119 Active China Funds, AUM $48bn.

2022 Performance & Attribution Report

In this report, we provide an overview of 2022 performance among the China active funds in our analysis. We look at annual performance broken down by Style and Market Cap focus, together with longer-term analysis of active versus passive. We then identify the drivers behind 2022 performance based on the average active China fund stock portfolio versus the iShares MSCI China ETF (MCHI).

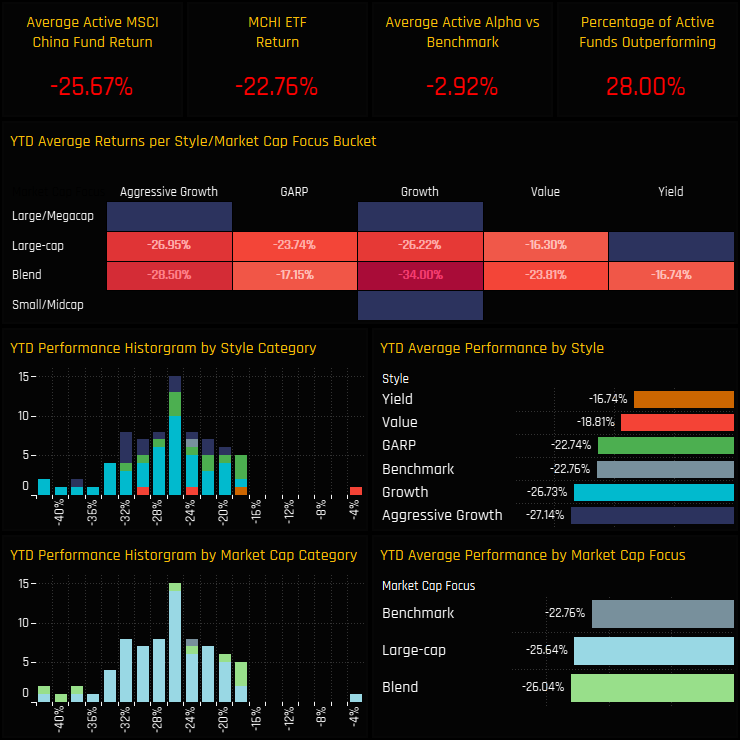

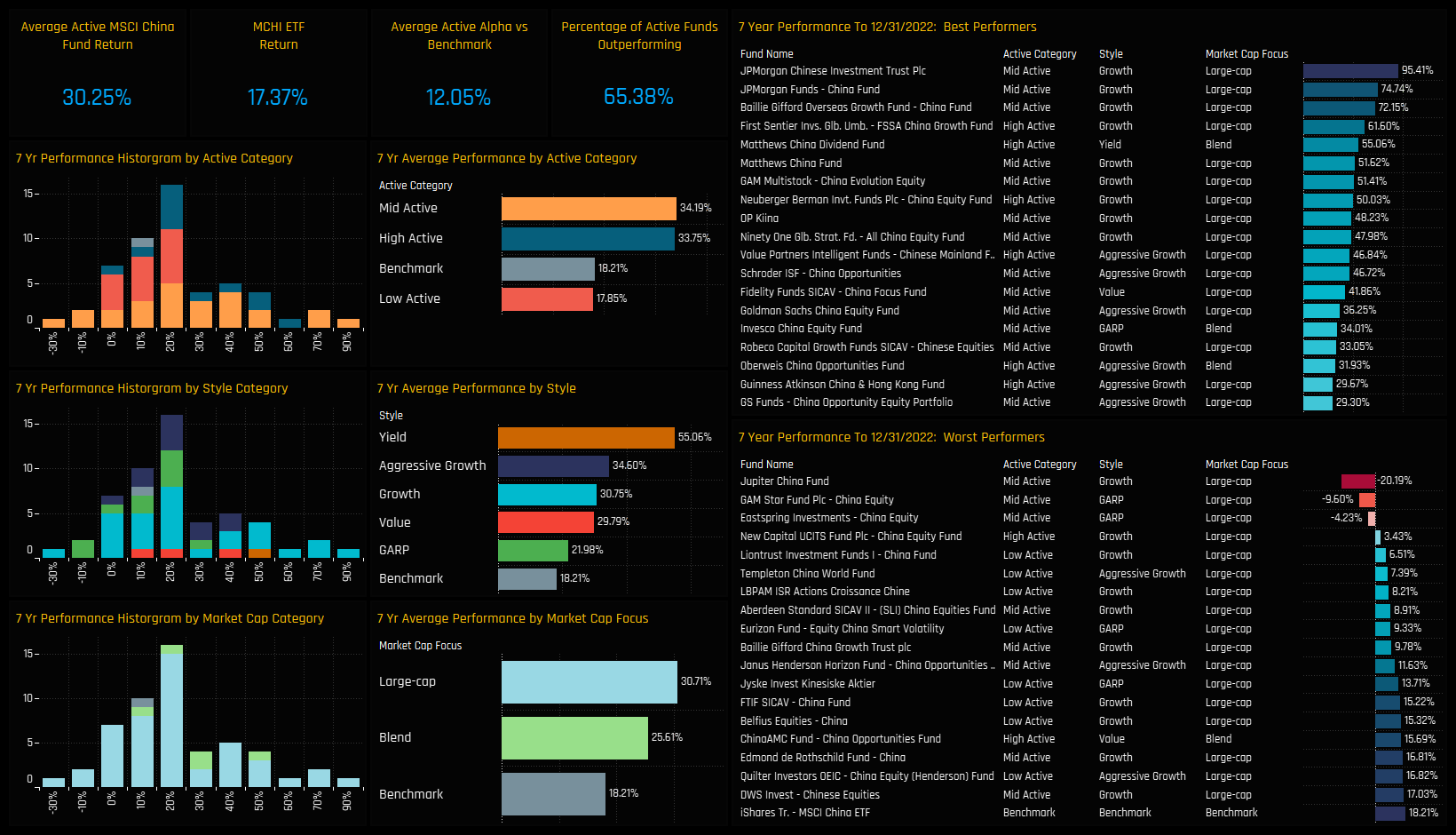

2022 was a rough year for active China managers on all fronts. In absolute terms, average returns came in at -25.67%. Versus the iShares MCHI ETF, this equates to a 2022 underperformance of -2.92%, with just 28% of strategies outperforming. There is a Style correlation to returns, with Yield and Value outperforming Growth/Aggressive Growth, though the small number of funds in the former categories needs to be taken in to account.

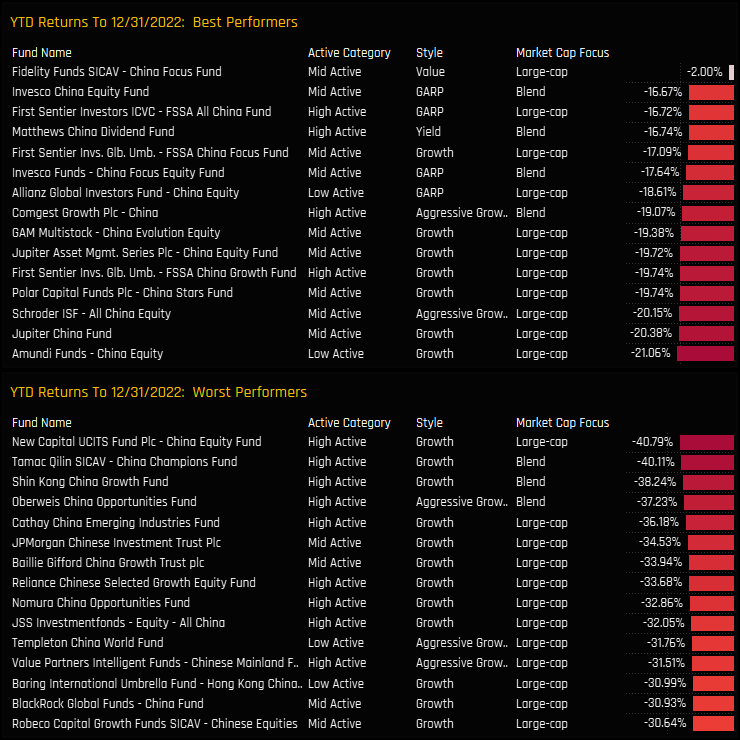

The top and bottom performers on the year are listed below. The Value outperformance is skewed heavily by the remarkable performance of the Fidelity China Focus Fund, which registered returns of -2% on the year, +14% ahead of the next best funds of Invesco’s China Equity and First Sentier All China Fund.

Time-Series Active v Passive

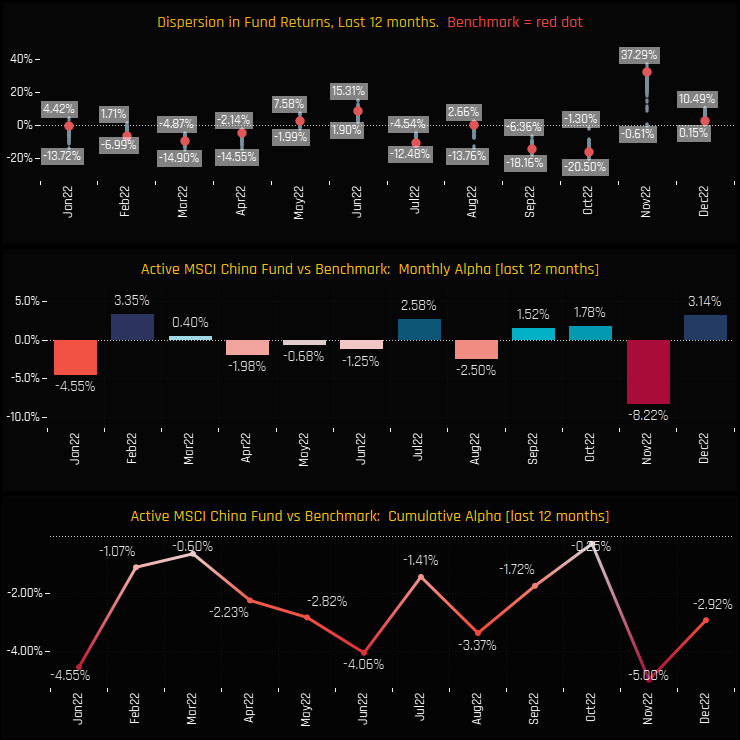

Versus the benchmark over the last 12 months it was a volatile picture. Though there were an equal number of outperforming months to underperforming, the big loss in November of -8.22% was enough to bring active China managers in the red for the year.

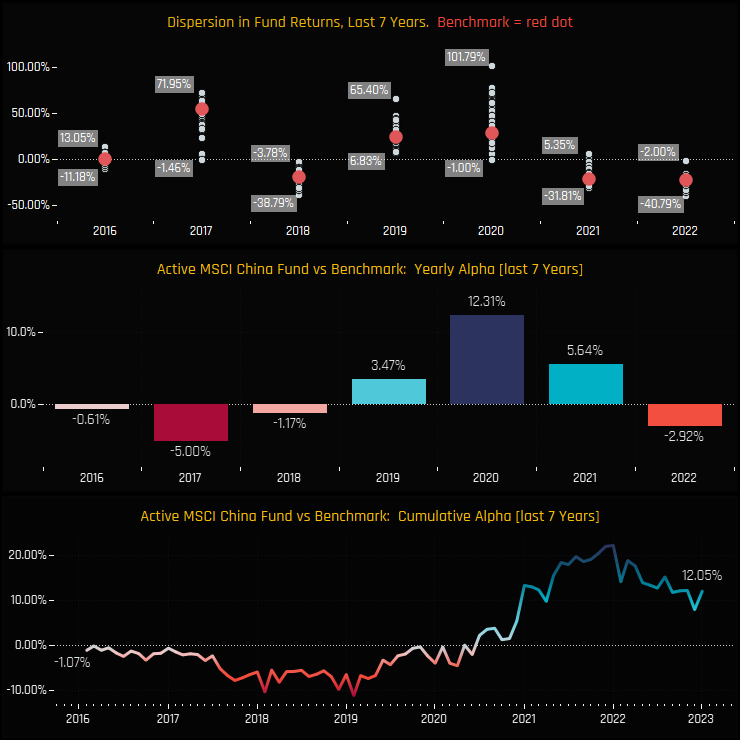

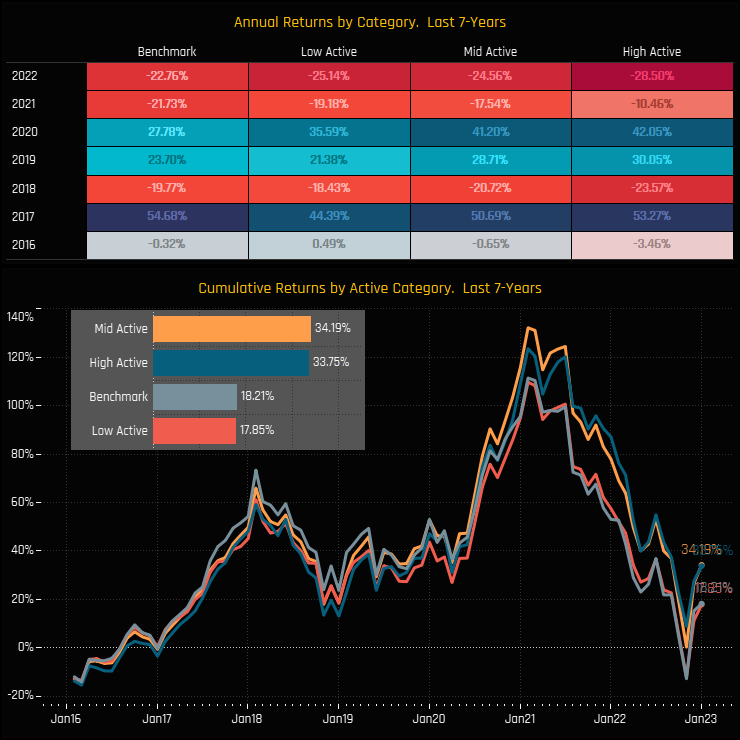

The underperformance in 2022 comes in contrast to the huge outperformance in 2019, 2020 and 2021. Over the last 7-years, active China managers are still ahead of the iShares MSCI China ETF by a significant 12.05%, on average.

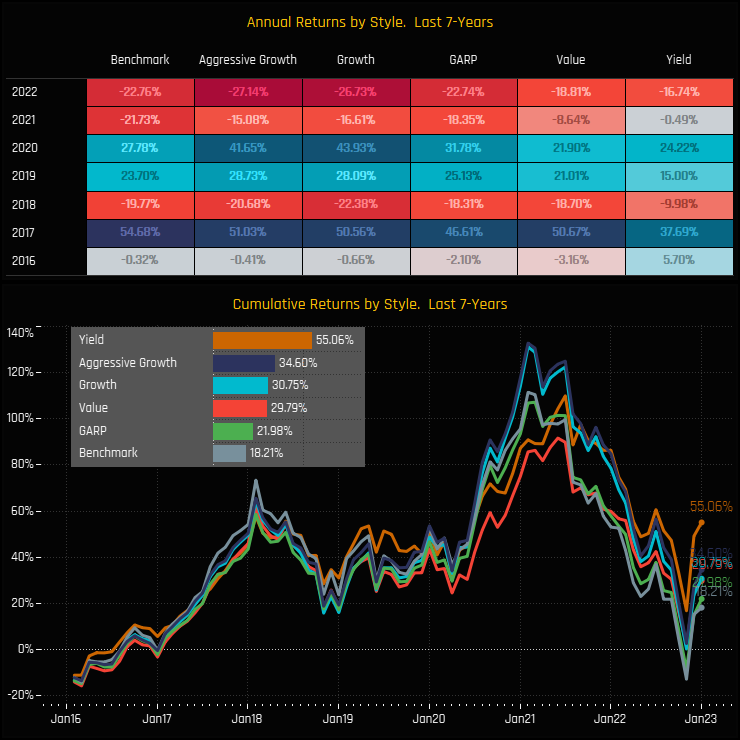

Performance by Style and Active Category

The charts below show the average annual performance (top) and cumulative performance (bottom) split by fund Style over the last 7-years. All Style groups are ahead of the index, though Aggressive Growth and Growth are the standouts. The average Yield return of 55.06% is driven by just 1 fund, so not a good representation of the Style.

Fund performance split by active category provides evidence that an active approach provides the best returns in China. High Active funds (active share >75%) and Mid-Active funds (60%< active share <75%) have generated double the returns of both the benchmark and Low Active funds (active share <60%) over a 7-year period.

7-Year Performance Summary

Contribution & Attribution Analysis

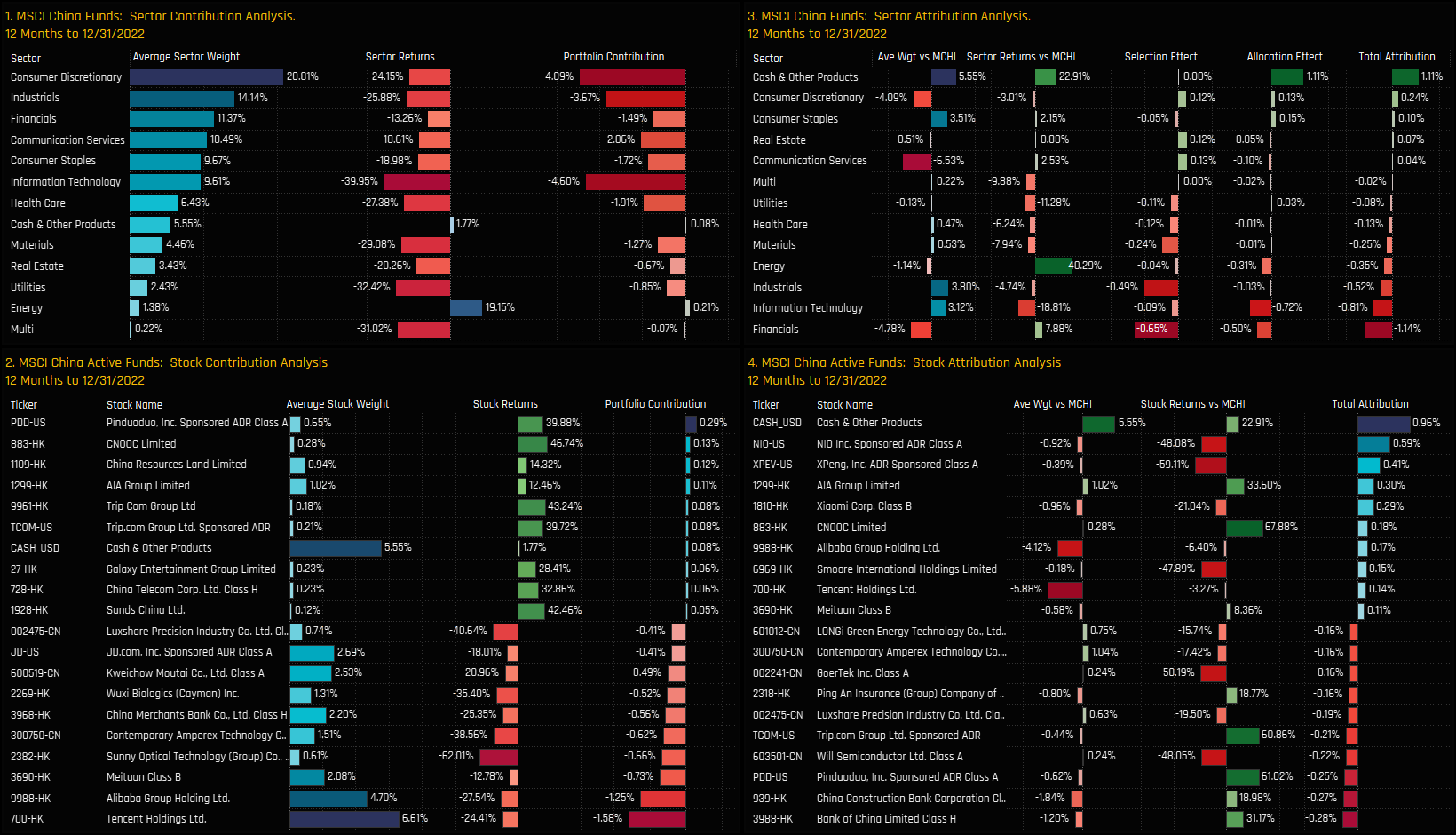

We now look at the drivers behind last year’s absolute and relative performance. We do this by creating a portfolio based on the average allocations of the 119 active strategies in our analysis. This theoretical portfolio, with no fees and based on monthly holding observations returned -22.9% on the year. On a sector level, -4.89% of this was driven by Consumer Discretionary holdings (ch1), -4.60% by Information Technology and -3.67% by Industrials. Energy, the star performer in 2022 but a tiny allocation, generated a paltry +0.21% towards portfolio returns in 2022. On a stock level, Pinduoduo, CNOOC and China Resources Land were the key drivers of positive returns, though these were outgunned by big losses from Tencent, Alibaba and Meituan, among others (ch2).

To understand where last year’s underperformance came from, we measure the attributes of this portfolio versus a representation of the benchmark based on the iShares MSCI China ETF (MCHI). The active portfolio underperformed by -1.76% in 2022, driven by underweights in Financials, overweights in Tech, together with poor stock selection in Industrials and Financials (ch3). On a stock level, underweights in China banks, Pinduoduo and Trip.com Group, together with overweights in Will Semiconductor and Luxshare Precision were the key drivers of underperformance (ch4). Of the few positives, cash holdings and good stock selection in Real Estate and Comm’ Services, together with underweights in NIO Inc and XPeng generated some outperformance. On the whole though, very little worked for active China managers in 2022. Roll on 2023!

For more analysis, data or information on active investor positioning, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- October 25, 2023

China Fund Positioning Analysis, October 2023

150 Active MSCI China Funds, AUM $47bn China Fund Positioning Analysis, October 2023 In this is ..

- Steve Holden

- August 10, 2022

China Communication Services: Lowest Exposure on Record

119 Active MSCI China Funds, AUM $60bn. China Communication Services Portfolio weights in the C ..

- Steve Holden

- August 18, 2022

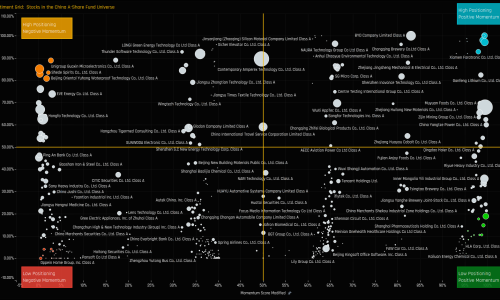

China A-Share Funds: Stock Sentiment Analysis

115 Active China A-Share Funds, AUM $63bn. China A-Share Stock Sentiment Investment levels amon ..