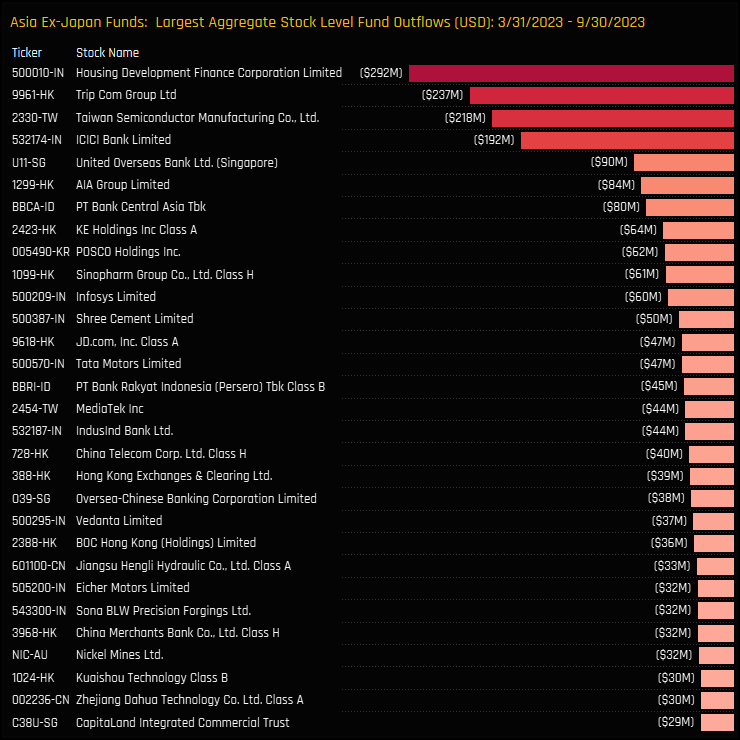

100 Active Asia Ex-Japan Funds, AUM $54bn

Betting on Recovery: Asia Ex-Japan Funds Return to Casino Stocks

• Ownership levels in Casino stocks bounce back after prolonged period of decline

• BlackRock, JP Morgan and Barings among Asia Ex-Japan funds to buy back in.

• Ownership levels remain low but sentiment has clearly switched, with Galaxy Entertainment and Sands China at the heart of the moves.

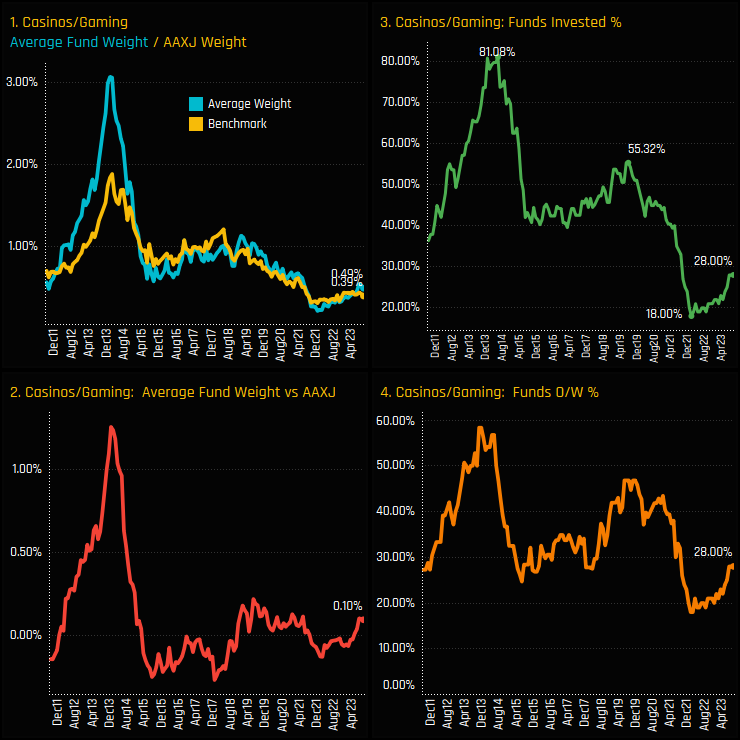

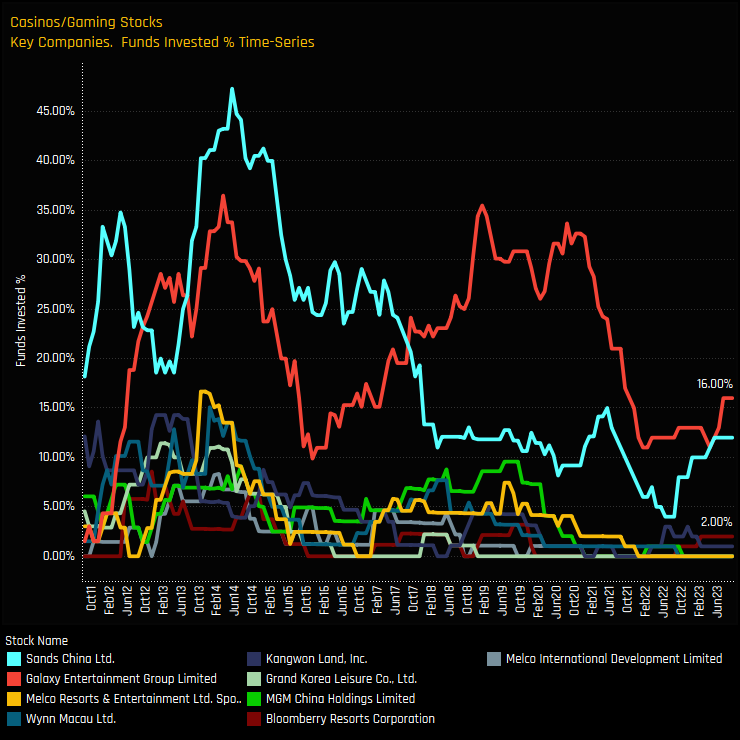

Time Series & Industry Activity

Ownership levels in the Casino/Gaming industry group are back on the up. An industry group once owned by over 80% of funds back in 2012 fell to a low of just 18% of funds towards the end of 2021 (ch3). Since then, a growing number of funds are buying back in, pushing average weights higher (ch1) and moving Casinos/Gaming to a net overweight among active Asia Ex-Japan managers (ch2). As it stands, all funds who hold Casino/Gaming exposure do so at higher levels than the benchmark iShares MSCI Asia Ex-Japan ETF (ch4).

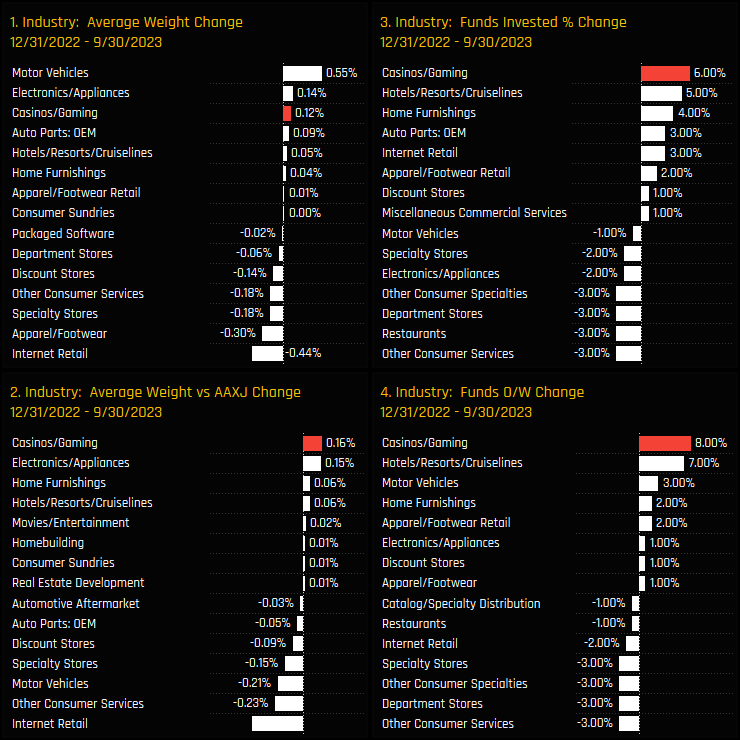

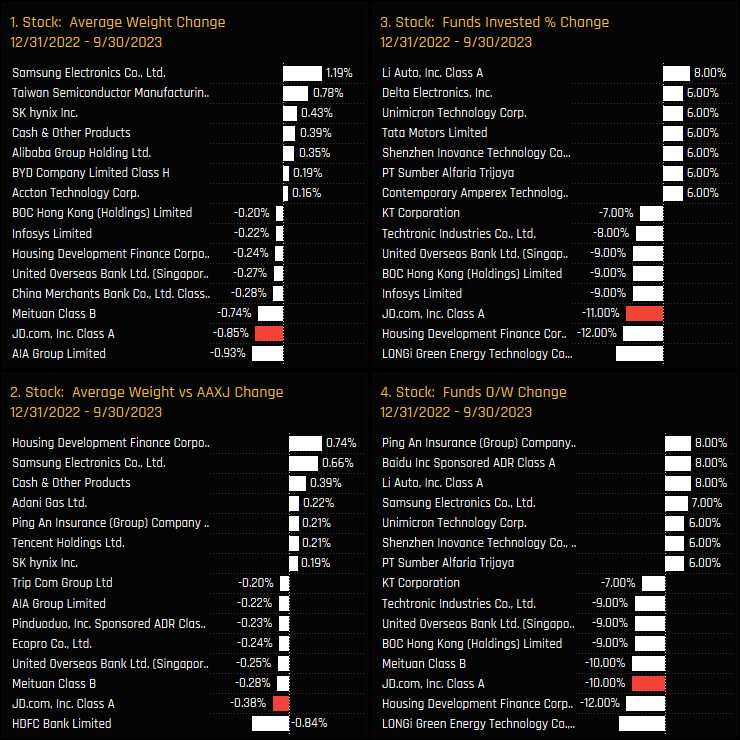

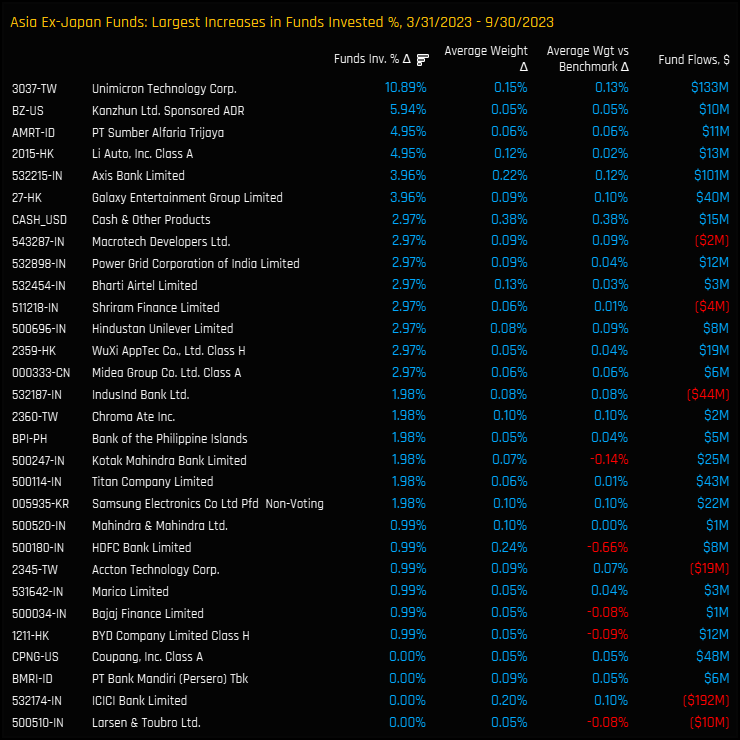

Through the course of 2023 Asia Ex-Japan funds have maintained this momentum. The charts below show the change in our fund ownership metrics between 12/31/2022 and 09/30/2023 for all Industry groups in the Consumer Discretionary sector. They highlight Casinos/Gaming as one of the key beneficiaries of manager rotation over the period, with the percentage of funds invested rising by +6% and funds overweight by +8%, the most of any other industry peer.

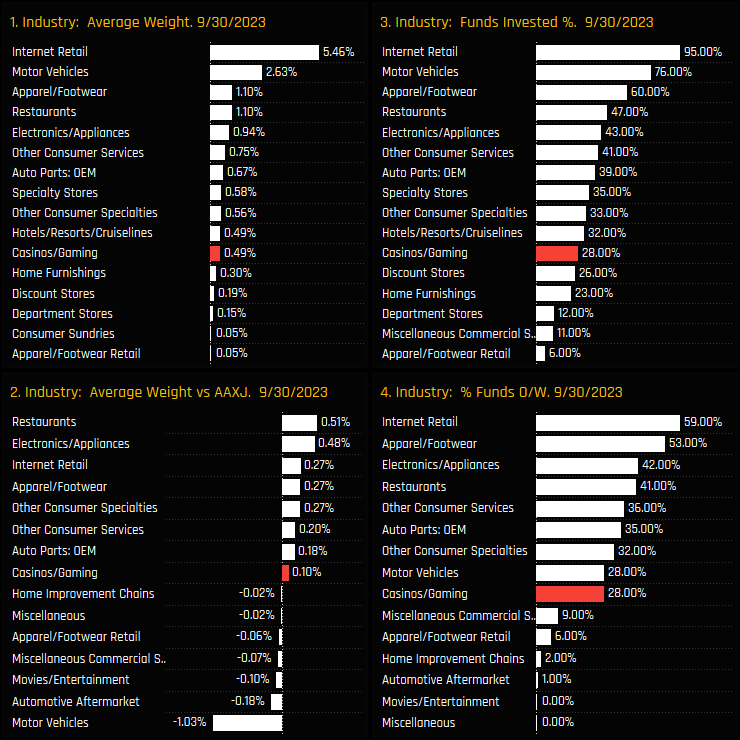

Industry Positioning & Sentiment

But despite this active rotation, Casinos & Gaming stocks are still a minor holding for the majority of managers in our analysis. They stand as the 11th largest average weight and the 11th most widely held Industry within the Consumer Discretionary sector, as charts 1 and 3 show below. Versus the benchmark, Casinos/Gaming are a very moderate overweight within the sector, with managers more bullishly positioned in Restaurants, Apparel/Footwear, Internet Retail and Electronics/Appliances.

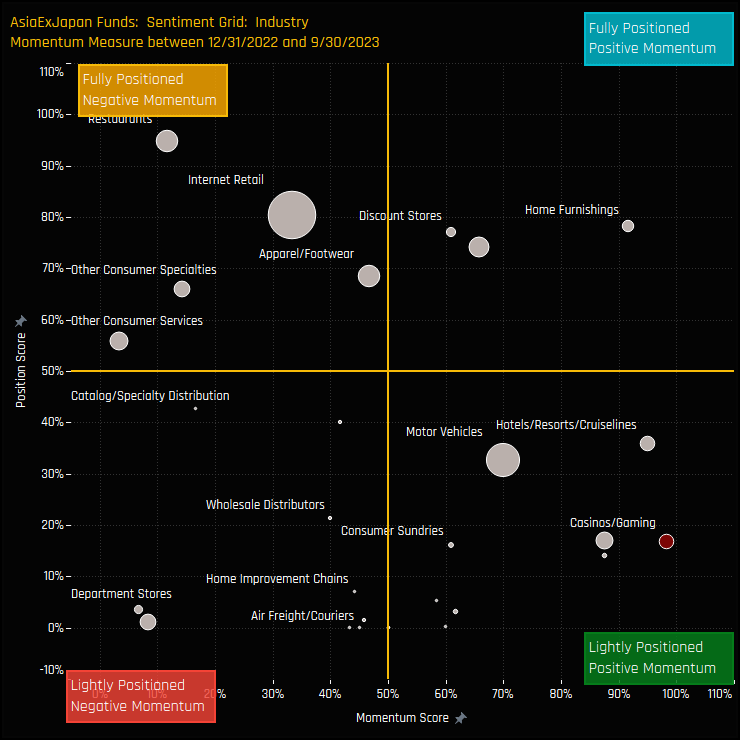

The Sentiment Grid below brings long-term positioning and short term manager activity together in a single chart. The Y-axis shows the ‘Position Score’, a measure of current positioning in each Industry compared to its own history going back to 2011 on a scale of 0-100%. The X-Axis shows the ‘Momentum Score’, a measure of fund manager activity for each Industry between 12/31/2022 and 09/30/2023 on a scale of 0% (maximum negative activity) to 100% (maximum positive activity). It highlights the Casino/Gaming Industry group as poorly positioned compared to its own history, but with the momentum measure the most positive among Consumer Discretionary peers.

Fund Holdings & Activity

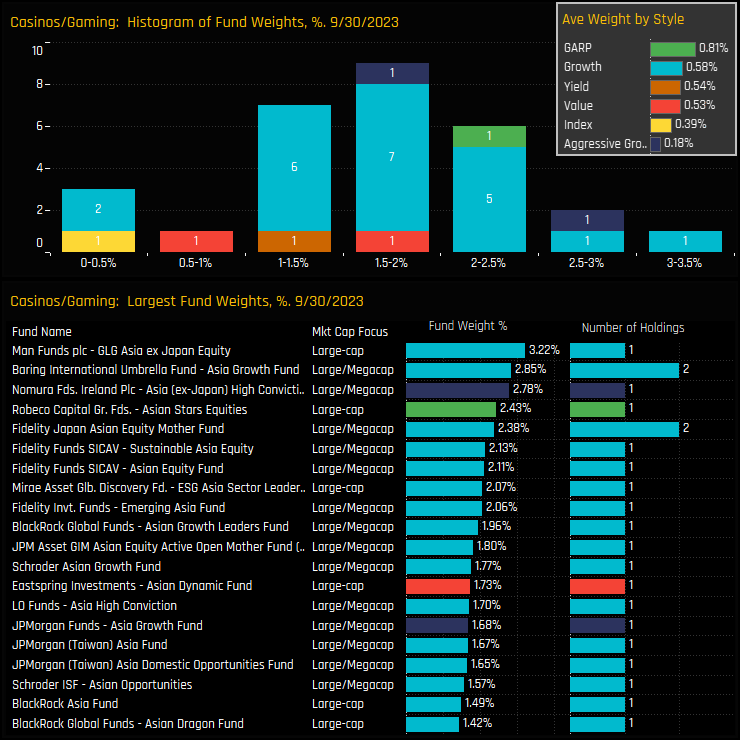

The top chart below shows the histogram of fund holdings in the Casino/Gaming industry group and the inset chart the average weight by fund Style. Allocations are concentrated in a fairly tight range, with the majority holding between 1% and 2.5% and the top holders only extending up to 3.2%. Fund allocations top out at 3.22% for Man GLG Asia Ex-Japan, with the majority of funds holding a single stock to express their view.

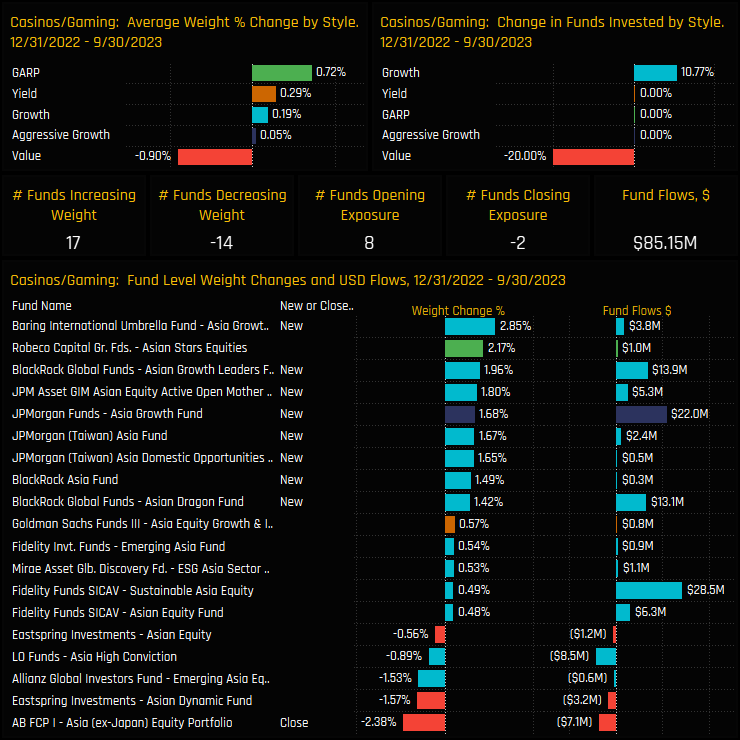

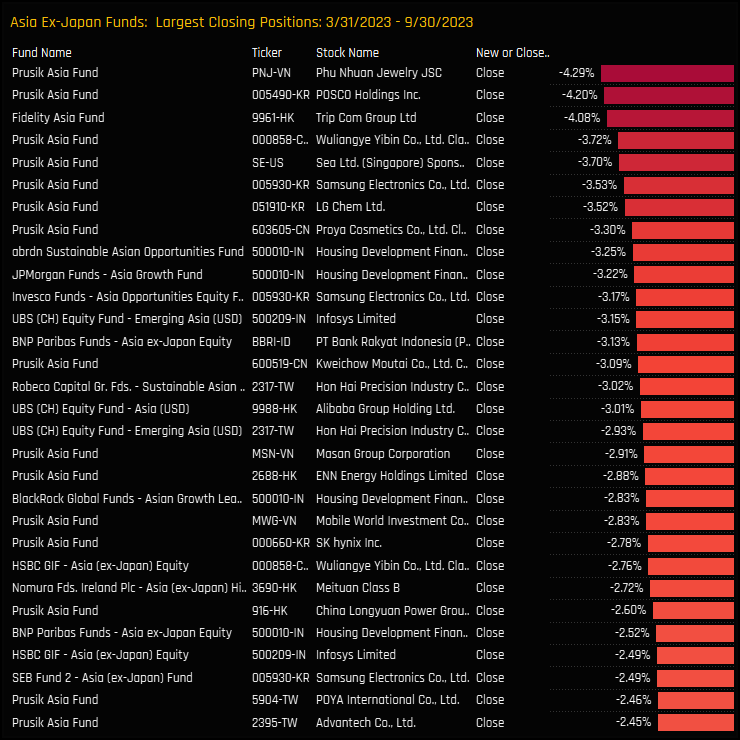

The charts below highlight the funds that are underpinning the recent allocation shift this year. Barings, BlackRock and JP Morgan make up the 8 funds that added new exposure over the period, with just 2 closing out. On a Style basis, a small number of Asia Ex-Japan Value strategies in our analysis took the opposite view, with AB Asia Ex-Japan closing out and Eastspring Asia Dynamic scaling back allocations.

Stock Holdings & Activity

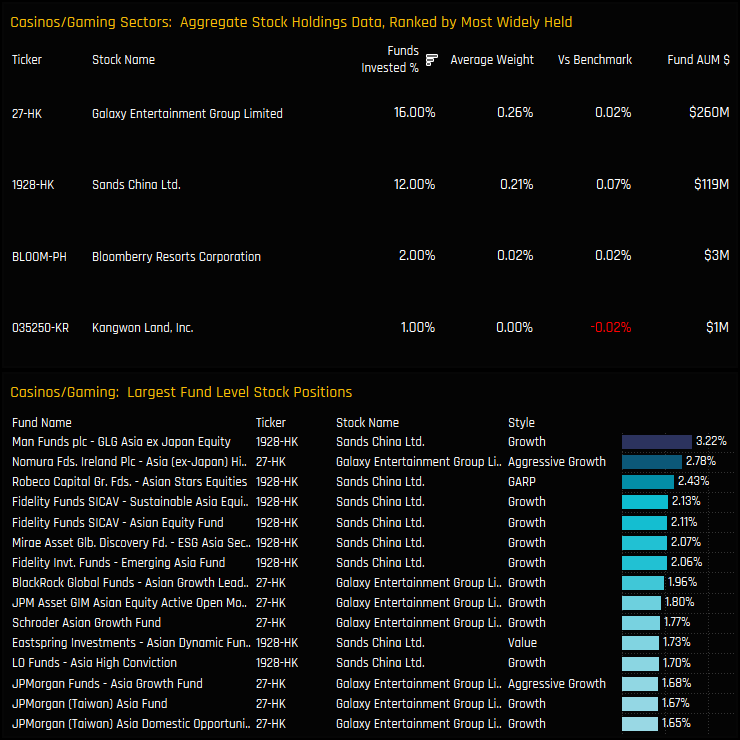

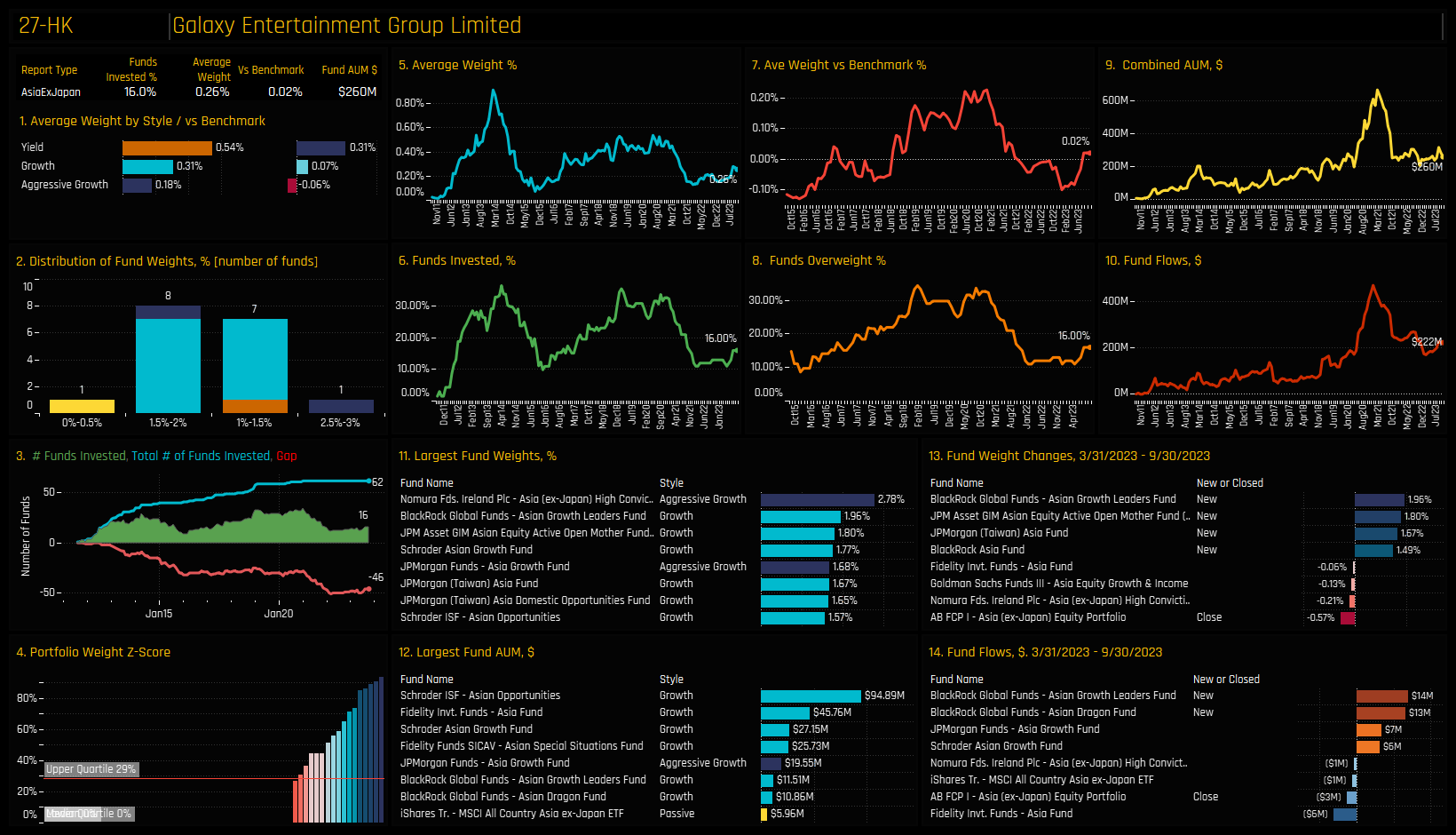

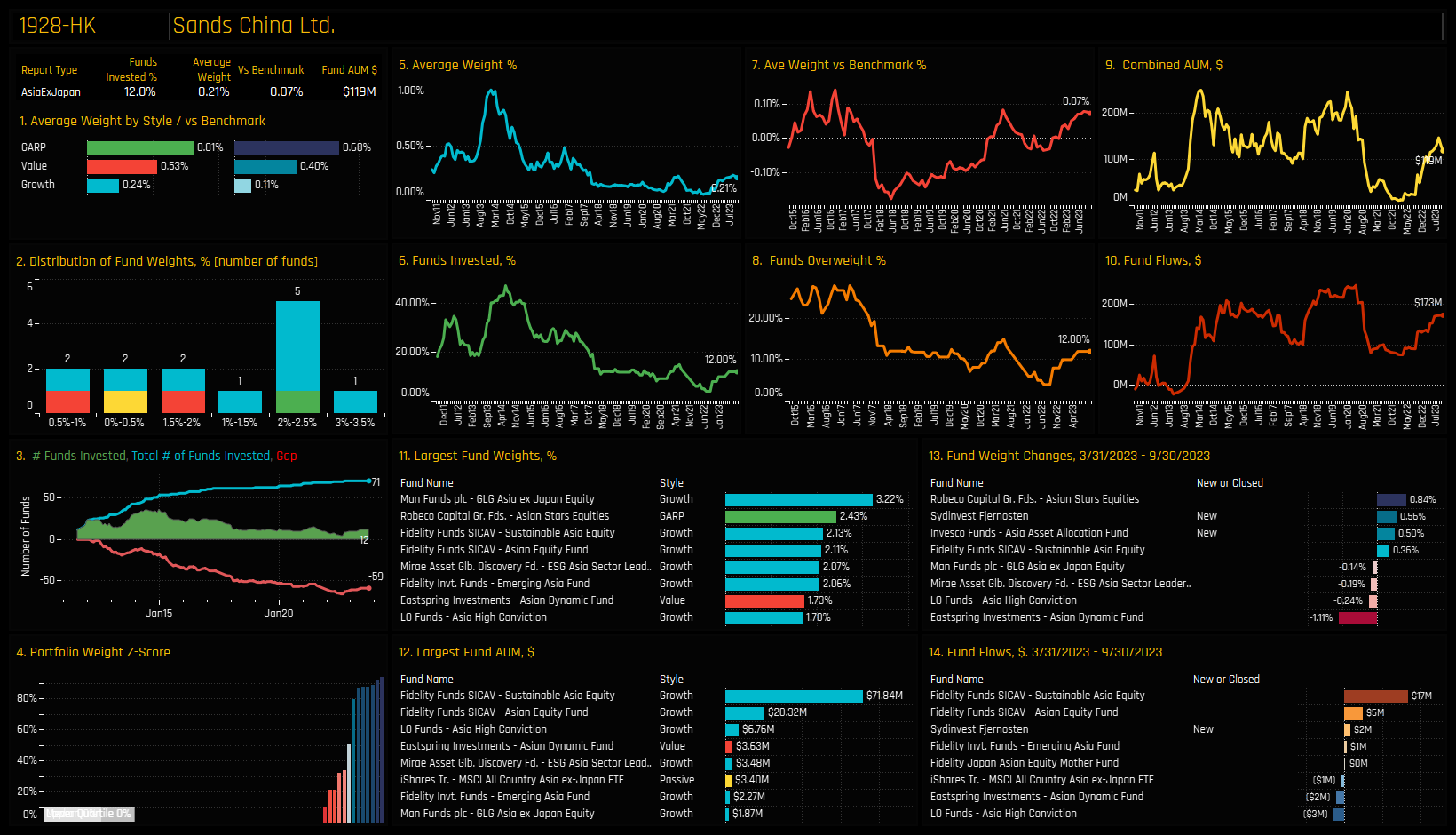

Just 4 companies comprise the entire Casinos/Gaming allocation, with Galaxy Entertainment the most widely held company with 16% of funds invested at an average weight of 0.26%. Sands China is slightly behind but well ahead of fringe holdings in Bloomberry Resorts Corp and Kangwon Land. Despite Galaxy’s more widespread ownership profile, Sands China dominates the larger fund levels positions, as shown in the bottom chart.

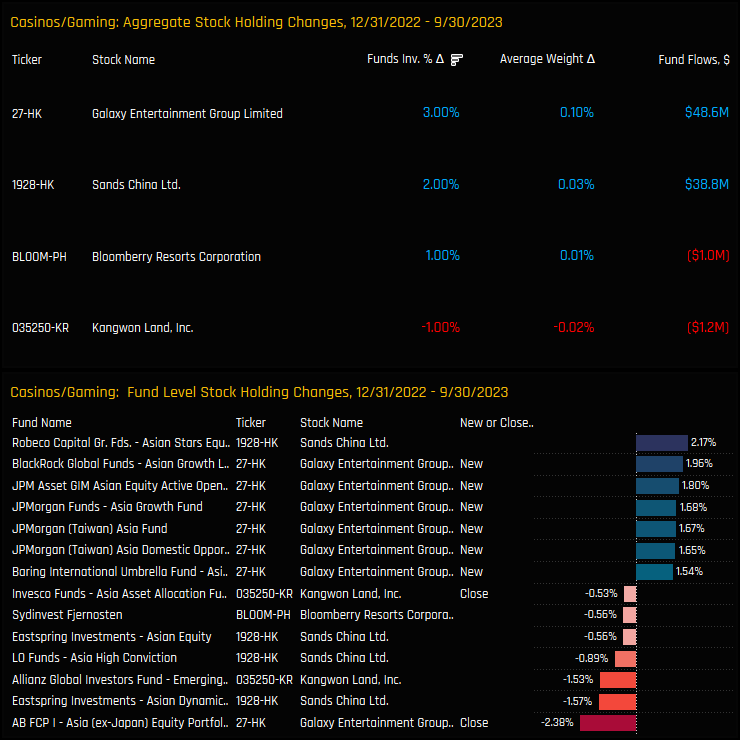

Stock level activity over the course of 2023 shows increases in investment levels for both Galaxy Entertainment and Sands China, but Galaxy certainly edges it in terms of the size and scale of new positions. Whilst Robeco Asian Stars increased their Sands China weight by +2.17%, BlackRock, JP Morgan and Barings all opened new exposure in Galaxy Entertainment in sizes ranging from 1.5% to 2%. It has formed the backbone of the recent rotation.

Conclusions & Links

The chart to the right shows the percentage of funds invested in each of the individual Casino/Gaming companies since 2011. It confirms that both Sands China and Galaxy Entertainment have been the mainstays of investment within the sector over the last decade. Both now sit towards the bottom of their historical ownership ranges but both have seen investment levels move from the lows.

So we find ourselves in the initial phases of a rebound, with a noticeable shift in sentiment as significant investment funds are re-entering the sector. Given that most previous investors are still observing from the sidelines, the path of least resistance may lean to the upside.

Click below for the extended data report on Casino/Gaming Asia Ex-Japan investor positioning. Scroll down for stock profiles on Galaxy Entertainment and Sands China

Stock Profile: Galaxy Entertainment Group Limited

Stock Profile: Sands China Ltd

100 Active Asia Ex-Japan Funds, AUM $54bn

JD.Com. Losing its Appeal?

• After a spike higher in fund ownership in 2021, active Asia Ex-Japan funds are beginning to close out positions.

• Funds including T.Rowe Price, LO Funds and Nikko AM have closed out exposure this year.

• JD.com remains a very well owned stock among institutional investors, at a time when performance is anything but stellar so far this year.

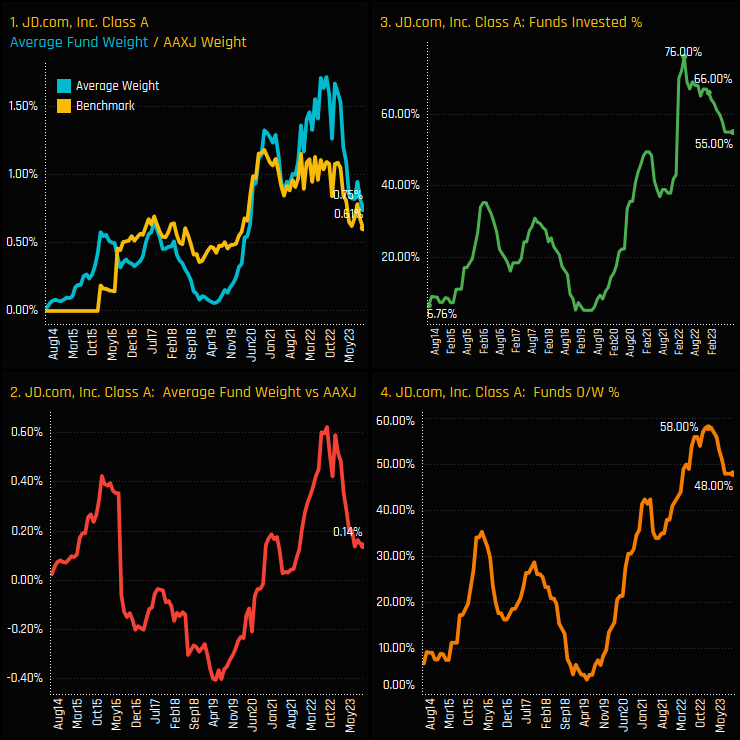

Time-Series & Stock Level Activity

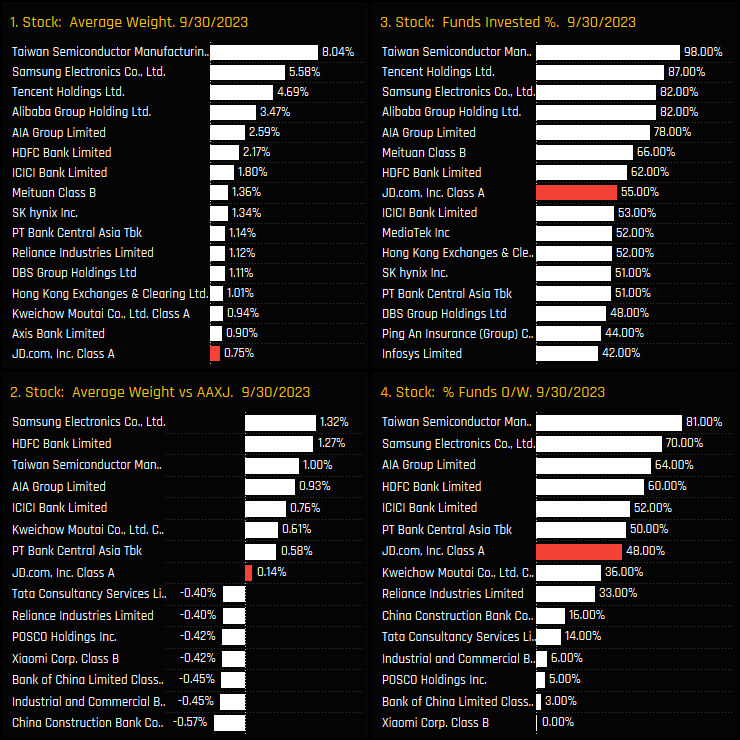

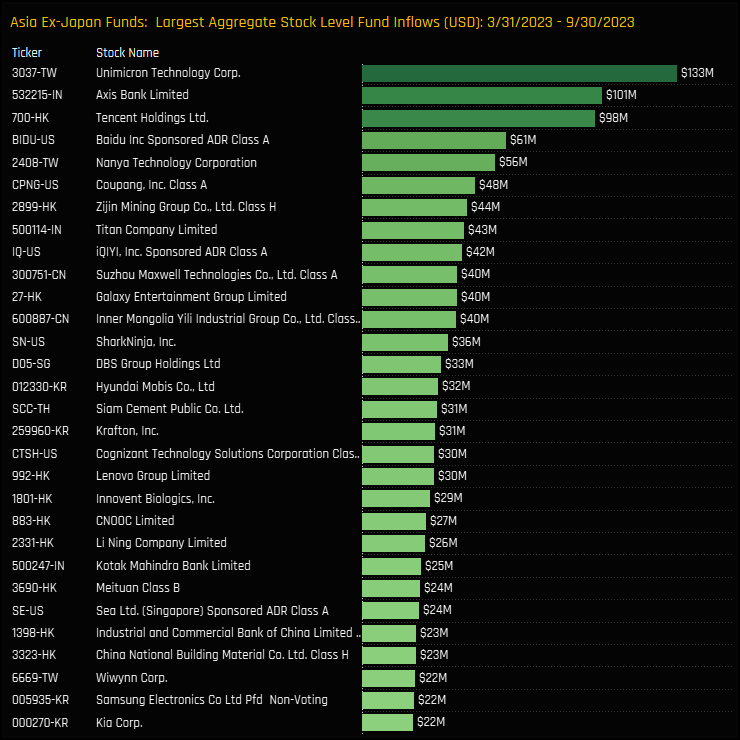

The percentage of Asia Ex-Japan funds invested in JD.com is falling. From a peak of 76% of funds in March 2022 an increasing number of funds are closing out positions, leaving 55% invested at the end of last month (ch2). In conjunction, average holding weights have fallen from 1.7% to 0.75% over a similar period (ch1) and benchmark overweights have moved closer to neutral (ch2). Despite these falls, JD.Com remains a well positioned stock, with 48% of the Asia Ex-Japan funds in our analysis positioned overweight.

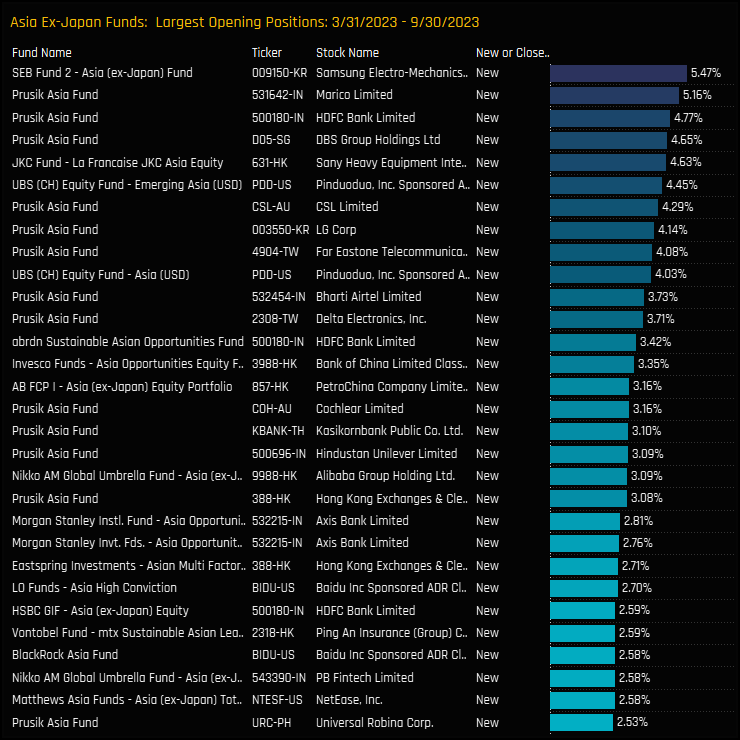

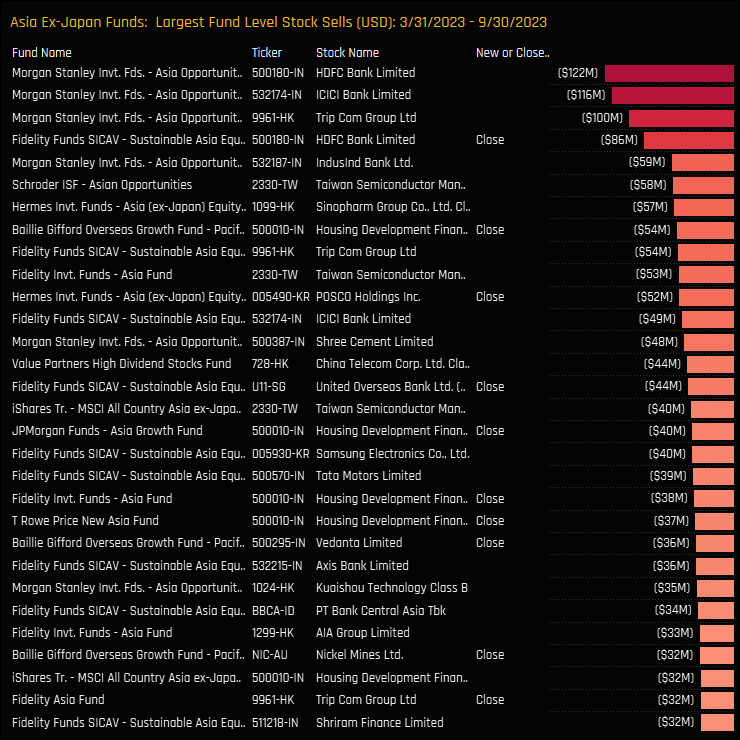

Fund activity for JD.Com in 2023 has been among the most negative of any stock. A total of 11% of funds closed out entirely (ch3), average weights fell by -0.85% (ch1) and overweights collapsed by -0.38% (ch2). Instead, Asia Ex-Japan funds opened up positions in Li Auto, Delta Electronics and Unimicron Technology Corp, among others. Sentiment towards JD.Com has clearly taken a turn for the worse.

Fund Activity & Positioning

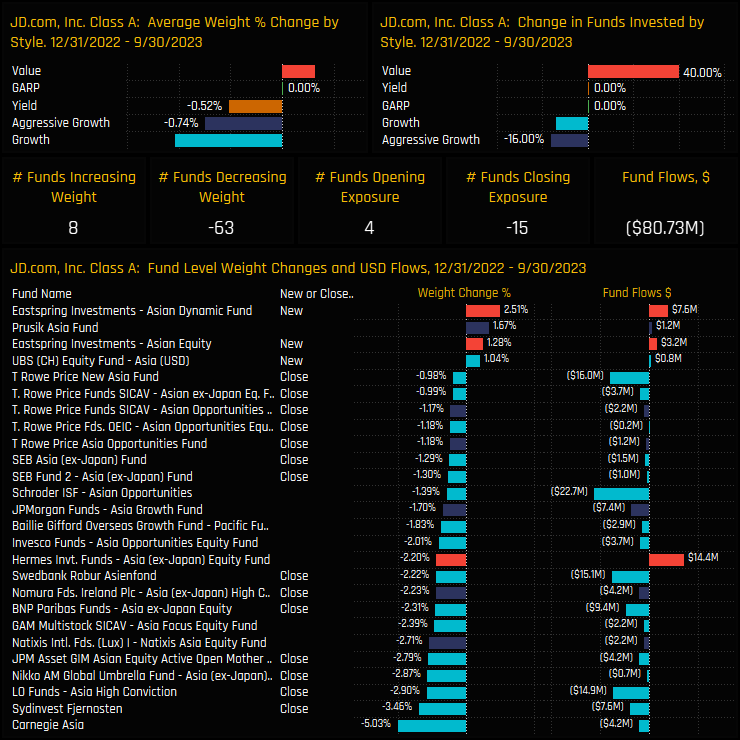

The fund activity underpinning this ownership decline can be seen in the charts below. Over the period 12/30/2022 to 09/30/2023, 63 funds saw weights decline versus 8 increase, whilst 15 funds closed positions versus 4 opening. Leading the exit were a number of Growth focused funds including Carnegie, Sydinvest and LO Funds, among others. Bucking the trend were opening positions from the Value funds of Eastspring (Asia Dynamic and Asian Equity).

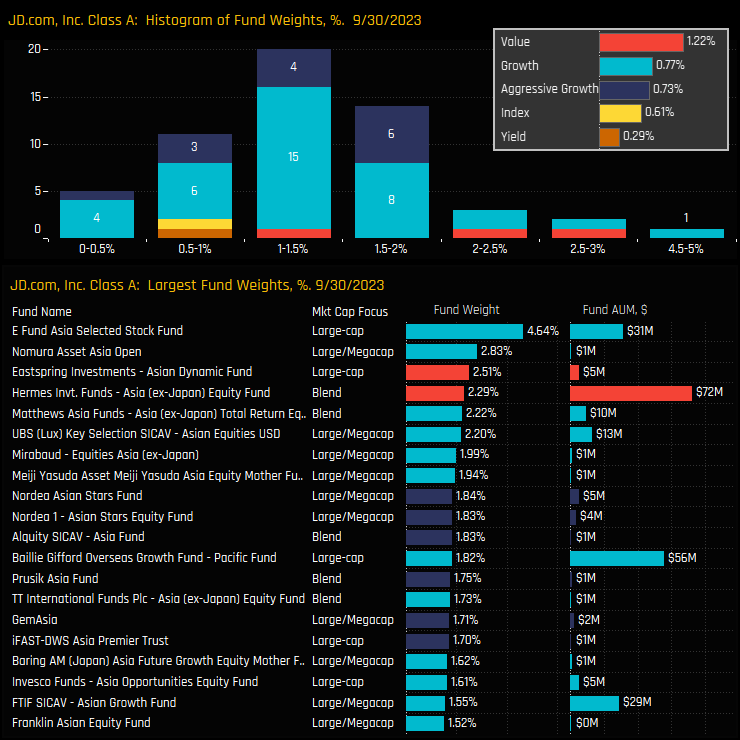

The top chart below shows the histogram of fund weights in JD.com, with the core of the distribution centered at between 0.5% – 2%. The small number of Value funds in our analysis are well invested, but the Growth strategies of E Fund Asia Selected Stock (4.64%) and Nomura Asset Asia Open (2.83%) are the top allocators.

Conclusions & Data Report

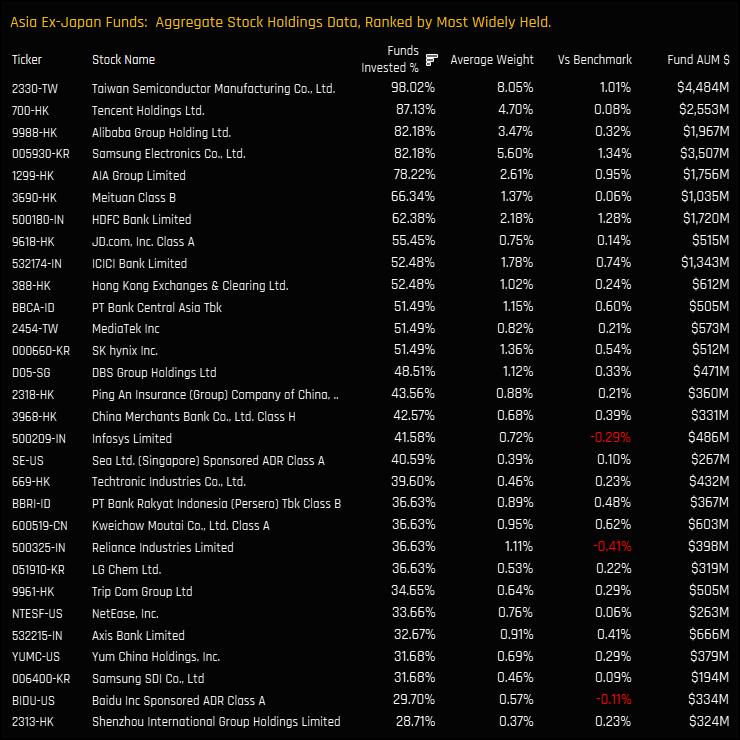

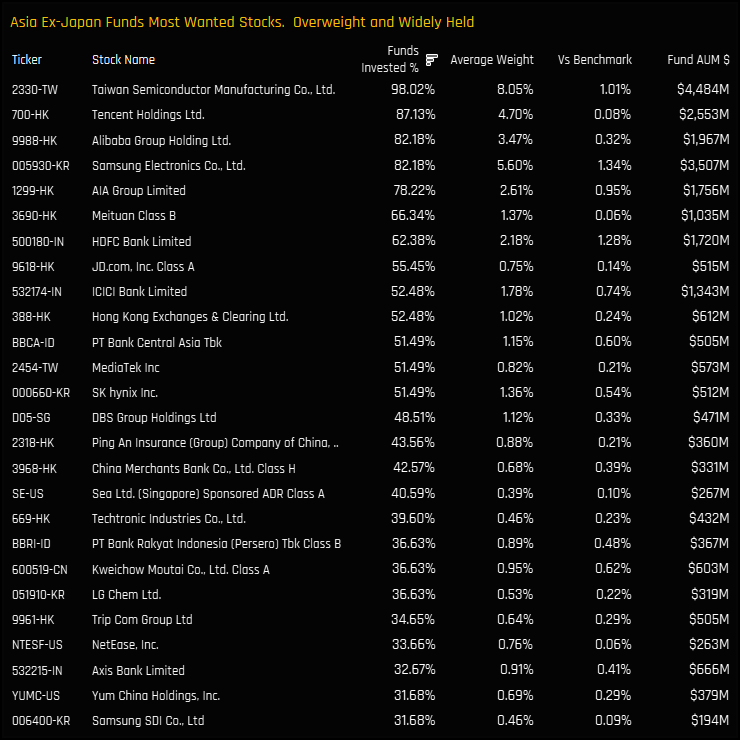

The charts to the right show the latest ownership statistics across the entire Asia Ex-Japan region. JD.com is still the 8th most widely held name, though average holding weights have fallen much further down the list.

It’s worth remembering that positioning took a huge spike higher over a short period between late 2021 and early 2022 (see first chart above), so the recent declines have merely brought ownership levels back towards the top of the longer-term range. In short, JD.com remains a very well owned stock among institutional investors, at a time when performance is anything but stellar so far this year.

Click on the link below for an extended report on positioning in JD.Com among the active Asia Ex-Japan funds in our analysis.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 28, 2024

Positioning Insights, August 2024

98 Active Asia Ex-Japan funds, AUM $189bn Active Asia Ex-Japan Funds: Positioning Insights, Aug ..

- Steve Holden

- March 17, 2025

Asia Ex-Japan: Positioning Chart Pack, March 2025

Asia Ex-Japan: 94 Funds, AUM $94bn Asia Ex-Japan: Positioning Chart Pack, March 2025 Inside Thi ..

- Steve Holden

- March 13, 2025

Xi’s Champions: A Closer Look at Fund Positioning

Global, GEM, Asia Ex-Japan, China Active Equity Xi’s Champions: A Closer Look at Fund Pos ..