275 Active UK Equity funds, AUM $145bn

UK Utilities

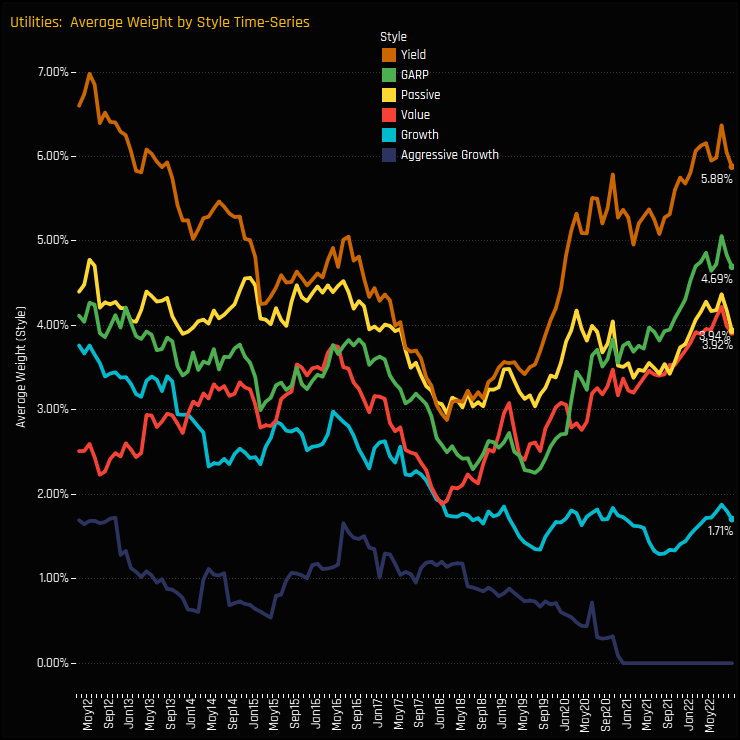

In this piece we provide a comprehensive analysis of Utilities sector positioning among active UK Equity funds. We find that Utilities exposure among active UK equity funds has been on an upward trend since bottoming out in 2019. Underweights have been closed as managers increase exposure to key stocks in the sector, led by Drax Group, SSE plc and United Utilities. Whilst Yield and GARP managers have led the charge higher, Growth and Aggressive Funds remain underinvested compared to their own history.

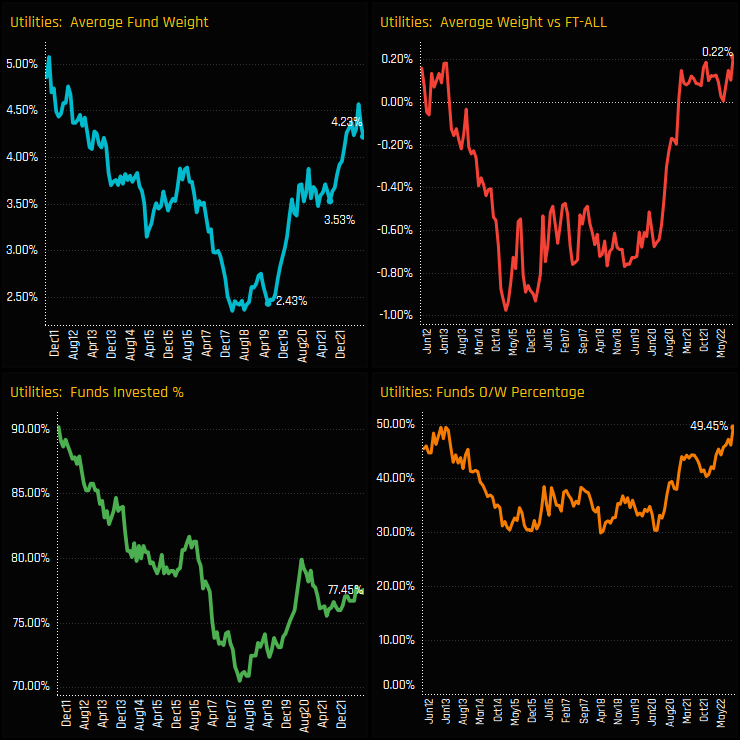

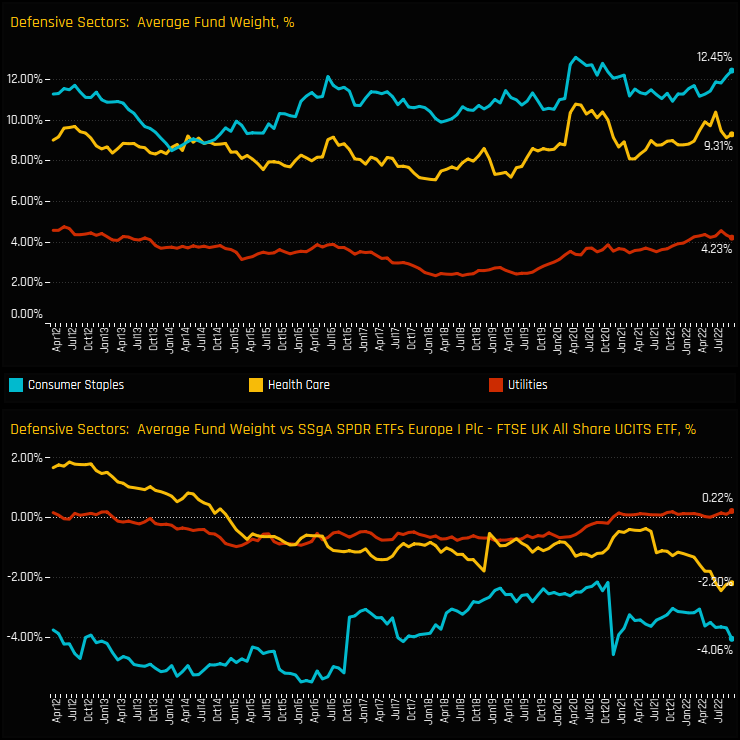

Time-Series Ownership Analysis

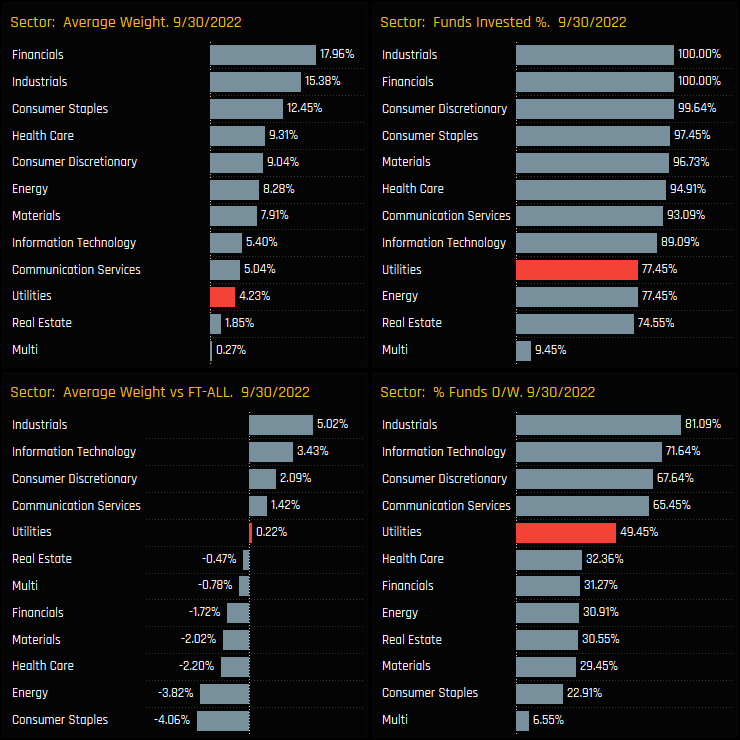

Sector Analysis

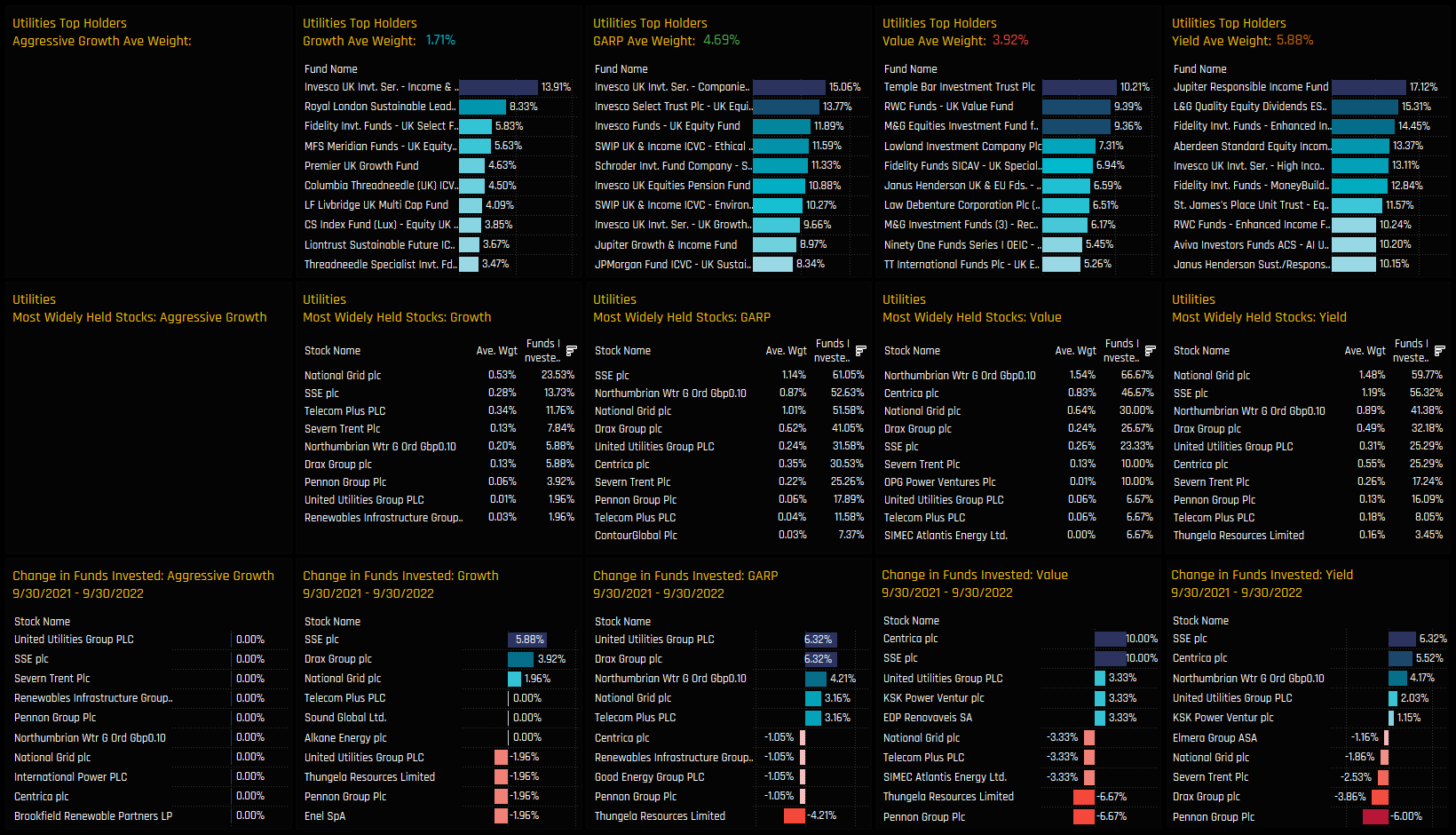

Fund Holdings & Style Analysis

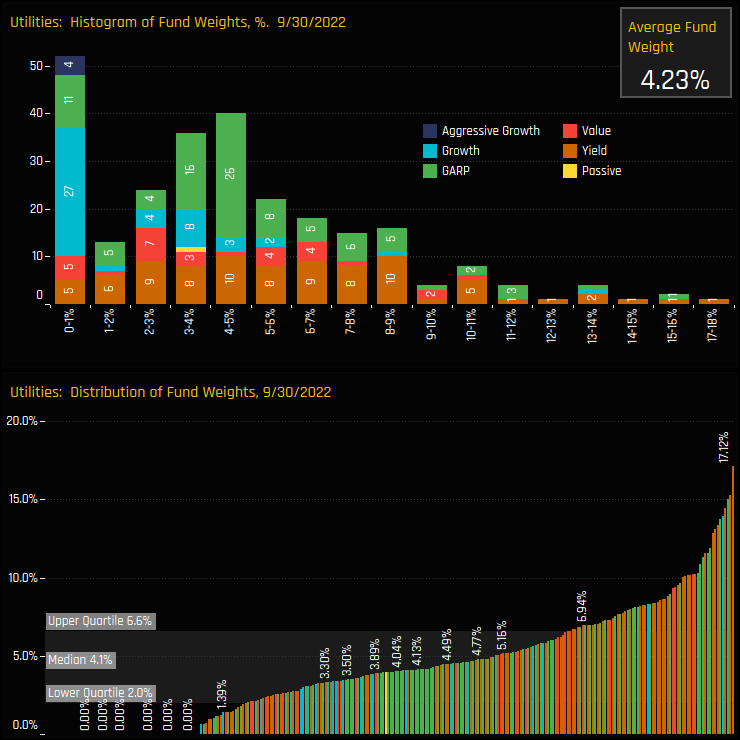

On a fund level, the majority of UK managers hold less than a 10% allocation in the Utilities sector, with 50% of managers sandwiched between the lower and upper quartiles of 2.0% and 6.6%. At the lower end are the 22.5% of funds who hold no exposure at all and the top end 4 funds who hold above 14%, topping out at 17.12%.

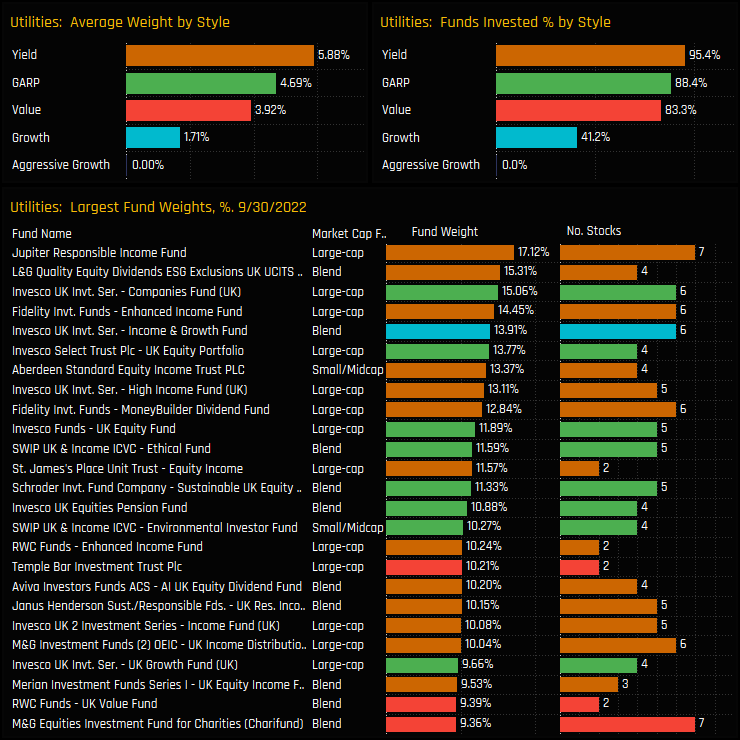

The largest holders are a mixture of Yield and GARP funds, led by Jupiter Responsible Income (17.12%) and L&G Quality Equity Dividends (15.31%). On average, Yield funds are the dominant Style group, with average weights of 5.88% and 95.4% of funds invested. This is in stark contrast to Growth managers, with just 41.2% of managers invested at an average weight of 1.71%. Not a single Aggressive Growth fund in our analysis has exposure to the Utilities sector!

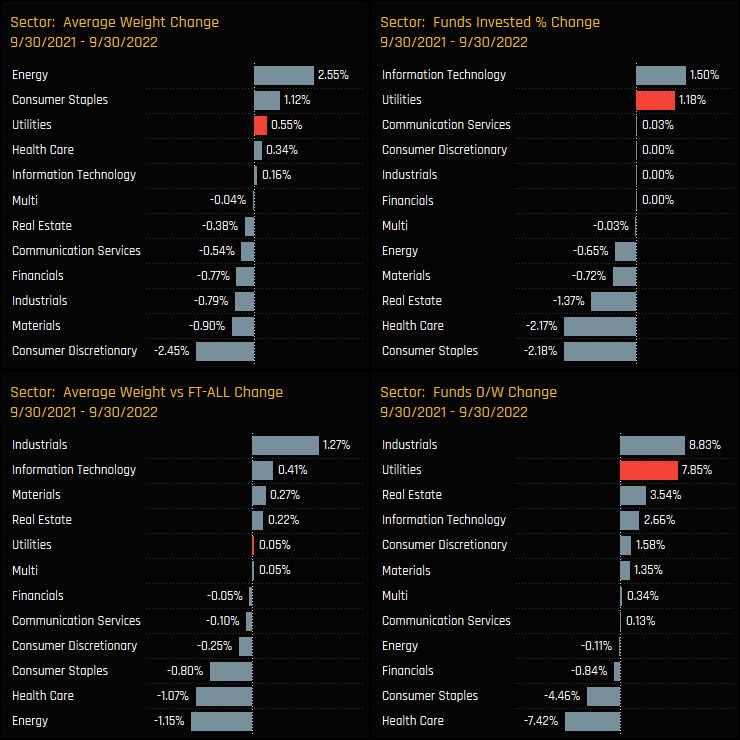

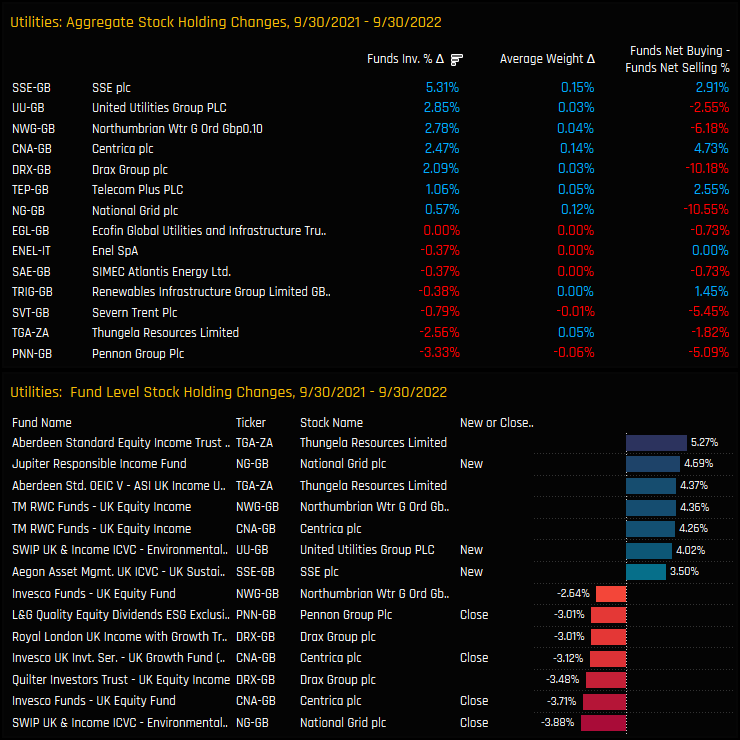

Fund Activity & Style Trends

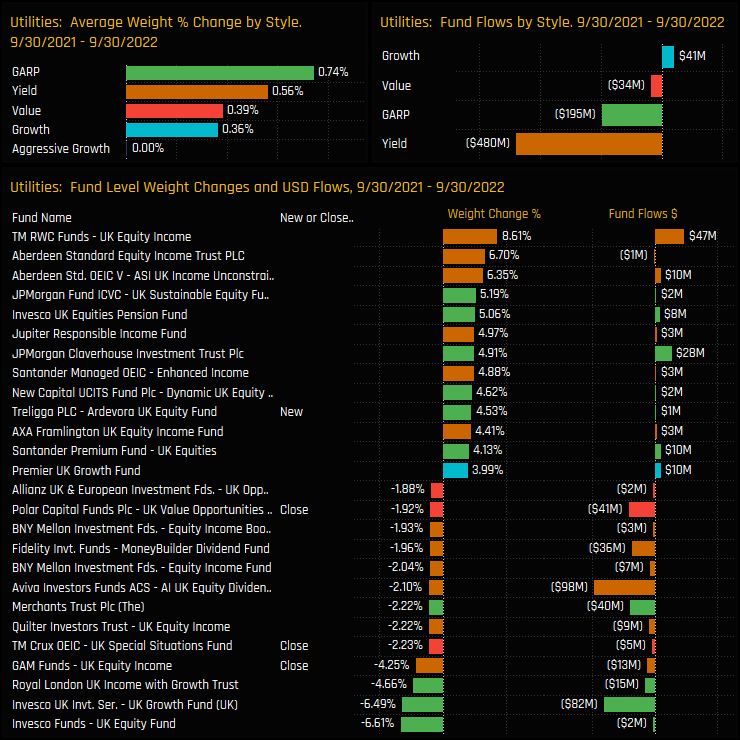

Fund activity between 09/30/2021 and 09/30/2022 is skewed to the buy side, with all Style groups seeing average Utilities allocations increase, save for Aggressive Growth. GARP and Yield funds were again the standouts, with new positions from Ardevora UK Equity (+4.53%) and large increases from RWC UK Equity Income (+8.61%) and Aberdeen Equity Income Trust (+6.7%). The net fund outflows from Yield and Value funds were on the back of -$10bn in net outflows for the UK equity fund group as a whole over the period.

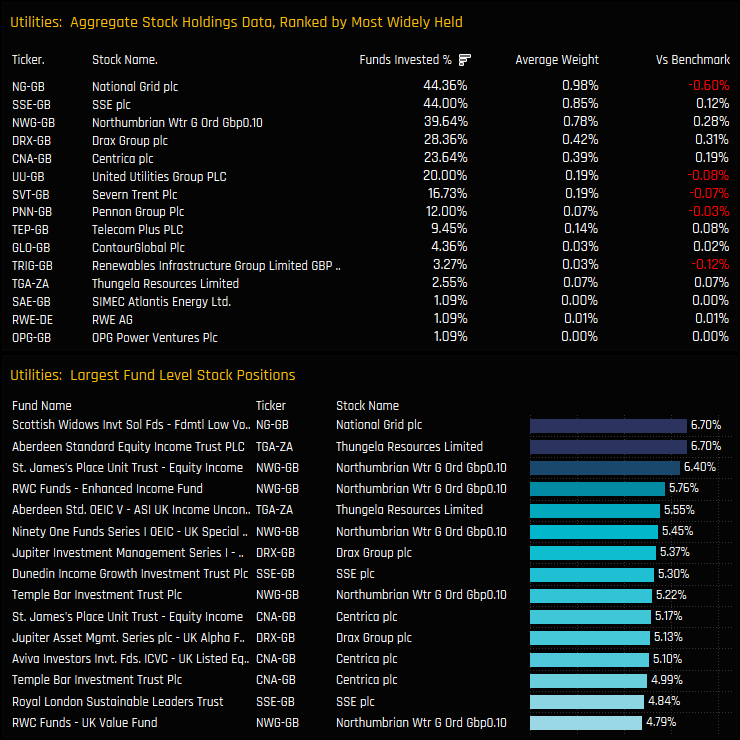

Stock Holdings & Activity Analysis

Stock Holdings by Style

Conclusions

Our data shows an increasing level of exposure towards the Utilities sector among active UK investors. From bottoming out in late 2019, average holding weights have climbed back towards the highs of the last decade.

Stock holdings are fairly concentrated, with 62% of allocations directed towards the top 3 holdings of National Grid plc, SSE plc and Northumbrian Water, though UK managers are raising exposure in 2nd tier names such as Centrica, Drax Group and United Utilities. There is clearly some depth to the sector.

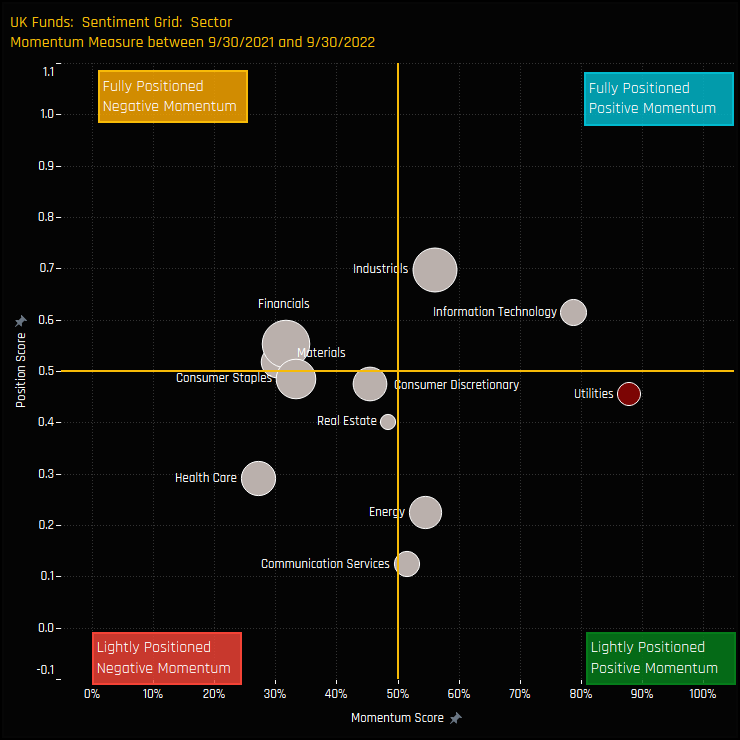

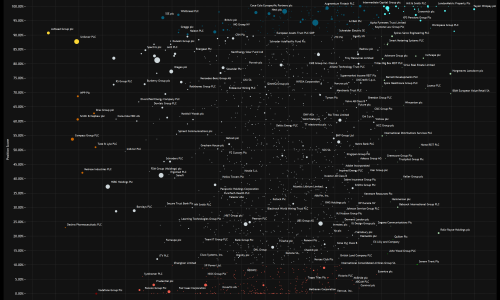

The chart to the right shows where current positioning in each UK sector sits versus history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each sector between 09/30/2021 and 09/30/2022 (x-axis). Utilities sit in the far right of the Grid, indicative of strong momentum among managers compared to all other sectors over the period.

On the positioning front, there is clearly headroom for allocations to move higher from here – remember there are 22.5% of managers still opting out of the Utilities sector entirely. For that to happen, the sector has to hold some appeal for Growth investors, who so far are significantly underinvested compared to their Value/Yield peers.

See below for more detailed profiles of the 5 key stock holdings in the Utilities sector, together with a link to the UK Active Fund Ownership Report for the Utilities sector.

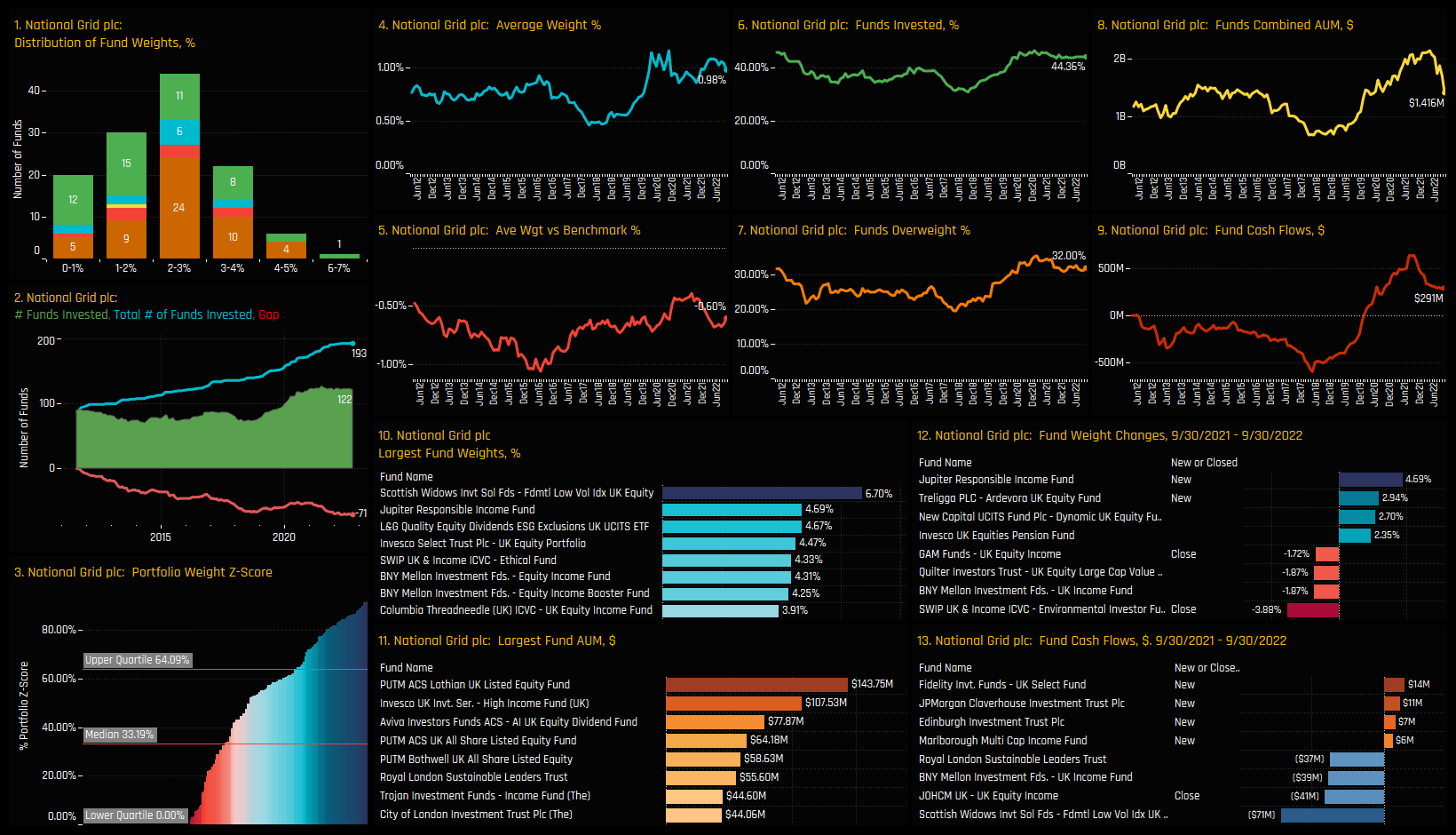

National Grid plc

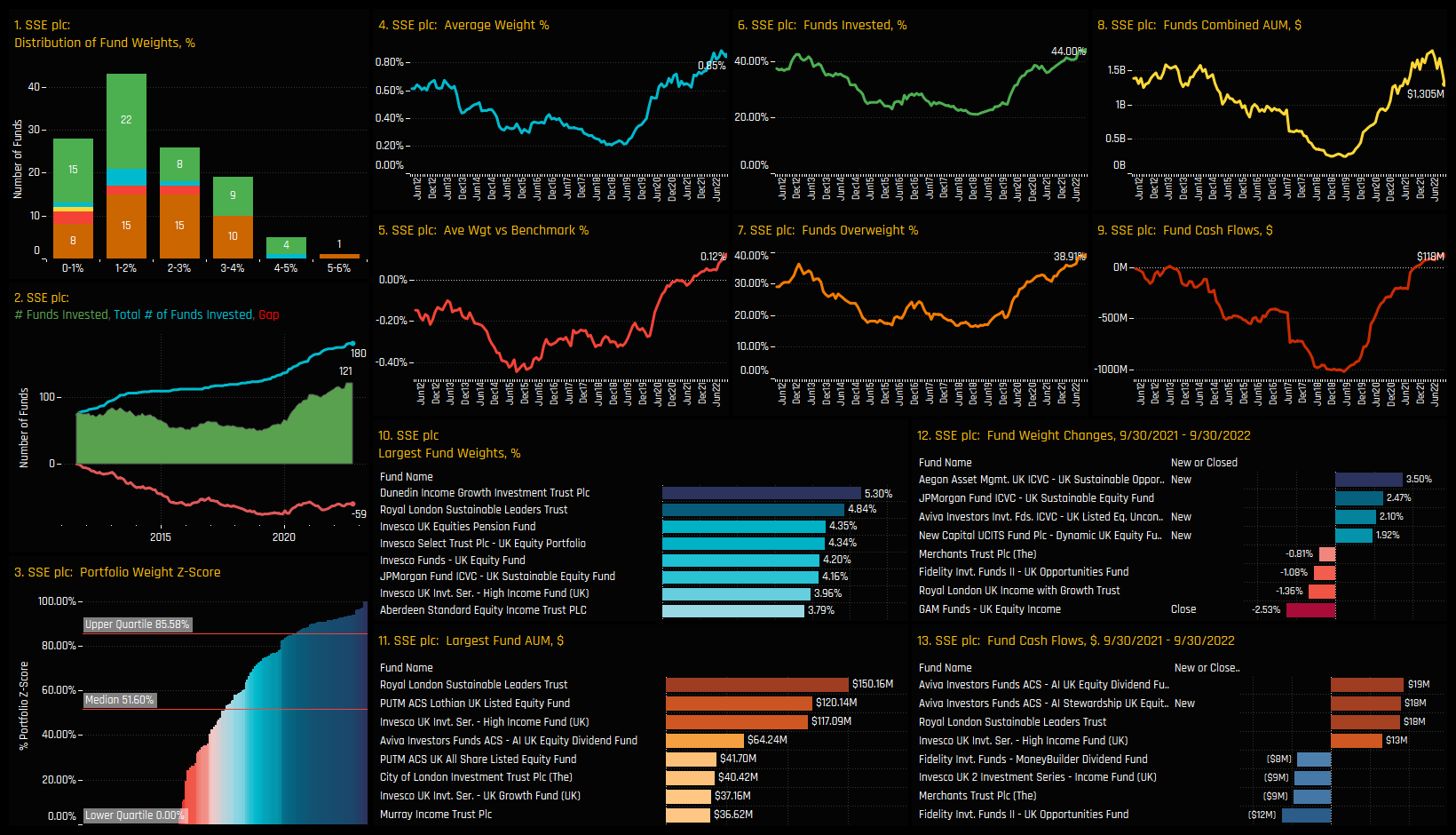

SSE plc

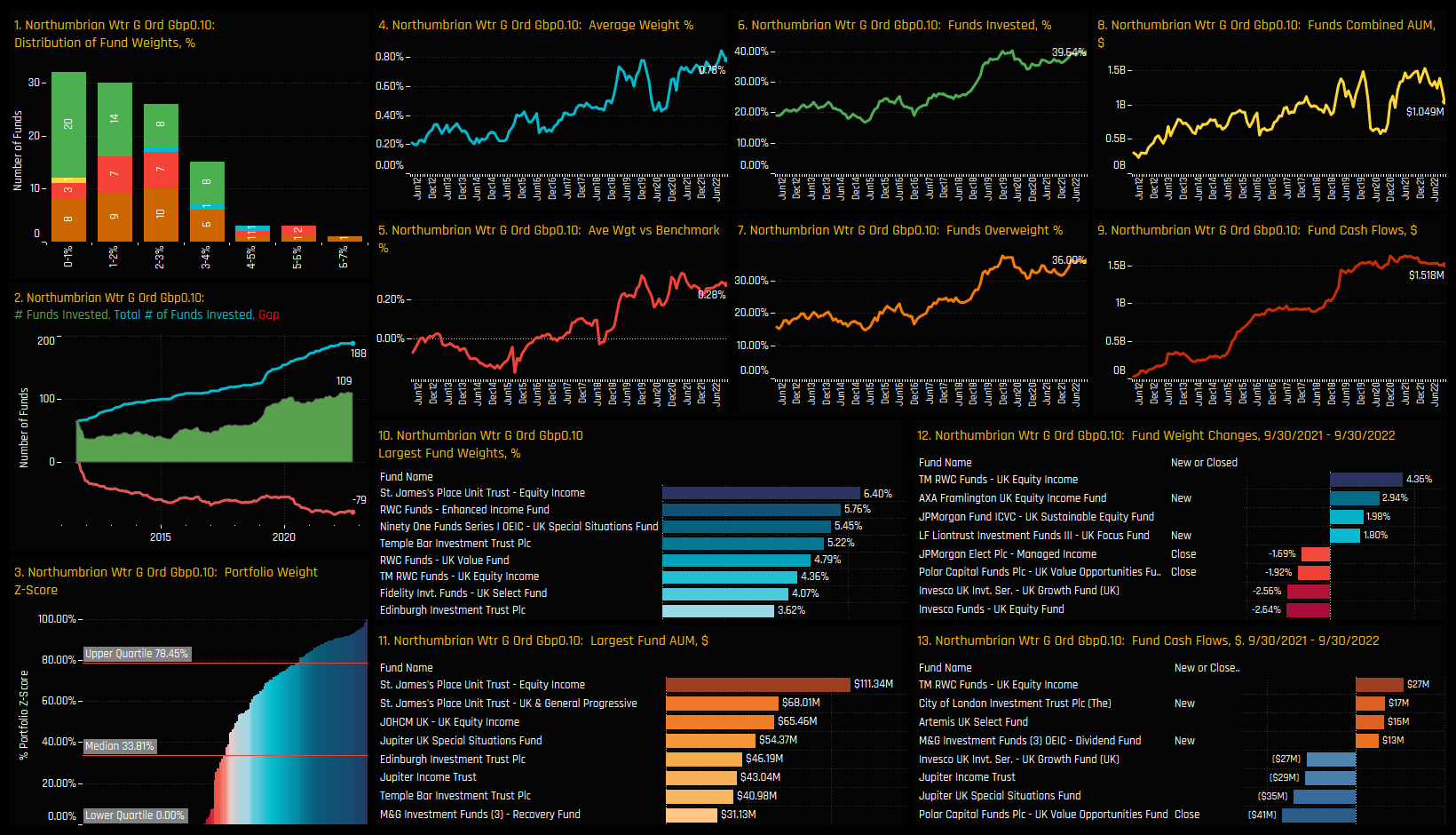

Northumbrian Water

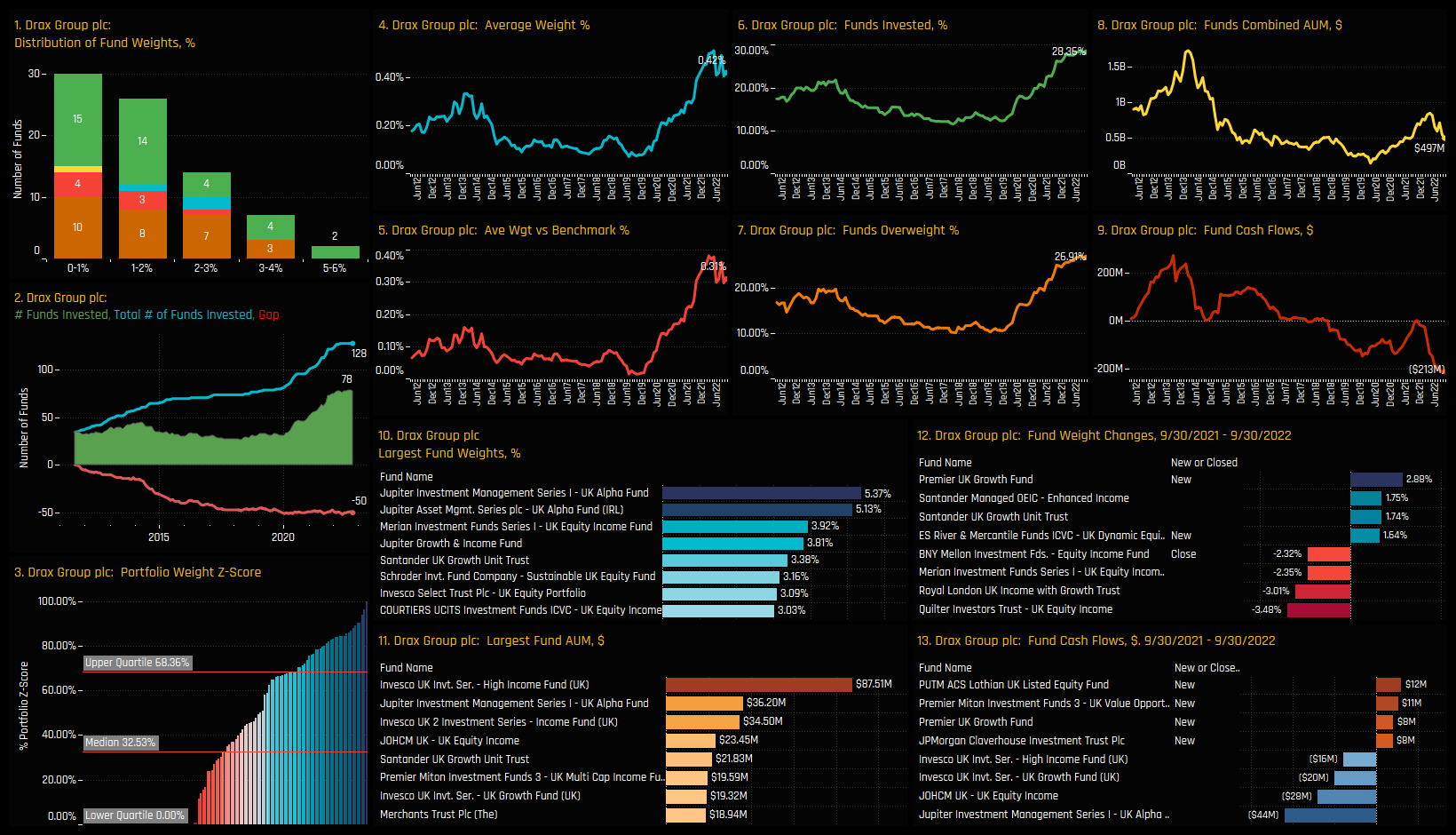

Drax Group plc

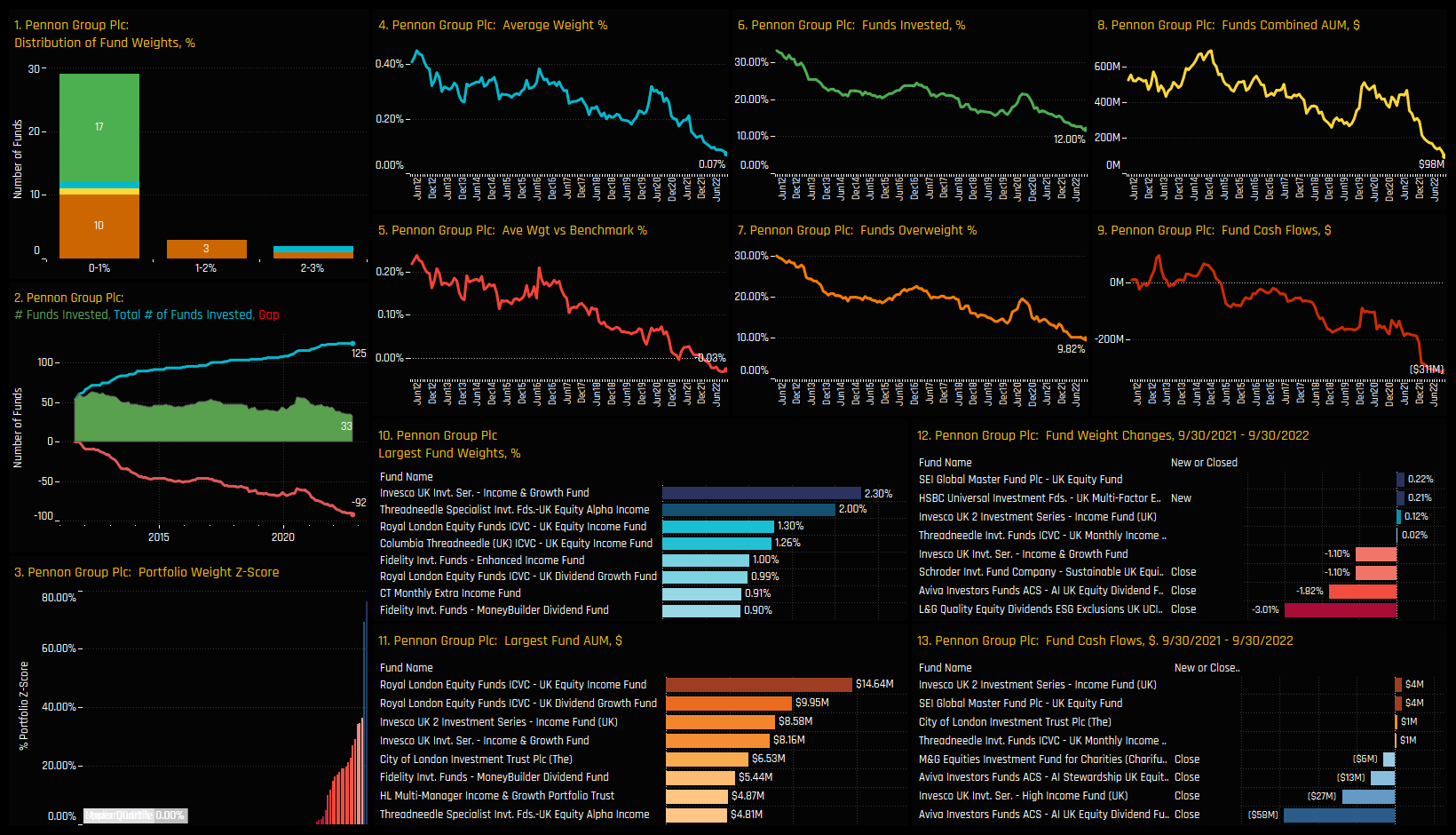

Pennon Group plc

Click on the link below for the latest data report on Utilities positioning among active UK funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- July 19, 2024

UK Funds: Performance & Attribution Review, Q2 2024

260 UK Equity funds, AUM $185bn UK Funds: Performance & Attribution Review, Q2 2024 Summar ..

- Steve Holden

- May 16, 2023

UK Fund Positioning Analysis, May 2023

267 UK Equity Funds, AUM $184bn UK Fund Positioning Analysis, May 2023 Tobacco: Kicking the Hab ..

- Steve Holden

- January 29, 2024

UK Fund Positioning Dashboards Overview

267 UK Funds, AUM $185bn UK Fund Positioning Dashboard Overview In this week’s analysis, ..