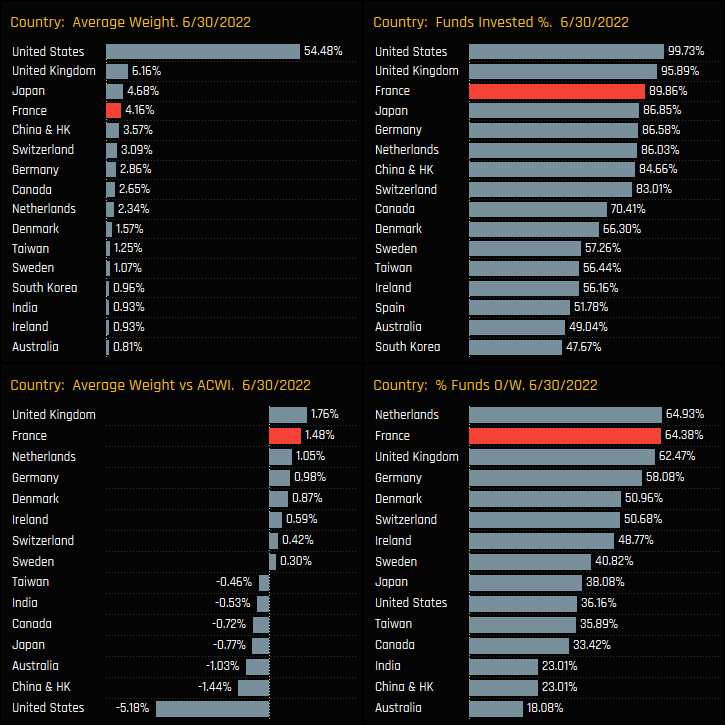

365 Active Global Funds, AUM $906bn

France

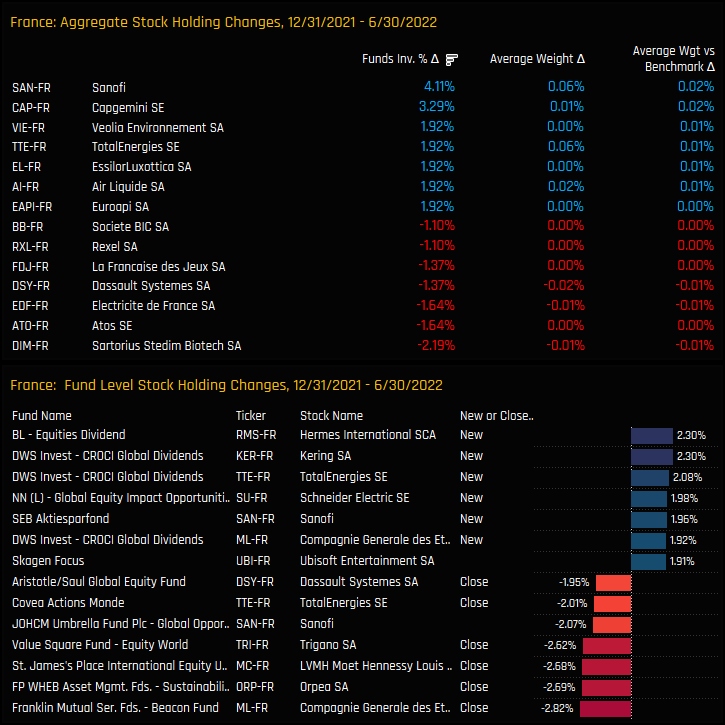

Global equity managers are positioned at their highest ever overweight in French equities. France is the 4th largest country allocation globally and the largest in the European Union. Versus the benchmark, only the Netherlands has more funds positioned overweight. Sanofi and Cap Gemini SA have benefited from fund rotation this year, with the percentage of funds invested in each name rising by 4.1% and 3.3% respectively.

Time Series & Country Positioning

Fund Holdings & Style

Stock Holdings & Activity

Stock Profile: Sanofi

Stock Profile: LVMH Moet Hennessy Louis Vuitton

Click on the link below for the latest data report on French positioning among active Global funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- September 13, 2022

Record Exposure as North American Rotation Continues

358 Active Global Funds, AUM $930bn North American Rotation Active Global investors are at reco ..

- Steve Holden

- March 27, 2024

Semiconductors: Winners Emerge as Allocations Hit Record Highs

339 global equity funds, AUM $1.1tr Semiconductors: Winners Emerge as Allocations Hit Record Hi ..

- Steve Holden

- November 26, 2024

Active Global Funds: Positioning Chart Pack, November 2024

336 Global active equity funds, AUM $1.1tr Active Global Funds: Positioning Chart Pack Summary ..