Saudi Arabia Special Report: A Tipping Point in EM Equity Allocations

- Steve Holden

- 0 Comments

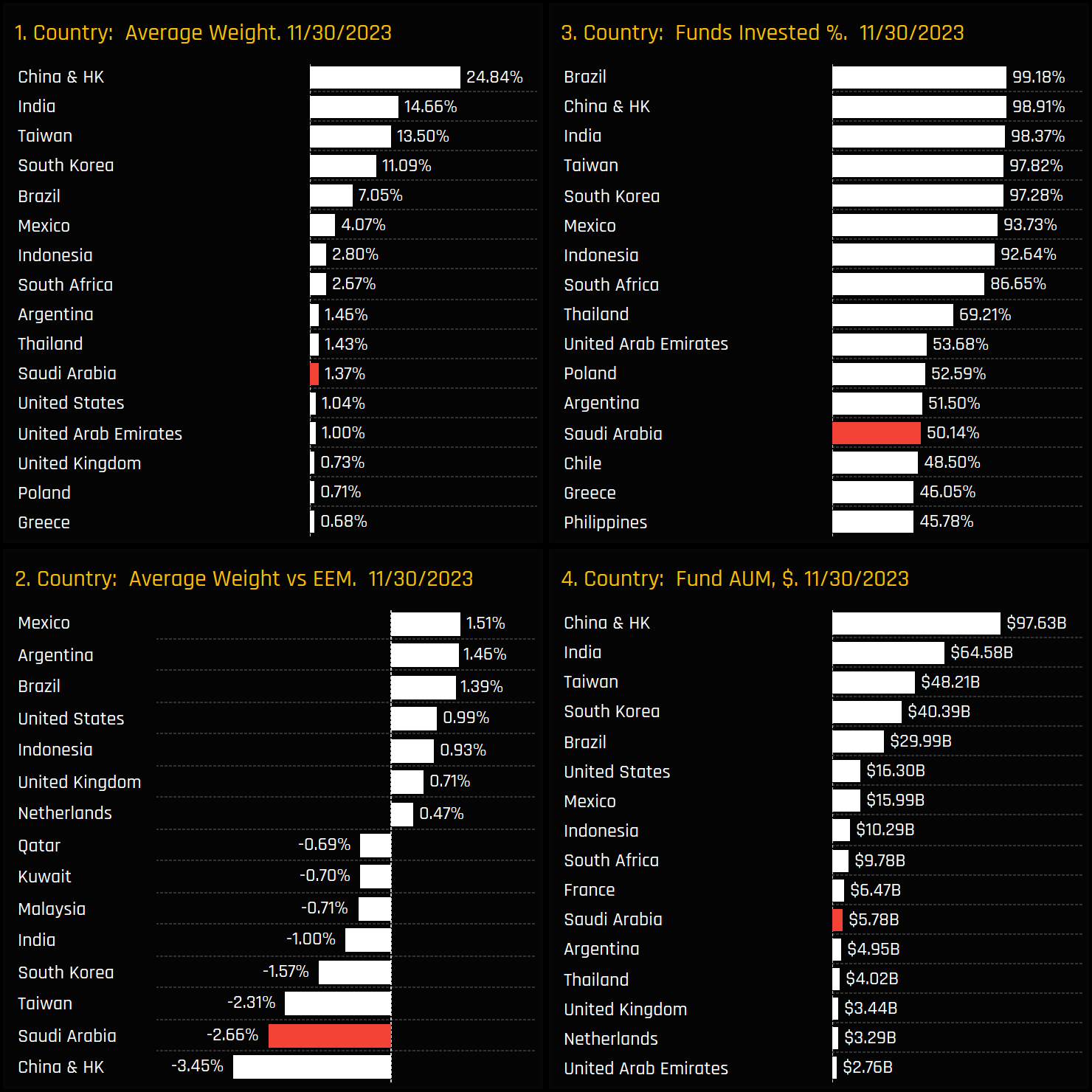

367 emerging market Funds, AUM $396bn

Saudi Arabia Special Report: A Tipping Point in EM Equity Allocations

2023 marks a pivotal year with EM investors significantly increasing holdings in the Saudi market.

Major EM investors from GQG Partners to Capital Funds record notable fund inflows into Saudi for the first time.

Despite growing interest, the Saudi market still presents ample room for broader investor engagement.

Saudi Arabia remains comparatively 'under-owned' in relation to its Asian and LATAM peers.

Saudi Fund Ownership Trends

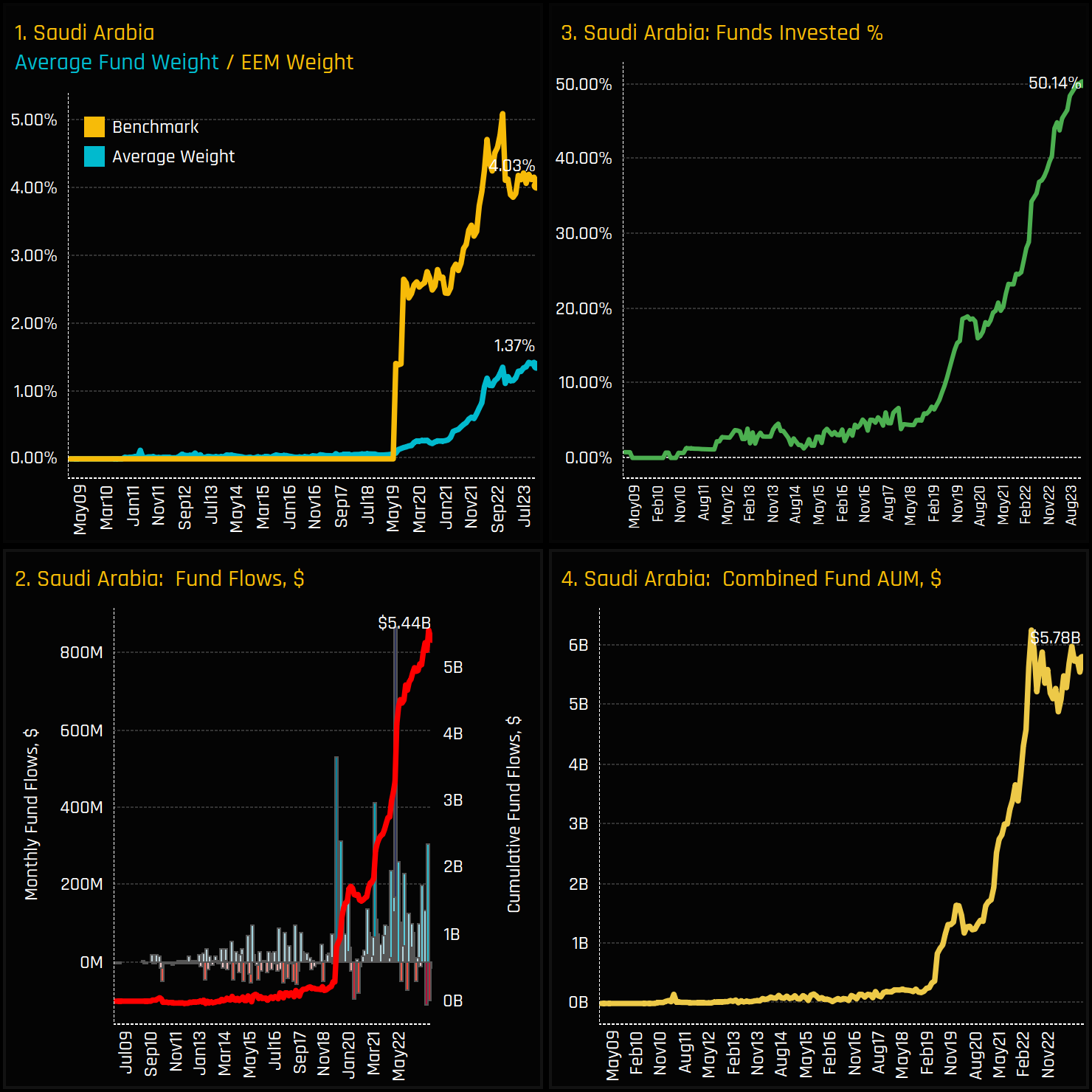

The percentage of active EM funds investing in Saudi stocks has surpassed 50% for the first time in our fund holdings history. Chart 3 below shows this remarkable rise in ownership, with the percentage of funds invested in Saudi Arabia doubling over the past 2-years, supported by consistent fund inflows as shown in chart 2. In the 55 months post-MSCI EM entry, 43 months have seen net inflows, totaling $5.15 billion. Average fund weights of 1.37% are close to their highest on record, with total Saudi assets of $5.8bn at the top of the decade-long range.

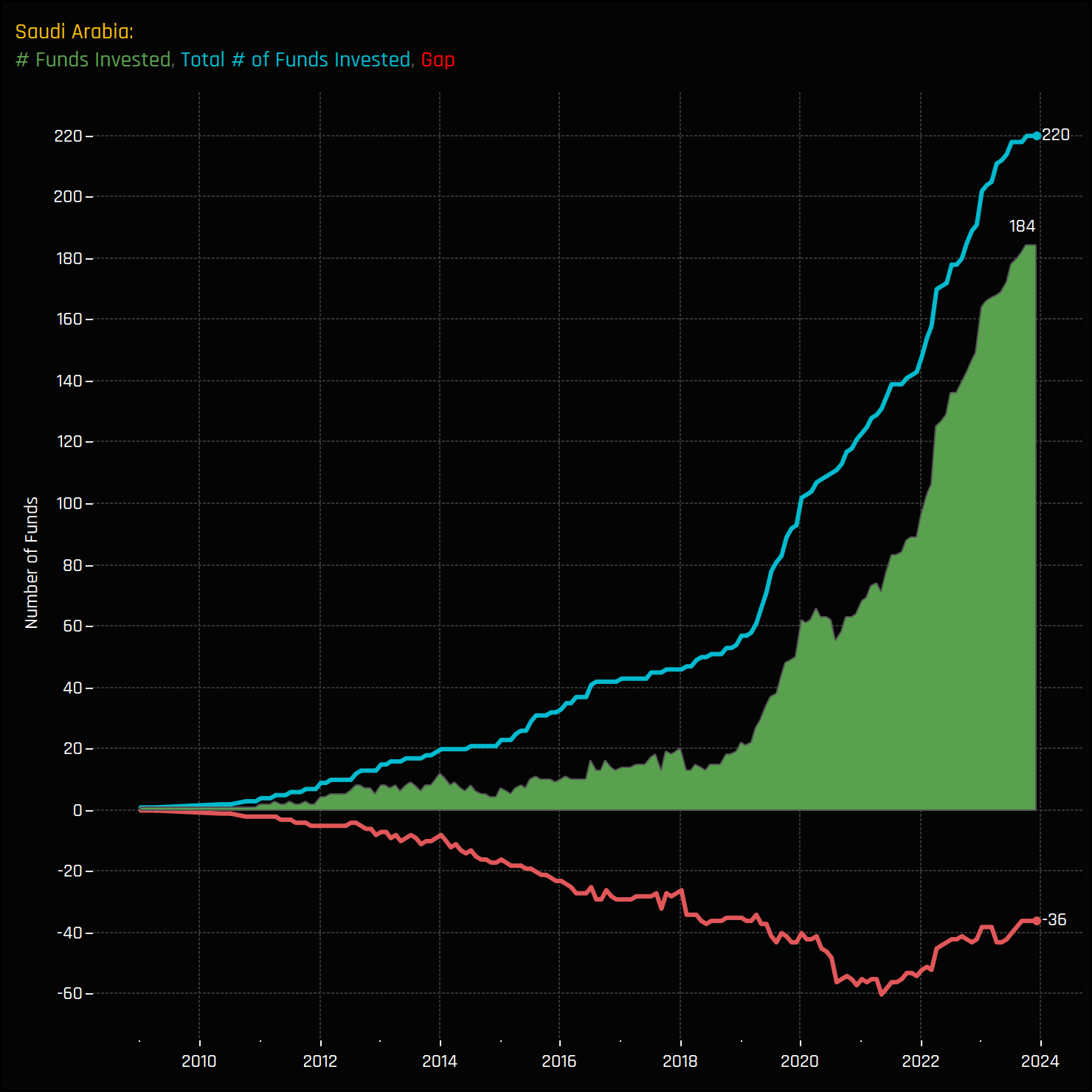

Though more than half of the 367 active EM strategies own Saudi today, a greater percentage have some history of ownership. The chart below shows the number of funds currently invested (green – 184) and the total who have ever invested (blue – 220). The difference is shown by the red line, with 36 funds previously invested who no longer hold a position. The point is, there are still 147 funds who have never invested in Saudi Arabia at all, accounting for $127bn in total fund AUM, so the potential for further ownership growth in clearly there.

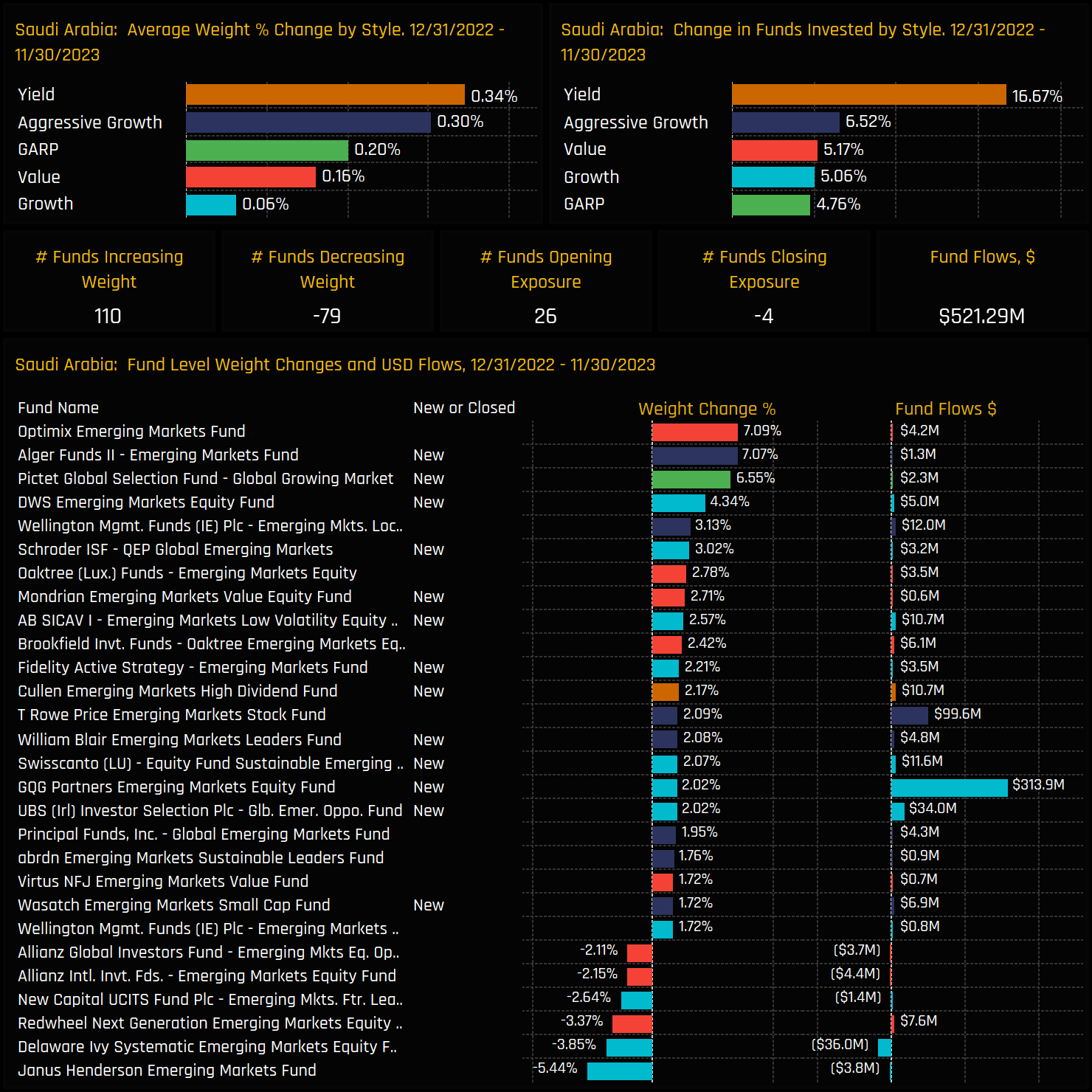

2023 Fund Activity

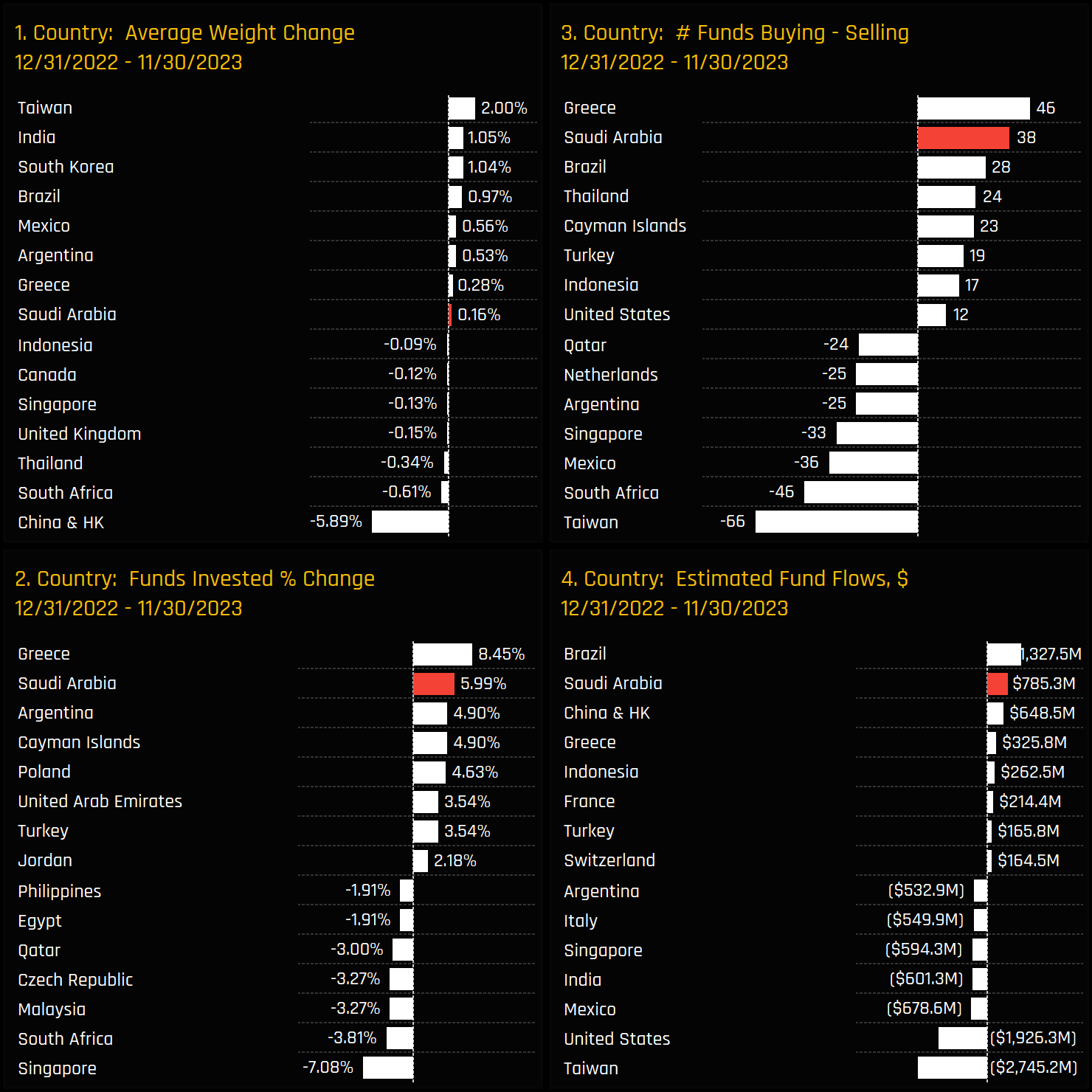

In 2023, Saudi Arabia really gained traction among EM active investors, as seen in the charts below. It achieved the second-highest fund inflows of $785m after Brazil (ch4), and a significant increase in the percentage of funds invested of +5.9%, just behind Greece (ch2). These metrics reflect a targeted and active reallocation towards Saudi assets over the year

Positioning Versus the Benchmark

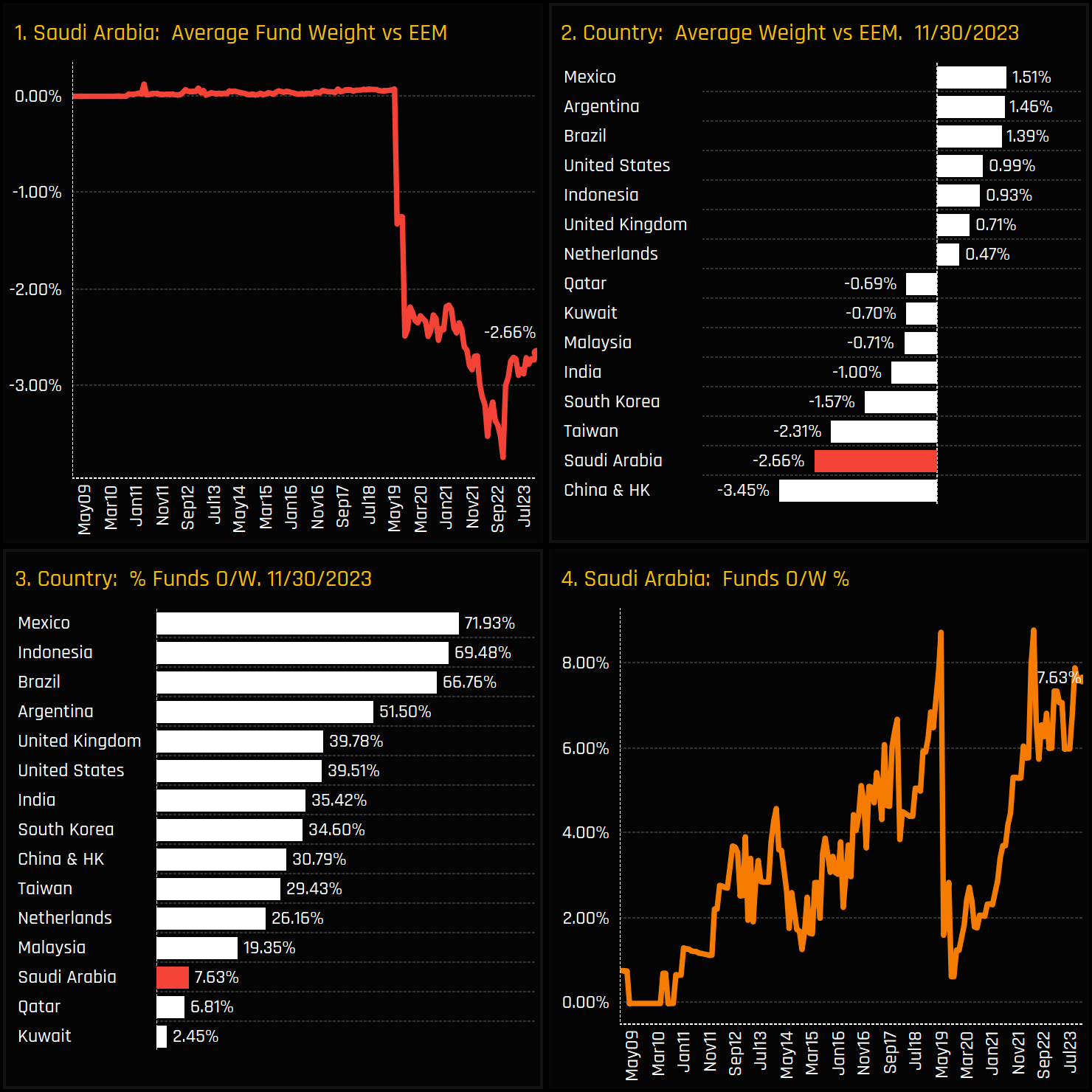

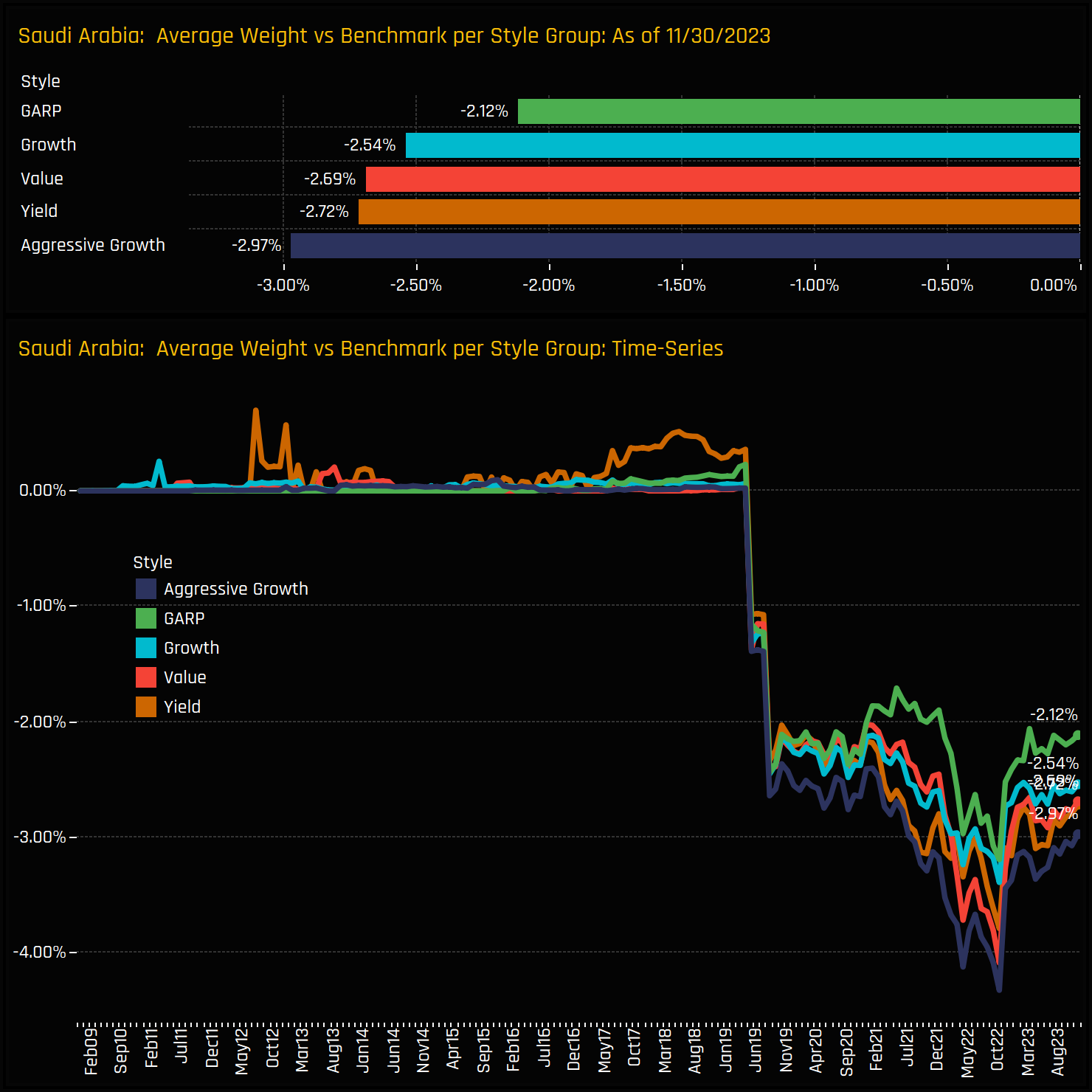

Active EM managers are increasing their exposure to Saudi Arabia, but they remain behind the MSCI Emerging Markets benchmark, on average. EM funds are underweight Saudi Arabia by -2.66% (Ch1), the second-largest country underweight after China & HK (Ch2). Although half of the managers in our analysis have Saudi exposure, only 7.6% exceed the 4.03% holding weight in the iShares MSCI Emerging Markets ETF (Ch3).

Examining the data by fund Style, the differences between various Style groups are minimal. All groups average an underweight position, ranging from GARP funds at a -2.12% underweight to Aggressive Growth funds at a -2.97% underweight.

Sector Holdings & Activity

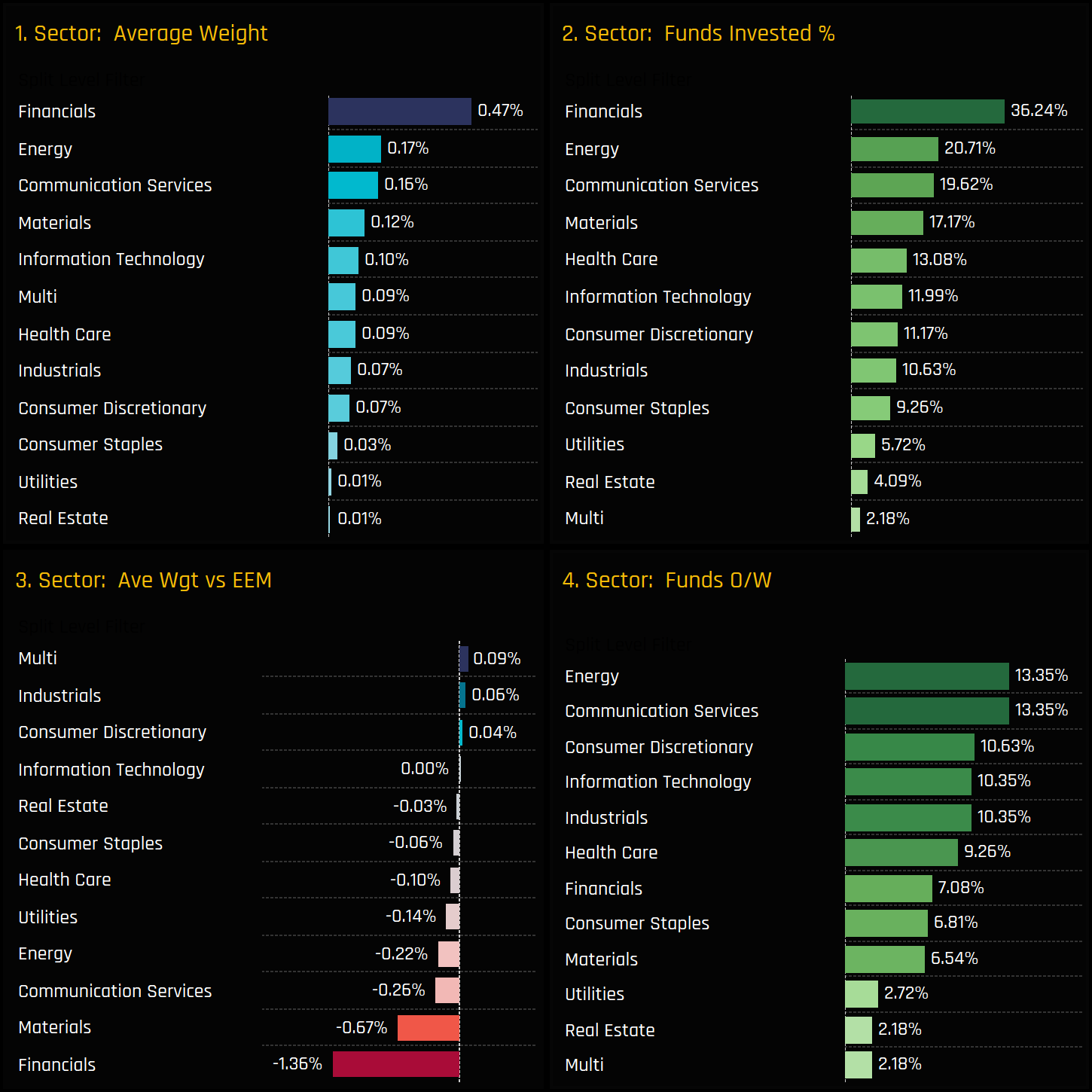

The charts below detail the sector exposures within the Saudi market. Financials lead, held by 36.2% of funds at an average weight of 0.47%, yet this is -1.36% underweight compared to the MSCI EM benchmark. Energy, Communication Services, and Materials are the only sectors owned by over 15% of funds, with Materials being a significant underweight exposure.

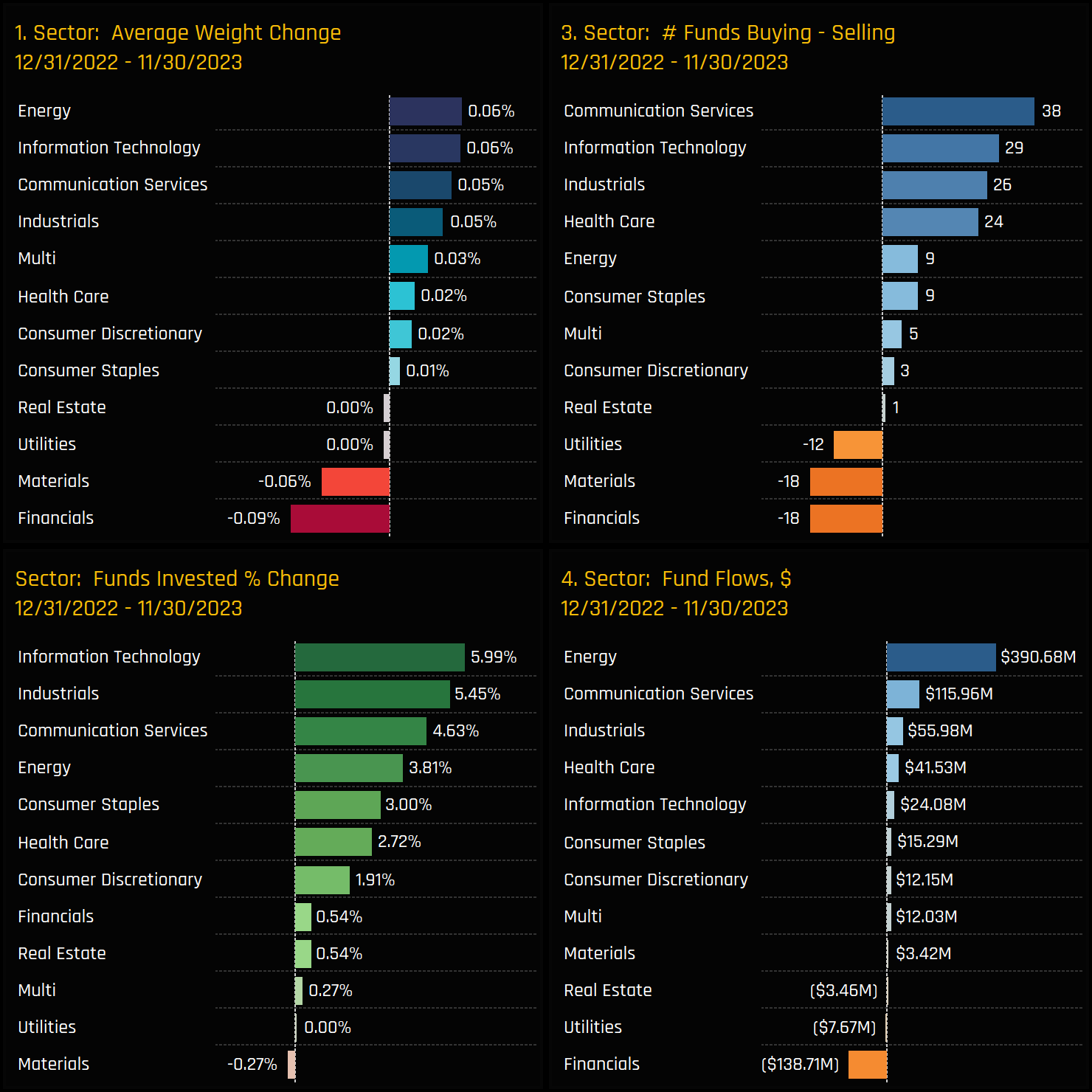

Sector activity over the course of 2023 does highlight a degree of rotation. EM funds increased exposure to Communication Services, Information Technology and Industrials, whilst scaling back their Financials and Materials holdings. In terms of fund flows, Energy dominated, with +$390m of net fund inflows on the year, followed by Communication Services (+$115m) and Industrials (+$56m).

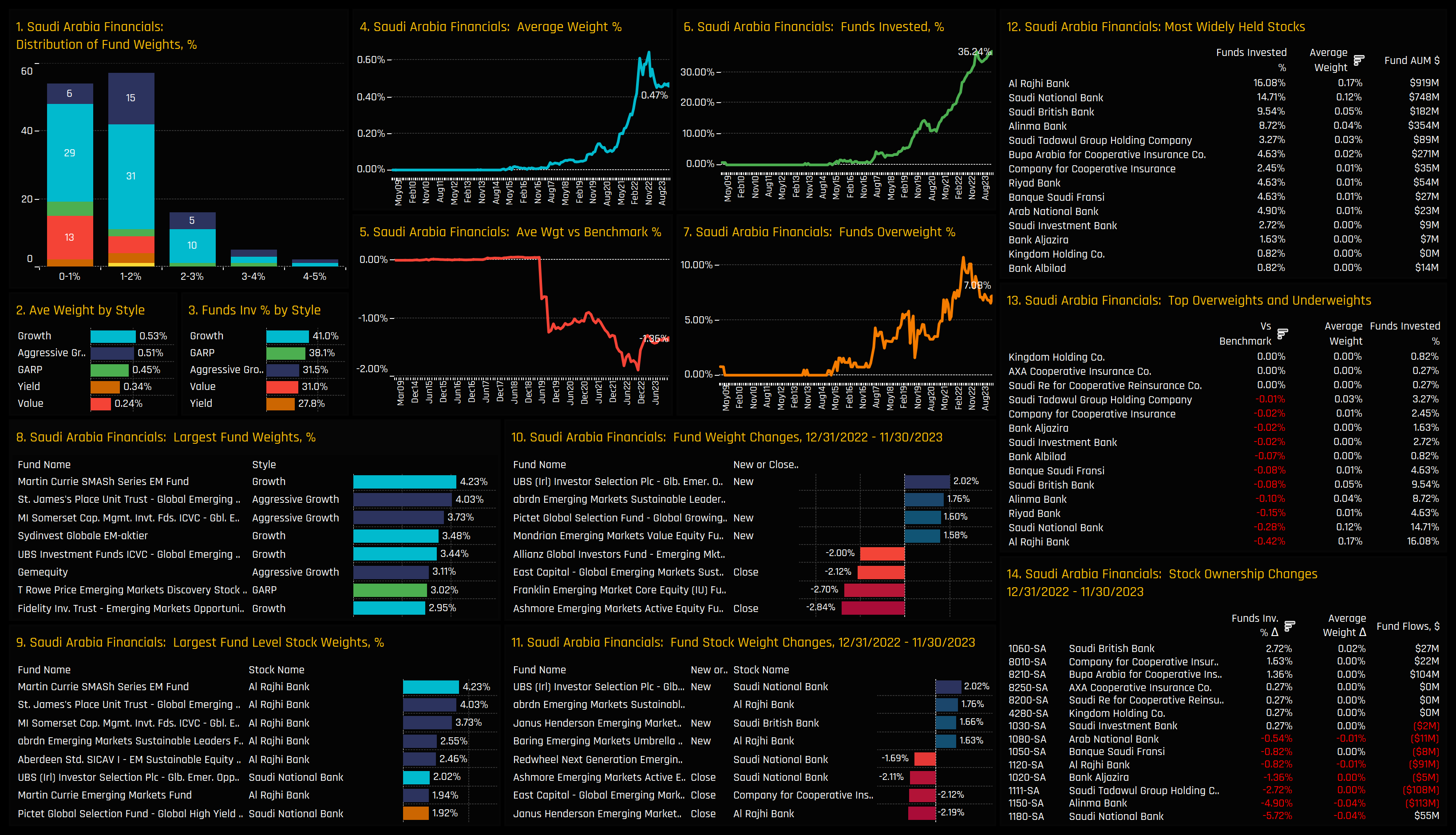

Sector Focus: Saudi Financials

The chart dashboard below provides the latest holding metrics for the Saudi Financials sector. Charts 1-3 show that most funds have less than a 2% stake in the sector, with Growth funds demonstrating a stronger preference over Value. The leading holders have stakes above 4% (Ch8), predominantly in Al Rajhi Bank (Ch9), which is the sector’s most commonly held bank (Ch12), owned by 16.1% of funds at an average weight of 0.17%. While ownership levels are near record highs, there has been a stagnation throughout the year, as evidenced by decreasing average weights and a lower percentage of funds overweight (Charts 4 & 7). Stock ownership changes lean towards selling, with -5.7% of funds closing positions in Saudi National Bank and -4.9% in Alinma Bank, although Saudi British Bank saw a +2.7% increase in fund ownership. The PDF attachment at the end of the report contains profiles for all major sectors.

Stock Ownership

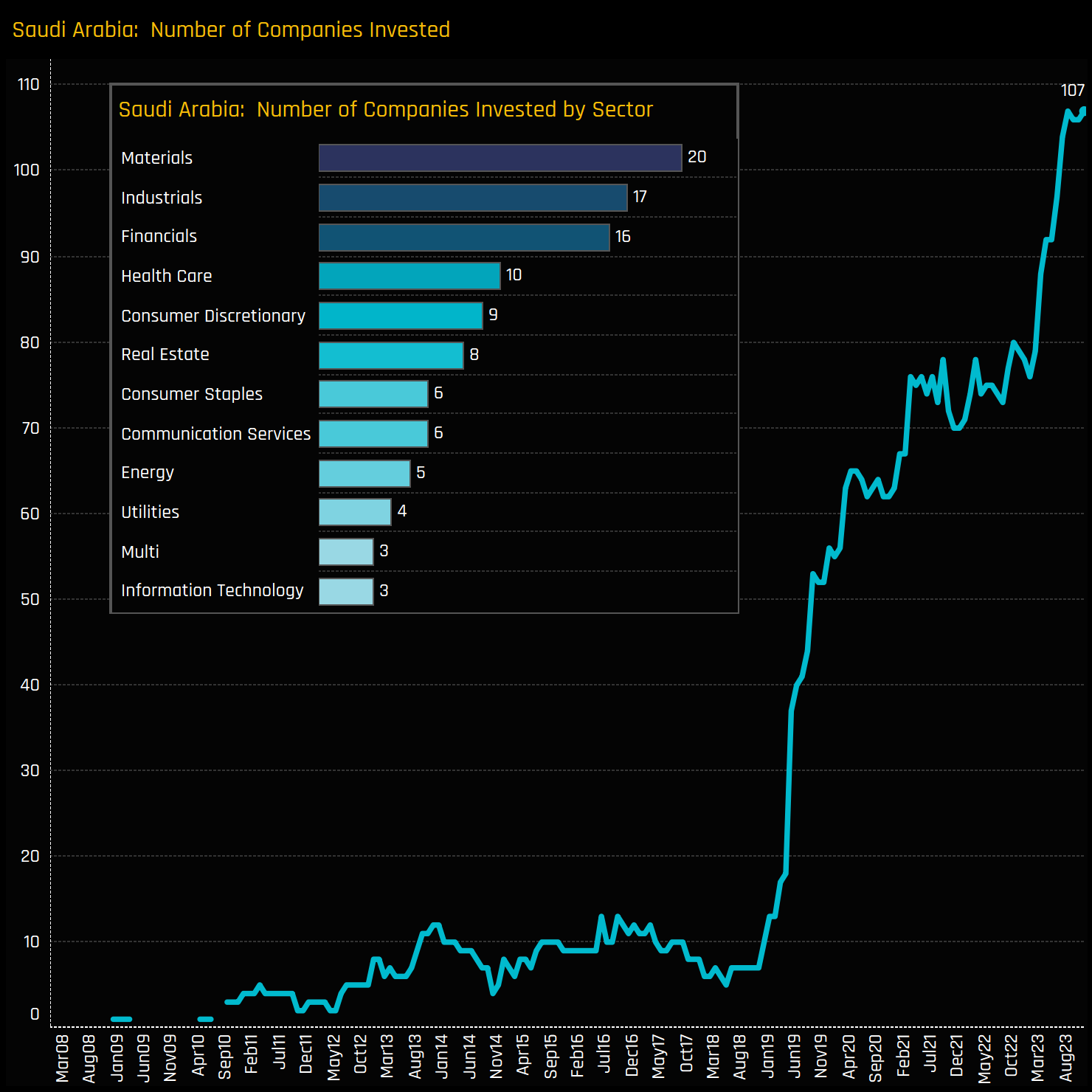

Alongside the rise in overall Saudi investment, there has been an expansion in the breadth of stock holdings. A record 107 companies have now found investment from the 367 EM funds in our analysis, indicating a willingness by investors to explore beyond the major index constituents. By comparison, the iShares MSCI Emerging Market ETF includes only 42 companies.

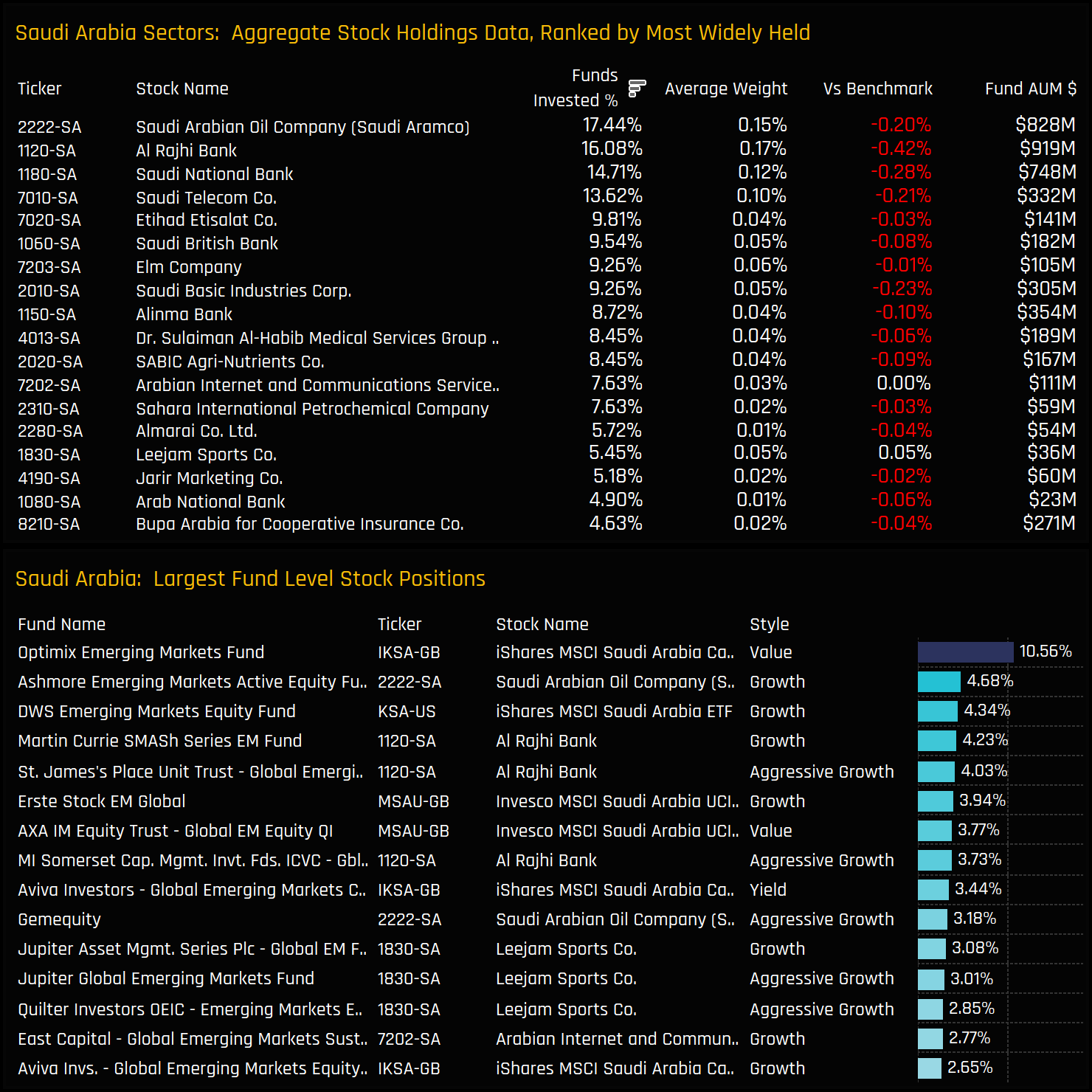

While the trend shows a diversification in holdings, the most favored investments are still in the major index constituents. Saudi Aramco has recently surpassed Al Rajhi Bank as the most commonly held stock, owned by 17.4% of funds at an average weight of 0.15%. However, overall ownership is relatively modest, with most companies held by less than 10% of funds and at weights below the benchmark. On an individual fund level, as shown in the bottom chart, decent sized positions are seen in Al Rajhi Bank and Leejam Sports, but index-based investments are more prevalent. This may reflect a desire for Saudi exposure but without the specific licenses to trade.

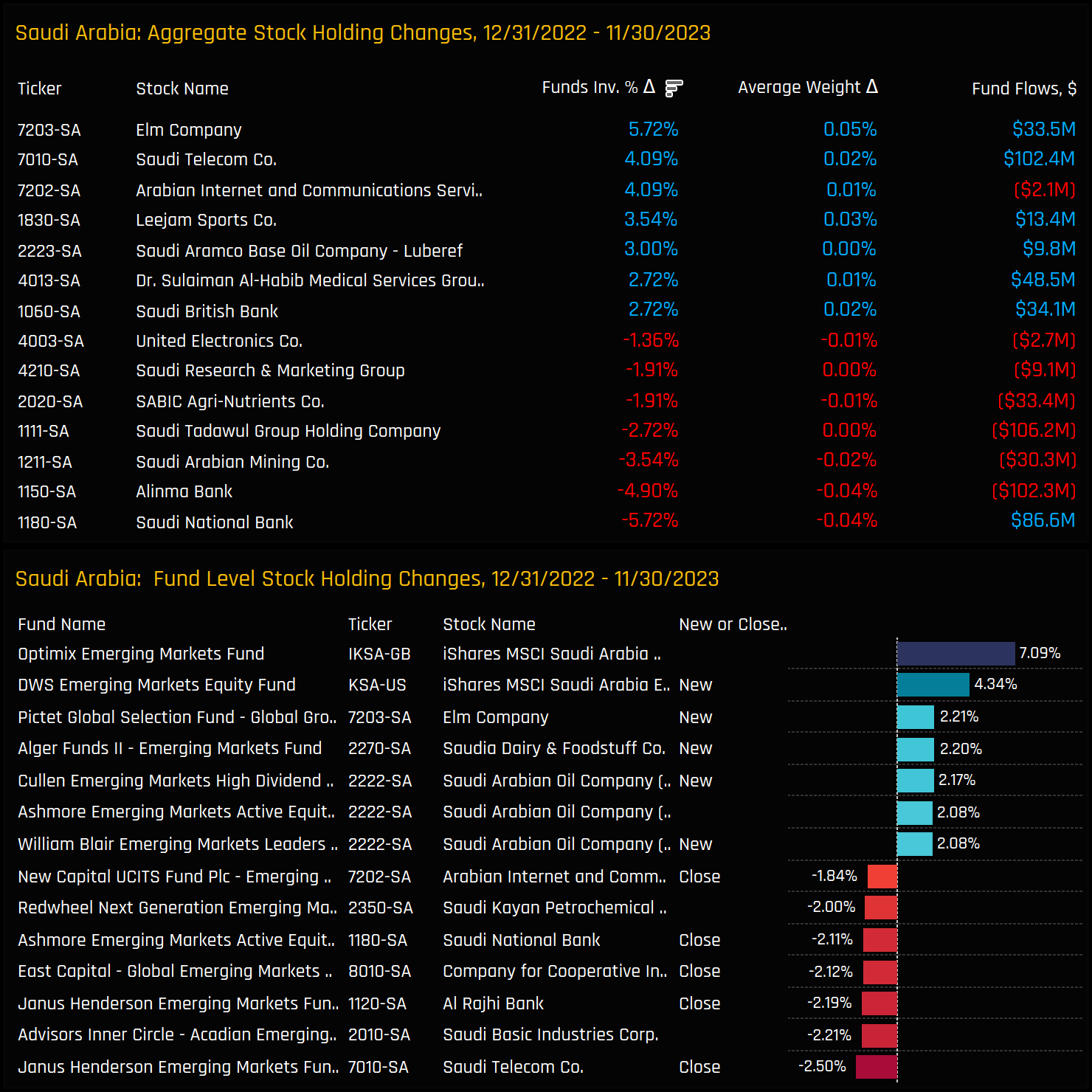

Stock Rotation

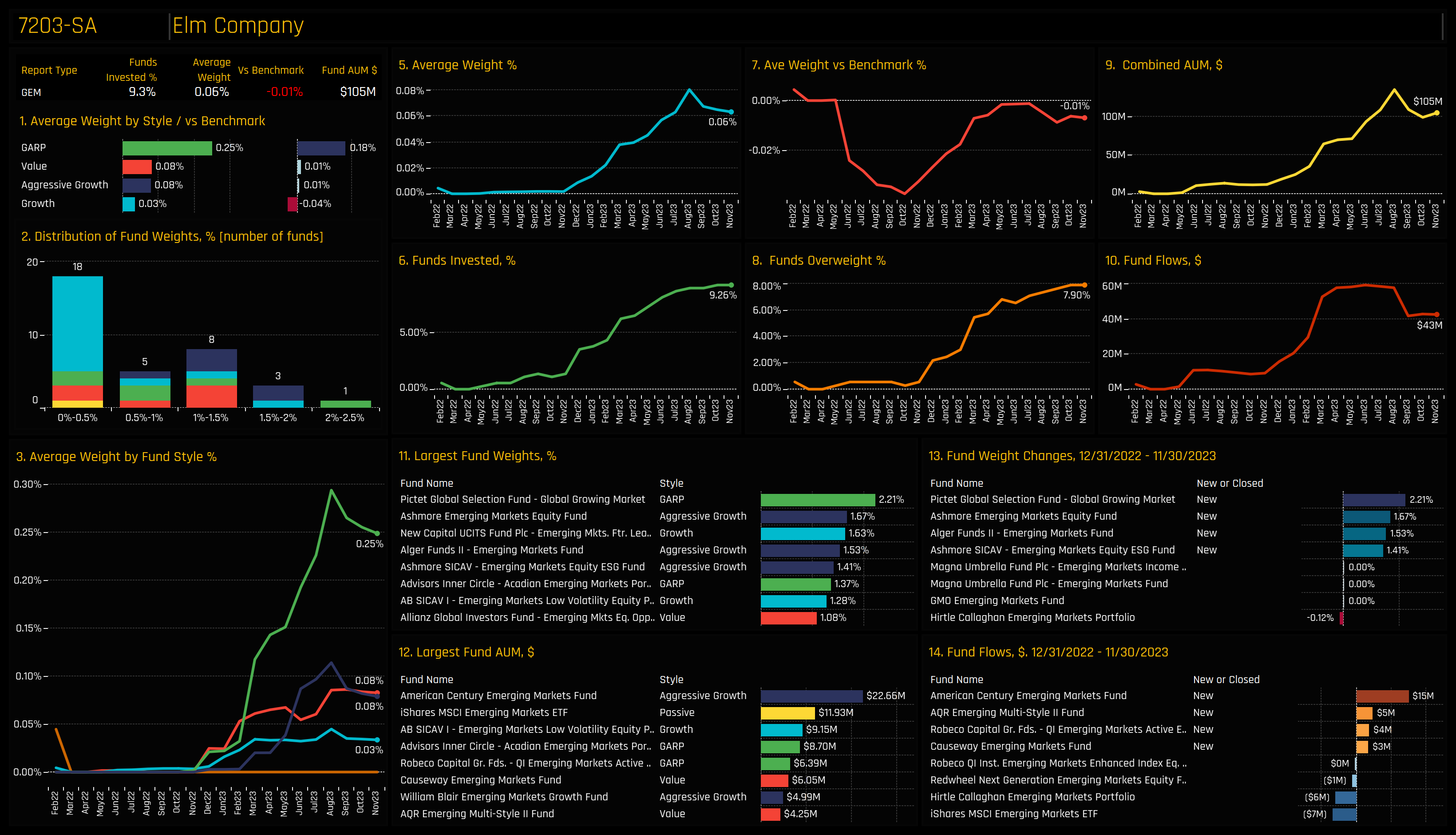

Stock activity throughout 2023 leaned towards the buy-side, though selling was also present. Elm Company saw the most significant growth in fund ownership, with the proportion of funds holding Elm rising by +5.72%, from 3.54% to 9.26%. Other substantial increases occurred in Saudi Telecom, Arabian Internet & Communication Services, and Leejam Sports. Against this, Saudi National Bank, Alinma Bank, and Saudi Arabian Mining Co. experienced declines in overall investment levels.

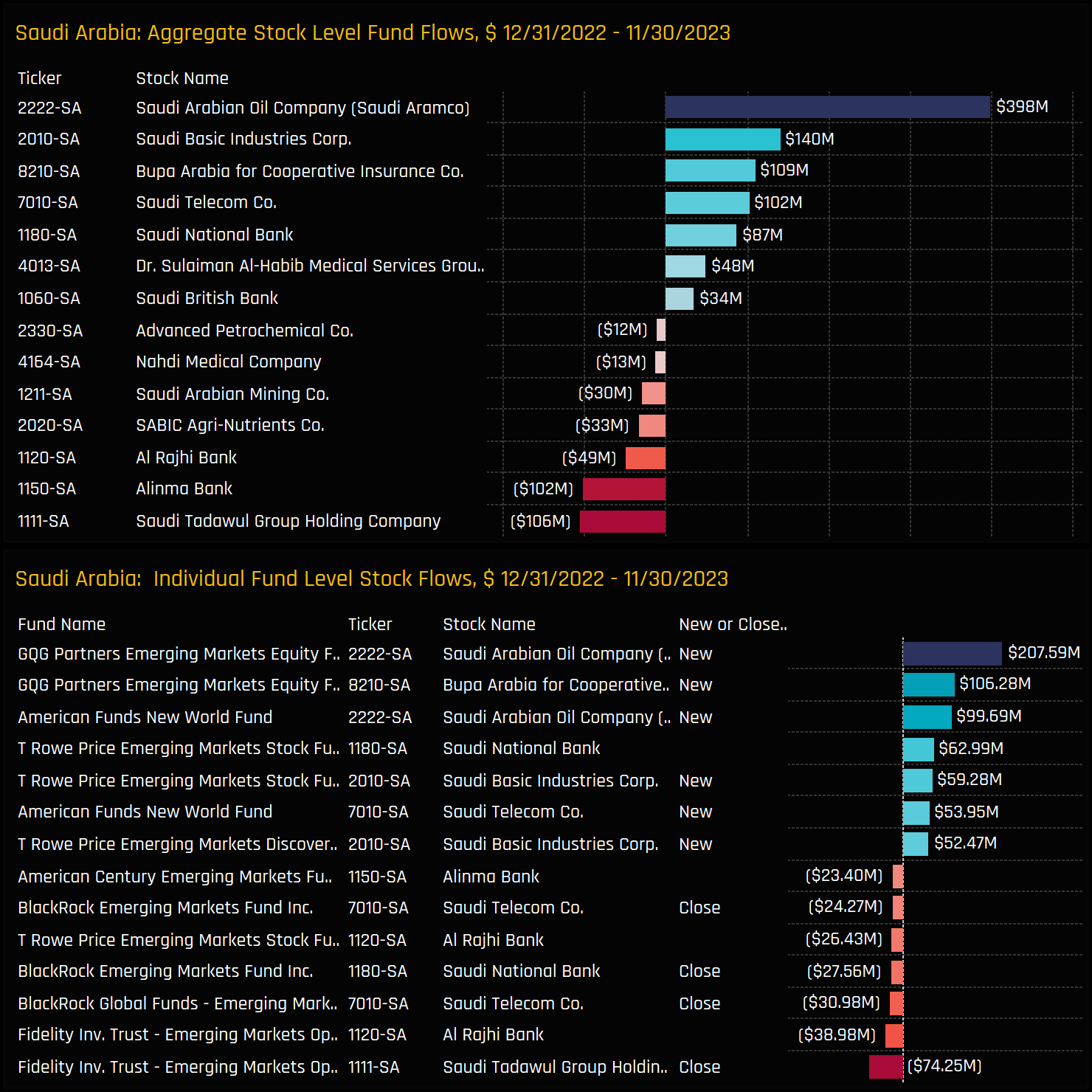

Focusing on estimated fund flows, the picture looks a little different. Saudi Aramco attracted the highest inflows, totaling $338m, primarily due to new investments from GQG Partners EM Equity and American Funds New World Fund. These funds entered the Saudi market for the first time this year, with GQG also initiating positions in Bupa Arabia, and American Funds in Saudi Telecom. On the outflow side, Fidelity and BlackRock led selling in Saudi Tadawul, Al Rajhi Bank, and Saudi Telecom.

Stock Profile: Elm Company

Elm Company is gaining traction with active EM investors. While held by just 9.26% of funds, 2023 marked the entry of prominent investors like Pictet, Ashmore, American Century, and Robeco into the company, among others. Investment sizes at the fund level are generally modest, with Pictet’s Global Growing Market holding the largest stake at 2.21%, and most others allocating less than 0.5% of their portfolios. Elm Company’s status as one of the PIF National Champions in the Technology sector highlights its role in offering diversification beyond the conventional Energy and Financials sectors. This distinct appeal has attracted selected EM managers this year, positioning Elm as a potentially favorable choice for the numerous funds still considering entry into the Saudi market. The PDF attachment at the end of this report provides profiles for all the major stocks in the Saudi market.

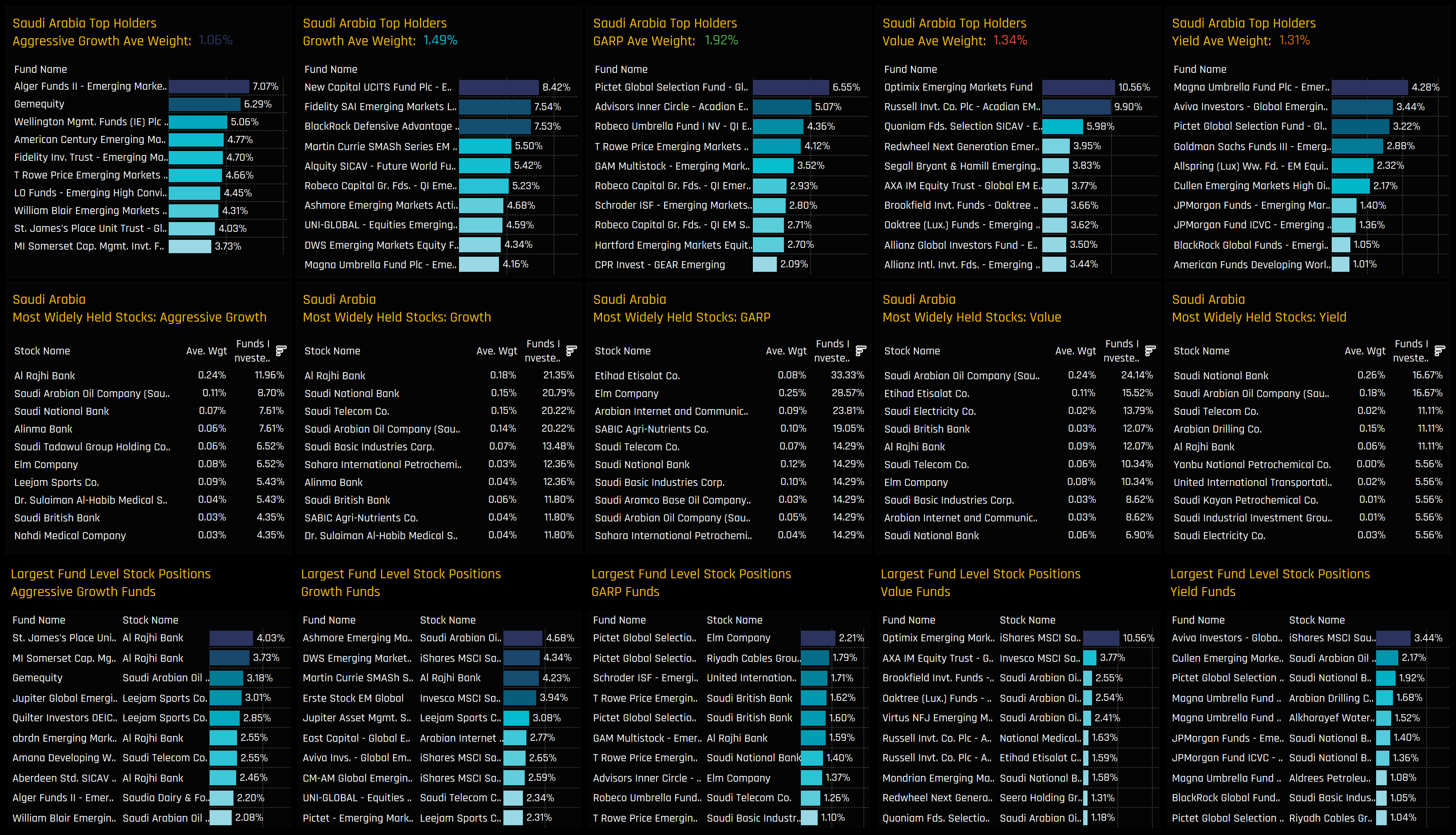

Stock Holdings by Style

Analyzing company holdings by fund Style uncovers notable differences in strategy. Saudi Aramco emerges as a common choice across all styles, while Value and GARP investors favor holdings in Etihad Etisalat Co and Saudi Telecom. In contrast, Aggressive Growth and Growth strategies favour Al Rajhi Bank and Saudi National Bank. Elm Company appears to offer something for funds at the extreme ends of the style spectrum, being a top 10 holding for both Value and Aggressive Growth funds.

Latest Positioning

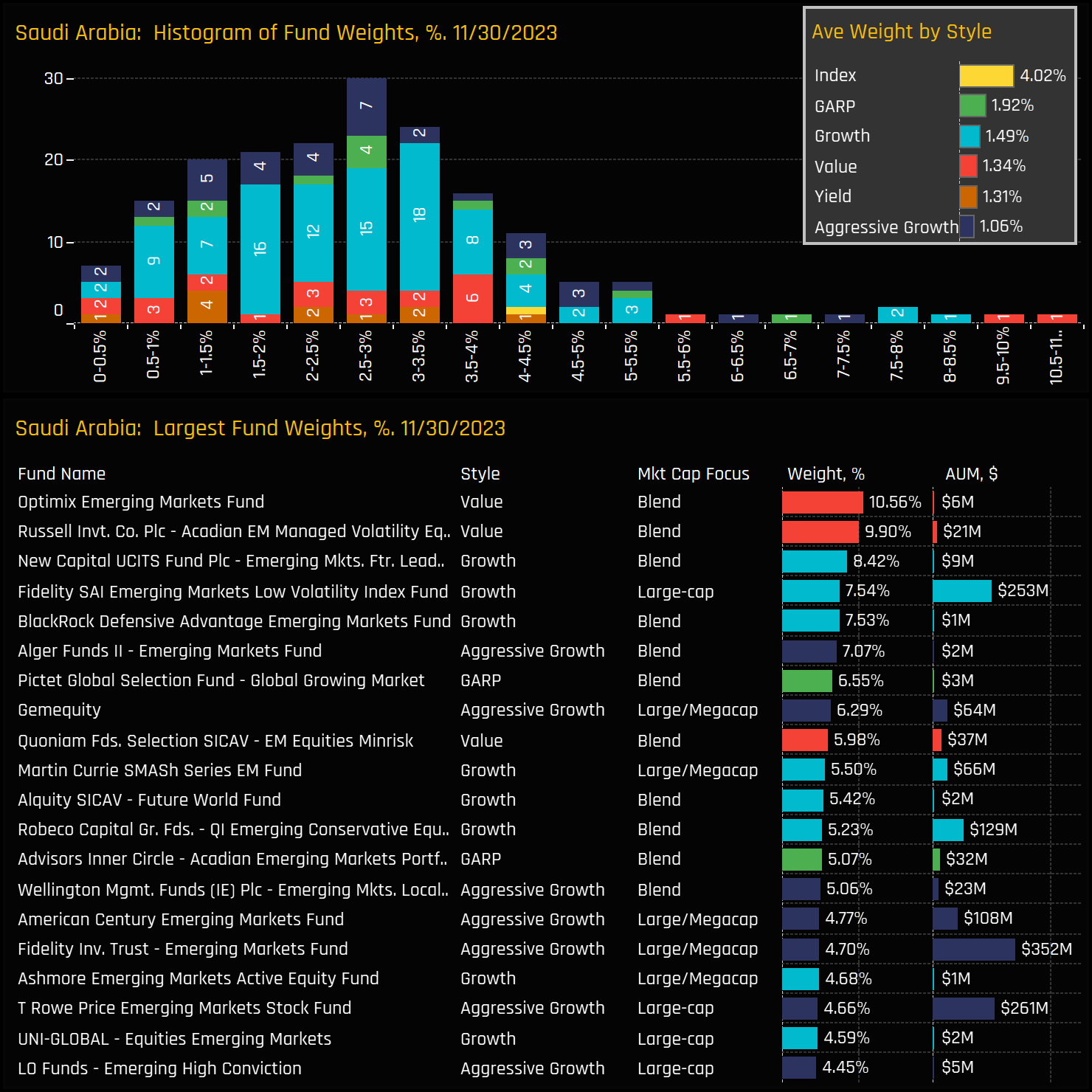

After the favorable shift towards Saudi in 2023, where does the market stand today? The charts below include a histogram of fund holdings (top) and the largest individual fund holdings (bottom). The core of the distribution of fund weights in Saudi Arabia sits between 1% and 4%, with a notable extension to the upside, peaking at Optimix’s 10.56% allocation. Intriguingly, Saudi Arabia’s market appeals across the Style groups, with a broad spectrum of sizeable allocations from Value through to Aggressive Growth funds.

Saudi Arabia now ranks as the 11th largest in average holding weight and the 13th most widely held country among active EM funds. Its ownership profile is akin to smaller ASEAN nations like Thailand and the Philippines, as well as EMEA countries such as Poland, and LATAM’s Chile and Argentina. Compared to the benchmark, EM active funds are reallocating their underweights in Saudi and China to bolster overweights in key LATAM countries like Mexico, Argentina, and Brazil

Conclusions & Data Report

As we look to the future, this report has underscored a significant shift towards Saudi exposure this year. However, nearly half of the funds in our study are not currently invested in Saudi Arabia, with 40% having never held a position in the country, ever. This surely indicates untapped potential for further investment.

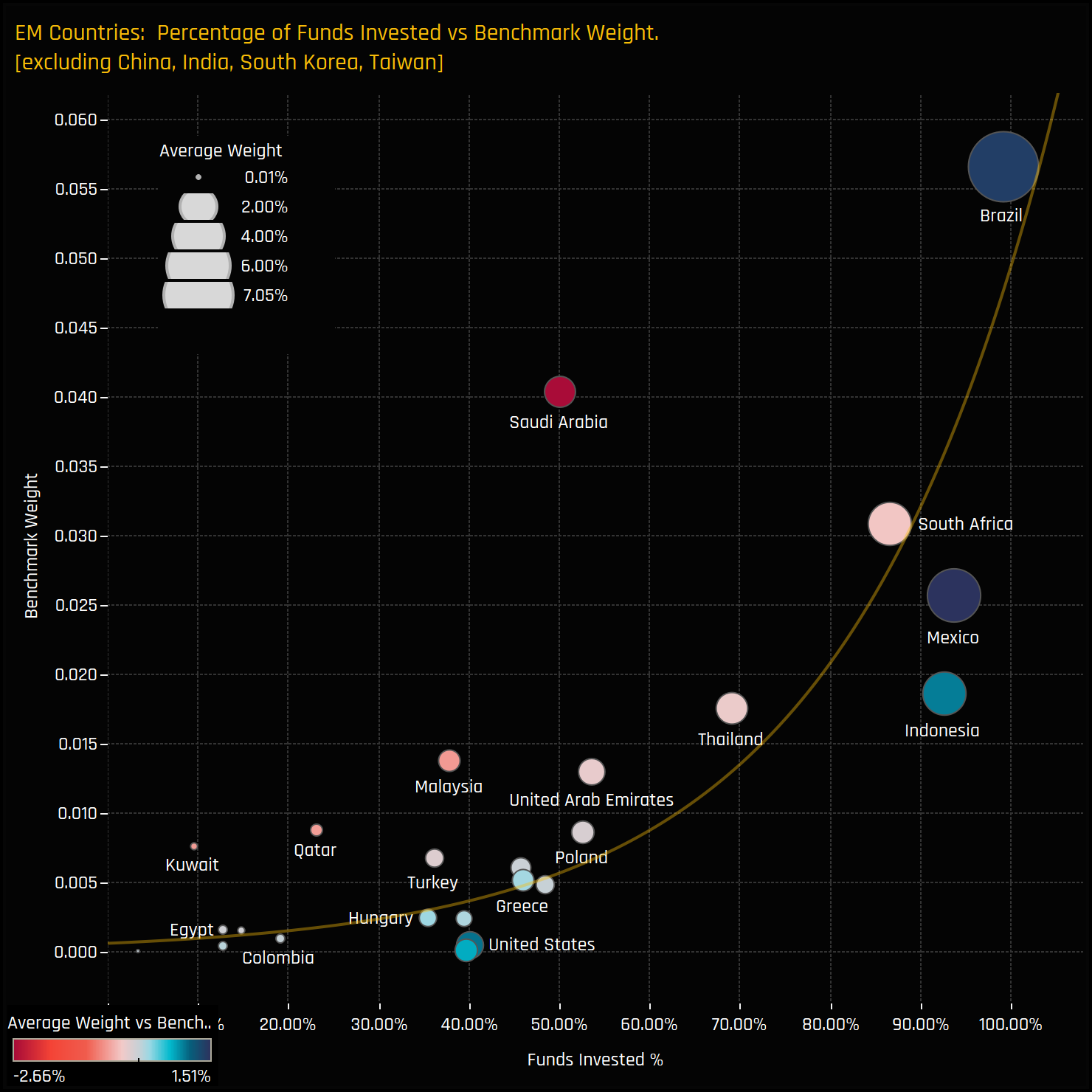

In fact, we would go as far as saying Saudi Arabia is still ‘under-owned’ here. The adjacent chart illustrates the correlation between the percentage of funds invested in each country and their respective benchmark weights. This relationship is positively skewed and grows exponentially towards 100% ownership (which is why we have excluded the universally held China, India, Taiwan, and South Korea from the chart). Saudi Arabia stands as a significant outlier from the trend line. To align with markets such as Brazil, South Africa, and Mexico, around 90% of funds should have exposure to Saudi Arabia. While nothing is certain, the 40% of funds that have yet to invest in Saudi Arabia account for $127 billion in total fund AUM, so the flow potential is real.

Historically, managers have been content with maintaining a benchmark underweight in Saudi, but as an increasing number of active investors increase their exposure, this stance has evolved into a peer group underweight. Consequently, the relative risks associated with non-investment in Saudi are escalating with each passing month

Please click on the link below for a broader report on Saudi Arabian investment among the 367 Emerging Market funds in our analysis.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 25, 2025

HDFC Bank Limited

338 GEM Equity Funds, AUM $450bn HDFC Bank Limited Record Ownership and Dominance Among EM Fina ..

- Steve Holden

- July 28, 2024

GEM Funds: Extreme Stocks, July 2024

352 Global Emerging markets active equity funds, AUM $429bn GEM Funds: Extreme Stocks Summary I ..

- Steve Holden

- October 24, 2024

Emerging Markets Ex-China Insights, October 2024

30 EM Ex-China Funds, AUM $1.7bn Active EM Ex-China Funds: Positioning Insights, October 2024 H ..