1600 Active Equity Funds, AUM $4.7tr

Fund Positioning Chart Pack

Global Funds: USA: Record Underweight as Shift to Europe Accelerates

Emerging Market Funds: GQG EM Equity Fund: Breaking From The Pack

Asia Ex-Japan Funds: Country/Sector Positioning Update

China Funds: A-Share Financials: Avoiding the Tail

UK Funds: The UK's Most Wanted Stocks

354 GLOBAL EQUITY FUNDS, AUM $952BN

USA: Record Underweight as Shift to Europe Accelerates

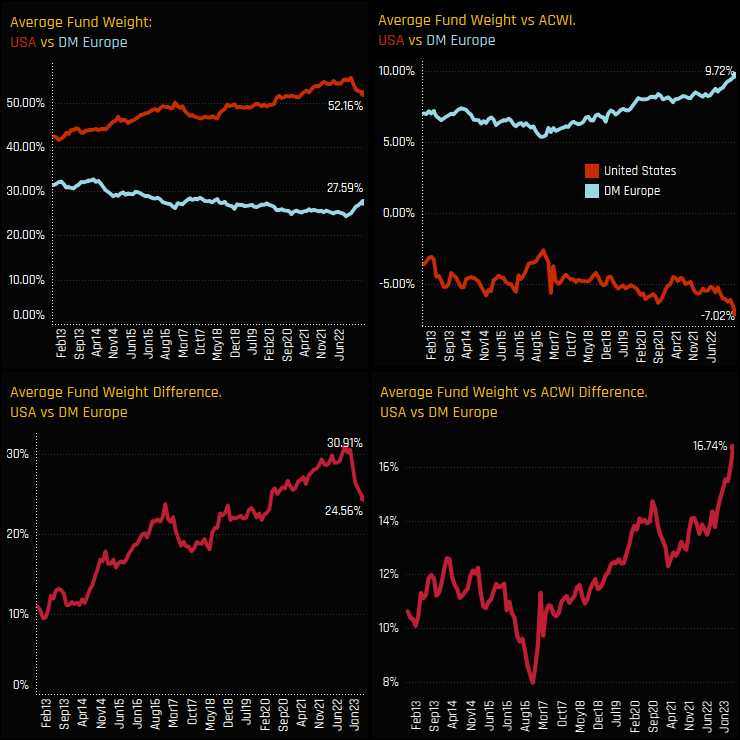

As part of our Global equity fund analysis, we took a deep dive in to the long-term trends in positioning between the USA and Developed Europe. The left hand charts in the dashboard opposite show the dispersion between US and Developed Market Europe fund weights among Global funds over the last decade, with the long-term dominance of the USA starting to reverse in late 2022. The right hand charts show the net over/underweight vs the SPDRs MSCI ACWI ETF, with Global funds increasing overweights in DM Europe and increasing underweights in the US, with today’s spread of +16.74% the highest on record.

In the full report we look at the sectors, stocks and funds driving this rotation, together with a full breakdown of the latest positioning among managers.

380 emerging market Funds, AUM $400bn

GQG EM Equity Fund: Breaking From The Pack

Part of the work we do at Copley involves the analysis of individual funds in each of our fund universes. It's important for funds to know where they differ from their active peer group, both for risk management purposes, sales and marketing and to keep ahead of investment trends in their market. We provide hundreds of metrics to help in this regard, and one them is a measure of country dispersion versus the peer group average.

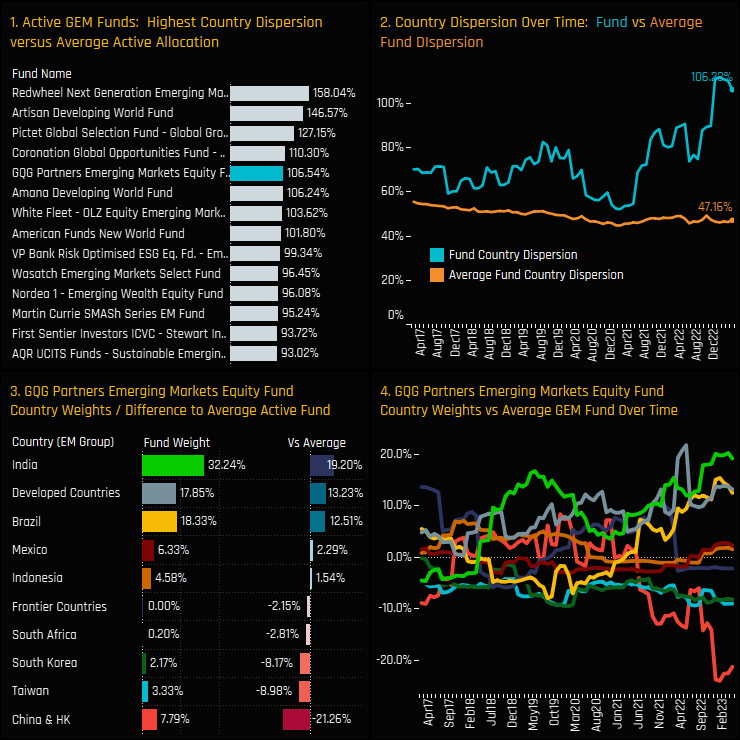

We provide a measure of country dispersion by first calculating the equally weighted average country weight across the 380 active EM funds in our analysis. We then take an individual fund and calculate the absolute differences between its country allocations and the average, and sum them together. The EM funds with the largest country dispersion are shows in chart 1 opposite, with GQG Partners Emerging Markets Equity the 5th highest with a combined country dispersion of 106.5%. Chart 2 shows the evolution of this dispersion over time, with GQG significantly breaking rank with the average GEM fund in recent years. Chart 3 breaks down the dispersion figure by it's individual country components. GQG is running a significant overweight in India, Developed Countries and Brazil compared to the average active fund. Against this, GQG is underweight China & HK stocks, Taiwan and South Korea. The recent rise in country dispersion has been driven by a rotation away from China & HK and in to India, Brazil and Developed market equities.

86 ACTIVE ASIA EX-JAPAN FUNDS, AUM $55BN

Country/Sector Positioning in Asia Ex-Japan

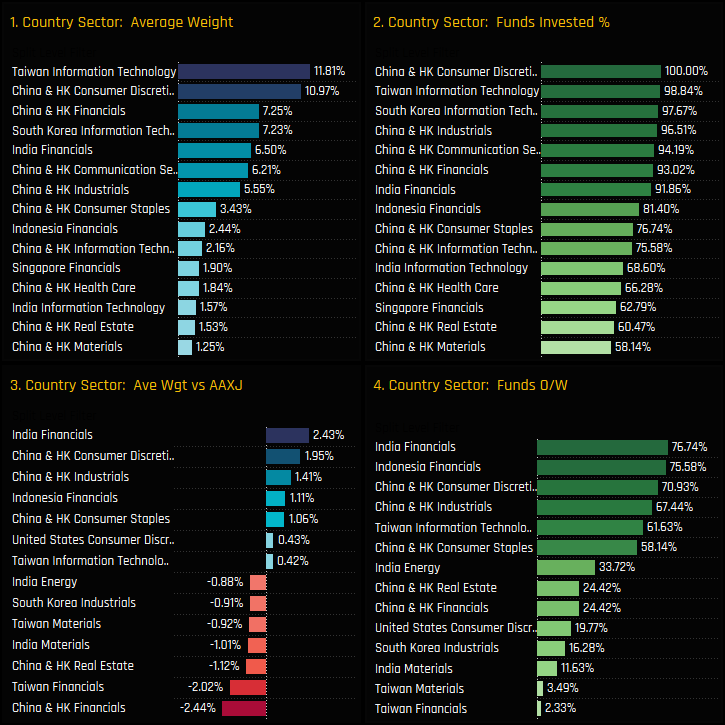

Our monthly analysis looks at aggregate positioning among active equity funds. We track holdings across regions, countries, sectors, country/sectors, industries and stocks. The chart set opposite highlights the latest positioning set up among country/sectors in the active Asia Ex-Japan fund universe.

Chart 1. The equally weighted average fund weight. Asia Ex-Japan funds allocate over half of their total allocations in just 7 country/sectors, led by Taiwan Information Technology (11.8%), China & HK Consumer Discretionary (10.97%) and China & HK Financials (7.25%).

Chart 2. The percentage of funds invested in each country/sector. The 7 top country/sectors are widely owned among Asia Ex-Japan investors. Every fund holds exposure to China & HK Discretionary stocks and 92% hold Indian Financials.

Chart 3. Average weight versus the iShares MSCI Asia Ex-Japan ETF (AAXJ). Active managers are overweight Indian Financials, China & HK Consumer Discretionary and China & HK Industrials, on average. Against this, underweights are led by China & HK Financials, Taiwan Financials and China & HK Real Estate.

Chart 4. The percentage of funds who are positioned overweight the AAXJ ETF. Over 3/4 of the funds in our analysis are overweight India Financials and Indonesian Financials - they are the consensus overweight positions in the active Asia Ex-Japan space. In contrast, hardly any funds are overweight Taiwan Financials and Taiwan Materials.

103 Active China A-Share Funds, AUM $51bn

China A-Share Financials: Avoiding the Tail

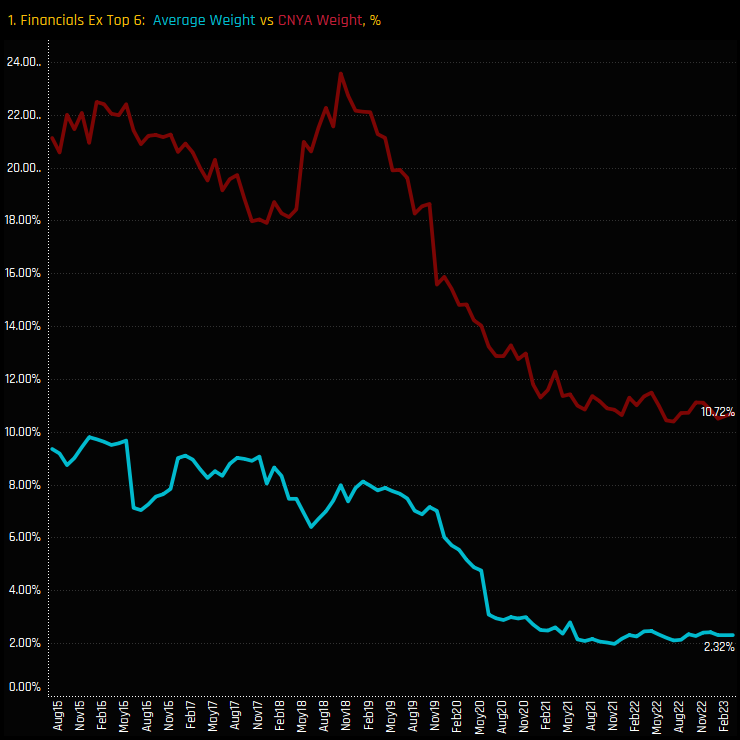

Ownership levels in the China A-Share Financials sector are at their lowest ebb. The driver of this decline appears to be the lack of confidence that active A-Share managers have outside of a small selection of well held companies. The top 6 most widely held Financial stocks make up 5.5% of the average active A-Share fund and 5.75% in the iShares MSCI China A-Share ETF. But its outside of this where the divergence between active and benchmark occurs. All of the stocks outside of the top 6 have struggled to attract interest from active A-Share investors.

The chart opposite shows the average holding weight in the Financials sector minus the top 6 stocks, for both active managers and the benchmark. Across 83 companies, active A-Share funds have allocated just 2.32% whereas the iShares MSCI China A-Share ETF has allocated 10.72%. The message seems pretty clear – stick to the top 6 and avoid the long tail.

267 UK EQUITY FUNDS, AUM $184BN

The UK's Most Wanted Stocks

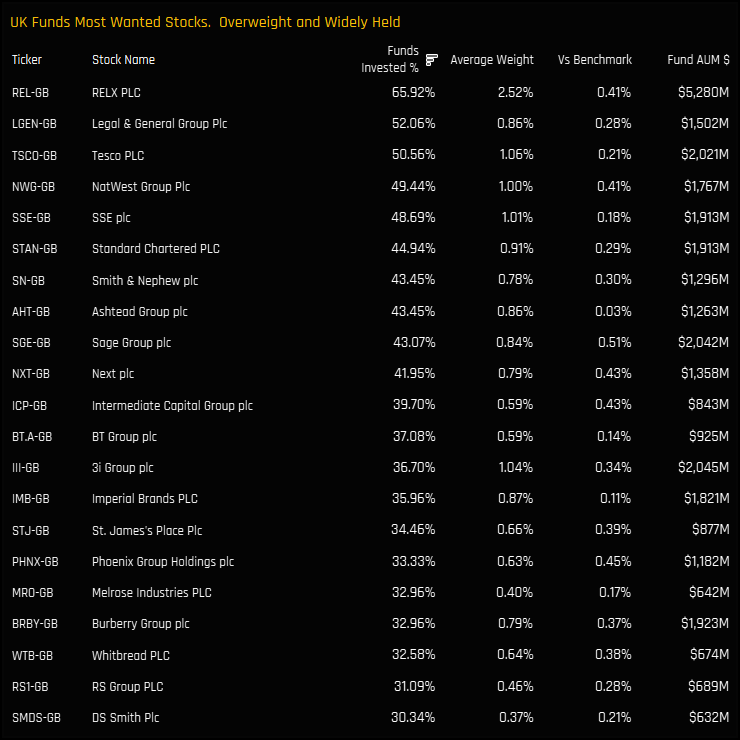

Every quarter we update 14 essential charts on aggregate and fund level stock positioning among the 267 active UK funds in our analysis.

The chart to the right screens for stocks that are held by more than 30% of the UK funds in our analysis and at average holding weights above the FTSE All Share Index. The list is headed by RELX PLC, a company owned by 65.9% of the funds in our analysis at an average weight of 2.52%, or overweight the benchmark by 0.41%.

A fund's relative performance is not only determined by its holdings, but also by its exclusions. By understanding how competitors are positioned, managers can gain clarity on where their outperformance will come from.

For more analysis, data or information on active investor positioning in your market, please get in touch with us on

Related Posts

- Steve Holden

- June 2, 2023

Copley Fund Research Fund Positioning Chart Pack II

1600 Active Equity Funds, AUM $4.7tr Fund Positioning Chart Pack BYD Co Ltd Becomes Most Popula ..

- Steve Holden

- January 10, 2024

Riding High: The Magnificent 7 Surge in Global Equity Funds

The Magnificent 7, comprising Microsoft, Apple, Alphabet, Amazon, Meta, NVIDIA and T ..

- Steve Holden

- March 6, 2024

UK Real Estate Hots Up

270 UK Equity Funds, AUM $190bn UK Real Estate Hots Up • Record number of UK funds now expose ..