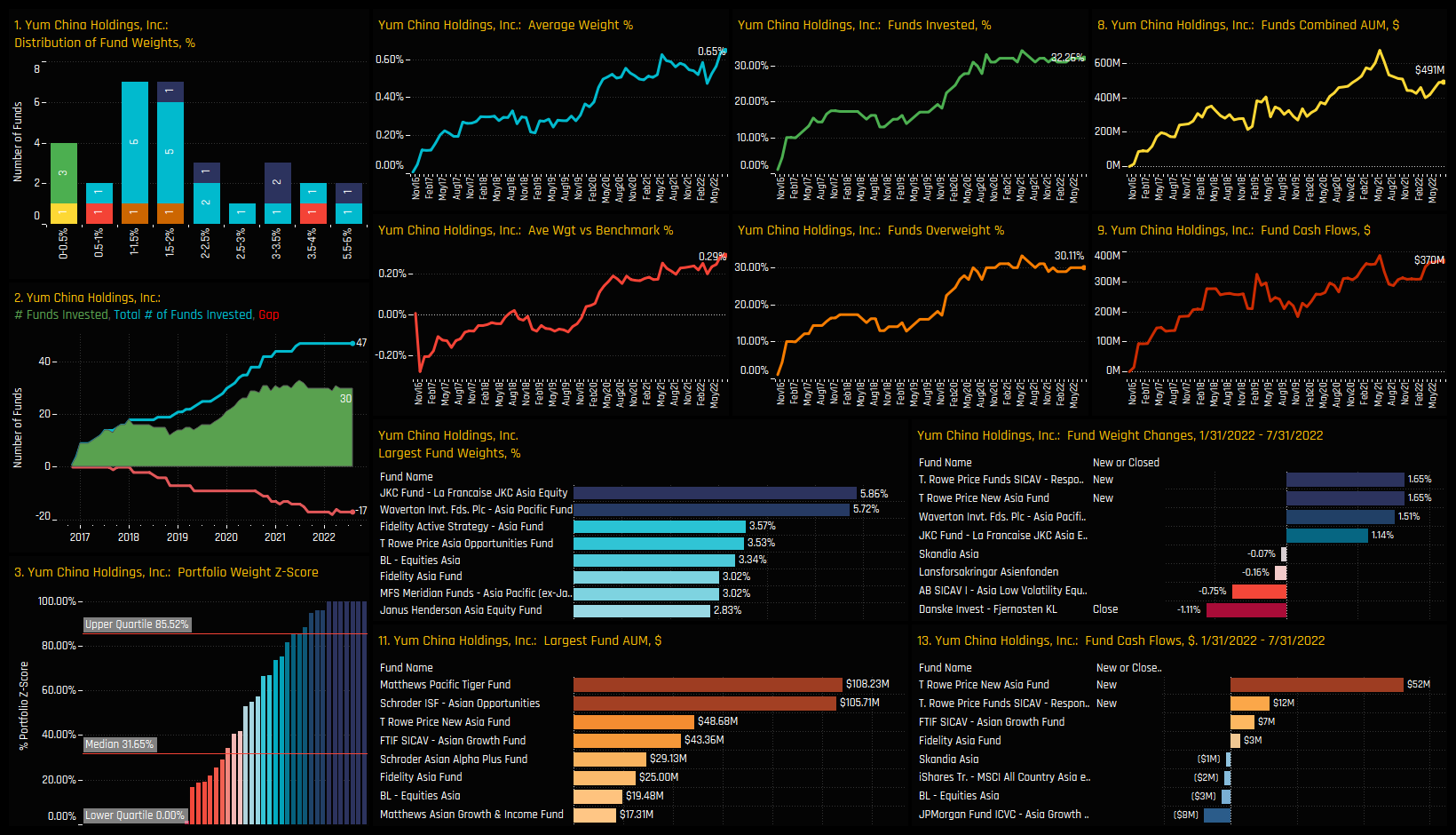

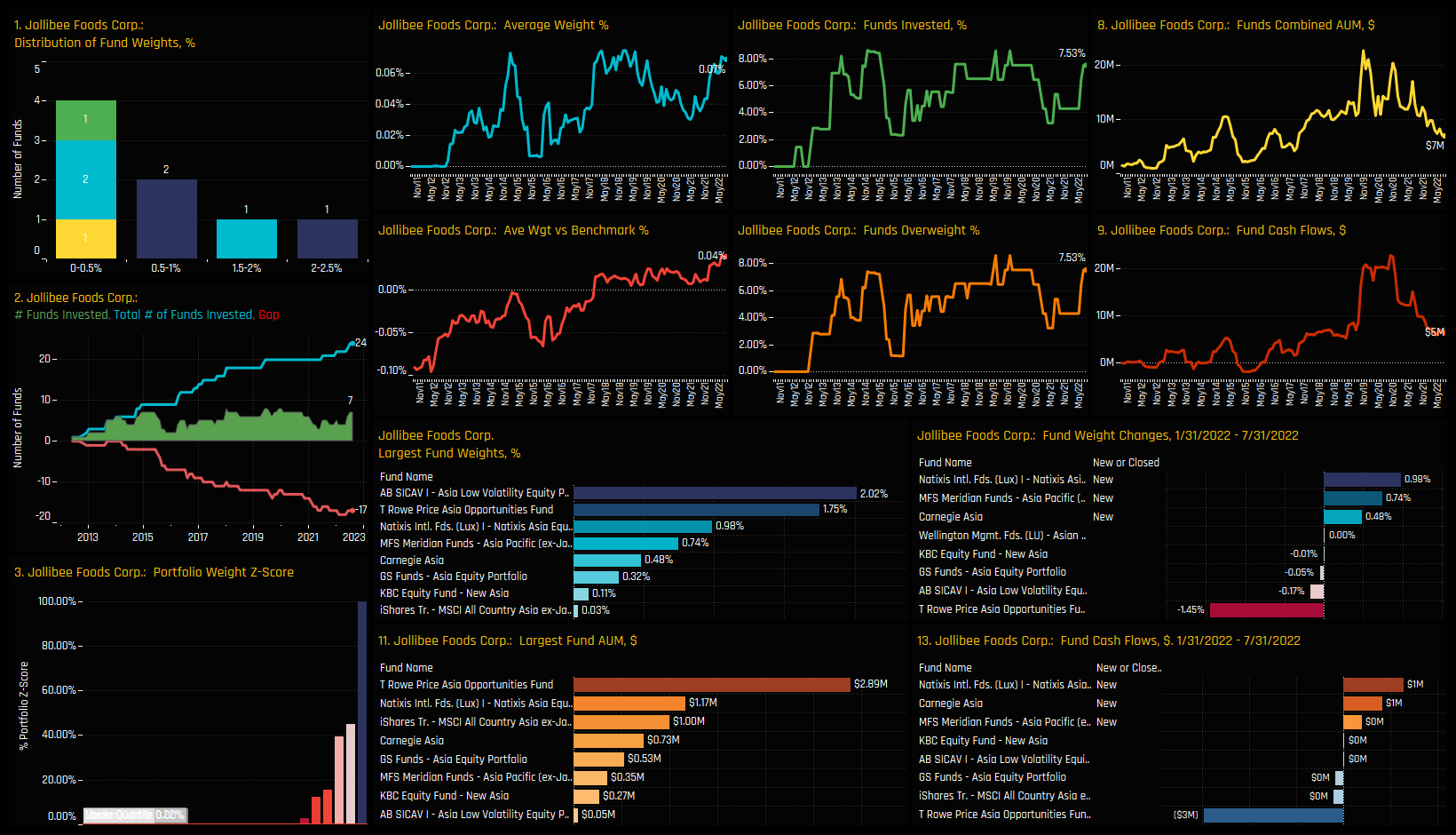

On a stock level, it feels rather like a bet on a single company rather than an Industry wide trend, with a clear over-reliance on Yum China Holdings as a representation for the whole sector. However, as selected funds buy in to some of the 2nd tier names, led by Jollibee Foods Corp, it suggests that the opportunity set within the sector is widening, and with that an increased potential for exposure to grow further.

Stock Profile: Yum China Holdings, Inc

Stock Profile: Jollibee Foods Corp

Click on the link below for the latest data report on Asian Restaurant positioning among active Global funds.

Finally, please click on the link below for the latest version of the Asia Ex-Japan active fund ownership report.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- October 17, 2022

China & HK Semiconductors: Fund Positioning Analysis

92 Asia Ex-Japan Funds, AUM $52bn, 115 China A-Share Funds, AUM $57bn, 117 MSCI China Funds, AU ..

- Steve Holden

- March 17, 2023

Asia Ex-Japan Fund Positioning Analysis, March 2023

89 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, March 2023 In ..

- Steve Holden

- October 11, 2022

Asia Ex-Japan Funds: Q3 Performance & Attribution

92 Asia Ex-Japan funds, AUM $60bn. Q3 Performance & Attribution In this piece, we provide a ..