359 Active Global Funds, AUM $832bn

Consensus Positioning

Consensus positioning is something that is often discussed in investment circles. More often then not it tends to be anecdotal: “Everybody owns [insert stock], nobody is overweight [insert country]” etc etc. The fact is, there are very few consensus positions in Global investing, with a vast opportunity set of thousands of companies the reason most portfolios differ enough to avoid mass herding around selected regions, countries, sectors or stocks. However, there are some exceptions. Certain areas where the majority are overweight, or most investors just avoid completely. In this analysis, we find out what they are.

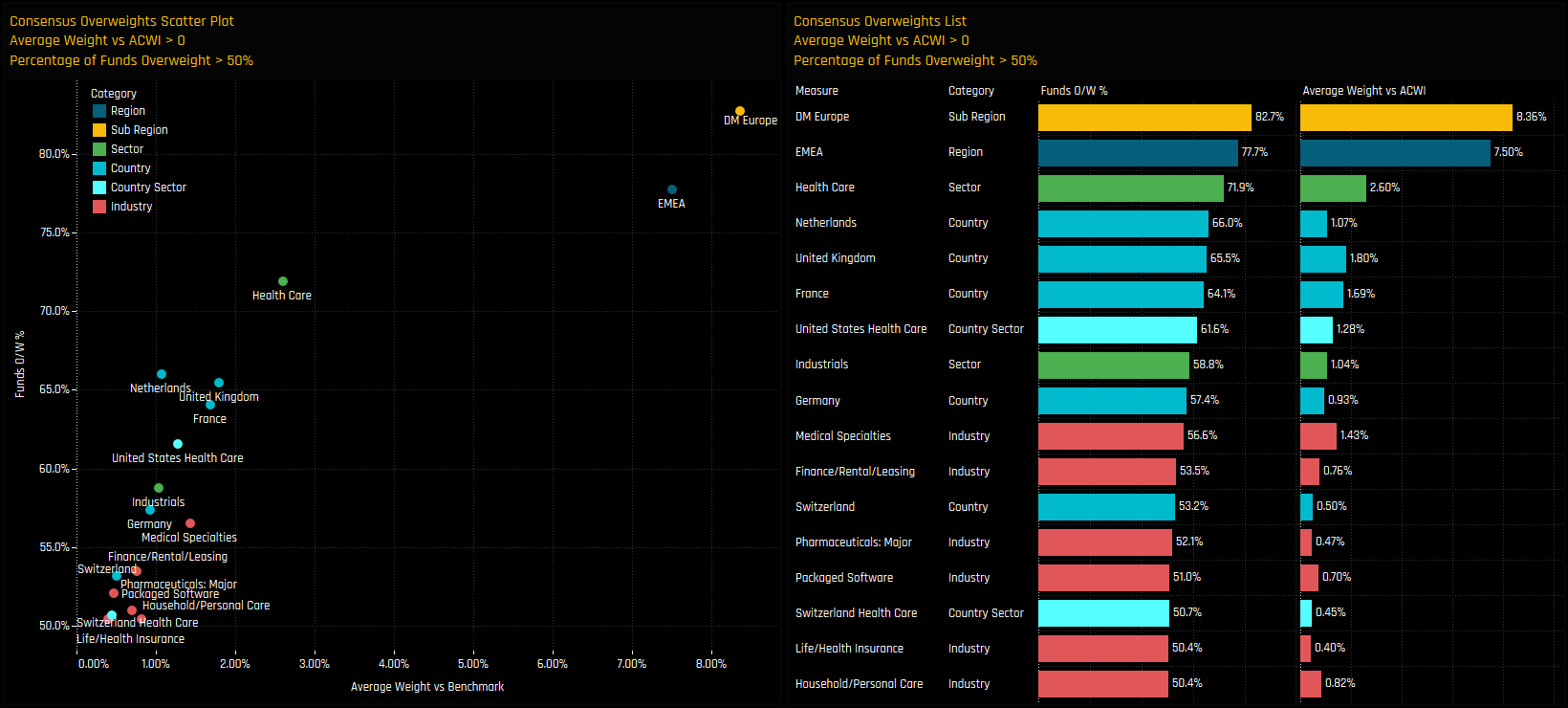

Consensus Overweights

We define a consensus overweight as a position that is held overweight on average, and by the majority of active investors versus the iShares All Country World ETF (ACWI). This can be a regional exposure, a sub-region, sector, country, country/sector or industry. The below charts plot all of the exposures that meet these criteria. The X-Axis shows the average overweight and the Y-Axis the percentage of funds who are overweight. Developed Europe is the standout here, with 82.7% of managers positioned overweight at an average +8.36% above the benchmark. It truly is THE consensus overweight among active Global investors.

The EMEA region as a whole is held overweight by 77.7% of funds, with DM Europe they key overweight Sub-Region. On a sector level, Health Care and Industrials standout as overweights held by the majority. Consensus country positioning is confined to those in the EMEA region, led by the Netherlands, the United Kingdom and France. On an industry level, Medical Specialties, Finance/Rental/Leasing and Major Pharmaceuticals are held overweight by the majority, albeit by just over 50% of managers in each.

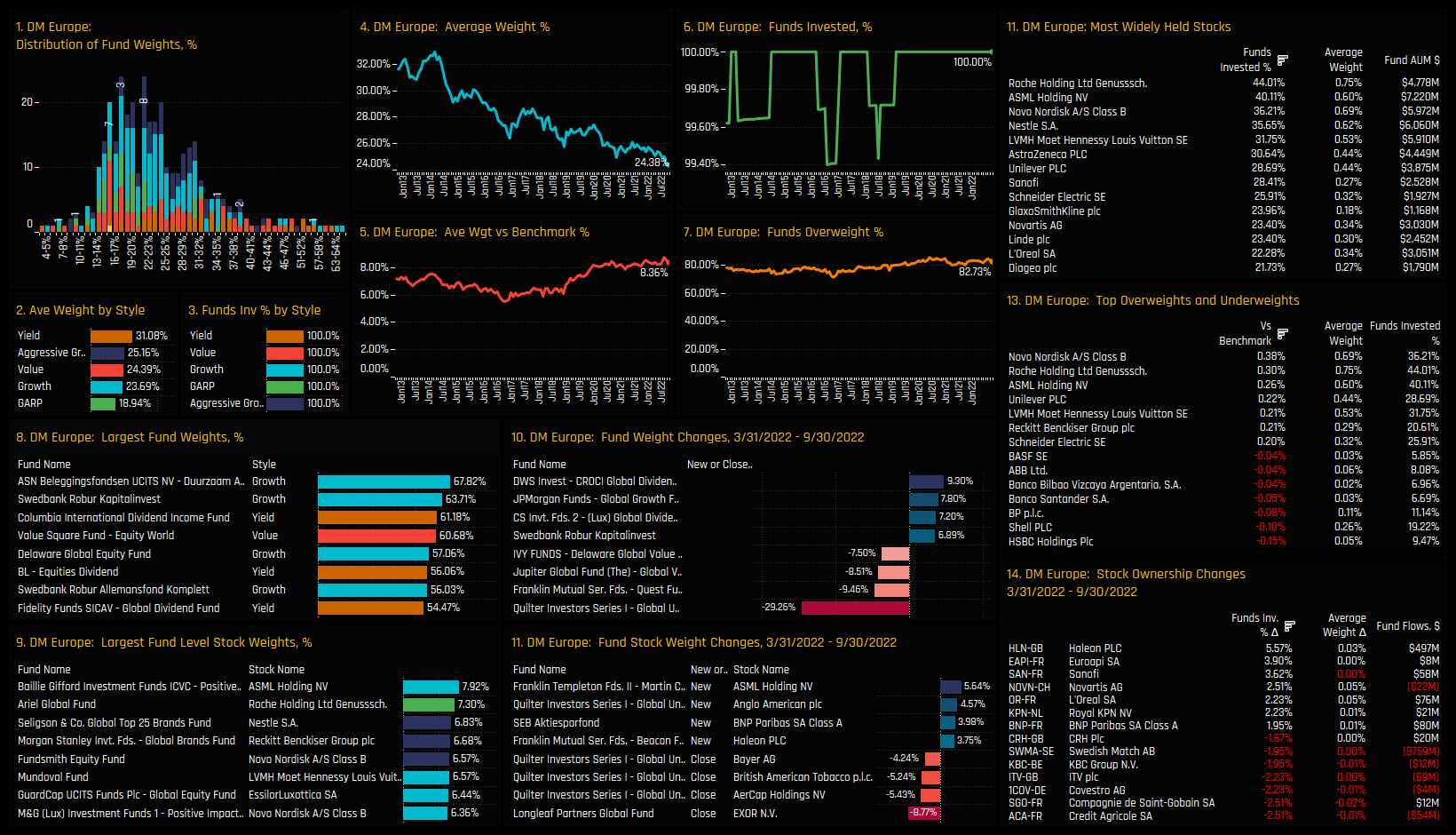

Developed Europe Focus

The below charts show the key ownership statistics for the Developed European region. Charts 1&2 show the distribution of fund weights in DM Europe together with the Style split. The bulk of allocations sits between 13% and 25%, though there is a long tail to the upside led by ASN Beleggingsfondsen’s 67.8% position. Yield managers carry the largest exposure, with average weights of 31.08% compared to GARP funds on 18.94%. Despite the consensus overweight stance, average weights in DM Europe are at their lowest ever levels of 24.38%.

On a stock level, the trio of Roche Holding Ltd, ASML Holding NV and Novo Nordisk A/S are the most widely held stocks and represent the largest overweight positions among active Global managers. They also feature among the larger single fund stock holdings, led by Baillie Gifford Positive Change’s 7.92% position in ASML Holding NV and Ariel Global Fund’s 7.3% holding in Roche Holding Ltd. Clearly, the vast majority of active Global investors wish to represent DM Europe as a larger weight than the benchmark’s modest 16% allocation.

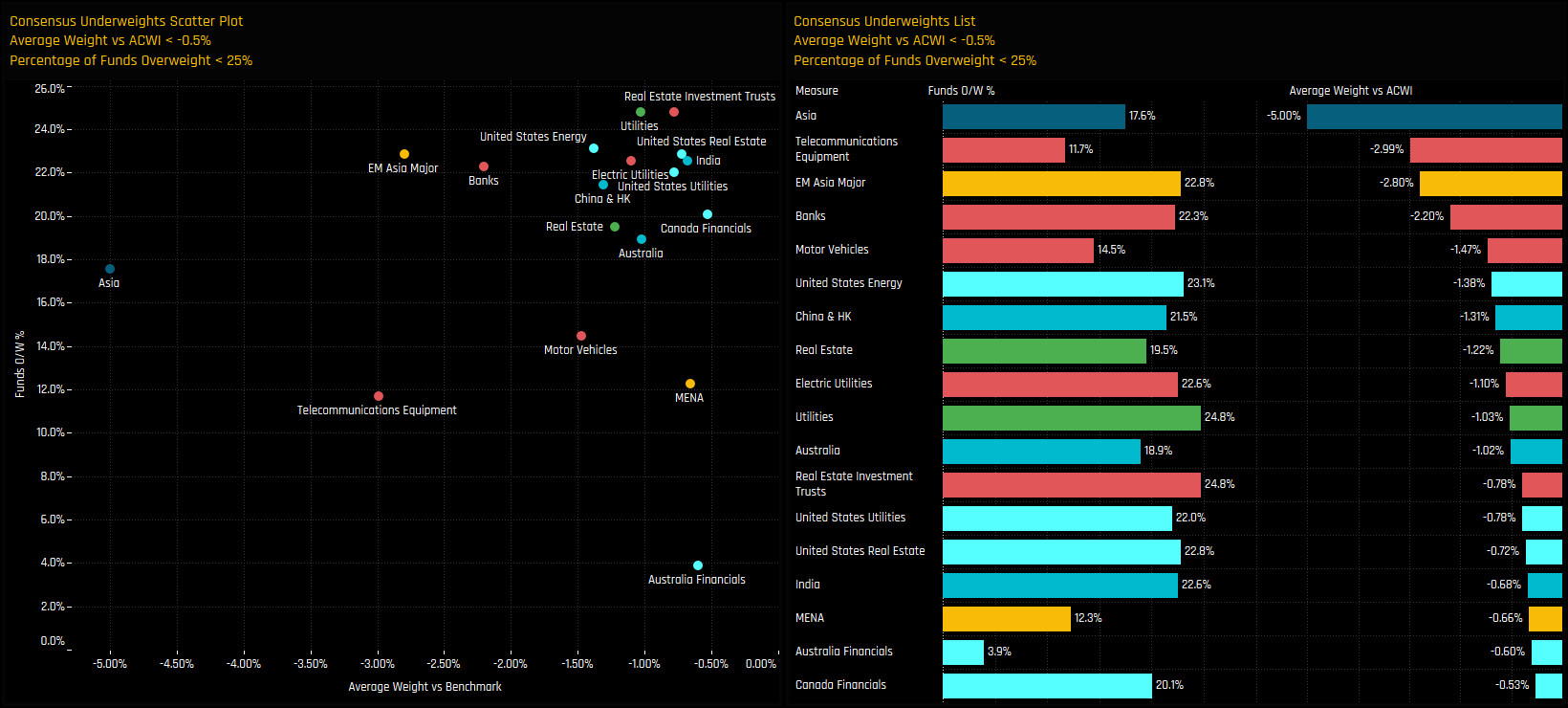

Consensus Underweights

To screen for consensus underweights, we look for exposures that are held underweight by more than three quarters of Global active investors, with average underweights of more than -0.5% versus the iShares MSCI ACWI ETF. This screen throws up 18 exposures, with the Asia region a standout, held overweight by just 17.6% of managers at an average underweight of -5.0%.

Outside of regional exposures, 5 key industries make the Consensus Underweight screening criteria, led by Telecommunications Equipment, Banks, Motor Vehicles and Electric Utilities. On a country level, China & HK is held overweight by just 21.5% of investors and India by 22.6%. Special mention goes to Australian Financials, held overweight by just 3.9% of investors at an average -0.60% below the index level.

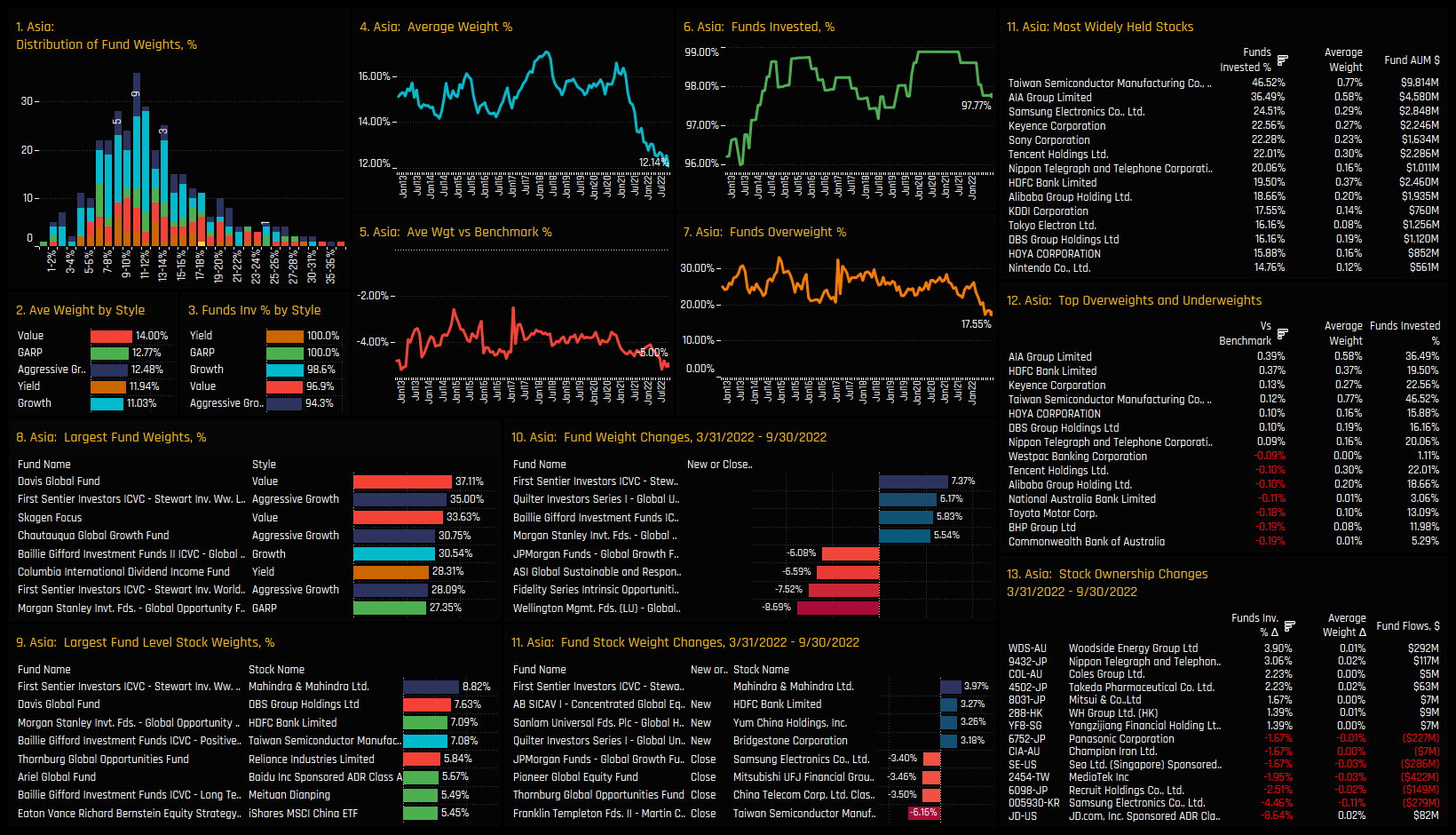

Asia Focus

Sentiment in Asian stocks has taken a dive over the last 24 months. Average holding weights have plunged to all-time lows of 12.14%, off from the highs of over 16% in late 2020. Relative to benchmark, just 17.6% of managers are overweight Asia at a net underweight of -5.0%. Despite a reputation for high growth, Asia is actually favoured by Value managers, with average weights of 14% ahead of the average Growth fund weight by +3%.

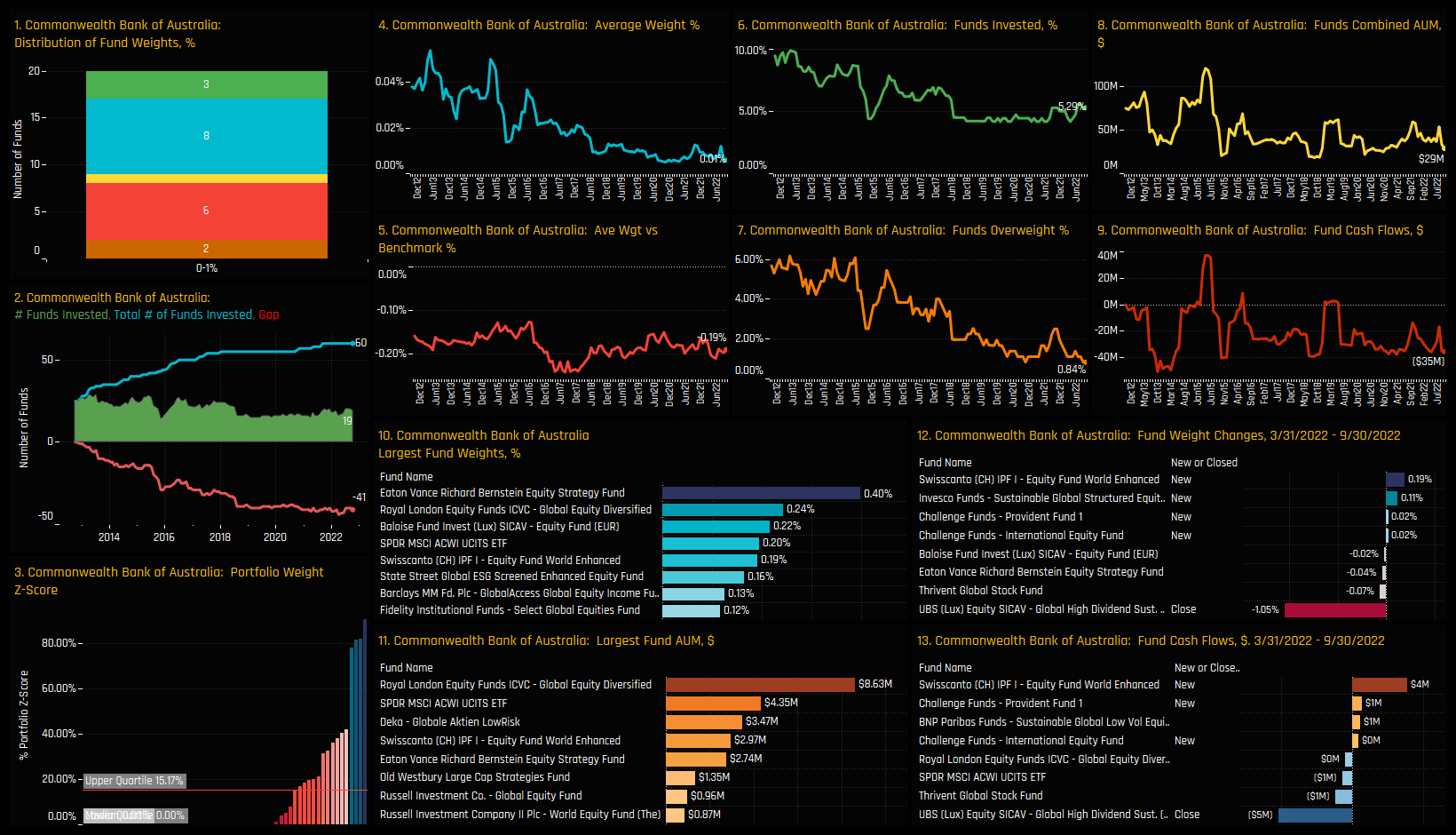

TSMC is the dominant stock holding in the region, owned by 46.5% of funds at an average weight of 0.77%. Underweights are led by the universally avoided Commonwealth Bank of Australia and National Australia Bank, in addition to BHP Group and Toyota Corp. Recent manager activity has seen an exodus out of JD.Com and reduced exposure to Samsung Electronics.

Consensus Stock Holdings

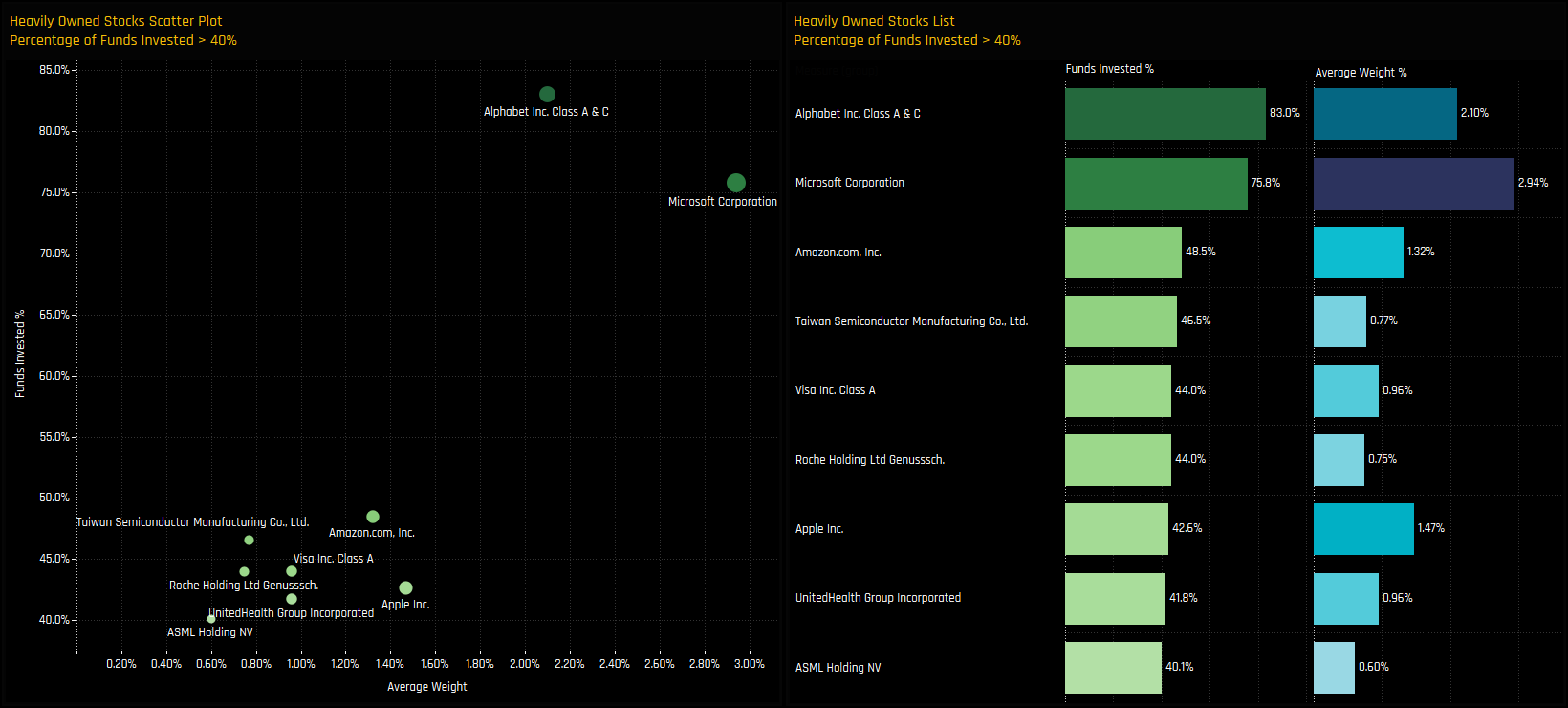

Given the breadth of investible options for active Global managers, it’s perhaps no surprise that there are very few stocks that we might term as universally owned. In fact, only 2 stocks, Microsoft Corporation and Alphabet (combined A & C listing) are held by more than 50% of the Global funds in our analysis.

If we relax the criteria further to include stocks that are held by more than 40% of managers (nearly consensus!) then a further 7 stocks make the grade, led by Amazon.com, TSMC and Visa Inc. Profiles of the top 3 are shown below.

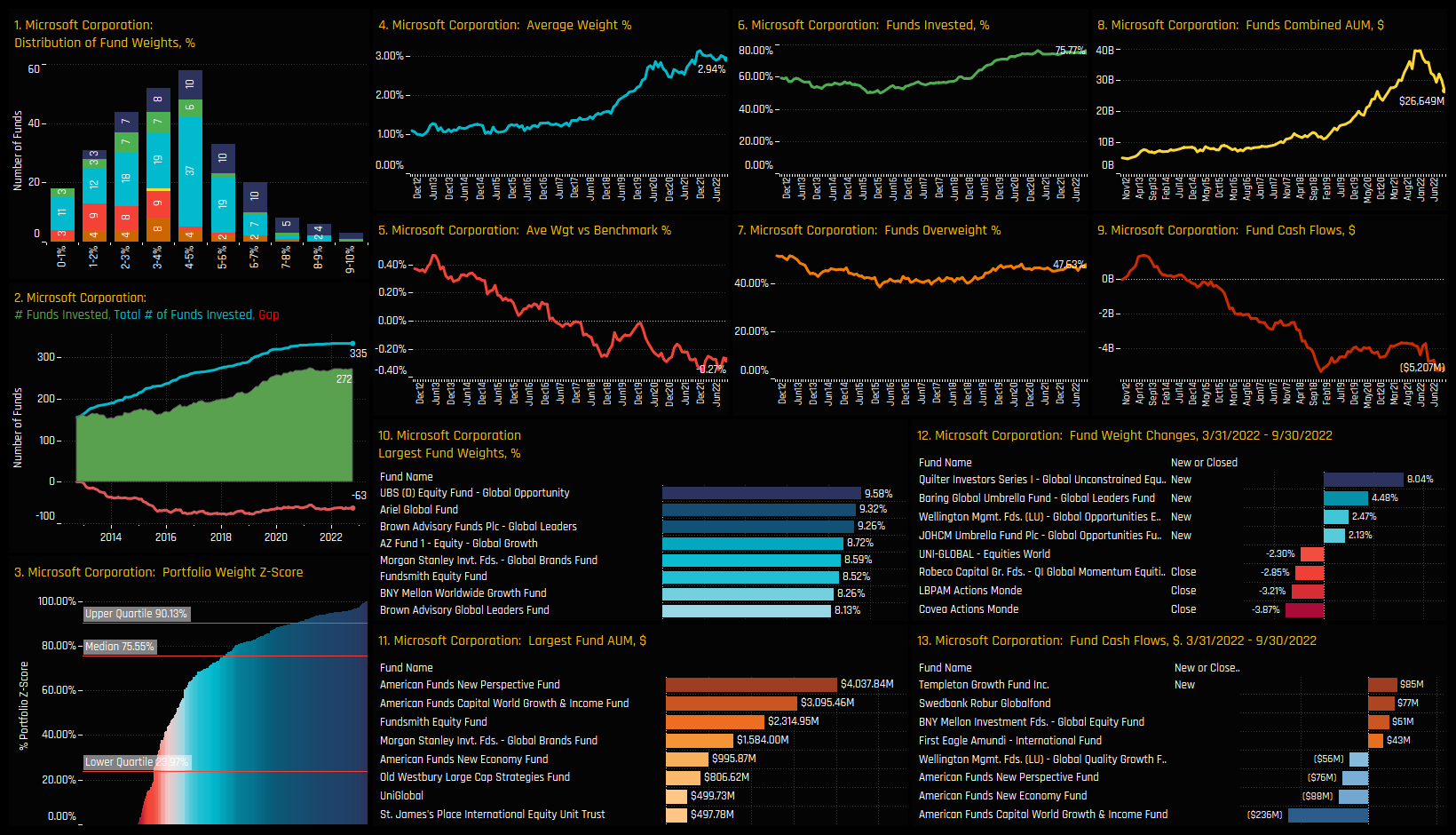

Stock Profile: Microsoft Corp

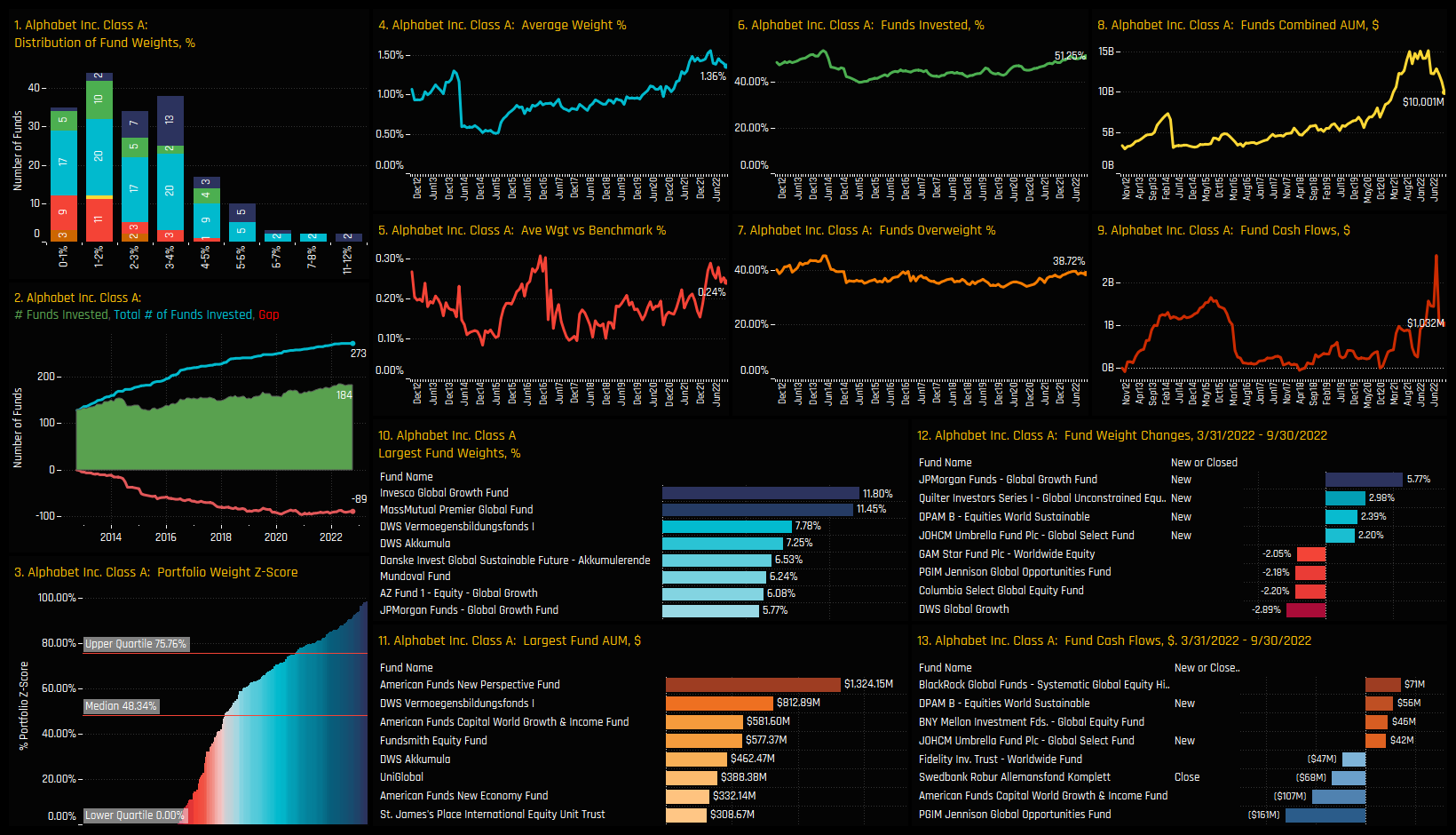

Stock Profile: Alphabet Class A

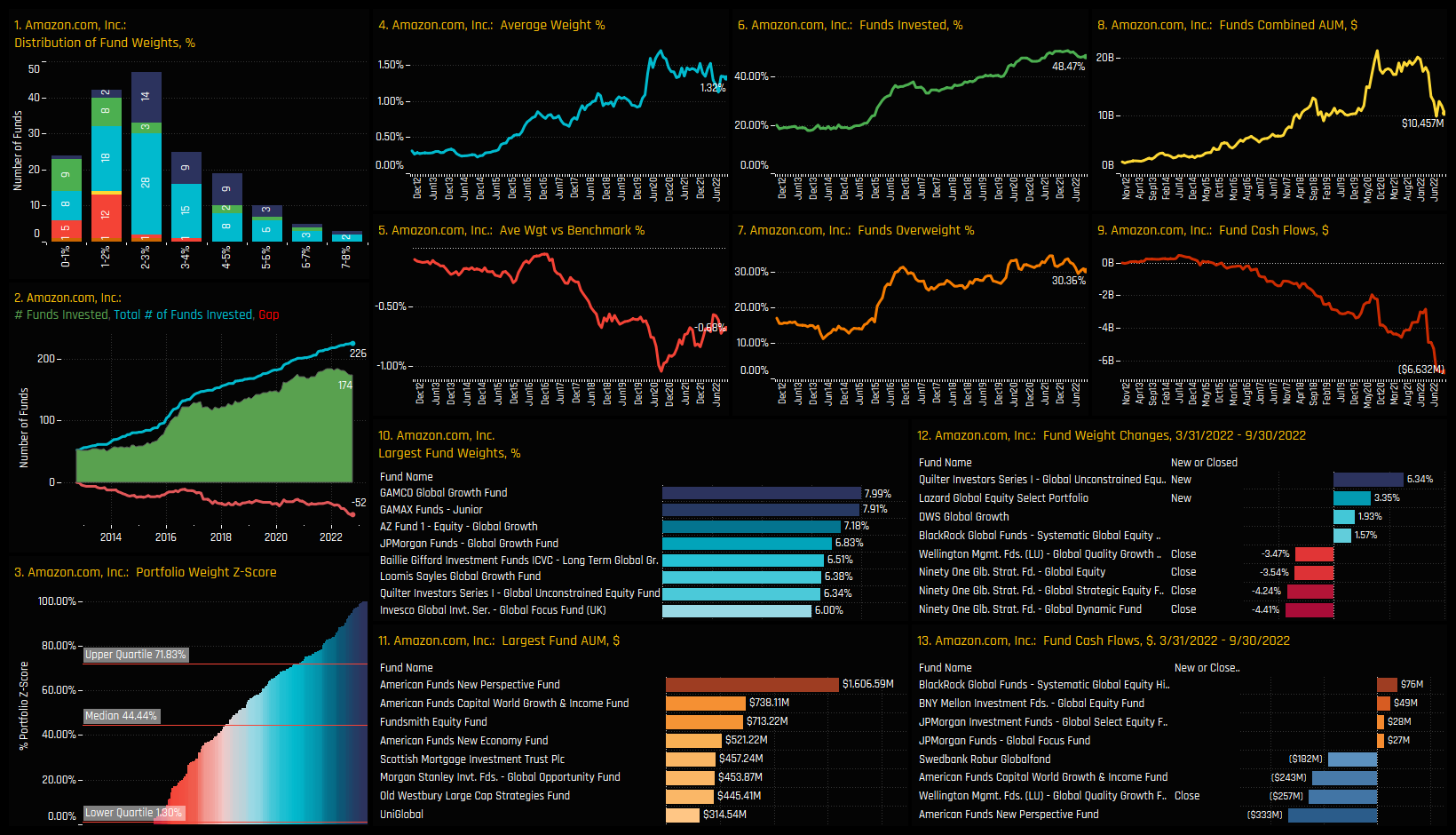

Stock Profile: Amazon.com

Under-Owned Stock Holdings

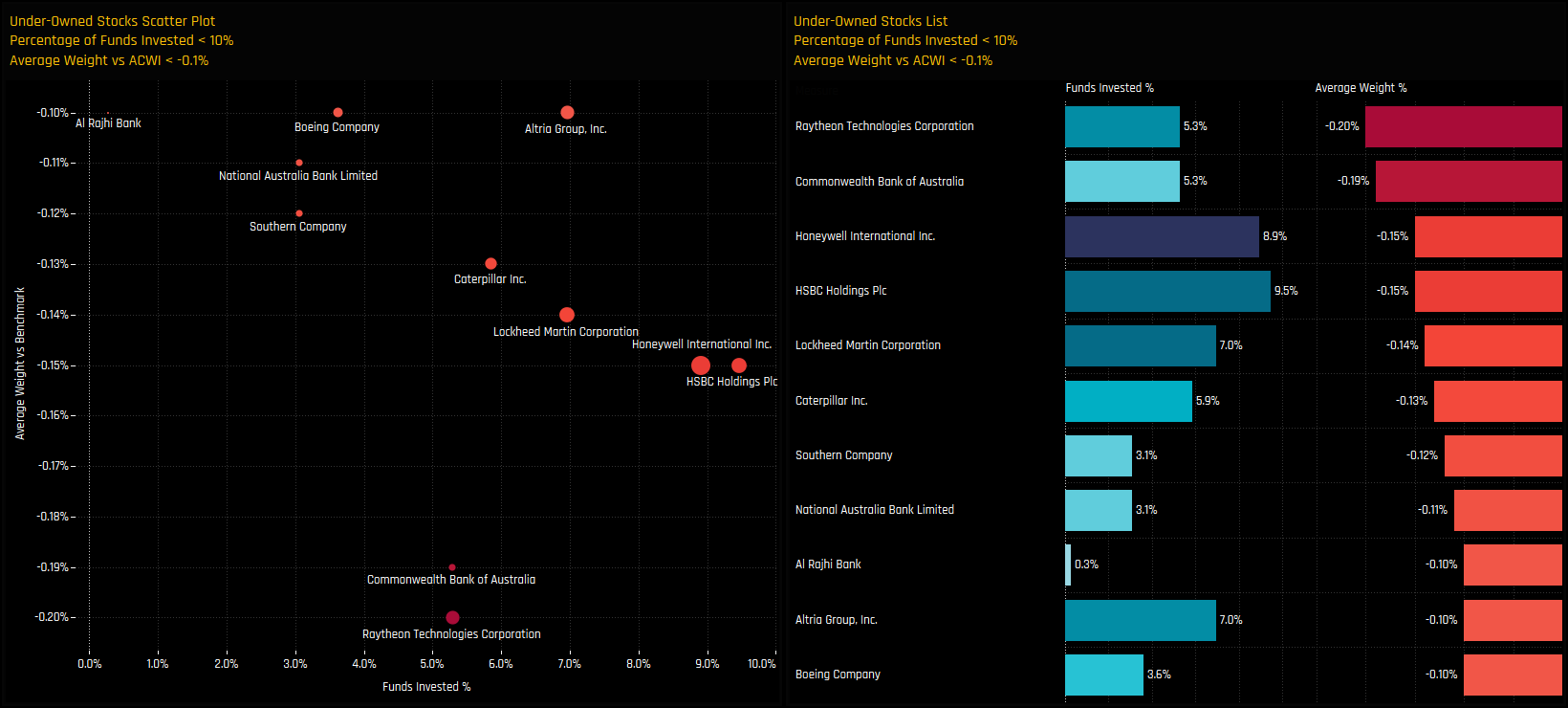

At the other end of the spectrum, what are the companies that are mostly avoided by active Global investors? We screen for this by looking at companies within the iShares ACWI ETF portfolio that are held by less than 10% of active managers and at a net underweight of more than -0.1%. Of the 2358 stocks in the ACWI portfolio, just 11 meet this criteria.

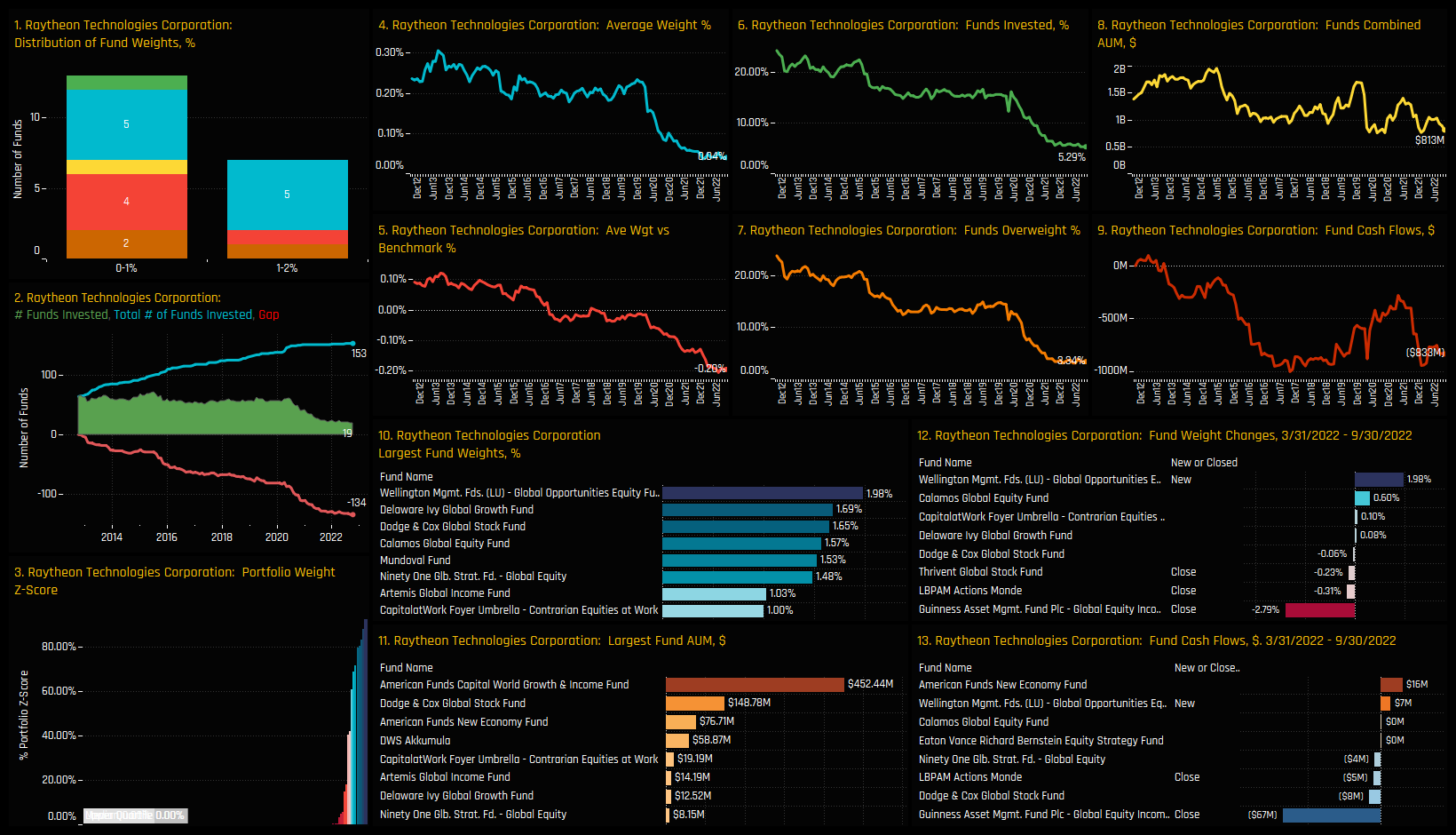

Raytheon Technologies Corp could be deemed the most under-owned stock ‘in the world’. It is owned by just 5.3% of Global managers at an average underweight of -0.20%. Of the non-US names, Al Rajhi Bank stands out as a stock owned by just 1 of the 359 global funds in our analysis. These are truly the untouchables of the global investment universe. Profiles for the top 3 under-owned stocks conclude the analysis.

Stock Profile: Raytheon Technologies Corp

Stock Profile: Commonwealth Bank of Australia

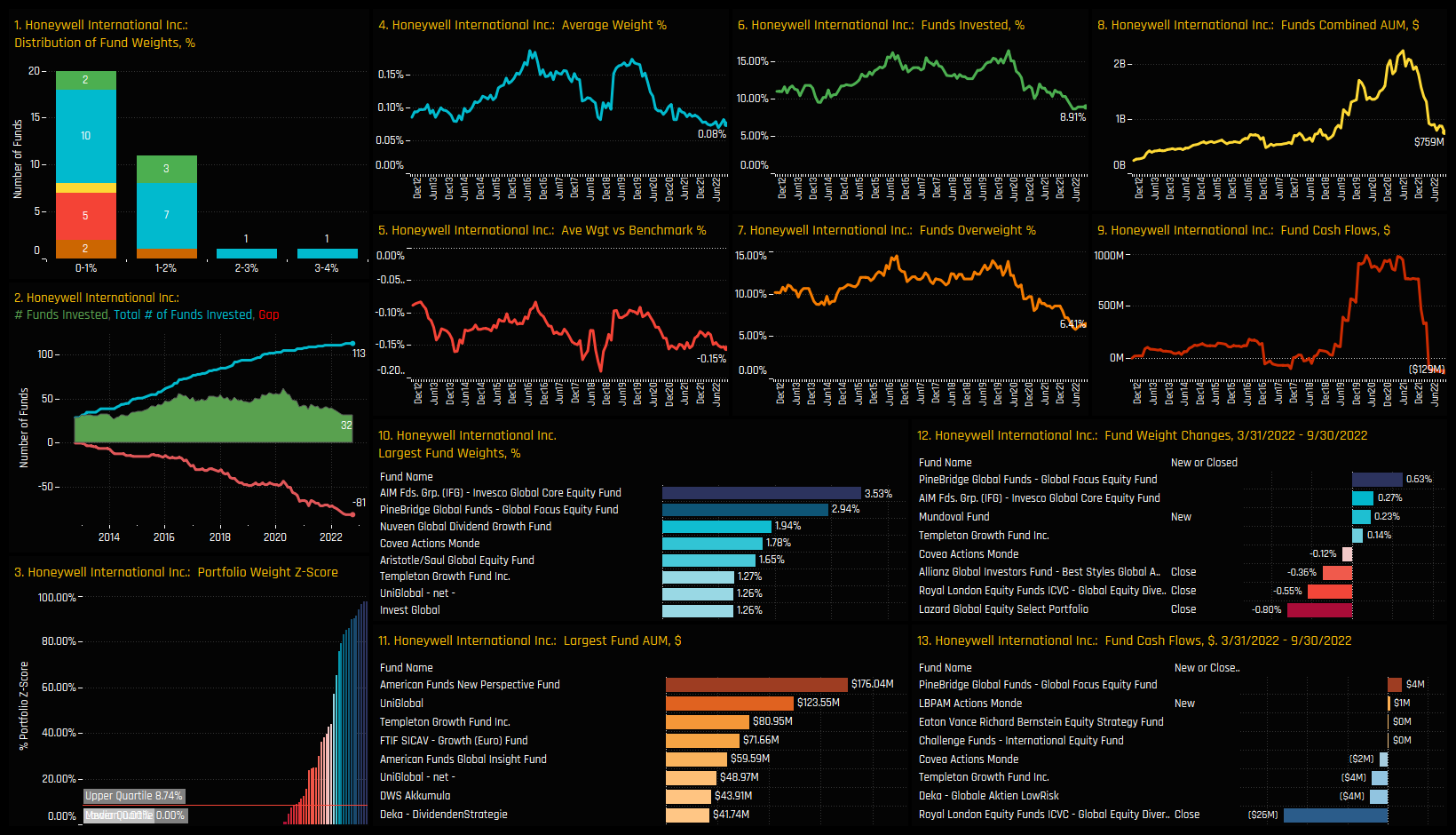

Stock Profile: Honeywell International Inc

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- February 16, 2023

Global Fund Positioning Analysis, February 2023

358 Global Equity Funds, AUM $914bn Global Fund Positioning Analysis, February 2023 In this iss ..

- Steve Holden

- July 26, 2023

Global Fund Positioning Analysis, July 2023

349 Global Equity Funds, AUM $988bn Global Fund Positioning Analysis, July 2023 In this issue: ..

- Steve Holden

- January 16, 2025

Global Funds: Performance & Attribution Review, 2024

336 Global active equity funds, AUM $1.2tr Global Funds: Performance & Attribution, 2024 &n ..