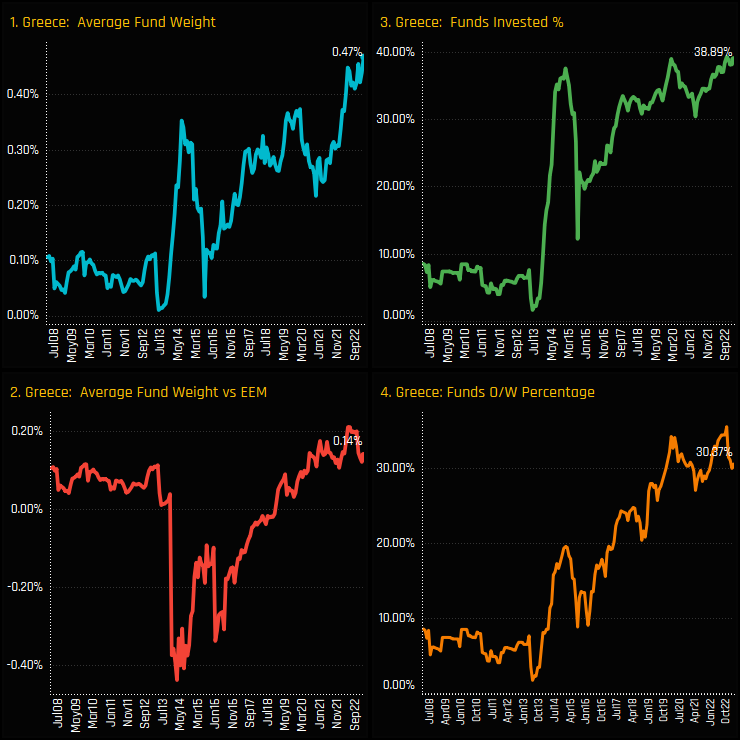

Time-Series & Peer Group Positioning

Greek allocations among active EM investors have risen to record levels. With Russia’s deletion from the CEEMEA investment landscape last year, Greece has taken up some of the slack, attracting a growing ownership base among the 270 EM funds in our analysis. The percentage of funds with Greek exposure is at the top of the 15-year range at 38.9%, with average weights hitting a record 0.47% last month.

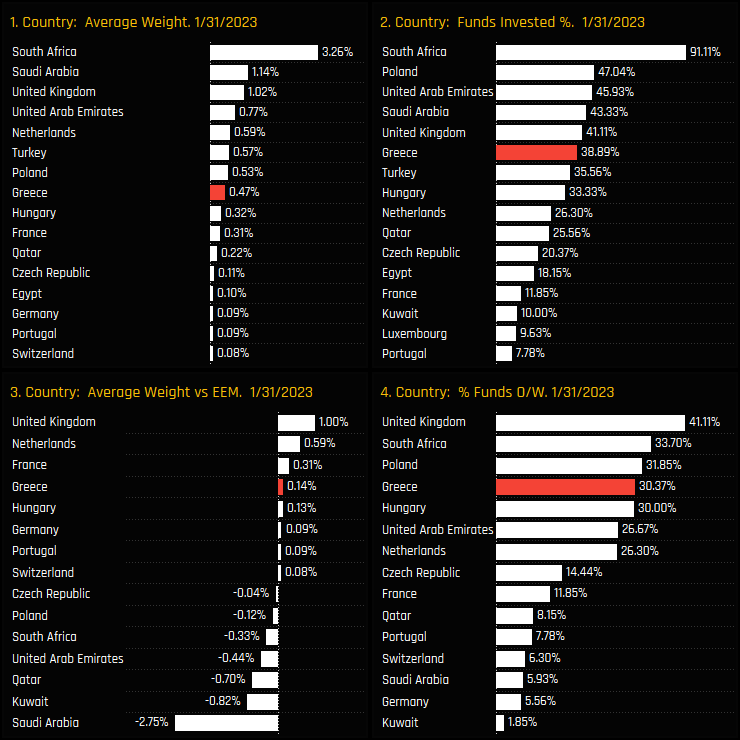

Versus EMEA country peers, Greece has leapfrogged Turkey as the 6th most widely held country and stands as the 4th largest overweight in the region, behind developed market holdings in the UK, Netherlands and France. It’s still a small allocation in absolute terms, but then so are most of the EMEA allocations outside of South Africa, Saudi Arabia and the UK. Its certainly starting to carve a place for itself among the Eastern European nations.

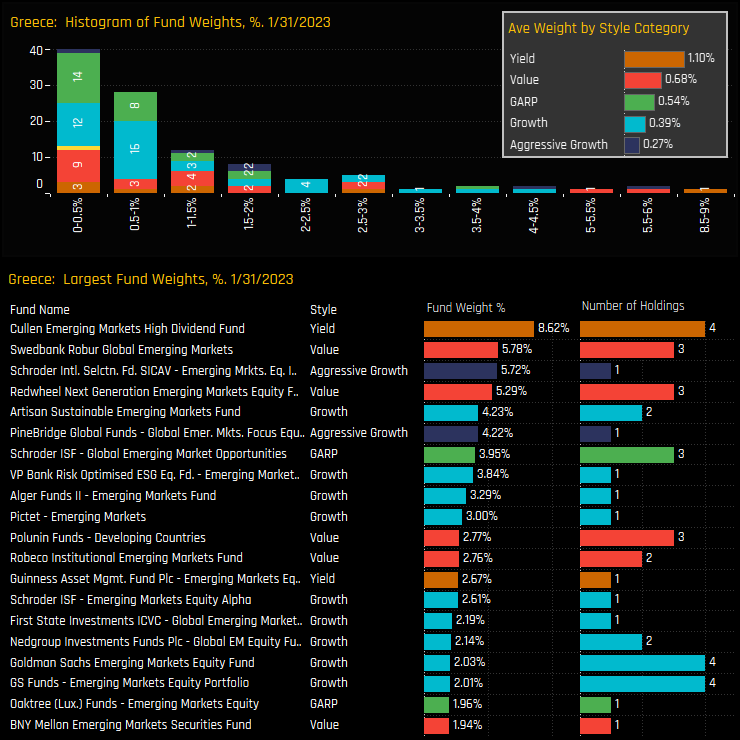

Fund Holdings & Activity

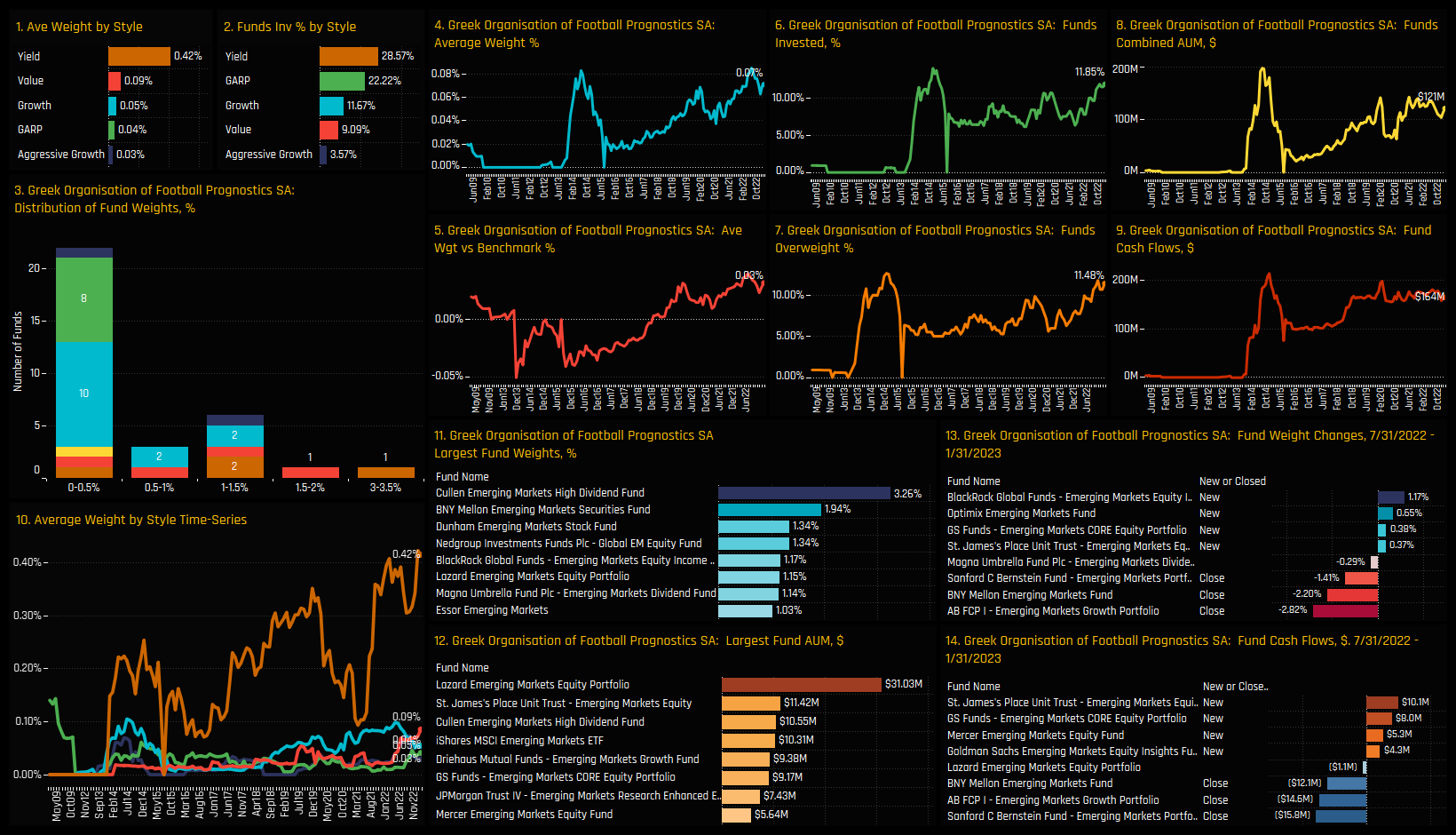

Among the 39% of funds who have exposure to Greece, most hold a sub-1% allocation, yet there are those with higher conviction, led by Cullen EM High Dividend (8.6%) and Swebank Robur Global EM (5.8%). On average, Yield and Value funds hold greater exposure than Growth/Aggressive Growth. However, some of the largest holding weights are occupied by Growth funds, with Artisan Sustainable EM (4.2%) and VP EM Optimised ESG (3.8%) leading the way.

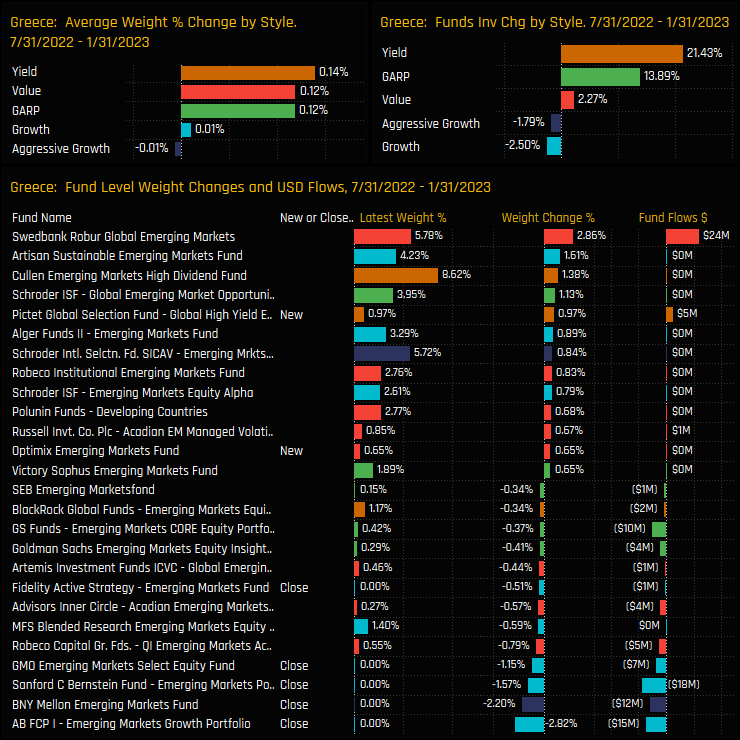

Activity over the last 6-months has seen the Style split widening, with 21.4% of Yield funds adding Greek exposure whilst 2.5% of Growth funds closed. Indeed, whilst opening positions outnumbered closures by a factor of 2, the closures were larger in magnitude, led by AB EM Growth (-2.8%) and BNY Mellon EM (-2.2%). Growth investors, it seems, are less enamoured with the Greek market than their Value peers.

Stock Holdings & Activity

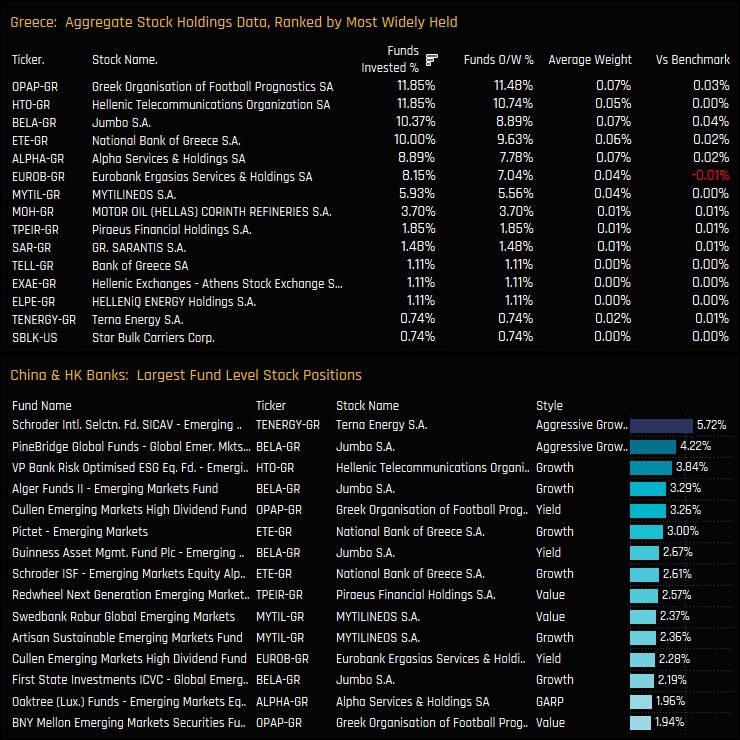

For such a small country allocation, stock ownership is understandably light. The most widely held companies are Greek Organisation of Football and Hellenic Telecommunications, both owned by 11.8% of funds. The top 7 stocks in the top chart below all share similar ownership profiles and account for 86% of the total Greek allocation.

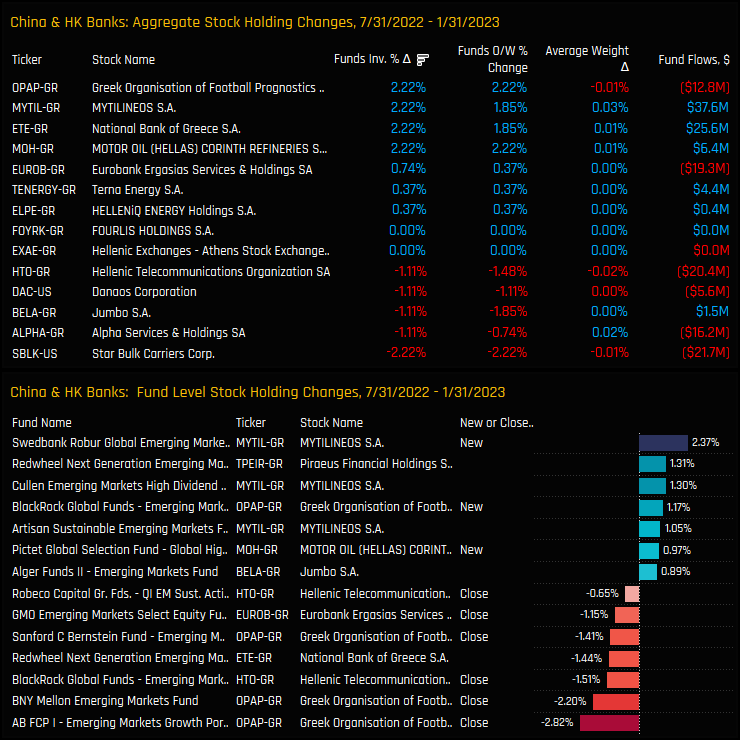

Stock ownership changes between 07/31/2022 and 01/31/2023 were marginally skewed to the buy-side, with net closures in Star Bulk Carriers and Alpha Services & Holdings offset by net openings in Greek Organisation of Football, MYTILINEOS and National Bank of Greece. On a single fund basis, some of the larger closures were in Greek Organisation of Football, despite the net increase in ownership over the period.

Conclusions & Data Report

Active EM investors are beginning to pay renewed attention to Greece as evidenced by record average weights, increasing fund ownership and a net overweight stance, indicating a growing conviction and eagerness to invest. This change in sentiment has been driven by EM Value and EM Yield investors, with Growth funds so far reluctant to rotate.

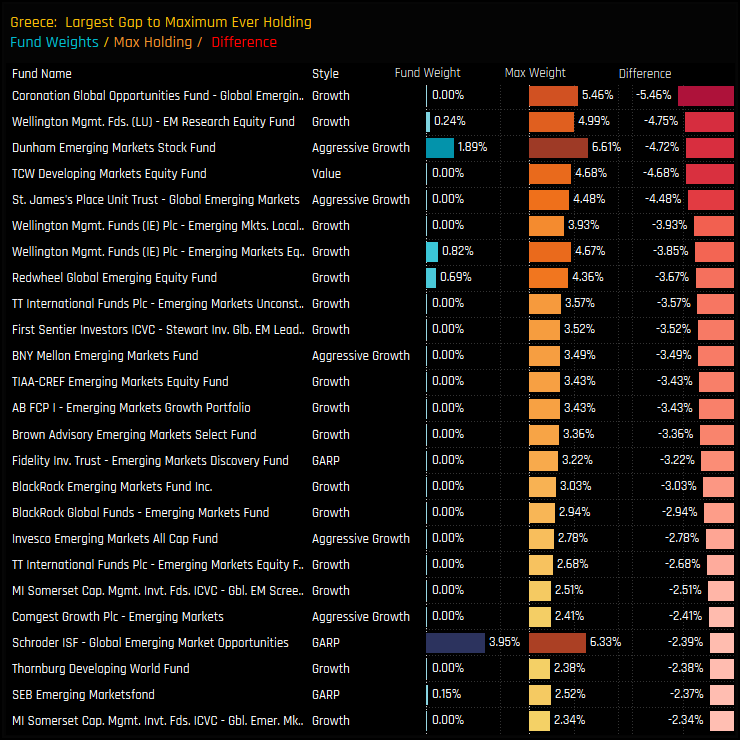

The chart to the right shows the funds with the largest ‘gaps’ between their current weight in Greece and their maximum ever weight since 2008. It shows a number of funds with previously large exposure to Greece who now hold nothing, or significantly less. Indeed, Greece is a well known market to EM investors, with 173 of the 270 funds in our analysis holding a position at some point, but only 105 of those are invested now. This points to the potential for increased ownership growth, especially in light of Russia’s omission from the EMEA landscape in 2022.

Scroll down for stock profiles on Greek Organisation of Football and Hellenic Telecommunications

Stock Profile: Greek Organisation of Football

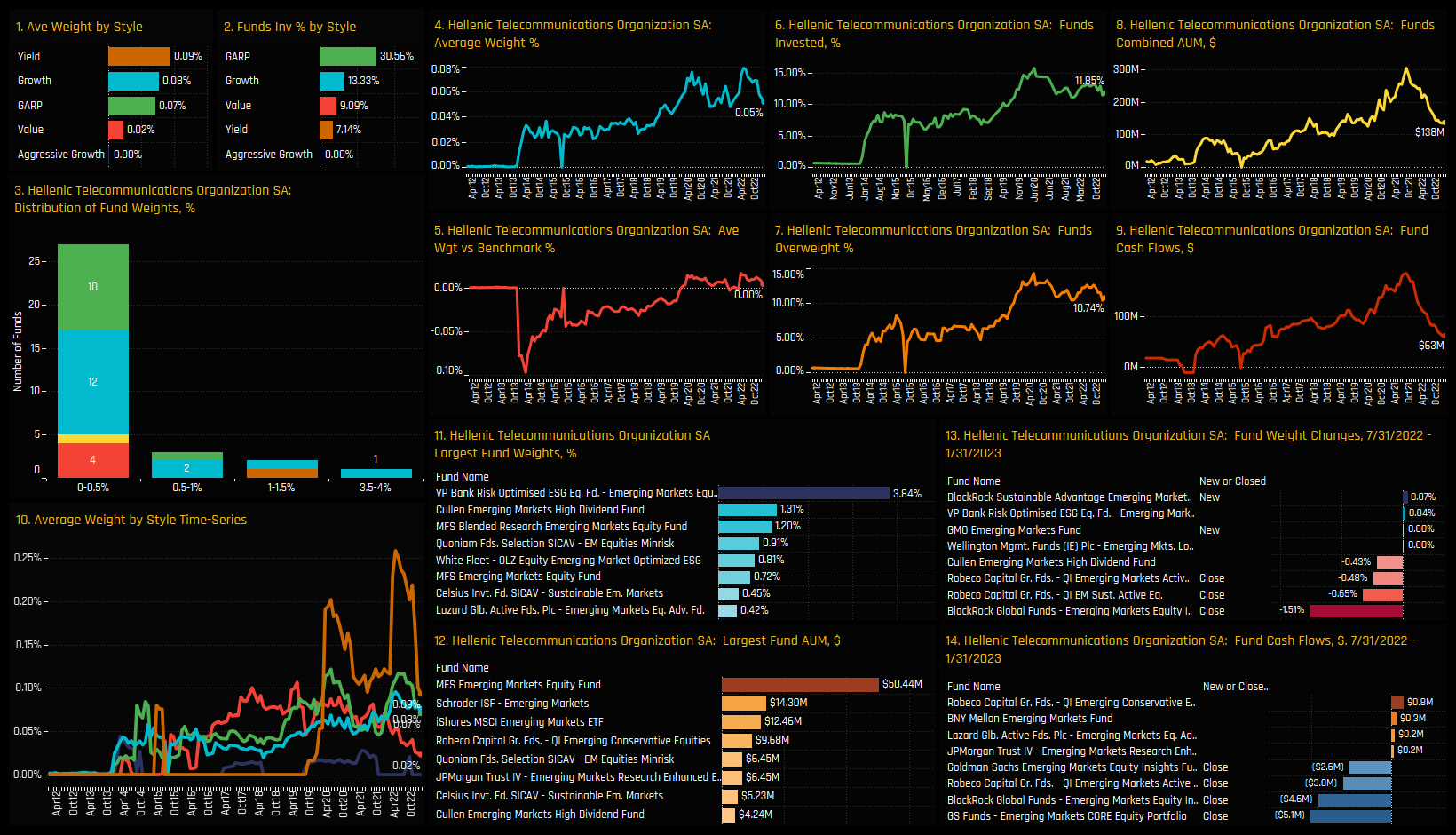

Stock Profile: Hellenic Telecommunications

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- January 15, 2023

Emerging Market Funds: Performance & Attribution in 2022

276 Active GEM Funds, AUM $343bn. 2022 Performance & Attribution Report In this report, we ..

- Steve Holden

- February 28, 2024

Global EM Funds: Country Positioning Update

361 emerging market Funds, AUM $400bn Country Positioning Update • China weights fall to lowe ..

- Steve Holden

- September 21, 2022

EMEA Focus: Allocations Hit All-Time Lows

275 ACTIVE GEM FUNDS, AUM $370BN EMEA Focus: Allocations Hit All-Time Lows In this piece, we pr ..