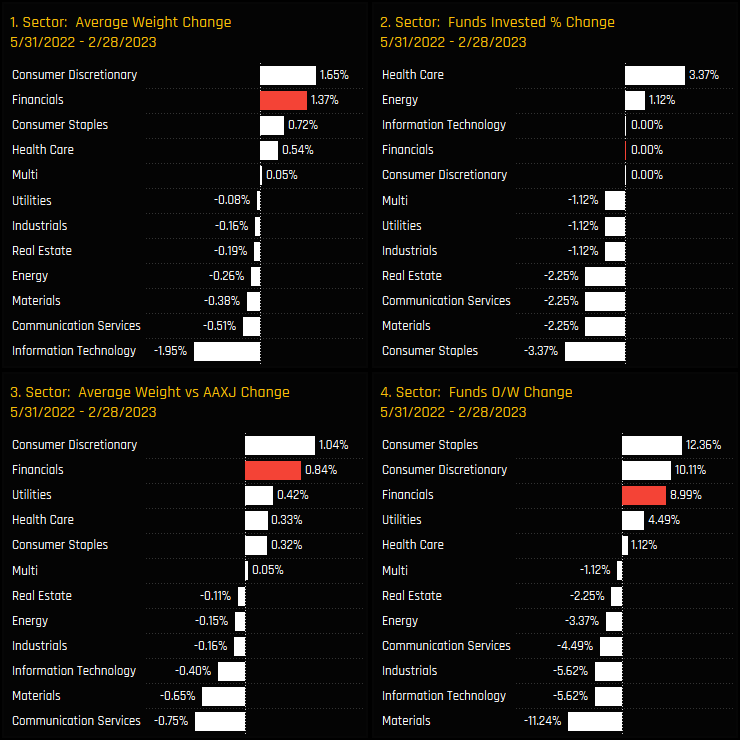

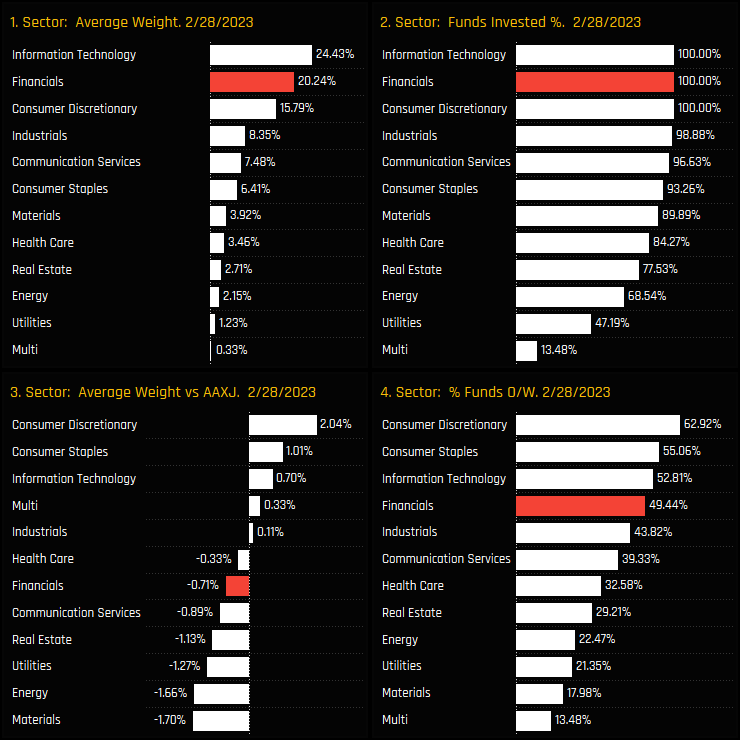

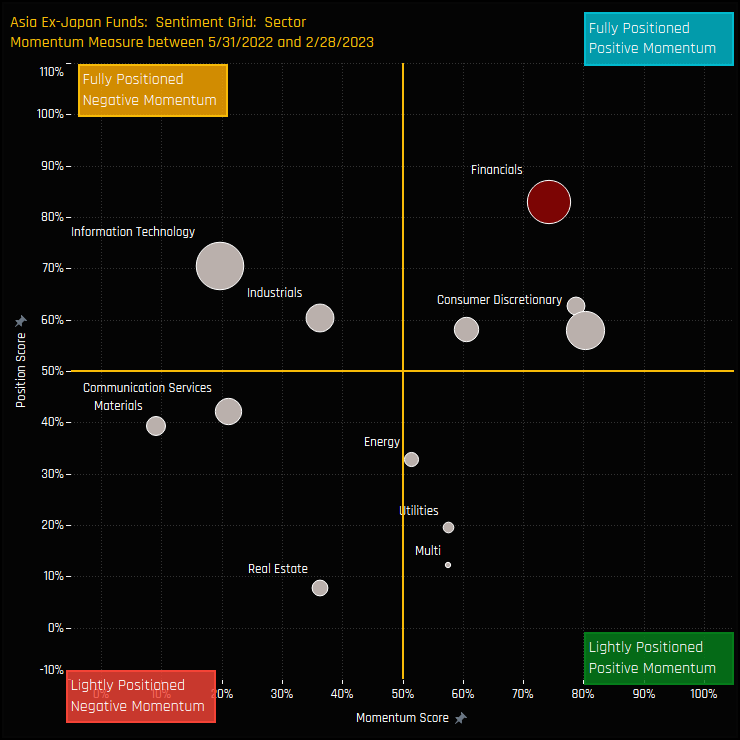

Sector Allocations & Sentiment

Fund Holdings & Activity

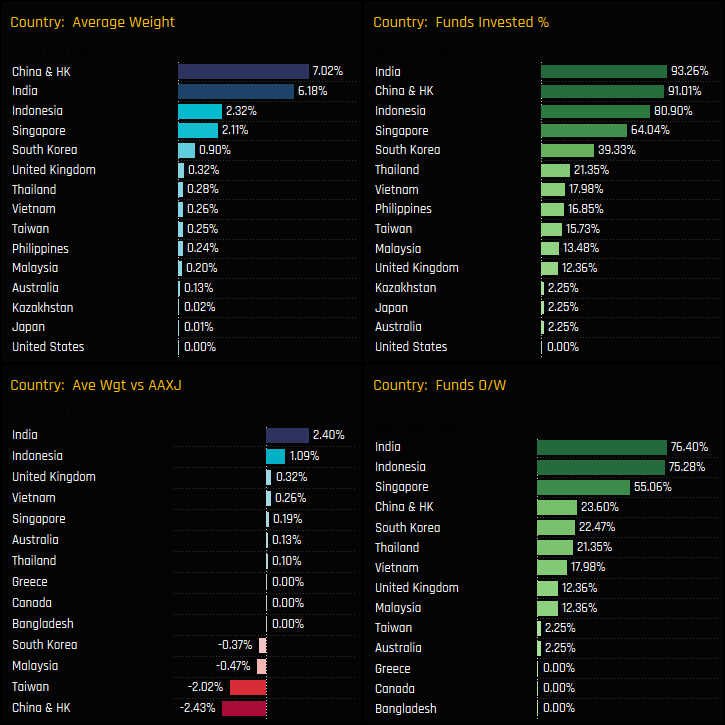

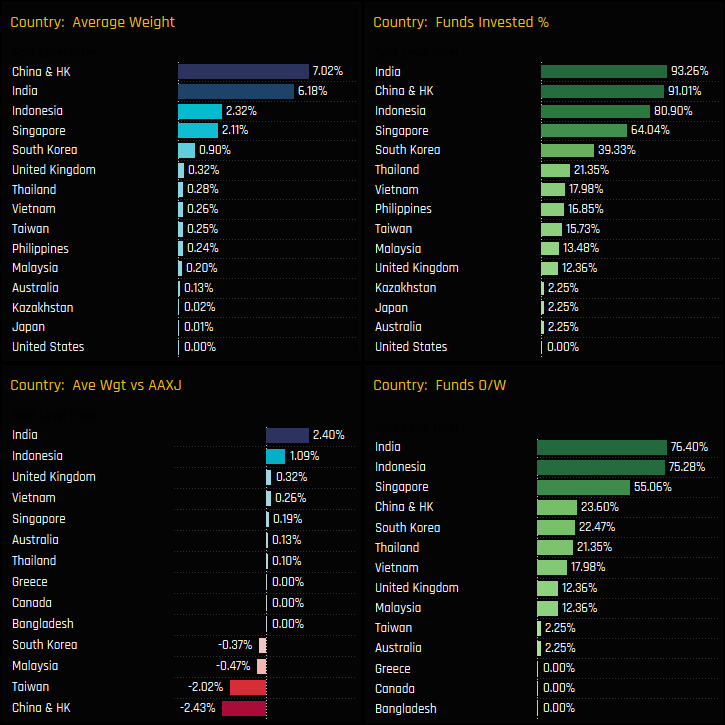

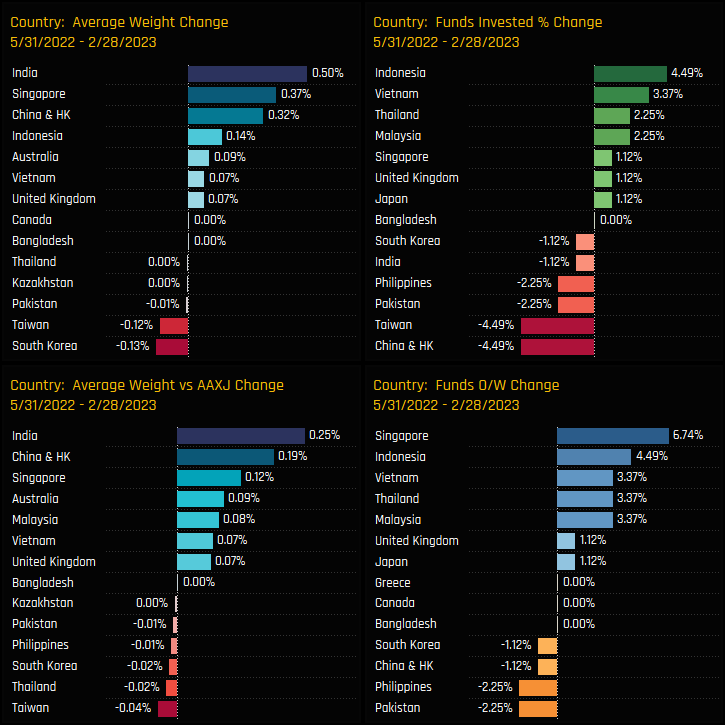

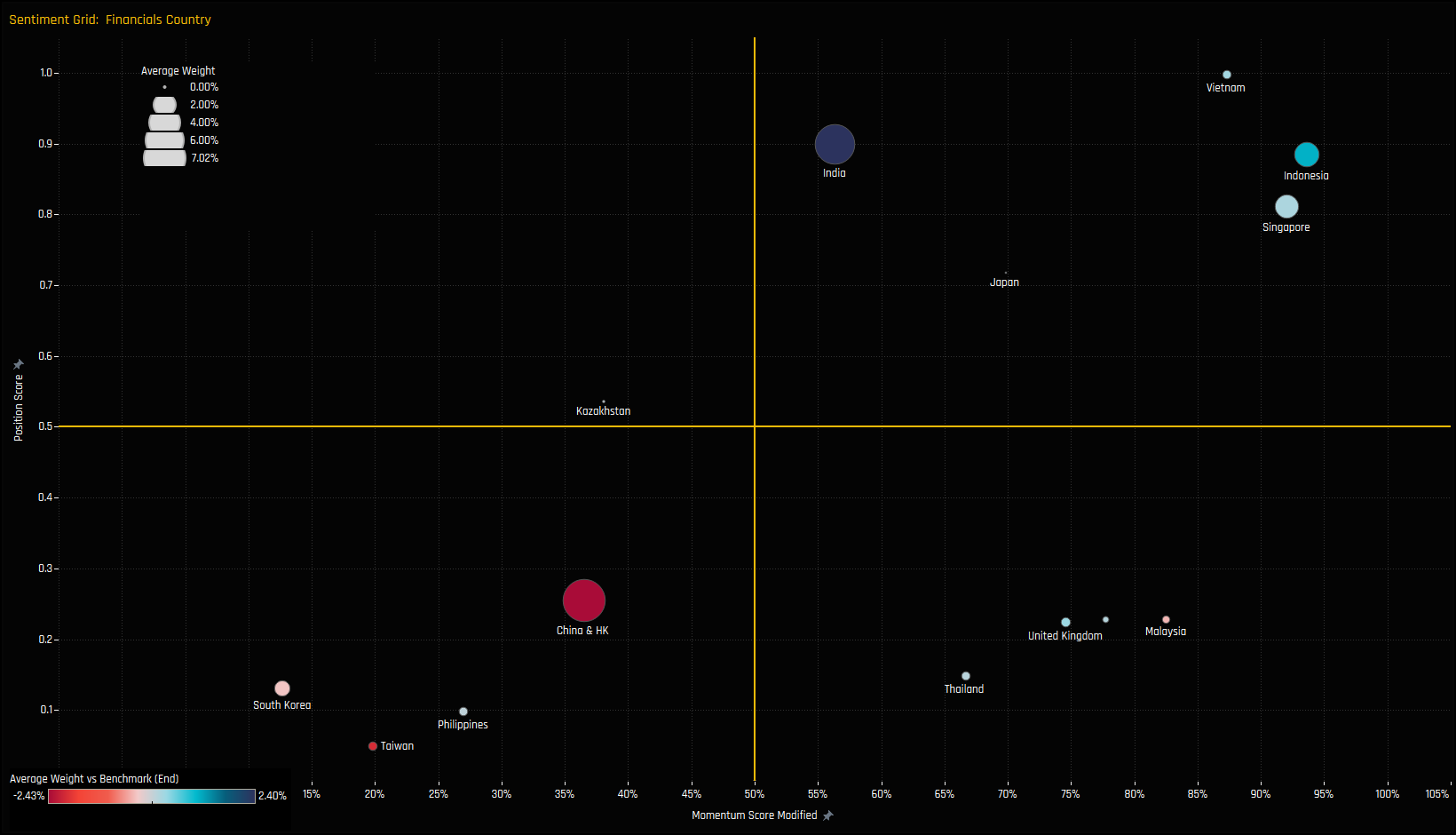

Financials Country Positioning

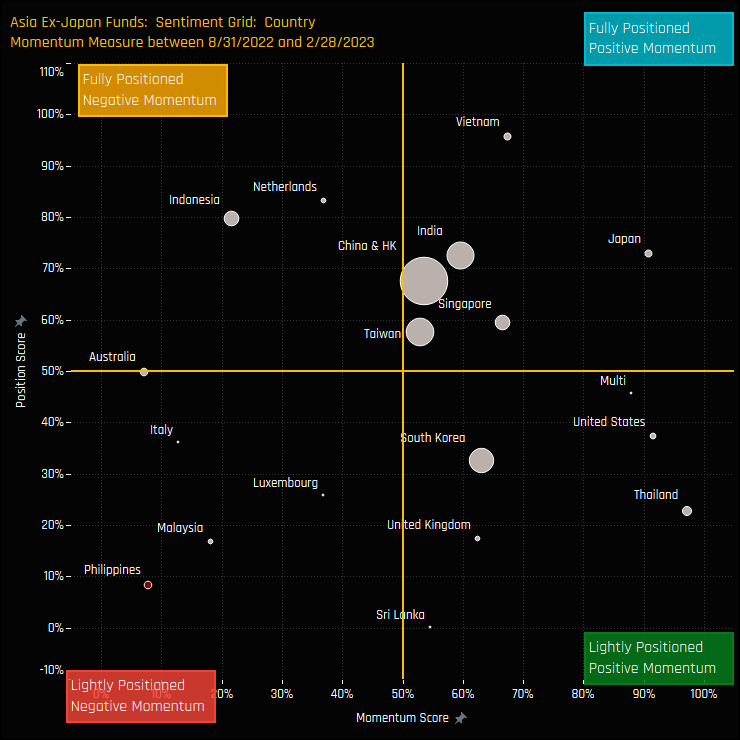

Country Sentiment

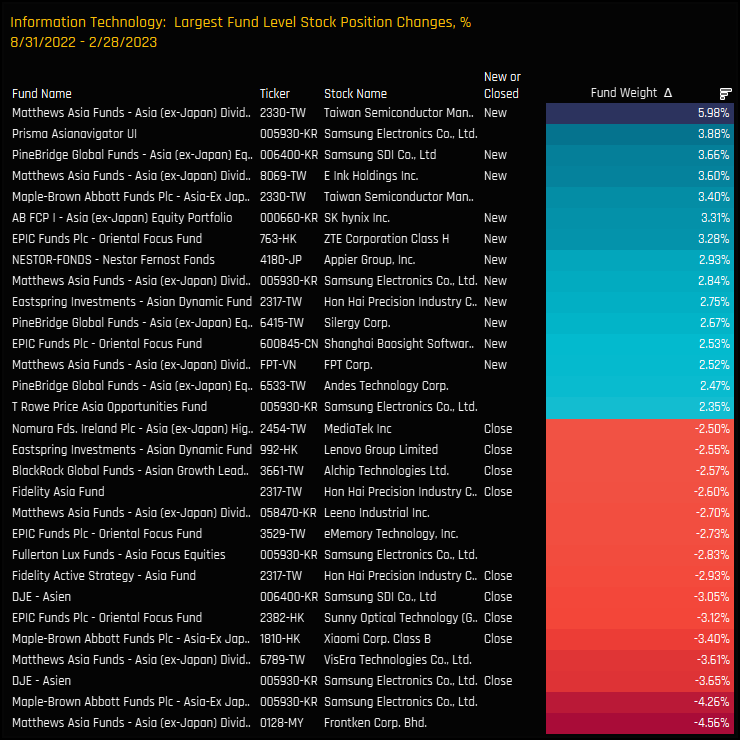

Stock Holdings & Activity

Conclusions & Links

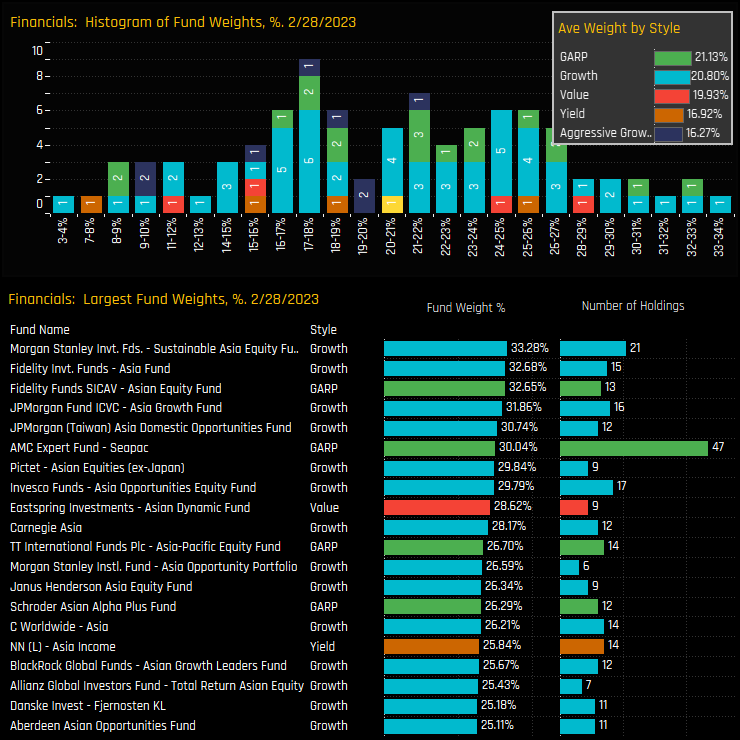

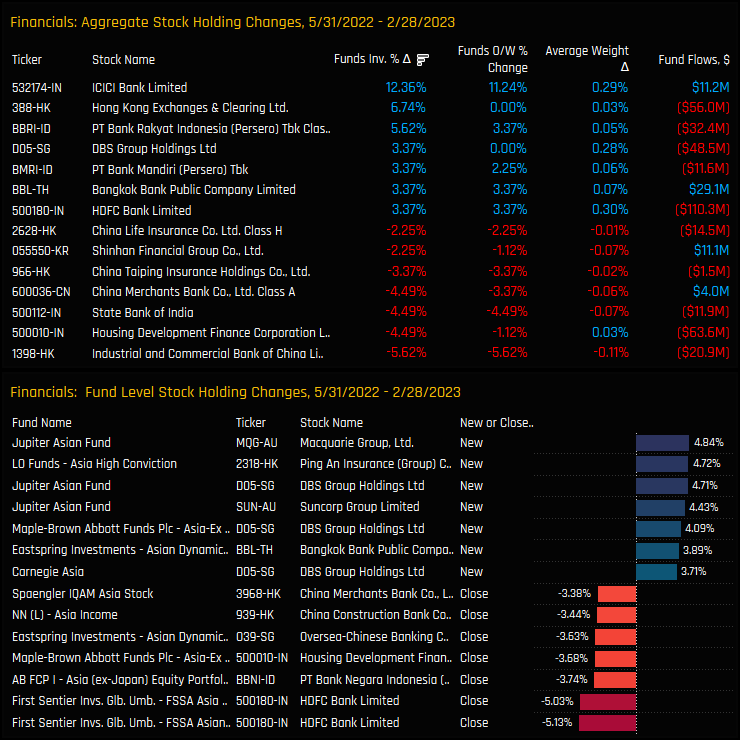

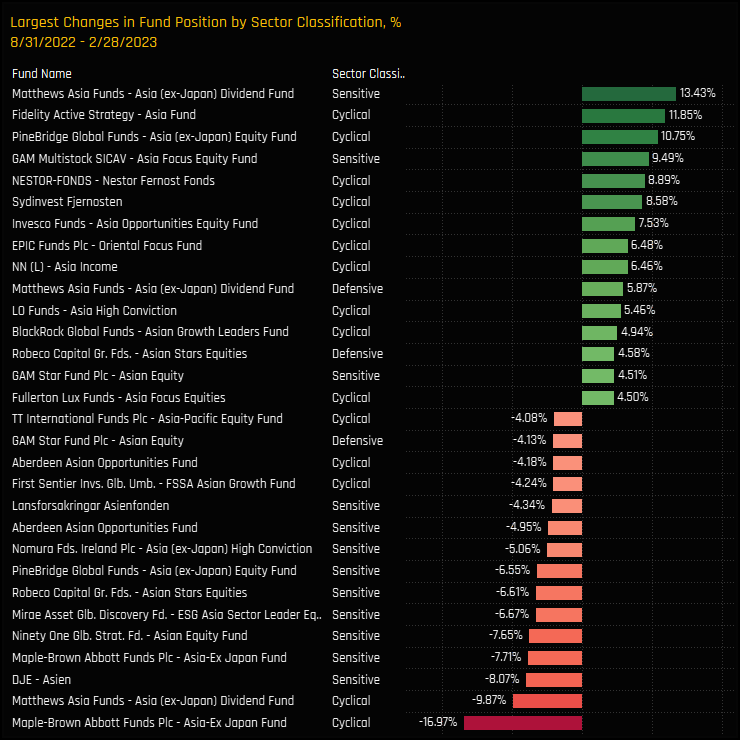

An increasing number of Asia Ex-Japan funds are positioning themselves overweight the Financials sector. Over the course of 2022 and in to 2023, managers have actively switched from underweight to overweight, though this has been a selective rotation. On a country level, selected ASEAN nations have benefited from inflows, whilst Asia Ex-Japan investors remain cautious on China & HK, Taiwan and South Korean Financials.

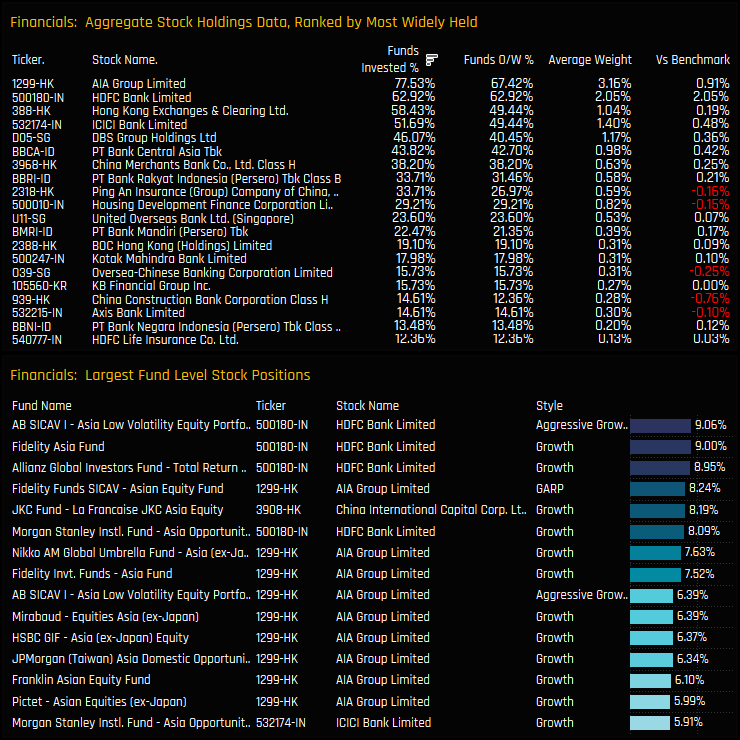

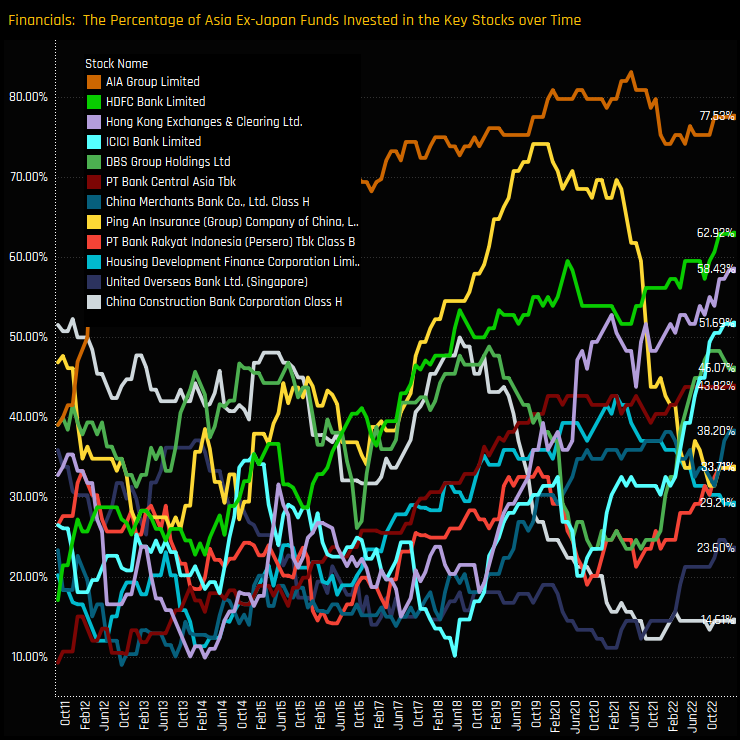

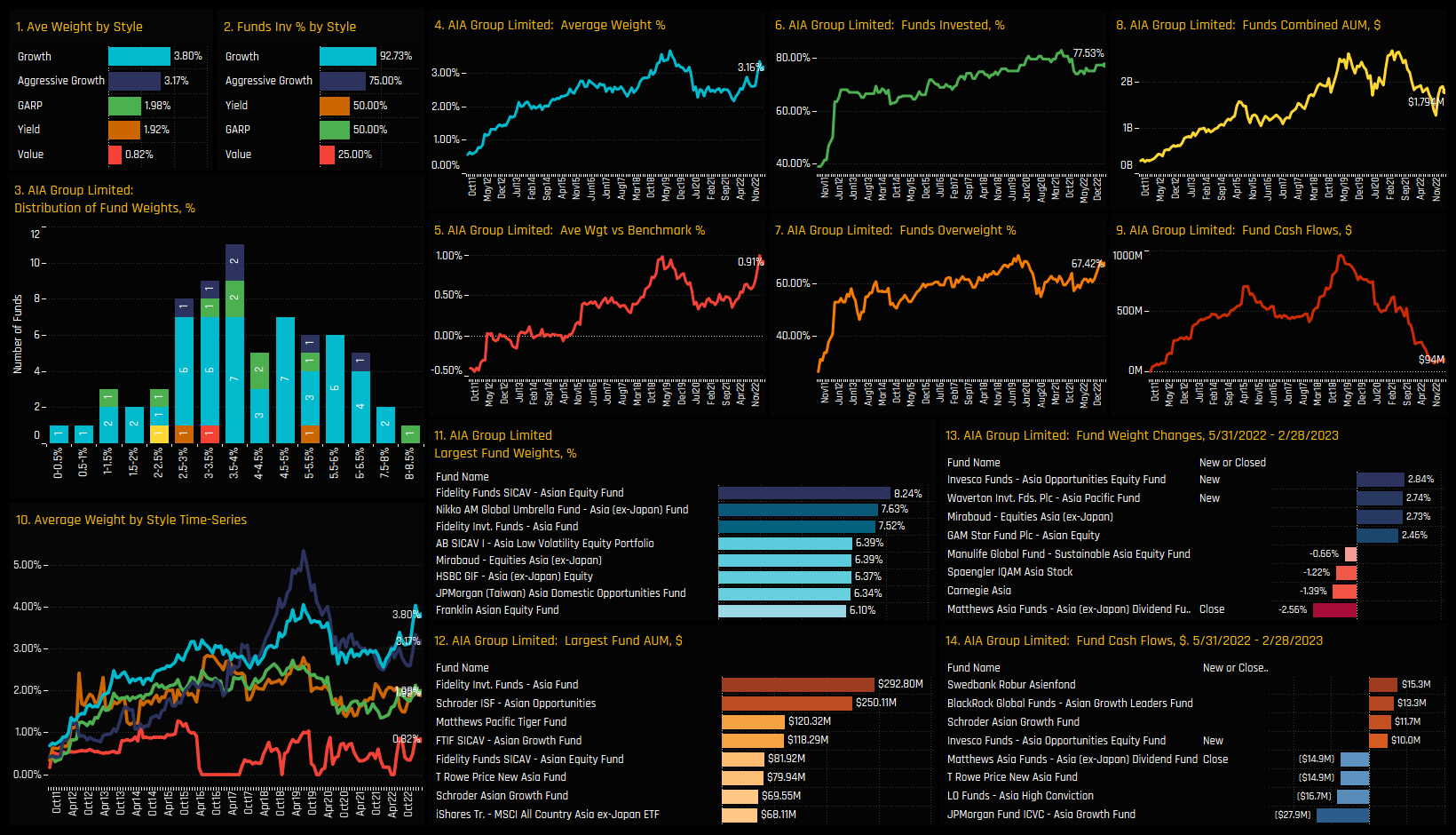

On a stock level, the sector is home to a number of high conviction holdings, led by AIA Group Limited and HDFC Bank, though there has been a strong degree of rotation among individual stocks. Over the longer-term, ownership levels have risen to record highs for a number of companies, including HDFC Bank, ICICI Bank and HK Exchanges & Clearing as the chart opposite shows. Against this, Ping An Insurance and China Construction Bank Corp have seen ownership levels fall heavily in recent years.

Please click below for an extended data report on the Financials sector. Scroll down for stock profiles for ICICI Bank and AIA Group Limited.

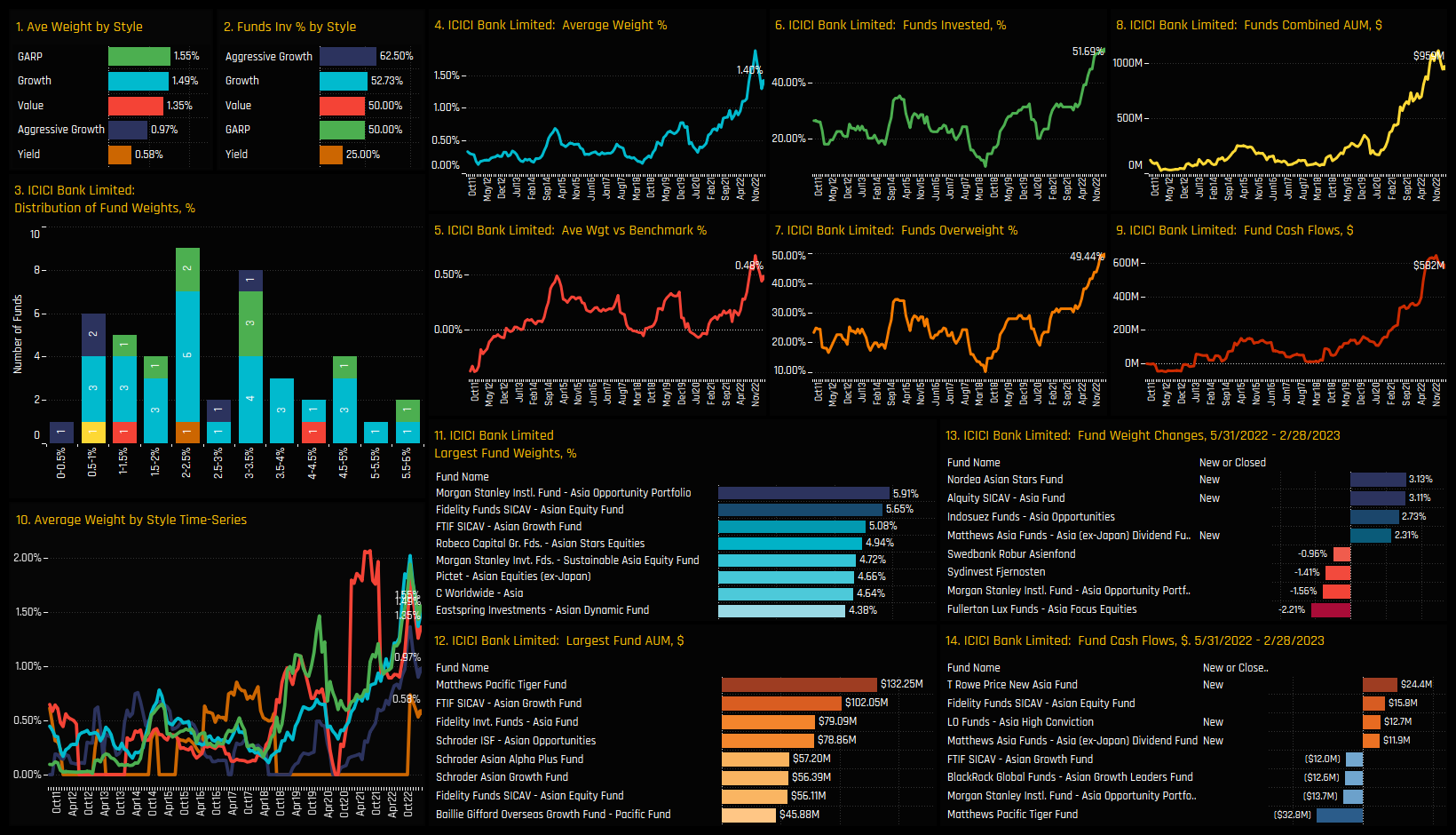

Stock Profile: ICICI Bank

Stock Profile: AIA Group Limited

Fund Holdings and Activity

Stock Holdings & Activity

Conclusion and Links

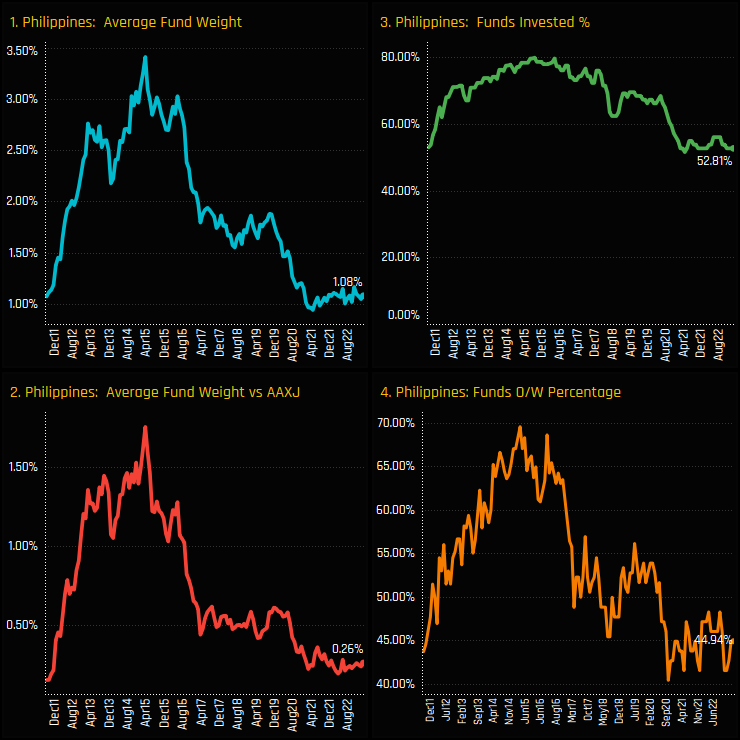

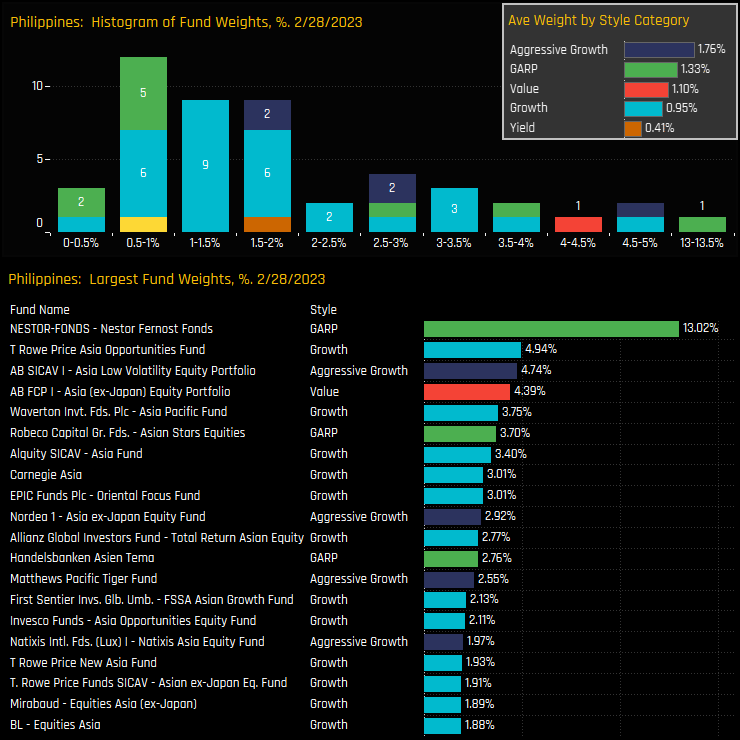

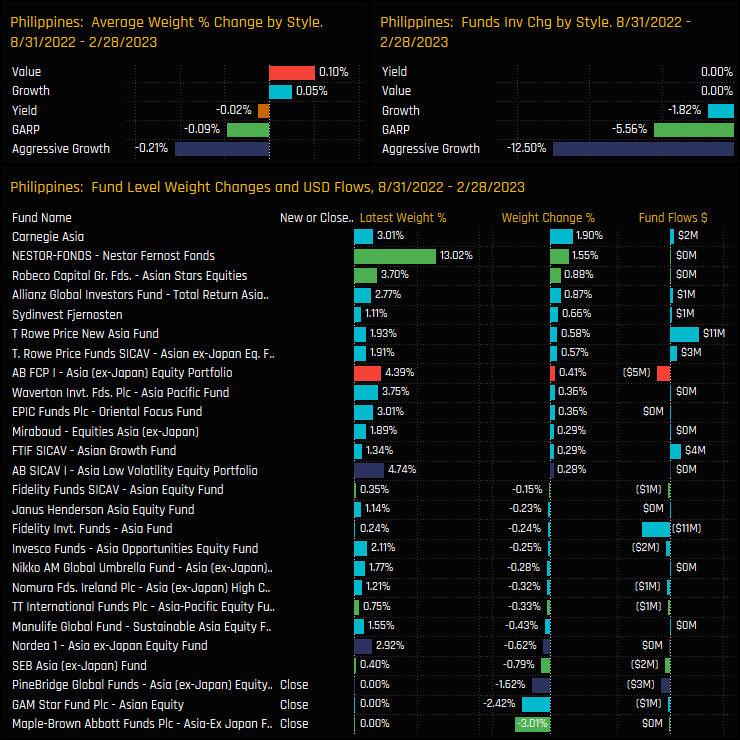

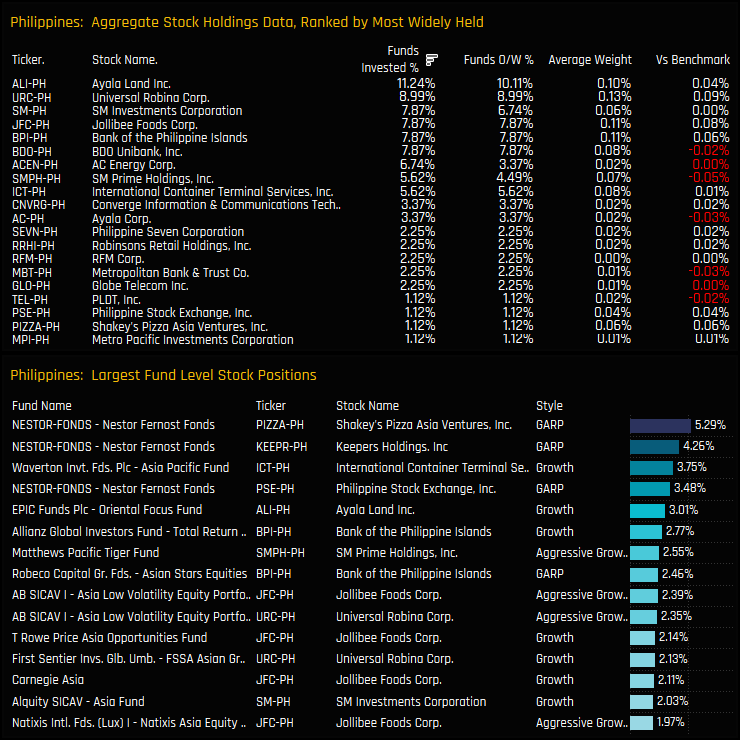

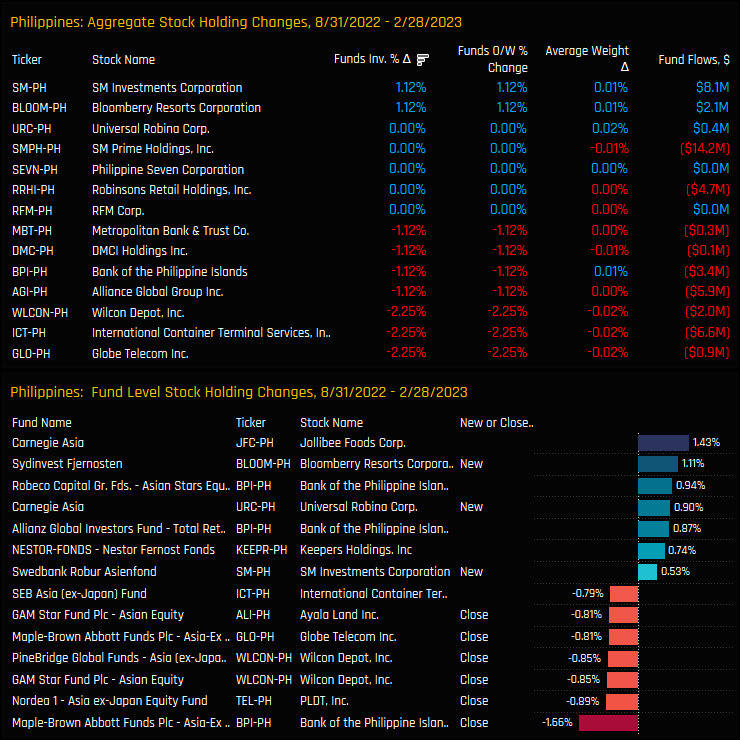

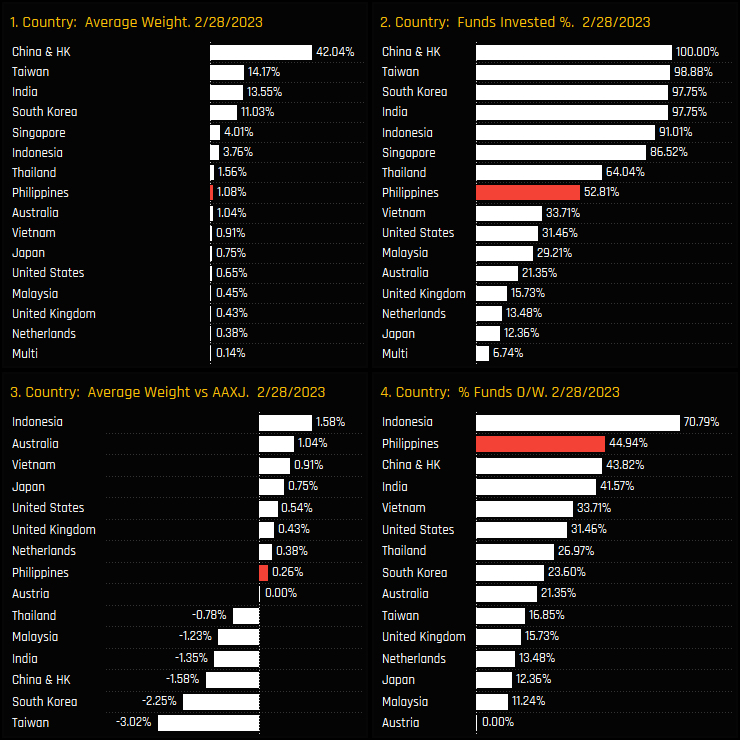

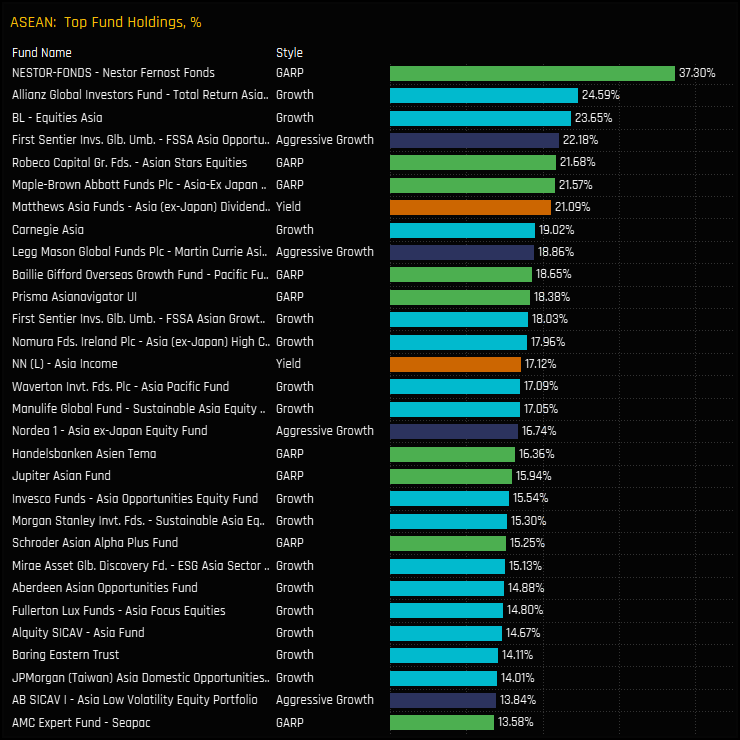

In a world where relative performance is king, the risks of NOT holding exposure to the Philippines is diminishing. Shrinking benchmark weights and a dwindling active investor base means it is becoming ever easier to avoid Philippines exposure entirely. The charts to the right show The Philippines well down the pecking order of both average fund weights (ch1) and the percentage of funds invested (ch2). Against the benchmark, the favourable rankings more reflect a small benchmark weight than a high conviction overweight.

Of course, this lack of positioning presents an opportunity for the contrarian investor, should the investment case present itself, but right now sentiment among the managers in our analysis isn’t pointing in that direction.

For more data and analysis on positioning in The Philippines among active Asia Ex-Japan investors, please click on the link opposite for the latest positioning report.

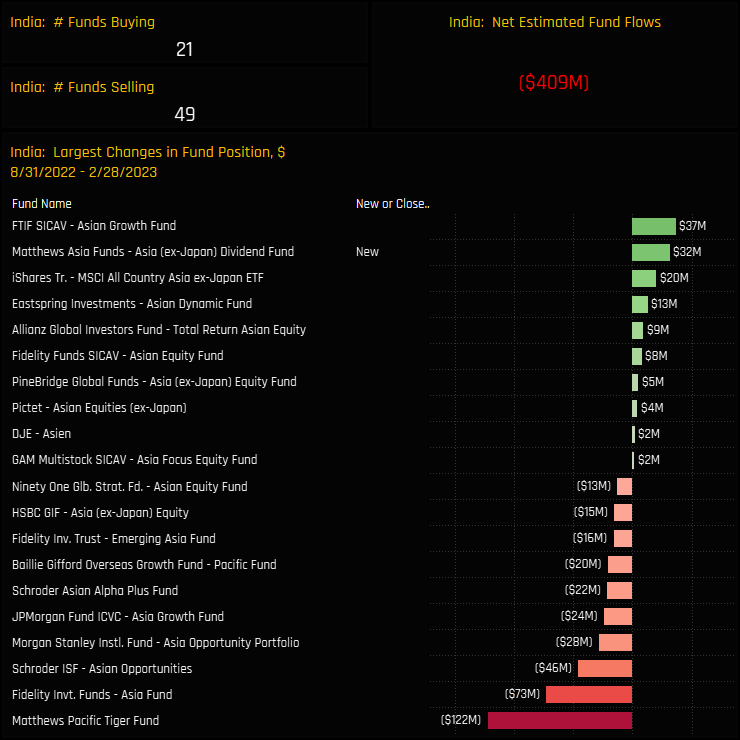

Fund Flows, $

Fund flows are also captured, with each 2-page dossier on the major sectors, regions and countries breaking down the largest flows on a fund level. The below chart shows the largest flows in India, the number of buyers and sellers and the net flows out of the country over the last 6-months.

Download

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- June 28, 2023

Asia Ex-Japan Fund Positioning Analysis, June 2023

86 Asia Ex-Japan Equity Funds, AUM $54.5bn Asia Ex-Japan Fund Positioning Analysis, June 2023 I ..

- Steve Holden

- January 17, 2025

Asia Ex-Japan: Performance & Attribution, 2024

98 Asia Ex-Japan active equity funds, AUM $55bn Asia Ex-Japan Funds: Performance & Attribu ..

- Steve Holden

- August 28, 2024

Positioning Insights, August 2024

98 Active Asia Ex-Japan funds, AUM $189bn Active Asia Ex-Japan Funds: Positioning Insights, Aug ..