Emerging Market Active Fund Performance & Attribution Review, 2023

- Steve Holden

- 0 Comments

365 emerging market Funds, AUM $412bn

Emerging Market Active Fund Performance & Attribution Review, 2023

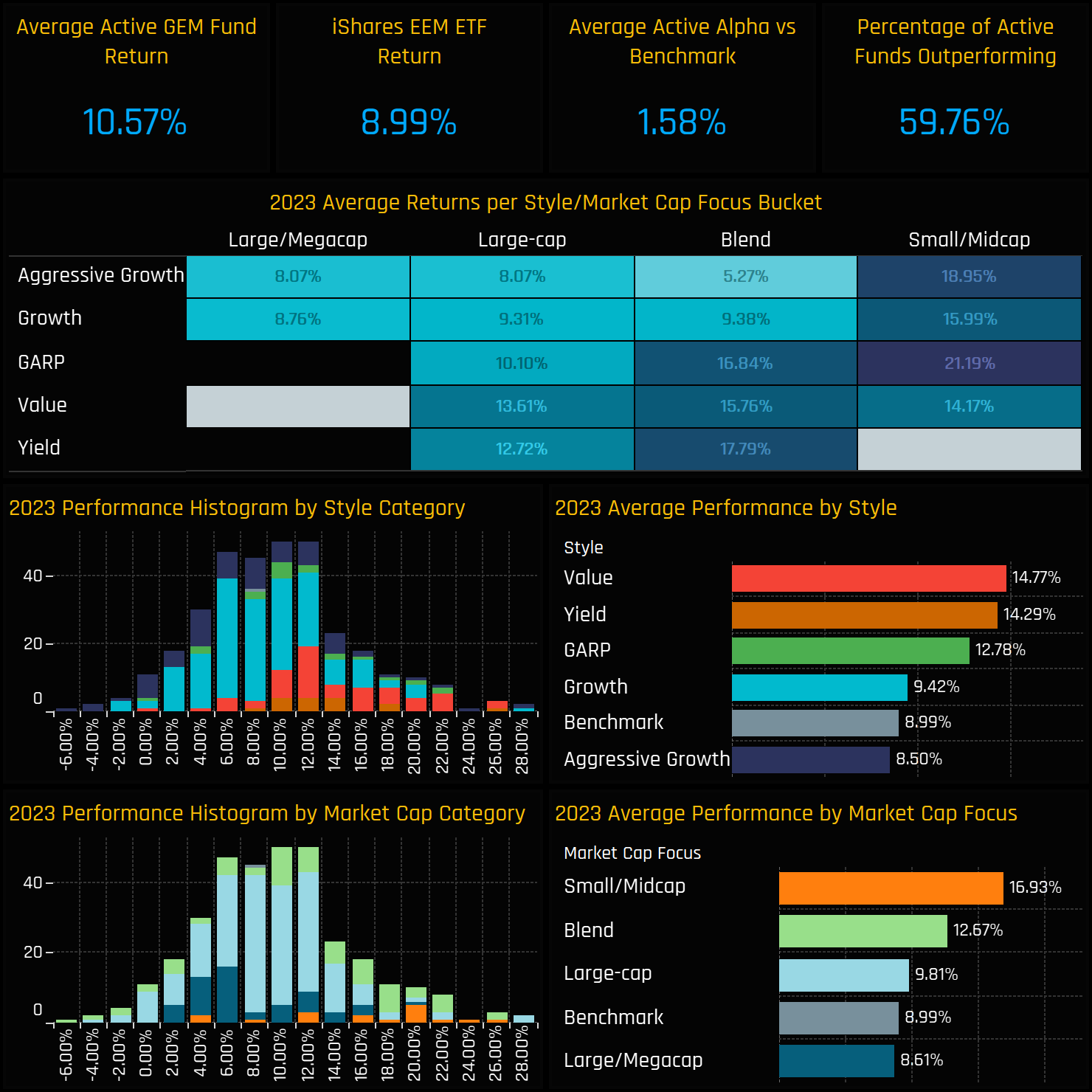

2023 was a good year for active EM managers as 60% outperformed, generating +1.6% of alpha versus the tradable benchmark.

Returns driven higher by strong performance from Value and Small/Midcap managers, whilst high Growth struggled.

China & HK positions were costly, whilst LATAM and Technology contributed the most to absolute performance.

2023 Fund Performance

Active EM funds had a good 2023. Average fund returns came in at a healthy 10.57%, ahead of the iShares MSCI Emerging Markets ETF by +1.58%, with 59.8% of funds outperforming. Broken down by Style, Value and Yield funds had the best year, averaging 14.77% and 14.29% respectively, with Aggressive Growth funds the only group to underperform the iShares MSCI EM return. From a Market Cap perspective, Small/Midcap funds were ahead by some margin, with 16.9% average returns compared to 8.6% for Large/Megacap. Across all funds, the core of the return distribution was between 6% and 12% on the year.

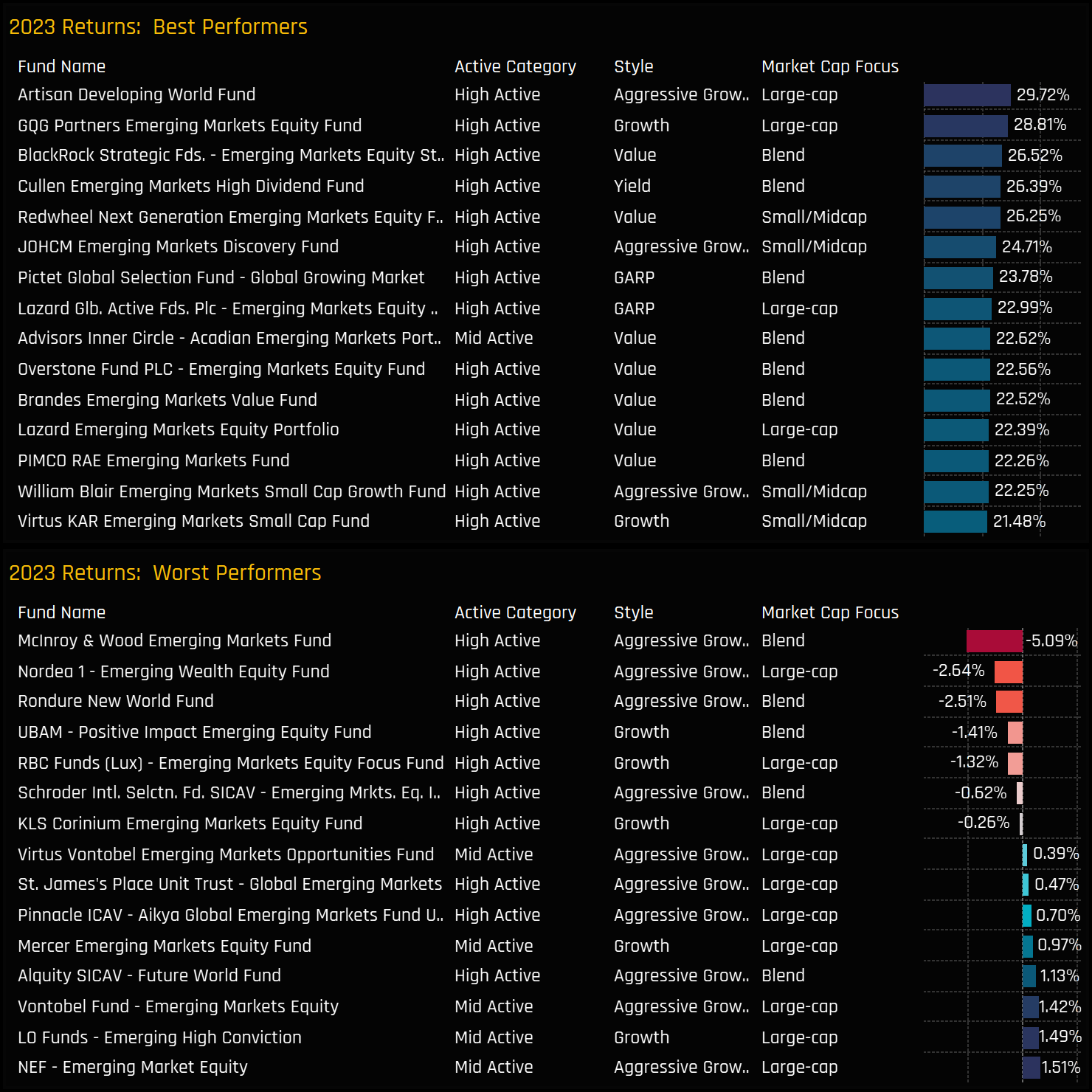

On an individual fund level, 24 funds posted 20%+ returns on the year, with the outperformers at the top end led by Artisan Developing World (+29.7%), GQG EM Equity (28.8%) and BlackRock’s Value/Blend EM Equity strategy (26.5%). At the bottom end, 7 funds posted negative returns led by McInroy & Wood Emerging Markets (-5.09%) and Nordea Emerging Wealth Equity (-2.64%). Of the top 15 performers, 7 were Value focused and 4 Small/Midcap.

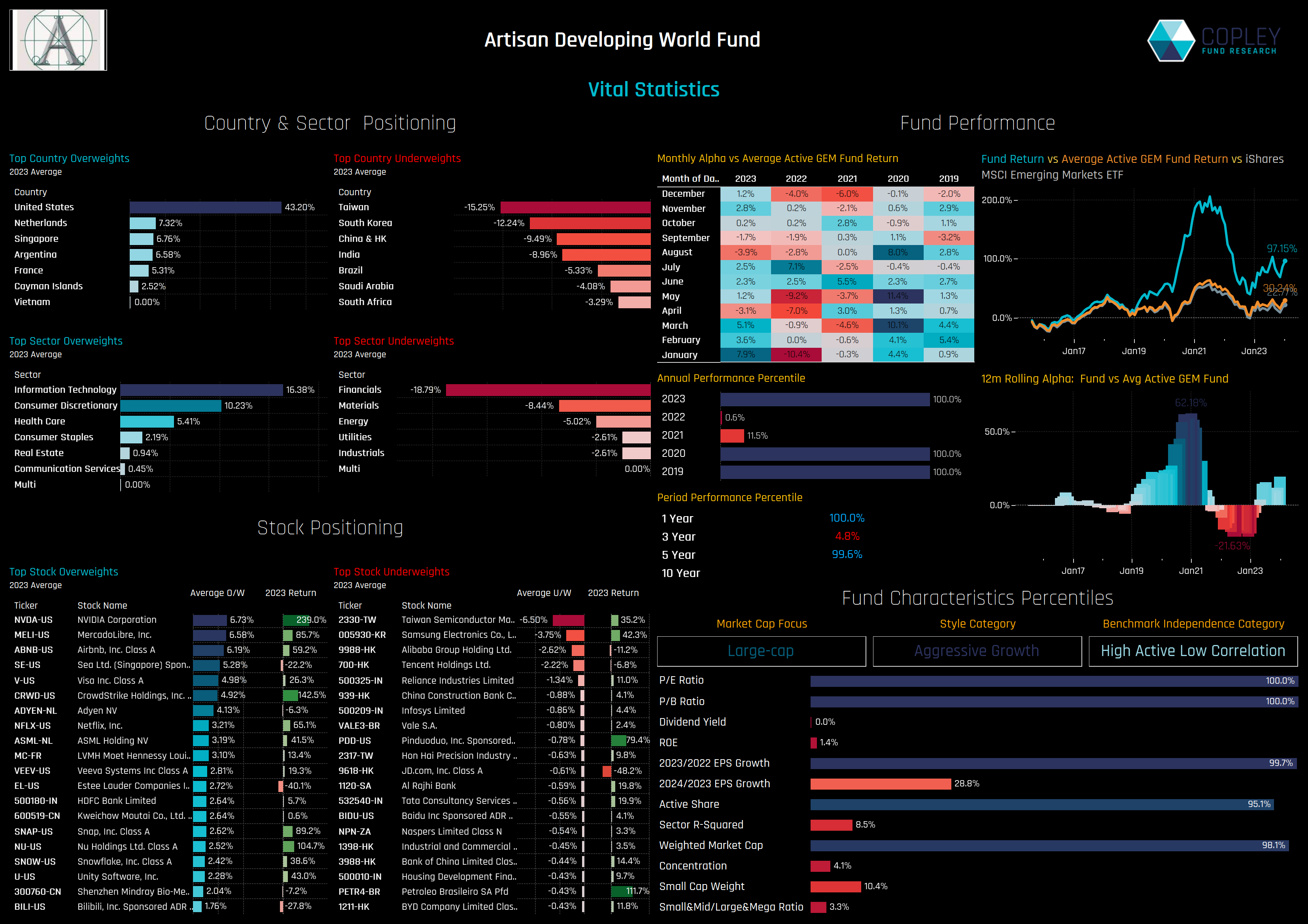

Artisan Developing World Fund

Artisan’s Developing World fund has topped the performance charts for another year, repeating the successes of 2019 and 2020. Despite officially benchmarking the MSCI Emerging Markets Index, the fund certainly treads a questionable line as to its emerging market credentials. The fund holds all major Emerging Market countries as significant underweight positions, led by Taiwan (-15.25%), South Korea (-12.24%) and China & HK (-9.49%), instead holding 43.2% of it’s portfolio in US companies and 65% in Developed Market securities. The fund’s strategy is geared towards high growth, and it has the highest P/E and P/B ratios of any fund in our analysis. Returns last year were driven by strong performance from key holdings such as NVIDIA, MercadoLibre and CrowdStrike Holdings, whilst also avoiding the key EM underperformers of Alibaba and Tencent.

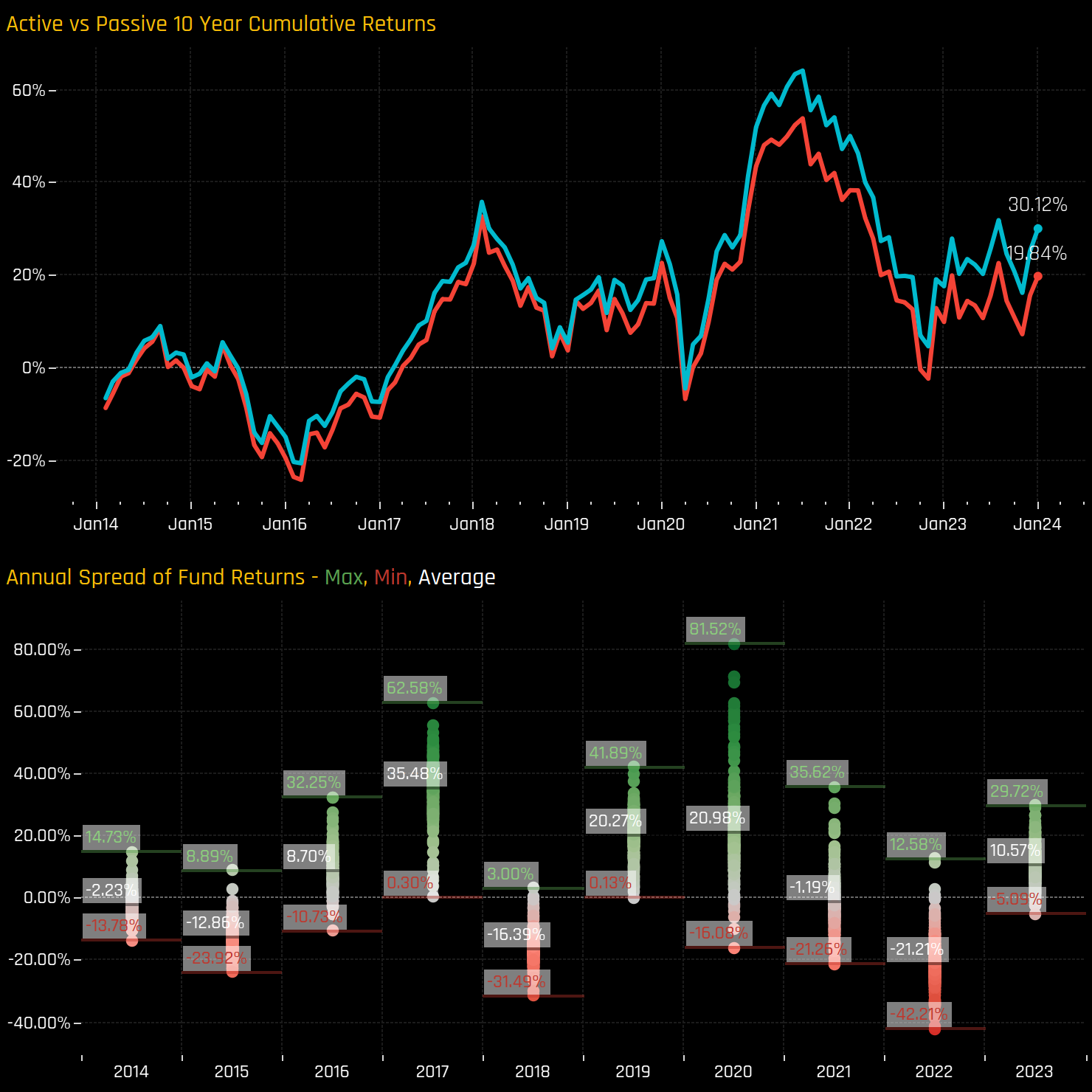

Active vs Passive in EM

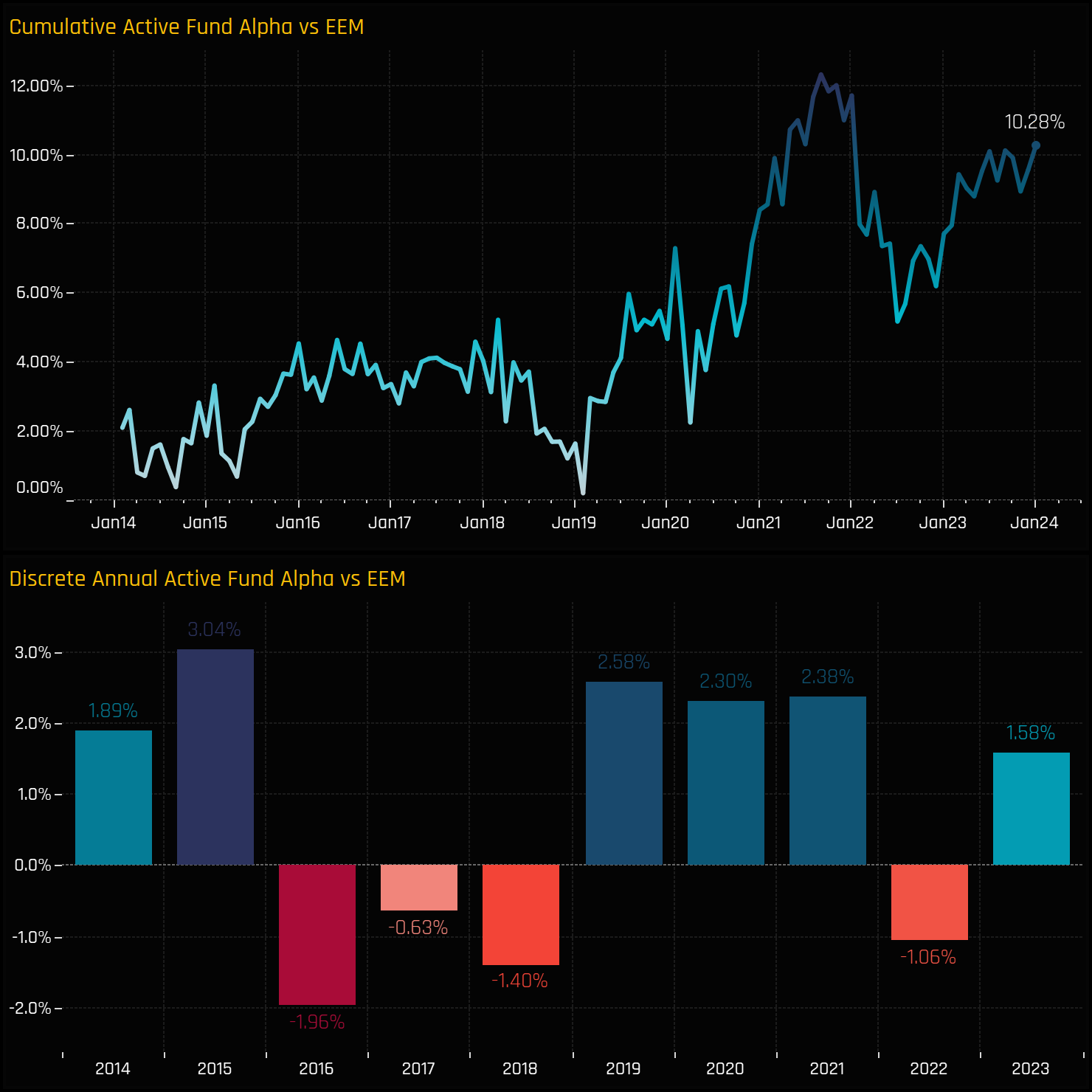

The spread between the highest and lowest returns on the year was 34.8%, with fewer occurrences of extreme outperformance than in 2020 or of extreme underperformance than in 2022. Cumulative 10-year returns for the active EM funds in our analysis stands at 30.12% versus 19.84% for the iShares MSCI EM ETF.

On an discrete annual basis, 2023 was the 4th year of outperformance for EM funds over the last 5-years. This year’s +1.58% alpha helped push 10-year cumulative outperformance over the iShares MSCI Emerging Markets ETF to +10.28%.

Portfolio Positioning & Performance

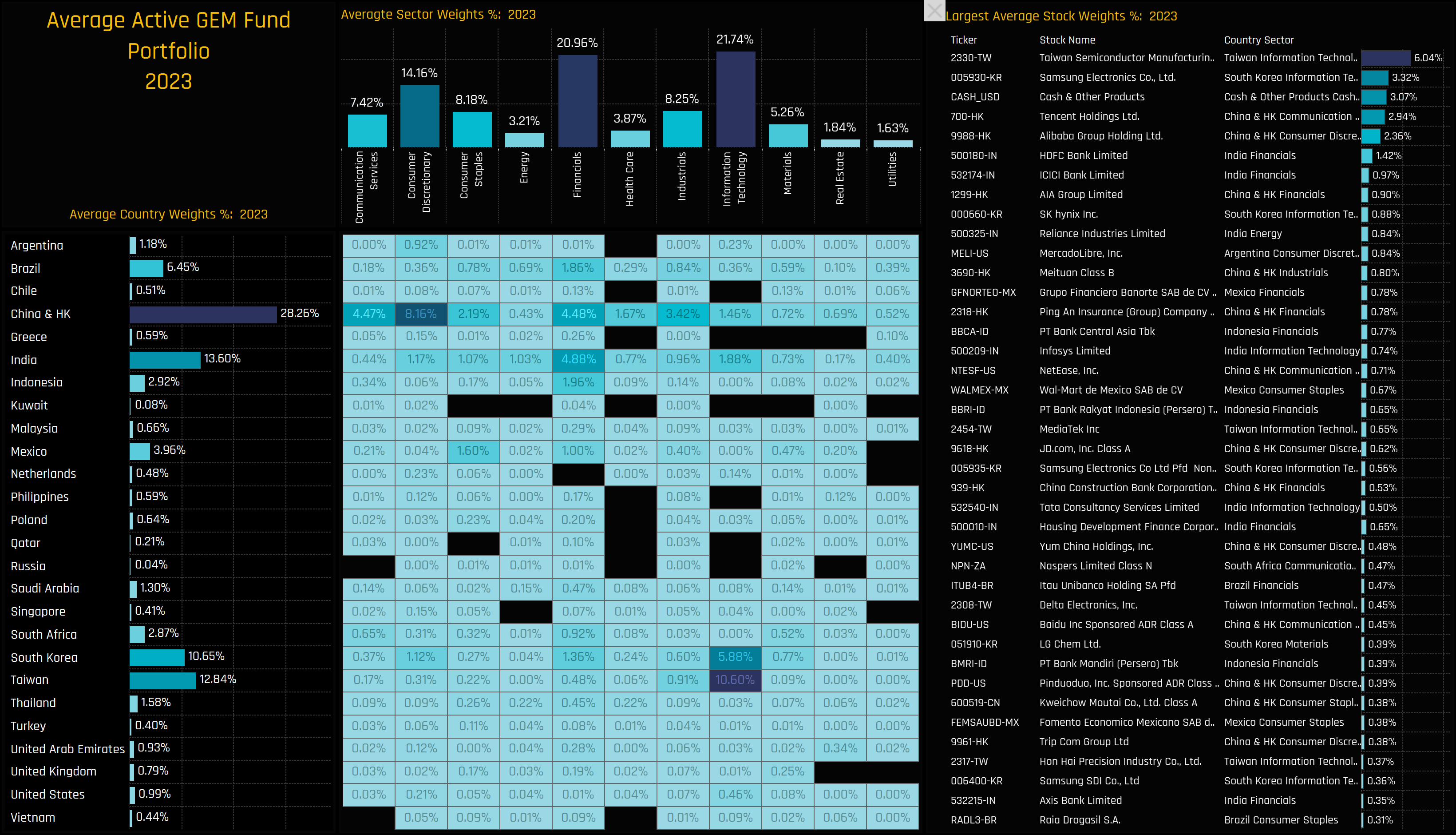

We now look to breakdown last year’s performance by country, sector and stock to understand the key drivers behind both absolute and relative returns. We do this by analysing a portfolio based on the average holding weights of the 365 individual strategies in our analysis.

The chart below breaks down the country, sector and stock weights of this portfolio, with the standout country/sectors those of Taiwan Technology (10.6%), China & HK Consumer Discretionary (8.16%) and South Korean Tech (5.88%). The largest stock positions are listed in the right-hand chart and led by TSMC, Samsung Electronics and Tencent Holdings.

Portfolio Performance

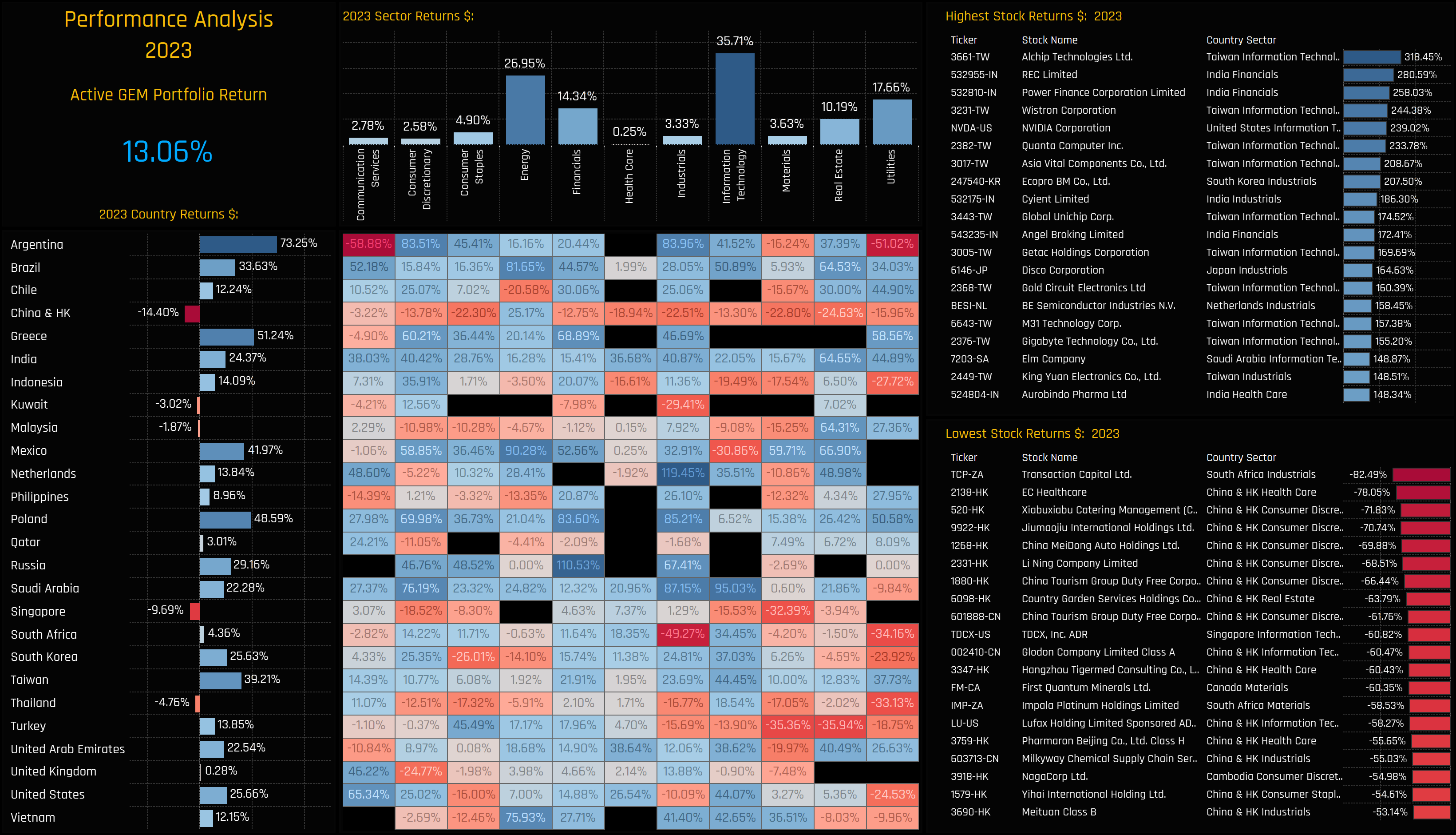

Based on monthly observations, the portfolio returned 13.06% in 2023, higher than the average actual fund returns of 10.57% mainly due to a lack of management fees and the infrequency of fund filings data (i.e this is a theoretical portfolio). The charts below show the 2023 performance of the major countries, sectors, country/sectors and stocks in the portfolio.

The huge underperformance of China & HK is the most notable metric, with all Chinese sectors except Energy producing negative returns on the year. Strong performance from the LATAM nations of Brazil, Mexico and Argentina were a standout, in addition to Taiwan Technology and Saudi Arabia across most sectors.

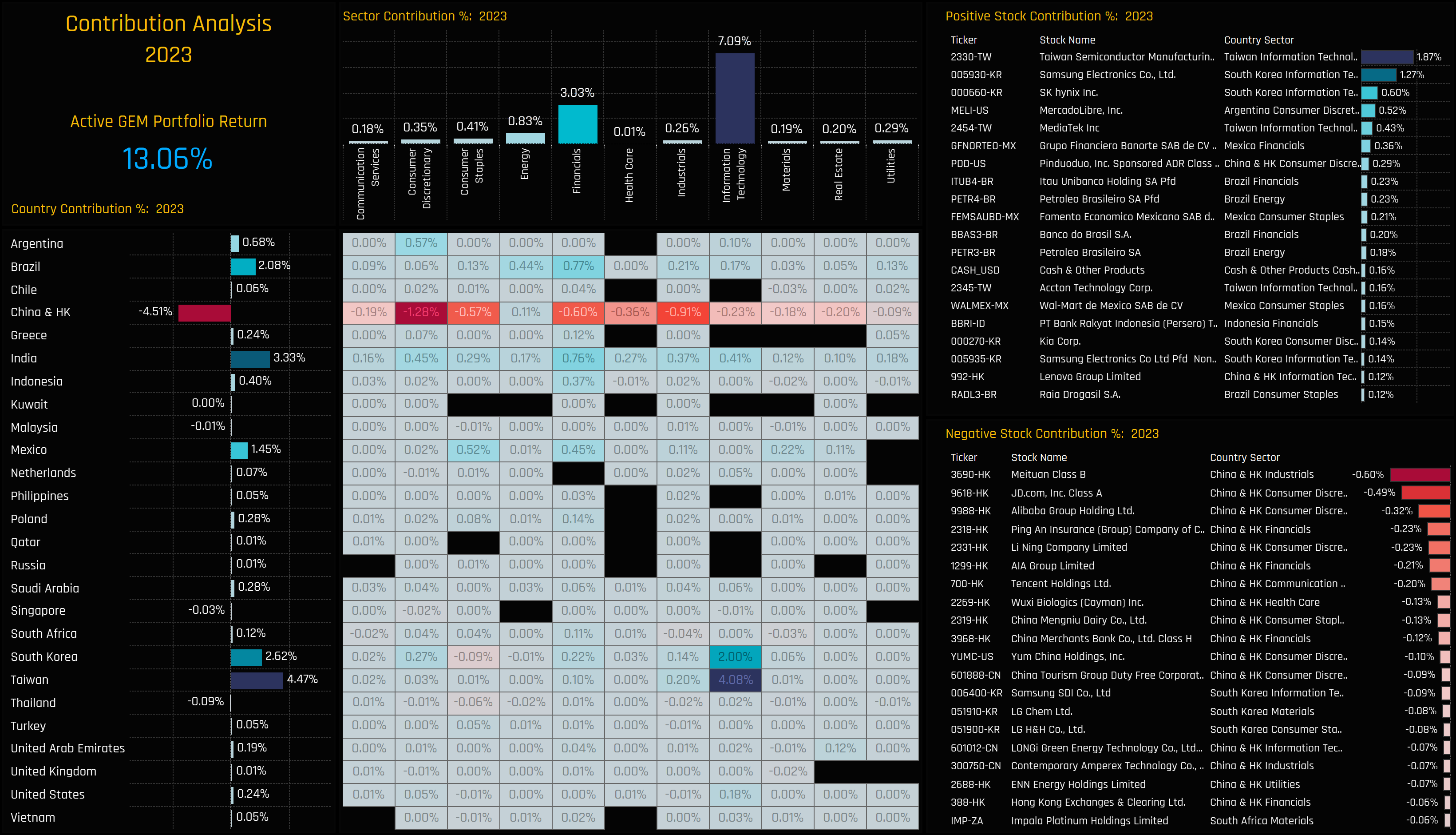

Portfolio Contribution

Marrying the performance figures with the average holding weights allows us to see the major contributors to performance in 2023. The poor performance of China & HK and 28.26% holding weight cost managers an average -4.51% in net losses on the year. In fact, China & HK was the only significant red spot across the whole EM complex, with all other countries and sectors contributing positively to net returns. On a sector level, Technology was the standout, whilst India joined LATAM as a major force in driving 2023 country returns. On a stock level, TSMC, Samsung Electronics and SK Hynix generated the most towards returns, whilst poor performance from Meituan, JD.Com and Alibaba Group Holdings were costly.

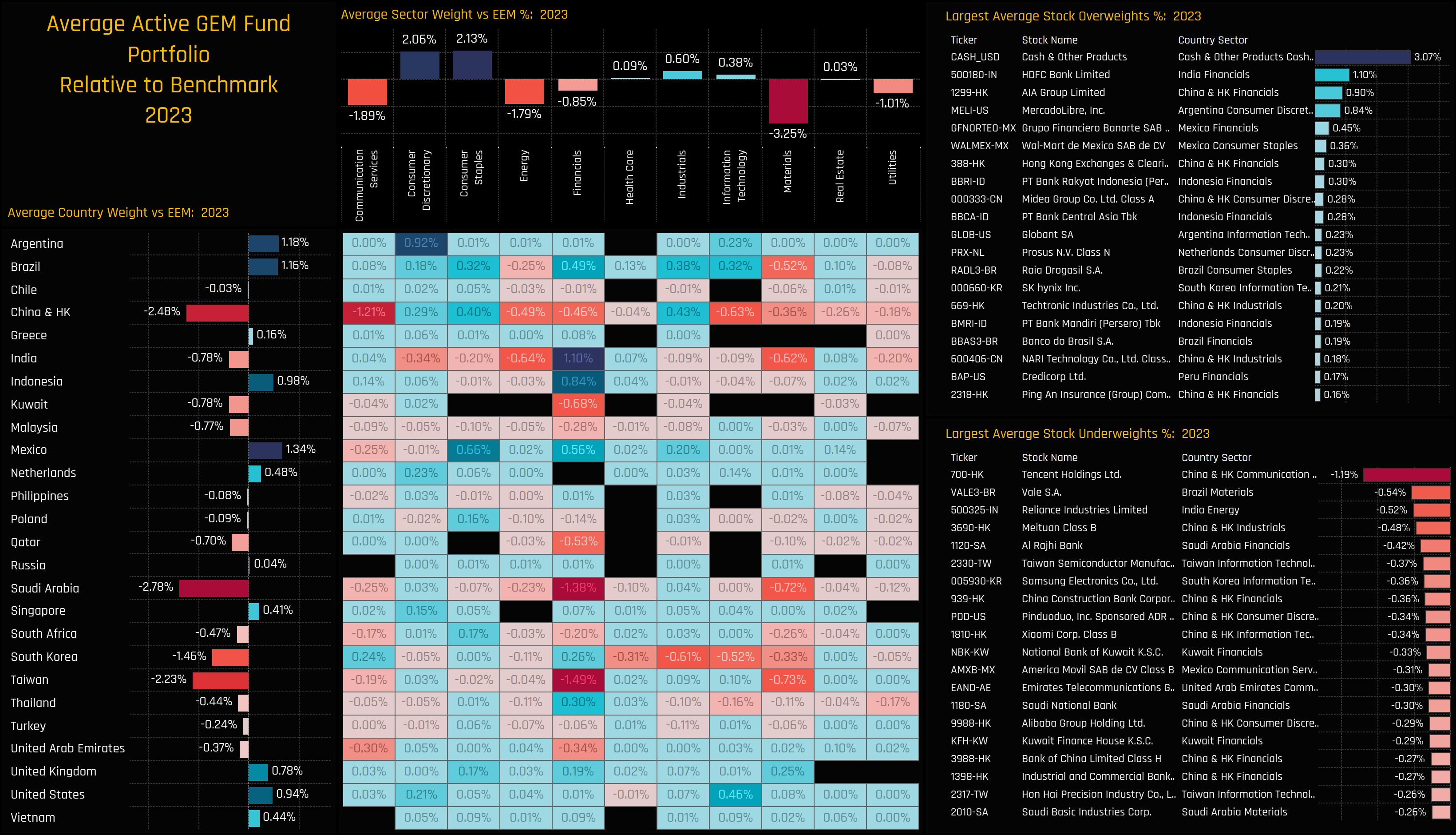

Positioning Relative to Benchmark

The positioning of the portfolio relative to the iShares MSCI EM ETF benchmark can be seen in the charts below. Underweights in Materials, Communication Services and Energy were offset by overweights in Consumer Discretionary, Consumer Staples and Cash. On a country level, large underweights in China & HK, Saudi Arabia and Taiwan were offset by overweights in the LATAM nations, together with out-of-benchmark positions in the UK and the USA.

The largest country/sector overweights were in Indian Financials, Argentina Consumer Discretionary and Indonesian Financials, offsetting underweights in Taiwan and Saudi Financials and China & HK Communication Services. On a stock level, managers were positioned overweight HDFC Bank, AIA Group and MercadoLibre against underweight Tencent, Vale and Reliance Industries, among others.

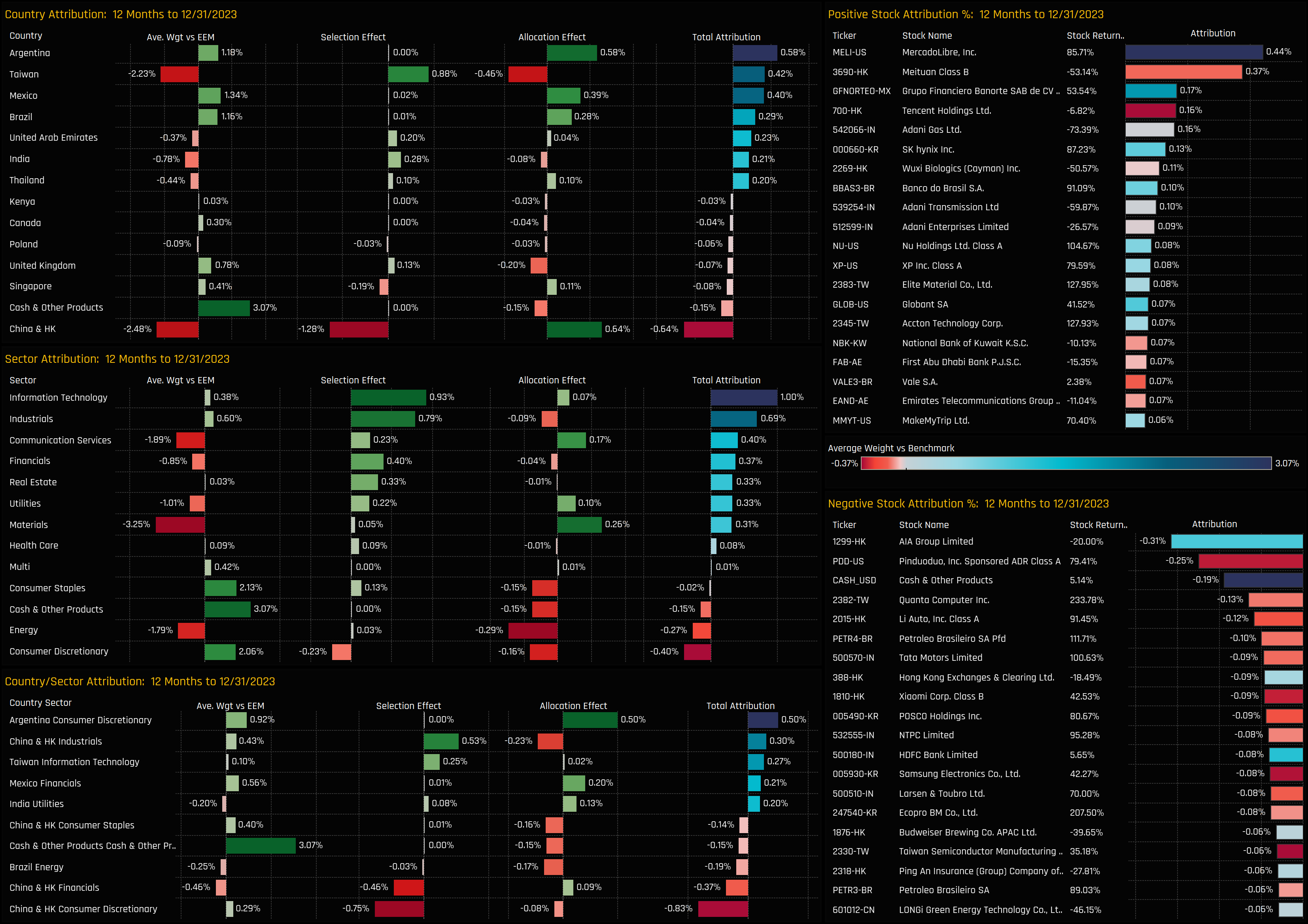

Performance Attribution

We perform attribution analysis on this portfolio versus a representation of the benchmark based on the iShares MSCI Emerging Markets ETF. As expected, and mirroring the outperformance seen in actual fund returns this year, the portfolio outperformed by +2.67% in 2023. A summary of the key drivers are documented below, but the winning positions on the year include LATAM overweights, China & HK underweights and excellent stock selection in Technology and Industrials. These positions far outweighed losses stemming from underweights in Taiwan, Cash Holdings and poor stock selection in China & HK.

What worked:

- Underweights in China & HK, Communication Services, Materials

- Overweights in Argentina, Brazil and Mexico.

- Stock selection in Tech, Industrials, Taiwan, India

- Underweights in Meituan, Tencent Holdings, Wuxi Biologics

- Overweights in MercadoLibre, Banorte, SK Hynix.

What Didn’t:

- Underweights in Taiwan, Energy, India.

- Overweights in the UK, Cash, Consumer Sectors.

- Stock selection in China & HK, Consumer Discretionary, China & HK Financials.

- Underweights in Pinduoduo Inc, Quanta Computer, Li Auto

- Overweights in AIA Group, HK Exchanges, HDFC Bank.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- October 13, 2024

GEM Funds: Performance & Attribution Review, Q3 2024

352 Global Emerging markets active equity funds, AUM $429bn GEM Funds: Performance & Attri ..

- Steve Holden

- November 22, 2023

GEM Fund Positioning Analysis, November 2023

370 emerging market Funds, AUM $368bn GEM Fund Positioning Analysis, November 2023 In this issu ..

- Steve Holden

- April 21, 2025

GEM Funds: Positioning Chart Pack, April 2025

343 emerging market Funds, AUM $410bn Active GEM Funds: Positioning Chart Pack, April 2025 &nbs ..