China & HK Semiconductors: Fund Positioning Analysis

- Steve Holden

- 0 Comments

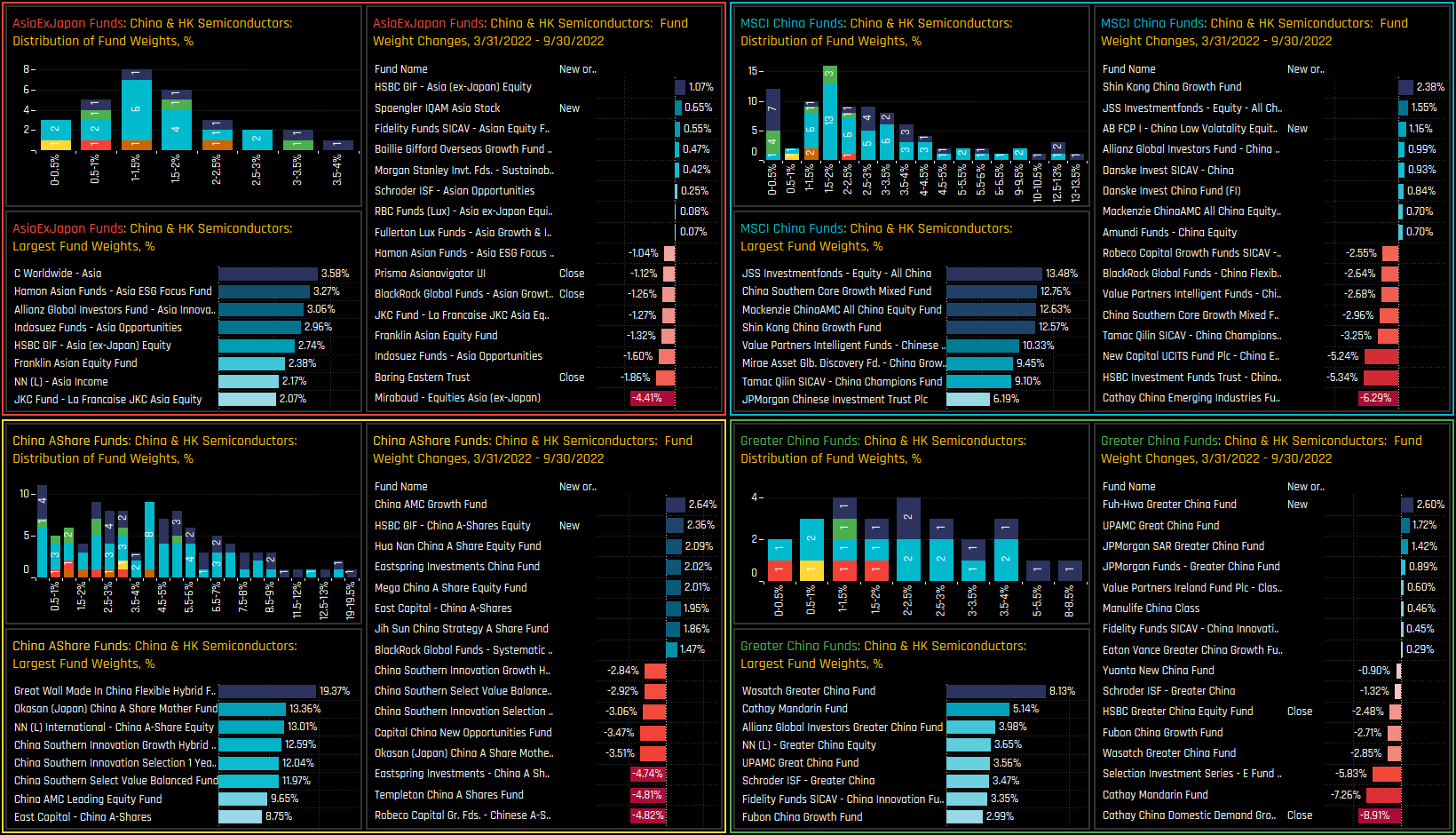

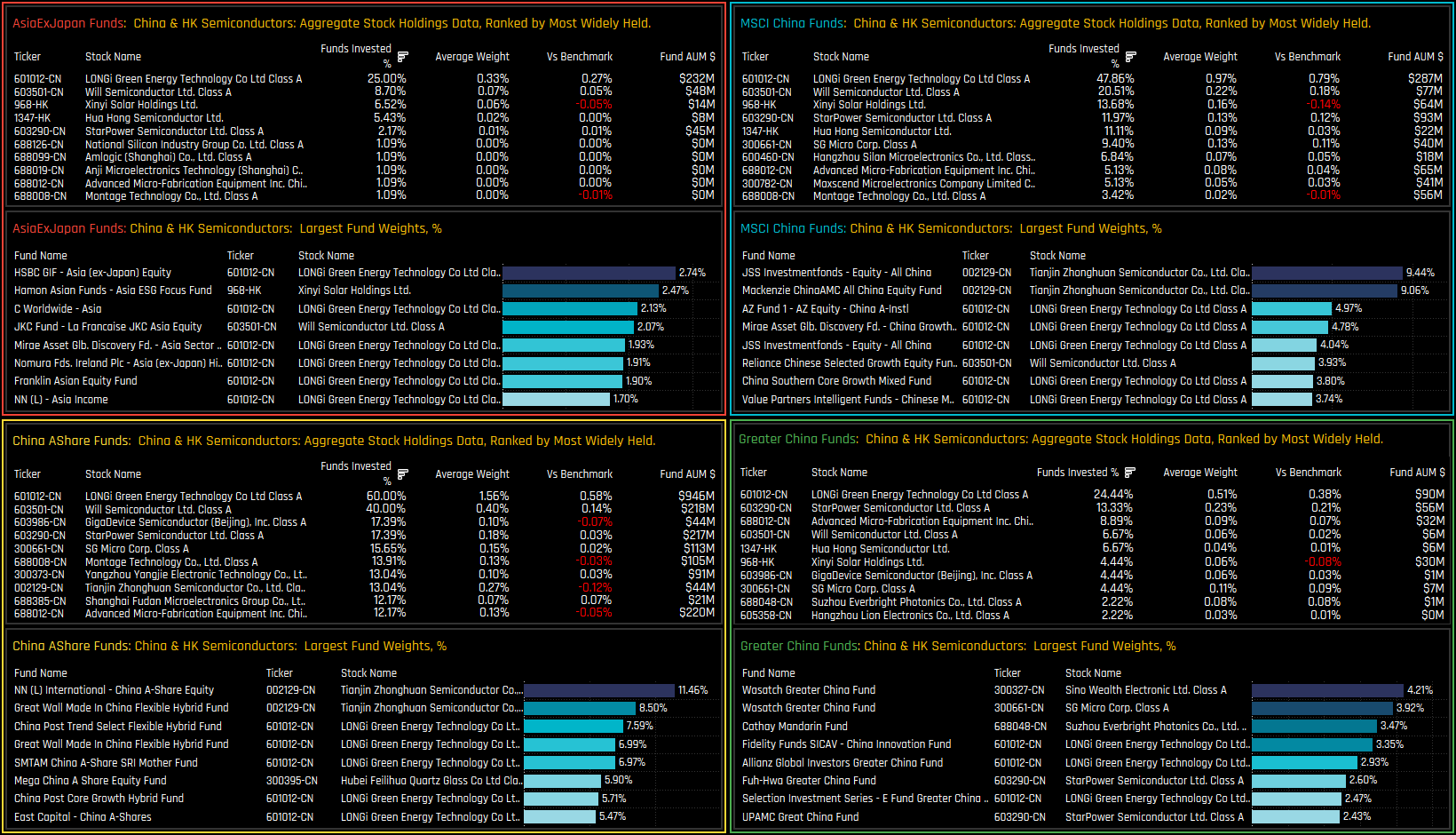

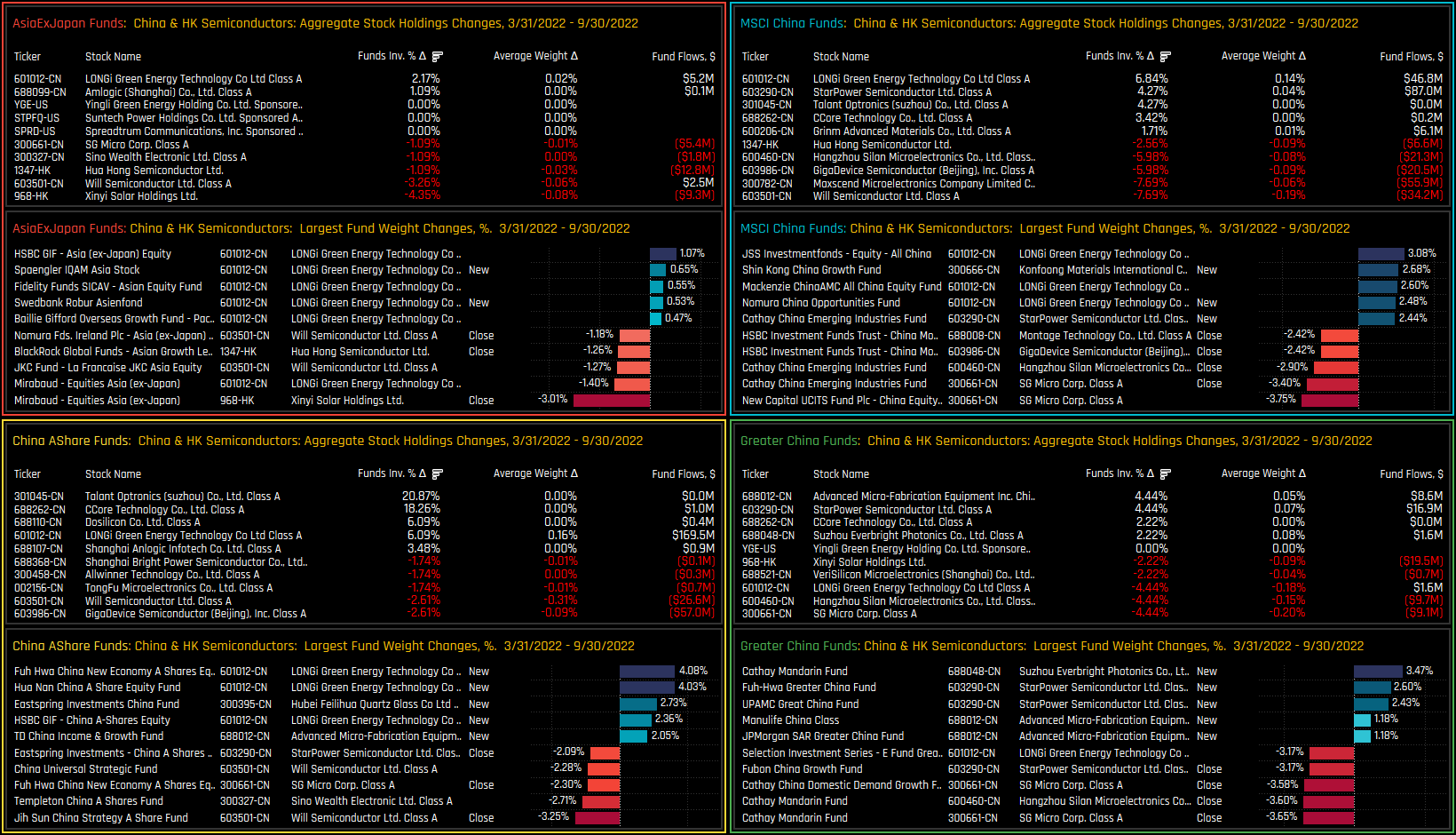

92 Asia Ex-Japan Funds, AUM $52bn, 115 China A-Share Funds, AUM $57bn, 117 MSCI China Funds, AUM $44bn, 45 Greater China Funds, AUM $15bn

China Semiconductors

With US sanctions hitting Chinese domestic Semiconductor stocks this week, we analyse allocations in the China & HK Semiconductor Industry group among Asia Ex-Japan, MSCI China, China A-Share and Greater China actively managed equity funds. Without the distraction of Taiwan technology or HK listed internet stocks, China A-Share funds are the most heavily exposed, whilst Asia Ex-Japan and Greater China funds have curtailed investment in recent months. On a stock level, LONGi Green Energy Technology is the high conviction holding by quite a margin, whilst Will Semiconductors has started to see closures from a number of managers. On the whole though, China & HK Semiconductor stocks do not represent a significant risk for the majority of managers in our analysis.

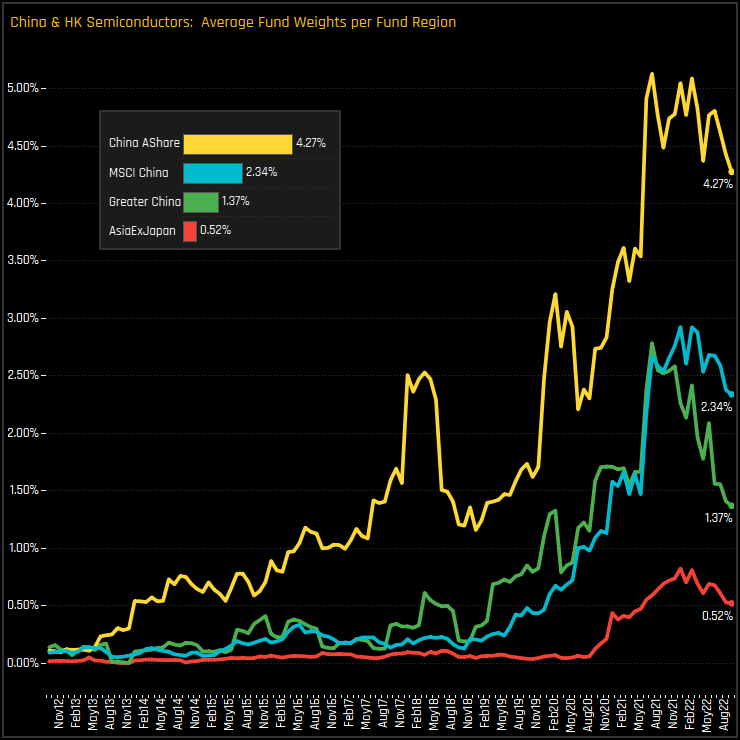

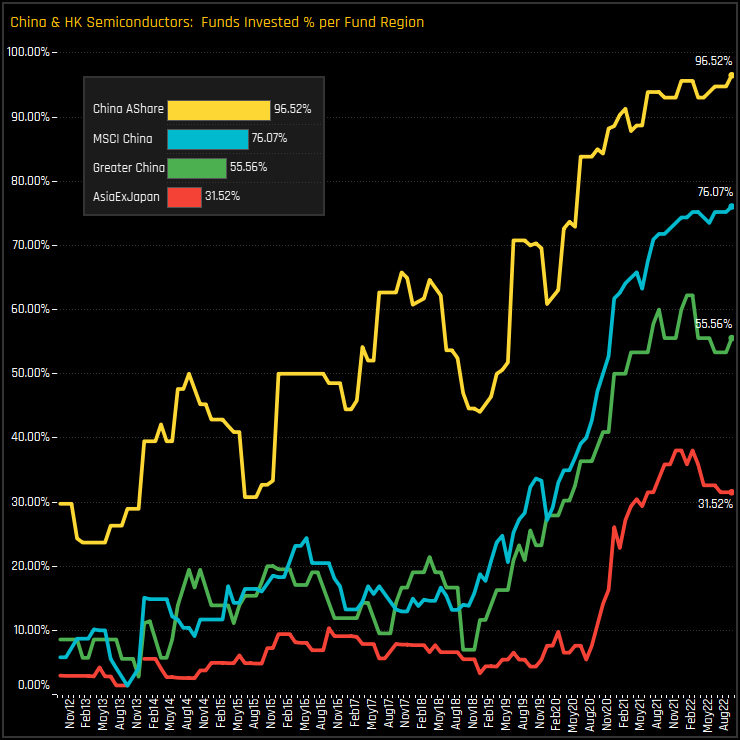

Ownership Growth

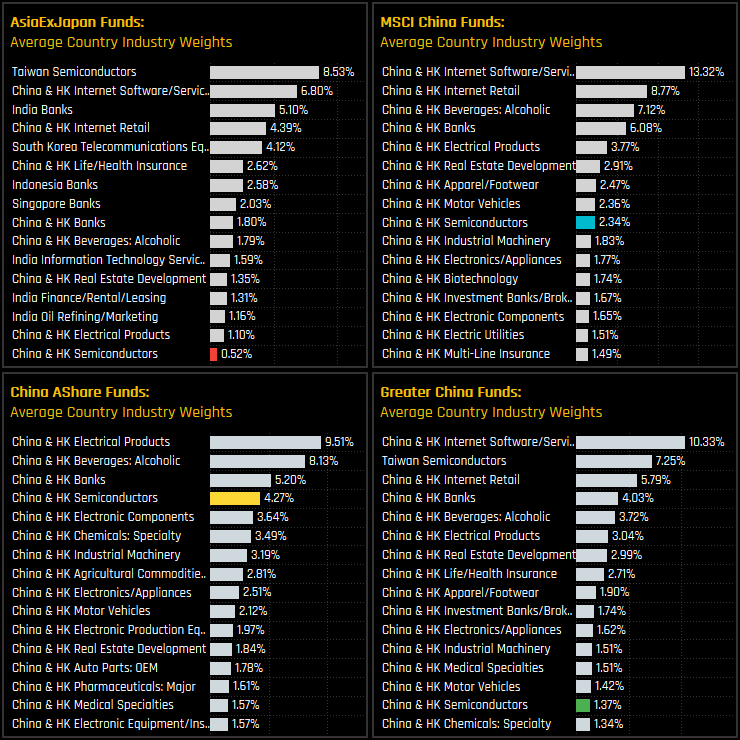

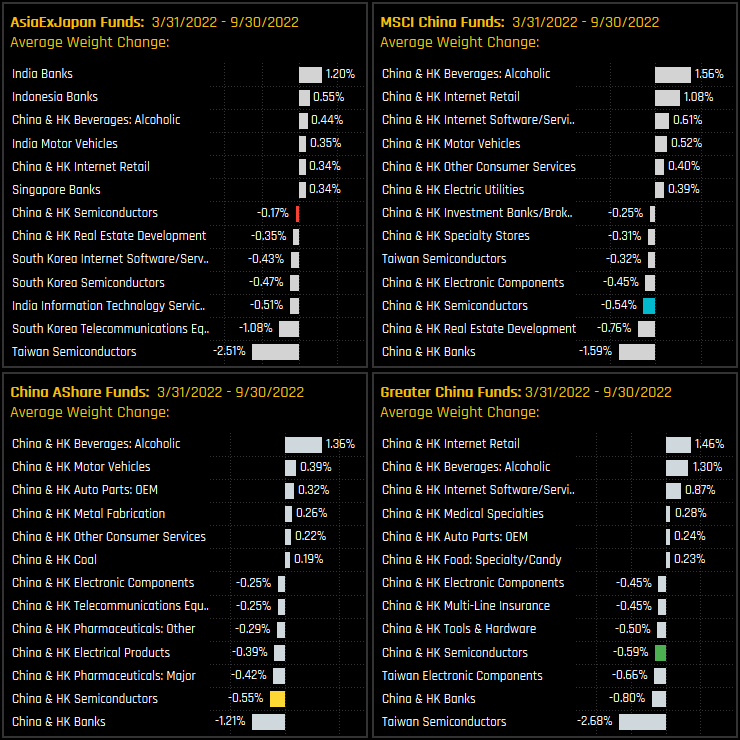

Country/Industry Analysis

Fund Holdings Analysis

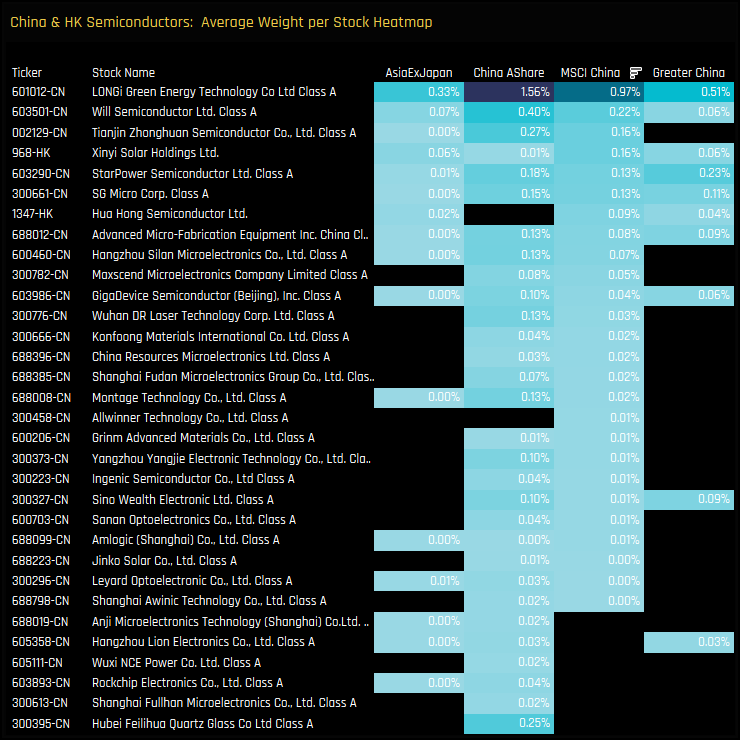

Stock Holdings

Stock Activity

Conclusions

Whilst China & HK Semiconductor allocations have seen good growth over the last decade, the rate of that growth has either slowed (MSCI China/China A-Shares) or started to reverse (Greater China/Asia Ex-Japan).

Of our 4 fund groups, China A-Share investors are the most exposed and currently sit at record allocations, whilst Asia Ex-Japan and Greater China funds have curtailed investment in recent months. On a stock level, the list of potential investments runs quite deep, with 71 stocks receiving some form of investment across the 4 fund groups. In reality though, exposure is concentrated in a dozen or so names, highlighted in the heatmap opposite.

In light of the recent sanctions by the US on the Chinese domestic Semiconductor industry, once again investors have to navigate the effect of political interference in the China equity market. At least, as opposed to the costly sanctions that effected Alibaba and Tencent last year, Semiconductors represent a much small allocation for the majority of investors across our 4 fund groups.

Click on the links below for the latest data reports on China & HK Semiconductor positioning among active Asia Ex-Japan, MSCI China, China A-Share and Greater China funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- September 26, 2024

Positioning Insights, September 2024

98 Active Asia Ex-Japan funds, AUM $51bn Active Asia Ex-Japan Funds: Positioning Insights, Sept ..

- Steve Holden

- October 30, 2023

Asia Ex-Japan Fund Positioning Analysis, October 2023

100 Active Asia Ex-Japan Funds, AUM $54bn Asia Ex-Japan Fund Positioning Analysis, October 2023 ..

- Steve Holden

- May 28, 2024

China Real Estate: Continued Fund Rotation Drives New Lows

144 active MSCI China equity funds, AUM $40bn China Real Estate: Continued Fund Rotation Drives ..