104 Asia Ex-Japan Funds, AUM $66bn

Philippines: Emerging Signs of Investment Recovery

• Philippines fund ownership shows signs of life after decade long bear market

• All measures of fund ownership increase over the last 6-months

• Asia Ex-Japan funds buy in to BDO Unibank, Bank of the Philippine Islands and Jolibee Foods Corp.

• Despite this, The Philippines remains a zero allocation for 50% of the funds in our analysis.

Time Series & Country Activity

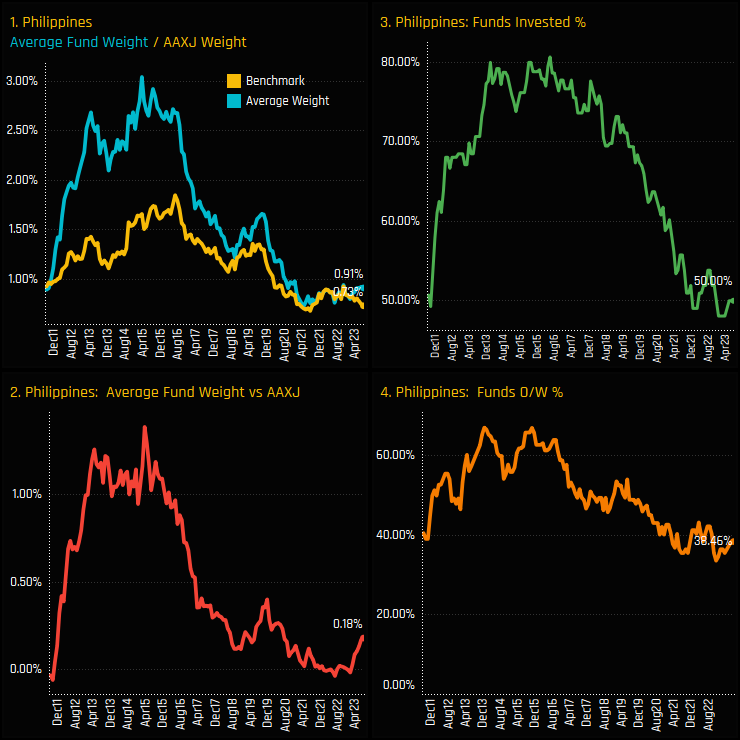

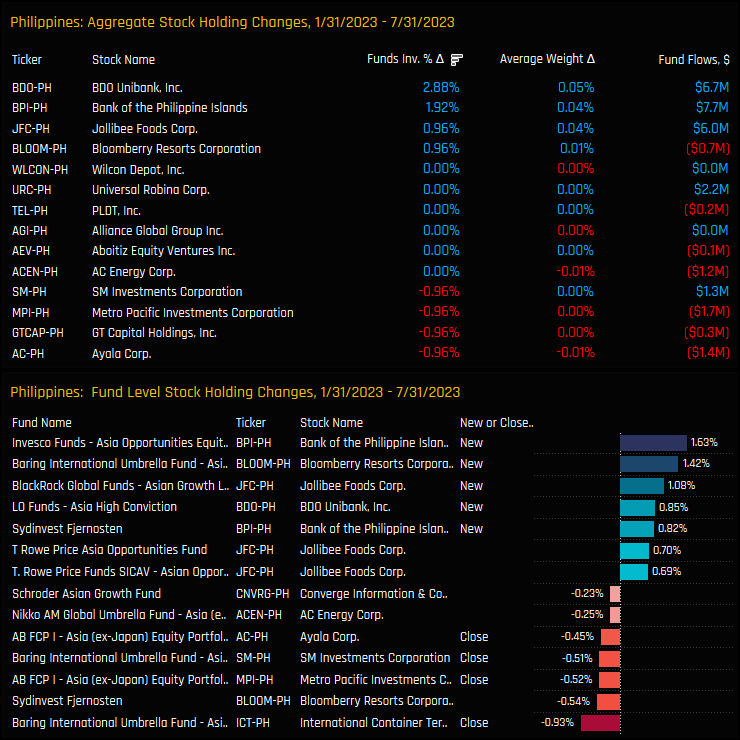

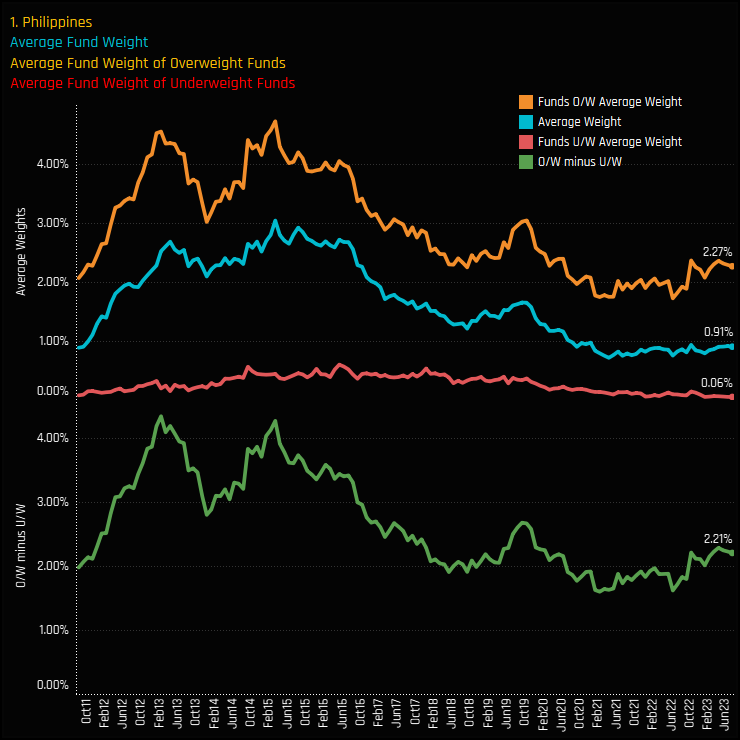

There are tentative signs that Asia Ex-Japan investors are starting to reconsider the Philippines investment case. Exposure among the 104 active funds in our analysis has been in decline over the last decade, with the percentage of funds falling from over 80% in 2016 to just 50% today (ch3). In tandem, average weights have fallen (ch1) as well as a significant overweight decline from over 1% to near flat at the end of 2022 (ch2). More recently though, the charts are showing small signs of a reversal.

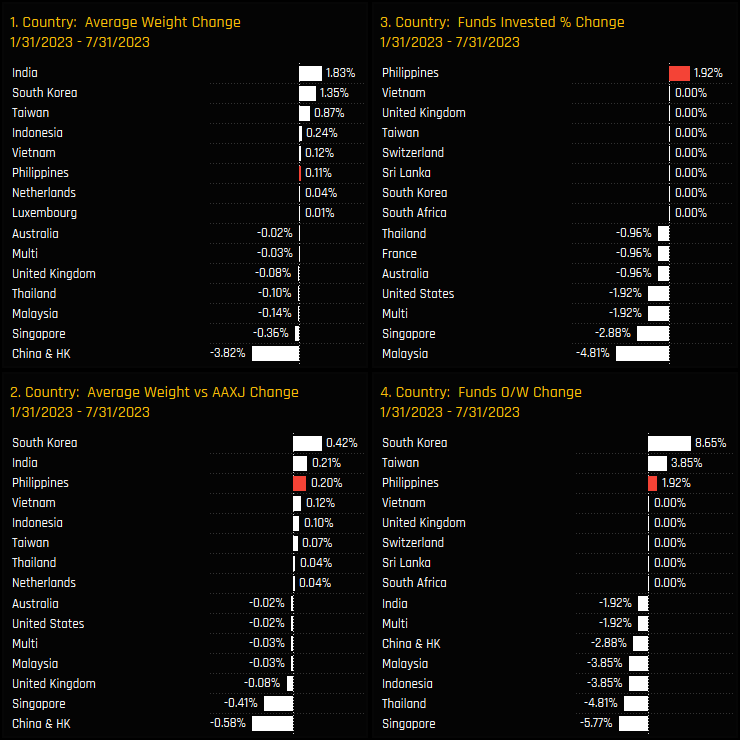

We can see this more clearly in the charts below, which measure changes in Country exposure between 01/31/2023 and 07/31/2023. The Philippines saw +1.92% of funds open new exposure (ch3), +1.92% switch to overweight (ch4), with average weights (ch1) and relative weights (ch2) moving higher in unison. These are not particularly aggressive moves and by no means come close to reversing the declines of the last decade, but they do signify a reversal in sentiment.

Country Positioning & Sentiment

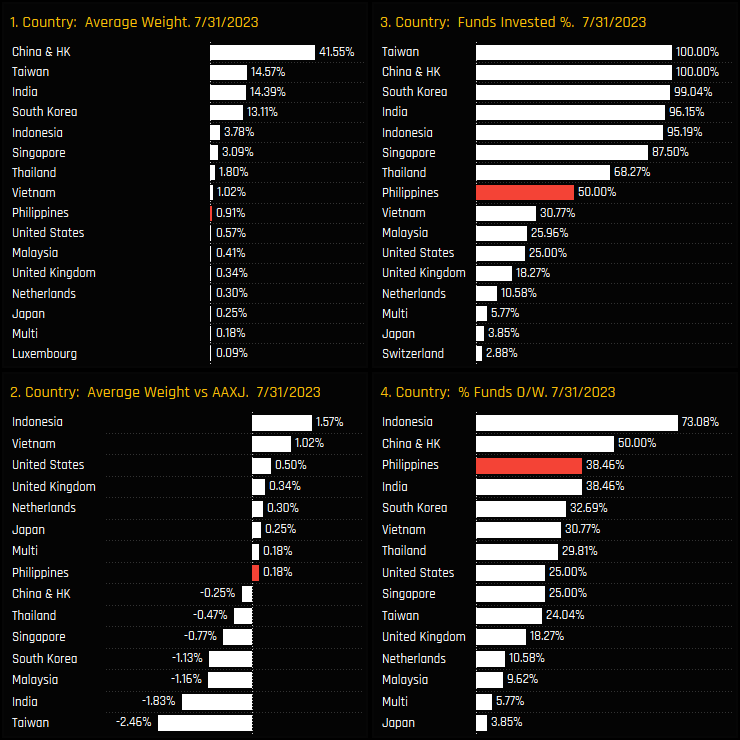

Current levels of positioning in The Philippines place it well down the pecking order of Country exposures in the Asia Ex-Japan region. It is the 8th most widely held country and the 9th largest on an average holding weight basis. The minor overweight of 0.18% should be viewed positively, with only 2 other countries (China and Indonesia) having more funds positioned overweight the benchmark. Most of the funds who have exposure to the Philippines do so with an overweight allocation.

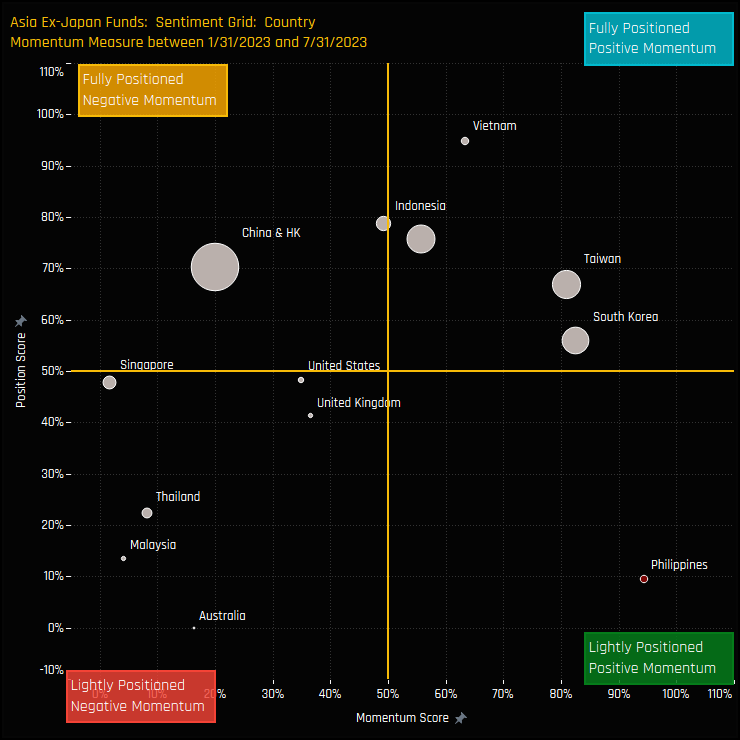

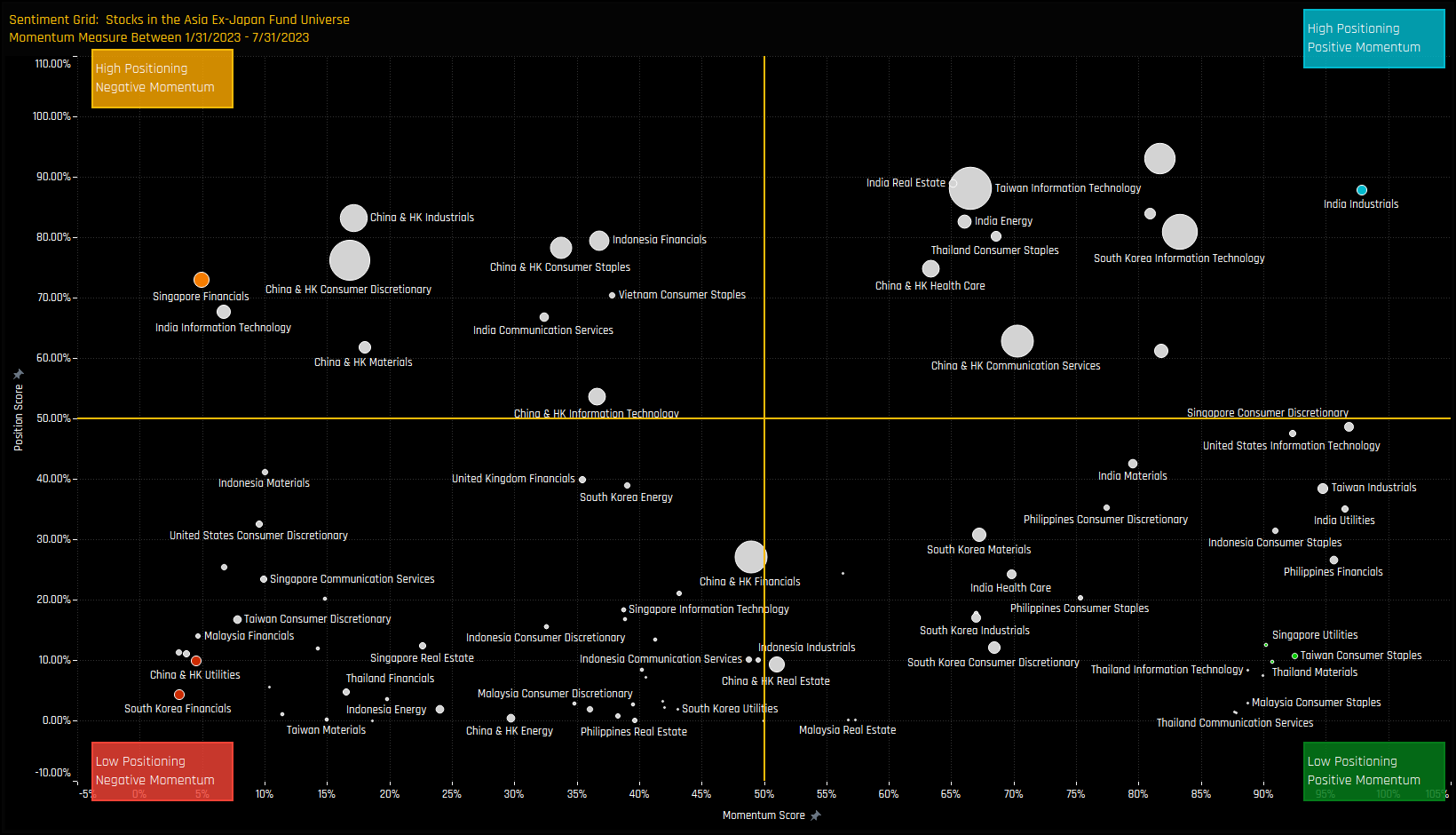

Capturing the relationship between long-term positioning and short term fund activity is the Sentiment Grid below. The Y-axis shows the ‘Position Score’, a measure of current positioning in each country compared to its own history going back to 2011 on a scale of 0-100%. The X-Axis shows the ‘Momentum Score’, a measure of fund manager activity for each country between 1/31/2023 and 07/31/2023 on a scale of 0% (maximum negative activity) to 100% (maximum positive activity). The Philippines position in the bottom right highlights the depressed levels of positioning combined with positive fund rotation.

Stock Positioning & Activity

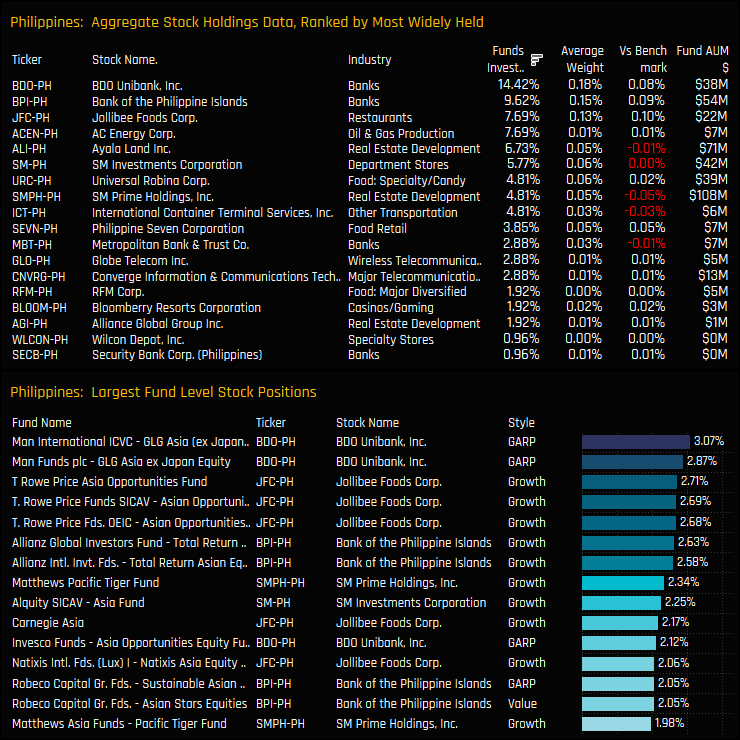

On a stock level, BDO Unibank, Bank of the Philippine Islands and Jollibee Foods Corp are the most widely held and largest holding weights. Combined, these 3 companies account for just over 50% of the total Philippines allocation. They also account for 12 of the largest 15 individual fund level positions, led by Man GLG in BDO Unibank (3.07%) and T Rowe Price in Jollibee Foods Corp (2.71%).

Indeed, the positive rotation in to the Philippines this year has been underpinned by ownership increases in these 3 companies. BDO Unibank led the way with the percentage of funds invested rising by +2.88% between 01/31/2023 and 07/31/2023, followed by Bank of the Philippine Islands (+1.92%) and Jollibee Foods Corp (+0.96%). The larger new positions were in the 1%-2% range and led by Invesco Asia Opportunities’, opening a position of 1.63% in the Bank of the Philippine Islands.

Conclusions & Links

The current set up of Philippines positioning among active Asia Ex-Japan funds is one of the have’s and the have-nots. The chart opposite splits the average holding weight in the Philippines by the 38.5% of funds positioned overweight and the 61.5% who are underweight. Obviously the former will always be greater than the latter, but the chart highlights that the average overweight is increasing and the total average weight is dragged down significantly by funds who are underweight, or who are avoiding Philippines exposure entirely. Not everyone, it seams, is bearish on The Philippines.

All of this points to a definite reason to be more constructive. The downward spiral of reduced allocations and position closure has finally reversed course, albeit in small size for now, whilst current positioning suggests that 38.5% of the funds in our analysis are quite bullish. Perhaps its time for the 50% of funds who are avoiding exposure to reconsider their stance – if that happens, then expect some upward pressure on prices.

Click below for the extended data report on Philippines investor positioning among Asia Ex-Japan funds.

104 Asia Ex-Japan Funds, AUM $66bn

Asia Ex-Japan Funds Country/Sector Radar

Investment levels among the key country/sectors in the investible Asia Ex-Japan universe differ greatly. Some country/sectors are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every country/sector in our Asia analysis. We highlight 7 country/sectors at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

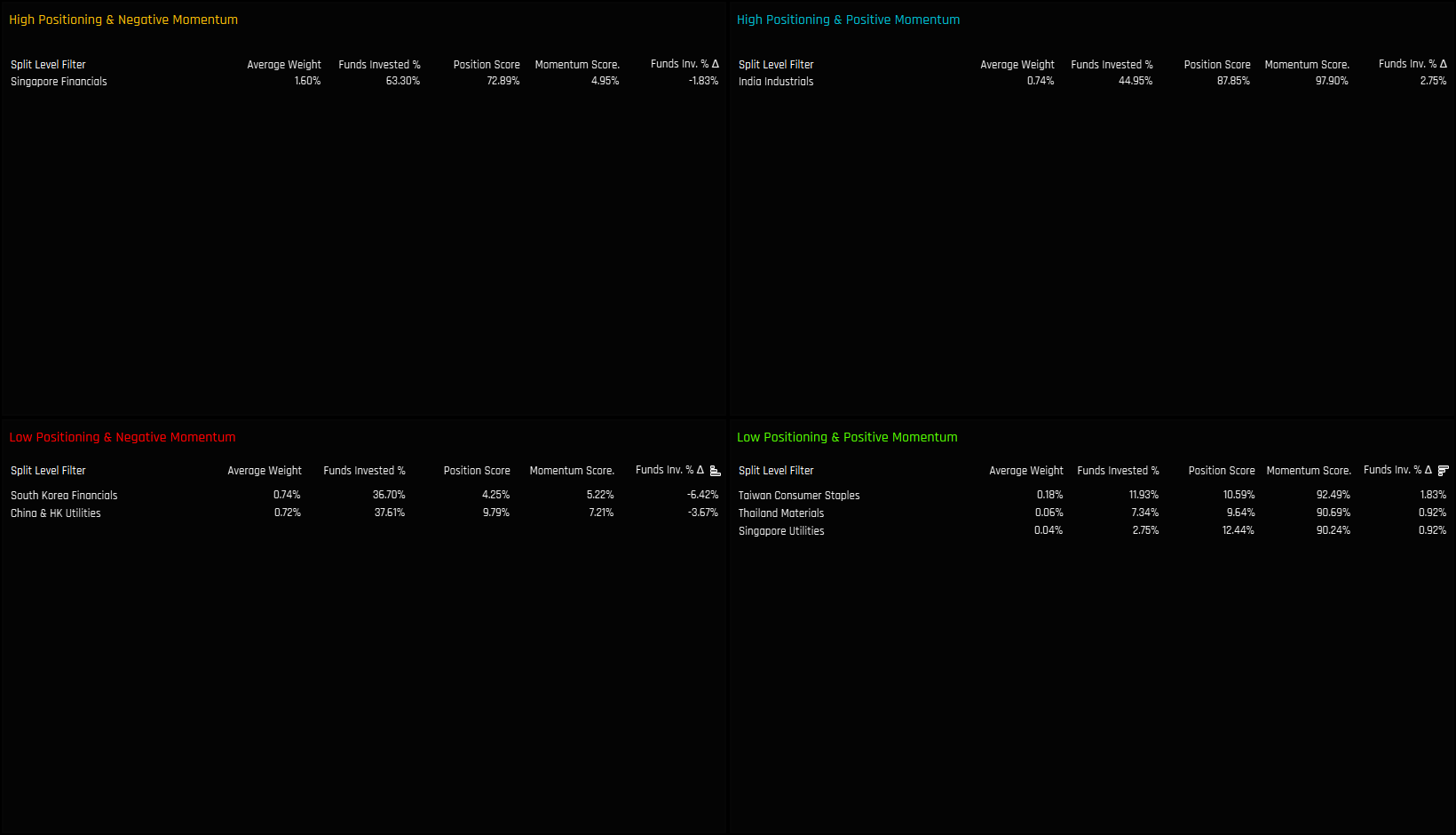

Country/Sector Sentiment

The Sentiment Grid below is designed to visualize the interplay between current fund positioning, long-term fund positioning and shorter-term fund manager activity for all country/sectors in the Asia Ex-Japan fund active universe. The Y-axis shows the ‘Position Score’, a measure of current positioning in each country/sector compared to its own history going back to 2011 on a scale of 0-100%. It takes in to account the percentage of funds invested in each country/sector versus history, the average fund weight versus history and the percentage of funds overweight the benchmark versus history. The higher the number, the more heavily a country/sector is owned by active Asia Ex-Japan managers compared to its own history.

Extreme Country/Sectors

- High Positioning & Negative Momentum: Position Score > 70%. Momentum Score < 5%

- Low Positioning & Negative Momentum: Position Score < 10%. Momentum Score < 10%

- Low Positioning & Positive Momentum: Position Score < 15%. Momentum Score > 90%

- High Positioning & Positive Momentum: Position Score > 85%. Momentum Score > 95%

Extreme Country/Sectors

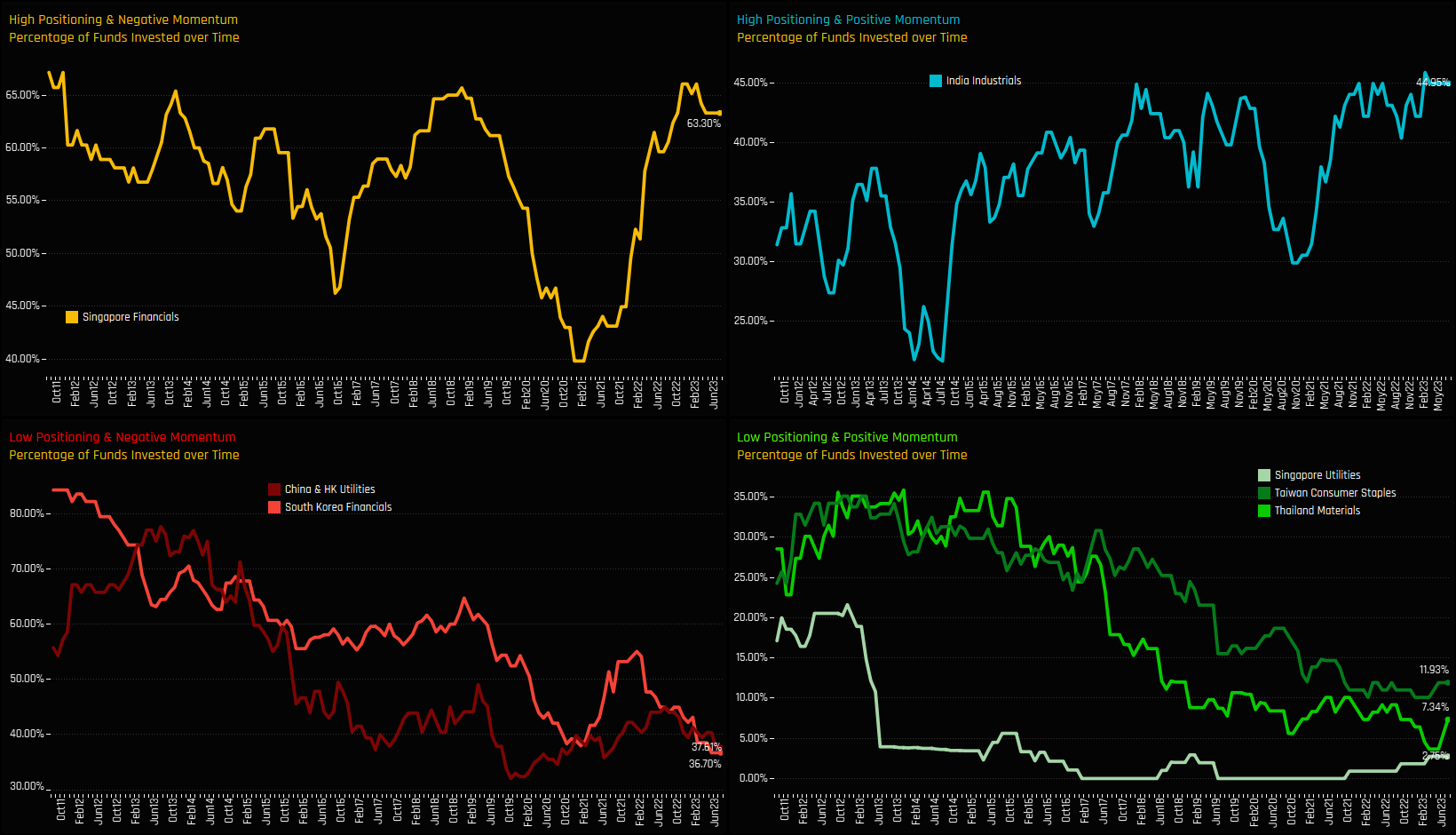

The following charts illustrate the proportion of active funds invested in each of the country/sectors listed above over time. This visualization provides an additional perspective how the Sentiment Grid works. For Singapore Financials in the top left chart, ownership levels have followed a cyclical path, with peaks and troughs occurring every 2-3 years. Perhaps we have reached the peak of the latest cycle. For China & HK Utilities and South Korean Financials (bottom left), ownership levels have been in multi-year declines, with recent selling pushing exposure levels to all-time lows.

For Indian Industrials, ownership levels are bumping up against at all-time highs after sustained increases in exposure among active Asia Ex-Japan managers since 2020 (top right). Finally, for Singapore Utilities, Taiwan Consumer Staples and Thailand Materials, ownership levels are at historical lows but recent activity has been skewed to the buy side – i.e something in the investment case has changed. Please scroll down for more detailed profiles of each country/sector to understand the funds and stocks behind the country/sector positioning extremes.

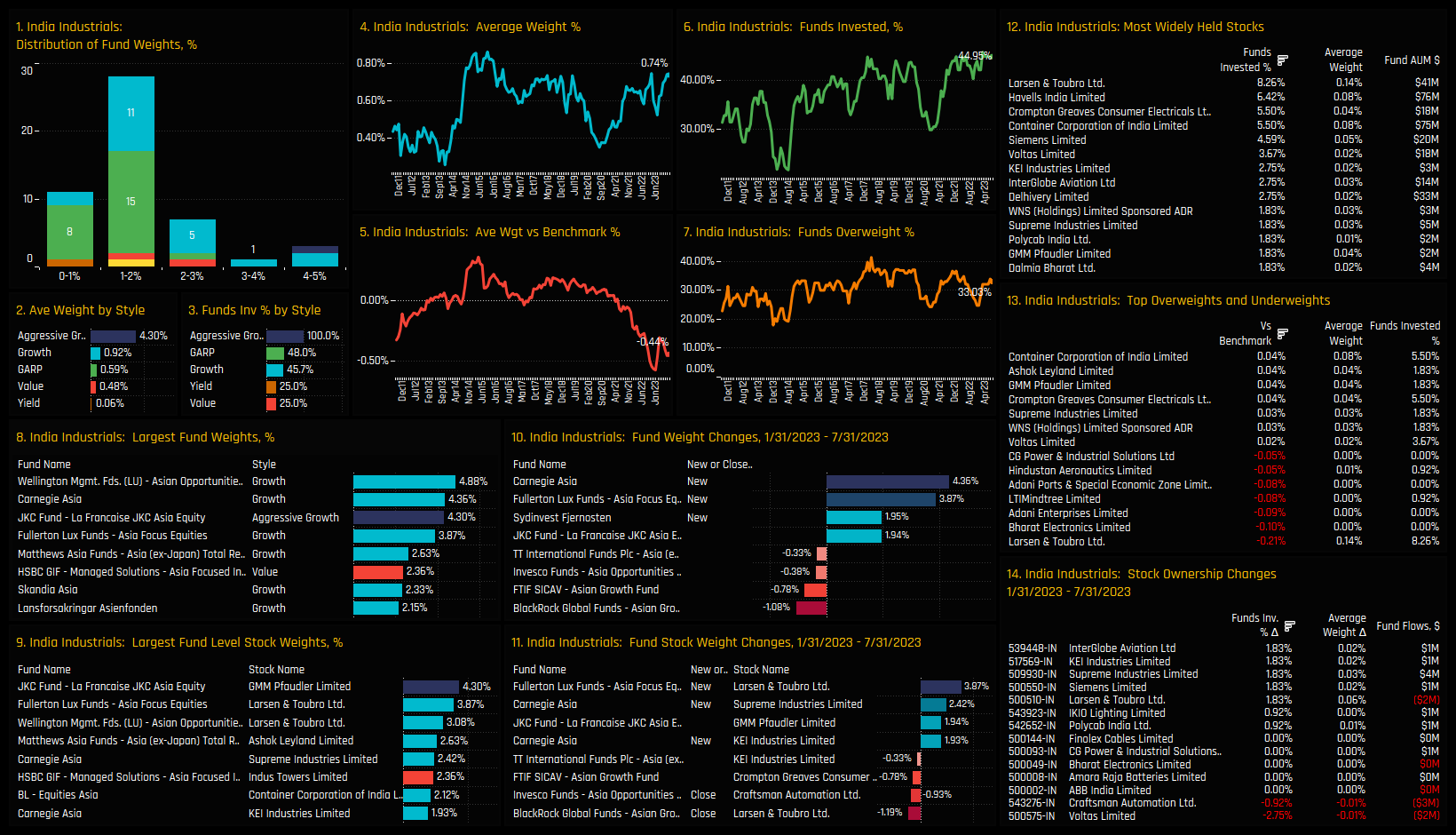

High Positioning & High Momentum: Indian Industrials

- Chart 1. Histogram of fund weights. The bulk of allocations sit below the 3% level, with max allocations between 4-5%.

- Chart 2 & 3. Growth funds are the major allocators, with Value and Yield funds largely absent from the investor base for now.

- Chart 4. The equally weighted average holding weight in Indian Industrials. The current weight of 0.74% is approaching a 5-year high.

- Chart 5. The equally weighted average holding weight minus the iShares MSCI Asia Ex-Japan Weight. Active funds are underweight by -0.44%, on average.

- Chart 6. The percentage of funds invested in Indian Industrials, at all-time highs of 44.95%.

- Chart 7. The percentage of funds overweight the Indian Industrials sector.

- Chart 8. The largest holders in Indian Industrials, with Wellington, Carnegie and JKC the key allocators.

- Chart 9. The largest fund level stock holdings in the Indian Industrials sector, led by JKC’s 4.3% position in GMM Pfaudler Ltd.

- Chart 10. The largest weight changes in Indian Industrials between 01/31/2023 – 07/31/2023. Carnegie’s opening position of 4.36% is the standout move.

- Chart 11. The largest individual fund level stock weight changes over the same period. Fullerton’s 3.87% opening position in Larsen & Toubro was the largest opening position.

- Chart 12. Aggregated Stock Holdings, ranked by the most widely held stocks in the sector. Larsen & Toubro is the most widely held, owned by 8.26% of Asia Ex-Japan fund managers.

- Chart 13. The top overweight and underweight stock holdings in the sector. Overweights led by Container Corp of India, underweights by Larsen & Toubro.

- Chart 14. The largest aggregate changes in stock ownership. Indian Industrials surge driven by increases in InterGlobe Aviation, KEI Industries and Supreme Industries.

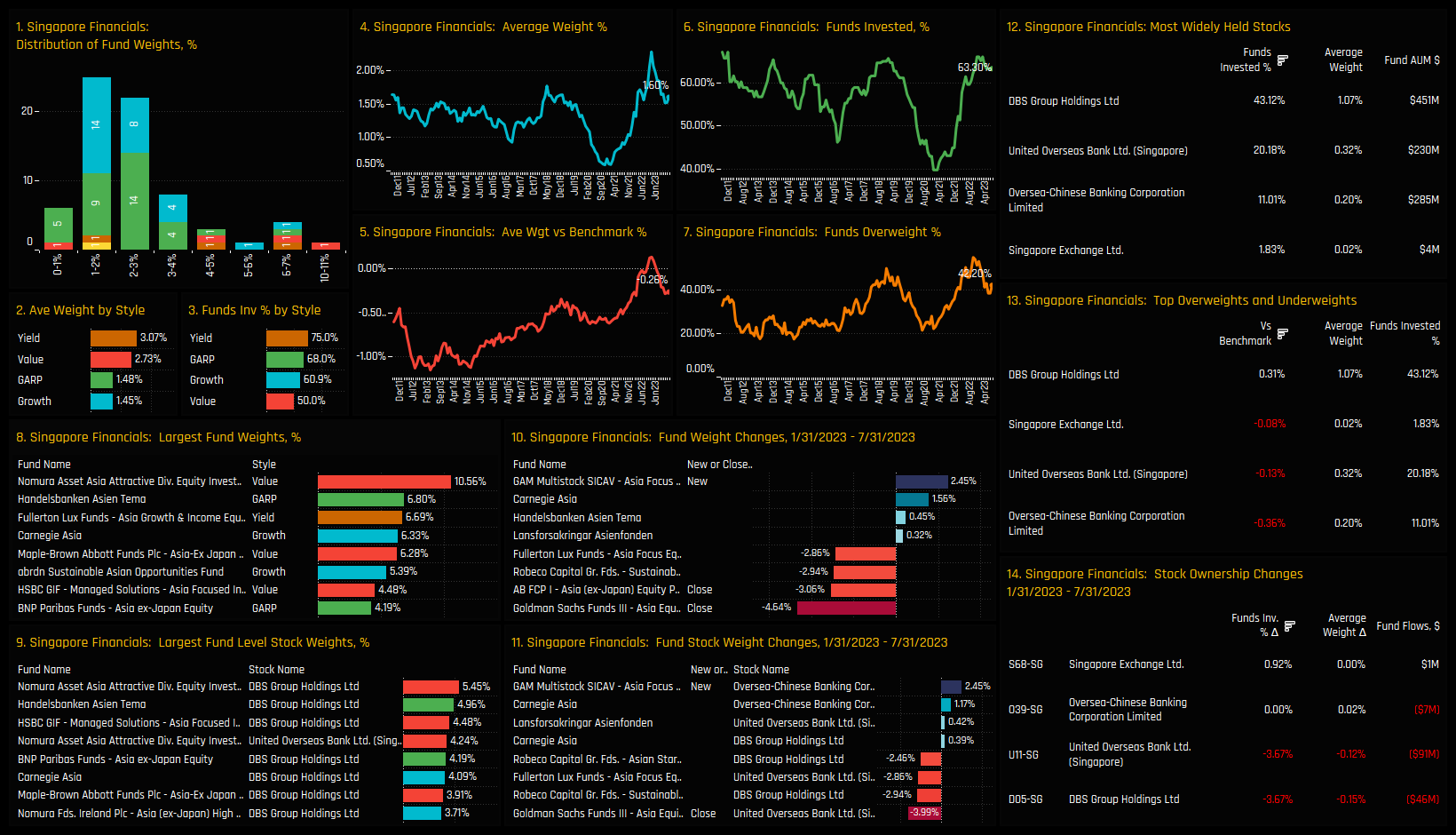

High Positioning & Low Momentum: Singapore Financials

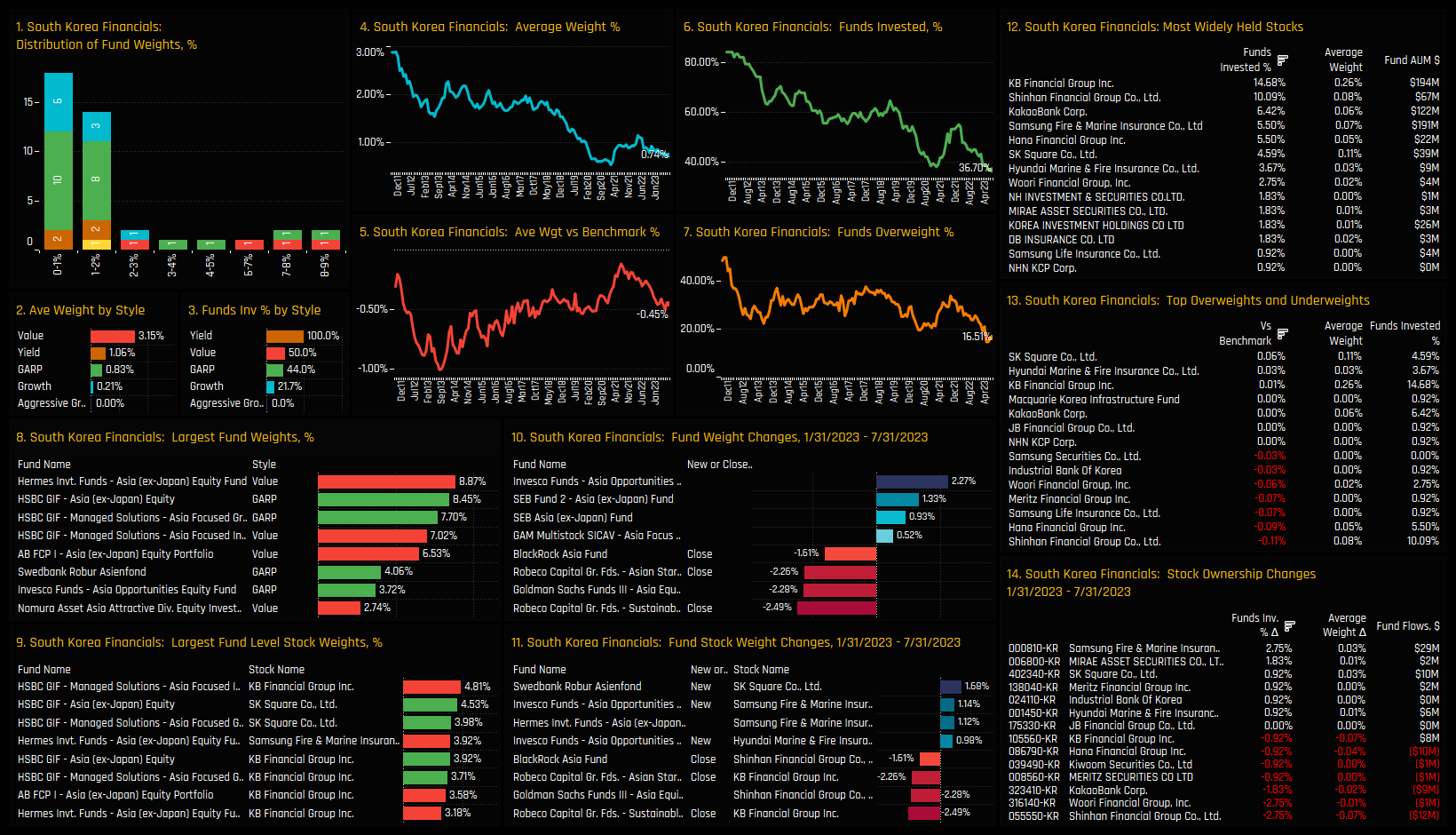

Low Positioning & Low Momentum: South Korean Financials

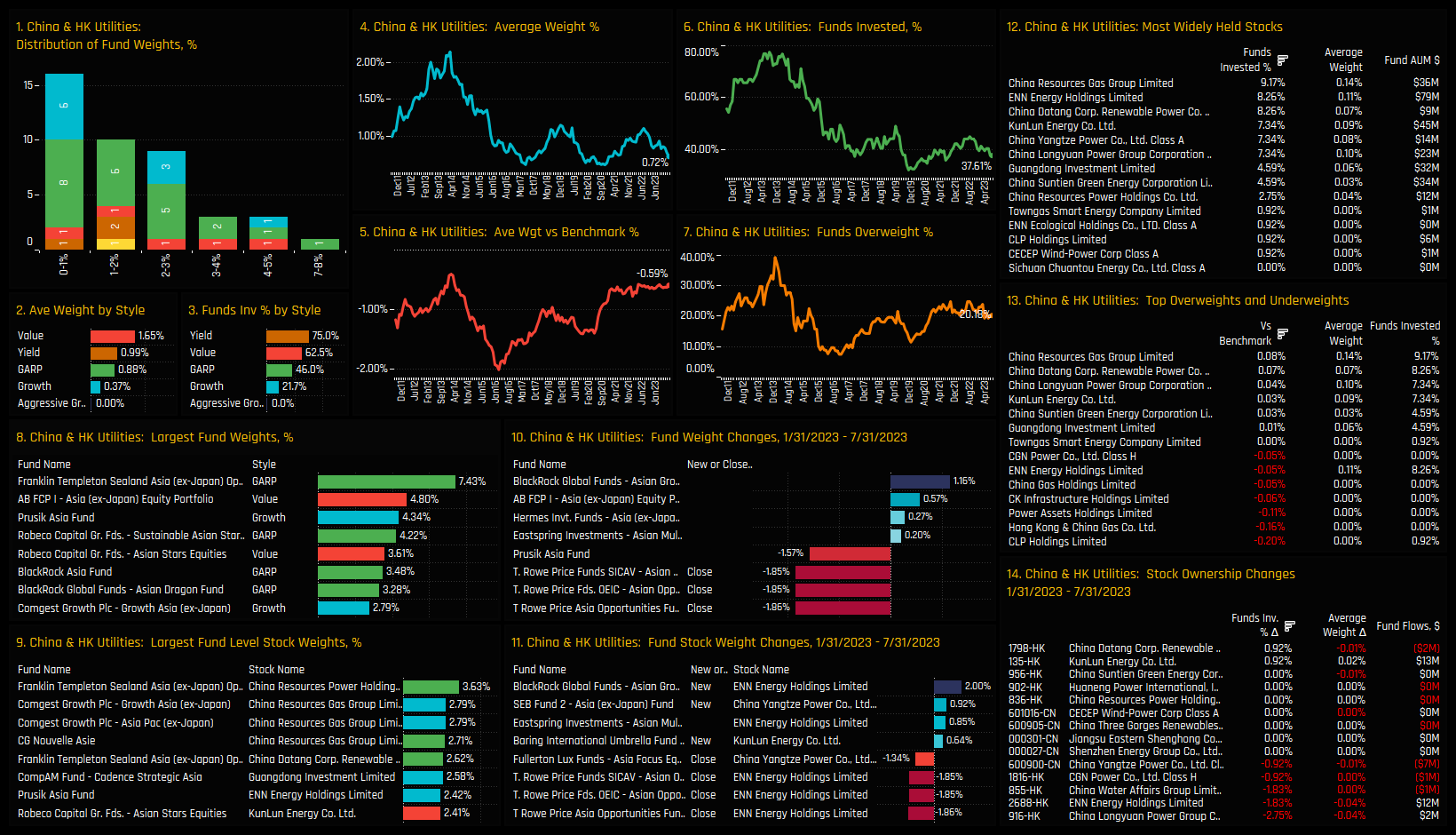

Low Positioning & Low Momentum: China & HK Utilities

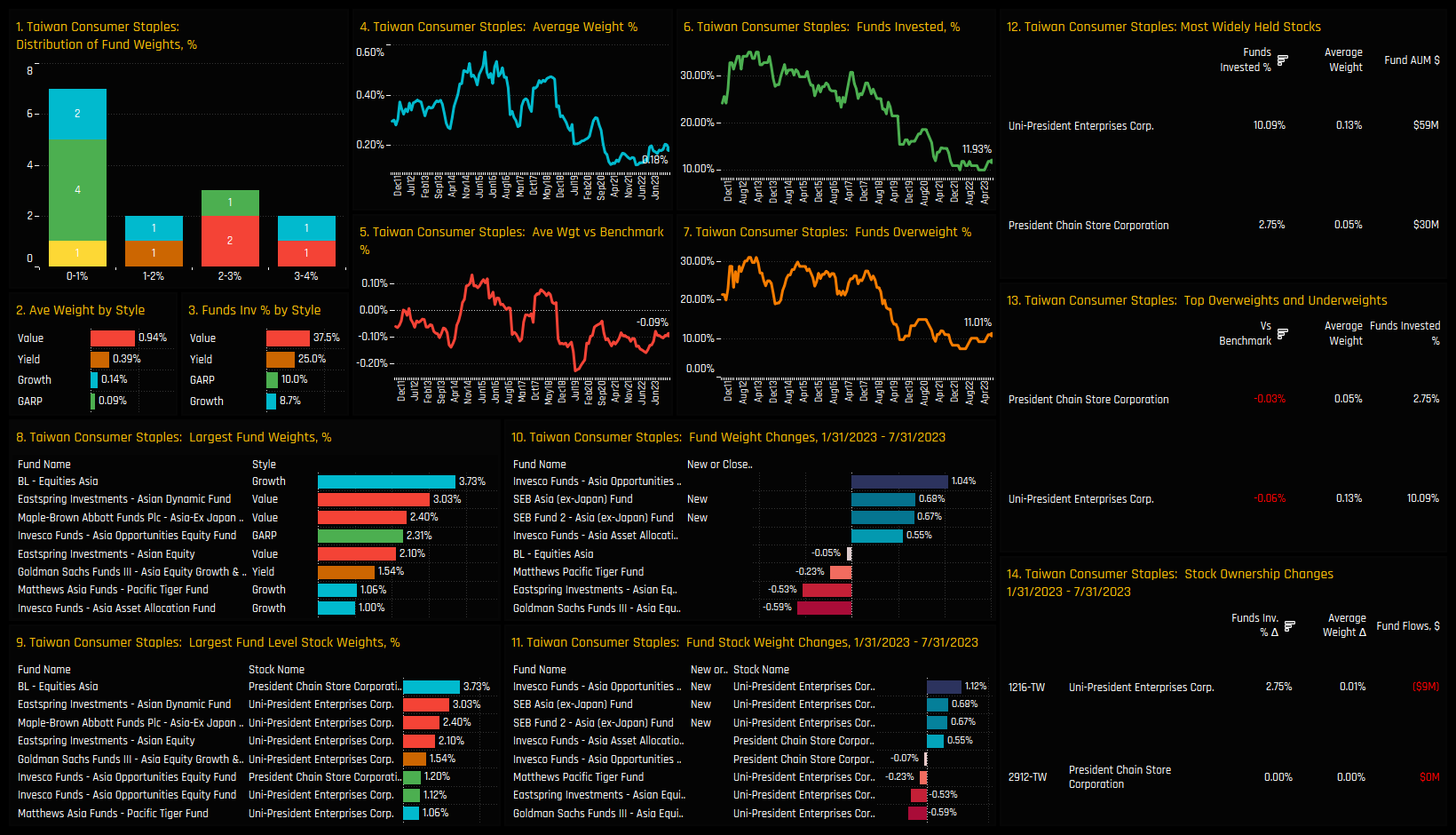

Low Positioning & High Momentum: Taiwan Consumer Staples

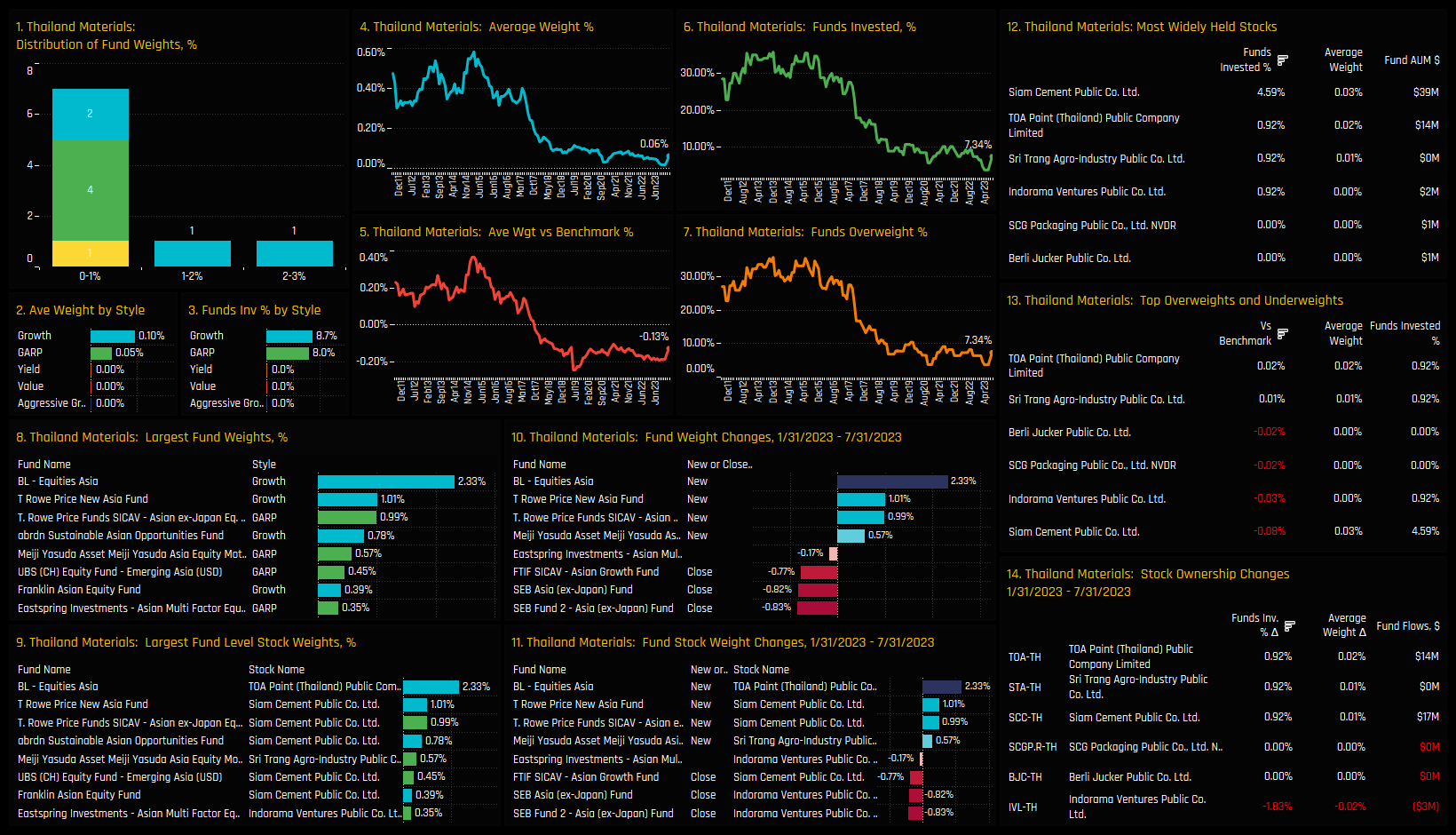

Low Positioning & High Momentum: Thailand Materials

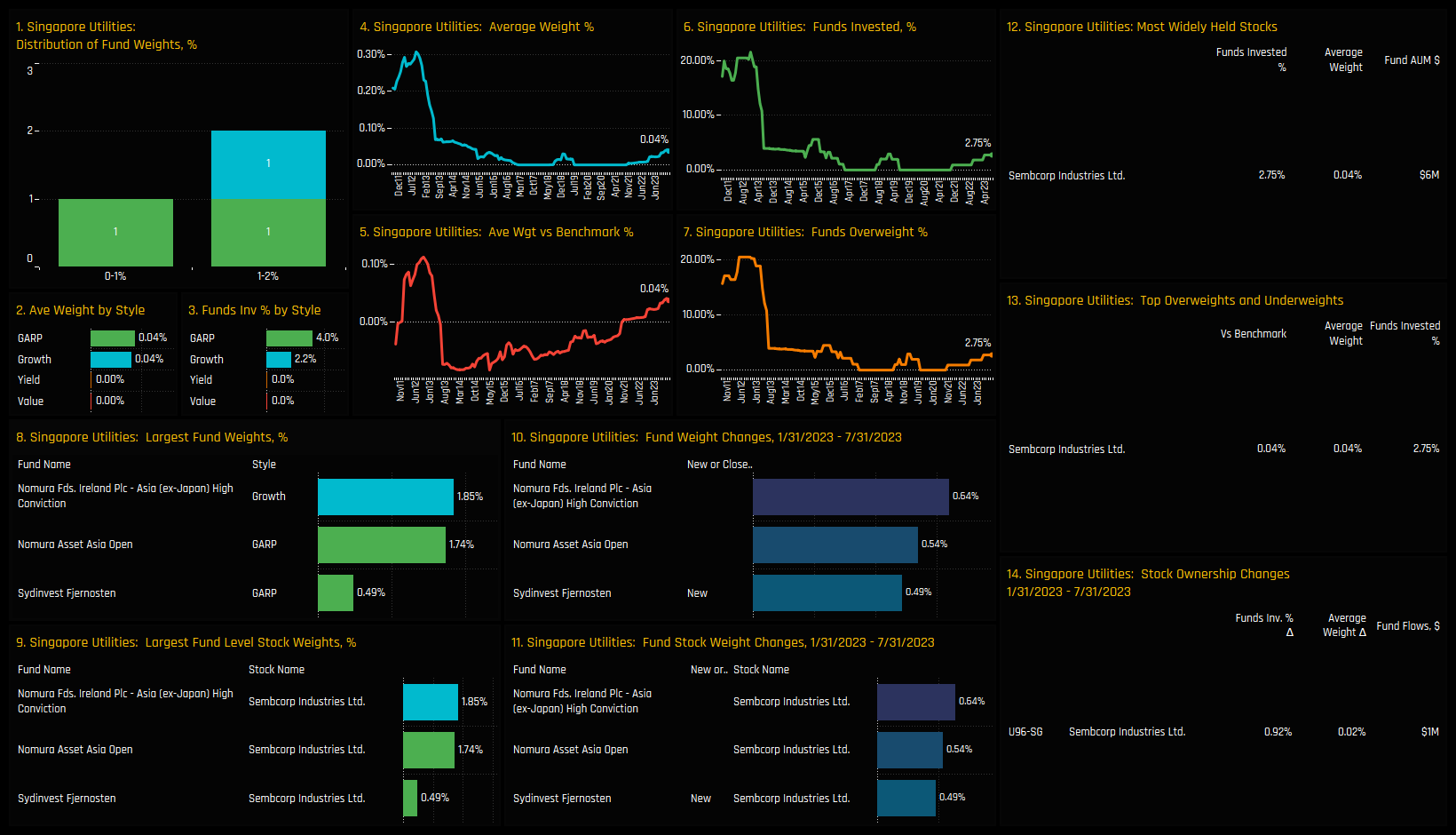

Low Positioning & High Momentum: Singapore Utilities

104 Asia Ex-Japan Funds, AUM $66bn

China & HK. Six Stocks Hit Peak Ownership

We like to screen for stocks at the extreme ends of their ownership range. It highlights to us a particular state of conviction, whether positive or negative among the stocks in our Asia analysis. On this score, a select group of China & HK companies have caught our eye this month.

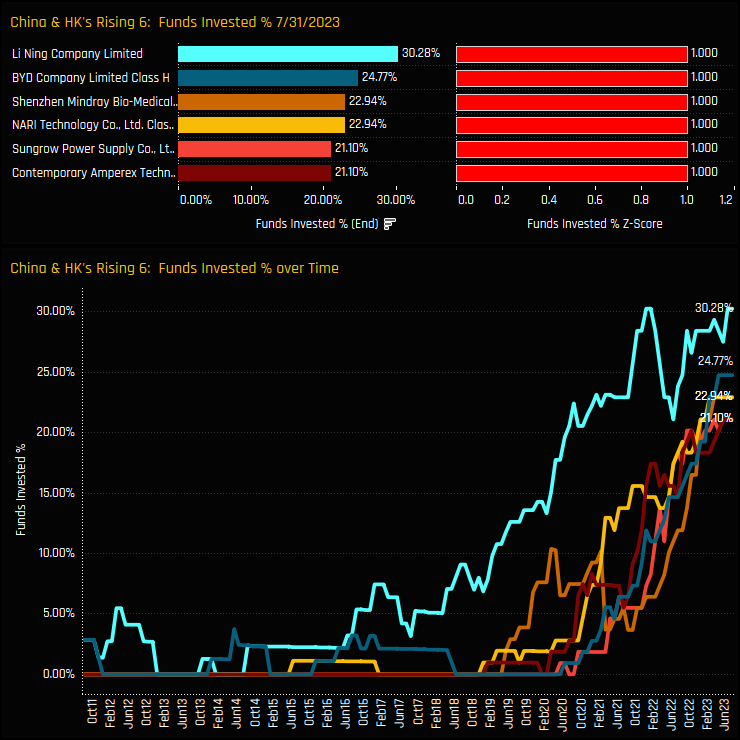

China & HK's Rising Six

The 6 stocks listed in the top chart below are all at record levels of ownership among the active Asia Ex-Japan funds in our analysis. The top chart below shows the percentage of Asia Ex-Japan funds invested in each stock together with the Z-Score of that level versus history going back to 2011. The bottom chart shows the evolution of the percentage of funds invested over time for each stock. All are at peak levels of ownership, and all but Li Ning Company have seen rapid investment growth over the past 3-years.

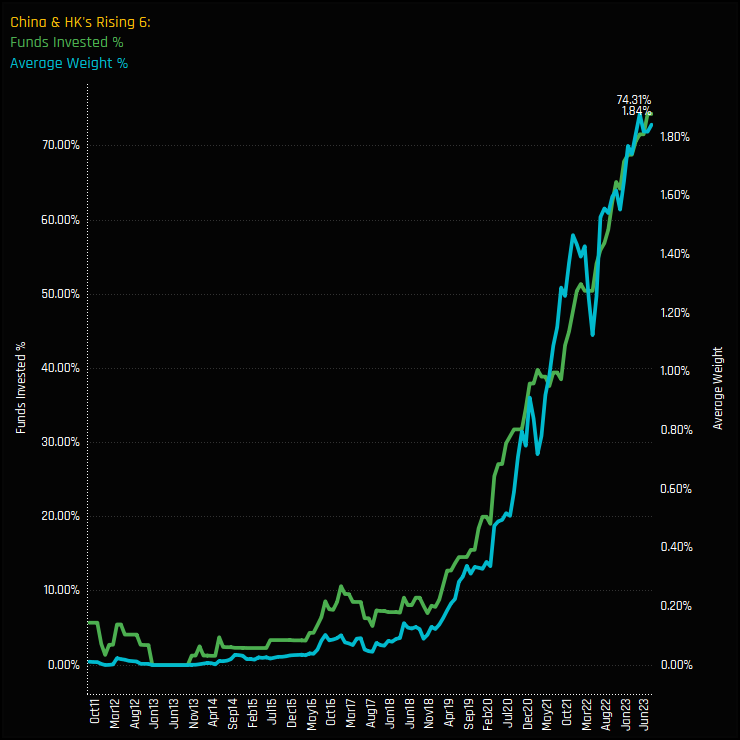

The charts below show how in combination, these 6 stocks have gained in significance within Asia Ex-Japan portfolios in recent years. The combined average weight has spiked higher to 1.84%, with 74.3% of funds holding at least 1 of the 6 companies listed. To provide the granular detail behind these moves, scroll down for profiles of the 6 companies listed, which show the key holders, the funds opening new positions and the major fund flows over the last 6-months.

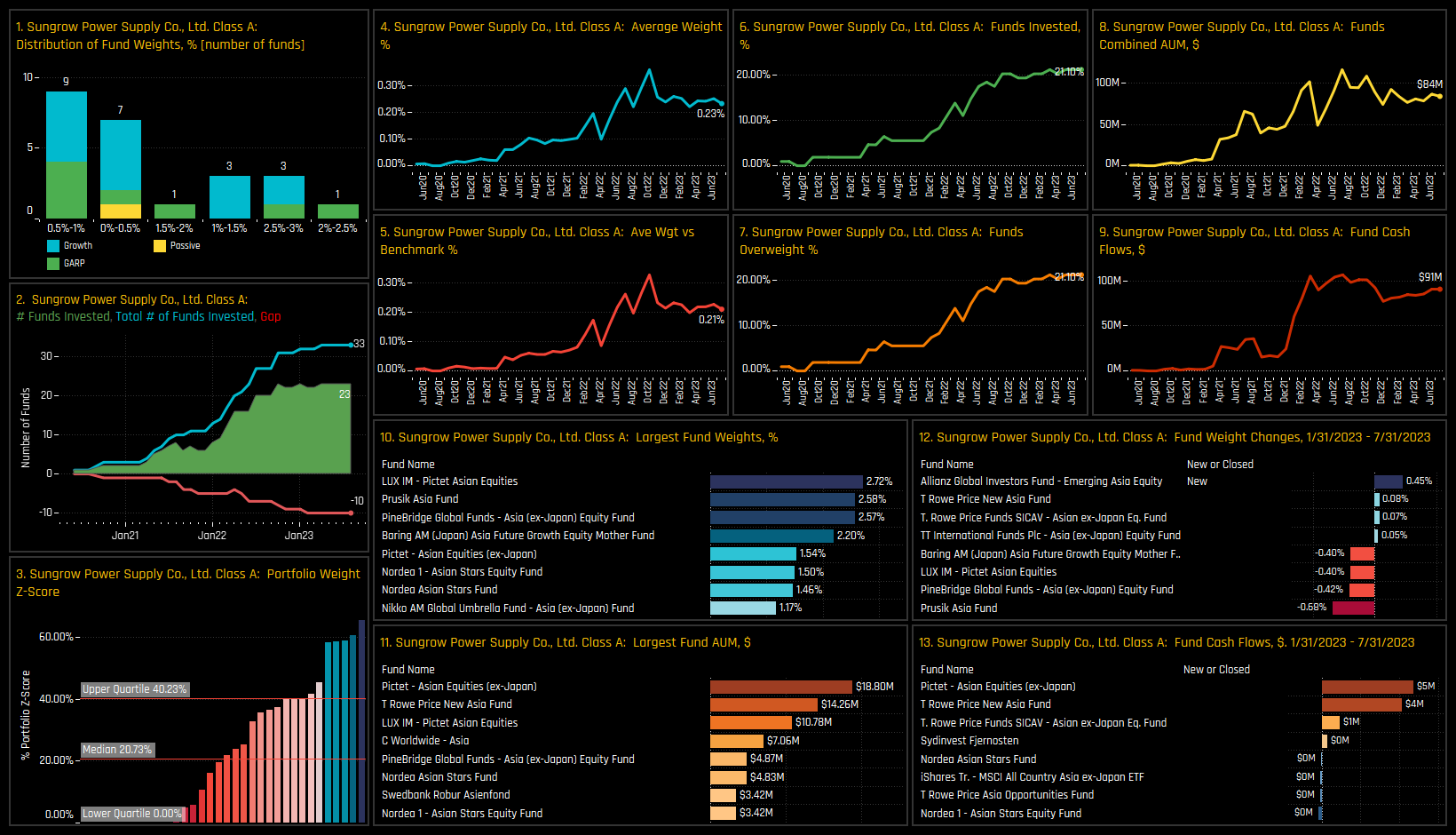

Stock Profile: Sungrow Power Supply

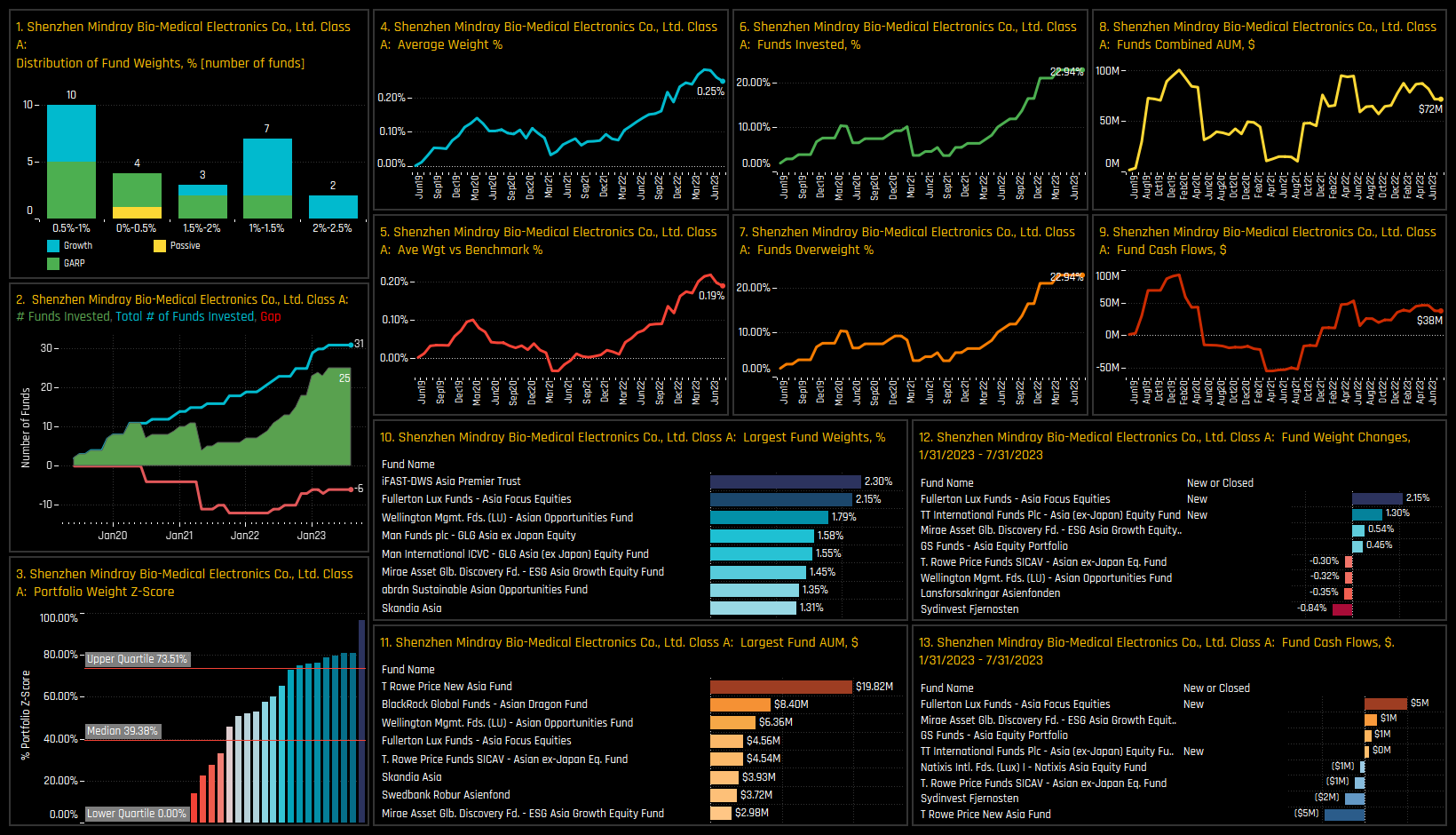

Stock Profile: Shenzhen Mindray Bio-Medical Electronics

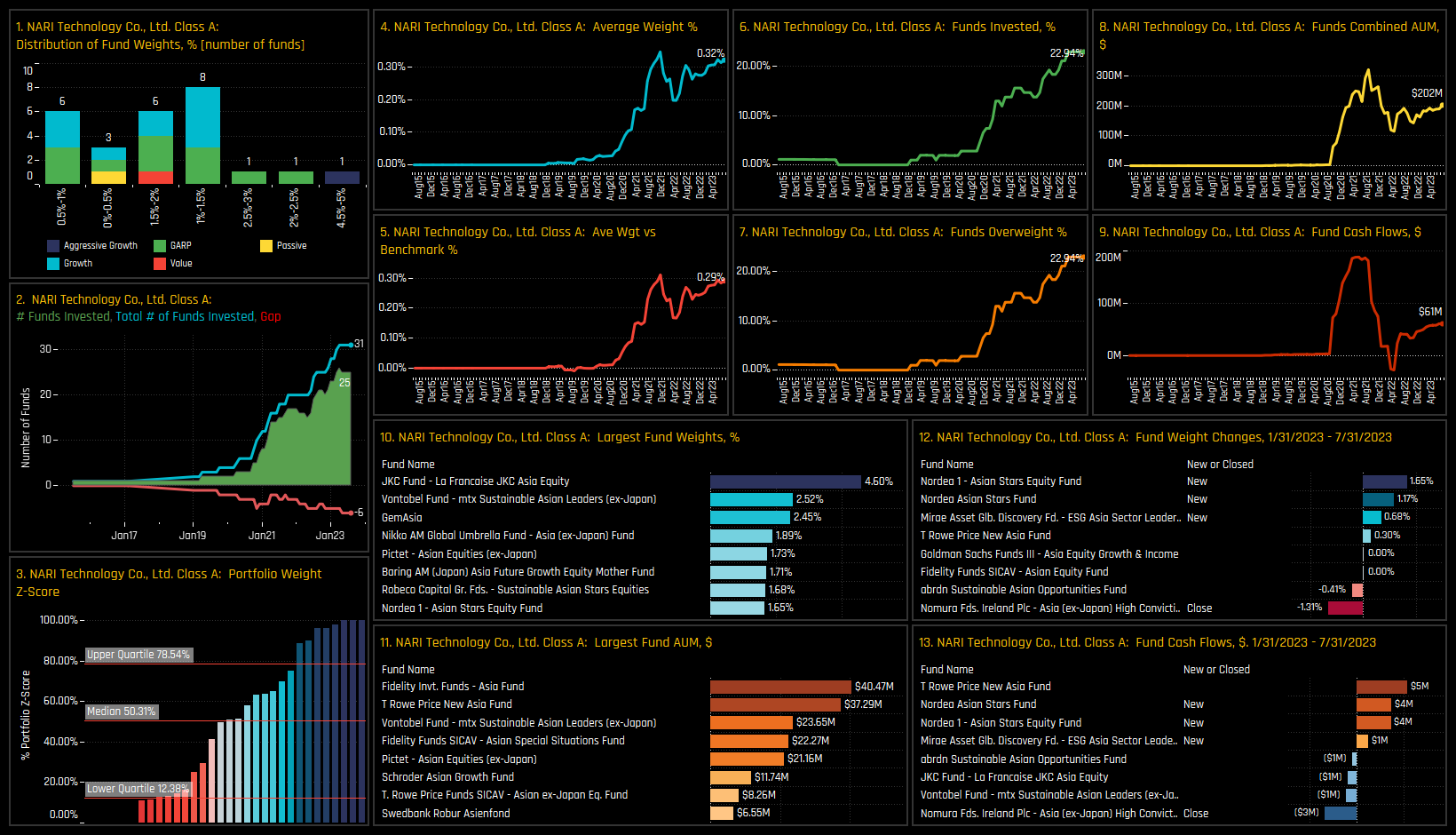

Stock Profile: NARI Technology

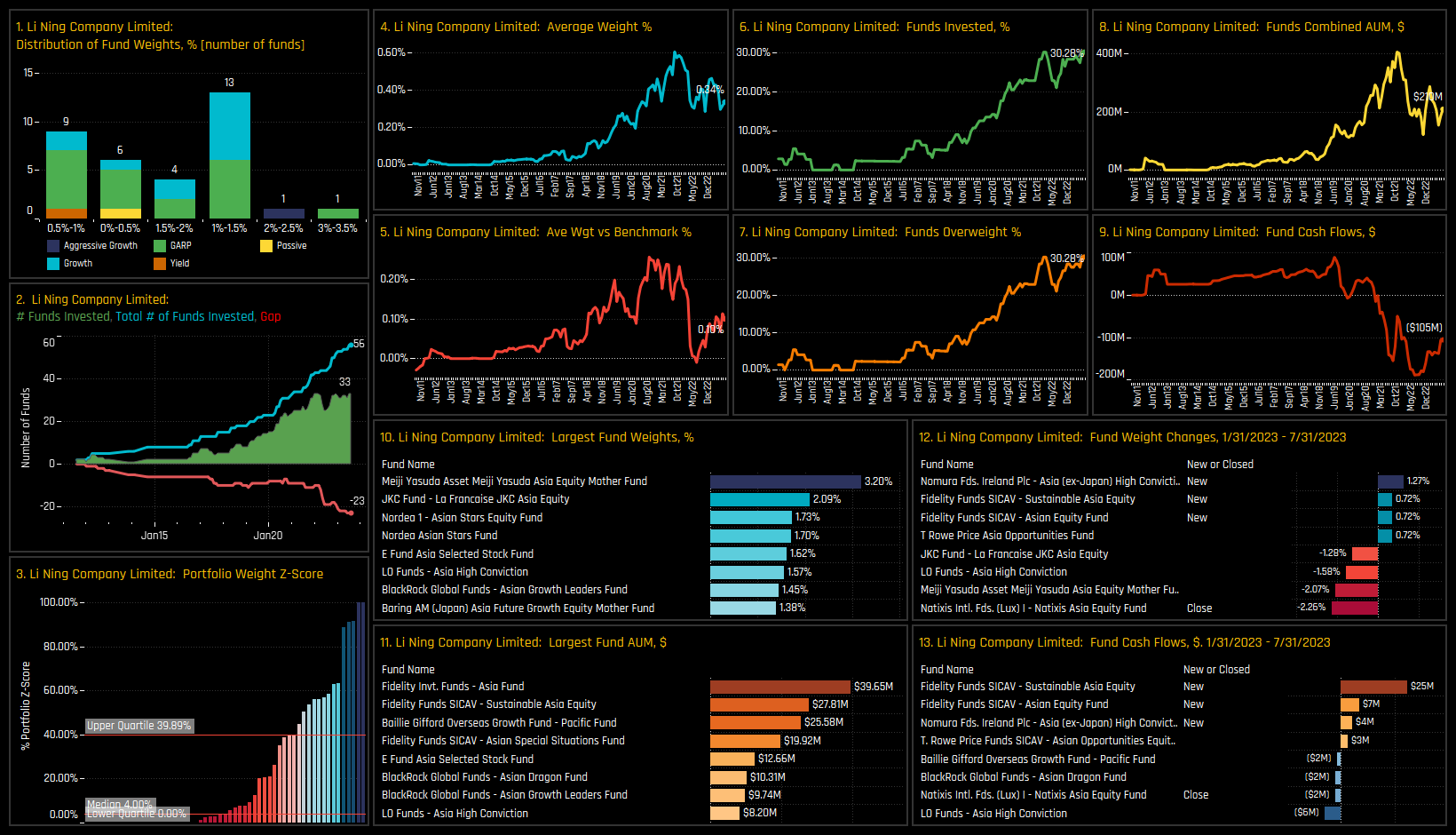

Stock Profile: Li Ning Company

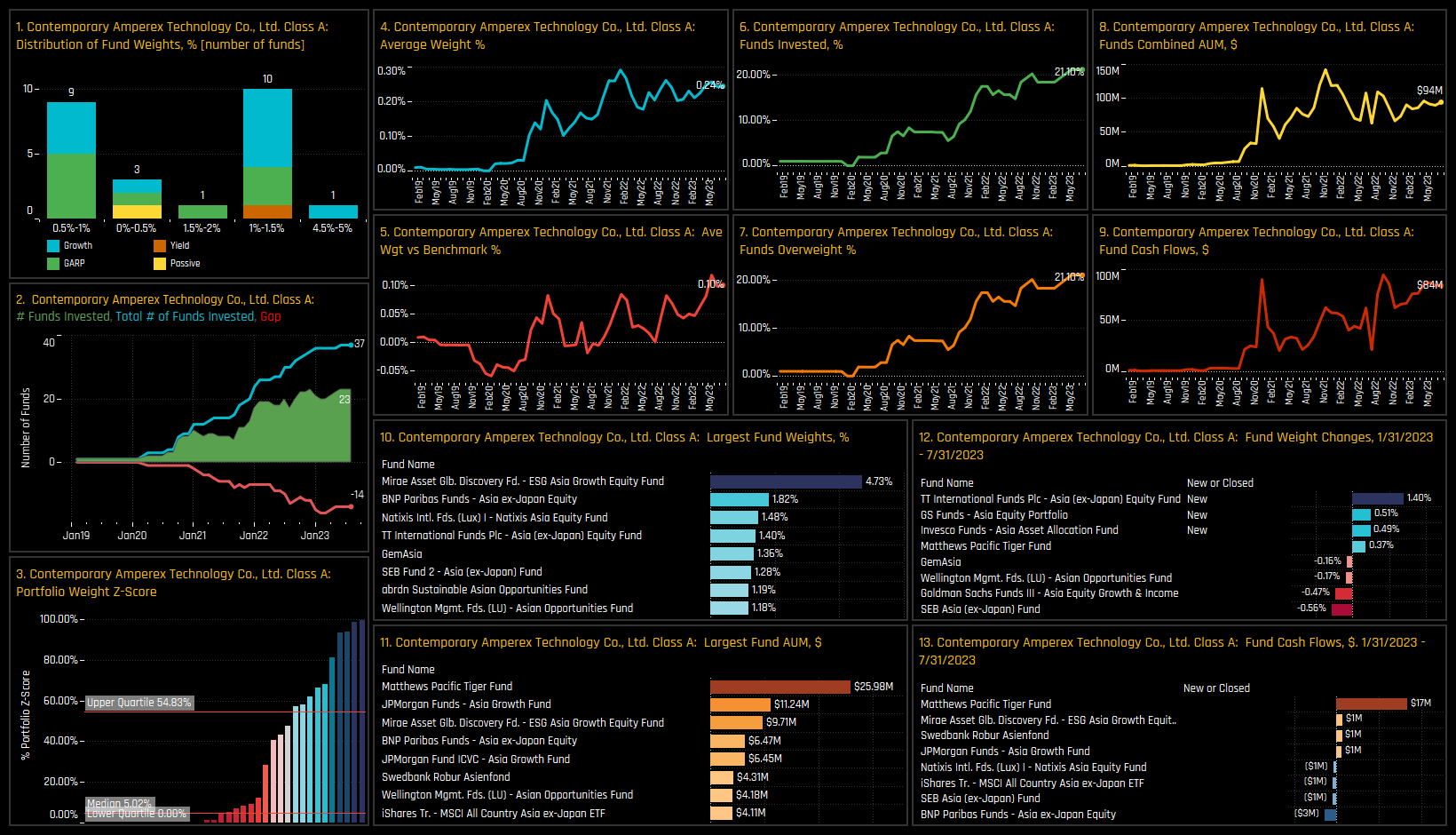

Stock Profile: Contemporary Amperex Technology

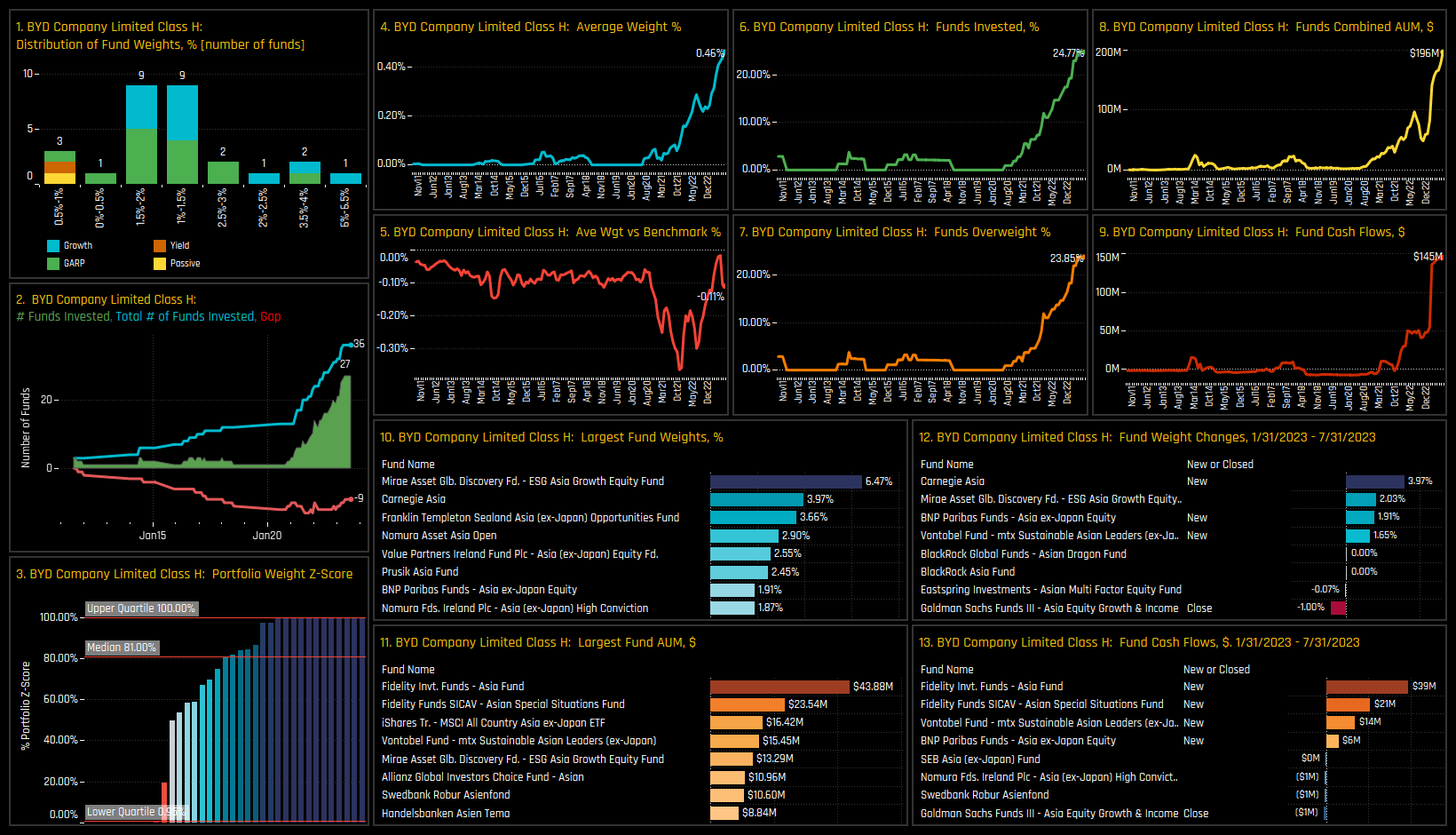

Stock Profile: BYD Company Limited

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- September 26, 2024

Positioning Insights, September 2024

98 Active Asia Ex-Japan funds, AUM $51bn Active Asia Ex-Japan Funds: Positioning Insights, Sept ..

- Steve Holden

- January 17, 2025

Asia Ex-Japan: Performance & Attribution, 2024

98 Asia Ex-Japan active equity funds, AUM $55bn Asia Ex-Japan Funds: Performance & Attribu ..

- Steve Holden

- September 28, 2023

Asia Ex-Japan Fund Positioning Analysis, September 2023

103 Asia Ex-Japan Funds, AUM $61.4bn Asia Ex-Japan Fund Positioning Analysis, September 2023 In ..