152 MSCI China Equity Funds, AUM $55bn

MSCI China Stock Radar

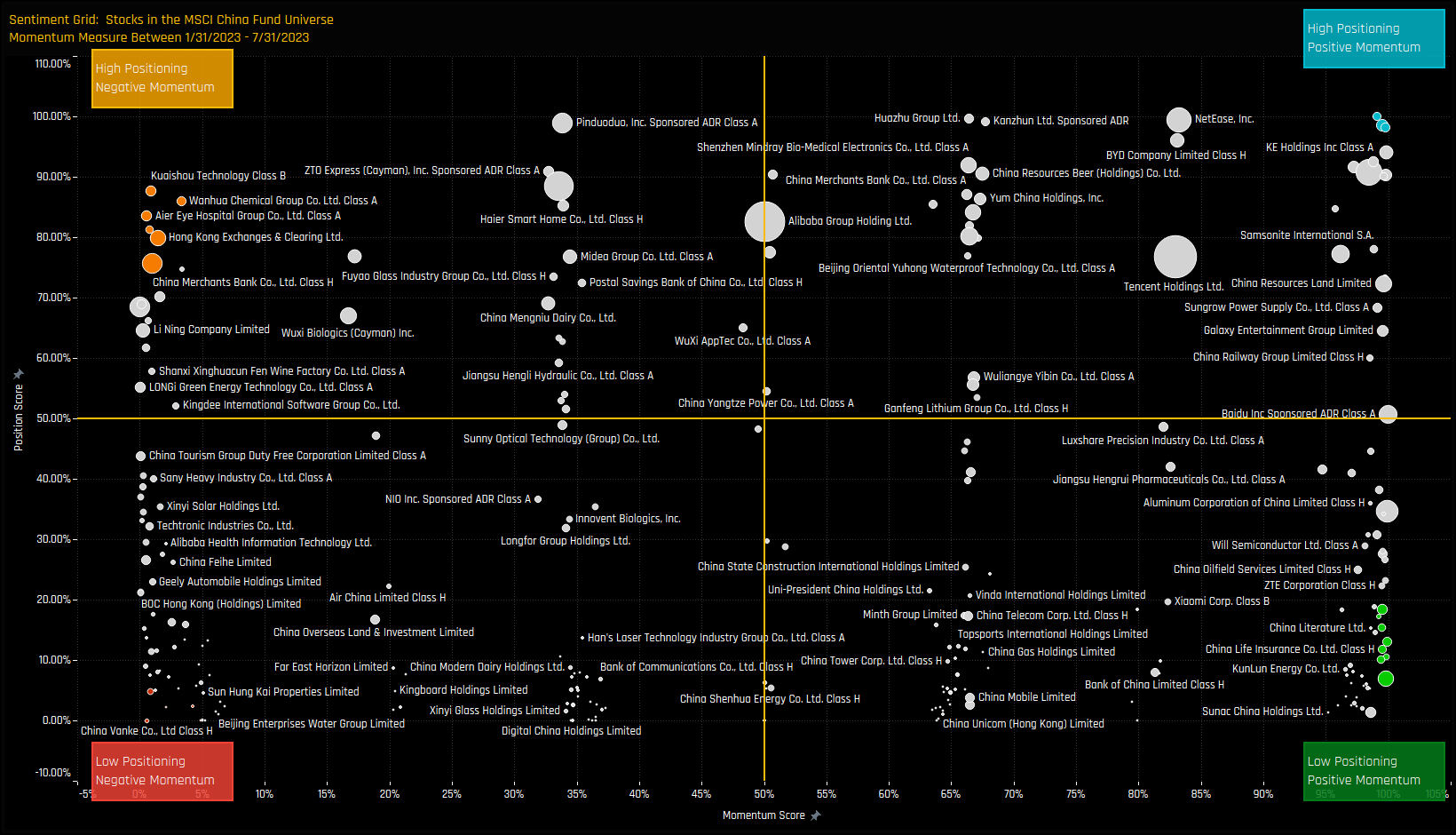

Investment levels among the thousands of stocks in the investible China universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in our MSCI China analysis. We highlight 8 stocks at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

Stock Sentiment

Extreme Stocks

- High Positioning & Negative Momentum: Position Score > 75%. Momentum Score < 5%

- Low Positioning & Negative Momentum: Position Score < 5%. Momentum Score < 5%

- Low Positioning & Positive Momentum: Position Score < 20%. Momentum Score > 99%

- High Positioning & Positive Momentum: Position Score > 95%. Momentum Score > 99%

Extreme Stocks Focus

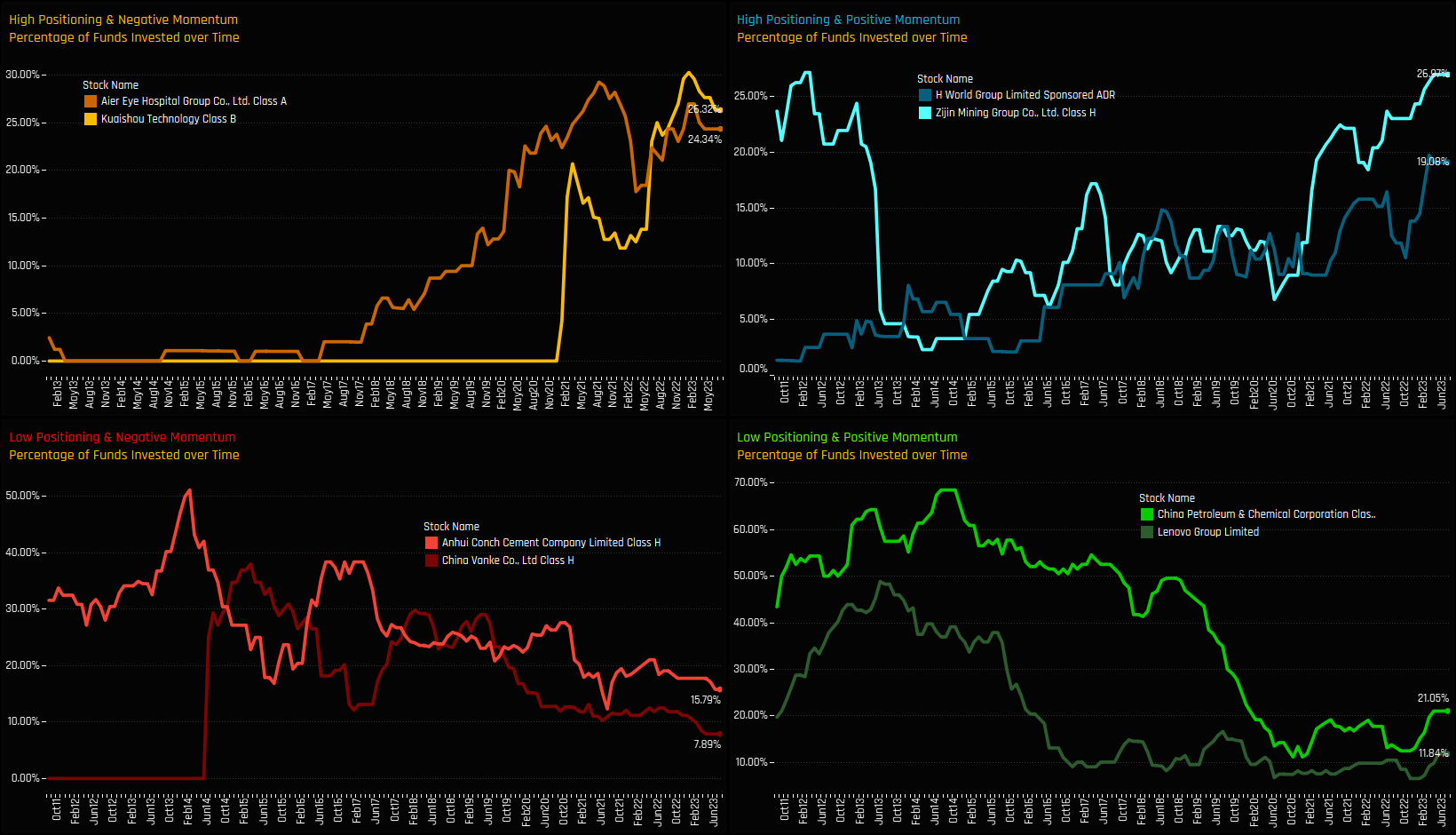

The following charts illustrate the proportion of active funds invested in the top 2 stocks within each of the 4 categories. This visualization provides an additional perspective how the Sentiment Grid works. For instance, in the chart located at the top-left, Aier Eye Hospital Group and Kuaishou Technology have experienced a decline in fund ownership from historically high levels. Moving to the chart in the bottom-left, both Anhui Conch and China Vanke are close to record low levels of ownership after multi-year declines.

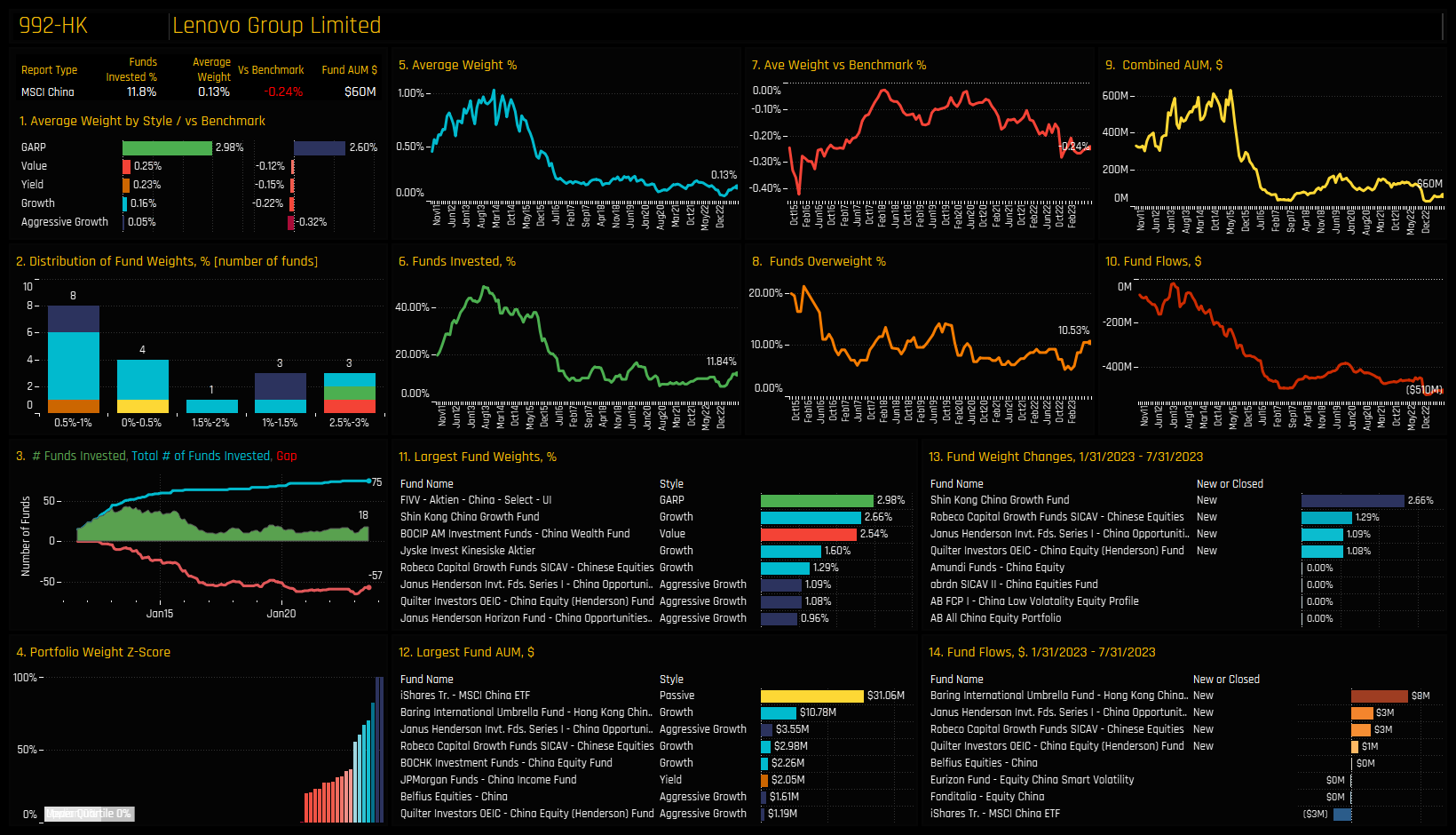

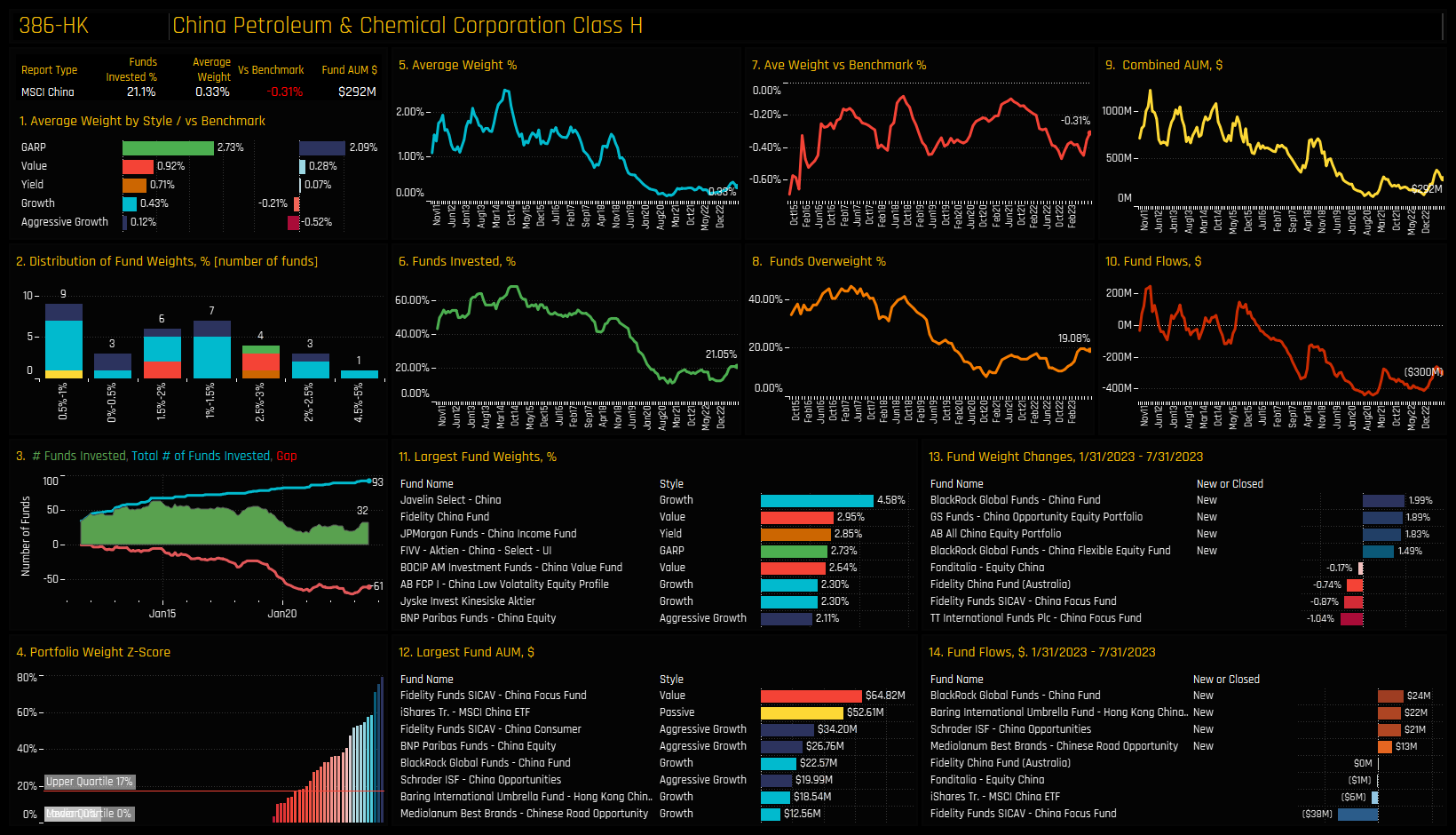

In the bottom right chart, both Lenovo Group and China Petroleum & Chemical Corp are at the lower end of their historical ownership ranges. However, both stocks have started to rebound from their lows, indicating a change in sentiment among selected managers. Finally, in the top right chart, H World Group and Zijin Mining Group are at peak levels of ownership following consistent increases in fund exposure over the past few months. In the subsequent charts, we offer more comprehensive profiles of each of the 8 stocks located at the extreme corners of our Sentiment Grid.

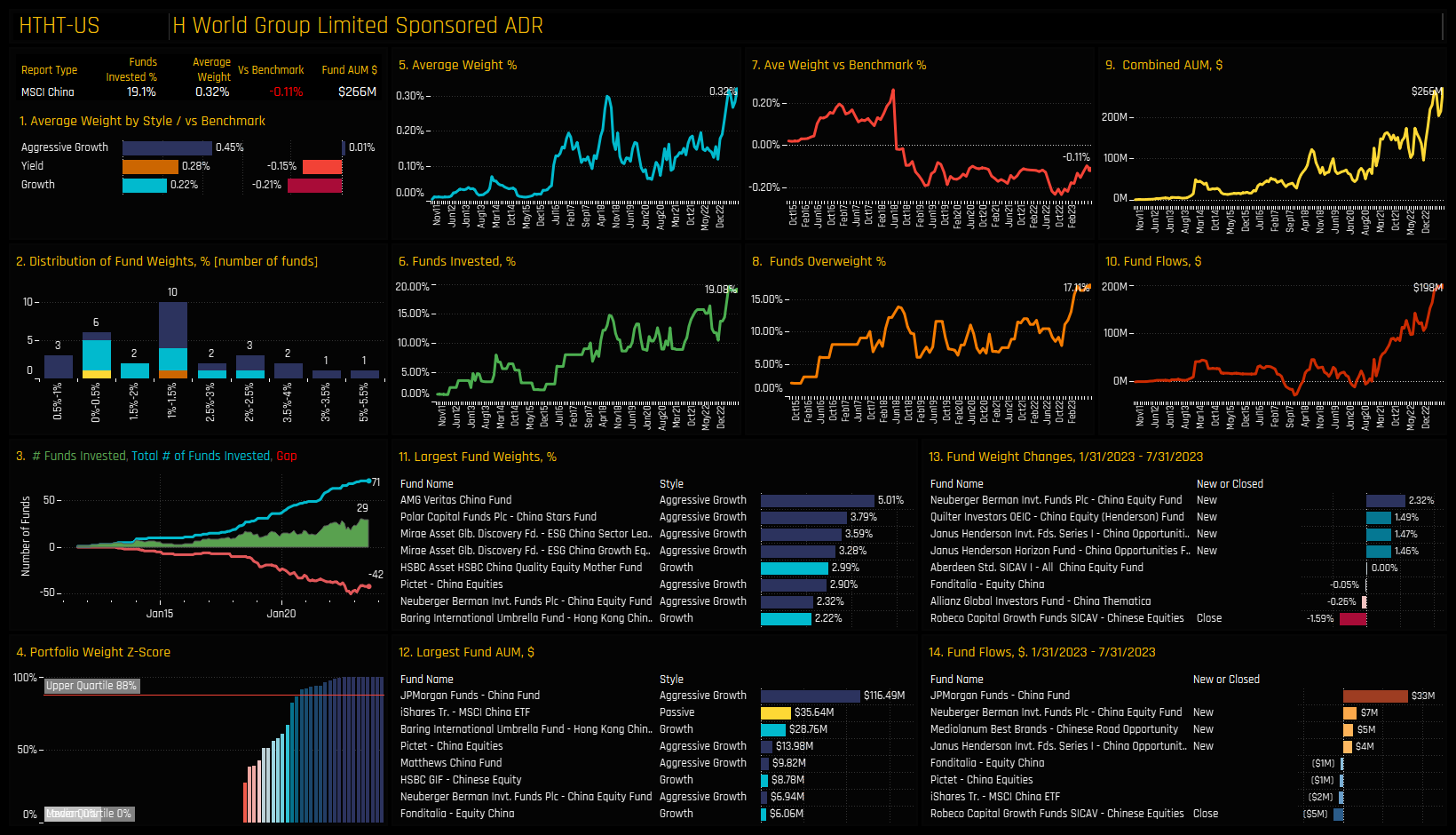

High Positioning & High Momentum: H World Group

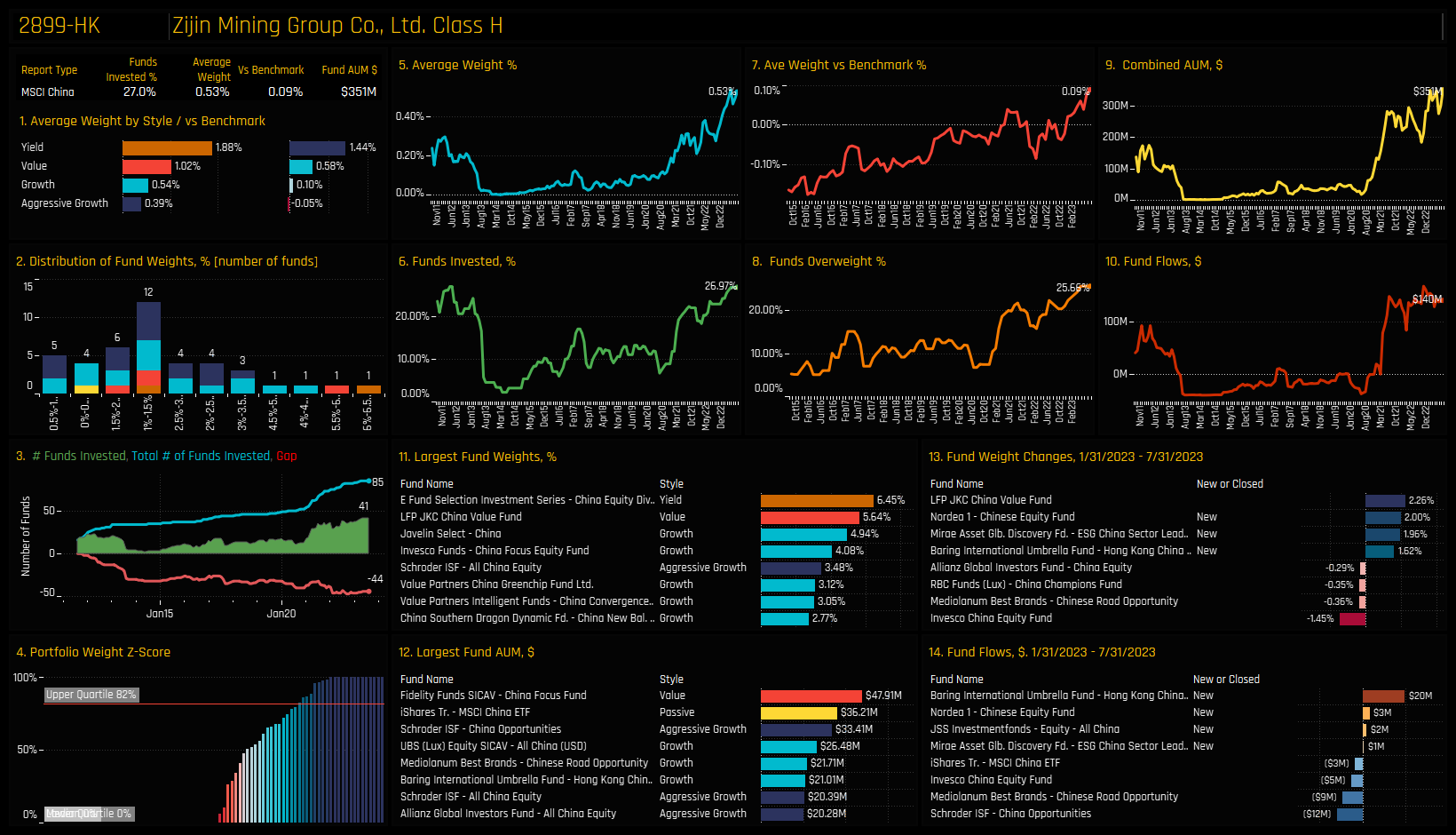

High Positioning & High Momentum: Zijin Mining Group

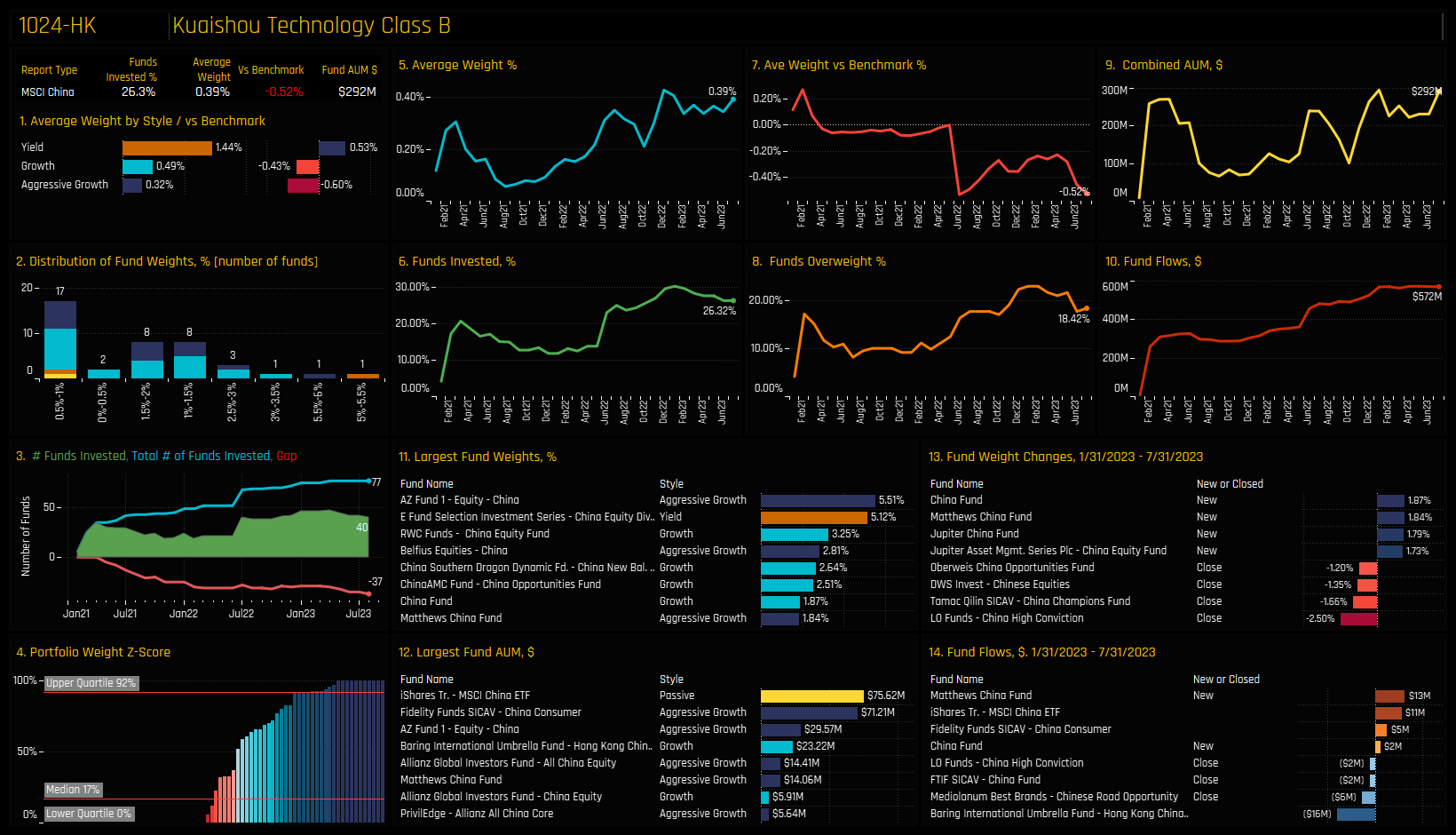

High Positioning & Low Momentum: Kuaishou Technology Class B

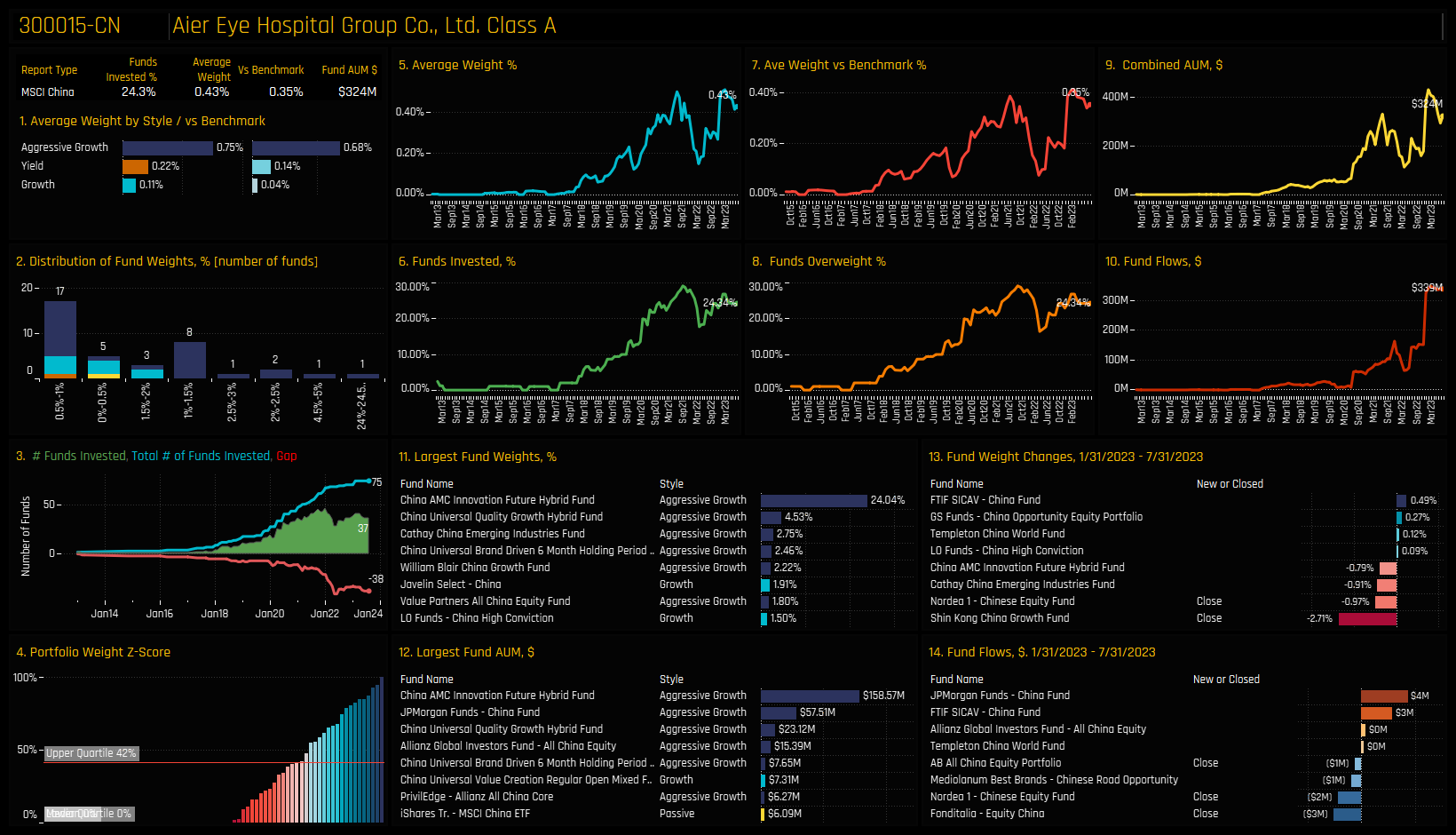

High Positioning & Low Momentum: Aier Eye Hospital

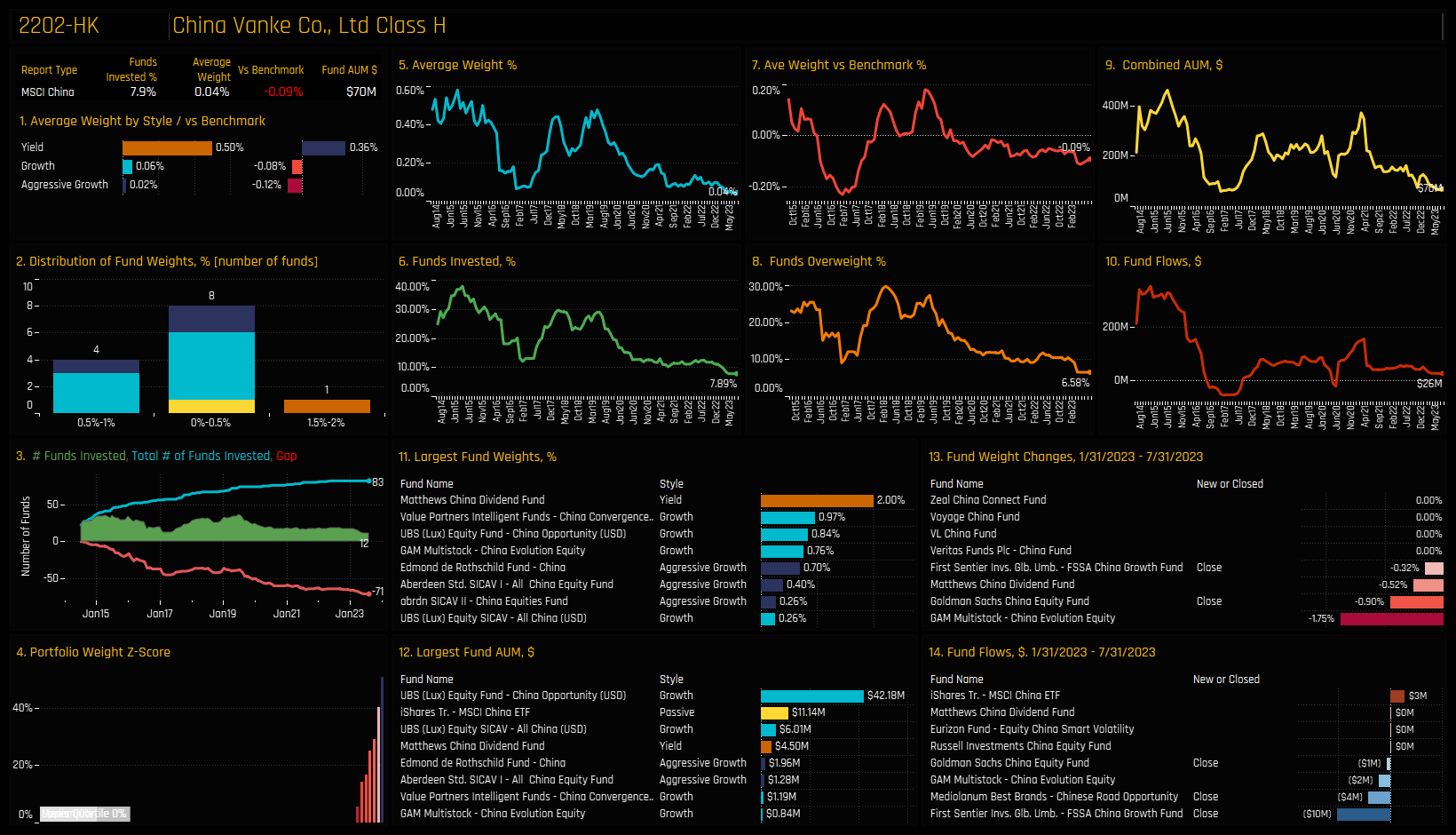

Low Positioning & Low Momentum: China Vanke

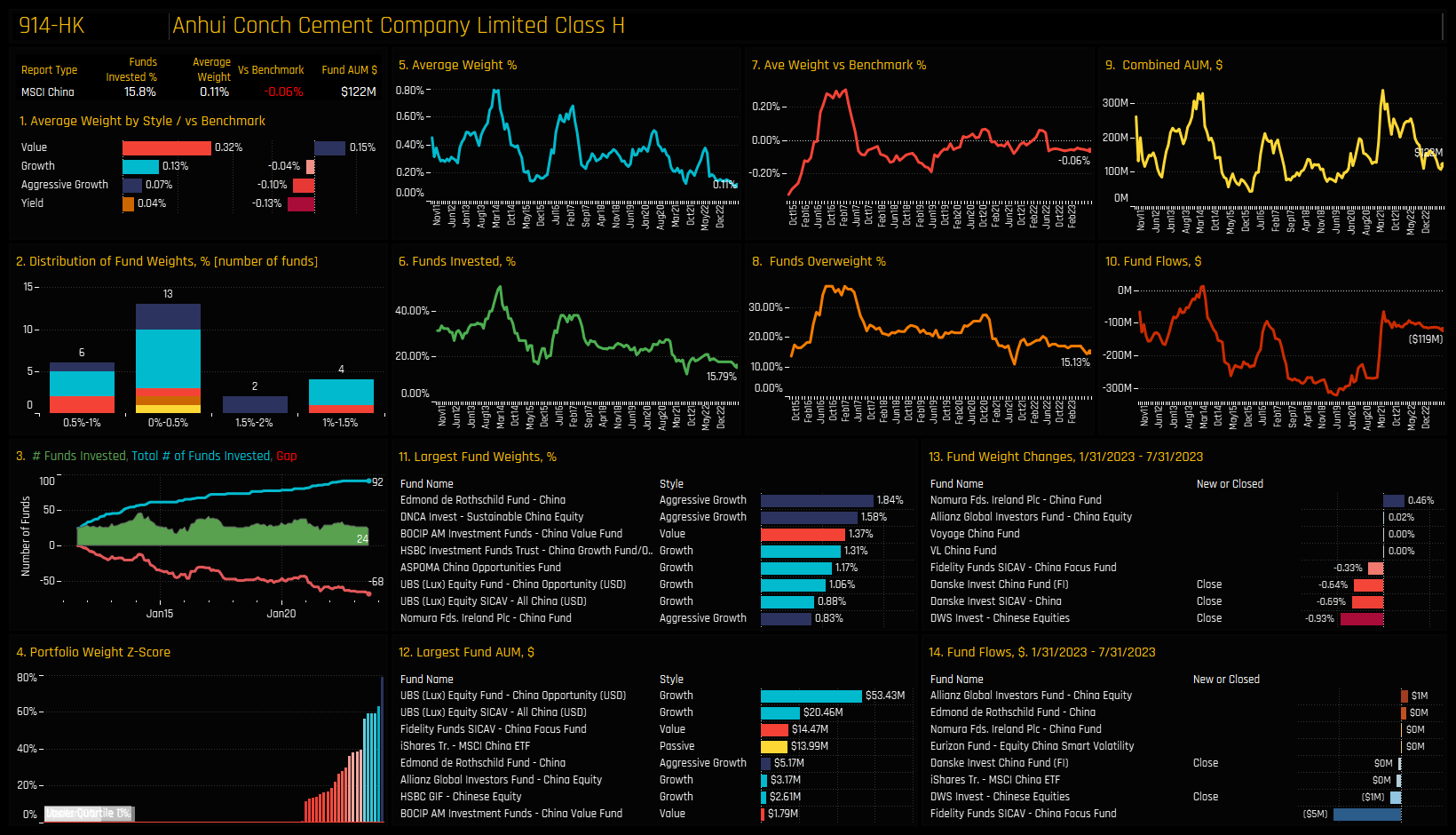

Low Positioning & Low Momentum: Anhui Conch Cement Co

Low Positioning & High Momentum: Lenovo Group Limited

Low Positioning & High Momentum: China Petroleum & Chemical Corp

Time-Series Analysis & Industry Rotation

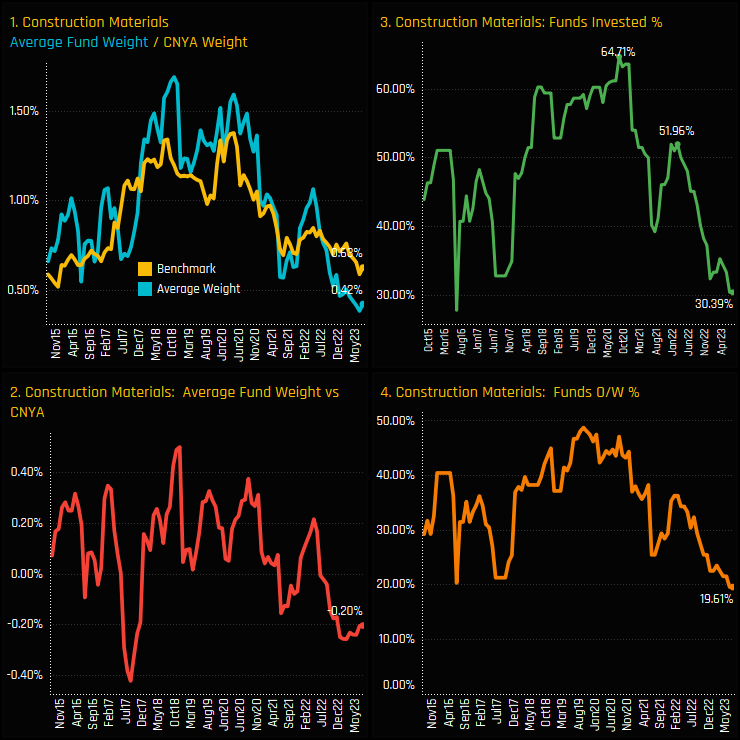

Ownership levels among active China A-Share funds in the Construction Materials sector are approaching their lowest levels on record. The percentage of funds with exposure has fallen from over 60% in late 2020 to just 30.4% today. This has driven average holding weights to record lows of 0.42%, moving managers to underweight the iShares CNYA ETF by -0.2% on average.

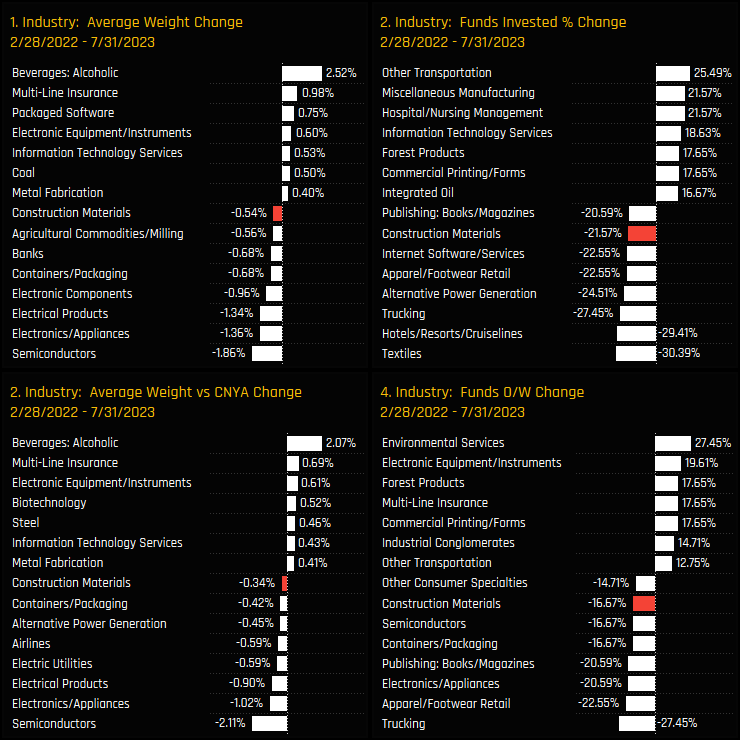

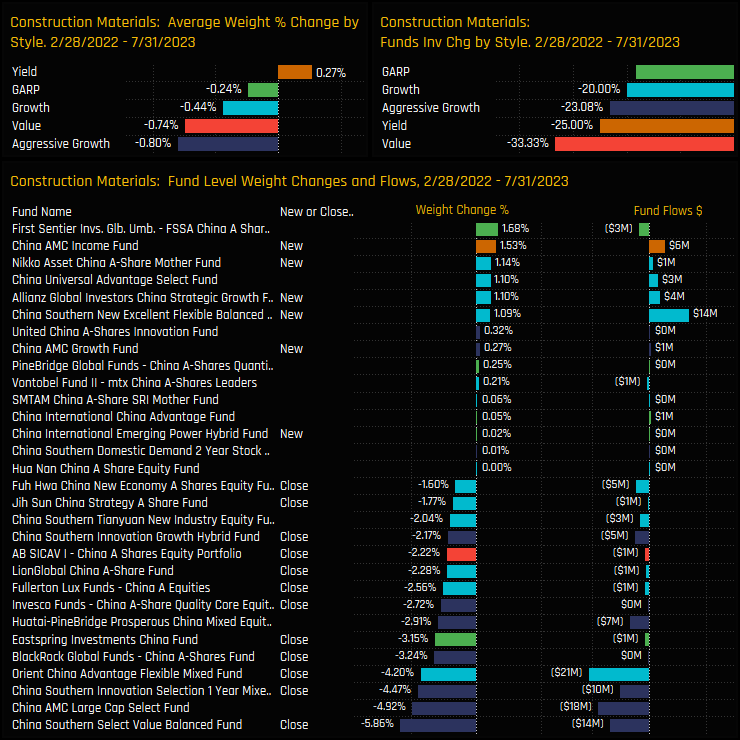

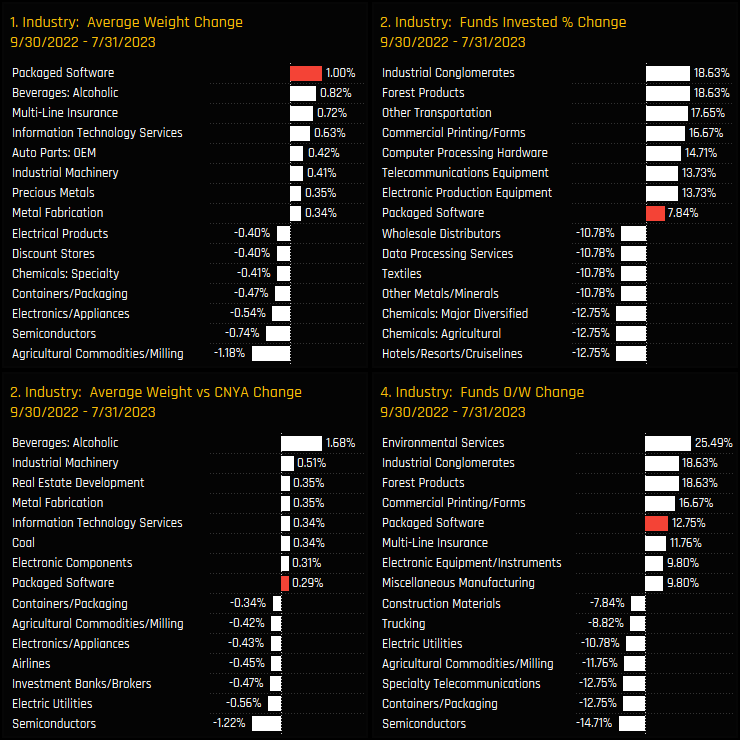

Since the last peak in ownership back in February 2022, Construction Materials have been the victim of some fairly aggressive manager rotation. All 4 of our ownership measures fell over the period, most notably the percentage of funds invested by -21.6% and average weights by -0.54%, both among the largest moves of any industry group. Active A-Share managers instead raised exposure to Alcoholic Beverages, Insurance and Packaged Software, among others.

Fund Activity & Latest Fund Holdings

The charts below show the funds that have been behind this drop in exposure. Over the same period 02/28/2022 – 07/31/2023, 28 funds closed positions compared to just 6 opening, led by a mixture of domestic funds (China AMC, China Southern) and international funds (Invesco, BlackRock, Fullerton, Alliance Bernstein). All Style groups saw outright ownership levels fall.

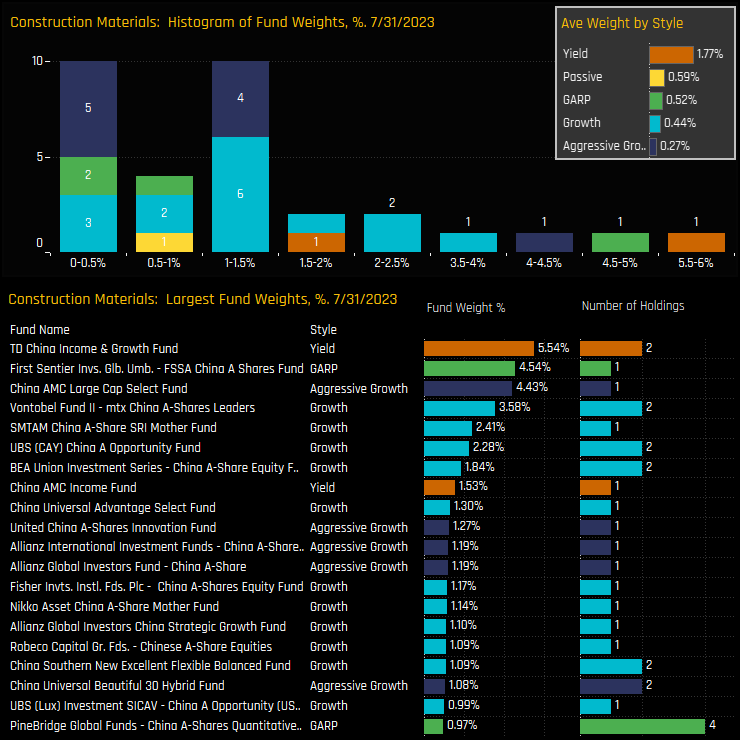

Those that do hold exposure to the Construction Materials sector typically hold less than a 1.5% stake, as shown in the top histogram below. Those with a more bullish view include 6 funds with a 2%+ allocation, led by TD China Income & Growth (5.54%) and First Sentier China A-Shares Fund (4.54%).

Latest Stock Holdings & Activity

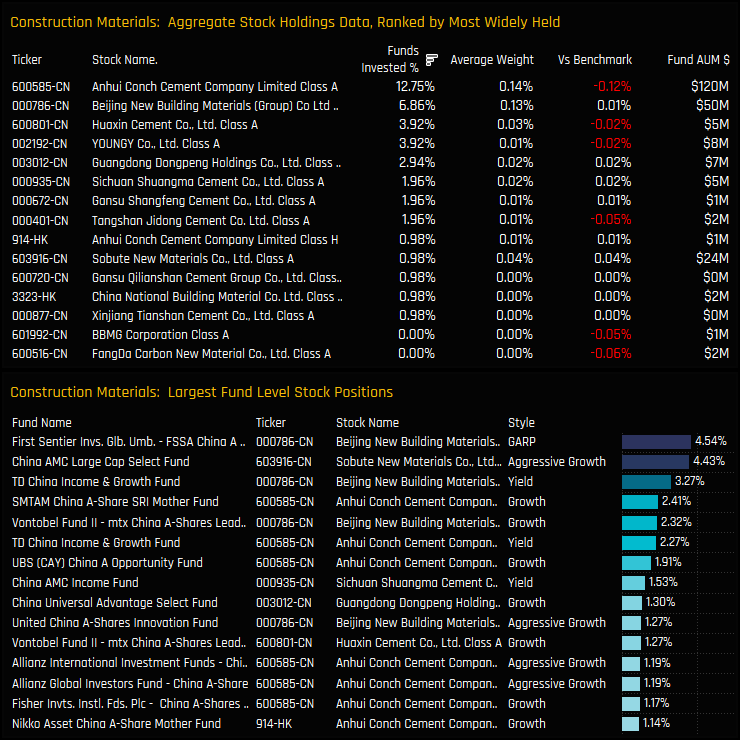

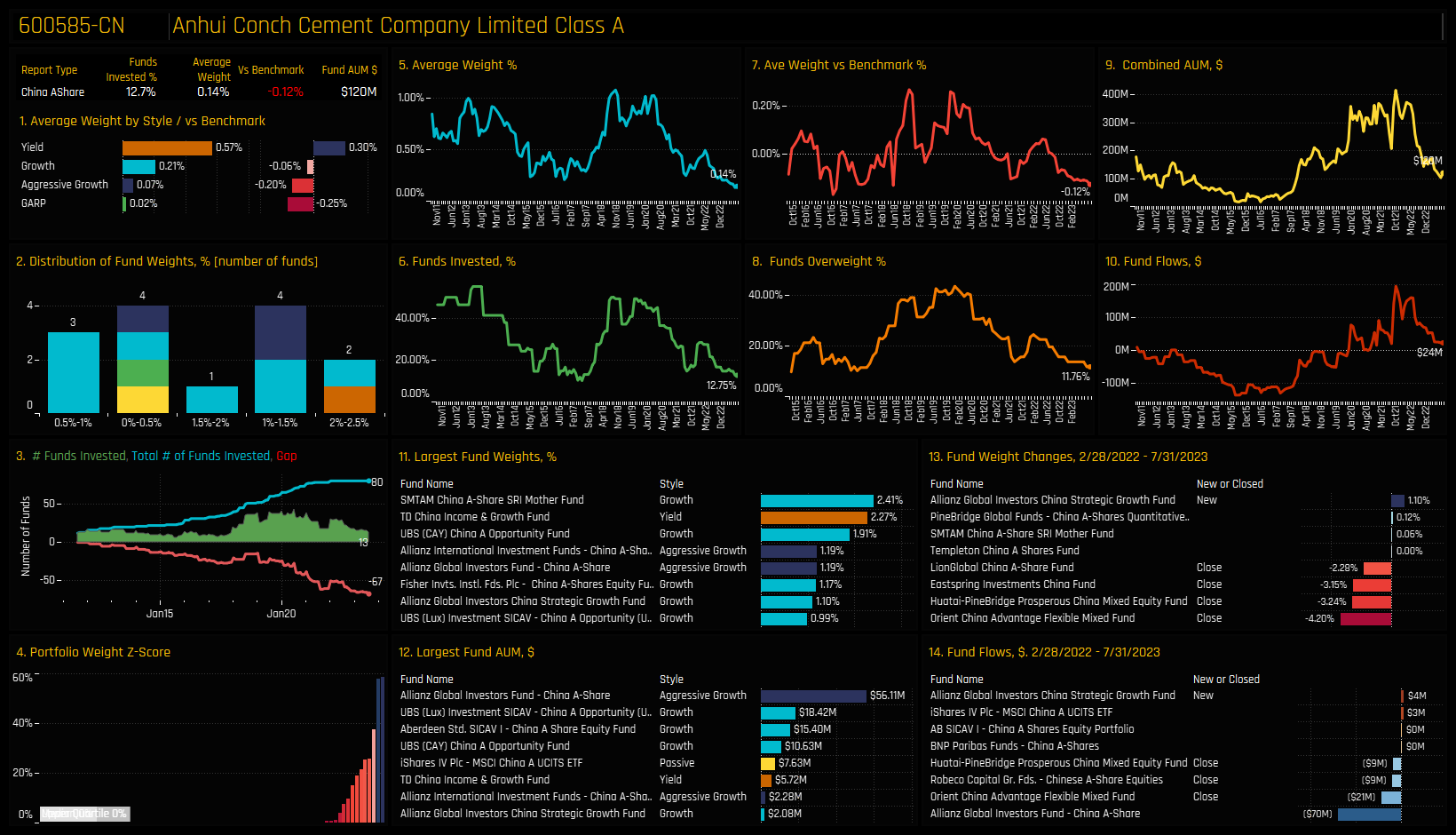

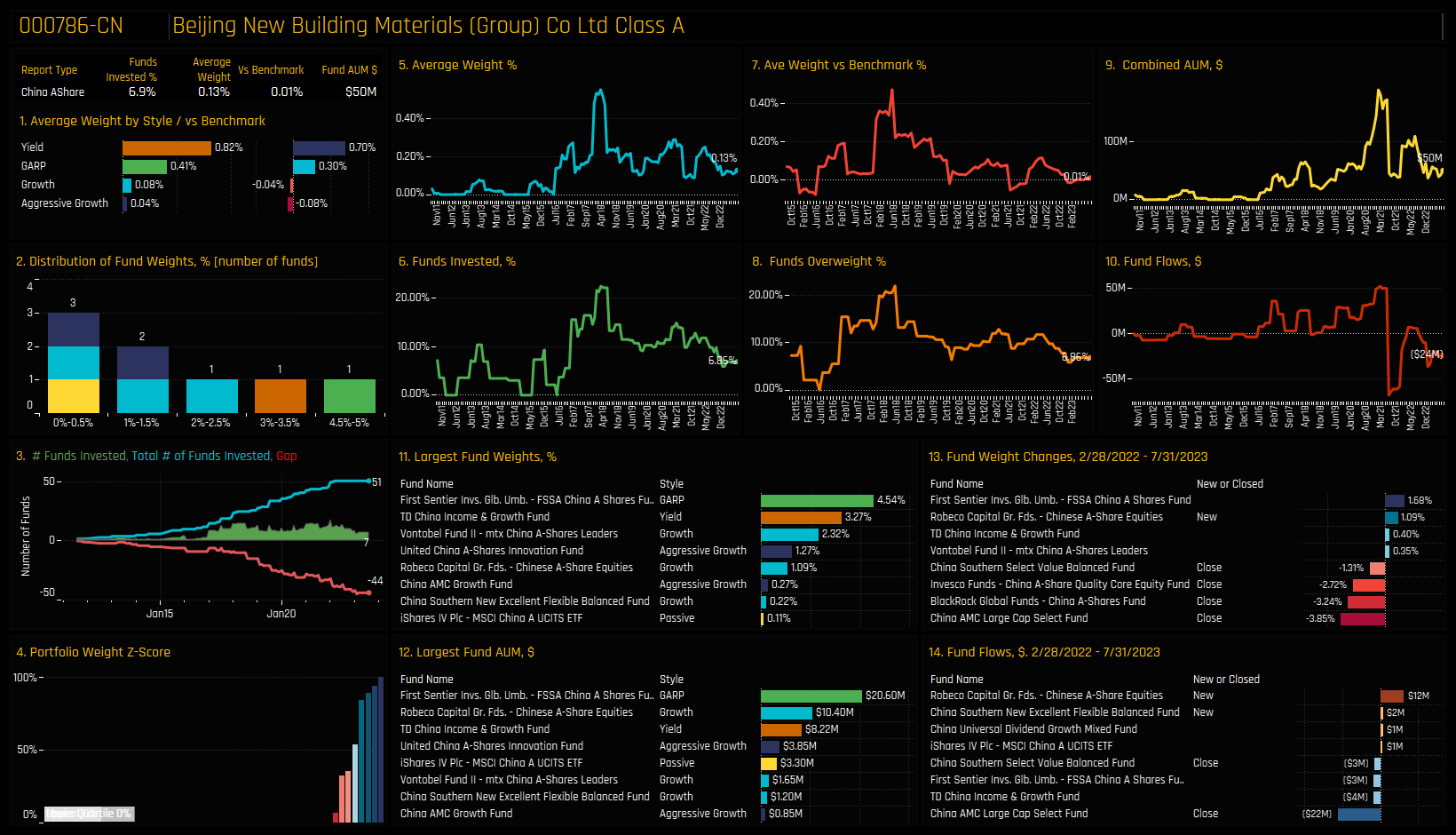

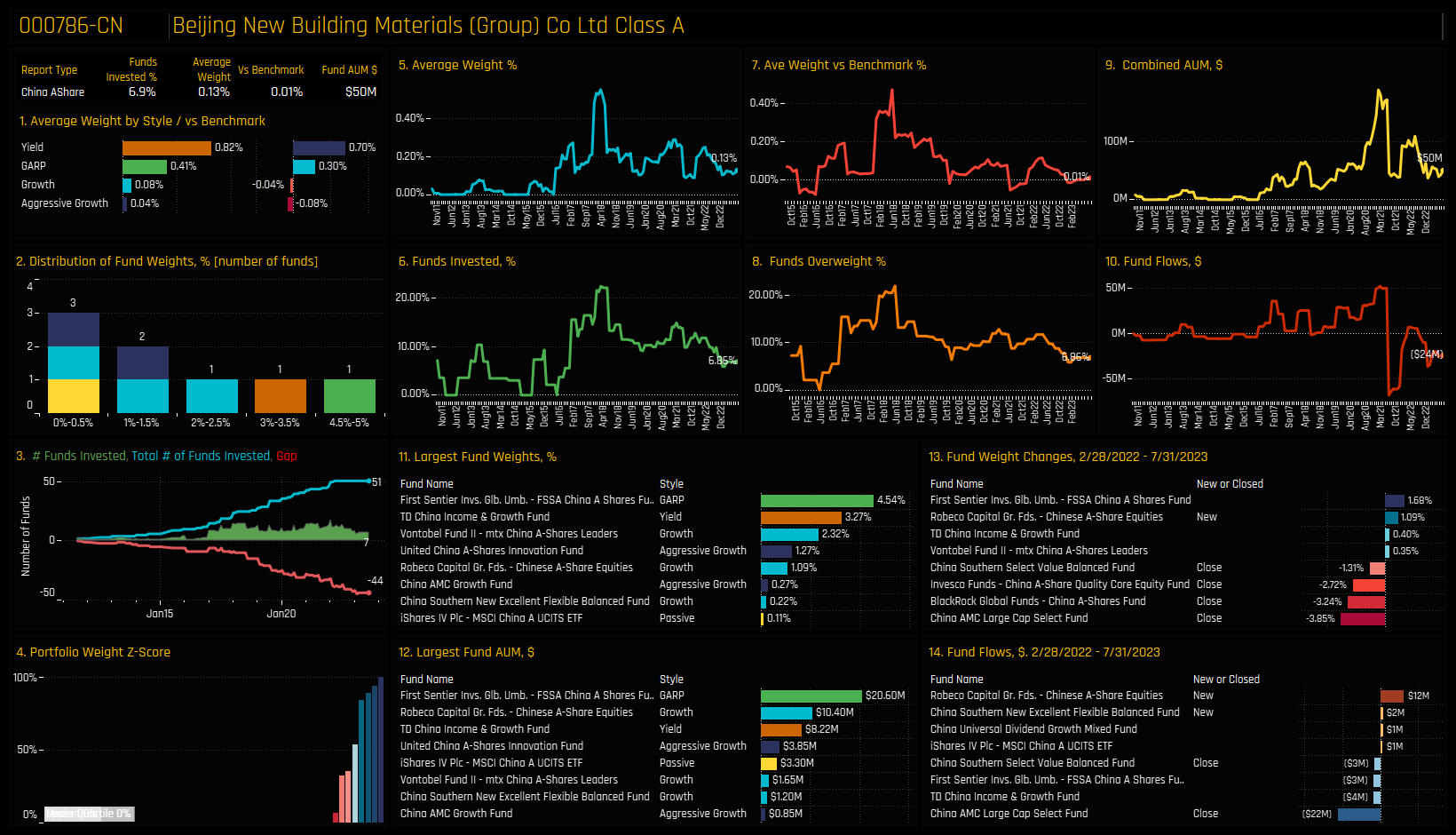

Stock ownership in the Construction Materials sector is spread across 13 companies, though exposure is heavily skewed towards the top 2 names. Anhui Conch Cement and Beijing New building Materials Group are owned by 12.8% and 6.9% of funds respectively and collectively account for over 60% of the total industry allocation. They also dominate the list of large individual fund holdings in the bottom chart, led by the First Sentier China A-Share fund’s 4.5% position in Beijing New Building Materials.

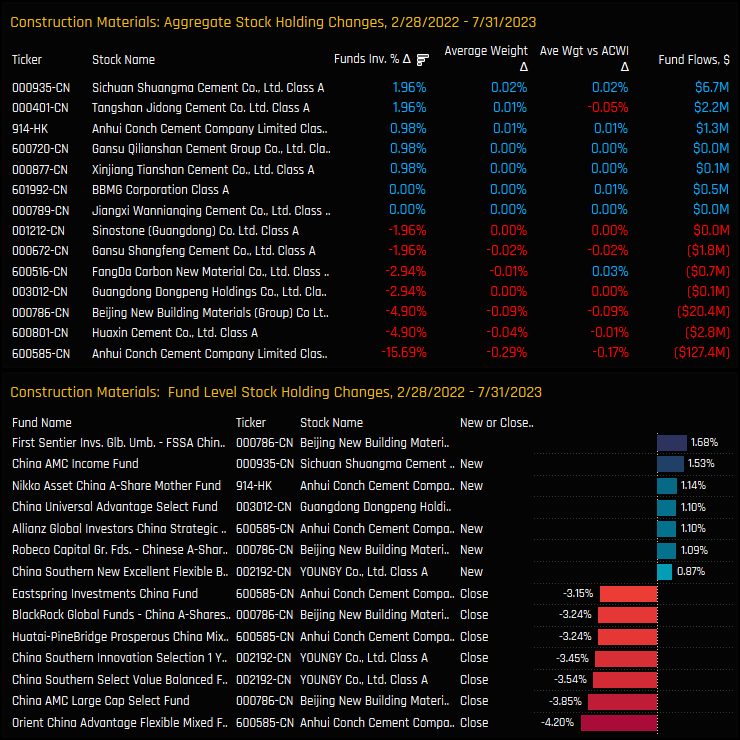

Aggregate stock level ownership changes over the same period are highlighted in the top chart below. It shows a large drop in ownership for Anhui Conch Cement, with a net 15.7% of the 102 funds in our A-Share analysis closing exposure. Huaxin Cement and Beijing New Building Materials also saw ownership levels fall but to a lesser extent. Single fund activity in the bottom chart shows the imbalance in position size between the closing and opening positions over the period.

Conclusions & Links

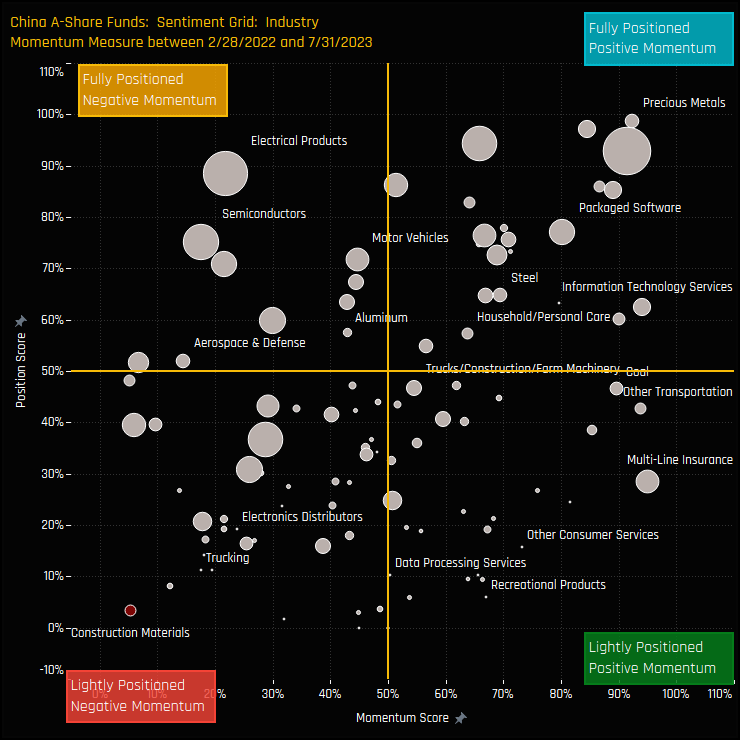

The sentiment grid opposite shows where current positioning in each Industry group sits versus its own history going back to 2015 on a scale of 0-100% (y-axis), against a measure of fund activity for each Industry between 02/28/2022 and 07/31/2023 (x-axis). The China A-Share Construction Materials industry group is out on its own in the extreme bottom-left quadrant, indicative of it’s record low positioning and continued outward rotation by active China funds.

Whilst some of this can be attributed to Anhui Conch Cement alone, the fact remains that there are very few bright spots to speak of in terms of positive activity over the last 18-months. Sentiment, as measured by fund activity and positioning, is as low as it gets.

Click on the link below for a more detailed data pack on A-Share fund positioning in the Construction Materials industry group. Scroll down for fund profiles on Anhui Conch Cement and Beijing New Building Materials.

Stock Profile: Anhui Conch Cement Class A

Stock Profile: Beijing New Building Materials Class A

Time Series & Industry Rotation

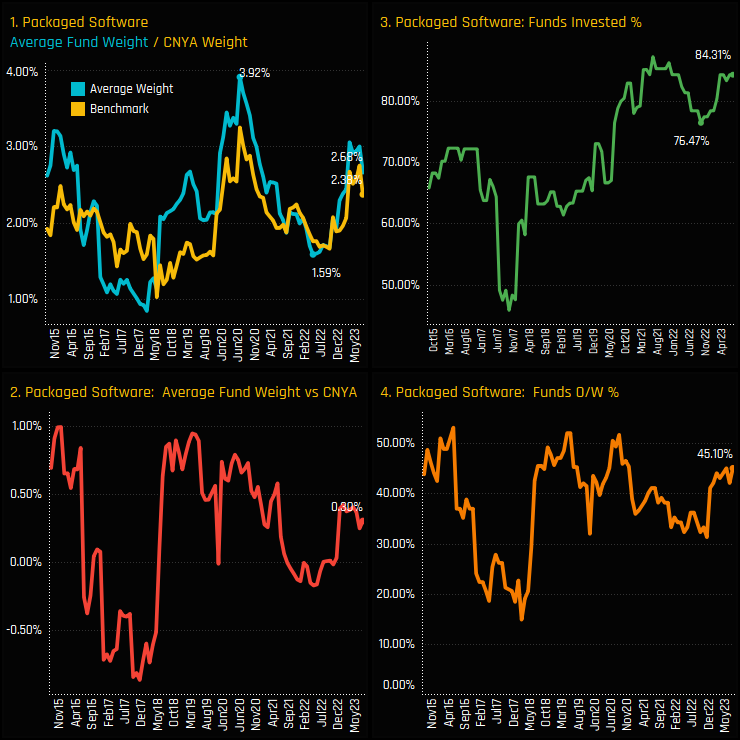

Ownership levels in the Packaged Software industry group are back on the up. Packaged Software allocations last peaked in mid 2020 with average weights of 3.92%, but slumped to just 1.59% over the next 2-years as investors reduced exposure. The recent revival has taken the percentage of funds invested from 76.5% to 84.3% and average weights back up to 2.68%. Versus the iShares CNYA ETF benchmark, 45.1% of funds are overweight the benchmark by +0.3% on average.

Since the last trough in September 2022, Packaged Software stocks have been among the key beneficiaries of manager rotation. All measures of ownership moved higher over the period, with average weight increases of 1% the most of any industry, driven by +7.8% of funds adding exposure and 12.75% moving to overweight. This was an active and deliberate rotation.

Fund Level Activity & Latest Holdings

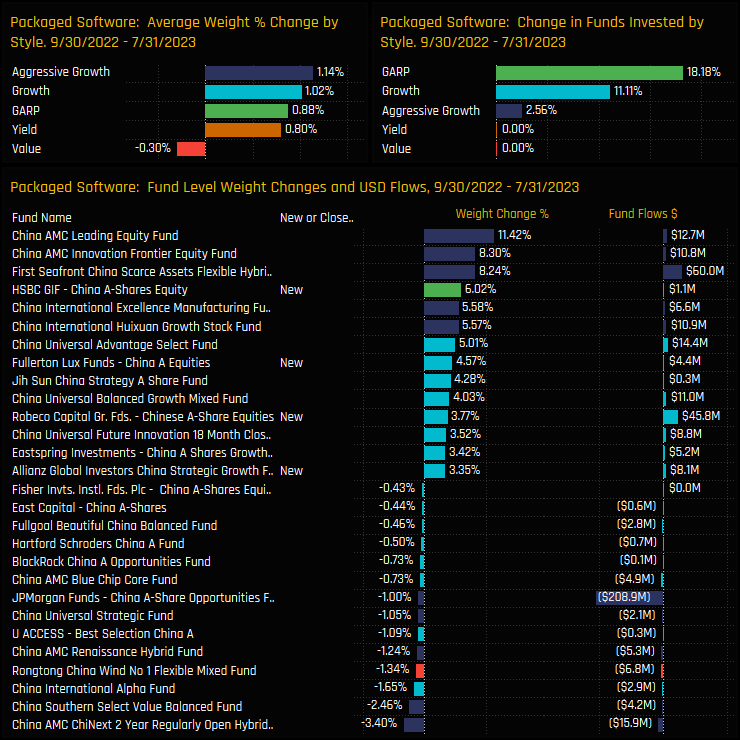

The funds driving allocations higher over this period were led by China AMC Leading Equity (+11.42%) and China AMC Innovation Frontier Equity (+8.3%), alongside new exposures from HSBC China A-Share (+6.02%) and Fullerton China A Equities (+4.57%). On a Style basis, Aggressive Growth and Growth funds saw allocations rise by 1.14% and 1.02% respectively, whilst Value funds decreased by 0.30% on average.

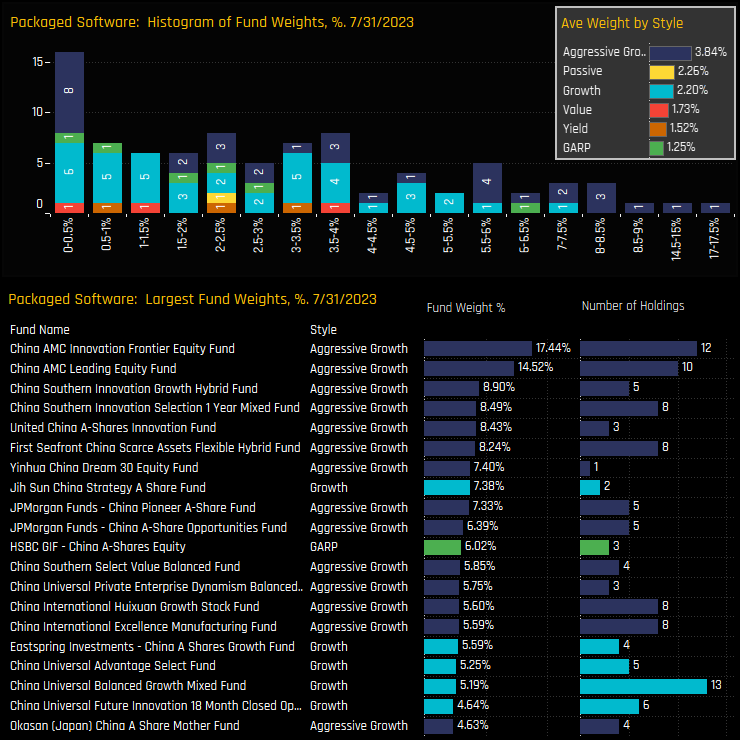

Funds that follow an Aggressive Growth strategy are the most bullish on the sector with average weights of 3.84%, making them the only Style group positioned overweight the CNYA benchmark. The histogram chart shows the bulk of allocations sitting below 4%, with the extended tail to the upside mainly occupied by high growth strategies. China AMC Innovation and Leading Equity top the list with 17.4% and 14.5% allocations respectively.

Latest Stock Holdings & Activity

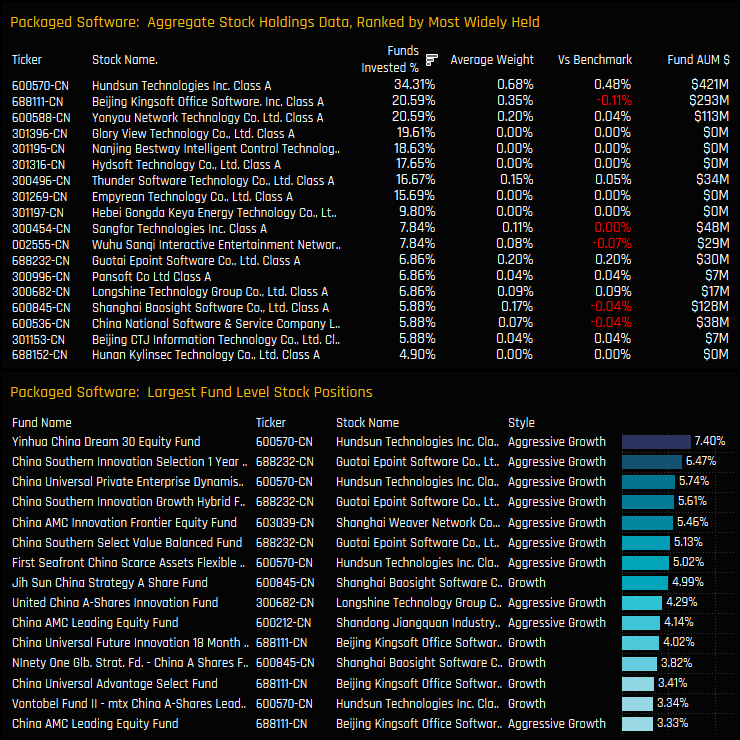

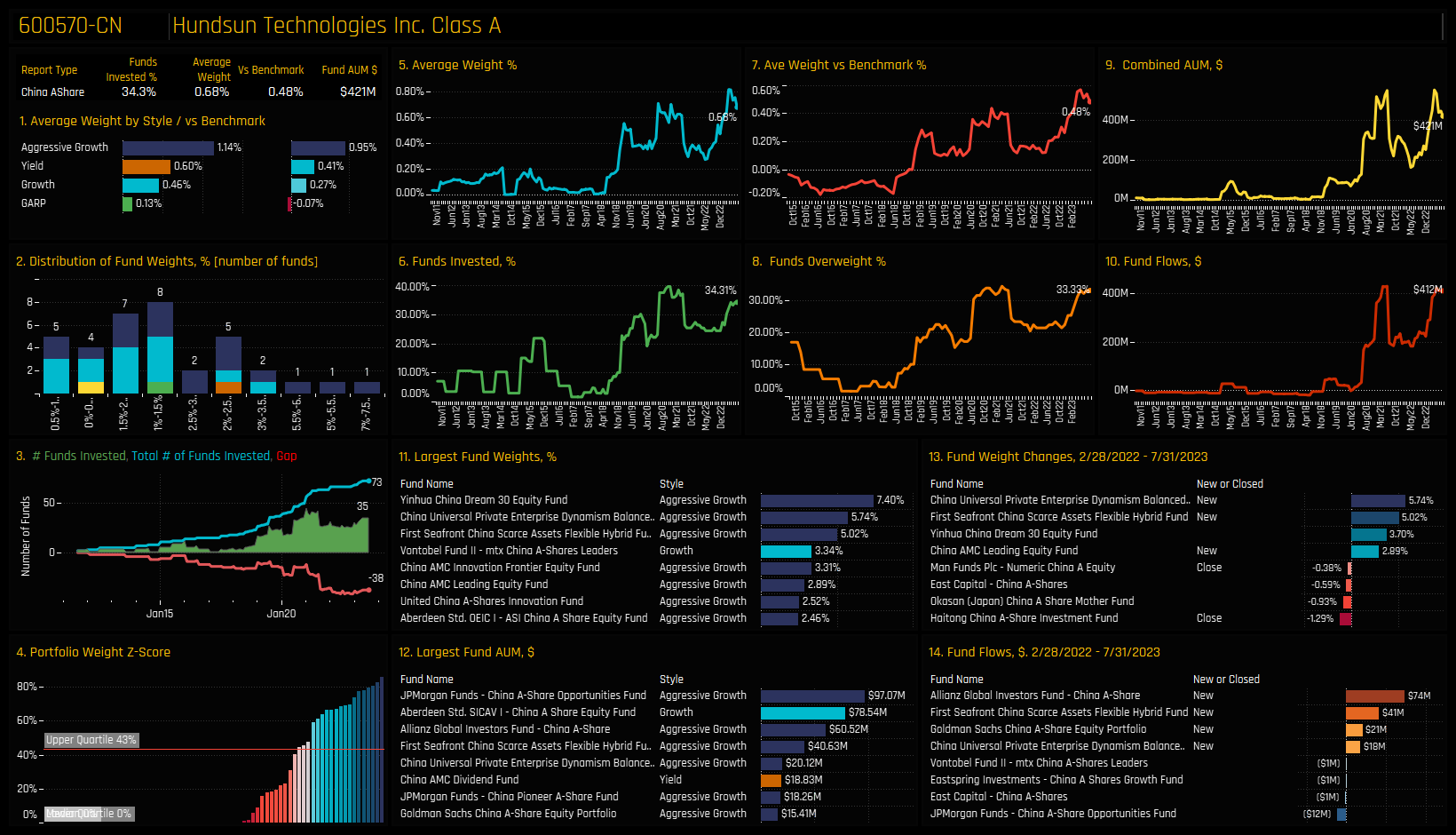

On a stock level, 3 companies dominate the holdings picture. Hundsun Technologies, Beijing Kingsoft Office Software and Yonyou Network Technology account for 46% of the total Packaged Software allocation. Hundsun is the most widely held, owned by 34.3% of funds at an average weight of 0.68% and is prevalent among the high conviction fund positions in the bottom chart.

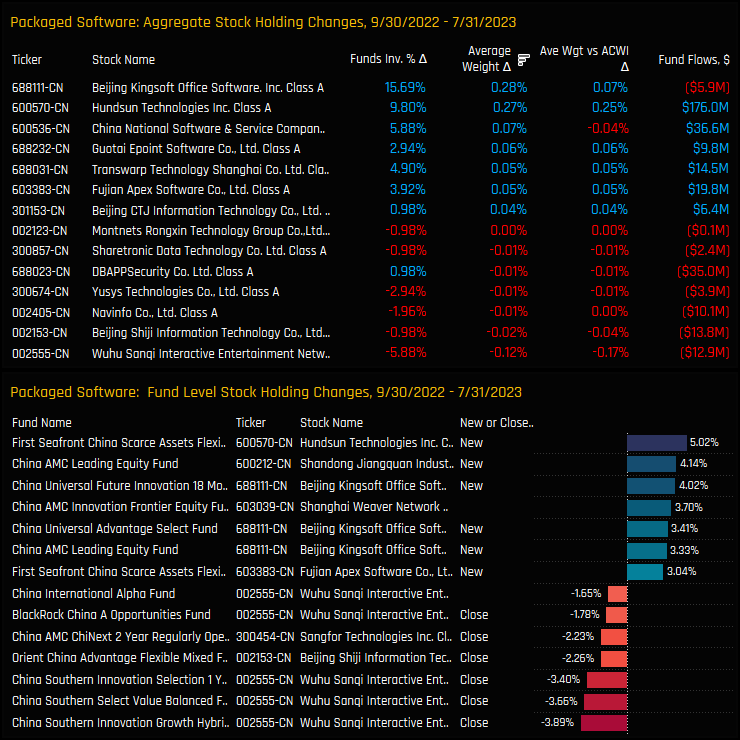

Stock level activity between 09/30/2022 and 07/31/2023 highlights Beijing Kingsoft Office Software and Hundsun Technologies as the key drivers behind the overall increase in Packaged Software allocations. The percentage of funds invested in Beijing Kingsoft increased by 15.7% and in Hundsun by 9.8%. Smaller increases were seen in China National Software, Guotai Epoint Software and Transwarp Technology, which more than offset decreases in Wuhu Sanqi Interactive Entertainment and Navinfo Co, among others.

Conclusions & Data Pack

This favorable rotation over the last 10 months has moved Packaged Software up the pecking order of Industry allocations among active China A-Share managers. It is now the 9th most widely held Industry group, sharing similar ownership characteristics to Major Pharma, Electronic Components and Specialty Chemicals (see data pack below).

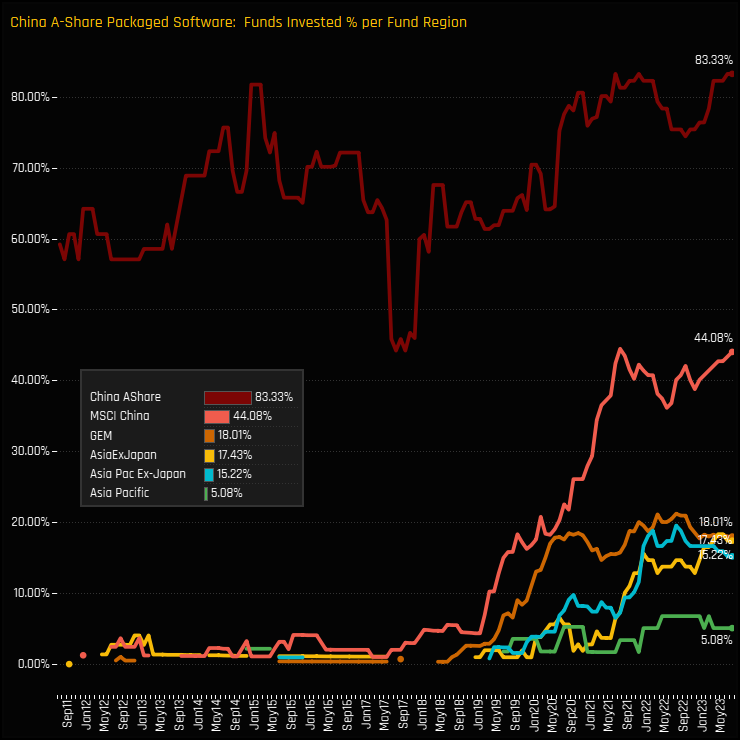

If we extend our analysis to the other fund groups with China exposure, China A-Share Packaged Software positioning has seen a similar rise in recent years, but hasn’t penetrated to the same degree as in dedicated China A-Share funds. For example, whereas over 80% of China A-Share managers have exposure, just 44.1% of MSCI China active funds and 18% of active Global Emerging Market Funds have an A-Share Package Software allocation.

Whilst this is understandable given the wealth of alternatives that these broader mandates allow, it still hints at the potential for further investment growth. Watch this space.

Click on the link below for an extended data pack on Packaged Software positioning among active China A-Share funds. Scroll down for stock profiles on Hundsun Technologies, Beijing Kingsoft Office Software and Yonyou Network Technology, together with links to the latest China positioning PDF reports.

Stock Profile: Hundsun Technologies Class A

Stock Profile: Beijing New Building Materials Class A

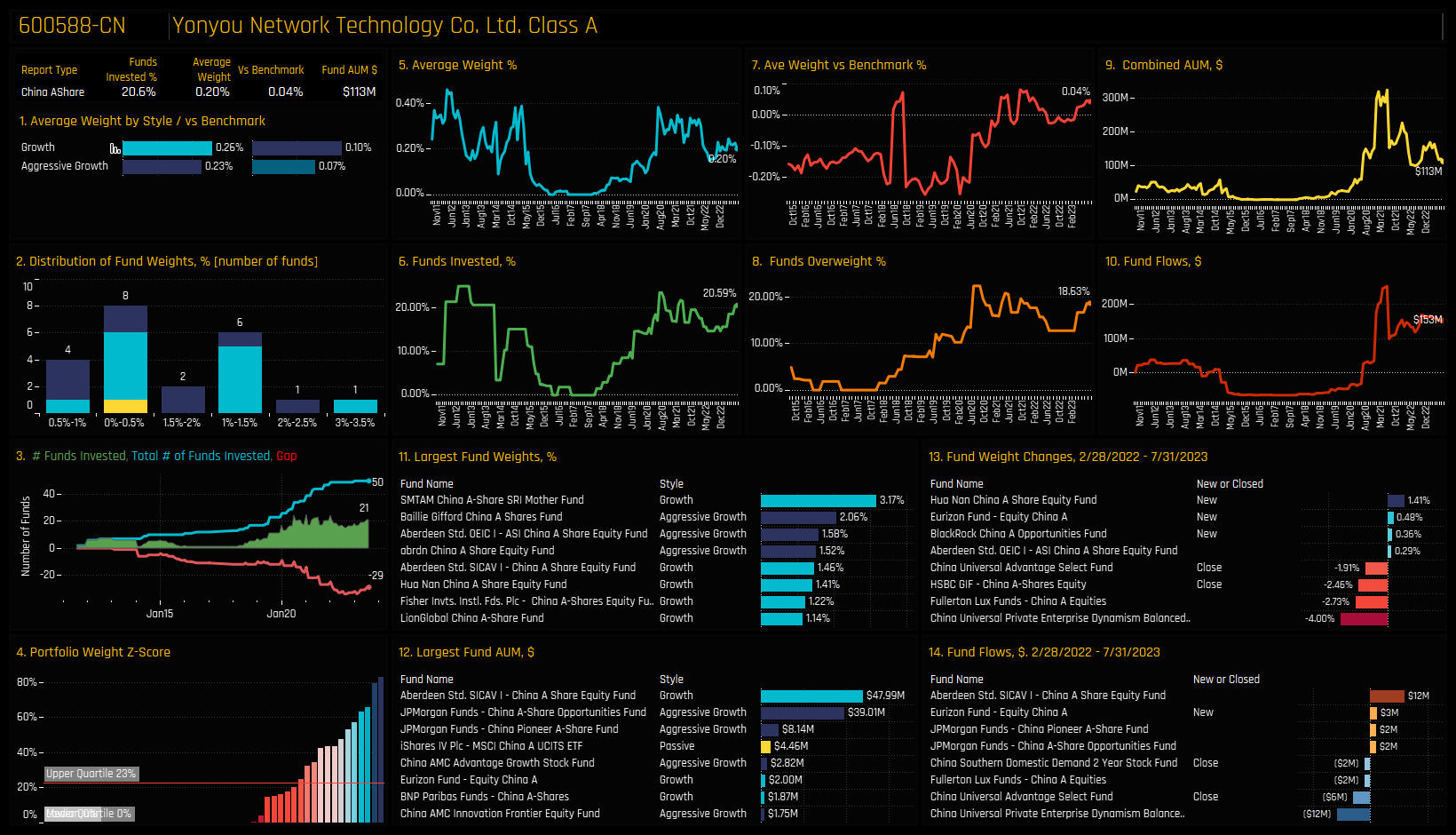

Stock Profile: Yonyou Network Technology Class A

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- January 17, 2025

China Funds: Performance & Attribution, 2024

138 active China equity funds, AUM $38bn China Funds: Performance & Attribution, 2024 Summ ..

- Steve Holden

- March 28, 2024

MSCI China Funds: Stock Radar

125 MSCI China active equity funds, AUM $38bn MSCI China Funds: Stock Radar Summary In this rep ..

- Steve Holden

- May 28, 2024

China Real Estate: Continued Fund Rotation Drives New Lows

144 active MSCI China equity funds, AUM $40bn China Real Estate: Continued Fund Rotation Drives ..