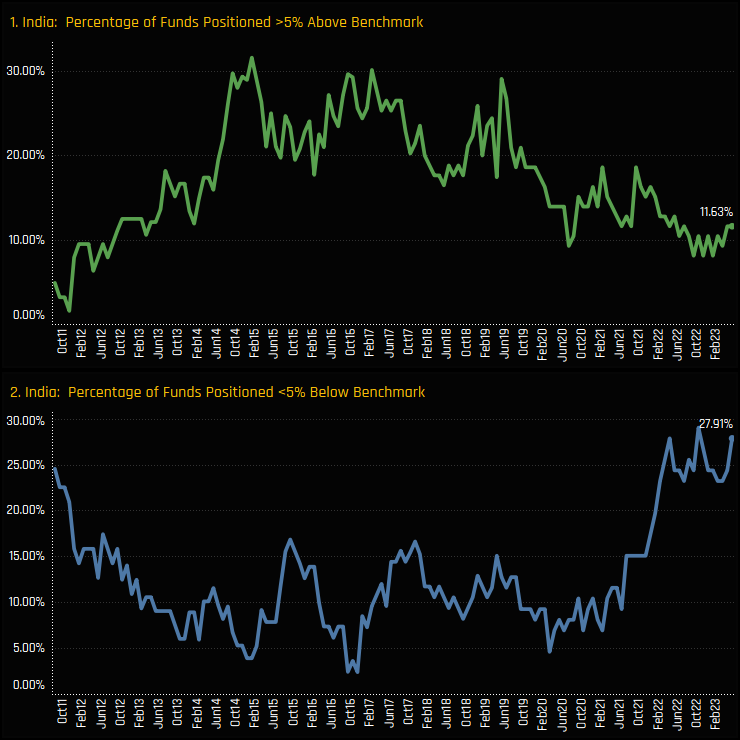

Time-Series & Country Rotation

Sector Activity & Long-Term Positioning

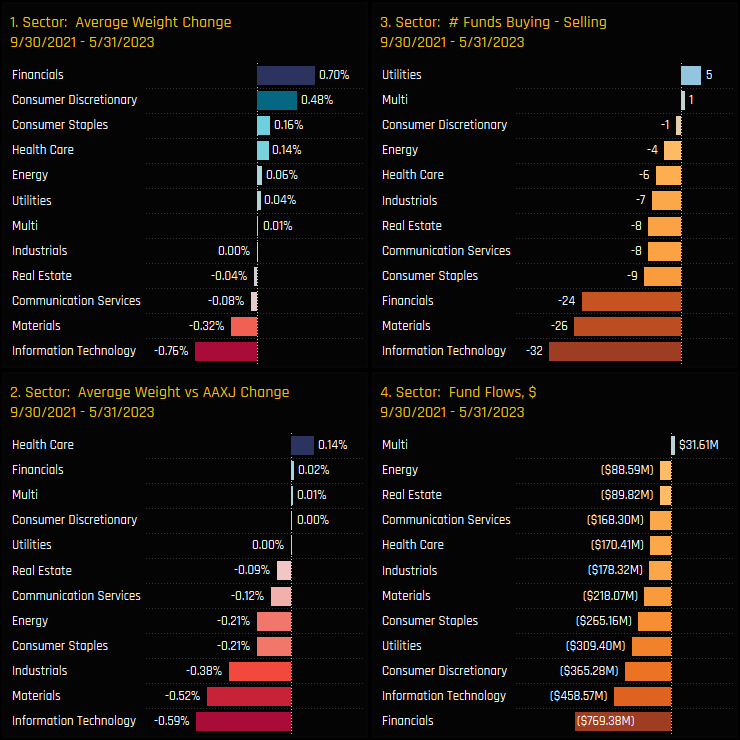

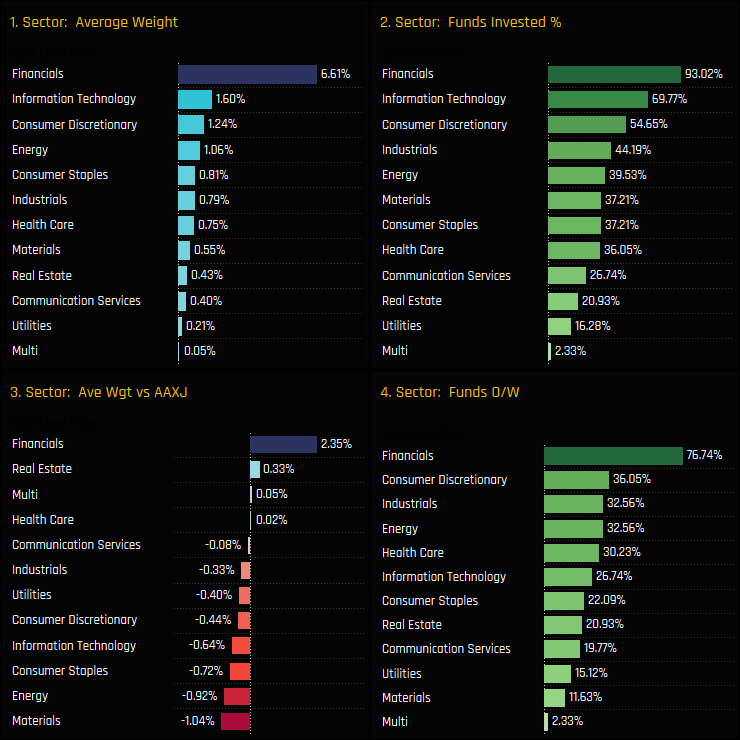

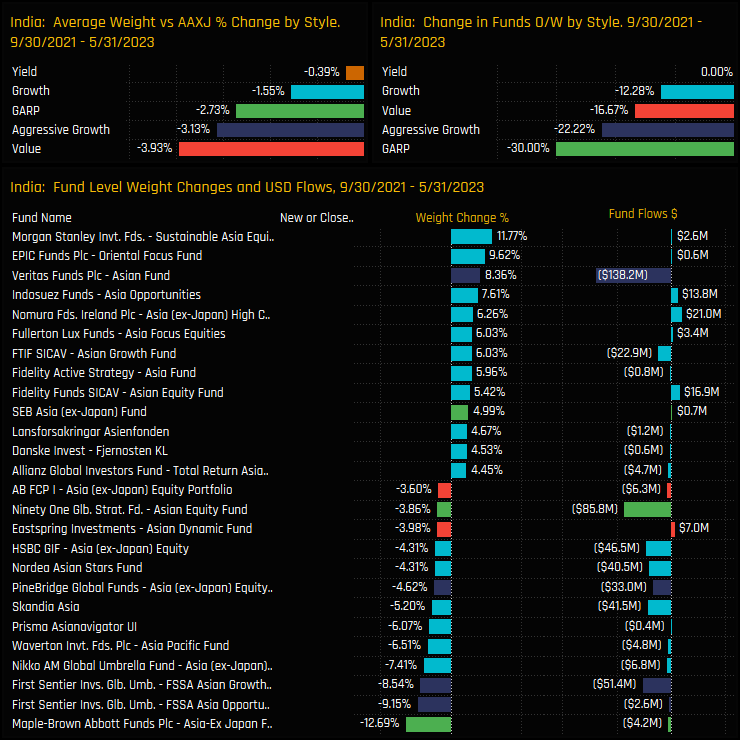

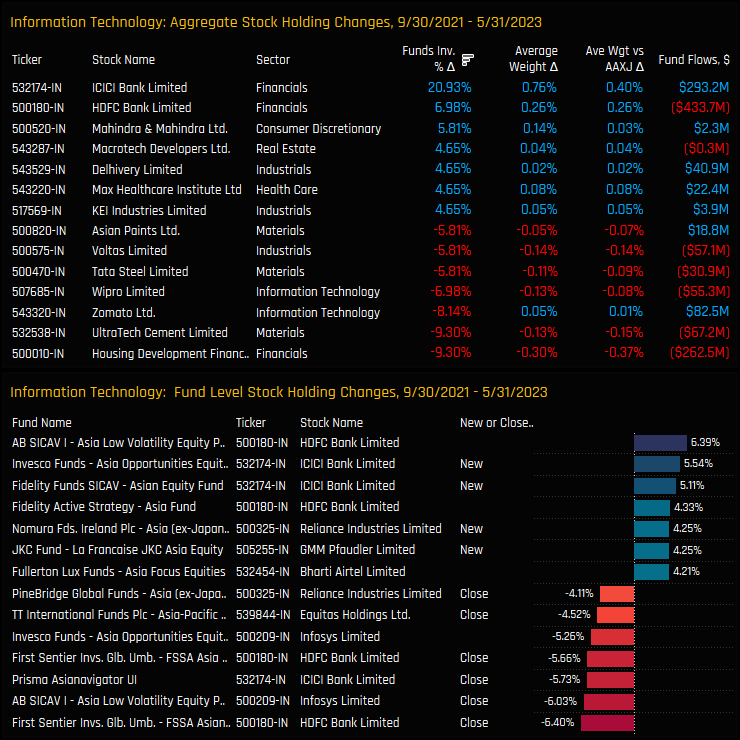

The below charts break down these Indian positioning changes by sector between 09/30/2021 and 05/31/2023. Whilst average weights in Financials and Consumer Discretionary increased in absolute terms (ch1), relative to benchmark, most sectors saw positioning decline, led by Information Technology, Materials and Industrials (ch2). Indian Technology stocks in particular took the brunt of the rotation, with absolute and relative declines the highest among sector peers after some heavy selling by active Asia Ex-Japan managers.

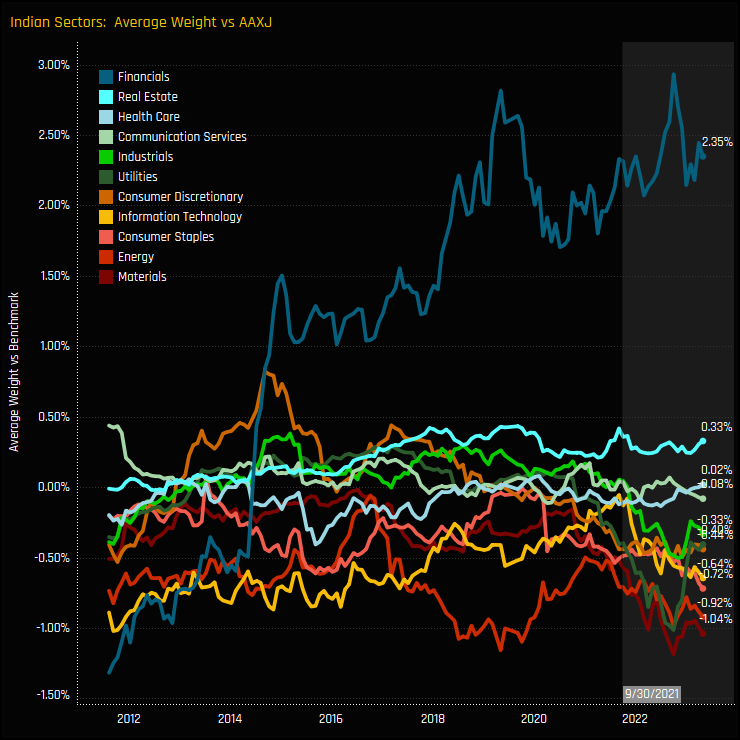

The long-term trends in Indian sector positioning versus the iShares MSCI Asia Ex-Japan ETF are shown in the chart below. Financials have been a long-standing overweight and remain so today, whilst underweights in Materials, Energy and Consumer Staples are towards their highest levels on record.

Latest Sector & Stock Positioning

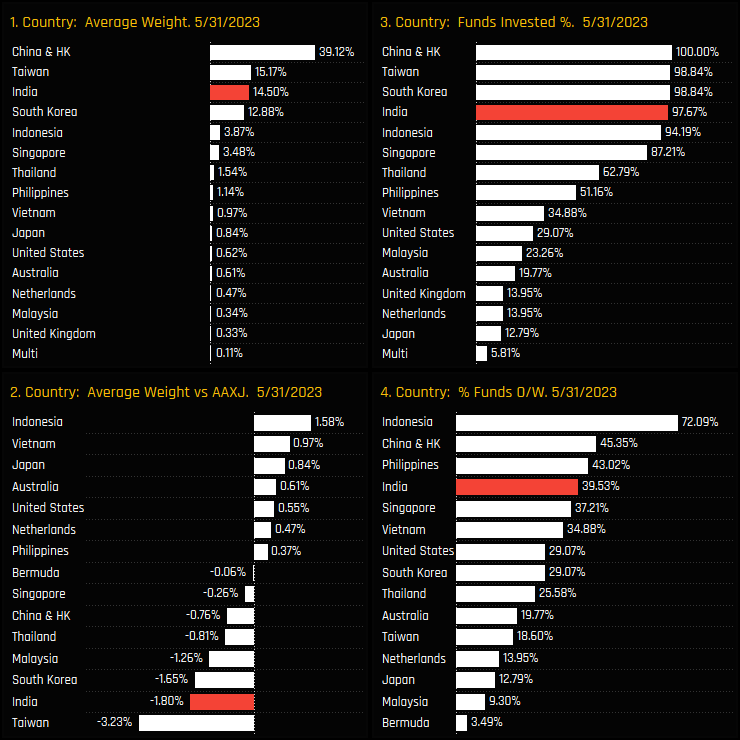

The latest stats for Indian sector ownership as of 05/31/2023 are shown in the chart quadrant below. Financials are the dominant sector by some margin, with average fund weights over 4% ahead of the chasing pack of Information Technology, Consumer Discretionary and Energy. This is a different stance from the benchmark, who hold these sectors much closer together in weight. As such, Financials represent a key overweight for active investors, with over 3/4 of the managers in our analysis positioned above the index, whilst the majority are underweight Indian Materials, Utilities and Communication Services.

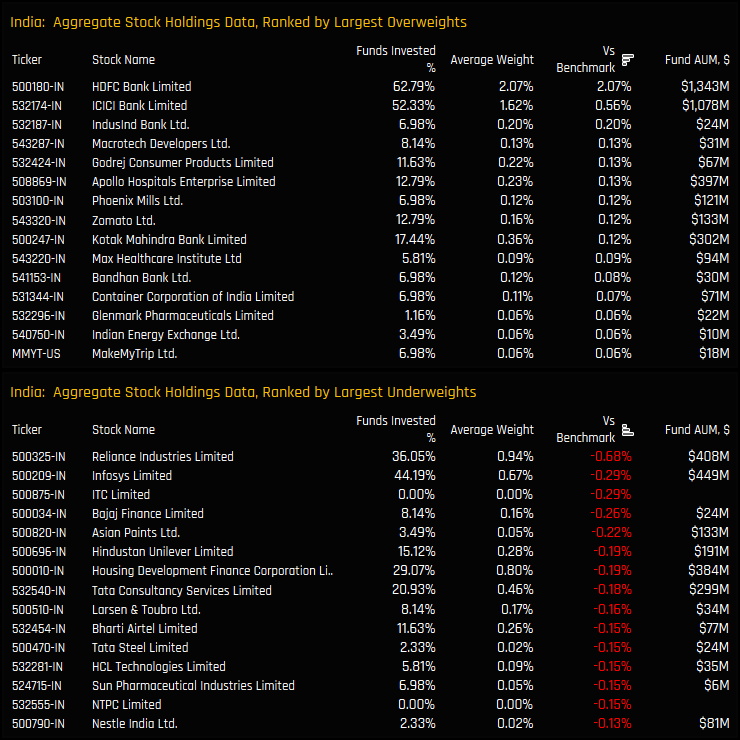

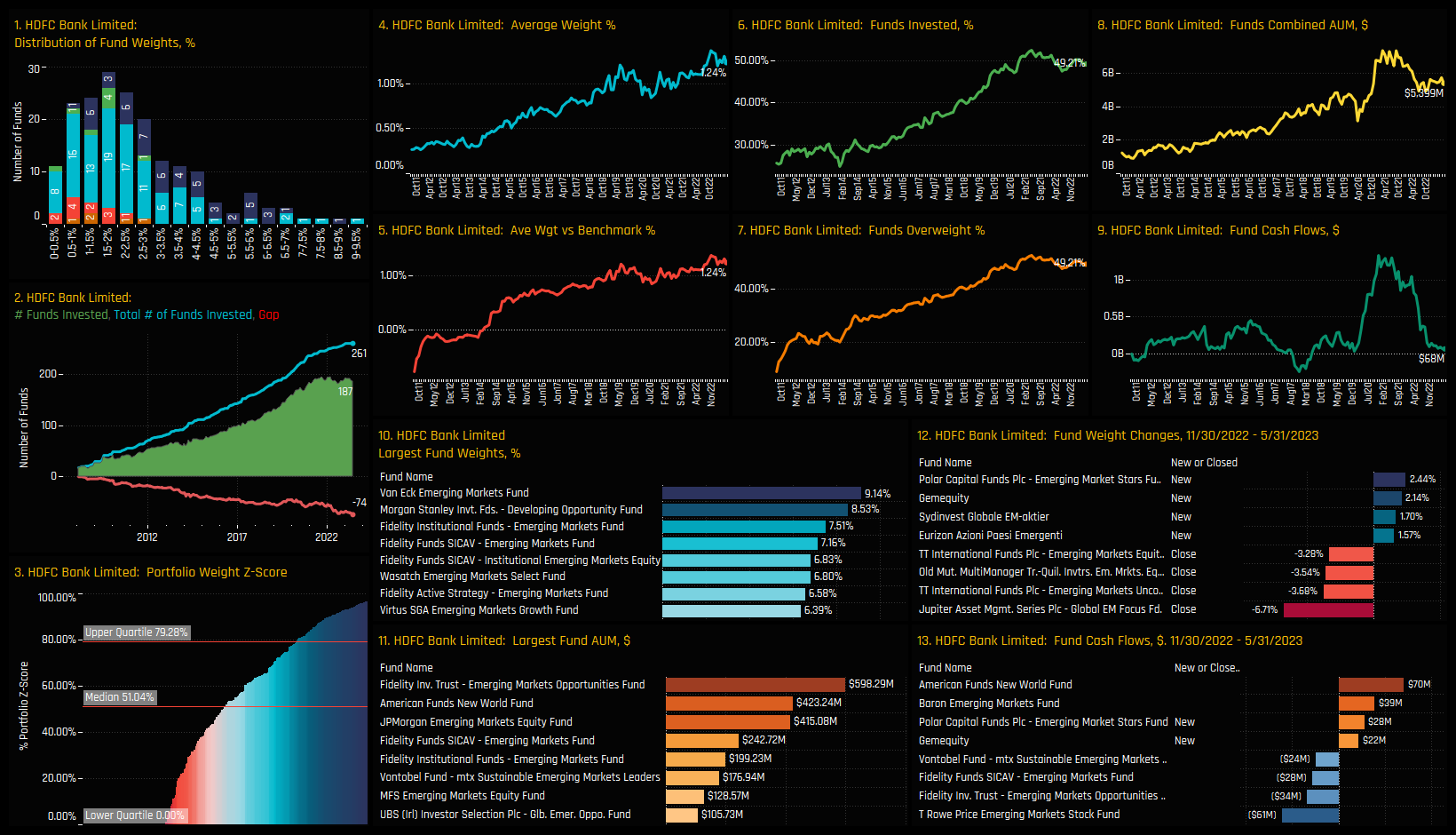

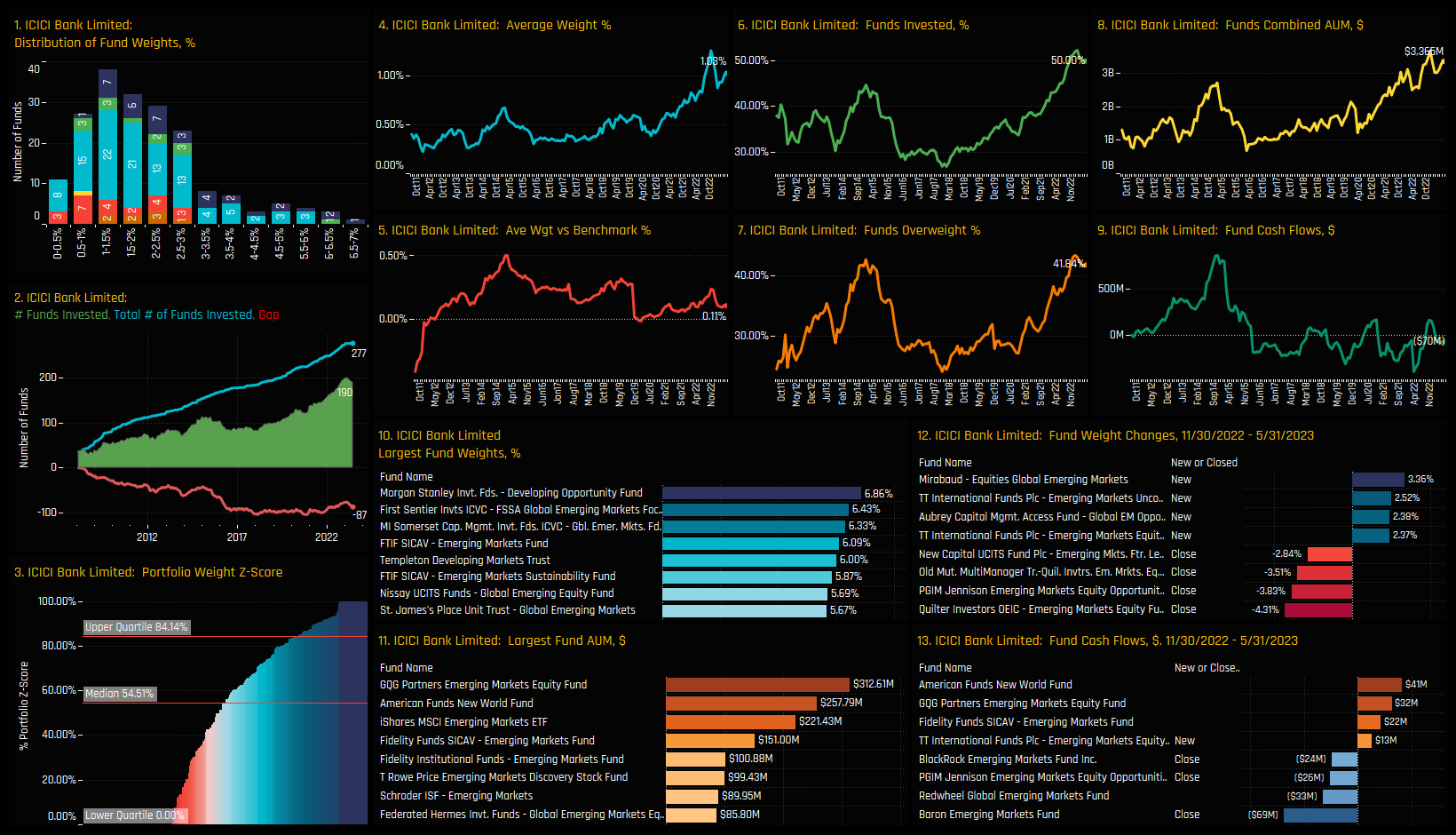

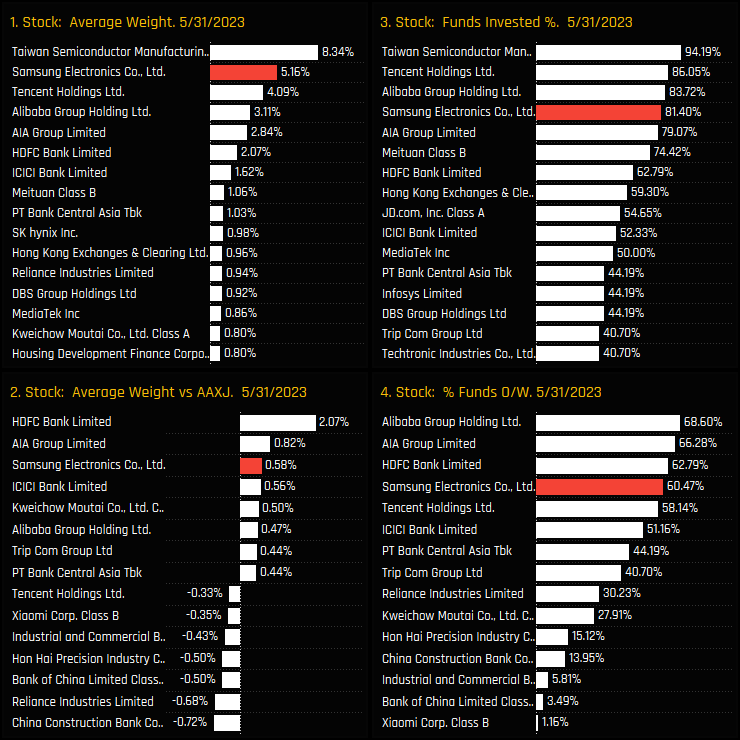

On a stock level, the largest net overweights and underweights are split in the 2 charts below. Overweights are led by out-of-benchmark HDFC Bank, a stock owned by 62.8% of managers at an average weight of 2.07%. ICICI Bank also stands out as a well owned stock held above benchmark on average. The underweights are led by Reliance Industries and Infosys, though these stocks are quite widely owned, in addition to the totally avoided ITC Limited and the lightly owned Bajaj Finance Limited.

Fund Holdings & Activity

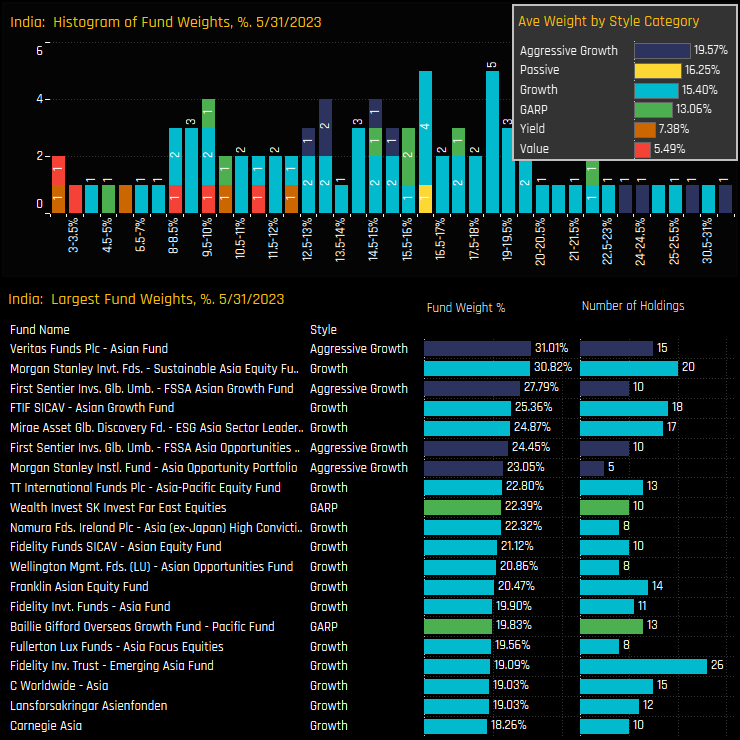

The histogram of fund weights in India is fairly evenly spread, with half of the managers in our analysis holding between a 10.5% and 18.1% weight. Those with a higher stake include the Veritas Asian Fund (31%) and Morgan Stanley Asia Equity (30.8%), whilst Hermes Asia Ex-Japan and Value Partners High Dividend hold less than a 1% stake. Split by Style, only Aggressive Growth funds are positioned overweight the benchmark, on average.

Stock Holdings & Activity

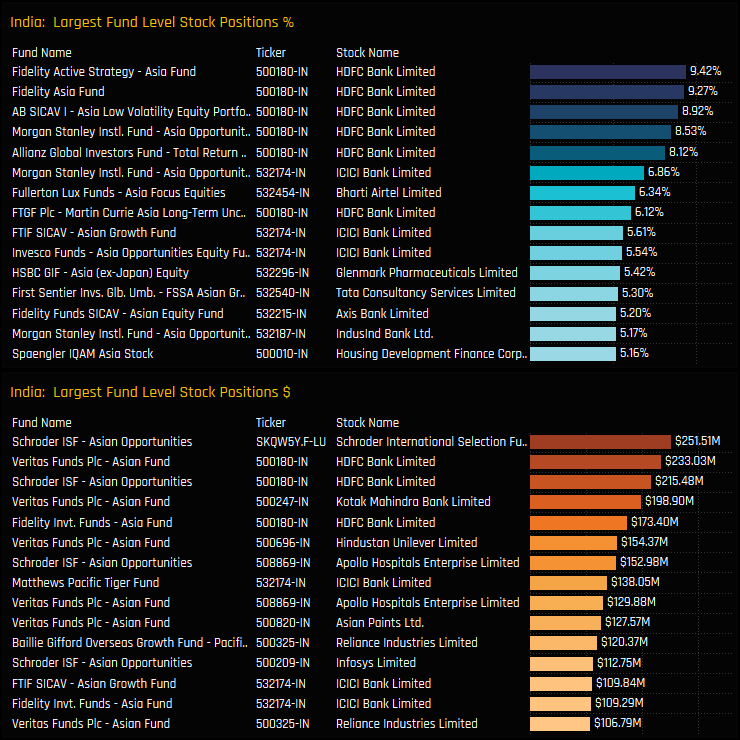

On an individual fund level, the larger stock holdings in percentage terms are in HDFC Bank Limited (Fidelity, Alliance Bernstein, Morgan Stanley) and ICICI Bank (Morgan Stanley, Templeton, Invesco). On a USD basis, positions from the larger funds in our Asian analysis such as Schroders Asian Opportunity, Veritas Asian Fund and Fidelity Asia dominate the bottom list across a number of companies.

Aggregate changes in stock holdings between 09/30/2021 and 05/31/2023 are shown in the top chart below. The total increase in Indian underweight was -1.96% over this period, and the stocks at the bottom half of the chart were the main drivers behind this, led by Housing Development Finance Corp, UltraTech Cement and Zomato Ltd. ICICI Bank was the standout on the positive side, attracting a further 20.9% of funds as overweights increased by +0.40%.

Conclusions

Links & Stock Profiles

Stock Profile: HDFC Bank Limited

Stock Profile: ICICI Bank Limited

Time-Series & Stock Positioning

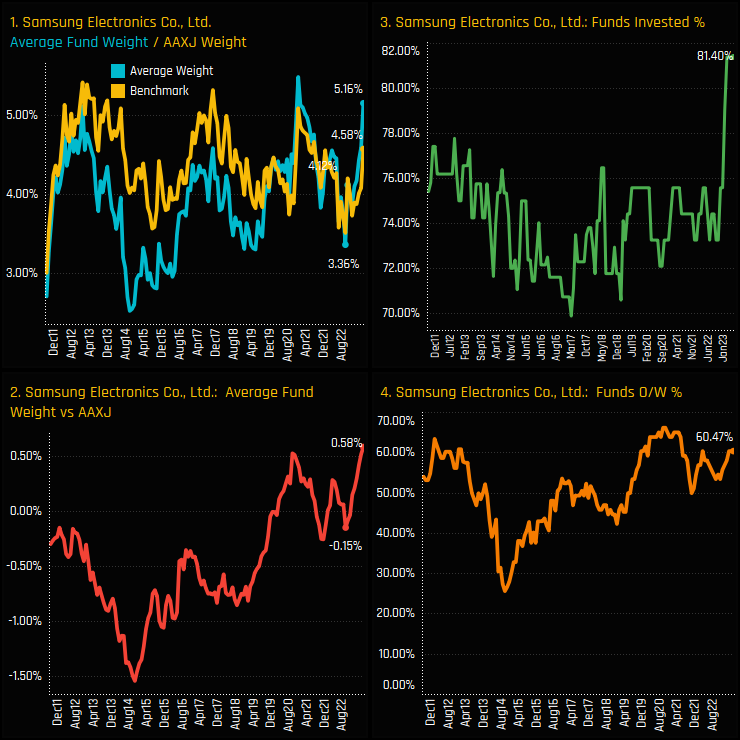

Asia Ex-Japan funds have increased ownership in Samsung Electronics to their highest levels on record. Samsung suffered something of a conviction crisis late in to last year, as average holding weights plunged to just 3.36% (ch1), or underweight the iShares MSCI Asia Ex-Japan ETF by -0.15% (ch2). But since then, fund managers have ramped up allocations, with the percentage of funds with exposure to Samsung Electronics spiking to a record 81.4% over the course of the last 6-months (ch3). We are now in a period where 60.5% of managers are positioned overweight (ch4).

The charts below show the latest ownership statistics for companies in the Asia Ex-Japan stock universe. Whilst TSMC is the regional leader by some distance, Samsung Electronics has cemented itself as the 2nd largest holding on an average weight basis, but lags behind Tencent Holdings and Alibaba Group Holdings in terms of the percentage of funds invested. It is one of 6 stocks that are held overweight by the majority of the Asia Ex-Japan funds in our analysis (ch4), and the 3rd largest stock overweight behind non-benchmark HDFC Bank and AIA Group Limited.

Fund Positioning & Activity

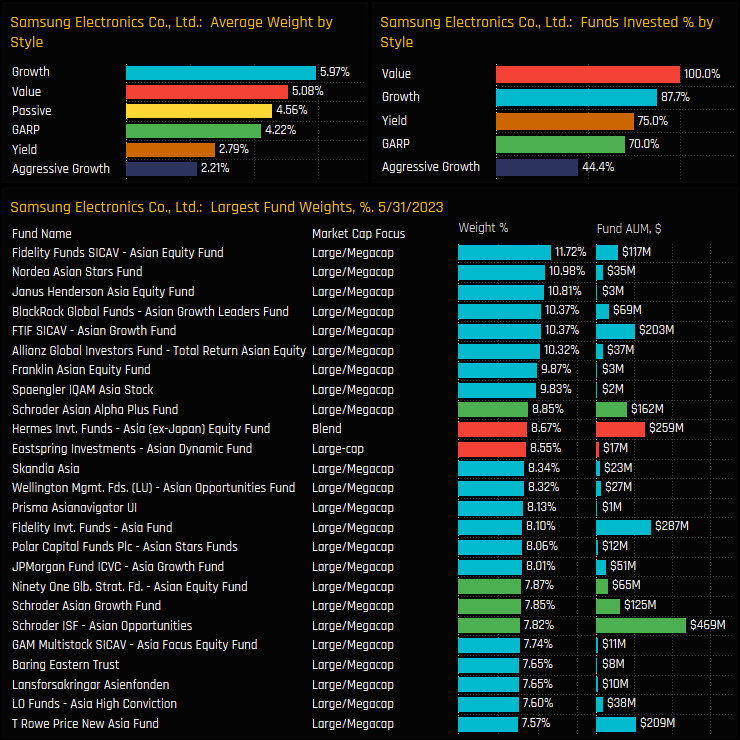

Underpinning Samsung’s record exposure is a strong holding picture among the managers in our analysis, with a number showing a +10% allocation, led by Fidelity Asian Equity (11.7%) and Nordea Asian Stars (10.98%). Growth and Value managers are the larger allocators, whilst Aggressive Growth funds are notable in their absence, with just 44.4% holding exposure compared to 87.7% of Growth funds and 100% of Value funds.

Conclusions & Links

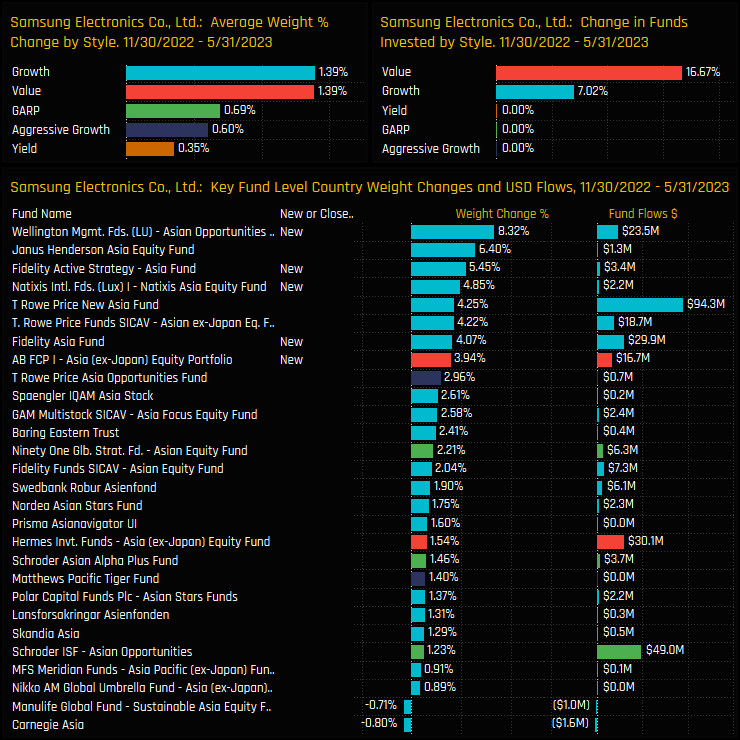

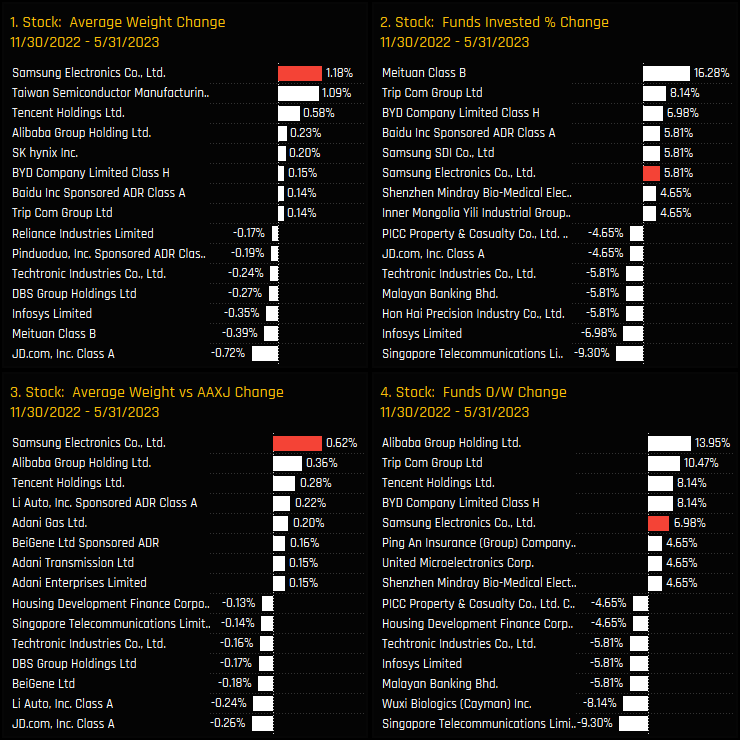

Over the last 6-months, Samsung has been a clear beneficiary of manager rotation. The charts opposite show Samsung capturing the largest increase in average holding weight (ch1) and the largest increase in net overweight (ch3) among Asia Ex-Japan peers over the last 6-months. It also saw the joint 4th largest increase in the percentage of funds with outright ownership (ch2), though was eclipsed by Meituan, Trip Com Group and BYD Company (see last month’s note BYD Company: Record Holdings for more info).

So despite being an easy stock for Asian funds to hold on account of its large index weight, active investors are going one step further, ramping up allocations to record levels and with the majority of managers positioned overweight. Samsung Electronics has cemented itself as one of the highest conviction holdings in the Asia Ex-Japan region right now.

Click on the link below for an extended data report on Samsung Electronics positioning among active Asia Ex-Japan funds.

86 Asia Ex-Japan Equity Funds, AUM $54.5bn

Asia Ex-Japan Stock Radar

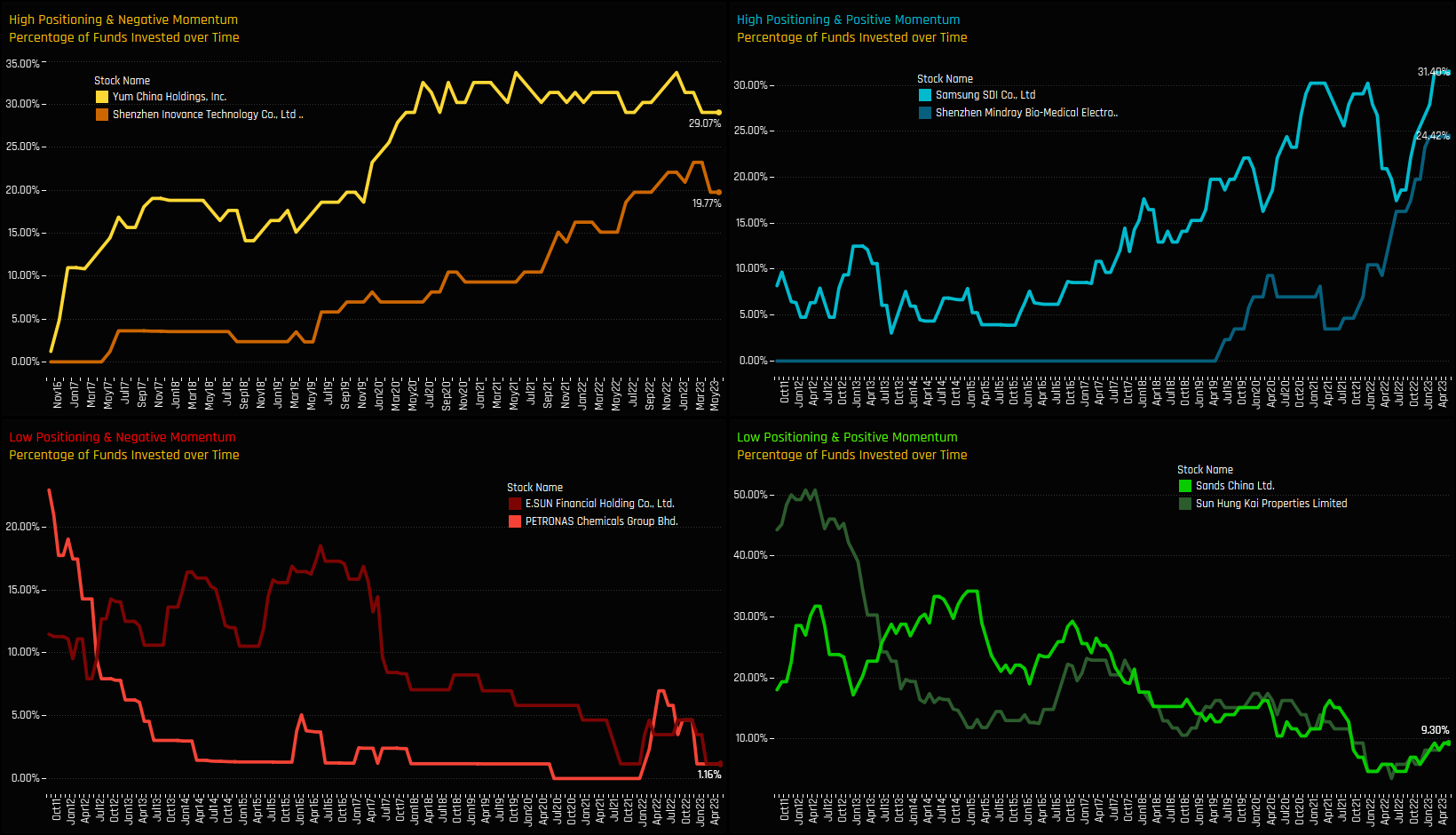

Investment levels among the thousands of stocks in the investible Asia Ex-Japan universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in our Asian analysis. We highlight 8 stocks at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

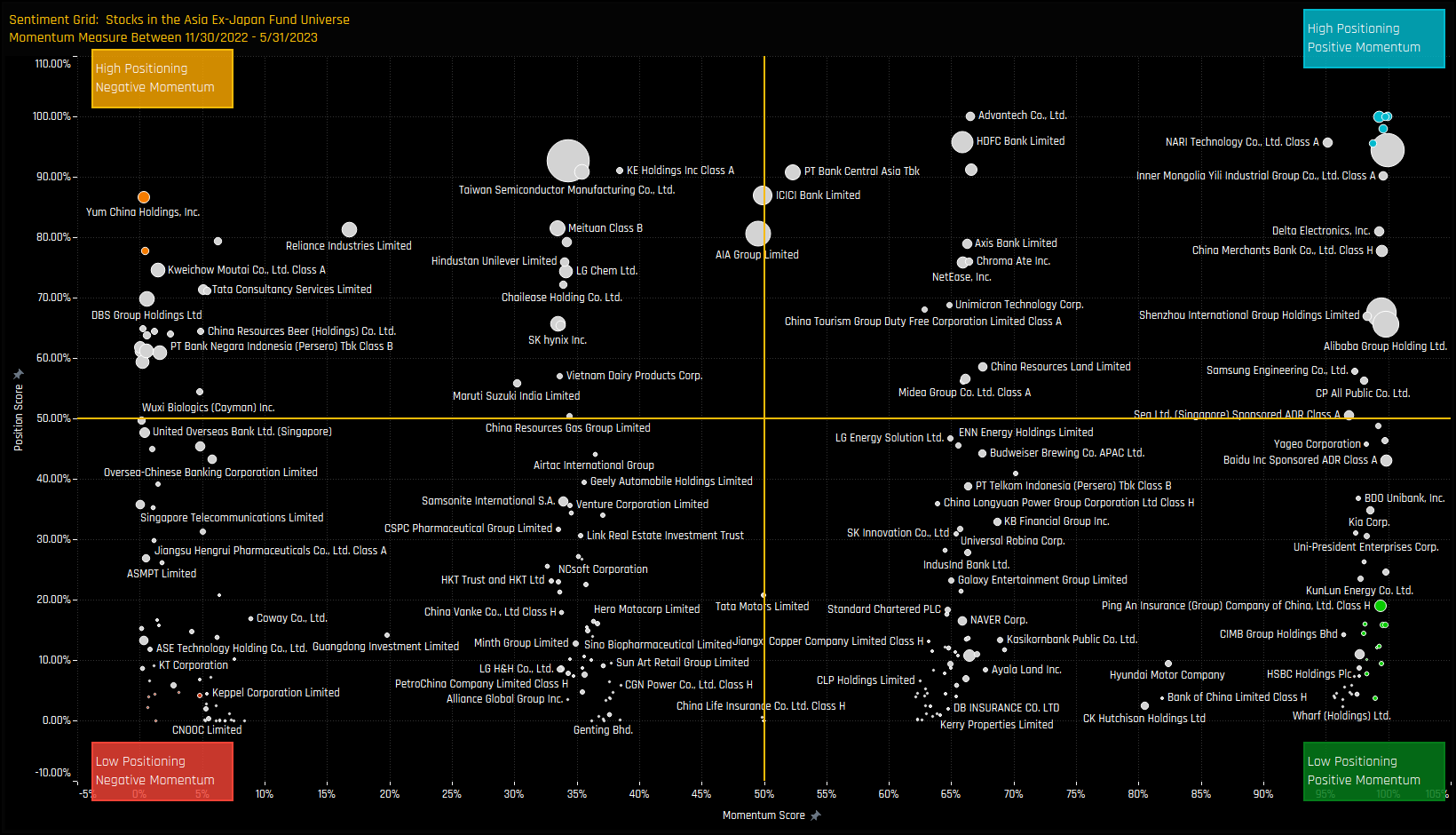

Stock Sentiment

The Sentiment Grid below is designed to visualize the interplay between current fund positioning, long-term fund positioning and shorter-term fund manager activity for all stocks in the Asia Ex-Japan fund active universe. The Y-axis shows the ‘Position Score’, a measure of current positioning in each stock compared to its own history going back to 2011 on a scale of 0-100%. It takes in to account the percentage of funds invested in each stock versus history, the average fund weight versus history and the percentage of funds overweight the benchmark versus history. The higher the number, the more heavily a stock is owned by active Asia Ex-Japan managers compared to its own history.

Extreme Stocks

- High Positioning & Negative Momentum: Position Score > 75%. Momentum Score < 5%

- Low Positioning & Negative Momentum: Position Score < 5%. Momentum Score < 5%

- Low Positioning & Positive Momentum: Position Score < 20%. Momentum Score > 98%

- High Positioning & Positive Momentum: Position Score > 95%. Momentum Score > 98%

Extreme Stocks Focus

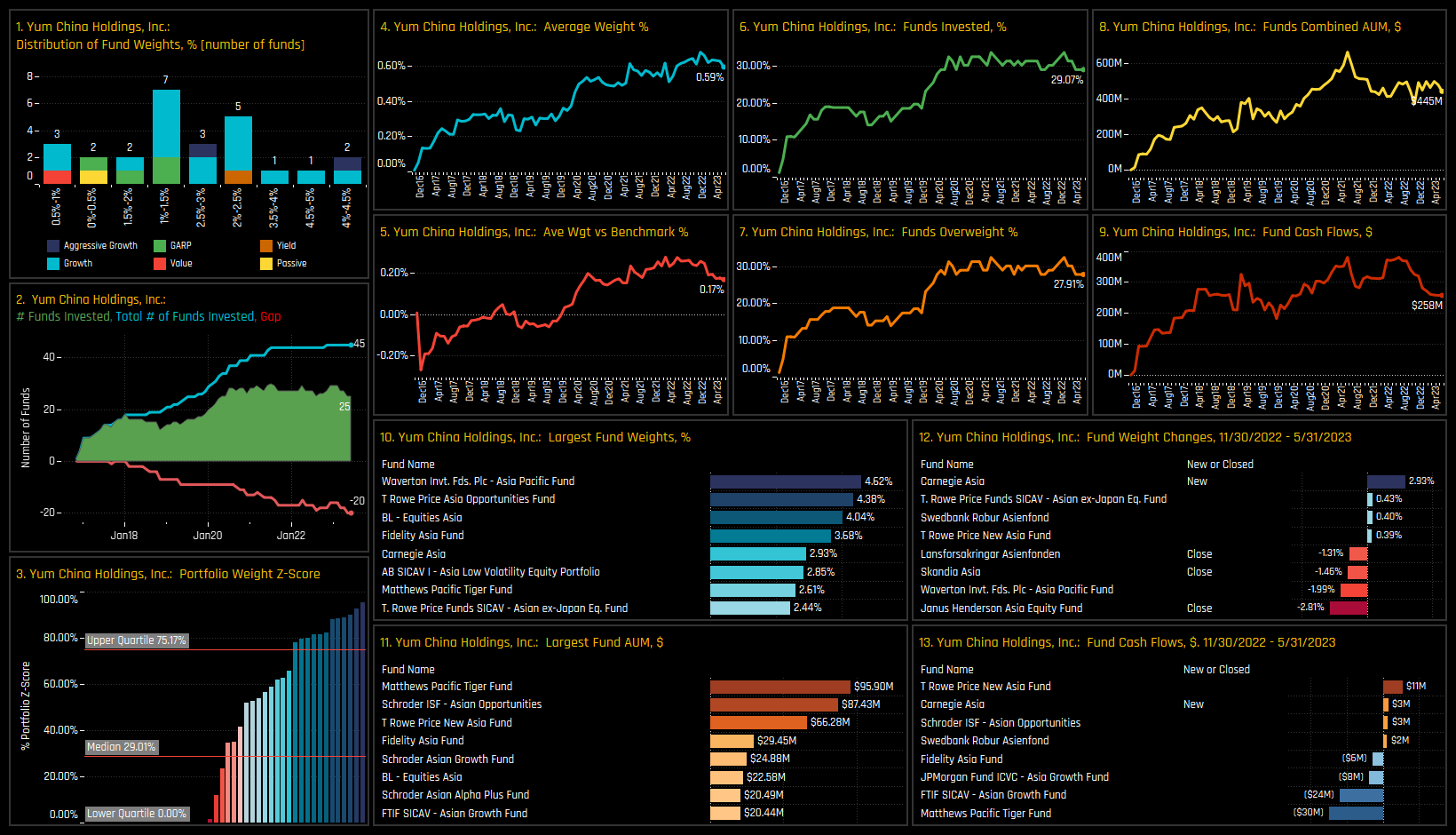

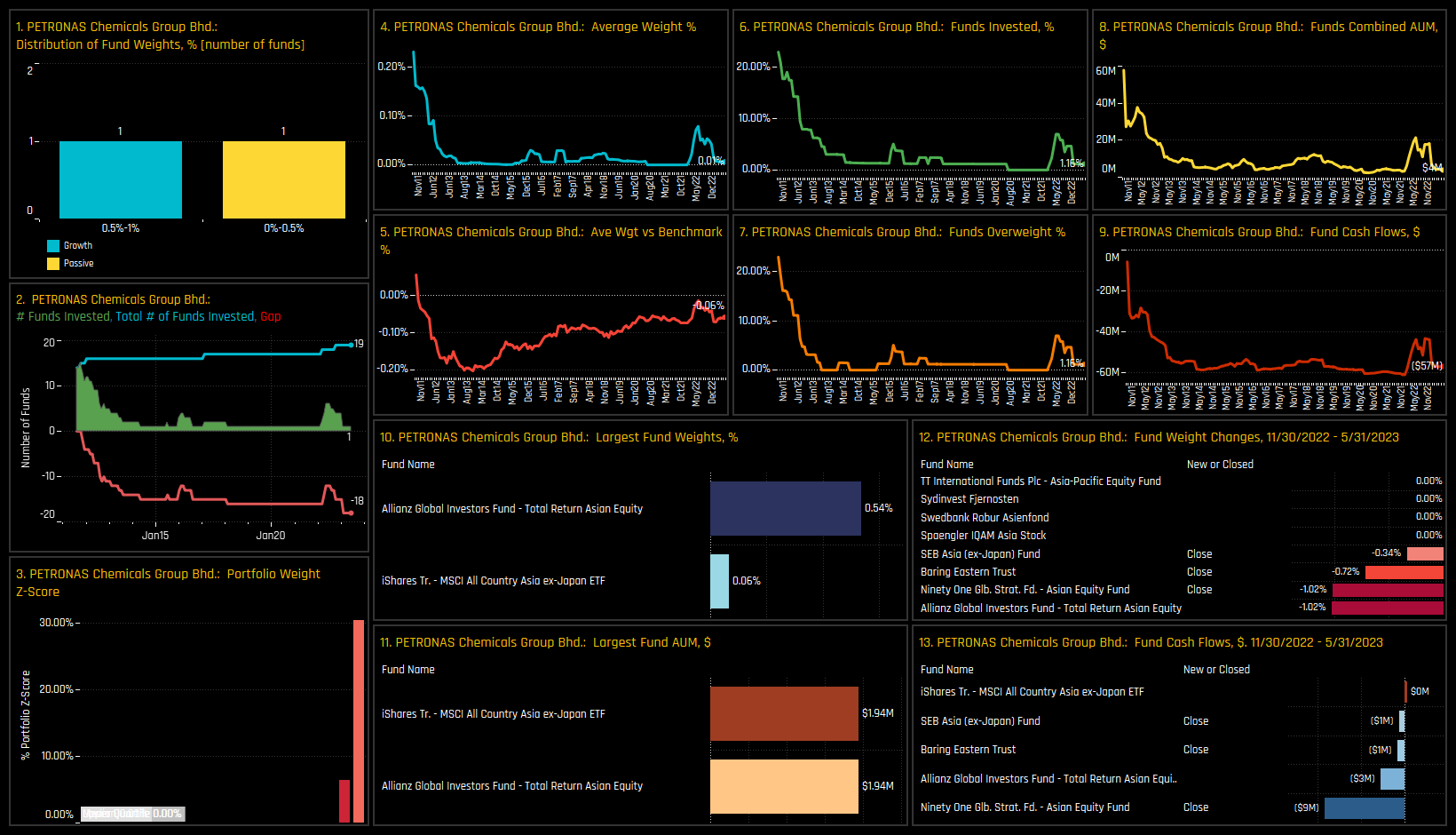

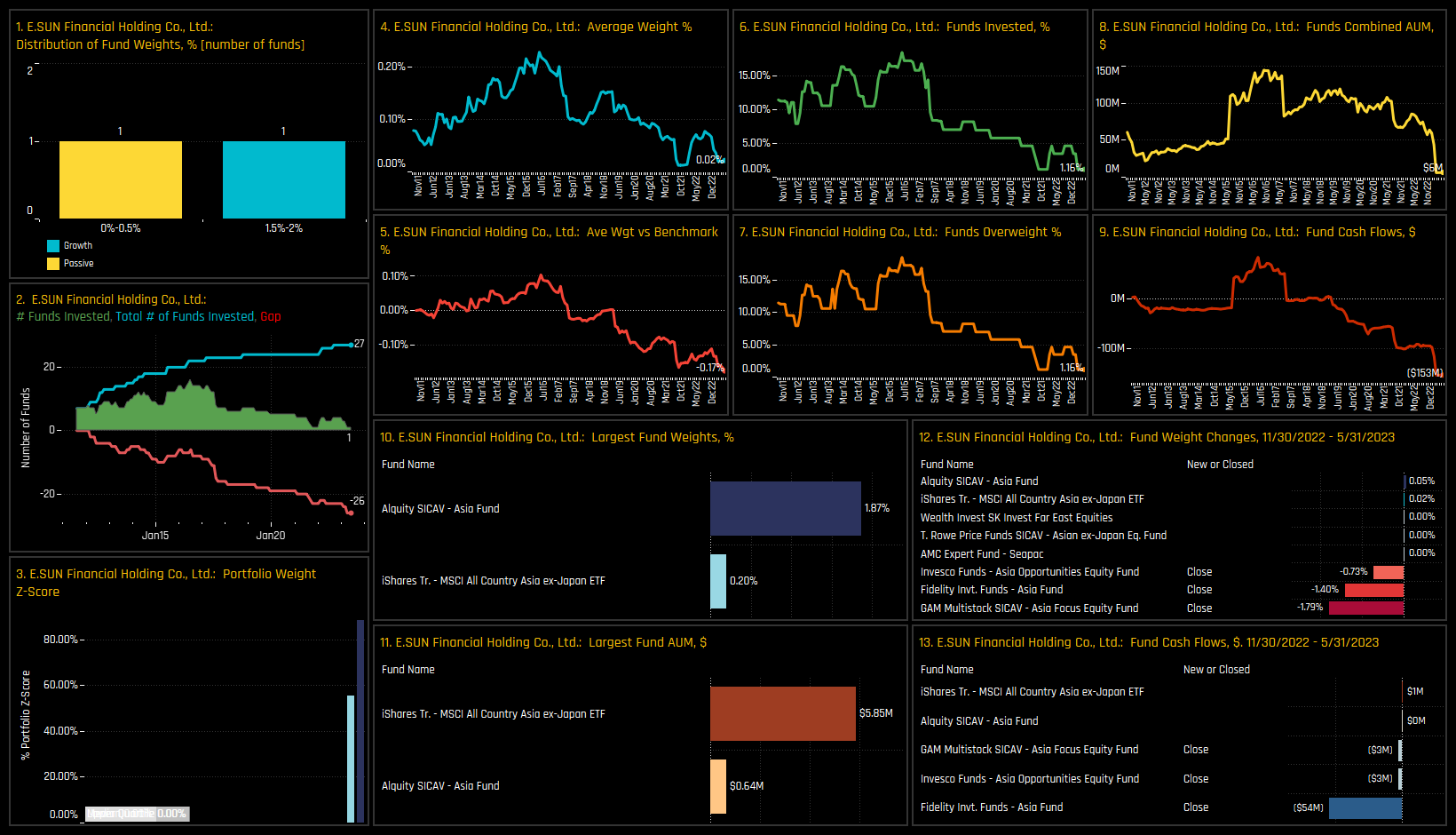

The following charts illustrate the proportion of active funds invested in the top 2 stocks within each of the 4 categories. This visualization provides an additional perspective how the Sentiment Grid works. For instance, in the chart located at the top-left, Yum China Holdings and Shenzhen Inovance Technology have experienced a decline in fund ownership from the all-time highs. Moving to the chart in the bottom-left, both E.SUN Financial and PETRONAS Chemicals are in long-term ownership decline, with additional selling in recent months pushing exposure to their lowest levels in 12 years.

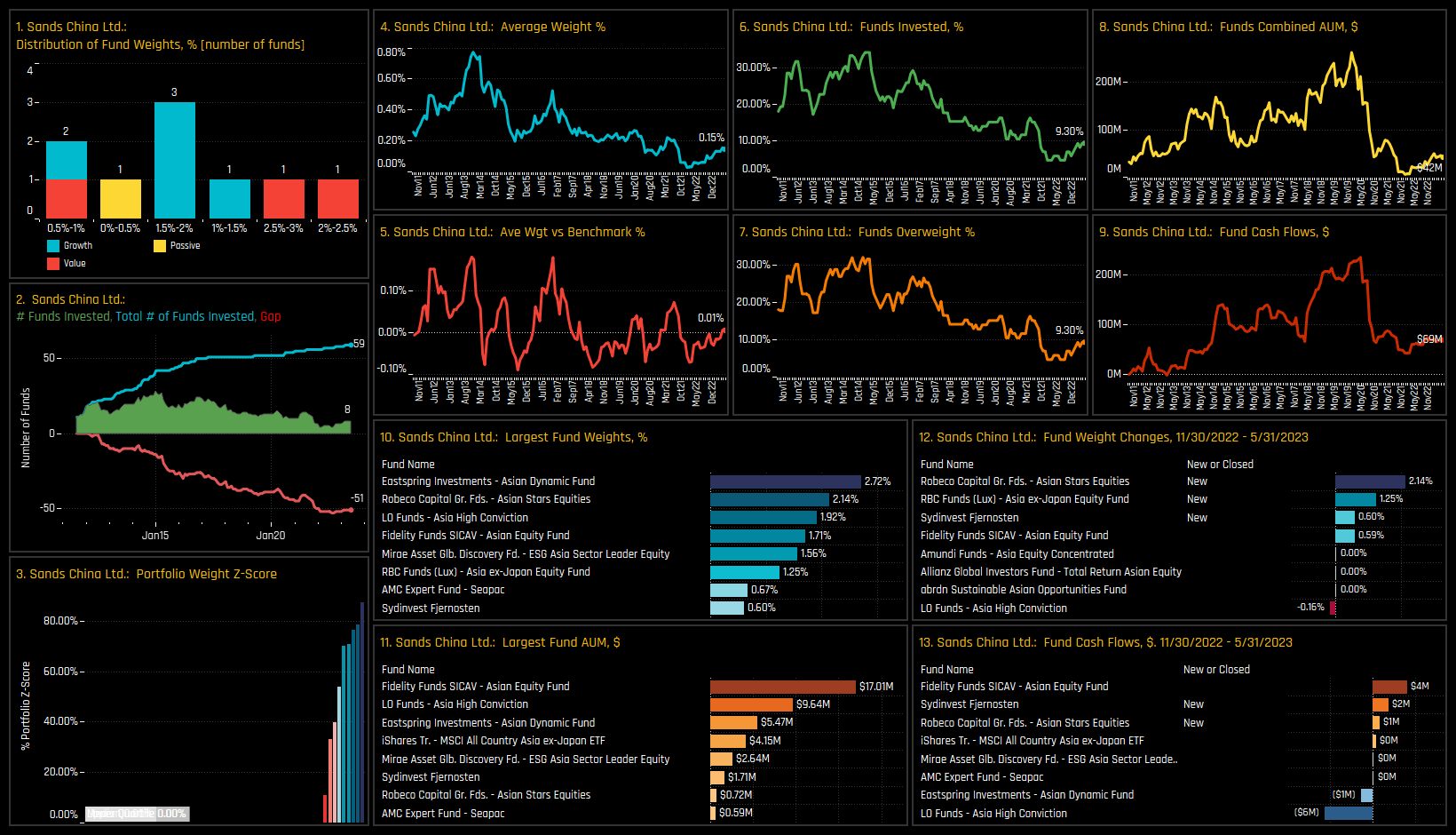

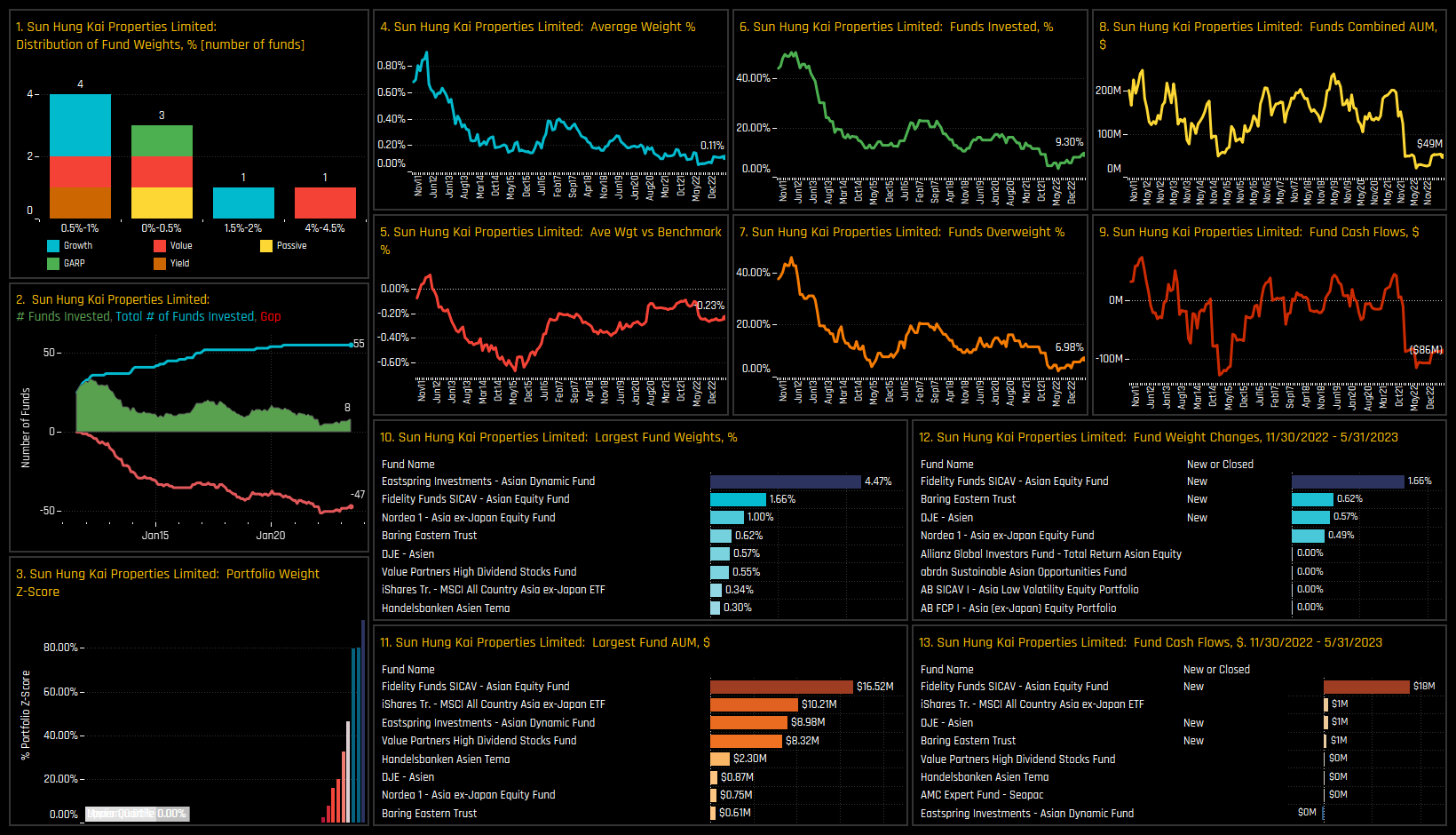

In the bottom right chart, both Sands China and Sun Hung Kai Properties are experiencing rising ownership after years of decline, sentiment has clearly started to shift to the upside in both names. Finally, in the top right chart, Samsung SDI Co and Shenzhen Mindray Bio-Medical Electronics are currently experiencing peak ownership levels, following consistent increases in fund exposure over the past few months. In the subsequent charts, we offer more comprehensive profiles of each of the 8 stocks located at the extreme corners of our Sentiment Grid.

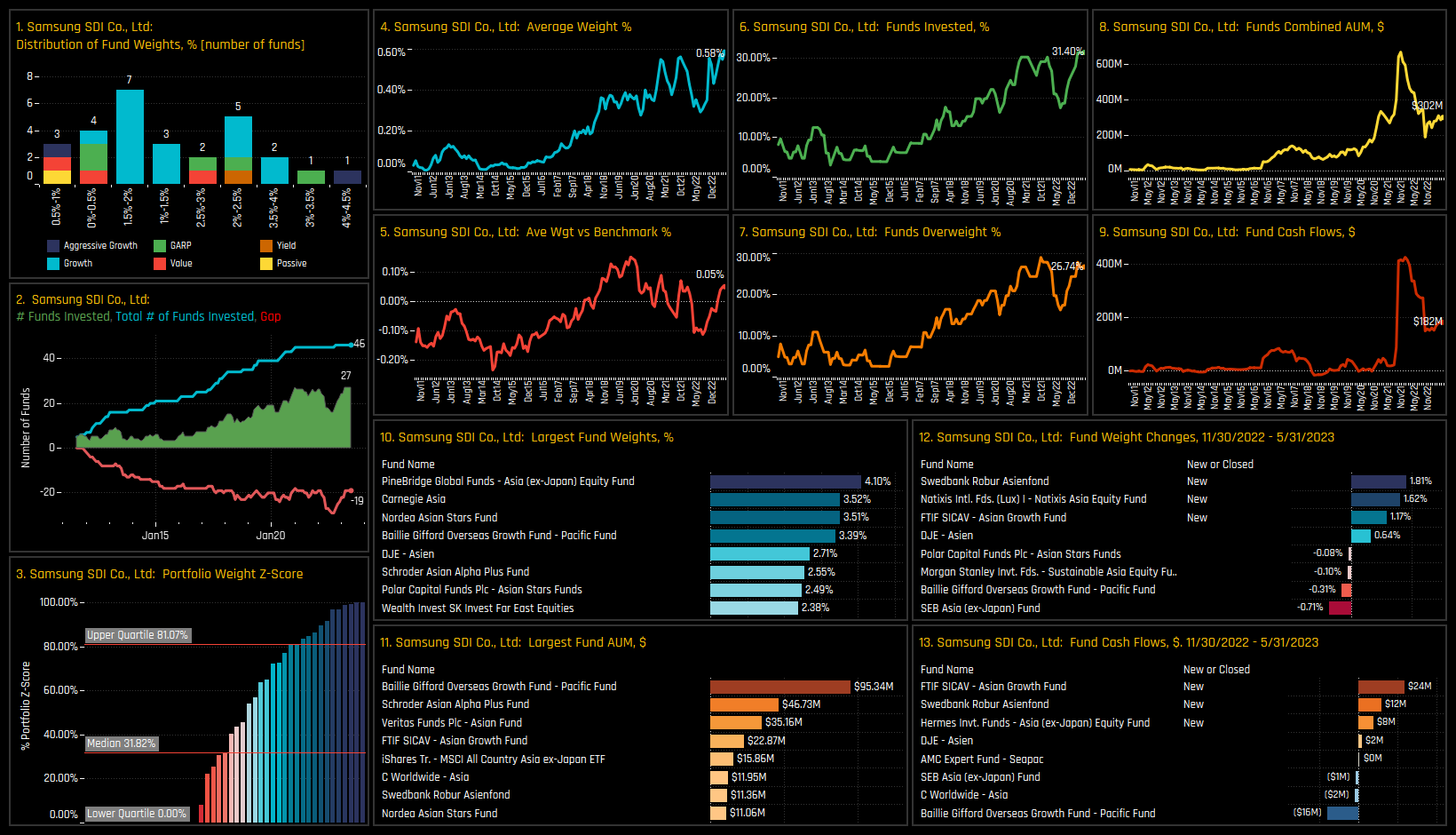

High Positioning & High Momentum: Samsung SDI Co

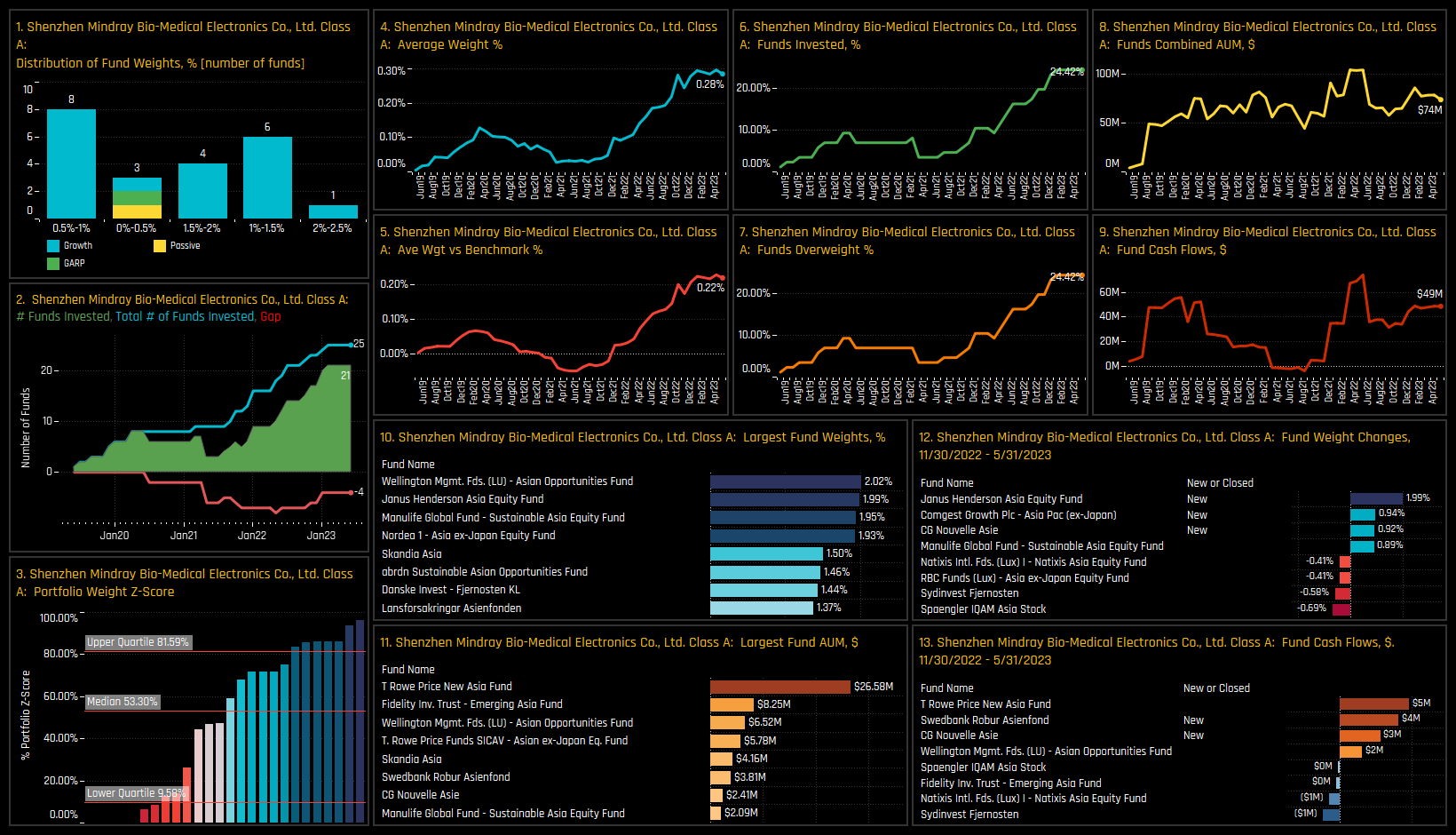

High Positioning & High Momentum: Shenzhen Mindray Bio-Medical Electronics

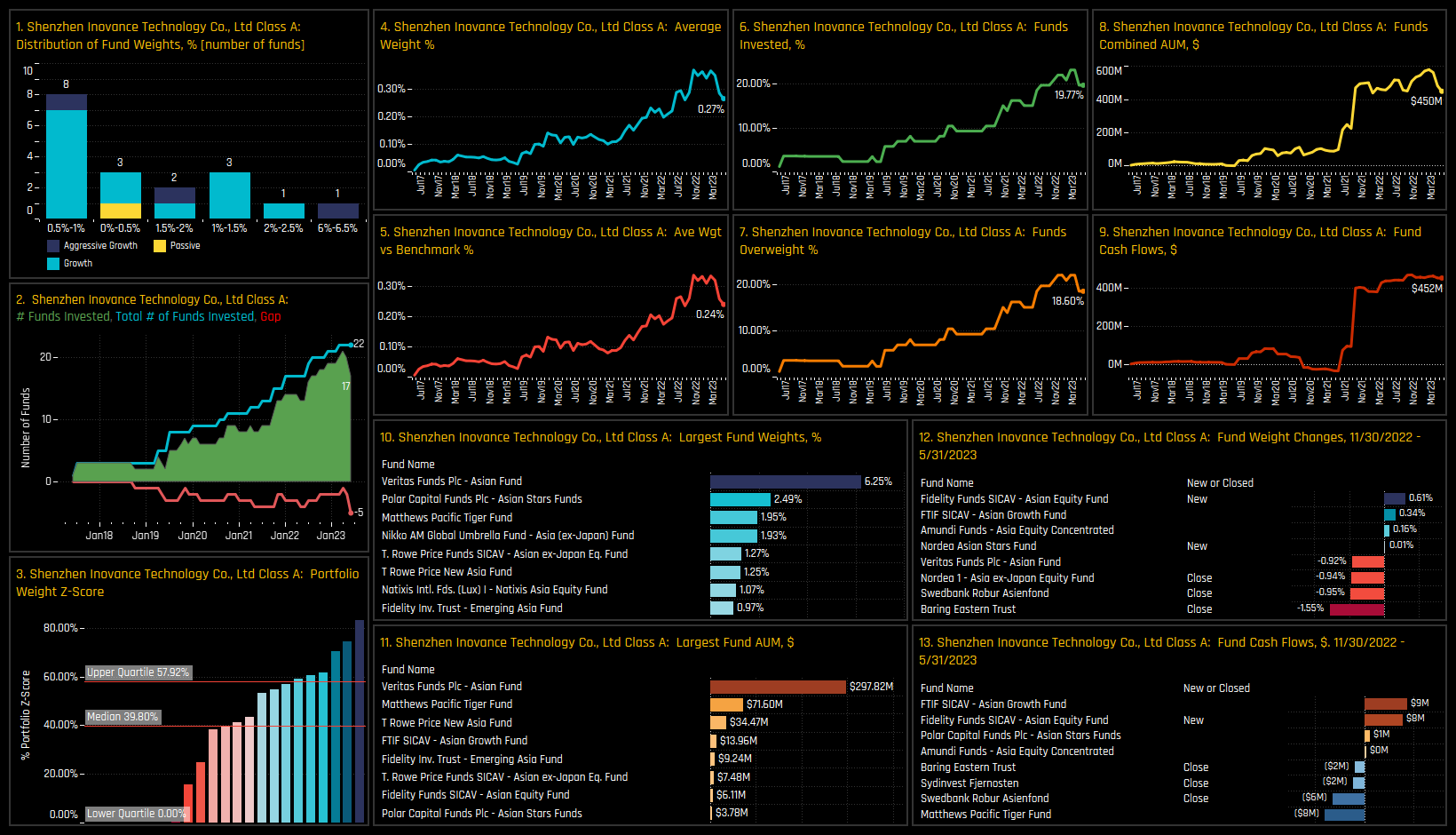

High Positioning & Low Momentum: Shenzhen Inovance Technology

High Positioning & Low Momentum: Yum China Holdings

Low Positioning & Low Momentum: PETRONAS Chemicals Group

Low Positioning & Low Momentum: E.SUN Financial Holding Co

Low Positioning & High Momentum: Sands China Ltd

Low Positioning & High Momentum: Sun Hung Kai Properties Ltd

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 29, 2023

Asia Ex-Japan Fund Positioning Analysis, August 2023

104 Asia Ex-Japan Funds, AUM $66bn Asia Ex-Japan Fund Positioning Analysis, August 2023 In this ..

- Steve Holden

- September 26, 2024

Positioning Insights, September 2024

98 Active Asia Ex-Japan funds, AUM $51bn Active Asia Ex-Japan Funds: Positioning Insights, Sept ..

- Steve Holden

- July 29, 2024

Asia Ex-Japan Funds: Extreme Stocks, July 2024

99 Asia Ex-Japan active equity funds, AUM $52bn Asia Ex-Japan Funds: Extreme Stocks Summary In ..