372 emerging market Funds, AUM $423bn

Istanbul or Bust: The Decline of Turkish Investor Positioning

• Turkish fund ownership falls to record lows after significant rotation

• Value managers sell down stakes but remain largest allocators. Aggressive Growth funds all but close out holdings

• No single company owned by more than 10% of managers. BIM and Koc Holdings the most widely held.

• Turkey falls to 9th largest country allocation in EMEA.

Time Series & Country Activity

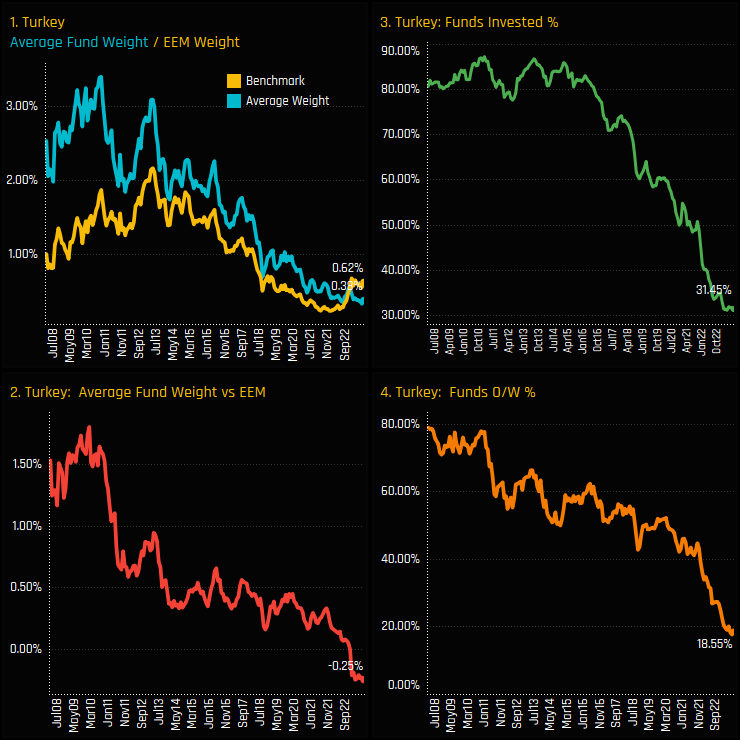

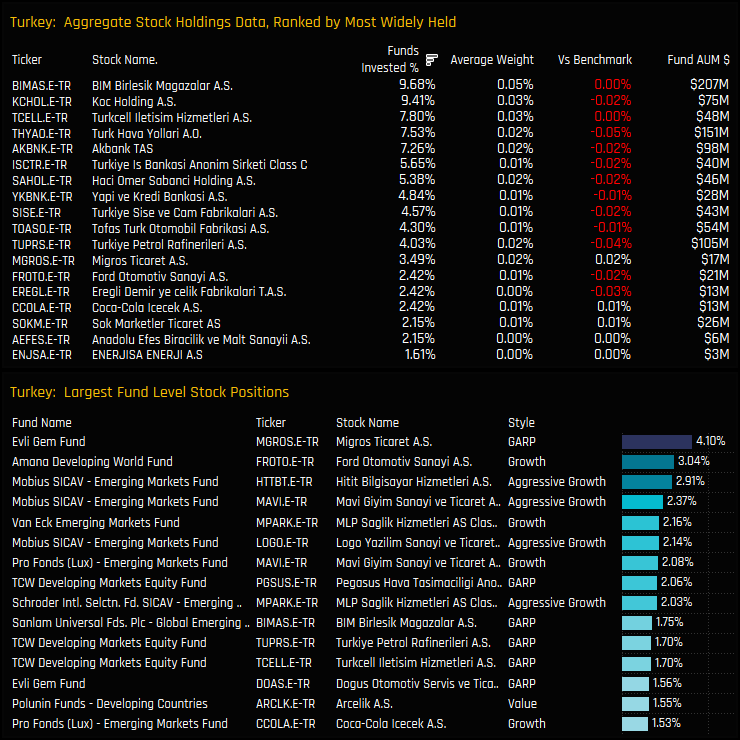

Ownership levels in Turkish equities have fallen to new lows among active Emerging Market equity funds. The percentage of funds invested in Turkey stands at an all-time low of 31.45%, pushing average holding weights to new lows of just 0.38%. For the first time since 2008, active managers are now running an underweight in Turkey, with just 18.6% of funds positioned ahead of the iShares MSCI Emerging Markets ETF.

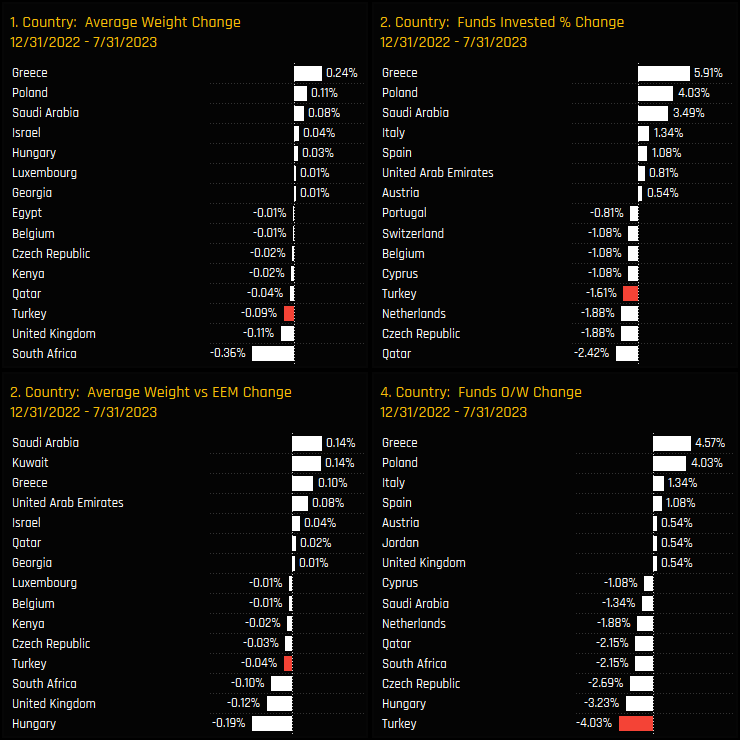

Fund activity through 2022 has extended the downward trajectory witnessed over the last decade. The below charts show the change in our ownership metrics for EMEA countries between 12/31/2022 and 07/31/2023. Turkey has been a key casualty of outward fund rotation, with all 4 measures of ownership moving lower over the period. Active GEM managers instead increased their Greek, Polish and Saudi Arabian allocations.

Fund Activity & Style Trends

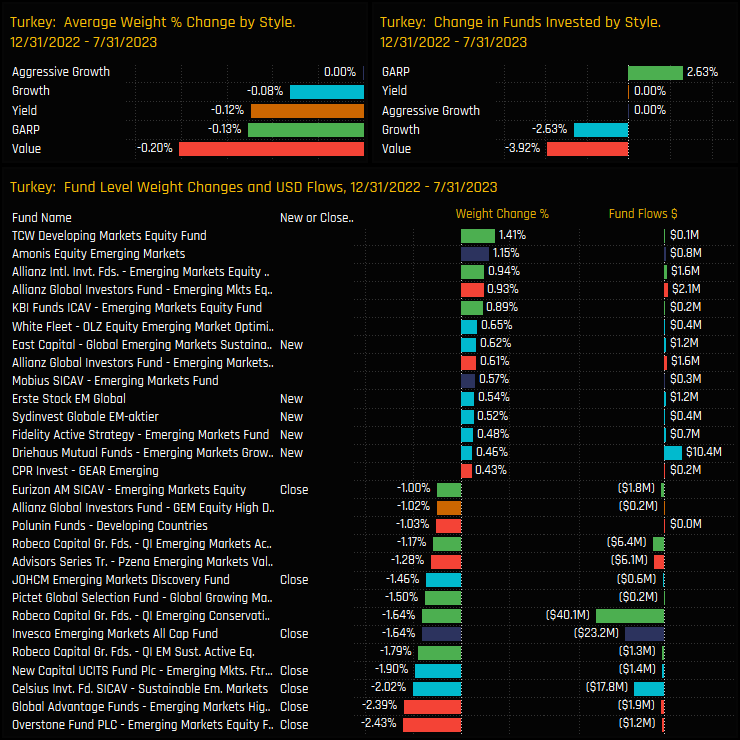

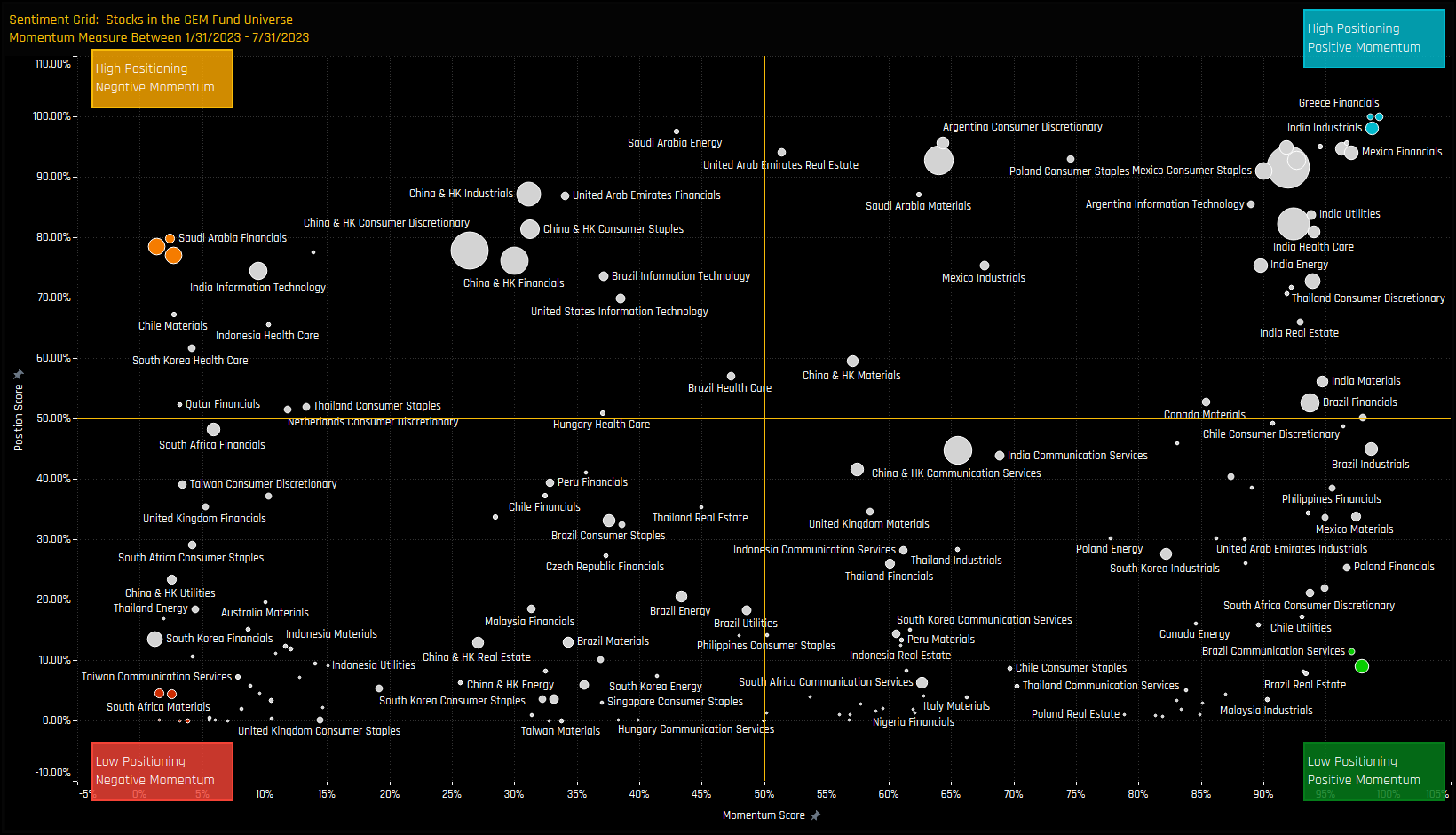

The charts below show the aggregate changes in Turkish allocations by fund Style (top) and the individual fund level changes (bottom), over the course of 2023. Value funds saw the largest drop in the percentage of funds invested and average weight, led by closures from Overstone EM Equity (-2.4%) and Global Advantange EM High Value (-2.4%). This wasn’t a slam dunk exodus though, with selected funds increasing weights or opening up new exposures.

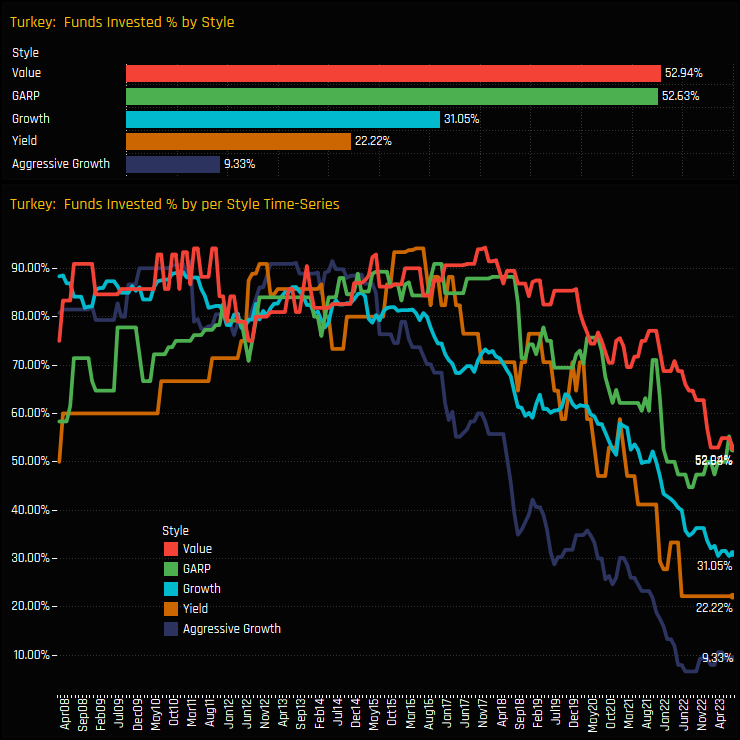

Despite the drawdown in Value fund allocations, they remain the most heavily invested Style group, with 52.9% of funds invested compared to 31% of Growth funds and just 9.3% of Aggressive Growth funds. Over time, the percentage of funds invested has fallen for all Style groups, but the most prominent move has been among Aggressive Growth strategies, who no longer view Turkey as a viable investment destination.

Fund Holdings & Stock Positioning

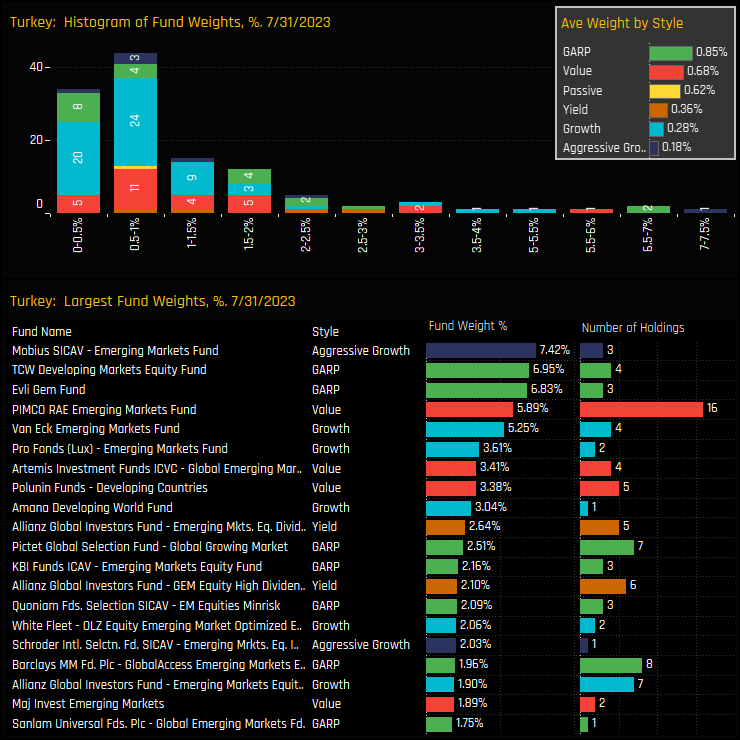

The histogram chart below shows the distribution of fund weights in Turkey for the 31.4% of funds who hold exposure. The majority of funds hold less than a 2% weight, with the extended tail to the right-hand side capping out at 7.4% for the Mobius EM Fund. GARP and Value funds are among the larger holders and stand as the only Style groups positioned overweight the iShares MSCI EM ETF.

With ownership levels in Turkey at all-time lows, it’s little surprise that ownership in individual stocks is light. The most widely held companies are BIM Birlesik and Koc Holding, owned by 9.7% and 9.4% of funds respectively. The once widely owned banks are almost totally avoided, with Akbank the most popular holding with 7.5% of funds holding a position.

Conclusions & Links

The sad demise of Turkey is no more evident when we look at the latest country positioning in the EMEA region. Once the 3rd largest country allocation in EMEA, Turkey has fallen down to 9th, with Hungary, Greece and the UK held by more funds. With index weights diminishing in line with active weights, the underweight of -0.25% is small in comparison to the larger benchmark countries of Saudi Arabia, Kuwait and Qatar.

So with both active weights and benchmark weights so small, the risks of not holding a Turkey position are diminishing for the average active manager. Only 16 of the 373 funds in our analysis hold more than a 2% allocation – To bet big on Turkey here is a significant non-consensus call.

Click below for the extended data report on Turkish EM investor positioning.

372 emerging market Funds, AUM $423bn

GEM Funds Country/Sector Radar

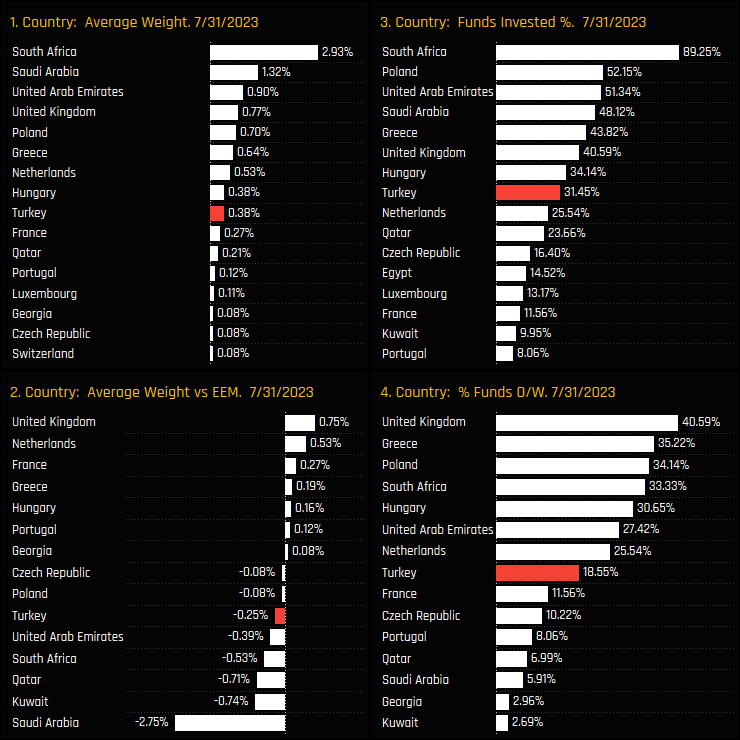

Investment levels among the key country/sectors in the investible Emerging Markets universe differ greatly. Some country/sectors are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every country/sector in our EM analysis. We highlight 11 country/sectors at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

Country/Sector Sentiment

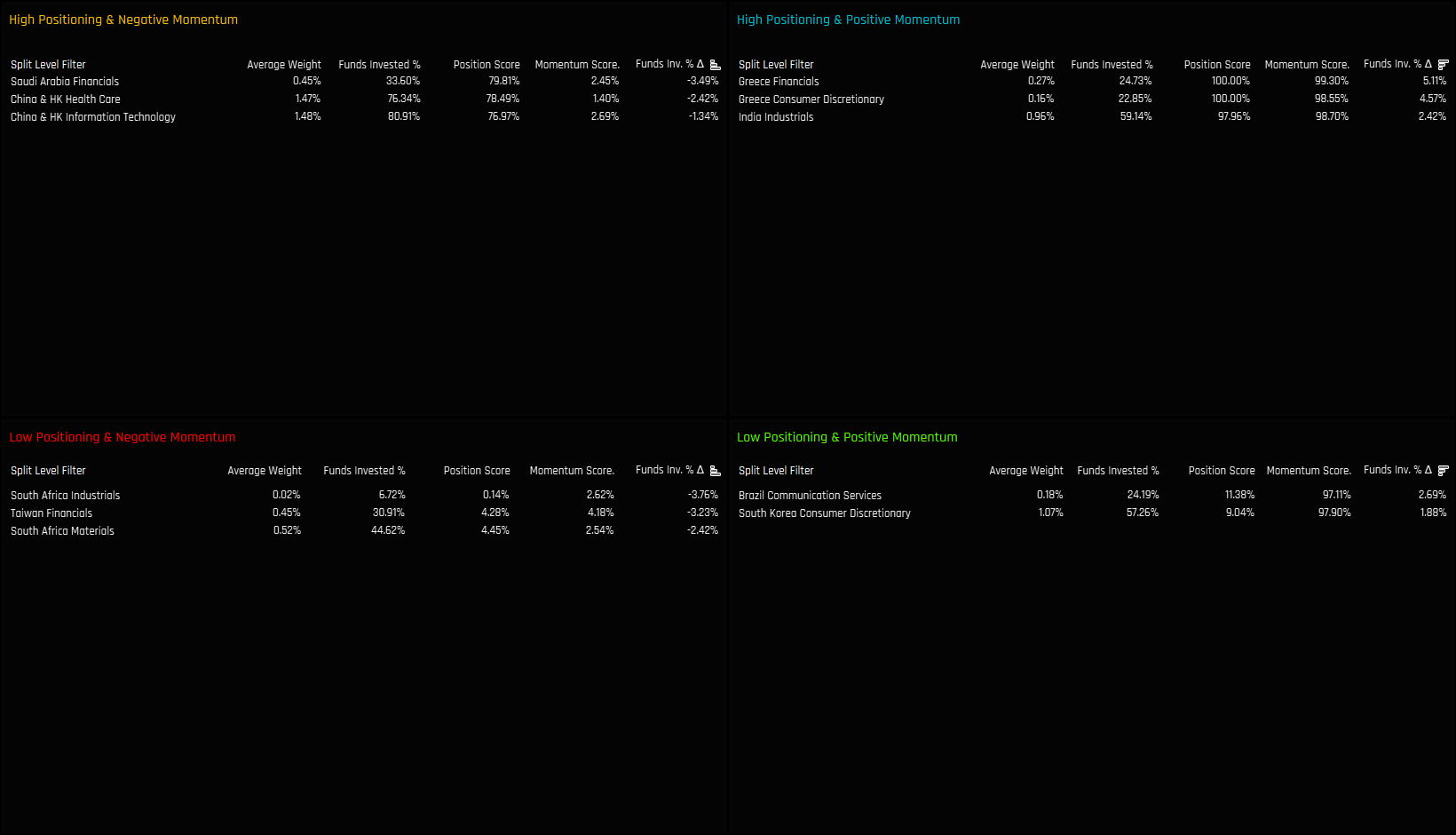

Extreme Country/Sectors

- High Positioning & Negative Momentum: Position Score > 75%. Momentum Score < 5%

- Low Positioning & Negative Momentum: Position Score < 5%. Momentum Score < 5%

- Low Positioning & Positive Momentum: Position Score < 20%. Momentum Score > 95%

- High Positioning & Positive Momentum: Position Score > 95%. Momentum Score > 98%

Extreme Country/Sectors

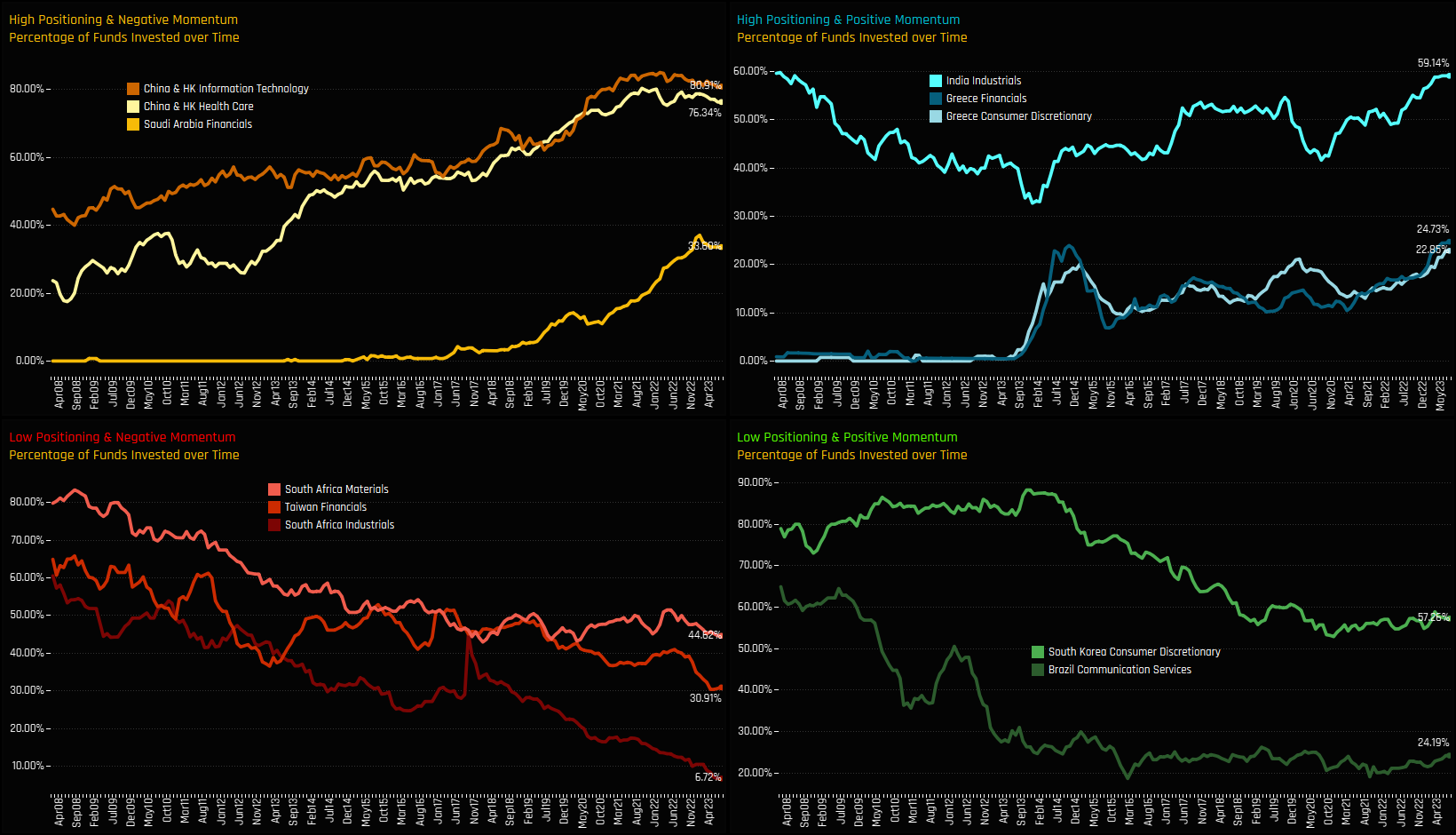

The following charts illustrate the proportion of active funds invested in each of the country/sectors listed above over time. This visualization provides an additional perspective how the Sentiment Grid works. For China & HK Tech, China & HK Health Care and Saudi Arabian Financials (top left), ownership has been on an upward path for number of years but we have past the peak as managers start to consolidate positions. For South African Materials, Taiwan Financials and South African Industrials (bottom left), ownership levels have been in multi-year declines, with recent selling pushing exposure levels to all-time lows.

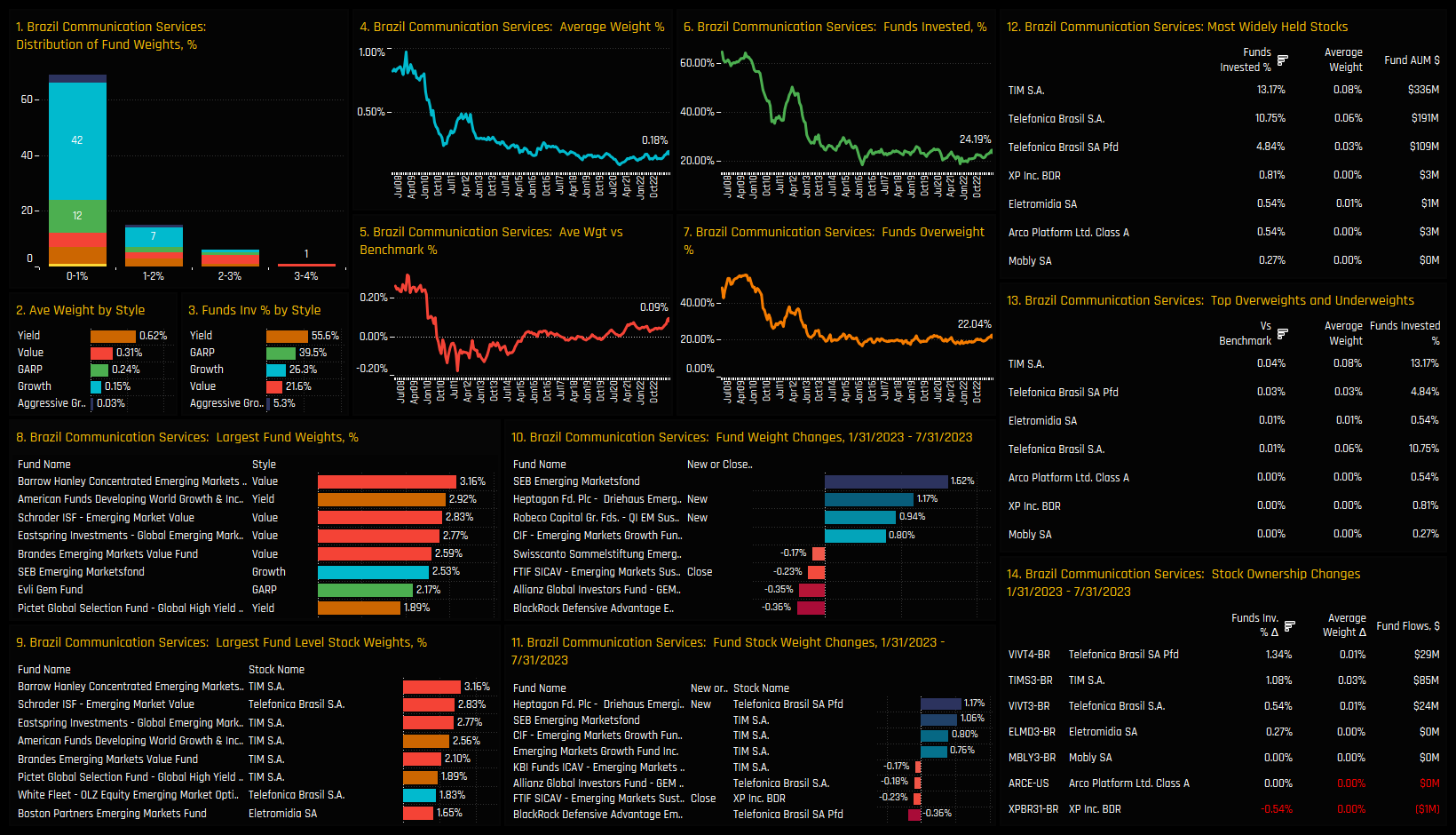

For Indian Industrials, Greek Financials and Greek Consumer Discretionary, ownership levels are at all-time highs after sustained increases in exposure among active EM managers (top right). Finally, for South Korean Consumer Discretionary and Brazilian Communication Services stocks, ownership levels are at historical lows but recent activity has been skewed to the buy side – something in the investment case has changed. Please scroll down for more detailed profiles of each country/sector to understand the funds and stocks behind the country/sector positioning.

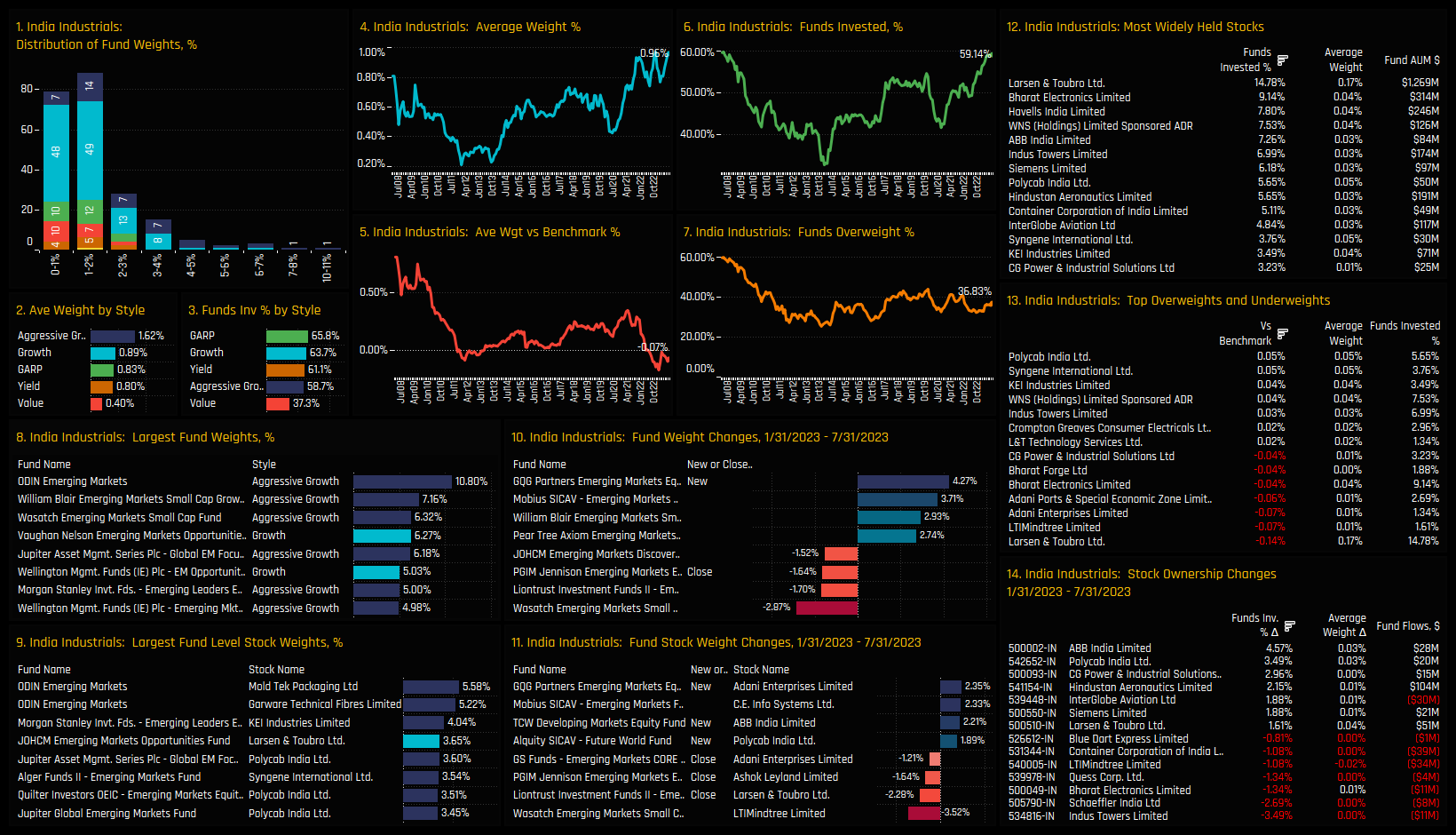

High Positioning & High Momentum: Indian Industrials

- Chart 1. Histogram of fund weights. The bulk of allocations sit below the 3% level, but with an upside tail that extends to 11%.

- Chart 2 & 3. Average weights and the percentage of funds invested in Indian Industrials by Style. Value funds are the obvious under-allocators, whilst Aggressive Growth sit on top.

- Chart 4. The equally weighted average holding weight in Indian Industrials. The current weight of 0.96% is the highest on record.

- Chart 5. The equally weighted average holding weight minus the iShares MSCI EM Weight. Active funds are marginally underweight, on average.

- Chart 6. The percentage of funds invested in Indian Industrials, again at all-time highs of 59.14%.

- Chart 7. The percentage of funds overweight the Indian Industrials sector.

- Chart 8. The largest holders in India Industrials, with ODIN, William Blair and Wasatch the key allocators.

- Chart 9. The largest fund level stock holdings in the Indian Industrials sector, led by ODIN’s positions in Mold Tek Packaging and Garware Technical Fibres.

- Chart 10. The largest weight changes in Indian Industrials between 01/31/2023 – 07/31/2023. GQG’s new position of 4.27% is the standout move.

- Chart 11. The largest individual fund level stock weight changes over the same period. GQG’s opening position in Adani Enterprises is the largest opening position.

- Chart 12. Aggregated Stock Holdings, ranked by the most widely held stocks in the sector. Larsen & Toubro is the most widely held, owned by 14.8% of EM fund managers.

- Chart 13. The top overweight and underweight stock holdings in the sector. Overweights led by Polycab India, underweights by Larsen & Toubro.

- Chart 14. The largest aggregate changes in stock ownership. Indian Industrials surge driven by increases in ABB India, Polycab and CG Power fund ownership.

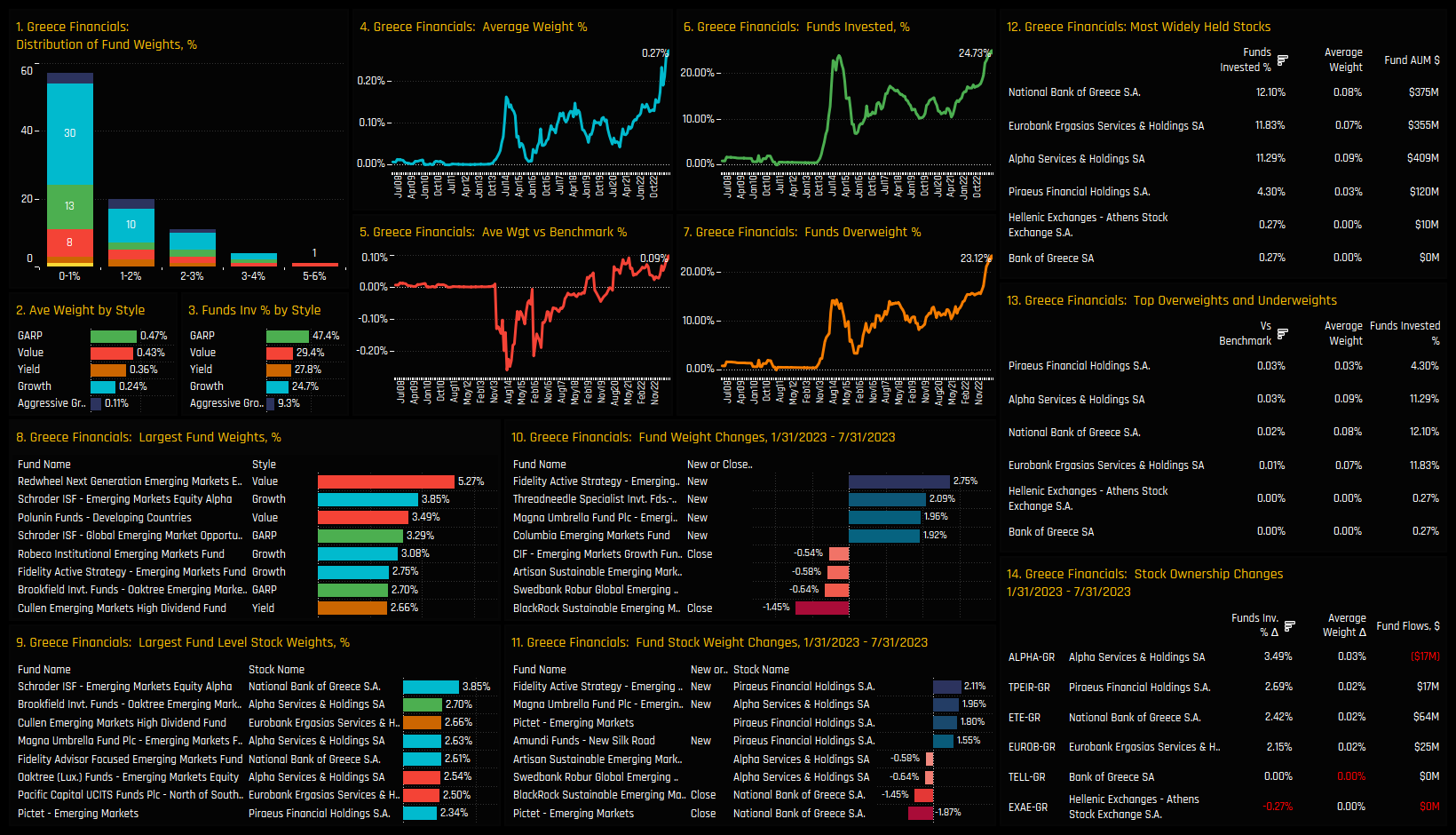

High Positioning & High Momentum: Greece Financials

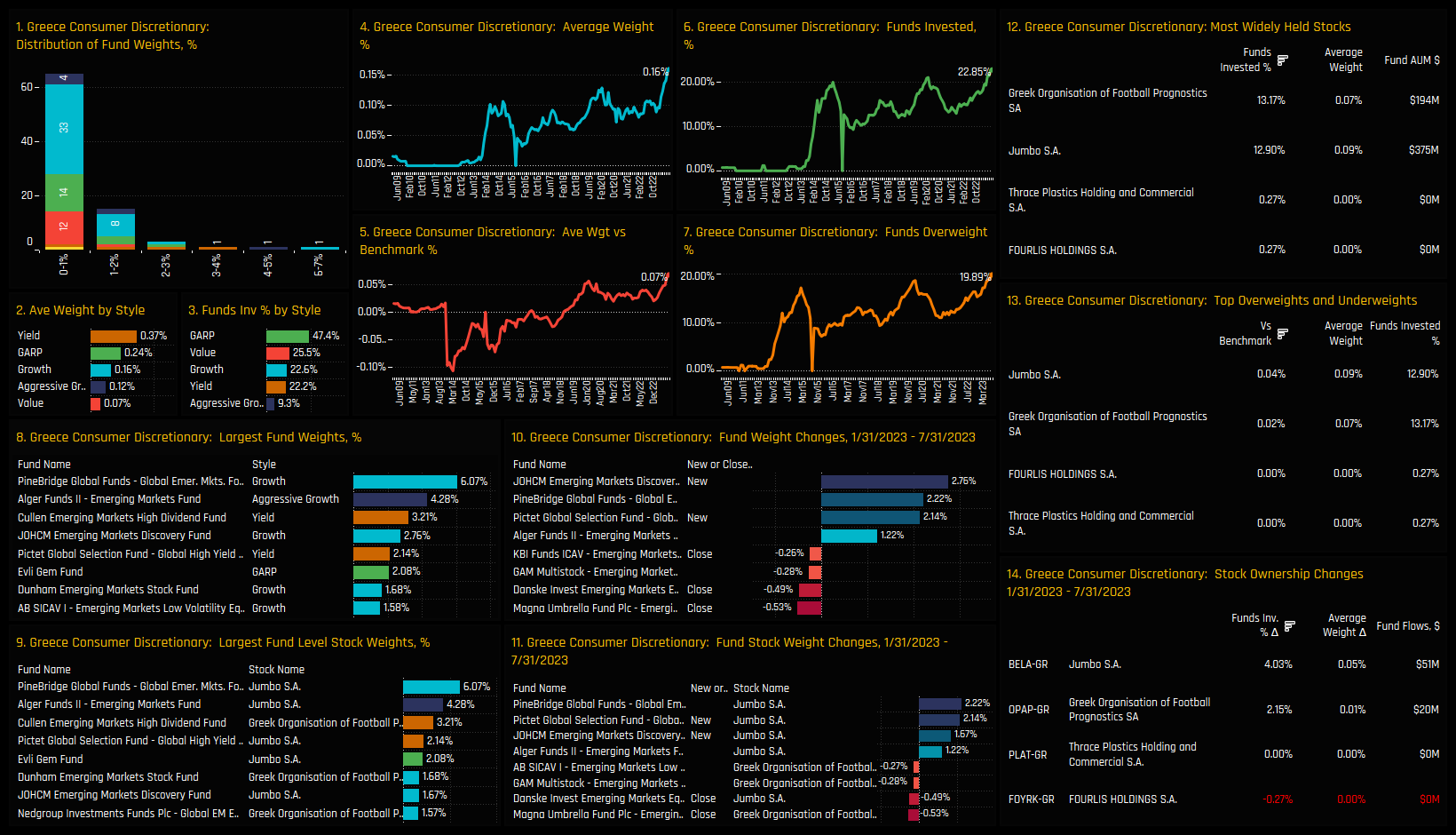

High Positioning & High Momentum: Greece Consumer Discretionary

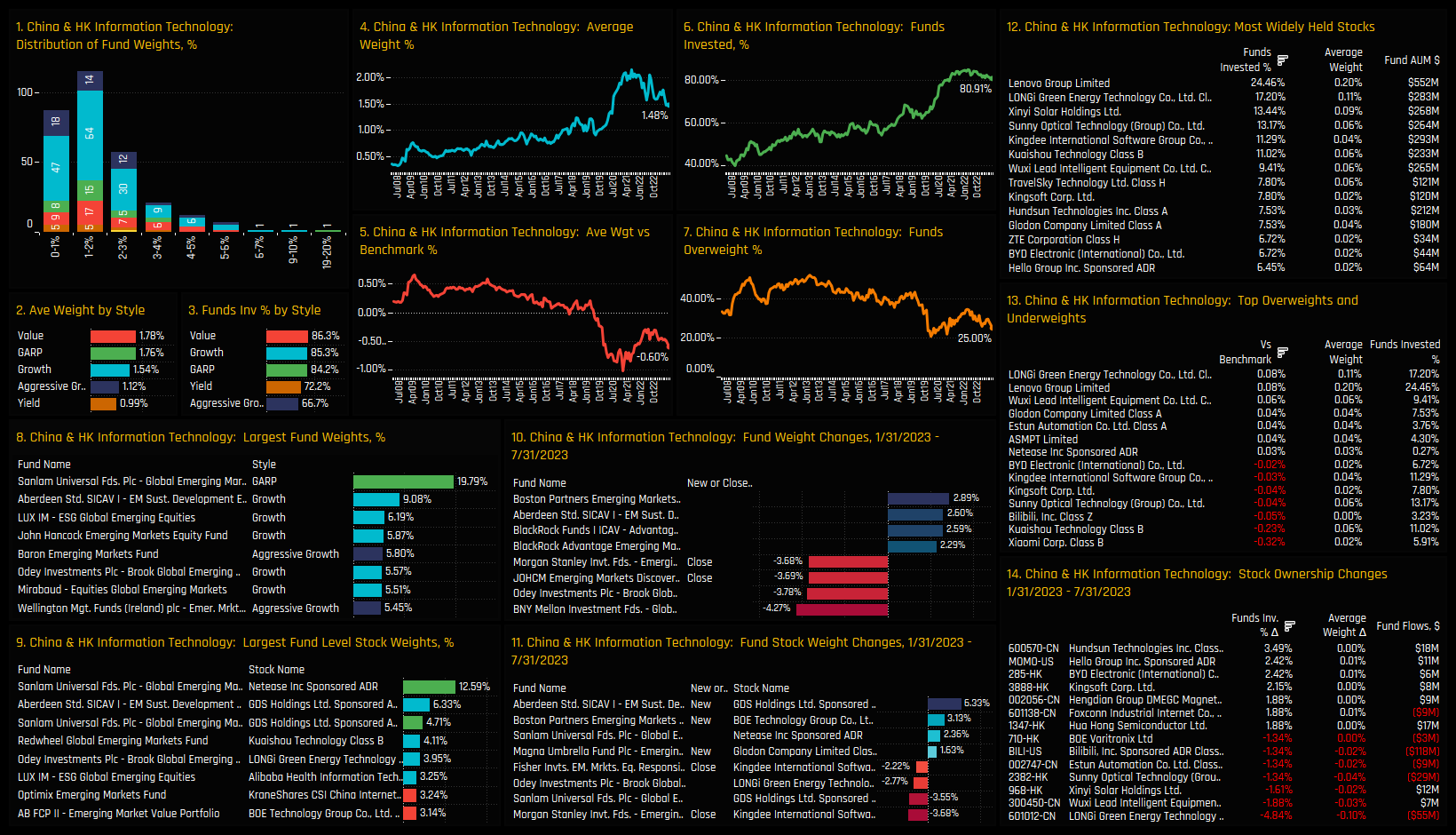

High Positioning & Low Momentum: China & HK Information Technology

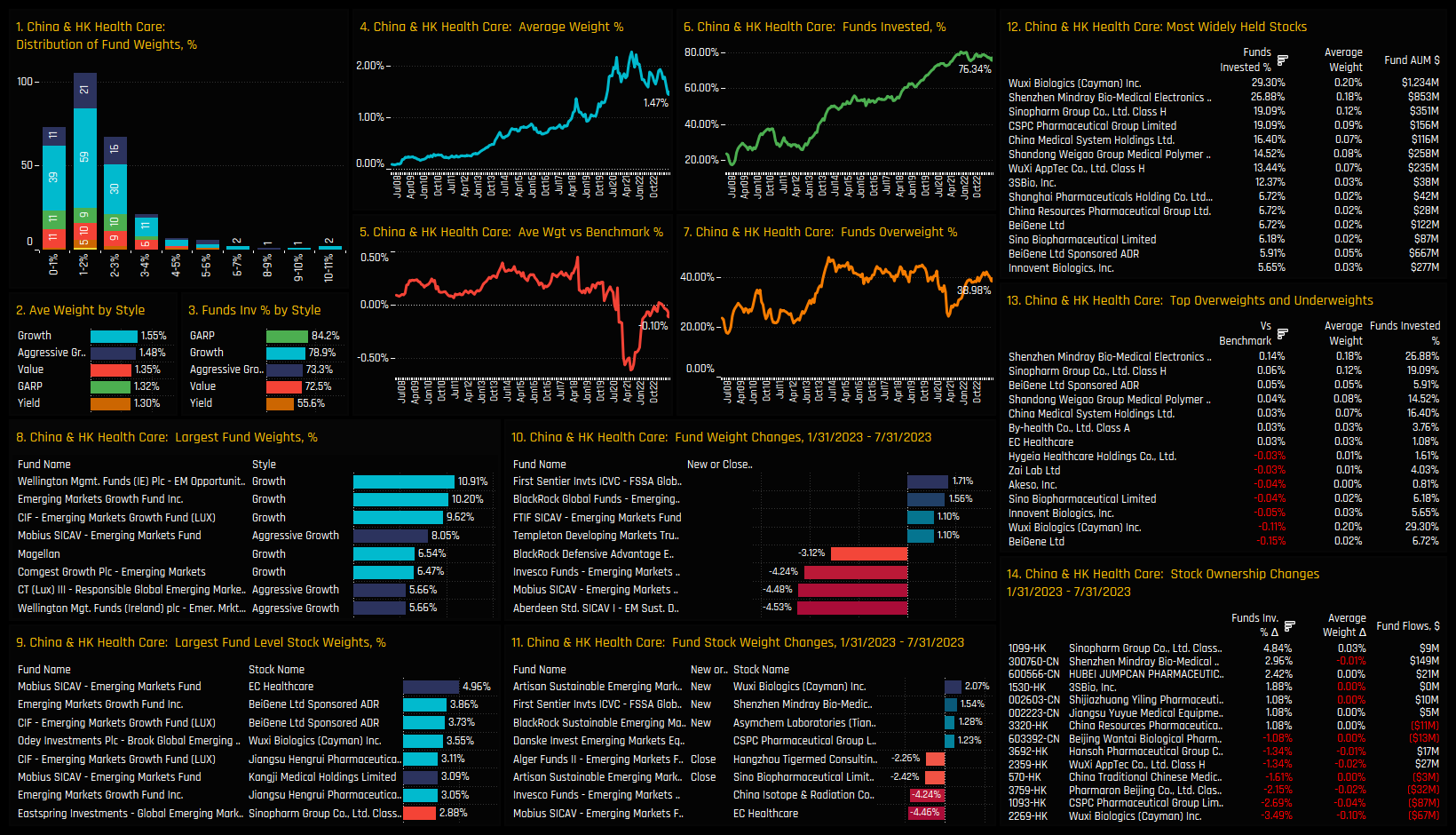

High Positioning & Low Momentum: China & HK Health Care

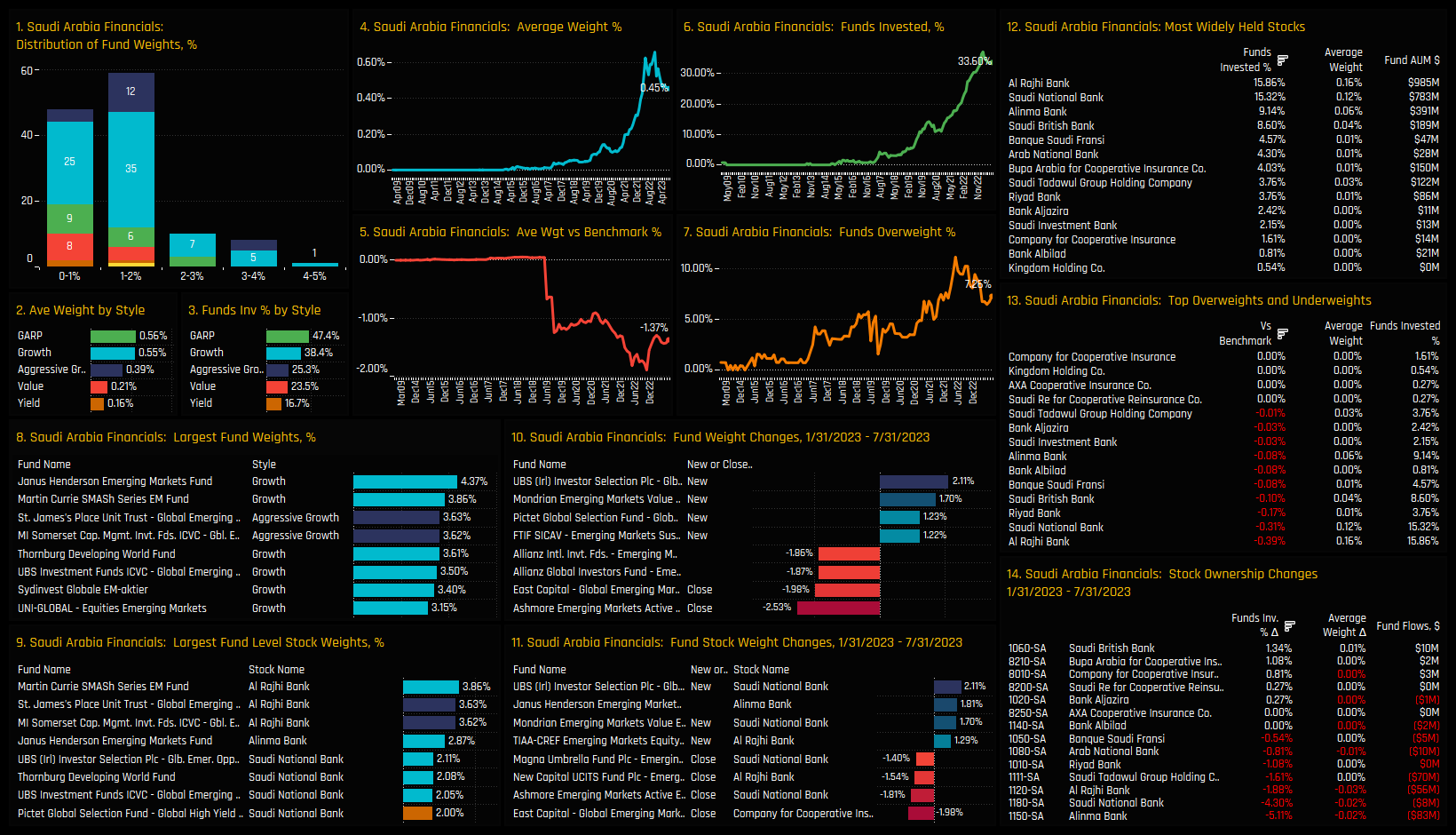

High Positioning & Low Momentum: Saudi Financials

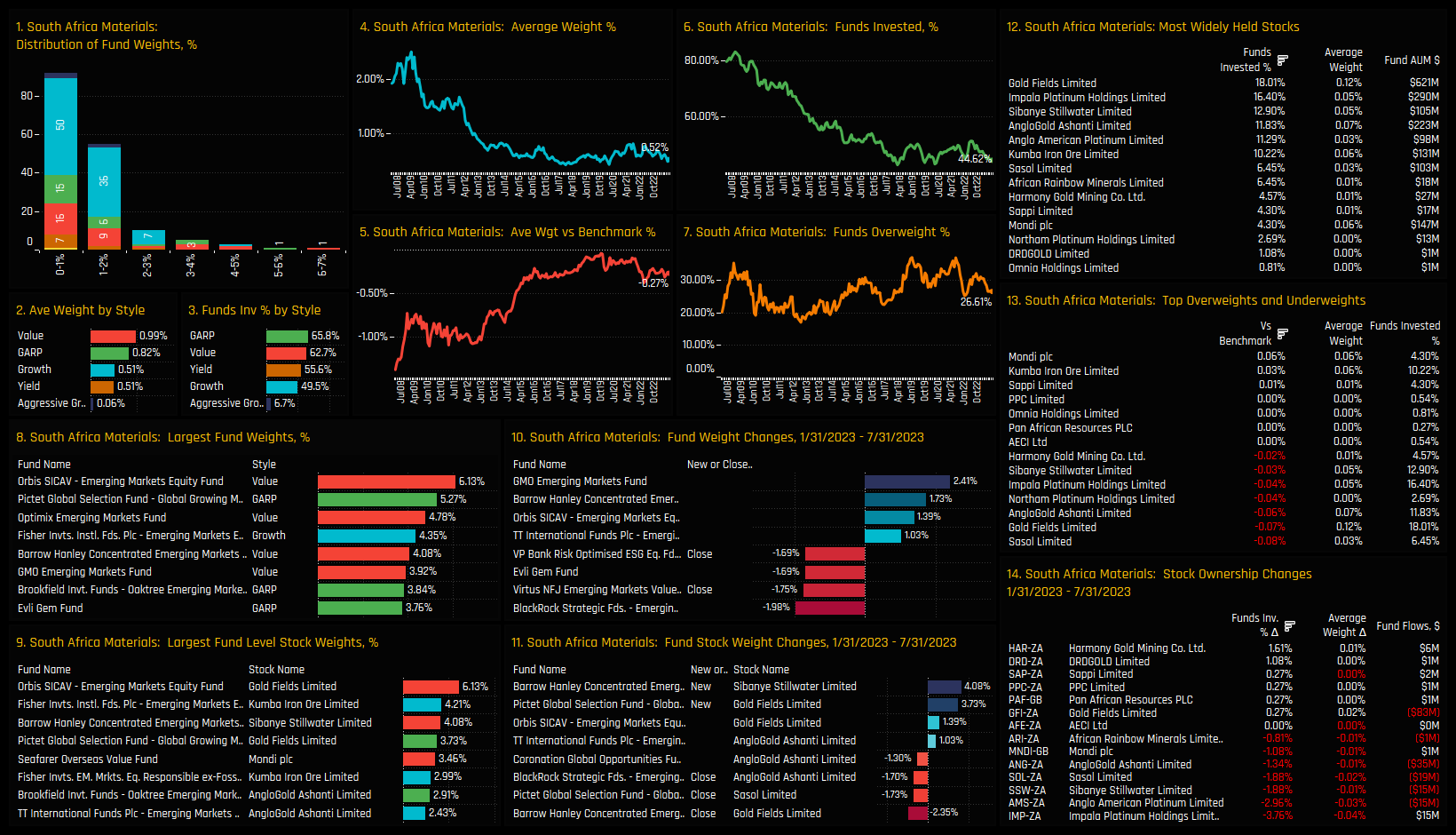

Low Positioning & Low Momentum: South African Materials

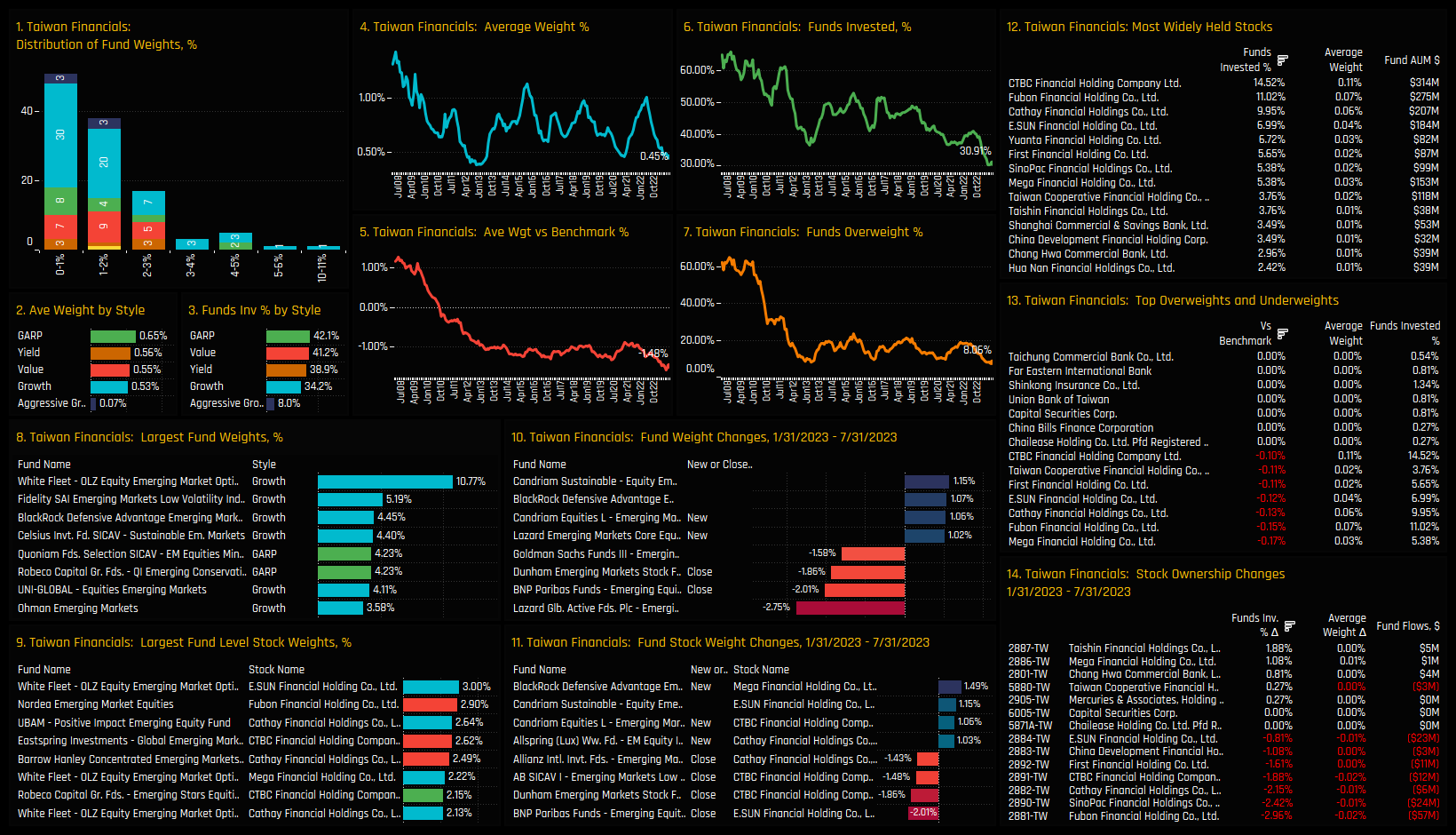

Low Positioning & Low Momentum: Taiwan Financials

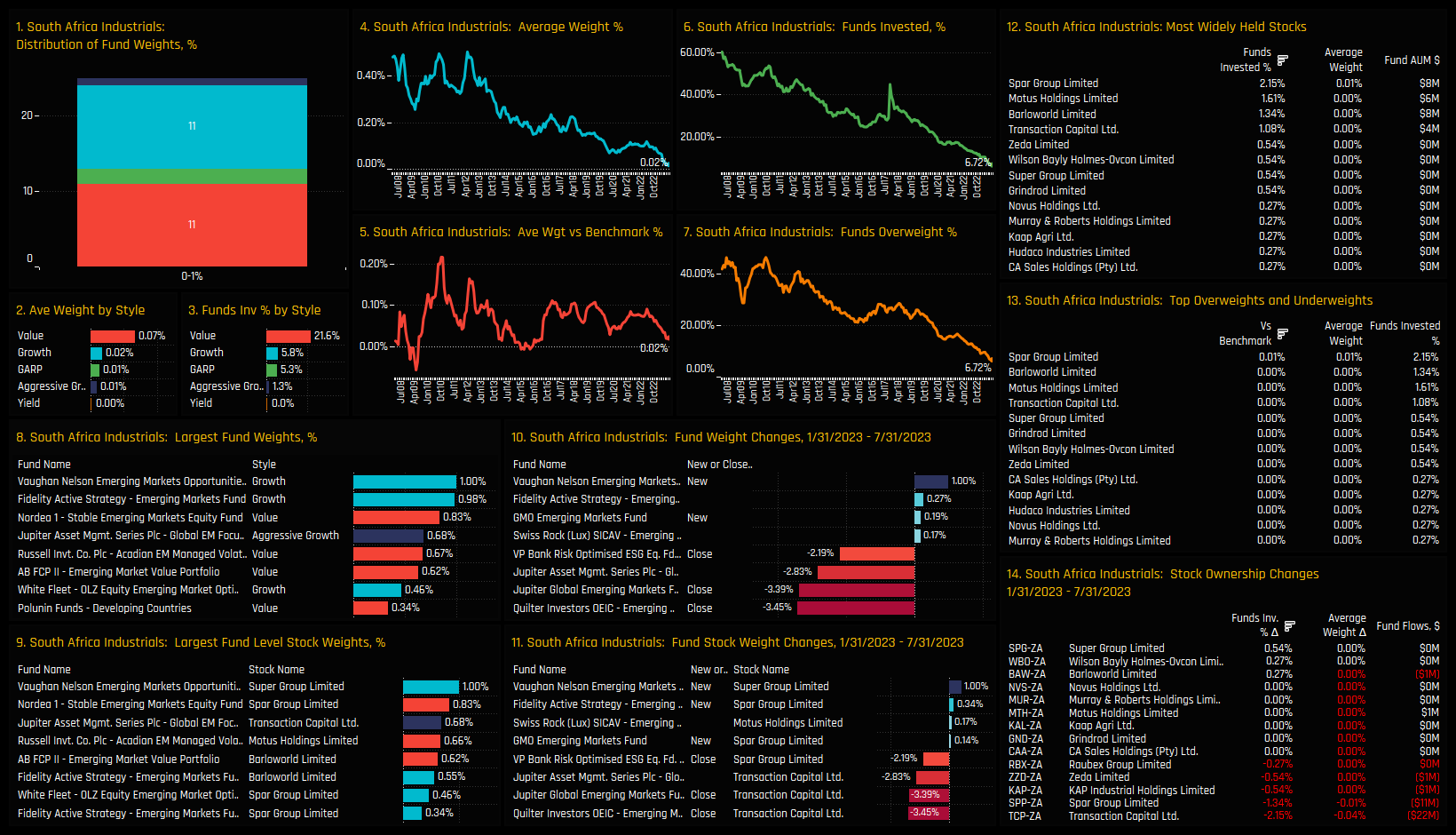

Low Positioning & Low Momentum: South Africa Industrials

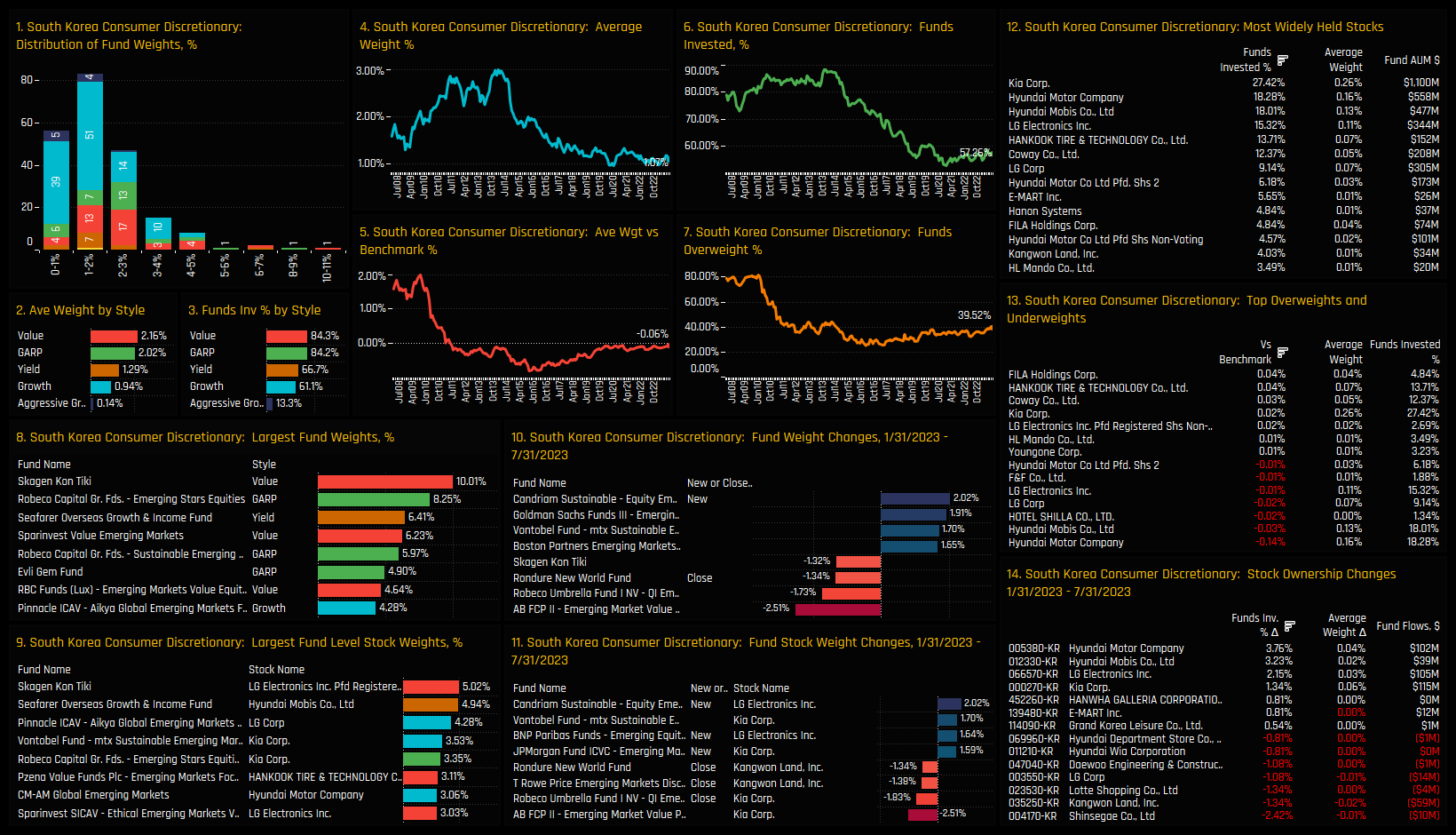

Low Positioning & High Momentum: South Korea Consumer Discretionary

Low Positioning & High Momentum: Brazil Communication Services

372 emerging market Funds, AUM $423bn

Climbing the Ranks: Record Ownership in Taiwan's Emerging Six

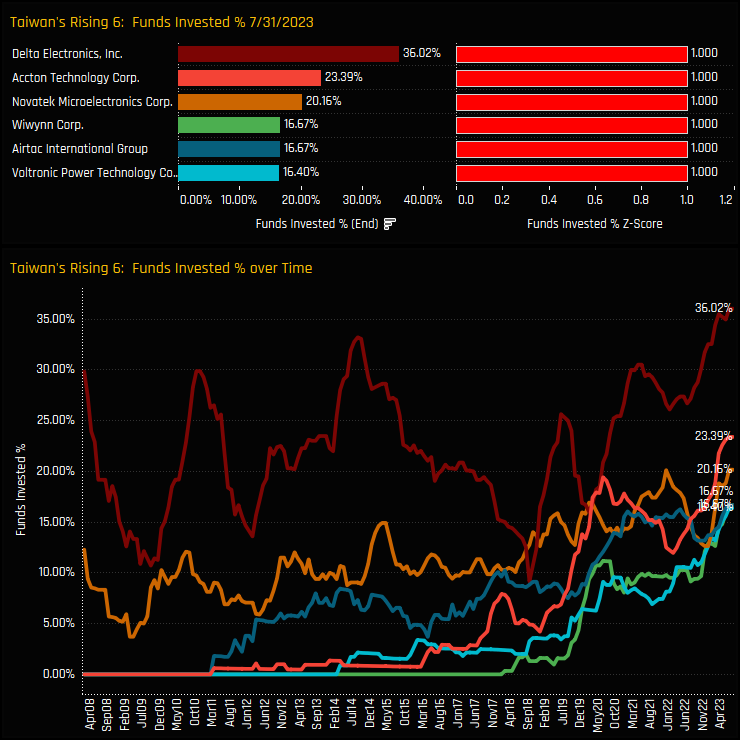

We like to screen for stocks at the extreme ends of their ownership range. It highlights to us a particular state of conviction, whether positive or negative among the stocks in our EM analysis. On this score, a select group of Taiwanese companies have caught our eye this month.

Taiwan's Emerging Six

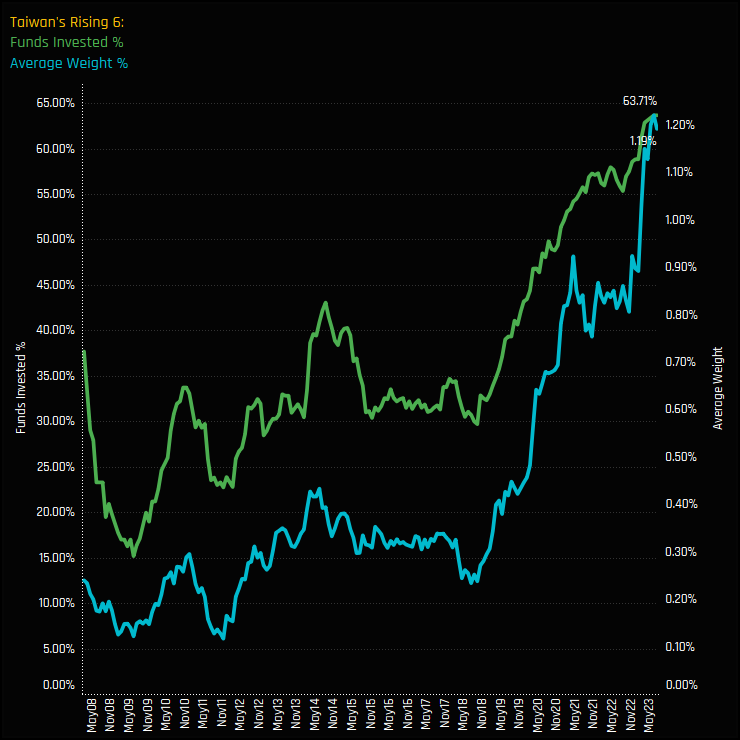

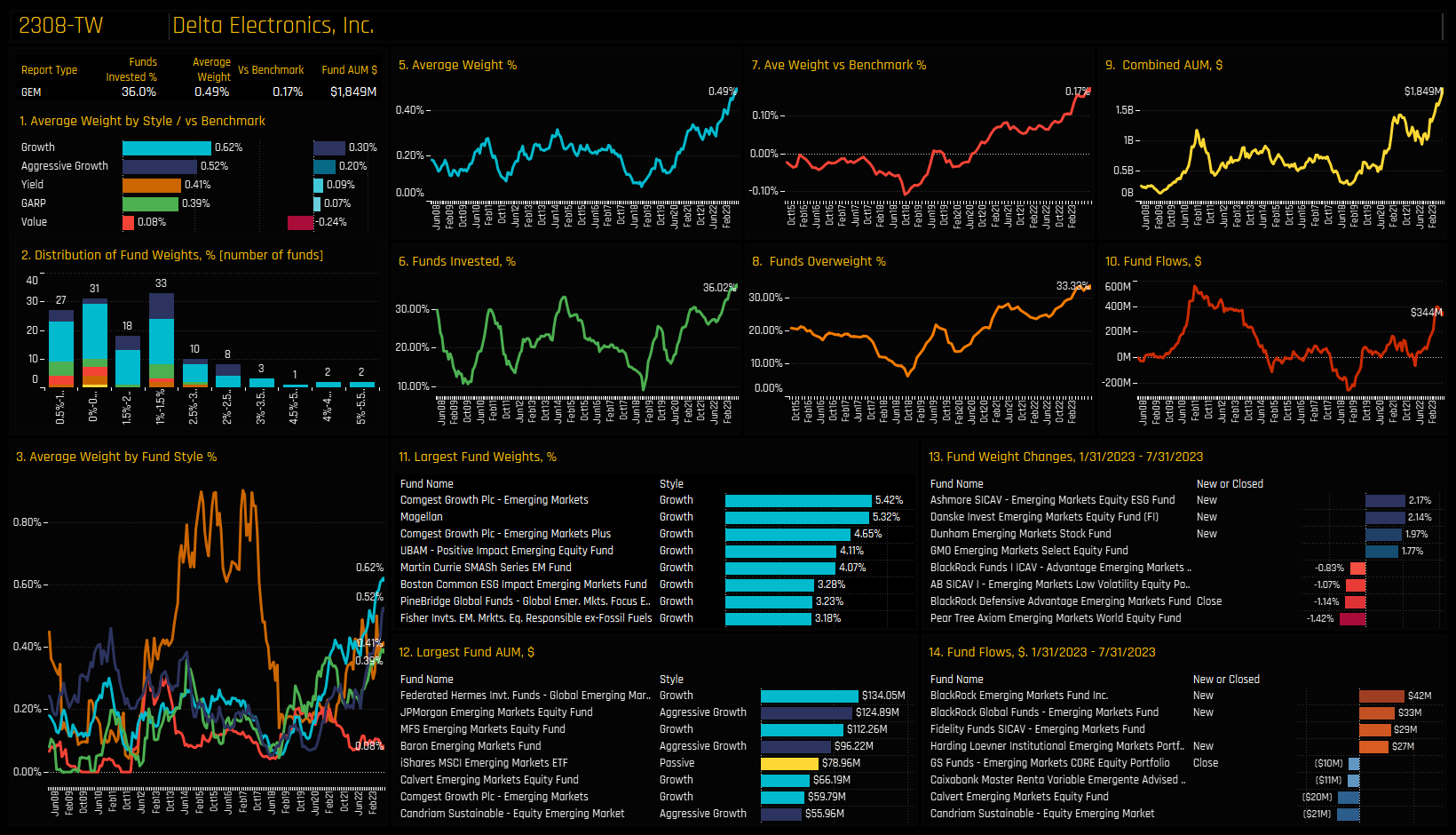

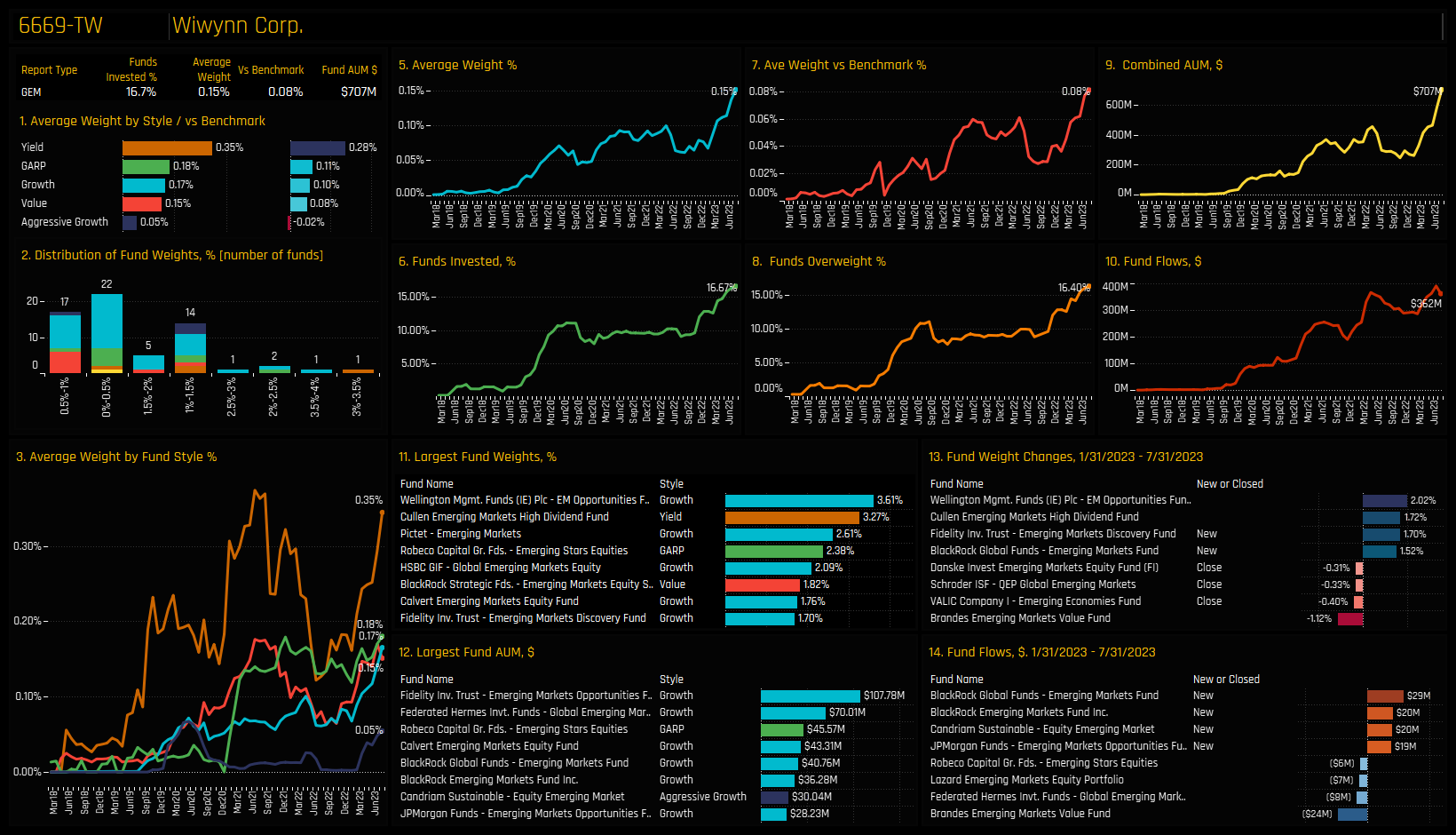

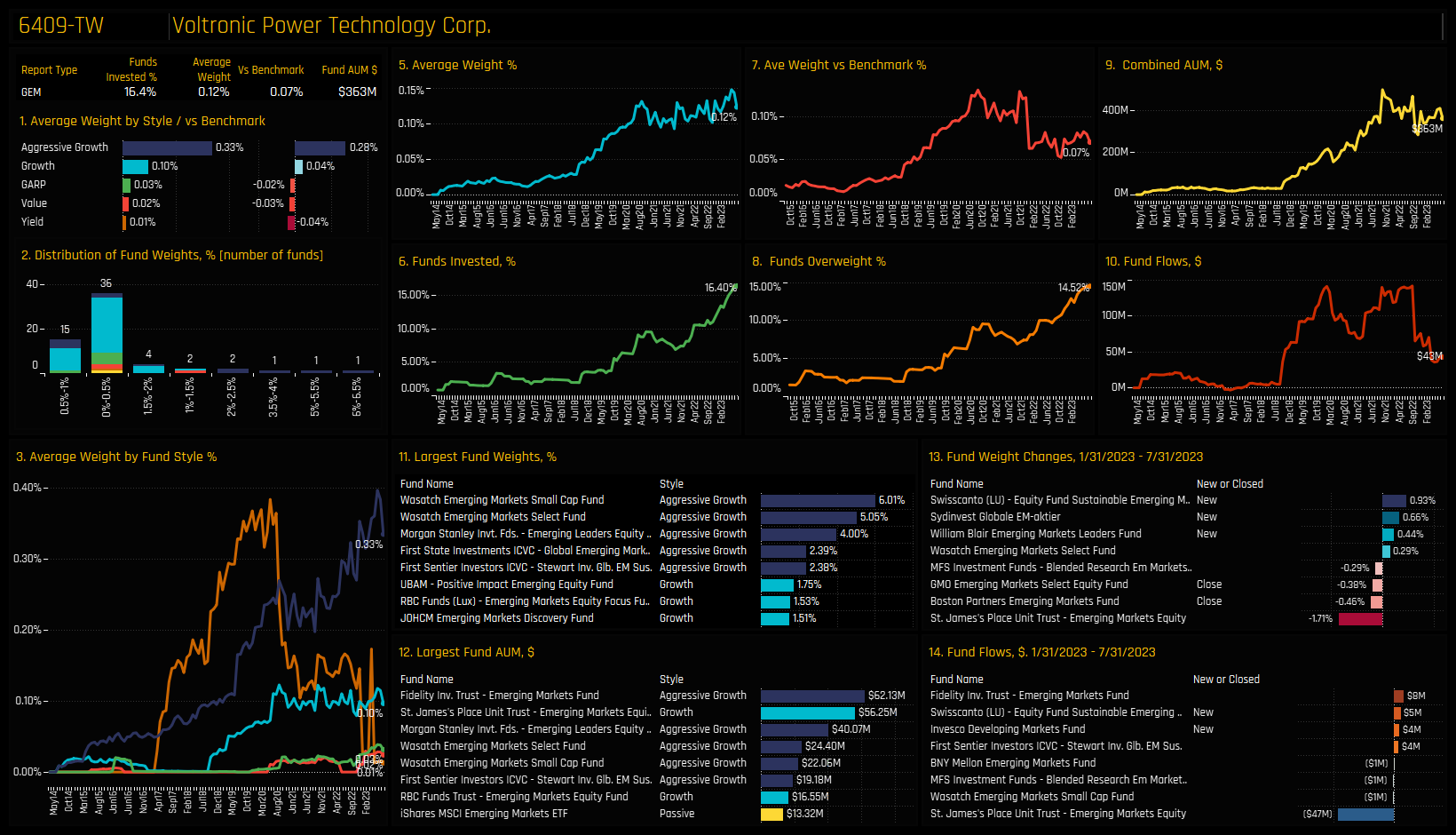

The 6 stocks listed in the top chart below are all at record levels of ownership among the active GEM funds in our analysis. They are led by Delta Electronics, a company owned by a record 36% of funds and with a recent surge of buying breaking through the previous ownership highs of 2014. Wiwynn Corp and Voltronic Power Technology Co have seen the path of investment growth move higher over a much shorter period. But to make this list, all must have captured investment from funds who have never invested before, and all must have seen an excess of opening positions over closing positions in recent months.

The charts below show how in combination, these 6 stocks have gained in significance within EM portfolios in recent years. The combined average weight has spiked higher to 1.19%, with 63.7% of funds holding at least 1 of the 6 companies listed. To provide the granular detail behind these moves, scroll down for profiles of the 6 companies listed, which show the key holders, the funds opening new positions and the major fund flows over the last 6-months.

Stock Profile: Delta Electronics

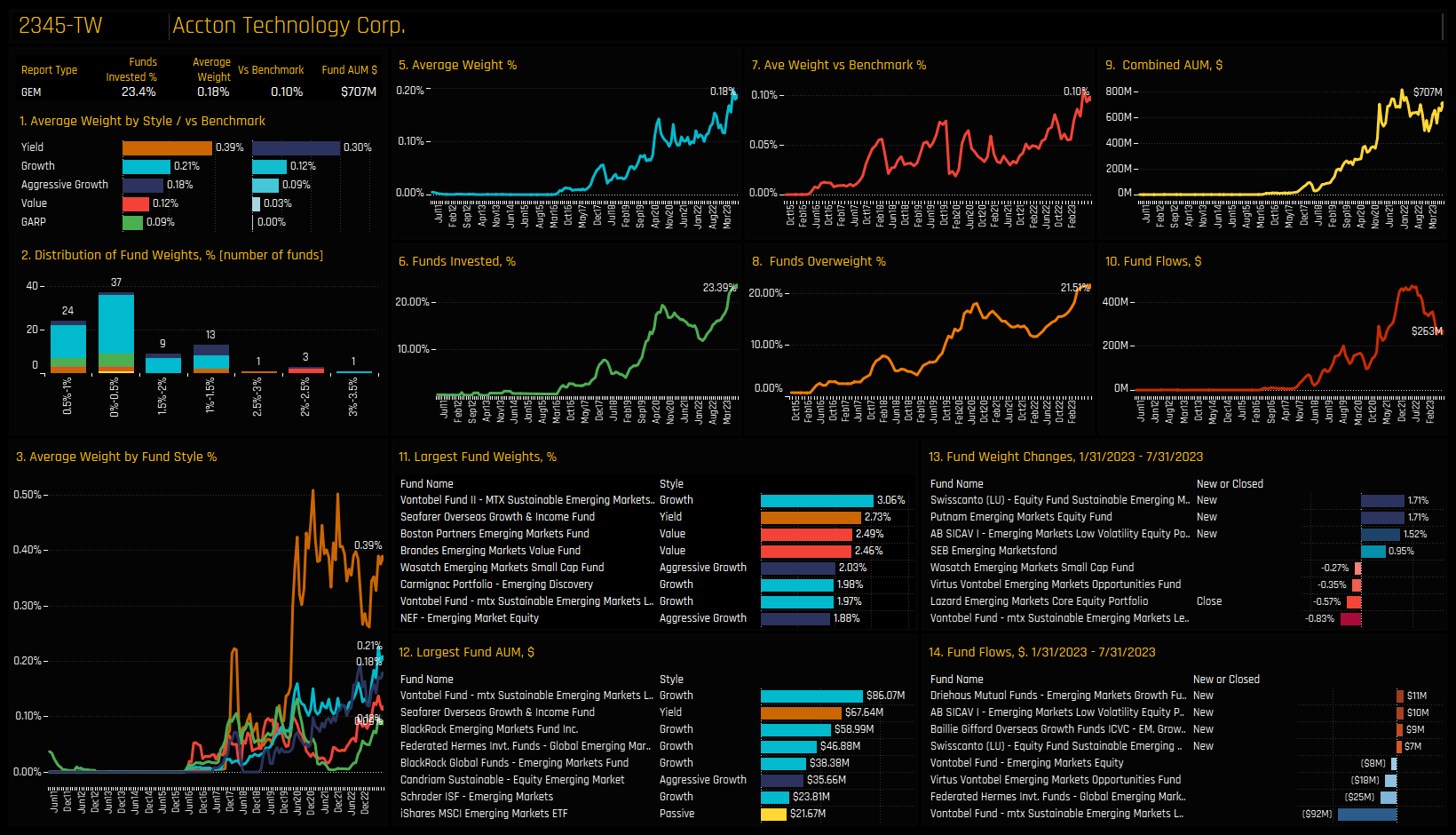

Stock Profile: Accton Technology

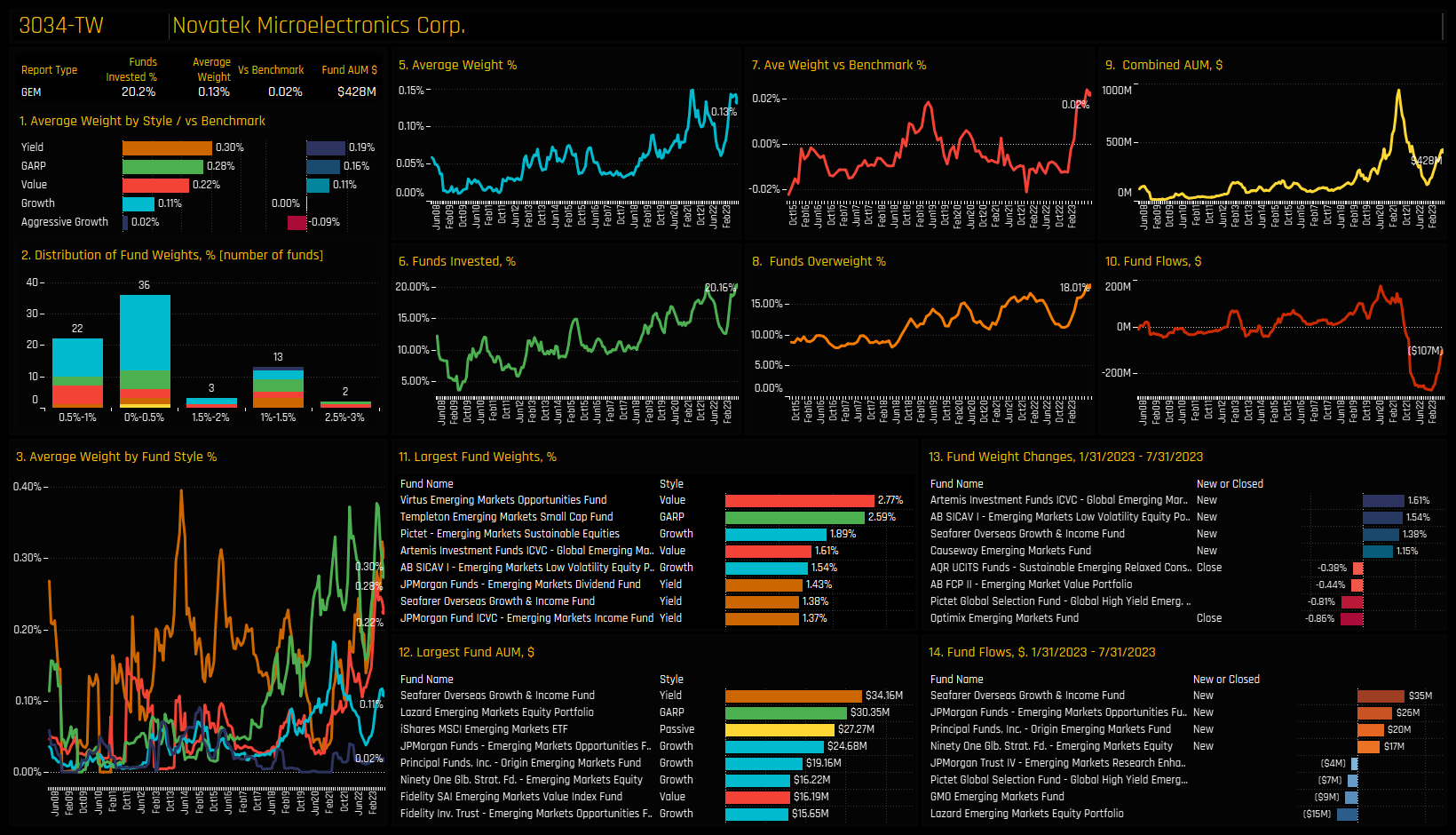

Stock Profile: Novatek Microelectronics

Stock Profile: Wiwynn Corp

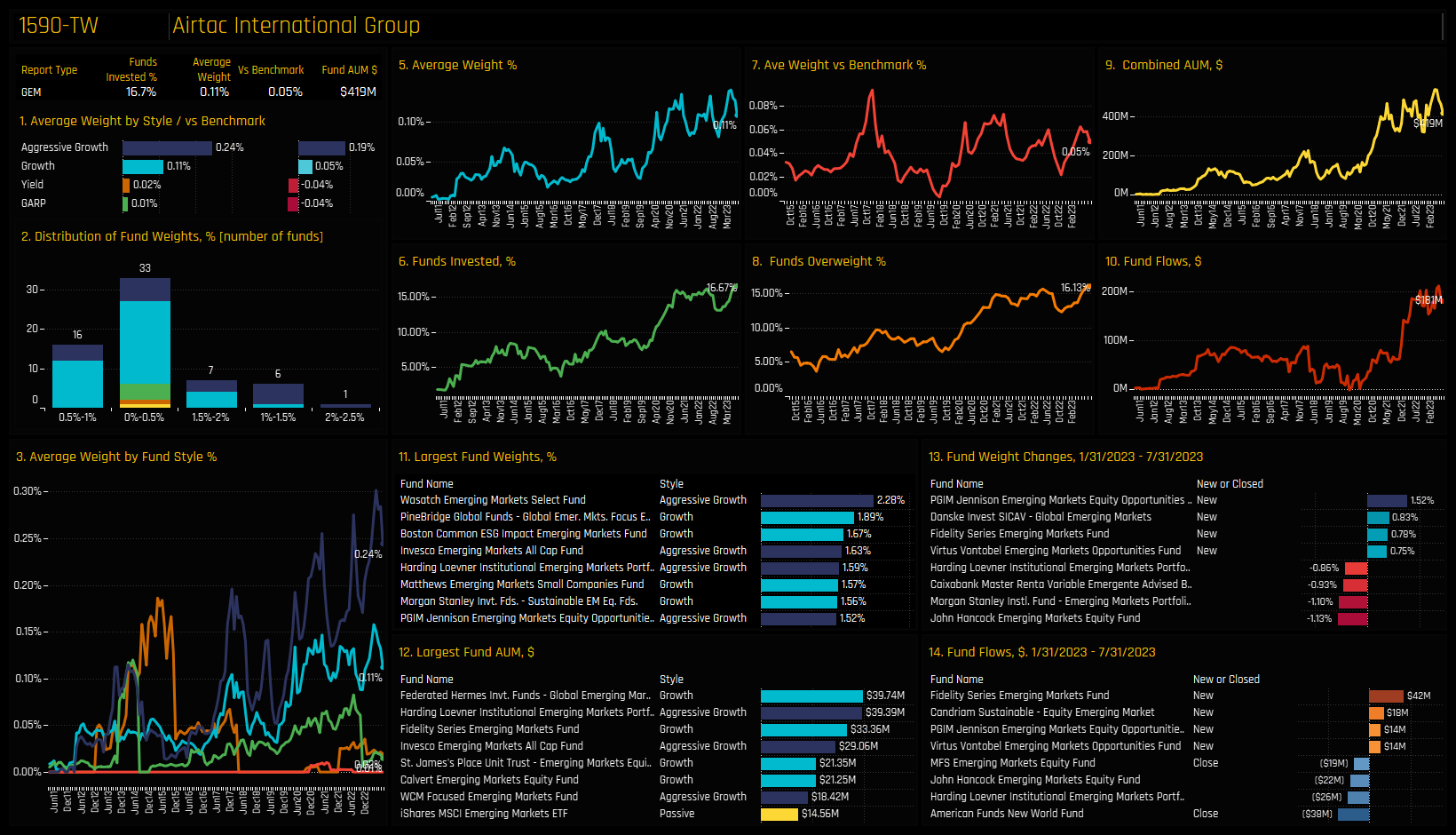

Stock Profile: Airtac International Group

Stock Profile: Voltronic Power Technology Corp

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- November 22, 2023

GEM Fund Positioning Analysis, November 2023

370 emerging market Funds, AUM $368bn GEM Fund Positioning Analysis, November 2023 In this issu ..

- Steve Holden

- July 15, 2024

GEM Funds: Performance & Attribution Review, Q2 2024

352 Global Emerging markets active equity funds, AUM $429bn GEM Funds: Performance & Attrib ..

- Steve Holden

- January 30, 2026

Active GEM Funds: Top-Down Positioning Update

China allocations have recovered from the lows, but momentum has stalled—masking active shift ..