146 China Equity Funds, AUM $46bn

China Macro: Sector Positioning Update

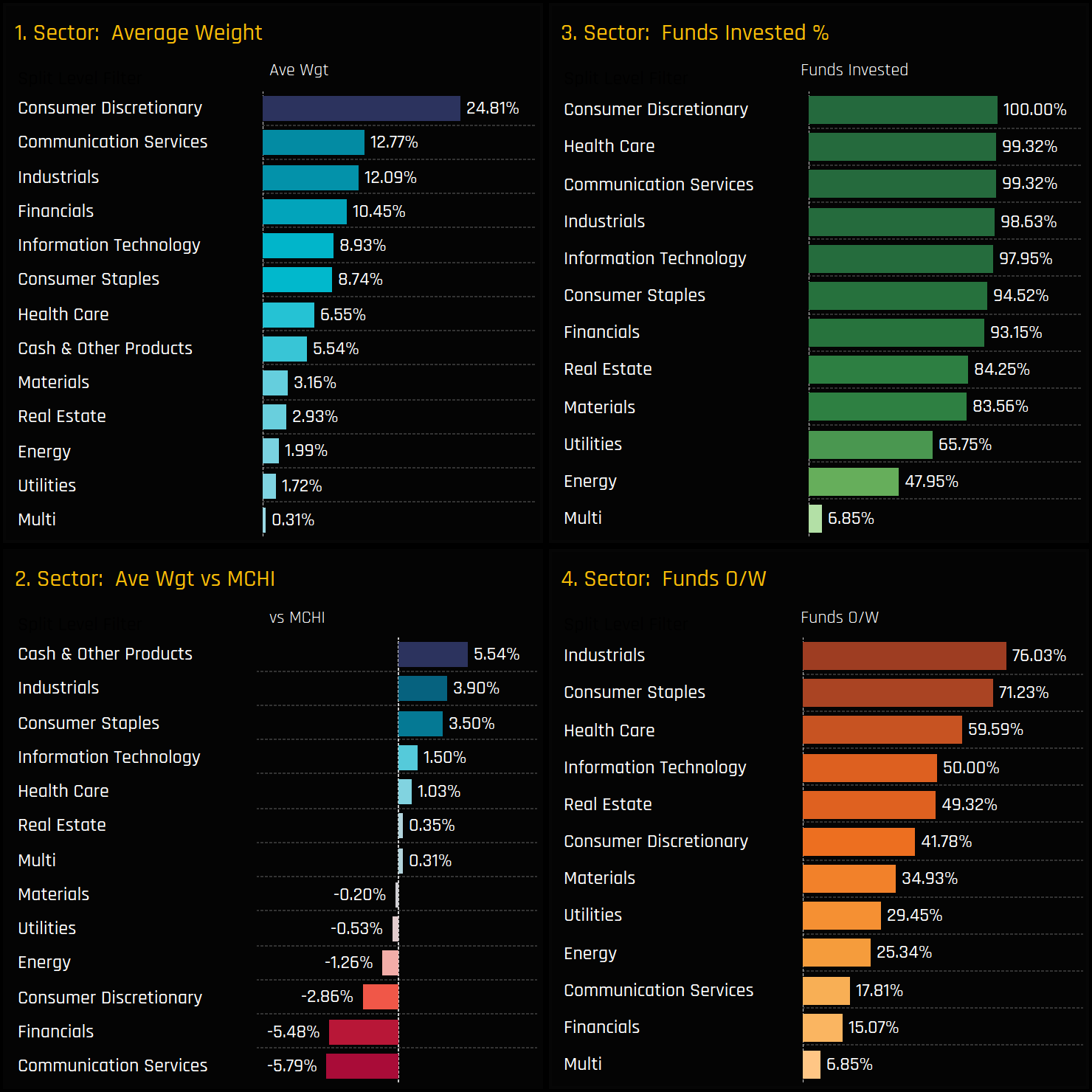

Industrials and Consumer Staples remain top overweights, though sentiment fragile for both.

Energy sector shows signs of a turnaround from long-term decline, whilst Financials remain unloved by China investors.

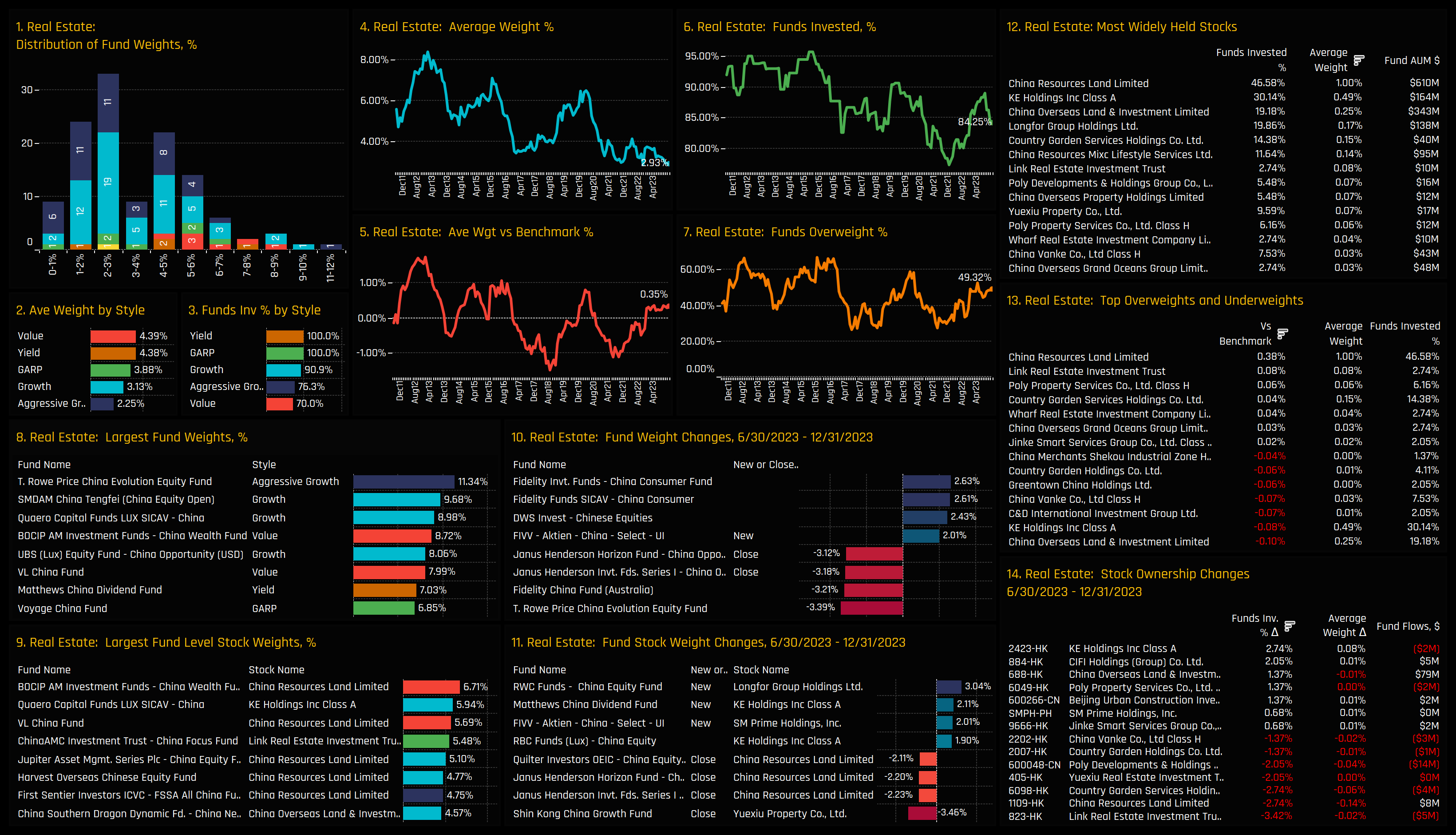

Real Estate allocations have hit record lows, with average holdings at just 2.93%, while Consumer Discretionary sector approaches all-time highs.

All Sectors Latest Positioning & Activity

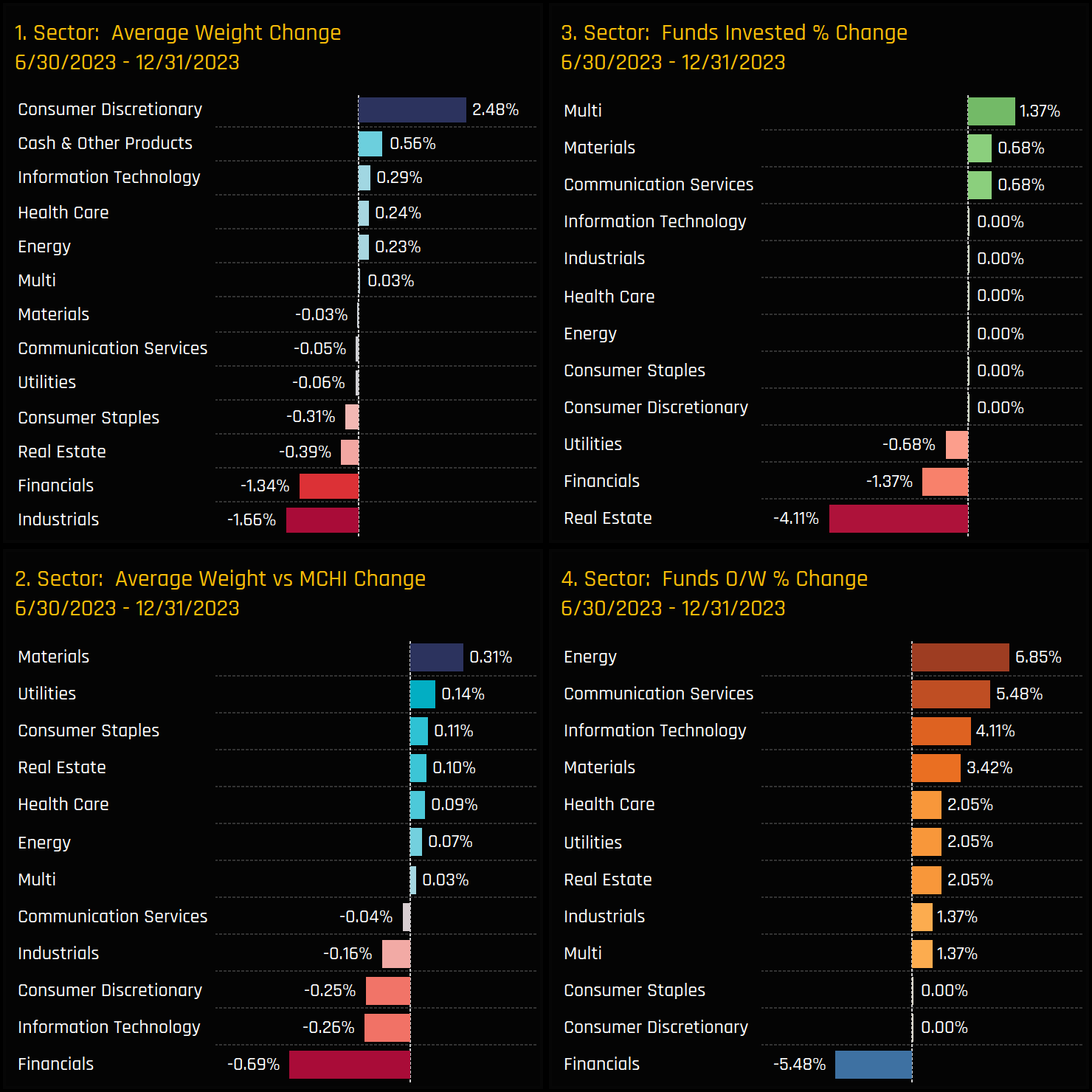

Between June 30, 2023, and December 31, 2023, sector ownership in active China funds has seen several significant shifts. Consumer Discretionary allocations experienced a sizeable increase, with average weights rising by +2.48%, although other ownership metrics have remained relatively stable, suggesting this increase might be primarily due to price movements rather than strategic reallocation. The Financials sector, however, saw more active changes with 1.37% of funds exiting the sector and 5.48% shifting to an underweight position, leading to lower average and relative weights. On a smaller scale, both the Energy and Materials sectors have experienced an uptick in investor interest, in contrast to Real Estate, which experienced a decline with 4.1% of investors completely withdrawing from the sector. The following sections provide detailed profiles of the key sectors in the China market.

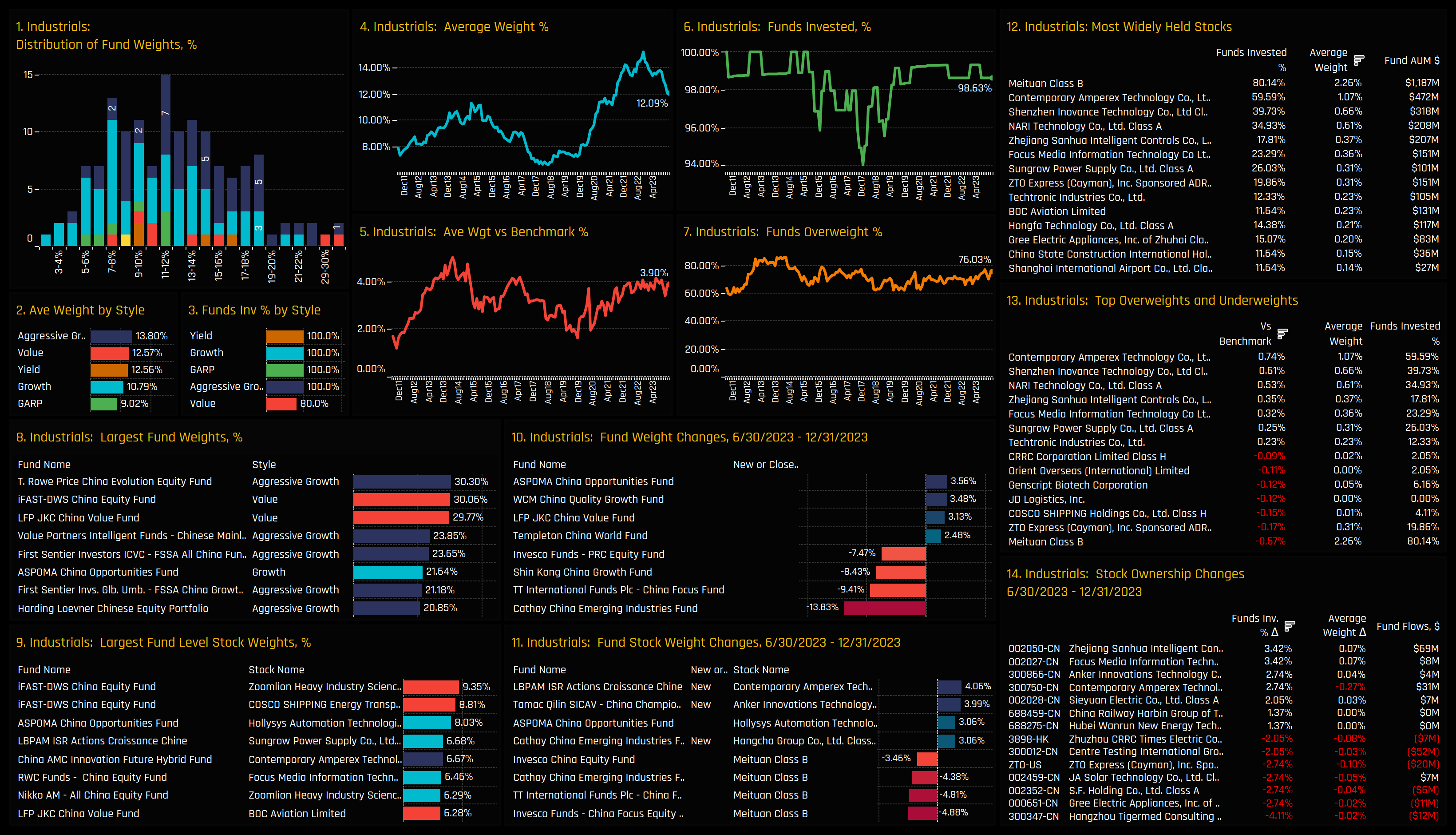

Industrials

Industrial stocks, while still favored by active China investors, have seen a noticeable decline in exposure, falling from 15.24% in October 2022 to 12.1% at the end of last month. Despite this, 76% of China funds maintain an overweight position in the sector, at the higher end of the 5-year range. Allocations vary, with top investors dedicating over 30% to Industrials, yet most funds hold between 7% and 19%. Meituan remains the dominant holding, present in 80% of funds at an average weight of 2.26%, albeit slightly underweight compared to the iShares MCHI ETF by -0.57%. Contemporary Amperex Technology, Shenzhen Inovance Technology, and NARI Technology also stand out as widely held stocks that are held overweight the benchmark. Recent stock rotation includes increased investment in Zhejiang Sanhua Intelligent Controls, Focus Media Information Technology, and Anker Innovations Technology, alongside reduced exposure to Hangzhou Tigermed and Gree Electric.

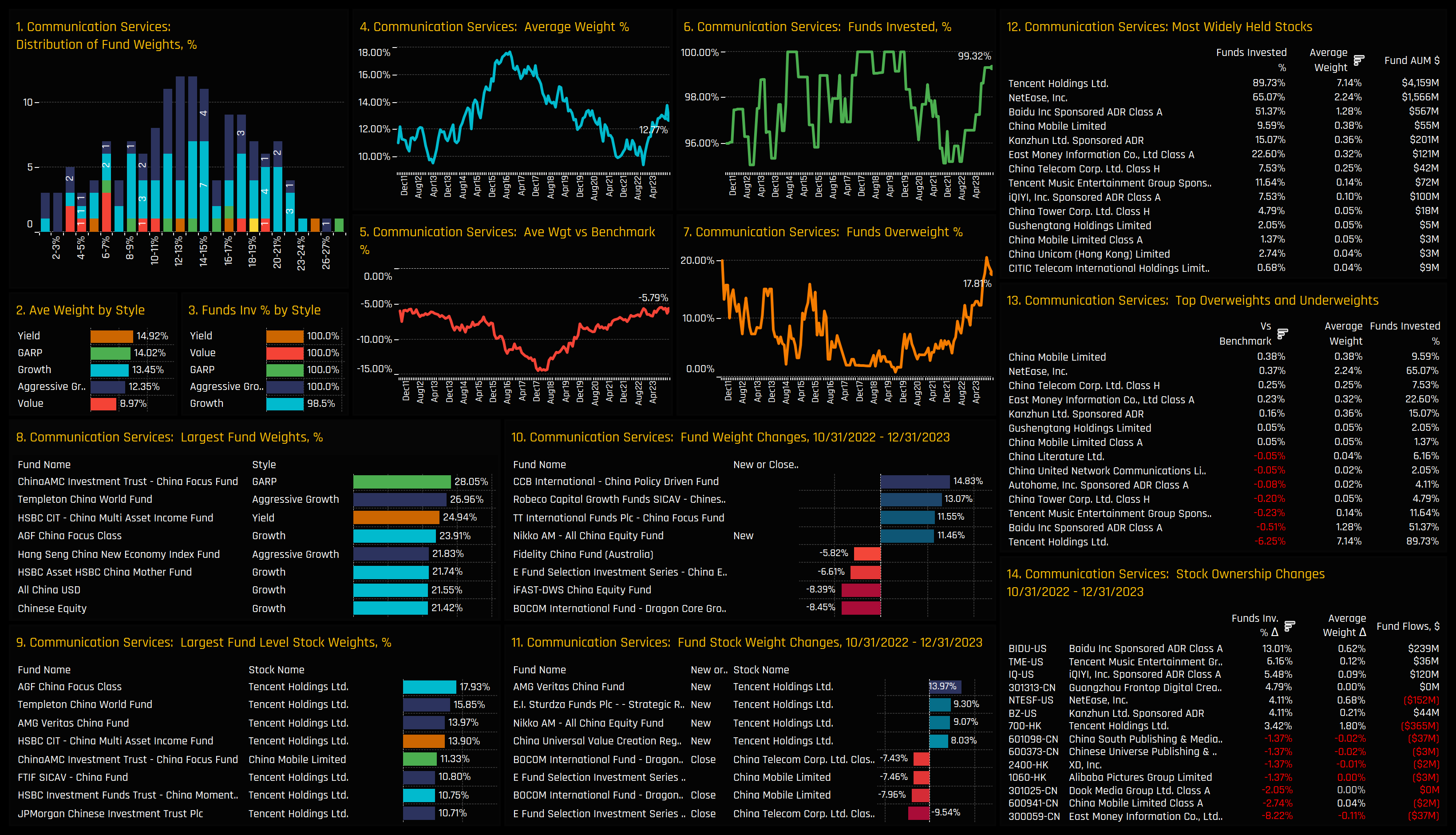

Communication Services

Communication Services, the second-largest sector allocation after Consumer Discretionary, has experienced a notable uptick in allocations, recovering from a low of 9.4% in late 2022 to 12.77% today. All ownership metrics have increased since then, largely propelled by renewed interest in Baidu Inc. Notably, 13% of the 146 funds covered in our China research initiated new positions in Baidu Inc between October 2022 and the end of 2023. This shift in sentiment has also favored other companies like Tencent Music and iQIYI Inc. However, East Money Information witnessed an 8.2% decline in fund’s invested during the same timeframe. The sustained underweight position in the Communication Services sector reflects not a general bearish sentiment, but rather a deliberate choice by managers to not align with the 13.4% benchmark weight in Tencent Holdings. Despite this, Tencent remains a cornerstone investment within the sector, held by 89.7% of managers at a substantial average weight of 7.14%, marking it as the most significant holding by a considerable margin.

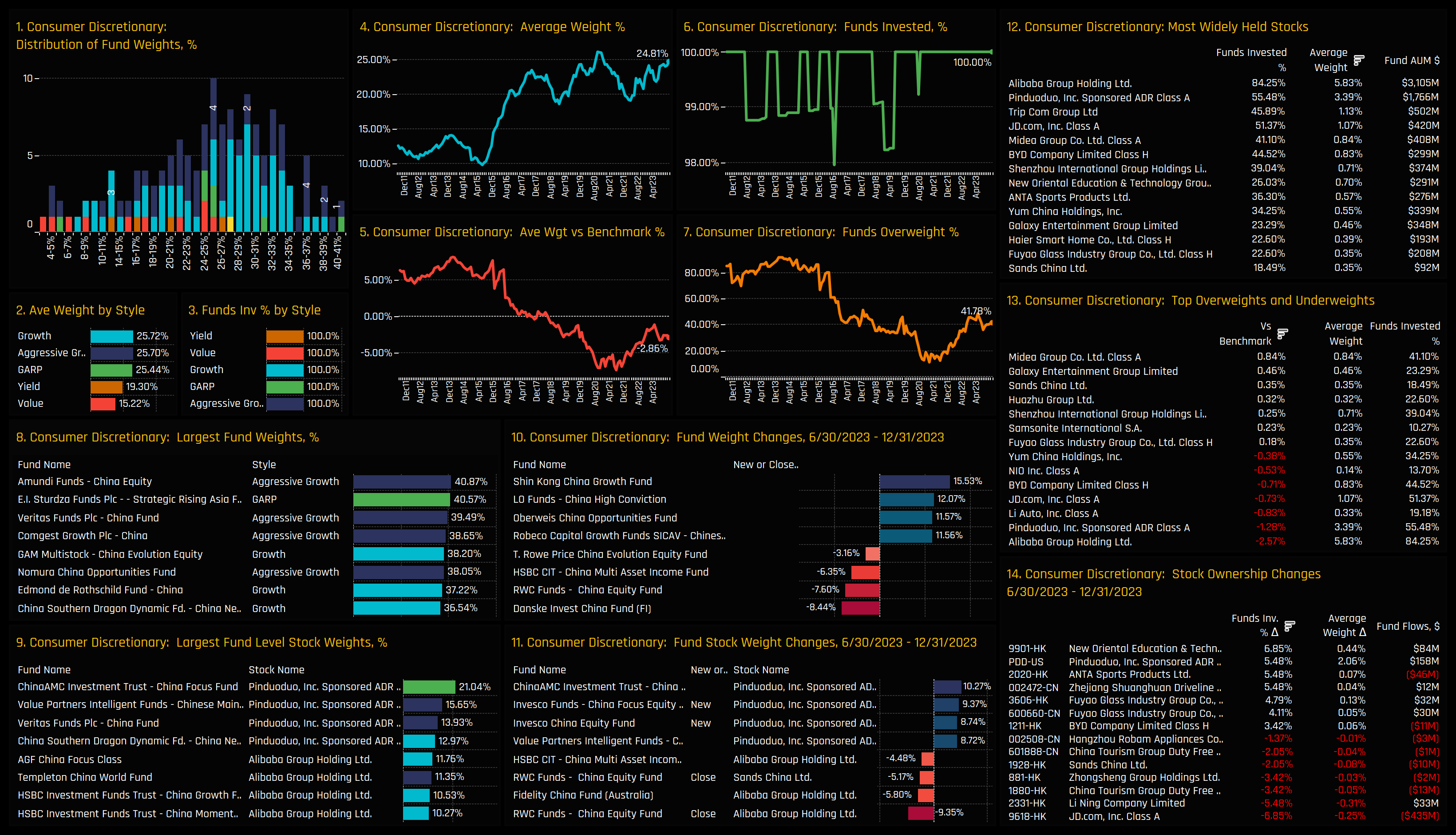

Consumer Discretionary

The largest sector weight among China investors, Consumer Discretionary allocations are closing in on their all-time highs. Underweights have closed in from the lows of 2021, though the majority of funds are still positioned below the iShares MSCI China ETF. Fund allocations are mainly clustered between 20% and 33%, with the top allocators of Amundi China Equity and E.I.Sturdza just tipping over the 40% level. In a similar vein to Tencent, Alibaba Group Holdings is the dominant holding, but also accounts for all of the underweight position in the sector. Notable increases in investment over the last 6-months belong to New Oriental Education and Pinduoduo Inc, whilst investors scaled back exposure to JD.Com and Li Ning Company.

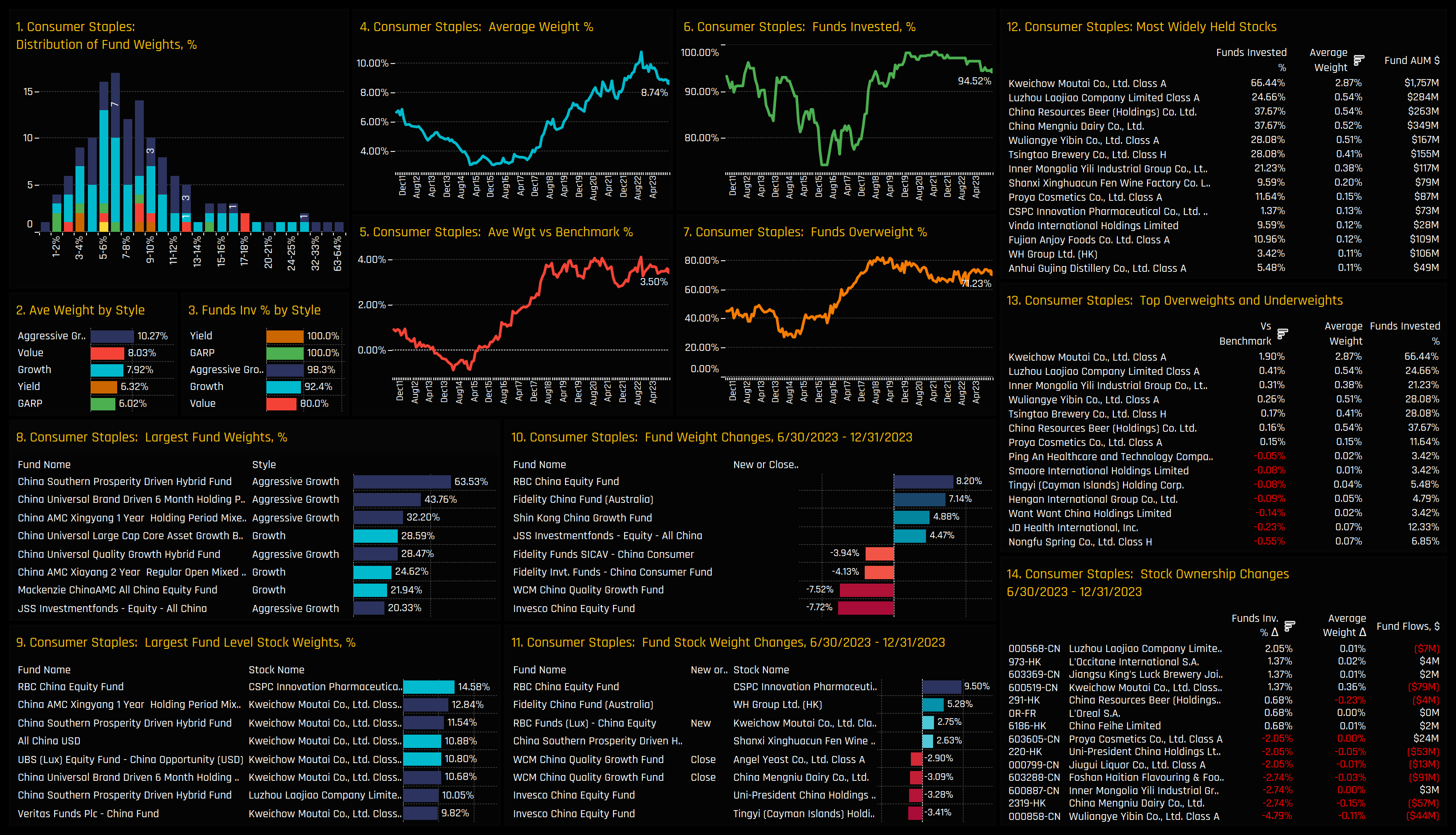

Consumer Staples

Sentiment towards the Consumer Staples sector appears to have taken a knock in recent months. Average holding weights have retraced from their highs, and the proportion of funds invested in the sector is also showing a slight downward trend. Despite this, ‘Staples continue to be an overweight choice for the majority of managers, with 71% positioned above the benchmark by an average of +3.5%. Average weights in the sector are skewed higher by a handful of funds with allocations exceeding 20%. In reality, the majority of investors hold a more modest stake, typically ranging between 4% and 12%. Stock holdings within the sector are well diversified. Seven companies are held by more than 20% of the funds in our analysis, with Kweichow Moutai Co being the most widely owned. Kweichow’ is owned by 66.4% of funds at an average weight of 2.87%, representing an overweight position of +1.90% compared to the benchmark. In contrast, stocks like Nongfu Spring Co and Want Want China Holdings, though prominent in the benchmark, are less favored among active investors.

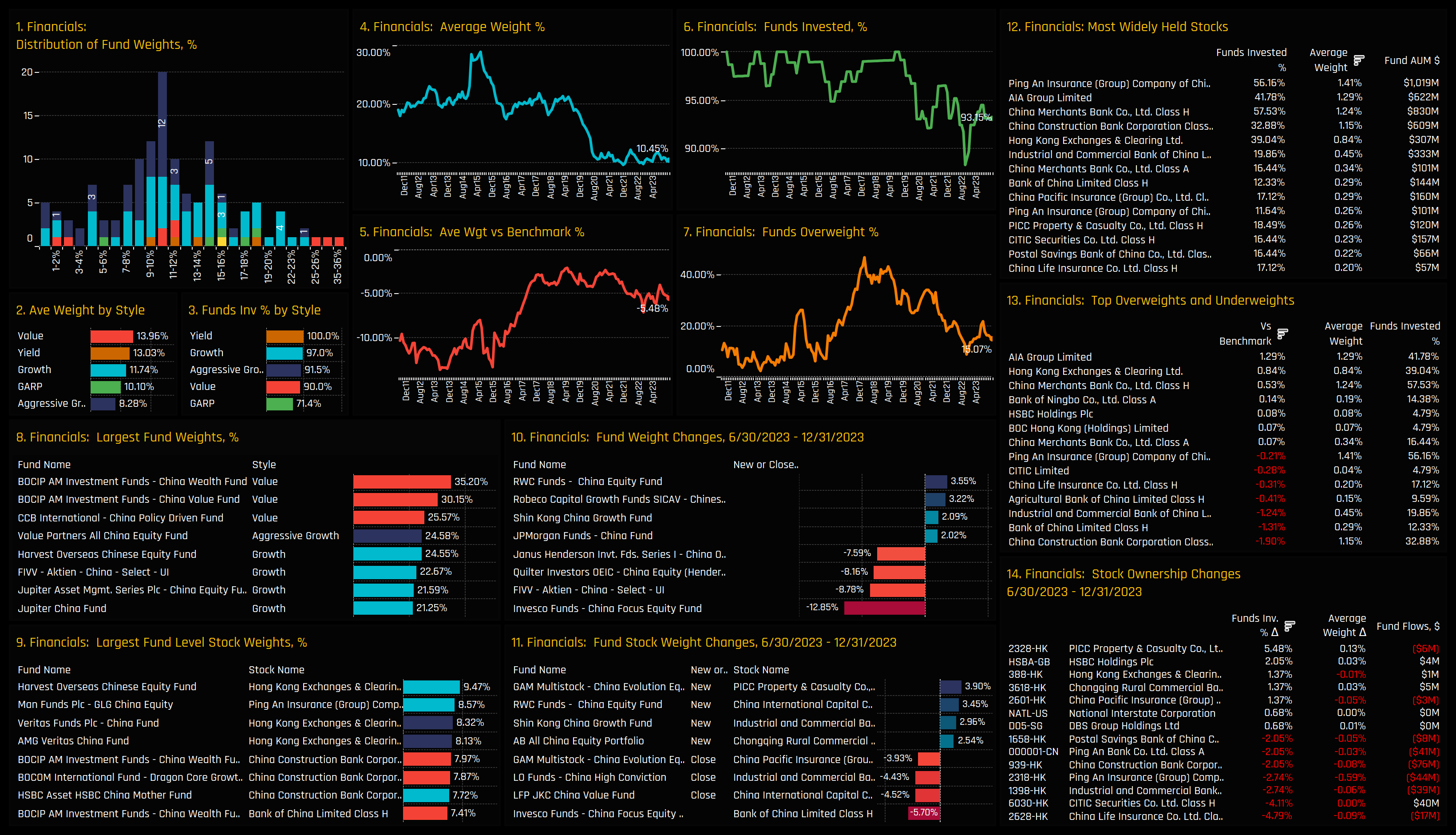

Financials

The Financials sector continues to experience a period of low conviction among investors, with allocations hovering near all-time lows. The sector’s average weight of 10.4% translates to a significant underweight of -5.48%, with only 15% of managers exceeding the benchmark. This trend suggests a level of skepticism regarding the sector’s ability to generate Alpha, particularly among Aggressive Growth funds, which average a mere 8.3% allocation. Despite some stocks in the Financials sector being widely held—five companies are owned by more than 30% of the funds in our analysis— more notable are the prominent underweights. China Construction Bank, Bank of China, and ICBC form the core of the net -5.45% underweight. Other contributors include less favored stocks like Agricultural Bank of China and China Life Insurance. (ch13). Stock rotation within the sector over the past six months has shown a preference for PICC Property, one of the few financial companies to see an increase in ownership. In contrast, investment in stocks such as China Life Insurance, CITIC Securities, and ICBC has declined, mirroring the overall reduction in sentiment within the sector.

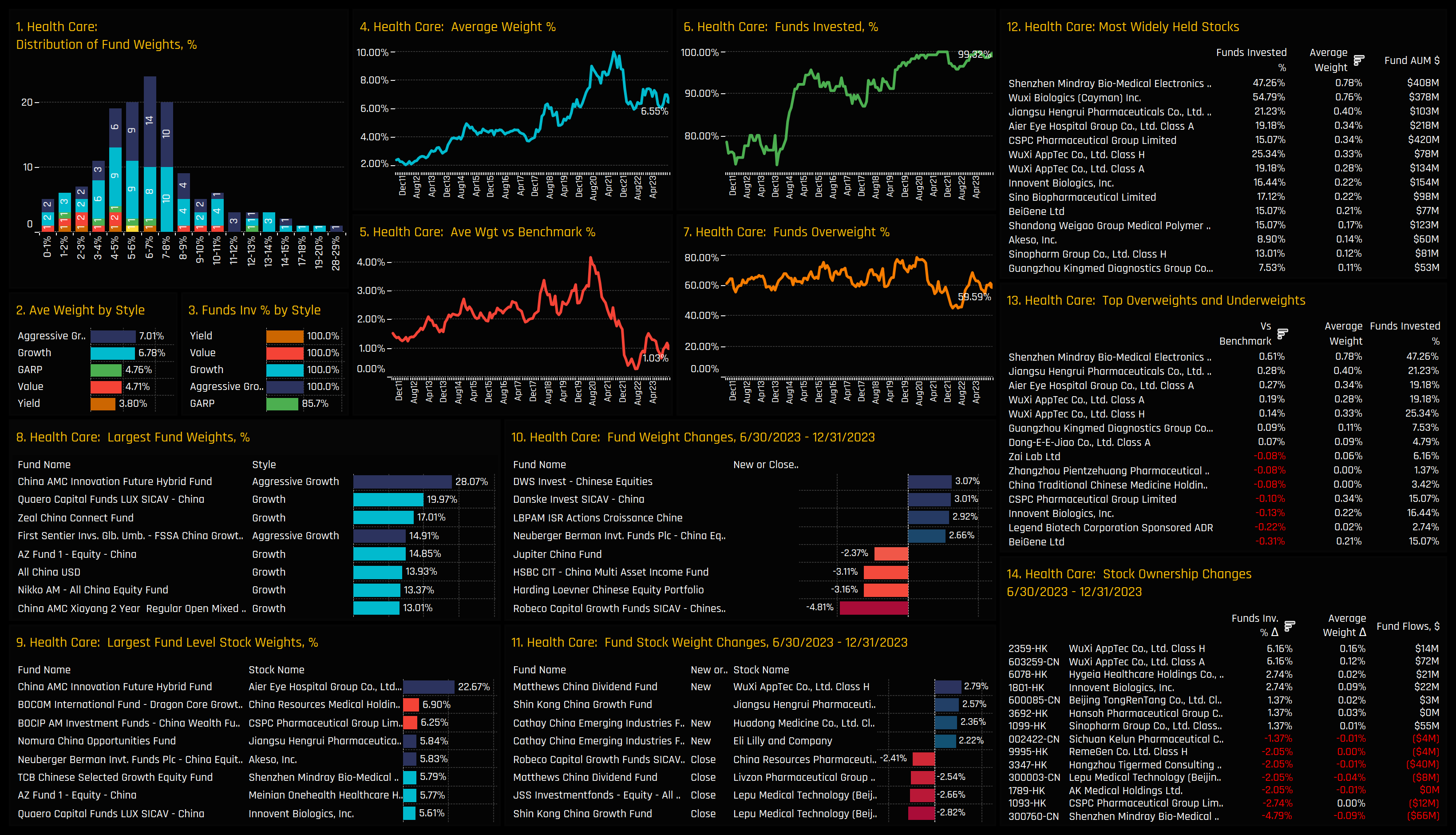

Health Care

The Health Care sector is currently undergoing a consolidation phase, following a notable decrease in allocations from 2020 to 2022. While still an overweight sector, the magnitude of this overweight has diminished from 4% in mid-2020 to 1.03% currently, with 59.6% of funds positioned above the benchmark. The majority of individual fund allocations in Health Care are under 8%, although high allocations from top investors like China AMC Innovation (28%) and Quaero Capital (20%) elevate the average. Shenzhen Mindray Bio-Medical Electronics and Wuxi Biologics are the sector’s leading stocks, owned by 47.2% and 54.8% of funds respectively. These two companies alone constitute 24% of the total Health Care allocation. Outside of these names, holdings are relatively small, with Jiangsu Hengrui Pharma, Aier Eye Hospital, and Wuxi AppTec contributing significantly to the net overweight. Although the overall Health Care weight has stabilized, there has been considerable rotation within the sector. Notable increases in investment in Wuxi AppTec, Hygeia Healthcare, and Innovent Biologics have been balanced by reductions in Shenzhen Mindray Bio-Medical Electronics and CSPC Pharmaceuticals.

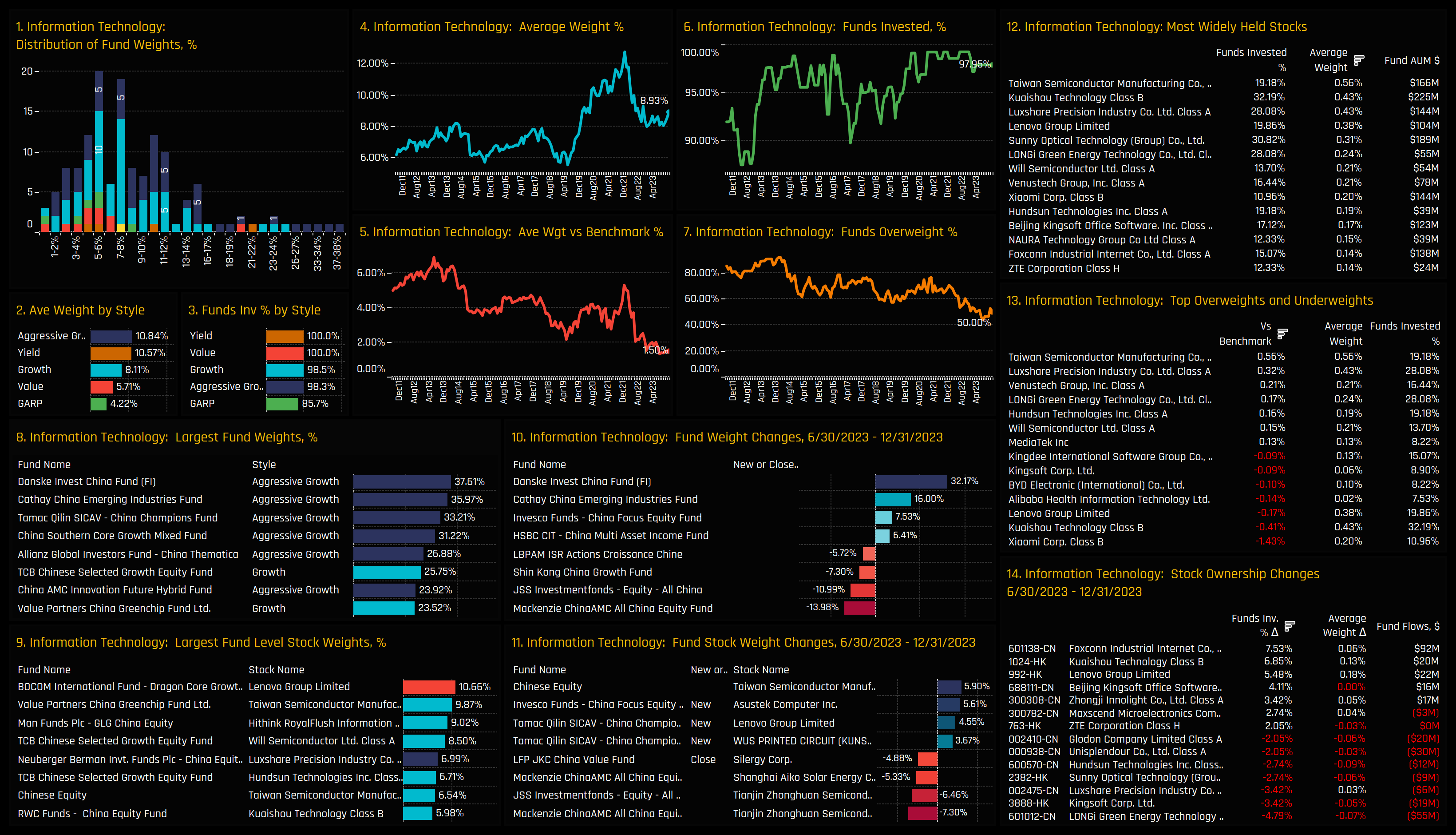

Information Technology

The Information Technology sector has experienced a downturn in recent years. From a peak allocation of 12.8% in late 2021, the sector has seen a significant reduction, with allocations hovering between 8% and 9% throughout 2023 (ch4). Correspondingly, the average overweight in the sector has dropped to its lowest level in over a decade (ch5). The distribution of allocations among individual funds reveals a right-sided skew, particularly among high-growth funds. This is exemplified by Danske Invest China and Cathay China Emerging Industries, with substantial allocations of 37.6% and 36%, respectively. Key players in the sector include Luxshare Precision, Sunny Optical Technology, LONGi Green Technology, and Kuaishou Technology, bolstered by the out-of-benchmark inclusion of TSMC. Venustech Group and Hundsun Technologies stand out as notable overweights in the sector. Conversely, Xiaomi Corp is a significant underweight and is largely avoided by investors.

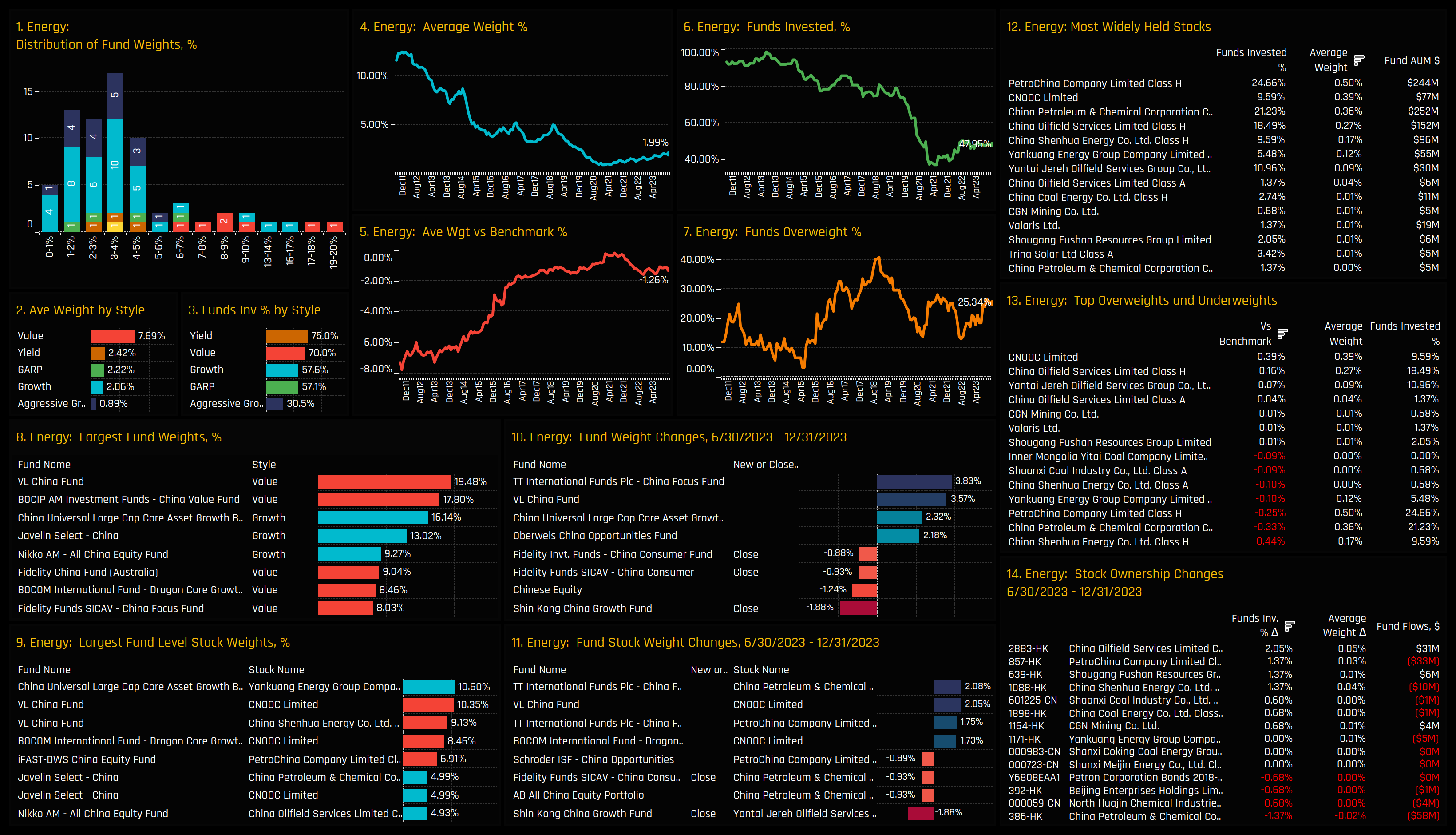

Energy

Energy sector allocations among active China funds have been in a long-term decline. Previously a universal holding in 2012 with allocations above 10%, Energy has gradually faded from prominence, with current average weights at just 1.99% and only 48% of the 146 funds in our analysis maintaining exposure. However, this long-term decline seems to be bottoming out, with a gradual yet intentional increase in investment over the past few years. While not a complete reversal, this shift indicates a change from strongly negative to mildly positive sentiment. Value funds are particularly well invested, averaging allocations of 7.69% in contrast to the mere 0.89% from Aggressive Growth funds. Stock ownership within the sector remains modest. PetroChina and China Petroleum & Chemical are the most commonly held stocks, supplemented by holdings in CNOOC and China Oilfield Services. The underweight in the sector is primarily due to light holdings in larger benchmark companies like China Shenhua Energy and China Petroleum & Chemical.

Real Estate

Real Estate sector allocations among active China investors have reached their lowest point on record. Following a volatile pattern of fluctuating allocations, the sector’s trajectory has largely been negative over the last decade, culminating in a record low average allocation of 2.93%. Despite a brief uptick in the number of funds investing in Real Estate between 2022 and late 2023, there was a notable reversal in August of the last year. China Resources Land remains a key investment within the sector, held by 46.6% of funds with an average weight of 1%, accounting for over a third of the total Real Estate allocation. This stock has been a significant factor in the sector’s recent decline, with 2.74% of funds reducing their exposure. Similar declines have been observed in Link Real Estate and Country Garden Services Holdings, whilst KE Holdings and CIFI Holdings saw modest increases in ownership.

Conclusions & Links

The landscape of sector allocations among active China equity funds reveals a dynamic and evolving investment environment. While certain sectors like Consumer Discretionary, Communication Services and Energy are seeing something of a resurgence, others such as Financials, Real Estate and Information Technology have experienced notable downturns, reflecting shifts in investor sentiment and strategic realignments.

Key sector overweights and underweights are often influenced by a few dominant companies, particularly Tencent Holdings and Alibaba Group Holdings, whose benchmark weights prove challenging for active investors to match.

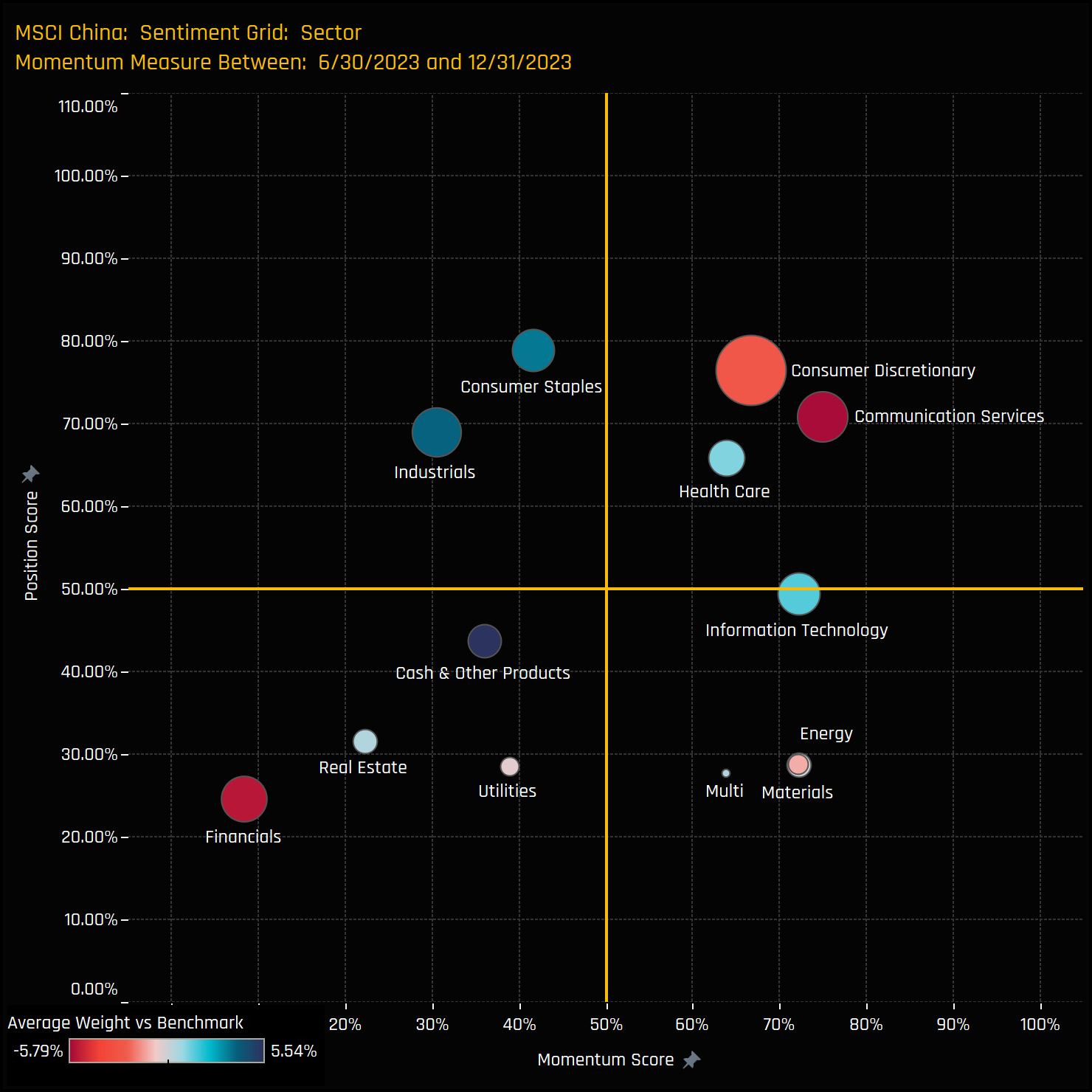

The Sentiment Grid opposite offers further insights into sector positioning in China. The ‘Position Score’ on the Y-axis quantifies current sector positions relative to historical data since 2011, ranging from 0-100%. The ‘Momentum Score’ on the X-axis, spanning 0% (maximum negative activity) to 100% (maximum positive activity), assesses fund manager activity between 06/30/2023 to 12/31/2023. The grid reveals a clear division: Financials and Real Estate are out of favor, marked by low historical allocations and negative manager activity. On the other hand, Consumer Discretionary and Communication Services are gaining traction, while there’s a noticeable waning of enthusiasm towards Industrials and Consumer Staples.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- November 22, 2022

China Fund Positioning Analysis, November 2022

277 Active China Funds, AUM $102bn China Fund Positioning Analysis, November 2022 In this issue ..

- Steve Holden

- October 25, 2023

China Fund Positioning Analysis, October 2023

150 Active MSCI China Funds, AUM $47bn China Fund Positioning Analysis, October 2023 In this is ..

- Steve Holden

- March 28, 2024

MSCI China Funds: Stock Radar

125 MSCI China active equity funds, AUM $38bn MSCI China Funds: Stock Radar Summary In this rep ..