Time-Series & Sector Activity

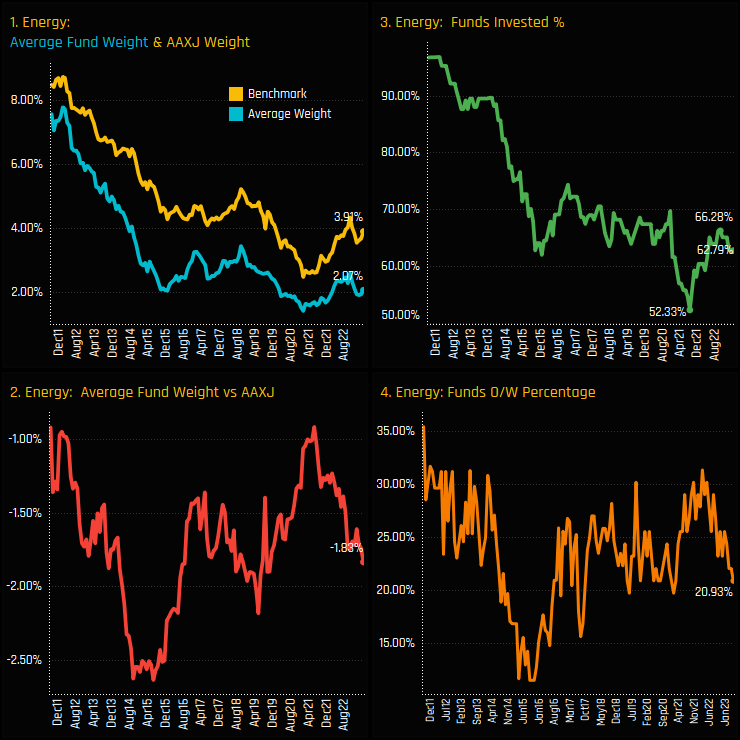

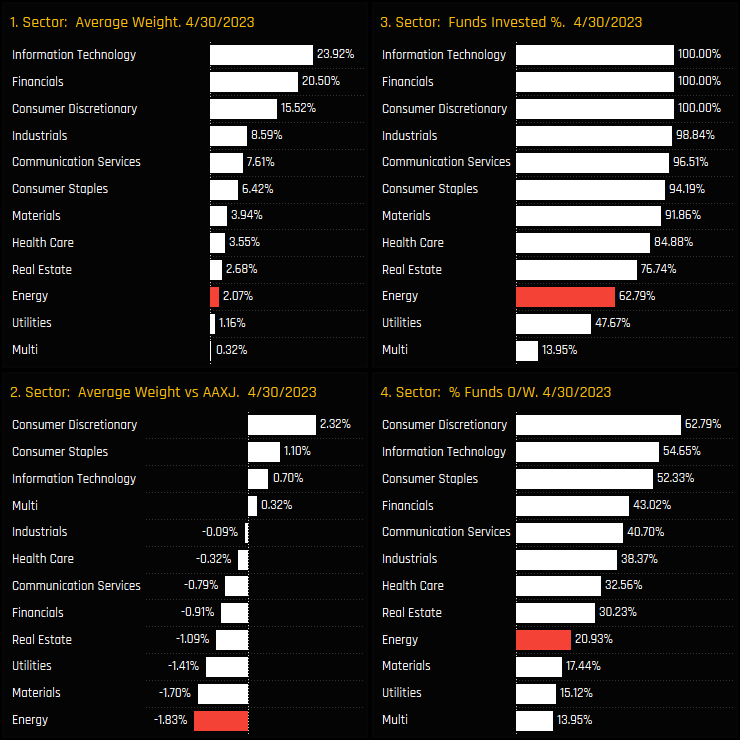

The recovery in Energy allocations among Asia Ex-Japan funds has stalled, and has started to reverse. The long-term decline in Energy exposure is plain to see in charts 1 and 3 below. They show falling average weights between the period 2011 and 2021, both in the benchmark and among active funds (ch1). More significantly, there has been a fall in the percentage of active funds with any exposure to the Energy sector at all (ch3). This trend hit a bottom in late 2021, with the percentage of funds invested rallying from a low of 52% to a high of 66.3% in October last year. Since then, the direction of travel has reversed, with funds either closing out entirely or switching to an underweight position (ch4).

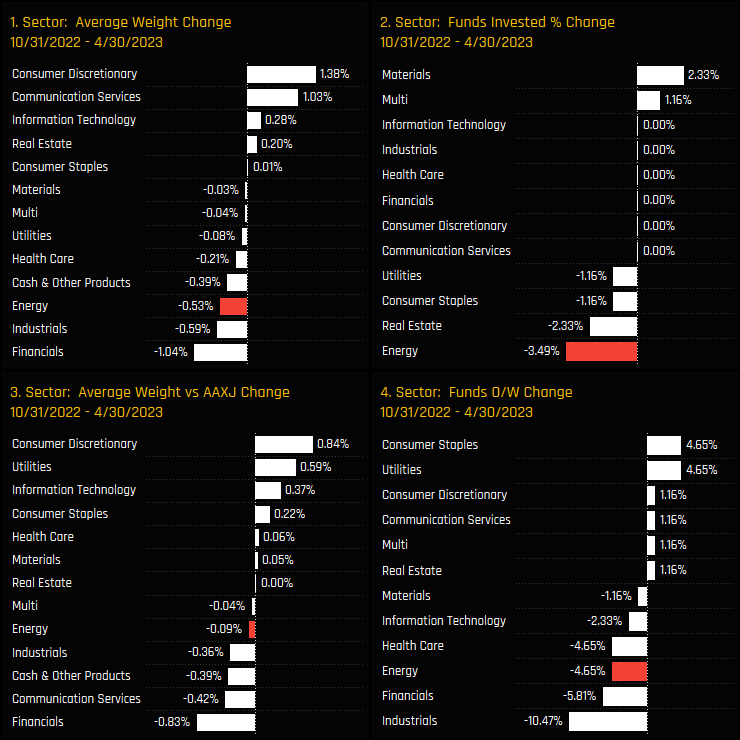

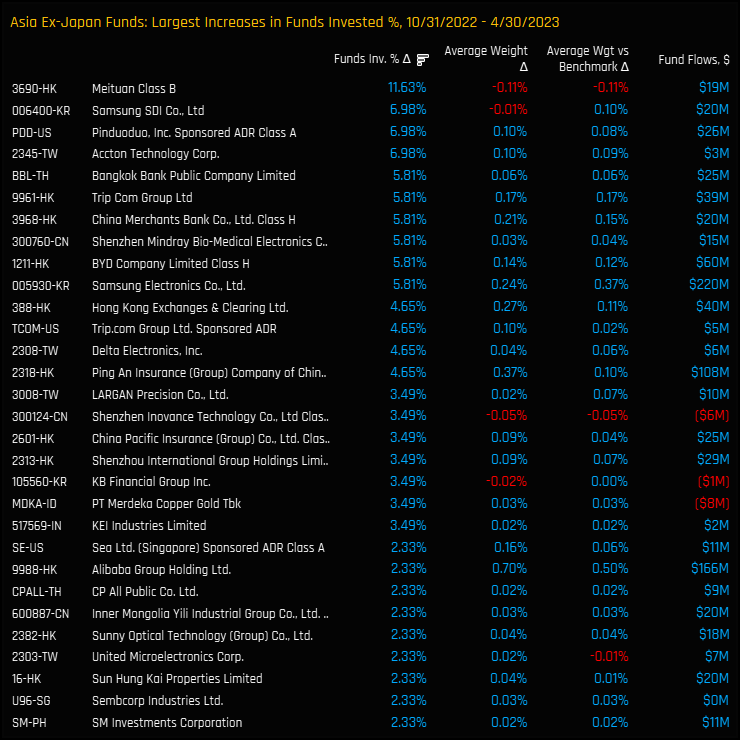

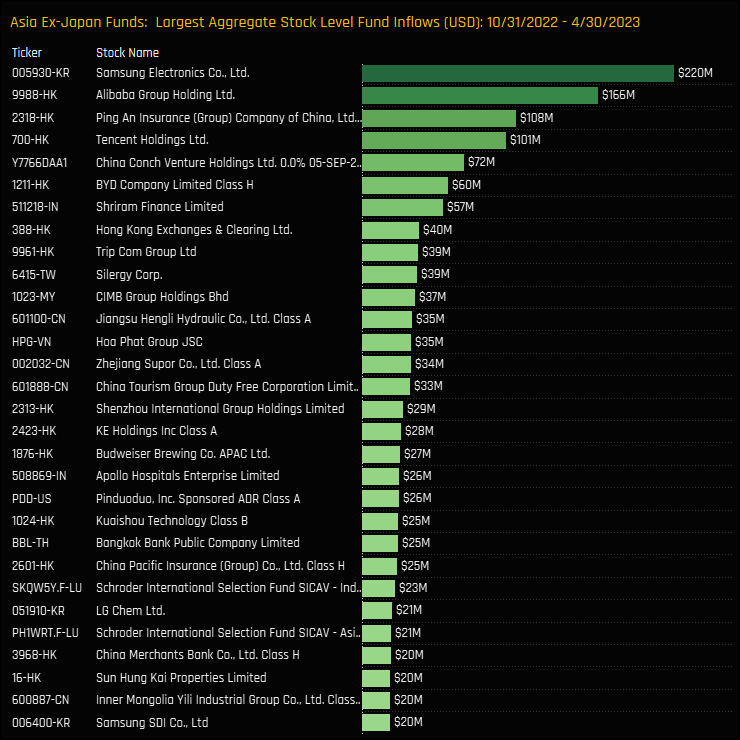

The charts below show the change in sector level ownership among Asia Ex-Japan funds since the start of the recent decline until today (10/31/2022 to 04/30/2023). The Energy sector saw the largest decline in outright ownership (ch2) and the 3rd largest drop in average fund weights (ch1) over the period, with Asia Ex-Japan investors instead increasing exposure to the Consumer Discretionary, Communication Services and Technology sectors. Versus the benchmark, net underweights increased by -0.09% as a further 4.65% of funds moved to underweight.

Fund Holdings & Activity

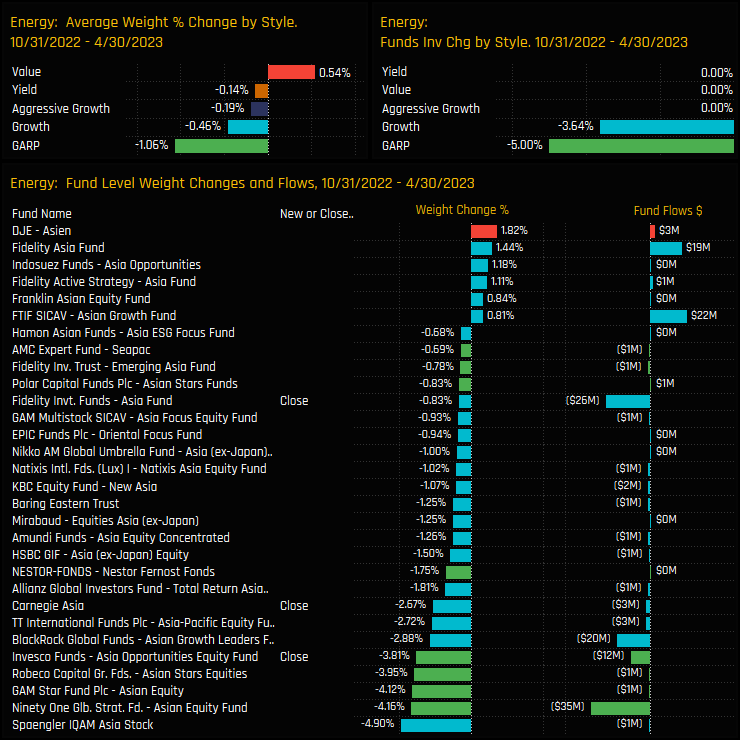

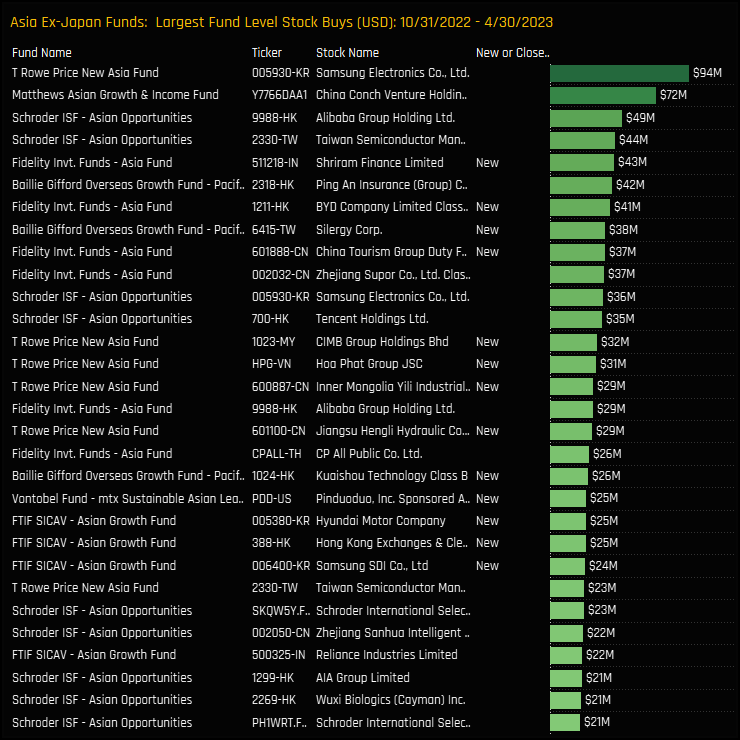

Over the same 6-month period, all Style groups except Value scaled back holdings as shown in the top charts below. GARP funds saw the largest declines, with -5% of funds closing exposure entirely and average weights falling by -1.06%. On a fund level, the majority of activity was to the sell side, with 3 closures and some large weight reductions led by Spaengler Asia Stock (-4.9%) and Ninety One Asian Equity (-4.2%).

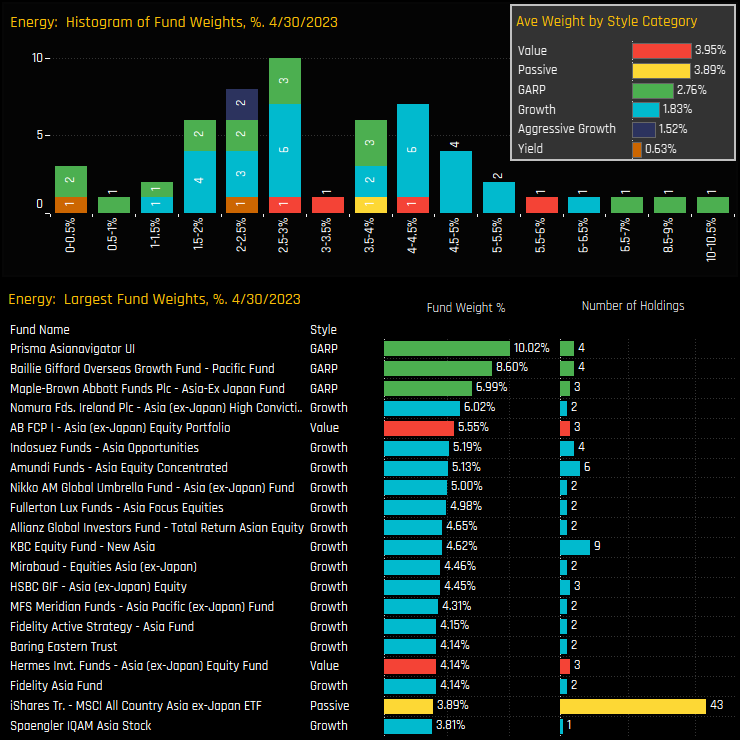

Of the remaining 62.8% of managers holding exposure to the Energy sector, the majority hold between a 1.5% and 5% allocation, with holdings maxing out at 10% for the Prisma Asianavigator Fund. Allocations are largely correlated to Style, with Value funds holding 3.95% on average versus Aggressive Growth on 1.52%. Most of the top holders own less than 4 stocks in the sector, compared to 43 for the iShares MSCI AAXJ ETF.

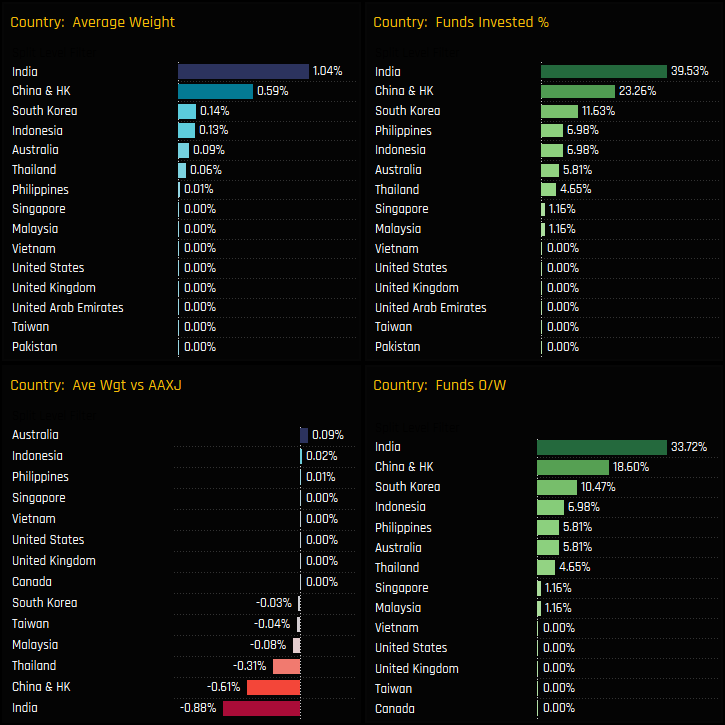

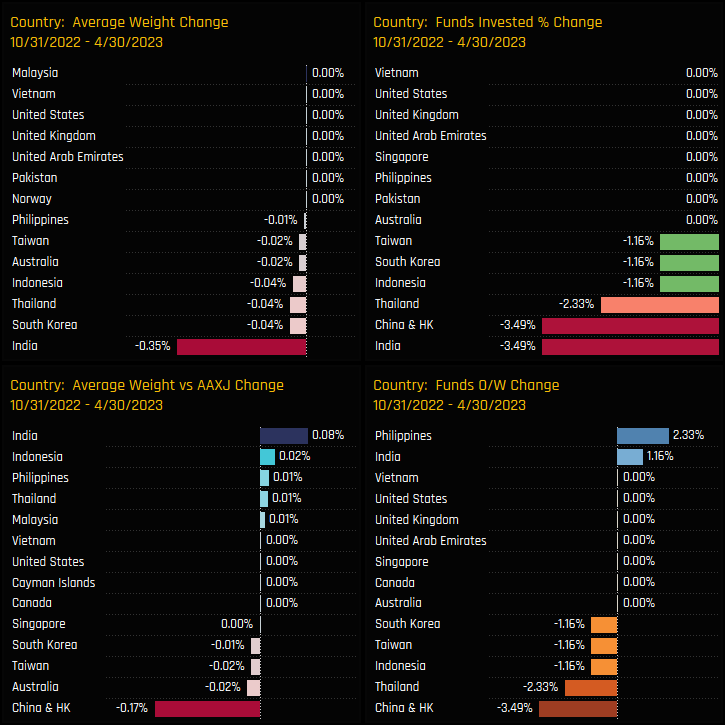

Country Holdings & Activity

Broken down by country, Energy is dominated by India and China & HK, who account for 79% of the total Energy allocation. Despite this, both countries are not widely held, with just 39.5% holding Indian Energy exposure and 23.3% China & HK Energy. As such, both countries represent net underweights compared to the iShares MSCI Asia Ex-Japan ETF, alongside the almost totally avoided Thailand.

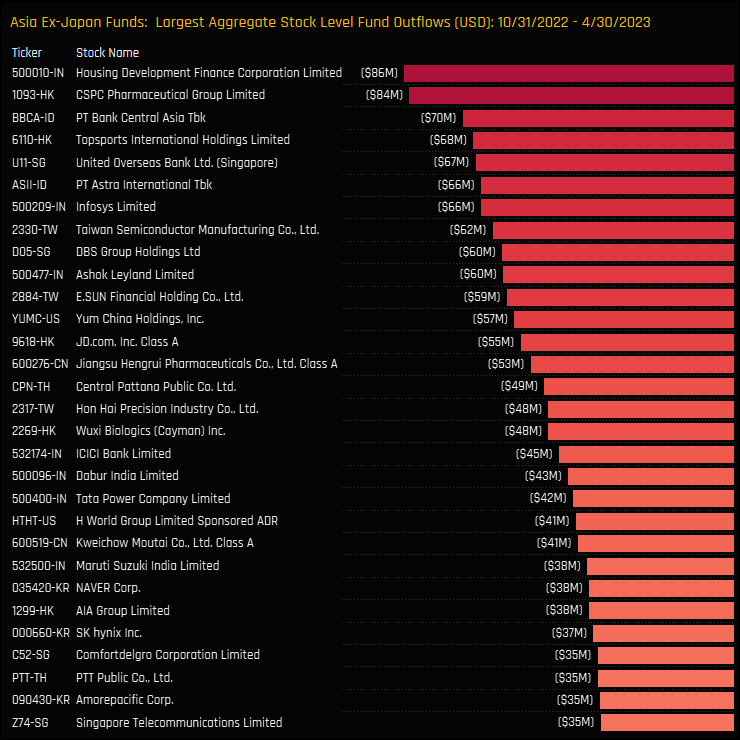

Country level changes over the last 6-months reflect the overall decline in Energy exposure, and are led by India’s -0.35% fall in average weight and -3.5% drop in funds invested. China & HK Energy faired little better, losing the same number of investors and with underweights increasing by a further -0.17%. In short, there were very few positives.

Stock Holdings & Activity

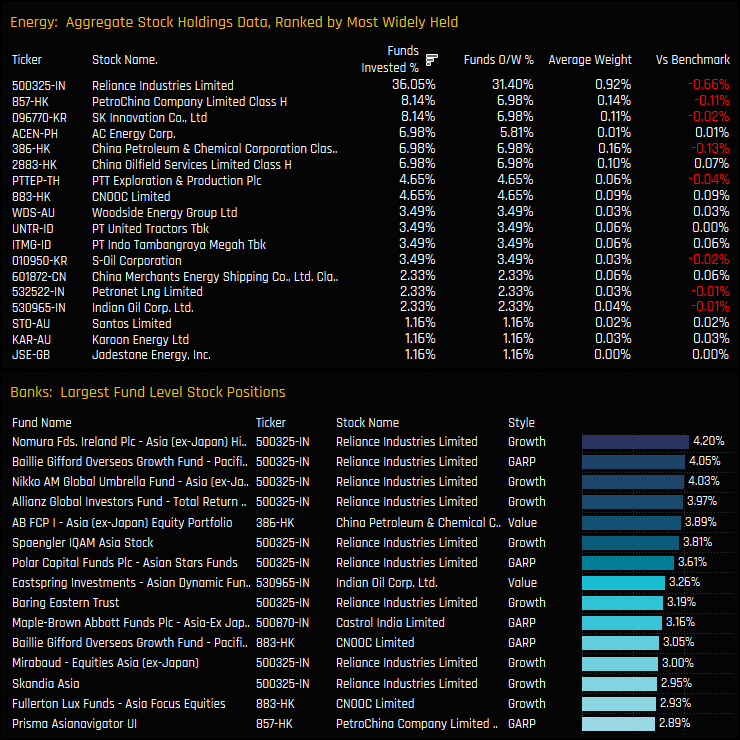

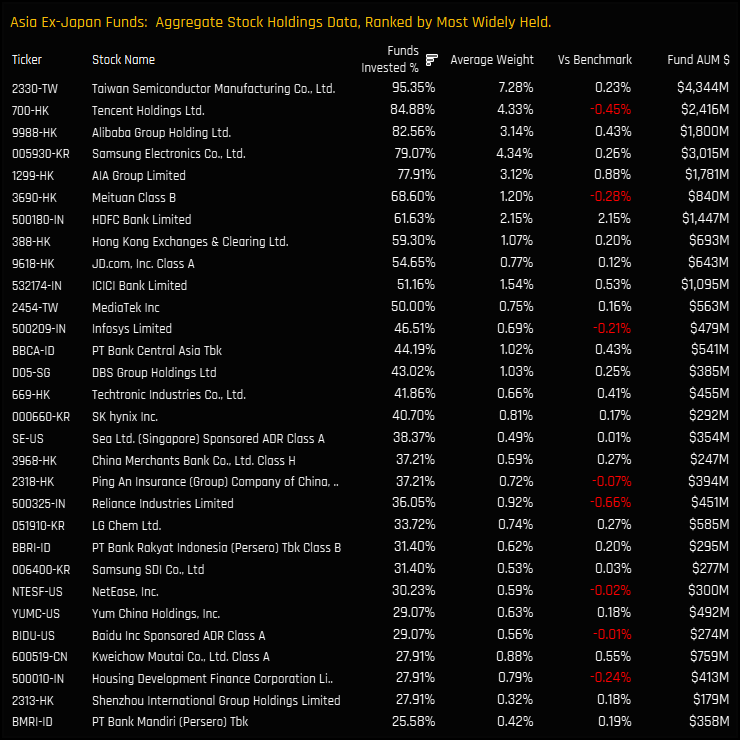

On a stock level, Reliance Industries is a hugely dominant exposure within the Energy sector. It is owned by 36% of funds at an average weight of 0.92% and accounts for almost all of the total Indian energy exposure. In contrast, China & HK Energy exposure is spread over a wider number of companies, with PetroChina Company, China Petroleum & Chemical and China Oilfield Services held by between 6%-8% of investors and at similar average weights.

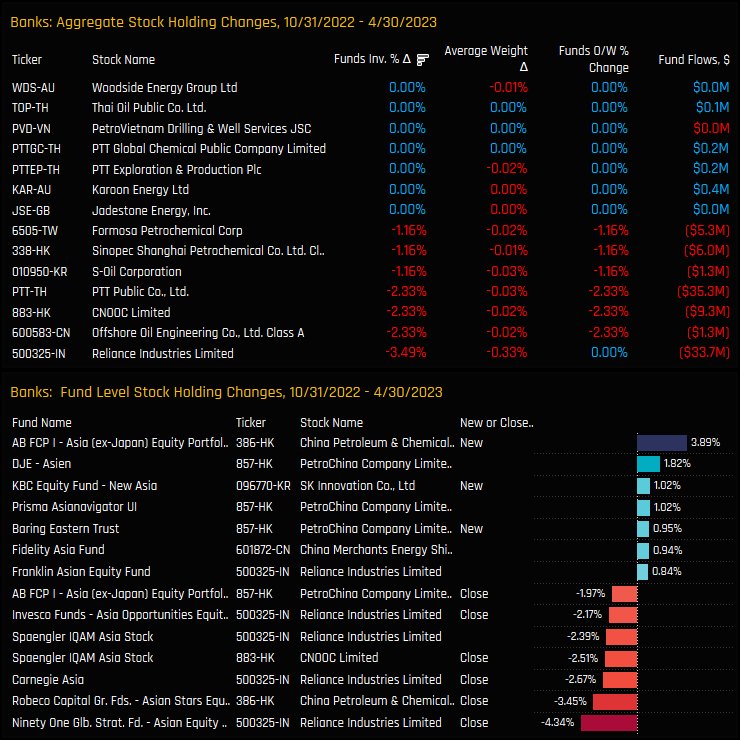

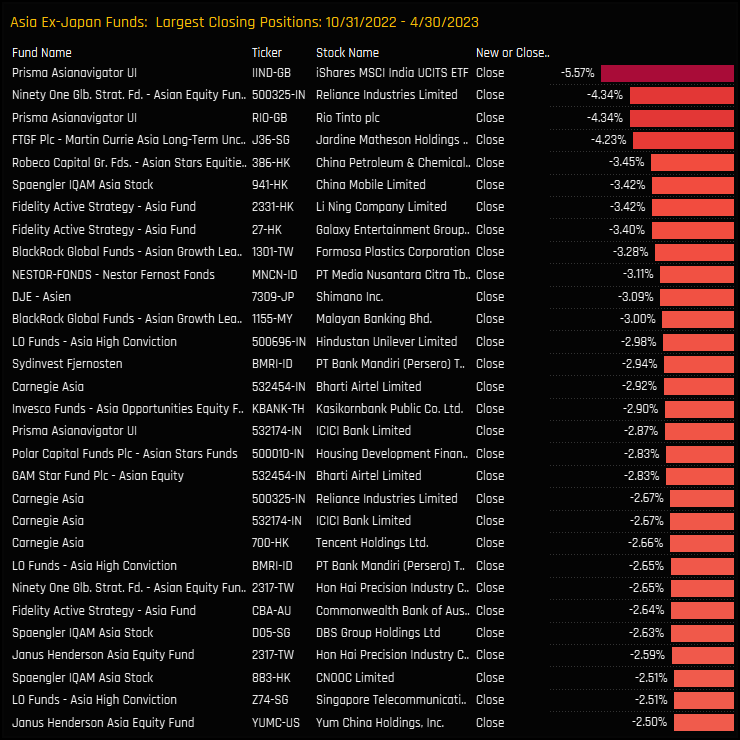

Stock ownership changes over the last 6-months were negative across the board. Reliance Industries lost investment from -3.5% of the funds in our analysis as average weights fell by -0.33%. Offshore Oil Engineering Co and CNOOC Limited saw the percentage of funds fall by -2.3%, with no stock seeing an increase over the period. On a fund level, the larger closures were in Reliance Industries and led by Ninety One Asian Equity (-4.34%) and Carnegie Asia (-2.67%).

Conclusions & Links

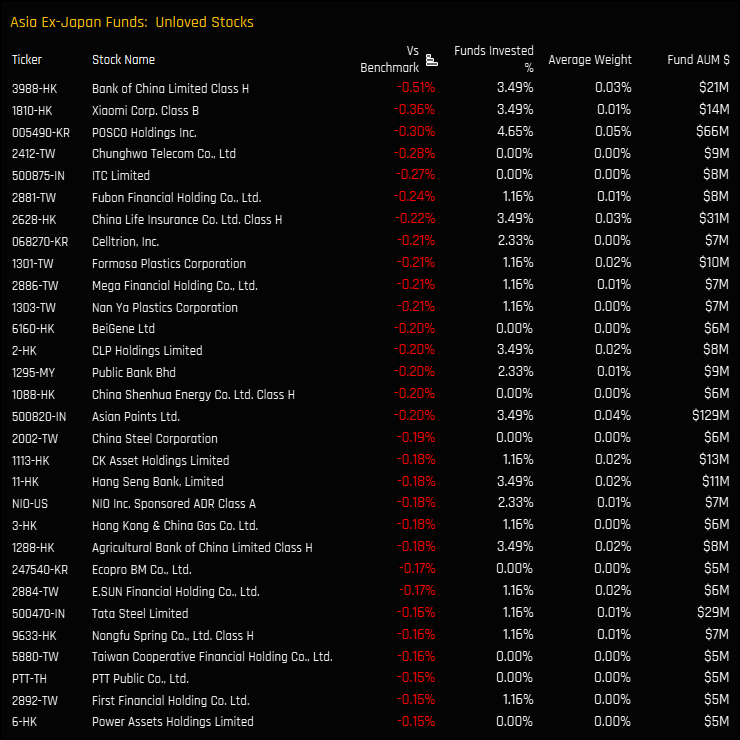

Active Asia Ex-Japan managers are reassessing their exposure to the Energy sector. After a brief respite from the long-term downward trend in ownership between 2021 – 2022, managers have once again started to reduce positions.

On a stock level, Reliance Industries is clearly the bellwether for the sector, accounting for almost half of the total Energy exposure among active funds. But recent activity has seen selected managers exit the stock, and it remains a key underweight for active managers in the region. Outside of Reliance Industries, there doesn’t appear to be a high degree of conviction among any of the other stocks in the sector.

The chart to the right shows Energy well down the pecking order of sector allocations among managers, with only Utilities a smaller allocation on average. Versus the iShares MSCI AAJX ETF, Energy is the largest sector underweight alongside Materials and Utilities, with managers overweight the Consumer sectors and Information Technology.

All of this combines to make Energy a low conviction holding among active Asia Ex-Japan managers. The funds in our analysis appear comfortable in being positioned underweight or with no exposure at all, and with an investible universe that is lacking appeal, there are few signs of this changing.

Click on the links below for a more detailed report on the Asia Ex-Japan Energy sector.

Time-Series & Stock Activity

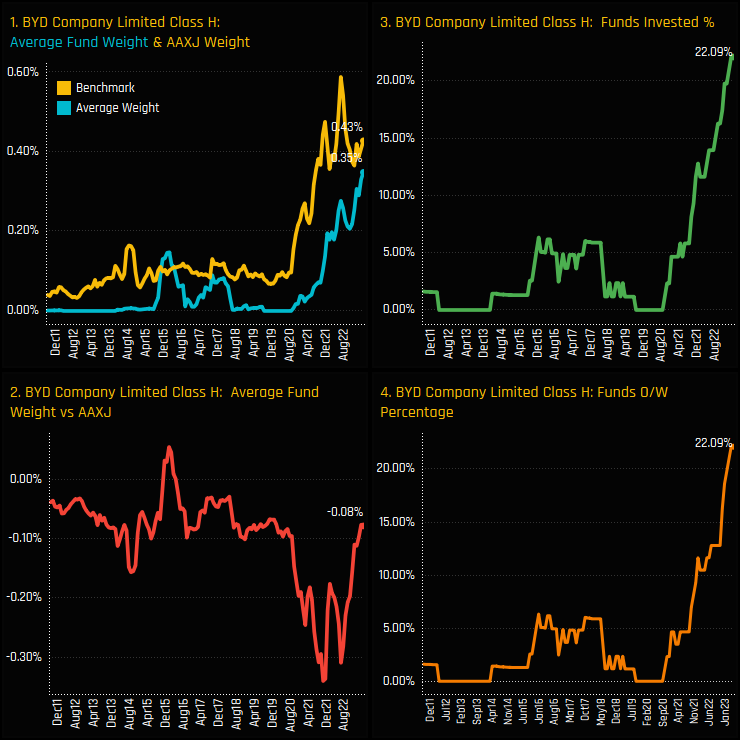

Ownership in BYD Company Limited H Shares has soared to record levels. A consistent ‘unloved’ stock among Asia Ex-Japan investors between 2010 and 2020, the percentage of funds invested has risen from zero at the end of 2020 to just over 22% today. This remarkable rise has resulted in the collapsing of a sizeable underweight position that ran from 2020 – 2022. Sentiment has never been stronger.

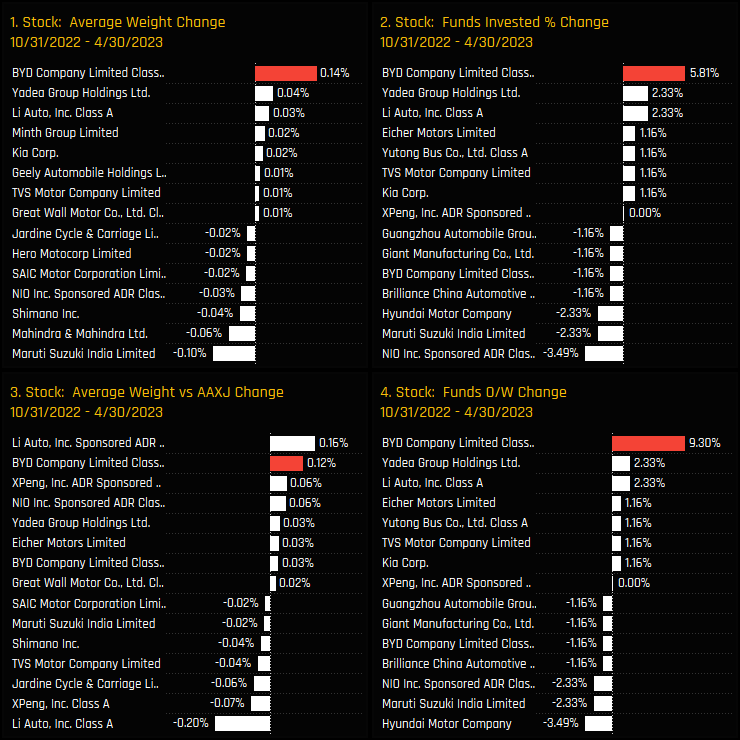

Over the last 6-months, BYD has maintained this positive momentum and has faired well versus Asia Ex-Japan peers in the Motor Vehicle industry group, as highlighted in the charts below. It captured the largest increase in average weight of +0.14% over the period, saw the percentage of funds invested rise by +5.8% and a further +9.3% of funds switch to overweight. This wasn’t part of an industry-wide move, with outflows seen in many of it’s competitors such as Nio Inc, Maruti Suzuki and Hyundai Motor Company.

Fund Activity & Positioning

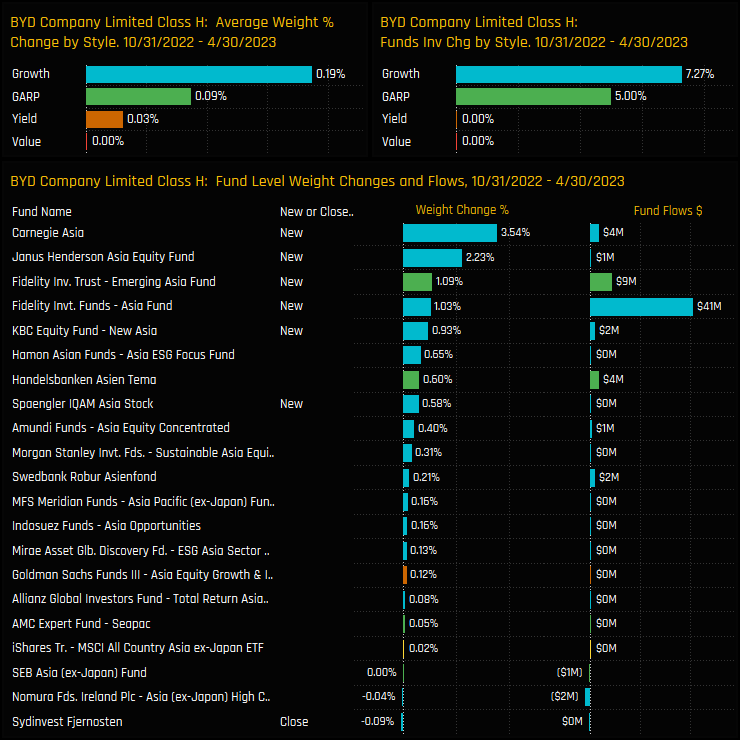

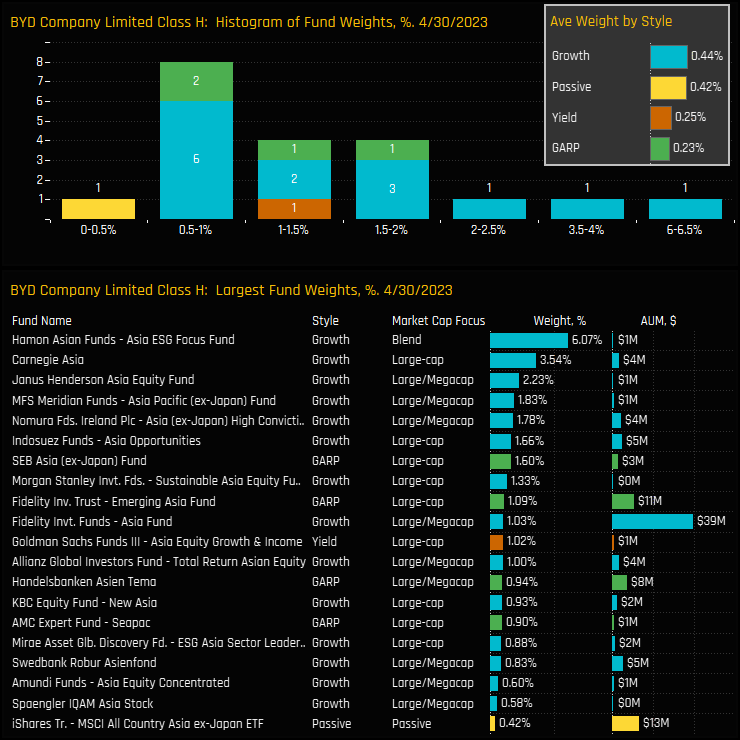

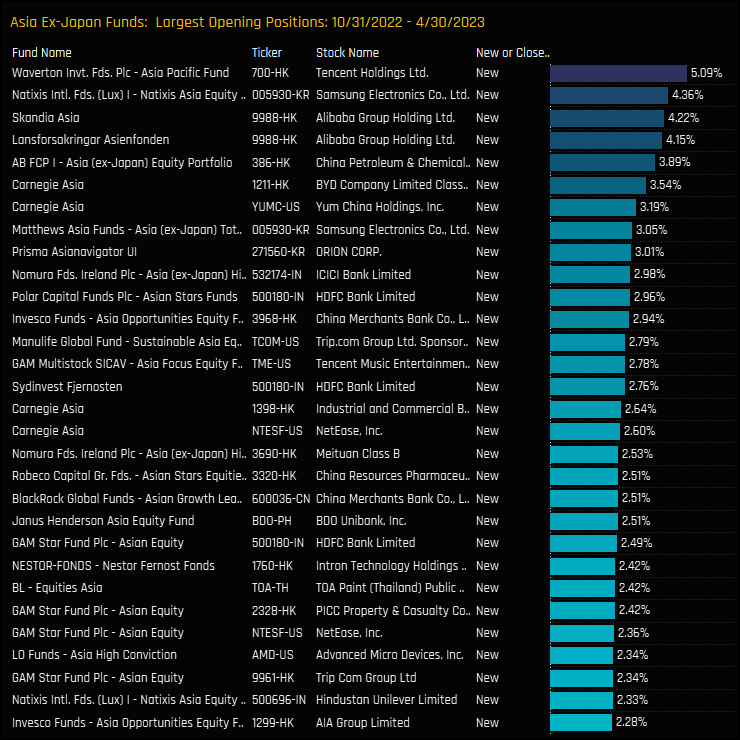

The below charts show the Style breakdown and fund level activity driving this rotation. On a Style basis, Growth and GARP funds were responsible for much of the move higher. On a fund level, between 10/31/2022 and 04/30/2023 a further 6 funds opened new positions in BYD, led by Carnegie Asia (+3.54%) and Janus Henderson Asia Equity (+2.23%).

The histogram of fund weights in BYD is shown in the top chart below, and highlights the majority of holders at between the 0.5% and 2% level. Only 3 funds are above 2% as shown in the bottom chart. BYD is therefore not a particularly large holding in the majority of portfolios, but all current holders are positioned ahead of the benchmark weight of 0.42%.

Conclusions & Links

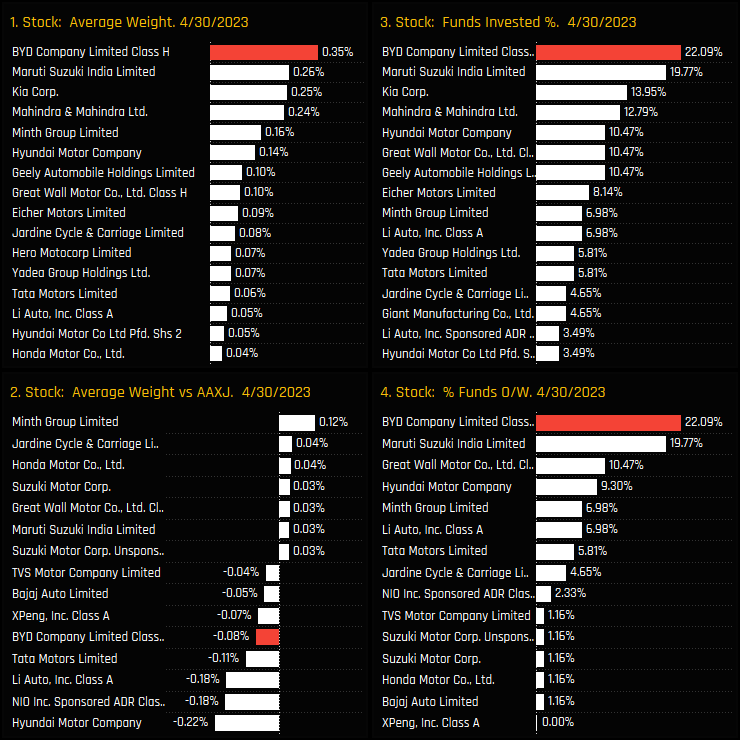

The chart to the right shows the latest ownership statistics for stocks in the Motor Vehicles industry group. BYD has risen up the ranks to become the most widely held and largest weight in the sector, surpassing Maruti Suzuki and Kia Corp over the last 2-years.

Clearly, Asia Ex-Japan investors are growing in confidence that BYD can maintain its leading position in the electric vehicle market, and further capitalize on the growing global trend towards sustainable transportation.

Click on the link below for an extended data report on BYD Company Limited Class H positioning among active Asia Ex-Japan funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- March 13, 2025

Xi’s Champions: A Closer Look at Fund Positioning

Global, GEM, Asia Ex-Japan, China Active Equity Xi’s Champions: A Closer Look at Fund Pos ..

- Steve Holden

- January 15, 2024

Asia Ex-Japan Active Fund Performance & Attribution Review, 2023

100 Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Active Fund Performance & Attribution Revi ..

- Steve Holden

- April 28, 2023

Asia Ex-Japan Fund Positioning Analysis, April 2023

89 Active Asia Ex-Japan Funds, AUM $55bn Asia Ex-Japan Fund Positioning Analysis, April 2023 In ..