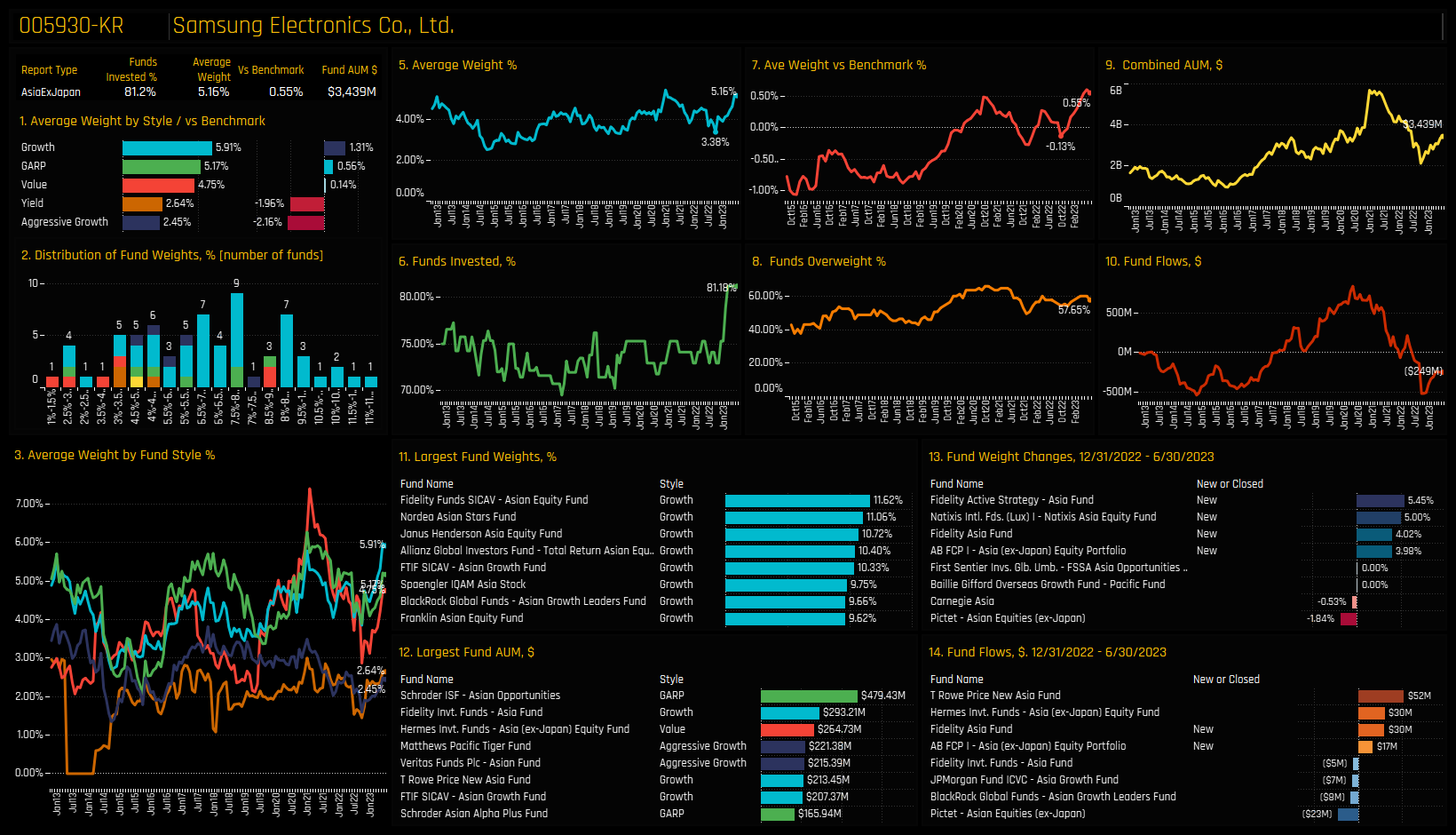

Asia Ex-Japan funds have increased ownership in Samsung Electronics to their highest levels on record. Samsung suffered something of a conviction crisis late in to last year, as average holding weights plunged to just 3.38% (chart 5 below), or underweight the iShares MSCI Asia Ex-Japan ETF by -0.13% (ch7). But since then, fund managers have ramped up allocations, with the percentage of funds with exposure to Samsung Electronics spiking to a record 81.2% over the course of the last 6-months (ch6), pushing average weights higher and moving active managers to near record overweights of 0.55%, on average.

New positions from Fidelity Asia (+5.45%) and Natixis Asia Equity (+5%) have unpinned this move (ch13), in addition to high conviction holdings of over 10% from Fidelity Asian Equity, Nordea Asian Stars and Janus Henderson Asia Equity, among others (ch11). So despite being an easy stock for Asian funds to hold on account of its large index weight, active investors are going one step further, ramping up allocations to record levels and with the majority of managers positioned overweight. Samsung Electronics has cemented itself as one of the highest conviction holdings in the Asia Ex-Japan region right now.

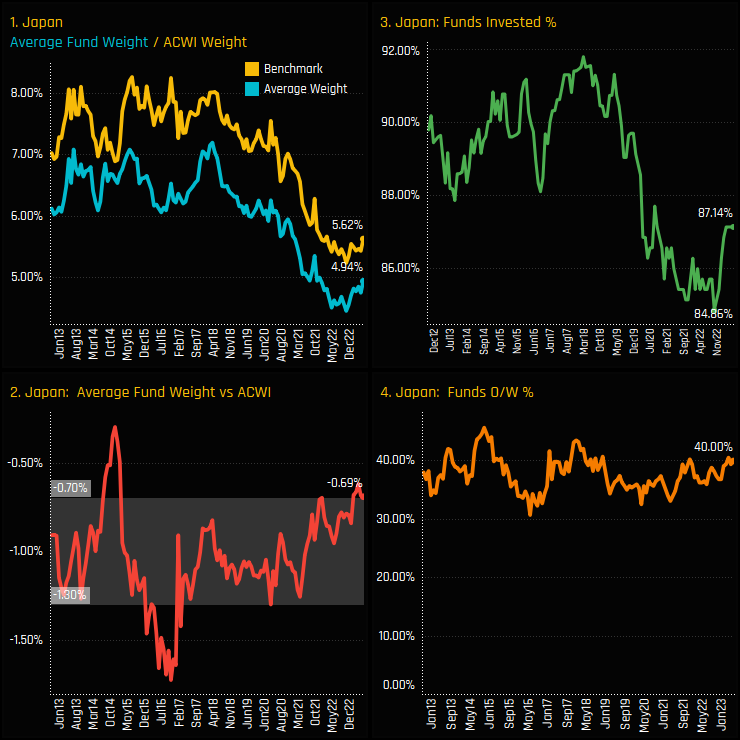

After a 5 year decline in Japanese exposure, active Global fund managers are beginning to warm to Japan’s investment credentials. Ownership levels in Japanese equities bottomed out in September of last year with 84.9% of funds invested, but moved higher to 87.14% as of the end of last month (ch3 below). Versus the iShares MSCI ACWI ETF, Japan has been a consistent underweight over the last decade, but today’s level of -0.69% below benchmark sits at the top end of the long-term range (ch2).

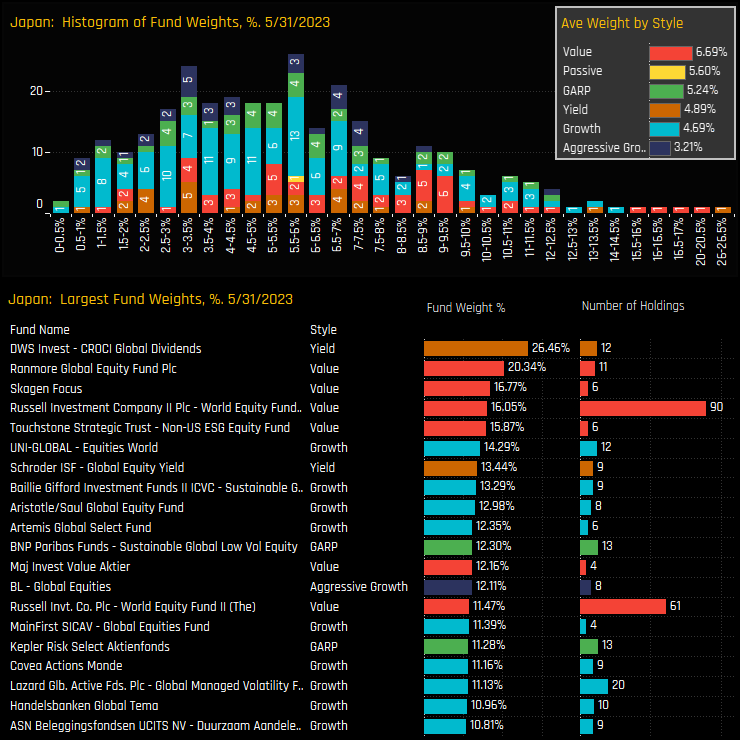

The histogram of individual fund weights in Japan shows the bulk of allocations are between the 2% and 8% level, but with a long tail to the upside. Fund allocations are well correlated to Style, with Value funds more heavily exposed than their Growth peers (inset chart). The Yield strategy of DWS CROCI Global Dividends is the largest holder on 26.46%, followed by a raft of Value strategies from Ranmore, Skagen and Russell, among others. In the full report we analyse the sectors, stocks and funds driving this reallocation.

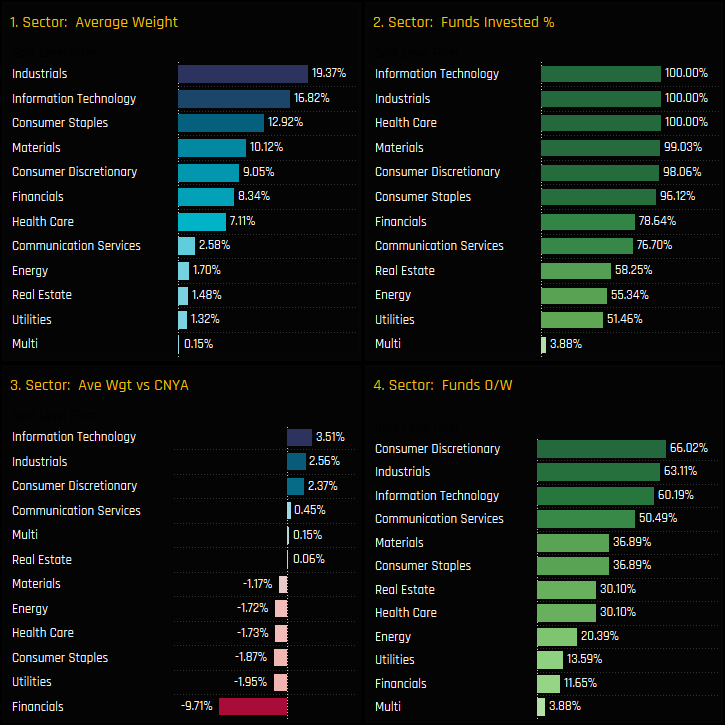

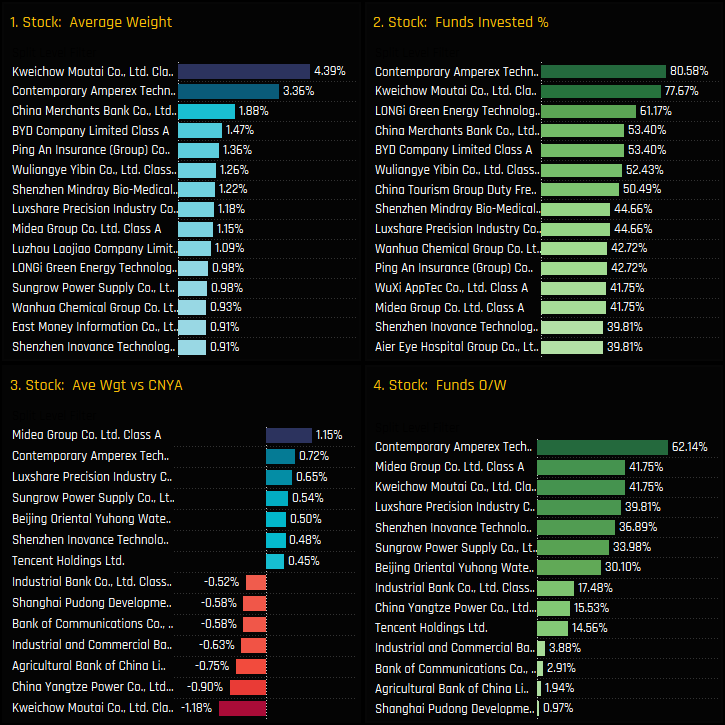

Among the 103 China A-Share strategies in our analysis, 84% of the total allocation sits in the 7 top sectors, led by Industrials, Technology and Consumer Staples (ch1). There is a significant gap to the less widely owned Communication Services, Energy, Real Estate and Utilities sectors. Active managers differ from the iShares MSCI China A-Shares ETF (CNYA) by running a significant underweight in the Financials sector, with average weights of 8.34% a massive -9.37% below benchmark (ch3) with only 11.7% positioned higher than the index (ch4). Offsetting this key underweight are consensus overweight positions in the Information Technology, Industrials and Consumer Discretionary sectors.

Drilling down to a stock level, 2 companies dominate above all others. Contemporary Amperex Technology and Kweichow Moutai are owned by 80.6% and 77.7% of A-Share managers respectively, well above the chasing pack of LONGi Green Energy and China Merchants Bank (ch2). Despite Kweichow’s average weight of 4.39%, this represents an average underweight of -1.18% versus the CNYA ETF, with active A-Share managers running overweights in Midea Group, Contemporary Amperex Technology and Luxshare Precision, on average. A host of domestic bank stocks underpin the Financials underweight, led by Agricultural Bank of China, ICBC and Bank of Communications.

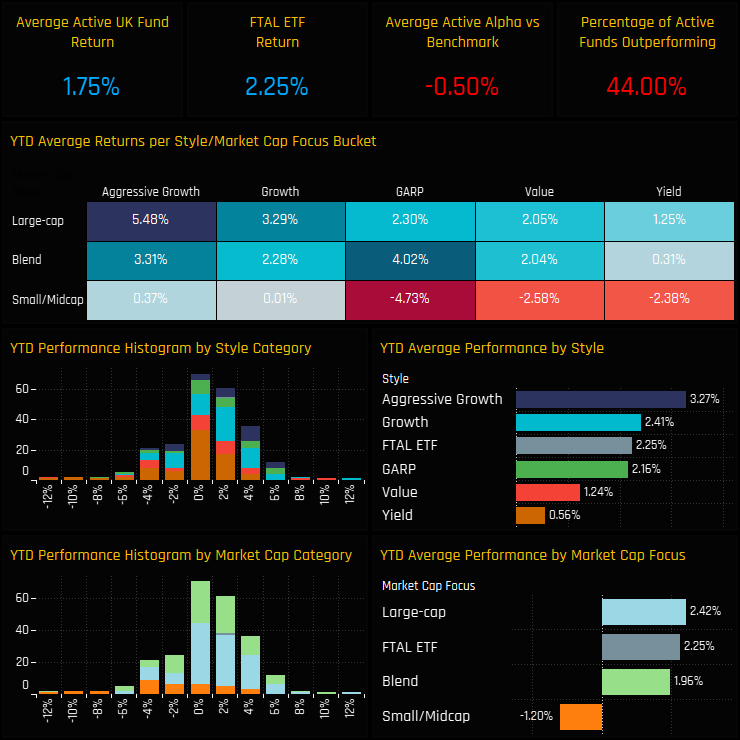

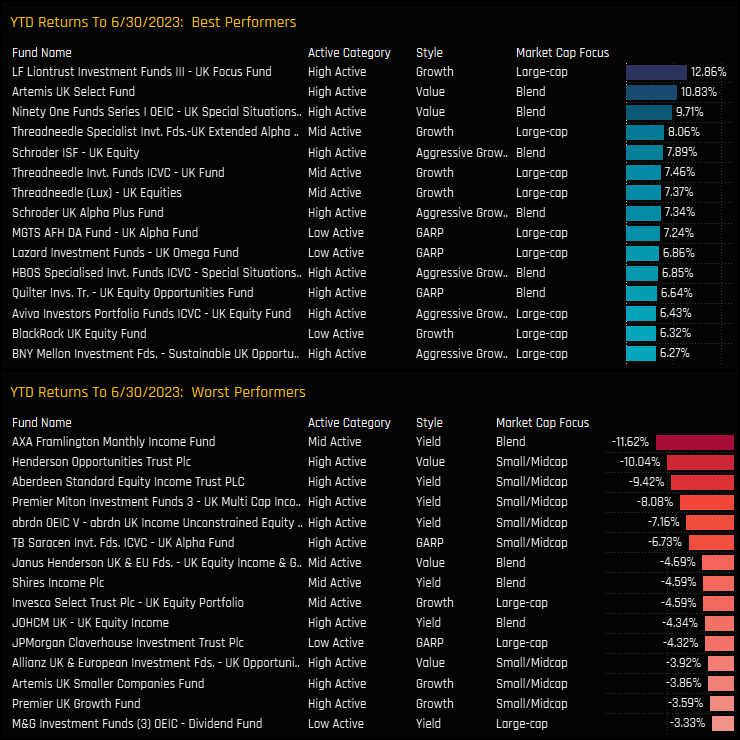

Active UK managers returned an average +1.75% in the first half of 2023, slightly behind the FTSE All Share ETF (FTAL) by -0.5% and with 44% of the 266 funds in our analysis outperforming. Returns were heavily effected by both Style and Market Cap Focus, with Aggressive Growth funds the outperformers on 3.27% against Yield on 0.56%. Small/Midcap strategies posted negative returns of -1.2% on average, with those at the Value end of the spectrum doing even worse.

On a single fund level there were exceptions to the Style averages, with the Value strategies of Artemis UK Select (10.83%) and Ninety One UK Special Situations (9.71%) among the top performers, but behind LF Liontrust UK Focus on +12.86%. A host of Small/Midcap strategies fill the lower order, but the Blend/Yield strategy of Axa Framlington Income takes the wooden spoon, losing -11.6% over the first half of the year. If you’re interested in how your fund has performed versus your Style and Market Cap peers, please get in touch.

380 EMERGING MARKET FUNDS, AUM $392BN

Emerging Market Stock Radar

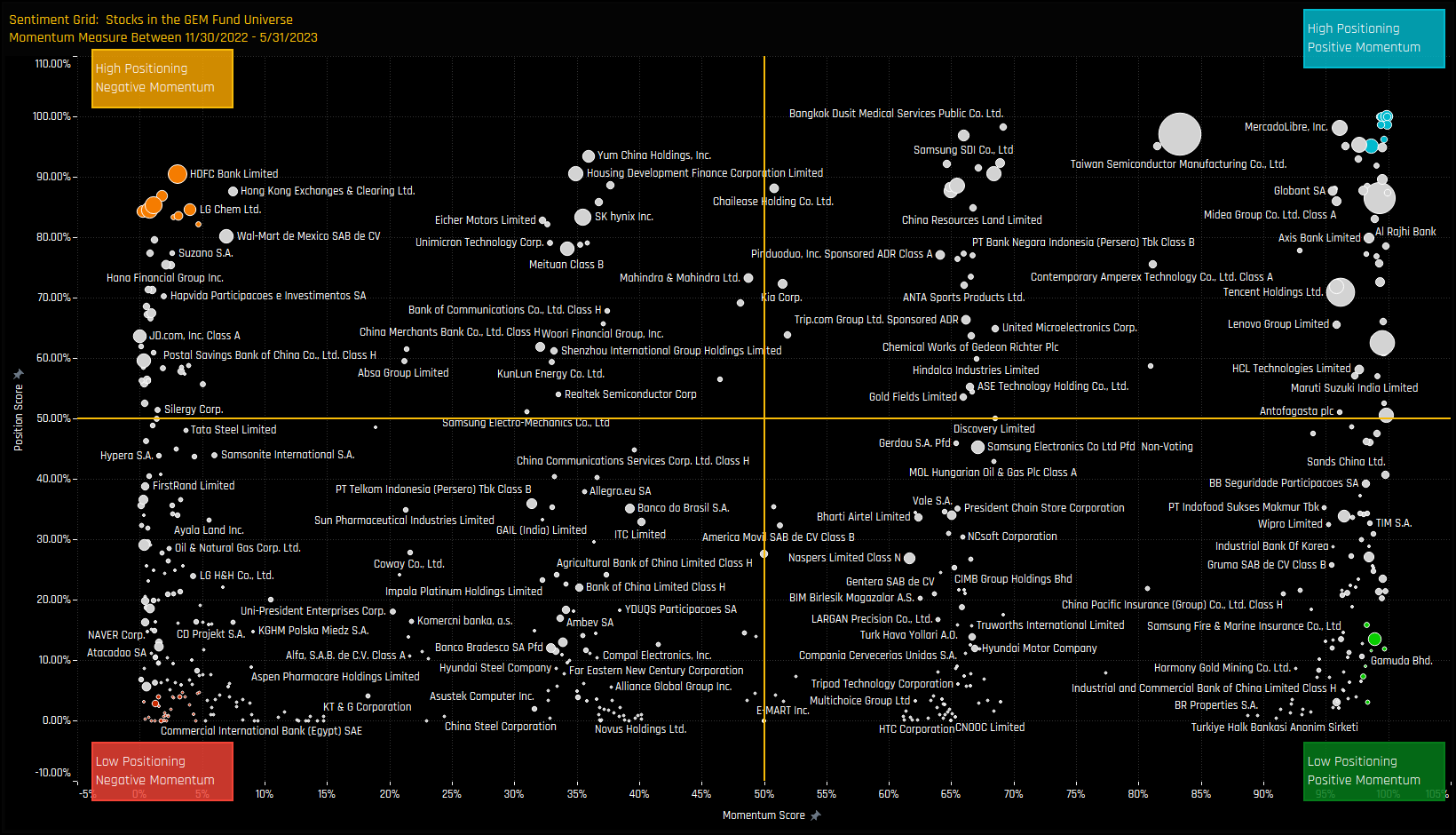

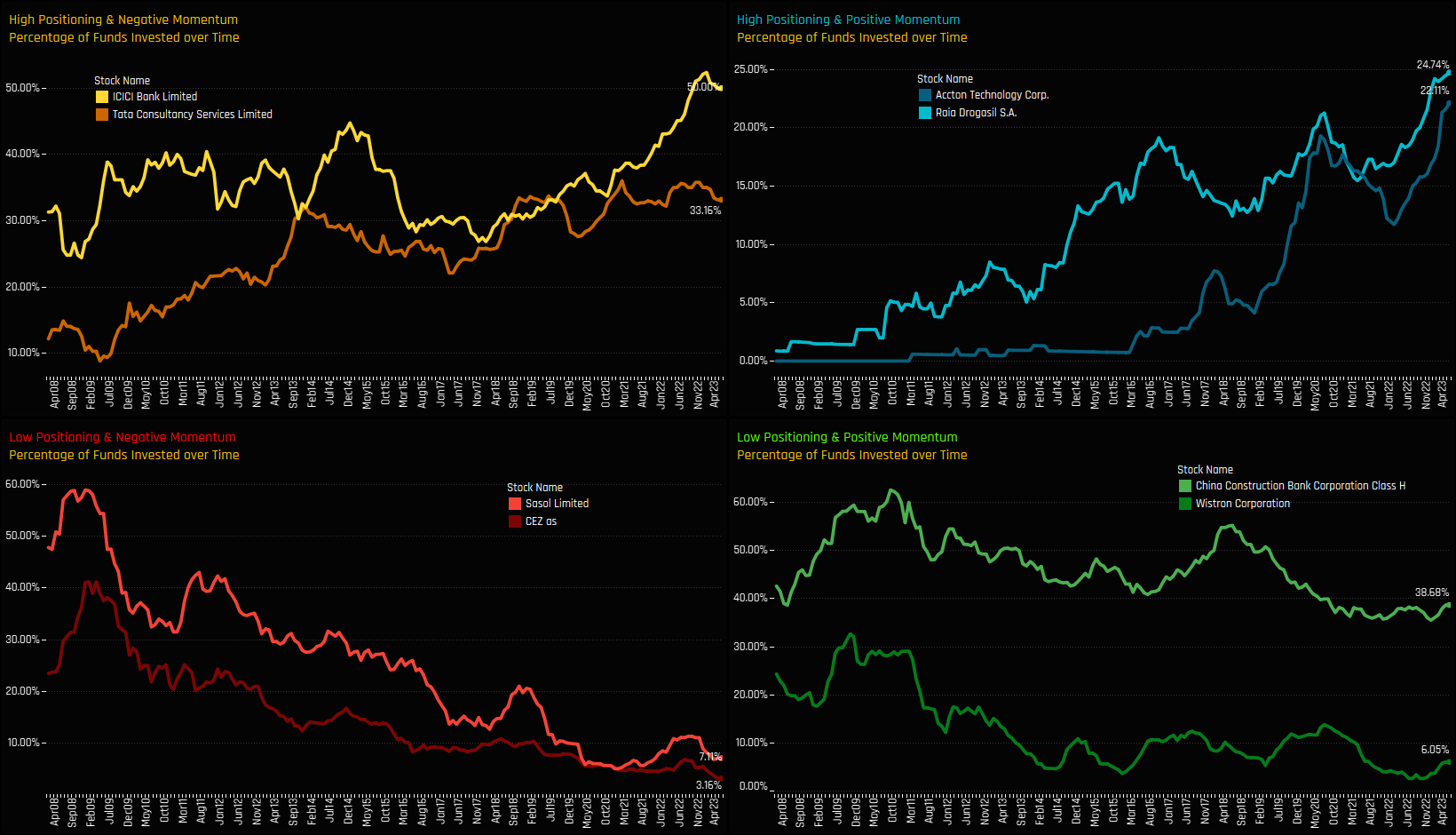

Investment levels among the thousands of stocks in the investible Emerging Markets universe differ greatly. Some stocks are widely owned, others largely avoided with ownership levels changing every month. We combine current and historical positioning against shorter-term manager activity to get a handle on where sentiment lies for every stock in our EM analysis. We highlight 8 stocks at the extreme ends of their own positioning ranges whilst also seeing significant changes in fund ownership.

Stock Sentiment

Extreme Stocks

The following charts illustrate the percentage of active EM funds invested in the top 2 stocks at the extreme ends of each corner. This visualization provides an additional perspective how the Sentiment Grid works. For instance, in the top-left chart, ICICI Bank Limited and Tata Consultancy Services are experiencing a reversal from peak levels of ownership after a prolonged period of growth. In the bottom-left, both Sasol Limited and CEZ have suffered a long-term decline in ownership, with additional selling in recent months pushing exposure to its lowest levels in 15 years.

In the bottom right chart, both China Construction Bank and Wistron Corp find themselves at the lower end of their historical ownership ranges. However, both stocks have started to rebound from their lows, with a number of managers opening new positions. Finally, in the top right chart, Accton Technology Corp and Raia Drogasil are currently experiencing peak ownership levels, following consistent increases in fund exposure over the past few months. In our full report we look in detail at the fund holdings and activity that underpin these 8 extreme stocks. Please get in touch for more details.

To request access to the full reports mentioned above or inquire about a subscription to our research, please e-mail me directly on the below:

Related Posts

- Steve Holden

- January 15, 2023

Emerging Market Funds: Performance & Attribution in 2022

276 Active GEM Funds, AUM $343bn. 2022 Performance & Attribution Report In this report, we ..

- Steve Holden

- February 20, 2023

Consensus Overweight in UK Stocks

358 Global Equity Funds, AUM $914bn Overweight Consensus in UK Stocks A record 70.4% of Global ..

- Steve Holden

- February 13, 2024

China: Darkest before the Dawn?

340 Global Equity Funds, AUM $1tr China: Darkest before the Dawn? Author: Steven Holden Date: ..