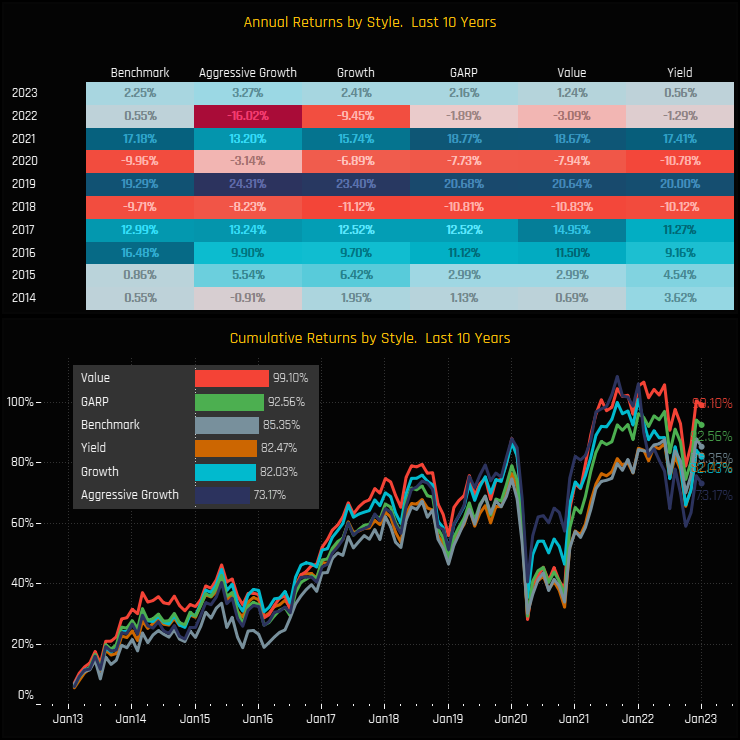

Performance

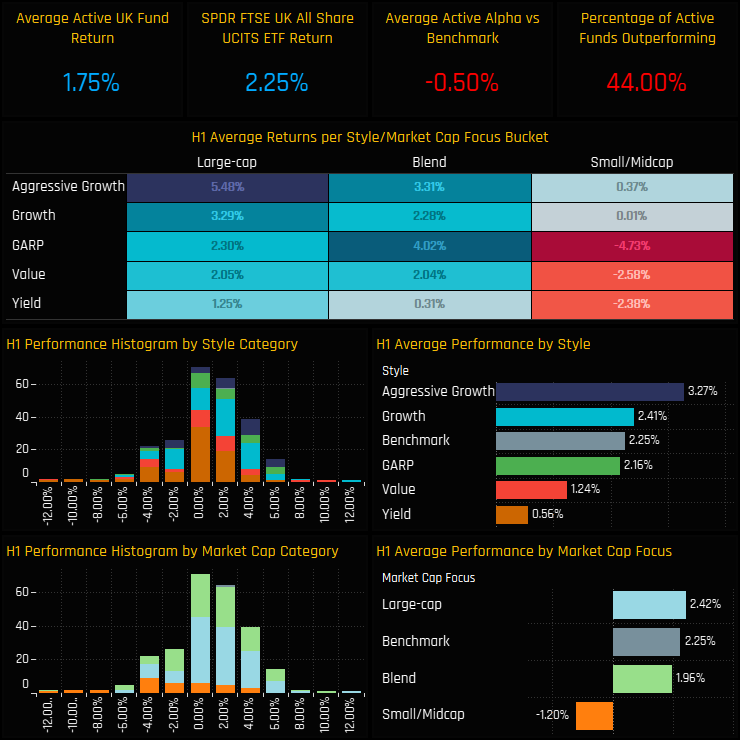

On a single fund level there were exceptions to the Style averages, with the Value strategies of Artemis UK Select (+10.83%) and Ninety One UK Special Situations (+9.71%) among the top performers, but behind LF Liontrust UK Focus on +12.86%. A host of Small/Midcap strategies fill the lower order, but the Blend/Yield strategy of Axa Framlington Income takes the wooden spoon, losing -11.6% over the first half of the year.

Performance Contribution & Attribution

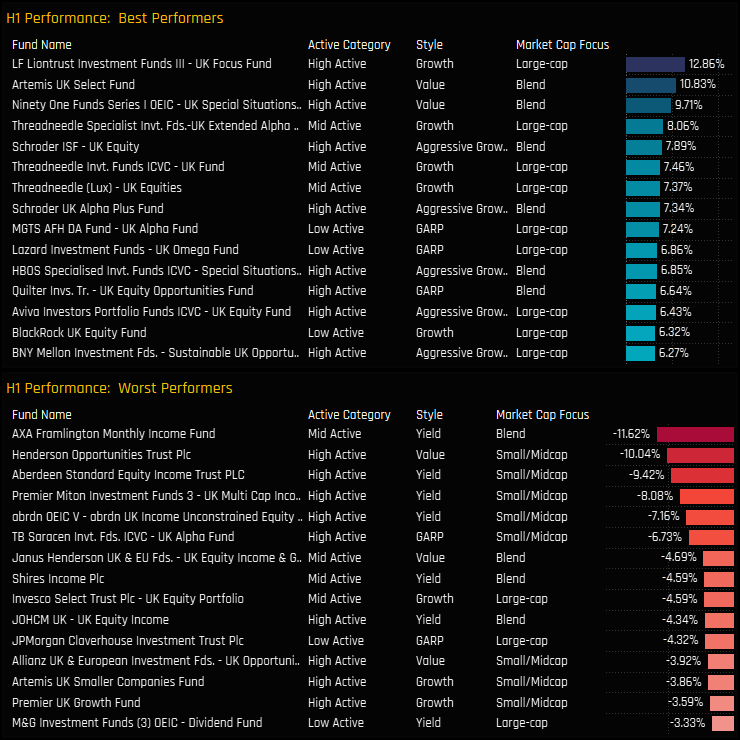

We perform attribution analysis on a portfolio based on the average allocations of the 266 active UK funds in our analysis, versus a representation of the benchmark based on the SPDRs FTSE All Share ETF.

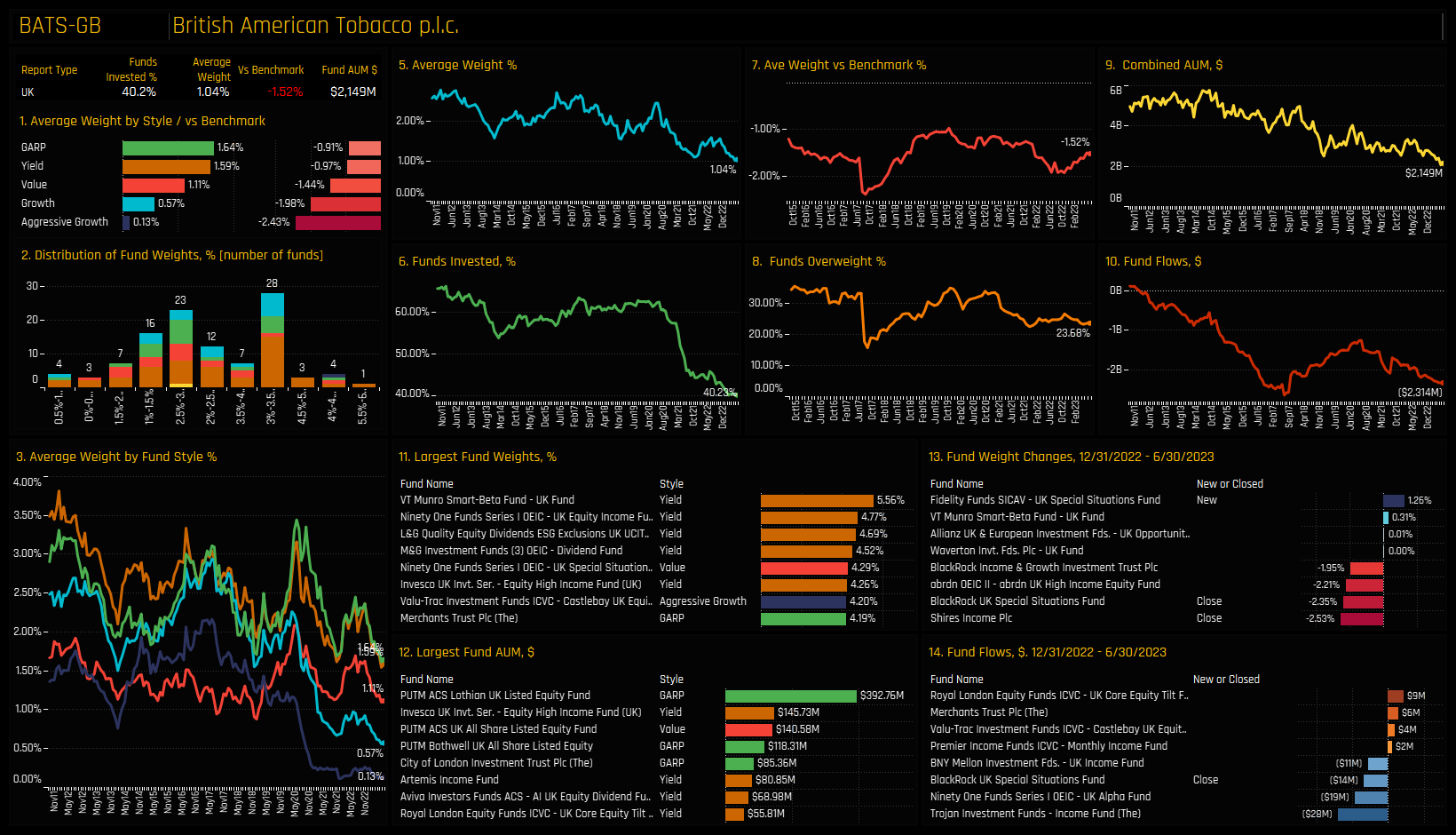

The moderately positive returns among UK active managers was driven by strong performance in the Consumer Discretionary and Technology sectors, which contributed +1.45% and +0.58% to Q1 returns respectively. Positive returns from the top sector weights of Financials and Industrials also contributed a combined +1.56% to H1 returns, offsetting -0.84% from losses in the Materials sector. Exposure to 3i Group, HSBC Holdings and RELX contributed the most on a stock level, whilst negative returns from Anglo American and British American Tobacco dragged on quarterly performance.

From an attribution perspective, good stock selection and a net underweight in the Consumer Staples sector generated +0.62% of relative outperformance over the period. Overweights in Consumer Discretionary and Information Technology were the right call, but poor stock selection offset the majority of the gains. Of the detractors to performance, poor stock selection in the Financials sector was the standout, losing -0.73% of performance against the SPDRs FTSE All Share ETF. On a stock level, underweights in Glencore, British American Tobacco and Diageo plc performed well, whilst underweights in HSBC, Flutter Entertainment, CRH Plc and Rolls Royce were costly to active UK managers over H1 2023.

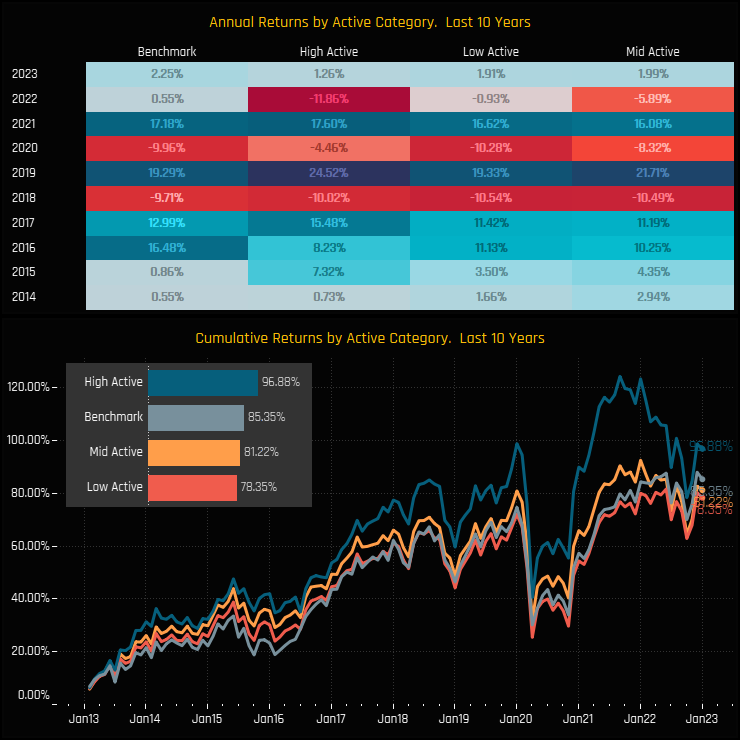

Long Term Performance

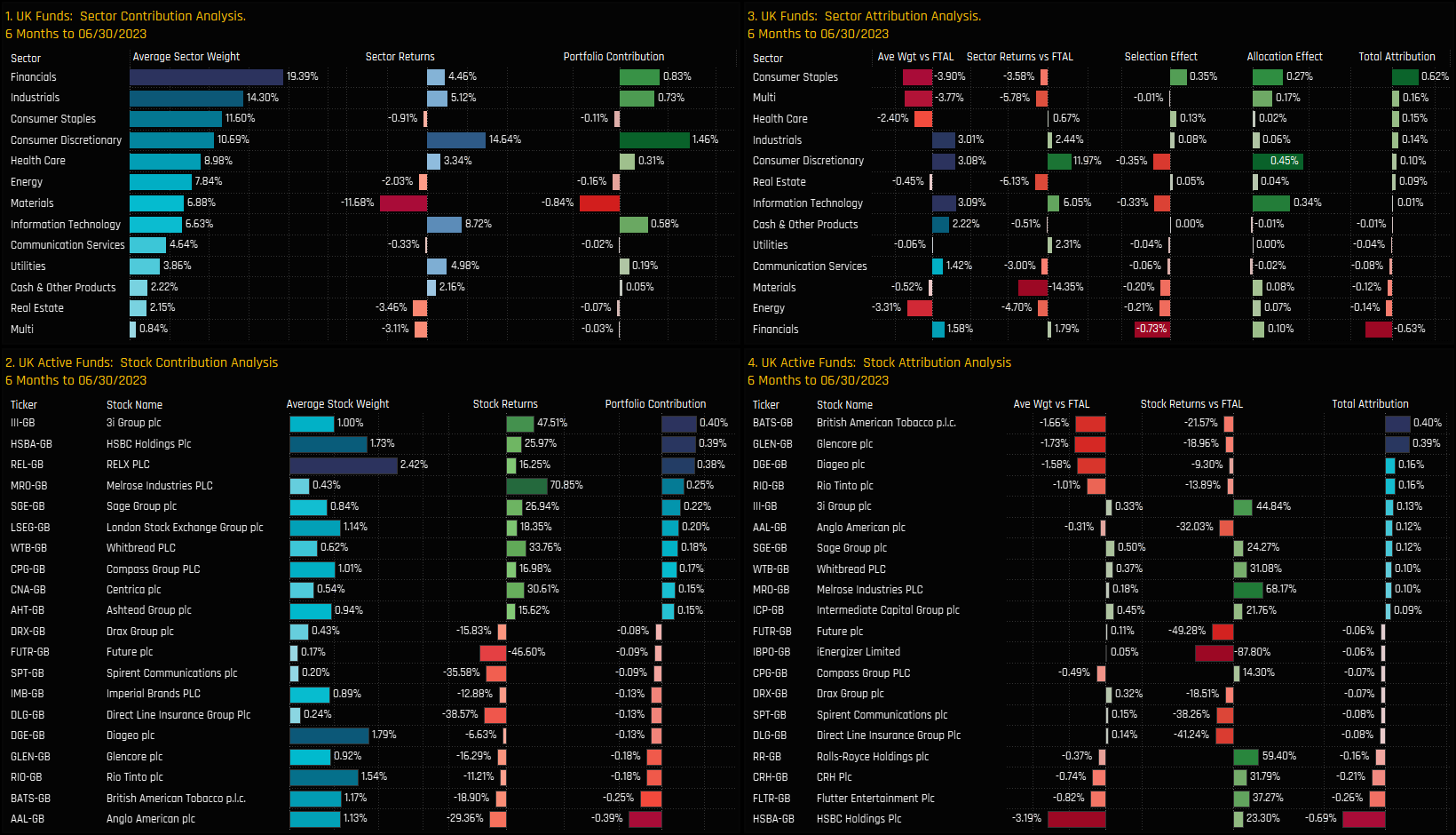

Over the past 10-years, returns have been largely correlated to fund Style. Value funds are the top performers with returns of 99.1% (in USD) and GARP on 92.6%, both ahead of the SPDRs FTSE All Share ETF Benchmark’s return of 85.4%. After 2022’s annus horribilis, Aggressive Growth and Growth managers lost their performance advantage, with both now underperforming the benchmark and peers over the 10-year period.

Split by the ‘activeness’ of the fund, things look good for those with a less benchmark centric approach. High Active funds – those with active shares versus the FTSE All Share Index of >75% have beaten then benchmark by over 10%, whilst Mid Active (60%<active share<75%) and Low Active (active share <60%) have underperformed over the longer term.

Time-Series & Tech Stock Positioning

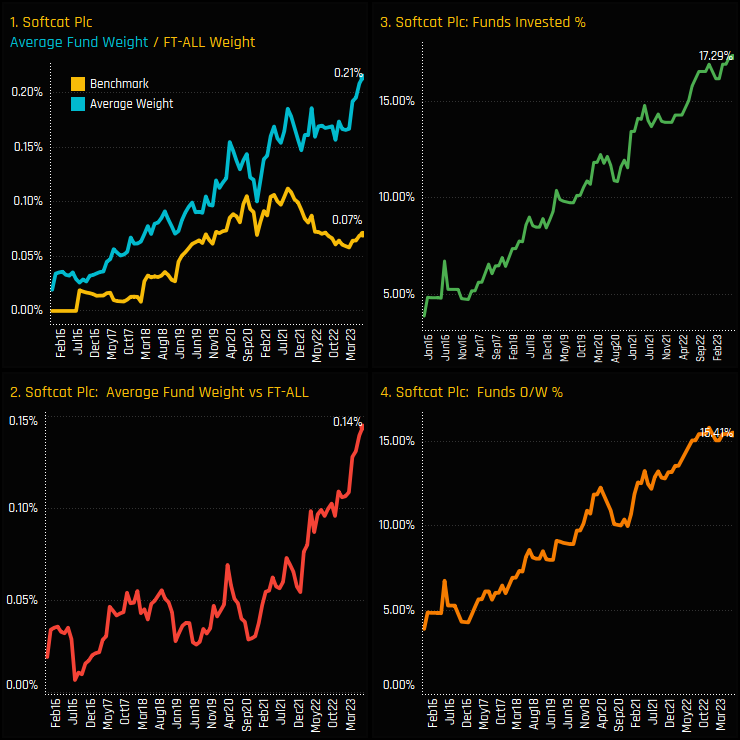

UK Fund exposure in Softcat PLC has reached new highs. The percentage of UK funds invested in Softcat PLC now stands at a record 17.3% (ch3) after seeing an almost linear growth in investment over the past decade. This has pushed average holding weights to 0.21%, breaking away from the FTSE All Share index weight in recent months to place active managers at record overweights of +0.14% (ch1&2).

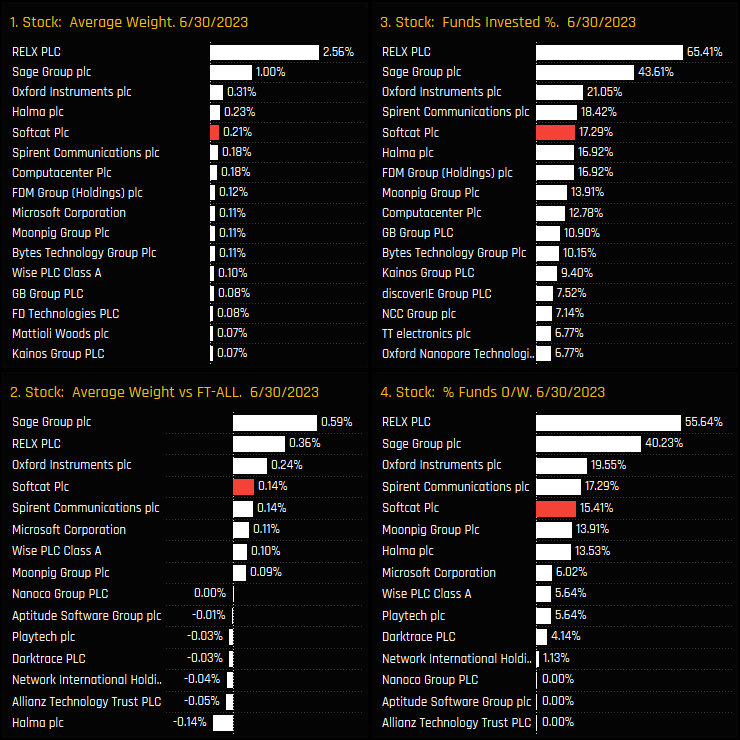

The below charts show our ownership statistics for stocks in the UK Information Technology sector. The recent ownership surge has moved Softcat PLC to the 5th most widely held Technology stock in the UK, sharing similar ownership characteristics to Spirent Communications, Halma PLC and Oxford Instruments. The sector leaders by some distance are RELX PLC and Sage Group PLC.

Fund Holdings

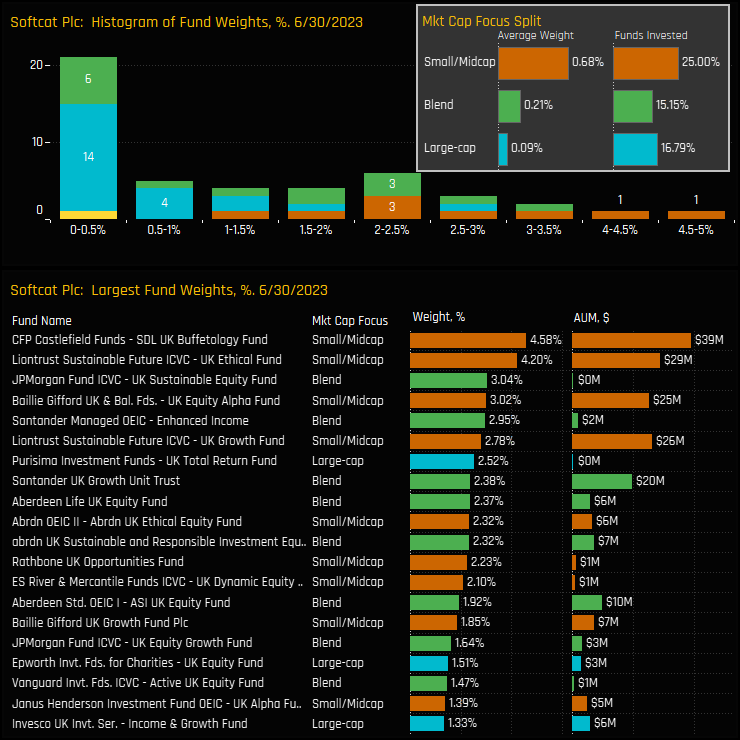

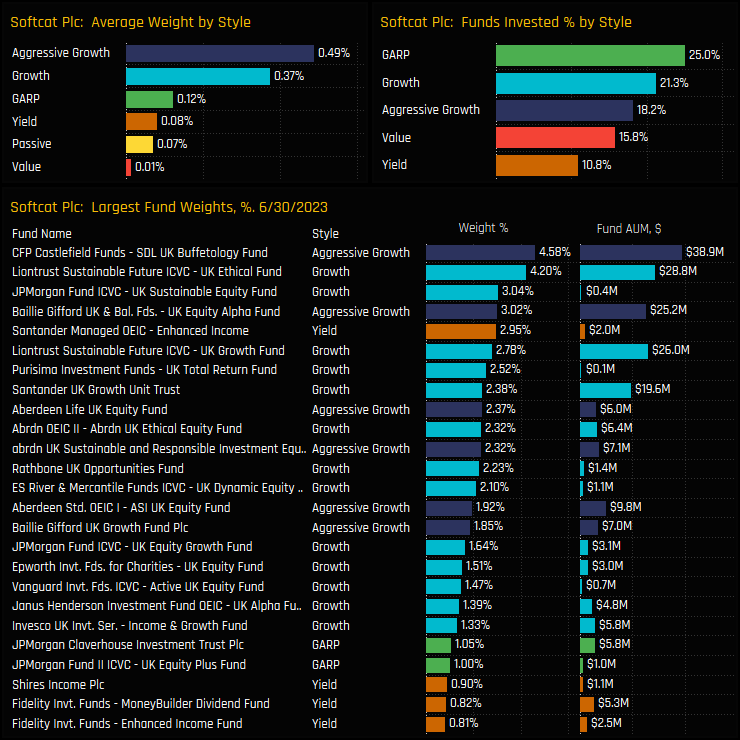

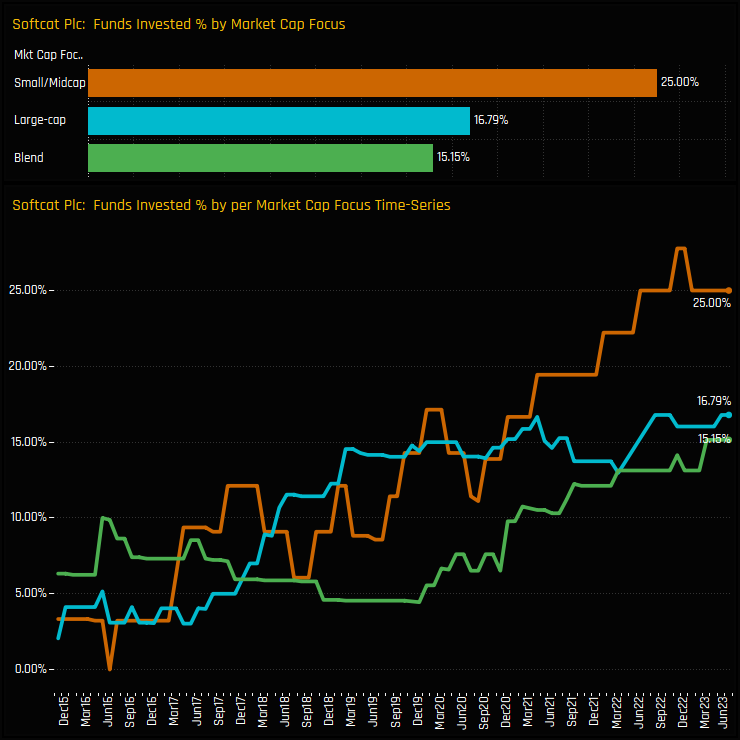

The distribution of fund weights in Softcat in the top chart below shows that most strategies hold less than a 0.5% weight, though higher conviction positions top out with Castlefield UK Buffetology (4.58%) and Liontrust UK Ethical (4.2%). Small/Midcap strategies are the most prominent holders on account of Softcat’s FTSE 250 status, but Large Cap and Blend funds do have some skin in the game. A quarter of the Small/Midcap strategies in our UK analysis hold exposure to Softcat at an average weight of 0.68%.

In terms of Style, Softcat’s appeal to high growth managers is evident in the charts below, with Aggressive Growth and Growth funds the larger allocators on average, and Value/Yield almost non-existent. The prominence of GARP funds, with 25% of funds invested infers that this growth isn’t unreasonably priced. The list of top holders in the bottom chart is dominated by high growth strategies.

Conclusions & Data Report

The chart to the right shows the percentage of funds invested in Softcat over time for each of our Market Cap Focus categories. Given Softcat’s market capitalization of <£3bn, the growth in exposure among Small/Midcap strategies is understandable. The fact that exposure is also at record highs among Largecap funds highlights Softcat’s appeal as a genuine alternative to the more established large-cap companies in the UK market.

But whilst investment growth in Softcat has been impressive, there is clearly room for ownership to move higher from here. Remember, over 80% of the 266 UK Equity funds in our analysis still do not hold a position. With Softcat approaching the boundaries of FTSE 100 inclusion, it’s not hard to envisage investment levels moving higher from here.

Click on the link below for an extended data report on Softcat PLC positioning among active UK Equity Funds.

266 UK Equity Funds, AUM $179bn

UK Stock Radar

Investment levels among the thousands of stocks in the investible UK universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in our UK analysis. We highlight 8 stocks at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

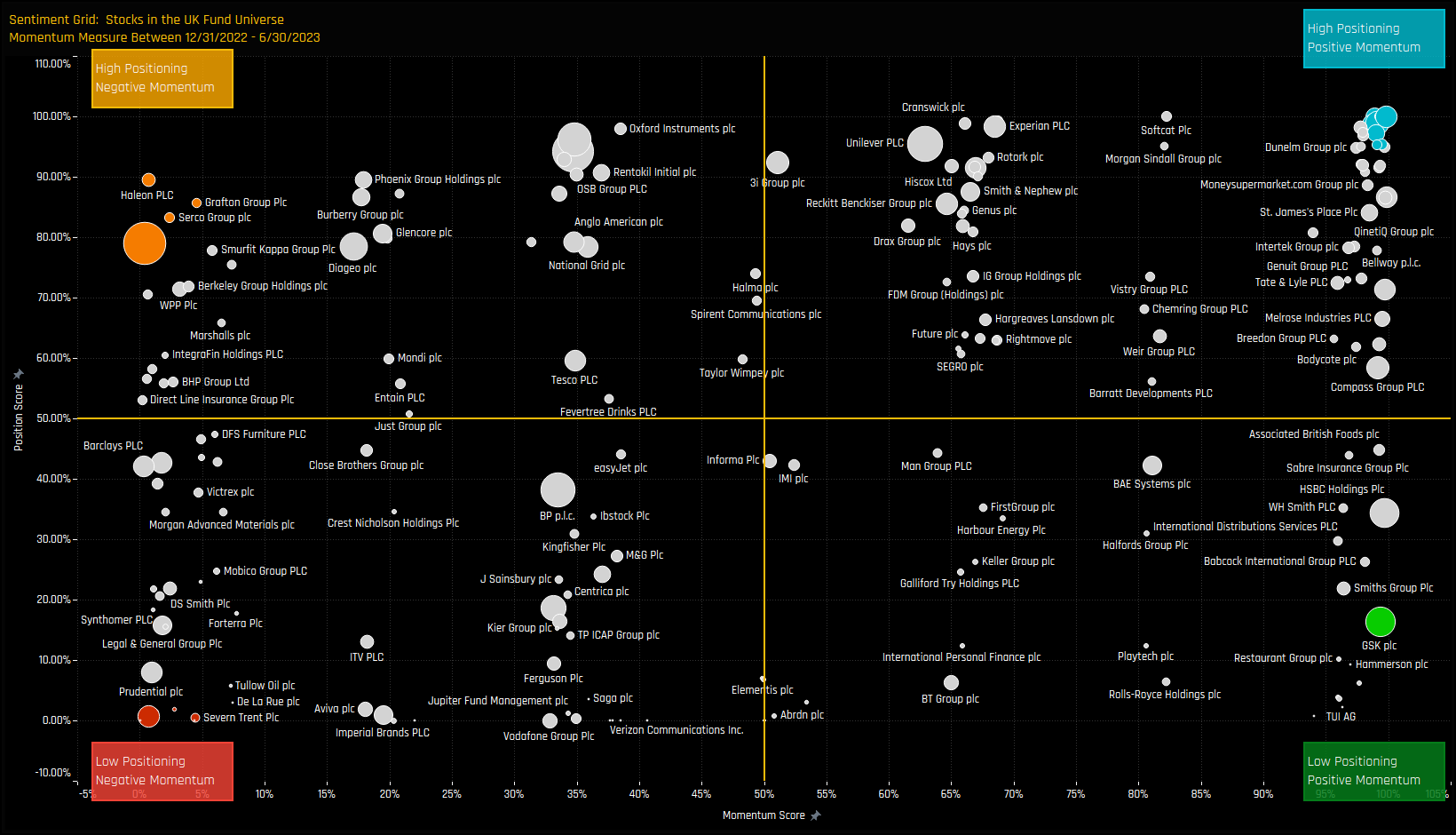

The Sentiment Grid

The Sentiment Grid below is designed to visualize the interplay between current fund positioning, long-term fund positioning and shorter-term fund manager activity for all stocks in the UK active fund universe. The Y-axis shows the ‘Position Score’, a measure of current positioning in each stock compared to its own history going back to 2012 on a scale of 0-100%. It takes in to account the percentage of funds invested in each stock versus history, the average fund weight versus history and the percentage of funds overweight the benchmark versus history. The higher the number, the more heavily a stock is owned by active Global managers compared to its own history.

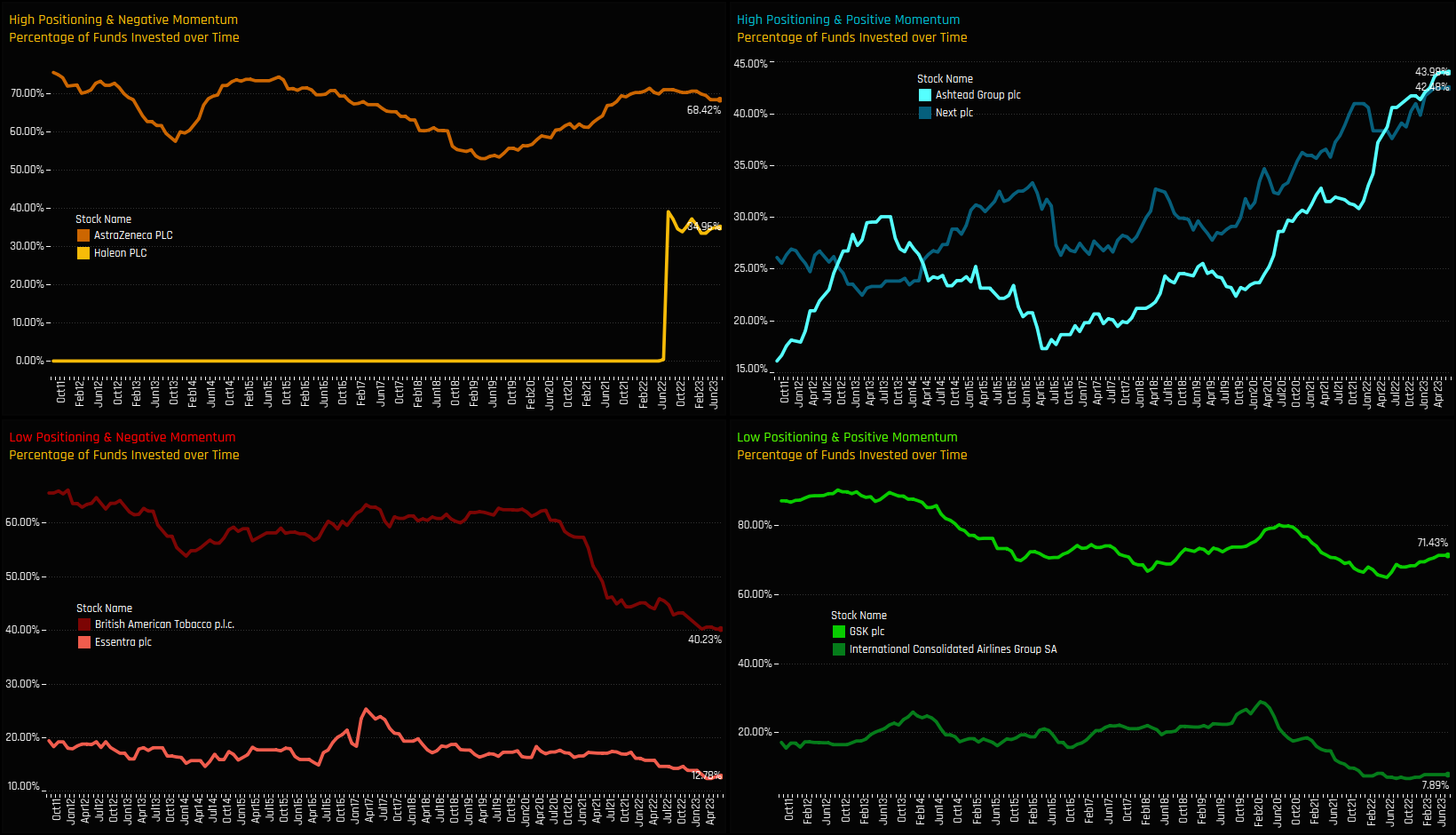

Extreme Stocks

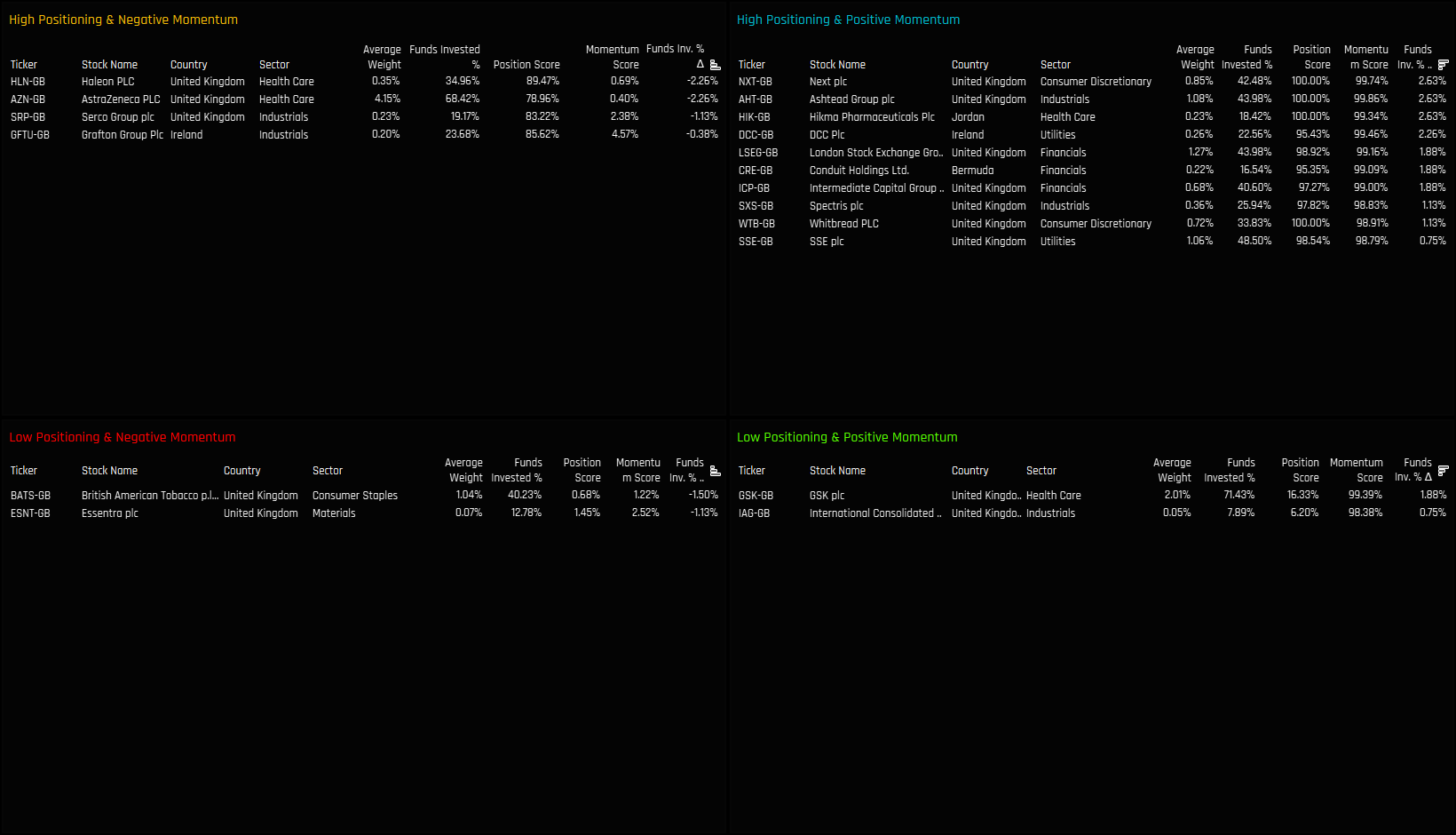

- High Positioning & Negative Momentum: Position Score > 75%. Momentum Score < 5%

- Low Positioning & Negative Momentum: Position Score < 5%. Momentum Score < 5%

- Low Positioning & Positive Momentum: Position Score < 20%. Momentum Score > 98%

- High Positioning & Positive Momentum: Position Score > 95%. Momentum Score > 99%

Extreme Stocks

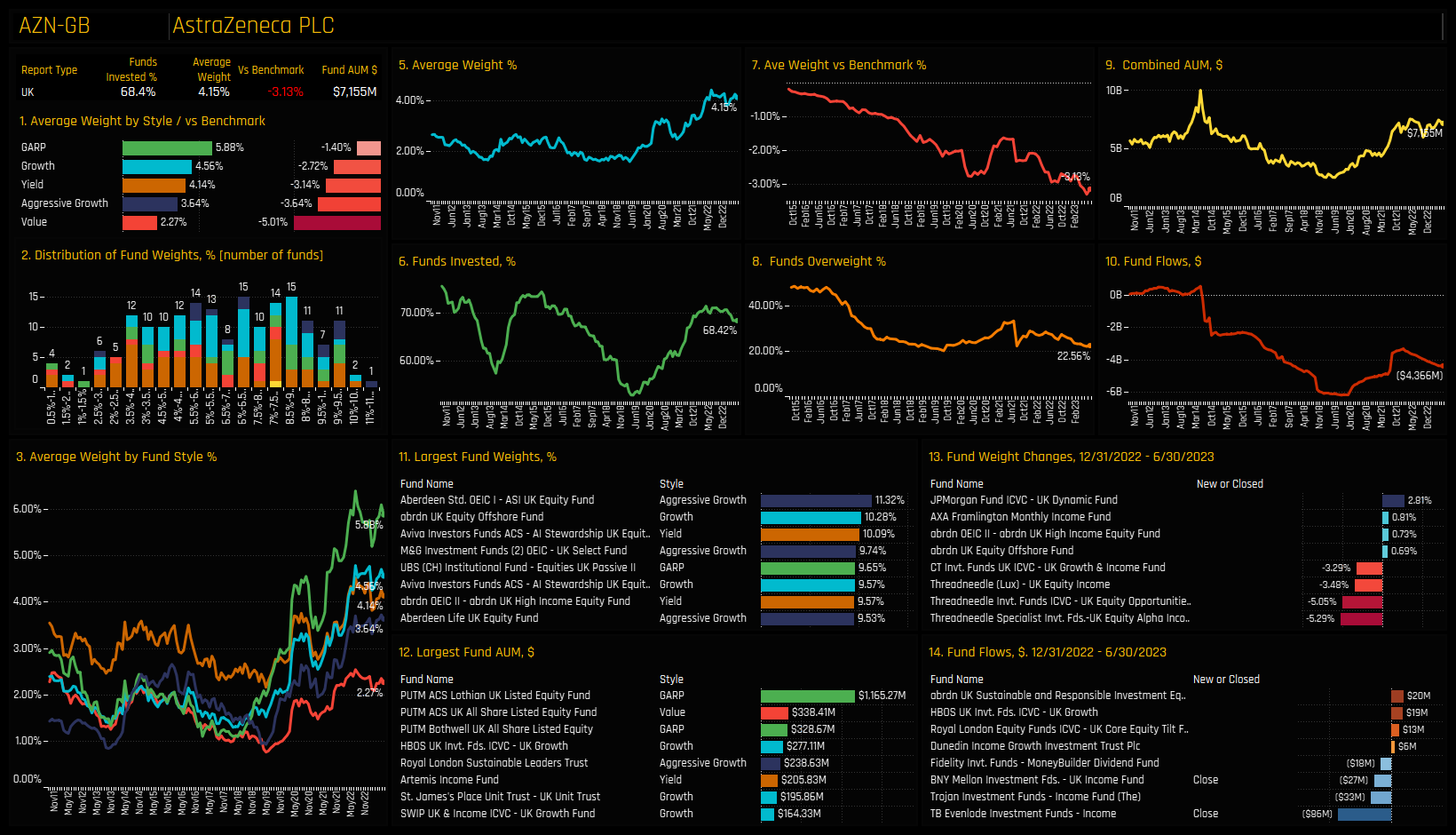

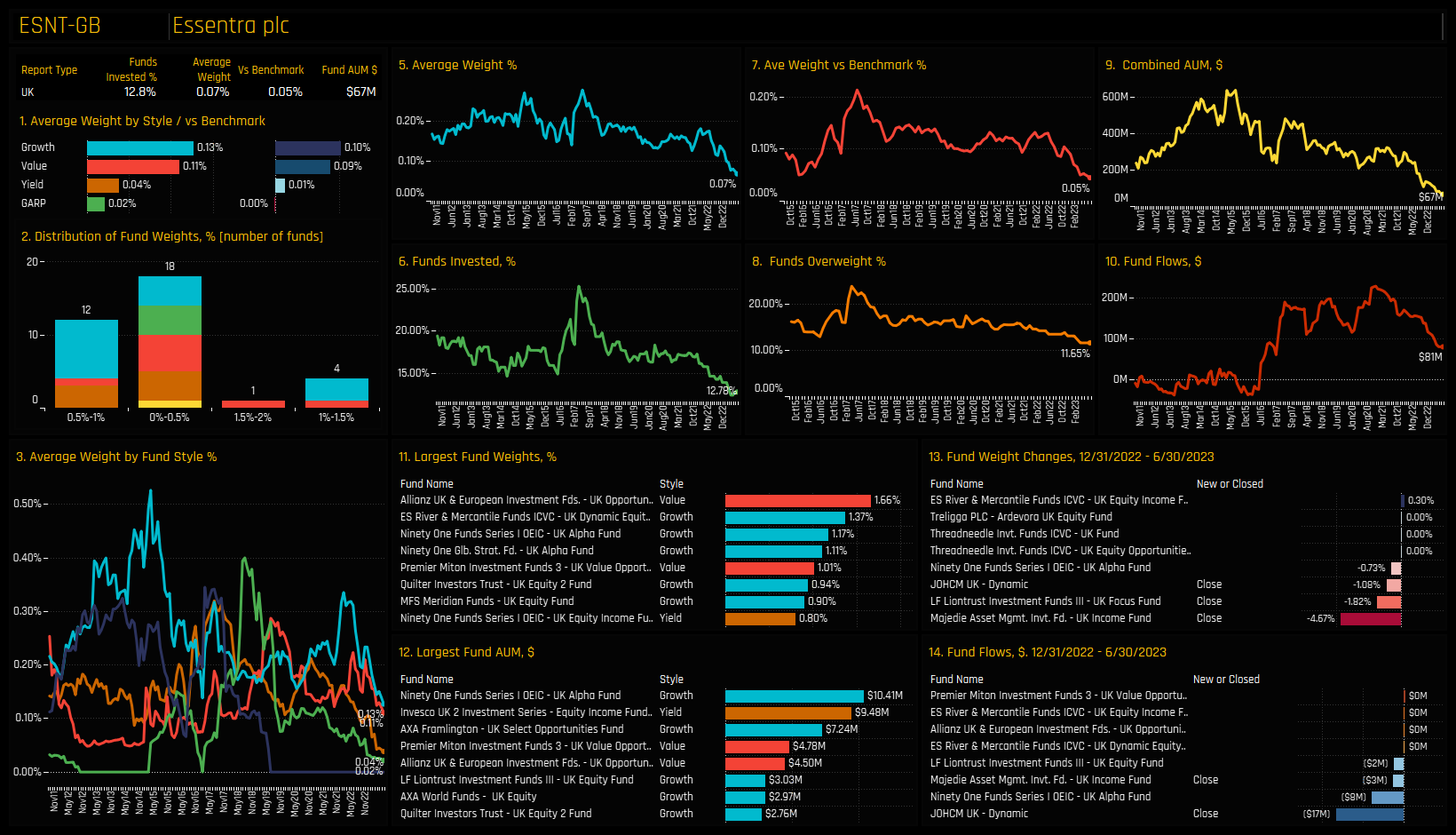

The charts below track the percentage of active funds invested in each of the top 2 stocks across the 4 categories. It’s another way to visualize how the Sentiment Grid works. For example, the top-left chart highlights AstraZeneca PLC and Haleon PLC, with the former entering a down cycle after a period of strong UK fund ownership growth between 2018 and 2022. Haleon is seeing some selling after an initially positive IPO early last year. In the bottom-left chart, BATS has seen selling by UK managers since 2020 onwards and Essentra PLC has drifted towards its lowest levels of ownership on record.

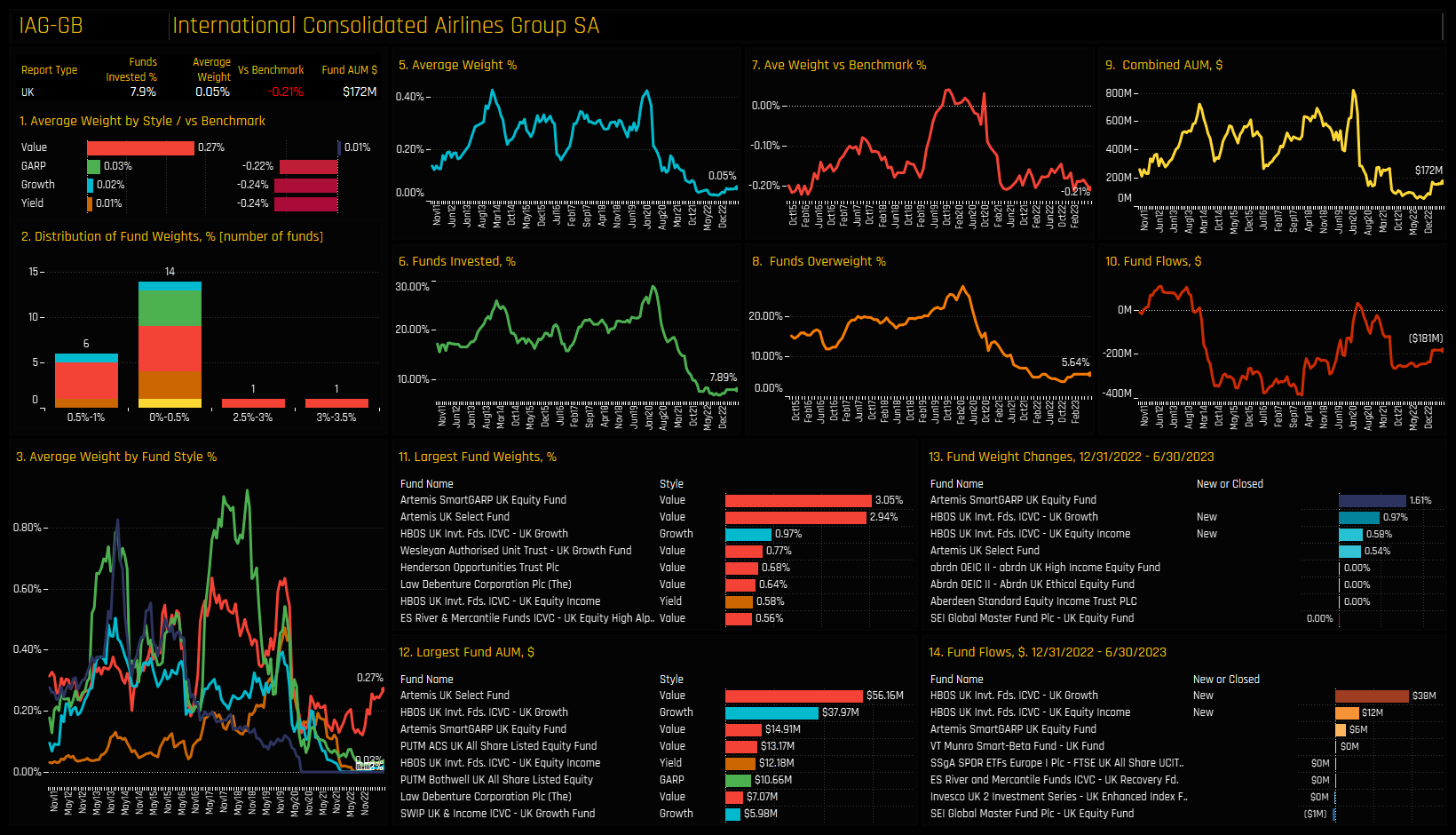

In the opposite case (bottom right), both GSK and IAG are at the bottom of their historical ownership ranges but both have started to climb from the lows. Top right shows Ashtead Group PLC and Next PLC capturing sustained increases in fund ownership in recent months to leave UK funds at their highest levels on record. In the charts that follow we provide more detailed profiles of each of the 8 stocks at the extreme corners of our Sentiment Grid.

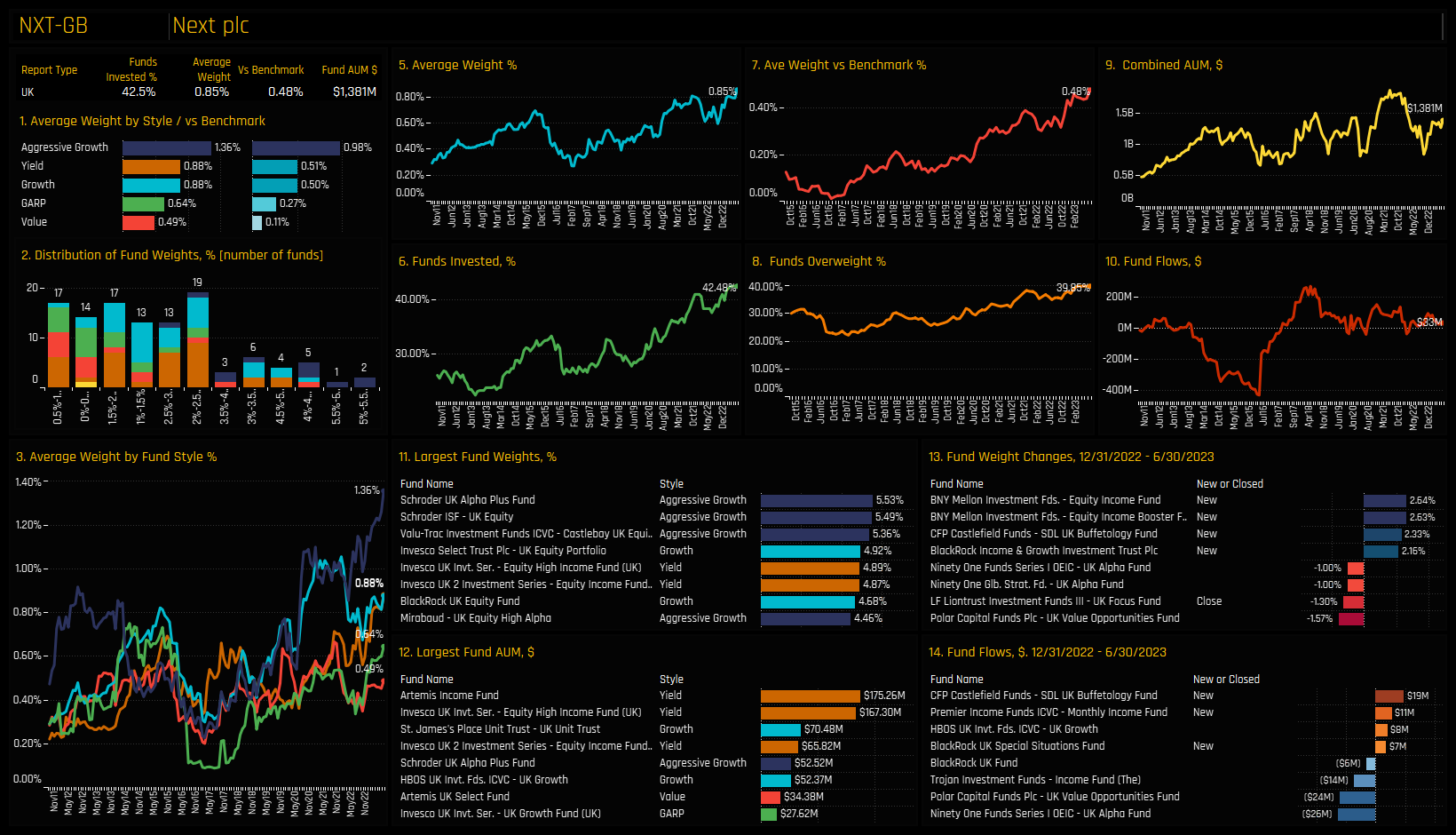

High Positioning & High Momentum: Next PLC

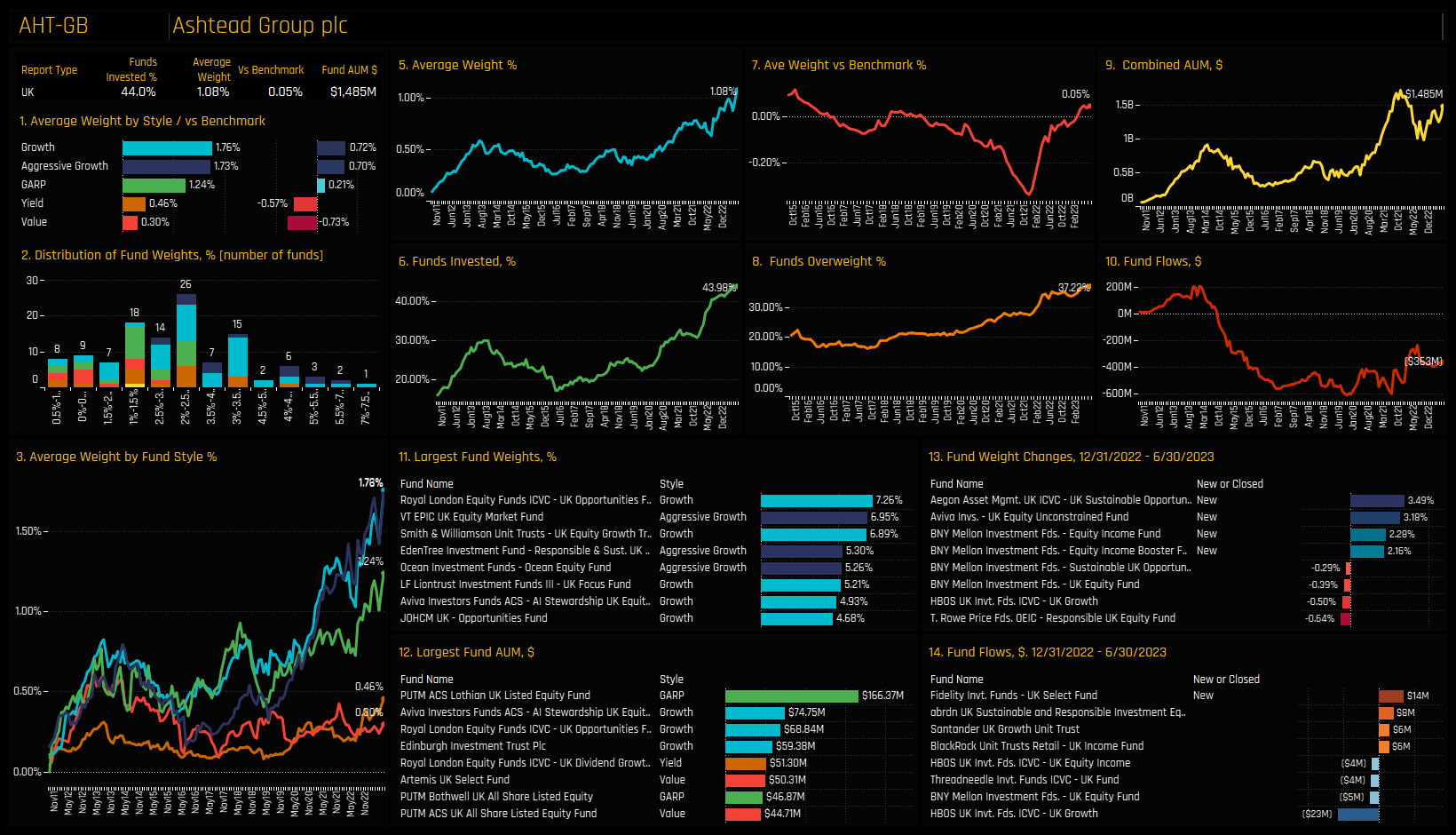

High Positioning & High Momentum: Ashtead Group PLC

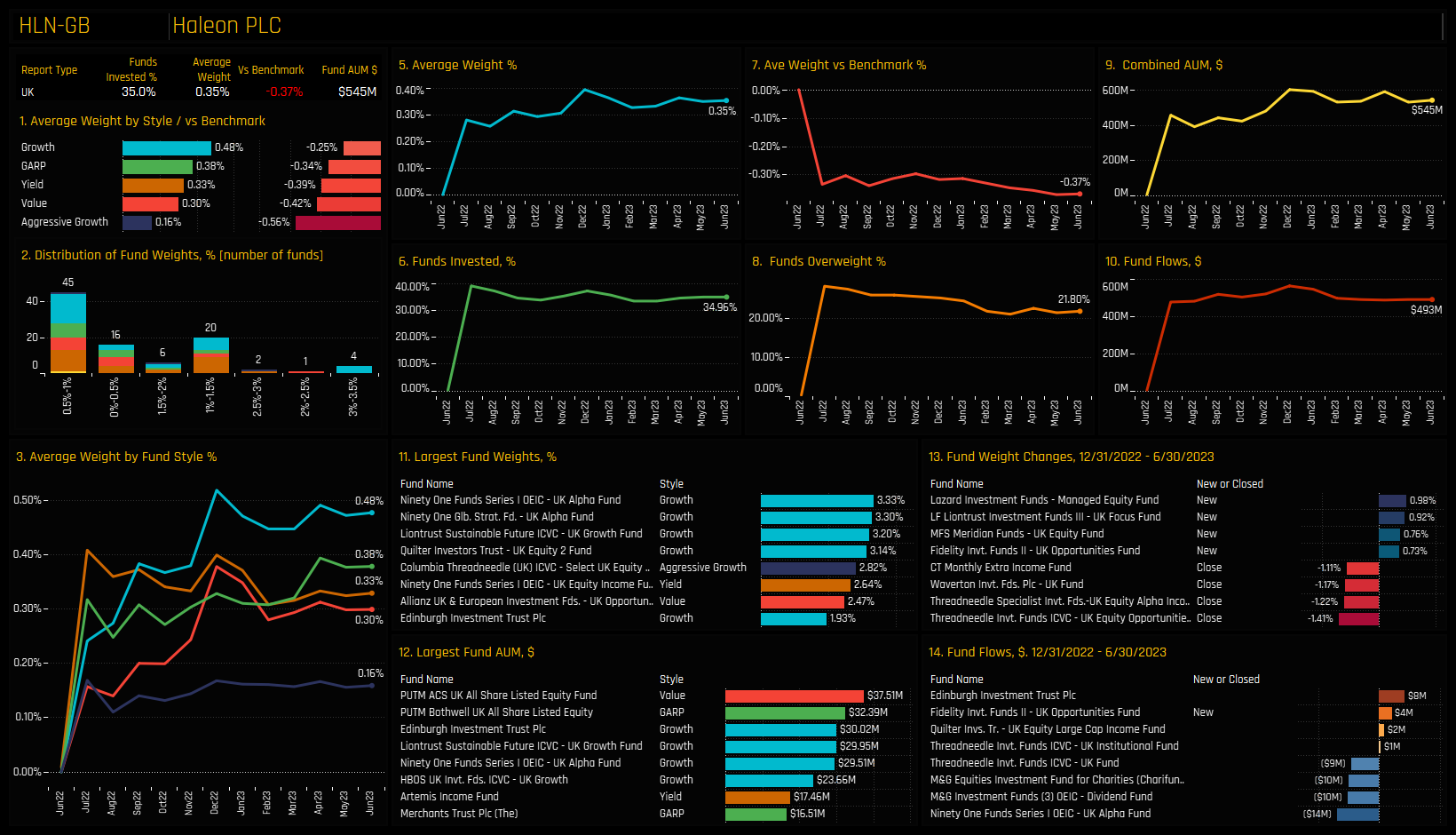

High Positioning & Low Momentum: Haleon PLC

High Positioning & Low Momentum: AstraZeneca PLC

Low Positioning & Low Momentum: Essentra PLC

Low Positioning & Low Momentum: British American Tobacco

Low Positioning & High Momentum: International Consolidated Airlines Group

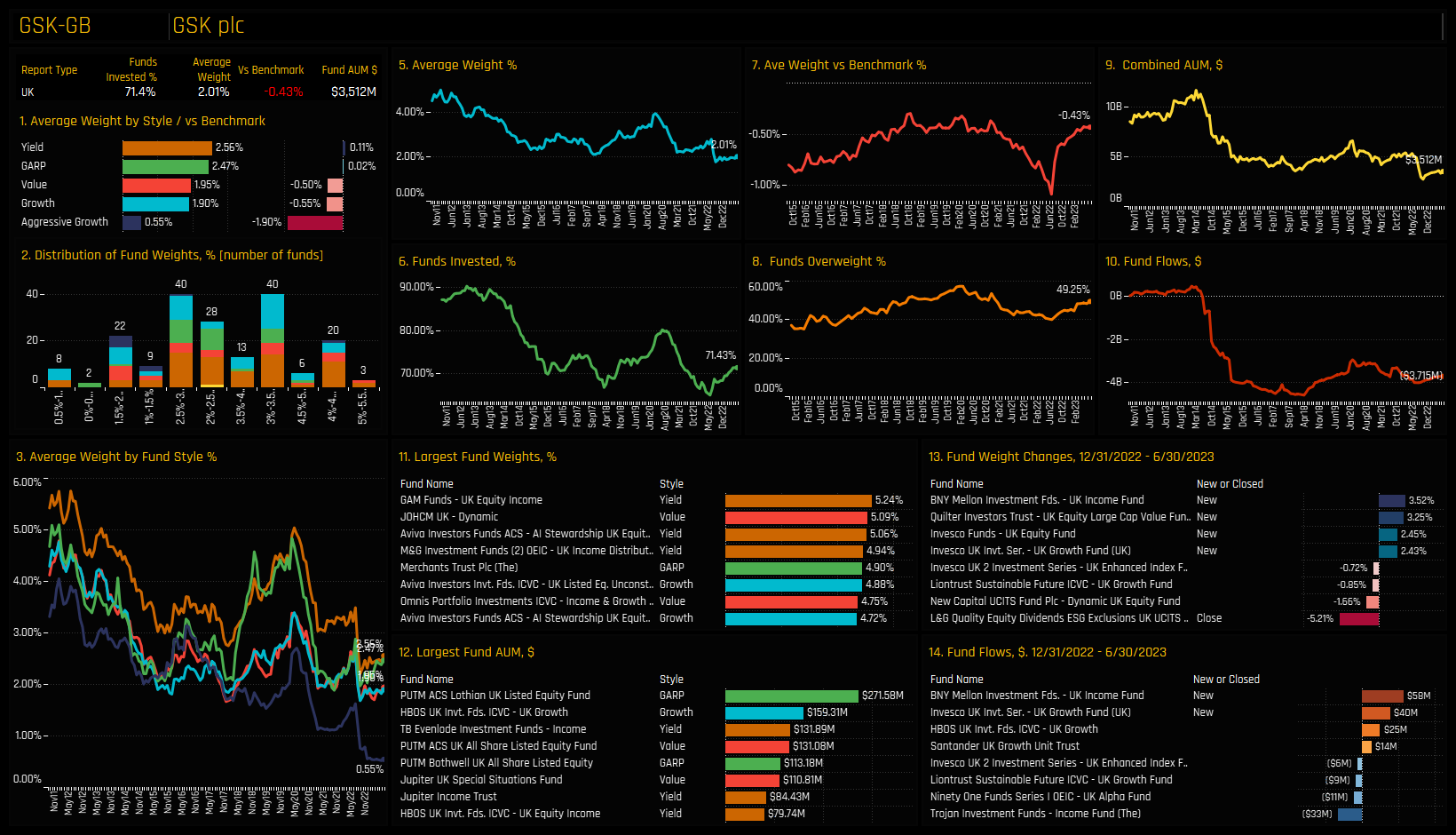

Low Positioning & High Momentum: GSK PLC

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- January 11, 2023

UK Active Funds: 2022 Performance & Attribution Report

273 Active UK Funds, AUM $176bn. 2022 Performance & Attribution Report In this report, we p ..

- Steve Holden

- March 27, 2023

UK Fund Positioning Analysis, March 2023

264 UK Equity Funds, AUM $176bn UK Equity Fund Positioning Analysis, March 2023 In this issue: ..

- Steve Holden

- February 2, 2023

UK Fund Positioning Analysis, January 2023

272 UK Equity Funds, AUM $174bn UK Fund Positioning Analysis, January 2023 In this issue: 2023 ..