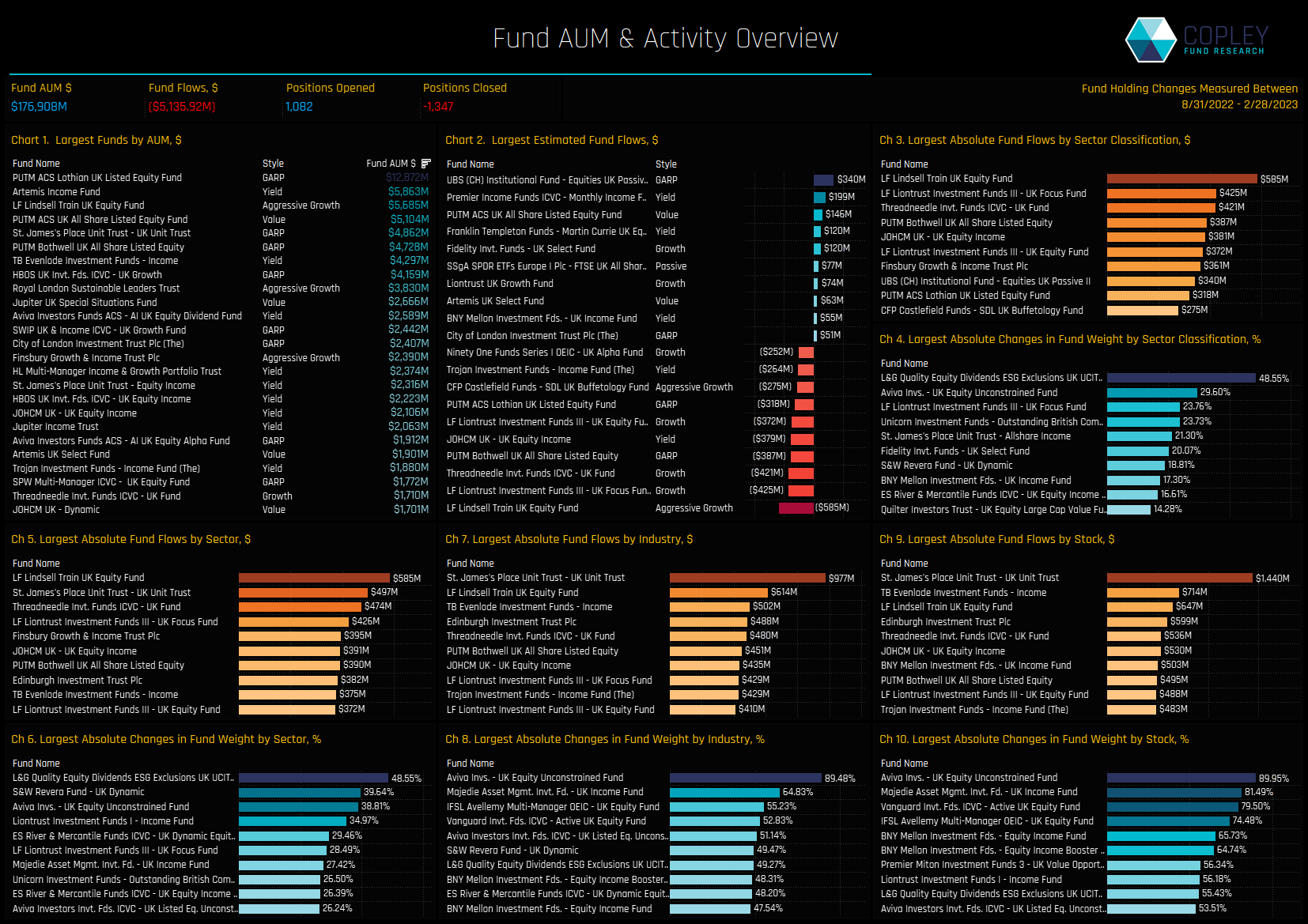

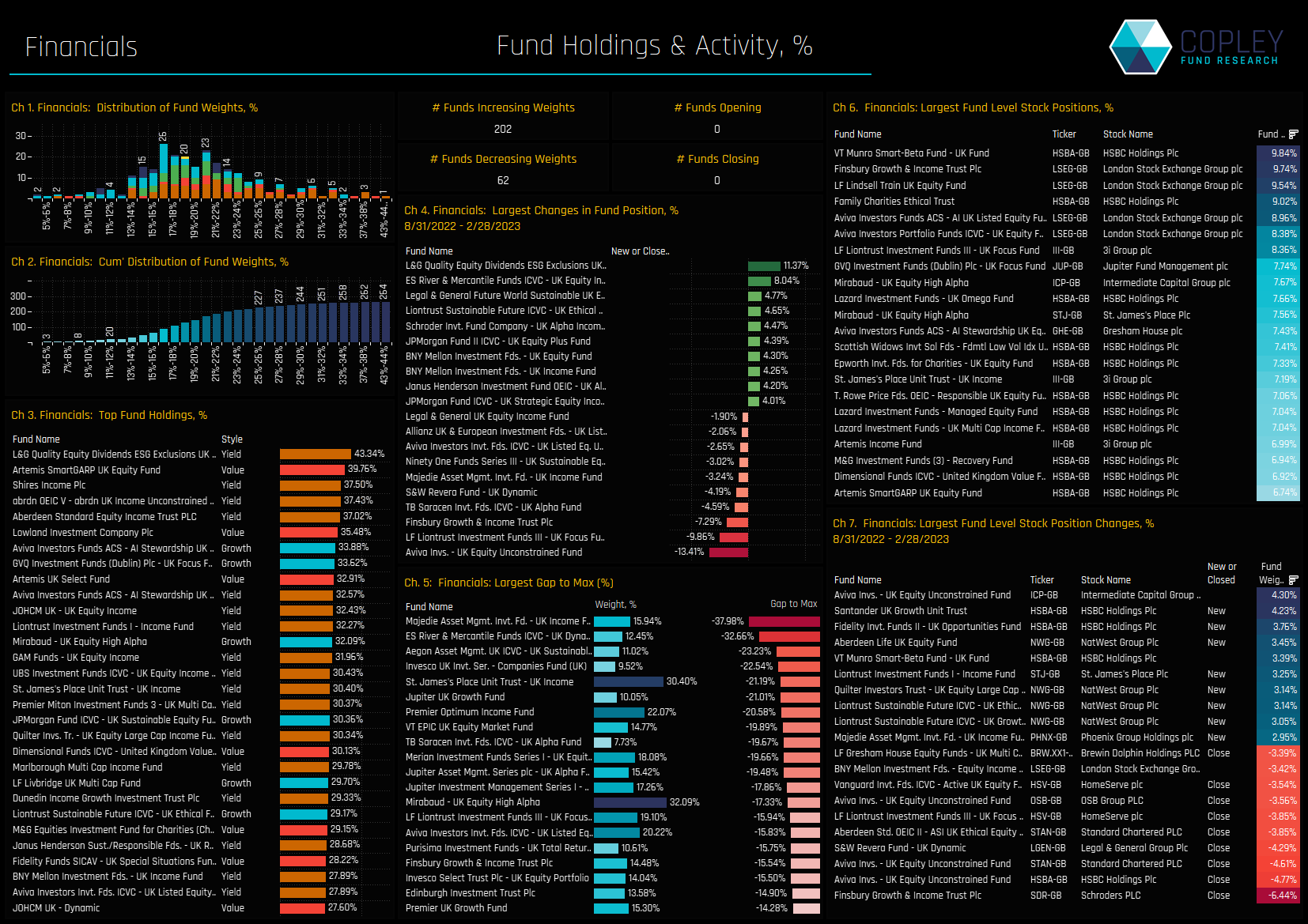

Fund AUM & Activity Overview

The below chart dashboard highlights the largest funds on an AUM basis and the largest estimated fund inflows and outflows in our UK analysis (ch1&2). The largest funds are led by PUTM ACS Lothian UK Listed Equity ($12.8bn) and Artemis Income ($5.8bn), contributing to a total AUM of $176bn. Over the period 08/31/2022 and 02/28/2023, the UK funds in our analysis saw estimated outflows of -$5.1bn, led by LF Lindsell Train UK Equity (-$585m), LF Liontrust UK Focus (-$425m) and Threadneedle UK (-$421m). For each fund, we provide a measure of activity across sector classifications, sectors, industries and stocks

For example, to arrive at a sector activity figure in chart 6, we add together the absolute change in each sector weight for each fund over the period 08/31/2022 – 02/28/2023. We do the same for fund flows in chart 5. Funds that were active on a fund flow basis across sectors, industries and stocks include LF Lindsell Train UK Equity, St James UK Unit Trust and TB Evenlode Income. On a portfolio weight basis, the funds displaying the highest levels of activity are led by L&G Quality Dividends ESG, Aviva UK Unconstrained and S&W Revera UK Dynamic.

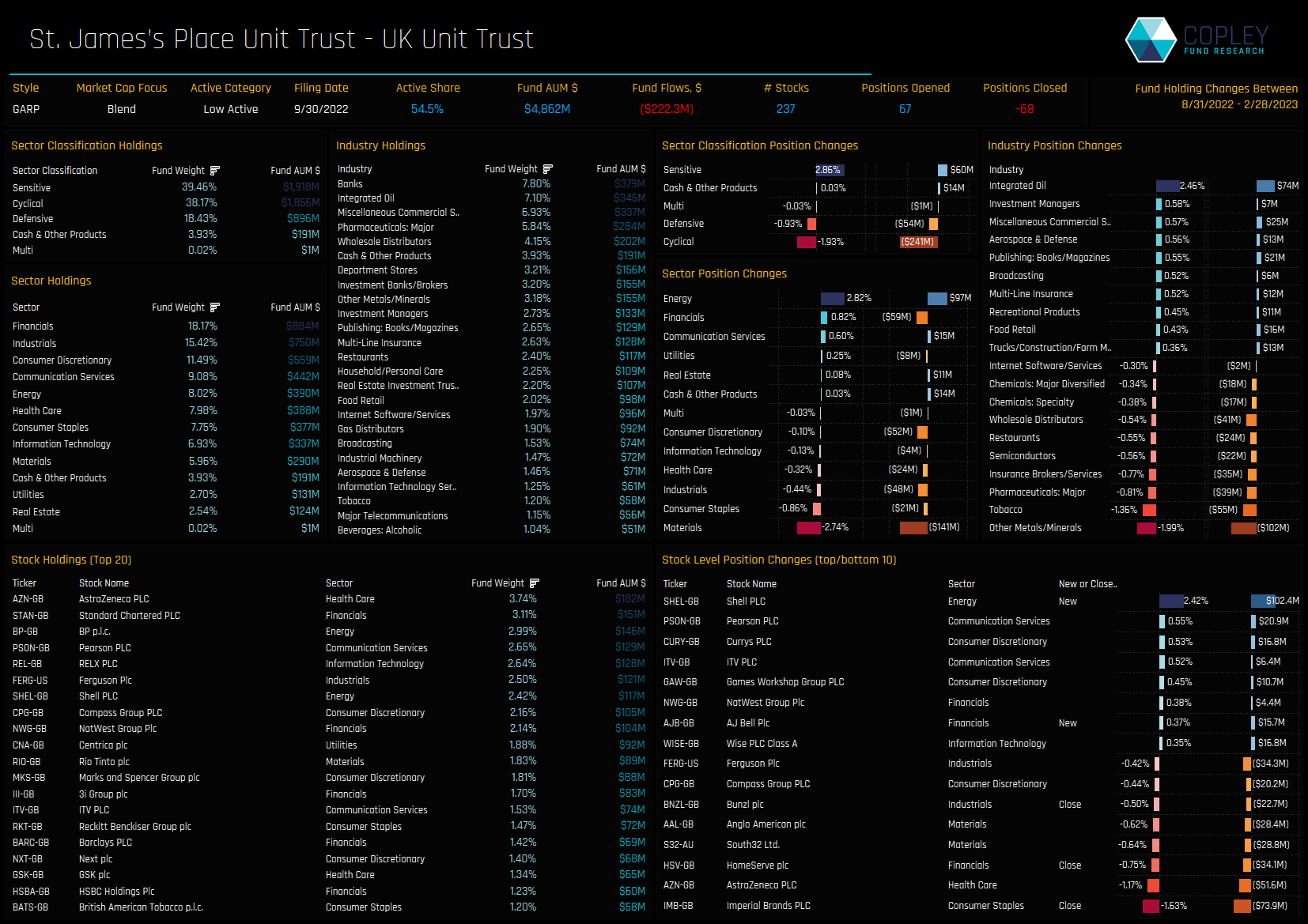

Fund Focus: St James's Place UK Unit Trust

St James’s Place UK Equity Trust is a low active strategy, holding 237 stocks and with an active share versus the SPDRs FTSE All-Share ETF of 54.5%. It is the 5th largest fund in our UK analysis. Cyclical and Sensitive sector allocations are well matched on 38.2% and 39.5% respectively, with Financials, Industrials and Consumer Discretionary accounting for a combined 45.6% of total allocations. Activity over the last 6-months has been fairly well balanced on a sector level, with a small rotation out of Materials and in to Energy.

On a stock level, things are more interesting. The fund is top of the list when it comes to gross absolute stock level flows, with combined buying and selling of $1.4bn. It opened 67 new positions and closed 68, and rebalanced across most of its 237 stock portfolio. These rebalances were all mainly small in nature, leaving the top 10 holdings in the fund largely unchanged, save for a new position in Shell plc. Closures were led by Imperial Brands, Homeserve plc and Bunzl plc.

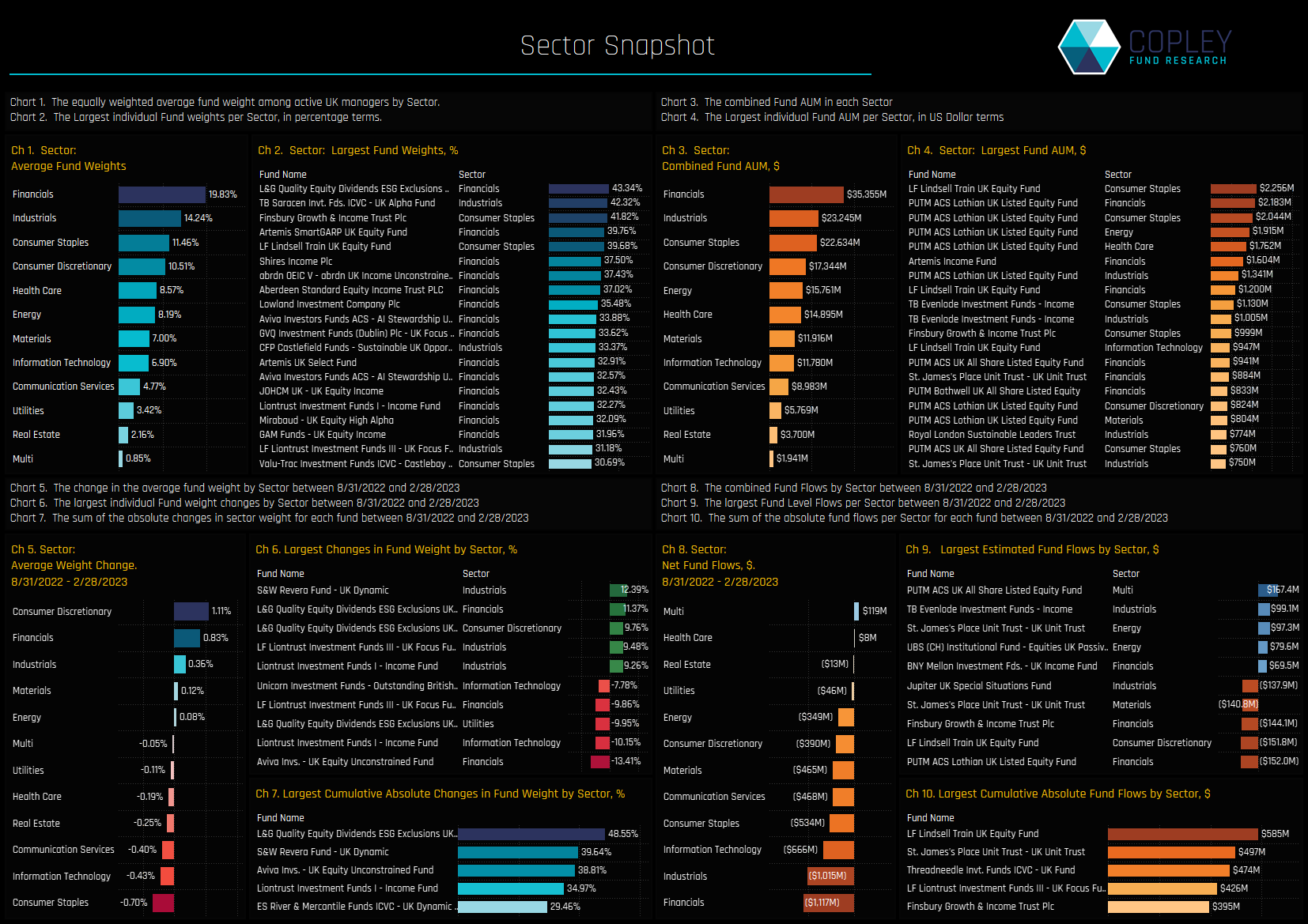

Sector Snapshot

The chart set below looks at the latest snapshot of Sector positioning among active UK managers, and the changes between 08/31/2022 – 02/28/2023. Financials and Industrials are the dominant weights, accounting for a combined 34% of total allocations, on average (ch1). Financials account for the bulk of the larger individual fund level positions in chart 2, led by L&G Quality Equity Dividend ESG Exclusions and Artemis SmartGARP UK Equity. Over the last 6-months, average holding weights have increased in Consumer Discretionary and Financials at the expense of Consumer Staples and Technology. Some of the larger fund level sector moves were out of Tech and in to Industrials (ch6).

On an AUM basis, of the $176bn in combined assets, $35.4bn are allocated towards Financials and $23.2bn to Industrials. LF Lindsell Train UK Equity’s $2.25bn holding in Consumer Staples tops the list of sector holdings (ch4), but PUTM ACS Lothian UK Listed Equity dominates the top 5. On a fund flows basis, $1.1bn of fund outflows were related to stocks in the Financials sector and $1bn to Industrials. Some of the more active funds include L&G Quality Equity Dividends ESG and S&W Revera UK Dynamic on a weight change basis, and LF Lindsell Train UK Equity and St James Place Unit Trust on a fund flows basis (ch7&10)

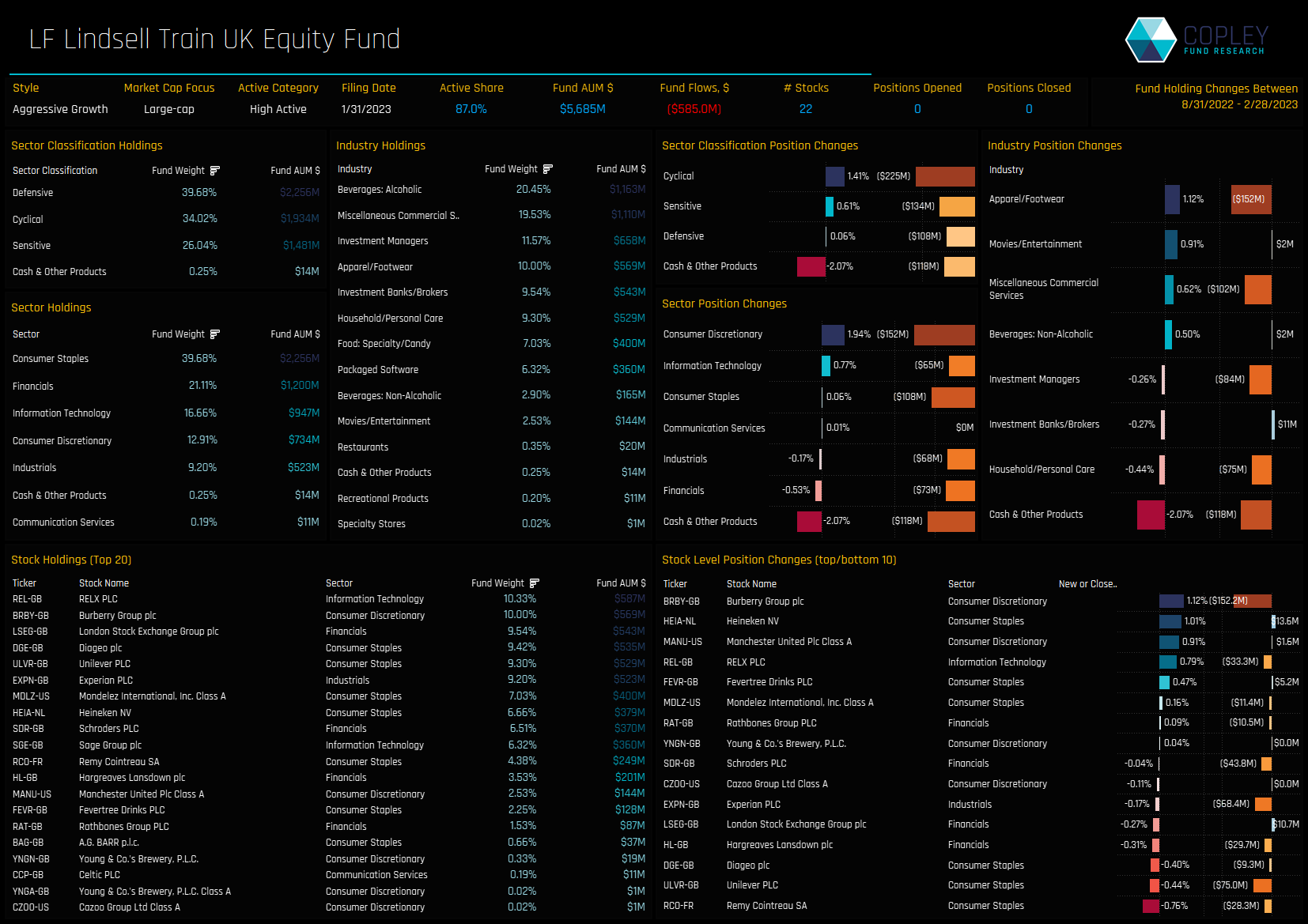

Fund Focus: LF Lindsell Train UK Equity

LF Lindsell Train UK Equity have kept things relatively unchanged over the last 6-months. There were no opening or closing stock positions over the period and limited sector rotation. The fund maintains a high concentration of just 22 stocks, with the top 6 holdings accounting for 57.8% of total allocations.

The large absolute changes in sector allocations on a USD basis were driven by an estimated -$585bn of outflows from the fund between 08/31/2022 and 02/28/2023. As such, all sectors saw net outflows, led by Consumer Discretionary (-$152m), Cash (-118m) and Consumer Staples (-$68m).

Sector Focus: Financials

Financials are the largest sector allocation and a key driver of returns for UK equity funds. The majority of the 264 funds in our analysis hold between a 13% and 28% allocation (ch1), though there are those who choose to allocate more, led mainly by strategies at the Yield/Value end of the spectrum (ch3). High sector rotation was notable from the L&G Quality Equity Dividends ESG Fund, ES River UK Equity, Aviva UK Equity Unconstrained and LF Liontrust UK Focus Fund.

On a stock level, HSBC Holdings dominates the list of large positions in chart 6, but sizeable allocations in the London Stock Exchange plc from Finsbury Growth & Income, LF Lindsell Train and Aviva Investors also stand out. On the stock activity side, new positions in NatWest Group are prevalent among the key stock holding changes, which we explore in more detail in the last section of the report.

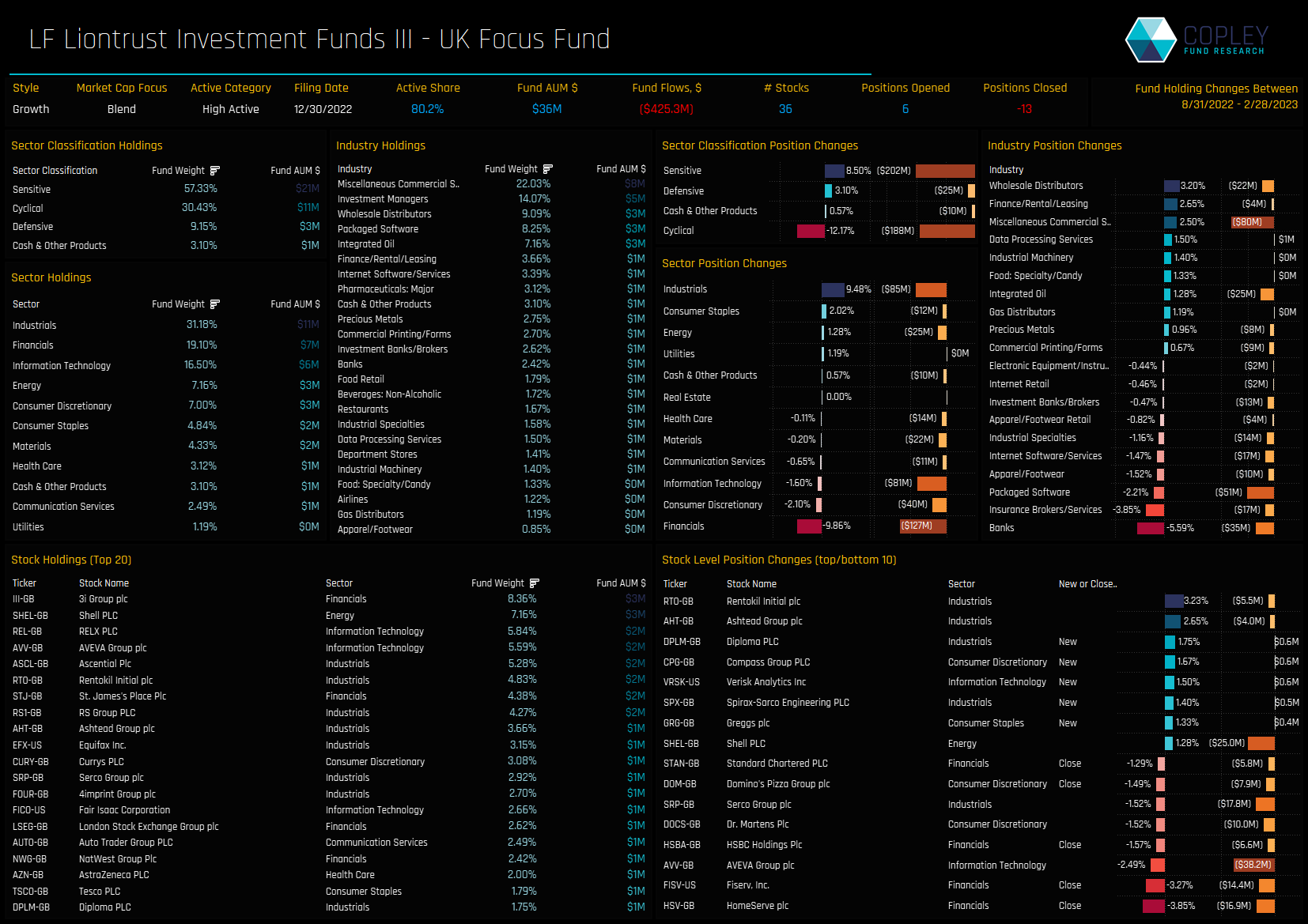

Fund Overview: Liontrust UK Focus

The Liontrust UK Focus Fund has a high active share of 80.2% and runs a concentrated portfolio of 36 companies, headed by 3i Group, Shell plc and RELX plc. Sector allocations are dominated by Industrials, with 5 of the top 10 stock positions within the Industrials sector. Over the period 08/31/2022 to 02/28/2023, the fund suffered an estimated -$425m of net outflows, leaving AUM at just $36m

The heavy sector activity within the Liontrust UK Focus Fund was driven by a rotation out of Financials (-9.8%) and in to Industrials (+9.5%). The rotation moves Industrials to the top sector allocation ahead of Financials. The fund opened 6 new positions and closed 13 as part of a heavy rebalance across the fund, increasing holdings in Rentokil and Ashtead Group and closing positions in HomeServe and Fiserve, among others.

Report Link

Please click on the link opposite to download the full report, which includes profiles for all sector classifications and sectors, in addition to profiles of selected funds based on AUM and fund activity.

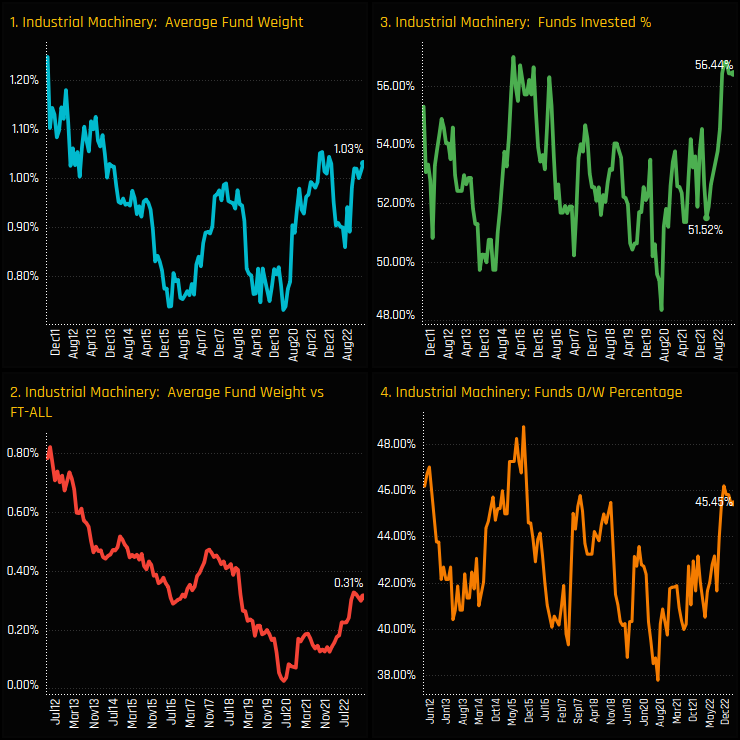

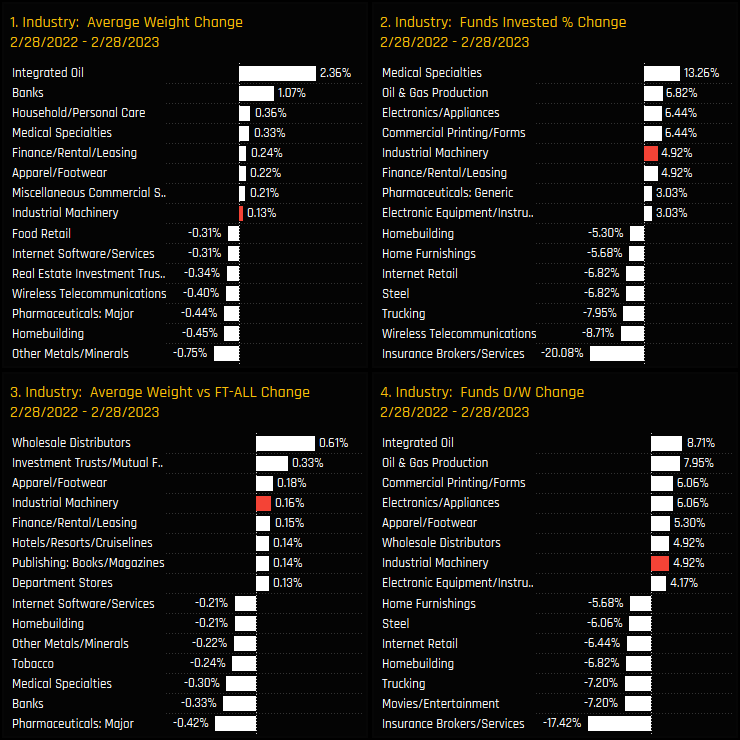

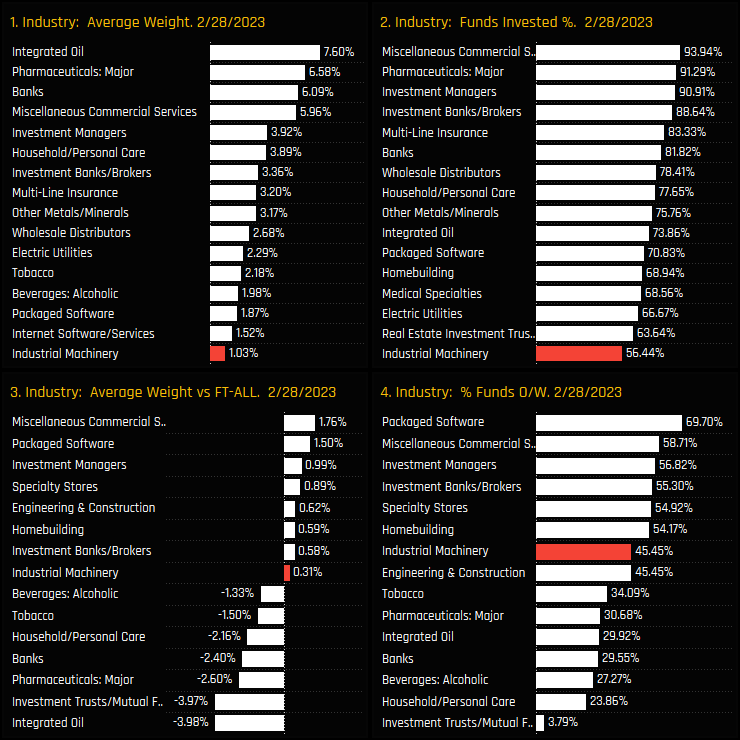

Time-Series & Industry Activity

UK fund exposure in the Industrials Machinery industry group is on the rise. Buying from UK managers over the last 12-months has pushed exposure back towards the higher end of the 10-year range. The below charts show all 4 measures of fund ownership moving higher, with the percentage of funds invested increasing from 51.5% to 56.4% between 02/28/2022 and 02/28/2023 (ch3), pushing average weights to 1.03% (ch1) and net overweights to 0.31% (ch2)

These changes were among the highest versus Industry peers over the last 12-months. Industrial Machinery stocks were a beneficiary of inflows alongside Oil & Gas, Electronics/Appliances and Medical Specialties, with UK managers scaling back exposure to Homebuilding (see Homebuilders: Negative Momentum), Insurance Brokers/Services and Internet Retail, among others.

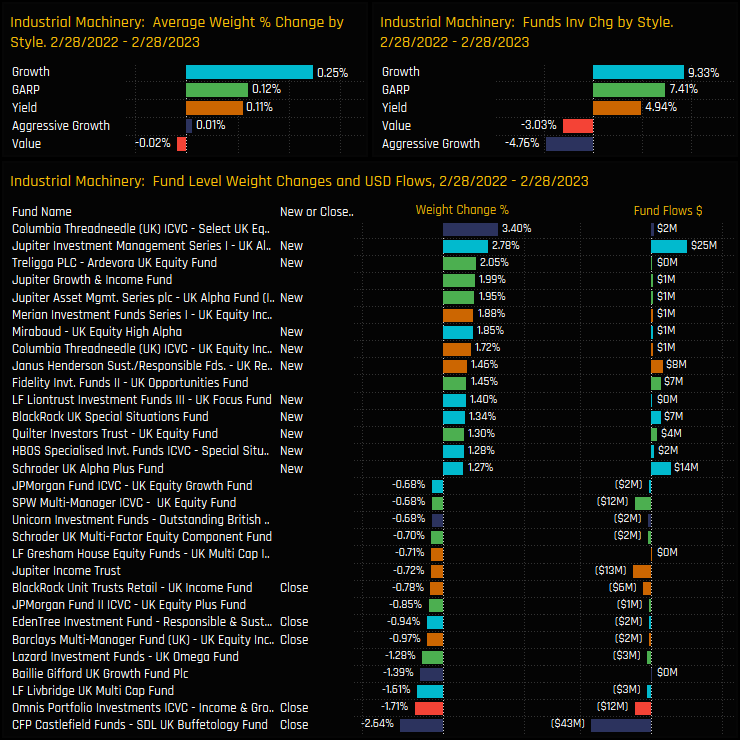

Fund Holdings & Activity

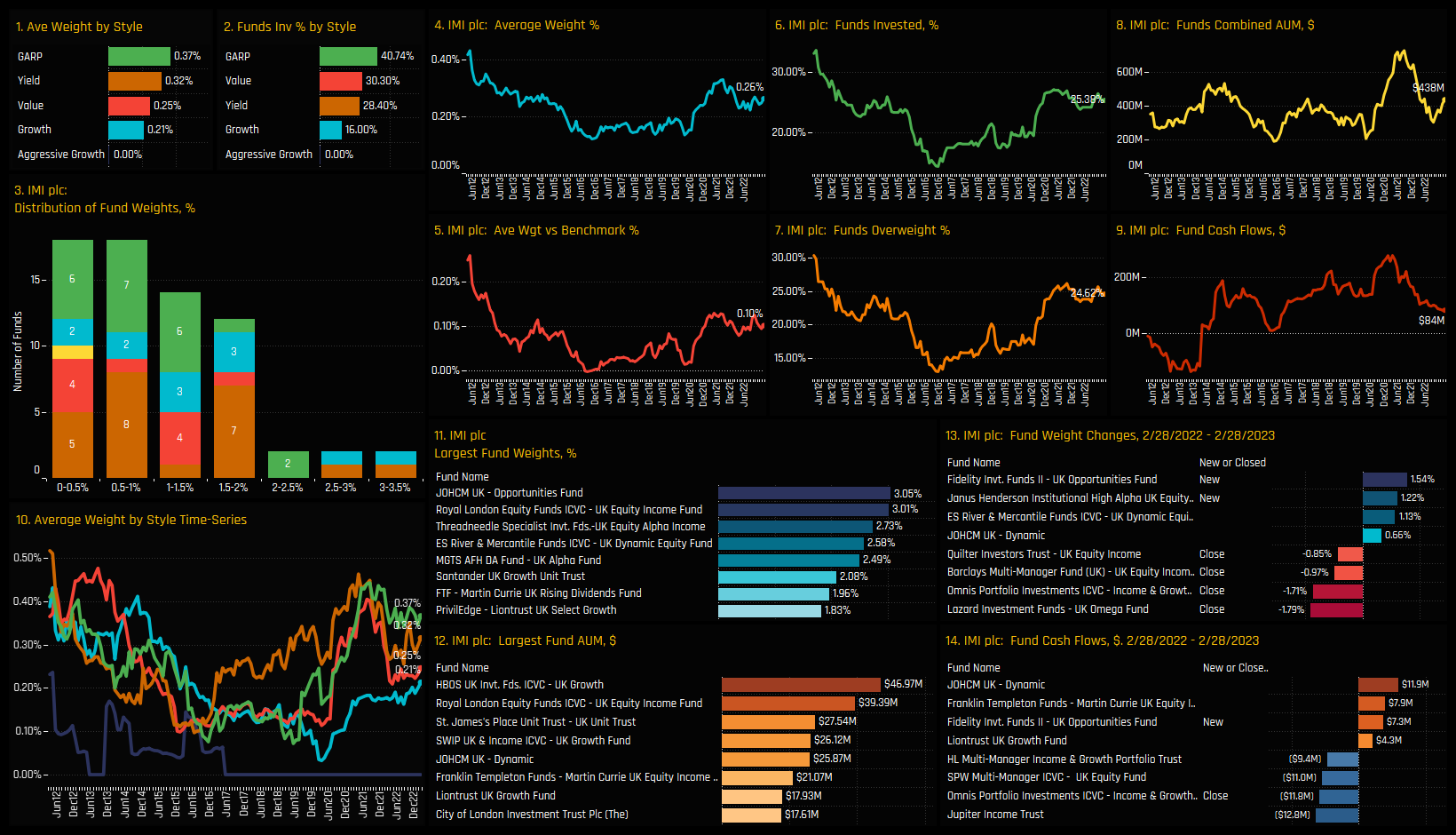

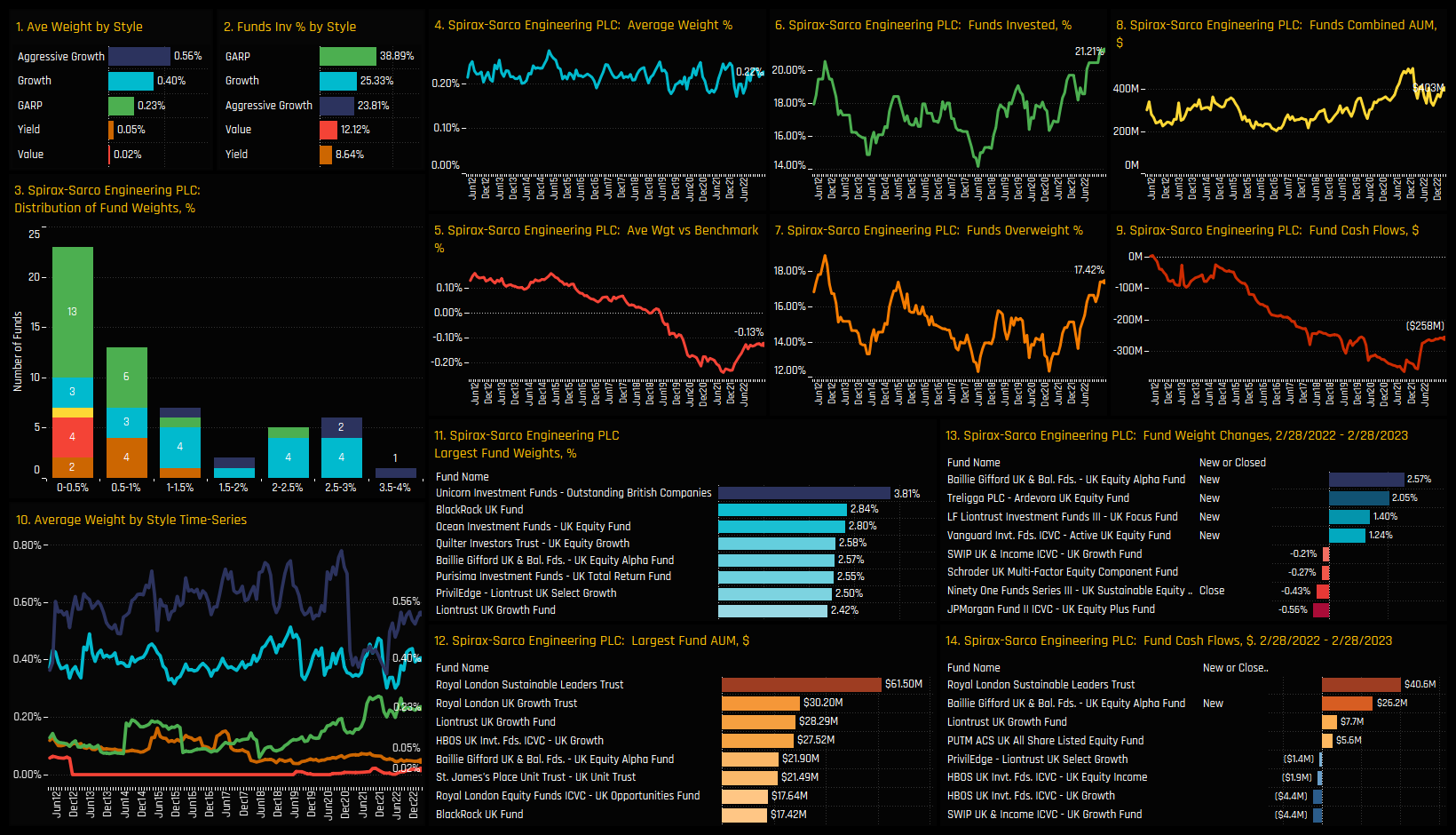

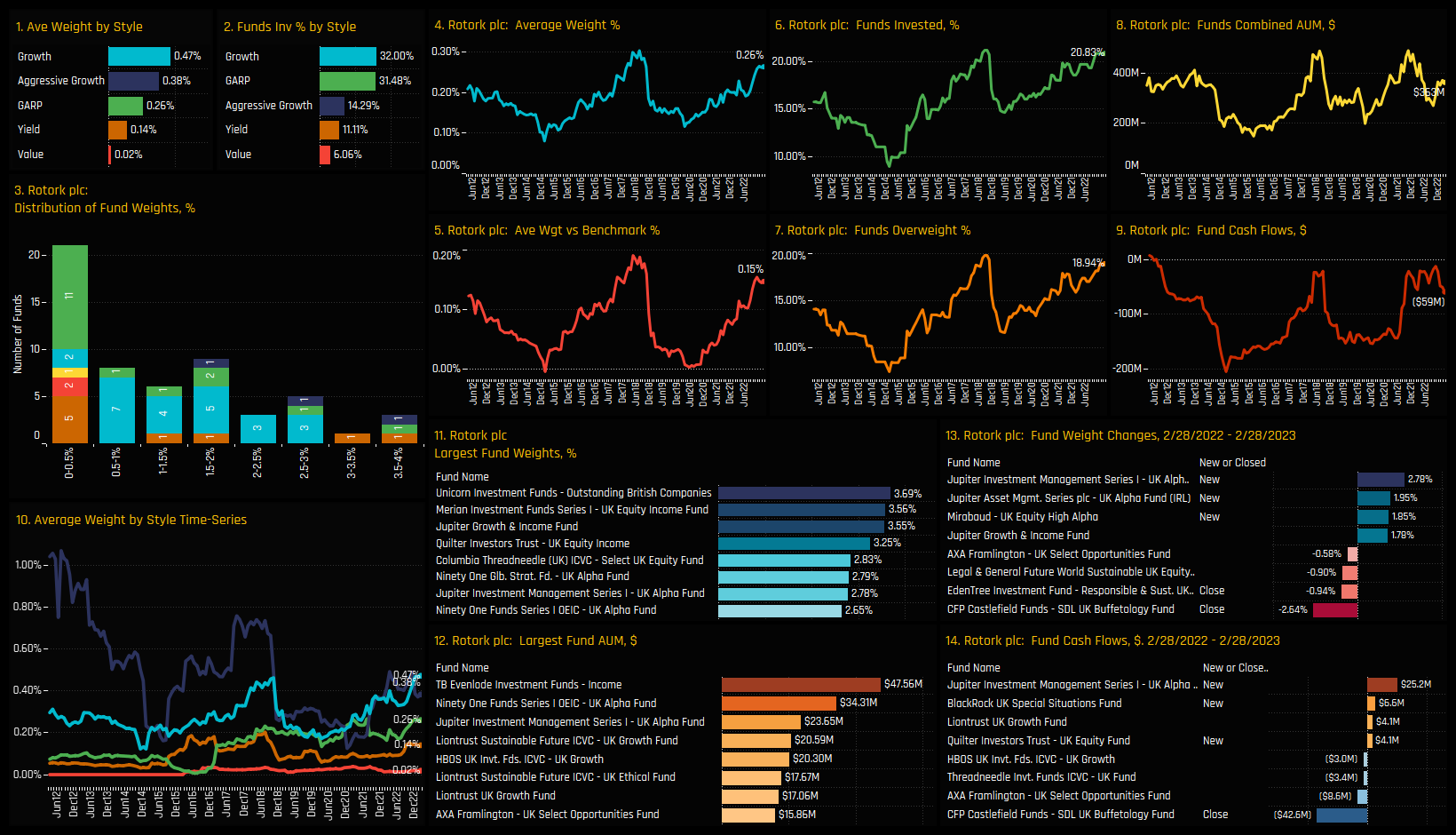

The rotation was driven by Growth, GARP and Yield strategies, with 9.3% of UK Growth Funds and 7.4% of UK GARP Funds opening up new exposure over the last 12-months. On a fund level, new positions from Jupiter UK Alpha (+2.8%) and Treligga UK Equity (+2.05%) led the way. It wasn’t all one-way traffic, with closures from Castlefield UK Buffetology and Omnis Income & Growth, among others.

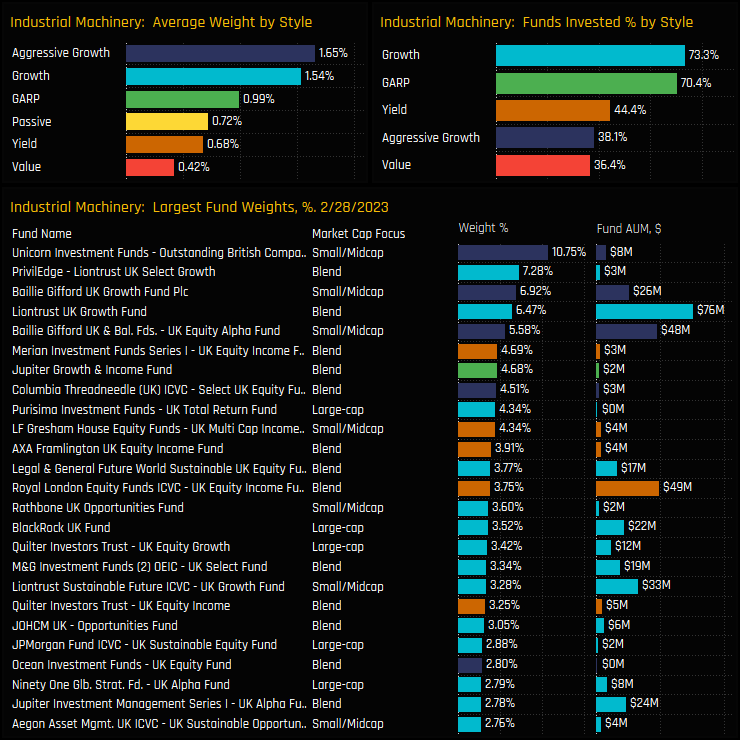

As it stands today, Industrial Machinery stocks are more commonly held among Growth and GARP investors, though large positions from selected Aggressive Growth funds have pushed up the averages. The Unicorn Outstanding British Companies Fund tops the list with a 10.75% allocation, well above the majority of the top holders who typically show a sub 5% weight. Small/Midcap and Blend strategies are prominent among the larger weights.

Stock Holdings & Activity

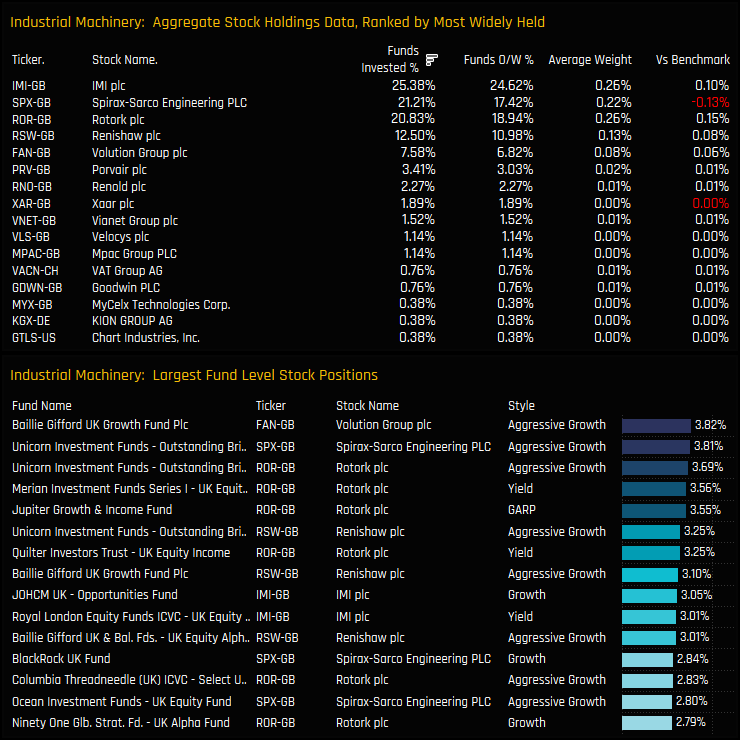

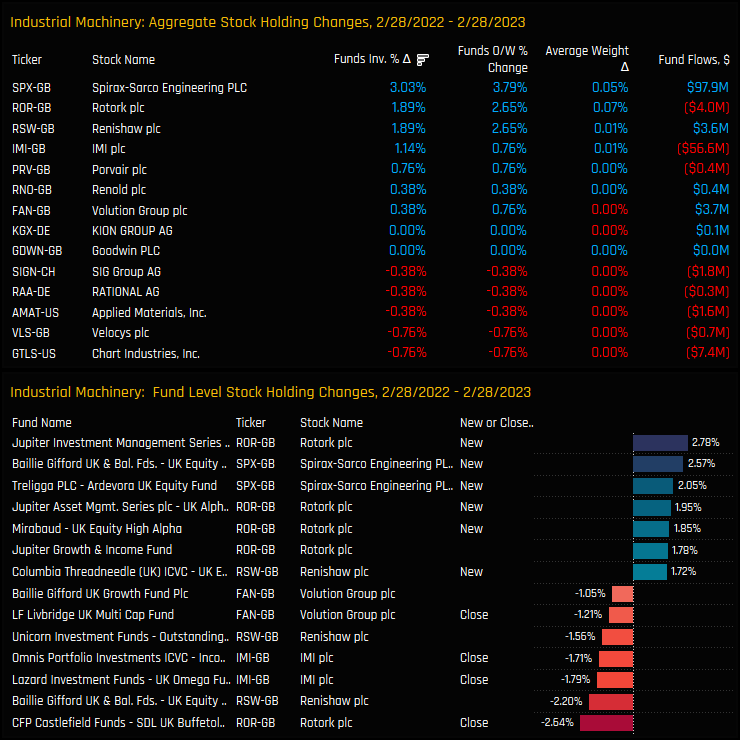

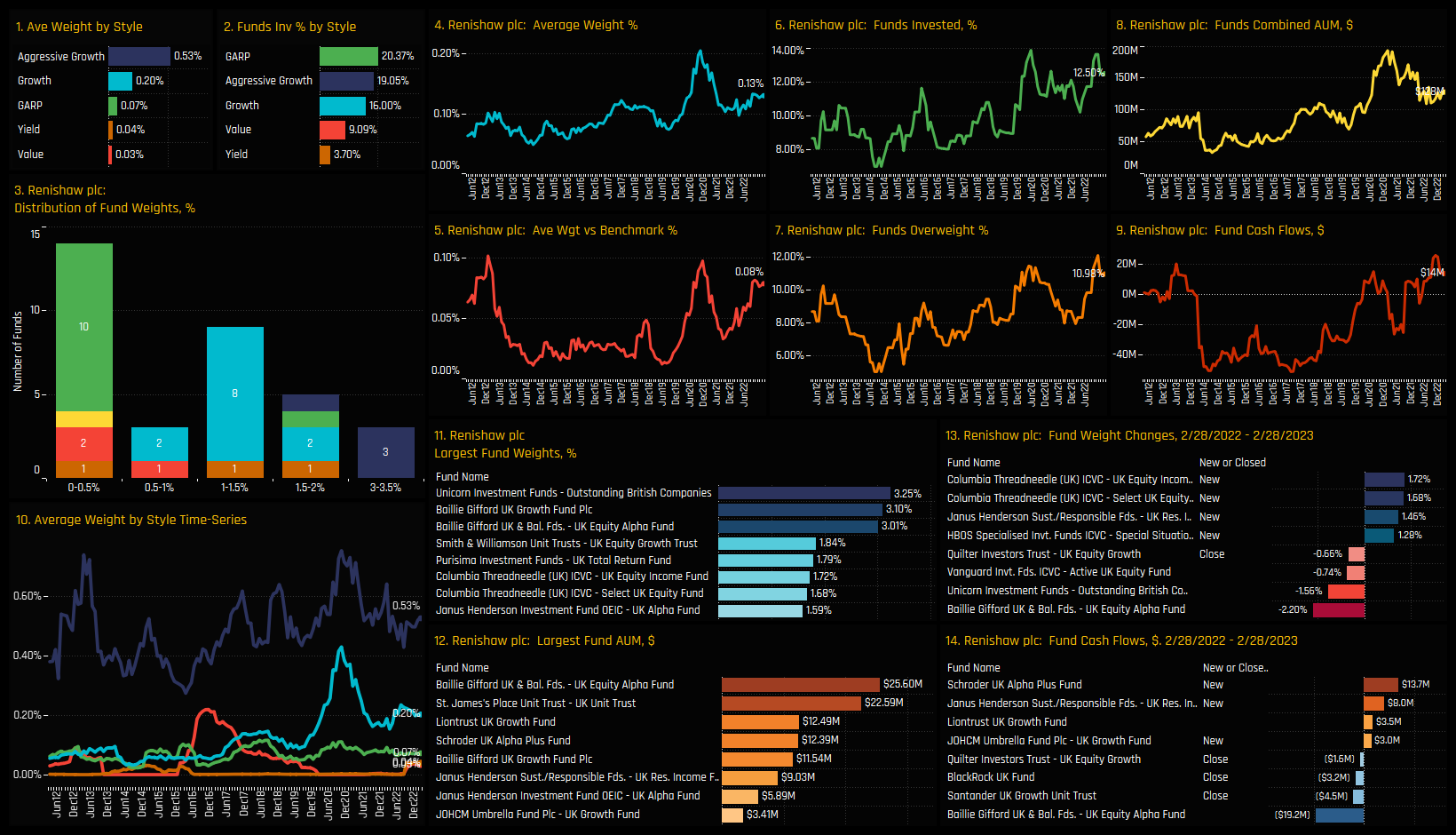

IMI plc, Spirax-Sarco Engineering and Rotork plc are the dominant holdings, all held by between 20% and 25% of UK managers and at similar average holding weights. All 3 stocks are prevalent among the larger positions in the lower chart, in addition to selected holdings in Valuation Group (Baillie Gifford) and Renishaw plc (Unicorn, Baillie Gifford)

The largest aggregate changes in stock positioning between 02/28/2022 and 02/28/2023 were positive, and led by Spirax-Sarco Engineering, Rotok plc and Renishaw plc. New positions in Rotork plc from Jupiter UK Alpha and in Spirax-Sarco Engineering from Baillie Gifford and Treligga PLC are the standout moves on fund level.

Conclusions & Data Report

The latest Industry level positioning among active UK equity funds is shown in the chart opposite. Integrated Oil, Pharmaceuticals and Banks are the dominant allocations, with Industrial Machinery well down the list despite the recent rotation. At a 1.03% average weight and held by 56.4% of managers, the Industrial Machinery sector is far from being a must have allocation.

Yet against the benchmark, positioning shows the confidence that selected managers are placing in Industrial Machinery stocks. The majority of those that hold an allocation do so at a greater weight than the SPDRs UK FTSE All-Share ETF, with only 6 other industry groups held overweight by more funds.

If we couple the recent strong momentum and high conviction overweights with the fact that 44% of funds are still uninvested, it’s not difficult to see the potential for the ownership base to grown further from here. These are stocks that should be on every UK investor’s radar.

Click on the link below for the latest data pack on Industrial Machinery positioning among active UK funds. Scroll down for stock profiles on IMI plc, Spirax-Sarco Engineering, Rotork plc and Renishaw plc

Stock Profile: IMI plc

Stock Profile: Spirax-Sarco Engineering

Stock Profile: Rotork plc

Stock Profile: Renishaw plc

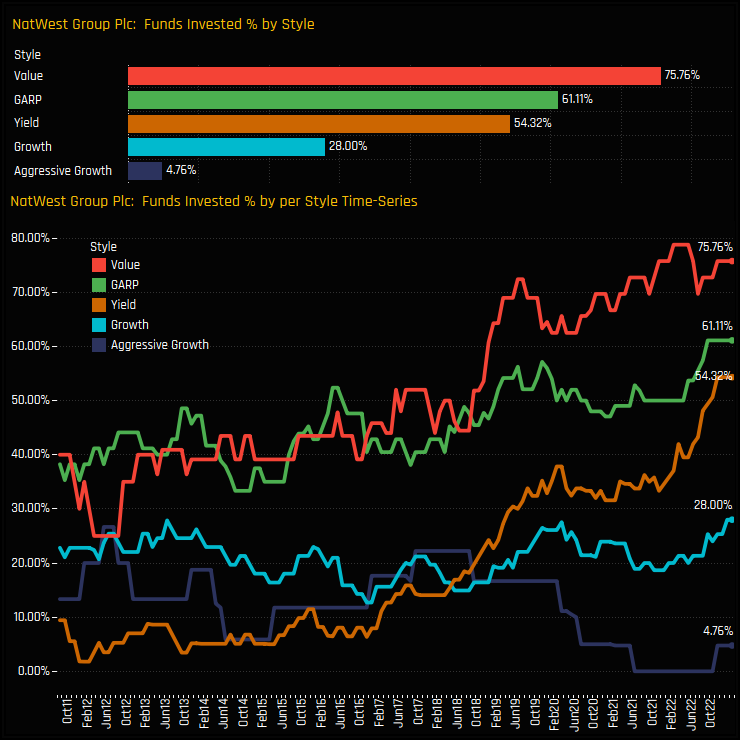

Time-Series and Stock Activity

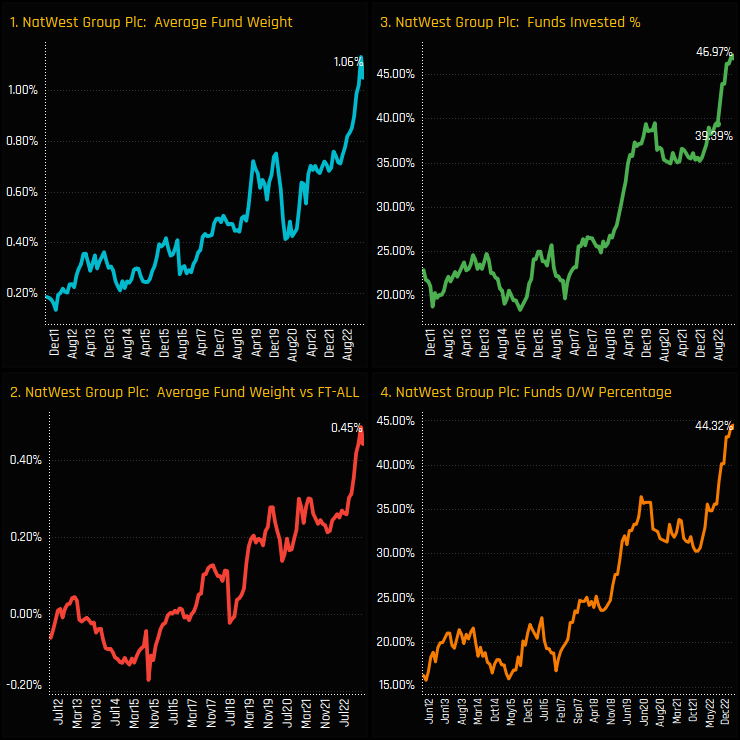

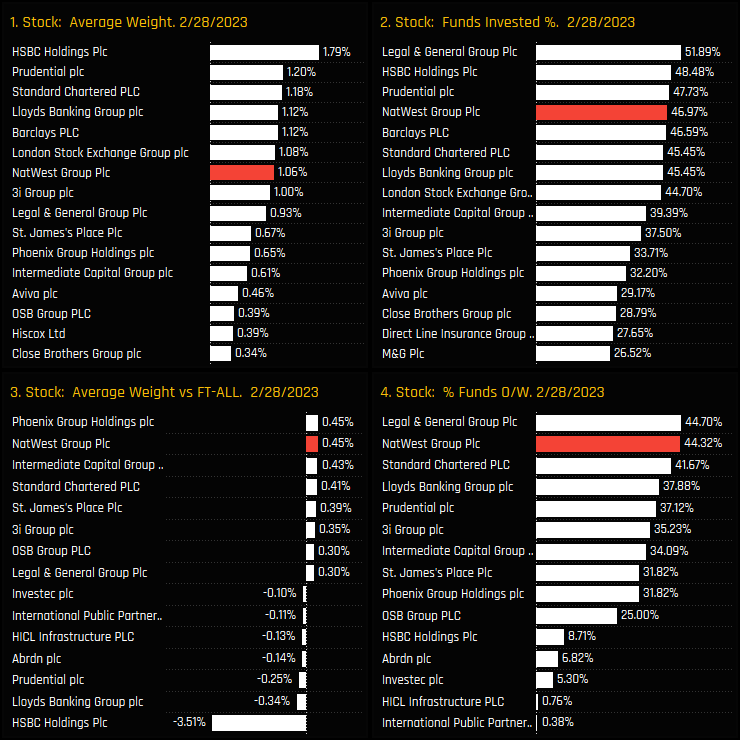

UK Fund ownership in NatWest Group plc continues to show its strength. After a pause in ownership growth between 2019 and 2022, UK managers re-engaged with the name from July of last year, with all measures of fund ownership surging higher. The percentage of UK funds invested in NatWest Group stands at a record 46.97%, with average fund weights breaking 1% for the first time in its own history. Versus the benchmark, a record 44.3% of managers are overweight the benchmark SPDRs FTSE All Share ETF.

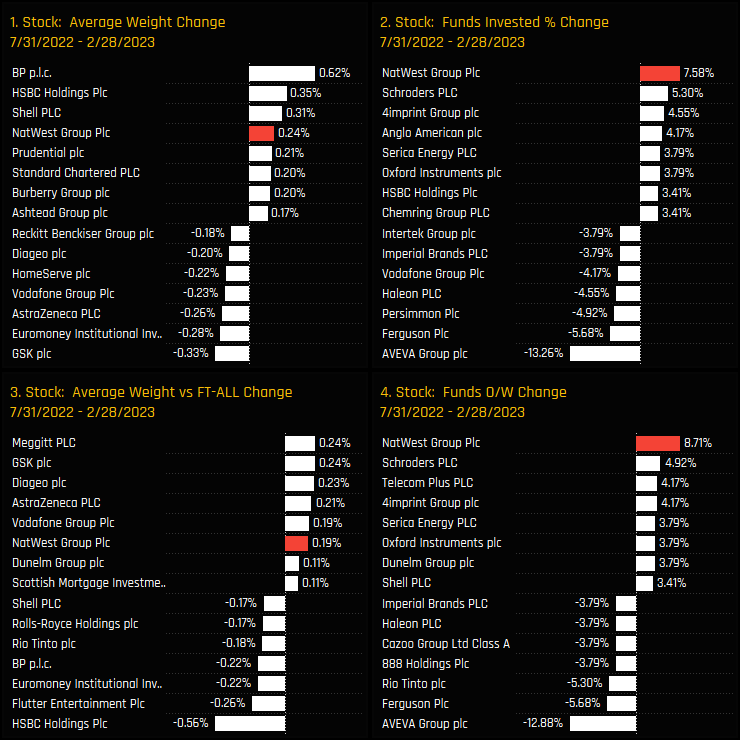

Between the period 07/31/2022 and 02/28/2023, no other stock has captured such a rise in ownership, with NatWest’s +7.6% increase in the percentage of funds invested beating that of Schroders PLC (+5.3%) and 4imprint Group plc (+4.55%). Only the UK large caps of BP, HSBC and Shell saw average fund weights rise more than NatWest Group over the period. This was an aggressive, active rotation.

Fund Activity and Style Trends

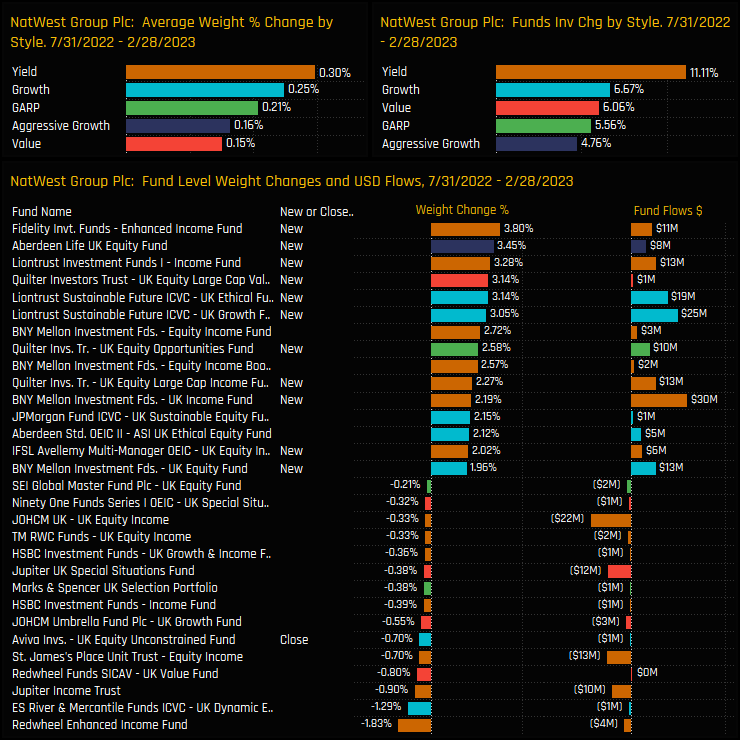

Between 07/31/2022 and 02/28/2023, new positions from Fidelity Enhanced Income (+3.8%), Aberdeen Life UK Equity (+3.45%) and Liontrust Income (+3.28%) led a total of 21 funds who opened exposure to NatWest Group. Yield managers were prevalent among the larger buyers, with 11.1% of the Yield funds in our analysis opening new positions, though all Style groups saw allocations rise.

There is a definite Style bias to the ownership picture. The bottom chart below shows the percentage of funds invested in NatWest Group over time, split by the Style of the fund. Value and GARP funds have consistently been the more widespread allocators, with Yield catching up over the last 2 years. Growth and Aggressive Growth funds are some way behind, and clearly find it harder to justify a position.

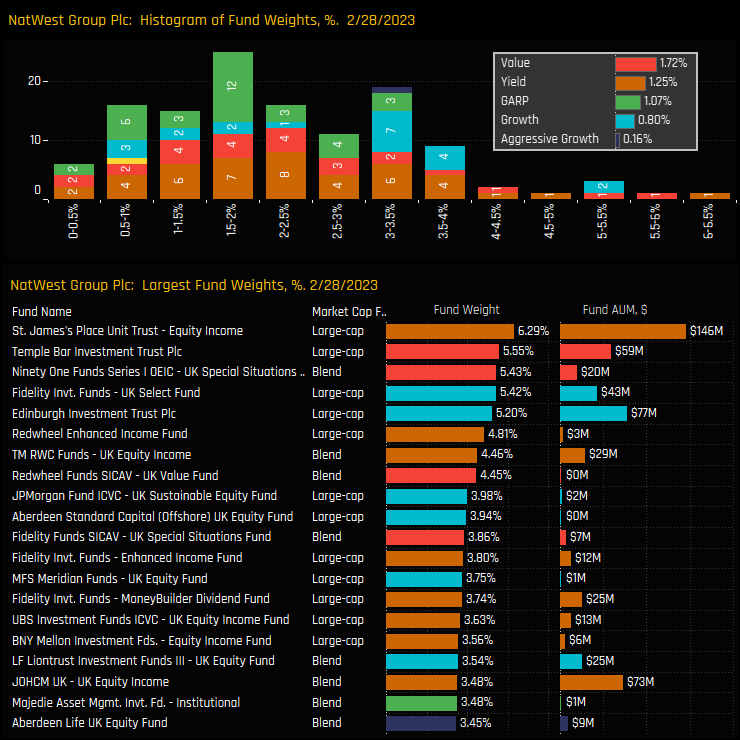

Fund Holdings & Financials Stock Positioning

The distribution of fund weights in NatWest Group is centered at between 1.5% and 3.5%, though it is a larger portfolio position for a number of managers. St James’s Place Equity Income (6.3%) and Temple Bar Investment Trust (5.6%) lead a group of managers who are comfortable with a +5% position. This is far from a fringe holding.

In fact, NatWest Group has climbed its way up to the 4th most widely held stock in the UK Financial sector, behind Prudential, HSBC and Legal & General. Moreover, it is the 2nd largest net overweight and the 2nd most popular overweight Financials position. On all accounts, NatWest is one of the top high conviction holding among UK active managers.

Links

Click on the link opposite for the latest data pack on NatWest Group plc positioning among active UK funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- April 18, 2024

UK Funds: Performance & Attribution Review, Q1 2024

268 UK Equity funds, AUM $192bn UK Funds: Performance & Attribution Review, Q1 2024 ..

- Steve Holden

- February 2, 2023

UK Fund Positioning Analysis, January 2023

272 UK Equity Funds, AUM $174bn UK Fund Positioning Analysis, January 2023 In this issue: 2023 ..

- Steve Holden

- October 13, 2022

UK Utilities Rotation

275 Active UK Equity funds, AUM $145bn UK Utilities In this piece we provide a comprehensive an ..