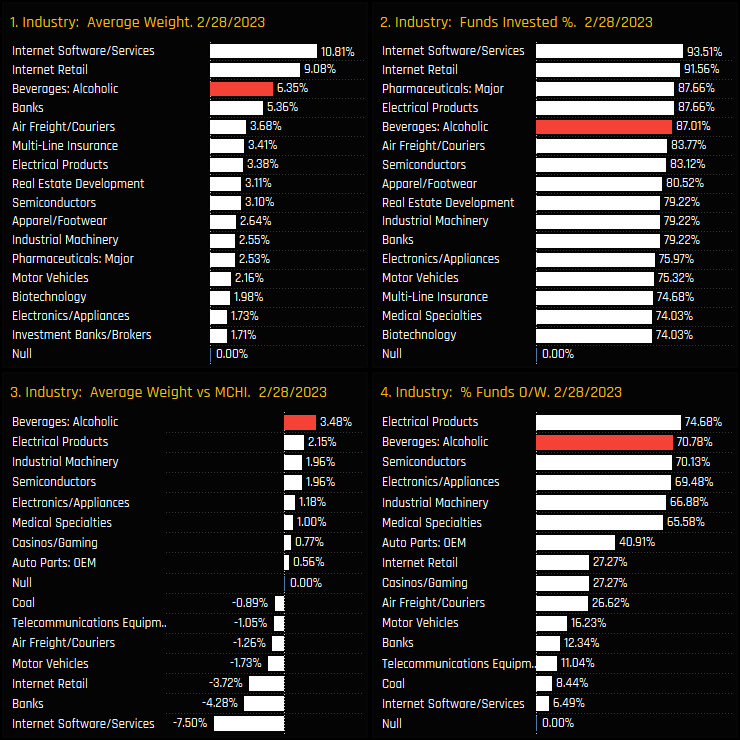

Fund ownership in the Alcoholic Beverages industry group continues to show its strength. Despite a performance set back in September of last year, managers remained invested throughout, with 87% of funds now holding exposure (ch3) and 70.8% of funds overweight the iShares MCHI ETF benchmark (ch4). All measures of ownership, both absolute and relative have resumed their upward trend.

Alcoholic Beverages are a key holding for active China managers. They are the 3rd largest industry weight on an average weight basis (ch1) behind Internet Software/Services and Internet Retail, and the 5th most widely held (ch2). Versus the benchmark, the +3.48% average overweight is the highest by a margin (ch2), with only Electrical Products positioned with more funds overweight the index (ch4).

Fund Holdings and Style Split

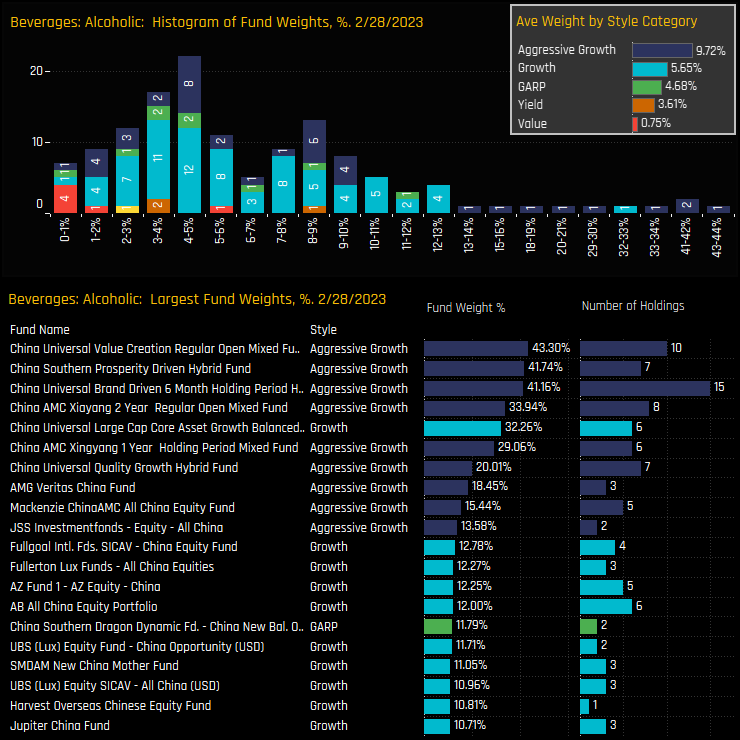

On an individual fund level, the holdings distribution is spread over a wide range, with most clustered at between 2% and 6% and a smaller group at between 7% and 13%. Those allocating more are predominantly local strategies with an Aggressive Growth bias, led by China Universal Value Creation (43.3%) and China Southern Prosperity (41.7%).

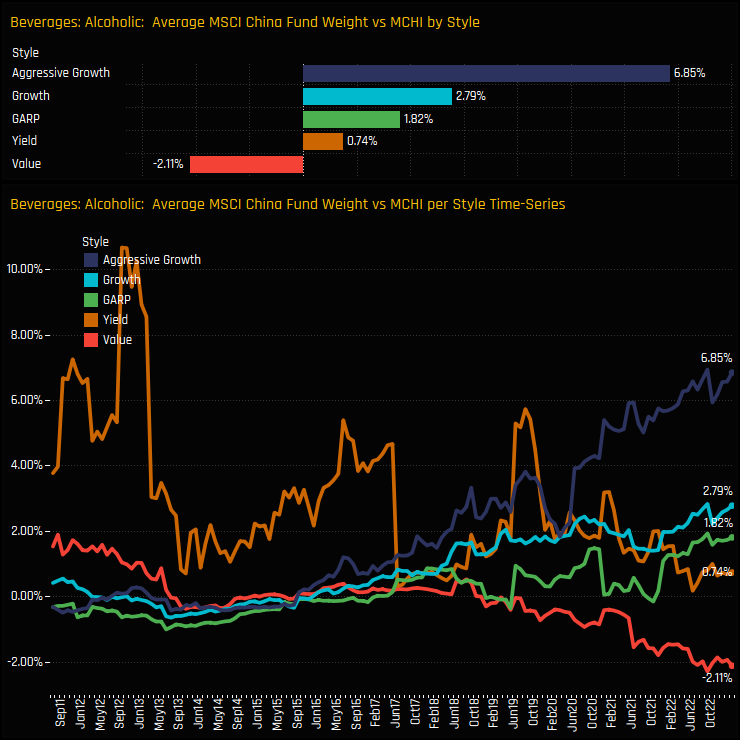

On a style basis, all groups are positioned overweight the iShares MCHI ETF with the exception of Value, on average. Over time, the spread between Aggressive Growth and Value has widened, with the former at near peak overweights of +6.85% and latter peak underweights of -2.11%.

Stock Holdings & Long-Term Trends

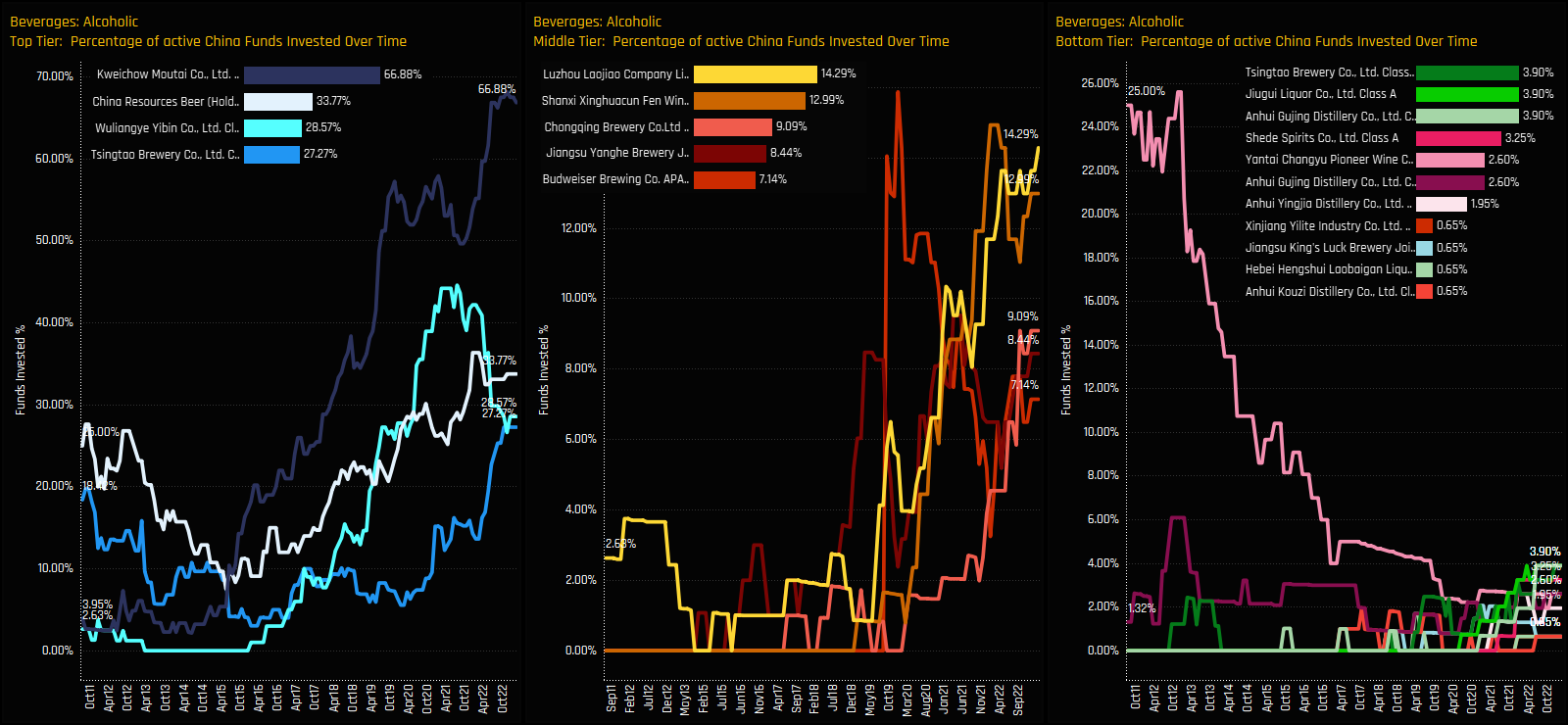

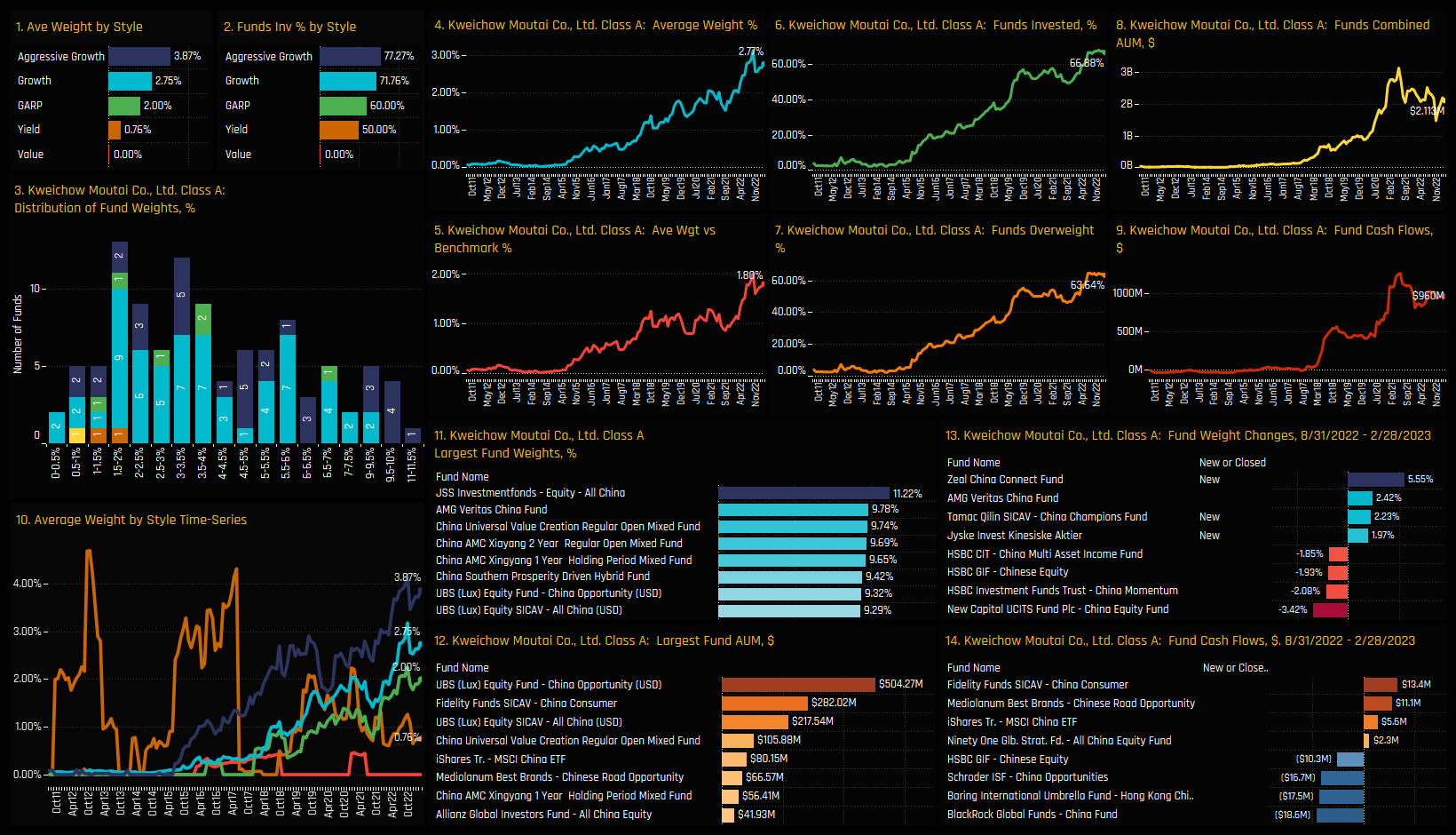

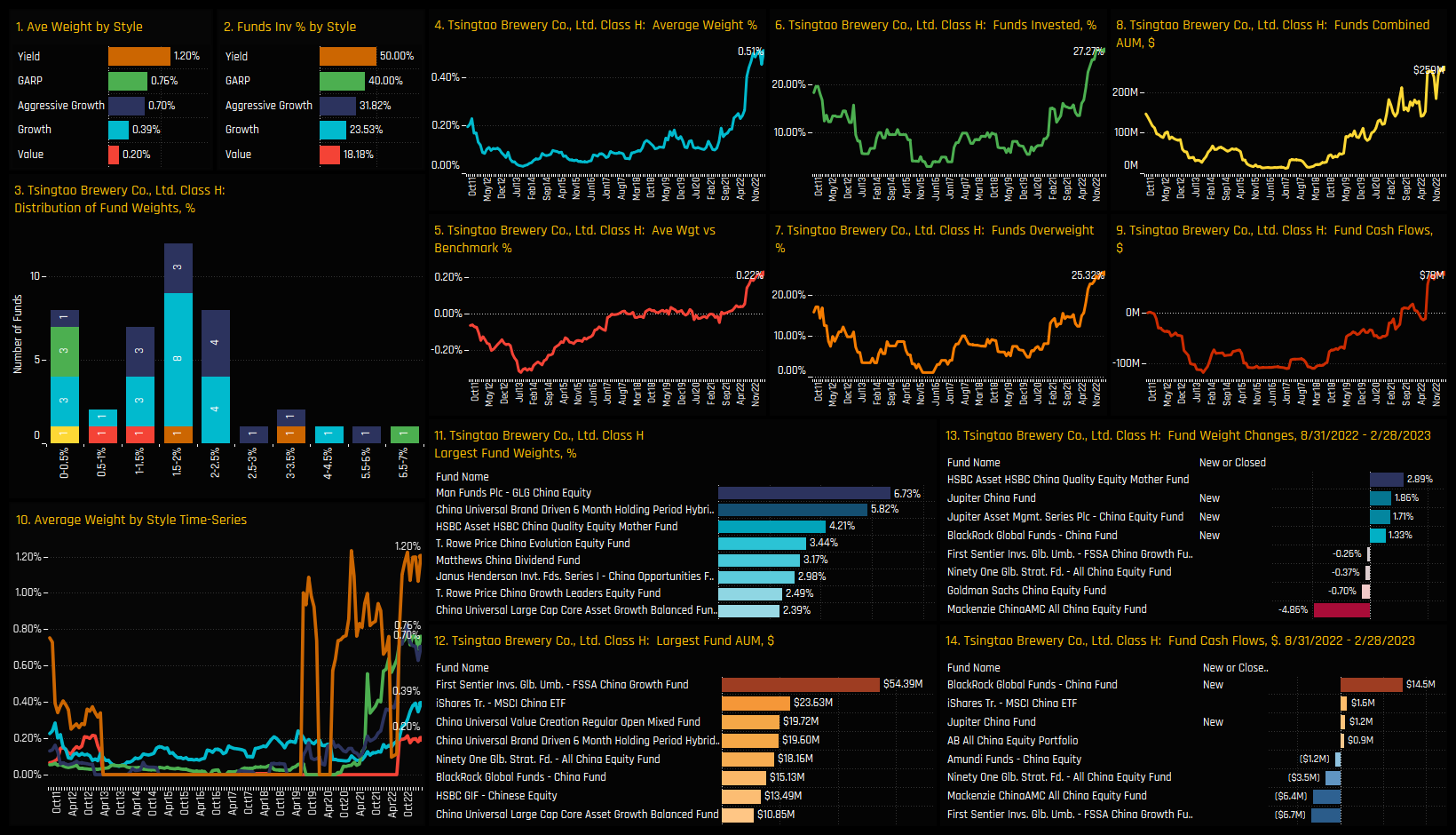

The industry has real depth when it comes to underlying stock allocations. A total of 20 stocks have found investment from at least one of the 154 MSCI China funds in our analysis, with ownership split in to 3 distinct tiers. At the top are the quartet of Kweichow Moutai, China Resources Beer, Wuliangye Yibin and Tsingtao Brewery. The left hand chart below shows the time-series of the percentage of funds invested in each, with Kweichow Moutai and Tsingtao at near peak levels, but Wuliangye Yibin seeing a degree of investor flight.

Middle tier names are highlighted in the center chart and include Luzhou Laojiao, Shanxi Xinghuacun Fen Wine, Chongqing Brewery, Jiangsu Yanghe Brewery and Budweiser Brewing Co. All but Budweiser are at the top of their ownership ranges. Finally, the bottom tier stocks that are all held by less than 4% of managers are in the right-hand chart. Most of these companies have little ownership history with the exception of Yantai Changyu Pioneer Wine, which used to be held by 25% of funds back in 2013.

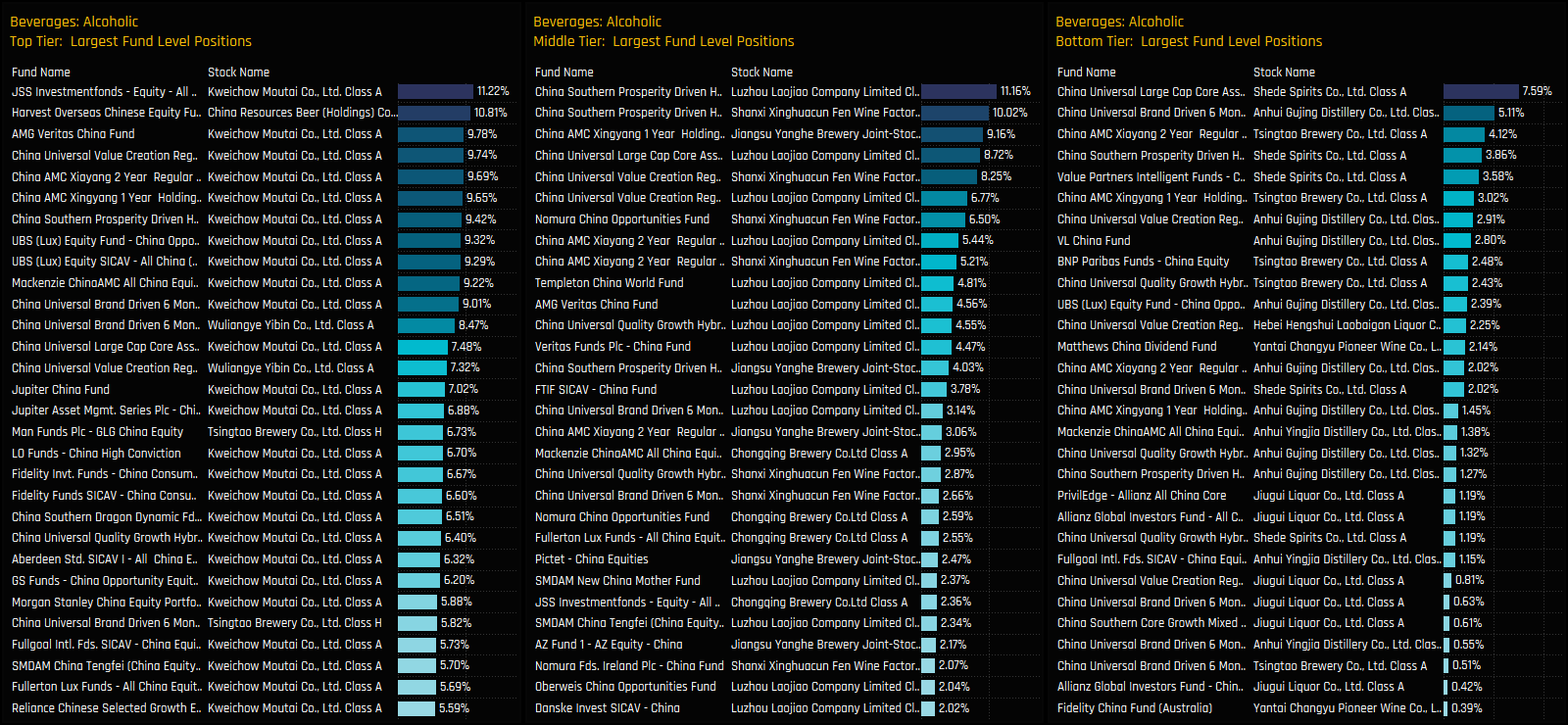

Fund Level Stock Holdings

Split by tier, the higher conviction single fund positions are in the Top-Tier names, and specifically in Kweichow Moutai. Of the top 30 fund positions among the 4 most widely held stocks, 26 are in Kweichow, with 10 funds holding more than a 9% portfolio weight.

Luzhou Laojiao and Shanxi Xinghuacun Fen Wine dominate the high conviction holdings among middle tier stocks, whilst Shede Spirits and Anhui Gujing Distillery have captured good sized investment in the bottom tier.

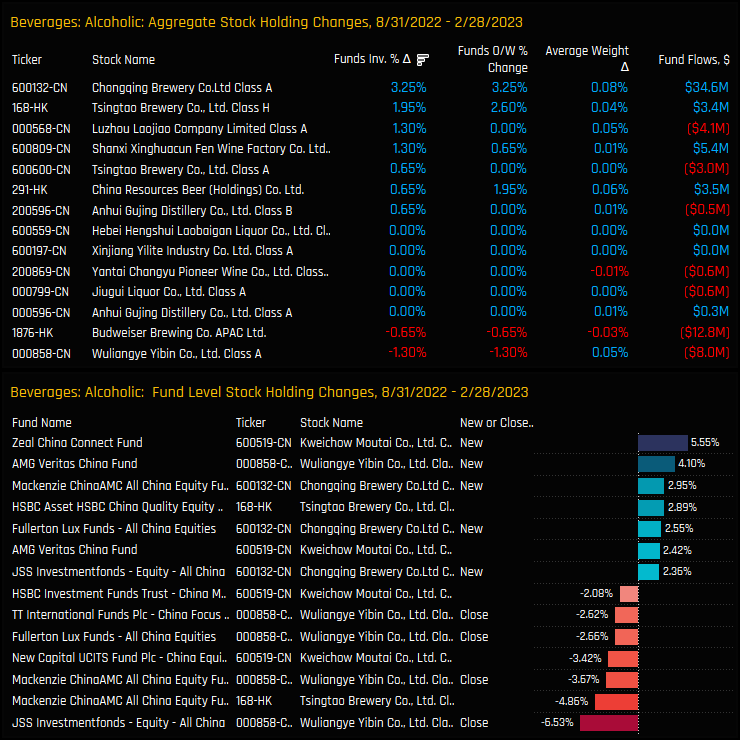

Stock Activity and Links

The chart to the right shows the net changes in stock ownership among Alcoholic Beverages companies over the last 6-months, both on aggregate in the top chart and on a fund level in the bottom chart. The picture is very positive, with Changqing Brewery capturing the largest increase in funds invested of +3.26%, followed by Tsingtao Brewery (+1.96%) and Luzhou Laojiao (+1.3%). Only Wuliangye Yibin and Budweiser Brewing saw a drop in ownership over the period.

This only serves to add to the picture of high conviction within the industry group. As the largest industry overweight and with record levels of positioning, Alcoholic Beverages remain a key theme for active China managers. Whilst there are clear favourites within the sector, notably the top-tier names as highlighted above, the middle and bottom-tier names provide depth to the sector that is sometimes lacking in other Industry groups, hinting at the potential for further investment growth or rotation among stocks.

Please click on the link below for more charts and data on the Alcoholic Beverages industry group among active MSCI China investors. Please scroll down for stock profiles on Kweichow Moutai, Tsingtao Brewery, Wuliangye Yibin and China Resources Beer.

Stock Profile: Kweichow Moutai

Stock Profile: Tsingtao Brewery Co

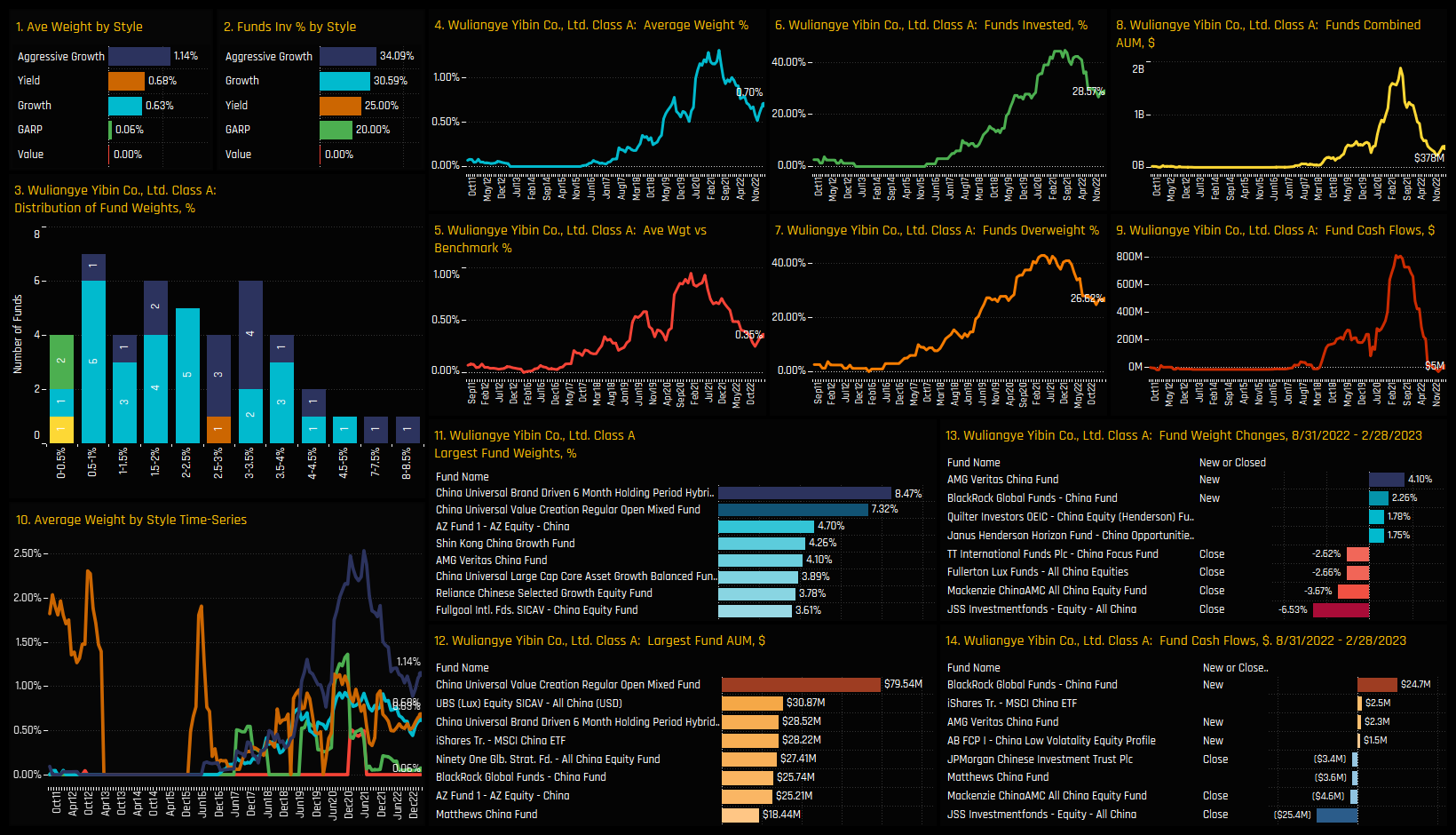

Stock Profile: Wuliangye Yibin

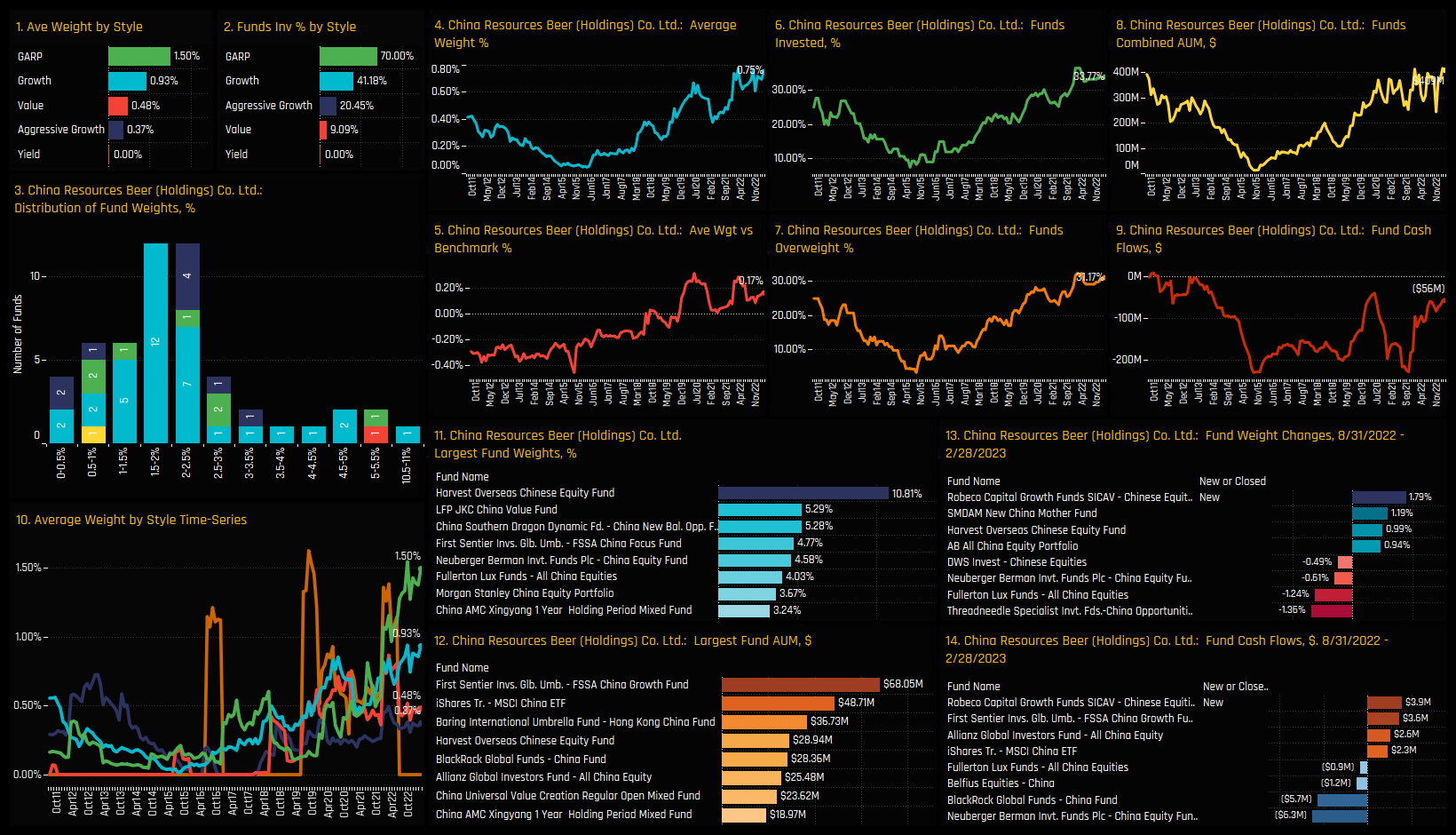

Stock Profile: China Resources Beer

Time-Series Analysis & Sector Activity

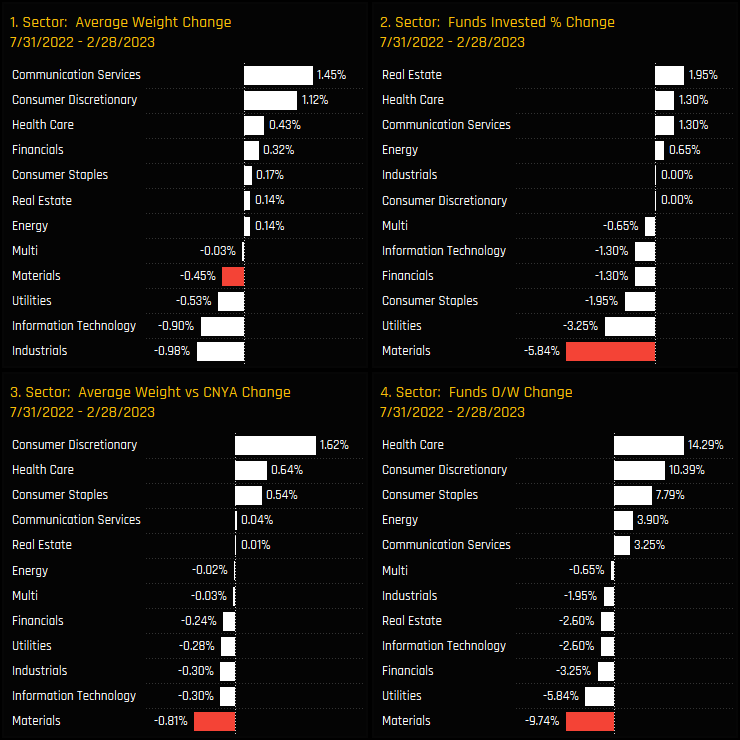

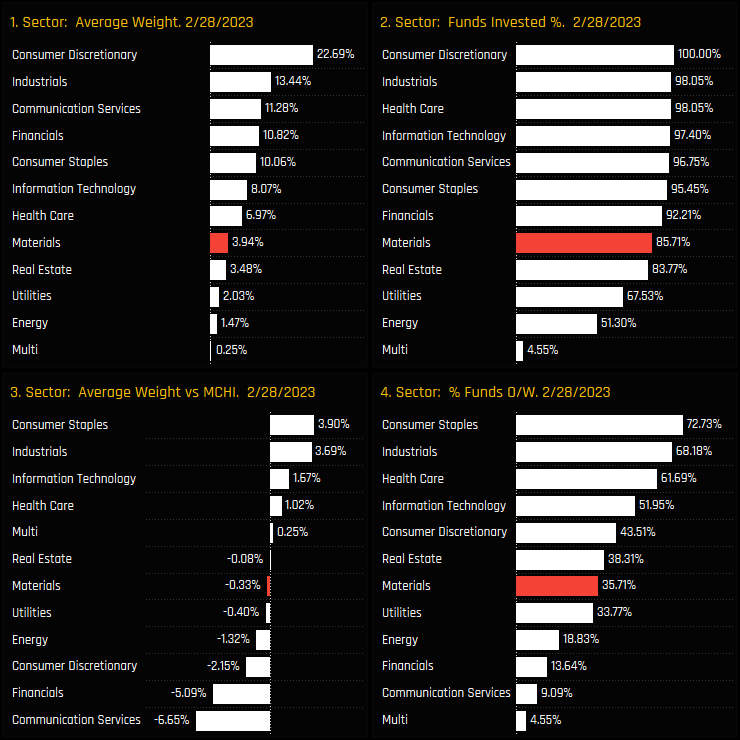

Active MSCI China managers are reducing exposure to the Materials sector, ending a 3 year ownership bull market that ran from early 2019 to July of last year. Since then, the percentage of funds invested has fallen from 91.6% to 85.7% (ch3) and average weights from 4.55% to 3.94% (ch1). This has pushed managers from an net overweight to an underweight position, with both measures of relative exposure at their all-time lows (ch2&4).

These moves are among the most severe among sector peers, highlighting the active nature of the rotation. From the peak in 07/31/2022, Materials suffered the largest decline in funds invested, funds overweight and average weights versus the MCHI benchmark. On an average weight basis, Materials were part of a quartet that saw declines, with weights in Communication Services, Consumer Discretionary and Health Care increasing.

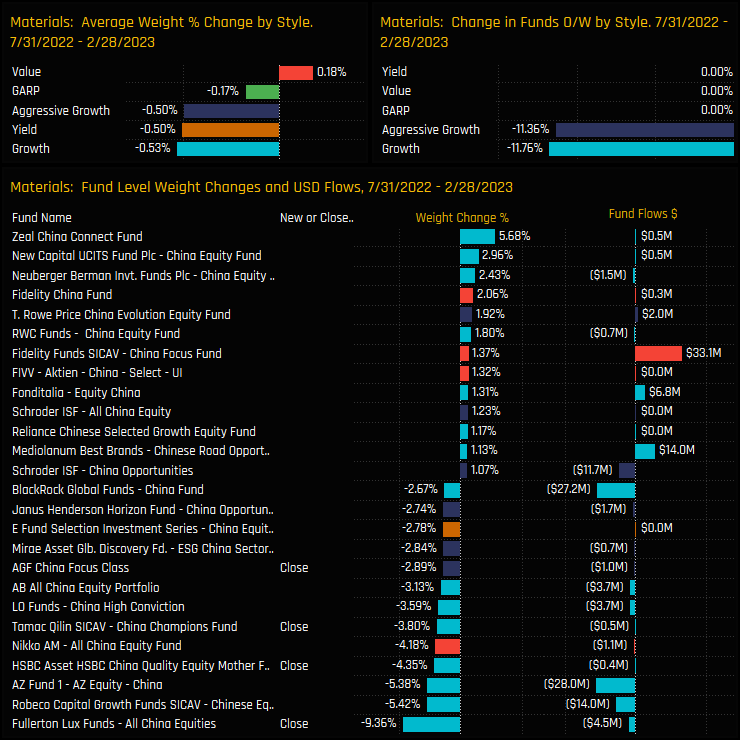

Fund Holdings & Activity

The funds behind this rotation include Fullerton All China, HSBC China Quality, Tamac Qilin China Champions and AGF China Focus who all closed exposure since the peak. In addition, Robeco Chinese Equities, AZ China and Nikko China Equity all reduced holding weights by more than 4%. On aggregate, 11.8% of Growth managers and 11.4% of Aggressive Growth managers moved from overweight to underweight between 07/31/2022 and 02/28/2023.

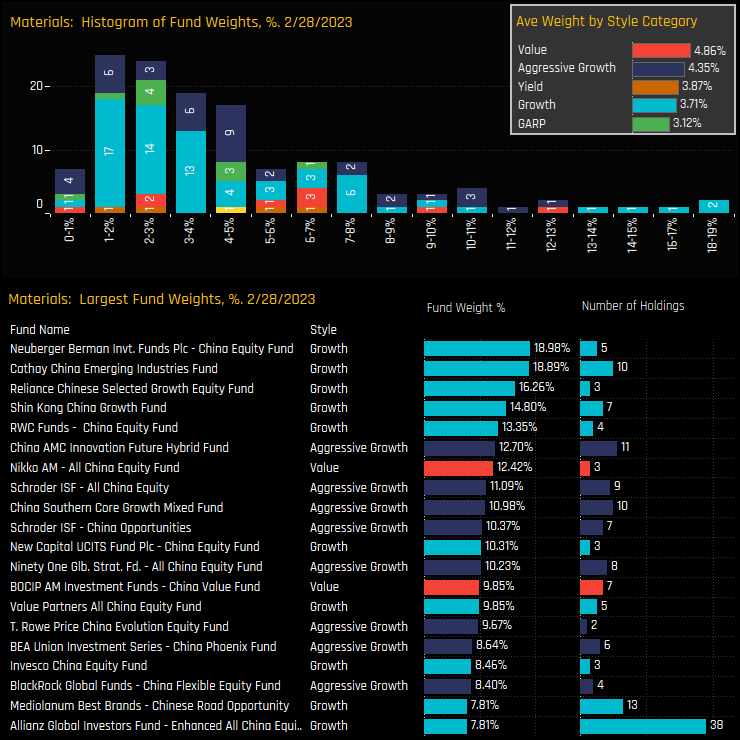

The holdings distribution is centered around the 1% – 5% level, but with the extended right-sided skew. Top holders are Neuberger Berman China Equity Fund (19%) and Cathay China Emerging Industries (18.9%), with a further 10 strategies holding more than a 10% weight. The style mix places Value and Aggressive Growth as the largest allocators on average, with little to split Growth, Yield and GARP investors.

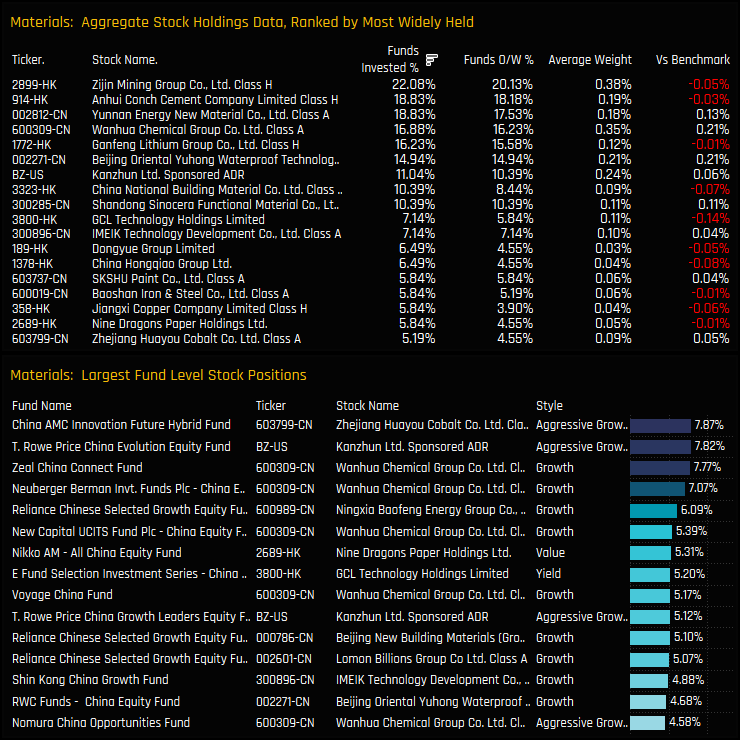

Stock Holdings & Activity

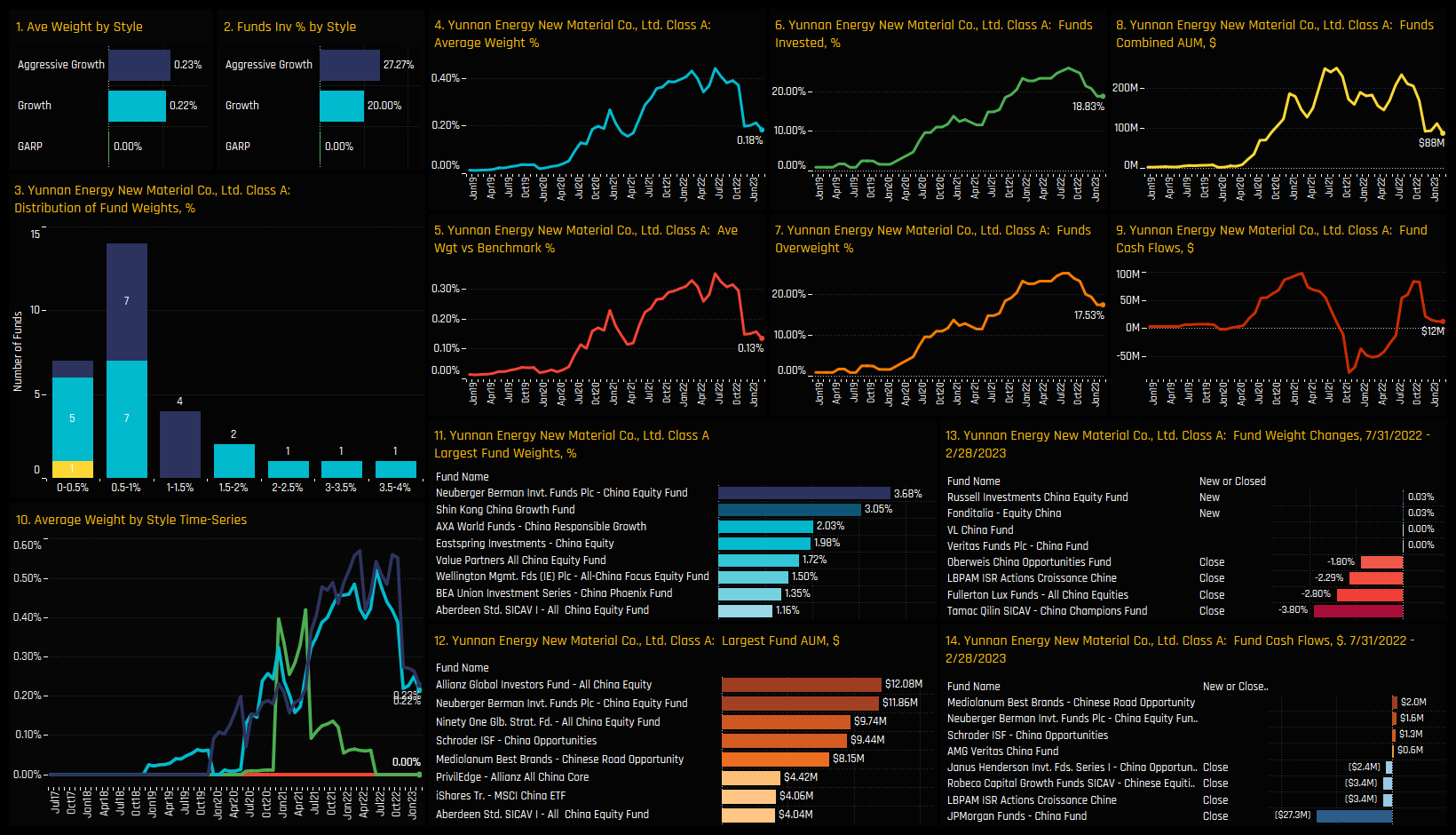

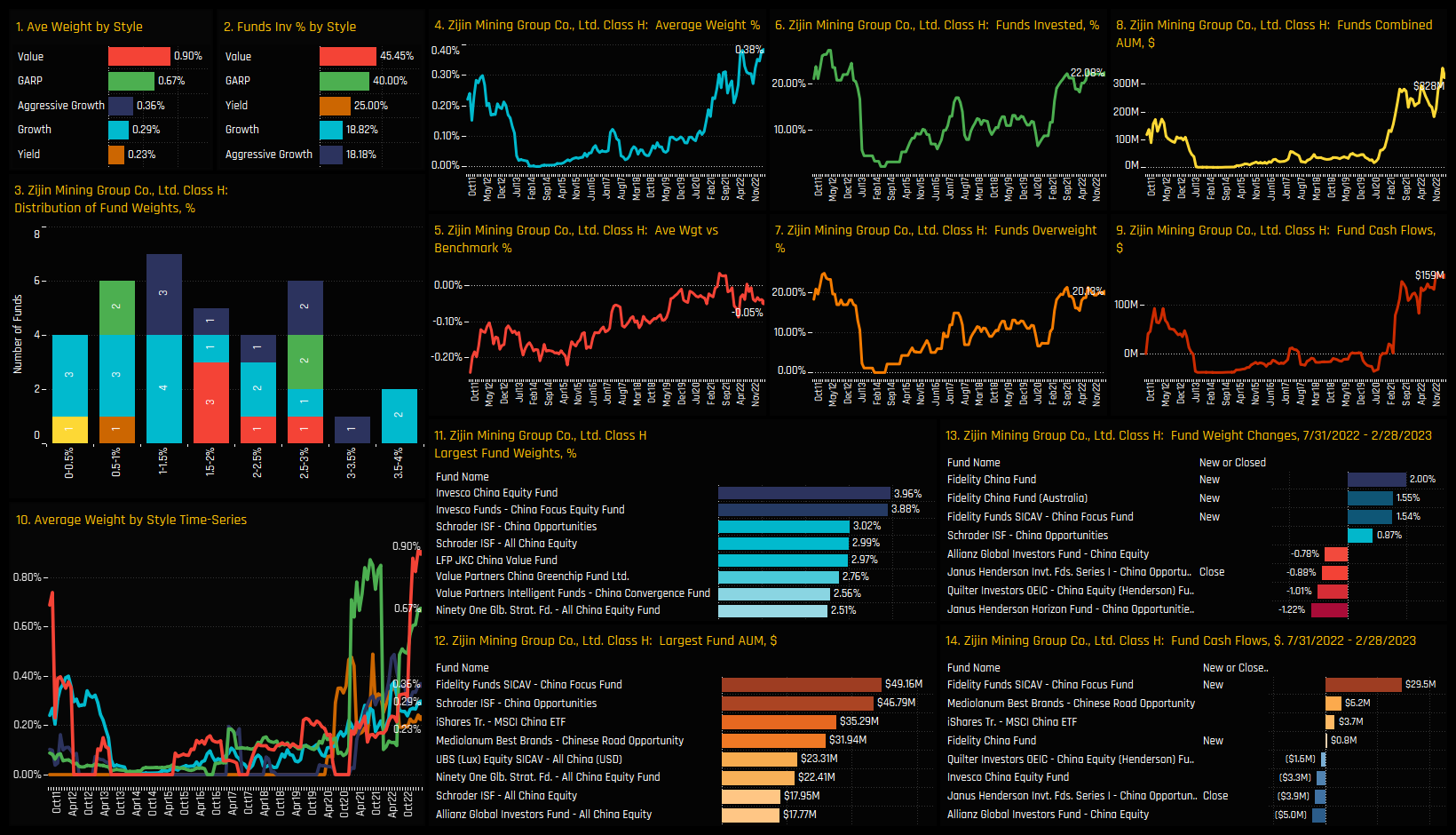

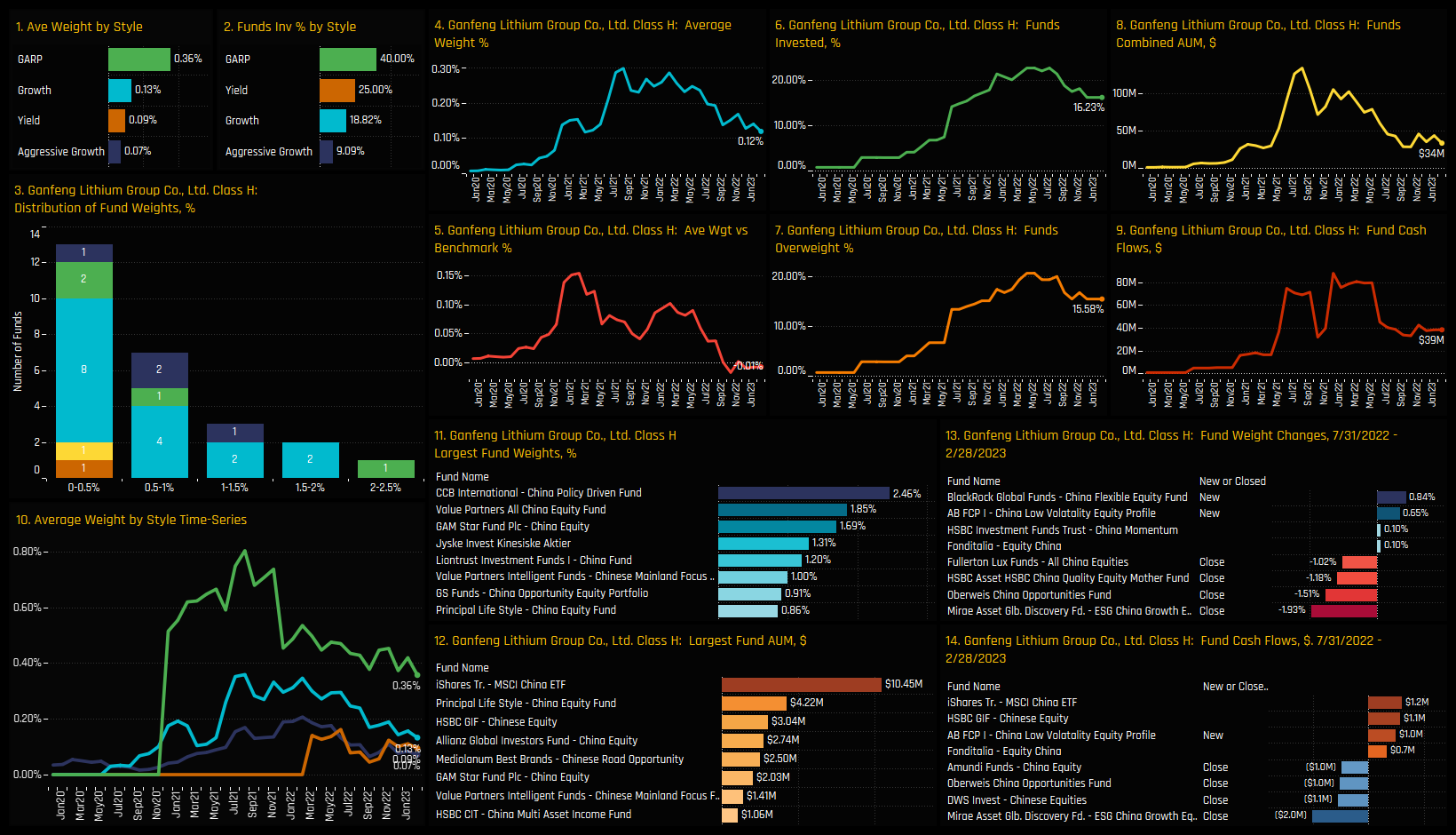

On a stock level, Zijin Mining Group is the most widely held company with 22.1% of China funds holding a position. Anhui Conch Cement, Yunnan Energy New Material, Wanhua Chemical and Ganfeng Lithium form a second tier of stocks that share similar ownership profiles. The larger individual fund level stock positions mostly sit outside these 5 companies, with China AMC Innovation Future’s position in Zheijiang Huayou Cobalt (7.9%) and T Rowe Price China Evolution in Kanzhun Ltd (7.8%) heading the pack.

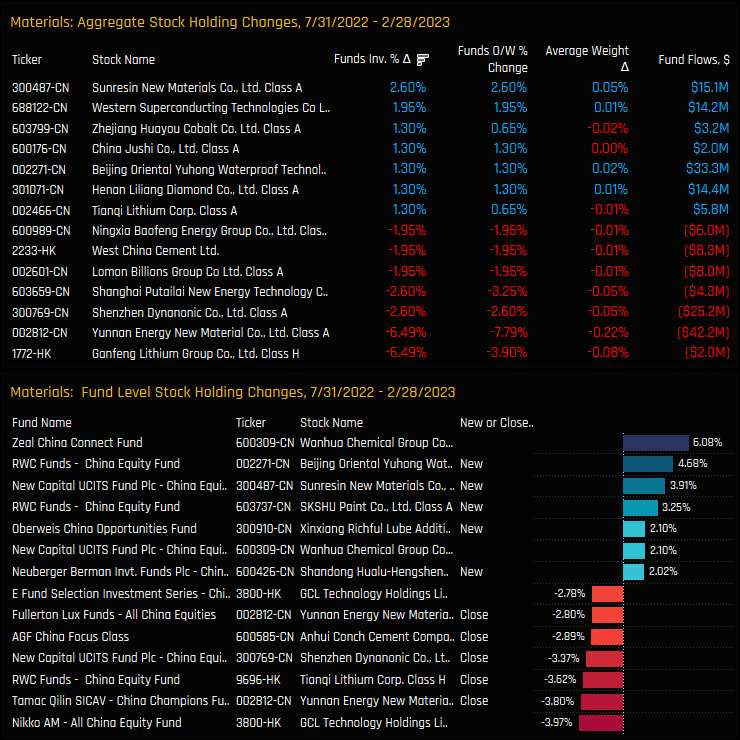

The stocks driving allocations lower are headed by Ganfeng Lithium Group and Yunnan Energy New Materials, who both saw the percentage of funds invested drop by -6.5% between 07/31/2022 and 02/28/2023. Closures in Yunnan Energy by Tamaq Qilin and Fullerton were compounded by weight reductions in GCL Technology by Nikko and E Fund. The positives were in Sunresin New Materials and Western Superconducting Technology, who both saw a moderate uptick in fund ownership over the period.

Conclusions & Links

This leaves Materials firmly in the bottom tier of sector allocations, alongside Real Estate, Utilities and Energy. These 4 sectors have a significant ownership gap to the 7 major sectors headed by Consumer Discretionary and Industrials.

Through the latter half of 2022, managers lost confidence in some of the key stocks in the sector. Companies such as Yunnan New Energy Materials and Gangfeng Lithium Group, that were threatening to make their mark among the big players in Chinese investment, lost the backing of numerous active China managers.

As it stands, the majority of the China funds in our analysis appear comfortable in running an underweight in the Materials sector.

Click below for the full data report on the Chinese Materials sector. Scroll down for stock profiles on Yunnan New Energy Materials, Gangfeng Lithium Group and Zijin Mining Group

Stock Profile: Yunnan Energy New Material

Stock Profile: Zijin Mining Group

Stock Profile: Ganfeng Lithium Group

Long Term Trends & Peer Group Activity

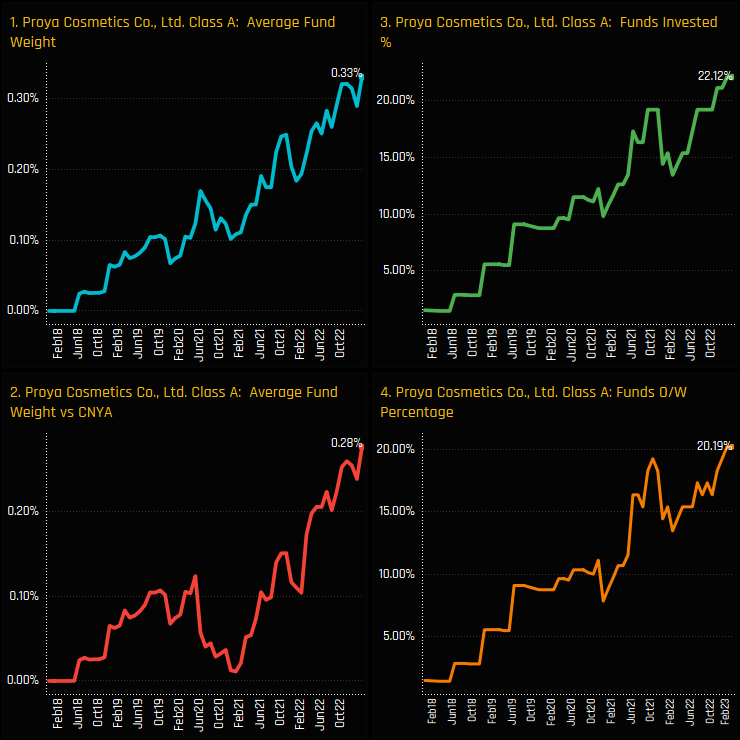

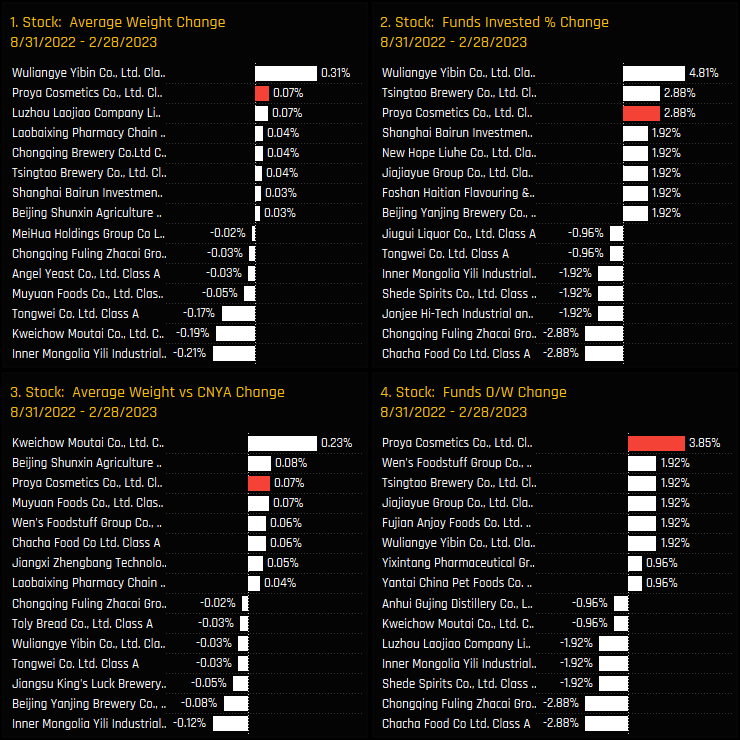

The below charts show the change in our ownership metrics for stocks in the China A-Share Consumer Staples sector over the last 6-months. Proya Cosmetics has been a key beneficiary of stock rotation among A-Share managers, with increases in both absolute and relative positioning among the highest compared to sector peers. China A-Share managers also increased exposure to Wuliangye Yibin Co and Tsingtao Brewery, whilst scaling back holdings in Inner Mongolia Yili Industrial Group and Chacha Food Co Ltd.

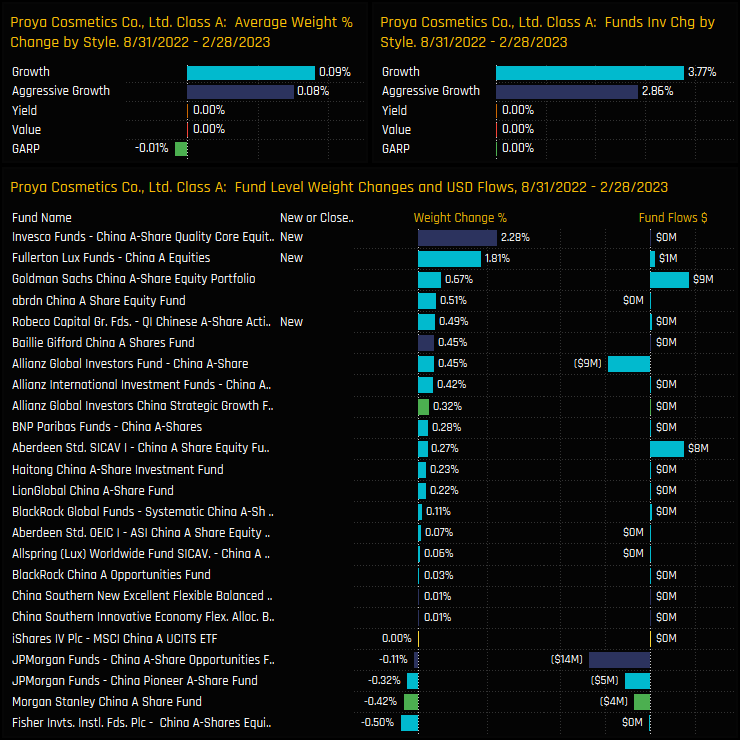

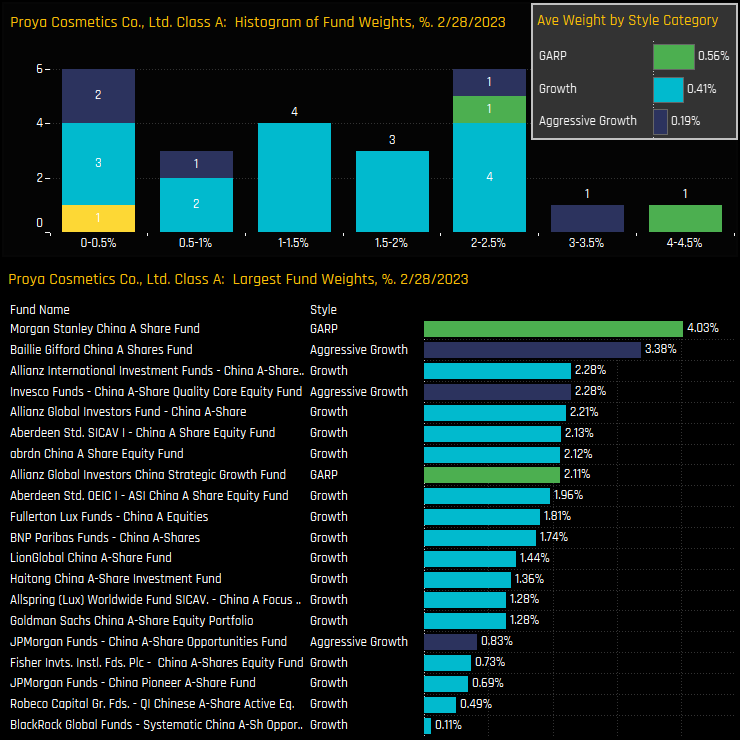

Fund Level Activity & Holdings

Conclusions & Links

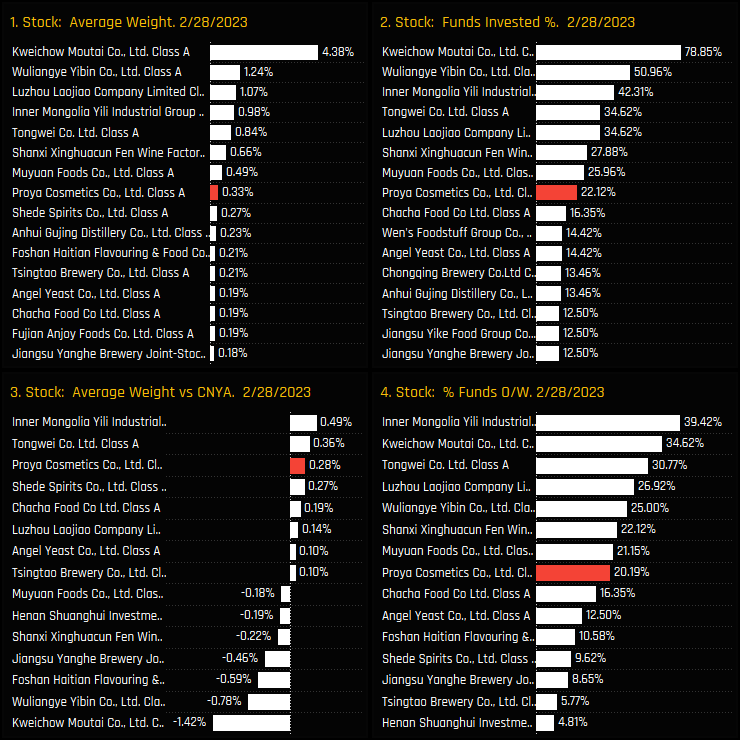

Positioning in Proya Cosmetics after the continued rotation has seen it catch up to established peers in the Consumer Staples sector. As it stands, Proya is now the 8th most widely held Consumer Staples company and the 3rd largest overweight among China A-Share ‘Staples peers. Kweichow Moutai (600519 CH) and Wuliangye Yibin Co Ltd A (000858 CH) remain the dominant holdings within the sector.

Proya Cosmetics is one of a small number of China A-Share companies that stands out among a sea of investible alternatives. The iShares MSCI China A ETF (CNYA US) contains 498 stocks, and Proya is the 474th largest weight. Among A-Share active funds though, Proya Cosmetics is the 56th largest average weight and the 50th most widely held stock, a sure sign that institutional investors see something worth investing in.

If we couple the recent strong momentum with the fact that 78% of funds are still uninvested, it’s not difficult to see the potential for the ownership base to make further gains from here. It’s a stock that should be on every China investor’s radar.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 16, 2023

China Fund Positioning Analysis, August 2023

254 China Equity Funds, AUM $100bn China Fund Positioning Analysis, August 2023 In this issue: ..

- Steve Holden

- April 27, 2023

China Fund Positioning Analysis, April 2023

257 China Equity Funds, AUM $108bn China Fund Positioning Analysis, April 2023 In this issue: Q ..

- Steve Holden

- November 22, 2022

China Fund Positioning Analysis, November 2022

277 Active China Funds, AUM $102bn China Fund Positioning Analysis, November 2022 In this issue ..