Time-Series & Industry Activity

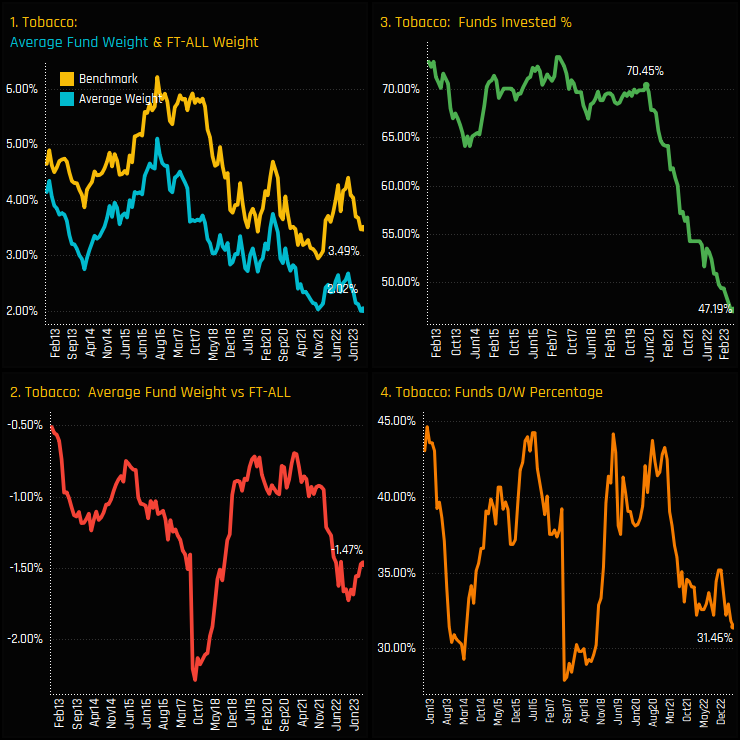

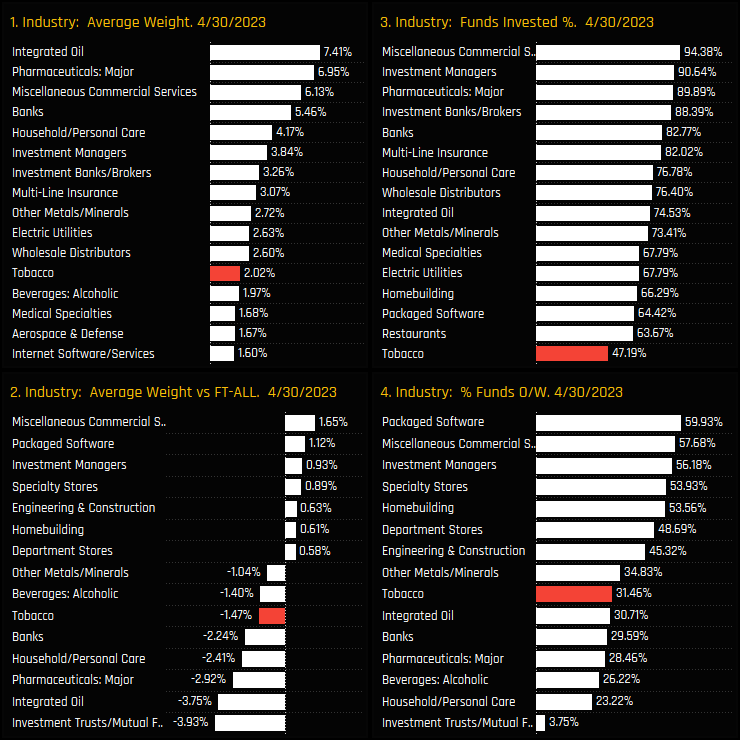

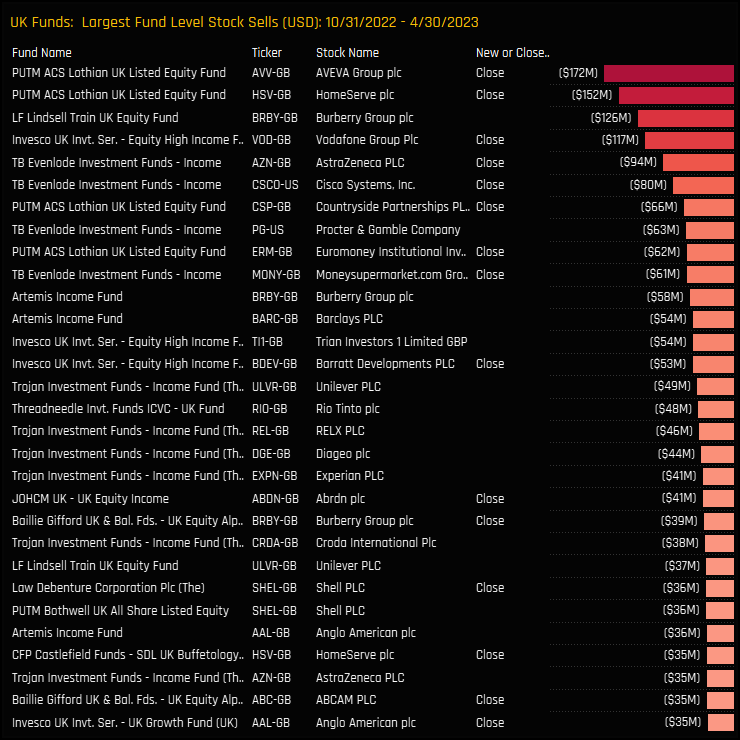

UK Fund ownership in the Tobacco industry group has fallen to its lowest level on record. Perhaps surprisingly, the decline only started to take effect in early 2020 when 70.45% of the UK funds in our analysis still had exposure (ch3). Since then, and perhaps as a result of a growing ESG awareness among investors, the trajectory of ownership has been on an aggressively downward path, with today’s 47.2% fund ownership the lowest on record. In conjunction with this, average weights are at record lows of 2.02% (ch1), or underweight the SPDRs FTSE UK All Share ETF by -1.47% (ch2).

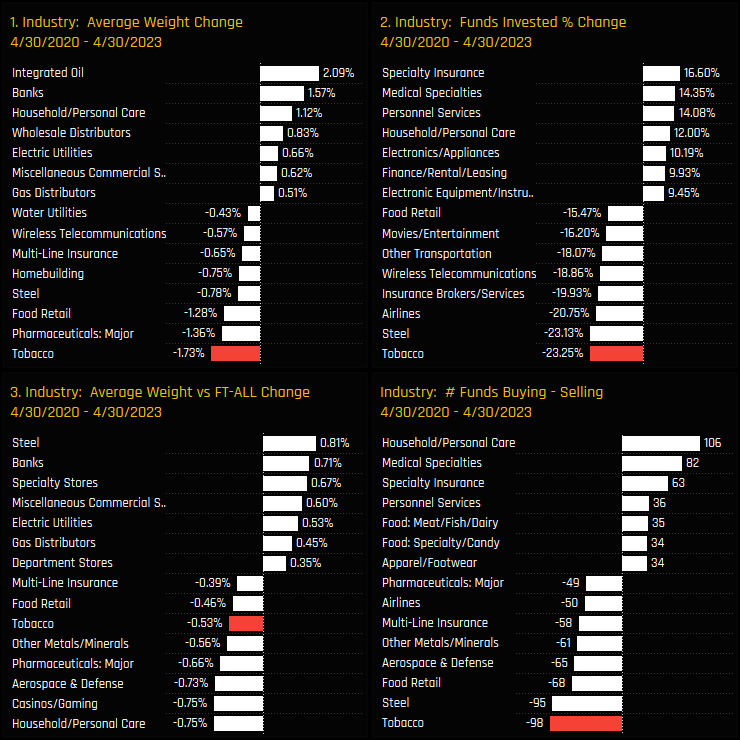

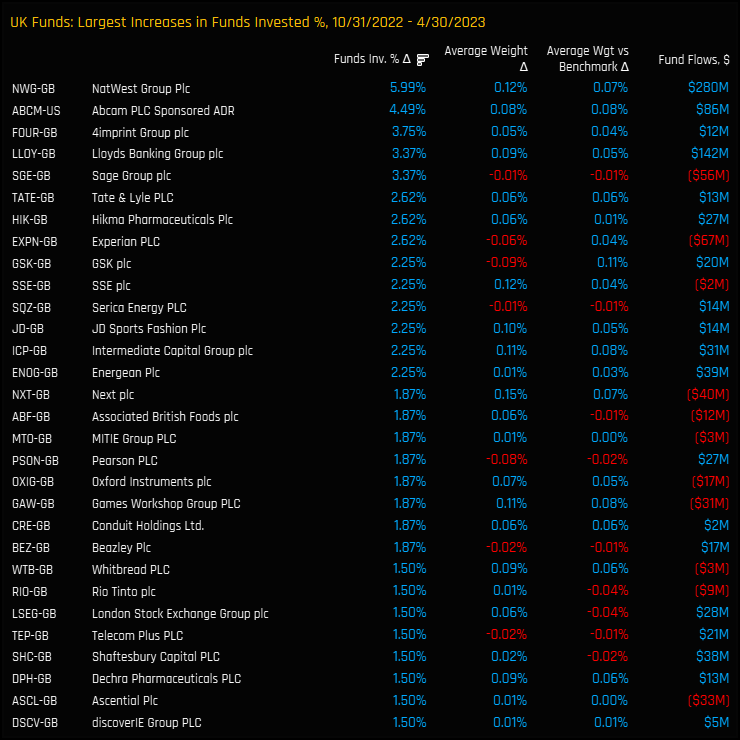

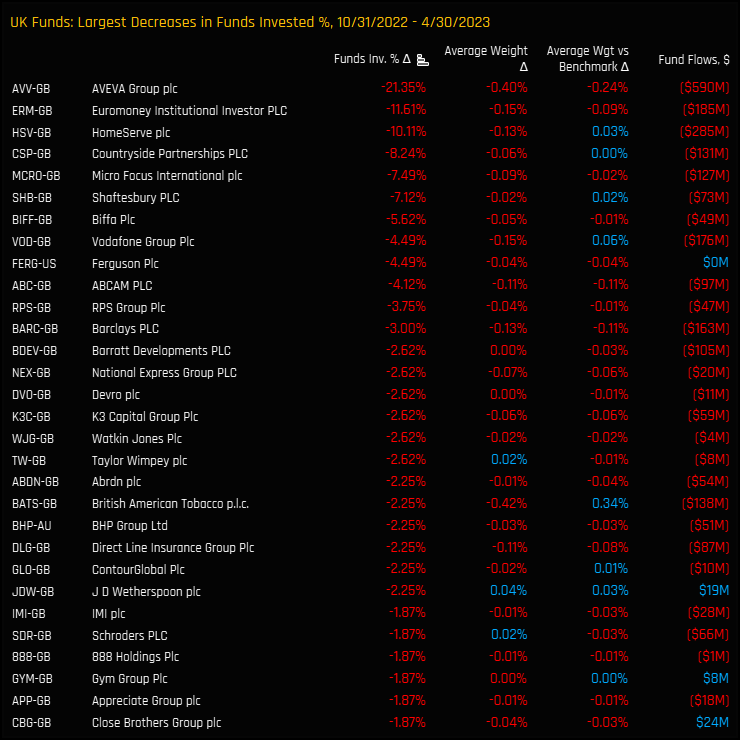

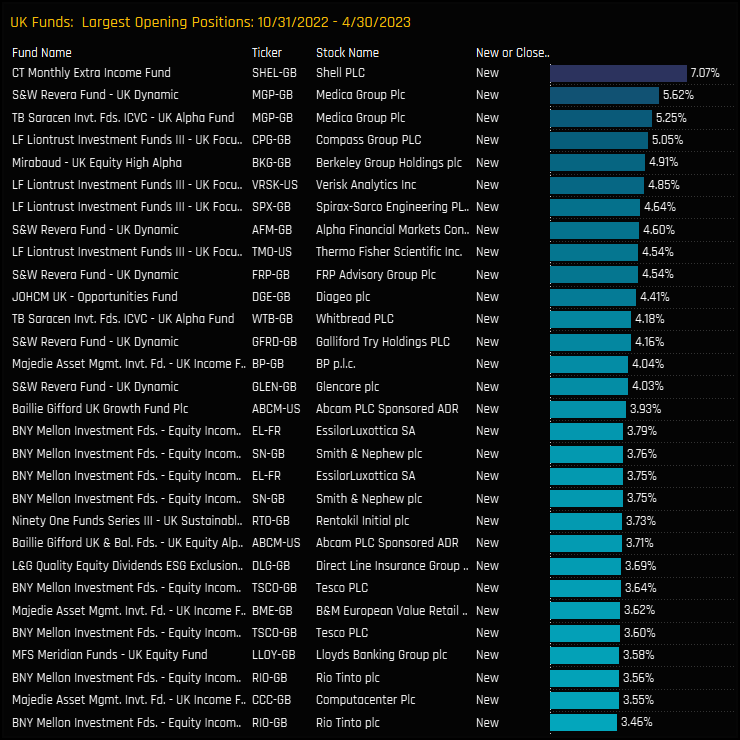

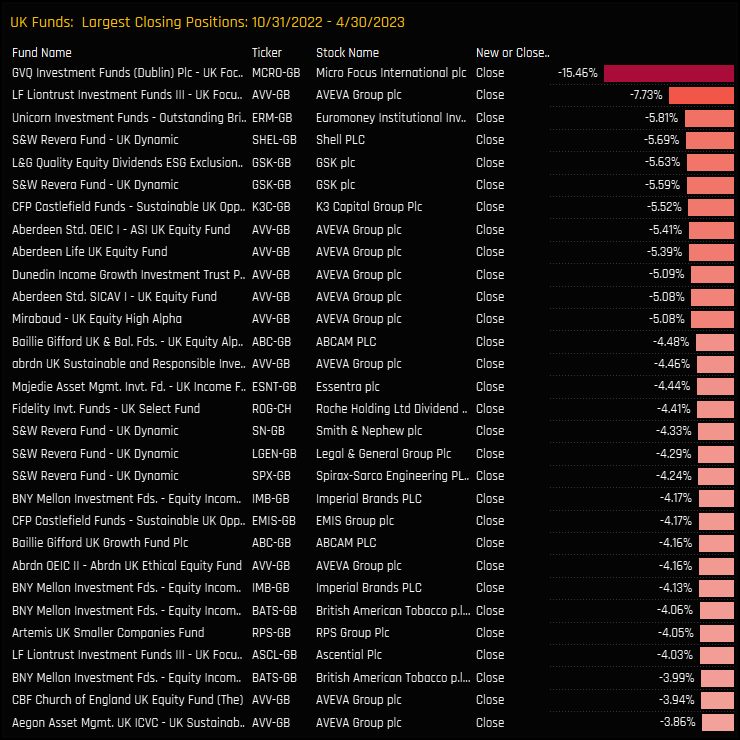

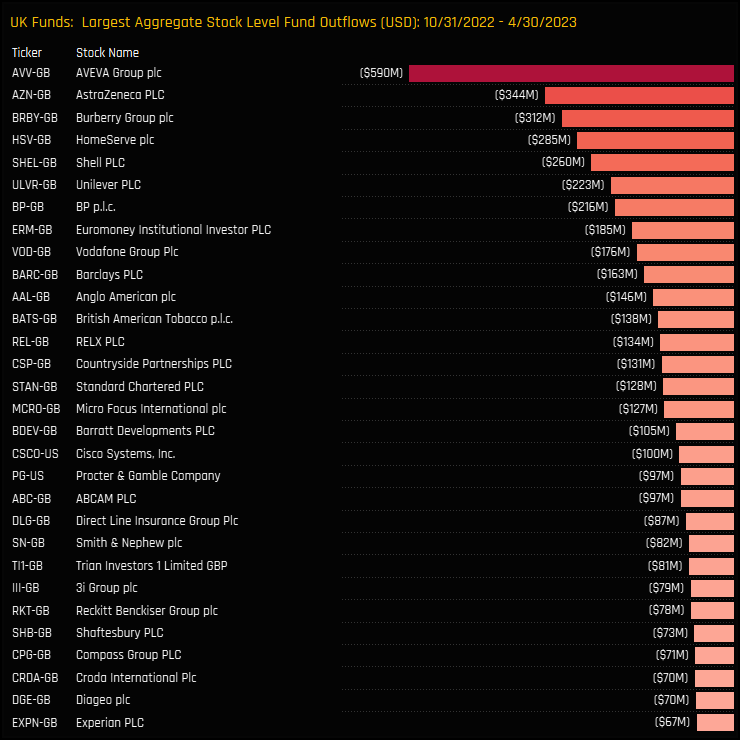

The charts below show the change in industry level ownership among UK funds since the start of the decline until today (04/30/2020 to 04/30/2023). Tobacco stocks saw the largest decline in outright ownership (ch2) and average fund weights (ch1) over the period, with UK investors instead increasing exposure to Integrated Oil, Banks and Specialty Insurance, among others. Versus the benchmark, net underweights increased by -0.53% and sellers (144) outnumbered buyers (46) by 98 funds, the most of any industry group. This has been a sustained and aggressive outward rotation.

Fund Activity & Latest Holdings

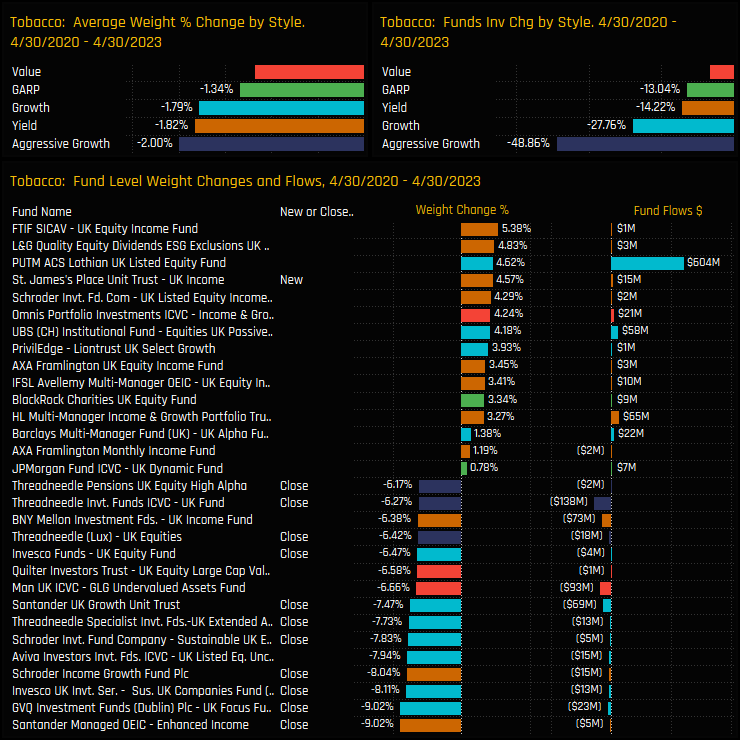

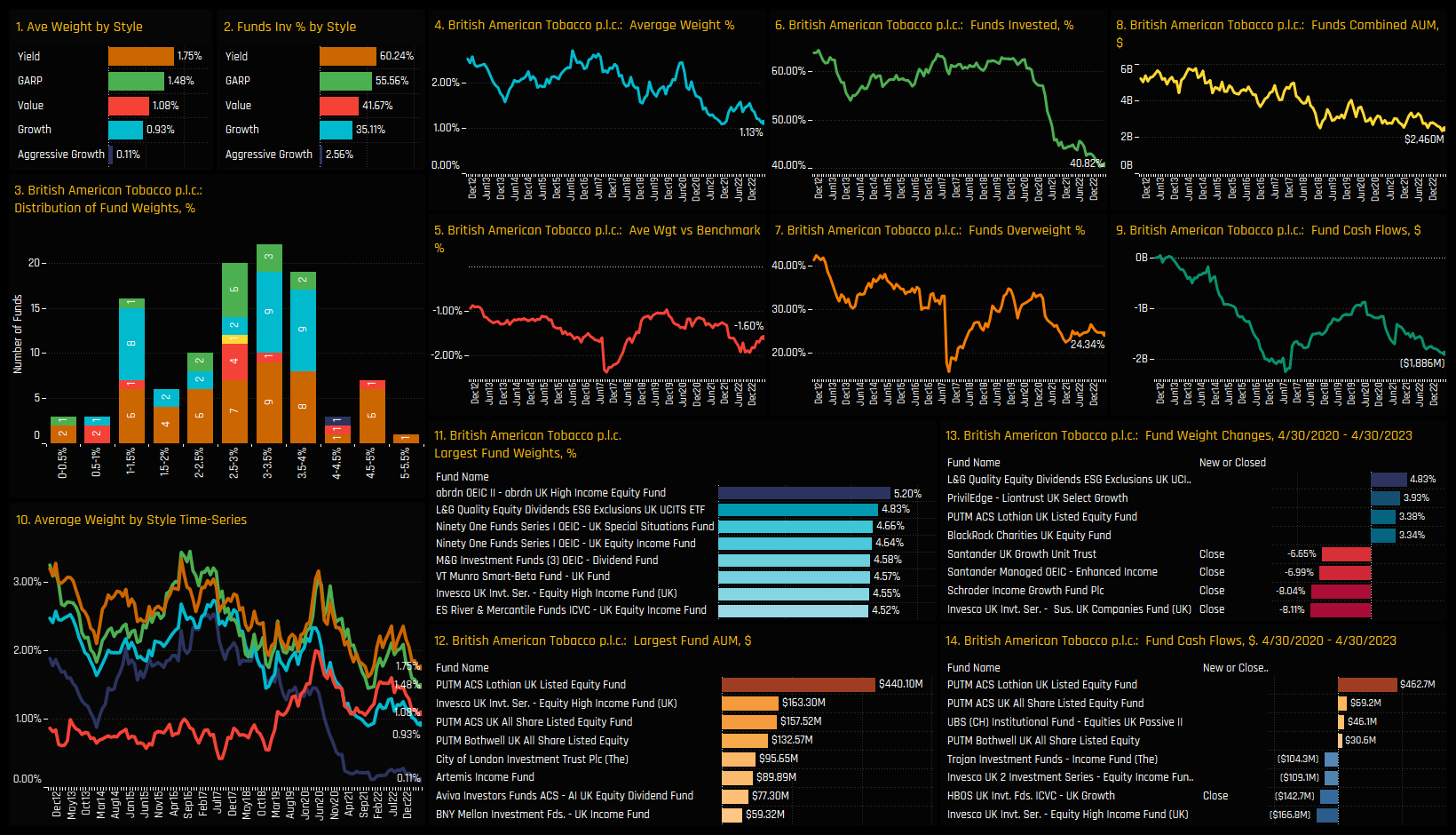

Over the same 3-year period, all Style groups scaled back holdings as shown in the top charts below. Aggressive Growth funds saw the largest declines, with 48.9% of funds closing exposure entirely and average weights falling by -2.0%. On a fund level, there were 59 closures over the period, led by Santander Enhanced Income (-9.02%) and GVQ UK Focus (-9.02%).

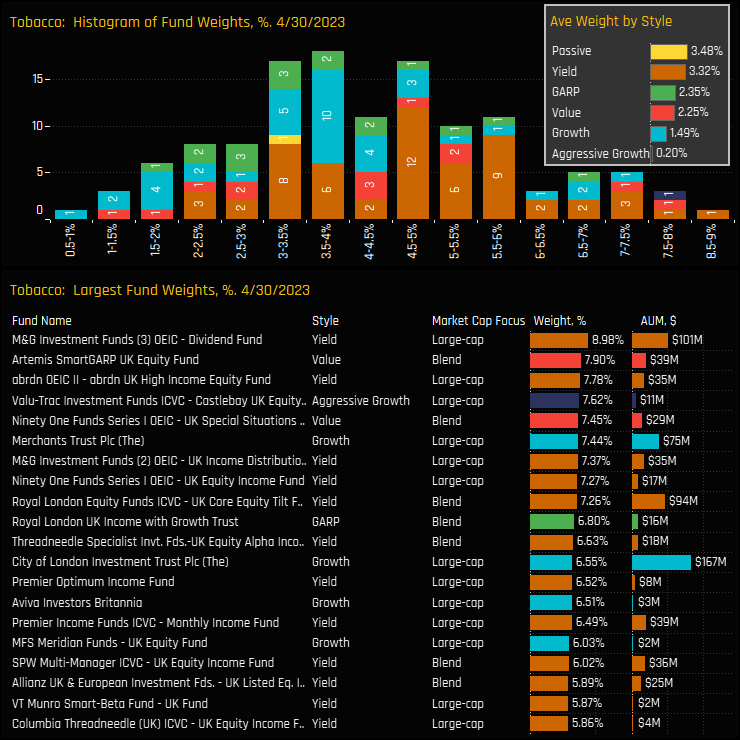

Of the remaining 47.2% of managers holding exposure to the Tobacco industry group, the majority hold between a 2% and 6% allocation, with holdings maxing out at 8.98% for the M&G UK Dividend Fund. All Style groups are positioned underweight the benchmark on average, with Yield funds the larger allocators by a margin and Aggressive Growth almost non-existent from the holdings register.

Stock Holdings & Activity

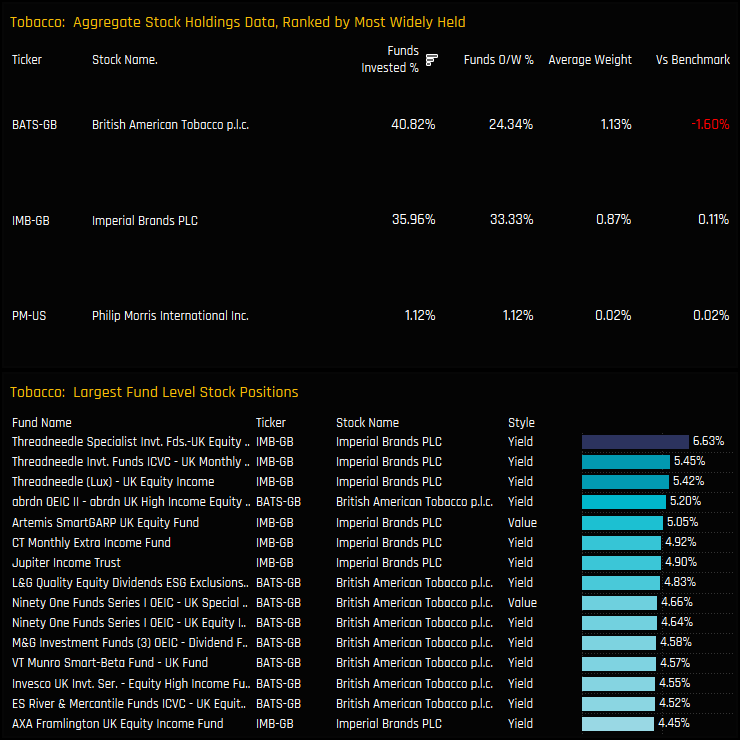

Of the 2 major Tobacco companies in the UK, British American Tobacco is the most widely held with 40.8% fund ownership compared to 35.96% for Imperial Tobacco. Versus the benchmark, the size of BATS positioning leaves managers underweight the FTSE UK All Share index by -1.6%, on average. On an individual fund level, the larger positions are among Yield managers in Imperial Brands, led by the Threadneedle suite of funds.

Stock ownership changes over the last 3-years were negative for all stocks. British American Tobacco lost investment from -21.5% of the funds in our analysis and Imperial Brands -12.6%. On a fund level, the larger closures were in BATS and led by Invesco Sustainable UK Companies (-8.1%) and Schroder UK Income Growth (-8.04%).

Stock Profile: British American Tobacco p.l.c

The decline in UK fund exposure in British American Tobacco has been severe to say the least. Once owned by more than 60% of the UK funds in our analysis (ch6), ownership has fallen to 40.8% of funds and with less than a quarter overweight the SPDRs FTSE All Share ETF (ch7). On a Style basis, Yield managers are the larger allocators, with 60.2% of Yield funds invested at average weights of 1.75%, whilst the decline in Aggressive Growth fund exposure can be seen clearly in chart 10. Despite the decline, BATS is still a key holding for a number of funds, led abrdn UK High Income (5.2%) and a further 10 funds with a >4% allocation.

Conclusions & Links

Tobacco stocks are taking an ever smaller percentage in the average UK equity fund. From once being the 3rd largest Industry allocation in early 2011, Tobacco has fallen to the 12th, with less than half of the UK funds in our analysis holding a position.

The decline has been severe and occurred over a relatively short period of time, with ownership levels still above 70% until the early part of 2020. Perhaps the increased scrutiny on ESG scores and the negative connotations of holding tobacco companies have taken their toll on investor sentiment.

For those that have closed out positions in the Tobacco sector, take comfort in the fact that this stance is now in the majority. For those who still hold a large stake, this is becoming an increasingly non-consensus view.

Click on the links below for more detailed reports on the UK Tobacco industry group.

Time-Series & Stock Activity

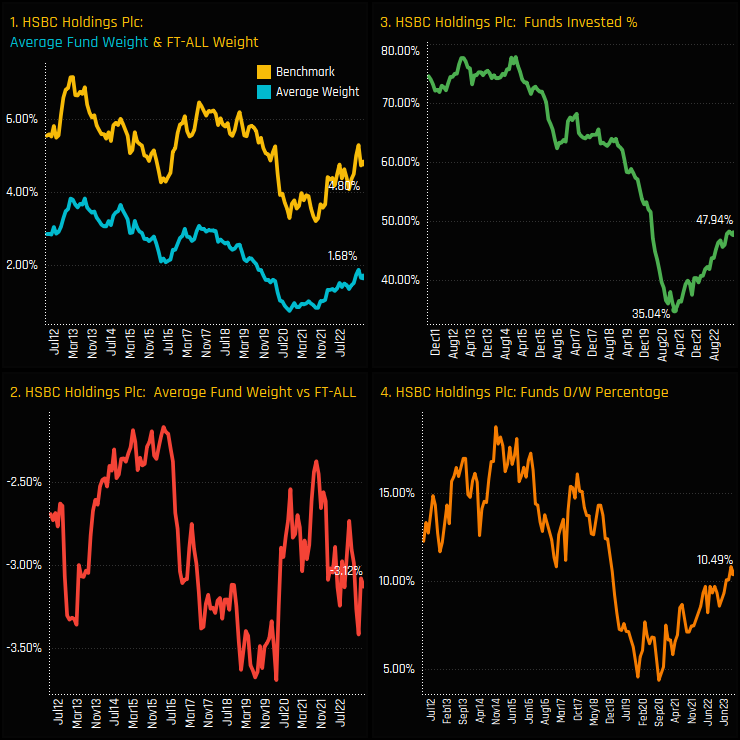

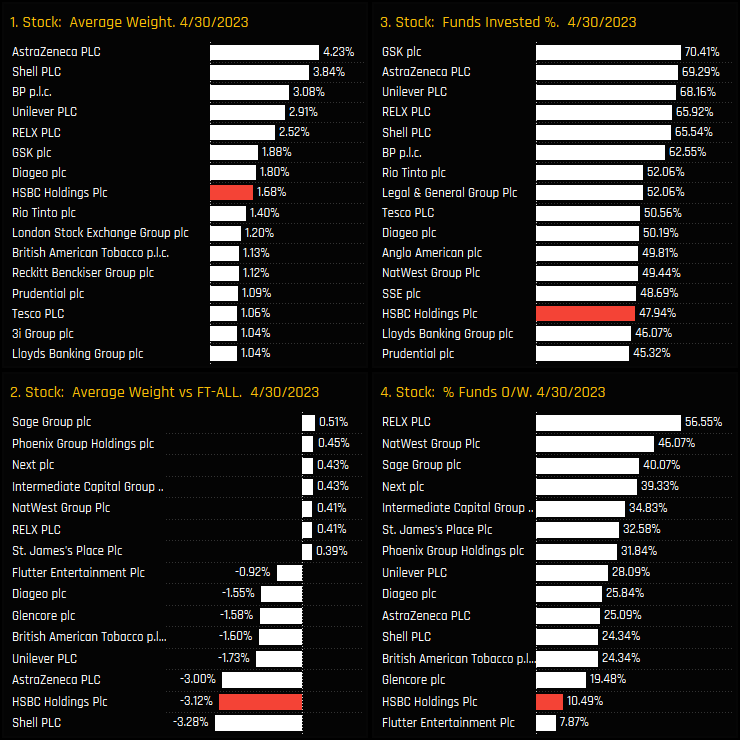

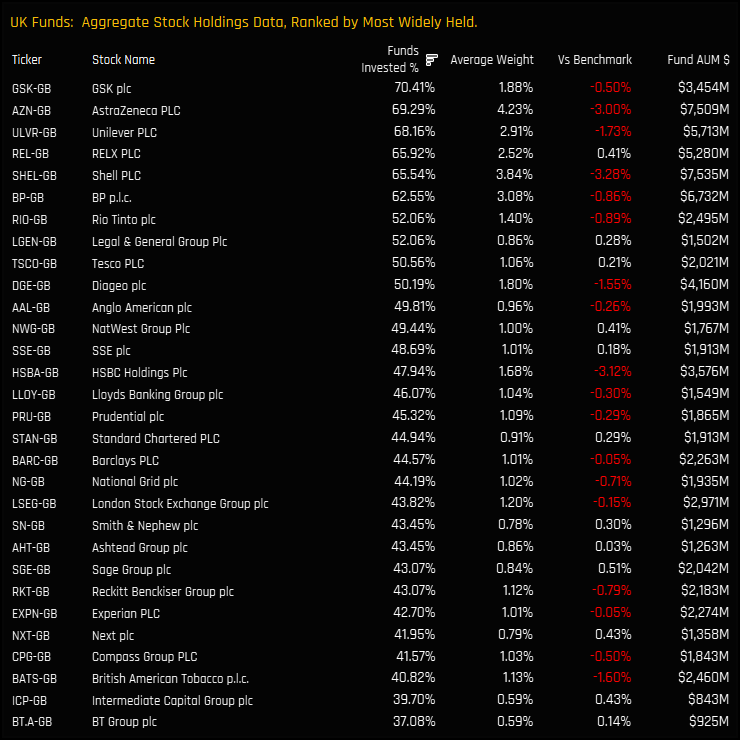

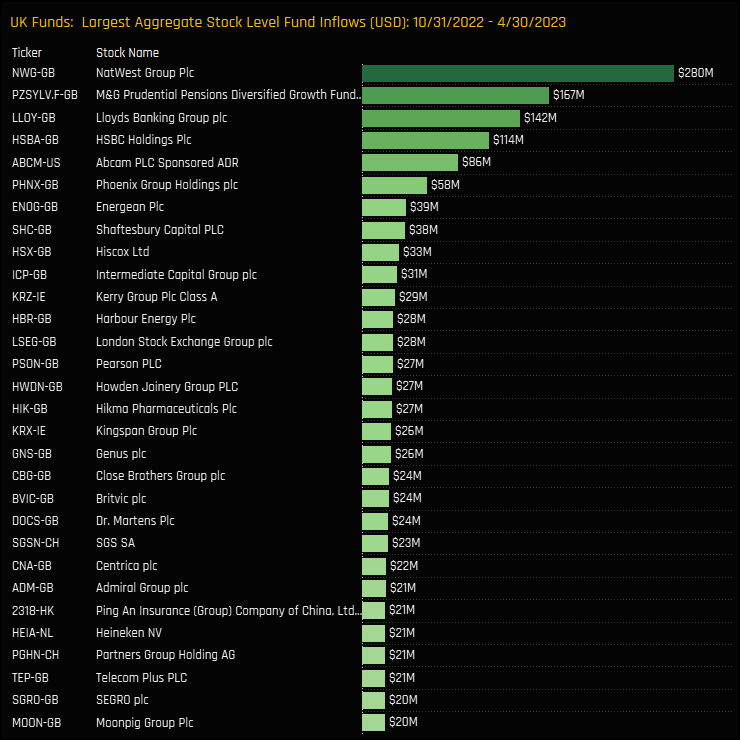

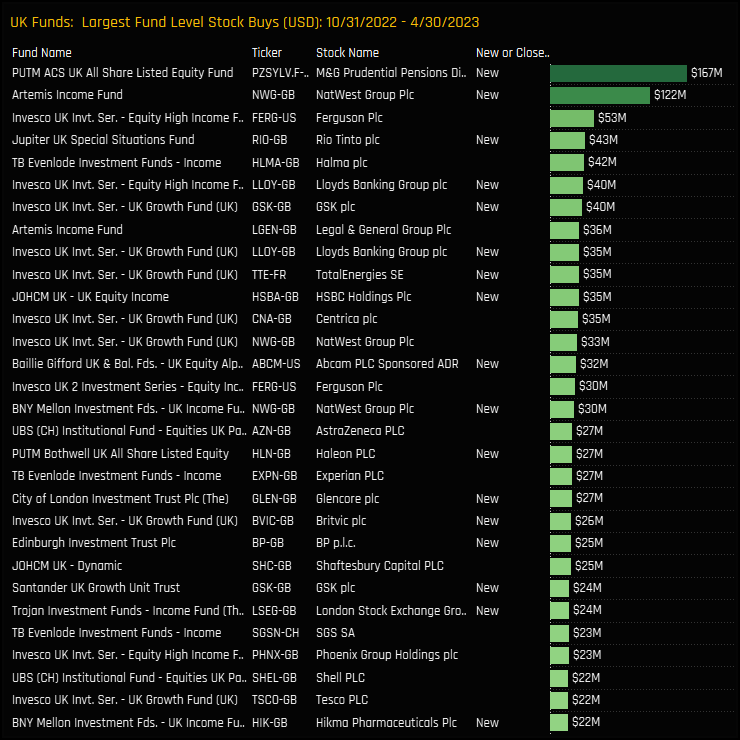

UK fund exposure in HSBC Holdings is on the rise. After a multi-year drop in ownership, UK allocations bottomed out with just 35% of funds invested in early 2021, down from over 70% between 2011-2015 (ch3). Since the lows, a growing number of active UK strategies are buying back in, with average weights moving to 1.68% (ch1) and 48% of funds invested. Despite these gains, current levels represent a significant underweight versus the SPDRs FTSE UK All Share ETF of -3.12% (ch2), with the vast majority of investors positioned below the index (ch4).

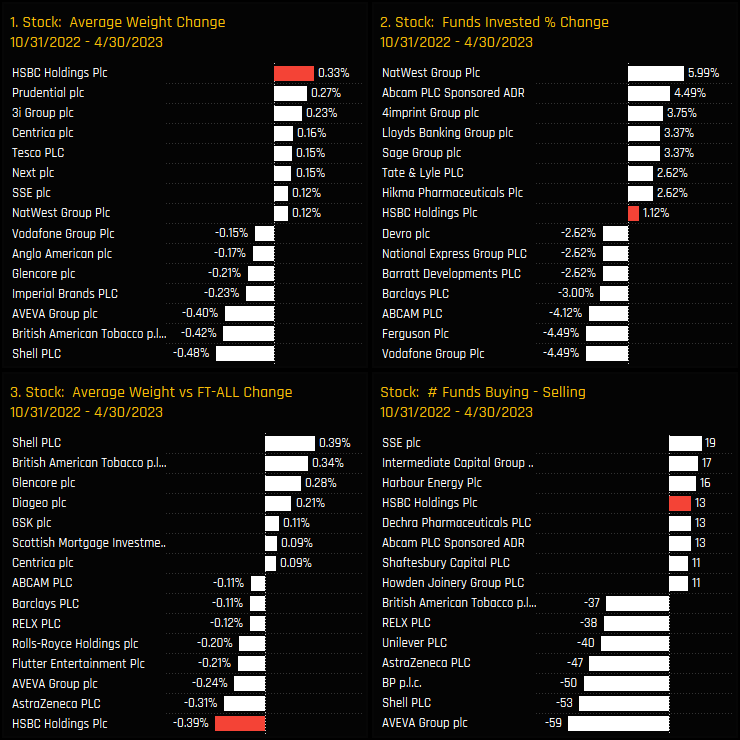

Over the last 6-months, HSBC Holdings has maintained this positive momentum and has faired well versus UK stock peers. It captured the largest increase in average weight of +0.33% over the period, had an excess of buyers over sellers and saw the percentage of funds invested rise by another +1.12%. Despite this positive rotation, the outperformance of HSBC over the period saw index weights make larger gains, increasing the net underweight by a further -0.39%.

Stock Positioning & Sentiment

HSBC Holdings is the 8th largest stock holding in the UK on an average weight basis and the 14th most widely held. Versus the FTSE All Share index, HSBC Holdings is one of three stocks that really differentiates UK active funds from their benchmark. On average, UK active funds hold 9.75% across HSBC Holdings, Shell PLC and AstraZeneca compared to 19.15% for the SPDRs FTSE UK All Share ETF.

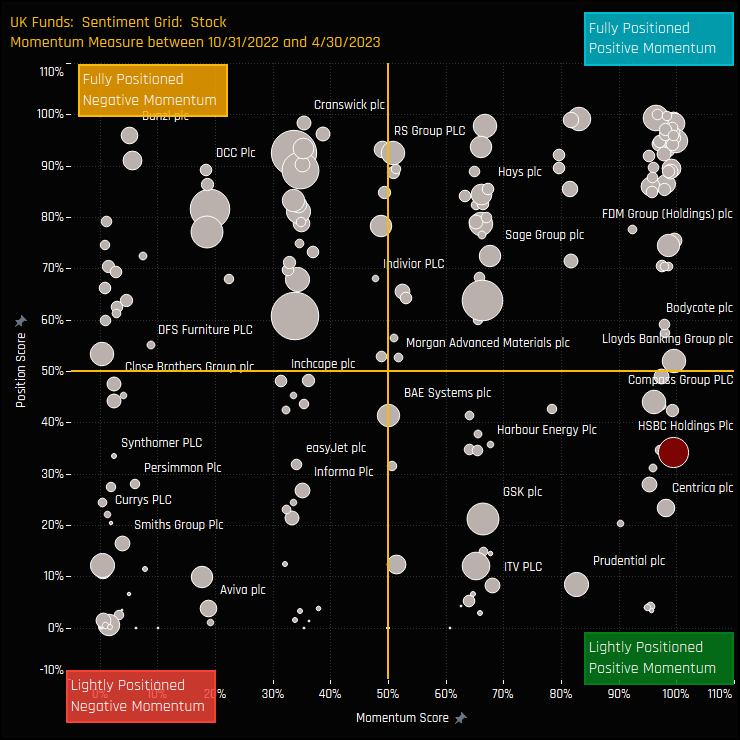

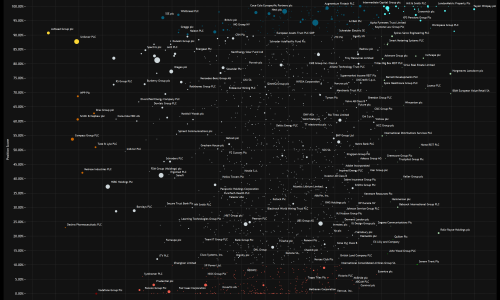

The sentiment grid below shows where current positioning in each UK stock sits versus its own history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each stock between 10/31/2022 and 04/30/2023 (x-axis). HSBC Holdings joins Centrica, Compass Group and Lloyds Banking Group as a stock with light positioning compared to it’s long-term history, but with more recent positive rotation.

Gap Analysis

The chart below highlights the scale of the drop in positioning in HSBC Holdings. The blue line represents the total number of UK funds (out of 267) who have ever held a position in HSBC, currently 226. The green shaded area is the number who currently hold a position (128) and the red line the difference. There are 98 funds with a previous history of investment in HSBC who are sitting on the sidelines for now, but that number is declining.

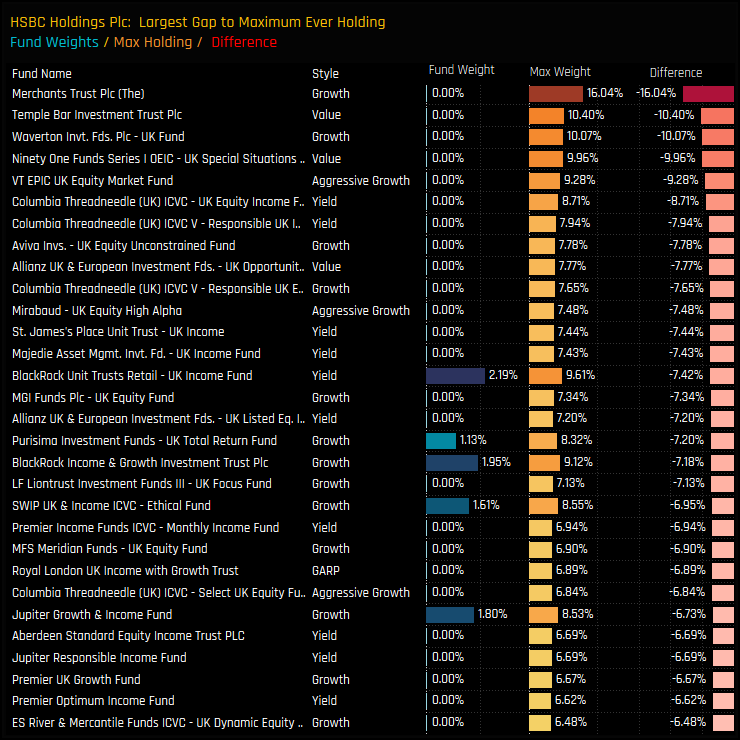

Many of those with previous history were once sizeable holders. The below chart ranks the funds with the largest differences between current weights in HSBC and their maximum ever weight since 2011. It highlights how HSBC Holdings was once a significant allocation for a number of funds, with many holding a +7% weight in the stock, but who currently hold nothing.

Stock Positioning & Activity

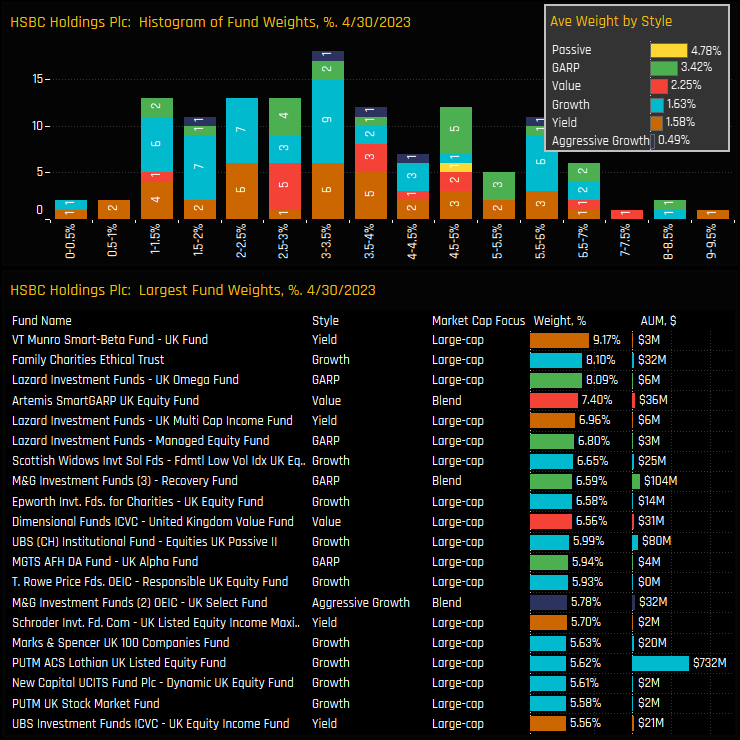

The currently holding distribution in HSBC is centered around the 2% to 5% range, with the top holders above 8% and led by VT Munro Smart-Beta UK on 9.14%. All Style groups are underweight the SPDRs FTSE UK All Share ETF on average, though HSBC clearly holds more appeal to those funds seeking ‘Growth At a Reasonable Price’. Aggressive Growth funds are notable for their marginal allocation of just 0.49% on average.

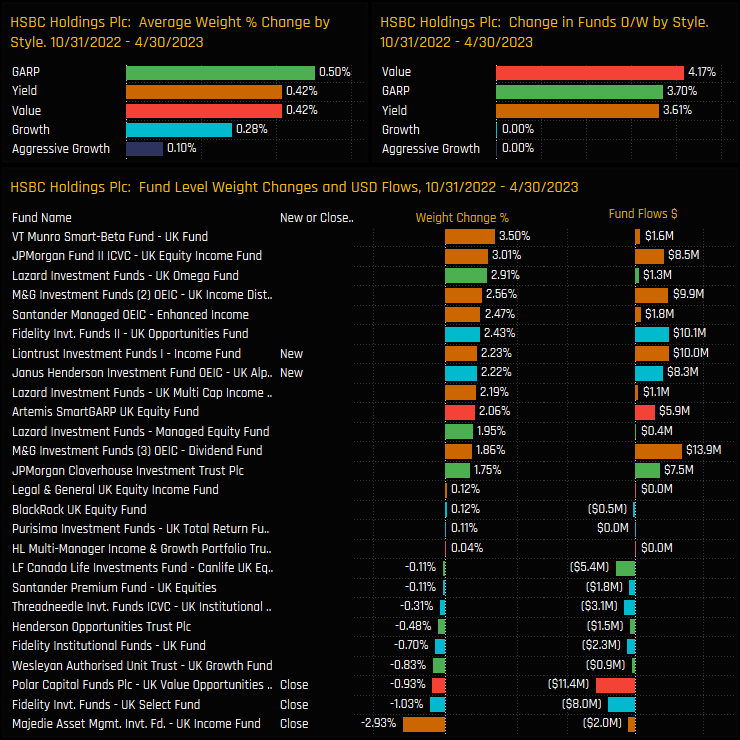

Over the last 6-months, all Style groups saw average allocations increase as a further 4.2% of Value funds, 3.7% of GARP and 3.6% of Yield investors switched to overweight. New positions outnumbered closing positions by a factor of 2, but the larger weight increases were from funds increasing existing holdings, and led by VT Munro Smart Beta (+3.5%) and JP Morgan UK Equity Income (+3%).

Conclusions & Links

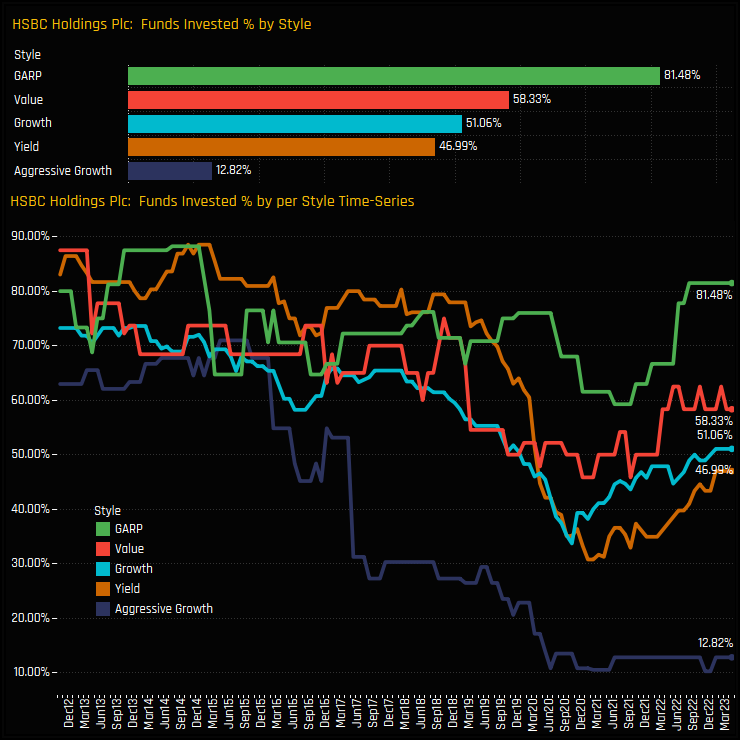

The chart to the right plots the evolution of HSBC ownership for each of the Style groups. The continued decline in Aggressive Growth fund ownership is countered by increases across the other Style groups since 2020/2021, most notably for GARP funds. Yield, Growth and Value funds still remain well below historical levels of positioning.

So compared to history, HSBC ownership is low. The shift in sentiment that started in 2020/2021 has simmered along at a relatively slow pace, though it is undoubtably happening. HSBC’s efforts to cut costs, dispose of non-core assets and focus on returning capital to shareholders has clearly resonated with a growing number of UK investors.

This combination of increasing ownership among active peers and rising benchmark weights only heightens the risk of not holding a position in HSBC for a UK equity fund. After all, active management is a relative pursuit. In our analysis, HSBC is shown to be a well known name among investors, with many having a history of holding a significant allocation. With outperformance this year of ~13% compared to the FTSE All Share index, HSBC Holdings is no longer a comfortable stock to avoid.

Click on the link below for an extended data report on HSBC positioning among active UK funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- April 18, 2024

UK Funds: Performance & Attribution Review, Q1 2024

268 UK Equity funds, AUM $192bn UK Funds: Performance & Attribution Review, Q1 2024 ..

- Steve Holden

- January 29, 2024

UK Fund Positioning Dashboards Overview

267 UK Funds, AUM $185bn UK Fund Positioning Dashboard Overview In this week’s analysis, ..

- Steve Holden

- October 18, 2023

UK Small/Midcap Fund Positioning Update

106 UK Small/Midcap Equity Funds, AUM $37bn UK Small/Midcap Fund Positioning Update, October 20 ..