Asia Ex-Japan Active Fund Performance & Attribution Review, 2023

- Steve Holden

- 0 Comments

100 Asia Ex-Japan Funds, AUM $55bn

Asia Ex-Japan Active Fund Performance & Attribution Review, 2023

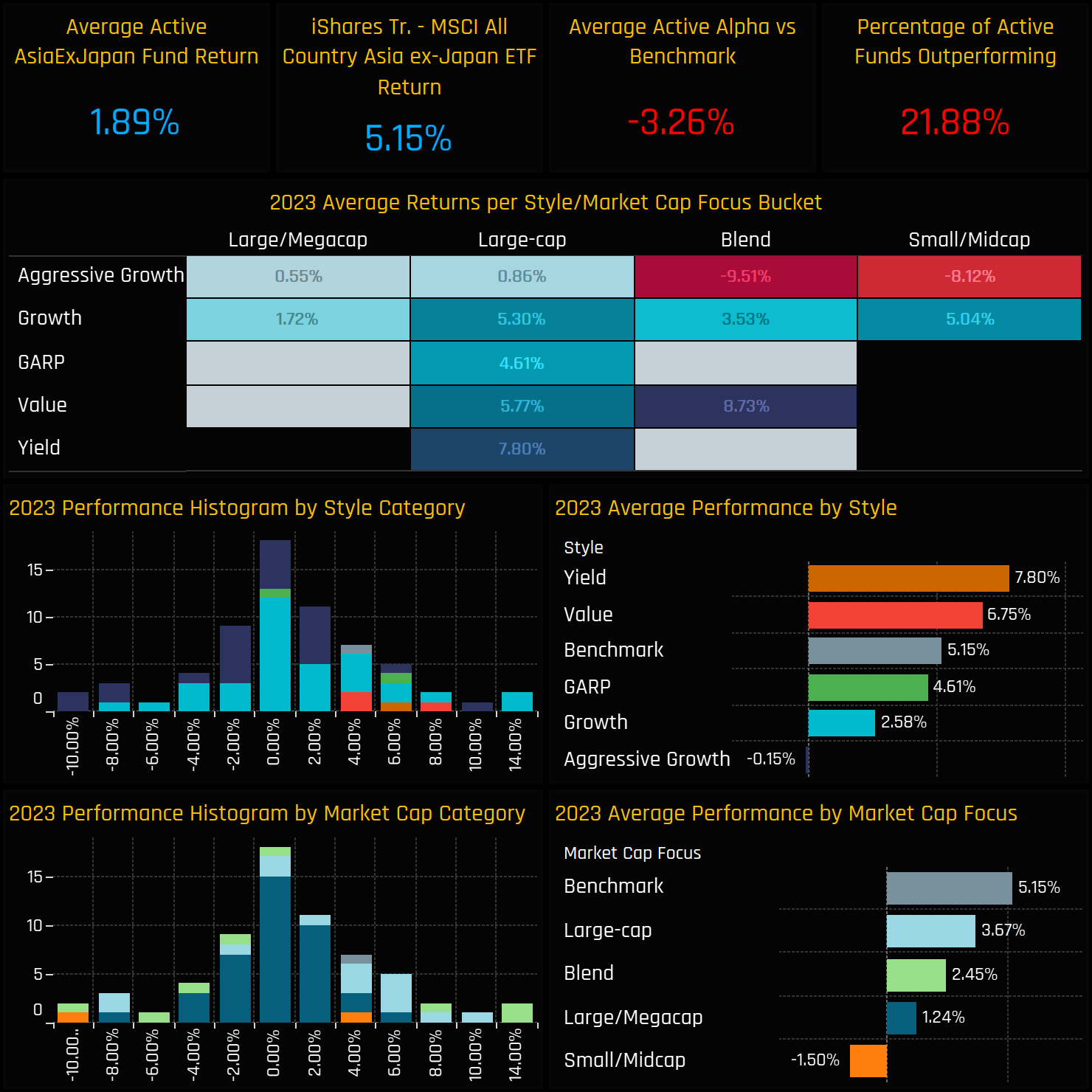

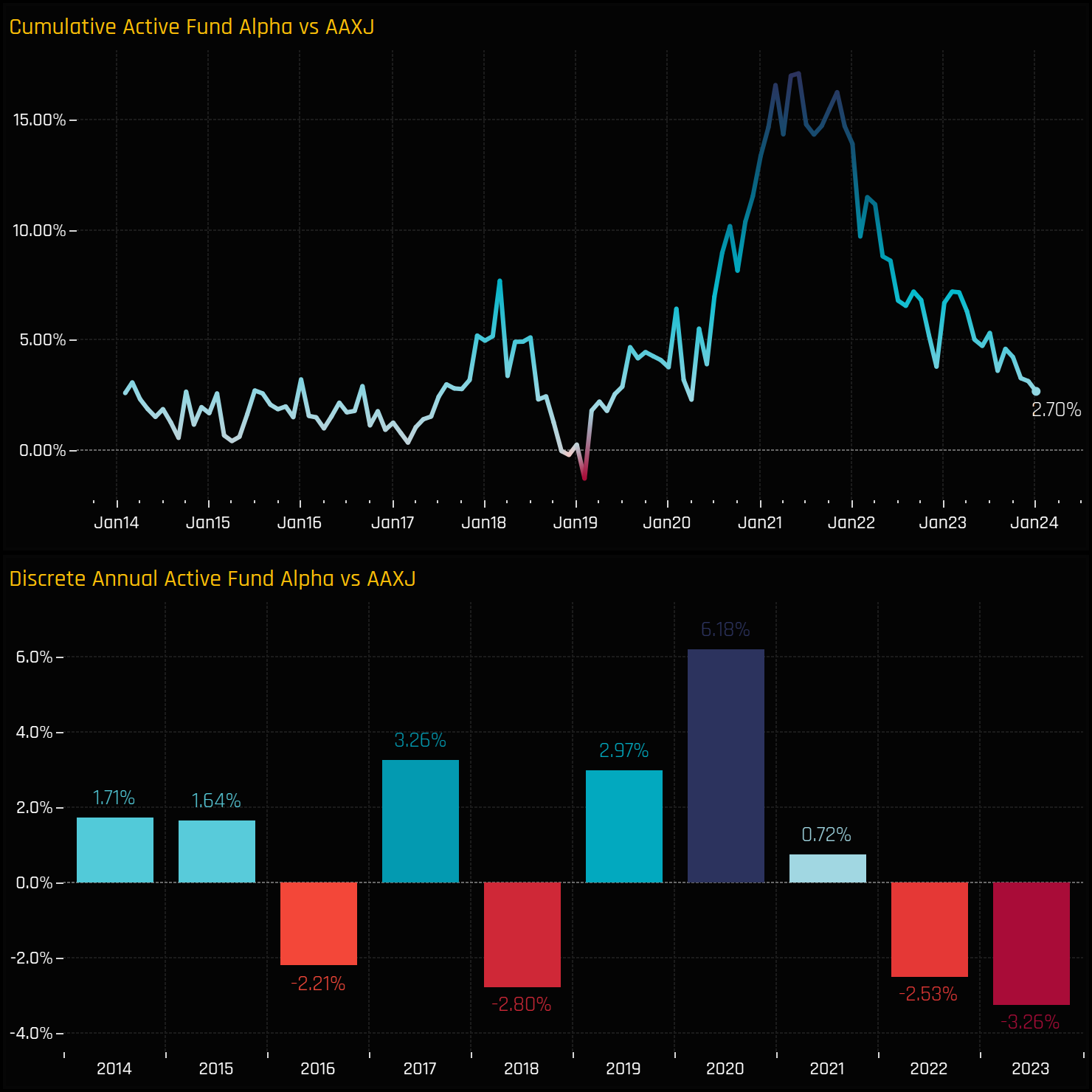

Active Asia Ex-Japan funds struggled in 2023, with only 21.9% outperforming and an average underperformance of 3.26% against the tradable benchmark.

Returns driven lower by poor performance from Aggressive Growth funds, whilst Value and Yield funds fared better.

Poor stock selection in China & HK was a key driver, far outweighing profitable Technology overweights over the course of the year.

2023 Fund Performance

Active Asia Ex-Japan funds faced a tough year in 2023, with the average fund return of 1.89% lagging behind the benchmark iShares Asia Ex-Japan ETF by 3.26%. Only 21.88% of the funds managed to outperform the benchmark. In terms of investment style, Value and Yield funds were the bright spots in a challenging environment, delivering returns of 6.75% and 7.8% respectively, and the only groups to outperform the benchmark. Aggressive Growth funds struggled significantly, failing to maintain positive territory with returns just below zero for the year.

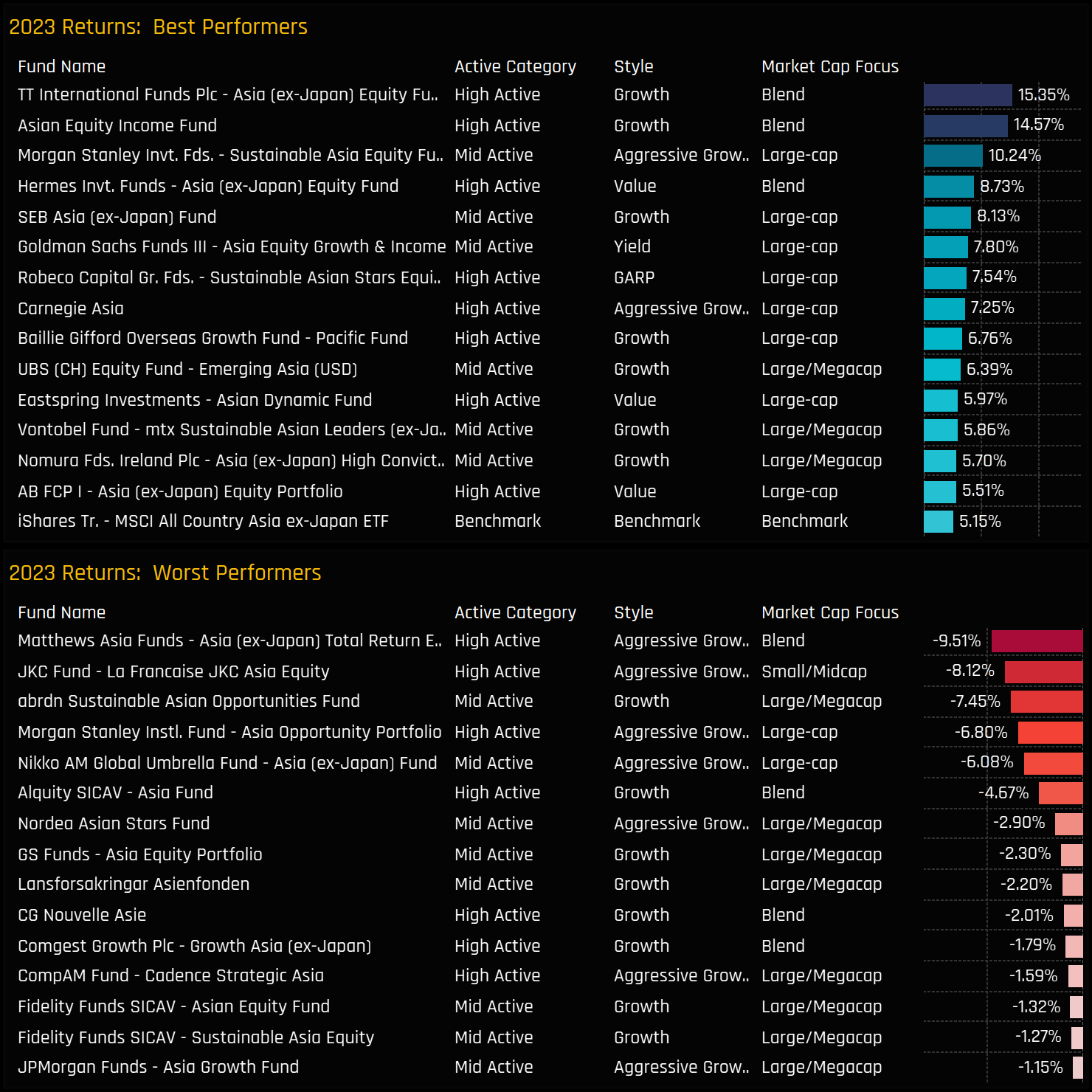

On an individual fund level, only 3 funds achieved 10%+ returns, with the outperformers led by the TT International Asia ex-Japan Equity Fund with 15.35% returns, followed by the Asian Equity Income Fund at 14.57%. The Morgan Stanley Sustainable Asia Equity Fund also performed well, yielding 10.24%. The bottom end consists of a number of Aggressive Growth strategies including Matthews Asia Ex-Japan Total Return (-9.5%) and JKC Asia Equity (-8.12%).

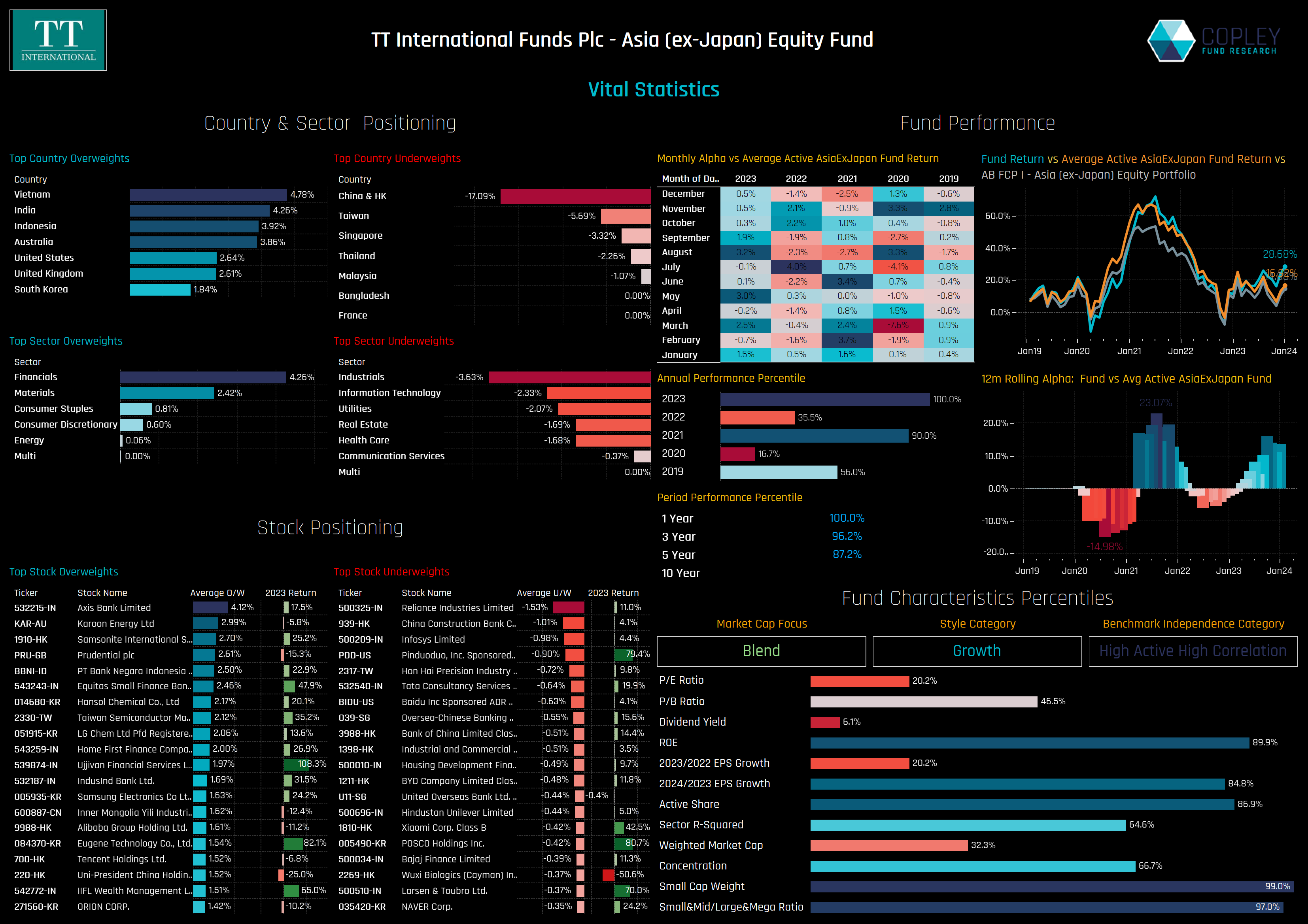

TT International Asia (Ex-Japan) Equity Fund

TT International’s Asia Ex-Japan fund this year was characterised by a significant underweight in China & HK, helping to fund overweights in Vietnam, India and Indonesian stocks. Throughout the year, the fund consistently maintained one of the lowest exposures to China & HK across the 100 active funds in our analysis. The ‘Blend’ classification of the fund reflects its balanced composition of large and small/midcap stocks, with a small-cap stock percentage surpassed by only one other fund. Notably, its success was bolstered by strong returns from unique Indian holdings like Equitas Small Finance Bank, Ujjivan Financial Services, and IIFL Wealth Management, which set it apart from its peers.

Active vs Passive in Asia Ex-Japan

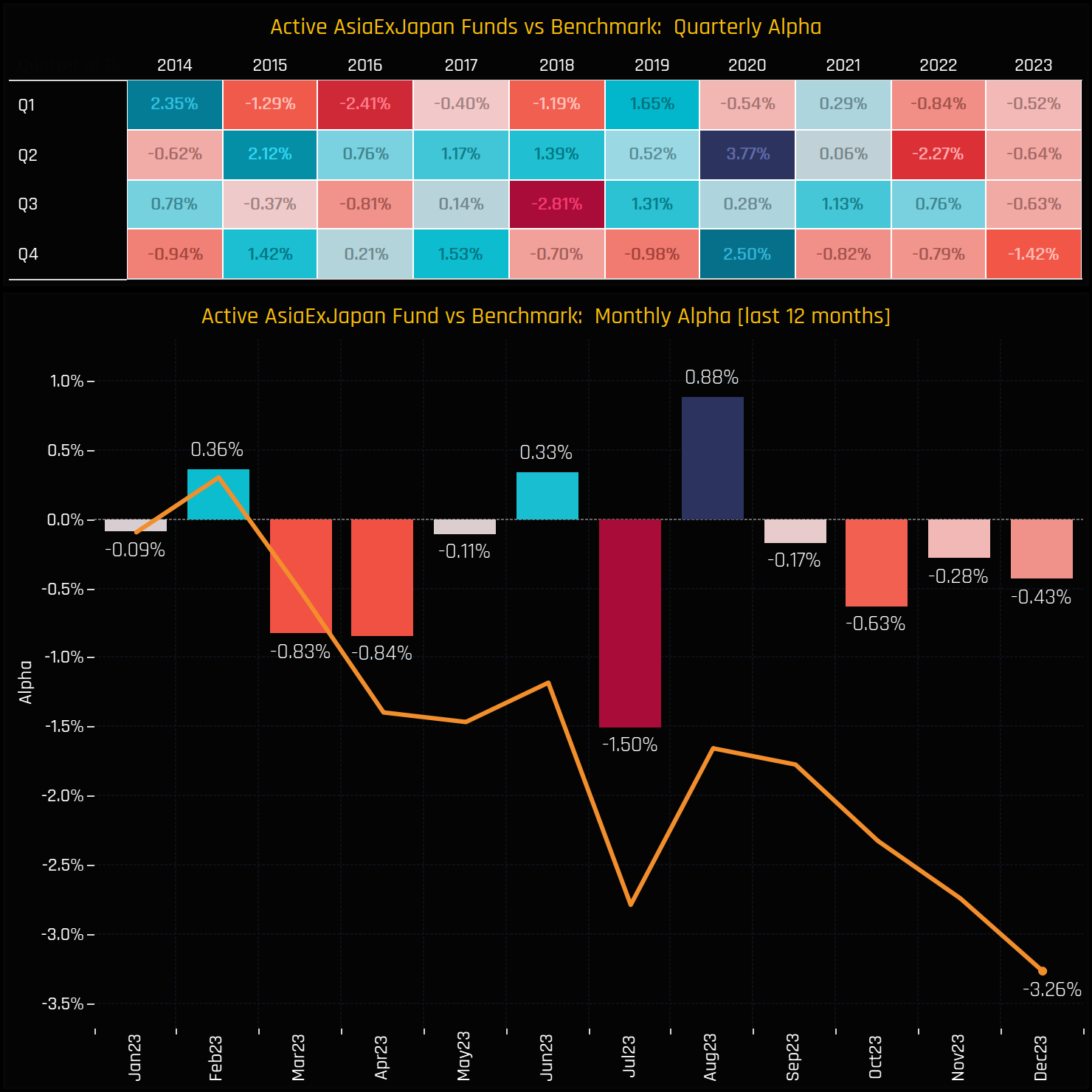

Over the last 9 quarters, only 1 has seen the average active fund in our analysis outperform the iShares MSCI Asia Ex-Japan ETF. Q4 was particularly challenging, with managers losing 1.42% in relative returns compared to the iShares MSCI Asia Ex-Japan ETF.

The underperformance seen in 2023 and 2022 has wiped out much of the outperformance captured between 2019 and 2021. The active funds in our analysis are just 2.7% above the iShares Asia Ex-Japan ETF over a 10-year period.

Portfolio Positioning & Performance

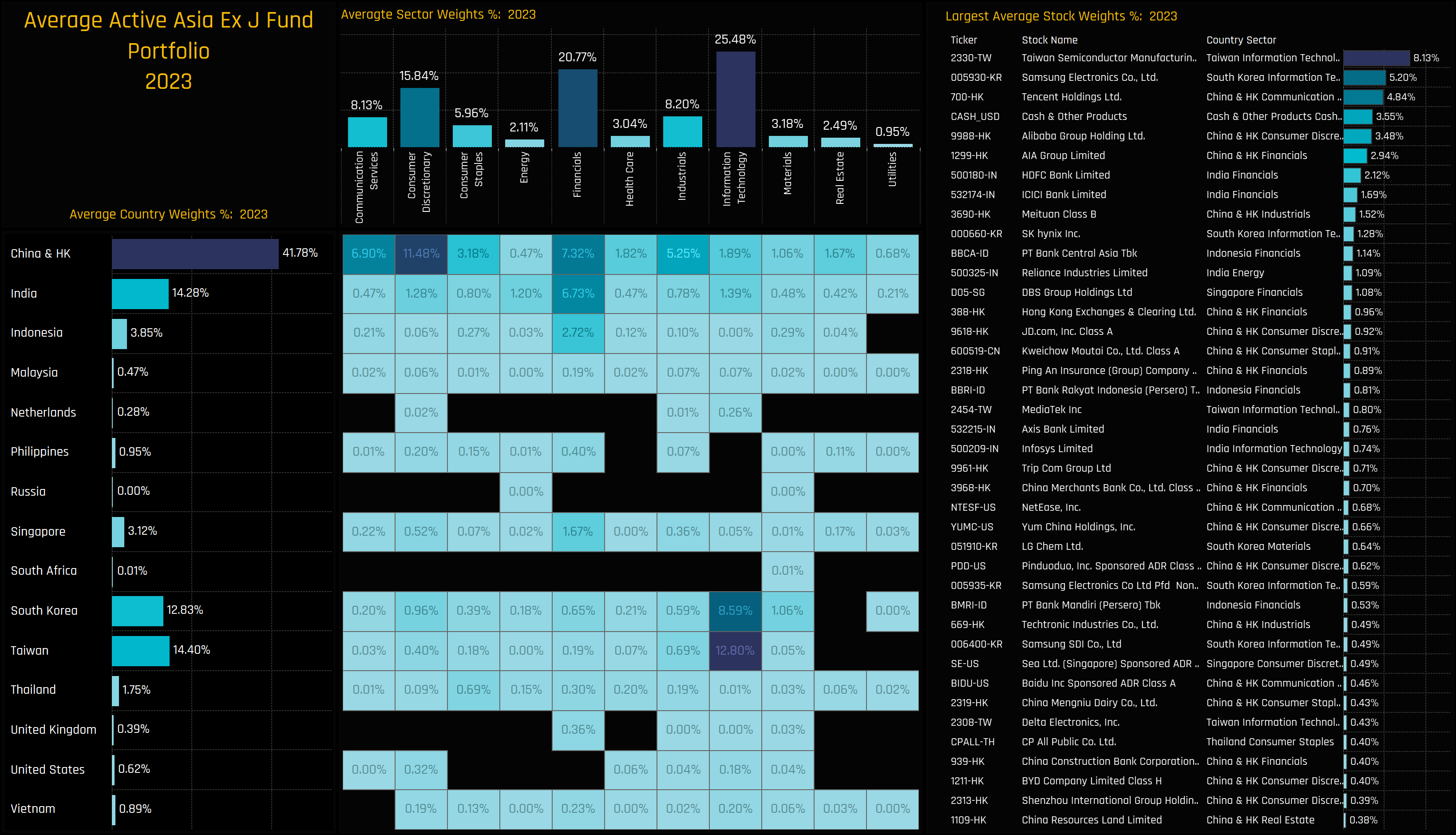

We now look to breakdown last year’s performance by country, sector and stock to understand the drivers behind the underperformance. We do this by analysing a portfolio based on the average holding weights of the 100 individual Asia Ex-Japan strategies in our analysis.

The chart below breaks down the country, sector and stock weights of this portfolio, with the standout country/sectors those of Taiwan Technology (12.8%), China & HK Consumer Discretionary (11.5%) and South Korean Tech (8.6%). The largest stock positions are listed in the right-hand chart and led by TSMC, Samsung Electronics and Tencent Holdings.

Portfolio Performance

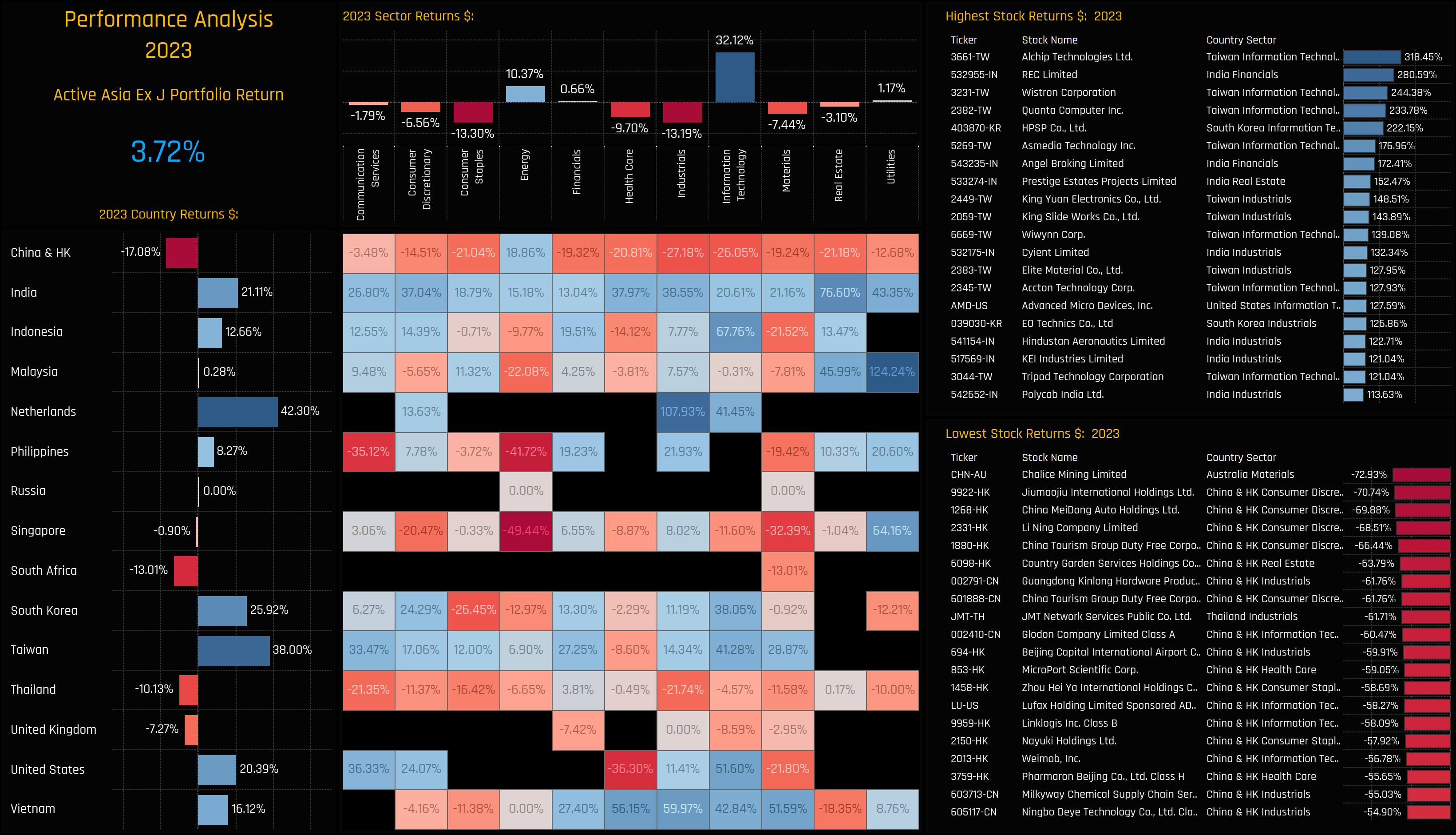

Based on monthly observations, the portfolio returned 3.72% in 2023, higher than the average actual fund returns of 1.89% mainly due to a lack of management fees and the infrequency of fund filings data (i.e this is a theoretical portfolio). The charts below show the 2023 performance of the major countries, sectors, country/sectors and stocks in the portfolio.

The huge underperformance of China & HK is the most notable metric, with all Chinese sectors except Energy producing negative returns on the year. India was quite the opposite with all sectors in the blue, whilst Taiwan Technology performed strongly on the back of some stellar individual stock performances (top right chart).

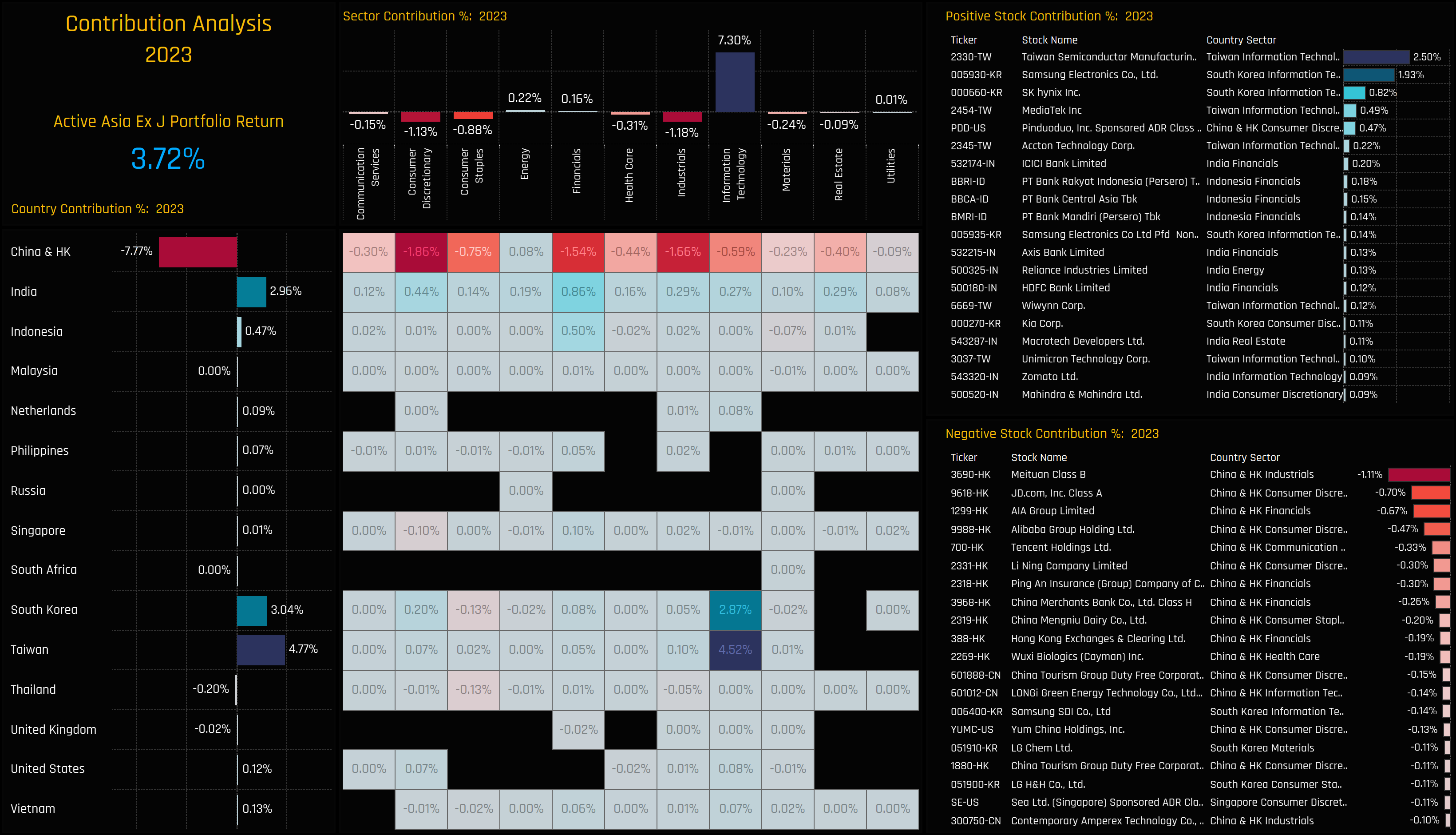

Portfolio Contribution

Marrying the performance figures with the average holding weights allows us to see the major contributors to performance in 2023. The poor performance of China & HK coupled with a 41.8% holding weight cost managers an average -7.77% in net losses on the year. China Consumer Discretionary and Industrials were particular bleak spots, led by heavy declines in Meituan and JD.Com. On the positive side, Taiwan, South Korea and India more than made up for China’s demise, with TSMC, Samsung Electronics and SK Hynix among the top contributors.

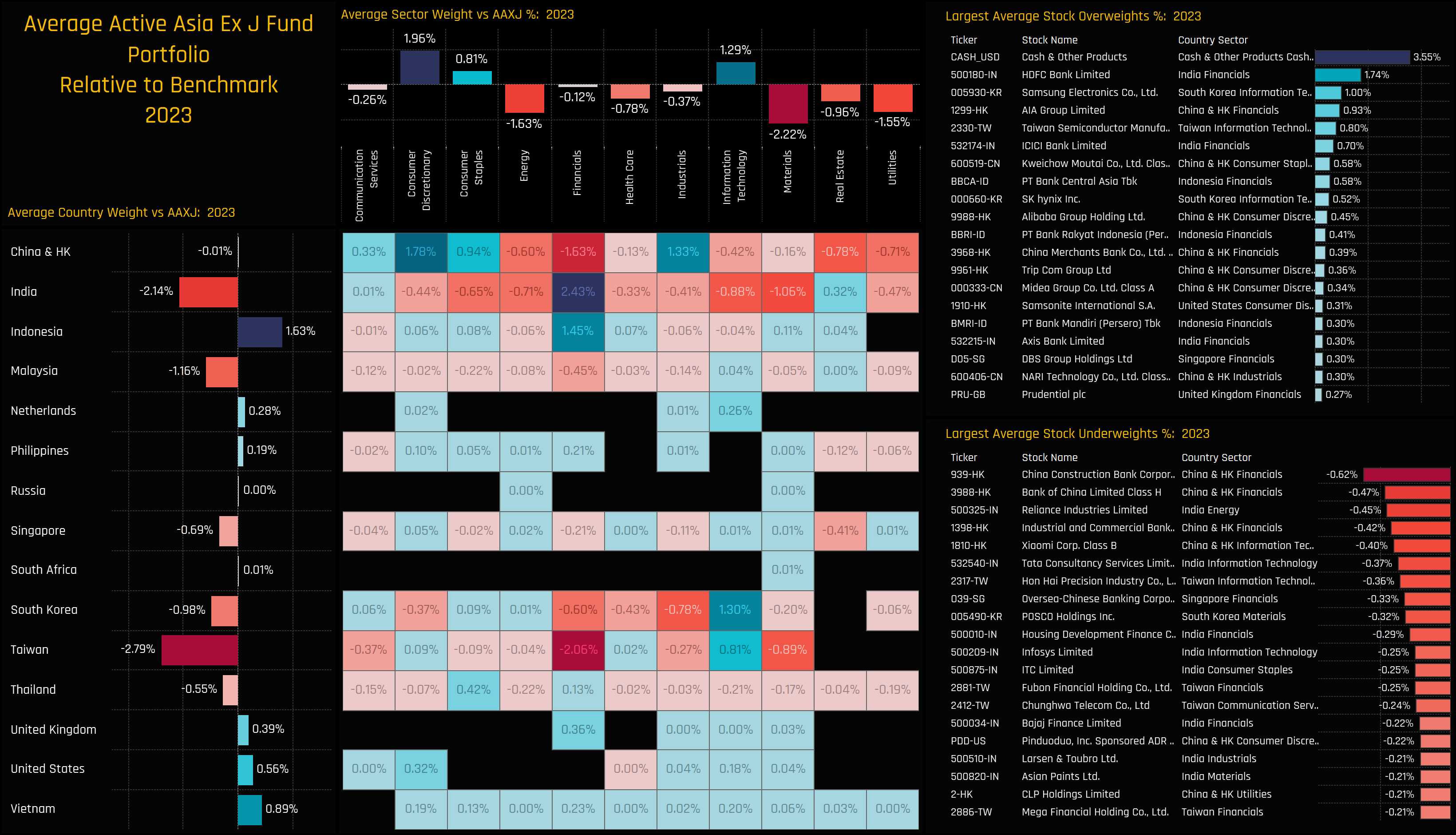

Positioning Relative to Benchmark

The positioning of the portfolio relative to the iShares MSCI Asia Ex-Japan ETF benchmark can be seen in the charts below. Underweights in India, Malaysia and Taiwan were offset by overweights in Indonesia, Vietnam and selected developed market holdings. China & HK was a relative neutral position on average throughout the year. Consumer Discretionary, Staples, Tech and Cash were the dominant sector overweights as managers maintained underweights in Materials, Energy and Utilities.

On a country/sector level, active fund managers hold a strategic underweight in China and Taiwan Financials, used to almost entirely finance overweight positions in Indian and Indonesian Financials. On a stock level, managers were positioned overweight HDFC Bank, AIA Group and Samsung Electronics against underweight China Construction Bank, Bank of China and Reliance Industrials.

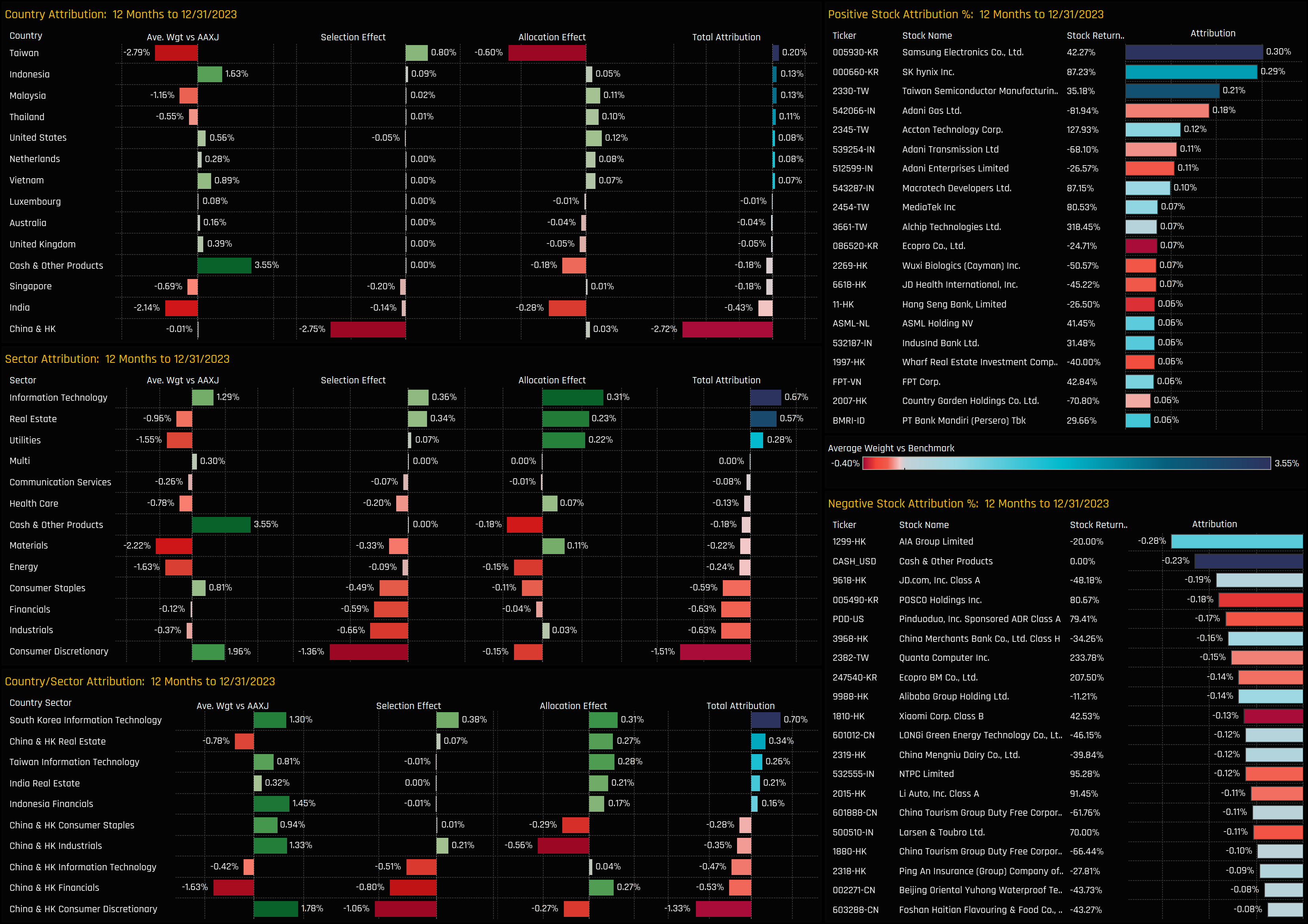

Performance Attribution

We perform attribution analysis on this portfolio versus a representation of the benchmark based on the iShares MSCI Asia Ex-Japan ETF. As expected, and mirroring the underperformance seen in actual fund returns this year, the portfolio underperformed by -2.7% in 2023. A summary of the key drivers are documented below. Despite managers taking a neutral stance on China & HK, stock selection was extremely costly, with overweights such as AIA Group and JD.Com performing poorly, against underweights in Pinduoduo Inc and Xiaomi performing well.

What worked:

- Underweights in Real Estate, Utilities, China & HK Financials

- Overweights in Technology, India Real Estate, Indonesia.

- Stock selection in Taiwan, Tech, Real Estate

- Underweights in Adani Gas, Adani Transmission, Adani Enterprises.

- Overweights in Samsung Electronics, SK Hynix, TSMC

What Didn’t:

- Underweights in Taiwan, Energy, India.

- Overweights in the Cash, Consumer Staples, Discretionary.

- Stock selection in China & HK, Consumer Discretionary, Industrials

- Underweights in POSCO Holdings, Pinduoduo, Quanta Computer.

- Overweights in AIA Group, JD.Com, China Merchants Bank.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- October 30, 2023

Asia Ex-Japan Fund Positioning Analysis, October 2023

100 Active Asia Ex-Japan Funds, AUM $54bn Asia Ex-Japan Fund Positioning Analysis, October 2023 ..

- Steve Holden

- March 29, 2024

Asia Ex-Japan Funds: Stock Radar

100 Asia Ex-Japan active equity funds, AUM $53bn Asia Ex-Japan Funds: Stock Radar Summary In th ..

- Steve Holden

- October 17, 2022

China & HK Semiconductors: Fund Positioning Analysis

92 Asia Ex-Japan Funds, AUM $52bn, 115 China A-Share Funds, AUM $57bn, 117 MSCI China Funds, AU ..